Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

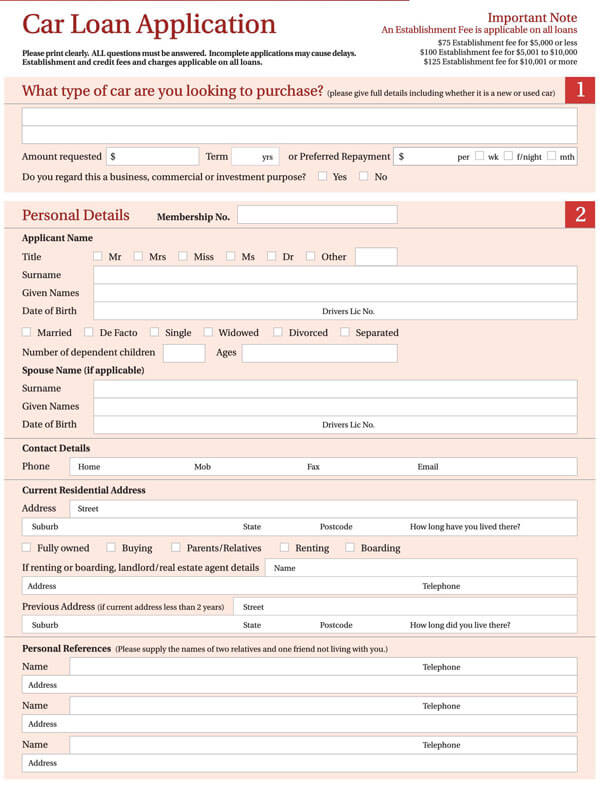

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

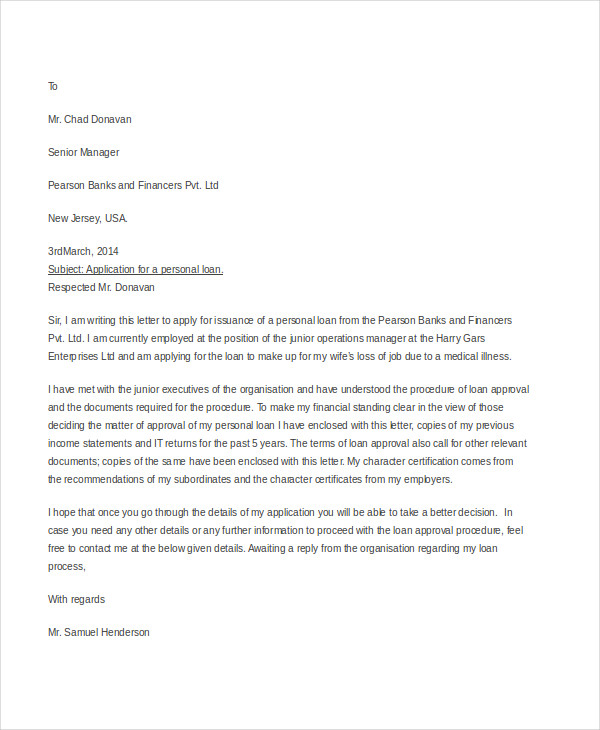

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Professional Loan Officer Cover Letter Examples for 2024

Your loan officer cover letter must immediately capture the hiring manager’s attention. Demonstrate your expertise in analyzing financial information with clarity. Highlight your proficiency in determining clients' creditworthiness and your impeccable record of managing loan portfolios. Show them your commitment to fostering trusting relationships with clients, ensuring you stand out.

Cover Letter Guide

Loan Officer Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Loan Officer Cover Letter

Key Takeaways

Embarking on a job hunt, you've likely discovered that a standout loan officer cover letter is your golden ticket. As tempting as it is to reiterate your resume, your cover letter’s true charm lies in narrating your proudest professional victory. It's a delicate dance of formality and personal touch—dodging cliches while keeping it concise. Aim for a one-page wonder that opens the door to your career dreams without sounding like everyone else’s tune. Let's craft that impressive narrative together.

- Personalize your loan officer cover letter and get inspired by other professionals to tell a compelling story;

- Format and design your loan officer cover letter to make an excellent first impression;

- Introduce your best achievement in your loan officer cover letter to recruiters;

- How to make sure recruiters get in touch with you, using your loan officer cover letter greeting and closing paragraphs.

What is more, did you know that Enhancv's AI can write your cover letter for you? Just upload your loan officer resume and get ready to forward your job application in a flash.

If the loan officer isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Loan Officer resume guide and example

- External Auditor cover letter example

- Audit Director cover letter example

- Finance Executive cover letter example

- Financial Analyst cover letter example

- Public Accounting Auditor cover letter example

- Financial Professional cover letter example

- Financial Risk Analyst cover letter example

- Accounts Clerk cover letter example

- Financial Operations Manager cover letter example

- Accounts Payable Manager cover letter example

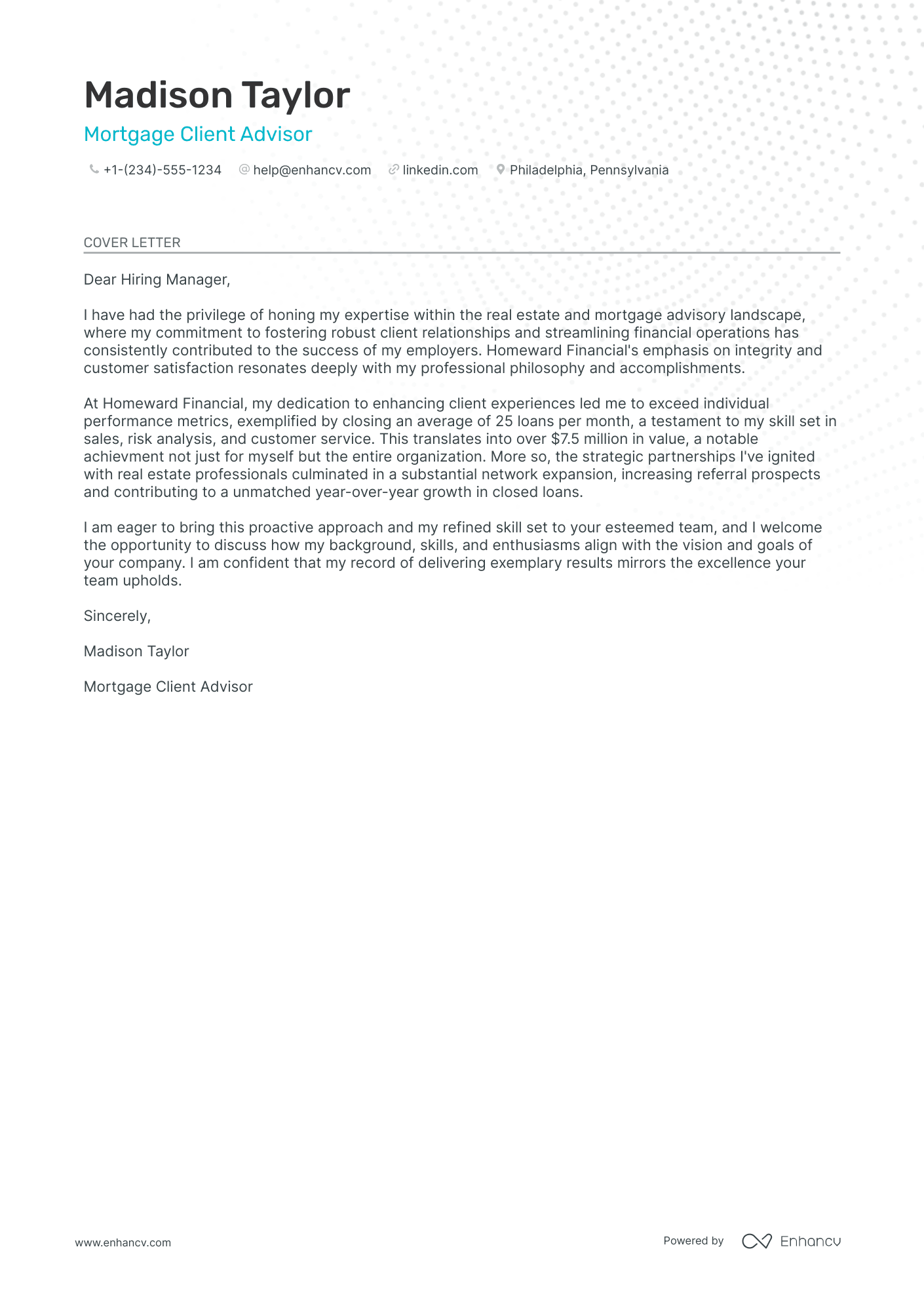

Loan Officer cover letter example

Madison Taylor

Philadelphia, Pennsylvania

+1-(234)-555-1234

- Illustrating quantifiable achievements (e.g., "closing an average of 25 loans per month") is essential in demonstrating the candidate's effectiveness and results-driven mindset, which is particularly valuable in a sales-oriented role within the financial sector.

- Emphasizing strong relationship-building skills and partnerships with industry professionals showcases the candidate's network and ability to generate business, which is crucial for roles reliant on referrals and collaborations in the mortgage industry.

- Mentioning personal alignment with the company's core values (e.g., "Homeward Financial's emphasis on integrity and customer satisfaction resonates deeply with my professional philosophy") helps to establish a cultural fit, important for both the applicant and employer.

The must-have sections and format of your loan officer cover letter

When writing your loan officer cover letter, keep in mind that it'll only be read by the recruiters and not the Applicant Tracker System (or software used to assess your profile). That's why you should structure your content with a/an:

- Header (apart from your contact information, include your name, the role you're applying for, and the date);

- Personalized salutation;

- Opening paragraph to win the recruiters over;

- Middle paragraph with key details;

- Closing that starts from clichés;

- Sign off (that's not mandatory).

Industry standards dictate your paragraphs to be single-spaced and to wrap your content in a one-inch margin. Designing your loan officer cover letter, refer to one of our templates , which automatically takes care of the spacing and margins.

Choose the same font for your loan officer cover letter as you did for your resume : the likes of Lato and Bitter would help you to stand out in a sea of cover letters in Arial or Times New Roman.

Export your whole loan officer cover letter from our builder in PDF to keep the same formatting and image quality.

The top sections on a loan officer cover letter

- Header: This should include the candidate's contact information and the date to ensure the recruiter knows who the letter is from and can easily get in touch for follow-up discussions specific to loan officer opportunities.

- Greeting: A personalized salutation addressing the hiring manager by name demonstrates the candidate's attention to detail and professionalism, which are crucial traits for a loan officer.

- Introduction: This brief section should capture the recruiter’s attention by outlining the candidate's relevant experience in finance or customer service, showcasing their suitability for the loan officer role.

- Body: The body should contain specific examples of past successes in financial analysis or customer relationship management, emphasizing skills and experiences that directly align with the loan officer position.

- Closing: Here, the candidate should reiterate their enthusiasm for the position, mention their availability for an interview, and include a courteous thank-you to the recruiter for considering their application for such a pivotal role within the financial industry.

Key qualities recruiters search for in a candidate’s cover letter

- In-depth understanding of lending procedures and regulations: Being knowledgeable about current lending laws ensures compliance and protects both the lender and borrower.

- Strong analytical skills: Loan officers must analyze applicants' financial data to assess creditworthiness and the risk involved in offering them a loan.

- Excellent interpersonal and communication skills: Building relationships with clients and effectively communicating loan terms and financial advice is crucial for client satisfaction and retention.

- Proven sales experience: Demonstrating the ability to sell financial products successfully is important since loan officers must persuade clients to choose their institution's offerings.

- Detail-oriented approach: Attention to detail ensures accuracy in loan processing, which is essential for maintaining legal compliance and avoiding costly errors.

- Customer service orientation: Offering exceptional customer service can differentiate a loan officer in a competitive market and lead to increased referrals and repeat business.

How to address hiring managers in your loan officer cover letter greeting

Goodbye, "Dear Sir/Madam" or "To whom it may concern!"

The salutation of your loan officer cover letter is how you kick off your professional communication with the hiring managers.

And you want it to start off a bit more personalized and tailored, to catch the recruiters' attention.

Take the time to find out who's recruiting for the role (via LinkedIn or the company page).

If you have previously chatted or emailed the hiring managers, address them on a first or last name basis.

The alternative is a "Dear HR team" or "Dear Hiring Manger", but remember that a "Dear Ms. Simmons" or "Dear Simon," could get you farther ahead than an impersonal greeting.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Specific Department] Team,

- Dear Mr./Ms. [Last Name],

- Dear [First Name] [Last Name],

- Dear [Job Title],

Your loan officer cover letter introduction and the value you bring

Moving on from the "Dear Recruiter" to your professional introduction .

Use those first two sentences of your loan officer cover letter to present the biggest asset you'd bring to the organization.

Don't go into too much detail about your achievement or the skill set, but instead - go straight for the win.

That is - what is your value as a professional?

Would you be able to build stronger, professional relationships in any type of communication? Or, potentially, integrate seamlessly into the team?

What comes next: your loan officer cover letter middle paragraphs

In the next three to six paragraphs (or the body of your loan officer cover letter) you have to prove your unique value .

Most candidates tend to mess up at this stage. They tend to just copy-paste information from their resume.

That's one big no-no.

Remember that when writing your loan officer cover letter, it has to be personalized. And, your ultimate aim is to catch the recruiter's eye.

So, look back on key job requirements and write down a list that includes the ones you cover.

Next, select just one key achievement from your professional (or personal) history that meets those advert keywords.

Narrate a story around how you've grown your skill set and knowledge. Also, aim to show the unique understanding or soft skills you bring about, thanks to your past success.

Thinking about the closing paragraph of your loan officer cover letter

Before your signature, you have extra space to close off your loan officer cover letter .

Use it to either make a promise or look to the future.

Remind recruiters how invaluable of a candidate you are by showing what you plan to achieve in the role.

Also, note your availability for a potential next meeting (in person or over the telephone).

By showing recruiters that you're thinking about the future, you'd come off as both interested in the opportunity and responsible.

What to write on your loan officer cover letter, when you have zero experience

The best advice for candidates, writing their loan officer cover letters with no experience , is this - be honest.

If you have no past professional roles in your portfolio, focus recruiters' attention on your strengths - like your unique, transferrable skill set (gained as a result of your whole life), backed up by one key achievement.

Or, maybe you dream big and have huge motivation to join the company. Use your loan officer cover letter to describe your career ambition - that one that keeps you up at night, dreaming about your future.

Finally, always ensure you've answered why employers should hire precisely you and how your skills would benefit their organization.

Key takeaways

Your loan officer cover letter is your best shot at standing out by showing your motivation and the unique skills you'd bring to the job:

- Chose no more than one achievement, which you'd be talking about in the body of your loan officer cover letter, by focusing on skills and outcomes;

- Address recruiters with their first or last name, or "Dear Hiring Manager" in your loan officer cover letter greeting;

- Introduce in no more than two sentences what makes your profile unique (perhaps it's your motivation, enthusiasm, or appreciation of the company you're applying for);

- Select the same font you have used in your resume (avoid Times New Roman and Arial, as most candidates tend to invest in them);

- Close your loan officer cover letter with a promise of how you see yourself growing in the company and the benefits you'd bring about.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

How To Make Waitressing Sound Good On A Resume

What makes a good resume, how to accept a job offer professionally, how to include your salary requirements in a cover letter: with examples and a template, how to write a resume for internal position, how to write a cover letter for an internship.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Loan Officer Cover Letter Example

Cover letter examples, cover letter guidelines, how to format an loan officer cover letter, cover letter header, cover letter header examples for loan officer, how to make your cover letter header stand out:, cover letter greeting, cover letter greeting examples for loan officer, best cover letter greetings:, cover letter introduction, cover letter intro examples for loan officer, how to make your cover letter intro stand out:, cover letter body, cover letter body examples for loan officer, how to make your cover letter body stand out:, cover letter closing, cover letter closing paragraph examples for loan officer, how to close your cover letter in a memorable way:, pair your cover letter with a foundational resume, key cover letter faqs for loan officer.

Start your Loan Officer cover letter by addressing the hiring manager directly, if possible. Then, introduce yourself and briefly mention the position you're applying for. You can also include where you found the job posting. In the first paragraph, it's important to grab the reader's attention. You can do this by stating a key achievement or experience that makes you a strong candidate for the role. For example, "As a Loan Officer with over five years of experience in providing excellent customer service and meeting sales targets, I am excited about the opportunity to bring my skills to XYZ Bank." This shows you're experienced and enthusiastic about the role.

The best way for Loan Officers to end a cover letter is by expressing gratitude for the reader's time and consideration, reiterating their interest in the position, and indicating their eagerness to discuss their qualifications further in an interview. For instance, "Thank you for considering my application. I am confident that my skills and experience make me a strong candidate for this role and I am eager to contribute to your team. I look forward to the opportunity to discuss my application further." This ending is professional, courteous, and shows initiative, which are all qualities that employers look for in Loan Officers. It's also important to include your contact information for easy follow-up.

In a cover letter, Loan Officers should include the following key elements: 1. Introduction: Start with a brief introduction about yourself and your current role. Mention where you saw the job posting and express your interest in the position. 2. Relevant Experience: Highlight your relevant experience in the lending industry. Discuss your role in assessing, authorizing, or recommending approval of loan applications. If you have experience with specific types of loans (e.g., mortgage, auto, personal, etc.), be sure to mention them. 3. Skills and Qualifications: Detail your skills and qualifications that make you a strong candidate for the role. This could include your analytical skills, attention to detail, customer service skills, and knowledge of loan underwriting and processing procedures. If you hold any certifications relevant to the loan industry, such as a Mortgage Loan Originator (MLO) license, include those as well. 4. Achievements: Discuss any notable achievements in your career, such as meeting or exceeding sales targets, implementing strategies that improved loan processing times, or maintaining a high customer satisfaction rate. 5. Understanding of the Company: Show that you've done your research and understand the company's mission and values. If possible, relate these to your own professional values and explain why you're a good fit for their team. 6. Closing: In your closing paragraph, express your interest in the opportunity to discuss your qualifications further in an interview. Thank the hiring manager for considering your application. Remember, your cover letter should be concise, professional, and tailored to each specific job application. It's your chance to show your enthusiasm for the role and the unique qualities you bring to the table.

Related Cover Letters for Loan Officer

Loan processor cover letter.

Bank Teller Cover Letter

Financial Analyst Cover Letter

Junior Financial Analyst Cover Letter

Senior Financial Analyst Cover Letter

Risk Management Cover Letter

Finance Manager Cover Letter

Investment Banker Cover Letter

Related Resumes for Loan Officer

Loan processor resume example.

Bank Teller Resume Example

Financial Analyst Resume Example

Junior Financial Analyst Resume Example

Senior financial analyst resume example, risk management resume example.

Finance Manager Resume Example

Investment Banker Resume Example

Try our AI Cover Letter Generator

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

Trending now: find out why.

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

- Create a Cover Letter Now

- Create a Resume Now

- My Documents

- Examples of cover letters /

Loan Officer

Loan Officer Cover Letter

You have the skills and we have tricks on how to find amazing jobs. Get cover letters for over 900 professions.

- Tata Senique - Career Expert

How to create a good cover letter for a loan officer: free tips and tricks

A well-written document can make a good impression on a recruiter or a prospective employer, and they will take a look at your resume and invite you for an interview. Here are our recommendations on how to make your letter engaging and well-encompassing your skills and qualifications. See how to use the recommendations in the loan officer cover letter example below.

Keep it short and succinct. Generally, cover letters are advised not to exceed one page. However, even one page is too long. Make it half a page. 2-3 full paragraphs, in addition to a short introduction and conclusion, are more than enough.

Don’t leave it unaddressed. Don’t go for a generic “Dear Hiring Manager.” “To Whom It May Concern” is also off limits. Do your research and find actual names of recruiters and/or employers.

Make the employer’s interest your priority. Focus on what you can make for the company to flourish and don’t mention how this job will boost your career prospects. Writing from the position of how the employer can benefit from your hiring is much stronger than a more selfish one.

Avoid clichés. In particular, it is too redundant to start with “My name is John Doe and I am applying for the position of.” Overall, try to avoid too obvious things, such as ‘I’m looking for a job,’ or negative things about yourself, such as ‘I’m inexperienced.’

Close strong and quick. Mention that your skills will help the company and that’s it. There is no need to iterate anything you already said in the body of the letter.

Don’t send your document without feedback. Try to give it to a couple of your friends to get a second opinion on how well you presented yourself. You will probably need to rewrite it a couple of times.

Sample cover letter for a loan officer position

The most effective way to digest the tips is to see their practical application. We have used all the important tips of the above units into a single a loan officer cover letter sample to demonstrate a winning document that can be created in GetCoverLetter editor.

Dear Kody, In response to your job posting on LinkedIn for a Loan Officer, I suggest myself as a perfect candidate for this position, given my 4-year experience as a junior bank loan officer at ATM Bank Ltd.

In my current role I have managed the loan processes at a bank focusing on pre-qualifying potential deals and finding mortgage leads. A necessity to work in compliance with laws and regulations taught me varied professional skills while high demands for efficient customer service gave me the ability to work with many different types of people. My knowledge of how to sell multiple financial products positions me to excel as a loan officer at your company.

I would welcome the opportunity to give you a more comprehensive idea of my accomplishments. More information on my experience is in my resume. Looking forward to hearing from you.

Sincerely, Lana.

This example is not commercial and has a demonstrative function only. If you need unique Cover Letter please proceed to our editor.

Do not waste on doubts the time that you can spend on composing your document.

How to save time on creating your cover letter for a loan officer

Our Get Cover Letter editor will help you make the process easy and fast. How it works:

Fill in a simple questionnaire to provide the needed information about yourself.

Choose the design of your cover letter.

Print, email, or download your cover letter in PDF format.

Why the Get Cover Letter is the best solution

The GetCoverLetter editor is open to any goals of applicants. Whether it be a presentation of a craft professional with a great list of achievements or even a loan officer without experience. Rest assured, the opportunities are equal for all the candidates.

We know how to turn an ordinary person into an ideal candidate thanks to our intensive study of industry criteria.

We don't use any random phrases but rather expressions that work. Our specialists know what recruiters are looking for.

You have the ability to compose the best application doc for loan officers online and get it via email without leaving your screen or even the couch.

All the above and other benefits of using our editor are only one click away.

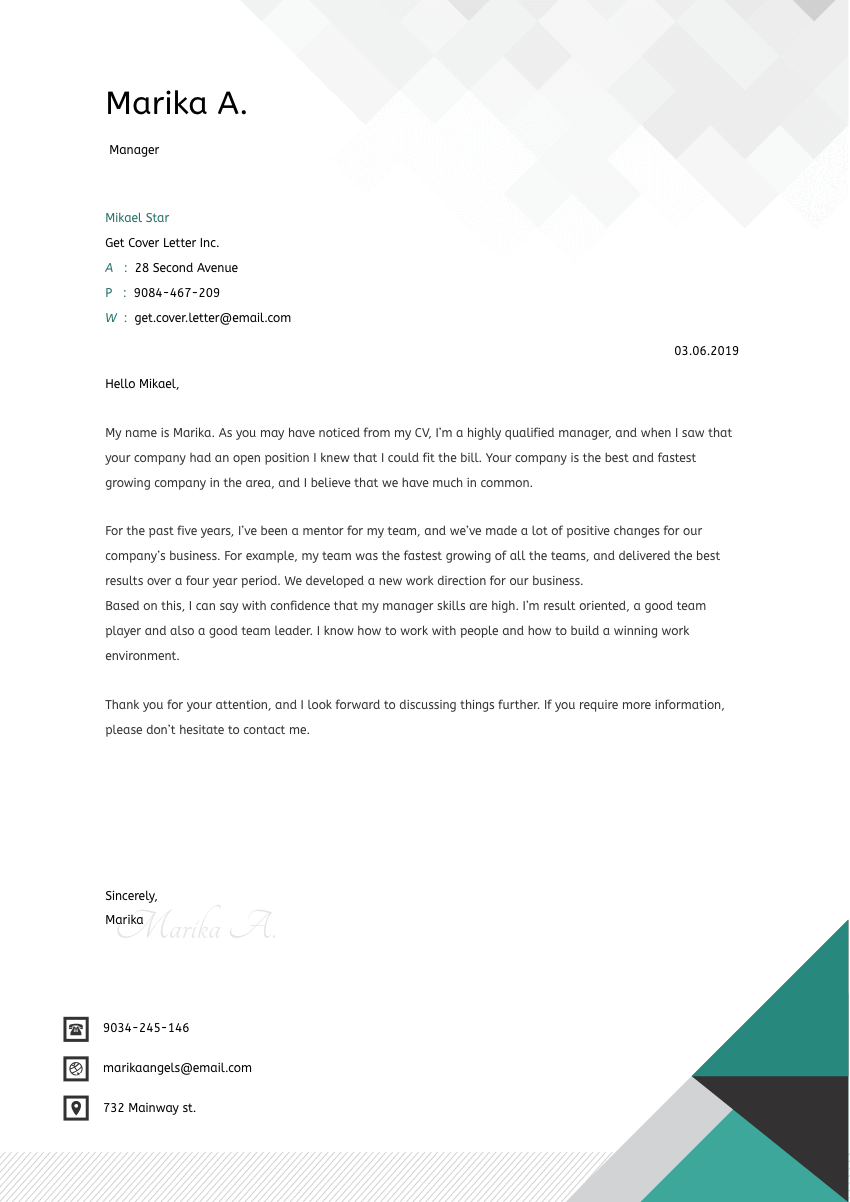

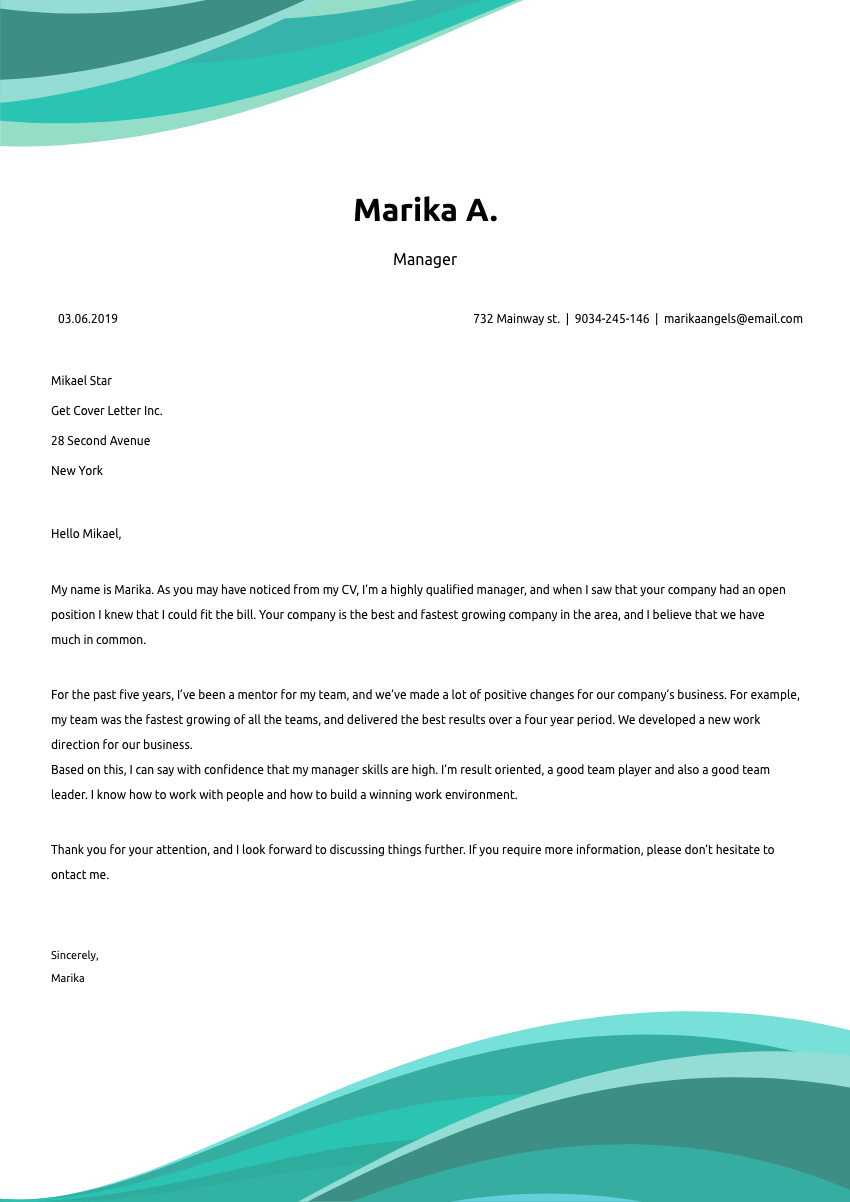

Templates of the best a loan officer cover letter designs

Any example of the document for a loan officer has a precise design per the requirements of the company or the general rules of business correspondence. In any case, the selection of templates in our editor will meet any expectations.

Or choose any other template from our template gallery

Overall rating 4.5

Overall rating 4.3

Get Cover Letter customer’s reviews

“We live in such a fast-paced world that it is great to have a service where you can get a document you need in a matter of minutes.”

“Writing seems simple. But it isn’t. Without GetCoverLetter I would probably have still struggled with writing it. Having used it once, I’m already having a job.”

“My problem was that I didn’t know how to turn my common traits into a job-winning but not boastful letter. It is an art, I must tell you. And this online constructor does it superbly.”

Frequently Asked Questions

The more unique the knowledge you get, the more space for new questions. Do not be affraid to miss some aspects of creating your excellent cover letter. Here we took into account the most popular doubts to save your time and arm you with basic information.

- What should my a loan officer cover letter contain? The main purpose of a cover letter is to introduce yourself, mention the job you’re applying for, show that your skills and experience match the needed skills and experience for the job.

- How to properly introduce yourself in a cover letter? Greet the correct person to which your cover is intended for. Introduce yourself with enthusiasm.

- How many pages should my cover letter be? Your cover letter should only be a half a page to one full page. Your cover letter should be divided into three or four short paragraphs.

- Don't focus on yourself too much

- Don't share all the details of every job you've had

- Don't write a novel

You have finished your acquaintance with valuable tips and tricks. Now is the time to create your own perfect cover letter.

Other cover letters from this industry

Do you need document formats and layouts? Do you want to see how to write letters for resume for other applications? Do you need an entry level one? Click on the links below and you will find answers to these questions and more.

- Loan Processor

- Investment Analyst

Loan Officer Cover Letter Examples

Use these Loan Officer cover letter examples to help you write a powerful cover letter that will separate you from the competition.

Loan officers work with clients to identify and assess their borrowing needs. They also work with lending institutions to get the best rates for their clients.

In order to be a successful loan officer, you need to be able to build relationships with clients and have a strong knowledge of the lending industry.

Use these examples to write a cover letter that will help you get the job you want.

Formal/Professional Writing Style Example

With a strong background in finance and over five years of experience in the banking industry, I am confident in my ability to excel as a Loan Officer at [Company Name]. My passion for providing excellent customer service and my expertise in analyzing financial data make me a strong candidate for this position.

In my current role as a Loan Officer at [Current Company], I have demonstrated exceptional skills in understanding clients’ financial needs and providing tailored solutions to meet their requirements. My ability to develop and maintain relationships with both colleagues and clients has proven invaluable in facilitating efficient loan processing and approvals.

My accomplishments in this role include:

– Successfully managing a loan portfolio worth $10 million, resulting in a 98% repayment rate and consistently exceeding target goals. – Implementing new risk assessment strategies, which reduced loan delinquency rates by 15% over a 12-month period. – Training and mentoring junior loan officers, fostering their professional growth and increasing team productivity.

Alongside my excellent communication and interpersonal skills, I have a Bachelor’s degree in Finance from [University Name] and possess sound knowledge of lending regulations and compliance. I am confident that my ability to accurately analyze clients’ financial positions and deliver personalized loan strategies will make me an asset to your team at [Company Name].

I am excited about the opportunity to contribute to your company’s ongoing success and be part of your dynamic Loan Officer team. I am available to discuss my qualifications further at your earliest convenience. Thank you for considering my application, and I look forward to speaking with you.

[Your Name]

Entry-Level Writing Style Example

As a recent finance graduate and a highly motivated individual, I believe my academic background and eagerness to learn make me an ideal candidate for this role.

I recently obtained my Bachelor’s Degree in Finance from XYZ University, where I gained a strong understanding of financial principles, risk management, and credit analysis. Throughout my coursework, I have developed a keen interest in mortgage lending and was particularly drawn to your company’s commitment to helping clients achieve their homeownership dreams.

While completing my degree, I had the opportunity to intern at a local credit union, where I provided exceptional customer service and assisted in processing loan applications. This experience allowed me to see first-hand how the lending process works and solidified my passion for pursuing a career as a Loan Officer. I also honed my communication and problem-solving skills, which I believe are integral to succeeding in this position.

I am excited about the opportunity to join your team and contribute to XYZ Company’s continued growth and success. I am eager to apply my educational background and enthusiasm for this industry in a role such as this, where I can further develop my skills and grow within the company.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further and am available for an interview at your convenience.

Networking/Referral Writing Style Example

I was recently referred to your company by Mr. James Smith, a valued colleague and long-time friend of mine at XYZ Bank. Mr. Smith impressed upon me the high standards of professionalism and customer service that your organization maintains, and I am confident that my background and experience make me a strong fit for this role.

Having worked in the financial industry for more than five years, I have gained extensive knowledge of loan products, credit risk assessments, and regulatory requirements. I pride myself on my ability to devise tailored solutions to meet the varied financial needs of clients, ensuring a positive customer experience.

In my previous role as a Loan Officer at ABC Bank, I was responsible for managing a portfolio of 200 clients with an overall loan value exceeding $50 million. I earned a reputation for excellent customer service and maintained a 95% loan approval rate, contributing significantly to the growth of the bank.

Furthermore, my strong analytical skills and attention to detail enable me to excel in assessing the creditworthiness of potential borrowers, minimizing risk, and ensuring compliance with all relevant regulations.

In closing, I am eager to contribute my expertise to your team as a Loan Officer and am confident in my ability to make a significant impact at your organization. Thank you for considering my application, and I look forward to the opportunity to discuss my suitability for this role in greater detail.

Enthusiastic/Passionate Writing Style Example

As a highly motivated and dedicated individual, it has always been my dream to contribute my expertise to a renowned financial institution such as yours. It is your company’s commitment to clients and dedication to responsible lending that has always resonated with me and aligns with my professional vision. It would be an incredible honor to be a part of your team and help individuals and businesses alike achieve their financial goals.

With a strong academic background in finance, years of experience in customer service, and a track record of successful loan management, I am confident that I possess the necessary skillset and passion to excel in this position. My experience has thoroughly equipped me to assist clients in a empathetic and knowledgeable manner, guiding them through the lending process and ensuring that they can make well-informed decisions.

What sets me apart from other candidates is my unrelenting enthusiasm and love for my work. It is my belief that great Loan Officers not only possess strong analytical skills and financial knowledge, but also a deep understanding of their clients’ needs and a genuine excitement to help them achieve success. As a driven and proactive problem solver, I eagerly seek out creative solutions and never shy away from challenges.

I am confident that my passion, dedication, and skills will be assets to your company and contribute to its continued success in the community. I look forward to the opportunity to speak with you further about how my expertise aligns with your goals and how, together, we can make a tangible impact in people’s lives.

Thank you for considering my application, and I hope to join your exceptional team of Loan Officers soon.

Problem-Solving Writing Style Example

As an experienced banking professional with a solid understanding of the industry, I am aware that one of the key challenges facing financial institutions today is effectively managing risk while maintaining customer satisfaction. With my strong background in assessing credit, efficient decision-making, and my ability to build long-lasting relationships, I am confident that I can help address these challenges and contribute positively to your company.

Throughout my career, I have consistently demonstrated a keen ability to scrutinize borrowers’ financial profiles and accurately evaluate their creditworthiness. This has not only allowed me to protect my employer’s interests but also resulted in dynamic growth in loan portfolios. I understand that a high level of financial integrity is essential in the current banking climate, and I am prepared to utilize my expertise to manage the risk to your business while ensuring customers receive the best possible service.

Furthermore, I recognize the importance of engaging with customers in today’s increasingly competitive market effectively. As a Loan Officer, I have maintained excellent customer satisfaction rates by promptly addressing concerns, providing targeted solutions, and nurturing valuable relationships. My strong communication skills have allowed me to work efficiently with both customers and colleagues, helping to streamline processes and create an environment of trust and cooperation.

To support my application, I have enclosed my resume that outlines my relevant experiences and achievements. I am excited about the opportunity to contribute positively to your organization as a Loan Officer and am eager to discuss my qualifications further at your earliest convenience.

Thank you for considering my application. I look forward to the possibility of working with you.

Storytelling/Narrative Writing Style Example

I recall the day when my parents’ small business encountered financial difficulties and they needed a loan to keep it afloat. I accompanied them to the bank, where we were greeted by a loan officer who treated us with empathy and guided us through the entire process. His professionalism and expertise not only helped my parents secure the loan they needed but also left a lasting impression on me. From that day on, I knew I wanted to be in a position where I could make a positive impact on people’s lives by helping them navigate through financial challenges.

As a graduate in finance and with over five years of experience in the banking sector, I believe that my background in financial analysis and customer service have prepared me well to excel as a Loan Officer. In my previous role at XYZ Bank, I successfully processed over 200 loan applications, resulting in a 95% approval rate. Maintaining strong relationships with clients and ensuring their satisfaction was always my top priority. I was recognized for my commitment to excellence and awarded the “Employee of the Year” in 2019.

I am confident that my passion for helping others, combined with my strong financial background and customer service skills, make me the ideal candidate for the Loan Officer position at your organization. I am excited about the opportunity to contribute to your team and support your clients in achieving their financial goals.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further and demonstrate my enthusiasm for this role.

Technical Director Cover Letter Examples

Digital strategist cover letter examples, you may also be interested in..., charge nurse cover letter examples, housing manager cover letter examples & writing tips, customer service administrator cover letter examples & writing tips, motion designer cover letter examples & writing tips.

All Formats

22+ Sample Loan Application Letters – PDF, DOC

There are times when we need financial aid to push through with our education, business ideas, or other personal projects or goals which require a huge amount of money for its realization. It is for this reason that lending companies have been existing ever since the days of old. Today, the primary step to being taken by someone who wants to borrow money from another individual or institution is to write a loan application letter .

Loan Application Letter

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

Formal Loan Purpose Application Letter to Senior Manager

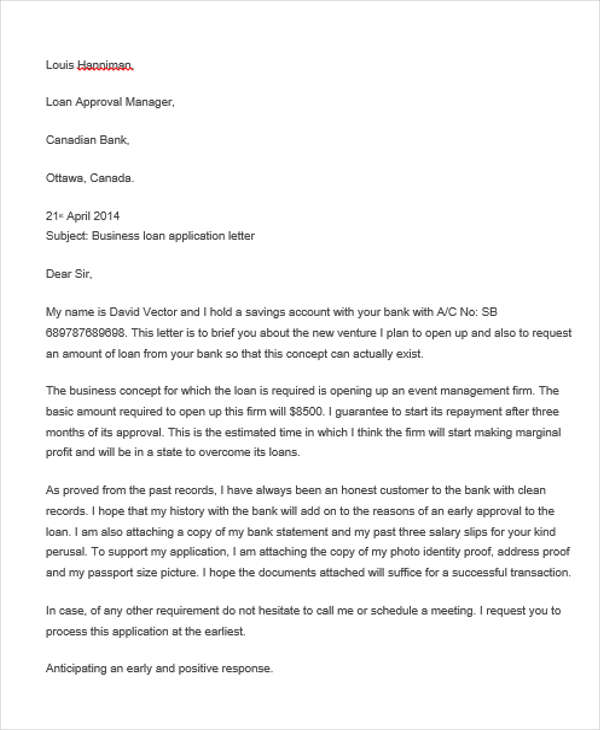

Formal Event Management Small Business Letter

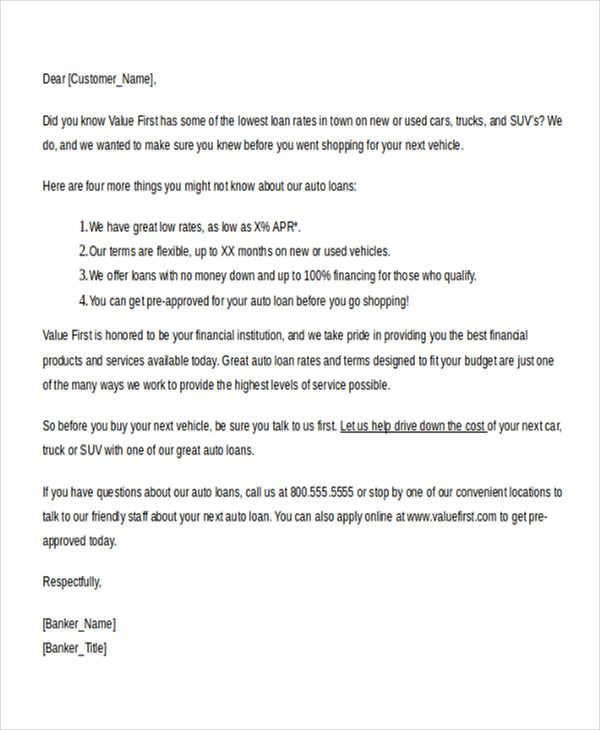

Sample Vehicle Application Letter Example

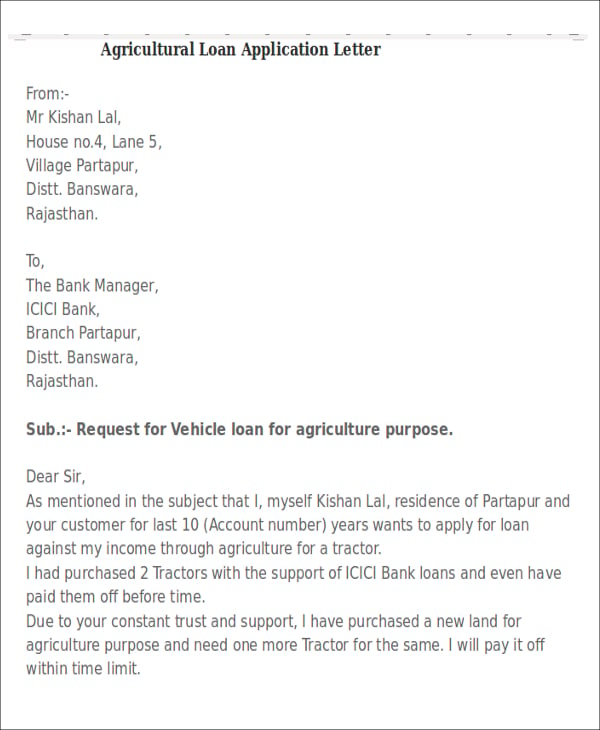

Agricultural Office Vehicle Application Letter Template

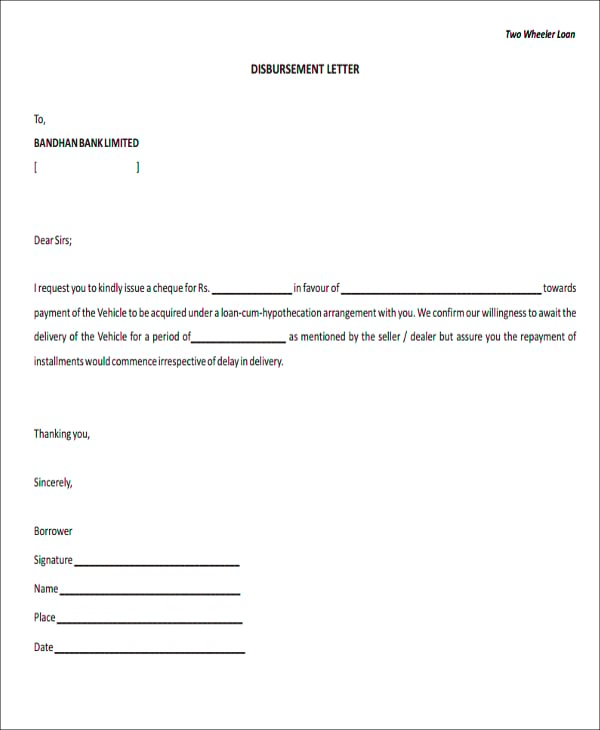

Sample Foreclosure Disbursement Application Form Letter

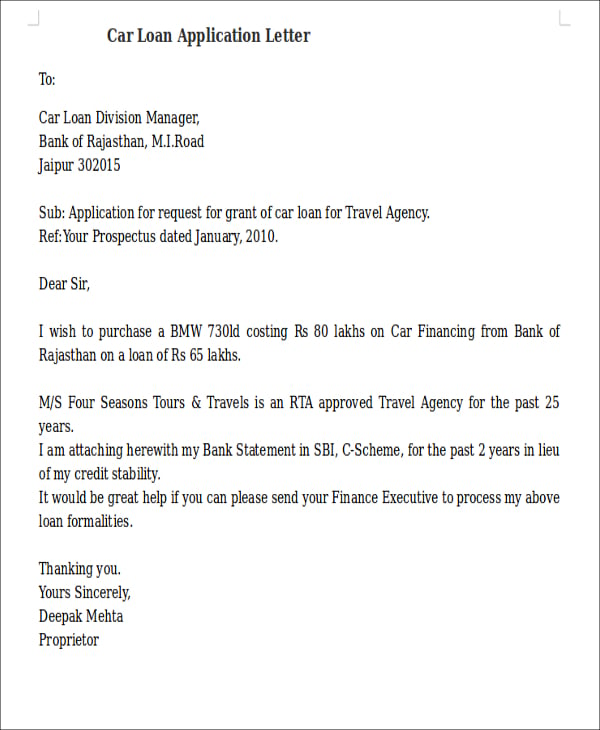

Example Work Travel Agency Letter

Application Letter to Canadian Bank for Loan

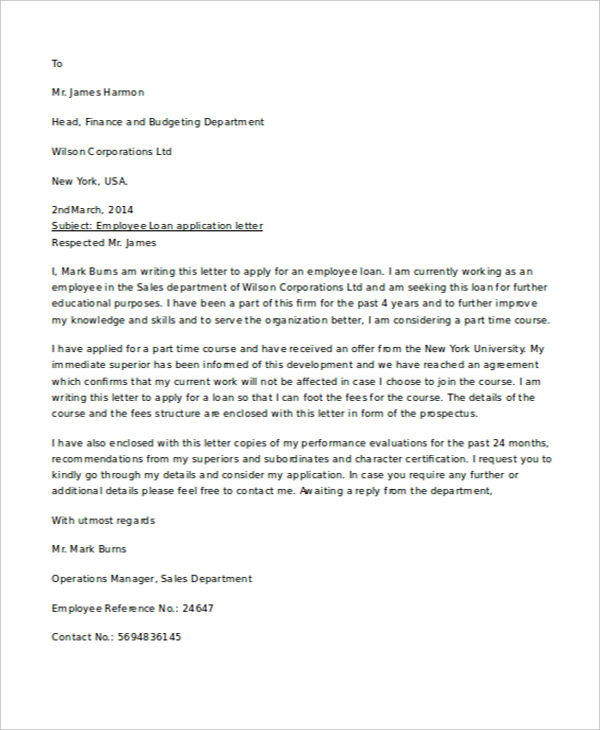

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract , the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

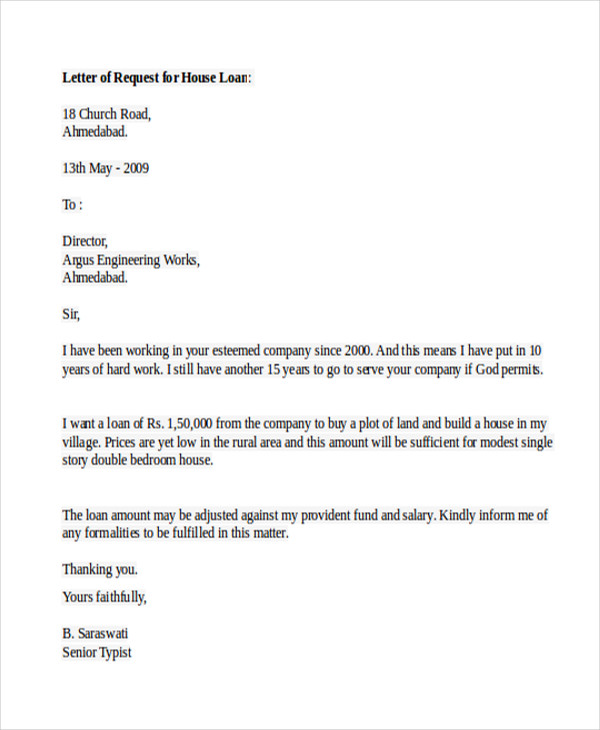

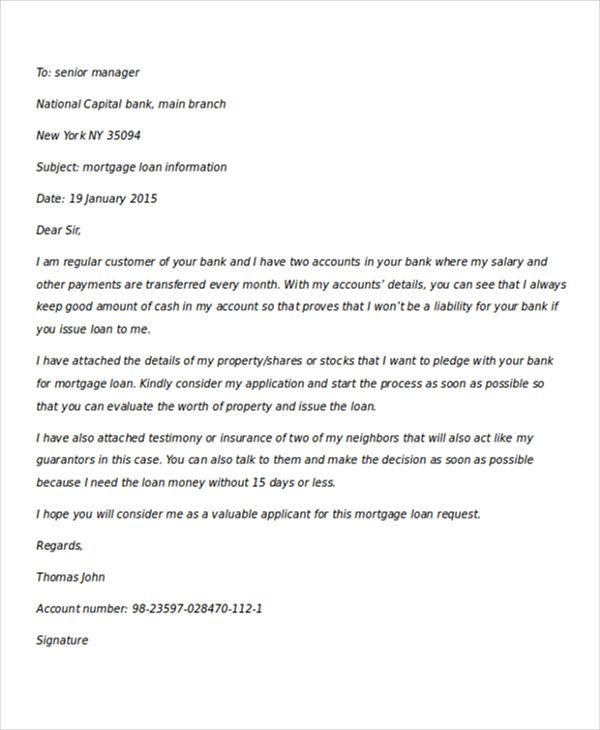

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

Basic Senior Typist Home Loan Application Letter Template

Mortgage Loan Application Letter with Boss Recommendation

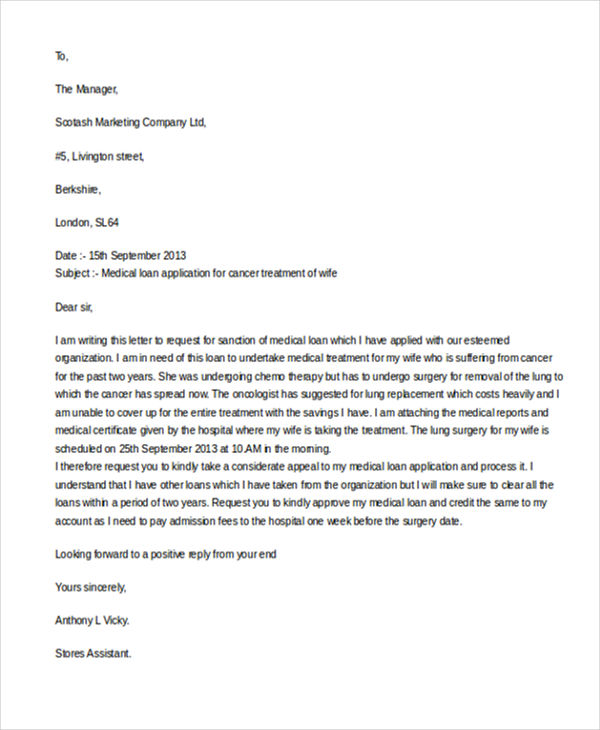

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

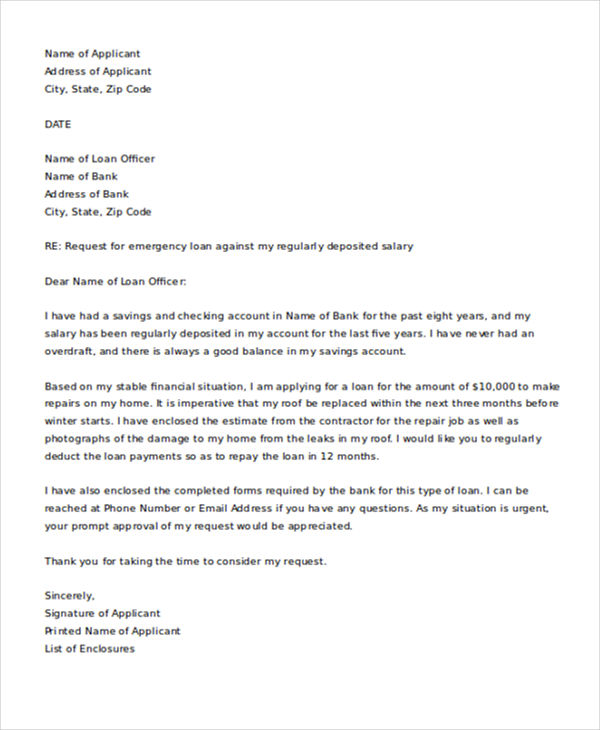

Request Urgent / Emergency Loan Letter for Borrowing Money

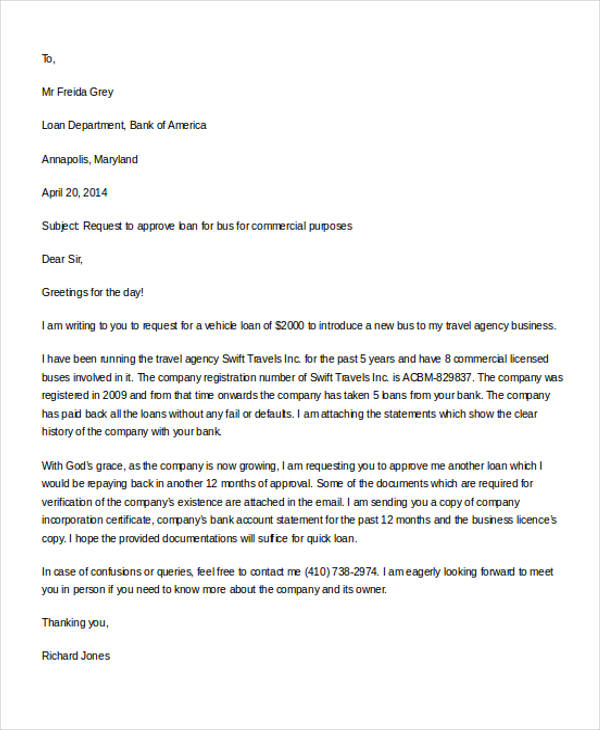

Free Commercial Vehicle Application Letter Template

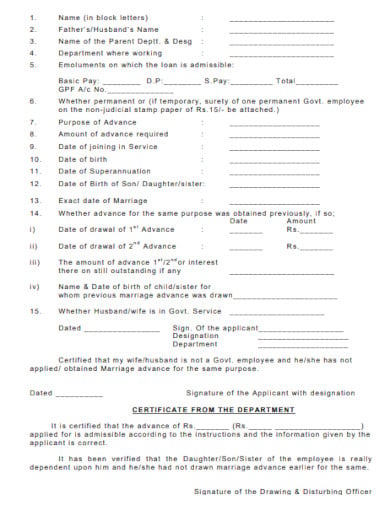

Loan Application Letter for Wedding/Marriage Template

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters .

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

More in Letters

Loan requisition letter, loan application letter template, sample loan application letter template, simple loan application letter template, loan application letter to employer template, personal loan application letter template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

COMMENTS

Name of Loan Officer. Name of Financial Institution or Bank. Address of Financial Institution or Bank. City, State, Zip Code. RE: Loan Application for $100,000. Dear [Loan Officer's Name], I am writing to formally request a loan of $100,000. As a loyal customer for the past 20 years, I have always trusted this institution with my financial ...

Header and greetings. The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting. In your header, include the following details: Your name. Your business names. The physical address of your business. Business telephone and cell phone numbers.

It should include: Your name and contact information: Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached. The date: Include the month, day, and year of the letter.

Related: How To Write a Letter in Block Format (With Example) 2. Create a header. A cover letter accompanies a resume, each being an extension of the other. Thus, as your resume contains a header, so does your cover letter. Begin by clicking into the header area of a new document. The header consists of two lines.

As a Loan Processor, your cover letter header should be clear, concise, and professional. Ensure your name, address, phone number, and email address are up-to-date and correctly formatted. If you know the name of the hiring manager, address them directly. If not, use a general salutation like "Dear Hiring Manager".

City, State, Zip Code. Home : 000-000-0000 Cell: 000-000-0000. [email protected]. Dear Mrs. Loper, Exactly one year ago I began a small cloth diaper company out of my own home. Over the last year my business has grown significantly to the point where I now need to expand. I am writing this letter to ask for a loan so that I can expand my business.

Subject: Loan application letter. Dear Sir/Madam, I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank. I am a salaried employee, and I work for a central government organisation as a research scientist.

Step 3: Structure Your Letter. A well-structured letter is key. Generally, it should include: Introduction: Briefly introduce yourself and state the purpose of the letter. Body: Detail your financial situation, loan purpose, and repayment plan. Conclusion: Summarize your request and express gratitude.

1. Be professional. A loan application is serious business to a bank and entails some risk. By keeping your letter professional, you come across as more trustworthy and a better investment. 2. Learn the loan officer's name. You want to address your application letter to a person, not a bank or team within the bank.

1 Loan Officer Cover Letter Example. Loan Officers excel at evaluating, authorizing, and recommending approval of loan applications, skillfully balancing risk and reward. Similarly, your cover letter is your chance to demonstrate your ability to assess and manage professional risks and rewards, showcasing your skills, experiences, and dedication.

Use this Loan Processor cover letter example to finish your application and get hired fast - no frustration, no guesswork. This cover letter example is specifically designed for Loan Processor positions in 2024. Take advantage of our sample sentences + expert guides to download the perfect cover letter in just minutes. 4.6.

Free Loan Officer cover letter example. Dear Ms. Moore: When I learned of JMA's need for a Loan Officer, I felt compelled to submit the enclosed resume. As an experienced loan officer and mortgage banking specialist with expertise in performing detailed credit and property assessments, originating and managing comprehensive loan applications ...

Cover Letter Examples >. Professional Loan Officer Cover... Your loan officer cover letter must immediately capture the hiring manager's attention. Demonstrate your expertise in analyzing financial information with clarity. Highlight your proficiency in determining clients' creditworthiness and your impeccable record of managing loan portfolios.

Address of Bank or Lending Institution. City, State, Zip Code. RE: Application for loan of $50,000. Dear Name of Loan Officer: This letter is a formal request that you favorably consider my loan application. I have been a patron of this bank for the past 20 years.

Best Cover Letter Greetings: The greeting in your cover letter should be professional and respectful, setting the tone for the rest of your letter. It's best to address the hiring manager directly if you know their name, but if not, a general professional greeting is acceptable. 1. "Dear Hiring Manager," 2.

Step 2: Start with Your Contact Information. Begin your letter with your contact information at the top, followed by the date and the lender's details. This establishes a professional tone from the outset. Example: Your Name. Your Business Name. Your Business Address. City, State, Zip Code. Date.

In addition to our loan officer cover letter example, here are some tips for making your first impression count. Do use a professional but friendly tone. Use this opportunity to showcase your authentic personality as well as your experience evaluating loan applications. Don't focus on gaps in your experience. If you are applying for a ...

We have used all the important tips of the above units into a single a loan officer cover letter sample to demonstrate a winning document that can be created in GetCoverLetter editor. Lana Sliverfox. Loan Officer. 101 Shore Road Lane. 8765-876-987 / loan&[email protected].

Loan Officer Cover Letter Sample. ... Cover letters are an important part of any job application, including for loan officers. Writing an effective cover letter for a loan officer role is a great way to show your interest in a job and make a positive impression on potential employers. Here are some key takeaways for writing an impressive loan ...

Dear Mr. Feffer, I am writing to express my interest in the Mortgage Loan Officer position Company Name currently has available. I know I would make an exceptional candidate with my blend of financing and customer service skills. With a Bachelor's Degree in Finance and six years working in the industry I believe I have the needed skills to excel.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further and demonstrate my enthusiasm for this role. Sincerely, [Your Name] Use these Loan Officer cover letter examples to help you write a powerful cover letter that will separate you from the competition.

11+ Part-Time Job Cover Letter Templates -Samples, Examples: 11+ Medical Letter Templates: 13+ Loan Application Letter Templates: 14+ Sample Employment Letter of Intent Templates - PDF, DOC: Essential Guidelines When Writing A Promotion Application Letter: 12+ Real Estate Letter of Intent Templates - PDF, DOC: 12+ Solicitation Letter Templates