How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

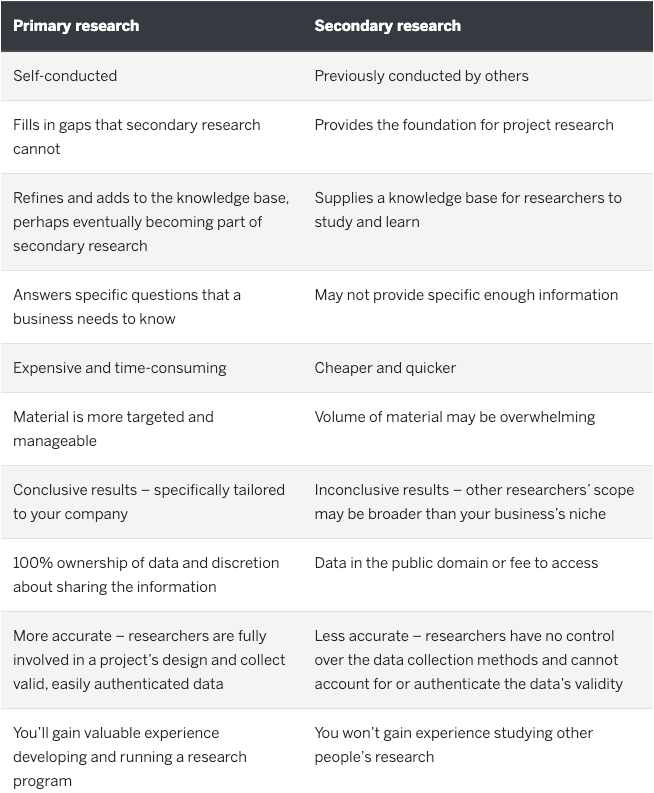

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

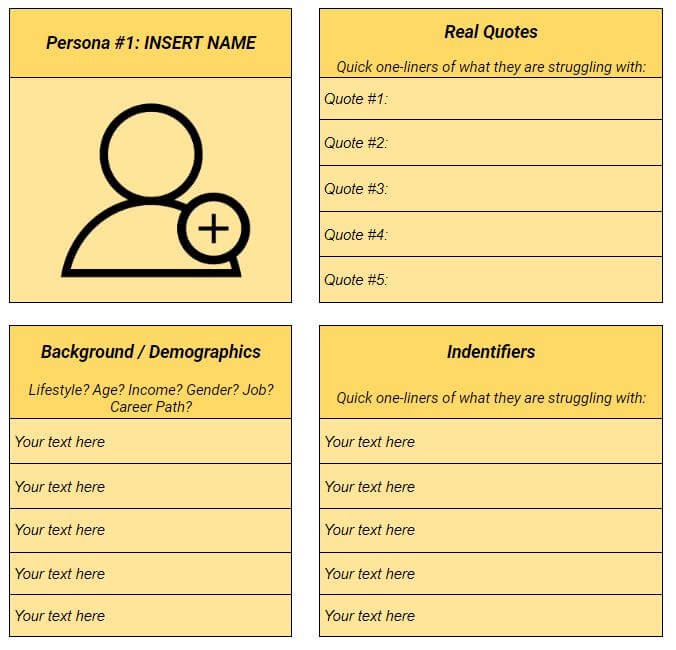

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

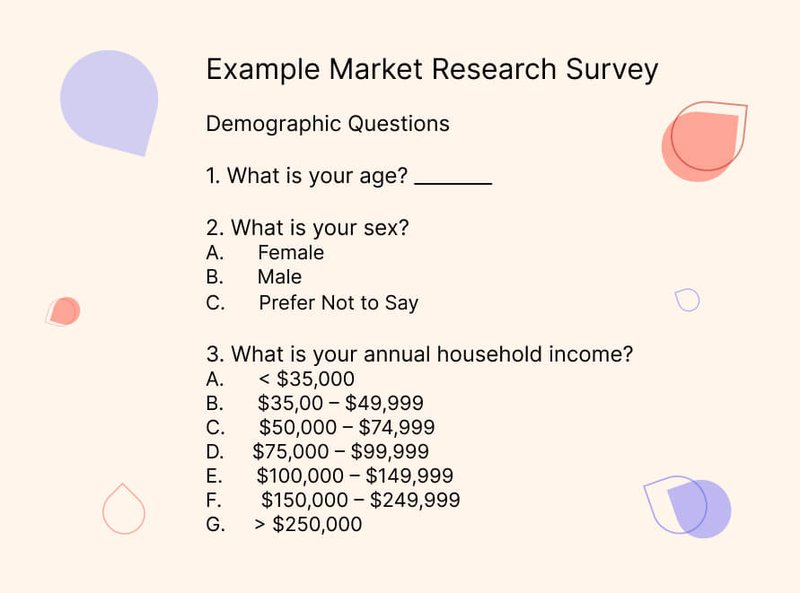

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

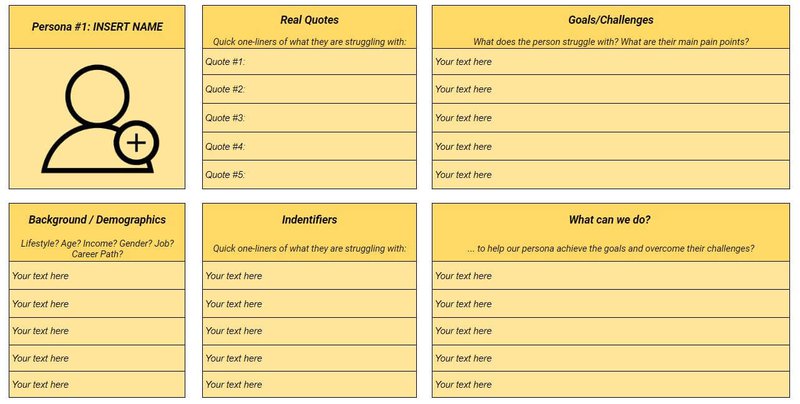

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

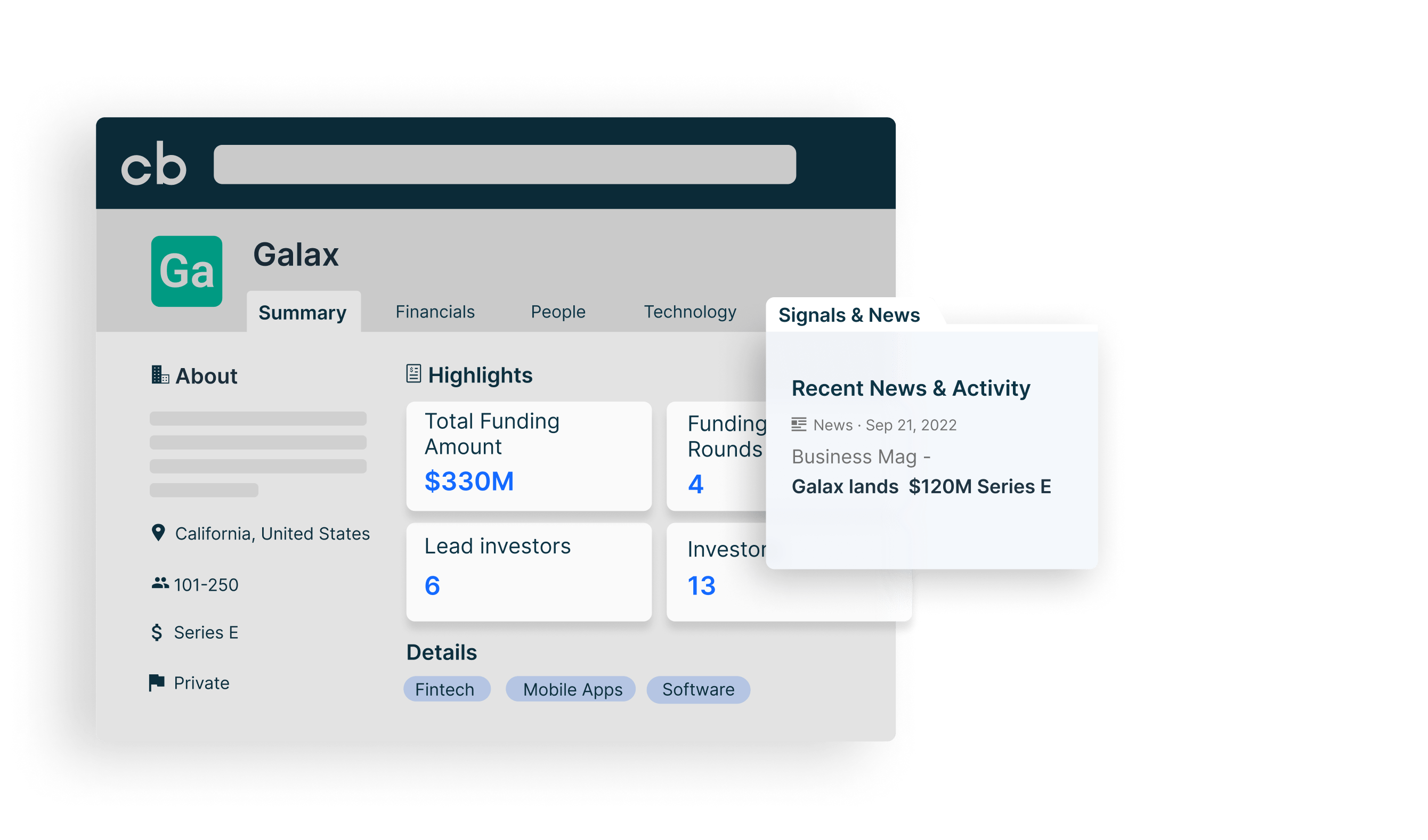

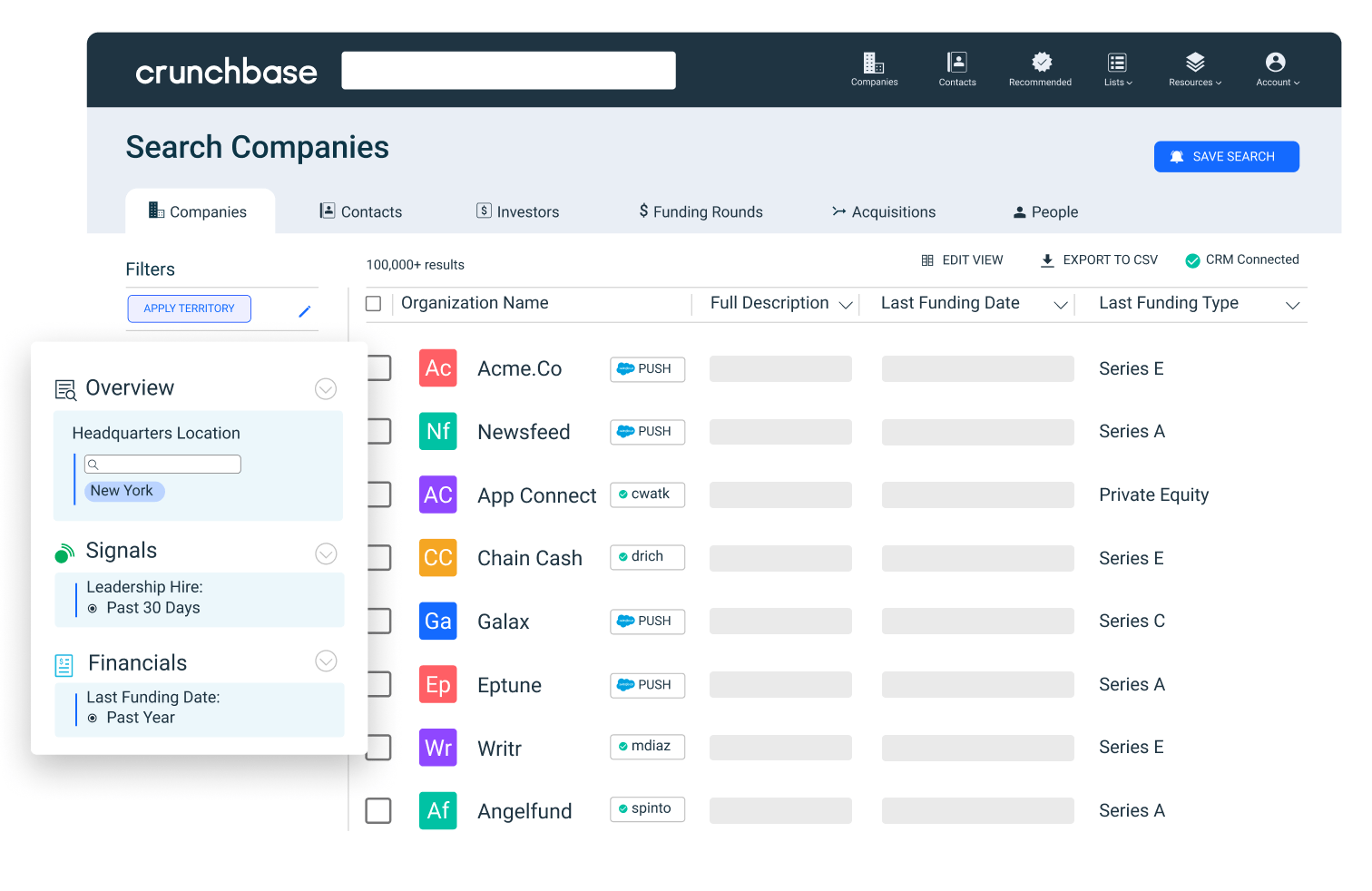

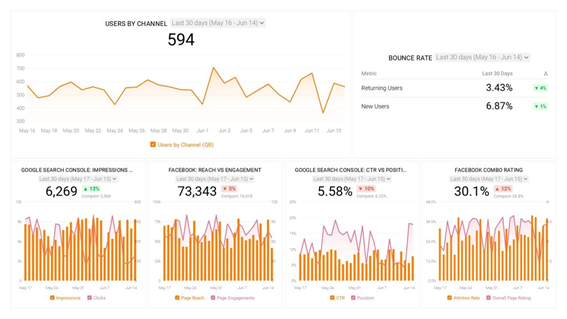

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

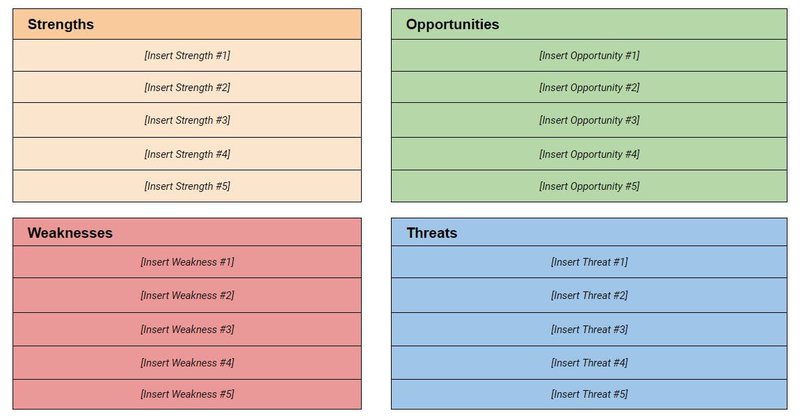

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

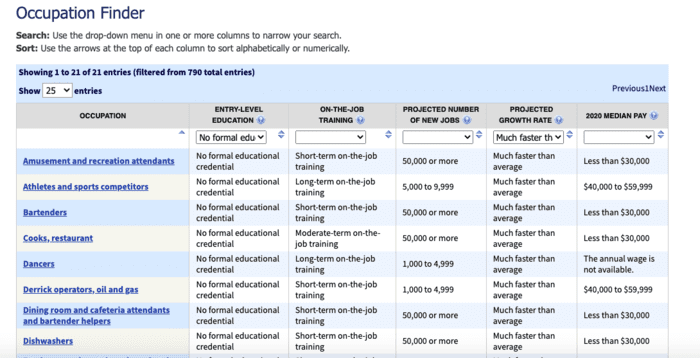

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![report income from market research → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

What is a Competitive Analysis — and How Do You Conduct One?

![report income from market research SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![report income from market research How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![report income from market research 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![report income from market research 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

The Ultimate Guide to Market Research [+Free Templates]

A comprehensive guide on Market Research with tools, examples of brands winning with research, and templates for surveys, focus groups + presentation template.

Rakefet is the CMO at Mayple. She manages all things marketing and leads our community of experts through live events, workshops, and expert interviews. MBA, 1 dog + 2 cats, and has an extensive collection of Chinese teas.

Learn about our

Natalie is a content writer and manager who is passionate about using her craft to empower others. She thrives on team dynamic, great coffee, and excellent content. One of these days, she might even get to her own content ideas.

Updated February 26, 2024.

![report income from market research The Ultimate Guide to Market Research [+Free Templates] main image](https://entail.mayple.com/en-assets/mayple/62b4087370d3b5eab8bfb6b6_marketingresearch1_e2786f4e8b966e44f1401562fa23c07b_2000-1699776197229.jpg)

Before you do anything in business you have to have a good grasp of the market. What’s the market like? Who are your competitors? And what are the pain points and challenges of your ideal customer? And how can you solve them? Once you have the answers to those questions then you are ready to move forward with a marketing plan and/or hire a digital marketing agency to execute it.

In this guide we break down what market research is, the different types of market research, and provide you with some of the best templates, tools, and examples, to help you execute it on your own.

Excited to learn?

Let’s dive in.

What is market research?

Market research is the process of gathering information about your target market and customers to determine the success of your product or service, make changes to your existing product, or understand the perception of your brand in the market.

“Research is formalized curiosity, it is poking and prying with a purpose.” - Zora Neale Hurston

We hear the phrase "product-market fit" all the time and that just means that a product solves a customer's need in the market. And it's very hard to get there without proper market research. Now, I know what you're going to say. Why not get actionable insights from your existing customers? Why not do some customer research?

The problem with customer research is two-fold:

- You have a very limited amount of data as your current customers don't represent the entire market.

- Customer research can introduce a lot of bias into the process.

So the real way to solve these issues is by going broader and conducting some market research.

Why do market research?

There are many benefits of doing market research for your company. Here are a few of them:

- Understand how much demand exists in the market, the market size

- Discover who your competitors are and where they are falling short.

- Better understand the needs of your target customers and the problems and pain points your product solves.

- Learn what your potential customers feel about your brand.

- Identify potential partners and new markets and opportunities.

- Determine which product features you should develop next.

- Find out what your ideal customer is thinking and feeling.

- Use these findings to improve your brand strategy and marketing campaigns.

“The goal is to transform data into information, and information into insight.” - Carly Fiorina

Market research allows you to make better business decisions at every stage of your business and helps you launch better products and services for your customers.

Primary vs secondary research

There are two main types of market research - primary and secondary research.

Primary research

Primary market research is when researchers collect information directly, instead of relying on outside sources of information. It could be done through interviews, online surveys, or focus groups and the advantage here is that the company owns that information. The disadvantage of using primary sources of information is that it's usually more expensive and time-consuming than secondary market research.

Secondary research

Secondary market research involves using existing data that is summarized and collected by third parties. Secondary sources could be commercial sources or public sources like libraries, other websites, blogs , government agencies, and existing surveys. It's data that's more readily available and it's usually much cheaper than conducting primary research.

Qualitative vs quantitative research

Qualitative research is about gathering qualitative data like the market sentiment about the products currently available on the market (read: words and meanings). Quantitative research deals with numbers and statistics. It's data that is numbers-based, countable, and measurable.

Types of market research

1. competitive analysis.

Every business needs to know its own strengths and weaknesses and how they compare with its largest competitors in the market. It helps brands identify gaps in the market, develop new products and services, uncover market trends, improve brand positioning , and increase their market share. A SWOT analysis is a good framework to use for this type of research.

2. Consumer insights

It's also equally important to know what consumers are thinking, what the most common problems are and what products they are purchasing. Consumer research can be done through social listening which involves tracking consumer conversations on social media. It could also include analyzing audiences of brands , online communities, and influencers, and analyzing trends in the market.

3. Brand awareness research

Brand awareness is a super important metric for understanding how well your target audience knows your brand. It's used to assess brand performance and the marketing effectiveness of a brand. It tells you about the associations consumers make when they think of your brand and what they believe you're all about.

4. Customer satisfaction research

Customer satisfaction and loyalty are two really important levers for any business and you don't have to conduct in-depth interviews to get that information. There is a wide range of automated methods to get that kind of data including customer surveys such as NPS surveys, customer effort score (CES) surveys, and regularly asking your customers about their experience with your brand.

5. Customer segmentation research

Customer segmentation research involves figuring out what buckets consumers fall into based on common characteristics such as - demographics, interests, purchasing behavior, and more. Market segmentation is super helpful for advertising campaigns, product launches, and customer journey mapping.

6. Interviews

Customer interviews are one of the most effective market research methods out there. It's a great way for business owners to get first-party data from their customers and get insights into how they are doing in real time.

7. Focus groups

Focus groups are a great way to get data on a specific demographic. It's one of the most well-known data collection methods and it involves taking a sample size of people and asking them some open-ended questions. It's a great way to get actionable insights from your target market.

8. Pricing research

Pricing strategy has a huge influence on business growth and it's critical for any business to know how they compare with the leading brands in their niche. It can help you understand what your target customer is willing to pay for your product and at what price you should be selling it.

To start, get automated software to track your competitors' pricing . Then, summarize your research into a report and group the results based on product attributes and other factors. You can use quadrants to make it easier to read visually.

9. Campaign research

It's also important for a brand to research its past marketing campaigns to determine the results and analyze their success. It takes a lot of experimentation to nail the various aspects of a campaign and it's crucial for business leaders to continuously analyze and iterate.

10. Product/service use research

Product or user research gives you an idea of why and how an audience uses a product and gives you data about specific features. Studies show that usability testing is ranked among the most useful ways to discover user insights (8.7 out of 10), above digital analytics and user surveys. So it's a very effective way to measure the usability of a product.

Now that you know the different types of market research let's go through a step-by-step process of setting up your study.

How to conduct a market research study

Looking for your next business idea? Want to check which niche markets are going to be best for it? if it's going to Here's a pretty simple process for conducting

1. Define your buyer persona

The first step in market research is to understand who your buyers are. For that, you need a buyer persona (sometimes called a marketing persona) which is a fictional generalized description of your target customer. You could (and should) have several buyer personas to work with.

Key characteristics to include in your buyer personas are:

- Job title(s)

- Family size

- Major challenges

Now that you've got your customer personas it's time to decide who to work with for your research.

2. Identify the right people to engage with

It's critical that you pick the right group of people to research. This could make or break your market research study. It's important to pick a representative sample that most closely resembles your target customer. That way you'll be able to identify their actual characteristics, challenges, pain points, and buying behavior.

Here are a few strategies that will help you pick the right people:

- Select people who have recently interacted with you

- Pull a list of participants who made a recent purchase

- Call for participants on social media

- Leverage your own network

- Gather a mix of participants

- Offer an incentive (gift card, product access, content upgrades)

3. Pick your data collection method(s)

Here's a quick breakdown of all the different ways you could collect data for your market research study.

Surveys are by far the fastest method of gathering data. You could launch them on your site or send them in an email and automate the whole process. Regular surveys can also help brands improve their customer service so they help kill two birds with one stone.

Interviews take a little longer and require a detailed set of interview questions. Never go into an interview without a clear idea of what you're going to be asking. It's also a little more difficult to schedule time and to get your potential or current customers on the phone or on Zoom.

Focus group

Focus groups are controlled interviews with groups of people led by facilitators. Participants in focus groups are selected based on a set of predetermined criteria such as location, age, social status, income, and more.

Online tracking

Online tracking is done through digital analytics tools like HotJar or Google Analytics. Tracking user behavior on your site gets you an accurate analysis of who your demographic is and what are the types of products or content that they engage with.

The problem here is that you never get to find out the 'why' - the reason behind their behavior - and that's why you need to combine digital analytics with other data collection methods like surveys and usability/product testing.

Marketing analysis

Another great way to collect data is to analyze your marketing campaigns which gives you a great idea of who clicked on your ads, how often, and which device they used. It's a more focused way of using tracking to zero in on a specific marketing campaign.

Social media monitoring

We've talked about this one before. Social monitoring or listening is when you track online conversations on social media platforms. You can use a simple social listening tool to get all the data you need by searching for specific keywords, hashtags, or topics.

Subscription and registration data

Another great way to collect data is to look at your existing audience. That might include your email list, rewards program, or existing customers. Depending on the size of your list, it could give you some broad insights into the type of customers/users you have and what they are most interested in.

Monitoring in-store traffic

Conduct a customer observation session to monitor your actual customers and how they behave in your store (physically or online). Observation is a market research technique where highly-trained market researchers observe how people or consumers interact with products/services in a natural setting.

4. Prepare your research questions

Write down your research questions before you conduct the research. Make sure you cover all the topics that you are trying to gain clarity on and include open-ended questions. The type of questions you use will vary depending on your data collection approach from the last step.

If you're doing a survey or an in-person interview then here are some of the best questions to ask.

The awareness stage

- How did you know that something in this product category could help you?

- Think back to the time you first realized you needed [product category]. What was your challenge?

- How familiar were you with different options on the market?

The consideration stage

- Where did you go to find out the information?

- What was the first thing you did to research potential solutions?

- Did you search on Google? What specifically did you search for? Which keywords did you use?

- Which vendor sites did you visit?

- What did you find helpful? What turned you off?

The decision stage

- Which criteria did you use to compare different vendors?

- What vendors made it to the shortlist and what were the pros/cons of each?

- Who else was involved in the final decision?

- Allow time for further questions on their end.

- Don't forget to thank them for their time and confirm their email/address to receive the incentive you offered

If you noticed, the progression of these questions follows the stages of the buyer's journey which helps you to gain actionable insights into the entire customer experience.

5. List your primary competitors

There are two kinds of competitors - industry competitors and content competitors. Industry competitors compete with you on the actual product or service they sell. Content competitors compete with you in terms of the content they publish - whether that's on specific keywords or they rank higher on topics that you want to be ranked for.

It's important to write a list of all of your competitors and compare their strengths, weaknesses, competitive advantages, and the type of content they publish.

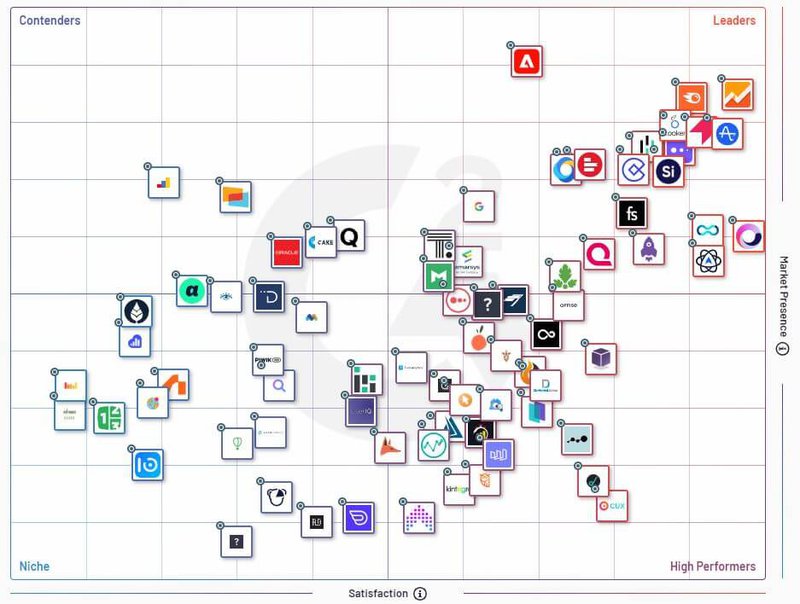

There are different ways to find your competitors. You can look on sites like G2 Crowd and check their industry quadrants.

You could also download a market report from Forrester or Gartner . And you could also search on social media or market research tools like SimilarWeb .

6. Summarize your findings

Now that you've done your research it's time to summarize your findings. Look for common themes in your research and try to present them in the simplest way possible. Use your favorite presentation software to document it and add it to your company database.

Here's a quick research outline you could use:

Background - your goals and why you conducted this study

Participants - who you've talked to. Break down the type of personas and/or customers you've spoken with.

Executive summary - what was the most interesting stuff you've learned? What do you plan to do about it?

Customer journey map - map out the specific motivations and behavioral insights you've gained from each stage of the customer journey (awareness, consideration, and decision).

Action plan - describe what action steps you're going to take to address the issues you've uncovered in your research and how you are going to promote your product/service to your target audience more effectively.

Market research template

Not sure where to begin? Need some templates to help you get started? We got them for you.

1. Market survey template

First and foremost, you need a template to run your market survey. In this template, you will find all the types of questions you should be asking - demographic, product, pricing, and brand questions. They can be used for market surveys, individual interviews, and focus groups.

We also present a variety of question formats for you to use:

- true/false questions

- multiple choice questions

- open response questions

2. SWOT analysis template

A strength, weakness, opportunities, and threats (SWOT) analysis is one of the best ways to do competitor research. It's a really simple analysis. There are four squares and you write down all four of these attributes for each of your competitors.

3. Focus group template

Not sure how to conduct focus groups? Here is a comprehensive template that will help you to take better notes and record your findings during the focus group meeting.

4. Marketing strategy template

The plan of action from your market research should become a vital part of your marketing strategy. We've actually created a marketing strategy template that you could download and use to update your marketing personas, your SWOT analysis, and your marketing channel strategies.

Market research examples

Here are some examples of the good, the bad, and the ugly in market research. Some brands thrive on research and some ignore it completely. Take a look.

McDonald's

McDonald’s sells its food in 97 countries around the world. Their secret? They do a lot of market research before they launch anything. The company uses four key questions in their research process:

- Which products are performing well?

- What prices are most affordable to customers?

- What are consumers reading and watching?

- What content do they consume?

- Which restaurants are most attended, and why?

They also extensively use customer feedback to improve their products. They even put some products up for a vote to see which ones are most loved by their customers.

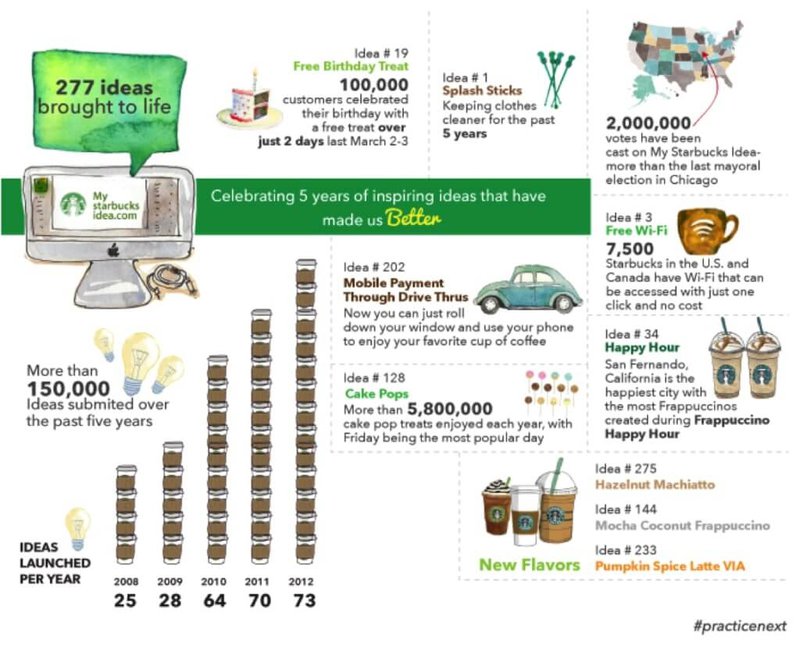

The iconic coffee brand is valued at almost $30 billion and has over 30,000 coffee shops around the world and part of that success comes from their obsession with customer service. They launched a brilliant idea called “My Starbucks Idea” to try and make the customer feel a part of the journey.

It was an open innovation platform where customers could post their idea for a new coffee drink or food item and if it was good a company representative would actually reach out to them. It had a leaderboard and every year the company would develop some of these ideas.

In 2012, Starbucks launched 73 coffee products from ideas they received from customers. Cake pops and pumpkin spice lattes were born out of this platform, all thanks to market research. Can you imagine a world without pumpkin spice lattes?

For all its innovation Facebook had an epic market research failure. In 2013, Facebook partnered with HTC to launch a smartphone called First. It had Facebook’s interface on its home screen and that was a really jarring change for most people. Instead of taking you to a home screen with your favorite apps, Facebook really took center stage.

To be fair, you could turn it off and get a regular Android home window but that would be missing the entire reason you bought the phone in the first place. So it was a complete mismatch to consumers’ wants and the phone flopped.

Turns out, that nobody wanted to see Facebook when they first opened their phone 😅.

Bloom & Wild

Bloom & Wild is a UK flower delivery brand that was looking for their next campaign. They did some research and found out that people think red roses are cliche and prefer to buy something else as a gift on Valentine’s Day. So the brand chose not to sell roses for Valentine’s Day 2021 and made it into a “No Roses Campaign”.

The results - they saw a 51% increase in press coverage year after year.

Top tools used for market research

Here are some of the top market research and digital analytics tools you should try out for your next research project.

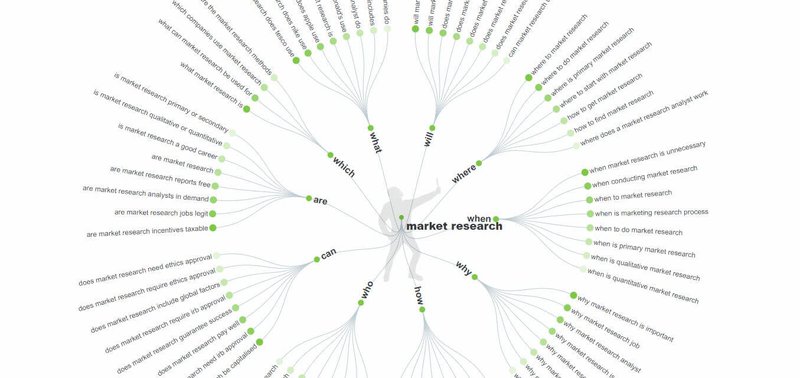

Answer the Public

Answer the public is a free market research tool that helps marketers figure out what questions people ask online. It's really easy to use. You put in a keyword or topic and it spits out a whole variety of questions and subtopics.

Spyfu is a search engine analytics platform that gives you data on where your competitors get their traffic from. It provides info on the kind of both organic traffic and PPC channels down to the specific keywords people used to find each site. It's a great tool to use to map the competitive landscape.

Think with Google

This is an online publication from Google's team where they publish consumer insights from real-time data and their own insights. It uses Google Analytics but presents it to you as a library of information. You can find industry data on a whole array of businesses from educational institutions to counseling services.

Want to do the most extensive market research possible? Use SimilarWeb. It's a competitive analysis and data tool that provides you with literally everything you need.

It has data on:

- Digital marketing data - SEO, traffic, advertising

- Economic trends - economic indicators like annual growth rate, audience, benchmarking

- eCommerce, investing, and even sales data

BuzzSumo is a great tool to use to get actionable insights from social media and content marketing. It aggregates data from various social media channels and shows you the type of content that users engage with and share on their pages.

Typeform is a survey tool that can help you make surveys and fun interactive forms. It's a great tool to use to make your forms more engaging for your audience. The tool has a bunch of easy templates and a ton of integrations to help you visualize that data and share it with your team.

Latana is a brand research tool that helps you understand consumer perception of your brand over time. It helps you answer some key questions about the type of values your customers have, and the type of audiences your competitors are targeting and helps you to focus your campaigns on the right audience for your business.

Statista is one of the most popular consumer data platforms around. It has a wealth of information about consumer markets, business conditions, and industry trends around the world. It's easier to use than most business publications because it aggregates all the data you need in one place. The downside is that it's a little pricy but perfect for teams that have the budget for it.

Dimensions.ai

Dimensions is a search engine for academic publications. It is a great resource if you're looking for deeper insights into things like psychology, micro and macroeconomics, and business trends. A lot of the articles are free to view just make sure you select the " All OA " option which stands for Open Access research.

Otter is an AI-powered transcription software for interviews and meetings. It sits in the background and transcribes your meeting for you and then provides you with a digitized conversation that can be stored, search for specific keywords, and analyzed. It's a great tool to use for doing interviews.

Yelp is a search engine for reviews of local businesses. It's one of the best sources of opinions about a whole variety of products and services. It's a great place to get ideas about the kind of interview questions you want to ask, to find out the pain points of your ideal customer, and to find deeper insights into your target audience.

You have to conduct your market research regularly if you want to see significant results. Try the different methods that we’ve outlined, see what works for you, and remember to keep your team’s focus on the customer. The more knowledgeable they are of your target customer’s needs and wants the better your targeting and marketing strategy will be.

Related Articles

Rakefet Yacoby From

What are the 5 P’s of Marketing?

Chandrima Chakraborty

15 Winning Content Marketing Strategies for eCommerce Brands

Freya Laskowski

SMS Codes Guide: What They Are, Pros + Cons, and Top Tips

Jack Chadwick

Marketing ROI: What It Is, How to Calculate and Maximize it in 2024

![report income from market research [Interview] Andy Crestodina on How to Write the Best Content for eCommerce](https://entail.mayple.com/en-assets/mayple/fit-in/280x280/617ffbda87b85d76b2646986_maypleandycrestodinainterviewcontentmarketingforecommerce_15e1b97b4bf3af165365d906b9c5bea3_2000-1699776043224.png)

[Interview] Andy Crestodina on How to Write the Best Content for eCommerce

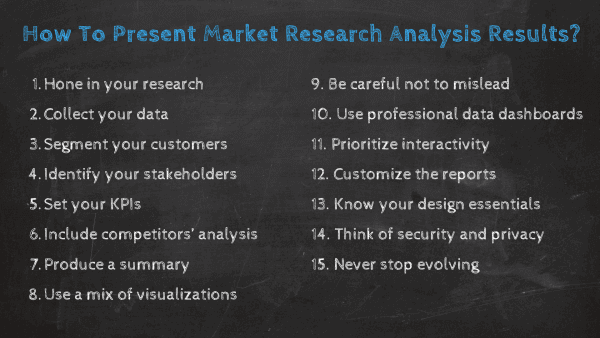

How To Present Your Market Research Results And Reports In An Efficient Way

Table of Contents

1) What Is A Market Research Report?

2) Market Research Reports Examples

3) Why Do You Need Market Research Reports

4) How To Make A Market Research Report?

5) Types Of Market Research Reports

6) Challenges & Mistakes Market Research Reports

Market research analyses are the go-to solution for many professionals, and for good reason: they save time, offer fresh insights, and provide clarity on your business. In turn, market research reports will help you to refine and polish your strategy. Plus, a well-crafted report will give your work more credibility while adding weight to any marketing recommendations you offer a client or executive.

But, while this is the case, today’s business world still lacks a way to present market-based research results efficiently. The static, antiquated nature of PowerPoint makes it a bad choice for presenting research discoveries, yet it is still widely used to present results.

Fortunately, things are moving in the right direction. There are online data visualization tools that make it easy and fast to build powerful market research dashboards. They come in handy to manage the outcomes, but also the most important aspect of any analysis: the presentation of said outcomes, without which it becomes hard to make accurate, sound decisions.

Here, we consider the benefits of conducting research analyses while looking at how to write and present market research reports, exploring their value, and, ultimately, getting the very most from your research results by using professional market research software .

Let’s get started.

What Is a Market Research Report?

A market research report is an online reporting tool used to analyze the public perception or viability of a company, product, or service. These reports contain valuable and digestible information like customer survey responses and social, economic, and geographical insights.

On a typical market research results example, you can interact with valuable trends and gain insight into consumer behavior and visualizations that will empower you to conduct effective competitor analysis. Rather than adding streams of tenuous data to a static spreadsheet, a full market research report template brings the outcomes of market-driven research to life, giving users a data analysis tool to create actionable strategies from a range of consumer-driven insights.

With digital market analysis reports, you can make your business more intelligent more efficient, and, ultimately, meet the needs of your target audience head-on. This, in turn, will accelerate your commercial success significantly.

Your Chance: Want to test a market research reporting software? Explore our 14-day free trial & benefit from interactive research reports!

How To Present Your Results: 4 Essential Market Research Report Templates

When it comes to sharing rafts of invaluable information, research dashboards are invaluable.

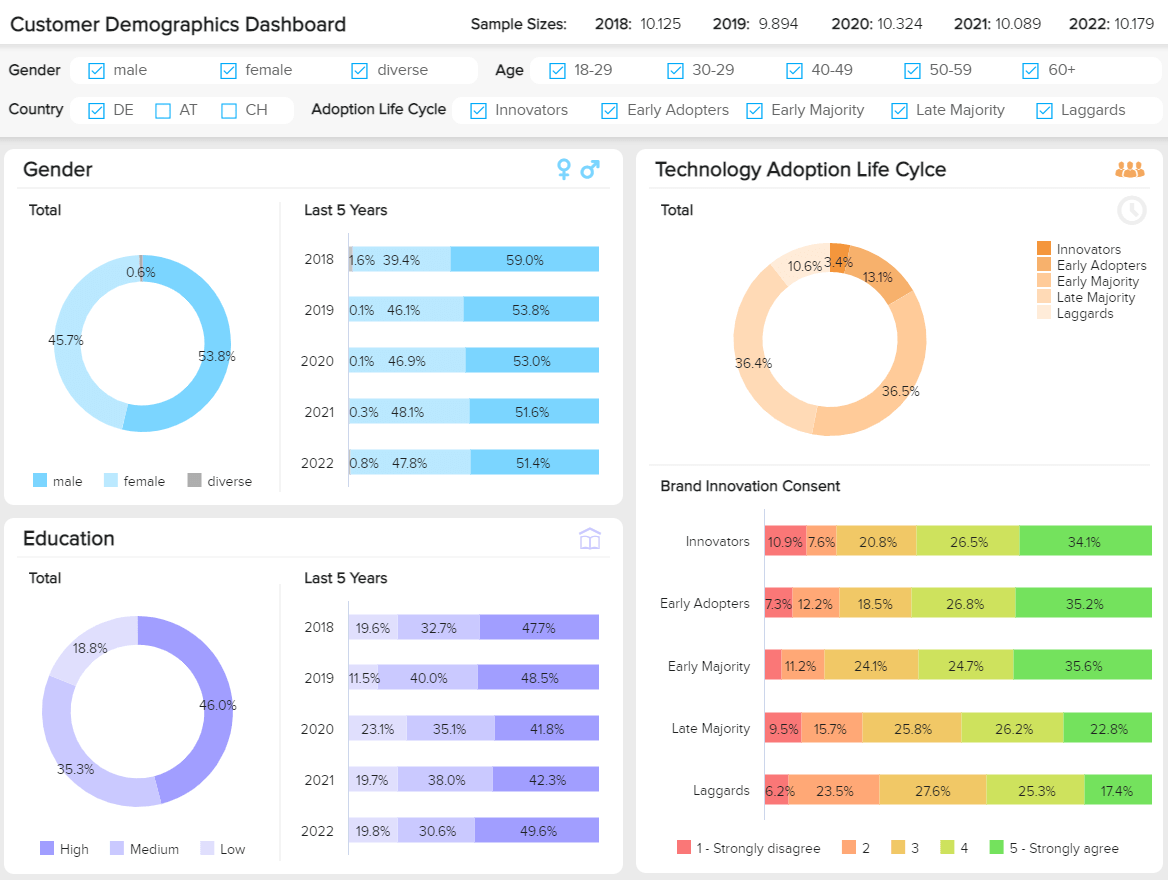

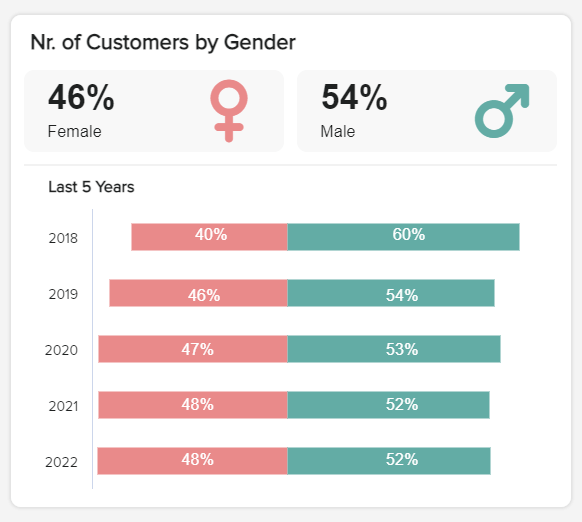

Any market analysis report example worth its salt will allow everyone to get a firm grip on their results and discoveries on a single page with ease. These dynamic online dashboards also boast interactive features that empower the user to drill down deep into specific pockets of information while changing demographic parameters, including gender, age, and region, filtering the results swiftly to focus on the most relevant insights for the task at hand.

These four market research report examples are different but equally essential and cover key elements required for market survey report success. You can also modify each and use it as a client dashboard .

While there are numerous types of dashboards that you can choose from to adjust and optimize your results, we have selected the top 3 that will tell you more about the story behind them. Let’s take a closer look.

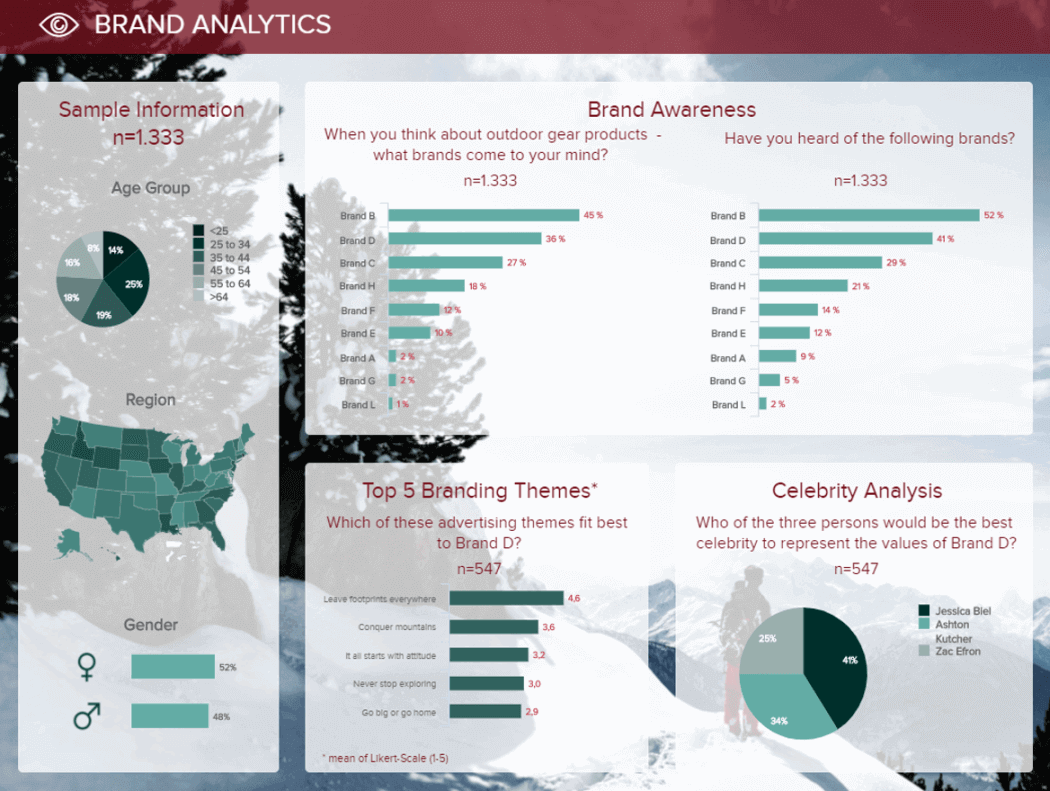

1. Market Research Report: Brand Analysis

Our first example shares the results of a brand study. To do so, a survey has been performed on a sample of 1333 people, information that we can see in detail on the left side of the board, summarizing the gender, age groups, and geolocation.

**click to enlarge**

At the dashboard's center, we can see the market-driven research discoveries concerning first brand awareness with and without help, as well as themes and celebrity suggestions, to know which image the audience associates with the brand.

Such dashboards are extremely convenient to share the most important information in a snapshot. Besides being interactive (but it cannot be seen on an image), it is even easier to filter the results according to certain criteria without producing dozens of PowerPoint slides. For instance, I could easily filter the report by choosing only the female answers, only the people aged between 25 and 34, or only the 25-34 males if that is my target audience.

Primary KPIs:

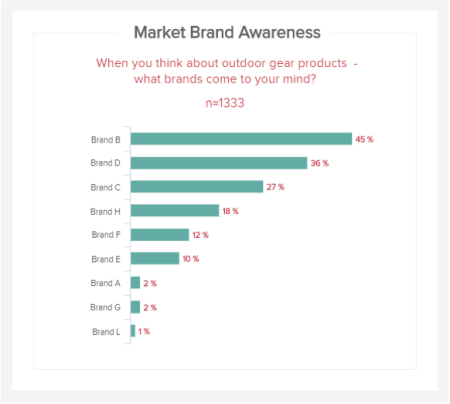

a) Unaided Brand Awareness

The first market research KPI in this most powerful report example comes in the form of unaided brand awareness. Presented in a logical line-style chart, this particular market study report sample KPI is invaluable, as it will give you a clear-cut insight into how people affiliate your brand within their niche.

As you can see from our example, based on a specific survey question, you can see how your brand stacks up against your competitors regarding awareness. Based on these outcomes, you can formulate strategies to help you stand out more in your sector and, ultimately, expand your audience.

b) Aided Brand Awareness

This market survey report sample KPI focuses on aided brand awareness. A visualization that offers a great deal of insight into which brands come to mind in certain niches or categories, here, you will find out which campaigns and messaging your target consumers are paying attention to and engaging with.

By gaining access to this level of insight, you can conduct effective competitor research and gain valuable inspiration for your products, promotional campaigns, and marketing messages.

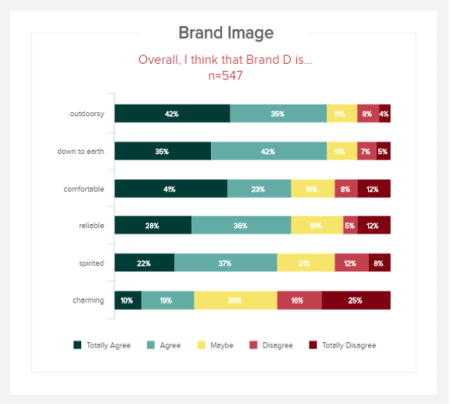

c) Brand image

When it comes to research reporting, understanding how others perceive your brand is one of the most golden pieces of information you could acquire. If you know how people feel about your brand image, you can take informed and very specific actions that will enhance the way people view and interact with your business.

By asking a focused question, this visual of KPIs will give you a definitive idea of whether respondents agree, disagree, or are undecided on particular descriptions or perceptions related to your brand image. If you’re looking to present yourself and your message in a certain way (reliable, charming, spirited, etc.), you can see how you stack up against the competition and find out if you need to tweak your imagery or tone of voice - invaluable information for any modern business.

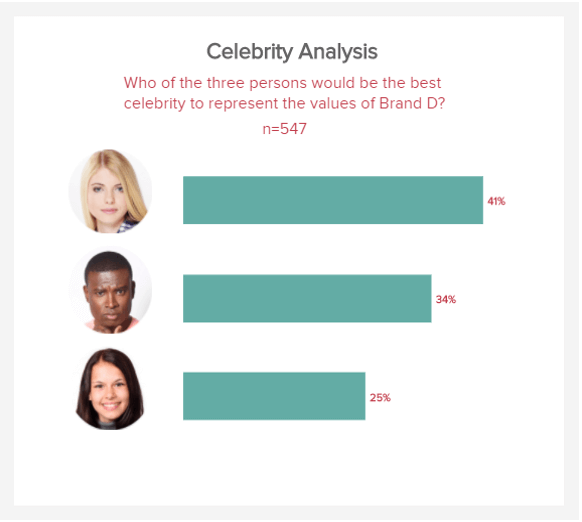

d) Celebrity analysis

This indicator is a powerful part of our research KPI dashboard on top, as it will give you a direct insight into the celebrities, influencers, or public figures that your most valued consumers consider when thinking about (or interacting with) your brand.

Displayed in a digestible bar chart-style format, this useful metric will not only give you a solid idea of how your brand messaging is perceived by consumers (depending on the type of celebrity they associate with your brand) but also guide you on which celebrities or influencers you should contact.

By working with the right influencers in your niche, you will boost the impact and reach of your marketing campaigns significantly, improving your commercial awareness in the process. And this is the KPI that will make it happen.

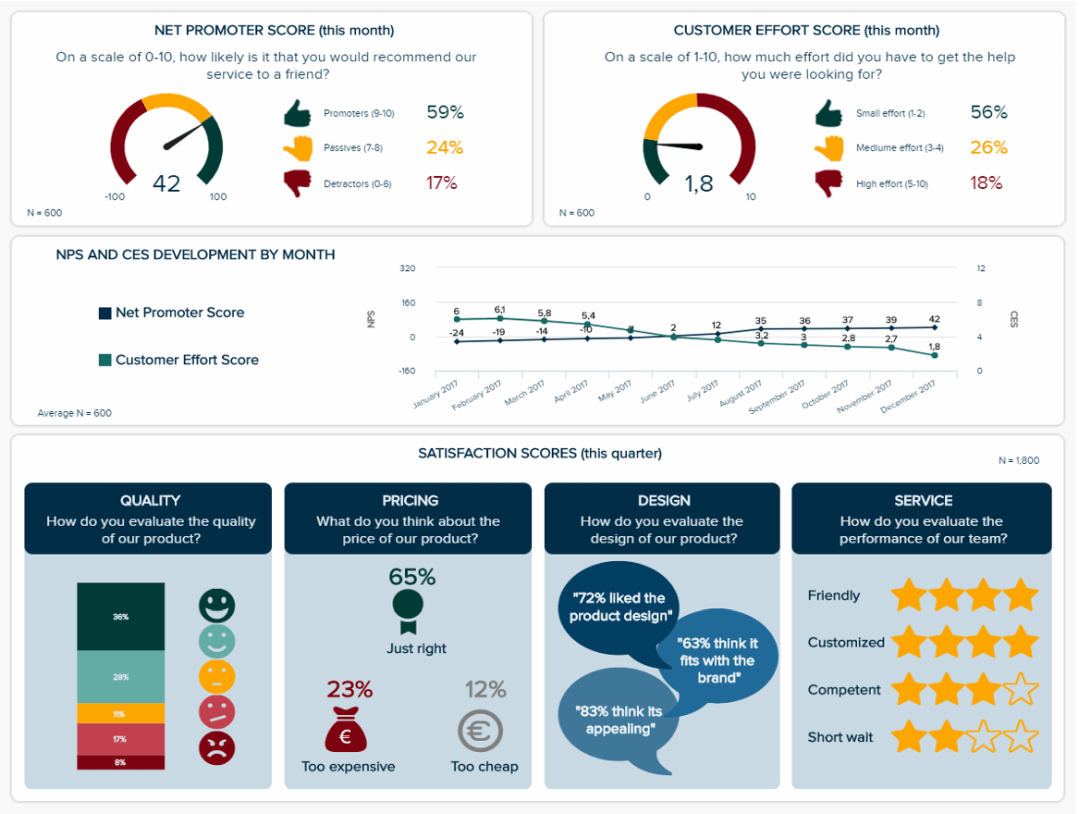

2. Market Research Results On Customer Satisfaction

Here, we have some of the most important data a company should care about: their already-existing customers and their perception of their relationship with the brand. It is crucial when we know that it is five times more expensive to acquire a new consumer than to retain one.

This is why tracking metrics like the customer effort score or the net promoter score (how likely consumers are to recommend your products and services) is essential, especially over time. You need to improve these scores to have happy customers who will always have a much bigger impact on their friends and relatives than any of your amazing ad campaigns. Looking at other satisfaction indicators like the quality, pricing, and design, or the service they received is also a best practice: you want a global view of your performance regarding customer satisfaction metrics .

Such research results reports are a great tool for managers who do not have much time and hence need to use them effectively. Thanks to these dashboards, they can control data for long-running projects anytime.

Primary KPIs :

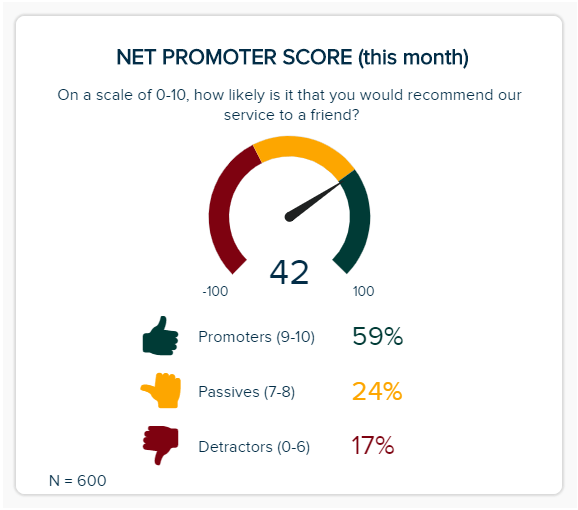

a) Net Promoter Score (NPS)

Another pivotal part of any informative research presentation is your NPS score, which will tell you how likely a customer is to recommend your brand to their peers.

Centered on overall customer satisfaction, your NPS Score can cover the functions and output of many departments, including marketing, sales, and customer service, but also serve as a building block for a call center dashboard . When you’re considering how to present your research effectively, this balanced KPI offers a masterclass. It’s logical, it has a cohesive color scheme, and it offers access to vital information at a swift glance. With an NPS Score, customers are split into three categories: promoters (those scoring your service 9 or 10), passives (those scoring your service 7 or 8), and detractors (those scoring your service 0 to 6). The aim of the game is to gain more promoters. By gaining an accurate snapshot of your NPS Score, you can create intelligent strategies that will boost your results over time.

b) Customer Satisfaction Score (CSAT)

The next in our examples of market research reports KPIs comes in the form of the CSAT. The vast majority of consumers that have a bad experience will not return. Honing in on your CSAT is essential if you want to keep your audience happy and encourage long-term consumer loyalty.

This magnificent, full report KPI will show how satisfied customers are with specific elements of your products or services. Getting to grips with these scores will allow you to pinpoint very specific issues while capitalizing on your existing strengths. As a result, you can take measures to improve your CSAT score while sharing positive testimonials on your social media platforms and website to build trust.

c) Customer Effort Score (CES)

When it comes to presenting research findings, keeping track of your CES Score is essential. The CES Score KPI will give you instant access to information on how easy or difficult your audience can interact with or discover your company based on a simple scale of one to ten.

By getting a clear-cut gauge of how your customers find engagement with your brand, you can iron out any weaknesses in your user experience (UX) offerings while spotting any friction, bottlenecks, or misleading messaging. In doing so, you can boost your CES score, satisfy your audience, and boost your bottom line.

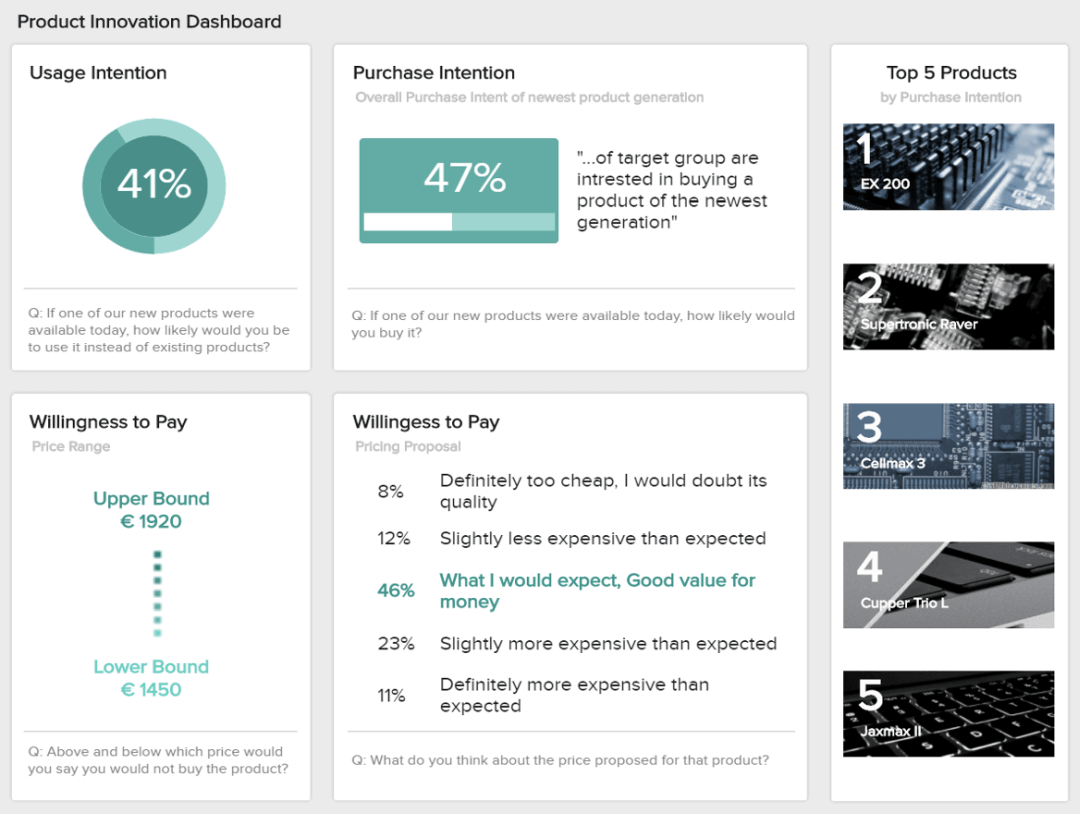

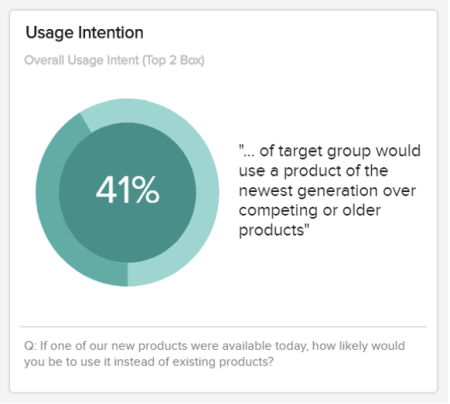

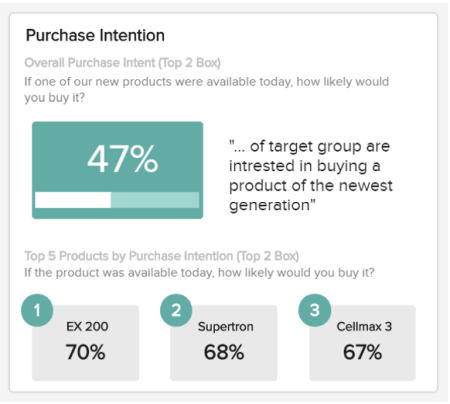

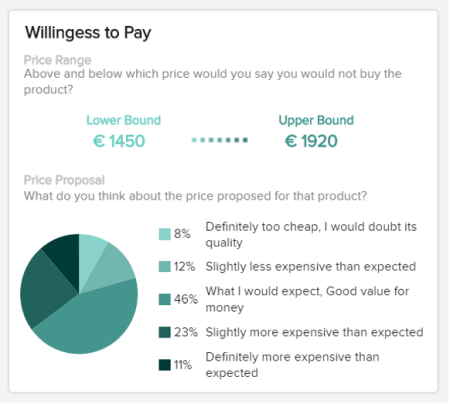

3. Market Research Results On Product Innovation

This final market-driven research example report focuses on the product itself and its innovation. It is a useful report for future product development and market potential, as well as pricing decisions.