Online Grocery Shopping Adoption: A Systematic Literature Review

Ieee account.

- Change Username/Password

- Update Address

Purchase Details

- Payment Options

- Order History

- View Purchased Documents

Profile Information

- Communications Preferences

- Profession and Education

- Technical Interests

- US & Canada: +1 800 678 4333

- Worldwide: +1 732 981 0060

- Contact & Support

- About IEEE Xplore

- Accessibility

- Terms of Use

- Nondiscrimination Policy

- Privacy & Opting Out of Cookies

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity. © Copyright 2024 IEEE - All rights reserved. Use of this web site signifies your agreement to the terms and conditions.

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

An equity-oriented systematic review of online grocery shopping among low-income populations: implications for policy and research

Angela c b trude.

1 Department of Pediatrics, University of Maryland School of Medicine, Baltimore, Maryland, USA

Caitlin M Lowery

2 Department of Nutrition, University of North Carolina at Chapel Hill, Chapel Hill, North Carolina, USA

Shahmir H Ali

3 Department of Social and Behavioral Sciences, New York University School of Global Public Health, New York, New York, USA

Gabriela M Vedovato

4 Institute of Health and Society, Federal University of Sao Paulo, Santos, Sao Paulo, Brazil

Associated Data

Online grocery services are an emerging component of the food system with the potential to address disparities in access to healthy food.

We assessed the barriers and facilitators of equitable access to healthy foods in the online grocery environment, and the psychosocial, purchasing, and dietary behaviors related to its use among low-income, diverse populations.

Data Sources

Four electronic databases were searched to identify relevant literature; 16 studies were identified.

Barriers to equitable access to healthy food included cost and limited availability of online grocery services in food deserts and rural areas. The expansion of online grocery services and the ability to use nutrition assistance benefits online were equity-promoting factors. Perceived low control over food selection was a psychosocial factor that discouraged online grocery use, whereas convenience and lower perceived stress were facilitators. Findings were mixed regarding healthfulness of foods purchased online. Although few studies assessed diet, healthy food consumption was associated with online grocery use.

Researchers should assess the impact of online grocery shopping on low-income families’ food purchases and diet.

Systematic Review Registration

PROSPERO registration no . CRD: 42021240277

INTRODUCTION

In the United States, noncommunicable diseases such as obesity, type 2 diabetes, and cardiovascular diseases disproportionately affect diverse racial and ethnic groups, including Black, Hispanic, and Native American populations. 1 , 2 Disparate access to and availability of healthy food, combined with economic inequality, have contributed to health disparities in diverse communities in the United States, 3–5 which are more likely to be under-resourced, underserved, and at high risk for poor diet, food insecurity, and obesity. 6

Of note, efforts to address income-related disparities in access to healthy food have focused on improving the availability of healthy foods at local food vendors, including the Healthy Food Financing Initiatives, 7 Staple Foods Ordinances, 8 and the Healthy Corner Stores Initiatives. 9 However, structural barriers to food access remain because households in low-income communities may have limited access to reliable transportation and live disproportionately far from sources of healthy foods, compared with predominantly White and high-income neighborhoods. 10 In response, there has been an emerging focus on interventions aimed at addressing physical barriers to healthy food by bringing food to people, such as the green cart program in New York City 11 and a virtual supermarket in Baltimore, Maryland. 12 Nevertheless, there is a pressing need to expand and refine these approaches.

Online grocery shopping is a new and growing component of the food system that addresses barriers related to physical access to healthy foods. In 2018, 34% of US shoppers reported purchasing groceries online at least sometimes. 13 Of those, 30% were from low-income households (< $40 000 annual household income) and 64% were parents with children. 13 In the United States, from January 2020 to January 2021, online retail sales increased by 39%. 14 Specifically for families living in low-income areas who may lack access to grocery stores and personal vehicles, 15 online grocery services have the potential to address barriers related to transportation. However, many underserved families have not been able to realize the benefits of online grocery shopping, due to disparities in technology access 16 and digital literacy, 17 limited delivery services, 18 delivery and membership fees, and minimum order policies. 19

The 2014 Farm Bill mandated a pilot program with food retailers to test the feasibility of allowing the use of Supplemental Nutrition Assistance Program (SNAP) benefits as payment for online grocery orders. 18 The ability to use the SNAP Electronic Benefits Transfer card online may address barriers related to physical access to healthy foods and the card provides an alternative payment method for purchasing groceries online for low-income households. Additionally, during the COVID-19 pandemic, online purchasing became a safe, socially distanced option to purchase groceries, which motivated the rapid expansion of the SNAP Online Purchasing Pilot (OPP) to 48 states and additional retailers. 20 The SNAP OPP expansion marked an important change in online grocery access among low-income populations in the United States: redemption of government benefits online increased to 67 times the amount of prepandemic redemptions. 21 Although increasing use of online grocery services has the potential to improve access to healthy foods, understanding barriers to its use and possible unintended consequences of online grocery shopping on food purchases and dietary habits among low-income and diverse populations is critical for the development of health- and equity-promoting policies.

In a previous scoping review, Jilcott Pitts et al 22 described barriers and motivators to online grocery shopping. However, few studies included in the review focused on diverse populations from low-income backgrounds, which are at greatest risk for health and social disparities. Furthermore, the Jilcott Pitts et al 22 review was conducted before the implementation of the OPP and the COVID-19 pandemic. Since then, online grocery shopping has become more accessible and additional studies on the topic have been published. In the present systematic review, we aimed to synthesize the existing evidence of the perceptions about and impact of online grocery shopping on low-income and diverse populations and to identify opportunities to inform policy and promote equity in the online food retail space. Therefore, using an equity lens, we examined online grocery shopping behaviors among diverse, low-income populations and aimed to answer the following questions: (1) What are the barriers to and enablers of equitable access to healthy food in online grocery services? (2) What are the psychosocial, purchasing, and dietary behaviors associated with online grocery service use among families from low-income backgrounds?

This systematic review was registered with the Prospective Register for Systematic Reviews CRD: 42021240277.

Data sources

Four electronic databases were searched for applicable articles: MEDLINE, PsycINFO, Web of Science, and Business Source Ultimate, spanning the public health, behavioral sciences, and business literature. The systematic search took place from September 2020 through October 2021 and included relevant studies on online grocery shopping targeting low-income families and diverse ethnic or racial populations.

Search strategies

A search strategy was developed on the basis of Medical Subject Heading terms and information from key articles identified a priori. 23–25 Boolean operators were used to combine keywords and Medical Subject Heading terms for a more focused search. Three topics were developed on the basis of the study research question: online, grocery shopping, and low income. Search terms included: online, internet, grocery shopping, grocery purchasing, food, produce, food assistance, Supplemental Nutrition Assistance Program, Women Infants Children Program, low-income, racial, and ethnic diverse groups. The complete search strategy is described in Appendix 1 in the Supporting Information online.

Eligibility criteria

This review included interventional or observational studies implemented in real-world settings, that used quantitative and/or qualitative methods, and were conducted among low-income populations experiencing food insecurity, participating in supplemental nutrition assistance programs (SNAP or the Special Supplemental Nutrition Program for Women, Infants, and Children [WIC]), and/or racially or ethnically diverse groups. Outcomes of interest included psychosocial, purchasing, and dietary behaviors, or equity promotion of access to healthy food in the online grocery environment. No restrictions were placed on geographic location of studies or the date of publication. Systematic, scoping, or narrative reviews; conference or dissertation abstracts; and general information articles were excluded. Study selection was completed using Covidence (Melbourne, Victoria Australia), following the methods outlined in the Preferred Reporting Items for Systematic Reviews and Meta-Analyses guidelines. The eligibility criteria are described in Table 1 , using the PI(E)COS (population, intervention/exposure, comparison, outcome, and study design) criteria.

PICOS criteria for inclusion and exclusion of studies

Abbreviations: SNAP, Supplemental Nutrition Assistance Program; WIC, Special Supplemental Nutrition Program for Women, Infants, and Children.

Data extraction

Title, abstract, and full-text extraction were conducted by 2 research assistants independently using Covidence with a random agreement of 90%. Two reviewers (C.M.L., G.M.V.) analyzed each study independently. A third author (A.C.B.T.) was available to resolve disagreements. Backward reference searching of included articles was conducted to identify additional papers.

Critical assessment

The methodological quality of each paper was assessed using JBI’s critical appraisal tools, 26 which have published checklists for most study types (eg, analytical cross-sectional studies, randomized control trials, qualitative research). No checklist was available from JBI for mixed-methods studies and case studies. Thus, the Mixed Methods Appraisal Tool was used for critical appraisal of studies using mixed-methods designs 27 and the Center for Evidence-Based Management’s critical appraisal of a case study was used for case studies. 28

The checklists included questions to determine the extent to which a study addressed the possibility of bias in its design, conduct, and analysis, and required the following responses for the JBI tool: “yes,” “no,” “unclear,” “not applicable”; and, for the Mixed Methods Appraisal Tool and Center for Evidence-Based Management’s too, “yes,” “no,” “can’t tell.” The answer “yes” means that a given appraisal criterion for satisfactory quality was met. The quality threshold was set by the research team a priori, in which studies scoring between 60% and 100% were deemed of moderate to high quality and were included in the review.

Evidence synthesis

An adjudication approach informed by the theory of planned behavior (TPB) 29 and health equity framework 30 was used for evidence synthesis. Domains for extraction included methods and findings related to the 4 pillars of the health equity framework (ie, reduce deterrents, build community capacity, improve social and economic resources, and increase healthy options) and psychosocial constructs of the theory of planned behavior (ie, perceived barriers, attitudes, social norms, and perceived behavioral control), in addition to purchasing and diet assessment and outcomes. Additional data extracted included target population, model or theory, study aims, target foods and food groups, diet and purchase measures, sample size, study design, methods, results, equity considerations, quality of research, study limitations, and study recommendations. Meta-analysis was not possible owing to the heterogeneity of the study designs, exposures or interventions, and outcomes.

Search results

The search criteria returned a total of 1612 citations, which dropped to 466 citations after the removal of duplicates ( Figure 1 ). Two additional articles were included from the bibliographic review. All titles and abstracts were screened and a total of 43 full-text articles were reviewed for eligibility. Overall, 16 articles were included for evidence synthesis, including 4 cross-sectional studies, 18 , 31–33 5 mixed-methods studies, 12 , 19 , 24 , 34 , 35 3 qualitative studies, 36–38 2 case studies, 39 , 40 and 2 experimental studies. 23 , 41 All studies were of moderate to high quality after the critical assessment.

Preferred Reporting Items for Systematic Reviews and Meta-Analyses flow diagram of studies included in the systematic review. 61 Abbreviations: SNAP, Supplemental Nutrition Assistance Program; WIC, Special Supplemental Nutrition Program for Women, Infants, and Children

Study characteristics

Studies included in this review were published between 2013 and 2021, all conducted in the United States ( Table 2 ). Nine studies targeted food insecure or low-income, racially diverse populations, 12 , 19 , 23 , 31 , 32 , 35 , 39–41 5 were conducted among individuals participating in nutrition assistance programs (SNAP or WIC), 24 , 34 , 36–38 1 targeted regions with low access to healthy foods or food retailers, 18 and 1 examined US states participating in the SNAP OPP expansion. 33 For most studies (n = 11), whether the work was informed by a theoretical model or theory was not reported. Of those articles in which that information was provided (n = 5), 2 studies were based on the theory of planned behavior, 24 , 37 2 on the nudge theory, 23 , 41 and in 1 study, the authors used a service ecosystem framework. 19 Sample size varied across the studies depending on whether the study was targeted at the regional (eg, 1250 census tracts in the OPP states), 18 retailer (eg, 2 retailers 34 or 1 retailer 39 ), or individual (eg, ranging from 7 36 to 206 adults 19 ) levels. Among the studies reporting a nutrition outcome (n = 9), 3 focused on specific healthy and unhealthy food and beverage items, 12 , 23 , 24 1 looked at fruits and vegetables only, 35 and 5 assessed all grocery items purchased. 19 , 23 , 31 , 34 , 41

Description of the studies included in the systematic review by domains of the equity-oriented framework to promote healthy food purchasing and diet in online grocery environments targeted at underserved populations

Abbreviations : EBT, electronic benefits transfer; F&V, fruits and vegetables; HEI, Healthy Eating Index; NYC, New York City; OPP, Online Purchasing Pilot; SNAP, Supplemental Nutrition Assistance Program; Rx, prescription; WIC, Special Supplemental Nutrition Program for Women, Infants, and Children; USDA, US Department of Agriculture.

Online grocery services

The types of online grocery ordering services varied across the studies. The majority of the studies (n = 9) were conducted in the context of a grocery store or food retailer that accepted orders online and offered grocery pick-up and/or delivery. 18 , 19 , 23 , 24 , 36–40 Of those, 3 studies were implemented with a pick-up option at a community location, 12 , 19 , 35 3 with store pick-up only, 32 , 34 , 36 and 3 offered pick-up or delivery services. 23 , 31 , 39 Six studies examined topics related to the SNAP OPP. 18 , 19 , 24 , 39 , 40

Barriers and enablers of equitable access to healthy foods via online grocery services

Figure 2 summarizes the findings from this systematic review. This is an equity-oriented framework focused on health promotion in online grocery services building on the 4 domains of Kumanyika’s framework for equity in obesity prevention (ie, reduce deterrents, build community capacity, social and economic resources, and increase healthy options). 30 Central to the present conceptual framework are the 4 equity domains that act as pillars for policy or systems interventions and community capacity to ensure that the online food environment supports equitable healthy food availability and access. In turn, the online food environment influences and is influenced by an individual’s perception of barriers, attitudes, and intentions to purchase groceries online, in line with the theory of planned behavior. 29

Equity-oriented framework to promote healthy food purchasing and diet in online grocery environments targeted at underserved populations . Abbreviations: SNAP, Supplemental Nutrition Assistance Program; WIC, Special Supplemental Nutrition Program for Women, Infants, and Children

Equity in online grocery shopping refers to the differential impact of policies and retailers’ practices (ie, disparate cost of grocery items online vs in the store 19 ) on online grocery shopping uptake and healthy food selection among rural and urban populations, 18 and groups of different ages, incomes, and races or ethnicities. 39 Five studies included in this review highlighted the importance of reducing deterrents to online grocery shopping to increase uptake and improve the quality of foods purchased by low-income, racially or ethnically diverse populations. 18 , 19 , 32 , 39 , 40 Disparate cost of equivalent grocery items at online retailers was reported in 1 study, in comparison with brick-and-mortar vendors in low-income neighborhoods in the United Sates 40 In another study, authors motivated by the SNAP OPP found that grocery ordering and delivery services were rarely available in rural food deserts. 18 Researchers who examined receipts from 2 retailers serving primarily low-income communities in Maine found that shoppers with lower incomes and who enrolled in a nutrition assistance program were less likely to shop online than their higher-income counterparts. 32 Authors of an analytical essay examining neighborhood variation in SNAP enrollment in NYC highlighted the importance of considering environmental and social barriers to SNAP participation, as well as disparate grocery costs and declining purchasing power of SNAP benefits. 19 In terms of uptake of online grocery services, a case study in Alabama reported that older, rural populations were not using SNAP online as frequently as younger shoppers were, and that online SNAP purchases made up a smaller share of all online purchases (20%) compared with in-store purchases (40%). 39 Four qualitative studies with SNAP and WIC families explored reasons for the low use of online grocery programs and all highlighted the perceived lack of control over grocery selection, especially of fresh produce and meats, as one of the major barriers, in addition to cost. 24 , 36–38

Study authors recommended future programs and interventions build community capacity to order groceries online by improving customer control in the online environment, 24 and by improving state communication about the SNAP OPP to include nutrition and health information. 33 Two interventions intended to build community capacity to select healthier foods online tested nudges, using a healthy default shopping cart. 23 , 41 The pilot program was promising; participants in the intervention arm selected more healthier items than those in the control condition (receiving nutrition education materials). 23 , 41 Although provision of health and nutrition information is lacking in state communications about the online policy, 33 Coffino et al 23 , 41 empirically demonstrated that consumers benefit from a virtual food environment that is supportive of healthy food choices. Additionally, 3 studies recommended that the US Department of Agriculture allow the use of WIC benefits online as a means to increase social and economic resources to improve food access for disadvantaged groups. 34 , 36 , 38

In 3 studies, researchers pilot tested approaches to increase healthy options in the online grocery environment among socially disadvantaged communities. 12 , 31 , 35 One intervention (Virtual Supermarket Program) facilitated grocery delivery and SNAP payment at community hubs for low-income, urban older adults. 12 Participants placed and received grocery orders in designated hubs, including public libraries, schools, and senior housing centers. 12 The Internet Grocery Service tested the feasibility of a grocery delivery service to increase access to healthy foods in a low-income urban food desert by providing vouchers for groceries and delivery fees. 31 Last, an intervention in rural communities tested the feasibility of an online produce market where participants redeemed Fruit and Vegetable Prescription Program vouchers and picked up orders from a community site. 35

Psychosocial factors of the TPB related to online grocery shopping

In 10 studies included in this review, authors assessed psychosocial behaviors related to online grocery shopping. In most of these studies (n = 6), psychosocial domains were assessed qualitatively 19 , 24 , 34 , 36–38 ; quantitative survey items were used in the other 4 studies. 12 , 23 , 31 , 35

Overall, attitudes toward online shopping varied by study. Some authors reported a lack of interest in or low perceived benefit of online shopping. 24 , 37 In others, participants expressed interest in online grocery services, although most seemed to view it as an occasional convenience rather than a complete substitute for in-store shopping. 31 , 36 , 38 For example, after the Internet Grocery Service intervention, 54.5% of participants responded that they would use the service 1–6 times per year, 24.3% said they would use it at least monthly, and only 9.1% reported they would never use it in the future. 31

Concerns about control over food selection emerged as a major barrier to uptake of online grocery services, 19 , 24 , 36 , 37 particularly with regard to the quality of fresh items 37 and the potential for losing money on unsatisfactory purchases. 19 Perceived high cost of online grocery shopping was another barrier to its uptake by underserved families. The potential for losing money on unsatisfactory purchases was a main concern 19 , 36 , 37 ; participants cited fees and the relative paucity of deals online compared with in-store purchases as disincentives for online shopping. 36 Additionally, the lack of social interaction during grocery shopping was another reported deterrent to online shopping, although some participants felt that the benefits offset the loss. 38

Online grocery ordering was perceived to be less stressful than in-store grocery shopping among women with children enrolled in WIC, because it eliminated the need for transportation and addressed the challenges of shopping in a store with children. 38 Although the evidence supporting reduced impulse purchases when shopping online is mixed, 23 , 36 participants also felt that online grocery shopping might result in fewer impulse buys of both unhealthy (eg, sweet snacks and chips) and sometimes healthy (eg, fruits) foods, compared with in-store purchases. 38 Additional benefits of online grocery services identified by participants included saving time and delivery of heavy or bulky items. 19

Both perceived behavioral control and normative beliefs positively influenced use of online grocery shopping during an intervention that was co-created by residents of a low-income housing community and researchers. 19 Participants reported that ordering groceries online was easier than they had anticipated, 19 a finding that was echoed by mothers participating in WIC in another study. 36 Participants also noted that although they were generally wary of online shopping, they trusted residents of their community and were willing to try the online grocery pilot. 19

Purchasing and diet behaviors related to online grocery shopping

Of the 11 studies in which researchers assessed online food purchasing behaviors, 12 , 19 , 23 , 24 , 31 , 32 , 34–36 , 39 , 41 consumer purchasing data were collected from itemized store receipts in 7 studies, 19 , 24 , 31 , 32 , 34 , 36 , 41 from online data monitoring in 1 study, 35 from stakeholder interviews and document review from a retailer in 1 study, 39 and were self-reported in 2 studies, 12 , 35

In 2 studies, authors quantitatively assessed impulse buying during online grocery shopping. 23 , 36 Participants in 1 study purchased more on impulse online than they did when shopping in a store, although not all impulse buys were unhealthy. 36 In another study, Coffino et al 23 did not find a difference in impulse purchases between consumers who received nutrition education (the control condition) and those who received the healthy-default shopping-cart intervention. 23

The impact of online grocery shopping on nutritional quality of purchases was mixed. A healthy-default shopping cart increased the healthfulness of food purchases and decreased fat, sodium, and cholesterol from foods purchased, 23 and led to greater overall nutritional quality. 41 The most frequently purchased items in the Internet Grocery Service pilot were animal proteins, fruits and vegetables, and caloric beverages. 31 SNAP Electronic Benefits Transfer online purchases were higher in sweet and salty snacks and lower in fruits than non-SNAP online purchases in a study 24 and had greater nutritional quality. In other studies, researchers were limited in their ability to quantitatively assess the impact of online grocery services on the healthfulness of food purchases, because of low uptake of online grocery shopping. For example, after a planned randomized controlled trial of online ordering failed due to low uptake, Martinez et al 24 pivoted to a mixed-methods design to understand low use of online services. Cohen et al 19 did not report on the food types that were purchased but noted that online orders made up a small percentage of dollars spent on food (∼3.1%).

Dietary intake was assessed in only 2 studies. In 1 study, authors assessed changes in daily servings of fruits and vegetables among children and their caregivers in response to an online food-market program. 35 The online program resulted in improved self-reported fruit and vegetable intake among children and decreased household food insecurity. 35 No dietary change was observed among caregivers. In the other study, self-reported intake data related to the Virtual Supermarket Program were collected. 12 Customers reported purchasing more fruits and vegetables and sugary drinks since the start of the virtual program. They also attributed eating more healthfully and perceived having greater access to affordable foods due to the program. 12

In this systematic review, we examined the potential for online grocery services to promote equitable access to healthy foods among underserved populations. Interest in the topic has grown substantially over the past few years, as evidenced by the burgeoning research and the SNAP OPP. Perceived barriers and TPB constructs associated with online grocery shopping identified in this systematic review focusing on low-income, diverse populations are consistent with findings from a previous scoping review. 22 Furthermore, the perspective afforded by the equity-oriented framework advanced the understanding of the main deterrents to online grocery shopping among low-income and diverse populations (eg, perceived high cost) and identified promising strategies to build on community capacity (eg, improving customer control over online purchases), opportunities to improve social and economic resources for food access (eg, allowing use of government benefits online), and strategies to increase healthy grocery options (eg, expanding online ordering and delivery services of healthy food vendors).

This investigation identified low availability of online grocery services in rural communities, perceived high costs, and perceived low behavioral control over food selection as important barriers to uptake of online grocery services by disadvantaged groups, which could widen inequities in access to healthy food. The ability to pay for groceries online with SNAP benefits was a motivator, 24 , 31 making an important case for future research on the expansion of the US Department of Agriculture online purchase pilot to other programs such as WIC and the Fruit and Vegetable Prescription Program. Pilot interventions tested strategies to improve healthy-food purchasing that could be incorporated into existing online grocery programs, including the default healthy-food online grocery cart, 23 , 41 and centralized delivery locations like public libraries and schools in hard-to-reach communities. 12 , 19 , 35 More research is needed on the feasibility of the use of other government benefits (eg, WIC, Fruit and Vegetable Prescription Program) in the online grocery environment as a means to improve social and economic resources for access to healthy food. Furthermore, researchers should examine and compare the cost-effectiveness of creating hubs for community grocery pick-up, expanding delivery buffers, and/or creating more supermarkets, with a particular focus on rural communities. Partnership with community centers and retailers to create community hubs and reduce delivery fees may be a promising strategy to improve access to healthy foods.

The few studies in which online food purchasing and dietary behaviors were examined among underserved populations reported potential increases in both unhealthier and healthier food choices. Fewer impulse purchases and reduced influence of children on parents’ buying behavior (ie, “pester power”) in the online environment are possible mechanisms to explain fewer unhealthy food purchases online. These findings are also supported by the multiple selves theory, because ordering groceries for delivery in the (relatively) distant future predicts more healthy food choices (should-self), whereas immediate purchases predicts more unhealthier food choices (want-self). 42 , 43 Conversely, the potential for targeted online marketing and personalized recommendations have been hypothesized to increase unhealthy food purchases online. 44 , 45 Although, to our knowledge, the effect of online marketing on unhealthy food selection has not been empirically tested, various simulated, online-grocery, experimental studies have demonstrated that targeted online marketing of healthy foods and provision of nutrition information were promising strategies to improve quality of foods purchased in the virtual environment. 46–48 On the other hand, there is plausible evidence that food and beverage industries have disproportionately targeted marketing of unhealthy items to low-income, diverse populations across media markets. 49–51 Authors of a 2013 study, which was outside the scope of the present review, assessed the nutritional quality of Bronx, NY–based grocery store circulars available online and found that >84% of products advertised on the first page were processed. 52 The influence of grocery store circulars on online grocery purchases merits further investigation. Given the potential for personalized online marketing of unhealthy foods in the online grocery environment, there is a need to better understand existing online marketing in the virtual grocery environment and to explore avenues for interventions to support selection of healthy foods online among underserved populations.

One mechanism that could explain greater purchases of healthy items online is through future episodic thinking, which is required for planning grocery shopping, 53 and aligns with the premise of the TPB to understand behavioral intentions. However, no study in this systematic review tested the influence of meal planning on online grocery purchases of healthy items. In 1 study included in the present review, authors held community cooking classes as part of an intervention to improve access to fruits and vegetables. 35 They reported an increase in fruit and vegetable consumption by children. 35 In a recent study among a sample of majority non-Hispanic White women in Maine, researchers reported that online purchases were associated with lower spending on sweet snacks and desserts compared with in-store purchases. 54 A potential explanation for the findings suggested by the authors included meal planning and the shopping lists built in to online grocery services. 55 Those authors also found that consumers spent more dollars per transaction online compared with in-store shopping. 54 Given that affordability of food is 1 of the main barriers to healthy diets among low-income populations 56 and that disparities in the cost of foods have been found between online and physical stores, 19 studies should be conducted to examine the financial impact of online purchases compared with in-store grocery purchases on low-income consumers’ spending. Most studies in which the influence of online grocery shopping on nutrition outcomes was evaluated relied on self-reported measures of purchase and diet. Therefore, the impact of online grocery shopping on supporting healthy eating practices should be further examined. Investigation of how the ability to use national food and nutrition assistance benefits online affects healthiness of food selection and dietary behaviors is another area that warrants more investigation.

Policy and research implications

Studies included in this review highlighted the importance of research to inform, develop, and evaluate policy and program efforts in the online grocery environment to promote the purchase and consumption of healthy foods among underserved populations. Findings from various studies underscored the need to make online grocery services more attractive to low-income groups through improving consumers’ perception of control over grocery selection 24 , 36–38 and addressing financial barriers by offering deals comparable to those in-store. 19 , 37

Environmental and social barriers to SNAP participation exist, especially for low-income populations in areas with a high cost of living. 40 In 6 studies, researchers explored perceptions and attitudes toward online grocery shopping among SNAP participants. Researchers identified barriers to online grocery services and suggested strategies to promote more equitable food access for low-income populations, including increased transparency and customer control, 24 competitive prices, 1-day delivery, SNAP Electronic Benefits Transfer online payment acceptance, 31 and use of hand-held devices to allow for payment at delivery, 12 some of which have already been included in the OPP expansion. Nonetheless, the low availability of grocery delivery service in the US Department of Agriculture–defined food deserts and rural areas is still a deterrent to equitable access to healthy foods. 18 , 39 It is crucial to maintain support for SNAP online post-pandemic and to expand online access to other food assistance programs, like WIC. 39 Zimmer et al 38 highlighted the potential benefits of online ordering to facilitate WIC food retail operations, and Jilcott Pitts et al 36 noted that the ability to use WIC online could help with linkage to nutrition education programs, improving access and food literacy for disadvantaged groups.

All but 2 studies 33 included in this systematic review collected data before the COVID-19 pandemic, which has affected the food system and families’ purchasing and dietary habits. 57–59 The pandemic also prompted the US Department of Agriculture OPP’s rapid expansion to most US states and the inclusion of additional authorized retailers, thus increasing access to online grocery services among underserved populations. 21 However, most studies included in this review were conducted prior to the roll out and expansion of the OPP when online grocery purchasing surged. 60 Therefore, interest in and uptake of online grocery shopping among low-income diverse populations presented in this systematic review are likely underestimated. Because of the increase in online grocery shopping uptake, social norms, attitudes, and barriers may have shifted, thus necessitating evaluations to examine changes among underserved populations due to the pandemic.

Limitations

This systematic review has some limitations. First, although information on online grocery shopping may be available in gray literature reports, websites, or other unexamined documents, we focused exclusively on peer-reviewed literature. The exclusive use of peer-reviewed literature helps ensure reasonable quality of the research reported. Second, the use of only peer-reviewed literature may lead to publication bias because studies with negative or null outcomes are less likely to be published. Third, the tools used to assess quality of study varied by study design and may not be comparable with each other, although all the tools are widely used and were selected to enhance comparability with other reviews. Fourth, studies included in this review varied methodologically in terms of study design, sample size, and locale. Only 2 studies had randomized controlled design; most studies had small and convenient sample sizes. Thus, findings should be interpreted with caution and may not be generalizable. Yet, the inclusive search strategy of a wide array of disciplines using both quantitative and qualitative designs is a strength of this review. Fifth, all studies included in this systematic review were conducted in the United States, despite the extensive literature on online grocery shopping in European countries. Given the focus of this study on low-income, diverse populations, the European-based studies did not meet the eligibility criteria for this review. More research examining online grocery shopping behaviors among underserved populations is needed outside of the United States. Last, given the variability in outcomes reported in the studies, it was not possible to conduct a meta-analysis to evaluate the pooled effect of online grocery shopping on health equity, healthy food purchasing, and diet among low-income, diverse populations.

CONCLUSIONS

Barriers to equitable access to healthy foods in online grocery services included higher cost and scarcity of delivery services in rural and food desert areas. The expansion of online grocery services and other grocery delivery programs paired with nutrition assistance programs were enablers of equitable access to food through online grocery shopping. Most studies included in this review assessed psychosocial factors associated with online grocery shopping uptake, which acted as deterrents to online grocery shopping (ie, lack of control, concerns around food selection, perceived high cost, lack of social interaction) or facilitators (ie, perception of less stress, less impulse buying, convenience, time-saving). Studies included in this review reported mixed findings related to healthiness of foods purchased online; in the few studies in which dietary behaviors were assessed, authors reported increases in consumption of healthy foods associated with online grocery uptake. Future research should examine the effects of online grocery shopping on purchasing and diet using validated, empirical measures, including itemized grocery receipts and food frequency questionnaires or multiple 24-hour dietary recalls. In light of the OPP expansion and emerging studies on the feasibility of accepting WIC online, more research is needed to test interventions to improve equitable access to healthy food via online grocery services and assess its impact on food purchases and dietary behaviors of low-income families.

Supplementary Material

Nuab122_supplementary_data, acknowledgements.

We thank Yunting Fu and Stephen Maher for their assistance with the search terms and search strategy. We thank Joy Lloyd-Montgomery and Meghan Sadler who conducted a first literature search.

Author contributions . A.C.B.T. designed the study and coordinated the literature search. A.C.B.T., C.M.L., and G.M.V. extracted and interpreted the data. All authors drafted and critically revised the manuscript, and approved the final version of the manuscript.

Funding . This work was supported by grant 77246 from Healthy Eating Research, a national program of the Robert Wood Johnson Foundation to A.C.B.T.

Declaration of interest . The authors have no relevant interests to declare.

Supporting Information

The following Supporting Information is available through the online version of this article at the publisher’s website.

Appendix S1 Systematic Review Search Strategies

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Online Grocery Shopping: An exploratory study of consumer decision making processes

Related Papers

International Journal for Research in Applied Science and Engineering Technology

Koyel sarkar

Patricia Harris

Conferencii

In the last decade online shopping has been a consumer behavior that has changed the usual patterns of buying behavior in the market. This paper aims to present a literature review on the differences between the consumer characteristics that tend to purchase online food products and those who are later innovators of this new form of shopping. In the countries of the European Union there is an increase of 17% of online purchases for food products with a doubled trend of these purchases for rural areas. In the US, online food sales are expected to keep up after the pandemic and it is expected to double by 2025. Nevertheless, more than a decade ago, there is still a large group of customers resisting this way of buying. On the contrary, some surveys show that situational factors, such as having a baby or developing health problems, are triggers for starting to buy groceries online and also once these situational factors are gone consumer discontinues this behavior. Consumers consider o...

Atithya: A Journal of Hospitality

Publishing India Group , Sunder Srinivasan

Online grocery shopping is a newly established e-commerce business. The report talks about the concept in general and how do you go about shopping groceries on the internet. It also explains the general preference, that is, amongst people who all prefer to shop groceries online. In addition, it also states the benefits and limitations of the said concept and how has it influenced so far. For this research, a questionnaire was drafted and passed around. The responses were then summarized and analyzed. The report also asserts that there are a few impacts of this e-commerce business. It has been observed that monetary saving, customer loyalty and cash free transactions are some of the major factors that are prominent amongst customers for online grocery shopping. In conclusion, online grocery services meet a number of consumer needs including providing products for niche markets or helping the time starved consumer shop for the mundane weekly groceries. With the advent of online grocery shopping services. There has been a big advantage for space people who are home-bound, handicap, sick or unwell or unable to move, who are able to utilize this service to the best. It is realized that the online shopping vendors are able to reach a vast area of customers where in the local supermarkets or markets have to be visited by people and people would not like to travel long distances for such kind of physical shopping.

International Journal of Retail & Distribution Management

Jonathan Reynolds

PurposeThe purpose of this paper is to analyse the online preference structures of consumers.Design/methodology/approachNovel choice‐based conjoint experiments are used and are administered online. A select group of high net worth online grocery shoppers are examined. Both qualitative and quantitative procedures are used to determine the most frequently cited attributes affecting online patronage.FindingsWhilst there is no single attribute on which a retailer could develop a competitive edge, a significant market advantage can be gained by being simultaneously “best in class” on the top four attributes.Practical implicationsThis research approach has significant practical application to a wide range of strategic marketing questions.Originality/valueThese findings give focus to the management task facing marketing executives in the UK multichannel grocery market. How these findings might be used within a marketing plan is illustrated.

Andre Barcelos , Renata Céli

Zona Sul was the first supermarket chain in Rio de Janeiro to provide online sales purchases services and it is the leader in its segment in the city. Therefore, it was chosen as the object of this study, which attempts to describe and analyze the decision-making process of consumers who use the Internet to shop for groceries. Twenty in-depth interviews were conducted with these consumers. The interviews were held at the moment they were shopping and the interviewees´ navigation was recorded by means of a software. The results showed that the interviewees search for convenience, speed and ease to purchase. Aspects from the website that partially compromise these objectives were identified. The conclusions bring suggestions to make the shopping process easier and faster.

International Journal of Scientific Research in Computer Science, Engineering and Information Technology

International Journal of Scientific Research in Computer Science, Engineering and Information Technology IJSRCSEIT

Online shopping has been known as a rapidly growing business, and although online grocery shopping has not followed these same growth patterns in the past, it is now being recognized for its potential. As such, the focus of previous online shopping research has seldom encompassed this specific retail market, with the existing studies focusing essentially on consumers’ motivations and attitudes, rather than how consumers actually shop for groceries online. Therefore, this dissertation has the objective of uncovering some of the details of consumer decision making processes for this specific online retail market, details which can help further both academic research and managerial knowledge. The general consumer decision making process is characterized by a pres delusional, a delusional and a post-decision phase. All of which were addressed in an exploratory fashion, through a mixed methods strategy which combined both quantitative and qualitative methods of data collection. One of the main results obtained through this study is the complementary of retail channels - as it was found that online grocery shopping serves essentially for major shopping trips, being complemented with smaller trips to traditional stores.

International Journal of Management and Sustainability

Asokan Vasudevan

Public Health Nutrition

Objectives(i) To determine the current state of online grocery shopping, including individuals’ motivations for shopping for groceries online and types of foods purchased; and (ii) to identify the potential promise and pitfalls that online grocery shopping may offer in relation to food and beverage purchases.DesignPubMed, ABI/INFORM and Google Scholar were searched to identify published research.SettingTo be included, studies must have been published between 2007 and 2017 in English, based in the USA or Europe (including the UK), and focused on: (i) motivations for online grocery shopping; (ii) the cognitive/psychosocial domain; and (iii) the community or neighbourhood food environment domain.SubjectsOur search yielded twenty-four relevant papers.ResultsFindings indicate that online grocery shopping can be a double-edged sword. While it has the potential to increase healthy choices via reduced unhealthy impulse purchases, nutrition labelling strategies, and as a method to overcome f...

IOP Conference Series: Materials Science and Engineering

FARRAH MERLINDA Muharam

RELATED PAPERS

Sangah Gray

Gabriela Viapiana

José Luis Mariscal Orozco

Proceedings of the American Society for Information Science and Technology

Ciaran Trace

ELZO A ARANHA

Suzita Ramli

Sophie Yvert-Hamon

Dina Rafidiyah

Journal of Medical Education

Journal of Medical Education JME

麦考瑞大学毕业证办理成绩单 购买澳洲Macquarie文凭学历证书,留学文凭学历学位认证

Revista médica de Chile

Sebastian Andres Salvo Bravo

Sociology of Health & Illness

IEEE Antennas and Wireless Propagation Letters

Samuel Moreno

Journal of Food Science and Technology

RAJEEV KUMAR

Ivana Misic

Revista Labor

Silvana Kamazaki

Contemporary Justice Review

International Journal of Scientific Research and Management

Abdülbaki KUMBASAR

Stenly Cicero Takarendehang

Journal of Hepatology

Roberto Gramignoli

Separation and Purification Technology

Jahir Ramos

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

The pricing strategies of online grocery retailers

- Open access

- Published: 28 November 2023

- Volume 22 , pages 1–21, ( 2024 )

Cite this article

You have full access to this open access article

- Diego Aparicio 1 ,

- Zachary Metzman 2 &

- Roberto Rigobon 3

3801 Accesses

2 Citations

1 Altmetric

Explore all metrics

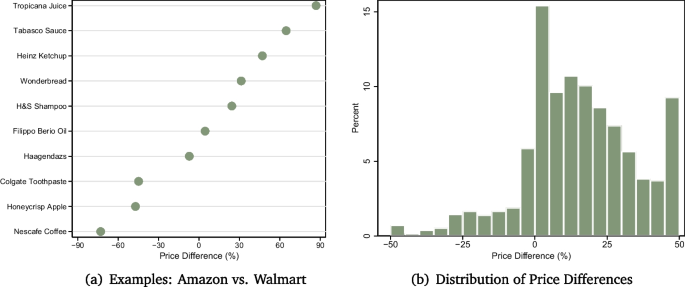

This paper documents the differences in pricing strategies between online and offline (brick-and-mortar) channels. We collect price data for identical products from leading online grocery retailers in the United States and complement it with offline data for the same products from scanner data. Our findings reveal a consistent pattern: online retailers exhibit higher price dispersion than their offline counterparts. More specifically, online grocers employ price algorithms that amplify price discrimination in three key dimensions: (1) over time (through frequent price changes), (2) across locations (by charging varying prices based on delivery zipcodes), and (3) across sellers (by setting dispersed prices for identical products across rival retailers).

Similar content being viewed by others

Competitive pricing on online markets: a literature review

Ethical Consumerism in Emerging Markets: Opportunities and Challenges

Market Segmentation for e-Tourism

Avoid common mistakes on your manuscript.

1 Introduction

“Almost 25 years ago, [...] we thought 19¢ was a fair price for one banana. Decades later, Bananas are still only 19¢ each, every day, in every store.”Trader Joe’s ( 2022 )

The Internet has reduced the barriers to search, enabling consumers to explore products and prices at a lower cost. One might imagine that this has led to vast price transparency and convergence within and across firms. However, at the same time, the Internet has fostered information and communications technologies (ICTs) that exploit customization opportunities.

This paper documents pricing patterns for grocery products in online and offline channels. We collect price data from the leading online grocery retailers in the United States: AmazonFresh and WalmartGrocery. Importantly, (a) we collect data for identical products, and (b) prices for the same product are collected at nearly the same time across retailers and across delivery zipcodes. To facilitate a comparison with the offline channel, we utilize NielsenIQ’s scanner data, specifically selecting the same products and cities. This approach allows us to examine three fundamental aspects of price dispersion: across locations, across retailers, and over time. To the best of our knowledge, this paper is the first to study grocery pricing with such detailed granularity.

Price dispersion is significantly higher among online retailers than among offline retailers. More specifically, online grocery retailers exacerbate price dispersion by utilizing algorithmic pricing —defined as the practice of automating price setting via a computer. Footnote 1 Our data reveals that price algorithms for online groceries are characterized by three novel stylized facts:

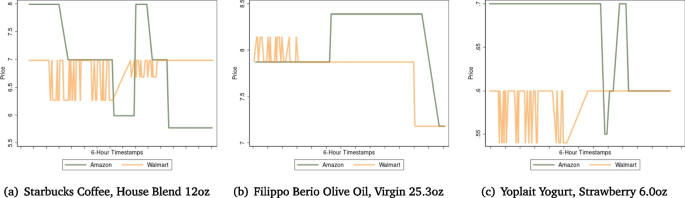

Extremely frequent price changes . We document a remarkably high temporal price variation. The average probability of a price change within two consecutive days exceeds 17% and, moreover, sometimes products have multiple price chances within a single day. For a retailer offering 20K products in a delivery zipcode, it means 2 price changes per minute.

Pronounced price discrimination across markets . Price algorithms set different prices for an identical product across different delivery zipcodes within the same retailer. That is, online grocers exhibit less uniform pricing than seen across the physical stores of offline retailers.

Persistent price disparities across rival firms . Amazon’s and Walmart’s price algorithms are able to track and match each other’s prices in real-time (for a specific product x delivery zipcode x day). Yet, price-matching occurs rarely. We generally observe significant price disparities across sellers for identical products in the same delivery zipcode. Moreover, this dispersion is larger than in the offline channel.

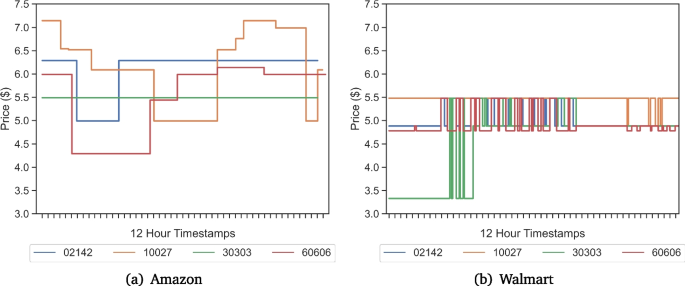

Algorithmic Pricing — Diet Coke. Notes: Prices of a Diet Coke 12 fl oz 12 Pack over the course of one month on AmazonFresh and WalmartGrocery. Prices are collected in 6- to 12-hour time intervals. Data details are discussed in Section 2

Figure 1 , displaying the prices of a 12-Pack Diet Coke, illustrates the three facts. First, algorithms update prices at a given location with high frequency, as captured by the constant fluctuations in the price of Diet Coke over time. Second, algorithms charge different relative prices across markets at a given point in time, and these relative prices are time-varying. For example, Walmart’s prices are sometimes $5.5 in New York and $3.4 in Atlanta, but sometimes both prices are $5.5. Lastly, there are significant price differences between Walmart and Amazon in a given zipcode and point in time. Amazon’s price in New York is $6.5 but Walmart’s price there is $5.5.

The three stylized facts collectively indicate that algorithmic pricing amplifies price dispersion . (1) Price algorithms increase price dispersion over time through frequent price changes. Algorithms exacerbate this variability by triggering numerous price updates in shorter time spans. (2) Price algorithms also lift price dispersion across markets. For example, AmazonFresh sets different prices for an identical item based on the delivery zipcode. Algorithms’ finer granularity of product x timestamp x zipcode level exacerbate price differences across locations. Finally, (3) price algorithms maintain persistent price disparities for the same item across sellers in the same delivery zipcode. As a result, algorithms increase price dispersion across sellers.

The remainder of the paper is organized as follows. Section 1.1 reviews the literature. Section 2 describes the data. Sections 3 , 4 , and 5 document the stylized facts. And Section 6 reviews our findings and suggests avenues for future research.

1.1 Related literature

There exists an extensive body of literature in economics and marketing that studies price dispersion. The availability of scanner data from offline supermarket chains throughout the U.S. (typically provided by NielsenIQ or IRI) has opened up new avenues for empirical research. Recent studies point out that prices tend to be more “uniform” across stores than across chains (Nakamura, 2008 ; Anderson et al., 2015 ; DellaVigna & Gentzkow, 2019 ; Arcidiacono et al., 2020 ; Hitsch et al., 2021 ). Nevertheless, price uniformity is not absolute. Indeed, these studies still observe some retailer-level price variation across different markets. Most notably, there is compelling evidence that retail chains engage in price discrimination across locations through “price zones” (Hoch et al., 1995 ; Chintagunta et al., 2003 ; Khan & Jain, 2005 ; Besanko et., 2005 ; Ellickson & Misra, 2008 ; Li et al., 2018 ; Adams & Williams, 2019 ). Additionally, there is evidence that offline prices across sellers (chains) are dispersed (Kaplan et al., 2019 ; Arcidiacono et al., 2020 ; Eizenberg et al., 2021 ).

In a similar vein, with the increasing availability of online data, it has become possible to examine the role, or lack thereof, of Internet frictions and price dispersion. While some studies document relatively high levels of uniform pricing in online markets, particularly as online transparency or competition intensify (Brown & Goolsbee, 2002 ; Cavallo, 2017 , 2019 ; Ater & Rigbi, 2023 ; Jo et al., 2022 ; Aparicio , Rigobon, 2023 ), it is clear that price dispersion still exists online, especially across sellers (Brynjolfsson & Smith, 2000 ; Baylis & Perloff, 2002 ; Chevalier & Goolsbee, 2003 ; Baye et al., 2004 ; Orlov, 2011 ; Overby & Forman, 2015 ; Gorodnichenko & Talavera, 2017 ; Gorodnichenko et al., 2018 ; Cavallo, 2019 ; González & Miles-Touya, 2018 ).

Another area of research related to the online channel has examined the rising frequency of price changes, often associated with the surge in artificial intelligence tools such as algorithms. Generally speaking, these tools reduce “menu costs” and intensify price variability (Chen, 2016 ; Cavallo, 2018 ; Seim & Sinkinson, 2016 ; Cavallo, 2019 ; Brown & MacKay, 2023 ; Hillen & Fedoseeva, 2021 ; Assad et al., 2020 ; Huang, 2022 ; Aparicio et al., 2022 ; Aparicio & Misra, 2023 ).

Although estimating time-series price variation using scanner data presents some obstacles (Campbell & Eden, 2014 ; Eichenbaum et al., 2014 ), our matched-product approach allows us to estimate comparable measures of price dispersion in both the online and offline channels. The importance of a matched-product approach has been highlighted in previous work. Hwang et al. ( 2010 ), for instance, examine store clientele and competitive structure using store assortment overlap. Moreover, Seim and Sinkinson ( 2016 ); Cavallo ( 2017 ); Ater and Rigbi ( 2023 ); Martinez-de et al. ( 2023 ) use matched-product datasets to investigate various retailing and pricing behaviors.

Most previous studies have primarily analyzed only one dimension of price dispersion and have tended to ignore the impact of price algorithms. Thus, to the best of our knowledge, this work is the first to examine three dimensions of price dispersion using a matched-product approach at the chain–product–zipcode level in the context of online groceries; plus, it is first to construct comparable measures for offline supermarkets. More specifically, we contribute to the literature by documenting novel facts about within-chain and cross-chain price dispersion, price variability over time, and differences between online and offline channels.

The market for groceries is the largest retail category in the United States, with estimated sales of $1.1 trillion, representing a meaningful portion of both CPI expenditures and the economy. While online grocery accounts for 12% of total grocery retail sales (i.e., $160 billion), its market value is growing rapidly: from 3% ($26 billion) in 2018 to 12% in just four years. Footnote 2

In this paper, we focus on the leading online grocery retailers in the United States: AmazonFresh and WalmartGrocery. As of 2019, the two e-commerce giants held a combined market share of at least 50%. We conduct additional analyses using FreshDirect, Peapod, Jet, and Instacart. Footnote 3

The data encompasses a wide range of products, including fresh produce, packaged food items, and cleaning and personal care products. Importantly, we matched identical products across all retailers to ensure comparability. To collect the data, we developed scripts that entered zipcodes into the retailers’ websites and then collected prices. A random VPN was also used to check robustness from different originating IP addresses. Appendix A.1 provides further details on the products and Appendix A.2 provides methodological information on collecting online data.

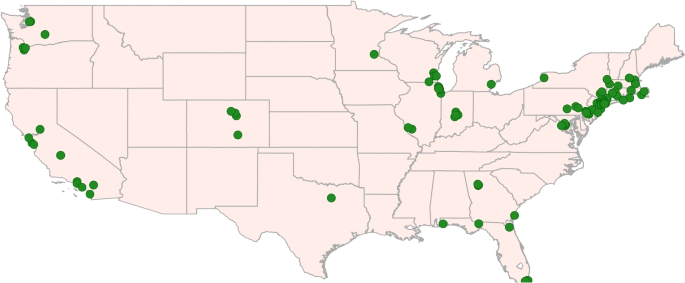

Delivery zipcodes of the online grocery retailers

We examine three dimensions of price dispersion: (a) variation within a retailer–location over time, (b) variation within a retailer across different locations, and (c) variation across rival retailers within a specific location. For dimension (a), we collected price data at high-frequency intervals (hourly differences within a day) for 8 zipcodes. For dimensions (b) and (c), we collected data for 50 zipcodes (in major cities across the U.S.) on a single day each month and with observations taken within minutes. Footnote 4 To the best of our knowledge, this empirical strategy to study algorithmic pricing is the most comprehensive to date, allowing us to recover pricing patterns at the granular level of product x zipcode x time. Figure 2 shows the delivery locations.

The second dataset used is NielsenIQ’s Retail Scanner (RMS) data provided by the Kilts Center at the University of Chicago. This data covers sales and prices at the store x week x UPC level. Importantly, we manually match products in the online data with those in the scanner data. We then narrow down the sample to matched products and stores located in the same cities as the online data (NielsenIQ includes the city but not the zipcode), as well as to grocery chains. A matched-product approach (and in matched cities) allows us to account for differences that may arise due to assortment composition or geographic coverage. Further methodological details are described in Appendix A.3 . Footnote 5

Table 1 presents an overview of the data. The monthly online data consists of 16,317 price observations for 74 matched online products across 50 zipcodes, 33 cities, and 14 states. The hourly online data covers 122,170 price observations for 70 products across 6 cities. The scanner data covers 418,477 price observations for 82 matched products across 37 retail chains and 32 cities.

3 Stylized fact 1: online prices change very frequently

Our analysis of price dispersion begins with the following question: How often do prices change in online groceries? To explore this, we compute the frequency of price changes across various time intervals.

Let L denote the time interval of interest. For a given product i at time t , sold by retailer r in delivery zipcode d , a price change occurs when the current price, \(p_{t}^{r,d,i}\) , differs from at least one of the prices collected within the last L weeks. More formally: \(\textit{Price Change}_{t}^{r,d,i} = 1 \textit{ } \text { if } \textit{ } \exists h: 1\le h \le L \text { such that } p_{t}^{r,d,i} \ne p_{t-h}^{r,d,i} \) . For instance, a weekly indicator of a price change takes the value 1 if the price of a retailer–zipcode–product has experienced at least one change during the previous 168 hours (7 days).

We then proceed to compare the online frequencies with those obtained using the offline data. To ensure comparability, (a) we use scanner data from grocery stores, (b) restrict the product sample to identical matched products, and (c) limit the sample to stores located in the same cities. We calculate the indicator of a price change for retailer r and store d between consecutive weeks w and \(w-1\) (or for the last 4 weeks). We note that scanner prices are weekly volume-weighted averages at the store x product level, which tends to overstate the frequencies of price changes (Eichenbaum et al., 2014 ; Campbell & Eden, 2014 ; Cavallo, 2018 ). To better account for measurement error, liquidation, or fractional prices in the scanner data, we bin prices in 10-cent intervals and exclude price changes smaller (in absolute value) than 5%. Footnote 6 We report robustness results in Appendix C.3 .

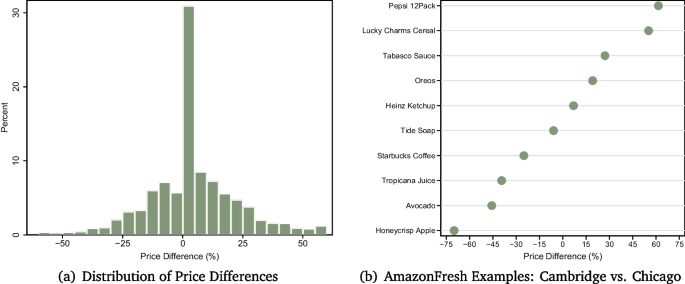

The results are shown in Table 2 . We find a significantly lower “stickiness” in the online data—that is, online prices exhibit far more variability than offline prices. Observe the weekly and monthly frequencies of price changes, which allow for a direct comparison between the online and offline channels. The probability of an (online) retailer–zipcode–product experiencing a price change within a week and a month is 44% and 75%, respectively. In contrast, the analogous measures for a chain–store–product are 31% and 43%, respectively.

These findings are robust using alternative frequency measures. The median duration is 1.1 weeks for online prices, whereas it is 3.1 weeks for offline prices. The third column shows that the differences are statistically significant. Appendix C.1 and C.2 report robustness results using a fixed-effects model and using all retail formats in the scanner data, respectively. Footnote 7

The availability of online data enables us to recover price changes at even finer time intervals: daily and intra-day price changes. Here, once again, we estimate remarkable pricing flexibility. The probability of a price change between two consecutive days is 17% and the intra-day probability is 8% (i.e., within hours of the same day). Furthermore, roughly 73% of the products at a given online retailer experienced at least one price change (across all zipcodes) in a random week. This temporal price variation surpasses most comparable statistics reported in the literature.

These facts indicate that online grocery retailers in our dataset utilize price algorithms to set prices. It is implausible that a “manager” could manually implement so many price changes each day across multiple delivery zipcodes. In fact, for a retailer offering 20,000 items in a single zipcode, it means 2 price changes in 1 minute or 3,400 price changes in 1 day. Footnote 8 To accomplish this price variability, algorithmic pricing automates the pricing decision and enables firms to trigger an unprecedented number of price changes—a key characteristic associated with the adoption or usage of algorithmic pricing (Chen, 2016 ; Brown & MacKay, 2023 ; Assad et al., 2020 ; Aparicio et al., 2022 ). For a literature review of AI and pricing, we refer the reader to Aparicio and Misra ( 2023 ).

An alternative approach to identify algorithmic pricing is to observe whether a retailer’s prices quickly respond to the prices set by another retailer. Chen ( 2016 )’s study of Amazon marketplace (not AmazonFresh) states that “sellers using algorithmic pricing are likely to base their prices at least partially on the prices of other sellers.” Therefore, we run their correlation test to confirm that price algorithms are setting prices. Specifically, we find the lowest price of Amazon and Walmart for the same zipcode–product within the past 2 days, and then estimate a correlation between these two prices at the retailer–zipcode–product–date level. We find a correlation of 90% (and similar in a fixed-effects regression), providing further evidence of algorithmic pricing.

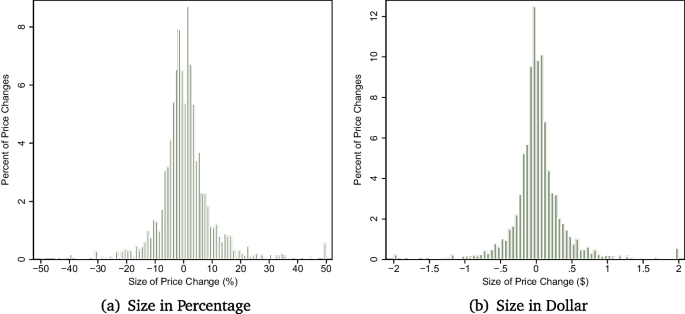

Histogram of size of price changes. Notes: Panels (a) and (b) display the histogram of the size of the daily price changes across all product-zipcode-timestamp combinations (conditional on a price change), expressed in percentage terms and in dollar terms, respectively. Values are restricted to an absolute value of 50% (or $2) for better visualization

In line with the notion that algorithmic pricing overcomes traditional “menu cost” and stickiness frictions, we also observe a substantial portion of tiny price changes. Conditional on a price change, approximately 50% of the changes are within 3.7%, and 25% are within 5 cents. Once again, it only makes sense to update prices by a few cents when pricing is automated. Panels (a) and (b) of Fig. 3 show the histogram of the size of the price change in percentage terms and in dollar terms, respectively.

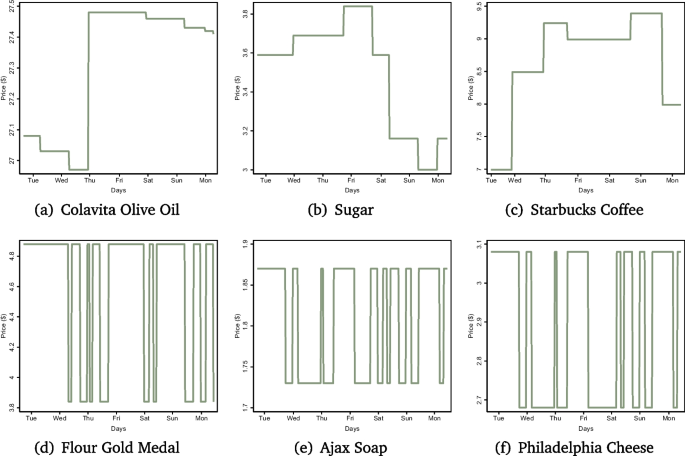

Pricing Heterogeneity — Experimentation vs. Hi-Lo. Notes: Panels (a) to (c) display Amazon’s prices in one week. Panels (d) to (f) display Walmart’s prices in one week. The unit of analysis is a retailer–zipcode–product

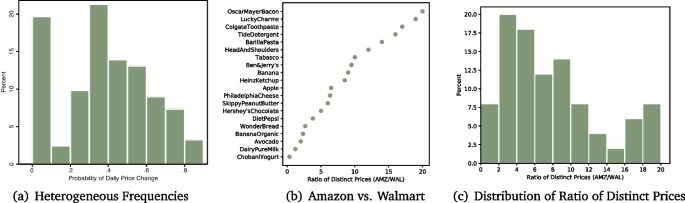

There is heterogeneity in the characteristics of algorithmic pricing. We make two key observations. First, Fig. 4 captures two typical, yet contrasting, patterns when algorithms trigger price changes: grid exploration (“experimentation”) vs. high-low (“Hi-Lo”). In both cases, there is a high frequency of price changes—and higher than offline stores, which rarely update prices multiple times during the same week. The distinction lies in the menu of prices. Panels (a) to (c) exemplify situations where the algorithm constantly explores different price points. For instance, in Panel (a), we observe 8 distinct prices for Colavita Olive Oil within a single week. In contrast, Panels (d) to (f) showcase instances where the algorithm alternates between a high price and a low price, resulting in a saw-tooth or Hi-Lo pattern. Hi-Lo pricing has been documented in the scanner data (Hitsch et al., 2021 ), but not with this velocity. We note that while these two pricing patterns are common, not all product–zipcode–weeks experience such high variability. Panel (a) of Fig. 5 shows the distribution of the probability of a daily price change and reports strong heterogeneity across products.

The second observation is that Amazon and Walmart employ one of those strategies but not both. Amazon’s algorithms tend to explore many distinct prices (e.g., Panels (a) to (c)), whereas Walmart’s algorithms exhibit a Hi-Lo pattern (e.g., Panels (d) to (f)). Footnote 9 Indeed, Amazon utilizes five times more distinct prices for the same matched product–zipcode than Walmart. To see this, we compute the number of distinct prices for each matched product–zipcode (separately by retailer), and then calculate the ratio of Amazon’s distinct prices to Walmart’s distinct prices. Panel (b) displays the ratios for a sample of products. For example, a ratio of 10 for Ben & Jerry’s indicates that, in a given zipcode, Amazon uses 10 times more distinct prices than Walmart. Panel (c) displays the distribution of such ratios. Appendix E reports additional results comparing Amazon vs. Walmart, and Appendix F describes additional pricing patterns by time of day and day of the week.

Thus far, we have established that the leading online grocery retailers (Amazon and Walmart) use algorithmic pricing to set prices, leading to an extremely high frequency of price changes (Fact 1). Next, we explore the role of algorithms in another dimension of price dispersion: across markets.

Heterogeneity in pricing strategies

4 Stylized fact 2: retailer-level price dispersion across markets

In Fig. 1 , we noticed that algorithms set different prices for an identical Diet Coke across various delivery locations at a given point in time . This suggests that price algorithms might reduce uniform pricing across markets within a retail chain. However, do these observations extend more broadly to other products? Here, we proceed to document the extent to which retailer-level price dispersion across markets is more pronounced in the online data compared to the offline data.

To measure price dispersion across markets, we collect prices for an identical product from a specific online retailer for different delivery zipcodes at nearly the same time. Price dispersion is measured across cities. Said differently, we compare the prices of Pebbles’ cereal in a Miami zipcode vs. a Chicago zipcode. We then compare online vs. offline price dispersion, as follows: (a) restrict NielsenIQ’s data to the same set of products, (b) select offline stores located in the same cities, and (c) select offline chains with stores in multiple cities. While we strive to closely mimic the online process, it is important to acknowledge that our empirical strategy is not perfect (e.g., we lack Amazon offline prices).

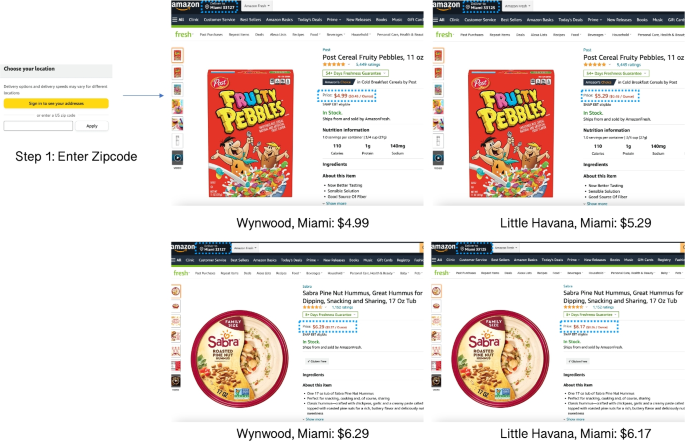

Zipcode price personalization — examples

Figure 6 illustrates the operationalization of price discrimination across markets by online grocery retailers. When users access the AmazonFresh website, they are prompted to enter a delivery zipcode or address. This means that prices (or assortments) are not visible unless a delivery zipcode is entered. Notably, Fig. 6 reveals a price difference for Pebbles’ cereal: $4.99 in Wynwood and $5.29 in Little Havana (two zipcodes within Miami). This translates to a 6% price difference for a 4-mile walking distance.

To formalize the analysis of price dispersion, we compute pairwise price differentials at the product x time x retailer level across all locations (in different cities). The unit of analysis is the same in the online and offline datasets. Footnote 10 Next, we compute the percentage difference in absolute value between two prices:

where \(p_{d,r}^{t,i}\) denotes the price of item i for retailer r , in location d , at time t . To simplify notation, we define a retailer x location as a retailer–zipcode (retailer–store) in the case of online (offline) data. Note that t stands for nearly the same timestamp in the online data, whereas t stands for the same week in the scanner data.

An alternative measure of uniform pricing is the share of identical prices. It can be defined as follows: \( \mathbbm {1}_{d,d'}^{t,i,r} = 1 \text { if } p_{d,r}^{t,i} = p_{d',r}^{t,i} ; 0 \text { otherwise} \) . In the case of within-retailer pairs, the indicator \(\mathbbm {1}_{d,d'}^{t,i,r}\) takes the value 1 when the price of the item i , in retailer r , at time t is the same across locations d and \(d'\) . As before, we bin offline prices to 10 cents.

The results are shown in Table 3 . We find that online retailers exhibit substantially higher price dispersion. For instance, the mean share of identical prices across cities is 35.5% online, compared to 61.0% offline. The median and average percent difference in online pairwise prices is 7.4% and 11.6%, respectively, whereas the equivalent measures in the offline data are 0% and 7.5%. Furthermore, this pattern is consistent across product categories (fresh items, packaged food, and personal and cleaning products). Footnote 11

The results remain similar using various robustness checks. Appendix C.1 reports similar results in a regression model controlling for product fixed effects. Appendix C.2 shows results using all retail formats in the scanner data (not just grocery chains). Appendix C.4 shows similar results using seven online grocers. Lastly, Appendix G ’s variance decomposition indicates that retailer x zipcodes account for a sizable portion of online price dispersion.

There is heterogeneity in the intensity of price dispersion. Panel (a) of Fig. 7 displays the histogram of the price differences. An observation in the plot is the price difference for a given product, within a retailer, between two markets at a given point in time. Roughly 30% of the products have little to no price dispersion, whereas 25% have price differences across delivery zipcodes exceeding 20% in absolute value. For visual intuition, Panel (b) provides examples for AmazonFresh (more examples are reported in Appendix H ).

Heterogeneity in price dispersion across markets

Our analysis has focused on retailer-level price dispersion across different cities in the U.S., rather than across zipcodes within a city. Our data is limited to examine retailer-level within-city price dispersion. Footnote 12 Nevertheless, we collected data for a few within-city zipcodes for AmazonFresh to inform the following question: Do online prices vary within a city? We find that price algorithms can charge different prices, for an identical product, across neighborhoods within a single city (as illustrated in Fig. 6 ). However, such within-city variations occur infrequently (roughly for 5% of the price pairs) and, interestingly, are less common than in the offline data. We report more detailed results in Appendix I .

We have established that price algorithms also amplify retailer-level price dispersion across markets (Fact 2). Next, we delve into another dimension of price dispersion: across sellers.

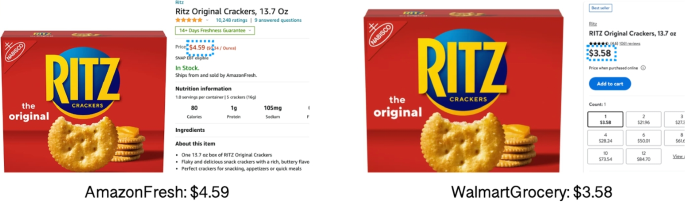

5 Stylized fact 3: price dispersion across local retailers

One might expect online markets to exhibit a higher cross-chain price elasticity compared to offline markets. Intuitively, the ease of finding the lowest deal online could result in lower price dispersion and overall prices. However, Fig. 8 paints a different picture: the price of Ritz Crackers is $4.59 on Amazon but $3.58 on Walmart. (Importantly, for the same delivery zipcode in San Francisco and at the same point in time.) This price disparity prompts us to examine whether price algorithms also amplify price dispersion across sellers, compared to offline stores.

As explained previously, we collect price data for identical products sold by multiple online grocery retailers, for the same delivery zipcodes at nearly the same time. To mimic this analysis for offline stores, we subset to the same items and to the same cities in the scanner data. We then proceed to measure price dispersion within a location and across sellers using Eq. 1 : a price pair for the same product between two online retailers, in the same zipcode at the same time (or between two offline stores of different chains). Footnote 13

Ritz Crackers 13.7 Oz — Amazon vs. Walmart