- Sample Business Plans

- Entertainment & Media

Indoor Soccer Business Plan

Are you a soccer enthusiast thinking of launching your own indoor soccer facility? While the business is rewarding and provides a good opportunity for profitability, to keep it successful you will need planning.

Yes, we are talking about a foolproof business plan! But, writing a business plan also needs a lot of information and resources. Are you confused about where and how to start your business plan writing journey? Worry not, here is our indoor soccer business plan template along with various examples to support you in writing yours. So, let’s hop in!

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write an Indoor Soccer Business Plan?

Writing an indoor soccer business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written at the end, after having the full knowledge of the whole business plan.

Here are a few key components to include in your executive summary:

Introduction of your Business

First things first, give a brief introduction to your business, so the audience knows what they are getting into. This section may include the location, business history, the type of indoor soccer business, etc. For example,

Introduction of GoalCraft

Introducing GoalCraft, the premier soccer destination in bustling Los Angeles, California! Established in 2022, we’re not just about the game; we’re a community-driven space where soccer enthusiasts unite for thrilling matches, top-tier training, and the joy of scoring goals. GoalCraft is more than a soccer facility — it’s your ultimate go-to for the perfect fusion of sport, camaraderie, and excitement.

Market Opportunity

Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap in the industry.

Highlight the indoor soccer services you offer your clients. The USPs and differentiators you offer are always a plus.

For instance, you may include professional coaching staff as your unique value proposition.

Marketing & Sales Strategies

Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

Financial Highlights

Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

Call to Action

Summarize your executive summary section with a clear CTA, for example, inviting investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your business. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

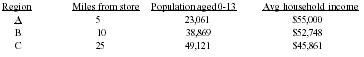

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers. For example,

Target market for GoalCraft

GoalCraft, located in the heart of Los Angeles, stands as a premier destination for soccer enthusiasts seeking a unique indoor soccer experience. As an innovative indoor soccer facility, GoalCraft offers a variety of programs and leagues tailored to different age groups and skill levels.

Founded with a vision to create a vibrant community hub for soccer lovers, GoalCraft is owned and operated by a dedicated team of individuals with a deep passion for the sport.

Our mission is to provide a dynamic and inclusive space where youth, adults, and fans can come together to enjoy the thrill of soccer. With a rich history of fostering teamwork, skill development, and a love for the game, GoalCraft is more than a soccer facility; it’s a home for the soccer community in Los Angeles.

Market size and growth potential

Describe your market size, growth potential, and whether you will target a niche or broader market.

For instance, in 2021, 10% of GenZ claim that they played soccer at least once. Thus, young people are engaging themselves in this sport resulting in the bright future of your business.

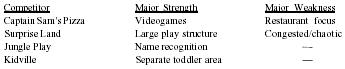

Competitive Analysis

Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your indoor soccer business from them. Point out how you have a competitive edge in the market.

The competitive edge can be personalized training, professional coaches, versatile field rentals, or anything else that attracts potential customers to your place.

Market Trends

Analyze emerging trends in the industry, such as technology disruptions, focus on containment, etc. Explain how your business will cope with all the trends.

For example, there is this growing demand for themed leagues between different teams, so how will you cope up with that?

Regulatory Environment

List regulations and licensing requirements that may affect your indoor soccer business, such as zoning laws, building regulations, licensing & permits, employee regulations, etc.

Here are a few tips for writing the market analysis section of your indoor soccer business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Indoor Soccer Facilities

This section should describe the specific facilities that will be offered to customers. To write this section should include the following:

Describe all the facilities

Mention the indoor soccer facilities your business will offer. This list may include facilities like:

- Playing fields

- Locker rooms

- Spectator areas

- Equipment rentals

- Training areas

- Fitness center

- Part room or event spaces

Quality measures

This section should explain how you maintain quality standards and consistently provide the highest quality service.

This may include field surface quality, facility cleanliness, safety standards, adequate ventilation, equipment maintenance, etc.

In short, this section of your indoor soccer plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP)

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

For example, diverse soccer programs, a prime location in Los Angeles, professional coaching staff, flexible booking options, etc.

Pricing Strategy

Describe your pricing strategy—how you plan to price your services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers to your indoor soccer business.

Marketing Strategies

Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, influencer marketing, and print marketing.

Sales Strategies

Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include multisession discounts, group discounts, referral programs, etc.

Customer Retention

Describe your customer retention strategies and how you plan to execute them. For instance, introducing loyalty programs, birthday offers, festival offers, etc.

Overall, this section of your indoor soccer business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your indoor soccer business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

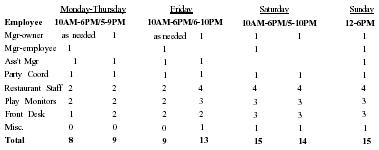

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here is an example,

Operational process for GoalCraft

The operational process of GoalCraft, our indoor soccer business, is designed to provide a seamless and enjoyable experience for everyone. Starting with facility management, we ensure our indoor soccer pitches are well-maintained, and meeting safety and quality standards.

Player registration is made easy through our user-friendly online platform, allowing individuals or teams to book time slots conveniently.

Upon arrival, our dedicated staff oversees the check-in process, ensuring all players have the required equipment and are aware of safety protocols.

The games are officiated by trained referees, adding a professional touch to the experience. We offer flexibility in scheduling, allowing players to reserve slots for regular matches, leagues, or tournaments.

Our operational process extends beyond the field to provide a comprehensive soccer experience, making GoalCraft the go-to destination for indoor soccer enthusiasts.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your indoor soccer business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO

Mention the founders and CEO of your indoor soccer business, and describe their roles and responsibilities in successfully running the business.

Key managers

Introduce your management and key team members, and explain their roles and responsibilities.

Compensation Plan

Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

Advisors/Consultants

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your indoor soccer business, highlighting how you have the perfect team to succeed.

8. Financial Plan

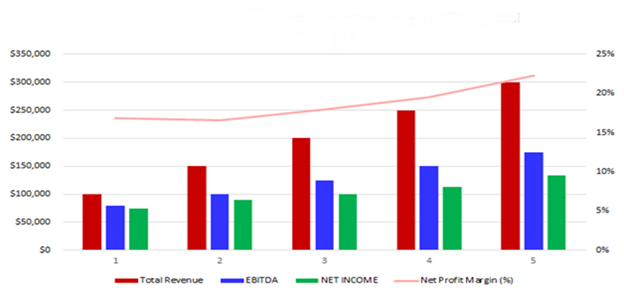

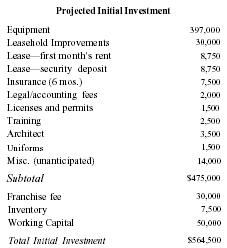

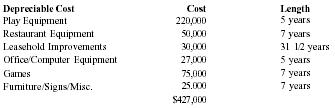

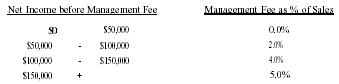

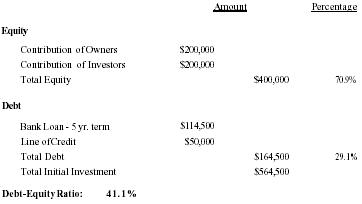

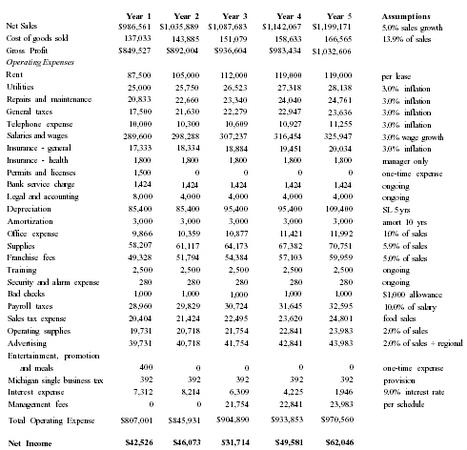

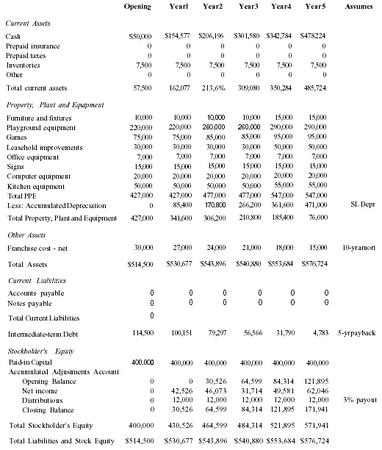

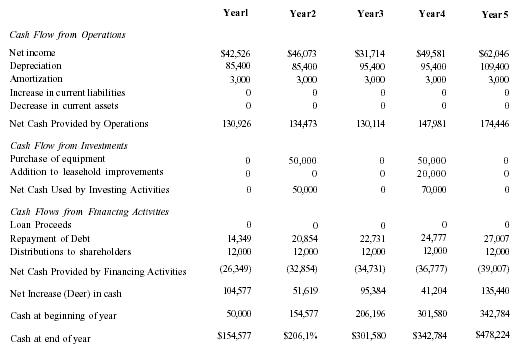

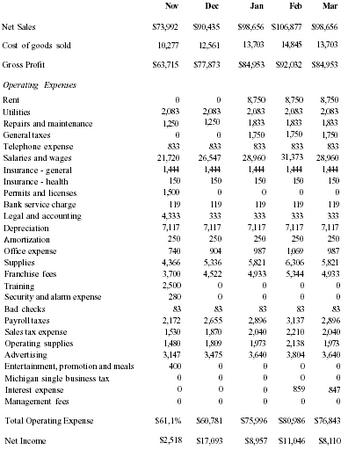

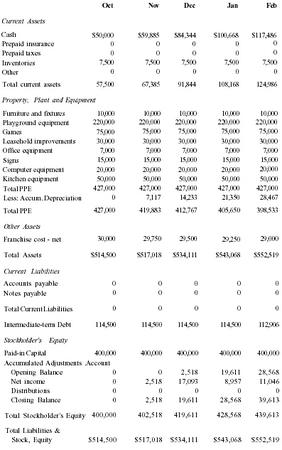

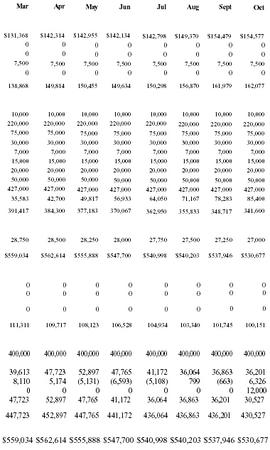

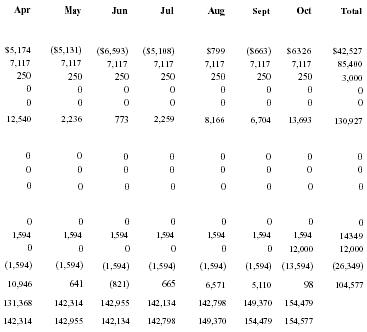

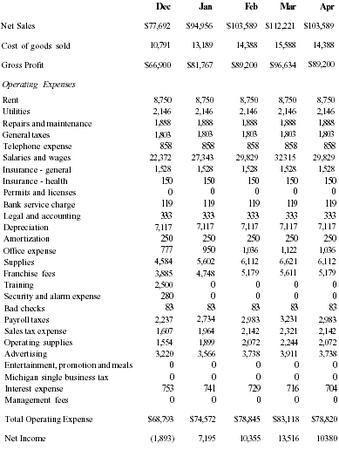

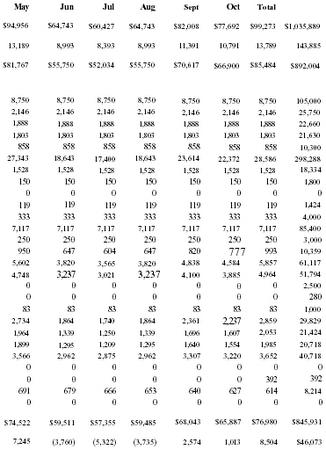

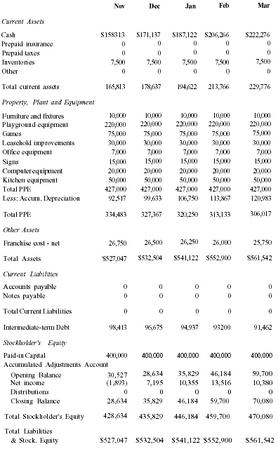

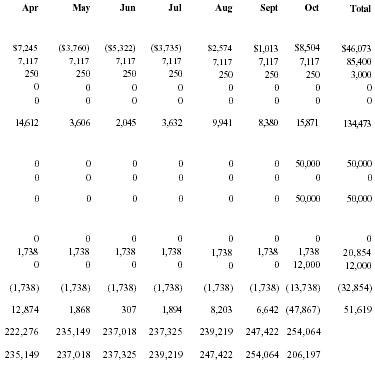

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement

Describe the projected revenue, operational, and service costs in your projected profit and loss statement. Make sure to include your business’s expected net profit or loss.

Cash flow statement

The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

Balance Sheet

Create a projected balance sheet documenting your indoor soccer business’s assets, liabilities, and equity.

Break-even point

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing Needs

Calculate costs associated with starting an indoor soccer business, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your indoor soccer business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample indoor soccer business plan will provide an idea for writing a successful indoor soccer plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our indoor soccer business plan pdf .

Related Posts

Sports Complex Business Plan

Baseball Batting Cage Business Plan

How to Craft Business Plan

Bowling Alley Business Plan

Play Cafe Business Plan

Pool Hall Business Plan

Frequently Asked Questions

Where to find business plan writers for your indoor soccer business.

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your indoor soccer business plan and outline your vision as you have in mind.

What is the easiest way to write your indoor soccer business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any indoor soccer business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our easy-to-use business plan software .

How detailed should the financial projections be in my indoor soccer business plan?

The level of detail of the financial projections of your indoor soccer business may vary considering various business aspects like direct and indirect competition, pricing, and operational efficiency. However, your financial projections must be comprehensive enough to demonstrate a complete view of your financial performance.

Generally, the statements included in a business plan offer financial projections for at least the first three or five years of business operations.

What key components should an indoor soccer business plan include?

The following are the key components your indoor soccer business plan must include:

- Executive summary

- Business Overview

- Market Analysis

- Products and services

- Sales and marketing strategies

- Operations plan

- Management team

- Financial plan

Can a good indoor soccer business plan help me secure funding?

Indeed. A well-crafted indoor soccer business plan will help your investors better understand your business domain, market trends, strategies, business financials, and growth potential—helping them make better financial decisions.

So, if you have a profitable and investable business, a comprehensive business plan can help you secure your business funding.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to Start an Indoor Soccer Facility Business

By: Author Tony Martins Ajaero

Home » Business ideas » Sports Industry

Do you want to start an indoor soccer facility? If YES, here is a complete guide to starting an indoor soccer facility business with NO money and no experience plus a sample indoor soccer facility business plan template.

If you are looking for a business to establish as a sports enthusiast, you should think towards building an indoor soccer facility. Starting an indoor soccer facility in an area that has loads of soccer lovers but few open fields can be very lucrative.

Soccer is a global sport and people who love the game will always look for ways to play the game much more than watching people play it. Building an indoor soccer facility can be expensive but you can be rest assured that you will make your money within a few years of launching your indoor soccer facility.

Suggested for You

- How Much Does It Cost to Build an Ice Hockey Skating Rink?

- How to Start a Basketball Training Business

- 50 Best Business Name ideas for Sports Podcast

- How Much Does It Cost to Start a Sporting Goods Store?

- How to Start a Boxing Gym With No Money

The fact that you are going to secure a facility big enough to contain a normal soccer pitch, spectator’s seats, changing room and parking means that you must truly be prepared for this business. If your indoor soccer facility is of high quality and it is located close to hotels and tourist sites, you will attract people including local and international soccer clubs that are in your city to play soccer matches.

No doubt, you should have an interest in soccer and also relationships with soccer teams in your area if indeed you want to do pretty well in this line of business. You should be able to convince parents and school managements to make use of your indoor soccer facility for their wards.

So, if you are serious about starting your own indoor soccer facility business, all you need do is to read this article and you will be well equipped.

Steps to Starting an Indoor Soccer Facility Business

1. understand the industry.

The Indoor Sports Facilities Management industry that the indoor soccer facility business falls under is indeed an active industry; players in the industry are basically involved in running indoor or outdoor sports and physical recreation venues, grounds and facilities et al.

It is important to state that the industry does not include businesses such as health centers, fitness centers or gyms et al. The industry is driven by increasing consumer spending on sports events and higher participation rates in organized sports especially at community levels.

The industry experienced steady growth in the last five years due to steadily rising consumer expenditure on recreation and culture, and growing spectator sport participation.

Despite the fact that the overall sport participation is currently at the same level as it was in the last five years, participation in amateur sports peaked in 2012 and 2013 which boosted revenue for operators of local, community and grassroots facilities.

Government investment in large-scale sports projects is a key source of revenue for industry participants and major redevelopment have also contributed to revenue growth over the last five years.

The Indoor Sports Facilities Management industry is indeed a very large industry and pretty much thriving in all parts of the world especially in developed countries such as United States of America, Canada, United Kingdom, Germany, Australia and Italy et al.

Statistics has it that in the united states of America alone, there are about 1,579 licensed and registered sports and recreation facilities including those who are into franchising responsible for employing about 14,644 employees and the industry rakes in a whooping sum of $1bn annually with an annual growth rate projected at 1.2 percent.

No establishment can boast of having a lion share of the available market in this industry. The Indoor Sports Facilities Management industry will continue to blossom because children and sports lovers will not relent in looking for a secured facility to play sports.

Despite the fact that the industry seems capital intensive, aspiring entrepreneurs who intend opening their own indoor soccer facilities can still get support from government and also access loans from financial institutions.

Some of the factors that encourage entrepreneurs to start their own indoor soccer facility business could be that the business is a thriving business and the business is highly regulated and with high starting barrier, hence it is open to only serious minded entrepreneurs.

Over and above, starting a sport and recreation facility business in the United States of America can be a bit stressful, it requires enough cash to acquire land large enough to accommodate the sport complex and also cash to equip the facility to meet the standard expected by potential users of the sports complex.

2. Conduct Market Research and Feasibility Studies

- Demographics and Psychographics

The demographic and psychographic composition of those who patronize indoor soccer facilities cut across organizations and individuals.

Schools, football clubs and individuals who don’t have where to play soccer or any indoor games would always source for indoor sports facilities around them hence the demographic composition for an indoor soccer facility is all encompassing.

The truth is that when it comes to playing or watching soccer games, there is indeed a wide range of available customers; every adult and children, both male and female are potential clients.

So, if you are thinking of starting an indoor soccer facility business, then you should make your target demographics all encompassing. It should include individuals, schools, soccer teams, corporate organizations, community associations, religious organizations and tourists within the location where your indoor soccer facility is located.

3. Decide Which Niche to Concentrate On

It is important to state that there is no niche area in this line of business. This is so because indoor soccer facility is a niche in the Indoor Sports Facilities Management industry.

Basically, indoor soccer facilities are facilities where soccer players and lovers go to either play soccer or watch people play soccer. Usually, people pick up membership and also renew their membership annually or as stated by the management of the indoor soccer facility.

The Level of Competition in the Industry

The competition that exists in the indoor soccer facility line of business goes beyond competition amongst indoor soccer facilities within your location, but also among every player in the Indoor Sports Facilities Management industry that also provide facilities for people to play soccer in and around your location. So, it will be right to say that the competition in the indoor soccer facility line of business is tough.

The truth is that no matter the level of competition in an industry, if you have done your due diligence and you brand and promote your services or business properly, you will always make headway in the industry. Just ensure that you provide a highly secured and safe indoor soccer facility for your clients and you know how to attract and reach out to your target market.

4. Know Your Major Competitors in the Industry

It is a known fact that in every industry, there are always brands that perform better or are better regarded by customers and the general public than the others.

Some of these brands are those that have been in the industry for a long time, while others are best known for how they conduct their businesses and the results they have achieved over the years. These are some of the leading indoor soccer facilities in the United States of America and in the globe;

- Soccer Fever

- Sportsplex USA Santee

- Americas Got Soccer

- Good Sports USA

- Pittsburgh Indoor Sports Arena

- Indoor Soccer Center – Bubble Ball Soccer & Knockerball – Los Angeles

- Soccer Centers/Dutch Total Soccer

- Ultimate Soccer Arenas

- Indoor Soccer Zone

- Soccer Planet USA

- Danvers Indoor Sports

- Universal Sports Academy

- Timpanogos Indoor Soccer

- Victory Sports Complex

- Fieldhouse USA-Winter Youth Basketball & Soccer

- We Play Indoor Soccer Complex

- LA Galaxy Soccer Center

- SocrLabs – Indoor soccer development center for explosive speed & agility for elite soccer players

- Glenn Warner Soccer Facility

Economic Analysis

If you are looking towards successfully launching a business and maximizing profits, then you need to ensure that you get your economic and cost analysis right and try as much as possible to adopt best practices in the industry you choose to build a business in.

Indoor soccer facility business is not a Green business in the United States and it is indeed a competitive business, as a matter of fact; you will come across several indoor soccer facilities when you go out there sourcing for a facility where you can play soccer or watch people play soccer.

So, if you are mapping out your economic and cost analysis , you should carry out thorough market survey and costing of the required amount needed to rent a big facility that is large enough to contain a full – sized soccer pitch including spectator’s stand, changing room and enough parking space.

You would have to lay out a synthetic pitch, provide chairs for your spectators, changing room, first aid stand, fire alarm system, multimedia equipment, public address system, commentary box, et al and also the running cost to successfully run the business.

Over and above, if you are considering starting an indoor soccer facility, then your concern should not be limited to the cost of registering the business, securing the required license, leasing and equipping the facility, but also on branding and on how to build a robust clientele base.

5. Decide Whether to Buy a Franchise or Start from Scratch

If you are looking towards starting an indoor soccer facility, you would have to start from the very scratch because you can hardly get the franchise of an indoor soccer facility to buy. It is a business that is open to all and sundry.

Besides starting an indoor soccer facility from the scratch is straightforward and not as complex as people think. With an indoor soccer facility, you should just try as much as possible to get the right business license and permits, secure a standard and secured facility, the required equipment and supply, build business relationship with key stakeholders and then leverage on every marketing tool within your disposal especially the internet to market your services.

Please note that most of the big and successful indoor soccer facilities around started from the scratch and they were able to build a solid business brand. It takes dedication, hard work and determination to achieve business success.

6. Know the Possible Threats and Challenges You Will Face

If you decide to start your own indoor soccer facility today, one of the major challenges you are likely going to face is the presence of well – established indoor soccer facilities and every player in the Indoor Sports Facilities Management industry who also provide facilities for people to play soccer in and around your location. The only way to avoid this challenge is to create your own market.

Some other challenges and threats that you are likely going to face are economic downturn and unfavorable government policies. There is nothing you can do as regards these threats and challenges other than to stay positive that things will work well for you.

7. Choose the Most Suitable Legal Entity (LLC, C Corp, S Corp)

Generally, you have the options of either choosing a general partnership, limited liability company, or even a sole proprietorship for an indoor soccer facility. Ordinarily, sole proprietorship should have been the ideal business structure for a small – scale indoor soccer facility especially if you are just starting out with a moderate start – up capital and covering just a small community.

But if your intention is to grow the business and offer your services to customers all across your state and throughout the United States of America, then choosing sole proprietor is not an option for you. Limited Liability Company, LLC or even general partnership will cut it for you.

Setting up an LLC protects you from personal liability. If anything goes wrong in the business, it is only the money that you invested into the limited liability company that will be at risk. It is not so for sole proprietorships and general partnerships.

Limited liability companies are simpler and more flexible to operate and you don’t need a board of directors, shareholder meetings and other managerial formalities.

These are some of the factors you should consider before choosing a legal entity for your indoor soccer facility; limitation of personal liability, ease of transferability, admission of new owners, investors’ expectation and of course taxes.

If you take your time to critically study the various legal entities to use for your indoor soccer facility with the ability to offer your services to customers all across the city and state that you operate, you will agree that limited liability company; an LLC is most suitable.

You can start this type of business as limited liability company (LLC) and in future convert it to a ‘C’ corporation or an ‘S’ corporation especially when you have the plans of going public.

8. Choose a Catchy Business Name

As it relates choosing a name for your business, you should be creative because whatever name you choose for your business will go a long way to create a perception of what the business represents.

Usually it is the norm for people to follow the trend in the industry they intend operating from when naming their business. If you are considering starting your own indoor soccer facility, here are some catchy names that you can choose from;

- Winning Team® Indoor Soccer Center, LLC

- Gunners™ Indoor Soccer Arena, LLC

- Sir Thomas McLaren Memorial© Indoor Soccer Center, Inc.

- Larry Star® Indoor Soccer Center, Inc.

- Little Rock Community© Indoor Soccer Center, Inc.

- Saint Paul Community® Indoor Soccer Center, Inc.

- Baton Rouge Community™ Indoor Soccer Facility, Inc.

- Front Views© Indoor Soccer Facility, LLC

- Williams Uriel & Sons® Indoor Soccer Facility, Inc.

- Des Moines Community® Indoor Soccer Arena, Inc.

9. Discuss with an Agent to Know the Best Insurance Policies for You

In the United States and in most countries of the world, you can’t operate a business without having some of the basic insurance policy covers that are required by the industry you want to operate from. So, it is important to create a budget for insurance and perhaps consult an insurance broker to guide you in choosing the best and most appropriate insurance policies for your indoor soccer facility.

Here are some of the basic insurance covers that you should consider purchasing if you want to start your own indoor soccer facility in the United States of America;

- General insurance

- Health insurance

- Liability insurance

- Risk insurance

- Workers Compensation

- Overhead expense disability insurance

- Business owner’s policy group insurance

- Payment protection insurance

10. Protect your Intellectual Property With Trademark, Copyrights, Patents

If you are considering starting your own indoor soccer facility, usually you may not have any need to file for intellectual property protection / trademark. This is so because the nature of the business makes it possible for you to successful run the business without having any cause to challenge anybody in court for illegally making use of your company’s intellectual properties.

But if you just want to protect your company’s logo and other documents or software that are unique to you or even jingles and media production concepts, then you can go ahead to file for intellectual property protection. If you want to register your trademark, you are expected to begin the process by filing an application with the USPTO.

11. Get the Necessary Professional Certification

Aside from your ability to give instructions as it relates to playing soccer and how to effectively officiate soccer games and manage such facility, professional certification is one of the main reasons why some indoor soccer facility owners stand out.

If you want to make an impact in the Indoor Sports Facilities Management industry, you should work towards acquiring all the needed certifications in your area of specialization. You are strongly encouraged to pursue professional certifications; it will go a long way to show your commitment towards the business.

Certification validates your competency and shows that you are highly skilled, committed to your career, and up-to-date in this competitive market. These are some of the certifications you can work towards achieving if you want to run your own indoor soccer facility;

- Certification from the International Facility Management Association (IFMA)

- Relevant Degree or Diploma in Physical and Health Education

Please note that you can successfully run and manage an indoor soccer facility in the United States and in most countries of the world without acquiring professional certifications as long as you have adequate experience cum background in the Indoor Sports Facilities Management industry.

12. Get the Necessary Legal Documents You Need to Operate

The essence of having the necessary documentation in place before launching a business in the United States of America cannot be overemphasized. It is a fact that you cannot successfully run any business in the United States without the proper documentations.

If you do, it won’t be too long before the long hand of the law catches up with you. These are some of the basic legal documents that you are expected to have in place if you want to legally run your own indoor soccer facility in the United States of America;

- Certificate of Incorporation

- Business License

- Tax Payer’s ID / Tax Identification Number

- Business Plan

- Non – disclosure Agreement

- Employee Handbook

- Employment Agreement (offer letters)

- Operating Agreement for LLCs

- Insurance Policy

- Online Terms of Use (since you operate online)

- Online Privacy Policy Document (basically for online payment portal)

- Company Bylaws

- Memorandum of Understanding (MoU)

- Contract Document

- Franchise or Trademark License (optional)

13. Raise the Needed Startup Capital

Starting an indoor soccer facility can be capital intensive even if you choose to start on a small scale. If you choose to start the business on a large scale with a standard and well – equipped facility; a big facility that is large enough to contain a full – sized soccer pitch including spectator’s stand, changing room and enough parking space, then you would need to go source for fund to finance the business because it is expensive to start a standard large – scale indoor soccer facility.

No doubt when it comes to financing a business, one of the first things and perhaps the major factors that you should consider is to write a good business plan .

If you have a good and workable business plan document in place, you may not have to labor yourself before convincing your bank, investors and your friends to invest in your business. Here are some of the options you can explore when sourcing for start – up capital for your indoor soccer facility;

- Raising money from personal savings and sale of personal stocks and properties

- Raising money from investors and business partners

- Sell of shares to interested investors

- Applying for loan from your bank/banks

- Pitching your business idea and applying for business grants and seed funding from donor organizations and angel investors

- Source for soft loans from your family members and your friends

14. Choose a Suitable Location for your Business

Even though you can afford to open an indoor soccer facility in any part of the United States of America, when it comes to choosing a location for your indoor soccer facility, the rule of thumb is that you should be guided by the access to a facility large enough to accommodate your indoor soccer facility.

Of course, if you are able to start your indoor soccer facility in the right location for such business, you won’t struggle to make headway with the business.

It cannot be overemphasized that the location you chose to start your indoor soccer facility is key to the success of the business, hence entrepreneurs are willing to rent or lease a facility in a visible location; a location where the demography consists of people and organizations who love soccer and with the required purchasing power and lifestyle.

Most importantly, before choosing a location for your indoor soccer facility, ensure that you first conduct a thorough feasibility studies and market survey. The possibility of you coming across a similar business that just closed shop in the location you want to open yours can’t be ruled out.

This is why it is very important to gather as much facts and figures before choosing a location to set – up your own indoor soccer facility. These are some of the key factors that you should consider before choosing a location for your indoor soccer facility;

- The demography of the location as it relates to the number of individuals who love soccer, schools, soccer teams, corporate organizations, community associations, religious organizations and tourists

- The demand for the services of indoor soccer facilities related businesses in the location

- The purchasing power of the residents of the location

- Accessibility of the location

- The number of indoor soccer facilities and related facilities where people can play soccer

- The local laws and regulations in the community/state

- Traffic, parking and security et al

15. Hire Employees for your Technical and Manpower Needs

On the average, there are no special technology/equipment needed to run this type of business. All you would need to run an indoor soccer facility are a big facility that is large enough to contain a full – sized soccer pitch including spectator’s stand, changing room and enough parking space.

You would have to lay a synthetic pitch, chairs for your spectators, changing room, first aid stand, fire alarm system, multimedia equipment, public address system, commentary box, et al, inventory-management software and other relevant software applications.

So also, you will definitely need computers, internet facility, telephone, fax machine and office furniture (chairs, tables, and shelves) amongst others and all these can be gotten as fairly used.

As regards leasing or outright purchase of an indoor soccer facility, the choice is dependent on your financial standing, but the truth is that to be on the safe side, it is advisable to start off with a short – term rent/lease while test running the business in the location.

If things work out as planned, then you go on a long – term lease or outright purchase of the property but if not, then move on and source for other ideal location / facility for such business.

When it comes to hiring employees for a standard indoor soccer facility, you should make plans to hire a competent Chief Executive Officer/Manager (you can occupy this role), Facility Manager/Admin and Human Resources Manager, Soccer Games Instructors and Trainers, Sales and Marketing Officer, Accounting Clerk, and Front Desk Officer.

On the average, you will need a minimum of 5 to 10 key staff members to run a medium – scale but standard indoor soccer facility.

The Service Delivery Process of the Business

Over and above, the business services process as it relates to indoor soccer facilities is straightforward and in most cases clearly defined.

It is the duty of professional soccer game instructors and trainers to help their clients acquire skills and knowledge of the game. They help their clients develop capability, capacity, productivity and performance as it relates to soccer game.

Usually, the facility is open to individuals and groups who would want to play soccer or practice for soccer competition. It is the practice for people to pick up membership if they want to freely make use of an indoor soccer facility.

In some cases, an indoor soccer facility organizes soccer competitions amongst local teams; such competitions could be for a full soccer team or a five aside soccer competition. They ensure that they source for sponsorship from relevant organizations in and around the community where the soccer facility is located.

Aside from membership and gate fee, this is another good avenue to generate money. You might likely not breakeven with your indoor soccer facility within the first year of starting the business because of the capital you invested in the business, but if you continue to attract more clients, you can be rest assured to start making profits after three years of starting the business.

The bottom line is to ensure that the fee you charge for people to make use your facility is affordable and flexible. It is important to state that an indoor soccer facility may decide to improvise or adopt any business process and structure that will guarantee them efficiency and flexibility; the above stated indoor soccer facility business process is not cast on stone.

16. Write a Marketing Plan Packed with ideas & Strategies

Right from the onset, you should be able to develop a good strategy to market your indoor soccer facility. Part of what you need to do to promote your indoor soccer facility is to organize soccer events in your community for teenagers and then invite stakeholders in the community to partner with you or to be your guests.

can market your indoor soccer facility to schools, soccer teams, and private organizations that would want to organize soccer events. It will pay you to ensure that you advertise your indoor soccer facility in the yellow pages in your community; you can as well print and distribute handbills and posters in areas where you can access your target market.

Generally, running a business requires that you should be proactive when it comes to marketing your goods or services. If you choose to launch an indoor soccer facility, then you must go all out to employ strategies that will help you attract customers or else you will likely struggle with the business because there are well – known brands determining the market direction for the Indoor Sports Facilities Management industry.

Businesses these days are aware of the power of the internet which is why they will do all they can to maximize the internet to market their services. In other words, a larger percentage of your marketing effort should be directed to internet users. Here are some of the platforms we will utilize to market your indoor facility;

- Introduce your indoor soccer facility by sending introductory letters alongside your brochure to households, schools, soccer teams, corporate organizations, community associations, religious organizations, hotels and resort centers within and outside the location where your indoor soccer facility is located

- Open your indoor sport facility with a party so as to capture the attention of residents who are your first targets

- Advertise on the internet, on blogs and forums, and also on social media like Twitter, Facebook, LinkedIn to get your message across, so that those on the social media or those who read blogs will know where to go when they need to pick up membership in an indoor soccer facility within your location

- Advertise your indoor soccer facility in relevant sports magazines, newspapers, TV and radio stations

- List your indoor soccer facility on yellow pages ads (local directories)

- Create different membership packages for different category of clients in order to work with their budgets and still make your indoor soccer facility available to them

- Leverage on the internet to promote your indoor soccer facility

- Join local chambers of commerce around you with the main aim of networking and marketing your services; you are likely going to get referrals from such networks

- Engage the services of marketing executives and business developers to carry out direct marketing

17. Develop Strategies to Boost Brand Awareness and Create a Corporate Identity

If your intention of starting an indoor soccer facility is to grow the business beyond the city where you are going to be operating from to become a national and international brand, then you must be ready to spend money on the promotion and advertisement of your brand.

No matter the industry you belong to, the truth is that the market is dynamic and it requires consistent brand awareness and brand boosting cum promotion to continue to appeal to your target market. Here are the platforms you can leverage on to boost your brand awareness and create corporate identity for your indoor soccer facility;

- Place adverts on both print (newspapers and sports magazines) and electronic media platforms

- Sponsor relevant community based events

- Leverage on the internet and social media platforms like Instagram, Facebook, Twitter, YouTube, Google + et al to promote your indoor soccer facility

- Install your billboards in strategic locations all around your city or state

- Distribute your fliers and handbills in target areas

- Contact households, schools, soccer teams, corporate organizations, community associations, religious organizations, hotels and resort centers within the location where your indoor soccer facility is located informing them about your business and the services you offer

- List your indoor soccer facility in local directories/yellow pages

- Advertise your indoor soccer center facility in your official website and employ strategies that will help you pull traffic to the site.

- Position your Flexi Banners at strategic positions in the location where your indoor soccer facility is located

- Ensure that all your staff members wear your branded shirts and all your vehicles and vans are well branded with your company logo et al.

18. Create a Suppliers/Distribution Network

In order to successfully run an indoor soccer facility, it is also advisable that you enter into business partnership with key stakeholders in and around the location where your indoor soccer facility is located. You can partner with organizations such as schools, soccer teams, corporate organizations, community associations, religious organizations, hotels and resort centers et al.

They are your biggest market and you can win them over by offering them incentives and rebates especially when they register as a team.

Free Download

Indoor Soccer Facility Business Plan Template

Download this free indoor soccer facility business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

Simple Business Plan Outline

How to Create a Business Plan Presentation

Industry Business Planning Guides

10 Qualities of a Good Business Plan

How to Start a Business With No Money

How to Write a Business Plan for Investors

How to Write a Business Plan

Business Plan Template

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

ZenBusinessPlans

Home » Sample Business Plans » Sports

How to Write an Indoor Soccer Facility Business Plan [Sample Template]

Are you about starting an indoor soccer facility? If YES, here is a complete sample indoor soccer facility business plan template & feasibility report you can use for FREE . Even though soccer might not be as popular in America as it is in Europe and other parts of the world, it is still has a huge number of lovers in America which is why the indoor soccer facility has turned out to be a lucrative business for any entrepreneur venturing into it.

However, as easy as it might look to run this kind of business, several factors are required if the business is to become a success. Factors such as huge capital, unique services as well as effective marketing strategies are very elemental in ensuring the business becomes a success.

A Sample Indoor Soccer Facility Business Plan Template

1. industry overview.

The indoor soccer facility market has no dominant companies that have a huge share of the industry. This industry however marked less revenue during the economic downturn as customers curtailed their spending to recreational spending to save and spend for things and activities that were deemed basic.

However, demand was not kept down for long as it surged especially when customers saw the benefits that could be accrued from engaging in soccer and therefore termed the expenses towards this industry as a necessary health and social expense. In addition to this, the positive economic outlook has seen an increase in sports participation, and this is also expected to drive the revenue growth.

The overall indoor sports market has annual revenue of $900 million with a positive projected growth pegged at 3.5% from 2011 to 2016. Also, there are over 3,800 indoor sports facilities all over the united states of America that has employed more than 22,000 people. This industry is expected to continue expanding even till the year 2022 and beyond.

Entrepreneurs looking to start this business will find that the barriers for new businesses are moderate with leasing not being considered a concern as much as employee wages. Most of the employees hired are usually of low skills or unskilled with the exception of the management staff and trainers.

Even though barriers in this industry are considered moderate, entry into urban markets is a bit more difficult as there are more restrictive zoning laws, shortage of real estate and the required lengthy permit processes for businesses of this nature. Also, those that would be constructing would require more permits as against those that intended to lease.

The number of participants in indoor soccer within the United States of America from the period of 2006 to 2014, and from the ages of 6 upwards has continually been on the increase as the figure has been pegged at 4.53 million. The United States Indoor Sport Association based in Virginia has pegged the number of indoor sports complexes excluding that of colleges, YMCAs and other non-profit indoor sports facilities as between 900 and 1,000.

Overall, the demand for indoor soccer facility is still on the increase especially as such facilities provide a cover against the weather during harsh weather periods.

2. Executive Summary

Soccer Star Premier Indoor Facility is a world class facility that is strategically located in Glenn Dale – Maryland and that intends to cater to all our various customers old and young, domestic and corporate, local and foreign. Our facility is aimed at those who intend to practice their soccer skills as well as pros who intend to undergo trainings.

We will use real grass for our indoor soccer facility so as to give our players a real experience of the soccer pitch. Our indoor soccer facility will also be fully air-conditioned as to ensure that all our customers enjoy convenience when using our facility.

Our vision as a company is to ensure that soccer and indeed sports lovers see us as the go-to place for trainings and soccer practice. We also aim to be able to provide services to those who are not soccer inclined, and also be amongst the top three indoor soccer facilities in the United States of America.

Our aim at achieving our vision and objectives has led us to develop strategies that will not only see us attaining this vision but will also ensure that we compete favorably against our competitors and stand out as well. Some of these strategies will be contained in the unique services we intend to offer our various customers.

Because we know the importance of having a solid business structure, we intend to ensure that we hire only competent employees that understand the business as well as our core values and are willing to work to see the business attain its goals and objectives.

Our employees will not only be well trained and undergo continuous training, they will have their performances continually appraised so that the hardworking ones might be adequately rewarded with incentives or promotion. We also intend to pay our employees very well as can be obtained in similar indoor soccer facilities start-up here in Maryland.

Our customers are very important to us and so we would ensure that we take good care of our customers and also offer excellent service to them in such a way as not to only retain them but to also attract new ones to patronize our services.

Mr. Steve McDermott who is a Chief Executive Officer is a successful entrepreneur and business person and has all the necessary expertise and business experience necessary to ensure that Soccer Star Premier Indoor Facility attain its intended goals and objectives.

3. Our Products and Services

Soccer Star Premier Indoor Facility intends to be able to provide soccer lovers a place where they can come to train and have fun, while also offering other our various customers other services as well from our very strategic location in Maryland.

Our intention to not stick to just one service stems from that fact that we know that we are able to offer more than we can without compromising in our standards. We intend to allow our facility be used by pros and coaches for training sessions.

We also intend to use our facility for non-soccer events all in an aim to boost the revenue of our company. All that we intend to offer will be legally permissible under the laws of the United States of America. Therefore some of the products and services we intend to offer are;

- Membership fees

- Ticket fees from audience

- Training sessions

- Rental rates

- Summer camps

- Soccer parties

- Sales of soccer equipment and paraphernalia

- Non-soccer events (meetings, shows, children parties, concerts)

4. Our Mission and Vision Statement

- Our vision is to be referred to as a world class and state of the art indoor facility and preferred go-to facility for soccer lovers of all skill levels in Glenn Dale – Maryland and amongst the top three indoor soccer facility in the United States of America.

- Our mission is to ensure that we provide an indoor soccer facility that is not only regarded as a state of the art facility for athletes of all ages and levels but also one that is regarded as environmentally safe for everyone.

Our Business Structure

Soccer Star Premier Indoor Facility is a world class facility that intends to offer soccer lovers and players a place to practice their craft. We intend to ensure that we maintain a certain standard and this can only be done if we get it right from the beginning by having a solid business structure that would project our core aim and objectives as a world class brand to our customers and stakeholders.

It is to this effect that we intend to hire only the best employees to run the various positions and handle the various tasks that we would assign to them.

We intend to first ensure that our management staff understand our core values as a business and also has the necessary experience needed to bring Soccer Star to be not only the preferred indoor soccer facility go-to in Glenn Dale – Maryland but to also become amongst the top three indoor soccer facility in the United States of America.

We intend to ensure that our employees – no matter the level and role = are adequately trained in customer care so that they are able to project this to all our customers, thereby communicating our brand and what we stand for effectively to the customers. The business structure we therefore intend to build at Soccer Star Premier Indoor Facility is;

Chief Executive Officer

Facility Manager

Human Resource Manager

Administrative Manager

Marketing Executives

Customer Service Executives

Technicians

Security Guard

5. Job Roles and Responsibilities

- Responsible for drafting strategies that would affect the direction of the organization

- Meets and promotes Soccer Star Premier Indoor Facility to high powered clients on behalf of the organization

- Sources for funds on behalf of the organization

- In charge of ensuring that the facility is kept up to standard always

- In charge of scheduling events and uses of the facilities

- Ensures that light repairs are carried out on the facilities

- In charge of sourcing, interviewing and hiring competent employees on behalf of the company

- Conducts orientation for new staff to ensure that they are settled in

- Carries out periodic performance appraisals on staff members

- In charge of ensuring that all administrative functions in the company are without hitches

- Ensures that the policies and goals of the organization are implemented by all staff

- Works with the CEO to review strategies that affect the organization

- In charge of conducting marketing survey and researches that will be used to identify target market on behalf of the company

- Engages in direct marketing by approaching potential clients on behalf of the company

- Reviews marketing strategies with an aim to modify or change them

- In charge of preparing all the financial reports and statements on behalf of the company

- Ensures that the company’s books are accurately reconciled with that of the bank at the end of the month

- Drafts and ensures that budget is effectively implemented

- In charge of directly attending to customers in terms of inquiries and complaints and ensures that all issues that crop up are adequately dealt with

- Maintains an accurate database of customers and sees to it that they are regularly updated

- Updates on information as regards industry and Soccer Star Premier Indoor Facility so as to be able to answer customers’ accurately

- In charge of all the electronics that are used within the indoor soccer facility

- Carries out light repairs on faulty electronics

- Ensures that new electronics are of good quality

- Ensures that the premises is secured during and after use

- Monitors the surveillance cameras to ensure that adequate security is maintained

- Patrols the premises at night to ensure that security is maintained

- In charge of picking and delivering stock to the company

- Ensures that the right amount of stock which correlates with the paperwork is onloaded and offloaded

- Carries out light repairs on the vehicle

- Ensures that the premises is kept clean and fresh always

- Cleans up the premises after each batch of trainings, games and events

- Cleans up the convenience for employee and customer use

6. SWOT Analysis

The indoor soccer facility business is one that might be a capital intensive business but is also rewarding to any entrepreneur who intend to go into this business. However, to be sure that we have our business concept well defined, we intend to hire a business consultant to help us look through and tell us if it will be worthwhile to go into this business, so we do not waste money and time.

Our business expert who is not only reputable but also experienced in this field made use of the SWOT (Strengths, Weakness, Opportunities and Threats) professional analysis to enable us know how our business was likely to perform in Glenn Dale – Maryland.

Below is the result of the SWOT analysis that was conducted on behalf of Soccer Star Premier Indoor Facility business;

Our strengths are also numerous and lies in the fact that we would be providing training sessions in our facility. Our indoor soccer facility will bring more benefits to the local community, and also capture the attention of the sporting bodies, and other corporate bodies who are likely to hire our venue.

Also, our employees are competent and well trained to handle all the various events that would likely be held at our facility. Finally, the experience of our owner, Mr. Steve McDermott in handling businesses and seeing them come to success will bring forth a positive bearing on our indoor soccer facility business.

The weaknesses we are likely to face stem from the fact that there are cheaper available options in the area. Also, we would need to look for and maintain a high number of casual and volunteer staff. Other weaknesses we are likely to face are pressure from our private investors and from the bank in order to reach our targets and pay back our loans, finally we would need to ensure that the premises are always kept fresh and clean.

- Opportunities

There are plenty of opportunities that abound to us in this business as well as the area where we are located in. The opportunities include the fact that we are an opportunity for a thriving youth center; we are also near schools which makes us the perfect go-to place for students after school.

The threats that we are likely to face while starting or running this business is the fact that it would take a while for our membership numbers to grow, thereby slowing down our revenue. Also, we would need to be able to handle the likelihood of another competitor starting up an indoor soccer facility in Glenn Dale – Maryland.

We are also likely to face threats from the existing soccer field that is quite close to us. Threats are a part of every business, and we are confident that we would be able to combat these threats once they arise.

7. MARKET ANALYSIS

- Market Trends

Due to the fact that there are less soccer fields than there should be, the demand for indoor soccer facilities have risen tremendously, and while America might not be a soccer loving country, there are still sufficient people who love the sport and play the sport to keep demand relatively stable.

This means that anyone intending to go into the indoor soccer facility business will need to not only have the capital but also be innovative enough to attract customers both soccer loving and non-soccer loving to the facility, by offering unique services that will attract the target market.

Another trend with the indoor facility business is that fact that owners of such businesses are also introducing other games into the business in order to stand out from competitors, and gain a huge share of the market. Also, owners of these facilities are also trying to make the facilities lively for those who do not like sports of any kind, as a means of retaining a huge share of the market.

Lastly, the internet and technology cannot be overlooked as a huge trend in the sense that more people are now more online than ever, which means that businesses have to double more efforts in marketing to those online. This can be done through the creation of an interactive and user friendly websites as well as engaging social media platforms.

Also, creating an app is another trend that could draw more customers and also allow them know more about the game whilst also being kept abreast of the different new services and products offered by the company.

8. Our Target Market

The target market for an indoor soccer facility might look pretty straightforward to a layman or an unserious business person, but because we take our business seriously, we know that the target market for our indoor soccer facility cannot be restricted to just those who love soccer or games in general, as there are other people that might need to use our indoor soccer facility as well.

It is to this effect that we conducted a market research that would help us have an idea of what target market we should draft our marketing strategies for, what they were likely expecting from us and what we should expect from them.

The results obtained from our market research have shown us that we would be offering our product and services to the following group of people;

- Young adults

- Organization

- Corporate businesses

- Concert promoters

- Sports coaches

- Government officials

Our competitive advantage

Soccer Star Premier Indoor Facility’s aim is to become a world class indoor soccer facility that is preferred amongst others here in Glenn Dale – Maryland. Our intention is also to become the top three indoor soccer facility her in the United States of America.

To achieve this, we would need to ensure that we perfect several strategies in order to allow us not only achieve our vision and objectives but to ensure that we are able to favorably compete and have an edge over our competitors.

We intend to build facility that is conducive and air conditioned and also in a location that makes it very easy for people in and outside Maryland to access. We aim to offer several other services too as this will attract more customers to our business, thereby increasing our revenue and giving us a better opportunity to have an edge over our competitors.

Having a sound business structure is very important and as such, we would not compromise on ensuring that we source for and recruit only employees who are not only competent but who have the necessary experience and expertise needed to make our company its intended goals and objectives.

Another competitive advantage we have as an edge over our competitors is the fact that our employees have been trained to offer excellent customer service to all our customers regardless of their position in the company and this is because we understand that without our customers, we likely might not be in business.

Lastly, because we know that happy employees make for greater productivity for a business, we would ensure that our employees are well paid and that they undergo continuous training that will enhance their skills and increase their productivity in the workplace.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Soccer Star Premier Indoor Facility is a fully air conditioned state of the art facility of 45,000 square feet that intends to offer indoor soccer facility to soccer lovers here in Glenn Dale – Maryland. We however intend to generate revenue from not only one source but from different sources in our aim to attract as many customers as we can to our indoor soccer facility.

Therefore the sources of income we intend to generate at Soccer Star Indoor Facility are:

10. Sales Forecast

Soccer and in general sports is always an activity that people would want to participate in either as participants or the audience.

Knowing this we are therefore strategically located in Glenn Dale – Maryland to ensure that we are easily accessible to our target market, and that we would also be able to generate enough revenue to cover our start-up capital by the third year of operation.

However to help us come up with an accurate sales projections that will better help us draft the right strategies to generate enough revenue for the company, we hired a reputable and experienced business consultant here in Maryland, who gathered data and used information from similar start-ups in and around Maryland to come up with a reliable sales forecast.

Stated below are the sales projections for a three year period that was conducted on behalf of Soccer Star Premier Indoor Facility here in Glenn Dale – Maryland;

- First Fiscal Year-: $950,000

- Second Fiscal Year-: $1,900,000

- Third Fiscal Year- : $3,800,000

N/B : The sales projection above was done based on current data and information obtained from the industry. This therefore means that should the information change within the stated period of time, this would likely affect have an impact on the above sales projection causing either an increase or decrease in the above figures.

- Marketing Strategy and Sales Strategy

An effective marketing starts with having a well-informed strategy. However, developing a marketing strategy that connects with your target market takes a lot of time and effort, because a good marketing strategy should help define your vision, mission and business objectives.

The importance of a marketing strategy is such that it can affect the way your whole business is run, and as such would require intense planning which can be done in collaboration with a marketing team.

It is to this effect that we hired a marketing consultant who would not only help us conduct the necessary marketing survey that will bring forth effective marketing strategies but will also work with our marketing team to ensure that each strategy drafted can be modified without affecting the overall goals and objectives of the company.

Our marketing efforts will also incorporate technology as we will use our website and social media platforms such as Facebook, Twitter and YouTube to aggressively market our products and services. We intend to motivate our marketing team and continually benchmark any success achieved.

We intend for our marketing goals to align with our overall business and corporate goals so that the company would achieve a uniform direction. Therefore, below are the strategies that Soccer Star intends to adopt in marketing our indoor soccer facility business;

- Approach schools, organizations and public agencies here in Maryland to introduce our indoor soccer facility

- Throw a soccer themed huge party when we finally open our doors to the public in such a way that will generate interest

- Ensure that our indoor soccer facility business is listed in offline directories

- Engage in direct marketing via our marketing team

- Ensure that we advertise our indoor soccer facility business in local newspapers, magazines and on radio and television stations

- Make use of social media platforms, blogs and forums to market our indoor soccer facility business.

11. Publicity and Advertising Strategy

Ensuring that we have great publicity for our business is a must; because it is only through a thorough promotion of our business can we not only increase our revenue generation but also ably compete with other indoor soccer facilities here in Glenn Dale – Maryland as well as in the whole of the United States of America.

We would need to explore all the means of promoting Soccer Star Premier Indoor Facility and so to this effect we have hire a publicity consultant here in Maryland who is not only reputable but also knowledgeable about the business and the industry in general.

Our publicity consultant has come up with different strategies that will not only promote our business and communicate our brand but also generate revenue for us thereby improving our bottom line. Therefore the strategies which we intend to adopt for our indoor soccer facility business are;

- Engaging in as well as sponsoring relevant community programs

- Placing adverts in local newspapers and relevant magazines as well as on radio and television stations

- Installing attractive billboards in strategic locations all around Maryland

- Making good use of our website as well as social media platforms like Facebook, Twitter, Instagram and YouTube to promote our indoor soccer facility

- Ensuring that our fliers are pasted in strategic locations while are handbills are distributed as well in schools

- Carrying out our publicity campaigns in schools and sponsoring soccer events

12. Our Pricing Strategy

Deciding what rates we would charge our members as well as visitors who intend to use our indoor soccer facility is not something that would require too much of a detailed strategy. This is because there are standard rates for some of the services we intend to offer to our customers. We may however need to review our prices for those who would want to use our facilities for other purposes and events other than soccer.

However, because we would want to attract as many customers as we can to out indoor soccer facility business, we intend to offer discounts in ticket prices and membership fees for the first two months of operations. This we believe will afford more customers to be able to use our facility and still stick around once the rates are normalized due to our superior services that would be offered here.

We however wish to assure our stakeholders that we would not run at a loss during the two months low rates we intend to offer to our customers.

- Payment Options

Due to the various services we intend to offer at Soccer Star Premier Indoor Facility, we have come up with different payment options guaranteed to suit the diverse preferences of our various customers. Therefore the payment options we intend to make available for our various customers are:

- Cash payment

- Payment via credit card

- Payment via Point of Sale (POS) Machine

- Payment via check

- Payment via online payment portal

13. Startup Expenditure (Budget)