Case Interview Types: Master Common Ones Before Your Interview

- Last Updated January, 2024

Rebecca Smith-Allen

Former McKinsey Engagement Manager

On Case Study Preparation , we described what a case interview question is and how you should approach answering one. You can think about that page as your Consulting Case Interview 101 course.

But if we could tell you how to ace your consulting case interview in just one page, Bain, BCG, McKinsey, and other top consulting firms would give out a lot more offers than they do every year.

On this page, we discuss the most common types of case study interview questions . We’ll take your understanding of how to answer these to the next level by outlining the key issues to consider when structuring your answer.

Let’s get started!

Here are the types of cases you might come across during your case interview :

- Profitability Cases 1.1 Profit Optimization 1.2 Revenue Growth 1.3 Pricing Optimization 1.4 Market Entry 1.5 M&A 1.6 Cost Optimization 1.7 Startup / Early-Stage Venture

- Non-Profitability Cases 2.1 Lives Affected 2.2 Retention 2.3 Industry Landscape and Competitive Dynamics

- Market Sizing Questions (also called dinner conversation cases)

- Case Interview Math (also known as consulting math) 4.1 Consulting Math Example 4.2 Summary of Key Things to Remember on Consulting Math Questions

How To Make the Most of Case Interview Practice Time

Help with case study interview preparation.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

Profitability Cases

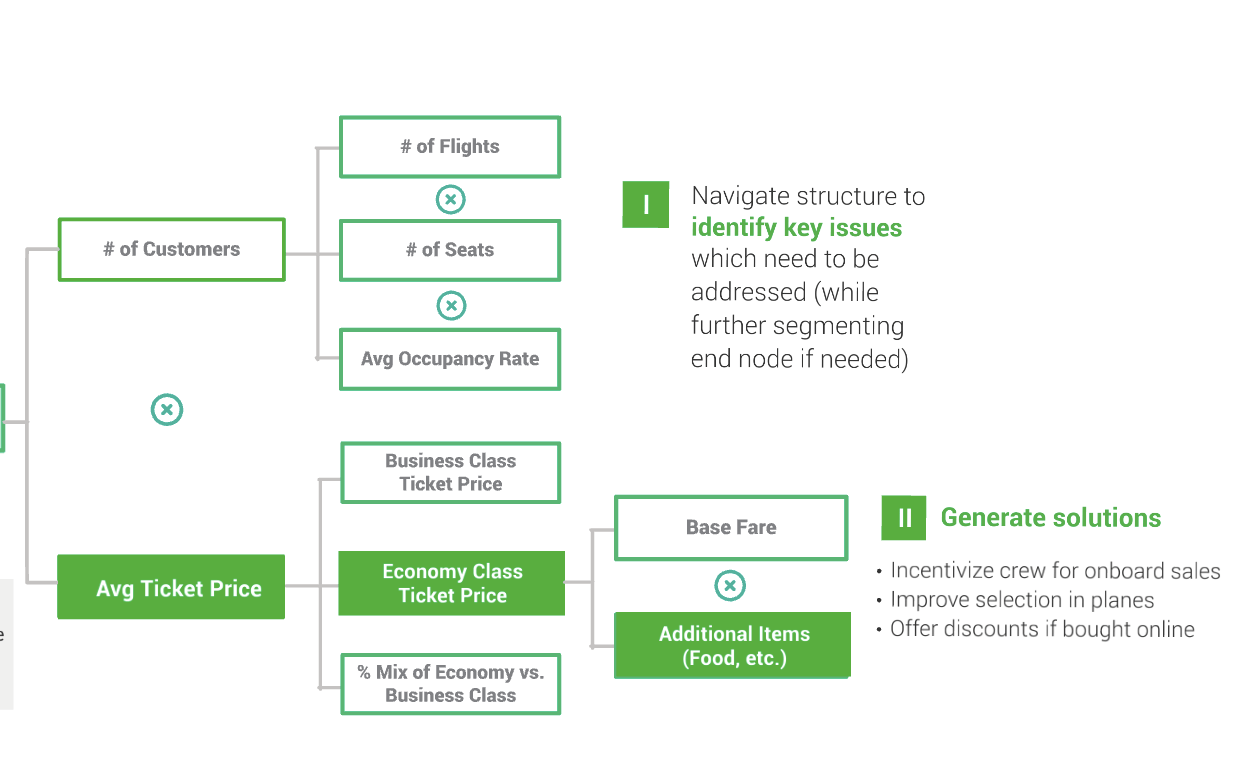

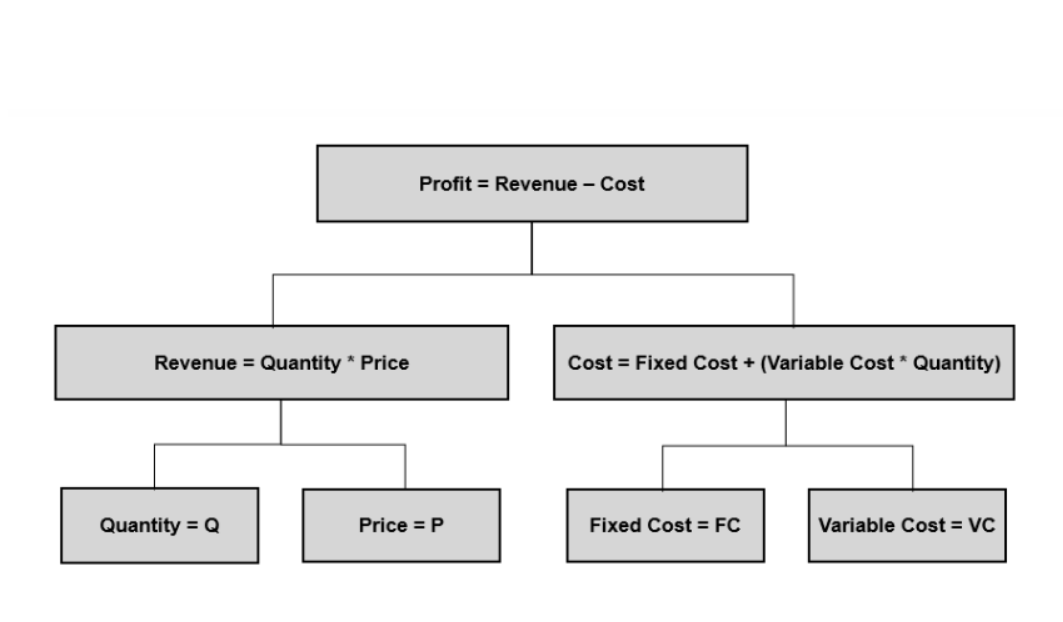

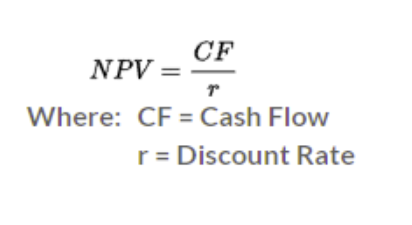

On this page , we discussed case interview frameworks that can help you structure your answers to case study interview questions, we introduced the profitability equation. It’s 1 of 2 basic business frameworks you can use to answer any type of case question.

This formula can help ensure you address all the key aspects of straightforward profitability cases like the following:

A sports apparel retailer has experienced declining sales in its stores over the past year and declining profits. How would you recommend they address their profitability problem?

A cell phone manufacturer is experiencing declining profitability despite strong sales. What should they do to improve their bottom line?

For more detail on the components in this formula and an example of how to use it to solve a case interview question, see our Case Interview Frameworks page . Below, we’ll discuss types of profitability problems that go beyond the basics.

Profit Optimization

Perhaps a company is profitable… just not profitable enough .

Maybe its margins are lower than those of an industry rival.

Maybe they’ve dipped below its own prior-year performance.

Perhaps management sees an opportunity to launch a new product, leapfrogging the competition, but needs to generate more cash to invest in development.

Any of these can be reasons to improve the performance of an already profitable company.

Sample questions:

A nationwide fast-food chain failed to meet Wall Street expectations on its latest investor call and as a result, its stock price fell significantly. Management wants help identifying opportunities to improve the bottom line.

The CEO of a regional hospital chain is concerned that his company’s profitability is half that of the market leader. How can the company grow its net income?

Use the Profitability Equation

In structuring your analysis of a profit optimization case, you should touch on all 4 components of the profitability equation to understand what the company is doing well and where things have taken a turn for the worse.

But the underlying problem in this type of case may be more subtle than in a basic profitability question.

Instead of a big jump in costs or the loss of a large customer wiping out a significant chunk of revenue, the company may be experiencing a couple of small problems that add up to bad news for the bottom line.

Benchmark Relative to Competition of Past Performance

For example, if our client is a TV manufacturer and we find out that our cost of producing a TV has increased overtime while our prices have remained the same, we can see that rising costs is the reason for our profits declining.

To turn around the situation, we could look into what the competition is doing to reduce costs. For example, if a competitor is sourcing the same materials as us but from a cheaper supplier, we want to see if we can lower our cost by sourcing from the same supplier.

Benchmark One Business Segment to Another

Another way consultants benchmark performance on revenue and cost levers is by comparing the performance in one business segment or type of end-customer to another .

Continuing with our TV manufacturing example, we might find that the client has seen costs rise on components in its high-end models but remain constant for its low-end models.

We can look into what is being done differently in the low-end product group: low-cost sourcing, process improvement, etc. to find opportunities to improve the cost position in the high-end segment.

Use Key Performance Indicators (KPIs)

The company may also need more disciplined business processes and a system for measuring key performance indicators .

Our TV manufacturer might institute a system for measuring cost per unit on a weekly or monthly basis in order to ensure they have an early warning system to monitor if costs are getting out of line.

To go with these KPIs, a regular process for reviewing the costs and taking necessary action could be instituted. Disciplined processes and performance indicators will help to fine-tune operations over time, taking them from good to best-in-class.

Key concepts to consider when addressing a profit optimization case:

The profitability equation including all its components,

- Benchmarks of cost and/or revenue relative to best-in-class competition and prior year performance.

- Benchmark the company’s performance segmented by product or type of customer .

- Opportunities for business process improvement and key performance indicators that will allow management to monitor profitability more closely.

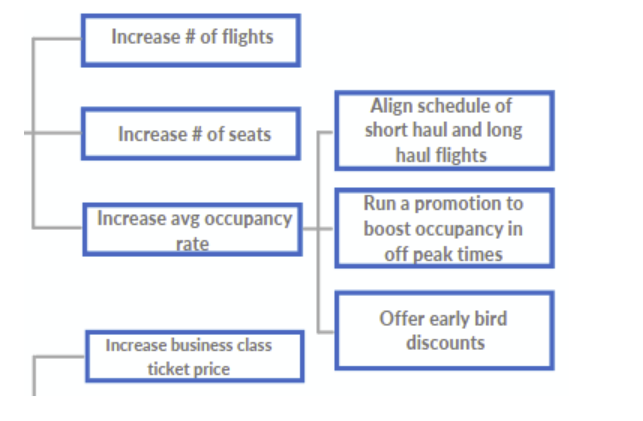

Revenue Growth

Revenue growth case questions focus on companies that, while already profitable, still want to grow.

They can do this by increasing market share, by selling their existing products to new markets, by selling new products to their existing customers, or by pursuing a combination of these opportunities.

They can also capture more revenue by increasing prices.

A national chain of fitness centers wants to leverage its brand equity by selling additional products and services to its client base. What incremental products and services can profitably grow revenue?

The president of a printer and ink manufacturer thinks there is an opportunity to provide after-sale service to its customer base. What might be the impact on revenue from entering this market?

Capture Additional Market Share

As its name suggests, this type of case study focuses on the first half of the profitability equation — revenue = price x quantity of units sold. in examining units sold, you should consider the company’s ability to capture additional market share for existing products in the markets it already serves. , what is the company’s current share of the market that of its largest competitor what would it take to capture additional share product improvements a shift in marketing and promotion.

If a chain of fitness centers was our client, for example, we’d look at whether the primary competition was 1 or 2 large chains or a number of small, single-location gyms and tailor our strategy to increase market share accordingly.

If the competition was single-location gyms, we could promote flexibility for members to use our facilities in multiple locations to bring in new customers. We could also leverage the client’s greater size to outspend the small gyms on advertising.

Branch into New Products or Markets

Also, consider the new products and/or markets the company could branch into . What products do competitors sell that the company doesn’t? Does the company have capabilities that would help them succeed in other markets?

Our fitness center client could consider selling new products like fitness apparel or vitamins. They could expand into new markets, such as towns and cities adjacent to ones currently served.

Offer Services to Existing Customers

In addition, consider services that can be sold to existing customers . Post-sales support for equipment, for example. Or consumables used with their products, like ink for a printer manufacturer. Our fitness center client could look into providing personal fitness coaching services to members.

Review Pricing

Lastly, consider the company’s flexibility to raise prices . Where do their prices stand relative to competitive products or services? Do their products or services have higher quality or value-added capabilities that would command a higher price?

For more examples of revenue growth case interviews, see our Revenue Growth Case article.

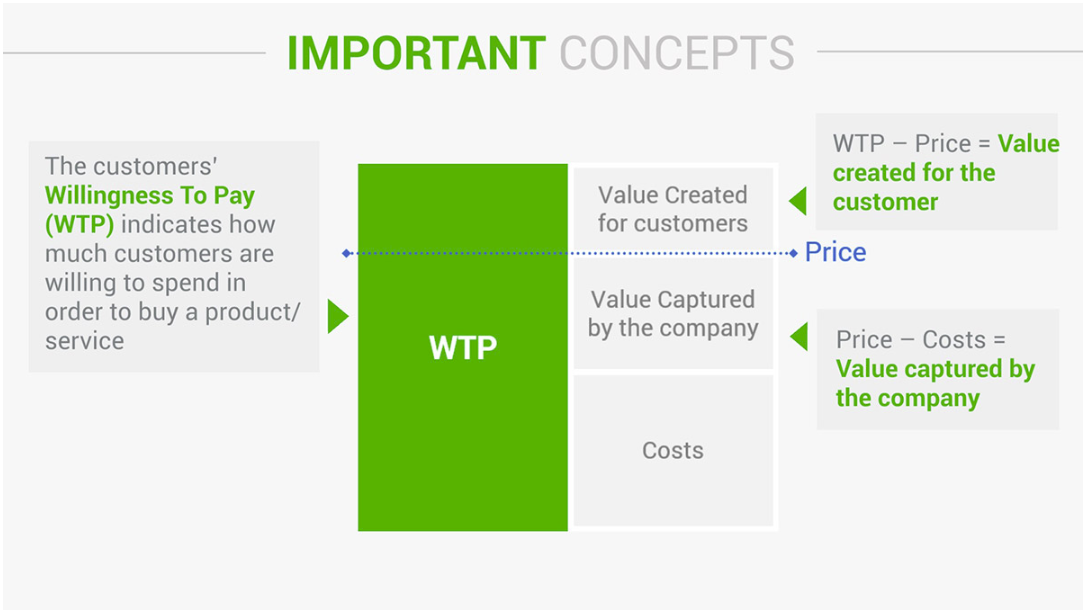

Pricing Optimization

A company must have a solid product or service offering to be able to take a price increase without seeing a significant loss of sales to competitors.

If their products or services are strong, then optimizing price can be an important lever to grow revenue.

A manufacturer of kitchen knives sells a range of products, from low-end to professional, to customers at different price points. They’ve developed a new line of knives in collaboration with a celebrity chef and would like help setting the prices for these products.

The airline industry has experienced significant changes in its pricing model over the past few years, with some airlines charging separately for checked baggage, meals, and beverages. A global carrier has asked us to help optimize the pricing of the additional services it provides to customers who fly with them.

Elasticity of Demand

When prices rise, demand for a product goes down and when prices fall, demand rises. You’ll remember this from Economics 101, or perhaps just from common sense. Pricing optimization is all about how much .

If you can raise prices with demand going down just a little, you can improve a company’s revenues by raising price. If a change in price has a big impact on demand, then raising price could be a big mistake.

The term for this is Price Elasticity of Demand . If demand for a product or service changes a lot in response to a change in price, it’s said to have price elasticity. Products with many substitutes or ones that consumers can easily do without are the most sensitive to price changes.

For example, if McDonald’s raised the price of the Big Mac, more customers might go to Burger King, Taco Bell, or just eat lunch at home. McDonald’s hamburger sales would fall dramatically.

Substitutes

For some products, demand is relatively insensitive to changes in price. This can be the case for luxury goods, for products that have few substitutes , or for when there are large switching costs. When the cost of home heating oil rises, some customers consider switching to natural gas to heat their homes. But if doing so will require buying a new furnace to run on gas or paying for pipes from their house to the gas distribution network, they won’t make the change unless the change in price is dramatic and/or expected to persist for a number of years.

3 Methods for Setting Prices

Competitive-based pricing — Setting prices based on the prices of other similar products in the market. This is the simplest method for setting prices. Companies who use competitive-based pricing are price takers.

Cost-based pricing —Setting prices as a function of the cost to provide a good or service plus a profit margin. Cost alone can’t be used to set pricing because if a company’s costs are out of line with its competitors, it may price itself out of the market.

Value-based pricing — Setting prices based on the value provided to customers. Luxury goods are priced well above the cost of their production because customers of these products value association with the prestigious image the product conveys. Products that provide significant value to customers in terms of saving time or providing features not found in other products can be priced higher because they are worth more to customers.

Value-based pricing the best pricing method but it can only be used for products and services that are sufficiently differentiated in the eyes of the customer that they will not change their buying behavior in response to higher prices.

Market Entry

Significant start-up costs will be incurred to develop and manufacture a new product, to launch the marketing campaign, or to build the sales force needed to find customers.

To ensure that spending money on start-up costs are worthwhile, due diligence needs to be done to estimate the size of the market being considered and the cost of successfully entering it.

A teen fashion retailer has seen its sales boom in the North American market for the past 5 years. They’re considering expansion into international markets. They’d like help identifying which markets provide the best opportunities for their line of clothing.

A not-for-profit organization has been successful at hiring the long-term unemployed to manufacturer furniture made from pallets and other recycled items. They’ve not only designed and created beautiful pieces of indoor and outdoor furniture, but also helped to improve the lives of individuals in one city. They’d like to expand to other products and potentially to other cities and have asked for our help in assessing their options.

There are 4 parts to any market entry case : market size, market attractiveness, costs of entry and capabilities required. Let’s look at each.

Market size

Market sizing is sometimes used as a case interview question on its own. See below for more details . It’s also usually the first part of a market entry case. It addresses how large a market is in terms of annual revenue, number of units sold, or both. The underlying issue is whether there is enough opportunity in a market to make it worth the up-front cost.

To determine whether the amount of sales revenue or unit volume is “enough,” estimate the size of the market based on the information provided by your interviewer or by using factors you can reasonably estimate about the market. You can then consider profit margins and what portion of the market the company must capture to break even.

Market attractiveness

The market a company is thinking about entering may be huge, but it can still be unattractive. Key questions include: What is the profit margin for companies already in the market? What does the competition in the market look like? Large firms with huge marketing budgets or small companies?

Costs of entry

Will new technology, equipment, sales staff, or something else be required to succeed in the new market? If so, what will it cost? The greater the investment required to enter a market, the more difficult it will be to recoup the initial investment.

Capabilities

Does the firm being discussed have what it takes to succeed in the new market? In some markets, the key to success is marketing expertise and distribution. In others, it’s low costs and disciplined business processes. Identify the key attributes of success in the market and whether the company possesses those attributes.

To learn how you can structure and break down a case such as these, visit the Case Interview Frameworks page can help you think through important factors in this type of consulting case interview question.

Above, we looked at how to analyze a market entry case.

If a market is attractive but the client does not have all the capabilities required to succeed in it, it may decide to buy the right capabilities through a merger or acquisition (M&A).

They could also consider M&A opportunities if they need to enter the market fast rather than build capabilities over time.

The number 3 competitor in the cellular phone services market is at a disadvantage relative to its larger competitors. Providing cellular phone service has high fixed costs—for the equipment that transmits calls, the retail stores that sell phones and provide in-person customer support, and the marketing spend that is key to customer attraction and retention. The CEO is considering acquiring a smaller competitor in order to gain market share. He would like our help thinking through this decision.

The president of a national drug-store chain is considering acquiring a large, national health insurance provider. The merger would combine one company’s network of pharmacies and pharmacy management business with the health insurance operations of the other, vertically integrating the companies. He would like our help analyzing the potential benefits to customers and shareholders.

When you get this type of case, ask your interviewer why the company is considering the merger or acquisition. They may provide key information on the size and attractiveness of the market the target company is in. Assuming the target company is in a large, attractive market and has the critical capabilities required to succeed in that market, then you should consider whether it is better to build the new business internally or undertake a merger or acquisition.

If two companies are considering a merger, they still have to persuade their shareholders that the 2 companies would be more valuable working together than on their own. The value the companies can create by working together is called synergy .

Synergies from a merger or acquisition can be on the cost side, the revenue side, or both. Cost synergies include leveraging fixed costs across more business or cutting costs duplicated in both firms’ operations. Revenue side synergies include selling a broader range of products through the existing sales force or distribution channel.

The synergies created by the merger or acquisition must be greater than the premium that must be paid to secure the deal in order for the transaction to make sense.

Integration

Mergers and acquisitions are large and complicated transactions. They require integrating the talent, systems, policies, and processes of the 2 organizations. Synergies that look good on PowerPoint slides do not always accrue in real life. In addition, key employees may quit during the disruption and uncertainty the M&A activity causes. Even if substantial synergies are identified, a company should consider whether it can successfully undertake the integration.

Regulatory Approval

Lastly, mergers of large companies in regulated markets (financial services, telecommunications) and concentrated markets (ones with only a few large competitors) can require government approval . The possibility of the government blocking the merger or acquisition should be considered in this type of case.

Cost Optimization

A top-3 home improvement retailer has seen price increases from several of its vendors, squeezing its bottom line. The company wants to know how it can cut costs to restore its margins to their previous levels.

The head of an automobile manufacturer has seen its production costs rise over the last several years. She wants your help in turning around this trend.

The most important thing to understand when addressing this type of case is what is going on with fixed costs and variable costs . The costs can be broken down and compared to competitors’ costs or costs in prior years to identify opportunities for improvement.

As a reminder, here are the definitions of fixed and variable costs:

Fixed Costs

Costs that you incur just because you are in business regardless of how many units you sell. Examples: factory rent, equipment depreciation, compensation for salaried employees, and property taxes. A way to think about fixed costs is that a cost that does not change over the short-term, even if a business experiences increases or decreases in its sales volume.

Variable Costs

Costs that only incur when you begin to produce units (if you sell nothing you have no variable costs). Examples: sales commissions, credit card transaction costs, and sales taxes. A way to think about variable costs is that a cost that does change over the short-term. More sales volume will mean more variable costs.

Startup / Early-Stage Venture

Startup and early-stage venture cases have some similarities to market entry cases.

Ensuring that the market the company is going after is big enough and has high enough margins to be attractive is important, as is understanding their competition.

Startups are small, nimble companies with only a handful of key employees and limited access to cash. These factors need to be taken into account.

A student from Iceland studying in the U.S. has determined there’s a big opportunity to bring Icelandic-style yogurt to this market. How would you recommend he proceed?

A software company has developed video technology that can be used to quickly and easily create short videos that can be sent to a colleague in place of typing a long email. This disruptive technology will take advantage of the cameras built into cell phones and laptops as well as consumers’ preference for watching a video rather than reading text. The company has a small number of beta customers and is looking for advice on how to ramp up their product to attract a wider audience.

When answering this type of case, focus on the key things that help these small, fast-growth ventures move with agility as they search for the product and business model that will attract customers and investors.

The Right People

They need the right people —ones with product savvy, marketing savvy and investor savvy to make it.

A Minimum Viable Product

They need a minimum viable product . This is an initial version of their product offering that will attract paying customers, allowing them earn money and to collect feedback that can be used to improve the product. It will also serve as a proof-of-concept to investors.

A Business Plan

Start-up and early stage venture also need an initial business plan addressing how they will bring their product to market.

Non-Profitability Cases

Some might focus on charitable organization. Others might focus on businesses issues that don’t relate directly to profits, such as employee retention or understanding the competitive dynamics in an industry.

An overview of how to approach non-profitability cases is found on this page .

This section focuses on key concepts to address in a few common types of non-profitability cases.

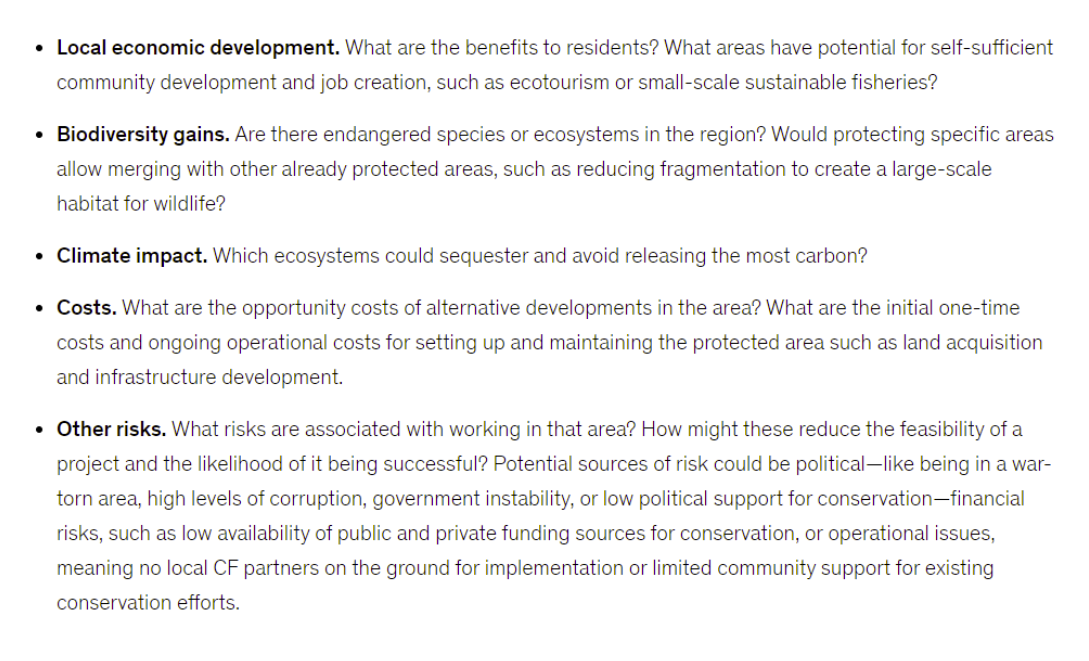

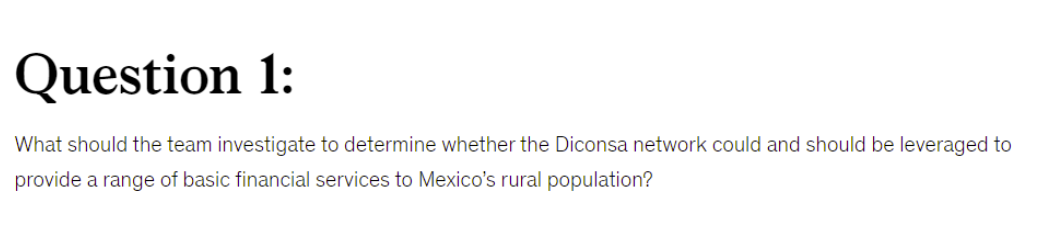

Lives Affected

Government agencies and charitable organizations don’t aim to maximize profits. Nonetheless, they do important work that affects many lives.

They might hire a consulting company to help them improve their effectiveness, or a consulting firm might take on an important project for a charitable organization on a pro-bono basis.

The state agency that administers the free summer lunch program for children of families under a certain income threshold wants to increase the reach of its program. How would you advise they approach this?

Malaria is a devastating disease, affecting hundreds of millions of individuals each year. It’s transferred to humans by mosquitoes, with most of the cases occurring in South Asia and Sub-Saharan Africa. Though drugs to treat the disease exist, many in the affected regions don’t have access to or can’t afford these drugs. The disease is a strain on the economies of several nations, perpetuating the cycle of poverty. What can be done to alleviate this disease and its adverse economic effects?

Key Performance Indicators (KPIs)

A detailed example of how to approach a lives affected case is provided here . As discussed in that case, the key to answering this type of question is to find the key performance indicator (KPI) the organization is trying to improve. In the case of the first sample question above, this is the number of free lunches served to needy children.

Benchmarking

Once you’ve established the KPI, the case can be answered in the same way you’d answer any case question on business improvement. You can benchmark the organization’s performance by looking at trends in the KPI over time or comparing the growth of the organization’s KPI to that of other organizations serving the same target population to assess whether the agency is doing a good job meeting their mandate or falling behind. If they are falling behind, drill down into the factors that might be causing them to do so.

Cases focused on employee retention are not directly about profits, though the loss of key skills when employees depart and the cost of training new hires require hurts the profitability of organizations with high turnover.

A fast-food chain is experiencing an increase in the already-high rate of employee turnover typical in its industry. It’s also experiencing trouble attracting qualified new employees. What would you suggest?

The school system in a middle-class suburban town is experiencing higher-than-normal rates of teacher attrition. With a tight budget, they are unable to simply raise salaries to hold onto experienced teachers. What options does the school system have for increasing teacher retention?

Conducting retention interviews —interviews with departing employees to find out why they’re leaving the organization—is a standard practice in most organizations. Because of this, there should be data available on what employees like about their jobs, don’t like about their jobs, why they looked for new opportunities and what new job they’re taking. Ask your interviewer for this information, as well as survey data on the job satisfaction of all employees. It can be used to develop a multi-pronged approach to improving employee retention.

- Look for opportunities to enhance aspects of the job that appeal to employees and change the negative aspects of working for the organization. For instance: What about the job is appealing?

- Do employees see the work of the organization positively impacting the broader community?

- Do employees like their colleagues, recognition they receive from management, the financial package provided?

Industry Landscape and Competitive Dynamics

Cases focused on the landscape of an industry and its competitive dynamics are about the big-picture strategic issues that must be taken into account to compete effectively in that industry.

The traditional newspaper industry is facing heavy pressure from free online news organizations that don’t face the cost of printing a traditional newspaper and are able to leverage Internet ads as a source of revenue. The publisher of an award-winning regional paper would like your help in assessing and responding to this new threat.

The food and beverage industry faces disruption to their traditional brands as organic and small-batch products gain favor with consumers. How should companies in this industry respond to this new of competitive threat?

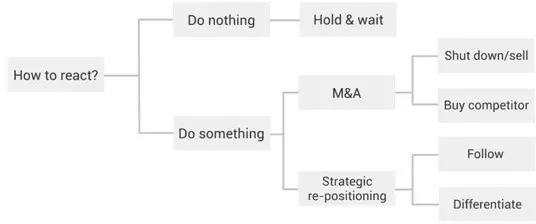

When analyzing this kind of case, first look for what is changing in the industry —consumer preferences, brand loyalty, barriers to entering the market, regulation, the industry’s cost structure, etc. Ensure you know what the source of change is before you begin to look for a strategy to help the client succeed in the new marketplace.

For tips on structuring a case like these, visit the Business Frameworks page . SWOT analysis and other frameworks include some factors to consider in this type of consulting case interview question.

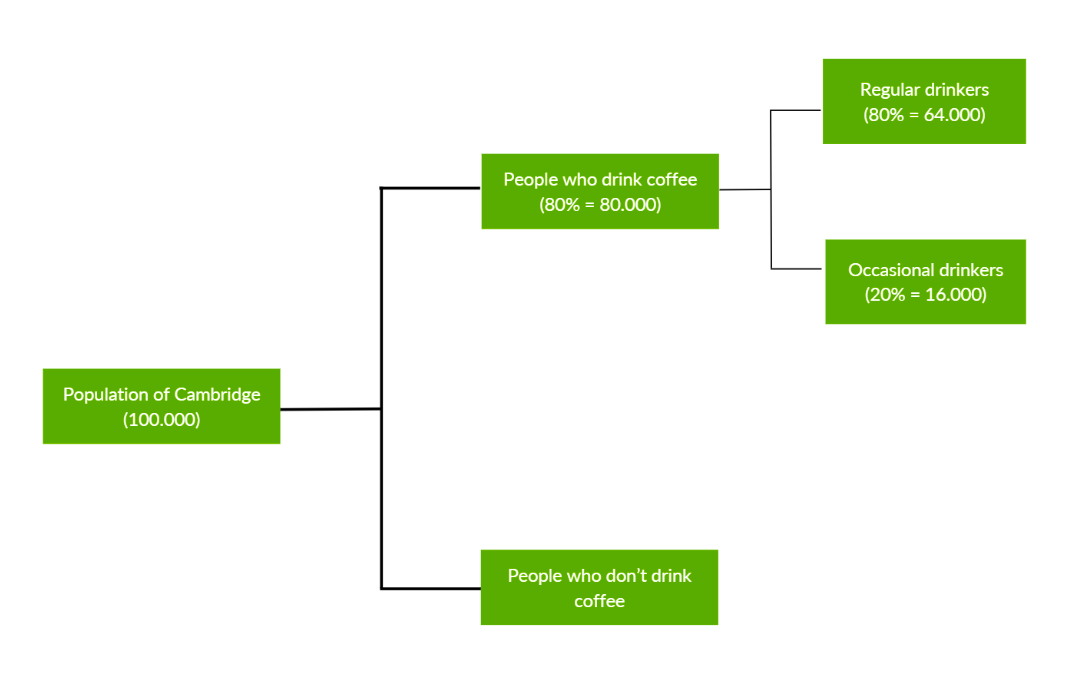

Market Sizing Questions (Also Called Dinner Conversation Cases)

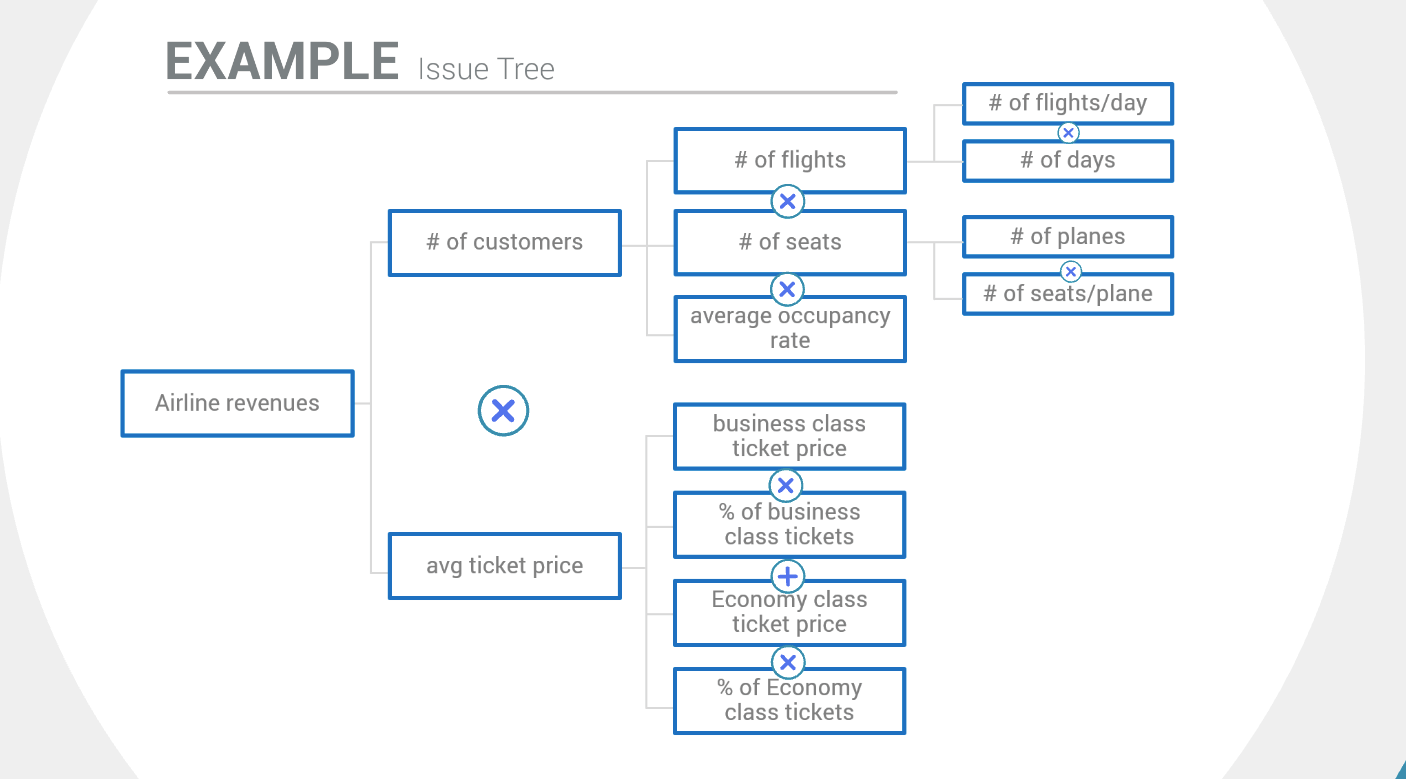

Market sizing cases are focused on establishing the size of a market in terms of annual revenue or the number of units sold rather than determining how to compete successfully in the market.

Consulting firms often ask market sizing questions early in the consulting interview process or in interviews of undergraduate students who may not have a deep business background.

They can also be one component of complicated, multi-step cases in later-round interviews. Market sizing questions focus on making logical estimates, showing creativity, and doing basic math.

What is the size of the market for organic toothpaste in the United States?

How many golf balls would fit inside the Empire State building?

What Are Consulting Interviewers Looking for on Market Sizing Cases?

With case interview questions of this type, you’re not expected to know the answer, but instead to show a logical way of deducing it. Committing a few key facts to memory would serve you well. For example, knowing the population of the United States (or the country you live in) would give you a good place to start as you think through the size of the market for various retail goods. Gross domestic product can help with sizing industrial markets.

Key Statistics to Know for Market Sizing Case Questions:

The Population of the United States 2019 – 329 million according to the US Census Bureau .

World population in 2015 – 7.4 billion according to the United Nations DESA / Populations Division .

2018 Gross Domestic Product of the United States – $20.5 trillion according to the Bureau of Economic Analysis of the U.S. Department of Commerce .

Statistics like these give you a good foundation to start your market size analysis. For instance, you could begin estimating the size of the U.S. market for organic toothpaste with the US population. From there, make logical assumptions:

- How many times a day does the average American brushes their teeth?

- How many toothpaste applications are in the average tube of toothpaste?

- How much does the average tube of toothpaste cost?

These assumptions will allow you to calculate the size of the overall toothpaste market in terms of annual revenue. To get to the annual revenue of organic toothpaste you’ll also need to estimate:

- What portion of toothpaste consumers prefers organic toothpaste?

You can (and should) bring paper and a pen into consulting interviews. Use these to keep track of your assumptions as you work through them and to do the basic math required to come to a conclusion.

Our Market Sizing Questions article has a list of the 7 steps to answering this type of question.

Key Things to Remember When Answering a Market Sizing Question:

- Ask clarifying questions. Does the interviewer want the market size in terms of dollars or units? For the United States, North America, the world?

- Use round numbers for simplicity. For instance, using $20 trillion for U.S. GDP rather than $20.5 would be fine.

- Creativity in your approach to approximating the market is important, but so is good sense. Don’t be so creative that your answer lacks credibility.

- Practice case math so you can do it quickly and correctly even under the stress of an interview.

- Give your answer a sniff-test at the end. Does it make sense? This will both show that you are careful in your analysis and give you the chance to fix an arithmetic mistake if you find you’re way off.

Case Interview Math (also known as consulting math)

Management consulting interviewers screen candidates to ensure that they can do basic math.

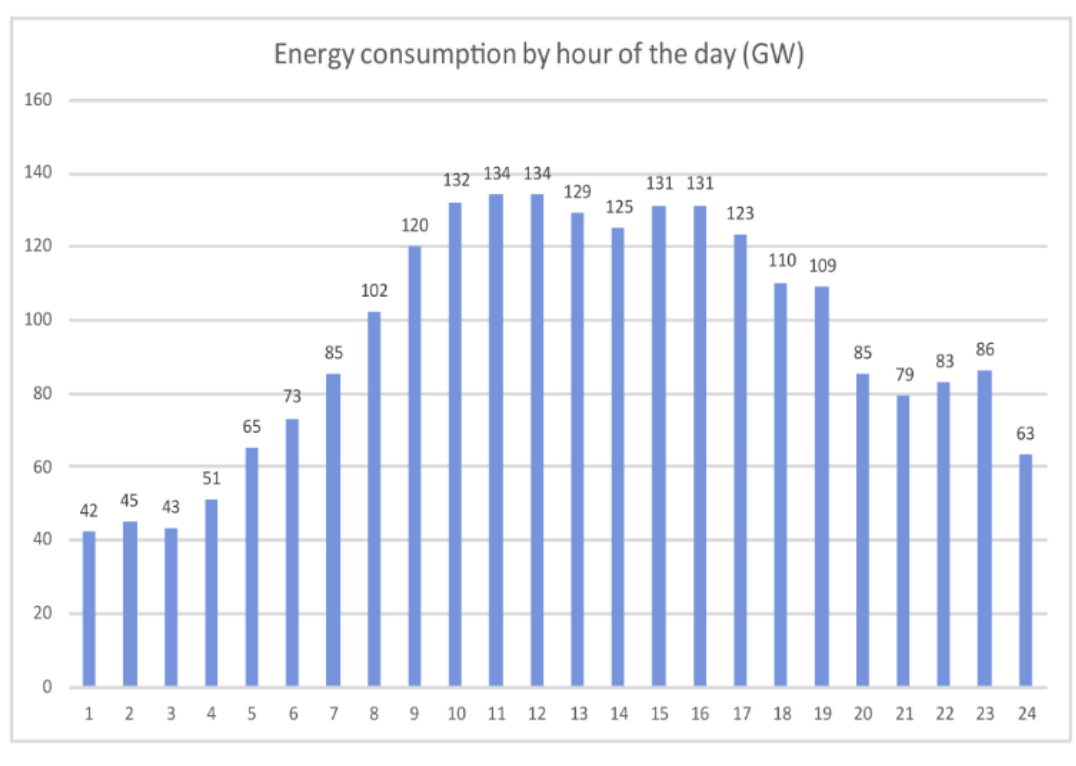

Don’t worry if you didn’t ace multivariate calculus, the math is usually basic arithmetic—addition, subtraction, multiplication, division and fractions/percentages. You may also be asked to extract data from charts and convert from one unit of measure to another.

As mentioned in the discussion of market-sizing case questions above, you can and should bring a paper and pen into the interview. It’s fine to write out your calculations.

Consulting Math Example

In each step, we’ll provide a sense of how we are making the estimate so that the interviewer knows we’re not just grabbing a number out of the air. We want our answer to be as grounded in fact as possible.

The population of the United States: 329 million. We’ll round to 330 million for simplicity.

The number of times the average American brushes their teeth – 2 times per day. Some people brush at lunchtime too, but that’s probably offset by people who only brush once a day.

330 million people brushing 2x’s per day gives us 660 million toothpaste applications/day.

To get to an annual number of toothpaste applications, we need to multiply by 365. That’s 241 billion toothpaste applications. We’ll round to 240 billion for simplicity.

A tube of toothpaste usually lasts me about 2 months. That means we need to divide by 120 toothpaste applications per tube to come up with the number of tubes sold annually (2 months x 30 days/month x 2 applications/day). 240 billion toothpaste applications / 120 applications per tube = 2 billion tubes of toothpaste sold in the U.S. every year.

The cost of toothpaste ranges from $1 for inexpensive brands to $4 for expensive brands, but the average cost is probably about $2. This means the total revenue for toothpaste sold in the U.S. is 2 billion tubes x $2 or $4 billion.

The percent of the toothpaste market that’s organic is a little tricky to estimate. In the grocery store I shop in, there’s 1 aisle of organic goods in a store that has 20 aisles – that means organic products make up 5% of shelf space (and presumably also of sales).

I think that people would be less likely to buy organic toothpaste than organic food, because you eat organic food, but you spit organic toothpaste out into the sink. Organic products always cost more and organic toothpaste doesn’t seem quite as important to your health.

Conclusion: Based on that, I’ll say that 1% of the market for toothpaste is organic, so if $4 billion in toothpaste is sold in the U.S. every year, $40 million of it is organic toothpaste.

Is our answer right?

Probably not exactly. There are different sizes of toothpaste tubes, a complication that we did not consider in this analysis. There might be some people who don’t brush their teeth every day. That would mean that we overestimated consumption.

But our estimate of the market size for organic toothpaste is reasonable and grounded in logical assumptions. We could sniff-test our answer by comparing it to a market size we know, or to GDP, one of the facts we suggested having in your back pocket for market sizing case questions.

U.S. GDP was about $20 trillion in 2018. Our estimations suggest that the overall toothpaste market is $4 billion. That means toothpaste is 1/5,000 of the U.S. economy, and the market for organic toothpaste is 1% of that.

That sounds plausible. If your answer showed that the market for organic toothpaste was larger than U.S. GDP, it would be a clear indication that you made a mistake somewhere along the way.

For the 4 types of math problems you’ll be asked to compute as part of case studies, read Case Interview Math.

Above, we’ve provided you with 11 different types of case interview questions you might be asked during your consulting interviews. We’ve also told you that you need to get great at doing case math.

Overwhelming? It can be.

But it doesn’t have to be.

The best way to prepare for your consulting case interviews is NOT to spend hundreds of hours reading every case study question and answer you can get your hands on. Instead, see our page on Case Interview Practice to find out how to make the most of your interview prep time. In addition, check out this video where Davis Nguyen, Founder of My Consulting Offer, talks about how mastering the case interview is made easier when you focus on the most common types of cases.

Here in an online workshop he conducted for Columbia University, NYU, and Cornell students, you can see why this approach is so effective:

After studying the information on this page, you have an in-depth understanding of the types of cases you could be asked to analyze in consulting interviews. From Davis’s video, you know why this is so important to focus on the main types of cases. You’re well prepared to find a case study practice partner and begin practicing.

As you prepare for case interviews, you should use this page in conjunction with Case Interview Examples , where you’ll find links to sample case study questions and their answers. Remember that while it is important to discuss all the appropriate aspects of a business case, it’s important to structure your analysis and your answer. Refer back to our page on Case Interview Frameworks to ensure that you’re not just practicing more cases, but doing them better.

If you still have questions, leave them in the comments below. We’ll ask our My Consulting Offer coaches and get back to you with answers.

- Market Sizing Questions

- Cost Reduction Case Interview

- Case Interview Workshop Video

- Written Case Interviews

- Market Sizing Cases

- M&A Case Study

- Revenue Growth Case Interview

- Pricing Case Interview

- Financial Services Cases

- The Healthcare Consulting Case Interview

- Supply Chain Cases

- The Social Impact Case Interview

- Case Interview Formulas

Thanks for turning to My Consulting Offer for advice on case study interview prep. My Consulting Offer has helped almost 89.6% of the people we’ve worked with get a job in management consulting. For example, here is how Thomas was able to get a BCG offer with just a short time to prepare..

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

Unkover your competitors’ Marketing Secrets

Say goodbye to wasting hours on competitor analysis by equipping your team with an AI-driven, always-on competitive intelligence platform.

Join now to lock in an exclusive 50% lifetime discount

Stay Ahead with AI-DRIVEN Competitive Intelligence

Always-on competitive intelligence team

Unkover is your AI-driven Competitive Intelligence team delivering critical updates about your competitors the moment they happen:

- Relevant Page Changes

- New Funding Rounds

- Customer reviews

- Press mentions

- Acquisitions & Exits

- SEO gaps & opportunities

Track your competitors website changes

Keep tabs on your competitors key pages

Why spend all day stalking the competition when you don’t have to?

With Unkover, you’ll know instantly when your competitors tweak their messaging or shake up their pricing. No more endless scrolling through their sites or second-guessing your strategies.

Let us do the heavy lifting for you, ensuring you’re always in the loop by notifying you the moment a critical change happens on your competitor’s pages.

Sit back, relax, and keep winning—Unkover makes sure you’re not just in the game, you’re always a step ahead.

Read your competitors emails

Get competitor insights directly from the source

Companies love updating their customers and prospects about relevant news, product updates, and special offers.

That juicy info from your competitors? It’s yours too. Unkover will automatically capture all their emails and bring them right to your doorstep—accessible to your entire team, anytime.

[COMING SOON: Our fine-tuned AI will sift through these emails, extract key information and send them over to the best team within your org. Less noise, more signal!]

There’s no use in gathering intelligence unless it’s actionable!

We hear you! Unkover’s goal is not to flood you with tons of data points that no one in your team will ever read. We gather competitive intelligence from thousands of data sources and use AI to highlight actionable information to the right team in your company.

Say goodbye to noise. We’re 100% signal.

A sneak peek into what’s coming

We’re excited to get Unkover in your hands as soon as possible and keep building the best competitive intelligence tool with your precious feedback. The roadmap for the next few months is already exciting, so take a look!

While we build and deliver, here’s our promise to you: as an early tester and customer, you’ll lock in an exclusive bargain price we’ll never offer again in the future.

Marketing Hub

Spy on your competitors’ full marketing strategy: social, ads, content marketing, email flows, and more.

Track competitive Win/Loss analysis and build battle cards. Get alerted at every pricing change.

Product Hub

Get immediate alerts when competitors announce new features or major releases. Identify strengths and weaknesses from online reviews.

Integrations

Get the competitive intelligence you need where you need it: Slack, eMail, MS Teams, Salesforce, Hubspot, Pipedrive and more.

slack integration

Never miss a beat

Unkover’s Slack integration lets you keep your whole team up to speed with your competitors’ updates.

Choose your plan

Join now to lock in an exclusive 50% lifetime discount

For startups and small teams, it’s the essential toolkit you need to keep an eye on a select few competitors.

Up to 5 competitors

50 pages monitored

10 email workflows

3-day data refresh

50% discount

Billed annually

Professional

For growing businesses, it allows you to monitor more competitors, pages, and email workflows.

Up to 10 competitors

100 pages monitored

20 email workflows

1-day data refresh

For large companies, it is tailored to meet the needs of multiple teams needing granular insights.

Custom number of competitors

Custom number of pages monitored

Custom number of email workflows

Hourly data refresh

Custom price

Billed monthly

How to Write a Case Study and Increase YOY Revenue by 25%

Voices.com saw a 25% increase in year-over-year revenue after publishing its case study.

If you want to replicate its revenue growth in your company, you’re in the right place.

This guide outlines how to write a case study in seven high-level steps, along with three very different real-world case study examples.

How to Write a Case Study in 7 High-Level Steps

A powerful story convinces prospective customers that you’re the real deal. This section outlines the seven core steps of writing an effective case study that attracts your ideal customers on autopilot.

Step 1. Gather marketers and sales in the same room

Too often, we hear stories of marketing and sales playing the blame game—and it’s a shame as alignment between these two opposing departments breaks down silos and unlocks revenue acceleration in the long run.

Consider the following statistics from LinkedIn :

- 60% of members believed that marketing-and-sales misalignment could damage financial performance

- LinkedIn members exposed to a company’s marketing messages on the platform are 25% more likely to respond to a message from said company’s salesperson

- Sales folks who often share quality content are 45% more likely to exceed their sales quota

CEOs (or other C-suite roles like CROs ) should gather marketing and sales in a room and get them on the same page. Rather than creating a marketing case study on the fly, let the sales team lead you .

Use the following questions to narrow down on the type of content you should create:

Questions #1-#3 shape the elements of your customer success story, such as the product features, angle, and headline.

Whereas, questions #4 and #5 identify your most profitable clients (a.k.a. your case study candidate) and the common attributes to focus on to attract more of them.

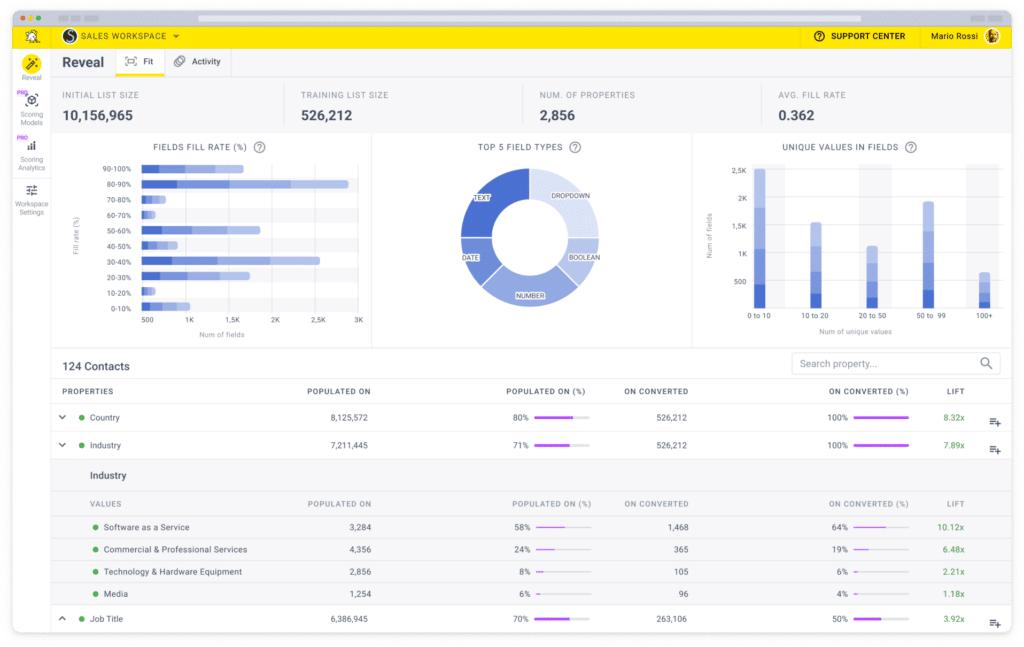

Your sales team’s response provides one side of the story. To gain a better understanding of your best customers today, use a tool like Breadcrumbs Reveal .

It analyzes your marketing, sales, and product data and tells you what attributes and actions are the best predictors of revenue. To get started:

- Connect your data sources with Reveal

- Define your criteria for success (e.g., enterprise plan)

Breadcrumbs Reveal will return a detailed view of your best customers today. It will also reveal your data health and the data that can be trusted.

Use the data provided to pin down the candidates for your client case studies—and update your ideal customer profile (ICP) while you’re at it.

Ideal Customer Profile (ICP) Worksheet

Learn how to create an Ideal Customer Profile and build a successful sales strategy with this Ideal Customer Profile (ICP) Worksheet.

Breadcrumbs Reveal is free for a limited time. Grab your free account to identify the attributes and actions that drive your revenue today.

Step 2. Pick the best candidate

Not all customers are equal. For example, a company that recently moved upmarket will focus on enterprise clients.

Now that you’ve identified your best customers today and the customer objections you need to overcome, it’s time to find the right candidate.

Ideally, the right candidate for your before-and-after story ticks these two boxes:

- Belongs in your best customer segments

- Achieves stellar results from your product or service

GrowSurf, a referral software company, focused on newsletter publishers.

Co-founder Kevin Yun explains his choice with Breadcrumbs, “They were running a great referral program and getting great results. The top five referrers had around 500 referrals collectively.”

Step 3. Request a case study interview

Writing case studies involves more than a compelling story, persuasive writing style, and authentic, real-world images that show the collaboration in action.

For all this to happen, you need to convince the client for an interview at the right time .

There are two options, according to David Ciccarelli, CEO and founder of Voices.com. Either you ask after delivering the work or when you’re starting to see significant results.

He explains to Breadcrumbs, “Asking before you finish the work will get you a quick ‘no.’ However, when you wait until the client has experienced success, you’re far more likely to get a ‘yes.’”

This brings us to the next question: who should ask the client for an interview?

Our take: the salesperson, as they’ve already established rapport and have the closest contact with the client.

At Voices.com, the account manager invites the customer for an interview. If it’s a yes, the account manager makes a nomination.

This process involves filling a form in the CRM , indicating the company name, point of contact, project details, and a link to the deliverables.

Next, these nominations are handed off to the communications manager, who acts as the case study’s creator and brand steward and determines if there’s a fit.

If there is, the Voices.com team proceeds with the case study interview .

Run a contest to gain momentum in your case study initiative . At Voices.com, the sales rep who submits the most number of nominations wins a prize.

Not only do you get the sought-after case study, but you also encourage the sales team to participate in a friendly game, boosting employee engagement by tenfold.

Step 4. Overcome concerns and objections

Sales reps who overcome objections enjoy a close rate as high as 64% —all the more reason you shouldn’t let the initial objections stop you from closing.

Yes, this applies to case studies.

There are various ways to bypass these initial nos.

If the client is sensitive about sharing results, instead of explicitly listing the exact figures in the case study, opt for a percentage format (e.g., “115% increase of revenue” rather than “…revenue increased to $593,938”).

Other ways to overcome objections include:

(i) Anonymizing names, roles, or even the name of their companies

(ii) Sharing process without diving into the strategy’s specifics

Describe the general approach to achieving results. Avoid the nitty-gritty that gives away your top strategies.

It’s a mouthful, but you get the idea.

Sometimes, clients need more context before agreeing to a case study interview. Share how you plan to use and distribute it.

What you want to do here is sweeten the pot.

Talk about how the case study improves their SEO or boosts visibility to potential customers .

Voices.com always tells its clients how it plans to share the case study via social media posts and its newsletter. Since the latter channel has hundreds of thousands of subscribers, it’s “sufficient enough to demonstrate the quality of the case study,” says David.

“For many clients, the added brand visibility is a huge incentive.”

A word of caution, if the objection centers around legal restrictions or if the client just isn’t interested, move on to the next client.

“Rather than jeopardizing our business relationship, we work at improving their experience,” adds David.

9 Winning Strategies for Aligning Sales and Marketing

B2B buyers want specialized attention, salespeople they can trust, and an easy buying process. Aligning…

Accessibility-Focused A/B Testing: 6 Strategies To Improve Inclusive B2B Campaigns

Did you know that 15% of the world’s population experience some form of disability in…

How To Integrate AI In Digital Marketing: 7 Tips For A Better Performance With AI

Most people have heard the buzz about artificial intelligence (AI) and the incredible feats it…

Step 5. Interview the client and gather intel

It’s D-Day.

Prepare a list of open-ended questions that outlines the client’s before-and-after transformation.

“When you frame your questions,” shares Kevin Yun, co-founder of GrowSurf, “You can synthesize the story from the transcript and craft a case study that resonates with prospects.”

Here are eight questions to get you started:

These answers are not only helpful in your case study, but also your customer research and content marketing strategy .

For example, #3 unearths insights about your competitors and shapes the backbone of your content strategy . This is also valuable if you’re wondering what to write for your product comparison posts.

Pro Tip : Keep the data at the back of your mind as you start planning for the case study content. While the customer quote adds the human element and the emotional ‘oomph’, it’s the data that proves your expertise.

“Consolidating all the data allows you to leverage key takeaways and highlights when building your first-ever business case study, “ shares Gabrielle Carreiro, founder of Binge Digital , with Breadcrumbs.

“This is important because not only do you want to back up your work with quantifiable results, but you also want to draw attention to the success you’ve driven and position yourself as a thought leader in your industry.”

Step 6. Create the case study and bring it to life

By now, you should have a lot of information at your fingertips. Review the interview transcript and edit the client’s answers into the following format:

- Overview : Introduce the client and the current state of the company, along with a compelling headline

- Problem : Describe the ‘trigger’ that led the client to look for your solution. Agitate the pain point and share what’s not working

- Solution : Explain what you did to solve the problem. This is the perfect chance to spotlight your process and value proposition (or better yet, your unique selling proposition)

- Results : Share the results you delivered in exact figures. If it’s not possible, anonymize the data

Design follows copy.

After writing the case study content, work with the design team to explore how you can bring the elements (e.g., case study headline, background colors) to life.

How To Develop A Powerful Voice Of The Customer (VoC) Strategy

You already know that there’s no way around “the voice of the customer” or VoC…

11 Customer Engagement Metrics for B2B SaaS Companies in 2024

The importance of customer engagement to your company’s profitability and growth cannot be overemphasized. According…

Eliminating Data Silos in Businesses: A Guide For Marketers

Some businesses manage without even realizing they’re dealing with data silos, so it’s not really…

Step 7. Distribute the case study and repurpose in other formats

Your new case study is finally completed.

Now all that’s left to do is to promote it and show everyone what you have accomplished in your space.

Consider the following distribution ideas to boost visibility:

- Upload it on a digital asset management platform (DAM) where every stakeholder can easily access the case studies

- Promote it in all employees’ email signatures

- Share it on social media and encourage your team to do the same

- Cross-post on channels like LinkedIn and Medium. Don’t forget to link it back to the original source.

- Guest post on relevant publications and non-competing blogs to add a backlink to your case study

- Print your case study and distribute it to prospects at networking events and large conferences. This beats handing out business cards that are bound to go missing amid the chaos!

- Pitch your case study to podcasts . Tell the podcast host about your unique process and offer your unique take to their listeners.

- Repurpose or expand your case study into a webinar , infographic, checklist, blog post, or ebook

- Subscribe to sourcing services like Help a Reporter (HARO) and Help a B2B Writer. Pitch your case studies when you come across a relevant opportunity

Content distribution is never a one-off task. Promote your case studies and repurpose them as needed to attract new clients .

3 Very Different Case Study Examples (And Why They Work)

This section details a real-world case study analysis featuring some of our favorite startups. By the end of it, you’ll walk away with a few ideas to inspire your own.

1. GrowSurf

Headline : How A Business Strategy Newsletter Grows Subscribers By 25% Every Month Using GrowSurf

Results : 22% of lead sign-ups

Why it works :

GrowSurf ’s case study starts with a bang.

The headline instantly speaks to the lead’s desire (i.e., grow subscribers every month).

It then lists common problems that leads relate to (using referral software to build a custom referral program without coding skills).

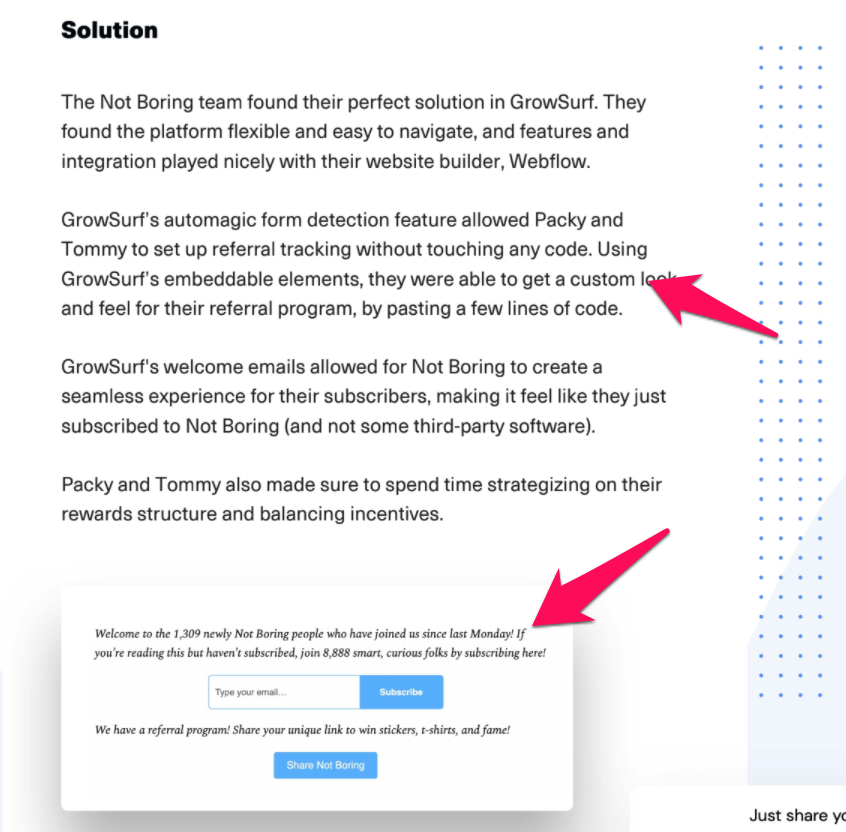

Next, we see GrowSurf diving into its specific features and how it effortlessly solved the client’s problem.

Note how GrowSurf showcases its automagic form detection tool and embedded elements while tying back to the client’s main problem (coding).

Notice how GrowSurf strategically places the screenshots ?

These pictures in action show how the referral software works. They fill in the lead’s curiosity gap .

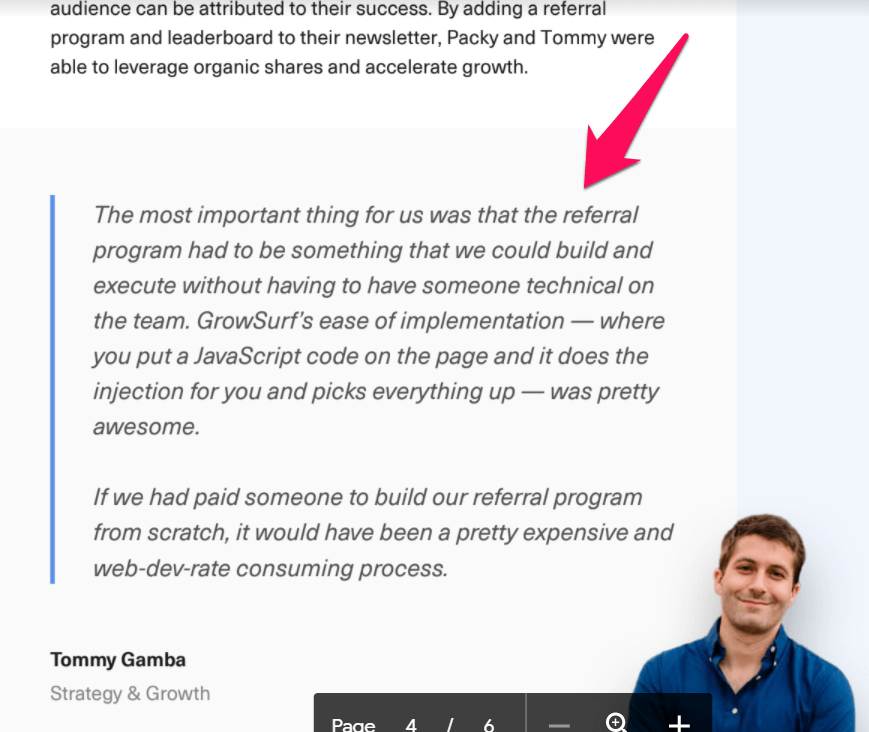

The case study ends with the results GrowSurf delivered, along with a great quote from its client.

See how the testimonial highlights the ease of use (no coding required) and the biggest benefit (lowering business costs and saving money).

A client’s quote that shows your value proposition is way more irresistible than you making a statement.

GrowSurf finishes off its case study with a great call to action (CTA).

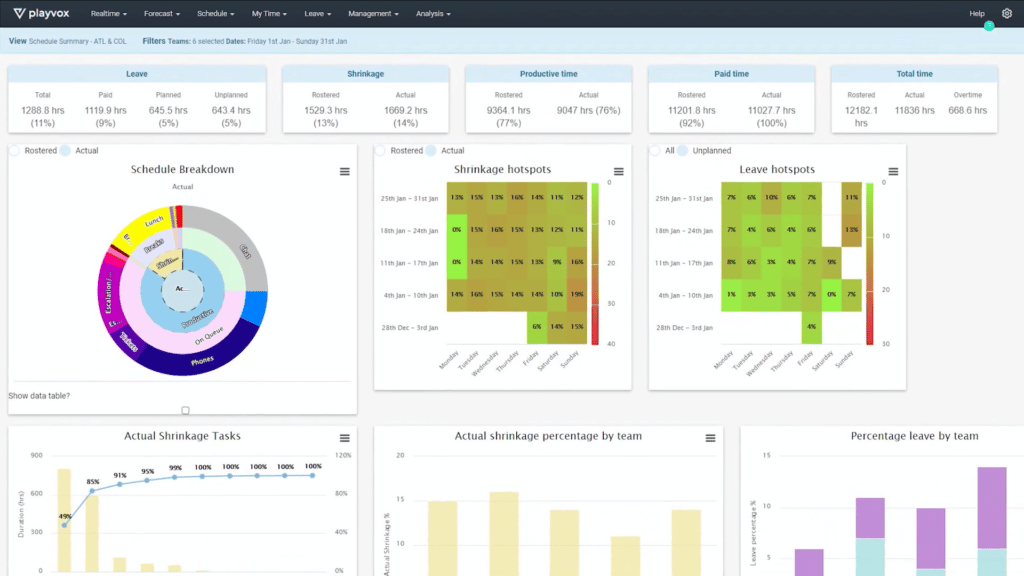

Headline : Zendesk for Playvox Testimonial

On-location video case studies pack a persuasive punch.

Playvox ’s video testimonial highlights its unique selling proposition (USP ), completely grabbing the prospect’s attention hook, line, and sinker (“…ability to be dynamic and adaptable.”).

It then segues to a screenshot of the product, showing it in action. This is crucial as it helps prospects envision what it’s like to use Playvox in their work.

The video then shows a series of video cuts, including the client’s headquarters and team members. It paints a professional impression, engaging prospective customers to continue watching the video.

Towards the end, the client shares the potential opportunity loss had they not discovered a solution like Playvox.

3. Voices.com

Headline : Coca Cola Case Study

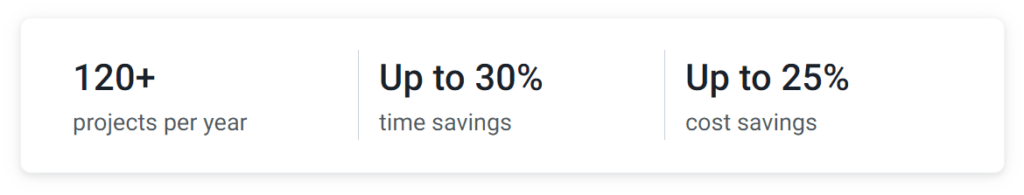

Results : 25% increase of year-over-year revenue. This case study is read more than 2500 times every year. It also attracted new businesses and expanded Voice.com’s relationship with the client.

Why it works :

Did Voices.com just prove simple headlines can work?

In this case, it did.

And that’s because Coca-Cola’s a famous international brand that enjoys global appeal (note: Playvox also uses a similar strategy).

It’s clear Voices.com knows its angle in this case study: Saving time and money.

As we scroll down, we see three key figures, which piques interest.

Right after giving us an overview of its client, Voices.com digs deep into the problem.

Note how these three paragraphs spotlight the wasted hours on locating and preparing the talent, frustrating delays, and disrupted operations.

Leads will nod their head in agreement as they read this section. This is a brilliant way to agitate major pain points .

Next up, the ‘meat’ of the case study.

Voices.com calls attention to its solution (e.g., pre-selecting and verifying the talent), along with the benefits and outcomes it delivered (i.e., work up to five projects a day, delegate 80% of administrative work).

There’s more.

Scroll down the case study, and we see video clips scattered within the post.

For leads that are still on the fence, these are visual proofs to address their objections to the quality of work .

Voices.com ends off on an impressive note. Towards the end, we see it reinforcing the results it delivered.

Now That You’ve Learned How To Write A Case Study, What’s Next?

Case studies highlight your unique expertise and convince a skeptical lead. If you haven’t been dedicating time and resources to create them, you’re missing out on many revenue opportunities .

Generally, leads who read case studies sit further down the funnel and are ready for sales . If you want to pitch these leads (what salesperson doesn’t?), use a contact scoring tool like Breadcrumbs .

Here’s how it works:

- Connect your CRM with Breadcrumbs

- Determine your ideal customer’s attributes in the Fit model (e.g., CMO from a $10ARR company with 50 employees)

- Determine the actions that show a buying intent in the Activity model

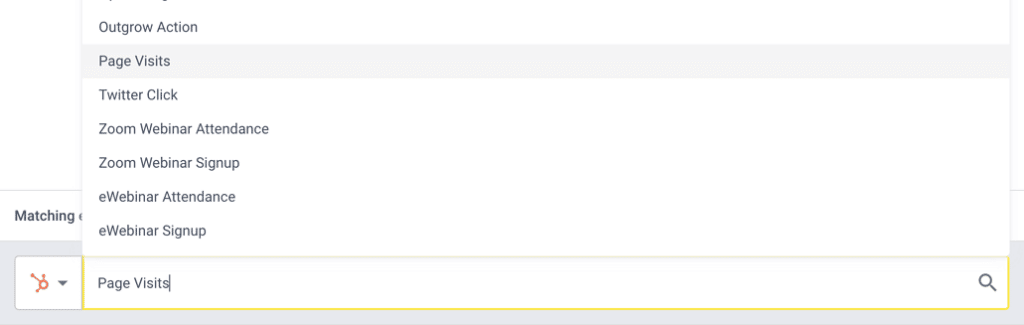

For example, if you want to target prospects who read case studies on your site, select Page Visits under Matching Event and include the URL accordingly.

Each action and attribute is assigned a score. The more actions a lead completes and the more attributes they “fit,” the higher their score will be.

Once they hit a threshold—a score predefined by you—Breadcrumbs will send all scoring information back to the CRM of your choice and alert you of the sales opportunity.

This helps you focus on sales-ready leads, gaining back hours of your time, closing more profitable deals, and crushing your quota.

Pro tip : Connect your product analytics and email marketing platforms with Breadcrumbs to gain a holistic view of the customer’s journey .

Breadcrumbs’ contact scoring tool also identifies at-risk customers, product-qualified leads , and cross- and upselling customers with sales potential. Book a 30-minute demo with us to improve your sales funnel today.

FAQs on How to Write a Case Study

1. what is a case study .

A case study is a written document or visual presentation that convinces and converts tough leads to customers by addressing their objections in a compelling way.

2. Why write a business case study?

A business case study is a powerful marketing and sales asset.

It fuels your content marketing efforts , promotes your business at events, and even wins investors’ votes (pro tip: include a snippet of your case study in your pitch deck presentation to prove your track record).

3. What should a case study look like?

That depends!

For instance, if it’s a video case study, it should feature the hero customer front and center and snippets of them at work. If it’s data-driven content, opt for an infographic case study that showcases eye-catching graphics.

4. How long should a case study be?

As long as it needs to convince a prospective client on the fence. A quick search shows it hovering around 500-1500 words.

5. What are the five essential elements of a great case study?

Introduction, problem, solution, results, and the hero of the case study—your customer.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Case Interview: A comprehensive guide

- Pyramid Principle

- Hypothesis driven structure

- Fit Interview

- Consulting math

- The key to landing your consulting job

- What is a case interview?

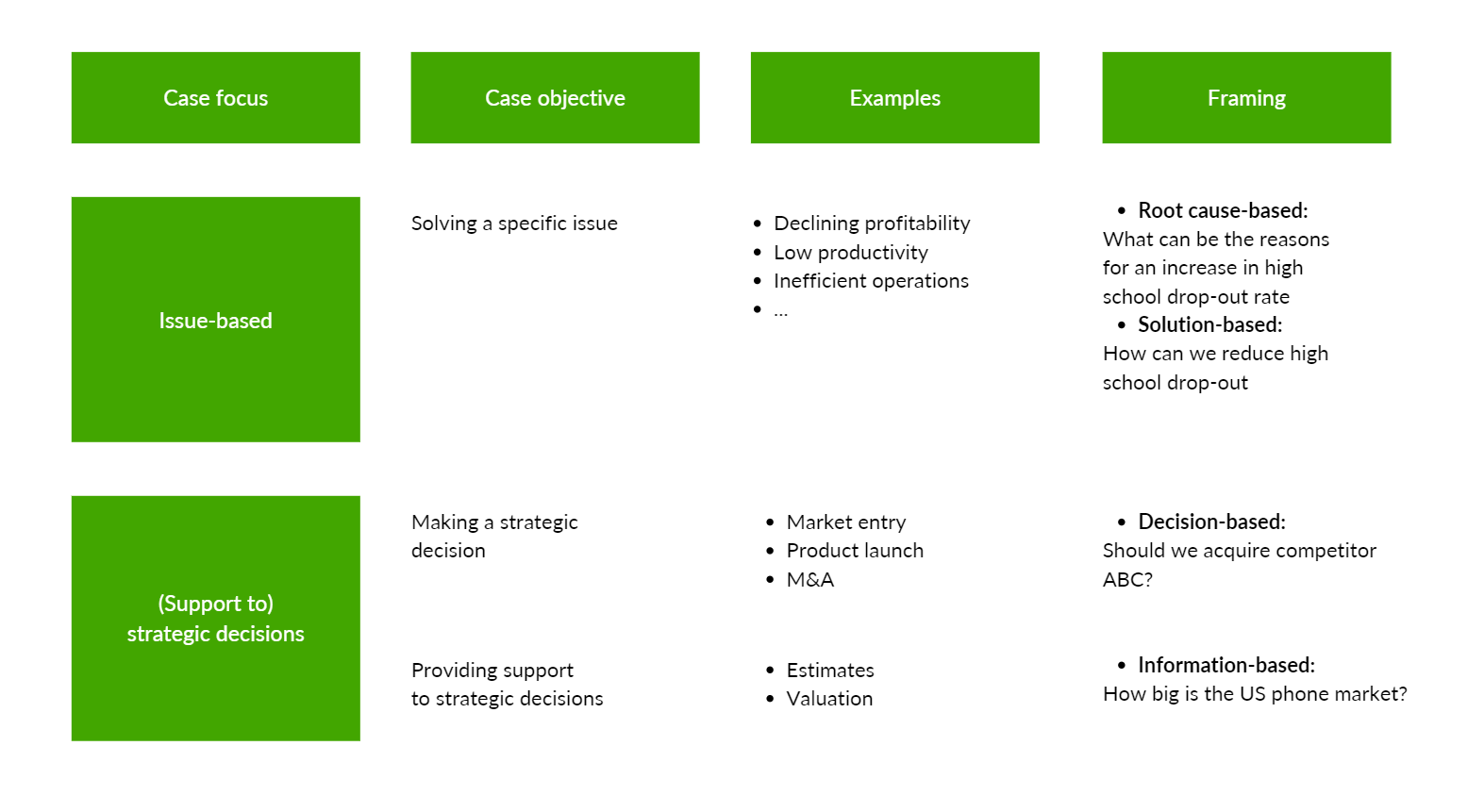

- Types of case interview

- How to solve cases with the Problem-Driven Structure?

- What to remember in case interviews

- Case examples or building blocks?

- How do I prepare for case interviews

- Interview day tips

- How we can help

1. The key to landing your consulting job.

Case interviews - where you are asked to solve a business case study under scrutiny - are the core of the selection process right across McKinsey, Bain and BCG (the “MBB” firms). This interview format is also used pretty much universally across other high-end consultancies; including LEK, Kearney, Oliver Wyman and the consulting wings of the “Big Four”.

If you want to land a job at any of these firms, you will have to ace multiple case interviews.

It is increasingly likely that you will also have to solve online cases given by chatbots. You might need to pass these either before making it to interview or be asked to sit them alongside first round interviews.

Importantly, case studies aren’t something you can just wing . Firms explicitly expect you to have thoroughly prepared and many of your competitors on interview day will have been prepping for months.

Don’t worry though - MCC is here to help!

This article will take you through a full overview of everything you’ll need to know to do well, linking to more detailed articles and resources at each stage to let you really drill down into the details.

As well as traditional case interviews, we’ll also attend to the new formats in which cases are being delivered and otherwise make sure you’re up to speed with recent trends in this overall part of consulting recruitment.

Before we can figure out how to prepare for a case interview, though, we will first have to properly understand in detail what exactly you are up against. What format does a standard consulting case interview take? What is expected of you? How will you be assessed?

Let's dive right in and find out!

Professional help

Before going further, if this sounds like a lot to get your head around on your own, don't worry - help is available!

Our Case Academy course gives you everything you need to know to crack cases like a pro:

Case Academy Course

To put what you learn into practice (and secure some savings in the process) you can add mock interview coaching sessions with expereinced MBB consultants:

Coaching options

And, if you just want an experienced consultant to take charge of the whole selection process for you, you can check out our comprehensive mentoring programmes:

Explore mentoring

Now, back to the article!

2. What is a case interview?

Before we can hope to tackle a case interview, we have to understand what one is.

In short, a case interview simulates real consulting work by having you solve a business case study in conversation with your interviewer.

This case study will be a business problem where you have to advise a client - that is, an imaginary business or similar organisation in need of guidance.

You must help this client solve a problem and/or make a decision. This requires you to analyse the information you are given about that client organisation and figure out a final recommendation for what they should do next.

Business problems in general obviously vary in difficulty. Some are quite straightforward and can be addressed with fairly standard solutions. However, consulting firms exist precisely to solve the tough issues that businesses have failed to deal with internally - and so consultants will typically work on complex, idiosyncratic problems requiring novel solutions.

Some examples of case study questions might be:

- How much would you pay for a banking licence in Ghana?

- Estimate the potential value of the electric vehicle market in Germany

- How much gas storage capacity should a UK domestic energy supplier build?

Consulting firms need the brightest minds they can find to put to work on these important, difficult projects. You can expect the case studies you have to solve in interview, then, to echo the unique, complicated problems consultancies deal with every day. As we’ll explain here, this means that you need to be ready to think outside the box to figure out genuinely novel solutions.

2.1. Where are case interviews in the consulting selection process?

Not everyone who applies to a consulting firm will have a case interview - far from it!

In fact, case interviews are pretty expensive and inconvenient for firms to host, requiring them to take consultants off active projects and even fly them back to the office from location for in-person interviews (although this happens less frequently now). Ideally, firms want to cut costs and save time by narrowing down the candidate pool as much as possible before any live interviews.

As such, there are some hoops to jump through before you make it to interview rounds.

Firms will typically eliminate as much as 80% of the applicant pool before interviews start . For most firms, 50%+ of applicants might be cut based on resumes, before a similar cut is made on those remaining based on aptitude tests. McKinsey currently gives their Solve assessment to most applicants, but will use their resulting test scores alongside resumes to cut 70%+ of the candidate pool before interviews.

You'll need to be on top of your game to get as far as an interview with a top firm. Getting through the resume screen and any aptitude tests is an achievement in itself! Also we need to note that the general timeline of an application can differ depending on a series of factors, including which position you apply, your background, and the office you are applying to. For example, an undergraduate applying for a Business Analyst position (the entry level job at McKinsey) will most likely be part of a recruitment cycle and as such have pretty fixed dates when they need to sit the pre-screening test, and have the first and second round interviews (see more on those below). Conversely, an experienced hire will most likely have a much greater choice of test and interview dates as well as more time at their disposal to prepare.

For readers not yet embroiled in the selection process themselves, let’s put case interviews in context and take a quick look at each stage in turn. Importantly, note that you might also be asked to solve case studies outside interviews as well…

2.1.1. Application screen

It’s sometimes easy to forget that such a large cut is made at the application stage. At larger firms, this will mean your resume and cover letter is looked at by some combination of AI tools, recruitment staff and junior consulting staff (often someone from your own university).

Only the best applications will be passed to later stages, so make sure to check out our free resume and cover letter guides, and potentially get help with editing , to give yourself the best chance possible.

2.1.2. Aptitude tests and online cases

This part of the selection process has been changing quickly in recent years and is increasingly beginning to blur into the traditionally separate case interview rounds.

In the past, GMAT or PST style tests were the norm. Firms then used increasingly sophisticated and often gamified aptitude tests, like the Pymetrics test currently used by several firms, including BCG and Bain, and the original version of McKinsey’s Solve assessment (then branded as the Problem Solving Game).

Now, though, there is a move towards delivering relatively sophisticated case studies online. For example, McKinsey has replaced half the old Solve assessment with an online case. BCG’s Casey chatbot case now directly replaces a live first round case interview, and in the new era of AI chatbots, we expect these online cases to quickly become more realistic and increasingly start to relieve firms of some of the costs of live interviews.

Our consultants collectively reckon that, over time, 50% of case interviews are likely to be replaced with these kinds of cases . We give some specific advice for online cases in section six. However, the important thing to note is that these are still just simulations of traditional case interviews - you still need to learn how to solve cases in precisely the same way, and your prep will largely remain the same.

2.1.3. Rounds of Interviews

Now, let’s not go overboard with talk of AI. Even in the long term, the client facing nature of consulting means that firms will have live case interviews for as long as they are hiring anyone. And in the immediate term, case interviews are still absolutely the core of consulting selection.

Before landing an offer at McKinsey, Bain, BCG or any similar firm, you won’t just have one case interview, but will have to complete four to six case interviews, usually divided into two rounds, with each interview lasting approximately 50-60 minutes .

Being invited to first round usually means two or three case interviews. As noted above, you might also be asked to complete an online case or similar alongside your first round interviews.

If you ace first round, you will be invited to second round to face the same again, but more gruelling. Only then - after up to six case interviews in total, can you hope to receive an offer.

2.2. Differences between first and second round interviews

Despite interviews in the first and second round following the same format, second/final round interviews will be significantly more intense . The seniority of the interviewer, time pressure (with up to three interviews back-to-back), and the sheer value of the job at stake will likely make a second round consulting case interview one of the most challenging moments of your professional life.

There are three key differences between the two rounds:

- Time Pressure : Final round case interviews test your ability to perform under pressure, with as many as three interviews in a row and often only very small breaks between them.

- Focus : Since second round interviewers tend to be more senior (usually partners with 12+ years experience) and will be more interested in your personality and ability to handle challenges independently. Some partners will drill down into your experiences and achievements to the extreme. They want to understand how you react to challenges and your ability to identify and learn from past mistakes.

- Psychological Pressure: While case interviews in the first round are usually more focused on you simply cracking the case, second round interviewers often employ a "bad cop" strategy to test the way you react to challenges and uncertainty.

2.3. What skills do case interviews assess?

Reliably impressing your interviewers means knowing what they are looking for. This means understanding the skills you are being assessed against in some detail.

Overall, it’s important always to remember that, with case studies, there are no strict right or wrong answers. What really matters is how you think problems through, how confident you are with your conclusions and how quick you are with the back of the envelope arithmetic.

The objective of this kind of interview isn’t to get to one particular solution, but to assess your skillset. This is even true of modern online cases, where sophisticated AI algorithms score how you work as well as the solutions you generate.

If you visit McKinsey , Bain and BCG web pages on case interviews, you will find that the three firms look for very similar traits, and the same will be true of other top consultancies.

Broadly speaking, your interviewer will be evaluating you across five key areas:

2.1.1.One: Probing mind

Showing intellectual curiosity by asking relevant and insightful questions that demonstrate critical thinking and a proactive nature. For instance, if we are told that revenues for a leading supermarket chain have been declining over the last ten years, a successful candidate would ask:

“ We know revenues have declined. This could be due to price or volume. Do we know how they changed over the same period? ”

This is as opposed to a laundry list of questions like:

- Did customers change their preferences?

- Which segment has shown the decline in volume?

- Is there a price war in the industry?

2.1.2. Structure

Structure in this context means structuring a problem. This, in turn, means creating a framework - that is, a series of clear, sequential steps in order to get to a solution.

As with the case interview in general, the focus with case study structures isn’t on reaching a solution, but on how you get there.

This is the trickiest part of the case interview and the single most common reason candidates fail.

We discuss how to properly structure a case in more detail in section three. In terms of what your interviewer is looking for at high level, though, key pieces of your structure should be:

- Proper understanding of the objective of the case - Ask yourself: "What is the single crucial piece of advice that the client absolutely needs?"

- Identification of the drivers - Ask yourself: "What are the key forces that play a role in defining the outcome?"

Our Problem Driven Structure method, discussed in section three, bakes this approach in at a fundamental level. This is as opposed to the framework-based approach you will find in older case-solving

Focus on going through memorised sequences of steps too-often means failing to develop a full understanding of the case and the real key drivers.

At this link, we run through a case to illustrate the difference between a standard framework-based approach and our Problem Driven Structure method.

2.1.3. Problem Solving

You’ll be tested on your ability to identify problems and drivers, isolate causes and effects, demonstrate creativity and prioritise issues. In particular, the interviewer will look for the following skills:

- Prioritisation - Can you distinguish relevant and irrelevant facts?

- Connecting the dots - Can you connect new facts and evidence to the big picture?

- Establishing conclusions - Can you establish correct conclusions without rushing to inferences not supported by evidence?

2.1.4. Numerical Agility

In case interviews, you are expected to be quick and confident with both precise and approximated numbers. This translates to:

- Performing simple calculations quickly - Essential to solve cases quickly and impress clients with quick estimates and preliminary conclusions.

- Analysing data - Extract data from graphs and charts, elaborate and draw insightful conclusions.

- Solving business problems - Translate a real world case to a mathematical problem and solve it.

Our article on consulting math is a great resource here, though the extensive math content in our MCC Academy is the best and most comprehensive material available.

2.1.5. Communication

Real consulting work isn’t just about the raw analysis to come up with a recommendation - this then needs to be sold to the client as the right course of action.

Similarly, in a case interview, you must be able to turn your answer into a compelling recommendation. This is just as essential to impressing your interviewer as your structure and analysis.

Consultants already comment on how difficult it is to find candidates with the right communication skills. Add to this the current direction of travel, where AI will be able to automate more and more of the routine analytic side of consulting, and communication becomes a bigger and bigger part of what consultants are being paid for.

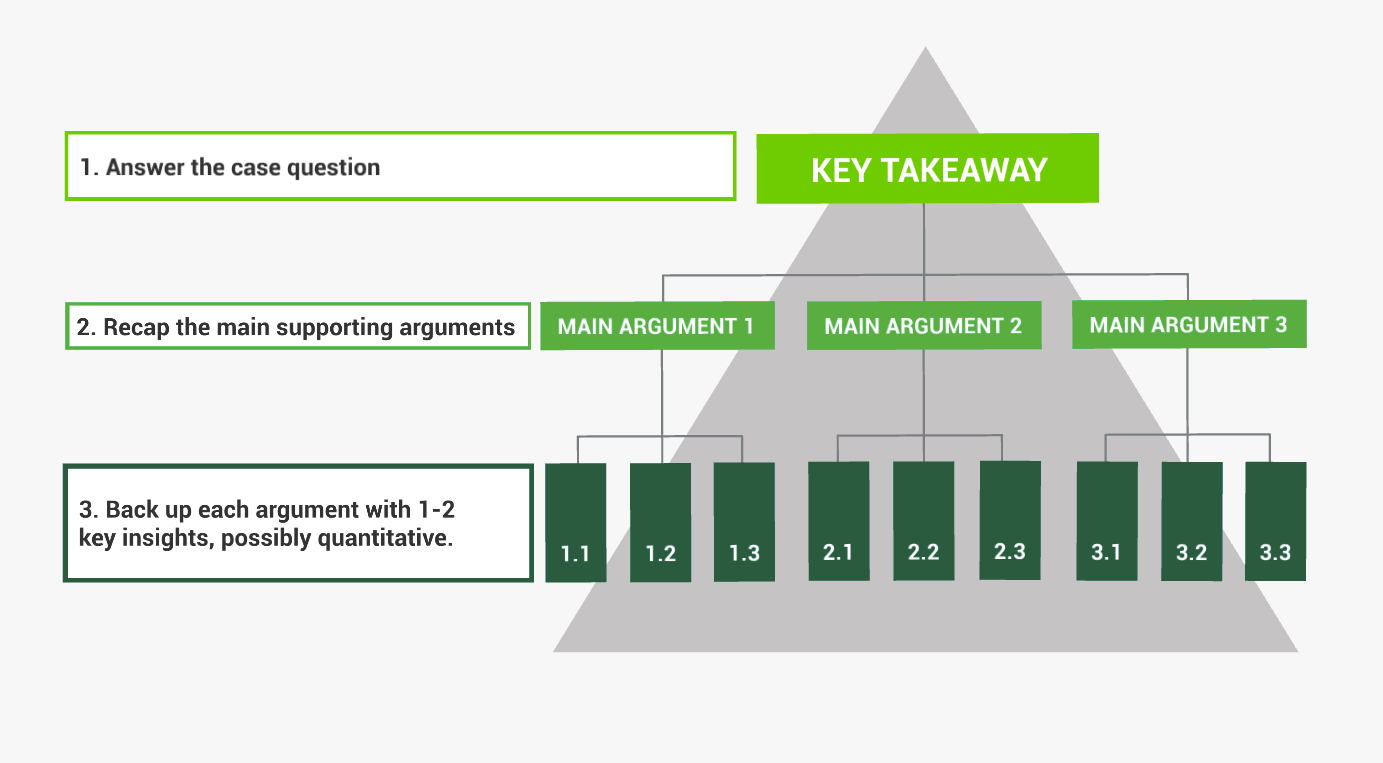

So, how do you make sure that your recommendations are relevant, smart, and engaging? The answer is to master what is known as CEO-level communication .

This art of speaking like a CEO can be quite challenging, as it often involves presenting information in effectively the opposite way to how you might normally.

To get it right, there are three key areas to focus on in your communications:

- Top down : A CEO wants to hear the key message first. They will only ask for more details if they think that will actually be useful. Always consider what is absolutely critical for the CEO to know, and start with that. You can read more in our article on the Pyramid Principle .

- Concise : This is not the time for "boiling the ocean" or listing an endless number possible solutions. CEOs, and thus consultants, want a structured, quick and concise recommendation for their business problem, that they can implement immediately.

- Fact-based : Consultants share CEOs' hatred of opinions based on gut feel rather than facts. They want recommendations based on facts to make sure they are actually in control. Always go on to back up your conclusions with the relevant facts.