Balanced Scorecard | Explained with Examples

The Balanced Scorecard is a strategic planning and management system used by organizations to align business activities with the vision and strategy of the organization, improve internal and external communications, and monitor organizational performance against strategic goals. It was originated by Dr. Robert S. Kaplan and Dr. David P. Norton in the early 1990s.

The Balanced Scorecard aims to provide a more comprehensive view of organizational performance beyond traditional financial measures by incorporating these additional perspectives. It serves as a framework for translating an organization’s strategic objectives into a coherent set of performance measures, providing a more balanced view of how well the organization is achieving its long-term goals.

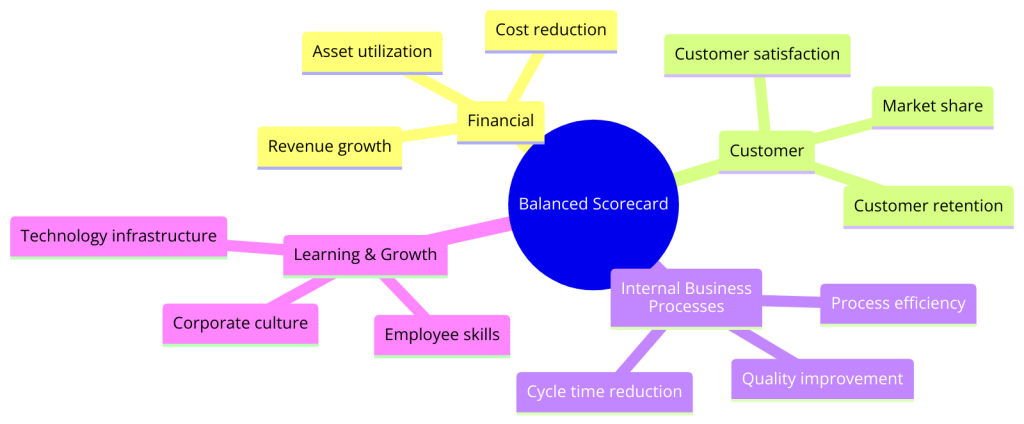

The Balanced Scorecard suggests that an organization is viewed from four perspectives and to develop metrics, collect data, and analyze it relative to each of these perspectives:

Financial Perspective

The Financial Perspective is one of the four pillars of the Balanced Scorecard, a strategic management tool that translates an organization’s mission and vision into a comprehensive set of performance metrics. The Financial Perspective focuses on the financial objectives of an organization and measures the economic consequences of actions taken in the other three perspectives (Customer, Internal Business Processes, and Learning and Growth).

The primary purpose of the Financial Perspective is to ensure that the company’s strategy, implementation, and execution contribute to bottom-line improvement. Traditional financial metrics like revenue growth, cost reduction, cash flow, and return on investment (ROI) are common in this perspective, but they are often complemented by more forward-looking indicators that can predict future financial performance.

Key Components of the Financial Perspective:

- Revenue Growth and Mix : This involves looking at the overall growth of revenue and analyzing the mix of revenue sources to ensure a diversified and sustainable income stream.

- Cost Management : This includes measures for controlling and reducing costs, improving operational efficiencies, and optimizing the use of resources.

- Asset Utilization : This involves metrics that assess how effectively the organization uses its assets to generate revenue. Examples include return on assets (ROA) and return on equity (ROE).

- Investment Strategy : This focuses on how capital investments support the organization’s long-term strategy. Metrics might include the payback period, internal rate of return (IRR), or the economic value added (EVA).

Importance:

The Financial Perspective is critical because it clearly shows whether the company’s strategy and operations contribute to bottom-line improvement. It ensures that strategic initiatives are financially viable and align with shareholder expectations. However, relying solely on financial measures can be misleading, as they often reflect past actions and decisions. This limitation is why the Balanced Scorecard includes non-financial perspectives to provide a more comprehensive view of the organization’s performance.

Integration with Other Perspectives:

The Financial Perspective is closely linked with the other perspectives of the Balanced Scorecard. For example:

- Customer Perspective : Satisfied and loyal customers often lead to better financial outcomes through repeat business and referrals, which can increase revenue and reduce marketing and sales costs.

- Internal Business Processes Perspective : Efficient and effective processes can lower operational costs, improve quality, reduce cycle times, and enhance productivity, all of which can positively impact the financial bottom line.

- Learning and Growth Perspective : Investments in employee development, organizational culture, and information systems can lead to innovations and improvements that drive long-term financial performance.

By integrating the Financial Perspective with the other perspectives, organizations can ensure a balanced approach to strategy execution that supports sustainable financial success.

Customer Perspective

The Customer Perspective is one of the four dimensions of the Balanced Scorecard. It is a strategic management tool that helps organizations translate their vision and strategy into action across four key areas: Financial, Customer, Internal Business Processes, and Learning and Growth. The Customer Perspective focuses on identifying and measuring the value delivered to customers, which is crucial for achieving financial success and sustainable growth.

Key Objectives of the Customer Perspective:

- Customer Satisfaction : Understanding and measuring how well the organization meets the expectations and needs of its customers. This can involve customer satisfaction scores, service quality assessments, and customer feedback.

- Customer Retention and Loyalty : Tracking the organization’s ability to retain customers over time, often reflected in customer loyalty rates, repeat purchase rates, and customer lifetime value. High retention rates indicate customer satisfaction, leading to increased revenue and reduced marketing costs.

- Market Share and Acquisition : Measuring the organization’s success in attracting new customers and expanding its presence in targeted market segments. This can involve tracking changes in market share, the effectiveness of marketing campaigns, and the rate of new customer acquisition.

- Customer Value Proposition : Ensuring the organization’s value proposition aligns with customer needs and preferences. This involves understanding what customers value most: price, quality, service, innovation, or something else, and ensuring that the organization delivers on these dimensions.

The Customer Perspective is critical because it focuses on the customer, who ultimately judges the company’s products and services. In many industries, especially those with high competition, attracting, satisfying, and retaining customers is a crucial determinant of financial performance. Furthermore, by focusing on customer needs and expectations, organizations can identify new opportunities for growth and innovation.

- Financial Perspective : Satisfied and loyal customers often lead to better financial outcomes, such as increased revenue from repeat purchases, higher transaction values, and lower costs associated with customer acquisition and retention.

- Internal Business Processes Perspective : To deliver the value that customers expect, organizations need to excel at internal processes such as product development, manufacturing, delivery, and after-sales service. Improvements in these areas can enhance customer satisfaction and loyalty.

- Learning and Growth Perspective : Developing the skills and capabilities of employees, fostering a customer-centric culture, and investing in technology and systems that improve customer interactions are all critical for delivering value to customers. This perspective supports the organization’s ability to innovate and adapt to changing customer needs.

Metrics and Measures:

To manage the customer perspective effectively, organizations typically use a variety of metrics, such as Net Promoter Score (NPS), customer satisfaction indices, customer complaint rates, customer retention rates, and market share growth. These metrics help organizations track their performance from the customer’s viewpoint and identify areas for improvement.

By prioritizing the Customer Perspective within the Balanced Scorecard framework, organizations can ensure that their strategic objectives are aligned with customer needs and expectations, driving both customer and financial success.

Internal Business Processes

The Internal Business Processes perspective is one of the four components of the Balanced Scorecard, a strategic management tool designed to provide a comprehensive framework for translating an organization’s vision and strategy into a coherent set of performance measures. This perspective focuses on the critical internal operations and processes an organization must excel at to meet its customer and financial objectives effectively.

Key Objectives of the Internal Business Processes Perspective:

- Operational Efficiency : This involves measuring and improving the efficiency of internal processes, which can include reducing cycle times, minimizing waste, and optimizing resource utilization. The goal is to deliver products and services faster, cost-effectively, and with higher quality.

- Process Quality : Ensures that internal processes can produce outputs that meet quality standards, leading to higher customer satisfaction and lower costs related to rework or defects.

- Innovation and Product Development : Focuses on the organization’s ability to develop new products and services, improve existing offerings, and bring these to market quickly. This can involve measures related to the number of new product launches, the success rate of new products, and the percentage of revenue from new products.

- Supply Chain Management : Optimizes the flow of materials, information, and finances as they move from supplier to manufacturer to wholesaler to retailer to consumer. Effective supply chain management can reduce costs, improve flexibility, and enhance customer satisfaction.

The Internal Business Processes perspective is crucial because it directs attention to the processes that impact customer satisfaction and the organization’s ability to achieve its financial objectives. By focusing on internal processes, organizations can identify inefficiencies and bottlenecks, improve quality, and drive innovation, all contributing to competitive advantage and long-term success.

- Customer Perspective : Excellence in internal processes directly impacts the quality, cost, and delivery of products and services, affecting customer satisfaction and loyalty. By improving internal processes, organizations can better meet customer needs and expectations.

- Financial Perspective : Efficient and effective internal processes can lead to lower operational costs, higher productivity, and improved profitability. Organizations can enhance their financial performance by reducing waste and improving process efficiency.

- Learning and Growth Perspective : The ability to improve internal processes often depends on the skills, knowledge, and capabilities of employees, as well as the organization’s culture and information systems. Investments in training, technology, and organizational culture can support continuous improvement and innovation in internal processes.

To manage and improve internal business processes, organizations might use a variety of metrics, such as:

- Cycle Time : The time required to complete a process from start to finish.

- Cost per Unit : The cost associated with producing a single unit of product or service.

- Defect Rates : The frequency of errors or defects in the outputs of a process.

- Process Throughput : The work or products produced within a given period.

- Capacity Utilization : The extent to which an organization’s total production capacity is used.

These metrics help organizations monitor their internal processes’ efficiency and effectiveness, identify improvement areas, and track progress over time.

By focusing on the Internal Business Processes perspective within the Balanced Scorecard framework, organizations can ensure that their internal operations are aligned with strategic objectives, contributing to overall performance and success.

Learning and Growth

The Learning and Growth perspective, also known as the “Organizational Capacity” perspective, is one of the four pillars of the Balanced Scorecard framework. This dimension focuses on the intangible assets of an organization, primarily its people, systems, and organizational procedures. The core idea is that long-term success is achieved through continuous improvement and the capability to innovate and change in alignment with market demands and opportunities.

Key Objectives of the Learning and Growth Perspective:

- Employee Skills and Knowledge : Emphasizes the importance of ongoing employee training and development to ensure the workforce has the necessary skills and knowledge to meet current and future demands. This includes technical skills relevant to specific job functions and soft skills facilitating effective communication, teamwork, and leadership.

- Employee Satisfaction and Retention : Recognizes that employee engagement and morale are critical to productivity and innovation. High employee satisfaction and retention rates indicate a positive organizational culture supporting personal and professional growth.

- Information Systems and Technology : Focuses on the role of technology in enabling efficient and effective business processes. This includes the hardware and software used by the organization and the systems and processes that ensure information is accurately captured, stored, and made accessible to decision-makers.

- Organizational Culture and Alignment : Pertains to creating a culture that supports the organization’s strategic objectives, encourages open communication, and fosters a sense of shared purpose among employees. Alignment ensures that everyone works towards the same goals and understands how their role contributes to the broader strategy.

The Learning and Growth perspective is essential for creating the foundation for achieving excellence in the other three Balanced Scorecard perspectives (Financial, Customer, and Internal Business Processes). It recognizes that an organization’s ability to innovate, improve, and meet customer needs over the long term depends on its people, systems, and procedures.

- Internal Business Processes : A skilled and knowledgeable workforce, supported by efficient information systems, can enhance process efficiencies, drive innovation, and improve quality, directly impacting operational performance.

- Customer Perspective : Engaged and well-trained employees are more likely to deliver superior customer service and contribute to developing products and services that meet evolving customer needs, thus enhancing customer satisfaction and loyalty.

- Financial Perspective : Investments in learning and growth initiatives can lead to long-term financial benefits, such as increased productivity, reduced operational costs, and enhanced revenue growth through innovation and improved customer satisfaction.

To manage the Learning and Growth perspective, organizations might use metrics such as:

- Employee Training Hours : The average number of training hours per employee, indicating the organization’s commitment to employee development.

- Employee Satisfaction and Engagement Scores : Regular surveys gauge how motivated, engaged, and satisfied employees are with their work and work environment.

- Turnover Rates : Particularly voluntary turnover rates, which can indicate the overall health of the organization’s culture and the effectiveness of its retention strategies.

- Technology ROI : The return on investment for technology initiatives, measuring how effectively technology investments support business objectives and process improvements.

By focusing on the Learning and Growth perspective within the Balanced Scorecard, organizations can invest in the capabilities and systems that will enable them to adapt, grow, and achieve long-term success.

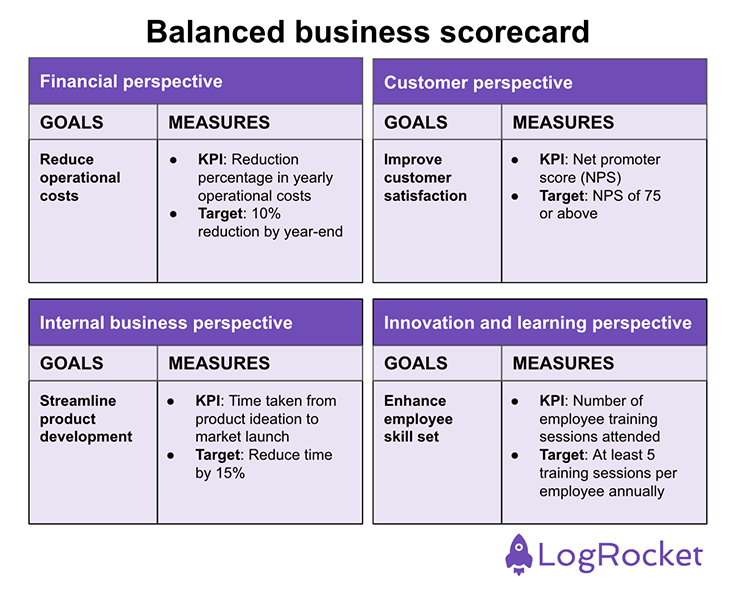

Examples of balanced scorecard

To illustrate the Balanced Scorecard approach, here are examples for each of the four perspectives:

- Revenue Growth : Measures the year-over-year increase in income generated from the organization’s activities.

- Cost Reduction : Targets specific areas where operational costs can be minimized without affecting product or service quality.

- Return on Investment (ROI) : Calculates the efficiency of various investments in terms of their generated returns.

- Cash Flow Analysis : Evaluate the inflows and outflows of cash, ensuring the organization maintains a healthy liquidity position.

- Customer Satisfaction Index : Surveys and feedback tools measure customers’ satisfaction with the products, services, and overall experience.

- Market Share : Assesses the company’s proportion of total sales in its industry, indicating competitive strength.

- Customer Retention Rate : Measures the percentage of customers the company retains over a certain period, reflecting customer loyalty and satisfaction.

- Net Promoter Score (NPS) : Gauges customer loyalty by asking how likely customers are to recommend the company to others.

Internal Business Processes Perspective

- Quality Control Metrics : Monitors defect rates, rework levels, and adherence to quality standards.

- Cycle Time : Measures the time required to complete a business process from start to finish, aiming to increase efficiency.

- Process Cost : Analyzes the cost associated with each critical process, identifying opportunities for cost-saving improvements.

- Innovation Pipeline Strength : Evaluates the number and potential of new ideas or projects in development, indicating the organization’s future growth prospects.

Learning and Growth Perspective

- Employee Turnover Rate : Monitors the rate at which employees leave the organization, indicating the overall work environment and employee satisfaction.

- Training Hours per Employee : Measures the investment in employee development, correlating with improved performance and innovation.

- Skill Assessments : Regular assessments to ensure employees have the necessary skills and competencies for their roles and future company needs.

- Employee Engagement Scores : Surveys to gauge employee engagement and identify areas for improvement in the organizational culture.

These examples show how a Balanced Scorecard might be implemented in an organization. The specific metrics can vary significantly depending on the industry, the organization’s strategic goals, and challenges.

Related Posts

How to Enjoy Success in the Amazon Marketplace

How To Write A Comprehensive Business Plan For Your Startup

Corporate Governance

Strategy vs Strategic planning

Mapping Strategy

Cost reduction strategies in business

Loss Leader Pricing Strategy: Explained with Examples

Volume Discount Pricing Strategy

Type above and press Enter to search. Press Esc to cancel.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Balanced scorecard

- Strategic analysis

How to Implement a New Strategy Without Disrupting Your Organization

- Robert S. Kaplan

- David P. Norton

- From the March 2006 Issue

Putting the Balanced Scorecard to Work

- From the September–October 1993 Issue

Coming Up Short on Nonfinancial Performance Measurement

- Christopher D. Ittner

- David F. Larcker

- From the November 2003 Issue

Using the Balanced Scorecard as a Strategic Management System

- From the July–August 2007 Issue

Measuring the Strategic Readiness of Intangible Assets

- February 01, 2004

Having Trouble with Your Strategy? Then Map It

- From the September–October 2000 Issue

8 Reasons Companies Don't Capture More Value

- Stefan Michel

- April 08, 2015

The Office of Strategy Management

- From the October 2005 Issue

How To Measure Your Company's Risk in a Downturn

- December 19, 2008

The Balanced Scorecard: Measures That Drive Performance

- From the July–August 2005 Issue

Lean Strategy

- David J. Collis

- From the March 2016 Issue

Managing Alliances with the Balanced Scorecard

- Bjarne Rugelsjoen

- From the January–February 2010 Issue

The Best-Performing CEOs in the World

- Morten T. Hansen

- Herminia Ibarra

- From the January–February 2013 Issue

Using Scorecards for Governance in the Corporate and Public Sector

- September 29, 2008

Having Trouble with Your Strategy? Then Map It (HBR OnPoint Enhanced Edition)

- October 01, 2000

Saving Money, Saving Lives

- Jon Meliones

- From the November–December 2000 Issue

The Explainer: The Balanced Scorecard

- October 14, 2014

The Emerging Capital Market for Nonprofits

- Allen S. Grossman

- From the October 2010 Issue

The Balanced Scorecard—Measures that Drive Performance

- From the January–February 1992 Issue

Building a Game-Changing Talent Strategy

- Douglas A. Ready

- Linda A. Hill

- Robert J. Thomas

- From the January–February 2014 Issue

AARP Foundation (B)

- Srikant M. Datar

- Marc J. Epstein

- Herman B. Leonard

- Thomas F. Goodwin

- June 25, 2007

Performance Management at Afreximbank (B)

- Siko Sikochi

- Anna Ngarachu

- Namrata Arora

- February 08, 2023

Chemical Bank: Implementing the Balanced Scorecard

- Norman Klein

- February 17, 1995

America Online, Inc.

- Krishna G. Palepu

- Amy P. Hutton

- February 13, 1996

HBR'S 10 Must Reads: The Essentials (Paperback + Ebook)

- Harvard Business Review

- Peter F. Drucker

- Clayton M. Christensen

- Michael E. Porter

- Daniel Goleman

- November 08, 2010

China Resources Corp. (A): 6S Management

- Dennis Campbell

- October 18, 2006

Compagnie Lyonnaise de Transport (A)

- Michael J. Roberts

- Michael L. Tushman

- May 07, 2001

Mobil USM&R (A1)

- June 26, 1997

Strategy That Works: How Winning Companies Close the Strategy-to-Execution Gap

- Paul Leinwand

- Cesare Mainardi

- February 02, 2016

Implementing a Three-Level Balanced Scorecard System at Chilquinta Energía

- Paulina Arroyo

- Marlei Pozzebon

- May 15, 2010

The Workforce Scorecard: Managing Human Capital to Execute Strategy

- Mark A. Huselid

- Brian E. Becker

- Richard W. Beatty

- March 14, 2005

Mobil USM&R (A): Linking the Balanced Scorecard

- September 05, 1996

Montefiore Medical Center

- Noorein Inamdar

- March 29, 2001

Angus Cartwright, III

- Kenneth J. Hatten

- William J. Poorvu

- Howard H. Stevenson

- Arthur I Segel

- John H. Vogel Jr.

- June 01, 1975

Media General and the Balanced Scorecard (B)

- Mark E. Haskins

- Darrell Eakes

- June 05, 2008

Strategic Performance Measurement of Suppliers at HTC

- Neale O'Connor

- Shannon Anderson

- June 09, 2011

- Lawrence P. Carr

- November 06, 2003

Breaking Bad Habits: Defy Industry Norms and Reinvigorate Your Business

- Freek Vermeulen

- November 14, 2017

First Commonwealth Financial Corp.

- November 04, 2003

China Lodging Group (A)

- Tatiana Sandino

- Shelley Xin Li

- Nancy Hua Dai

- July 01, 2015

ECI’s Balanced Business Scorecard

- July 01, 2005

Target Setting

- May 14, 2006

Popular Topics

Partner center.

- Pricing Customers Get a Demo

- Platform Data Reporting Analytics Collaboration Security Integrations

- Solutions Strategic Planning Organizational Alignment Business Reporting Dashboards OKRs Project Management

- Industries Local Government Healthcare Banking & Finance Utilities & Energy Higher Education Enterprise

8 Real-Life Balanced Scorecard Examples

Tricia Jessee

Tricia manages our implementation and onboarding team to ensure the success of ClearPoint customers.

Proof that the Balanced Scorecard is the right strategy management framework for you

Table of Contents

You already know that the Balanced Scorecard (BSC) is an extremely popular strategic framework—but you may be wondering, “Will it actually help my organization get the results we want?” That’s a fair question, and before you commit to an overhaul of your current strategy, you’ll want to see some real-life Balanced Scorecard examples.

Well, you’re in luck! Because below, we’ll discuss eight real organizations that have used the BSC—or some variation of it—to grow their company and their strategic success.

1. The Boys & Girls Clubs Of Puerto Rico (BGCPR)

In Puerto Rico, 57% of the island’s one million youth live below the poverty line. The BGCPR offers these young people the hope of a better future. Just over a decade ago, BGCPR nearly shut their doors due to an economic downturn. That’s when the CEO and president got to work restructuring the nonprofit and decided to adopt the Balanced Scorecard to manage their strategy and revitalize their organization. Their scorecard helped them establish managerial discipline and promote cultural change, leading to their rapid growth. Today, BGCPR has 11 facilities!

Read the full BGCPR case study .

2. Durham, North Carolina

For years, the city of Durham operated without a strategic plan. But during the economic downturn and with budgets cuts, Durham’s city manager convinced elected officials that the time was right to commence the strategic planning process. With a scorecard, the city of Durham was able to make more data-driven decisions and collaborate with the county government, enabling the two governments to pool resources, reduce or eliminate duplication of effort, and deliver a higher level of service to Durham residents.

Read the full Durham, North Carolina, case study .

3. Fort Lauderdale, Florida

After the recession, Fort Lauderdale needed to manage costs in a way that balanced strategic cuts with strategic investments. In response, the Fort Lauderdale city manager created an office to oversee the development of the city’s first-ever strategic plan and to manage process improvement. Fort Lauderdale residents were asked for ideas about how to improve the city over the next 25 years. This information, combined with internal goals, resulted in a new strategic system that connected departments through scorecards and presented them publicly in an unprecedented show of transparency.

Read the full Fort Lauderdale, Florida, case study .

4. LSU College Of Engineering

When Richard Koubek became dean of the LSU College of Engineering, he set forth Vision 2015, the college’s five-year strategic plan. This new scorecard-driven management process has propelled the college ahead in all of its strategies.

One area that has benefited greatly is the college’s external partnerships. Because the College delivered on its promise to provide Louisiana businesses and employers with first-rate engineers, the state’s economic development organizations have used LSU engineering as a magnet to recruit businesses to the state. IBM even opened a services venture in Baton Rouge.

Since implementing Vision 2015, enrollment for the College of Engineering is up 41% (twice the national average), and LSU now has the fifth fastest-growing engineering college in the United States.

Read the full LSU College of Engineering case study .

Rare began using the Balanced Scorecard to measure and manage its performance. With measures at the heart of its operations, this global conservation nonprofit has been able to achieve greater transparency and accountability—while expanding its scale, reach, and impact. With its scorecard in place, Rare has been able to draw upon its metrics to report biological impacts to constituents and to the public—something they couldn’t dream of before their scorecard implementation.

Rare’s strategy management process has helped the organization clarify its focus, and the organization’s metrics have played an important part in engaging donors. Within five years, Rare has gone from a $9 million per year operation to more than $20 million per year and has been named one of the top 100 NGOs in the world.

Read the full Rare case study .

6. Pacific Gas & Electric (PG&E)

PG&E wanted to present their data in a high-level view with the ability to drill down—and found their solution in the Balanced Scorecard. PG&E was able to use Balanced Scorecard (BSC) software to customize with their branding and design elements, and update their scorecard pages to allow for period comparisons. Each page is completely customized to their liking and includes current results, year-to-date and end-of-year data, and other forecast targets.

Read the full PG&E case study .

7. SBS Group

SBS Group—a consulting and IT services organization—needed a system to construct its strategic plan, manage initiatives and measures, and cascade to the field level, and knew the Balanced Scorecard could manage all of these areas.

Using scorecard software, SBS group was able to migrate their Excel-based scorecards into scorecard software, which provided a number of benefits. They could manage cross-scorecard collaboration, information sharing, employee-scorecard linkages, and more. They were also able to set up scorecards according to their preferences, define measures, and create initiatives. Altogether, SBS Group’s scorecarding capability has helped them assess and prioritize their initiatives.

Read the full SBS Group case study .

8. Certified Financial Analyst (CFA) Institute

The CFA team embarked on an effort to update the organization’s long-term strategy involving the entire organization and were able to advance their strategy, integrate their scorecard, and create a change agenda, workplans, and multi-year, high-level metrics. With the help of their scorecard, they were able to get leadership on board with aligning strategy and operations, and employees invested in CFA’s mission.

Read the full CFA Institute case study .

Download Now: Balanced Scorecard Excel Template

All eight of these organizations were able to see strategic success using the Balanced Scorecard framework . If you want to test the waters and build out a simple scorecard before committing to something more substantial. Try us out today!

How can a balanced scorecard help an organization?

A balanced scorecard helps an organization by providing a comprehensive framework that aligns business activities with the organization's vision and strategy. It facilitates performance measurement across multiple perspectives, such as financial, customer, internal processes, and learning and growth. This holistic approach ensures balanced consideration of all key areas, improves strategic planning, enhances communication, and drives organizational performance.

How does a balanced scorecard work?

A balanced scorecard works by translating an organization's strategic objectives into a set of performance measures across four perspectives:

- Financial: Measures financial performance and profitability. - Customer: Assesses customer satisfaction and market share. - Internal Processes: Evaluates the efficiency and quality of internal operations. - Learning and Growth: Focuses on employee development and organizational innovation. These measures are tracked and analyzed to monitor progress toward strategic goals, identify areas for improvement, and ensure that all parts of the organization are aligned with its strategic vision.

How do you create a balanced scorecard in Excel?

To create a balanced scorecard in Excel:

- Define Objectives: Identify the strategic objectives for each of the four perspectives (Financial, Customer, Internal Processes, Learning and Growth). - Develop Metrics: Establish specific, measurable metrics for each objective. - Set Targets: Determine target values for each metric to define success. - Collect Data: Gather the necessary data to measure performance against the metrics. - Create the Template: Set up an Excel template with columns for objectives, metrics, targets, actual performance, and status indicators. - Input Data: Enter the collected data into the template. -Analyze and Visualize: Use Excel features such as charts and conditional formatting to visualize performance and highlight areas needing attention. - Review and Adjust: Regularly update the scorecard and review progress, making adjustments as needed.

What is a balanced scorecard example?

A balanced scorecard example could look like this:

- Financial Perspective: Objective: Increase revenue growth Metric: Revenue growth rate Target: 10% annual increase Actual: 8% increase

- Customer Perspective: Objective: Improve customer satisfaction Metric: Customer satisfaction score Target: 90% Actual: 85%

- Internal Processes Perspective: Objective: Enhance operational efficiency Metric: Average processing time Target: 3 days Actual: 4 days

- Learning and Growth Perspective: Objective: Foster employee development Metric: Employee training hours Target: 40 hours per year Actual: 35 hours per year Each perspective includes specific objectives, metrics, targets, and actual performance, providing a comprehensive view of the organization's strategic performance.

Latest posts

The ClearPoint Strategy Success Framework: Managing Projects

The ClearPoint Strategy Success Framework: Aligning Organizations

The ClearPoint Strategy Success Framework: Organizing Strategy

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

What is a balanced scorecard? Examples and template

Some managers may choose to focus on financial data to measure success. Others may focus on operational processes or customer satisfaction.

Instead of focusing on measuring only one aspect of a business, the balanced scorecard takes a holistic approach.

After all, a single measure can’t accurately represent all elements of a business. By using a scorecard, managers can get a balanced view of financial performance, operational processes, and customer satisfaction.

What is a balanced scorecard?

A balanced scorecard provides a comprehensive overview of how a company is performing currently. It takes into account finances, operational processes, customer satisfaction, and employee performance. Using a balanced scorecard can help managers find issues and improve business outcomes.

Ultimately, a balanced scorecard is a tool to help drive strategy, implement business actions, and improve financial performance.

What are the benefits of a balanced scorecard approach?

A balanced scorecard seeks to uncover the answers to four questions:

- How do customers see us?

- What must we excel at?

- Can we continue to improve and create value?

- How do we look to shareholders?

Here are a few more benefits of using a balanced scorecard:

Improves focus

Puts all measures in one document, forces consideration of all operational measures, improves communication with senior managers, removes control bias.

The balanced scorecard forces managers to choose only a few critical measures to determine performance. Many companies suffer from data overload and don’t know how to glean actionable insights from all of the data they collect. A balanced scorecard provides only key information, which helps you to avoid getting bogged down with too many numbers and figures.

Since balanced scorecards focus on critical data, it makes it easier to bring several elements into a single management report. A balanced scorecard contains everything a manager needs to make informed decisions. It can help managers focus on customer-oriented products, improve quality, and better internal processes.

Because operations, finances, and customer satisfaction are presented together, you’re forced to consider how each aspect affects the other. Sometimes, you might make a decision purely on financial data without considering that the result may lead to poorer internal processes and lower customer satisfaction. A balanced scorecard helps prevent this scenario because the data is available to you.

Implementing the balanced scorecard is hard to do without involving senior management. These people often have a better understanding of the company’s vision and processes. This improvement in communication often helps remove underlying assumptions about a company’s performance and goes beyond only focusing on financials.

Traditional performance management measures are designed to dictate what they want employees to do and gauge whether they are doing it. This approach doesn’t always work well in modern business because the standard way of doing things may become obsolete within a year.

Over 200k developers and product managers use LogRocket to create better digital experiences

Instead, the balanced scorecard puts vision and strategy at the center. It works to establish goals and pull employees toward a shared company vision. The balanced scorecard lets managers view interrelationships and lets employees determine the best course of action to meet company goals.

What are the 4 perspectives of a balanced scorecard?

The balanced scorecard is comprised of four perspectives:

Financial perspective

Customer perspective, internal process perspective, learning and growth perspective.

Each perspective focuses on a different aspect of an organization’s business strategy. Let’s dig a little deeper into what these perspectives provide to the balanced scorecard:

The financial perspective hones in on how the company looks to shareholders. Assuring shareholders they are receiving a return on their investment is crucial to the growth of the company. Executives may analyze data regarding the company’s financial performance and determine whether the company is profitable and make adjustments for improvement.

To sell your product or service, customers need to have a desire satisfied. The customer perspective determines customer satisfaction with the company’s current products and services. The more satisfied the customers are, the more likely they are to stay customers.

Data collected for this perspective can include customer feedback and competitor analysis. Based on the results, you can start to offer new products, promote high-satisfaction features, or improve product quality.

A proper analysis of business processes answers what you are good at doing and what you are bad at doing. Finding these answers can help you fix issues with bottlenecks, product delays, and other performance problems. It can also help you determine core competencies.

Essentially, this perspective aims to find opportunities to run at maximum efficiency.

Also known as the organizational capacity perspective, this area focuses on employees and their ability to produce work that improves and creates value for the company. It examines whether employees are receiving the training and resources they need to do their job. It also analyzes company culture and leadership performance.

More great articles from LogRocket:

- How to implement issue management to improve your product

- 8 ways to reduce cycle time and build a better product

- What is a PERT chart and how to make one

- Discover how to use behavioral analytics to create a great product experience

- Explore six tried and true product management frameworks you should know

- Advisory boards aren’t just for executives. Join LogRocket’s Content Advisory Board. You’ll help inform the type of content we create and get access to exclusive meetups, social accreditation, and swag.

Balanced scorecard examples

Let’s look at a couple of real-world examples of balanced scorecards:

Case study 1: Improving financial performance with a balanced scorecard

A company is looking for ways to improve its financial performance. However, it focuses purely on financial metrics to make these evaluations. This means they miss out on discovering how internal processes, customer satisfaction, and employee productivity can have an impact on its bottom line.

By taking a balanced scorecard approach, it notices an opportunity to use the excess capability to market its existing products to a new, relevant audience. This adds revenue to the company with only moderate expenses. Periodic financial reports prove that this new campaign improved sales and overall market share.

Case study 2: Enhancing customer satisfaction through a balanced scorecard approach

In this example, a company has made vast improvements in its delivery performance and overall product quality. But over the course of three years, the company didn’t have financial improvement and saw its value go down.

So what happened? By using the balanced scorecard, the company can notice that it failed to recognize the aspect of customer satisfaction and the demand for new products. Executives will need to rethink their strategy and consider the ways it can better meet the needs of their customers.

How to create a balanced scorecard (with template)

To make your own balance scorecard, follow these eight steps:

- Define purpose — Determine what you want to achieve with a balanced scorecard and identify the business unit you will be analyzing

- Interview senior managers — The facilitator will interview senior managers to get their perspectives on the company’s strategic goals and performance measures

- Discuss with executive management — Top management will define the mission and strategy as well as what measures will be used to determine success

- Interview senior managers — Senior managers are interviewed a second time to review and consolidate input to create a first draft of the balanced scorecard

- Hold a manager workshop — All levels of managers gather to discuss the mission, strategy, and the first draft of the balanced scorecard. They may begin to implement an action plan or create stretch performance goals

- Hold a senior executive workshop — Senior executives approve of the balanced scorecard and develop stretch performance goals for measures

- Initiate an action plan — Based on the balanced scorecard, an implementation plan is created and communicated to everyone in the organization

- Review balanced scorecard — The balanced scorecard is not a one-and-done plan or a long-term goal list; it needs to have periodic reviews to ensure management is properly using excess capacity or removing it. Otherwise, operational improvements won’t help the bottom line

When everything is said and done, your balanced scorecard should look something like this:

Keep in mind, even the most efficient balanced scorecard doesn’t guarantee success. It only takes a company’s strategy and turns it into a measurable action plan. However, you can make better-informed decisions when it takes into account all variables of the scorecard instead of only focusing on one or two aspects.

A balanced scorecard creates value for the average employee. The measures are designed to motivate employees to fulfill the company’s strategic vision. While the balanced scorecard establishes goals, it leaves employees and managers to adopt behaviors and actions they deem appropriate to reach those goals.

This approach provides flexibility in a work environment that is constantly changing and evolving. Since the goals are created in a holistic manner, it will ideally lead to better financial performance as the company improves operations, customer satisfaction, and employee productivity.

Featured image source: IconScout

LogRocket generates product insights that lead to meaningful action

Get your teams on the same page — try LogRocket today.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #product strategy

Stop guessing about your digital experience with LogRocket

Recent posts:.

How PMs can best work with UX designers

With a well-built collaborative working environment you can successfully deliver customer centric products.

Leader Spotlight: Evaluating data in aggregate, with Christina Trampota

Christina Trampota shares how looking at data in aggregate can help you understand if you are building the right product for your audience.

What is marketing myopia? Definition, causes, and solutions

Combat marketing myopia by observing market trends and by allocating sufficient resources to research, development, and marketing.

Leader Spotlight: How features evolve from wants to necessities, with David LoPresti

David LoPresti, Director, U-Haul Apps at U-Haul, talks about how certain product features have evolved from wants to needs.

Leave a Reply Cancel reply

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is a Balanced Scorecard?

- 26 Oct 2023

Think of your business’s most valuable assets. Talented employees, customer relationships, brand loyalty, research capabilities, and a strong company culture may come to mind. Yet, the things that often create the most value are intangible and difficult to measure and track.

When crafting business strategy , you must account for intangibles and give them as much weight as financial goals. In the online course Strategy Execution , Harvard Business School Professor Robert Simons introduces the concept of the balanced scorecard to help you do just that.

Here’s a primer on the balanced scorecard and three steps to apply it to your organizational strategy.

Access your free e-book today.

The balanced scorecard is a tool designed to help track and measure non-financial variables. Developed in 1992 by HBS Professor Robert Kaplan and David Norton, it captures value creation’s four perspectives.

“The balanced scorecard combines the traditional financial perspective with additional perspectives that focus on customers, internal business processes, and learning and development,” Simons says in Strategy Execution . “These additional perspectives help businesses measure all the activities essential to creating value.”

The four perspectives include:

- Financial perspective: Do your plans and processes lead to desired levels of economic value creation? Metrics include sales revenue, operating expenses, net income, and investment in assets.

- Customer perspective: Does your target audience perceive your product, services, and brand in the desired way? Metrics include quality, delivery speed, and customer service experience.

- Internal business process perspective: Do your organizational processes create value for customers? Metrics to track are related to operations and customer management, innovation, regulatory, and social processes.

- Learning and growth perspective: Does your organization support and utilize human capital and infrastructure resources to meet goals? Areas to consider are human capital (people, talent, and knowledge), information capital (databases, networks, and technology), and organizational capital (leadership capabilities and cultural alignment to company goals), each with its own set of metrics.

You should use the balanced scorecard in tandem with a strategy map , a visual way to illustrate the cause-and-effect relationships underpinning your business strategy.

“Without a strategy map, what you’re calling a balanced scorecard is really just a list of measures,” Simons says in Strategy Execution. “And those measures may or may not tie back to your intended strategy. Without a strategy map to tell the story, people in your organization will have no clue where those measures came from.”

The purpose of a balanced scorecard is to add actions to your strategy map and clarify which goals make others possible.

To get started, here are three steps to crafting your organization’s strategy map and balanced scorecard.

Related: How One Television Producer Is Putting Her Strategy Execution Skills into Action

How to Create a Balanced Scorecard: 3 Steps

1. craft a strategy map.

Before creating your balanced scorecard, you must craft a strategy map to base it on. Start by listing the scorecard’s four perspectives in this order:

- Financial perspective

- Customer perspective

- Process perspective

- Learning and growth perspective

“Learning and growth” will be the foundation, so position it at the bottom of your strategy map.

Next, list your goals in each category using action verbs. What do you intend on doing? For example, in the “learning and growth” category, you could write “train staff on a new content management system.” Next to “customer perspective,” you could write “increase customer satisfaction.”

These goals are what Simons calls “critical performance variables.” For your strategy to succeed, you must achieve them.

“This exercise is asking you to imagine what variables are so serious that—if you failed to deliver on them—you could imagine your entire strategy collapsing,” Simons says in Strategy Execution . “These are the critical performance variables that you must monitor if you want your business to succeed.”

Finally, draw arrows pointing upward between each perspective category, so “learning and growth” points to “process,” which points to “customer,” which points to “financial.”

“The arrows are the most important part of a strategy map,” Simons says in the course. “They reveal cause-and-effect relationships so that everyone in a business can understand the theory of value creation. The outputs from one stage are the inputs to the next.”

2. Select Measures

Once you’ve created your strategy map, start your balanced scorecard by selecting how you’ll measure progress for each objective.

Assess measures using three questions:

- Does the measure link to my strategy map?

- Is it objective, complete, and responsive?

- Does it link to economic value?

For example, if your objective is to “increase customer satisfaction,” measures could include:

- Number of referrals

- Number and speed of resolved support tickets

- Number of testimonials

- Net promoter score (NPS)

Link these measures to the goal in the strategy map to objectively measure, change, and tie them to your organization’s economic value.

Selecting the right measures is critical because, as the balanced scorecard’s creators note in the Harvard Business Review , “What you measure is what you get.”

“You can have the best strategy in the world,” Simons says in Strategy Execution . “You can communicate that strategy to employees in different ways—town hall meetings, videos, company newsletters. But at the end of the day, what everyone pays attention to is what they're measured on. So, you need to be sure that measures throughout the business reflect your strategy, so that every employee will devote their efforts to implementing that strategy.”

However you decide to measure objectives is where your team will focus its efforts, so choose wisely.

Related: 5 Strategy Execution Skills Every Business Leader Needs

3. Set Targets

The final step to creating your balanced scorecard is setting targets. What metrics must you hit to achieve your goals using your selected measurements? Consider the metric you want to reach and within what timeframe.

In the case of increasing customer satisfaction, targets for each sample measurement could be:

- Number of referrals: Garner 500 referrals next year

- Number and speed of resolved support tickets: Resolve 75 percent of support tickets within 48 hours

- Number of testimonials: Gather 100 testimonials next year

- Net promoter score (NPS): Target an average score of eight or above by 2026

Setting targets helps quantify what successful strategy execution means for each measure.

In Strategy Execution , Simons notes that, when looking at your balanced scorecard, the further you move to the right, the more you can objectively measure and reward performance. The further you move left, the more performance is subjective.

Set challenging but achievable targets. Remember that not accomplishing your “learning and growth” goals can impact the rest of your strategy map.

Building and Leveraging Your Strategy Toolkit

After creating your strategy map and balanced scorecard, the last, ongoing step is tracking and reporting progress toward each objective.

Use both to align on strategy, flag areas needing more attention, and highlight how goals connect. Everyone’s efforts funnel into a specific part of the strategy critical to the team’s overall success.

The balanced scorecard is just one tool to help execute your organization’s strategy. By opening up to new ways of thinking about strategy, you can reach business goals and advance your career as a strategic leader.

Are you interested in designing systems and structures to meet your organization’s strategic goals? Explore our eight-week Strategy Execution course, and other online strategy courses , to hone your strategic planning and execution skills. To find the right HBS Online strategy course for you, download our free flowchart .

About the Author

A Case Study on Balanced Scorecard Implementation

- July 17, 2024

Home » Resources » Case Studies » Balanced Scorecard in a charity

Balanced Scorecard in a charity

Solving performance problems using a modern balanced scorecard in a charity: the diana, princess of wales memorial fund.

This case study describes the application of the modern balanced scorecard approach in a charity. The case study was developed with the support of Diana, Princess of Wales Memorial Fund and published with their kind approval.

A shorter version of this article, entitled “ Demonstrating and managing performance in a charity ” appeared in “Trust and Foundation News”, the journal of the Association of Charitable Foundations (ACF), June 2009.

Download this case study as a pdf Balanced scorecard charity case study for the Diana, Princess of Wales Memorial Fund

The Fund’s Report and Financial Statement to their Trustee’s 2008 , refers to their Balanced Scorecard:”

“How do we measure our performance? In order to ensure the careful monitoring of performance towards the achievement of the initiatives’ objectives the fund has adopted an integrated approach to internal reporting including both financial and non-financial measures. The “Balanced Scorecard” has been adopted for each of the initiatives as part of this integrated approach. These are primarily used for performance management at strategic (Board) level and tactical (management) level.”

Introduction – Why did the charity want a balanced scorecard?

There is a need to demonstrate effectiveness and performance across the charity sector. But how do we do it? How do we demonstrate the efficacy of our projects and activities? How do we demonstrate value to our beneficiaries? How do we demonstrate to the Trustee Board that the strategy is being executed?

The usual answer is to immediately look for ways to measure performance. At the Diana, Princess of Wales Memorial Fund (the Fund), they took a more subtle approach: an approach that involved maps of their strategy and a modern, strategic, balanced scorecard.

The Fund went beyond simply attempting to measure activity and results. They moved to clearly showing what they are doing and how those activities will deliver results. Even in an innovative, lean, charity like the Fund, the techniques used and the process of developing these modern balanced scorecards has had positive effects.

Their “Strategy map and balanced scorecard” has created a more constructive dialogue with the Fund’s Board of Directors than simple measurement would have done. It helps the Fund’s managers to demonstrate how they are implementing their part of the overall strategy, despite being at different stages of implementation, with different emphasis and different benefits. In addition, it helps the Fund’s managers show how they are contributing towards the Fund’s overall strategy. And, the approach has made it easier to trace through and describe the impact of the Fund on its ultimate beneficiaries.

Introducing the approach has also provided new ways to think about, and think through, the Fund’s strategy. As a result the Fund has identified where capabilities and knowledge need development, and where its initiatives (the Fund’s teams) can help each other improve across the organisation.

The up to date, strategic balanced scorecard approach used at the Fund has potential benefits for charities across the sector. It can help planning processes be more systematic and less political. It helps internal communication of the strategy as a whole. It makes discussing scarce resources, performance and results easier. With the new Charities Act, it could even be used to communicate with Stakeholders.

This case study explains the Diana, Princess of Wales Memorial Fund’s approach and the benefits the Fund has identified.

The situation at the Diana, Princess of Wales Memorial Fund

The Diana, Princess of Wales Memorial Fund was already demonstrating its success. The Fund focuses on three main initiatives, the Palliative Care Initiative, the Refugee and Asylum Seekers Initiative and the Partnership Initiative. Each initiative has a desired outcome and a set of strategic objectives to be achieved over a five year period. For example, objective one of the Palliative Care Initiative is; ‘An HIV/AIDS community and donors that has integrated palliative care into the continuum of care for people with HIV/AIDS and their families. The Fund’s existing Strategic Plan 2007 – 2012 already articulated the objectives for each of the Initiatives.

However, the Fund felt it could communicate its strategy and demonstrate measurable progress more effectively. The Fund decided to investigate the modern balanced scorecard approach and invited the specialist strategic balanced scorecard consultancy Excitant to help them.

Like many charities and other organisations, the Fund already had a “balanced scorecard”. Like many balanced scorecards, this was a collection of measures in various categories, or perspectives that informed the operation of the Fund. However, these measures told little of the story of the strategy. In common with many, what might be called “operational scorecards”, the measures were primarily financial and operational, with some covering staff and culture. It also tended to tell managers what had happened. While the previous scorecard was far more balanced than most financial reporting, it didn’t yet tell the story of the Fund’s strategy and how it would succeed.

At the initial briefing with Excitant, the management team explained that they wanted to be forward looking and demonstrate how the Fund’s strategy was working. They wanted something that they owned as managers and helped them communicate both inside and outside the Fund. Something that was more was useful to them as managers, than their operational measures. As one manager put it, “We don’t want the sort of over-detailed, resource intensive, micro-management scorecards that the NHS uses”. As another manager said, “I want to fall in love with the balanced scorecard.”

So it was agreed to develop a modern balanced scorecard which, as a starting point, ignored measures. Instead, Fund staff explored their strategies and developed strategy maps.

Developing the Fund’s strategic balanced scorecard

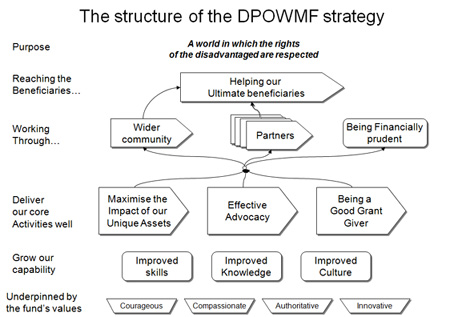

Early versions of balanced scorecards collected or developed measures in various perspectives, typically financial, customers, processes and learning and growth. Whilst this adds “balance” to the measurement of an organisation, it often becomes a process of collecting, classifying and adding extra operational measures, but does not help to address the implementation of the strategy. By 1995/6, Norton & Kaplan realised that there is a need to articulate how the strategy will make a difference to the organisation, its customers and financial results, and is therefore measured and managed. These developments are encapsulated in what are called “strategy maps” which map, and show pictorially, how the strategy will be delivered. The framework of the Fund’s strategy map is shown in figure 1.

The first development was to define objectives in each perspective. Never, ever, start with measures. Starting with measures means you end up managing only those things you believe you can measure. In contrast, starting with objectives has the advantage that you know why you are measuring any particular aspect of the organisation. You choose how best to measure what you want to manage (the objective). If a measure turns out to be a poor measure or indicator for the objective, it can be discarded and a better one found. It also makes cascading and communicating balanced scorecards far easier. Instead of forcing a measure to exist at many levels, objectives allow appropriate measures at any level of the organisation.

As can be seen from a simplified version of the Fund’s strategy map, these objectives are developed in each perspective. In the Fund’s case, the beneficiaries have objectives, the partners have objectives, and there are financial objectives. There are also objectives for the activities of the Fund and objectives for growth and development of the Fund’s capability.

This approach did cause some discussion at the Fund. In the charitable sector much effort has been put into trying to systematically measure the impact on ultimate beneficiaries. As the effects of the Fund’s interventions are often diluted and subject to many other influences and many players, it can be hard to demonstrate when particular investments and actions have actually made the difference. This is even more difficult where interventions are designed to bring about policy change or influence governments such as, for example, assessing the Fund’s role in campaigning to secure an international treaty banning cluster munitions or , in ensuring that the crucial role of palliative care is recognised by national governments in Sub-Saharan Africa. Therefore, there was some initial scepticism that we could achieve anything against this background. As one member of staff observed, “We have been trying to measure effect in the sector for 20 years and no one has really succeeded.”

Rather than starting with measures, the Fund started with the objectives of beneficiaries. The Fund explored the bigger system of policy change and intervention that it was a part of, which made explicit what the Fund was trying to achieve. The managers explained how the activities of the Fund would ultimately influence and improve the lives of people and ensure that the rights of the disadvantaged were respected. This thinking, and the set of objectives that came out of it, was captured in their detailed strategy maps.

This highlights the second important aspects of strategy maps and strategic balanced scorecards: looking at the relationships between objectives; the cause and effect relationship; the lines of influence and effect. By concentrating on the links and relationships between the objectives we can describe what will drive change. The Fund can describe how its strategy and activities should ripple through and make a difference to the lives of the ultimate beneficiaries. This is done by asking, “If this is what our beneficiaries need, what do we have to focus on to make sure we deliver that for them?” We also ask the question, “If we are to do this better as an organisation, what capabilities in the Fund do we need to improve? “.

In many ways it is the links between the objectives that matter more than the objectives themselves. If we grant these funds, to our partners, will it help them make a real difference to the ultimate beneficiaries? How do we know? Can we demonstrate it? Of course this thinking is embedded within all levels of management within the charity sector, including each of the Fund’s managers. The approach made the thinking explicit and captured it as a strategy map. This strategy map made it easy to tell the story of the strategy, on a single page. Once explained and detailed, its progress can then be seen, tracked, and managed.

Developing the Fund’s strategy maps

The simplified framework for the Fund’s strategy map is shown in figure 1. The purpose of the Fund is clearly stated at the top of the strategy map. The ultimate target for the Fund is to help the eventual beneficiaries, as captured in its mission statement. As a grant making organisation, the Fund helps its beneficiaries by giving grants to and working with selected partners, who have the capacity to deliver each initiatives’ desired outcomes. For instance, the Palliative Care Initiative wants people across Sub-Saharan Africa with life limiting illnesses, such as HIV/AIDS, to have access to palliative care that alleviates their physical pain and provides psychosocial, spiritual and bereavement support. In order to achieve this, the initiative believes medical and nursing schools need to train doctors and nurses in palliative care skills. In working towards achieving this objective, the Palliative Care Initiative with The True Colours Trust (one of the Sainsbury Family Charitable Trusts) is holding a conference in Kampala, Uganda in October 2008 aimed at the heads of medical and nursing schools from 10 Sub-Saharan Africa countries, to encourage them to incorporate palliative care into the core curricula of medical and nursing schools. The conference is being held in partnership with the African Palliative Care Association. The Palliative Care Initiative balanced scorecard reflects these partnerships.

At the same time the Fund will seek to influence the wider community: governments, the media, and the public at large, and develops advocacy and campaigning strategies to create the greatest impact possible given the inputs. An example of this can be seen in the Fund’s membership of the Cluster Munitions Coalition, a global network of over 250 civil society organisations, working to secure an international treaty to ban the use of cluster bombs. In another case the Fund, in partnership with The Children’s Society and Bail for Immigration Detainees, is seeking to influence the UK government to end the detention of children for immigration purposes. These aspects are represented in the “wider community objectives”.

Of course the charity needs to satisfy certain financial objectives. Like any other charity, the Fund needs to demonstrate financial prudence, efficiency and effectiveness in its operations and use funds. These, and other financial objectives, are represented in the financial perspective.

As might be expected the Fund’s three initiatives are at different stages of development and delivery. The campaign to increase the protection of civilians from the effects of cluster munitions and other explosive remnants of war is mature, with the Fund enjoying well established good relationships with key partner organisations. The work in palliative care is better developed in some Sub-Saharan African countries than others, so the Fund continues to develop an increasingly influential network of partners. The campaign for the rights of young asylum seekers is at an earlier stage with many of the key partnerships being developed. So, whilst each initiative is at a different stage of maturity of implementation, they are all delivering within the same strategy.

This can be seen in the overall Fund strategy which has three main themes: Maximising the unique assets of the fund, effective advocacy and being a good grant giver. Within these three themes the managers developed another level of detail that described what good practice and success was for the Fund as a whole. The emphasis that each initiative has in these three themes will vary, but each will be implementing a part of that strategy.

Beneath these major themes to the strategy, the Fund’s management identified a number of enablers of their strategy. On the simplified version of the strategy map these have been shown as improved skills, knowledge and culture. In the full strategy map these were specified in much more detail. Some transcending the Fund: others, depending on the maturity of their strategy, specifically applying to parts of the Fund and the strategy. Discussing and agreeing these led to the identification of opportunities to share knowledge and collaborate better within the Fund. This highlights how the approach creates conversations that add value to the organisation.

Finally, as with any charity, the Fund’s thinking, work and its strategy are underpinned by its core values and its mission: ”By giving grants to organisations, championing charitable cause, advocacy, campaigning and awareness-raising, the Fund works to secure sustainable improvements in the lives of the most disadvantaged people in the UK and around the world.”

The managers and their teams then developed the details of where their emphasis was within the overall strategy. They also detailed the characteristics of success. For instance, advocating for palliative care in Sub-Sahara Africa, results in different approaches in different countries as governments viewed the issue differently, some were more receptive than others. This focused the activities of that initiative manager and their team. Likewise, different types of partner organisations required handling and working with, in different ways: all within an overall strategy for the Fund.

Only once each initiative had developed its strategy map, from the overall framework, and was happy with it, did they start to detail the scorecard behind the strategy map. The scorecard detail provided them with the opportunity to set out the measures, targets, actions and responsibilities for each of the elements of their strategy. Now, there was detail as to how each of the initiative’s objectives will be delivered, together with any issues and an assessment of progress by the initiative’s manager. Overall this ensured a complete picture for the initiative, which could be viewed across the initiatives to get the overall picture for the Fund as a whole.

Learning from the process

The process of thinking through the strategy map and developing it, in itself helped the team at the Fund. This is very common as the approach encourages a more strategic view than is often taken with traditional balanced scorecards. Overall the work quickly produced a clear picture of the Fund wide strategy and what subsequent action was required. As a result, the consistent strategy became easier to assess despite different parts being in different stages of maturity.

One initiative used the approach to think through their strategy in more systematic detail. They used it as an aid to strategy development and thinking. This helped them detail and articulate their strategy far more clearly than they had before. Across the Fund, the common framework helped the initiatives create points of collaboration, conversation and improvement, where previously they were not as prominent.

From a financial and resource management perspective the approach helped them to assess the most effective, efficient and economic use of the Fund’s limited resources. For example, the initiatives were able to assess the most cost effective balance between grant making and other activities to achieve their objectives. The approach, being focused on objectives rather current activities, helped Fund staff to reconsider the process of strategy evaluation and make decisions objectively.

It took barely two months for the Fund to move from initial briefings to the development of the detailed scorecards for each initiative. Most importantly, this was achieved with minimal consultancy support. This was due to the consultancy approach used being designed to maximise skill transfer, understanding of the underlying principles and ownership. Thus it became “my strategy and scorecard”. After all they were the ones who would continue to use them to discuss and present progress on their strategy.

Operational use

Operationally the management teams review and update their strategic balanced scorecards every month with each of the three main initiatives reporting to the Board of Directors in detail every three months.

The two initiatives that were more mature and articulated their strategy in the strategy maps and strategic balanced scorecard continue to use their weekly task and deliverable lists for day to day management. However these detailed lists now operate in the context of the overall strategy, so it is easy to link through from the operational, day to day, detail to the overall strategy and larger objectives. For them the strategic balanced scorecard provides a broader context that informs, explains and reports their day to day activities. The range of objectives on the strategy map provides an agenda to ensure all aspects are covered each week.

The team that developed and articulated their strategy using the strategy map thinking are also using the approach for their operational, day to day, performance management. For them the approach is more embedded. They operate the balanced scorecard at a more detailed level and then abstract the essence of it for their board reporting.

Both approaches work for the initiatives. Both easily link to the overall scorecards and strategy maps. Most importantly, when there are discussions about the most effective and efficient use of resources across the Fund, it is far easier to asses the overall needs, common themes and look where improvements can be made across the Fund in the most cost effective way.

Presenting to the Board of Directors

An important role for the strategic balanced scorecard was to explain and present the strategy to the Board in a succinct and effective manner. The Board was given a comprehensive introduction to the new way of presenting the strategy, which has been very positive. The breadth of material and its natural structure has helped the managers quickly demonstrate the overall picture to the Board; it has allowed the Directors to get the wider picture and to focus in on areas that need attention. The Director Board feel more confident that they are seeing the bigger picture and can discuss detail as they wish.

Dr Astrid Bonfield, the Chief Executive of the Diana, Princess of Wales Memorial Fund, has also found the approach valuable. “When I am preparing for a Board meeting I simply go through the three strategic balanced scorecards for each part of the Fund. Once I have done this I feel I am fully briefed to answer any questions about the detail within each area. It has made preparing for Board meetings much simpler, quicker and more effective. It also helps discussions with the initiative staff. This is a feeling every Chief Executive would want to have.”

On receipt of new reporting methods, many Boards often request more detail to be assured that they are getting the full picture. After a few meetings involving strategic balanced scorecard reporting at the Fund, the Board decided they were happy with less detail being provided and the initial reporting was simplified. This is a common cycle that Boards go through when experiencing the strategic balanced scorecard for the first time: at first, more detail is required, in assurance that managers are providing the bigger picture. The level of information presented is reduced, once Boards are confident that the detail is available and that things are running smoothly. The strategic balanced scorecards assure the Board that they can access more or less detail as they wish.

Taking a wider view, all the Fund’s initiatives operate in dynamic external environments where external forces may either invalidate or even achieve the Fund’s objectives. It is therefore necessary (as it should be in most organisations) to assess the continuing validity of the strategies employed and the objectives to be achieved. A measures based approach did not allow this. The modern balanced scorecard and strategy map, however, provide a clear and concise framework in which to do this. It is easier to explain what has happened and easier to refine the strategy as a result.

Conclusions

A year after the introduction of the balanced scorecard approach, how is it working out?