- Home

- Research Collections

- Dissertations and Theses (Ph.D. and Master's)

Essays on Cryptocurrency

Deep Blue DOI

Collections, remediation of harmful language.

The University of Michigan Library aims to describe library materials in a way that respects the people and communities who create, use, and are represented in our collections. Report harmful or offensive language in catalog records, finding aids, or elsewhere in our collections anonymously through our metadata feedback form . More information at Remediation of Harmful Language .

Accessibility

If you are unable to use this file in its current format, please select the Contact Us link and we can modify it to make it more accessible to you.

Cryptocurrencies: market analysis and perspectives

- Published: 17 September 2019

- Volume 47 , pages 1–18, ( 2020 )

Cite this article

- Giancarlo Giudici 1 ,

- Alistair Milne 2 &

- Dmitri Vinogradov ORCID: orcid.org/0000-0002-5426-1690 3 , 4

129k Accesses

125 Citations

35 Altmetric

Explore all metrics

The papers in this special issue focus on the emerging phenomenon of cryptocurrencies. Cryptocurrencies are digital financial assets, for which ownership and transfers of ownership are guaranteed by a cryptographic decentralized technology. The rise of cryptocurrencies’ value on the market and the growing popularity around the world open a number of challenges and concerns for business and industrial economics. Using the lenses of both neoclassical and behavioral theories, this introductory article discusses the main trends in the academic research related to cryptocurrencies and highlights the contributions of the selected works to the literature. A particular emphasis is on socio-economic, misconduct and sustainability issues. We posit that cryptocurrencies may perform some useful functions and add economic value, but there are reasons to favor the regulation of the market. While this would go against the original libertarian rationale behind cryptocurrencies, it appears a necessary step to improve social welfare.

Explore related subjects

- Artificial Intelligence

Avoid common mistakes on your manuscript.

1 Introduction

Cryptocurrencies continue to draw a lot of attention from investors, entrepreneurs, regulators and the general public. Much recent public discussions of cryptocurrencies have been triggered by the substantial changes in their prices, claims that the market for cryptocurrencies is a bubble without any fundamental value, and also concerns about evasion of regulatory and legal oversight. These concerns have led to calls for increased regulation or even a total ban. Further debates concern inter alia: the classification of cryptocurrencies as commodities, money or something else; the potential development of cryptocurrency derivatives and of credit contracts in cryptocurrency; the use of initial coin offerings (ICO) employing cryptocurrency technology to finance start-up initiatives; and the issue of digital currencies by central banks employing cryptocurrency technologies.

These discussions often shed more heat than light. There is as yet little clearly established scientific knowledge about the markets for cryptocurrencies and their impact on economies, businesses and people. This special issue of the Journal of Industrial and Business Economics aims at contributing to fill this gap. The collection of papers in the special issue offers six distinct perspectives on cryptocurrencies, written from both traditional and behavioural viewpoints and addressing both financial questions and broader issues of the relationship of cryptocurrencies to socio-economic development and sustainability.

Here in this introduction we set the stage by defining and discussing the main concepts and issues addressed in the papers collected in this special issue and previewing their individual contributions. Cryptocurrencies are digital financial assets, for which records and transfers of ownership are guaranteed by a cryptographic technology rather than a bank or other trusted third party. They can be viewed as financial assets because they bear some value (discussed below) for cryptocurrency holders, even though they represent no matching liability of any other party and are not backed by any physical asset of value (such as gold, for example, or the equipment stock of an enterprise). Footnote 1

As the word cryptocurrency, and the other terminology employing ‘coin’, ‘wallets’ in the original whitepaper proposing the supporting technology for Bitcoin (Nakamoto 2008 ) all suggest, the original developers consciously attempted to develop a digital transfer mechanism that corresponded to direct transfer of physical cash used for payments or other financial assets—such as a precious metals and ‘bearer bonds’—that like cash also change hands through physical transfer.

What about the arrangements used for financial assets recorded in digital form (such as bank deposits, equities or bonds but not bearer bonds or bank notes)? Ownership arrangements for these assets depend on the information system maintained by a financial institution (commercial bank, custodian bank, fund manager) determining who is entitled to any income or other rights it offers and has the right of sale or transfer. Originally these systems were paper based, but since the 1960s they have utilised first mainframe and more recently computer systems. Footnote 2 If there is a shortcoming in their information system, for example a breach of security that leads to theft or loss or failure to carry out an instruction for transfer, then the financial institution is legally responsible for compensating the owner of the asset.

In the case of cryptocurrencies, it is the supporting software that both verifies ownership and executes transfers. Footnote 3 There is no requirement for a ‘trusted third party’. Footnote 4 This approach though requires a complete historical record of previous cryptocurrency transfers, tracing back each holding of cryptocurrency to its initial creation. This historical record is based on a “blockchain”, a linking of records (“blocks”) to each other in such a way that each new block contains information about the previous blocks in the growing list (“chain”) of digital records. So that every participant in the cryptocurrency network sees the same transaction history, a new block is accepted by agreement across the entire network.

The applications of this technology are not necessarily finance-related; it can be applied to any form of record-keeping; however if the block refers to a financial transaction then each transaction in the blockchain, by definition, includes information about previous transactions, and thus verifies the ownership of the financial asset being transferred. Falsifying ownership, i.e. counterfeiting (which, one could imagine, is easy, as digital objects can be easily duplicated by copying), is impossible because one would have to alter preceding records in the whole chain. Since records are kept in the network of many users’ computers, a “distributed ledger”, this is rather unthinkable.

There is a substantial computer science literature on the supporting cryptocurrency technologies, including on the security of public key cryptography, efficient search tools for finding transactions on the blockchain, and the ‘consensus’ mechanisms used to establish agreement on ledger contents across the network. Footnote 5 Commentators expect new more efficient approaches will replace the mechanisms currently used in Bitcoin and other cryptocurrencies. Footnote 6 This though would not affect our definition of cryptocurrencies (as an asset and some technology which verifies ownership of the asset), which is independent of any particular technological implementation. Footnote 7

Cryptocurrencies can be seen as part of a broader class of financial assets, “cryptoassets” with similar peer-to-peer digital transfers of value, without involving third party institutions for transaction certification purposes. What distinguishes cryptocurrencies from other cryptoassets? This depends on their purpose, i.e. whether they are issued only for transfer or whether they also fulfil other functions. Within the overall category of cryptoassets, we can follow the distinctions drawn in recent regulatory reports, distinguishing two further sub-categories of cryptoassets, on top of cryptocurrencies: Footnote 8

Cryptocurrencies : an asset on a blockchain that can be exchanged or transferred between network participants and hence used as a means of payment—but offers no other benefits.

Within cryptocurrencies it is then possible to distinguish those whose quantity is fixed and price market determined (floating cryptocurrencies) and those where a supporting arrangement, software or institutional, alters the supply in order to maintain a fixed price against other assets (stable coins, for example Tether or the planned Facebook Libra).

Crypto securities : an asset on a blockchain that, in addition, offers the prospect of future payments, for example a share of profits.

Crypto utility assets : an asset on a blockchain that, in addition, can be redeemed for or give access to some pre-specified products or services.

A further distinguishing feature of crypto securities and crypto utility assets is that they are issued through a public sale (in so called initial coin offerings or ICOs). ICOs have been a substantial source of funding for technology orientated start-up companies using blockchain based business models. These classifications of cryptoassets are critical for global regulators, since they need to determine whether a particular cryptoasset should be regulated as an e-money, as a security or as some other form of financial instrument, especially in relation to potential concerns about investor protection in ICOs. Footnote 9

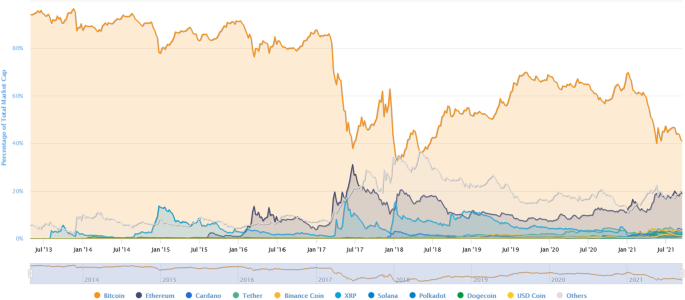

Floating cryptocurrencies account for the very large majority of the cryptoasset market capitalisation (Tether, a stablecoin, and Bitfinex’s UNUS SED LEO, a utility coin, are in the top 12 cryptoassets by market capitalisation, all the rest are floating cryptocurrencies). Table 1 summarises the market share of leading cryptocurrencies at the time of writing.

What is the value of cryptocurrencies? On the one hand, cryptocurrencies should be able to ease financial transactions through elimination of the intermediaries, reduction of transaction costs, accessibility to everyone connected to the Internet, greater privacy and security (see, e.g., discussions in Böhme et al. 2015 ; Richter et al., 2015 ). Footnote 10 On the other hand, the real economic value transferred in the transactions of freely floating cryptocurrencies such as Bitcoin’s BTC and Ethereum’s Ether remains unclear. Despite the exhaustive and unfalsifiable record of all previous transactions held cryptographically, as in the Bitcoin blockchain, the information only refers to nominal numbers, i.e. the amount of cryptocurrency units transferred. One can, however, get an idea of the market value of cryptocurrencies by looking at their exchange rates against existing fiat currencies. This is possible thanks to cryptocurrency exchanges, which provide a nearly continuous price record for all actively traded cryptocurrencies. Although the resulting exchange rates are highly volatile, they reveal that cryptocurrencies have a non-zero value for those prepared to pay fiat currency in order to purchase them.

What drives this value in the absence of a backing asset or an issuer’s liability? Some advocate it is the cost of “mining” (energy and time spent on computational efforts required to complete formation of a new block in the chain, and rewarded by a newly issued cryptocurrency unit), however the cost borne by one member of the network does not justify the value of the new cryptocurrency unit for other members of the network (see also Dwyer 2015 , who argues the cost of mining is sunk and as such should be disregarded in the market value analysis). Others claim their market value is driven by the speculative bubble; yet, strictly speaking, the bubble is manifested in upward price deviations from the fundamental value (see, e.g., Siegel 2003 , for a review of definitions), hence the bubble explanation is only partial and raises further questions about what drives investors’ beliefs that feed their demand and thus support the bubble.

If it is the ease and the speed of transactions, then new transaction technologies and fund transfer systems that greatly improved in the recent decade (such as Transferwise and similar systems) should have wiped out a big chunk of the cryptocurrency value, yet this does not seem to be the case. A possible answer may lie in the features that distinguish cryptocurrencies from other assets and payment systems. Privacy, or rather anonymity, is a prominent distinctive feature popping up in most discussions of cryptocurrencies. The value of a cryptocurrency is then effectively a measure of how much users value anonymity of their transactions. While anonymity may be attractive for illegal activities (and some research reviewed below suggests cryptocurrencies are often used for these purposes), one cannot rule out users may simply wish more privacy, trying to avoid the “Big Brother” effect of traditional transactions. Of course, there may be other factors, for example, fashion (users want to use the technology others are talking about), hi-tech appeal (the desire to use the most modern technology) or curiosity (the desire to try something new), among others, but these phenomena appear shorter-lived than the allure of anonymity.

A key development in the rise of cryptocurrencies and other cryptoassets has been the emergence of cryptoexchanges where anyone can open accounts and trade cryptoassets both against each other and against fiat currencies. In a survey by Hileman and Rauchs ( 2017 ), the US dollar, the Euro and the British Pound are currently most widely traded against cryptocurrencies, while the importance of the Chinese Renminbi (CNY) significantly diminished after the tightening of the regulation by the People’s Bank of China; about three-quarters of large exchanges provide trading support for two or more cryptocurrencies. Above, we highlighted that cryptoexchanges provide extensive cryptocurrency pricing and trading information in the public domain. The emergence of these exchanges has created an entire ‘ecosystem’ of services and participants, seeking to provide liquidity, exploit price discrepancies for profit and to support investment by both retail and professional investors.

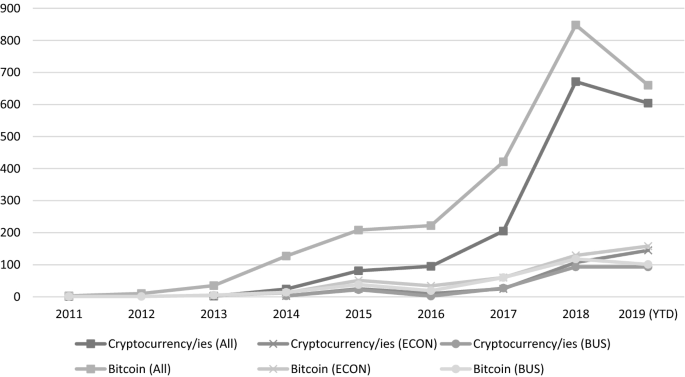

Academic interest in cryptocurrencies started to soar in 2014 (see Fig. 1 ): the Scopus database lists 127 publications containing the word ‘Bitcoin’ in the title or abstract or keywords and 24 containing ‘cryptocurrency’ or ‘cryptocurrencies’ in 2014. In 2017 and especially in 2018 the number of publications grew fast, and in 2019 the trend is continuing. Interestingly, academic work focuses much more on the Bitcoin than on the more general topic of cryptocurrencies, although in 2018 and in 2019 the gap narrowed. It appears that—apart from the Bitcoin frenzy—there is a growing attention to the general phenomenon of cryptocurrencies. However, focusing only on the ‘Economics, Econometrics & Finance’ and ‘Business, Management & Accounting’ sections of Scopus reveals that the interest in the topic surged a few years later Footnote 11 , although the number of publications is still rather low: in 2018 there were just over 100 titles on the topic in the above fields. The remaining contributions come from the ‘Computer Science’, ‘Engineering’ and ‘Mathematics’ disciplines.

Publications listed on the Scopus database containing ‘Cryptocurrency/ies’ and ‘Bitcoin’ in the title or abstract or keywords. The graph reports the number of publications tracked by the Scopus database ( http://www.scopus.com ) accessed on August 10, 2019 containing the words “Cryptocurrency/ies” or “Bitcoin” in the title or abstract or keywords. The subsample ECON refers to the category Economics, Econometrics & Finance while the subsample BUS refers to Business, Management & Accounting

This special issue of the Journal of Industrial & Business Economics offers a multifaceted view on the cryptocurrency phenomenon. Contributions have been selected with the objective to extend the existing knowledge about cryptocurrencies, which themselves embody innovations and technological change, and may appear to be a lucrative form of fund raising for small businesses; extra emphasis is made on areas of the journal’s particular interest, such as environment, sustainability and social responsibility. The remainder of this editorial proceeds as follows. In Sect. 2 we describe the contributions that shed light on the relationship between cryptocurrencies and financial investments. In Sect. 3 we focus on behavioral issues, while in Sect. 4 we introduce the development of the socio-economic perspectives related to cryptocurrencies and discuss initial coin offerings as a potential source of funds for small businesses. Finally, Sect. 5 concludes discussing the research agenda for the future.

2 Cryptocurrencies and neoclassical finance

Cryptocurrencies can be used both as a means of payment and as a financial asset. Glaser et al. ( 2014 ) provide evidence that, at least for the Bitcoin, the main reason to purchase a cryptocurrency is speculative investment. Financial securities, such as ETNs (exchange traded notes) and CFDs (derivative products) that replicate Bitcoin’s price performance are made available by brokers, expanding the speculative investment opportunities to an even larger set of investors. With this in mind, it makes sense to evaluate cryptocurrencies as financial assets.

The cross-section of cryptocurrency returns has been analyzed in a number of papers. Urquhart ( 2016 ) shows that Bitcoin returns do not follow random walk, based on which he concludes the Bitcoin market exhibits a significant degree of inefficiency, especially in the early years of existence. Corbet et al. ( 2018 )analyze, in the time and frequency domains, the relationship between the return of three different cryptocurrencies and a variety of other financial assets, showing lack of relationship between crypto- and other assets. Liu and Tsyvinski ( 2018 ) investigate whether cryptocurrency pricing bears similarity to stocks: none of the risk factors explaining movements in stock prices applies to cryptocurrencies in their sample. Moreover, movements in exchange rates, commodity prices, or macroeconomic factors of traditional significance for other assets play little to none role for most cryptocurrencies. The latter invalidates the view on cryptocurrencies as substitutes to monies, or as a store of value (like gold), and rather stresses they are assets of their own class. The review of the literature in Corbet et al. ( 2019 ) summarizes the most interesting findings on the role of cryptocurrencies as a credible investment asset class and as a valuable and legitimate payment system.

The relative isolation of cryptocurrencies from more traditional financial assets suggests cryptocurrencies may offer diversification benefits for investors with short investment horizons. Bouri et al. ( 2017 ) as well as Baur et al. ( 2018 ) find that Bitcoin is suitable for diversification purposes as its returns are uncorrelated with those of most major assets. Interestingly, they provide empirical evidence of the predominant usage of Bitcoins as speculative assets, though this is done on the data on USD transactions only and thus likely reflects the behavior of U.S. cryptocurrency investors mainly. Relatedly, Adhami and Guegan ( 2020 ) find that similarly to cryptocurrencies, cryptotokens are also a useful diversification device though not a hedge.

One way to understand similarities and differences between cryptocurrencies and more traditional financial assets is to estimate relationships known for traditional assets. A pattern that has received a lot of attention in the finance literature is the co-movement of the trading volume and returns/volatility of financial assets (a by far non-exhaustive list of examples would include Admati and Pfleiderer ( 1988 ), Foster and Viswanathan ( 1993 ), and Andersen ( 1996 )—for equity markets; Bessembinder and Seguin ( 1993 )—for futures; notably, no clear evidence of such a relationship exists for currencies, i.e. for exchange rates, see, e.g. Côté 1994 ). This special issue includes a contribution by Figà-Talamanca ( 2020 ), who, inter alia , investigate this relationship for cryptocurrencies, along with the impact of “relevant events”, which are key disruptive changes to the market infrastructure. They find that Bitcoin trading volume does not affect its returns but detect a positive effect of Bitcoin trading volumes on return volatility. While their focus is mainly on market attention, these results highlight similar forces rule cryptocurrency markets and those for more traditional financial assets, again supporting the view of cryptocurrencies as investment assets. Footnote 12

The risk of holding cryptocurrencies is discussed in this special issue by Fantazzini and Zimin ( 2020 ). Cryptocurrency prices may drop dramatically because of a revealed scam or suspected hack, or other hidden problems. For example, on June 26th, 2019, the Bitcoin price lost more than 10 % of the value in a few minutes because of the crashes and outages of the Coinbase digital exchange. As a consequence, a cryptocoin may become illiquid and its value may substantially decline. Fantazzini and Zimin ( 2020 ) propose a set of models to estimate the risk of default of cryptocurrencies, which is back-tested on 42 digital coins. The authors make an important point in extending the traditional risk analysis to cryptocurrencies and making an attempt to distinguish between market risk and credit risk for them. The former, as typical in the finance literature, is associated with movements in prices of other assets. The latter is associated in traditional finance with the failure of the counterparty to repay, but as cryptocurrencies presume no repayments, defining credit risk for them is tricky. The authors’ approach is to see the “credit” risk of cryptocurrency in the possibility of them losing credibility among users, and thus becoming value-less, or “dead”. The authors find, notably, that the market risk of cryptocurrencies is driven by Bitcoin, suggesting some degree of homogeneity in the cryptomarket. As for the credit risk, the traditional credit scoring models based on the previous month trading volume, the one-year trading volume and the average yearly Google search volume work remarkably well, suggesting indeed a similarity between the newly defined credit risk for cryptocurrencies and the one traditionally used for other asset classes.

3 Cryptocurrencies and behavioral finance and economics

A large strand of the literature explains market phenomena that work against the neo-classical predictions, from the perspective of unquantifiable risk, or ambiguity. Most commonly, ambiguity is associated with the impossibility to assign probability values to events that may or may not occur. In the case of cryptocurrencies, this type of uncertainty may arise for two reasons: (1) the technology is rather complicated and opaque to unsophisticated traders, and (2) the fundamental value of cryptocurrencies is unclear. As we highlighted above, even if it is strictly positive, it is likely to derive from intangible factors and as such is rather uncertain. Dow and da Costa Werlang ( 1992 ) demonstrate that under pessimism (ambiguity aversion) uncertainty about fundamentals leads to zero trading in financial markets, yet this does not seem to apply to cryptocurrencies. In Vinogradov ( 2012 ) not only does the no-trade outcome depend on the degrees of optimism and pessimism, which may vary, but it also manifests only under high risk (in the standard sense). Still, again, although cryptocurrency returns exhibit high volatility, trade volumes are significant. In Caballero and Krishnamurthy ( 2008 ) uncertainty leads to “flights to quality” in traditional asset markets, which, if properly applied to cryptocurrencies, might also explain the crashes we recently observed.

Obtaining information is crucial to reduce uncertainty. Figà-Talamanca ( 2020 ) focus on a rather general definition of the demand for information, as manifested in the google search index. According to them, the intensity of the internet search for cryptocurrency-related keywords significantly affects cryptocurrency volatility (but not return); this impact vanishes once one controls for “relevant events”. These relevant events are effectively announcements of either restrictions (and even bans) on cryptocurrency usage, or of the widening of the cryptocurrency market. While we remain largely agnostic regarding what people find when they search for cryptocurrency related terms on the Internet, the events give us an indication of the type of information that actually matters for cryptocurrency investment decisions, and hence for pricing. In uncertainty, when finding relevant information is uneasy, investors might resort to watching and mimicking other, presumably better informed, investors’ decisions, resulting in herding (Trueman 1994 ; Devenow and Welch 1996 ), addressed in this special issue by Haryanto et al. ( 2020 ), see below.

Uncertainty and attitudes to it are not the only reasons why neoclassical predictions may fail. Shiller ( 2003 ) notes that market participants are humans and can make irrational systematic errors contrary to the assumption of rationality. Such errors affect prices and returns of assets, creating market inefficiencies. Studies in behavioral economics highlight inefficiencies, such as under- or over-reactions to information, as causes of market trends and, in extreme cases, of bubbles and crashes. Such reactions have been attributed to limited investor attention, overconfidence, mimicry and noise trading, explanations of many of which find roots in Kahneman and Tversky’s ( 1979 ) prospect theory, which postulates that decision makers evaluate outcomes from the perspective of their current endowment (and are predominantly loss-averse) and “revise” probabilities of outcomes when making decisions (predominantly overweighting probabilities of bad outcomes and underweighting those of good ones). The loss-aversion led Shefrin and Statman ( 1985 ) to formulate the ‘disposition effect’ in investment decisions: investors in traditional assets tend to keep assets that lose value too long and sell those that gain in value too early.

Three features distinguish cryptocurrency markets: investors are non-institutional, risk (volatility of returns) is high, and the fundamental value is unclear. Under these conditions behavioral biases should be even more pronounced than in traditional asset markets. In this special issue Haryanto et al. ( 2020 ) study the disposition effect and the herding behavior in the cryptocurrency realm by investigating the trading behavior at a cryptoexchange: they find a reverse disposition effect in bullish periods where the Bitcoin price increases while a positive disposition effect is observed in bearish periods. They also find that in different market conditions herding moves along with market trend (in the bullish market a positive market return increases herding, while in the bearish market a negative market return has the same effect). The reverse disposition effect in the bullish market indicates investors exhibit more optimism and expect returns to further grow, which is consistent with the exponential price growth in a bubble in the absence of a clearly defined fundamental value. This lack of clarity regarding the fundamental value is also supported by the asymmetric herding behavior: when the price grows in a bullish market, investors look at other market participants to see whether others also think the price will continue to grow (similarly but with the opposite sign for the bearish market).

This special issue also contributes to the debate on the existence of a ‘bubble’ in the cryptocurrency market (see Baek and Elbeck 2015 ; Cheah and Fry 2015 ). The contribution by Moosa ( 2020 ) highlights that the Bitcoin was in a bubble up to the end of 2017. The analysis claims that the volume of trading in Bitcoin can be explained predominantly in terms of price dynamics considering past price movements, particularly positive price changes, and that the path of the price is well described by an explosive process.

4 Socio-economic perspectives

Critiques emphasize cryptocurrencies are not exempt from frauds and scandals. For example, several millions in Bitcoin from the Japanese platform Mt. Gox in 2014 and $50 million in Ether during the Decentralized Autonomous Organization (DAO) attack in 2016 were stolen. Moreover, cryptocurrency payments, being largely unregulated, do not restrict any purchases, including those illegal. Böhme et al. ( 2015 ) provide summary data showing that, at least in the beginning of the Bitcoin era, most transactions were used for drug purchases. Foley et al. ( 2019 ) estimate that about 46 % of Bitcoin transactions are associated with illicit activities, but that the illegal share of Bitcoin activity declined over time with the emergence of more opaque cryptocurrencies. On top of that, users appear unprotected as payments are often irreversible, and an erroneous transfer cannot be cancelled, unlike credit card payments (Böhme et al. 2015 ).

On the positive side, the development of the cryptocurrency market contributes to the dynamics of access to finance (Adhami et al. 2018 ). The advent of the blockchain technology allowed entrepreneurial teams to raise capital in cryptocurrencies and fiat money (which has to be exchanged into a cryptocurrency) through the issuance of digital tokens (Initial Coin Offerings, ICOs) and the development of ‘smart contracts’ (Giudici and Adhami 2019 ). Tokens give their buyers a right to use certain services or products of the issuer, or to share profits, in which case they resemble equity. Special cryptoexchanges then serve the secondary market for tokens. The OECD ( 2019 ) lays out basic principles and typical steps of an ICO. An important distinction between tokens and cryptocurrencies is though that there is a liability or some sort of commitment behind the token, and this liability determines its value. Now that this cryptoasset bears more similarity with traditional assets, one would expect also the main predictions of neoclassical finance to come true. In fact, in a recent empirical study of cryptotokens, Howell et al. ( 2018 ) demonstrate the effects of asymmetric information on tokens trading: their liquidity and trading volume are positively associated with the information inflow. The latter is achieved through voluntary disclosure of information (including the operating budget and their business plans), and quality signaling (e.g. information on prior venture capital funding of the issuer).

Cryptocurrencies, which underlie the ICO procedure, are claimed to provide much more equitable and democratic access to capital as well as greater efficiency, compared to fiat money, allowing peer-to-peer transactions and avoiding the intermediation of banks (Nakamoto 2008 ; Karlstrøm 2014 ). This is normally done via an ICO, and could be a relevant opportunity for small business, which often experience a gap in funding and miss competences to relate with professional investors (Giudici and Paleari 2000 ). OECD ( 2019 ) also reports ICOs are a potential route for low cost finance for SMEs.

Will cryptocurrencies favor a process of “democratization” of funding? This has been widely discussed by practitioners and investors, with a great variety of views. For example, The World Economic Forum White Paper (WEF 2018 ), claims that cryptocurrencies and blockchain technologies could increase the worldwide trading volume, moving to better levels of service and lower transaction fees. To this extent, the contribution by Ricci ( 2020 ) in this special issue considers the geographical network of Bitcoin transactions in order to discover potential relationships between Bitcoin exchange activity among countries and national levels of economic freedom. The study shows that high levels of freedom to trade internationally, that guarantee low tariffs and facilitate international trade, are strongly connected to the Bitcoin diffusion. On the one hand, the freedom to trade internationally could increase the foreign trade through the use of alternative payment instruments capable of reducing transaction costs (like cryptocurrencies), on the other, low capital controls could encourage the use of cryptocurrencies for illegal conduct, such as money laundering.

The reward system for cryptocurrency ‘miners’ creates an incentive to leverage on computing power, increasing the consumption of energy. For example, Böhme et al. ( 2015 ) note that computational efforts of miners are costly, mainly because the proof-of-work calculations are “power-intensive, consuming more than 173 megawatts of electricity continuously. For perspective, that amount is … approximately $178 million per year at average US residential electricity prices.” The sustainability topic is raised in this special issue by Vaz and Brown ( 2020 ). They posit that there are significant sustainability issues in the cryptocurrency development exceeding potential benefits, that are captured typically by a few people. Therefore, they call for different institutional models with government and public engagement, as to avoid that the market is driven mostly by private money and profit motivations.

5 Conclusions

Growing attention has been paid to cryptocurrencies in the academic literature, discussing whether they are supposed to disrupt the economy or are a speculative bubble which could crash and burn or favor money laundering and criminals. In support of the first view, it is often argued they meet a market need for a faster and more secure payment and transaction system, disintermediating monopolies, banks and credit cards. Critics, on the other hand, point out that the unstable value of cryptocurrencies make them more a purely speculative asset than a new type of money.

The reality is somewhere in between these two positions, with cryptocurrencies performing some useful functions and hence adding economic value, and yet being potentially highly unstable. The trend is towards a regulation of cryptocurrencies, and more generally of all crypto-assets, and to their increased trading on organized and regulated exchanges. This would go against the original libertarian rationale that originated the Bitcoin but is a necessary step to provide protection for market participants and reduce moral hazard and information asymmetries.

How will future research build on the articles in this special issue and on other recent studies of cryptocurrencies? It is of course always difficult to anticipate substantial future research contributions, especially in relation to such a recent and novel phenomenon like cryptocurrencies. But we would argue that there are a few major issues that deserve continued attention from scholars in finance, economics and related disciplines.

One is the need for a much closer examination of the ‘market microstructure’ of cryptoexchanges. Some recent research already draws attention to the functioning of cryptoexchanges. For example, Gandal et al. ( 2018 ) investigate price manipulations at the Mt. Gox Bitcoin exchange; a notable by-product of their research is the finding that suspicious trading on one exchange led to equal price changes on other exchanges, suggesting traders can effectively engage in arbitrage activities across exchanges. Similarly, signs of efficiency are detected in Akyildirim et al. ( 2019 ) who investigate pricing of Bitcoin futures on traditional exchanges—Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE). Importantly, in their study information flows and price discovery go from futures to spot markets, in contrast to previous results for traditional assets; a likely explanation is the difference in the type of traders at cryptoexchanges (that determine the spot price) and both CME and CBOE. Footnote 13 Yet more has to be learnt about cryptoexchanges. Their open nature distinguishes them from conventional stock exchanges and dealer markets with transactors directly accessing the market rather than relying on brokers as intermediaries. Is this open nature helpful, providing greater liquidity and narrowing trading spreads? Or does it disadvantage some investors, limiting regulatory oversight and allowing a core of participants to manipulate market prices at the expense of other investors? Do the technical arrangements supporting cryptoexchanges, notably the use of distributed ledger or blockchain technology which eliminates the need for post-trade settlement, lead to more efficient trading outcomes in terms of price, liquidity and speed of execution? Could these technologies also improve the efficiency of outcomes in conventional financial exchange?

The second issue, widely debated in the cryptocurrency literature, is whether cryptocurrencies have a fundamental own value. Dwyer ( 2015 ) conjectures the limitation of the quantity produced can create an equilibrium in which a digital currency has a positive value: this limitation is a form of commitment, replacing the implicit obligation of Central banks to exchange fiat money into gold. Hayes ( 2017 ) advocates the cost of production view on cryptocurrency pricing; yet, as we discussed earlier, from a market equilibrium perspective, being sunk cost (as in Dwyer 2015 ), it does not matter for the pricing of existing coins. Footnote 14 A concurrent work by Bolt and Van Oordt ( 2019 ) outlines three key elements of the cryptocurrency value: convertibility into fiat money or ability to buy goods and services, investors’ expectations, and factors that determine acceptance of the cryptocurrency in the future, by both vendors and buyers. Simultaneously, Schilling and Uhlig ( 2019 ) offer a model where cryptocurrencies are a reliable medium of exchange and compete against fiat money: this role implies the current price of cryptocurrencies is the expectation of their future value (a martingale), yet interestingly, competition and substitutability between the two imply in their analysis cryptocurrencies should disappear in the long run equilibrium. The authors admit that their analysis abstracts away such distinctive features of cryptocurrencies as “censorship resistance, transparency, and speed of trading”. Above we have provided a simplified argument explaining that cryptocurrencies may have a value by offering features, such as anonymity of transactions, not covered by traditional currencies. Many findings, also those included in this special issue, point towards the intangible nature of the cryptocurrency value. Knowing more about it, we would be better equipped to understand the price dynamics and, reciprocally, the price dynamics would improve our understanding of decisions made by investors. So far, we remain very much agnostic in this respect.

The third issue is the societal role of cryptocurrencies and their regulation. While many discussions of cryptocurrencies stress that they are free of regulation, and the desire to be unregulated was one of drivers behind their creation, there is considerable controversy both about the application of existing regulation to cryptocurrencies and other cryptoassets and also what if any new regulations may be needed to protect investors, prevent financial crime and ensure financial stability. Are crypto investments securities and therefore subject to securities law (in the US this has been determined by the so-called Howey test)? What about the regulation of cryptoexchanges and the problems of hacking with some prominent examples of theft and failure to enforce “know-your-customer” (KYC) and anti-money-laundering (ALM) regulations?

Globally, regulators are shifting towards a tougher stance. Some exchanges are seeking to engage with regulators and be fully compliant. Others prefer to operate outside of regulation. A simple argument is that one has to protect investors and users from financial and technological risks they face. However, as papers presented in this special issue demonstrate, cryptocurrencies differ from traditional assets, hence the validity of traditional arguments, such as systemic stability, consumer protection and promotion of competition, is not clear. As our literature review and papers in this special issue underscore, cryptocurrencies do not comove with other assets; they help diversification and do not pose an immediate danger for systemic stability. There appears to be a significant and growing degree of competition between different cryptocurrencies and cryptoexchanges, and yet we have to understand whether and why such a competition is desirable for the society.

Similarly, we need to understand whether there is a need to protect consumers. In traditional asset markets and in banking such protection improves allocation of resources and promotes economic growth and welfare, which is not straightforwardly applicable to cryptocurrencies and existing other cryptoassets. An extra dimension that arises from the studies in our special issue is the sustainability and environmental impact of cryptocurrencies, and this is again different from other asset classes.

Last but not the least, yet another major issue is how cryptocurrency technologies may affect conventional fiat currency issued by central banks. Footnote 15 Emerging literature on the competition between cryptocurrencies and fiat money raises concerns that the emergence of privately issued cryptocurrencies could weaken the monetary policy tools employed by the central bank and result in welfare losses (Zhu and Hendry 2018 ; Schilling and Uhlig 2019 ). Fernández-Villaverde and Sanches ( 2019 ) find that when private currency competes with a central bank issued e-money the former should vanish in equilibrium, yet it remains unclear what happens if cryptocurrencies are not a perfect substitute to fiat money. Footnote 16 Cukierman ( 2019 ), building on the analysis by Roubini ( 2018 ), brings the discussion to a further level by discussing the potential also for cryptocurrency issue by the central bank being used to implement fully reserved or narrow banking and thus to promote financial stability.

We hope this special issue contributes to our understanding of cryptocurrencies and surrounding issues. We also reckon it helps generate knowledge and materials useful for practitioners and scholars, involved in studying and shaping the cryptocurrency market for the future. Very possibly this will evolve and become very different from what we observe today, but for sure already now cryptocurrencies embody an innovation capable of moving our financial markets and economies forward in terms of efficiency and growth. We just need to learn using this innovation properly.

From the accounting perspective, cryptocurrencies are investment assets, sometimes even treated similarly to stocks for accounting purposes (Raiborn and Sivitanides 2015 ).

Milne ( 2015 ) provides a history of the information systems used in securities markets.

A more detailed yet still accessible overview of the key features of the current technology behind cryptocurrencies can be found in Böhme et al. ( 2015 ). Narayanan et al. ( 2016 ) provide a detailed textbook description. A key feature is that ownership is identified with a public cryptographic key. The matching private cryptographic key can then be used both to confirm ownership of the associated public key and to instruct transfers of the cryptocurrency to other public keys. The number of these keys is effectively unlimited. In the case of Bitcoin these keys are 256-bit binary numbers, so in consequence there are 2 256 possible public keys; an almost unimaginably large number.

Third parties may still play a role in the functioning of a cryptocurrency. For example, 5 % of XRP, the cryptocurrency that supports Ripple international payments platform is held by Ripple themselves, and their decisions to buy or sell affect market supply. Third parties also support stablecoins such as Tether or Facebook’s proposed Libra currency.

Blockchains are validated and updated within peer-to-peer networks using a ‘consensus mechanism’ (for example “proof of work” or “proof of stake”, see Tschorsch and Scheuermann 2016 ) that prevents members of the network from creating a false version of history. This consensus then supports a fully decentralized secure verification of ownership and exchange (Pilkington 2016 ; Goldstein et al. 2019 ). In the case of Bitcoin, the term block was originally used because its consensus mechanism (‘mining’) is applied to append ‘blocks’ of around 1000 transactions at a time to the chain of transaction records.

For a review of several prominent consensus mechanisms see Baliga ( 2017 ).

Ripple (XRP) is an example of a cryptoasset that does not use blockchain. However, it has a different purpose designed primarily to mediate conversions from currency to currency, or from any asset A to asset B.

For example (Bank of England, Financial Conduct Authority, and HM Treasury 2018 ; ESMA 2019 ; EBA 2019 ) and also (Hacker and Thomale 2017 ). The term ‘token’ is often used as a shorthand reference to cryptoassets, especially for crypto securities and crypto utility assets (e.g. Adhami and Guegan 2020 ), though Milne ( 2018 ) argues that this usage can be misleading, disguising similarities with more conventional financial assets.

Recent discussion of these issues includes FSB ( 2018 ), FCA ( 2019 ) and Blandin et al. ( 2019 ).

Note that transactions in cryptocurrencies are subject to such restrictions as the lack of reversibility, i.e. an erroneous transaction cannot be cancelled as soon as it is written in the block. More traditional payment systems, such as bank transfers and credit card payments, are more flexible in this respect.

This delay may also reflect slower publication process in our field, with most papers going through a few not so fast rounds of revisions (let alone rejections) before they get published. Huisman and Smits ( 2017 ) review recent evidence on the duration of the publication process; their sample shows, for example, that tit takes twice as long to publish in Economics than, e.g. in Medicine, with an average first response time in Economics and Finance being 16–18 weeks (comparable to Azar’s 2007 , estimate of 3–6 months). Their sample does not account for the number of previous rejections though. John Cochrane witnesses most of his publications were rejected 2–3 times before getting eventually published ( https://johnhcochrane.blogspot.com/2017/09/a-paper-and-publishing.html ); further anecdotal evidences are in Shepherd ( 1995 ).

“Similar forces” here does not mean similar factors: like Liu and Tsyvinski ( 2018 ), Figà-Talamanca ( 2020 ) find a strong dependence of cryptocurrency returns of their past values, which distinguishes them from other asset classes.

Interestingly, CBOE futures present an informational advantage over the CME alternative, possibly because of the smaller size of contracts and hence the larger number of investors actively trading.

It may matter though for the decision to mine new coins (the marginal cost of coin production should be below market price, which stands for the marginal profit). Hayes ( 2017 ) also points at the difficulty of the mining algorithm as a driver of cryptocurrency prices. This measure may be an indicator of the reliability of the cryptographic technology behind the cryptocurrency, and thus part of the fundamental value, as it represents security of transactions, valued by the users.

Pieters ( 2020 , forthcoming) provides a useful wider review of central banks and digital payments technologies.

Fernández-Villaverde and Sanches ( 2019 ) also advance an interesting idea that cryptocurrencies, being “private money”, create limits for monetary policy and, at the same time, provides market discipline for the government.

Adhami, S., Giudici, G., & Martinazzi, S. (2018). Why do businesses go crypto? An empirical analysis of initial coin offerings. Journal of Economics & Business, 100, 64–75.

Google Scholar

Adhami, S. & Guegan, D. (2020). Crypto assets: the role of ICO tokens within a well-diversified portfolio. Journal of Industrial & Business Economics (forthcoming) .

Admati, A. R., & Pfleiderer, P. (1988). A theory of intraday patterns: Volume and price variability. The Review of Financial Studies, 1 (1), 3–40.

Akyildirim, E., Corbet, S., Katsiampa, P., Kellard, N., & Sensoy, A. (2019). The development of Bitcoin futures: Exploring the interactions between cryptocurrency derivatives. Finance Research Letters . https://doi.org/10.1016/j.frl.2019.07.007 . (in press) .

Article Google Scholar

Andersen, T. G. (1996). Return volatility and trading volume: An information flow interpretation of stochastic volatility. The Journal of Finance, 51 (1), 169–204.

Azar, O. H. (2007). The slowdown in first-response times of economics journals: Can it be beneficial? Economic Inquiry, 45 (1), 179–187.

Baek, C., & Elbeck, M. (2015). Bitcoins as an investment or speculative vehicle? A first look. Applied Economics Letters, 22 (1), 30–34.

Baliga, A. (2017). Understanding Blockchain Consensus Models. Persistent White paper. https://pdfs.semanticscholar.org/da8a/37b10bc1521a4d3de925d7ebc44bb606d740.pdf . Accessed 14 Sept 2019.

Bank of England, Financial Conduct Authority, and HM Treasury. (2018). Cryptoassets taskforce: Final report. London.

Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 54, 177–189.

Bessembinder, H., & Seguin, P. J. (1993). Price volatility, trading volume, and market depth: Evidence from futures markets. Journal of financial and Quantitative Analysis, 28 (1), 21–39.

Blandin, A., Cloots, A. S., Hussain, H., Rauchs, M., Saleuddin, R., Allen, J. G., et al. (2019). Global cryptoasset regulatory landscape study . Cambridge: Cambridge Centre for Alternative Finance.

Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 29 (2), 213–238.

Bolt, W., & Van Oordt, M. R. (2019). On the value of virtual currencies. Journal of Money, Credit and Banking . https://doi.org/10.1111/jmcb.12619 .

Bouri, E., Molnár, P., Azzi, G., Roubaud, D., & Hagfors, L. (2017). On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters, 20, 192–198.

Caballero, R. J., & Krishnamurthy, A. (2008). Collective risk management in a flight to quality episode. The Journal of Finance, 63 (5), 2195–2230.

Cheah, E.-T., & Fry, J. (2015). Speculative bubbles in bitcoin markets? An empirical investigation into the fundamental value of bitcoin. Economics Letters, 130, 32–36.

Corbet, S., Lucey, B., Urquhart, A., & Yarovaya, L. (2019). Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis, 62, 182–199.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 156, 28–34.

Côté, A. (1994). Exchange rate volatility and trade. Bank of Canada .

Cukierman, A. (2019) Welfare and political economy aspects of a central bank digital currency. Centre for Economic Policy Research, discussion paper DP13728, May 2019.

Devenow, A., & Welch, I. (1996). Rational herding in financial economics. European Economic Review, 40 (3–5), 603–615.

Dow, J., & da Costa Werlang, S. R. (1992). Uncertainty aversion, risk aversion, and the optimal choice of portfolio. Econometrica: Journal of the Econometric Society , 60 (1), 197–204.

Dwyer, G. P. (2015). The economics of bitcoin and similar private digital currencies. Journal of Financial Stability, 17, 81–91.

EBA. (2019). Report with Advice for the European Commission on crypto-assets. https://eba.europa.eu/documents/10180/2545547/EBA+Report+on+crypto+assets.pdf . Accessed 14 Sept 2019.

ESMA. (2019). “Advice: Initial coin offerings and crypto-assets. https://www.esma.europa.eu/sites/default/files/library/esma50-157-1391_crypto_advice.pdf . Accessed 14 Sept 2019.

Fantazzini, D., & Zimin, S. (2020). A multivariate approach for the joint modelling of market risk and credit risk for cryptocurrencies. Journal of Industrial & Business Economics (this issue) .

FCA. (2019). Guidance on cryptoassets feedback and final guidance to CP 19/3. Policy Statement PS19/22. Financial Conduct Authority July 2019.

Fernández-Villaverde, J., & Sanches, D. (2019). Can currency competition work? Journal of Monetary Economics, in press, . https://doi.org/10.1016/j.jmoneco.2019.07.003 .

Figà-Talamanca, G., & Patacca M. (2020). Disentangling the relationship between Bitcoin and market attention measures. Journal of Industrial & Business Economics (this issue) .

Foley, S., Karlsen, J., & Putnins, T. (2019). Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies? Review of Financial Studies, 32 (5), 1798–1853.

Foster, F. D., & Viswanathan, S. (1993). Variations in trading volume, return volatility, and trading costs: Evidence on recent price formation models. The Journal of Finance, 48 (1), 187–211.

FSB. (2018). Crypto-asset markets Potential channels for future financial stability implications (p. 10). Basel: Financial Stability Board.

Gandal, N., Hamrick, J. T., Moore, T., & Oberman, T. (2018). Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics, 95, 86–96.

Giudici, G., & Adhami, S. (2019). The governance of ICO projects: Assessing the impact on fundraising success. Journal of Industrial and Business Economics, 46 (2), 283–312.

Giudici, G., & Paleari, S. (2000). The provision of finance to innovation: A survey conducted among Italian technology-based small firms. Small Business Economics, 14 (1), 37–53. https://doi.org/10.1023/A:1008187416389 .

Glaser, F., Zimmermann, K., Haferkorn, M., Weber, M. C., & Siering, M. (2014). Bitcoin-asset or currency? revealing users’ hidden intentions. Revealing Users’ Hidden Intentions (April 15, 2014). ECIS.

Goldstein, I., Wei Jiang, W., & Karolyi, G. A. (2019). To FinTech and Beyond. The Review of Financial Studies, 32 (5), 1647–1661. https://doi.org/10.1093/rfs/hhz025 .

Hacker, P., & Thomale, S. (2017). Crypto-securities regulation: ICOs, token sales and cryptocurrencies under EU financial law. European Company and Financial Law Review, 15 (4), 645–696.

Hayes, A. S. (2017). Cryptocurrency value formation: an empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics , 34 (7), 1308–1321.

Haryanto, S., Subroto A., & Ulpah M. (2020). Disposition effect and herding behavior in the cryptocurrency market. Journal of Industrial & Business Economics (this issue) .

Hileman, G., & Rauchs, M. (2017). Global cryptocurrency benchmarking study. Cambridge Centre for Alternative Finance . https://cdn.crowdfundinsider.com/wp-content/uploads/2017/04/Global-Cryptocurrency-Benchmarking-Study.pdf . Accessed 14 Sept 2019.

Howell, S. T., Niessner, M., & Yermack, D. (2018). Initial coin offerings: Financing growth with cryptocurrency token sales (No. w24774). National Bureau of Economic Research.

Huisman, J., & Smits, J. (2017). Duration and quality of the peer review process: The author’s perspective. Scientometrics, 113 (1), 633–650.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47 (2), 263–292.

Karlstrøm, H. (2014). Do libertarians dream of electric coins? The material embeddedness of bitcoin. Scandinavian Journal of Social Theory, 15 (1), 25–36.

Liu, Y., & Tsyvinski, A. (2018). Risks and returns of cryptocurrency (No. w24877). National Bureau of Economic Research.

Milne, A. (2015). Central securities depositories and securities clearing and settlement: Business practice and public policy concern. In M. Diehl, B. Alexandrova-Kabadjova, R. Heuver, & S. Martínez-Jaramillo (Eds.), Analyzing the economics of financial market infrastructures . Hershey: IGI Global.

Milne, A. K. L. (2018) Argument by False analogy: The mistaken classification of Bitcoin as token money (November 25, 2018). https://ssrn.com/abstract=3290325 .

Moosa, I. (2020). The Bitcoin: A Sparkling Bubble or Price Discovery? Journal of Industrial & Business Economics (this issue) .

Nakamoto, S. (2008). Bitcoin: a peer-to-peer electronic cash system. https://bitcoin.org/bitcoin.pdf . Accessed 14 Sept 2019.

Narayanan, A., Bonneau, B., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies: A comprehensive introduction . Princeton: Princeton University Press.

OECD. (2019). Initial coin offerings (ICOs) for SME financing, http://www.oecd.org/finance/initial-coin-offerings-for-sme-financing.htm .

Pieters, G. (2020). Central banks and digital currencies. In R. Rau, R. Wardrop, & L. Zingales (Eds.), The Palgrave handbook of alternative finance . Basingstoke: Palgrave MacMillan.

Pilkington, M. (2016). Blockchain technology: Principles and applications. In F. Xavier Olleros & M. Zhegu (Eds.), Research handbooks on digital transformations (pp. 225–253). Cheltenham: Edward Elgar.

Raiborn, C., & Sivitanides, M. (2015). Accounting issues related to Bitcoins. Journal of Corporate Accounting & Finance, 26 (2), 25–34.

Ricci, P. (2020). How economic freedom reflects on the Bitcoin transaction network. Journal of Industrial & Business Economics (this issue) .

Richter, C., Kraus, S., & Bouncken, R. C. (2015). Virtual currencies like Bitcoin as a paradigm shift in the field of transactions . International Business & Economics Research Journal, 14 (4), 575–586.

Roubini, N. (2018). Exploring the cryptocurrency and blockchain ecosystem . Washington, DC: Testimony for the Hearing of the US Senate Committee on Banking, Housing and Community Affairs.

Schilling, L., & Uhlig, H. (2019). Some simple bitcoin economics. Journal of Monetary Economics (forthcoming).

Shefrin, H., & Statman, M. (1985). The disposition to sell winners too early and ride losers too long: Theory and evidence. The Journal of Finance, 40 (3), 777–790.

Shepherd, G. B. (1995). Rejected: Leading economists ponder the publication process . Sun Lakes: T. Horton and Daughters.

Shiller, R. J. (2003). From efficient markets theory to behavioral finance. Journal of Economic Perspectives, 17 (1), 83–104.

Siegel, J. J. (2003). What is an asset price bubble? An operational definition. European Financial Management, 9 (1), 11–24.

Trueman, B. (1994). Analyst forecasts and herding behavior. The Review of Financial Studies, 7 (1), 97–124.

Tschorsch, F., & Scheuermann, B. (2016). Bitcoin and beyond: A technical survey on decentralized digital currencies. IEEE Communications Surveys and Tutorials, 18 (3), 2084–2123.

Urquhart, A. (2016). The inefficiency of Bitcoin. Economics Letters, 148 (1), 80–82.

Vaz, J., & Brown, K. (2020). Sustainable development and cryptocurrencies as private money. Journal of Industrial & Business Economics (this issue) .

Vinogradov, D. (2012). Destructive effects of constructive ambiguity in risky times. Journal of International Money and Finance, 31 (6), 1459–1481.

WEF. (2018). Trade Tech—A new age for trade and supply chain finance, The World Economic Forum in collaboration with Bain & Company. World Economic Forum, January 2018. http://www3.weforum.org/docs/White_Paper_Trade_Tech_report_2018.pdf . Accessed 14 Sept 2019.

Zhu, Y., & Hendry, S. (2018). A framework for analyzing monetary policy in an economy with e - money (December 31, 2018). https://ssrn.com/abstract=3318915 or http://dx.doi.org/10.2139/ssrn.3318915 . Accessed 14 Sept 2019.

Download references

Author information

Authors and affiliations.

Politecnico di Milano, Milan, Italy

Giancarlo Giudici

University of Loughborough, Loughborough, UK

Alistair Milne

University of Glasgow, Glasgow, UK

Dmitri Vinogradov

National Research University Higher School of Economics, Russian Federation, Perm, Russia

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Dmitri Vinogradov .

Ethics declarations

Conflict of interest.

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Giudici, G., Milne, A. & Vinogradov, D. Cryptocurrencies: market analysis and perspectives. J. Ind. Bus. Econ. 47 , 1–18 (2020). https://doi.org/10.1007/s40812-019-00138-6

Download citation

Received : 07 September 2019

Revised : 07 September 2019

Accepted : 11 September 2019

Published : 17 September 2019

Issue Date : March 2020

DOI : https://doi.org/10.1007/s40812-019-00138-6

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Cryptocurrencies

- Cryptoassets

JEL Classification

- Find a journal

- Publish with us

- Track your research

Financially Ever After: A Thesis on Cryptocurrency and the Global Financial Economy

91 Pages Posted: 27 Jul 2020

Eunice Mensah

Aix-Marseille University, Students

Date Written: June 26, 2020

This paper reveals the struggle for regulatory balance between ensuring progressive innovation and stifling fraudulent sophistry in the emerging disruptive blockchain economy. With a particular focus on cryptocurrencies, it envisions a practical solution in technological advancement that combines economic considerations and monetary policy in the roll-out of and implementation of a framework for the health of the financial economy - the Competitive Popularity Approach (CPA). The CPA framework is a three-part framework that draws from elements of market capitalisation, competitive business strategies and technological advancement to encourage innovation while maintaining regulatory supervision over the financial sector. It considers the possibility of harnessing technological advancement by providing a theoretical incentive for developing a multi-dimensional, self-regulating ecosystem through the promising potential of blockchain technology in order to achieve a semblance of the balance we desire. With the state adoption of the core tenets of this framework on a sufficiently international scale, the financial sector may witness an exponential transformation for the better. The framework essentially directs us to create, integrate and regulate. This may sound simple but is in fact a complex, intricate web of details which are not as easy to achieve. The paper discusses this framework in a manner that is neither perfect nor complete. At best, it could be described as skeletal. This is necessarily the consequence of the relatively nascent state of the technology in spite of its ground-breaking potential. There is still a lot about the technology that we have to uncover, uncertainties about the effectiveness of legal manoeuvres we have to experiment, and a number of factors we may have not even foreseen yet to even regard as worth considering. The debate has only just begun. Whether or not the blockchain economy will live up to the revolution it is predicted to create is still riddled with uncertainty. Yet regardless of what policymakers ultimately decide, there is no denying that this phenomenon is not disappearing anytime soon. It is hoped that the CPA framework will jumpstart a chain reaction for a discussion that will inspire us to take a step towards a bold new normal financially ever after.

Keywords: Cryptocurrency, Regulation, Blockchain.

Suggested Citation: Suggested Citation

Eunice Mensah (Contact Author)

Aix-marseille university, students ( email ).

20 Rue De Cuques, 13100 Aix en Provence, 13100 France

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, io: productivity, innovation & technology ejournal.

Subscribe to this fee journal for more curated articles on this topic

International Finance eJournal

Monetary economics: international financial flows, financial crises, regulation & supervision ejournal, other financial economics ejournal.

Help | Advanced Search

Computer Science > Cryptography and Security

Title: deciphering the blockchain: a comprehensive analysis of bitcoin's evolution, adoption, and future implications.

Abstract: This research paper provides a comprehensive analysis of Bitcoin, delving into its evolution, adoption, and potential future implications. As the pioneering cryptocurrency, Bitcoin has sparked significant interest and debate in recent years, challenging traditional financial systems and introducing the world to the power of blockchain technology. This paper aims to offer a thorough understanding of Bitcoin's underlying cryptographic principles, network architecture, and consensus mechanisms, primarily focusing on the Proof-of-Work model. We also explore the economic aspects of Bitcoin, examining price fluctuations, market trends, and factors influencing its value. A detailed investigation of the regulatory landscape, including global regulatory approaches, taxation policies, and legal challenges, offers insights into the hurdles and opportunities faced by the cryptocurrency. Furthermore, we discuss the adoption of Bitcoin in various use cases, its impact on traditional finance, and its role in the growing decentralized finance (DeFi) sector. Finally, the paper addresses the future of Bitcoin and cryptocurrencies, identifying emerging trends, technological innovations, and environmental concerns. We evaluate the potential impact of central bank digital currencies (CBDCs) on Bitcoin's future, as well as the broader implications of this technology on global finance. By providing a holistic understanding of Bitcoin's past, present, and potential future, this paper aims to serve as a valuable resource for scholars, policymakers, and enthusiasts alike.

| Subjects: | Cryptography and Security (cs.CR) |

| Cite as: | [cs.CR] |

| (or [cs.CR] for this version) | |

| Focus to learn more arXiv-issued DOI via DataCite |

Submission history

Access paper:.

- Other Formats

References & Citations

- Google Scholar

- Semantic Scholar

BibTeX formatted citation

Bibliographic and Citation Tools

Code, data and media associated with this article, recommenders and search tools.

- Institution

arXivLabs: experimental projects with community collaborators

arXivLabs is a framework that allows collaborators to develop and share new arXiv features directly on our website.

Both individuals and organizations that work with arXivLabs have embraced and accepted our values of openness, community, excellence, and user data privacy. arXiv is committed to these values and only works with partners that adhere to them.

Have an idea for a project that will add value for arXiv's community? Learn more about arXivLabs .

- Open access

- Published: 07 February 2022

Cryptocurrency trading: a comprehensive survey

- Fan Fang 1 , 2 ,

- Carmine Ventre 1 ,

- Michail Basios 2 ,

- Leslie Kanthan 2 ,

- David Martinez-Rego 2 ,

- Fan Wu 2 &

- Lingbo Li ORCID: orcid.org/0000-0002-3073-1352 2

Financial Innovation volume 8 , Article number: 13 ( 2022 ) Cite this article

94k Accesses

188 Citations

19 Altmetric

Metrics details

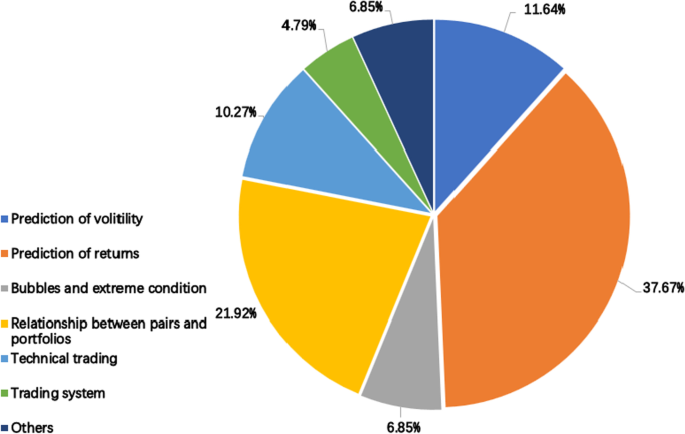

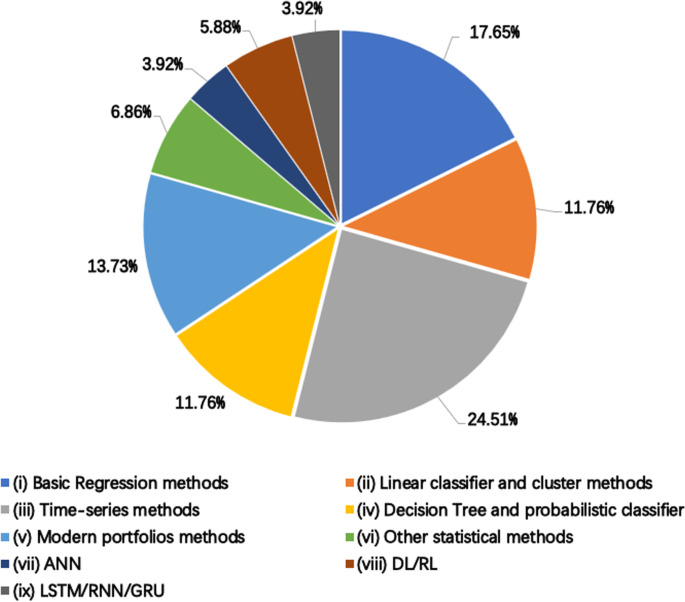

In recent years, the tendency of the number of financial institutions to include cryptocurrencies in their portfolios has accelerated. Cryptocurrencies are the first pure digital assets to be included by asset managers. Although they have some commonalities with more traditional assets, they have their own separate nature and their behaviour as an asset is still in the process of being understood. It is therefore important to summarise existing research papers and results on cryptocurrency trading, including available trading platforms, trading signals, trading strategy research and risk management. This paper provides a comprehensive survey of cryptocurrency trading research, by covering 146 research papers on various aspects of cryptocurrency trading ( e . g ., cryptocurrency trading systems, bubble and extreme condition, prediction of volatility and return, crypto-assets portfolio construction and crypto-assets, technical trading and others). This paper also analyses datasets, research trends and distribution among research objects (contents/properties) and technologies, concluding with some promising opportunities that remain open in cryptocurrency trading.

Introduction

Cryptocurrencies have experienced broad market acceptance and fast development despite their recent conception. Many hedge funds and asset managers have begun to include cryptocurrency-related assets into their portfolios and trading strategies. The academic community has similarly spent considerable efforts in researching cryptocurrency trading. This paper seeks to provide a comprehensive survey of the research on cryptocurrency trading, by which we mean any study aimed at facilitating and building strategies to trade cryptocurrencies.

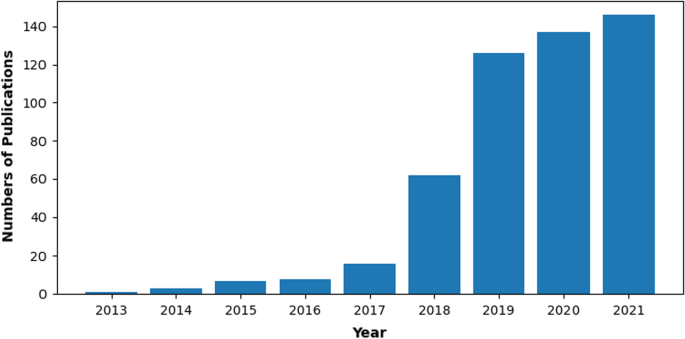

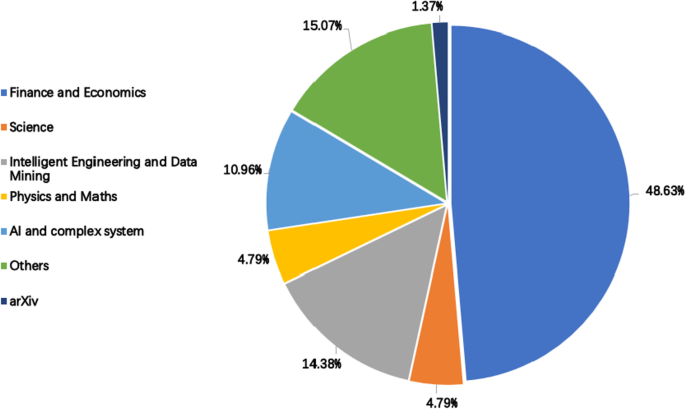

As an emerging market and research direction, cryptocurrencies and cryptocurrency trading have seen considerable progress and a notable upturn in interest and activity (Farell 2015 ). From Fig. 1 , we observe over 85% of papers have appeared since 2018, demonstrating the emergence of cryptocurrency trading as a new research area in financial trading. The sampling interval of this survey is from 2013 to June 2021.

The literature is organised according to six distinct aspects of cryptocurrency trading:

Cryptocurrency trading software systems (i.e., real-time trading systems, turtle trading systems, arbitrage trading systems);

Systematic trading including technical analysis, pairs trading and other systematic trading methods;

Emergent trading technologies including econometric methods, machine learning technology and other emergent trading methods;

Portfolio and cryptocurrency assets including research among cryptocurrency co-movements and crypto-asset portfolio research;

Market condition research including bubbles (Flood et al. 1986 ) or crash analysis and extreme conditions;

Other Miscellaneous cryptocurrency trading research.

In this survey we aim at compiling the most relevant research in these areas and extract a set of descriptive indicators that can give an idea of the level of maturity research in this area has achieved.

Cryptocurrency Trading Publications (cumulative) during 2013–2021(June 2021)

We also summarise research distribution (among research properties and categories/research technologies). The distribution among properties defines the classification of research objectives and content. The distribution among technologies defines the classification of methods or technological approaches to the study of cryptocurrency trading. Specifically, we subdivide research distribution among categories/technologies into statistical methods and machine learning technologies. Moreover, We identify datasets and opportunities (potential research directions) that have appeared in the cryptocurrency trading area. To ensure that our survey is self-contained, we aim to provide sufficient material to adequately guide financial trading researchers who are interested in cryptocurrency trading.

There has been related work that discussed or partially surveyed the literature related to cryptocurrency trading. Kyriazis ( 2019 ) investigated the efficiency and profitable trading opportunities in the cryptocurrency market. Ahamad et al. ( 2013 ) and Sharma et al. ( 2017 ) gave a brief survey on cryptocurrencies, merits of cryptocurrencies compared to fiat currencies and compared different cryptocurrencies that are proposed in the literature. Mukhopadhyay et al. ( 2016 ) gave a brief survey of cryptocurrency systems. Merediz-Solà and Bariviera ( 2019 ) performed a bibliometric analysis of bitcoin literature. The outcomes of this related work focused on specific area in cryptocurrency, including cryptocurrencies and cryptocurrency market introduction, cryptocurrency systems / platforms, bitcoin literature review, etc. To the best of our knowledge, no previous work has provided a comprehensive survey particularly focused on cryptocurrency trading.

In summary, the paper makes the following contributions:

Definition This paper defines cryptocurrency trading and categorises it into: cryptocurrency markets, cryptocurrency trading models, and cryptocurrency trading strategies. The core content of this survey is trading strategies for cryptocurrencies while we cover all aspects of it.

Multidisciplinary survey The paper provides a comprehensive survey of 146 cryptocurrency trading papers, across different academic disciplines such as finance and economics, artificial intelligence and computer science. Some papers may cover multiple aspects and will be surveyed for each category.

Analysis The paper analyses the research distribution, datasets and trends that characterise the cryptocurrency trading literature.

Horizons The paper identifies challenges, promising research directions in cryptocurrency trading, aimed to promote and facilitate further research.

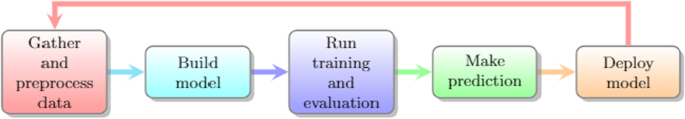

Figure 2 depicts the paper structure, which is informed by the review schema adopted. More details about this can be found in " Paper collection and review schema " section.

Tree structure of the contents in this paper

Cryptocurrency trading

This section provides an introduction to cryptocurrency trading. We will discuss Blockchain , as the enabling technology, cryptocurrency markets and cryptocurrency trading strategies .

Blockchain technology introduction

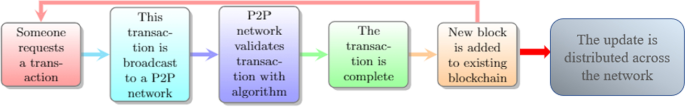

Blockchain is a digital ledger of economic transactions that can be used to record not just financial transactions, but any object with an intrinsic value (Tapscott and Tapscott 2016 ). In its simplest form, a Blockchain is a series of immutable data records with timestamps, which are managed by a cluster of machines that do not belong to any single entity. Each of these data block s is protected by cryptographic principle and bound to each other in a chain (cf. Fig. 3 for the workflow).

Cryptocurrencies like Bitcoin are conducted on a peer-to-peer network structure. Each peer has a complete history of all transactions, thus recording the balance of each account. For example, a transaction is a file that says “A pays X Bitcoins to B” that is signed by A using its private key. This is basic public-key cryptography, but also the building block on which cryptocurrencies are based. After being signed, the transaction is broadcast on the network. When a peer discovers a new transaction, it checks to make sure that the signature is valid (this is equivalent to using the signer’s public key, denoted as the algorithm in Fig. 3 ). If the verification is valid then the block is added to the chain; all other blocks added after it will “confirm” that transaction. For example, if a transaction is contained in block 502 and the length of the blockchain is 507 blocks, it means that the transaction has 5 confirmations (507–502) (Johar 2018 ).

Workflow of Blockchain transaction

From Blockchain to cryptocurrencies

Confirmation is a critical concept in cryptocurrencies; only miners can confirm transactions. Miners add blocks to the Blockchain; they retrieve transactions in the previous block and combine it with the hash of the preceding block to obtain its hash, and then store the derived hash into the current block. Miners in Blockchain accept transactions, mark them as legitimate and broadcast them across the network. After the miner confirms the transaction, each node must add it to its database. In layman terms, it has become part of the Blockchain and miners undertake this work to obtain cryptocurrency tokens, such as Bitcoin. In contrast to Blockchain, cryptocurrencies are related to the use of tokens based on distributed ledger technology. Any transaction involving purchase, sale, investment, etc. involves a Blockchain native token or sub-token. Blockchain is a platform that drives cryptocurrency and is a technology that acts as a distributed ledger for the network. The network creates a means of transaction and enables the transfer of value and information. Cryptocurrencies are the tokens used in these networks to send value and pay for these transactions. They can be thought of as tools on the Blockchain, and in some cases can also function as resources or utilities. In other instances, they are used to digitise the value of assets. In summary, cryptocurrencies are part of an ecosystem based on Blockchain technology.

Introduction of cryptocurrency market

What is cryptocurrency.

Cryptocurrency is a decentralised medium of exchange which uses cryptographic functions to conduct financial transactions (Doran 2014 ). Cryptocurrencies leverage the Blockchain technology to gain decentralisation, transparency, and immutability (Meunier 2018 ). In the above, we have discussed how Blockchain technology is implemented for cryptocurrencies.