Monetary Policy Notes & Questions (A-Level, IB)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | IB Economics Notes Directory

Monetary Policy Definition: – Monetary policy occurs when the government uses interest rates or money supply to change the level of aggregate demand (AD) and national income (GDP) in the economy. – Interest rates is the monetary gain from lending money, and also the monetary cost of borrowing money. – Money supply is the total amount of money circulating an economy, generally referring to cash and bank deposits/balances.

Monetary Policy Examples & Explanation: Monetary policy is a type of demand-side policy, as it helps the government achieves its macroeconomic objectives by changing AD. A decrease in interest rates is a common response to a negative economic shock or downturn, for example during the 2008 Financial Crisis and the recent Coronavirus Epidemic . This is because a fall in interest rates leads to a lower cost to borrow for businesses and individuals. This incentivises them to increase their borrowing for investment or consumption, and as a result will increase AD, stimulating the economy. Although this works in theory, it can be hard to imagine a Hawaiian pizza place securing a loan to open up a second store during the pandemic. Another issue with lowering interest rates is they may not be able to be lowered even further (e.g. imagine if interest rates are already at 0.1% to start with). As a result, governments may implement quantitative easing which affects the money supply of the economy instead.

Monetary Policy Economics Notes with Diagrams

There are considerations of having a negative or zero interest rates when the economy is depressed. UK small businesses are offered loans with zero interest during the pandemic, and this is mainly for them to meet their costs and survive. When interest rate turns negative, it means that banks charge depositors (lenders) and pay borrowers. This will incentivise savers in the economy to consume, and increase borrowing, but put more pressure on banks like in Japan.

Monetary Policy Video Explanation – EconPlusDal

The left video explains monetary policy, the right evaluates the advantages and disadvantages of the policy.

Receive News on our Free Economics Classes, Notes/Questions Updates, and more

Monetary policy multiple choice & essay questions (a-level), monetary policy in the news, related a-level, ib economics resources.

Follow us on Facebook , TES and SlideShare for resource updates.

You may also like

Monopoly Notes & Questions (A-Level, IB)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | […]

Types of Business Objectives Notes & Questions (A-Level, IB Economics)

Subsidies Notes & Questions (A-Level, IB Economics)

Supply-Side Policy Notes & Questions (A-Level, IB)

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Understanding the Role of Monetary Policy in the Economy

In this blog, we’ve previously sought to explain differences between fiscal and monetary policy . Briefly:

Monetary policy is typically the responsibility of a central bank. In the U.S., that’s the Federal Reserve—more specifically, the Federal Open Market Committee (FOMC). The FOMC includes the Fed Board of Governors, who are presidential appointees confirmed by the Senate; the New York Fed president; and regional Reserve bank presidents who serve as voting FOMC members on a rotating basis . Monetary policy refers to actions the FOMC takes to pursue its dual mandate of price stability and maximum sustainable employment.

Fiscal policy , meanwhile, refers to revenue collection and spending decisions made by a government: What is taxed and by how much, where appropriations go, which agencies and programs are prioritized and to what extent, etc. At a federal level, fiscal decisions are made by Congress and the administration. The Federal Reserve is not involved in setting fiscal policy.

Policy Actions amid Coronavirus

Historically, both fiscal and monetary policies have played a role when an economic shock occurs. The novel coronavirus, in addition to having devastating impacts on public health, is now affecting the global economy as well.

Amid many other news stories you’ve seen about COVID-19, you likely heard that the Fed has recently taken multiple actions (through the FOMC and the Fed Board of Governors) in accordance with its mandate.

These actions included, on March 15, reducing the target range for the federal funds rate to zero to .25%. The Fed also acted to provide liquidity in the financial system, to support the flow of credit to households and businesses, and to increase its holdings of Treasury and mortgage-backed securities.

You can see the latest Federal Reserve actions and statements summarized on the Board of Governors’ COVID-19 page .

In this article, we’ll explain more about the Fed, monetary policy and a central bank’s role. To help, I consulted economist David Wheelock, who serves as St. Louis Fed deputy director of Research. He has studied Federal Reserve history going back to its establishment in 1913.

Q: To what extent can monetary policy influence the broader economy?

Wheelock: That's a very good and important question.

Fundamentally, monetary policy can influence the price level—the rate of inflation, the aggregate price level in an economy. And it is appropriate to provide a more expansionary monetary policy when there's evidence that inflation is falling or will fall below the desirable level.

In the Fed’s case, we target a 2% rate of inflation . For example, recently there was evidence in the Treasury market that expected inflation had fallen. In circumstances like that, an easing of monetary policy is an attempt to stimulate the economy in such a way as to help bring the inflation rate and expected inflation back to target.

Again, in the long run, monetary policy only really affects the inflation rate, the price level. But in the short run, it can influence the “real” side of the economy as well, and therefore have an influence on employment and GDP growth and so forth.

And so, in an event where it seems that the economy may be weakening or might slow down—particularly in context where inflation expectations are going down—policymakers may recalibrate monetary policy to a more accommodative or expansionary level in order to cushion that decline, or hopefully give it a boost back to the Fed’s legislated goals of price stability and maximum sustainable employment.

By the same token, if you see signs of overheating—inflation rising, maybe financial speculation running away such that it might cause problems in the economy down the road—it would be appropriate to calibrate monetary policy to a tighter stance, to try to resist that.

Q: How can adjusting interest rates make an impact on the economy?

Wheelock: In the United States, the Federal Reserve targets the federal funds rate , and that is the primary tool that the Fed uses to implement monetary policy. This is a market-determined rate; it is determined by the supply and demand for federal funds—essentially, the deposits that banks have with the Federal Reserve—in the overnight market.

The Federal Reserve has an objective, or a target, for this market-determined rate. It uses other administered rates, such as interest on excess reserves , in order to try to encourage the fed funds rate to get as close to the target as possible.

If the federal funds rate is falling, then in some sense, the cost of funds for banks is falling. So banks are able to pass that along to borrowers in the form of lower interest rates on car loans or mortgage loans, and so forth.

It’s important to note, though, that short-term rates—such as rates on short-term Treasury bills and securities, or money market rates—are more closely tied to the federal funds rate than the rates on longer-term loans.

Q: Do interest rates affect employment?

Wheelock: Regarding employment, the classic textbook argument is that if a central bank wants to try to boost employment, it uses its tools to try to encourage lower interest rates, which will stimulate borrowing. That will enable more consumers to buy cars and houses, and it will encourage firms to invest in new plants and equipment or to build up their inventories. In so doing, they’ll likely hire workers, which will tend to lower the unemployment rate.

That’s the textbook Econ 101 version. In practice, it’s not quite so neat and simple, but that’s the basic idea.

So while there may be ways a central bank can help boost employment in the short run, in the long run, monetary policy is only going to affect the inflation rate. Unemployment and things in the real economy are going to be determined by the technology, the amount of labor, even the weather—things that are not under the direct influence of monetary policy.

Q: Beyond interest rates, what tools do central banks have?

Wheelock: As we saw for a long time after the 2007-09 financial crisis, when the federal funds rate was effectively at zero, the Fed employed so-called unconventional policy tools.

This included forward guidance , which involves giving guidance to the public about where the Fed expects monetary policy to be over time—for example, how long it expects to keep the federal funds rate at zero. By communicating like that, the Fed can have an influence on longer-term interest rates in the economy, thereby having an effect even when it is not currently adjusting the federal funds rate.

Of course, the Fed has also engaged in the quantitative easing, or QE, programs where it bought large volumes of longer-term government securities and mortgage-backed securities. And there's evidence that those were effective in terms of influencing markets and the economy. Quantitative easing is a type of open market operation , an injection of reserves into the banking system that can influence the supply of credit.

As the March 15 FOMC statement said, the Committee will keep monitoring the implications of incoming information for the economic outlook, including information related to public health, and it will use its tools and act as appropriate to support the economy.

Q: Can you describe the Fed’s role as a “lender of last resort”?

Wheelock: Historically, the main operation of a central bank was to provide a lending facility and serve as a “lender of last resort” to the banking system in the event of a liquidity shortage.

The central bank is there to provide that supply of liquidity.

I would point out that, as the Fed showed during the financial crisis, the discount window can be important if banks are finding a need to borrow reserves or if there is disruption in financial markets such that there's a sudden liquidity shortage or freezing of markets.

In the financial crisis, the Fed came up with a number of programs to try to provide liquidity to specific aspects of financial markets to keep the gears of the financial system well-lubricated, with the goal of keeping the economy going as best we could. For example, the Fed set up a facility to support the commercial paper market. Recently, the Fed recently announced it would establish a new Commercial Paper Funding Facility to support the flow of credit to firms during the coronavirus pandemic.

Q: To what extent can monetary policy assist?

Wheelock: Clearly, there are some limits to what monetary policy can do. This pandemic is, of course, something that public and private health experts are working on diligently. The Fed does not employ doctors or clinicians or biologists, so we're not able to provide support in terms of the real solution: identifying treatments or a vaccine for COVID-19.

Economically, the central bank is not the only game in town, and there are others who have an important role in a situation like this.

But the Fed can to try to cushion the blow and help the economy weather whatever storm this is. As Chairman Powell said at his March 3 press conference , “We can and will do our part … to keep the U.S. economy strong as we meet this challenge.”

Additional Resources

COVID-19 : Read a statement from St. Louis Fed President Jim Bullard, and find resources that may be helpful during this unprecedented time.

Christine Smith works in the External Engagement and Corporate Communications Division at the St. Louis Fed.

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Media questions

All other blog-related questions

ReviewEcon.com

AP, IB, and College Microeconomic and Macroeconomic Principles

9 key questions about monetary policy answered

Monetary policy tools.

Updated 11/3/2023 Jacob Reed 1. What is monetary policy? Monetary policy is how a country’s central bank works to achieve the economic goals of price stability and full employment. Central banks use monetary policy tools to change interest rates.

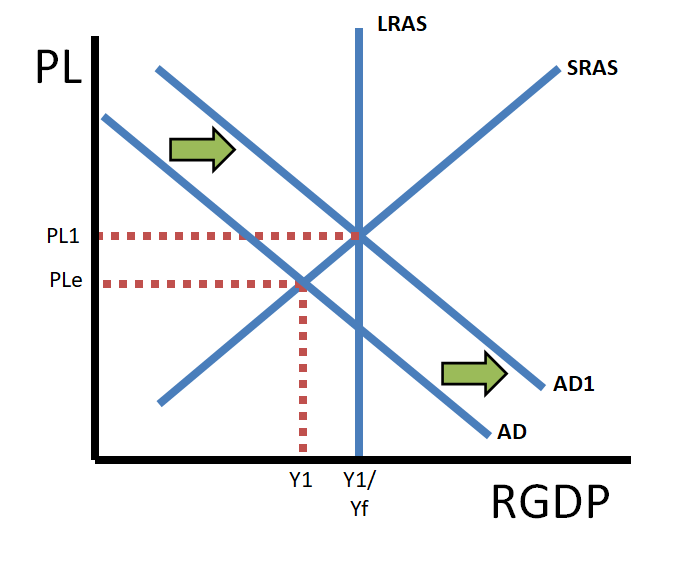

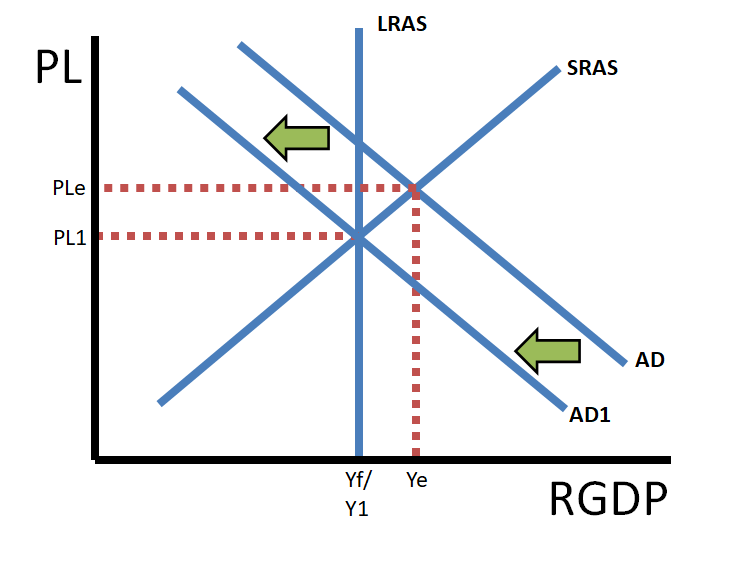

Those changes in interest rates change the quantity of investment (and other interest rate sensitive spending), which shifts the aggregate demand curve in the AS/AD model. That AD shift can change the price level to achieve price stability and change real output to achieve full employment.

2. What is Ample vs Scarce (limited) reserves?

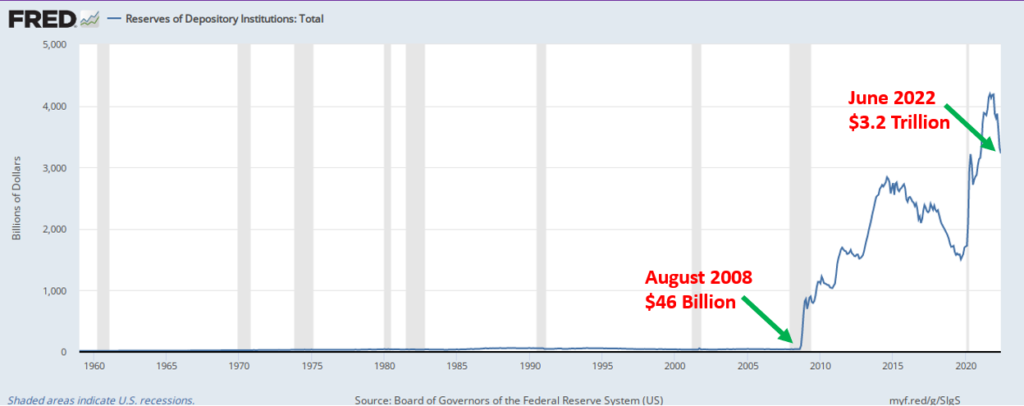

Until recently the world’s economies operated in a system of scarce or limited reserves. That means banks loaned out nearly all of their excess reserves. With limited reserves in the banking system, small changes to the amount of bank reserves dramatically change the money supply and with that, the nominal interest rate in the money market. Central banks operating in a scarce reserves system use open market operations, the discount rate, and the reserve requirement to change the bank reserves and the nominal interest rate.

During the recession of 2008, the amount of reserves within the US banking system dramatically increased. Banks stopped loaning out nearly all of their excess reserves and old monetary policy tools became less effective at impacting the nominal interest rate. As a result, the Federal Reserve (and other central banks with an ample reserves system) must use new tools to change the nominal interest rate. The primary monetary policy tool is now Interest on Reserves.

In both systems, changes in the interest rate are used to achieve the goals of full employment and stable prices. Central banks work to lower interest rates to fight unemployment (to close a recessionary gap) and raise interest rates to fight inflation (to close an inflationary gap).

3. How does Monetary Policy work in a scarce reserves system?

In a scarce reserves system, 3 tools are used to shift the money supply and change the nominal interest rate in the money market. Each of those tools is described below:

Open market operations (the preferred tool of central banks with a scarce reserves system) include just 2 things: buying and selling government bonds (securities). When central banks buy bonds, the bond sellers deposit the proceeds in checking accounts. That increases excess reserves in the bank, allowing them to make more loans. More loans increases the money supply and decreases the nominal interest rates. When the central bank sells bonds the public buyers pay with money from their checking accounts. The money supply decreases and the nominal interest rate rises.

Note: You could see questions on your exams asking about open market policies or open market actions. These questions are about buying or selling bonds. These questions are not asking about discount rates or reserve requirements.

The reserve requirement (or required reserve ratio) is the percentage of demand deposits (or checkable deposits) which cannot be loaned out. If the reserve requirement is 10% and a customer makes a $1000 deposit, the bank may loan out $900 of excess reserves while keeping $100 of required reserves on hand. Decreasing the reserve requirement increases the loans banks can make. New loans increase the money supply and decrease the nominal interest rate in the money market. Increasing the reserve requirement decreases the money supply and increases the nominal interest rate.

The discount rate is the interest rate banks are charged when they borrow money from the central bank. If banks do not have enough money to cover the required reserves, they may borrow money from the central bank and pay the discount rate for the short-term (overnight) loan. Increasing the discount rate makes it more expensive for banks when they don’t have enough to cover their required reserves. That causes banks to loan less money, which decreases the money supply. Decreasing the discount rate makes it less expensive for banks when they don’t have enough funds to meet their required reserves. That causes banks to loan more, which increases the money supply.

All 3 of the above tools are used to target the interest rate banks charge each other for overnight loans. That interbank rate impacts all other interest rates in the economy. This rate is called the policy rate and is known as the Federal Funds Rate in the United States (but the US Federal Reserve uses the ample reserves framework).

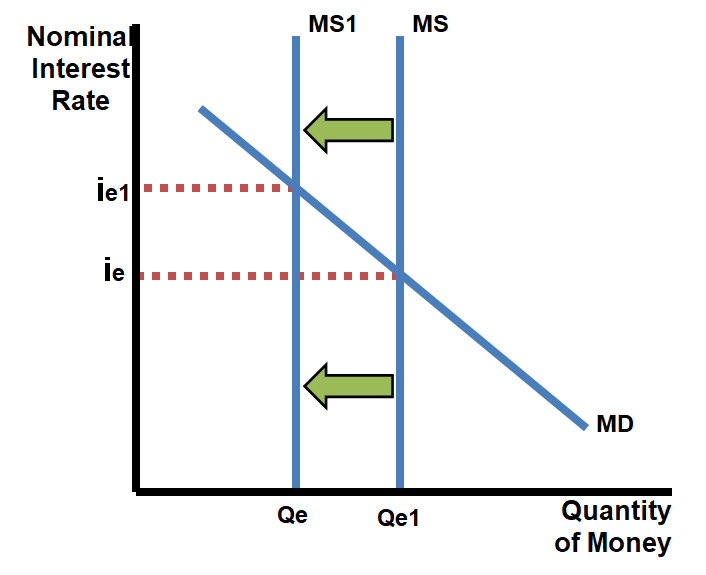

Contractionary Monetary policy is used to fight inflation. In a scarce reserves system a central bank can sell bonds on the open market, increase the discount rate, and/or increase the reserve requirement. Any of those actions will decrease the money supply and increase the nominal interest rate.

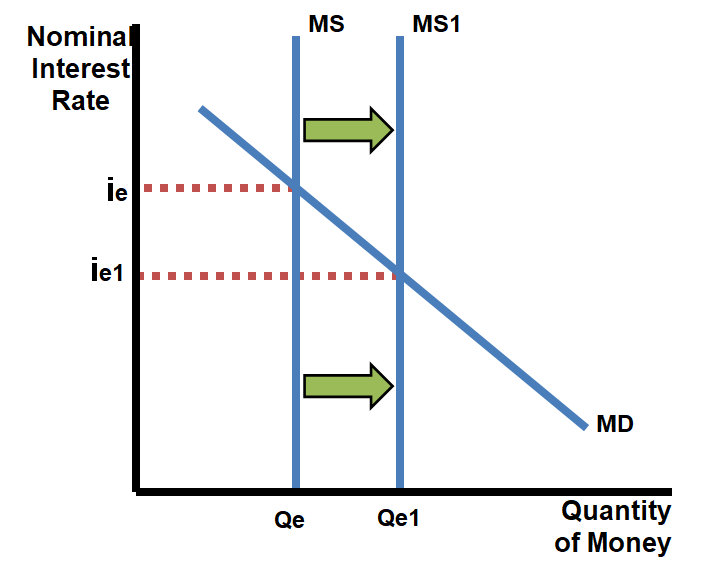

Expansionary Monetary Policy is used to fight unemployment. In a scarce reserves system and central bank can buy bonds on the open market, decrease the discount rate, and/or decrease the reserve requirement. Any of those actions will increase the money supply and decrease the nominal interest rate.

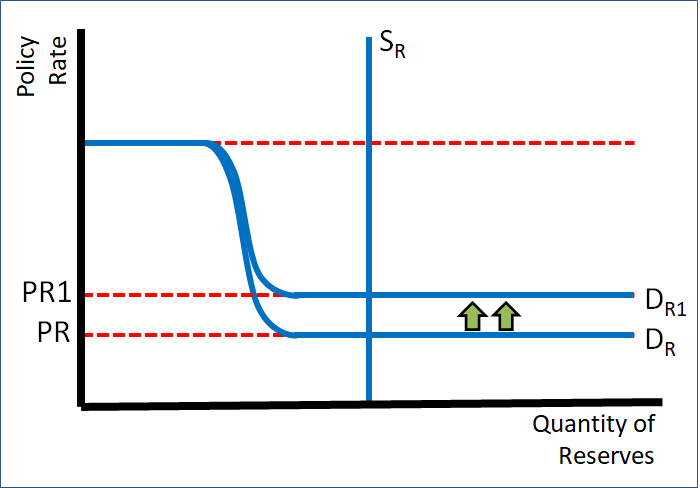

4.What is the reserves market graph?

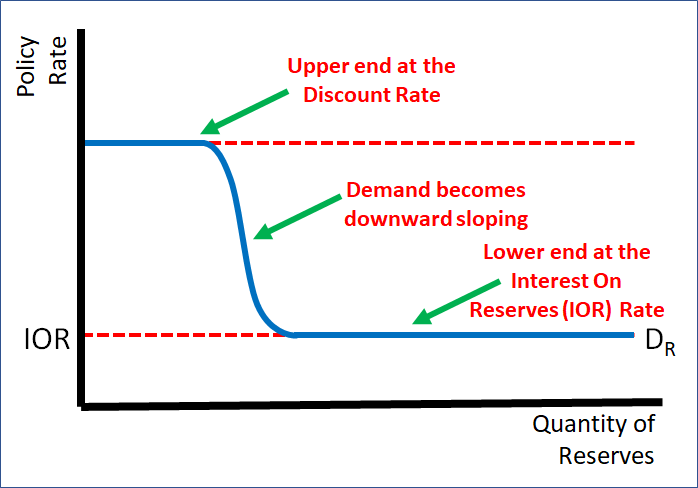

The reserves market is the model used by central banks with an ample reserves system (as opposed to the money market above used in the scarce reserves system). It shows how changes in Interest On Reserves can be used to target specific policy rates (again, the Federal Funds rate is the name of the US policy rate in the US).

The Demand for Reserves is a downward sloping curve with a flat upper end and flat lower end. The upper end is the horizontal section on the top of the demand for reserves. That upper end is at the discount rate. It is horizontal at the discount rate because banks will not demand (borrow) reserves at any interest rate higher than the discount rate. An increase in the discount rate lifts the upper end, and a decrease in the discount rate lowers the upper end.

There is a middle downward sloping section of the demand for reserves. There we see the inverse relationship between the policy rate and the quantity of reserves demanded. When the supply of reserves intersects the downwards loping section of the demand, the economy has a scarce reserves system.

The lower end of the demand for reserves is the horizontal section at the bottom of the curve. That lower end is at the Interest on Reserves Rate. When there are ample reserves, the interest on reserves acts as a floor. At high quantities of reserves, the policy rate moves towards the interest on reserves rate through a process called arbitrage (We’ve been told arbitrage is not on the AP Macro exam), that flattens and lifts the lower section of the demand for reserves, creating the lower end. Increasing the Interest on Reserves.

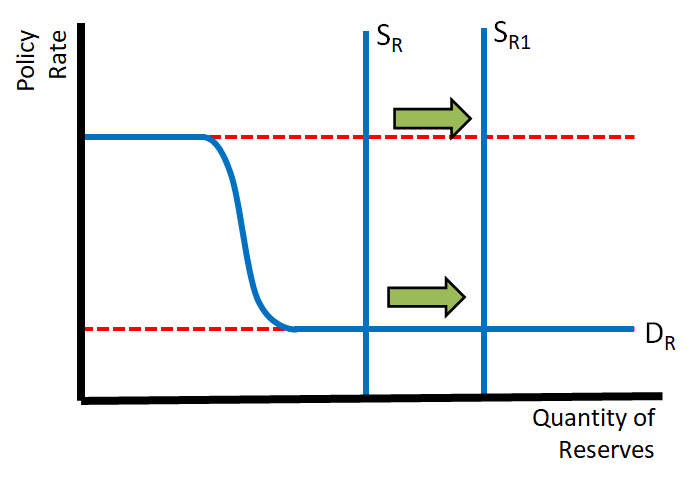

The Supply of Reserves is the controlled by the actions and policies of the central bank. The supply of reserves is not responsive to the policy rate, so it is vertical at the equilibrium quantity of reserves. The central bank uses open market operations to shift the supply of reserves. Buying bonds, increases the supply and that action is used to keep the reserves market in ample reserves (where the supply intersects the demand on the lower end). Selling bonds will shift the supply to the left.

The Policy Rate (PR) is found at the intersection of the supply and demand. When the supply intersects the demand at the lower end (when there are ample reserves), small changes in the supply do not change the policy rate. As a result, open market operations do not change the policy rate in ample reserves. The policy rate is targeted by changing the interest on reserves rate to increase or decrease the lower end.

5. How does Monetary Policy work in an ample reserves system?

In an ample reserves system, central banks use the reserves market to influence nominal rates. The targeted rate for interbank lending is the policy rate (called the Federal Funds Rate in the United States).

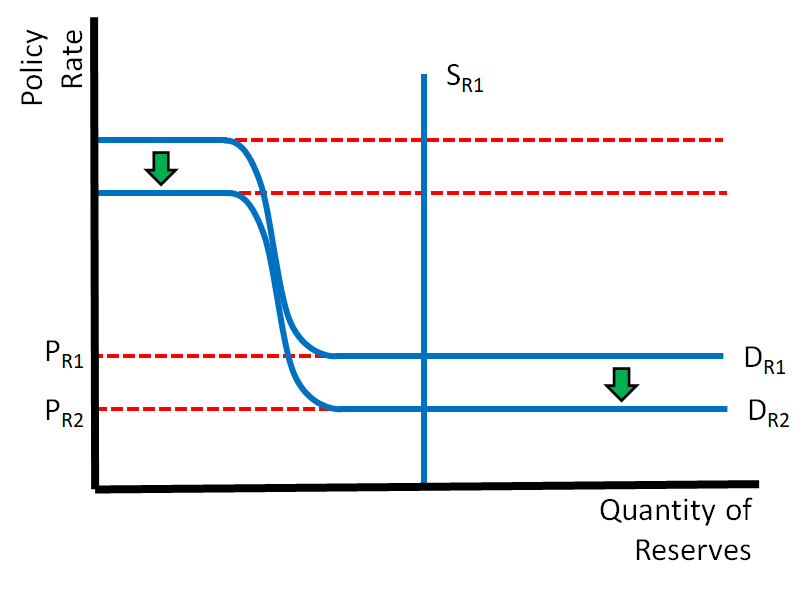

Interest on Reserves is the primary tool used by central banks with an ample reserves system. Interest on reserves is the interest rate paid by the central bank to banks for their reserves. Since central banks can earn this rate on their reserves, the lower end of the demand for reserves moves up with an increase in the interest on reserves rate and down with a decrease in the interest on reserves rate. Thse shifts of the lower end of the demand for reserves changes the policy rate (Federal Funds Rate in the US).

Open Market Operations is used to maintain an ample reserves system. If banks make more loans, the supply of reserves decreases. Open market purchases shift the supply of reserves to the right, which keeps the supply on the lower end of the demand.

Administered rates include both the Interest on Reserves rate and the discount rate. Increasing administered rates shifts the upper and lower end of the demand curve upward. Decreasing administered rates shifts the upper and lower end of the demand curve downward.

6. What is expansionary monetary policy?

It doesn’t matter if an economy has scarce or ample reserves, expansionary monetary policy decreases interest rates. Lower interest rates increase gross investment. That shifts aggregate demand to the right. Expansionary monetary policy can be used to fight unemployment. It results in greater real output (real GDP) and that means more employment and less unemployment. Expansionary policy also increases the price level.

Scarce Reserves Expansionary Policy (money market):

- Decrease Discount Rate

- Decrease Reserve Requirement

Ample Reserves Expansionary Policy (reserves market):

- Decrease interest on Reserves or Decrease Administered Rates

7. What is contractionary monetary policy?

Contractionary monetary policy, on the other hand, increases interest rates. Higher interest rates decrease gross investment. That shifts aggregate demand to the left. Contractionary monetary policy can be used to fight inflation. It results in a lower price level which eases inflationary pressures. Contractionary policy also decreases real output and increases unemployment.

Scarce Reserves Contractionary Policy (money market):

- Increase Discount Rate

- Increase Reserve Requirement

- Increase interest on Reserves or Increase Administered Rates

8. How does monetary policy impact the growth rate?

Since the interest rate directly impacts the quantity of investment and gross investment includes purchases of physical capital, interest rates can impact the growth rate of the economy. Higher interest rates tend to decrease investment and with it the growth rate. Lower interest rates tend to increase investment and the growth rate.

9. How does expansionary monetary policy impact the long run?

As mentioned above, expansionary monetary policy shifts the aggregate demand (AD) right; causing the price level and real output to increase in the short run. In the long run (as you learned in the section about the AS/AD model), wages and other input prices adjust to the price level. Since the rightward shift of the AD curve caused an increase in the price level, wages and other input prices will eventually increase to that level. When that happens, the higher input costs cause the short run aggregate supply (SRAS) to shift left. The long run result is only an increase in price levels with no increase in real output.

Up Next: Review Games: Money Multiplier , Fiscal Policy/Monetary Policy Sorting Content Review Page: Money Market Graph

Other recommended resource: ACDC

**AP©, Advanced Placement Program©, and College Board© are registered trademarks of the College Board, which was not involved in the production of, and does not endorse, this material. IB is a registered trade mark of International Baccalaureate Organization which was also not involved in the production of and does not endorse this material.**

I would like to acknowledge the work of Dick Brunelle and Steven Reff from Reffonomics.com whose work inspired many of the review games on this site. I would also like to thank Francis McMann, James Chasey, and Steven Reff who taught me how to be an effective AP Economics teacher at AP summer institutes; as well as the countless high school teachers, and college professors from the AP readings, economics Facebook groups, and #econtwitter.

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

- Online Lessons

Evaluating Monetary Policy (Online Lesson)

Last updated 28 Apr 2020

- Share on Facebook

- Share on Twitter

- Share by Email

In this online lesson, we cover some of the key approaches for evaluating the effectiveness of monetary policy. You may want to take a look at the lesson introducing monetary policy and the lesson for quantitative easing first.

WHAT YOU'LL STUDY IN THIS ONLINE LESSON:

- A review of the main types of macro policy and key aspects of monetary policy

- Evaluating monetary policy and its effectiveness by looking at why the interest rate transmission mechanism may not work in practice

- The need for alternative monetary policy approaches

- Inflation targeting

- Broader evaluation points

Additional teacher guidance is available at the end of this lesson.

Thank you to Peter McGinn and Jon Clark for their contributions to this lesson.

HOW TO USE THIS ONLINE LESSON

Follow along in order of the activities shown below. Some are interactive game-based activities, designed to test your understanding and application of monetary policy. Others are based on short videos, including activities for you to think about and try at home, as well as some extra worksheet-based activities.

If you would like to download a simple PDF worksheet to accompany the video activities, you can download it here: Evaluating Monetary Policy . You can print it off and annotate it for your own notes, or make your own notes on a separate piece of paper to add to your school/college file.

ACTIVITY 1: VIDEO - REVIEW OF THE TYPES OF MACRO POLICY

Test yourself against "The Cube" in this quick review activity of the different types of macro policy.

ACTIVITY 2: VIDEO - MONETARY POLICY KEY TERMS

Before we can address some of the key evaluation points for monetary policy, it's important to make sure that the essential monetary policy terminology is spot on! Check your knowledge in this quick review video.

ACTIVITY 3: GAME - MULTIPLE CHOICE QUESTIONS

Test yourself against the clock with these MCQs on monetary policy.

ACTIVITY 4: VIDEO - BREAKDOWN OF THE TRANSMISSION MECHANISM

For the last decade or so, changes to Bank Rate have not been as effective as they had been in the past. The interest rate transmission mechanism has broken down in parts. This video activity takes you through some of the reasons for this.

ACTIVITY 5: READING AND THINKING TIME - INFLATION TARGETS

From the 1990s onwards, a number of Central Banks decided to introduce inflation targets as part of their monetary policy approach.

For a brief overview of the UK's inflation target, take a look at the Bank of England information here . You can follow this up with a slightly more in-depth explanation of inflation targeting from the IMF here .

Next, take a look at this article from the Federal Reserve Bank of San Francisco on the pros and cons of inflation targeting. You could also read this opinion piece from CNBC , which considers whether inflation targets should be scrapped in light of the impact of COVID-19.

Finally, download this tutor2u resource On Target . On the 2nd page, you will find a series of statements regarding inflation targeting as a monetary policy. Some are advantages of this approach whilst others are disadvantages. Your task is to i) organise the statements into advantages and disadvantages ii) rank those statements from "most convincing" to "least convincing".

ACTIVITY 6: GAME - INFLATION TARGETS

In this Higher or Lower game, build your knowledge of how different economies approach inflation targeting.

ACTIVITY 7: VIDEO - UNCONVENTIONAL MONETARY POLICY

When Central Banks realised that the traditional interest rate transmission mechanism was not going to be as effective as they'd hoped following the Financial Crisis of 2007-2009, they had to turn to some alternative approaches. This video introduces you to some of these unconventional approaches to monetary policy.

ACTIVITY 8: SYNOPTIC THINKING

In your A level exams, you will need to be able to use your economics in a synoptic way i.e. making connections across different aspects and topics in your course. Download this tutor2u Synoptic Assessment Mat to help you practise this skill in relation to monetary policy.

ACTIVITY 9: VIDEO - GENERAL EVALUATION POINTS FOR MONETARY POLICY

In this final video for this lesson, we take you through some of the wider evaluation points for monetary policy.

ACTIVITY 10: DATA RESPONSE

The best way to work out how well you've understood the material in the online lessons on monetary policy is to have a go at some exam-style questions! We've put together a data response set of questions that you could tackle. If you are doing AQA Economics then download this AQA-style data response . If you are doing Edexcel Economics, then download this Edexcel-style data response . If you are following an alternative specification, ask your teacher which of these is the most appropriate for you.

ACTIVITY 11: ESSAY ANALYSIS

An effective way of learning how to write good essays is to read essays that would be awarded high marks in an exam and then analyse the reasons why they would be awarded high marks. You can have a go at this for the following two essays:

- Evaluating the effectiveness of inflation targeting as a tool of monetary policy

- Evaluating the impact of monetary policy on economic performance

Jot down some notes on the key features of these essays, and try highlighting the aspects of the essay that you might not have thought to include yourself if you had tackled that essay title.

EXTENSION READING

The Bank of England has produced a number of reports which aim to compare and contrast different approaches to monetary policy. T his paper focuses on comparing credit easing with quantitative easing, and is worth a read.

This transcript of a speech for the ECB considers why some commentators have regarded recent monetary policy as ineffective, and attempts to explain why they are wrong.

ADDITIONAL TEACHER GUIDANCE

This lesson comprises:

- around 30 minutes of guided video, spread over 5 videos, and supported by an accompanying worksheet

- around 20-25 minutes of student thinking time and activity, spread throughout those 5 videos

- an independent reading and ranking activity on inflation targeting, which could take students anywhere between 15 minutes and 1 hour, depending on their level of involvement

- 2 interactive games testing their application and knowledge of monetary policy

- a synoptic thinking activity (solutions available within the activity download)

- a suggested data response activity

- an essay-based activity, in which 2 example essays on monetary policy are provided (along with some examiner commentary) and students need to consider the strong features of these essays

- extension reading

We anticipate that the "core" of the lesson would take around one hour, with an extra 90 minutes for the written tasks. For the data response activity, there is a choice between an AQA-style and an Edexcel-style data response. Please advise your students which is the most appropriate for them, especially if you follow a different awarding body specification. You can find suggested answers to the AQA DR here and to the Edexcel DR here .

- Monetary policy

- Unconventional Monetary Policy

- Central Bank

- Inflation target

- Quantitative easing (QE)

You might also like

What is money.

21st September 2015

Richard Koo Explains a Balance Sheet Recession

6th November 2016

Analysis of Interest Rate Changes (MCQ Revision Questions)

Practice Exam Questions

How the US Federal Reserve sets interest rates

28th November 2017

Macroeconomic Objectives (2020 Update)

Topic Videos

Inflation and Deflation - 2021 Revision Update

Economics of inflation - the wage-price-spiral.

In the News Teaching Activity – China’s economy experiences deflation in October (Nov 2023)

20th November 2023

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

We serve the public by pursuing a growing economy and stable financial system that work for all of us.

- Center for Indian Country Development

- Opportunity & Inclusive Growth Institute

- Monetary Policy

- Banking Supervision

- Financial Services

- Community Development & Outreach

- Board of Directors

- Advisory Councils

Work With Us

- Internships

- Job Profiles

- Speakers Bureau

- Doing Business with the Minneapolis Fed

Overview & Mission

The ninth district, our history, diversity & inclusion, region & community.

We examine economic issues that deeply affect our communities.

- Request a Speaker

- Publications Archive

- Agriculture & Farming

- Community & Economic Development

- Early Childhood Development

- Employment & Labor Markets

- Indian Country

- K-12 Education

- Manufacturing

- Small Business

- Regional Economic Indicators

Community Development & Engagement

The bakken oil patch.

We conduct world-class research to inform and inspire policymakers and the public.

Research Groups

Economic research.

- Immigration

- Macroeconomics

- Minimum Wage

- Technology & Innovation

- Too Big To Fail

- Trade & Globalization

- Wages, Income, Wealth

Data & Reporting

- Income Distributions and Dynamics in America

- Minnesota Public Education Dashboard

- Inflation Calculator

- Recessions in Perspective

- Market-based Probabilities

We provide the banking community with timely information and useful guidance.

- Become a Member Bank

- Discount Window & Payments System Risk

- Appeals Procedures

- Mergers & Acquisitions (Regulatory Applications)

- Business Continuity

- Paycheck Protection Program Liquidity Facility

- Financial Studies & Community Banking

- Market-Based Probabilities

- Statistical & Structure Reports

Banking Topics

- Credit & Financial Markets

- Borrowing & Lending

- Too Big to Fail

For Consumers

Large bank stress test tool, banking in the ninth archive.

We explore policy topics that are important for advancing prosperity across our region.

Policy Topics

- Labor Market Policies

- Public Policy

Racism & the Economy

Policy has tightened a lot. how tight is it (an update).

May 7, 2024

Over the past few years, I have published a series of essays assessing where we are in our inflation fight and highlighting some important questions policymakers are facing. My most recent essay was in February of this year, where I questioned how much monetary policy was actually restraining demand. This essay is an update to that commentary, and I now examine the current stance of monetary policy in more detail. 1

I will argue that the Federal Open Market Committee (FOMC) has tightened policy significantly, compared with prior cycles, both in absolute terms and relative to the market’s understanding of neutral. But I will also observe that the housing market is proving more resilient to that tight policy than it generally has in the past. Given that housing is a key channel through which monetary policy affects the economy, its resilience raises questions about whether policymakers and the market are misperceiving neutral, at least in the near term. It is possible that once the reopening dynamics of the post-COVID economy have concluded, the macro forces that drove the low-rate environment that existed before the pandemic will reemerge, pulling neutral back down. But the FOMC must set policy based on where neutral is in the short run to achieve our dual mandate goals in a reasonable period of time. The uncertainty about where neutral is today creates a challenge for policymakers.

Economic Update

Since my last update in February, two significant economic developments have occurred simultaneously: Inflation appears to have stopped falling and economic activity has proven resilient, continuing the robust activity we saw in the latter half of 2023.

The FOMC targets 12-month headline inflation of 2 percent. While we saw rapid disinflation in the second half of 2023, that progress appears to have stalled in the most recent quarter (see Figure 1). The question we now face is whether the disinflationary process is in fact still underway, merely taking longer than expected, or if inflation is instead settling to around a 3 percent level, suggesting that the FOMC has more work to do to achieve our dual mandate goals.

During this time, economic activity has continued to show remarkable strength, as shown in Figure 2. While the most recent headline GDP appears somewhat weaker than prior quarters, that slowdown was driven largely by inventories and net exports. Underlying domestic demand remained strong.

The labor market, the other half of our dual mandate, has also remained strong with the unemployment rate at a historically low 3.9 percent.

Policy Is Much Tighter than the Pre-pandemic Period

In prior essays I wrote that the single best proxy for the overall stance of monetary policy is the long-term real rate, specifically the 10-year Treasury inflation-protected securities (TIPS) yield. Focusing on a long-term rate incorporates the expected path of both the federal funds rate and balance sheet, not just the current level of the federal funds rate. Moreover, it adjusts the expected path of policy by expected future inflation—the relevant comparison—rather than by recently realized inflation.

As I noted in earlier essays, prior to the pandemic the 10-year real yield was about zero, which I estimate was roughly a neutral policy stance at that time. In response to the pandemic, the FOMC acted aggressively to support the economy by driving the federal funds rate to the effective lower bound and massively expanding our balance sheet. Those combined effects drove the 10-year real yield to roughly -1 percent, as shown in Figure 3. Since we began our tightening cycle two years ago, 10-year real yields have more than fully retraced their pandemic decline and are now around 2.2 percent. Thus, we are clearly in a tighter stance now than immediately before the pandemic.

This Tightening Cycle Appears to Be as Aggressive as the 1994 Cycle

Data from the TIPS market only go back 20 years or so; thus, to evaluate earlier tightening cycles one must make a number of assumptions about the neutral rate and about inflation expectations.

I do not think comparisons to the 1970s and early 1980s are particularly relevant to us today because in those decades, the FOMC had to establish its inflation-fighting credibility, so the required monetary tightening was very large.

The tightening cycle in 1994 might be a better benchmark because at that time, as is true now, the FOMC had a lot of credibility with the public. Inflation was not as high in 1994, however, as it was in this episode. So it is not a perfect comparison either.

Minneapolis Fed staff’s best estimate is that when the FOMC raised the policy rate by 300 basis points in the 1994 tightening cycle, this translated into an increase of about 200 basis points in the 10-year real rate (Figure 4), which was coincidentally also about 200 basis points above the then-neutral 10-year real rate. So that is the key: It seems as though policy drove the 10-year real rate about 200 basis points above neutral.

How does that compare to our current tightening cycle? (See Figure 3.) If my estimate of neutral being zero before the pandemic still holds, then we have accomplished similar or a bit more tightening in this cycle than was achieved in the 1994 tightening cycle.

Yield Curve Suggests Policy Is Tight

As I stated earlier, the underlying inflationary dynamics are quite different today than in 1994, so simply repeating the 1994 tightening might not be enough. And perhaps the unique dynamics of the post-COVID reopening economy have caused neutral to increase.

Another indicator I look at to assess the stance of monetary policy is the shape of the yield curve. Specifically, if the yield curve is inverted, it might indicate that monetary policy is in a contractionary stance. A lot of public attention is given to the yield curve, and there is a robust debate about whether an inverted yield curve is a reliable recession indicator. I wrote about this in 2018. Setting aside its usefulness as a predictor of recessions, the yield curve does seem to give some indication of the stance of monetary policy. The long end of the yield curve should offer some signal of where market participants believe interest rates will settle once current economic and policy shocks have run their course; if markets understand that neutral has moved, it should be reflected in the long end of the curve. If current short rates are higher than long rates, then that might signal an overall tight stance of policy today. Figure 5 shows the history of the (nominal) yield curve with a number of inversions over the past 50 years, including the current inversion. 2

Depending on the specific measures chosen, the yield curve has now been inverted for more than 20 months, which is a relatively long and somewhat deeper inversion than most prior cycles, the Volcker disinflation period being the exception. The current inverted yield curve suggests that policy is in fact tight relative to the market’s understanding of neutral.

The Resilience in the Housing Market Nonetheless Raises Questions

Housing is traditionally the most interest-rate-sensitive sector of the economy. Prior yield curve inversions also coincided with a marked slowdown or even contraction in residential investment, as shown in Figure 6. Curiously, while residential investment fell in the first part of our tightening cycle, it has since reversed and has grown 5 percent over the past year.

What could explain this apparent resilience in residential real estate given monetary policy that has led to an inverted yield curve? We know that following the Global Financial Crisis, the country built far fewer housing units than were needed to keep up with population growth and household formation. Thus, there appears to be a significant shortage of housing that will take a long time to close. In addition, responses to COVID have led to an increase in people working from home, and that has led to increased demand for housing. In recent years there has also been a significant increase in immigration. While the long-run effect of increased immigration on inflation is unclear, immigrants nonetheless need a place to live, and their arrival in the U.S. has likely also increased demand for housing. Policy actions by the FOMC have driven 30-year mortgage rates from around 4.0 percent prior to the pandemic to around 7.5 percent today. Perhaps that level of mortgage rates is not as contractionary for residential investment as it would have been absent these unique factors which are driving housing demand higher. In other words, perhaps a neutral rate for the housing market is higher than before the pandemic.

Other Signals from the Real Economy Are Mixed

Monetary policy is a blunt instrument that eventually affects virtually the entire economy, not only housing. While high interest rates may not be slowing housing as much as in prior tightening cycles, it is nonetheless having an impact on other sectors of the economy. For example, auto loan and credit card delinquencies have increased from very low levels and are now at rates higher than existed before the pandemic, indicating that some consumers are feeling stress from increased borrowing costs. Overall, however, economic activity, consumer spending and the labor market have proven surprisingly resilient.

The FOMC has undeniably tightened policy meaningfully, both relative to the pre-pandemic period and to some prior tightening cycles. Nonetheless, it is hard for me to explain the robust economic activity that has persisted during this cycle. My colleagues and I are of course very happy that the labor market has proven resilient, but, with inflation in the most recent quarter moving sideways, it raises questions about how restrictive policy really is. If policymakers and market participants are misperceiving the neutral policy rate, that could explain the constellation of data we are observing. This is also a communication challenge for policymakers. In my own Summary of Economic Projections (SEP) submission, I have only modestly increased my longer-run nominal neutral funds rate level from 2 percent to 2.5 percent. The SEP does not provide a simple way to communicate the possibility that the neutral rate might be at least temporarily elevated.

1 These comments reflect my own views and may not necessarily represent the views of others in the Federal Reserve System or of the Federal Open Market Committee.

2 Conceptually, the real yield curve is a better measure of the stance of monetary policy than the nominal yield curve. That said, because nominal and real spreads have been quite similar over the past 18 months, the nominal spread in Figure 5 currently provides an equivalent measure of the stance of monetary policy. I plot nominal yields in Figure 5 simply because they are available for a longer time period than TIPS yields.

Related Content

Policy Has Tightened a Lot. How Tight Is It?

Policy Has Tightened a Lot. Is It Enough? (A Second Update)

The Interaction between Inflation and Financial Stability

Sign up for news and events.

- IAS Preparation

- UPSC Preparation Strategy

Monetary Policy

Monetary policy is adopted by the monetary authority of a country that controls either the interest rate payable on very short-term borrowing or the money supply. The policy often targets inflation or interest rate to ensure price stability and generate trust in the currency.

The monetary policy in India is carried out under the authority of the Reserve Bank of India.

What are the main objectives of monetary policy?

Simply put the main objective of monetary policy is to maintain price stability while keeping in mind the objective of growth as price stability is a necessary precondition for sustainable economic growth.

In India, the RBI plays an important role in controlling inflation through the consultation process regarding inflation targeting. The current inflation-targeting framework in India is flexible.

What role does the Monetary Policy Committee play?

The Reserve Bank of India Act, 1934 (RBI Act) was amended by the Finance Act, 2016, to provide for a statutory and institutionalized framework for a Monetary Policy Committee, for maintaining price stability, while keeping in mind the objective of growth. The Monetary Policy Committee is entrusted with the task of fixing the benchmark policy rate (repo rate) required to contain inflation within the specified target level.

The Government of India, in consultation with RBI, notified the ‘Inflation Target’ in the Gazette of India dated 5 August 2016 for the period beginning from the date of publication of the notification and ending on March 31, 2021, as 4%. At the same time, lower and upper tolerance levels were notified to be 2% and 6% respectively.

Monetary Policy – UPSC Notes:- Download PDF Here

What are the instruments of monetary policy?

Some of the following instruments are used by RBI as a part of their monetary policies.

- Open Market Operations: An open market operation is an instrument which involves buying/selling of securities like government bond from or to the public and banks. The RBI sells government securities to control the flow of credit and buys government securities to increase credit flow.

- Cash Reserve Ratio (CRR): Cash Reserve Ratio is a specified amount of bank deposits which banks are required to keep with the RBI in the form of reserves or balances. The higher the CRR with the RBI, the lower will be the liquidity in the system and vice versa. The CRR was reduced from 15% in 1990 to 5 % in 2002. As of 31st December 2019, the CRR is at 4%.

- Statutory Liquidity Ratio (SLR): All financial institutions have to maintain a certain quantity of liquid assets with themselves at any point in time of their total time and demand liabilities. This is known as the Statutory Liquidity Ratio . The assets are kept in non-cash forms such as precious metals, bonds, etc. As of December 2019, SLR stands at 18.25%.

- Bank Rate Policy: Also known as the discount rate, bank rates are interest charged by the RBI for providing funds and loans to the banking system. An increase in bank rate increases the cost of borrowing by commercial banks which results in the reduction in credit volume to the banks and hence the supply of money declines. An increase in the bank rate is the symbol of the tightening of the RBI monetary policy. As of 31 December 2019, the bank rate is 5.40%.

- Credit Ceiling: With this instrument, RBI issues prior information or direction that loans to the commercial bank will be given up to a certain limit. In this case, a commercial bank will be tight in advancing loans to the public. They will allocate loans to limited sectors. A few examples of credit ceiling are agriculture sector advances and priority sector lending.

Related Links:

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

IAS 2024 - Your dream can come true!

Download the ultimate guide to upsc cse preparation, register with byju's & download free pdfs, register with byju's & watch live videos.

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, ft professional, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

- Make and share highlights

- FT Workspace

- Markets data widget

- Subscription Manager

- Workflow integrations

- Occasional readers go free

- Volume discount

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

- My View My View

- Following Following

- Saved Saved

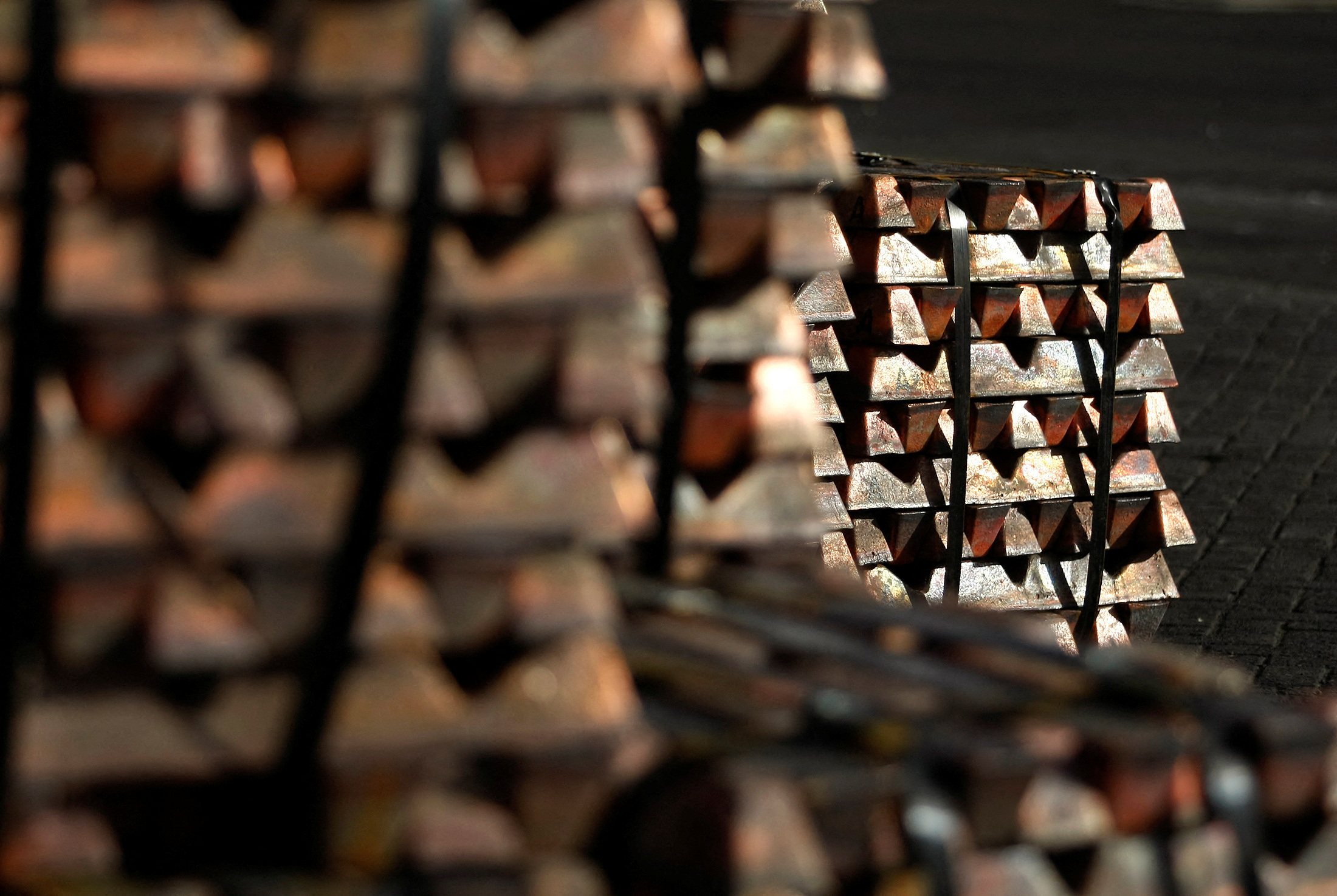

Main facts about the copper market as prices hit record highs

- Medium Text

INDUSTRIAL USES

Production chain by type and by region, major exporters and importers, supply-demand balance.

Sign up here.

Reporting by Polina Devitt; Editing by Jan Harvey

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Flooding caused by heavy rain and rivers bursting their banks in Armenia and Georgia has left one person dead, villages cut off and hundreds of people being evacuated from their homes, according to television footage and media reports in the region.

The tornado left trucks overturned, homes damaged and nearly 250,000 households without power, the report said.

Markets Chevron

EU should follow U.S. on tariffs over Chinese goods, Italy minister says

The European Union should follow the example of the United States and protect its industry by imposing tariffs on Chinese products, Italian Industry Minister Adolfo Urso said on Saturday.

Advertisement

Supported by

G7 Finance Ministers Close Ranks as Tensions with Russia and China Fester

Western economic officials projected a united front, and braced for retaliation, as they prepped tougher sanctions and tariffs.

- Share full article

By Alan Rappeport

Alan Rappeport reported from Stresa, Italy, where he is covering the G7 finance ministers meeting.

Top finance officials from the world’s advanced economies moved toward an agreement on Saturday over how to use Russia’s frozen central bank assets to aid Ukraine and warned against China’s dumping of cheap exports into their markets, aiming to marshal their economic might to tackle twin crises.

The embrace of more ambitious sanctions and protectionism came as finance ministers from the Group of 7 nations gathered for three days of meetings in Stresa, Italy. The proposals under consideration could deepen the divide between the alliance of wealthy Western economies and Russia, China and their allies, worsening a global fragmentation that has worried economists.

Efforts by the Group of 7 to influence the two powerful adversaries have had limited success in recent years, but rich countries are making a renewed push to test the limits of their combined economic power.

In a joint statement, or communiqué, released on Saturday , policymakers said they would stay united on both fronts as geopolitical crises and trade tensions have emerged as the biggest threats to the global economy.

“We are making progress in our discussions on potential avenues to bring forward the extraordinary profits stemming from immobilized Russian sovereign assets to the benefit of Ukraine,” the statement said.

Regarding China, the finance ministers expressed concern about its “comprehensive use of nonmarket policies and practices that undermines our workers, industries, and economic resilience.” They agreed to monitor the negative effects of China’s overcapacity and “consider taking steps to ensure a level playing field.”

Growing concern over how to handle Russia and China dominated the three days of meetings on the banks of Lake Maggiore. The U.S. has been pushing for a harder approach to dealing with Russia’s assets and China’s exports, while European countries have been treading more cautiously as they navigate their internal divisions.

Economic leaders spent much of their time grappling with the details of how they would proceed with unlocking the value of $300 billion in frozen Russian central bank assets to provide a longer-term stream of aid to Ukraine beginning next year.

“The key point is to ensure the right and strong and longstanding financing for the Ukrainian government,” Bruno Le Maire, the French finance minister, said on the sidelines of the meetings on Friday. “They need our support and they can rely on the united support of all G7 countries.”

By Saturday, there was growing momentum behind a U.S. proposal to use the windfall profits from those assets to create a loan for Ukraine that could be worth up to $50 billion and be backed by some Group of 7 countries.

“It really is the main option that is currently under consideration,” Treasury Secretary Janet L. Yellen said on Saturday following the meeting. “There does seem to be broad-based support for the general notion that that’s a productive way forward.”

But outstanding questions remained, including how countries would share the burden of risk associated with the loan if interest rates fall, which would erode the profits generated by the assets, and what would happen to the loan when the war eventually ends. Another complicating factor in using the assets to back a long-term loan is that the European Union sanctions authorizing the immobilization of most of those Russian assets must be regularly renewed.

The finance ministers will be racing over the next three weeks to work through the details of their options. They anticipate that Group of 7 leaders will decide how to proceed when they convene in Italy next month.

Urgency to reach an agreement has intensified as international weariness over the war has made it more difficult for the United States and Europe to continue delivering aid packages to Ukraine. Looming elections around the world, and in America in particular, have added to pressure to provide Ukraine with a stream of future funding.

“It would be nice to get this mechanism locked down, so that whatever the outcome of the U.S. election, you have $50 billion to play with,” said Charles Lichfield, a senior fellow at the Atlantic Council.

Although Russia dominated the talks, fears about the threat of China’s excess industrial capacity loomed large. Policymakers worry that a flood of heavily subsidized Chinese green energy technology products will cripple the clean energy sectors in the United States and Europe, leading to lost jobs and reliance on China for solar panels, batteries, electric vehicles and other products.

President Biden increased tariffs on some Chinese imports last week, including levying a 100 percent tax on electric vehicles, and left in place taxes on more than $300 billion worth of Chinese goods that President Donald J. Trump had imposed. This week, Ms. Yellen called on Europe and the Group of 7 to more forcefully confront China over its trade practices.

“We need to stand together and send a unified message to China so they understand it’s not just one country that feels this way, but that they face a wall of opposition to the strategy that they’re pursuing,” Ms. Yellen said at a news conference at the opening of the meetings.

European countries are pursuing their own investigations into China’s trade practices and are considering more tariffs. However, they are taking different approaches and some nations, such as Germany, worry that a trade fight with China would be damaging to their own economies , which depend heavily on exports to the Chinese market. Germany’s finance minister, Christian Lindner, warned that trade wars are “all about losing.”

There were indications this week that both China and Russia are preparing their responses to the Group of 7’s actions.

The China Chamber of Commerce to the E.U. said on Tuesday that Beijing was considering a temporary tariff increase on car imports following the new U.S. tariffs and the prospect of new levies in Europe.

“This potential action carries implications for European and U.S. automakers,” the business group wrote.

At the same time, Russia is also mobilizing its response to Western plans to use its assets to help sustain Ukraine. A spokeswoman for Russia’s foreign ministry described the idea of using the profits from the assets as an attempt to legitimize theft at the state level and said that the European Union would feel the full measure of Russian retaliation.

President Vladimir V. Putin also signed a decree on Thursday indicating that Moscow would move to compensate itself for any losses that it incurs from the freeze on its sovereign assets by seizing U.S. property. Although Russia has little access to U.S. state assets, it could pursue private investors’ property in Russia or funds in Russian accounts.

Ms. Yellen dismissed Russia’s threats on Saturday, noting that it had already been warning that it would seize U.S. property.

“That’s not going to deter us from going ahead and taking action in support of Ukraine,” she said.

However, officials in Europe, where most of Russia’s assets are held, remain mindful of the potential for repercussions. Paschal Donohoe, president of the Eurogroup, a club of European finance ministers, said that the prospect of Russian retaliation had been a frequent subject of discussions.

“There is of course always the possibility that Russia may initiate additional measures in the future,” Mr. Donohoe said, explaining that he is confident that the Western allies had the authority to take the actions they were considering. “Any action we take with regard to any sanction or any additional economic measures will respect international law.”

It is uncertain if the policies that the finance ministers are considering will succeed in encouraging Russia or China to change course. Despite internal differences, the ministers appeared to agree that a united front is their best hope.

“The G7’s renewal of strong unity is being forged amid the challenges posed by Russia’s brutal aggression in Ukraine and China’s growing authoritarianism and economic woes,” said Mark Sobel, a former longtime Treasury Department official who is now the U.S. chairman of the Official Monetary and Financial Institutions Forum.

Alan Rappeport is an economic policy reporter, based in Washington. He covers the Treasury Department and writes about taxes, trade and fiscal matters. More about Alan Rappeport

IMAGES

VIDEO

COMMENTS

Monetary Policy Definition: - Monetary policy occurs when the government uses interest rates or money supply to change the level of aggregate demand (AD) and national income (GDP) in the economy. - Interest rates is the monetary gain from lending money, and also the monetary cost of borrowing money. - Money supply is the total amount of ...

Explore the Tools of Economic Control! Learn about Expansionary Fiscal Policy and Monetary Policy, and how they impact inflation. Discover Strategies to Reduce and Control Inflation using both Policies. Dive into Policy Measures during a Recession and get insights on A Level Economics Essays for Fiscal and Monetary Policy. Unravel the concept of Liquidity Trap in Monetary Policy and explore ...

monetary policy shocks due to high marginal cost of external funds. This implies that monetary policy might be less effective during crisis time due to a larger fraction of constrained firms. My results reconcile previous empirical findings and argue that the seemingly contrary conclusions are, to some extent, consistent with each other.

Fundamentally, monetary policy can influence the price level—the rate of inflation, the aggregate price level in an economy. And it is appropriate to provide a more expansionary monetary policy when there's evidence that inflation is falling or will fall below the desirable level. In the Fed's case, we target a 2% rate of inflation.

Monetary Policy MC & Essay Questions - A-Level Economics. Mar 24, 2020 •. 0 likes • 7,347 views. Qurious Education. Essay and Multiple-Choice Exam Questions for Monetary Policy in GCE A-Level Economics for all exam boards (Edexcel, AQA, OCR, Eduqas)

Monetary policy is how a country's central bank works to achieve the economic goals of price stability and full employment. Central banks use monetary policy tools to change interest rates. Macro 4.6 Monetary Policy - Ample Reserves and Scarce Reserves. Those changes in interest rates change the quantity of investment (and other interest rate ...

Monetary policy is the use of control over money supply and interest rates in order to manage demand. There are a range of macroeconomic objectives, including stable inflation, high employment, economic growth, neutral balance of payments, equality and protecting the environment. Monetary policy can only be used to fix some of these. ...

The federal funds rate The FOMC's primary means of adjusting the stance of monetary policy is by changing its target for the federal funds rate. 5 To explain how such changes affect the economy, it is first necessary to describe the federal funds rate and explain how it helps determine the cost of short-term credit.. On average, each day, U.S. consumers and businesses make noncash payments ...

Essays on Monetary Policy with Informational Frictions Abstract This dissertation presents three essays addressing the role of informational frictions in monetary policy. In particular, motivated by the observation that central banks around the world are often ... Together, these essays shed light on the unanswered questions of how the public ...

4 answers. Jun 5, 2023. Fiscal balance such as reduction in the fiscal deficit and Current Account Deficit impacts the interest rates indirectly when the Monetary Policy is setting out the target ...

Essays in Monetary Policy Abstract This dissertation presents three chapters addressing issues pertaining to monetary policy, in-formation, and central bank communication. The -rst chapter studies optimal monetary policy in an environment where policy actions provide a signal of economic fundamentals to imperfectly informed agents.

Questions and model answers on 12. Financial Markets & Monetary Policy for the AQA A Level Economics syllabus, written by the Economics experts at Save My Exams. ... Essay 2. Since 1998, the Bank of England has had responsibility for the operation of monetary policy and maintaining price stability. In response to the financial crisis of 2007 ...

Monetary and fiscal policy Introduction Fiscal policy is defined as the power that the federal government poses that enables it to impose taxes and also spend to achieve its goals in the economy. On the other hand, the monetary policy is maintaining the programs that try to increase the nation's level of business through regulation the supply ...

Time: 43:48 to 51:39 Length: 7 minutes; 51 seconds Questions for Classroom Discussion: 1. Summarize the economic conditions and events during the Great Depression. Discuss the stock market crash, the change in price levels, the fall in output, the rise in unemployment, and the increase in the number of bank failures. 2.

Monetary policy involves changes in interest rates, the supply of money & credit and exchange rates to influence the economy. ... (Revision Essay Plan) Practice Exam Questions. Exchange Rates - Five Key Definitions Topic Videos. UK Economy Update 2019: Monetary and Fiscal Policy ... 10 question multi-choice quiz on Demand and Supply-Side ...

On May 6, 2022, I first published an essay explaining why I focus on long-term real rates to evaluate the overall stance of monetary policy, which includes effects from both the setting of the federal funds rate and changes to the Federal Reserve's balance sheet. Please see that essay for a discussion of why long-term real rates drive economic activity rather than short rates or nominal rates.

We've put together a data response set of questions that you could tackle. If you are doing AQA Economics then download this AQA-style data response. ... an essay-based activity, in which 2 example essays on monetary policy are provided (along with some examiner commentary) and students need to consider the strong features of these essays ...

Monetary policy is crucial to the economy and impacts all types of economic and financial decisions individuals make. For example, depending on the state of the economy, individuals may decide whether to obtain a loan to purchase a new car or house or to start their own company, whether to expand a business by investing in a new plant or equipment, and whether to put savings in a bank, in ...

Essay: Bank of Canada. Essay question: Back of Canada monetary policy (800-1000 words) Introduction o Independency of BOC o Quantitative easing (buying/selling bonds to banks) o T-Account (balance sheet) Expansionary policy o During the pandemic, BOC has adopted several monetary policies to stabilize the economy.

This essay is an update to that commentary, and I now examine the current stance of monetary policy in more detail. 1 I will argue that the Federal Open Market Committee (FOMC) has tightened policy significantly, compared with prior cycles, both in absolute terms and relative to the market's understanding of neutral.

A Level Economics. Our extensive collection of resources is the perfect tool for students aiming to ace their exams and for teachers seeking reliable resources to support their students' learning journey. Here, you'll find an array of revision notes, topic questions, fully explained model answers, past exam papers and more, meticulously ...

Monetary policy is adopted by the monetary authority of a country that controls either the interest rate payable on very short-term borrowing or the money supply. The policy often targets inflation or interest rate to ensure price stability and generate trust in the currency. The monetary policy in India is carried out under the authority of ...

The recent increase of inflation globally has led to a renewed interest in understanding the link between inflation and wages. In Uruguay, the presence of centralized wage bargaining and indexation practices raises the question as to what extent wage growth dynamics can make the response of inflation to shocks more persistent. We use a medium-scale DSGE model which incorporates indexation in ...

"Let's face it: for a long period of time, the CBN did not embrace orthodox monetary policies," Cardoso said. "We want to go back to using an orthodox method, and it will take us to where ...

The stories that matter on money and politics in the race for the White House. US defence secretary Lloyd Austin will visit Cambodia next month as Washington engages the country's new American ...

Rishi Sunak has vowed to introduce mandatory national service for 18-year-olds if he is re-elected, in his first major policy announcement since the start of the election campaign earlier this week.

SUPPLY-DEMAND BALANCE. The global 26.5 million-ton refined copper market was balanced in 2023, but faces a surplus of 162,000 metric tons this year and 94,000 tons in 2025, according to the ICSG ...

Treasury Secretary Janet L. Yellen said there appeared to be "broad-based support" among finance ministers from the Group of 7 nations for the idea of using frozen Russian assets to aid ...

STAR-Delaware Merit supports students' educational enrichment and financial empowerment DOVER, Del. — Lt. Governor Bethany Hall-Long and school leaders gathered on Thursday to recognize more than 60 students as part of a new program to support the educational journeys of Black students. STAR-Delaware Merit is a statewide merit awards initiative coordinated by Lt. Governor Bethany […]