How to write the business plan for a grant application?

Small business grants give free money to startups and existing businesses to help them flourish.

Free money doesn’t come easy, though. You’ll need to first research and find the right grant for your business. Then you need to persuade the body offering the grant why they should give one to your business.

Most grants have their own specific application process, where businesses provide information so the body can decide whether it fits their specific funding criteria.

It’s important to accompany your grant application with a strong business plan. Besides, including most of the basic information that goes into a grant application (like the service or product you’re offering and your staffing plan) it also includes a financial forecast - showing the funding body how profitable your business is likely to be.

Writing a business plan also provides another opportunity to convince them that your business objectives align with the grant’s purpose.

If you haven’t written a business plan for a grant application before, don’t worry.

From information on where to find small business grants, to what you need to include in a business plan for a grant application, here are some key points to consider when applying for a small business grant.

In this guide:

What’s the difference between a small business grant and a loan?

What are the main types of small business grants, where can i find small business grants in the uk, where can i find small business grants in the us, what is a grant application, what information do i need to have before applying for a small business grant, why do you need a business plan for a grant application, what should you include in a business plan for a grant application.

- How long should a business plan be for a grant application?

What tool should I use to write my grant application business plan?

Business plan templates for a grant application, key takeaways.

Let's first define what a small business grant is, explore why they are given out and then compare it to a business loan.

What is a small business grant?

Small business grants are financial assistance provided by governments, organizations, or institutions to support small businesses in various stages of their development.

Unlike loans, which require repayment with interest, grants are typically awarded as non-repayable funds.

These grants aim to encourage entrepreneurship, stimulate economic growth, and address specific societal needs.

For example, a small retail store might receive a grant to upgrade its storefront and enhance its customer experience, while a local farmer could obtain a grant to invest in sustainable farming practices.

Grants come in different forms and may target specific industries, demographics, or geographic regions.

They can cover a wide range of expenses, including equipment purchases, marketing efforts, research and development projects, and employee training.

Small business owners often apply for grants to access resources that would otherwise be financially out of reach.

However, it's important to note that grant funding is competitive, and applicants typically need to meet certain criteria and demonstrate the potential impact of their proposed projects.

How it differs from a business loan?

While both grants and loans provide financial assistance to businesses, there are key differences between the two.

Unlike grants, business loans must be repaid over time, usually with interest.

Loans are typically provided by banks, credit unions, or other financial institutions, and they require collateral or a good credit history to secure.

For example, a small manufacturing company might take out a loan to purchase new machinery or expand its production facilities.

One of the main advantages of grants over loans is that they do not need to be repaid, which can significantly reduce the financial burden on small businesses, especially those in the early stages of development.

Additionally, grants often come with fewer restrictions on how the funds can be used compared to loans, which may have specific repayment terms and conditions.

However, grants are typically more competitive to obtain, and applicants may need to undergo a rigorous application process, including demonstrating the feasibility and impact of their proposed projects.

Understanding these differences will help you determine the most suitable financing option for your business needs and goals.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

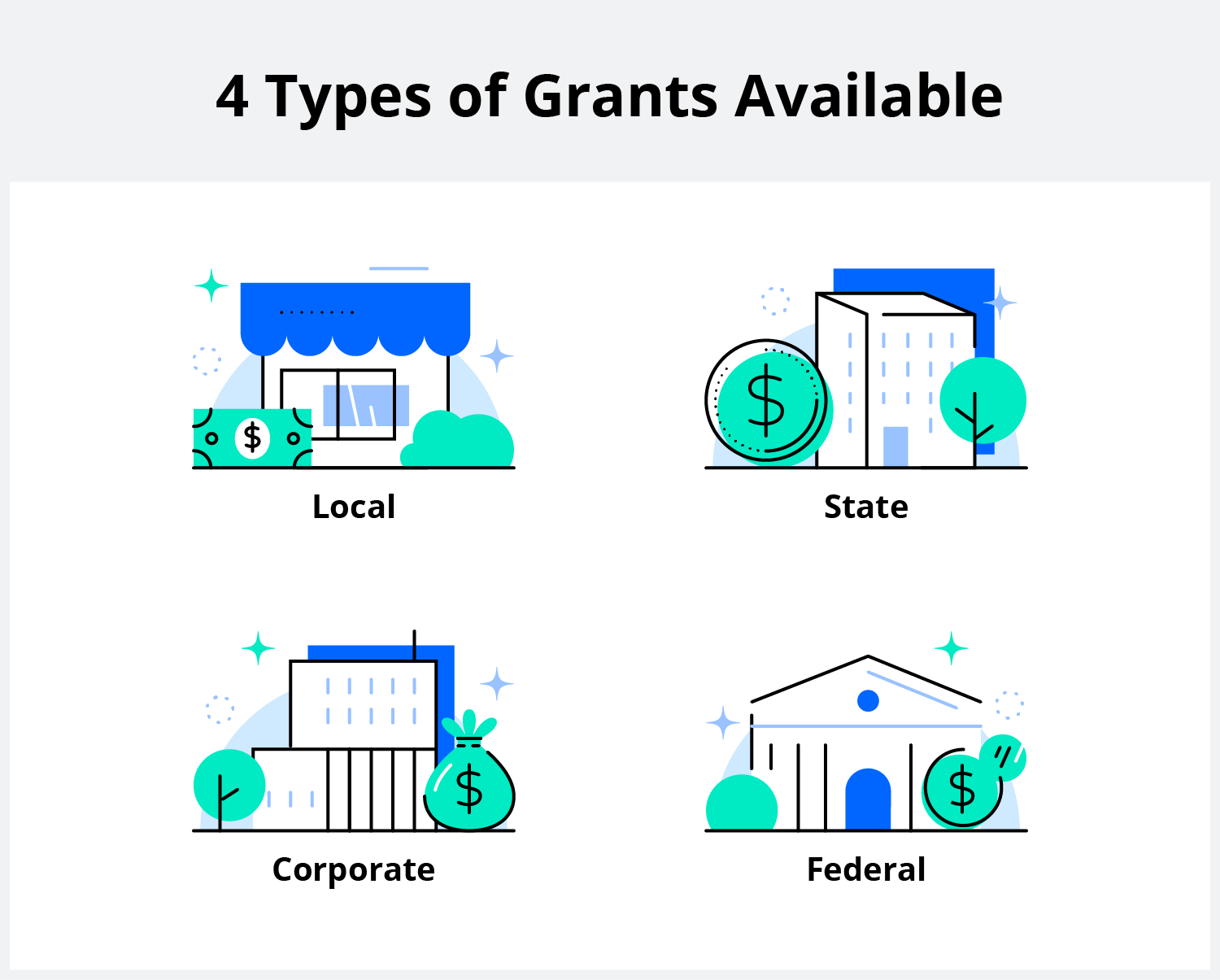

There are four main types of small business grants:

Government grants

Research and development grants, startup grants, non-profit grants.

Let's take a look at each one in more detail.

Government grants are funds provided by the government to support various types of businesses, ranging from start-ups to established enterprises.

These grants are often aimed at fostering economic growth, innovation, and job creation within specific industries or communities.

For instance, a government grant might support a small retail business in upgrading its technology infrastructure to enhance online sales, or it could help a local farmer invest in sustainable agricultural practices.

In the UK, small business owners can explore grants offered by entities such as Innovate UK , which provide financial support for innovation and business expansion.

Similarly, in the US, the Small Business Administration (SBA ) offers grants like the Small Business Innovation Research (SBIR) program, which funds research and development projects with commercial potential.

These grants can significantly alleviate financial burdens and provide crucial resources for small businesses to thrive.

Research and development (R&D) grants are specifically designed to support businesses in conducting innovative research and developing new products or services.

Small businesses engaged in R&D activities can benefit from these grants to cover the costs associated with experimentation, prototyping, and market testing.

For example, a small manufacturing company may receive an R&D grant to explore and develop eco-friendly materials for its product line.

In the UK, organizations like the UK Research and Innovation (UKRI) offer funding opportunities for small businesses involved in cutting-edge research projects.

In the US, the National Science Foundation (NSF) provides grants to small businesses conducting high-risk, high-reward R&D initiatives.

By tapping into these resources, small business owners can accelerate their innovation efforts and gain a competitive edge in their respective industries.

Startup grants are tailored to support aspiring entrepreneurs in launching their new ventures.

These grants provide essential financial assistance during the early stages of business development, helping entrepreneurs cover initial expenses such as equipment purchases, marketing efforts, and operational costs.

For instance, a budding entrepreneur in the hospitality industry might receive a startup grant to renovate a space for a new café or restaurant concept.

In the UK, organizations like The Prince's Trust offer startup grants and mentorship programs to young entrepreneurs looking to turn their business ideas into reality.

These startup grants not only provide crucial financial support but also offer valuable guidance and networking opportunities for new business owners.

Non-profit grants are funds awarded by charitable organizations, foundations, or government agencies to support the initiatives of non-profit organizations.

These grants are typically aimed at addressing social, environmental, or community needs, rather than generating profit.

Non-profit organizations can use these grants to fund programs, projects, or operational expenses.

For example, a non-profit focused on environmental conservation might receive a grant to implement a recycling education program in local schools.

In the UK, non-profit organizations can explore grant opportunities from entities like the National Lottery Community Fund which supports a wide range of community projects and initiatives.

In the US, organizations such as the Bill & Melinda Gates Foundation or the Ford Foundation offer grants to non-profits working on issues such as healthcare, education, and poverty alleviation.

These grants play a crucial role in enabling non-profit organizations to make a positive impact on society and address pressing social challenges.

The financial aid available to your business will depend on where in the UK you're based, your business’ size, your industry and whether you’re a startup or looking to expand your business.

By tapping into these resources, you can uncover potential funding sources to support your business endeavors in the UK market.

Small business grants in the US can be valuable resources for entrepreneurs looking to start or grow their businesses.

Understanding where to find these grants is essential for accessing financial support.

In this section, we'll explore some key avenues where small business owners can discover grant opportunities.

Government agencies

Government agencies at the federal, state, and local levels often offer grant programs to support small businesses.

For example, the Small Business Administration (SBA) administers various grant initiatives aimed at fostering entrepreneurship and economic development.

Small business owners can visit the SBA's website or contact their local SBA office to explore available grant programs.

Additionally, state economic development agencies and local chambers of commerce may also provide information on grants tailored to businesses within their jurisdiction.

Private foundations and Non-profit organizations

Private foundations and Non-profit organizations also play a significant role in providing grants to small businesses.

These entities may focus on specific industries, geographical regions, or social causes.

For instance, a non-profit organization dedicated to supporting women-owned businesses might offer grant opportunities exclusively for female entrepreneurs.

Small business owners can research and identify relevant foundations and nonprofits that align with their business goals and values.

Online platforms like GrantWatch or Foundation Directory Online can help streamline the search process by providing comprehensive databases of grant opportunities.

A grant application is a document or set of documents that is submitted to a grant-giving body with the purpose of securing funding for a startup or an existing business venture.

Normally, grants are awarded to small businesses with the aim of generating jobs, energizing local communities and strengthening the economy.

While there’s an abundance of grants available to small businesses, obtaining one from the government can be quite tricky. Government grants are renowned for being quite complex and have a lot of stages.

Each grant will come with its own unique criteria for applying, too. For example, if you’re applying for a research grant from a UK-based foundation then they may require that all your research is carried out within the UK. Or if you’re seeking funding as part of an initiative to make your business more sustainable, you might need to prove your business’s dedication to carrying out eco-friendly practices.

Whether you’re a startup or an existing business, the same rule applies when taking your first step in applying for a grant: research the funding body and the grant in question as thoroughly as possible so you know exactly what they’re looking for in a grant application.

According to Swoop , businesses should prepare the following information before applying for a small business grant:

- Create a realistic financial forecast to show your business’ financial position

- Provide evidence that shows how your business meets the specific grant qualifying criteria

- Specify exactly what your business plans to do with the money allocated

- Provide evidence that your team will be able to successfully meet this objective

- Be clear about the exact outcome you expect and whether there will be a return on the grant funder’s investment. This enables them to evaluate the efficiency of their grant.

The rationale behind writing a business plan for a grant application is simple: funding bodies want to know that they’re giving their money to a business they can trust.

Writing a business plan will be an opportunity for you to neatly present all the information listed above. If you're not sure how to go about structuring a business plan, you can use business plan software. Most business plan software comes equipped with an inbuilt structure and instructions, ensuring you include all the information a funding body expects to see.

If you’re a start-up, a business plan also provides the perfect opportunity to show the grant-giving body that your business’ mission aligns with its own specific mission and purpose.

If you’re already in operation, a business plan will show your business’ financial position and, if applicable, the positive impact it’s had on your community thus far. This helps alleviate any fear that your business is at risk of going under, making them more likely to get involved.

Understanding the importance of a business plan is paramount when it comes to securing grant funding for your small business.

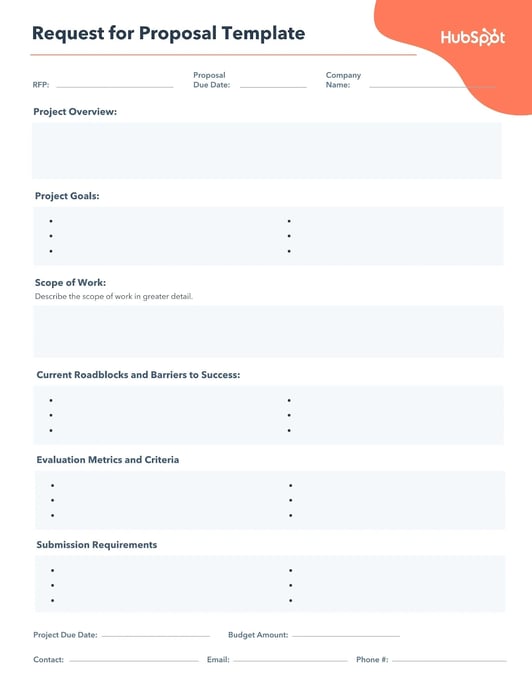

Crafting a compelling business plan is crucial when applying for a grant, as it provides potential funders with a comprehensive understanding of your business and its potential impact.

Let's delve into the key components that should be included in your business plan for a grant application.

Executive summary

The executive summary serves as an overview of your entire business plan, highlighting key aspects of your business in a concise manner.

It should include a brief introduction to your business, its mission, objectives, target market, and unique selling proposition.

For example, a small retail business seeking a grant to expand its operations might include information about its successful track record, customer base, and growth potential in the executive summary.

Company description

The company overview provides detailed information about your business, including its history, legal structure, ownership, and management team.

For example, you could state that your business is owned by four shareholders, each contributing 25% to total equity and that it is a limited liability company based in London.

Description of your product/service

This section outlines the products or services offered by your business, emphasizing their unique features and benefits.

Small business owners should clearly define their offerings and explain how they address the needs of their target market.

For example, a small manufacturing company applying for a grant might showcase its innovative product design or eco-friendly manufacturing processes to demonstrate its competitive edge.

Market analysis

A thorough market analysis is essential for demonstrating market demand and identifying potential opportunities and challenges.

Small business owners should research their target market, industry trends, competitors, and customer demographics.

For instance, a construction company seeking a grant may analyze local housing trends, demand for specific construction services, and competitor pricing strategies to inform its market strategy.

The strategy section outlines your business's approach to achieving its objectives and gaining a competitive advantage.

Small business owners should define their marketing, sales, and operational strategies, as well as any plans for expansion or diversification.

For example, a business services firm applying for a grant may detail its digital marketing strategy, networking efforts, and plans to introduce new service offerings to attract clients.

This section provides insight into the day-to-day operations of your business, including production processes, staffing requirements, and facilities management.

Small business owners should describe how their operations support the delivery of products or services to customers efficiently and effectively.

For example, a hospitality business applying for a grant may outline its staffing structure, customer service protocols, and inventory management systems to showcase its operational capabilities.

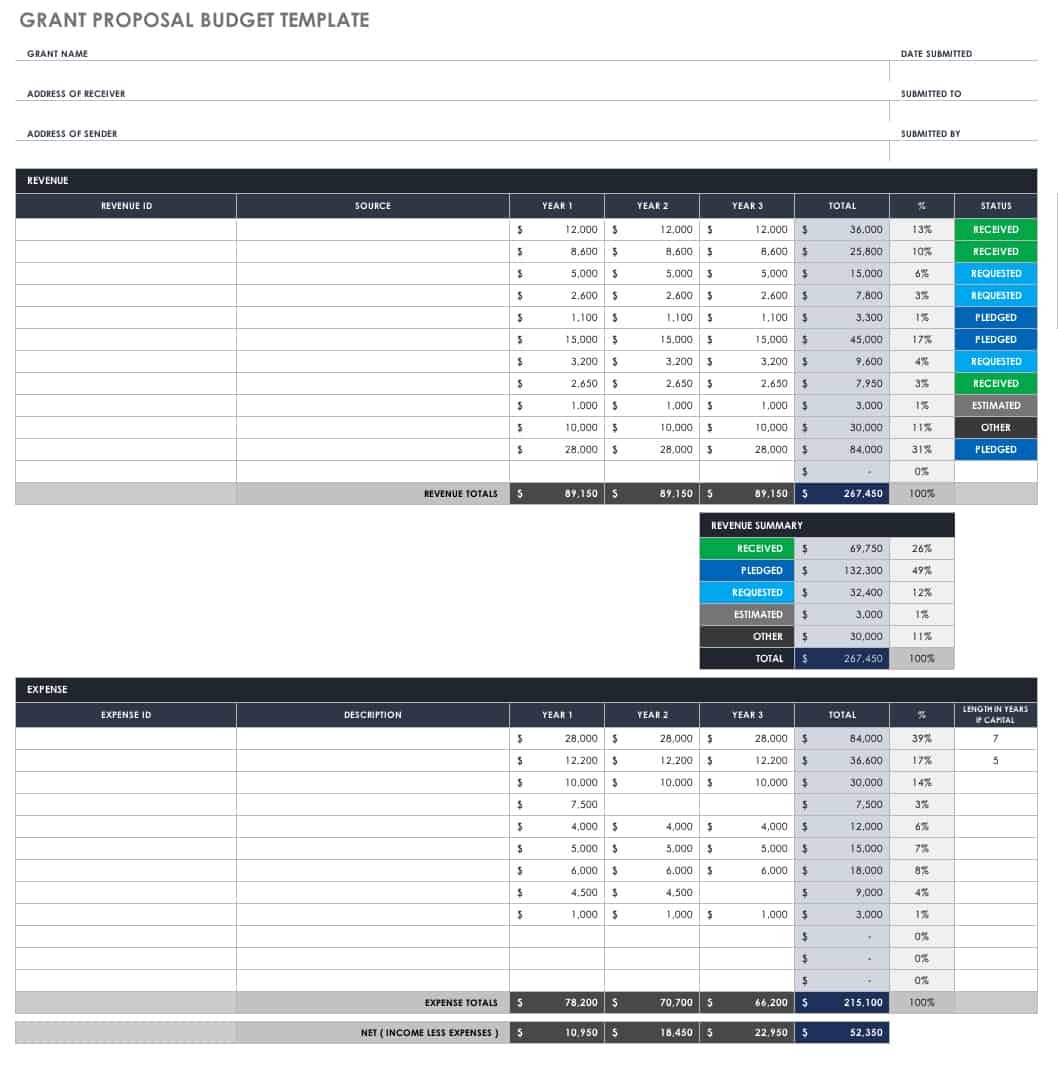

Financial forecast

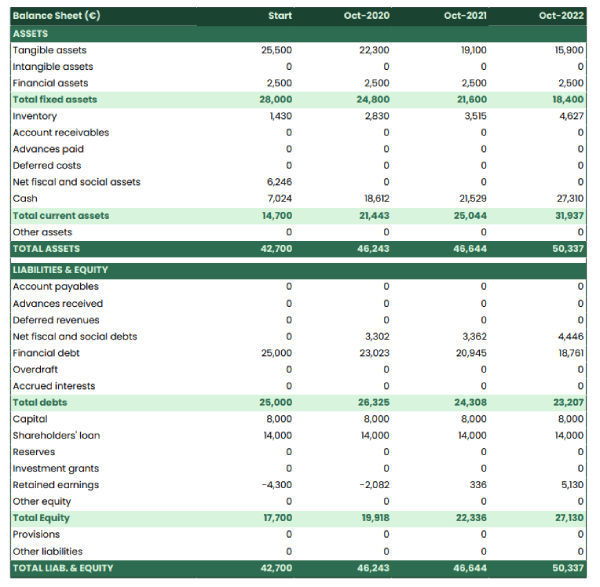

The financial forecast projects your business's future financial performance, including revenue, expenses, and cash flow.

Small business owners should include detailed financial projections, such as income statements, balance sheets, and cash flow statements, to demonstrate the viability of their business model.

For example, a small agriculture business applying for a grant may forecast revenue growth based on anticipated crop yields, pricing trends, and market demand for its products.

Whilst writing your business plan, we recommend that you have the grant-giving body’s mission and purpose open on a separate tab. Where possible, refer back to the foundation’s mission in your business plan to show how it aligns with your business’ own values.

You could even go a step further by adding buzzwords from the funding body’s mission statement in your plan to show how much you’ve thought it out.

How long should a business plan for a grant application be?

The length of a business plan for a grant application can vary depending on the specific requirements of the grant provider.

In general, however, it's best to keep your business plan concise and focused, typically ranging from 10 to 20 pages.

Small business owners should prioritize clarity and relevance, focusing on presenting essential information in a compelling manner.

By keeping the business plan concise, applicants can ensure that funders can easily grasp the key aspects of their business and make informed decisions regarding grant funding.

If you haven’t written a business plan for a grant application before, the process can feel a little overwhelming.

Using business plan software is a great way to create a high-quality business plan quickly and efficiently.

There are many business planning software out there, so it’s important to choose the right one for you.

Most business plan software generate three full financial statements for you, helping you give the foundation as realistic a picture of your business’ finances as possible.

For grant applications, we recommend going with a business plan software that lets you model grants. This gives the funding body total transparency as to how exactly their grant would be used within the business.

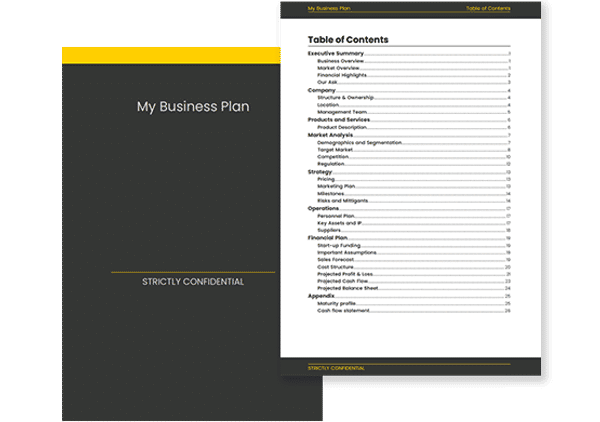

Attractive visuals and a striking cover page with your business’s name and logo will also help your business stand out. So we recommend choosing a business plan software that breaks your numbers into colourful, easy-to-read charts and tables and automatically generates a cover page for you.

If you’re not sure which business plan software to go for to create your business plan for a grant application, we recommend trying The Business Plan Shop .

As well as having the features listed above, our online business plan software enables you to:

- Create a financial forecast to show your business’ financial potential

- Run a quality check to identify any issues with your forecast before sending it to a funding body

- Follow clear instructions to write a professional business plan

- Draw inspiration from the templates stored within our business plan software

- Track your actuals against your forecast

Above is an example of how your business plan for a grant application might like look in PDF format, including a table of contents and stylish cover page.

By leveraging these tools, you can streamline the process of creating your business plan and present a compelling case for grant funding.

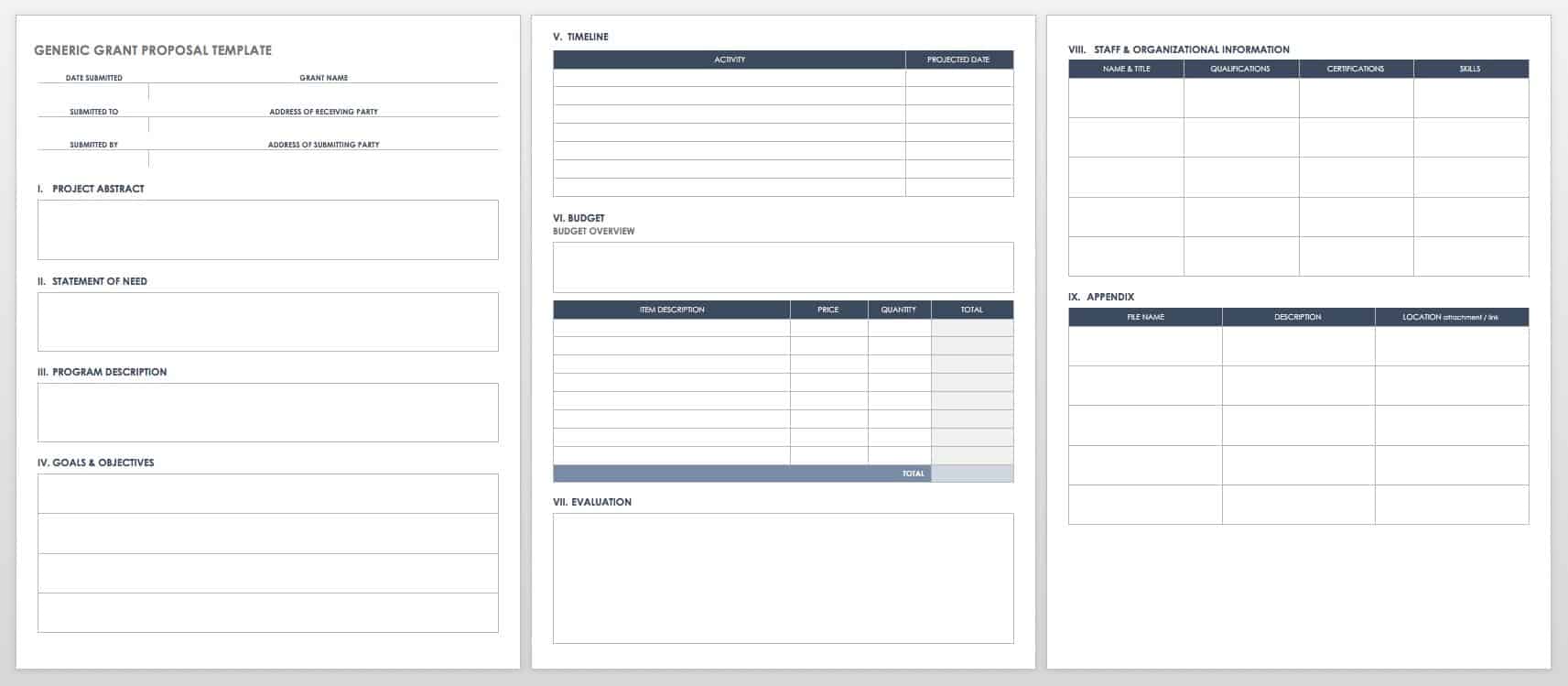

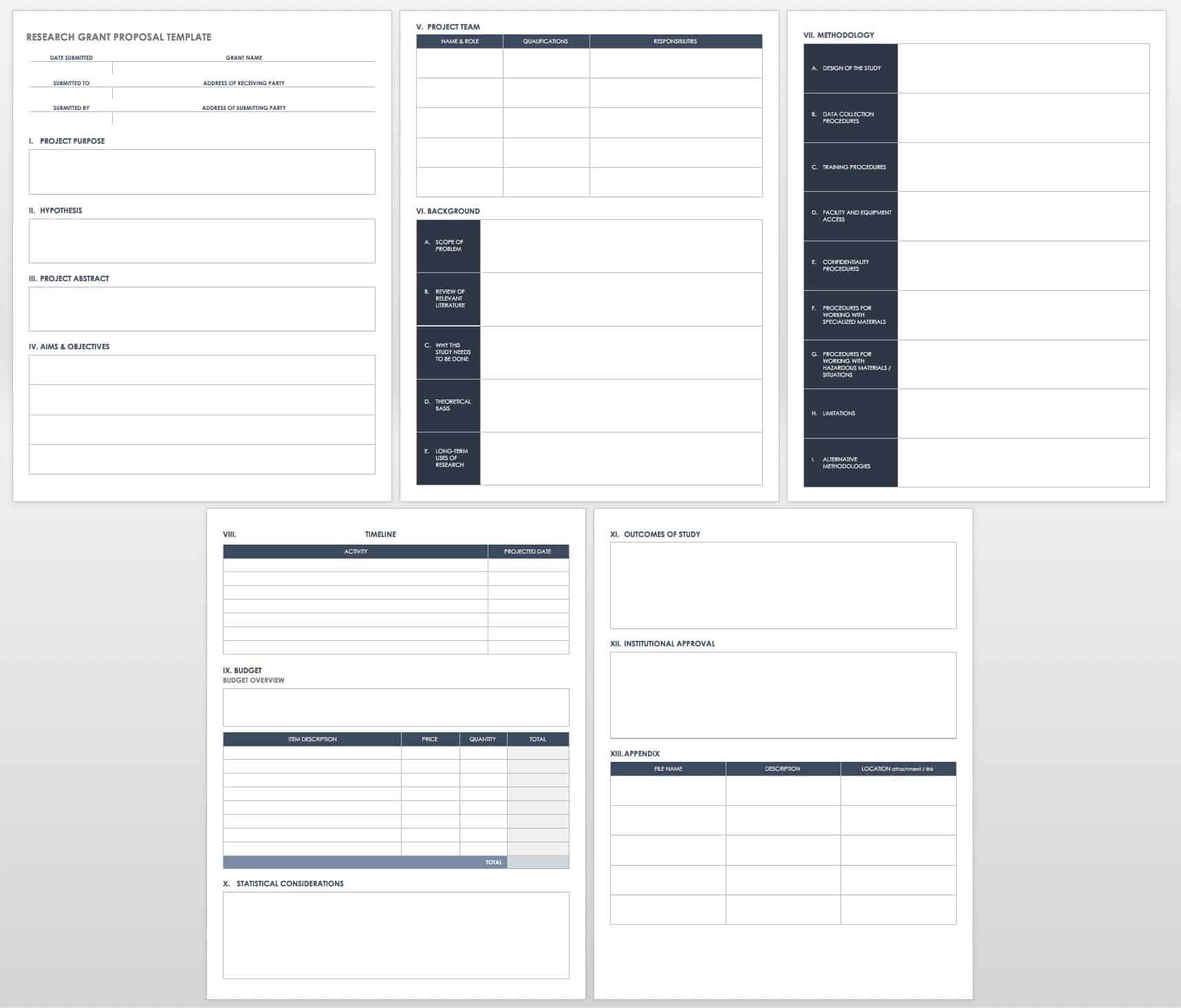

When applying for a grant, having a well-structured business plan is essential to showcase your business's potential and suitability for funding.

Whilst our current business plan templates aren’t designed solely for grant applications, they can easily be tweaked to make it for that purpose.

The structure remains the same as illustrated in the outline above - all you need to do is replace the numbers and text with your own details!

The Business Plan Shop offers you templates for most industries, including retail, hospitality and services.

Now that we've covered the essential aspects of preparing a business plan for a grant application, let's recap the key points to remember.

- Use business plan software such as The Business Plan Shop to turn writing a business plan for a grant application into a breeze.

- Understand the different types of small business grants available: government grants, research and development grants, startup grants, and non-profit grants offer various opportunities for financial assistance.

- Thoroughly research grant opportunities: explore government agencies, private foundations, and nonprofit organizations to find suitable grant programs for your business.

- Tailor your business plan to the grant requirements: customize your business plan to align with the specific criteria and objectives of the grant you're applying for.

- Be prepared to demonstrate financial viability: provide realistic financial projections and evidence of your business's ability to generate revenue and sustain operations.

- Follow application guidelines carefully: pay attention to the requirements and deadlines specified by the grant provider, and ensure your application meets all criteria for consideration.

- Seek assistance if needed: don't hesitate to reach out to business advisors, mentors, or grant specialists for guidance and support throughout the grant application process.

Also on The Business Plan Shop

- How to do market research for a business plan

- How to write a business plan for a bank loan

- How investors analyse business plans

- The difference between a business plan and a business case

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

- Submissions & Reviews

- Publishing & Journals

- Scholarships

- News & Updates

- Resources Home

- Submittable 101

- Bias & Inclusivity Resources

- Customer Stories

- Get our newsletter

- Request a Demo

How to Start a Grant Program from Scratch

Start a grant and make a real impact that lifts up your community.

Creating a grant and becoming a grant funder may take some effort, but it can be incredibly rewarding and impactful if you do it right.

It can also—no exaggeration—change the world.

Giving back to your community through starting a grant program is an admirable act of altruism that ensures your resources will be used on specific projects, consistently over time, and in line with your interests, passions, and goals.

But where do you start when you start a grant? Even if you already have funding secured, launching a grant opportunity can be intimidating and daunting, especially if you’ve never done it before.

Starting a grant without taking the proper steps can create tax issues, waste resources, or decrease the impact of your final program.

Launching a grant the right way takes significant planning, research, and thoughtfulness. Here’s how to start a grant one step at a time, to get you from idea to implementation.

1. Choose your focus and mission

The issue your grant program addresses should be specific, but not so specific that you’ll have trouble finding applicants.

Grantmaking goals tend to fall into one or more the following broad categories:

- Help marginalized groups

- Educate

- Save the environment

- Work toward equality

- Forward science/knowledge

- Provide basic needs

- Spread humanity

Within one or more of those goals, identify a specific angle for your organization’s mission. Your grant may center on funding housing for the homeless in your city, bankrolling science classes for African-American girls in middle school, or creating more habitats for spotted owls.

If you don’t have a clear idea for your organization’s focus or mission, consider funding a project based on your passions and interests. For example, do you spend a lot of time outdoors, or do you play music professionally? That could guide your community grant.

Also consider what helped you find success: perhaps it was an arts program that made you less shy, or an after school math team program that helped you find your strengths.

Next, make certain that the community actually needs what you want to offer by conducting a needs analysis. There may already be similar programs or grants in place; your grant wouldn’t create much of an impact in that case. Referencing a grant report that outlines existing programs in your area can save you a lot of time and help you focus your grant on real needs.

Bottom line: when you start a grant, choosing a mission should be a careful consideration of your areas of interest and the needs of those you want to help.

2. Determine whether you need to set up a foundation

Private foundations often fund grants from one source—like an individual, an estate, or a corporation. They are tax-exempt and managed by a director or a board of trustees and allocate their money to nonprofit organizations who apply for funds.

If you have private funds with which to establish your grantmaking program, you’ll likely want to establish an incorporated private foundation.

If you’re planning to fund your grants via a fundraising plan and public donations, you’ll likely need to establish a public charity, community foundation, or nonprofit organization. These organizations are also tax-exempt and are funded by public donations or grants from larger entities.

If you don’t care about the tax benefits of offering grants, your options are wide open as long as you have funding secured. You can distribute your money as you’d like, and focus on the nitty gritty of determining your mission and how you will collect, review, and accept proposals.

However, the vast majority of people and groups establishing grants definitely want to take advantage of the tax benefits.

Because foundations involve significant start-up costs and efforts, you may consider running your grant through an already established foundation, charity, nonprofit, or other organization. This is a good option if you:

- Don’t mind working with a larger group

- Are comfortable giving up some control

- Can locate an organization that shares your mission and goals

- Don’t wish to run your own foundation

If this option sounds best to you, begin by researching possible organizations to work with and contacting their leaders with your grant idea. In this case, you’ll want to skip down a few steps and firmly establish your grant’s funding, focus, and mission before you go any further.

Otherwise, continue to the next step to learn more about starting your own grantmaking foundation.

3. Consult with legal and tax professionals

You’ll want to consult with an attorney, accountant, and/or financial advisor to validate your decision to set up and incorporate a foundation (or not).

These professionals can also help you with the following documents and forms:

- Articles of incorporation

- Foundation bylaws

- Tax-exempt status (IRS Form 1023)

While incorporating and achieving tax-exempt status are not required, they are highly recommended for most people who wish to start a private foundation.

Having tax-exempt status saves you from having to pay the government for your charitable endeavors and increases the impact of your grant program.

Incorporation allows your foundation to become its own legal entity, which ensures that it can continue even after your involvement ends. It also ensures that you will not be personally liable if legal issues arise.

4. Assemble a Board of Directors

Once you’ve created your grantmaking entity, it’s time to put together a Board of Directors or panel of trustees. The size of this group can vary, but every one should have a few things in common:

- Passionate about the mission of the grant

- Available to dedicate time and energy to your cause

- Knowledgeable about some aspect of your grant program or mission

It’s completely acceptable to add friends or acquaintances to your board. But it’s also important to achieve diversity: not only is it the right thing to do, but it will help your foundation to have a board with a wide range of experiences and knowledge.

Consider an application process for your board. You can even use Submittable to collect, review, and select board member applications much in the same way you’d use it with grant proposals.

5. Determine grant funding details

Finally, with the assistance of your new board, it’s time to dig into the details of your grant funding.

Depending on your goals, your mission, and the funds you have available, you need to make decisions about both time and money. More specifically, you should focus on three questions:

What’s the best size for your grant program?

Do you want to give a very large amount of money to one large organization, like some federal grants and government grants do? Or do you want to give a series of microgrants to dozens, hundreds, or thousands of grantees, as you would with small business grants or small business loans?

Depending on your program, one avenue could have a much larger impact than the other.

What’s the best duration for your grant program?

Different grants have different lifecycles. Some run annually, some run seasonally, and others run continuously.

Which grant lifecycle gives you enough time to execute on administrative tasks while also allowing your money to make a difference?

How will grant funds be used?

As the one awarding funds, you get to decide exactly how grant funds can be used by grantees.

You can be as strict or lax as you’d like—although in recent years, the trend in philanthropy has been to give grantees more leeway to spend their grant money on general operating costs or adjacent expenses.

Remember: these funding details are not set in stone and you can make changes as you learn. When you start a grant program, you will make mistakes and require adjustments (and that’s okay!).

6. Write a business plan

Next up: your business plan. Specifically, when you start a grant program, your business plan should include details on how you’ll allocate the program’s funds, and what resources you’ll need to make the program efficient and effective.

You want to strike a smart balance between spending on grants versus administrative and operational costs. After all, effective grant management requires having sufficient resources.

Luckily, your board of directors will be there to help you through each part of this step, from allocating spending to hiring.

7. Write a marketing plan

Branding and marketing are your next project. You’ll need a logo and tagline, and you’ll need to establish your tone and voice. You’ll need a website and social media accounts, too.

You’ll also need to start thinking about brand awareness and your marketing budget for advertising and PR.

Be sure to reserve part of your marketing budget for advertising your call for grant proposals.

8. Establish the grant’s terms

Writing out a grant’s guidelines at this point should be pretty straightforward since you’ve already determined your mission, your focus, your funding details, and your lifecycle.

The grant’s terms and guidelines should include absolutely everything that a grant writer would need to know to apply, including:

- All important deadlines

- All grant requirements

- All application requirements

- The grant’s goal/mission

- The amount of the grant

- The grant’s timeline

- The grant’s reporting requirements

Once you have your guidelines, format them so that they’re easy to read and accessible on a landing page.

Make certain that your landing page is branded and easy to find for grant writers and grant seekers. Submittable’s grant management system makes it easy to set up your branded landing page and guidelines.

Want to speed up your grant management process?

Submittable simplifies even robust grant review processes to save you time.

9. Set up an application process

It’s finally time to set up your grant application online so you can start accepting grant proposals.

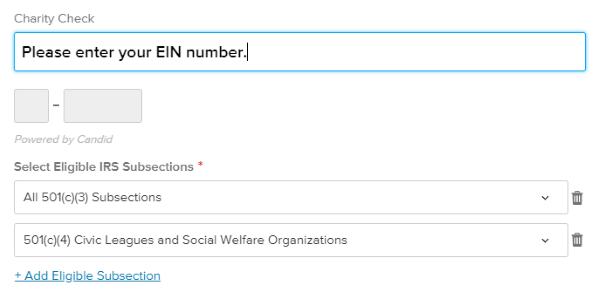

With the help of your grant administrators, use a grant management platform like Submittable to build your application form.

When creating your grant application form , find a happy medium between asking for too much information (which creates a barrier to applying) and not asking for enough information (which makes it hard to pick the best applications).

The length of your application should also reflect the size and heft of your grant. A grant writer will put more time and effort into a government grant or federal grant worth millions, but less time into a small business grant that is for a few hundred or a few thousand dollars.

Submittable’s form builder has the fastest implementation of any platform by a long shot, and our features make it easy to create responsive, accessible forms with logic and conditions that fit your exact needs.

Plus, Submittable’s eligibility quizzes save you and applicants time by screening out unqualified candidates before they even get to your application.

10. Organize a review process and post your call for proposals

Assemble a review board and a process for reviewing grant applications and picking successful grant proposals.

Considerations for your review board:

- How many people will you need to review grant proposals?

- Will any or all of these people need specific expertise?

- How will they be compensated?

- How much time will they need to dedicate to you?

- Where will your reviewers be located? Will they be remote?

- What kind of training will your reviewers require?

- How will you ensure diversity and inclusion on your board?

Considerations for your review process:

- What will your scoring rubric be?

- How many rounds of review will you require?

- Will you engage in anonymous review, or keep any fields hidden?

- How will you minimize bias during your process?

- How long will this process take?

- Will you share review comments or notes with your grant applicants?

- How will you determine the final decision?

Submittable makes it easy to systematize almost all of these considerations, making your review process more efficient, more effective, and less prone to bias.

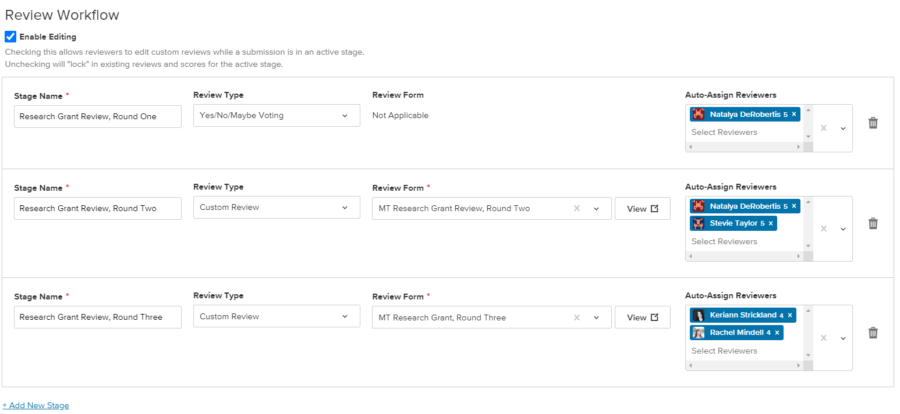

One of Submittable’s many review features includes multiple rounds of review, so that you can easily divide and conquer even the largest and most complex grant application processes.

Welcome to the world of giving

Establishing a grant the right way takes time, resources, effort, and care. But even small business grants and grants for individuals can change lives and shape the world we live in. A grant award of any size can make your community better. Start a grant, change the world.

Once you establish your foundation, create your board, and turn your thoughts into a mission, Submittable can help you with every detail of collecting and reviewing grant applications.

Making a grant is work, but it doesn’t have to be quite as much work as it used to be.

Sarah Aswell is an editor and content strategist at Submittable. She’s also a writer and stand-up comedian who gets rejected via Submittable all the time. You can read her comedy criticism at Forbes , follow her on Twitter , or learn more about her creative work on her website .

Better grants management starts here

Try the trusted and intuitive option for streamlined grants management.

Watch a demo

About Submittable

Submittable powers you with tools to launch, manage, measure and grow your social impact programs, locally and globally. From grants and scholarships to awards and CSR programs, we partner with you so you can start making a difference, fast. The start-to-finish platform makes your workflow smarter and more efficient, leading to better decisions and bigger impact. Easily report on success, and learn for the future—Submittable is flexible and powerful enough to grow alongside your programs.

Submittable is used by more than 11 thousand organizations, from major foundations and corporations to governments, higher education, and more, and has accepted nearly 20 million applications to date.

HOW IT WORKS

The Ultimate Grant Writing Guide (and How to Find and Apply for Grants)

Securing grants requires strategic planning. Identifying relevant opportunities, building collaborations, and crafting a comprehensive grant proposal are crucial steps. Read our ultimate guide on grant writing, finding grants, and applying for grants to get the funding for your research.

Updated on February 22, 2024

Embarking on a journey of groundbreaking research and innovation always requires more than just passion and dedication, it demands financial support. In the academic and research domains, securing grants is a pivotal factor for transforming these ideas into tangible outcomes.

Grant awards not only offer the backing needed for ambitious projects but also stand as a testament to the importance and potential impact of your work. The process of identifying, pursuing, and securing grants, however, is riddled with nuances that necessitate careful exploration.

Whether you're a seasoned researcher or a budding academic, navigating this complex world of grants can be challenging, but we’re here to help. In this comprehensive guide, we'll walk you through the essential steps of applying for grants, providing expert tips and insights along the way.

Finding grant opportunities

Prior to diving into the application phase, the process of finding grants involves researching and identifying those that are relevant and realistic to your project. While the initial step may seem as simple as entering a few keywords into a search engine, the full search phase takes a more thorough investigation.

By focusing efforts solely on the grants that align with your goals, this pre-application preparation streamlines the process while also increasing the likelihood of meeting all the requirements. In fact, having a well thought out plan and a clear understanding of the grants you seek both simplifies the entire activity and sets you and your team up for success.

Apply these steps when searching for appropriate grant opportunities:

1. Determine your need

Before embarking on the grant-seeking journey, clearly articulate why you need the funds and how they will be utilized. Understanding your financial requirements is crucial for effective grant research.

2. Know when you need the money

Grants operate on specific timelines with set award dates. Align your grant-seeking efforts with these timelines to enhance your chances of success.

3. Search strategically

Build a checklist of your most important, non-negotiable search criteria for quickly weeding out grant options that absolutely do not fit your project. Then, utilize the following resources to identify potential grants:

- Online directories

- Small Business Administration (SBA)

- Foundations

4. Develop a tracking tool

After familiarizing yourself with the criteria of each grant, including paperwork, deadlines, and award amounts, make a spreadsheet or use a project management tool to stay organized. Share this with your team to ensure that everyone can contribute to the grant cycle.

Here are a few popular grant management tools to try:

- Jotform : spreadsheet template

- Airtable : table template

- Instrumentl : software

- Submit : software

Tips for Finding Research Grants

Consider large funding sources : Explore major agencies like NSF and NIH.

Reach out to experts : Consult experienced researchers and your institution's grant office.

Stay informed : Regularly check news in your field for novel funding sources.

Know agency requirements : Research and align your proposal with their requisites.

Ask questions : Use the available resources to get insights into the process.

Demonstrate expertise : Showcase your team's knowledge and background.

Neglect lesser-known sources : Cast a wide net to diversify opportunities.

Name drop reviewers : Prevent potential conflicts of interest.

Miss your chance : Find field-specific grant options.

Forget refinement : Improve proposal language, grammar, and clarity.

Ignore grant support services : Enhance the quality of your proposal.

Overlook co-investigators : Enhance your application by adding experience.

Grant collaboration

Now that you’ve taken the initial step of identifying potential grant opportunities, it’s time to find collaborators. The application process is lengthy and arduous. It requires a diverse set of skills. This phase is crucial for success.

With their valuable expertise and unique perspectives, these collaborators play instrumental roles in navigating the complexities of grant writing. While exploring the judiciousness that goes into building these partnerships, we will underscore why collaboration is both advantageous and indispensable to the pursuit of securing grants.

Why is collaboration important to the grant process?

Some grant funding agencies outline collaboration as an outright requirement for acceptable applications. However, the condition is more implied with others. Funders may simply favor or seek out applications that represent multidisciplinary and multinational projects.

To get an idea of the types of collaboration major funders prefer, try searching “collaborative research grants” to uncover countless possibilities, such as:

- National Endowment for the Humanities

- American Brain Tumor Association

For exploring grants specifically for international collaboration, check out this blog:

- 30+ Research Funding Agencies That Support International Collaboration

Either way, proposing an interdisciplinary research project substantially increases your funding opportunities. Teaming up with multiple collaborators who offer diverse backgrounds and skill sets enhances the robustness of your research project and increases credibility.

This is especially true for early career researchers, who can leverage collaboration with industry, international, or community partners to boost their research profile. The key lies in recognizing the multifaceted advantages of collaboration in the context of obtaining funding and maximizing the impact of your research efforts.

How can I find collaborators?

Before embarking on the search for a collaborative partner, it's essential to crystallize your objectives for the grant proposal and identify the type of support needed. Ask yourself these questions:

1)Which facet of the grant process do I need assistance with:

2) Is my knowledge lacking in a specific:

- Population?

3) Do I have access to the necessary:

Use these questions to compile a detailed list of your needs and prioritize them based on magnitude and ramification. These preliminary step ensure that search for an ideal collaborator is focused and effective.

Once you identify targeted criteria for the most appropriate partners, it’s time to make your approach. While a practical starting point involves reaching out to peers, mentors, and other colleagues with shared interests and research goals, we encourage you to go outside your comfort zone.

Beyond the first line of potential collaborators exists a world of opportunities to expand your network. Uncover partnership possibilities by engaging with speakers and attendees at events, workshops, webinars, and conferences related to grant writing or your field.

Also, consider joining online communities that facilitate connections among grant writers and researchers. These communities offer a space to exchange ideas and information. Sites like Collaboratory , NIH RePorter , and upwork provide channels for canvassing and engaging with feasible collaborators who are good fits for your project.

Like any other partnership, carefully weigh your vetted options before committing to a collaboration. Talk with individuals about their qualifications and experience, availability and work style, and terms for grant writing collaborations.

Transparency on both sides of this partnership is imperative to forging a positive work environment where goals, values, and expectations align for a strong grant proposal.

Putting together a winning grant proposal

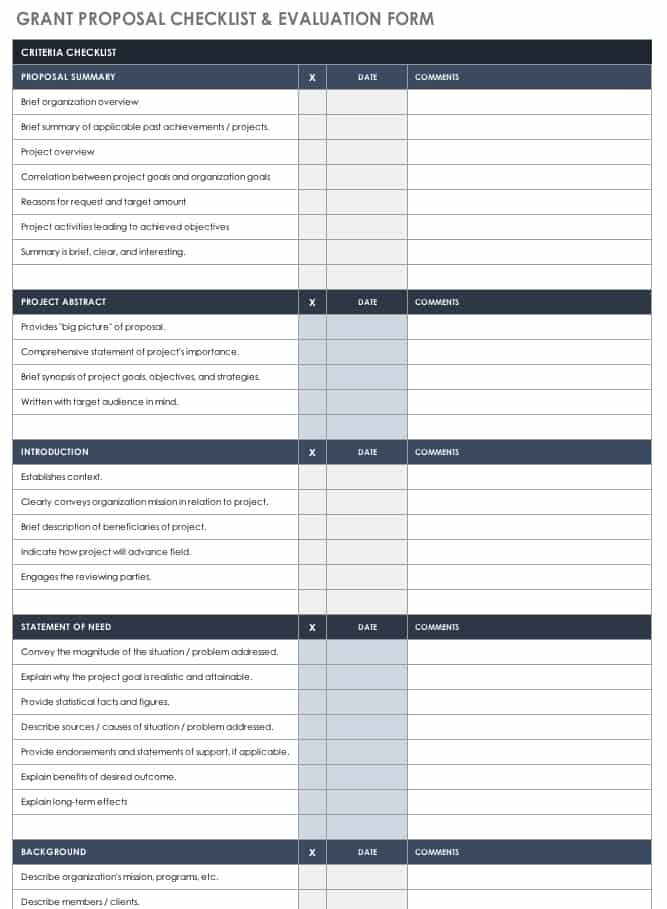

It’s time to assemble the bulk of your grant application packet – the proposal itself. Each funder is unique in outlining the details for specific grants, but here are several elements fundamental to every proposal:

- Executive Summary

- Needs assessment

- Project description

- Evaluation plan

- Team introduction

- Sustainability plan

This list of multi-faceted components may seem daunting, but careful research and planning will make it manageable.

Start by reading about the grant funder to learn:

- What their mission and goals are,

- Which types of projects they have funded in the past, and

- How they evaluate and score applications.

Next, view sample applications to get a feel for the length, flow, and tone the evaluators are looking for. Many funders offer samples to peruse, like these from the NIH , while others are curated by online platforms , such as Grantstation.

Also, closely evaluate the grant application’s requirements. they vary between funding organizations and opportunities, and also from one grant cycle to the next. Take notes and make a checklist of these requirements to add to an Excel spreadsheet, Google smartsheet, or management system for organizing and tracking your grant process.

Finally, understand how you will submit the final grant application. Many funders use online portals with character or word limits for each section. Be aware of these limits beforehand. Simplify the editing process by first writing each section in a Word document to be copy and pasted into the corresponding submission fields.

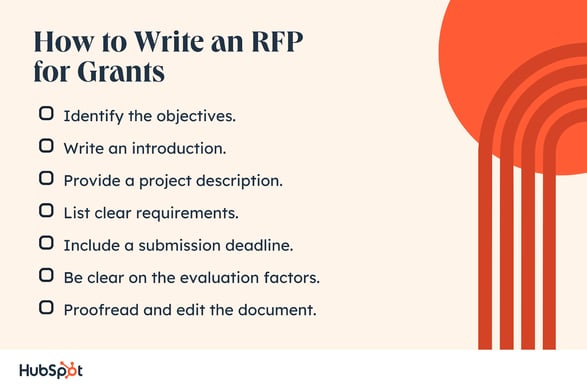

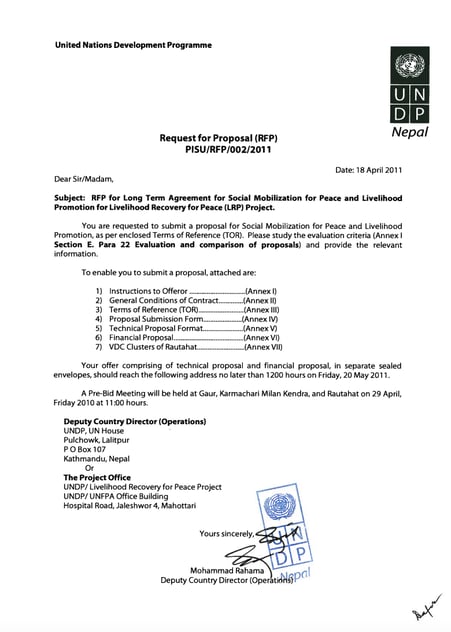

If there is no online application platform, the funder will usually offer a comprehensive Request for Proposal (RFP) to guide the structure of your grant proposal. The RFP:

- Specifies page constraints

- Delineates specific sections

- Outlines additional attachments

- Provides other pertinent details

Components of a grant proposal

Cover letter.

Though not always explicitly requested, including a cover letter is a strategic maneuver that could be the factor determining whether or not grant funders engage with your proposal. It’s an opportunity to give your best first impression by grabbing the reviewer’s attention and compelling them to read further.

Cover letters are not the place for excessive emotion or detail, keep it brief and direct, stating your financial needs and purpose confidently from the outset. Also, try to clearly demonstrate the connection between your project and the funder’s mission to create additional value beyond the formal proposal.

Executive summary

Like an abstract for your research manuscript, the executive summary is a brief synopsis that encapsulates the overarching topics and key points of your grant proposal. It must set the tone for the main body of the proposal while providing enough information to stand alone if necessary.

Refer to How to Write an Executive Summary for a Grant Proposal for detailed guidance like:

- Give a clear and concise account of your identity, funding needs, and project roadmap.

- Write in an instructive manner aiming for an objective and persuasive tone

- Be convincing and pragmatic about your research team's ability.

- Follow the logical flow of main points in your proposal.

- Use subheadings and bulleted lists for clarity.

- Write the executive summary at the end of the proposal process.

- Reference detailed information explained in the proposal body.

- Address the funder directly.

- Provide excessive details about your project's accomplishments or management plans.

- Write in the first person.

- Disclose confidential information that could be accessed by competitors.

- Focus excessively on problems rather than proposed solutions.

- Deviate from the logical flow of the main proposal.

- Forget to align with evaluation criteria if specified

Project narrative

After the executive summary is the project narrative . This is the main body of your grant proposal and encompasses several distinct elements that work together to tell the story of your project and justify the need for funding.

Include these primary components:

Introduction of the project team

Briefly outline the names, positions, and credentials of the project’s directors, key personnel, contributors, and advisors in a format that clearly defines their roles and responsibilities. Showing your team’s capacity and ability to meet all deliverables builds confidence and trust with the reviewers.

Needs assessment or problem statement

A compelling needs assessment (or problem statement) clearly articulates a problem that must be urgently addressed. It also offers a well-defined project idea as a possible solution. This statement emphasizes the pressing situation and highlights existing gaps and their consequences to illustrate how your project will make a difference.

To begin, ask yourself these questions:

- What urgent need are we focusing on with this project?

- Which unique solution does our project offer to this urgent need?

- How will this project positively impact the world once completed?

Here are some helpful examples and templates.

Goals and objectives

Goals are broad statements that are fairly abstract and intangible. Objectives are more narrow statements that are concrete and measurable. For example :

- Goal : “To explore the impact of sleep deprivation on cognitive performance in college students.”

- Objective : “To compare cognitive test scores of students with less than six hours of sleep and those with 8 or more hours of sleep.”

Focus on outcomes, not processes, when crafting goals and objectives. Use the SMART acronym to align them with the proposal's mission while emphasizing their impact on the target audience.

Methods and strategies

It is vitally important to explain how you intend to use the grant funds to fulfill the project’s objectives. Detail the resources and activities that will be employed. Methods and strategies are the bridge between idea and action. They must prove to reviewers the plausibility of your project and the significance of their possible funding.

Here are some useful guidelines for writing your methods section that are outlined in " Winning Grants: Step by Step ."

- Firmly tie your methods to the proposed project's objectives and needs assessment.

- Clearly link them to the resources you are requesting in the proposal budget.

- Thoroughly explain why you chose these methods by including research, expert opinion, and your experience.

- Precisely list the facilities and capital equipment that you will use in the project.

- Carefully structure activities so that the program moves toward the desired results in a time-bound manner.

A comprehensive evaluation plan underscores the effectiveness and accountability of a project for both the funders and your team. An evaluation is used for tracking progress and success. The evaluation process shows how to determine the success of your project and measure the impact of the grant award by systematically gauging and analyzing each phase of your project as it compares to the set objectives.

Evaluations typically fall into two standard categories:

1. Formative evaluation : extending from project development through implementation, continuously provides feedback for necessary adjustments and improvements.

2. Summative evaluation : conducted post-project completion, critically assesses overall success and impact by compiling information on activities and outcomes.

Creating a conceptual model of your project is helpful when identifying these key evaluation points. Then, you must consider exactly who will do the evaluations, what specific skills and resources they need, how long it will take, and how much it will cost.

Sustainability

Presenting a solid plan that illustrates exactly how your project will continue to thrive after the grant money is gone builds the funder's confidence in the project’s longevity and significance. In this sustainability section, it is vital to demonstrate a diversified funding strategy for securing the long-term viability of your program.

There are three possible long term outcomes for projects with correlated sustainability options:

- Short term projects: Though only implemented once, will have ongoing maintenance costs, such as monitoring, training, and updates.

(E.g., digitizing records, cleaning up after an oil spill)

- Projects that will generate income at some point in the future: must be funded until your product or service can cover operating costs with an alternative plan in place for deficits.

(E.g., medical device, technology, farming method)

- Ongoing projects: will eventually need a continuous stream of funding from a government entity or large organization.

(E.g., space exploration, hurricane tracking)

Along with strategies for funding your program beyond the initial grant, reference your access to institutional infrastructure and resources that will reduce costs.

Also, submit multi-year budgets that reflect how sustainability factors are integrated into the project’s design.

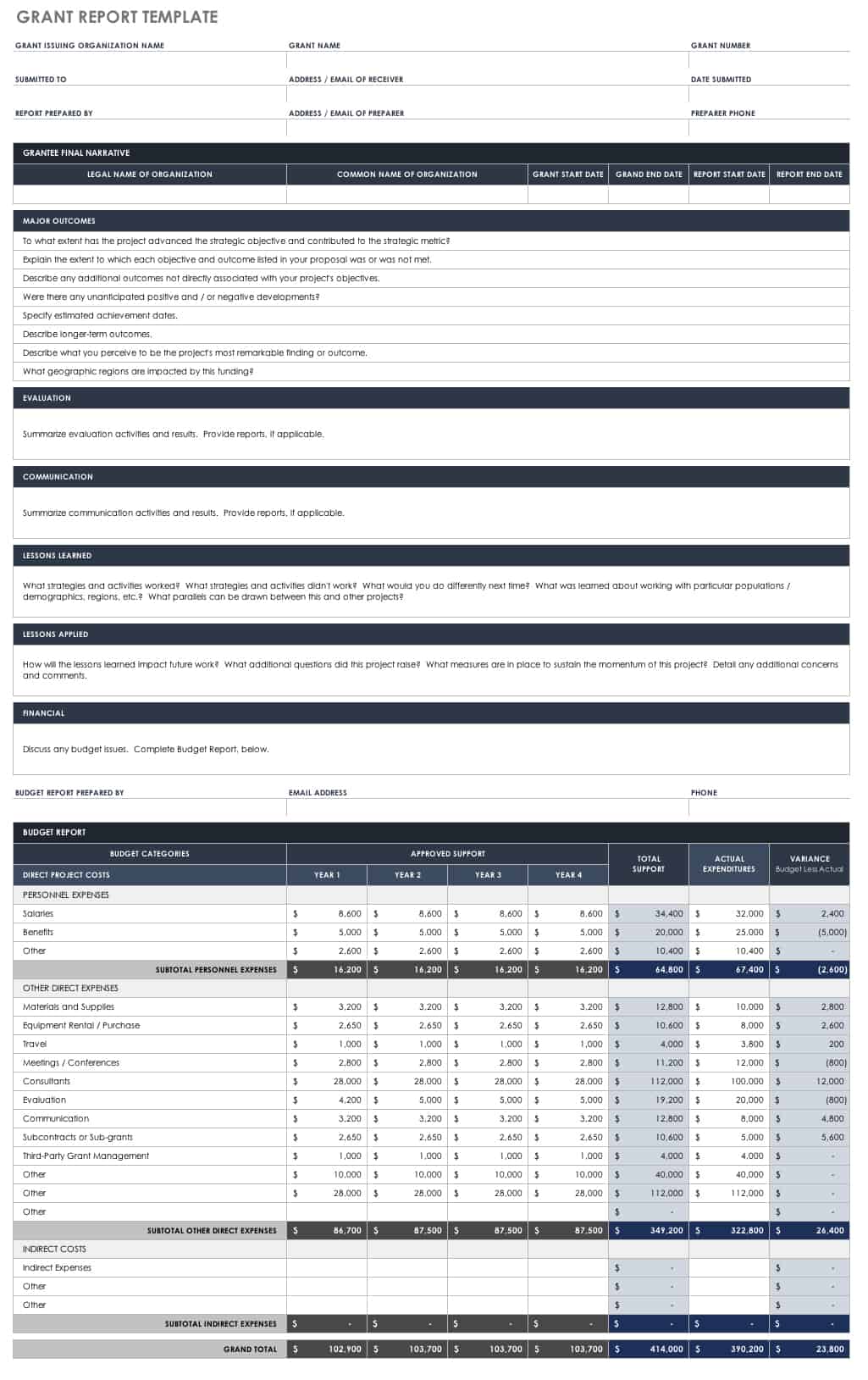

The budget section of your grant proposal, comprising both a spreadsheet and a narrative, is the most influential component. It should be able to stand independently as a suitable representation of the entire endeavor. Providing a detailed plan to outline how grant funds will be utilized is crucial for illustrating cost-effectiveness and careful consideration of project expenses.

A comprehensive grant budget offers numerous benefits to both the grantor , or entity funding the grant, and the grantee , those receiving the funding, such as:

- Grantor : The budget facilitates objective evaluation and comparison between multiple proposals by conveying a project's story through responsible fund management and financial transparency.

- Grantee : The budget serves as a tracking tool for monitoring and adjusting expenses throughout the project and cultivates trust with funders by answering questions before they arise.

Because the grant proposal budget is all-encompassing and integral to your efforts for securing funding, it can seem overwhelming. Start by listing all anticipated expenditures within two broad categories, direct and indirect expenses , where:

- Direct : are essential for successful project implementation, are measurable project-associated costs, such as salaries, equipment, supplies, travel, and external consultants, and are itemized and detailed in various categories within the grant budget.

- Indirect : includes administrative costs not directly or exclusively tied to your project, but necessary for its completion, like rent, utilities, and insurance, think about lab or meeting spaces that are shared by multiple project teams, or Directors who oversee several ongoing projects.

After compiling your list, review sample budgets to understand the typical layout and complexity. Focus closely on the budget narratives , where you have the opportunity to justify each aspect of the spreadsheet to ensure clarity and validity.

While not always needed, the appendices consist of relevant supplementary materials that are clearly referenced within your grant application. These might include:

- Updated resumes that emphasize staff members' current positions and accomplishments.

- Letters of support from people or organizations that have authority in the field of your research, or community members that may benefit from the project.

- Visual aids like charts, graphs, and maps that contribute directly to your project’s story and are referred to previously in the application.

Finalizing your grant application

Now that your grant application is finished, make sure it's not just another document in the stack Aim for a grant proposal that captivates the evaluator. It should stand out not only for presenting an excellent project, but for being engaging and easily comprehended .

Keep the language simple. Avoid jargon. Prioritizing accuracy and conciseness. Opt for reader-friendly formatting with white space, headings, standard fonts, and illustrations to enhance readability.

Always take time for thorough proofreading and editing. You can even set your proposal aside for a few days before revisiting it for additional edits and improvements. At this stage, it is helpful to seek outside feedback from those familiar with the subject matter as well as novices to catch unnoticed mistakes and improve clarity.

If you want to be absolutely sure your grant proposal is polished, consider getting it edited by AJE .

How can AI help the grant process?

When used efficiently, AI is a powerful tool for streamlining and enhancing various aspects of the grant process.

- Use AI algorithms to review related studies and identify knowledge gaps.

- Employ AI for quick analysis of complex datasets to identify patterns and trends.

- Leverage AI algorithms to match your project with relevant grant opportunities.

- Apply Natural Language Processing for analyzing grant guidelines and tailoring proposals accordingly.

- Utilize AI-powered tools for efficient project planning and execution.

- Employ AI for tracking project progress and generating reports.

- Take advantage of AI tools for improving the clarity, coherence, and quality of your proposal.

- Rely solely on manual efforts that are less comprehensive and more time consuming.

- Overlook the fact that AI is designed to find patterns and trends within large datasets.

- Minimize AI’s ability to use set parameters for sifting through vast amounts of data quickly.

- Forget that the strength of AI lies in its capacity to follow your prompts without divergence.

- Neglect tools that assist with scheduling, resource allocation, and milestone tracking.

- Settle for software that is not intuitive with automated reminders and updates.

- Hesitate to use AI tools for improving grammar, spelling, and composition throughout the writing process.

Remember that AI provides a diverse array of tools; there is no universal solution. Identify the most suitable tool for your specific task. Also, like a screwdriver or a hammer, AI needs informed human direction and control to work effectively.

Looking for tips when writing your grant application?

Check out these resources:

- 4 Tips for Writing a Persuasive Grant Proposal

- Writing Effective Grant Applications

- 7 Tips for Writing an Effective Grant Proposal

- The best-kept secrets to winning grants

- The Best Grant Writing Books for Beginner Grant Writers

- Research Grant Proposal Funding: How I got $1 Million

Final thoughts

The bottom line – applying for grants is challenging. It requires passion, dedication, and a set of diverse skills rarely found within one human being.

Therefore, collaboration is key to a successful grant process . It encourages everyone’s strengths to shine. Be honest and ask yourself, “Which elements of this grant application do I really need help with?” Seek out experts in those areas.

Keep this guide on hand to reference as you work your way through this funding journey. Use the resources contained within. Seek out answers to all the questions that will inevitably arise throughout the process.

The grants are out there just waiting for the right project to present itself – one that shares the funder’s mission and is a benefit to our communities. Find grants that align with your project goals, tell your story through a compelling proposal, and get ready to make the world a better place with your research.

The AJE Team

See our "Privacy Policy"

A Guide to Writing a Small Business Grant Proposal

Last Updated on

January 19, 2023

While there may be more opportunities for non-profit organizations when it comes to grant funding, grants for small business owners are not rare.

In fact, small businesses received more than $334 billion in total award obligations through the SBA in 2021 , spread across more than 9 million transactions and 7 million new awards. Over $254 million was spent through grants alone. The amount spent on grant awards has risen in 2022 as well, increasing to more than $455 million.

Federal contracts and financial assistance are out there. And that is without mentioning small business research grants and other types of non-governmental contracts and awards.

Grants for small businesses can often be a better option than a loan, as grants do not require repayment of any kind. The caveat? Your goals need to align with the goals of the organization or awarding agency you’re seeking a grant from.

Many grants are dedicated to supporting non-profit work or specific research initiatives. However, small business grants are dedicated to helping owners and founders achieve specific business goals or projects that align with a funding agency’s mission or a particular initiative.

This includes research grants designed to support businesses working on research and development that has a high potential for commercialization. As a biotech founder, CEO, or employee, this is most likely the exact type of grant you’re looking for.

Like non-profit grants, small business grants are offered through both government and non-government agencies. Furthermore, unlike loans, grants do not need to be paid back.

In this article, we’ll review small business grants, grant proposals, and how to write small business grant proposals. We’ll also review some best practices for grant writing, the differences between a “good” and “bad” proposal, the various types of grants available, and additional resources to help you write a small business grant.

Need new or refurbished lab equipment? Excedr leases.

See our equipment list and browse a sample selection of what we can source. Or, if you’re ready, request an estimate.

What Is a Small Business Grant Proposal?

A small business grant proposal, like a typical grant proposal, is a clear and concise presentation of what you’re proposing to do before it actually happens. It usually takes the form of a written document that you either prepare online or physically.

You send your proposal to a particular funding agency that’s providing a grant opportunity you’re interested in.

The presentation should thoroughly explain the reasons for your proposal and why you’re applying for grant funding from a specific funder. Explain the who, what, when, where, how, and why of your proposed project or program.

When you clearly and concisely explain your proposal in an organized and well-thought manner, you will have a better chance at receiving approval from the grant reviewers.

What Are the Steps to Developing a Grant Proposal?

There are several steps you should take to develop an effective proposal. First, begin with an idea, followed by planning, strategy, and success.

What is the idea you’re hoping to make a reality? It’s ideally something you’re already working on and are seeking additional funding to help continue developing, but it can also be something you’re planning on starting and need funding to begin that journey.

Once you know what you’re trying to accomplish, you need to start planning. Flesh out the details of what your program, project, or initiative is all about that you’re seeking funding for.

After planning, you’ll need to start forming a strategy. This involves detailing your approach and methodology regarding bringing your program or project to life. How will you effectively put your plan into action?

With a strategy in place for success, you’ll be able to show the funder how you will accomplish what you’re setting out to do and how you will evaluate your accomplishments, giving the funder confidence in you by showing them you’ve got a game plan.

From here, you will want to take some additional steps before you start researching grant and developing your proposal:

- Make sure your idea can be funded, as some things are not eligible for grant funding

- Read the grant application guidelines carefully, they will help you determine if you actually qualify or not

- Make note of the eligibility requirements and what the funder is requesting; you might not be eligible or have everything they’re asking for

Lastly, ask yourself:

- Is my proposal doable?

- Does it have a focused goal?

- Can you provide everything a funder is asking for in the application? (If you can’t, you’re putting yourself in a position to become disqualified, wasting time and effort)

- Is it in alignment with your own goals and, most importantly, with the goals of the potential funding agency?

- Is there a beginning, middle, and end? (Granting agencies do not fund projects forever; in fact, most grants only last a year or two, depending on who’s providing the grant)

- Can you meet the deadline? (Grants have deadlines; if you start too late, you’ll have to rush and that can lead to mistakes and disqualification)

Grant Proposal Review & Common Elements

Grant proposal guidelines and instructions vary from funder to funder. This means the required information and formatting may be different from proposal to proposal. To better understand the common elements, it can help to review grant proposal guidelines and instructions to get a sense of what will be asked of you.

In the guidelines that you can typically find on the funding agency’s website, you’ll see exactly what you need to do in order to apply for a grant. While following these guidelines and instructions does not guarantee you’ll get funding, it does increase the likelihood of getting approved.

If the guidelines provide a list of do’s and don’ts, take note. Funding agencies will have various requests for you that include things they’d like to see in your application and things they wouldn’t like to see.

There may also be a checklist for completed requirements. If that’s the case, you can use the checklist to track your progress and make sure you don’t miss anything. Budget your time to make sure you’ve got enough time to get everything together that is required of you before the deadline. You don’t want to rush. It can lead to mistakes, which will automatically disqualify you in most cases.

Similarly, if you don’t complete and submit the proposal by the listed due date, your application will automatically be denied. We can’t stress this enough—give yourself enough time!

You’ll also see in the guidelines that a grant proposal must include information submitted in a specific order. Make sure to do this, and follow the instructions for each section exactly. Funders will most likely reject your application if your proposal is not in the correct order.

There are additional requirements for proposals that can include submitting the proposal to a specific address or department, rules about how you can submit the application, and reporting leadership or major staffing changes after you’ve submitted your proposal.

Do your diligence and read the guidelines and instructions carefully. Grant proposal reviews can be the best way to learn what to expect. That said, there are some elements, or sections of information, seen across many different types of grant proposals. These can include:

- A cover sheet or letter of intent that allows the agency to estimate how many independent reviewers will be needed; it also helps the agency avoid potential conflicts of interest in the review

- A short executive summary, or “abstract” in the non-profit world, summarizing your grant proposal

- A table of contents; it should help the reviewer find what they need quickly and easily should they want to flip to a specific section

- A needs statement and problem statement describing the purpose of your project, the need you’re addressing, or problem you’re solving, and why the project is important

- A project description or narrative explaining the project you want to fund in greater detail; you can separate different ideas into sections to better explain each aspect of your project and review the expected outcomes; this description can sometimes be included in the executive summary

- A list of your goals; ideally you will pick SMART (Specific, Measurable, Attainable, Realistic, Timeline) goals

- A description of the methods you will use, in addition to project management plans and timeline, illustrating how you will achieve your goals and objectives

- A staffing list showing how you will staff your project

- A detailed budget explaining what the money will be used for

- A cover letter providing an introduction of yourself or your business as the grant seeker, in addition to a description of your ethos, professionalism, and proposed project or business goal

You will most likely need to include information about yourself and your business as well, including:

- Your business’s mission and history

- Your business’s financial health and stability

- Any additional support documents, usually in the form of appendices; additional records, endorsements, tax status information, personnel bios, letters of support, etc.

Including this information is not only important, it’s necessary. Without it, your application will be disqualified.

Remember, this isn’t the exact order for every grant proposal. Proposals vary from funder to funder, and each may ask for a different order that the information above should be included. It’s vital that you follow the grant’s instructions exactly and include everything that’s asked for.

Before You Start, Research

Before you start writing your grant proposal, you’ll want to research the grant or grants you are applying for and the organization to whom you are submitting your proposal. This is part of the pre-award phase, covered in more detail on grants.gov .

Also consider who your audience is, what the grant’s expectations are, and how you will achieve your goals if you secure funding. To properly prepare for your application, it’s important that you:

- Follow the steps for developing a grant proposal listed above; this means clearly defining what you want to do, why you want to do it, how you’ll do it, when you’ll do it, and who you’ll do it for—remember to be SMART when defining your goals (Specific, Measurable, Achievable, Relevant, and Time-bound.)

- Identify an awarding agency or organization that funds projects or goals like the one you have in mind and figure out if their goals align with your own.

- Identify a grant funding opportunity before you begin the application process; it’s important that you find a grant that matches your proposal and goals and a funder whose mission aligns with yours.

- Review the agency’s grant proposal guidelines, eligibility requirements, and instructions document to determine if you are eligible and have everything on hand that they’ll require.

- Register to apply for grants through websites like grants.gov and sbir.gov ; depending on the agency, you will have to go through several steps to register and may be required to complete different types of registration to receive all the necessary identification.

- Review any grant proposal samples you might have or can find in order to get a better understanding of what a good or bad proposal looks like.

Research will help you identify a grant you can actually apply for, an agency that will want to work with you, and a better feel of what the funder’s interests actually are. This will vary from funder to funder, but doing your research will help greatly.

How to Write a Small Business Grant Proposal

The grant writing process can be quite arduous. But, there are a variety of ways to approach it. The best way you can handle the writing process, in our experience, is to begin with great research, followed by developing an effective proposal that carefully follows all the instructions and guidelines a funding agency provides, including everything they ask for. It’s all about giving the information that is required, not pushing the information that you want.

After taking all the necessary steps, such as registering your business in the proper places, identifying a grant funding opportunity, and determining your eligibility, you’ll begin preparing your written application and developing your proposal.

Below we break down the basic approach to writing a small business grant proposal based on our own experience as a small business.

Keep in mind that this is a guide for you to learn how to write a proposal. We outline a general approach of how to write a small business grant proposal. It will help you be well-prepared to begin the writing process, but does not necessarily follow exactly how a funder will want you to put together your proposal. Remember to follow instructions carefully!

Be meticulous in your following of the proposal’s instructions. This means including all the necessary documentation, completing the required forms, and staying on top of deadlines.

Write Your Cover Letter

You can start by writing your cover letter. However, it may help to leave this till the end of your application, as you might have a clearer idea of the main parts of your proposal and their value.

That said, if you do start with your cover letter, make sure to keep it short but impactful—you need to capture the attention of the agency’s reviewers.

Say what you need without using too much fluff, being as direct as possible without missing the important parts. And make sure to connect your project and goals with the funding agency’s own. If you can make a connection between their mission, funds, and your proposed project, you will have a better chance of getting approval.

Write Your Executive Summary

Next, write your executive summary. This serves as an overview of why your organization wants the grant, what your funding needs are, and how you plan to follow through with the project. Be as engaging as possible, using short and clear sentences that concisely illustrate the main aspects of your proposal.

Introduce Your Business

You can introduce your business next. Share as much relevant information as you can about your infrastructure, history, mission, experience, etc.

Here you include a biography of key staff, your business track record (success stories), company goals, and philosophy; essentially, highlight your expertise.

Client recommendations, letters of thanks, feedback from customers and the general public are must-have things to write in a grant proposal.

Also include all valid industry certifications (ISO or Quality Certifications), licenses, and business and indemnity insurance details.

You need to show that your company or organization has the capacity and the ability to meet all deliverables from both an execution perspective but also meet all legal, safety, and quality obligations.

Write Your Needs & Problem Statements

Now, write your needs and problem statement. It should illustrate the problem you will solve and how the grant funds will help you do it. It will be important to convey the scope of the problem or need of addressing and what sets you apart from others trying to solve the same problem or need. It can be helpful to include any research you’ve done on this matter as well.