AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Financial Statements Template

Ajay Jagtap

- December 7, 2023

- 13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup or small business, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

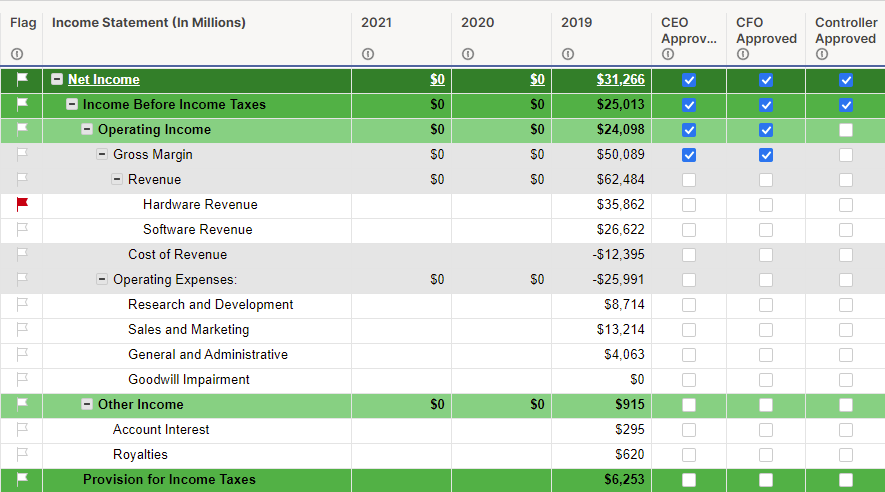

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

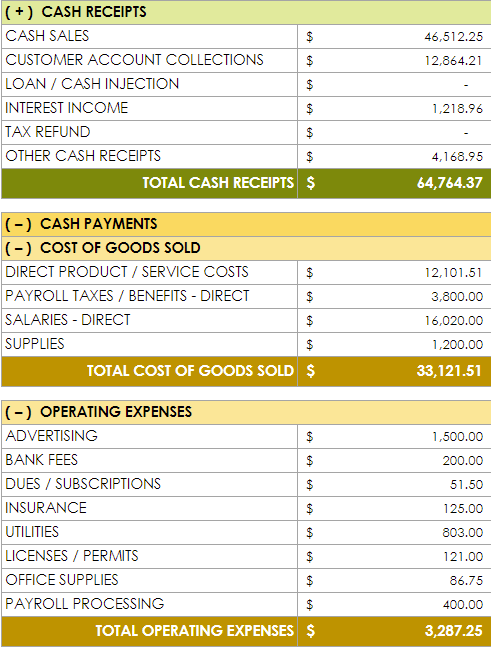

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

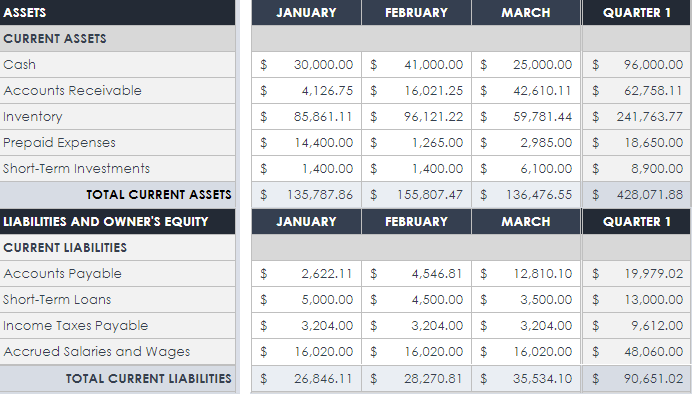

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

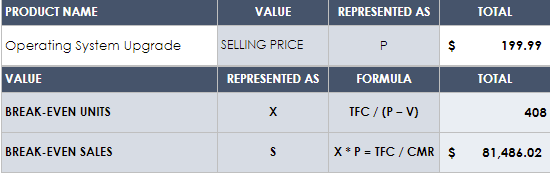

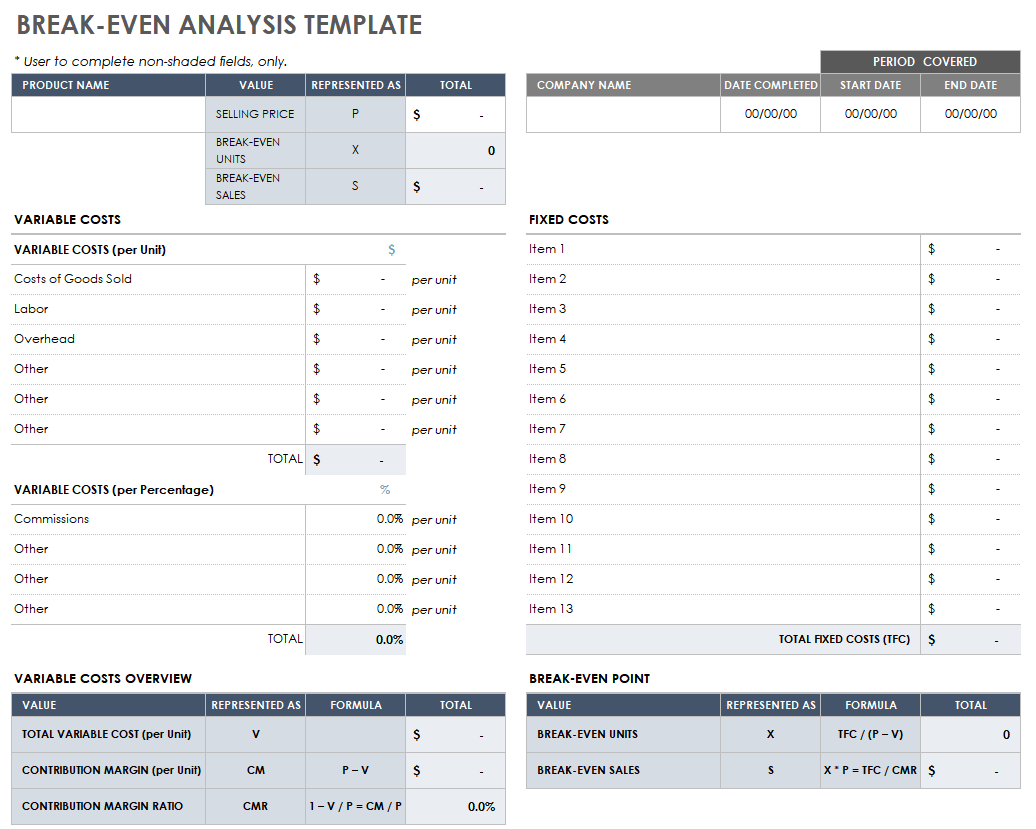

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup or small business.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your small business and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan for your business plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

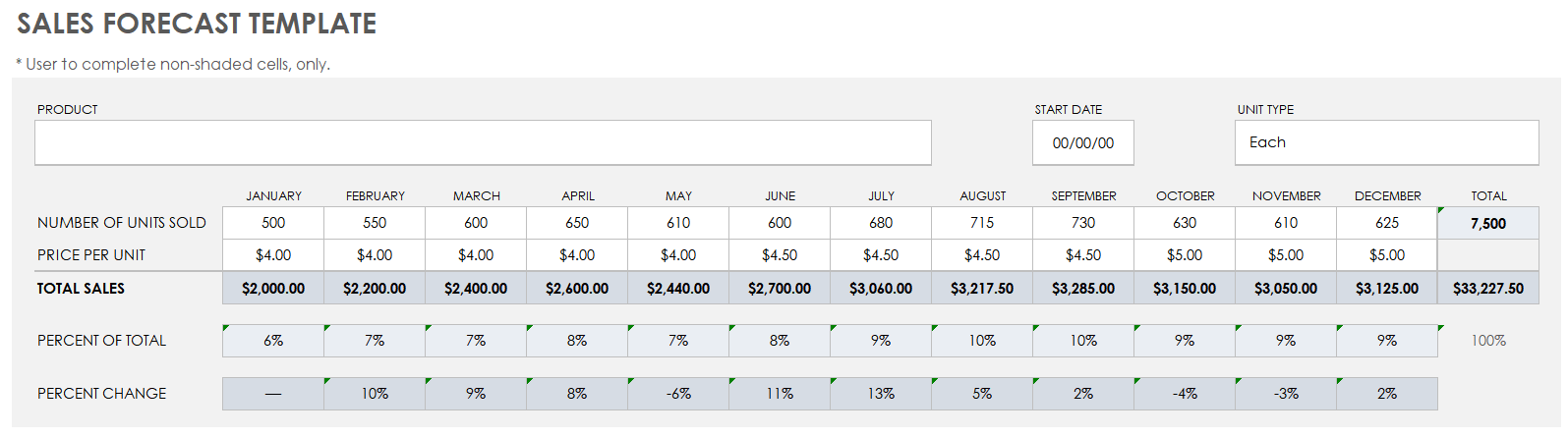

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

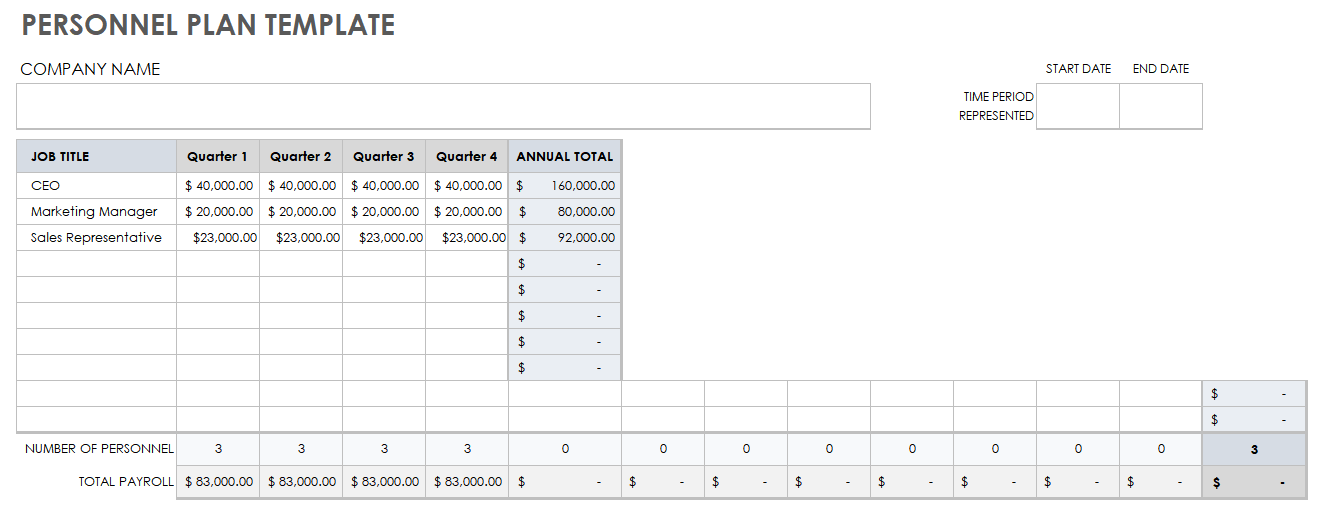

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

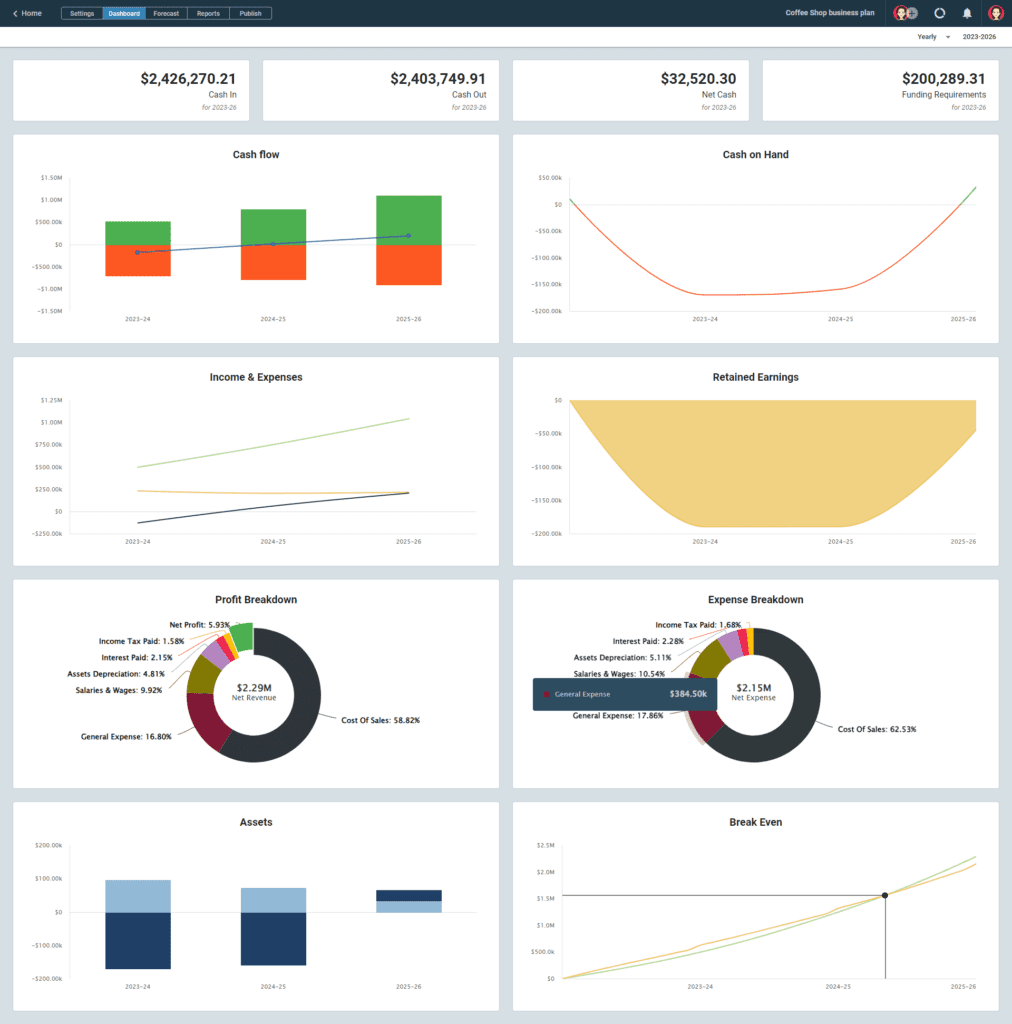

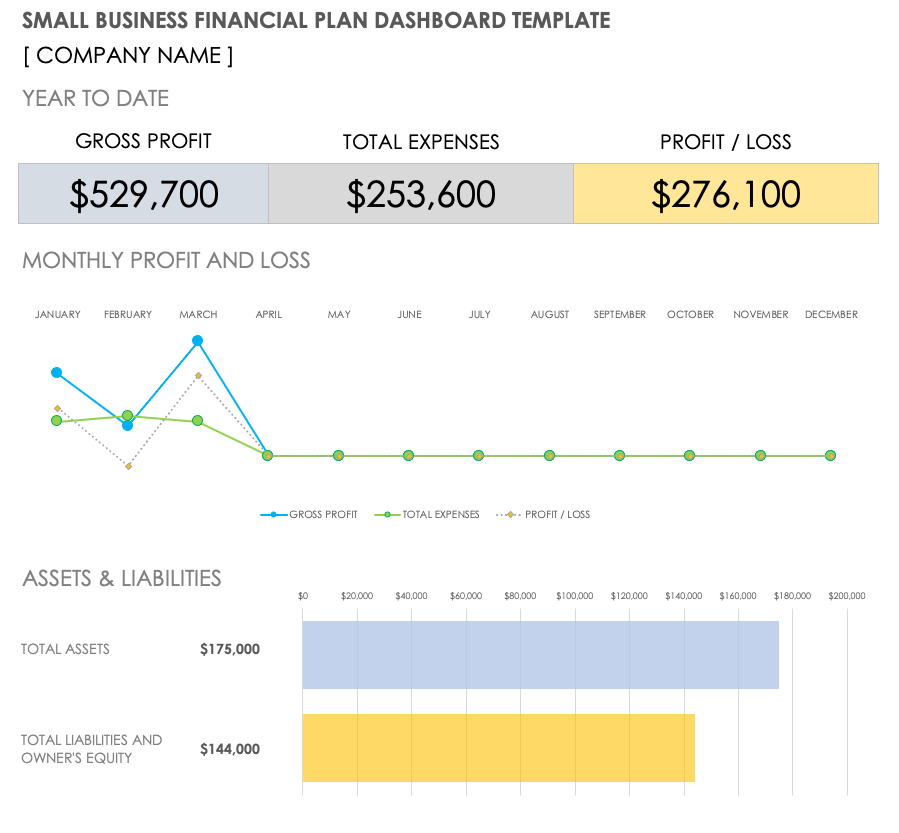

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

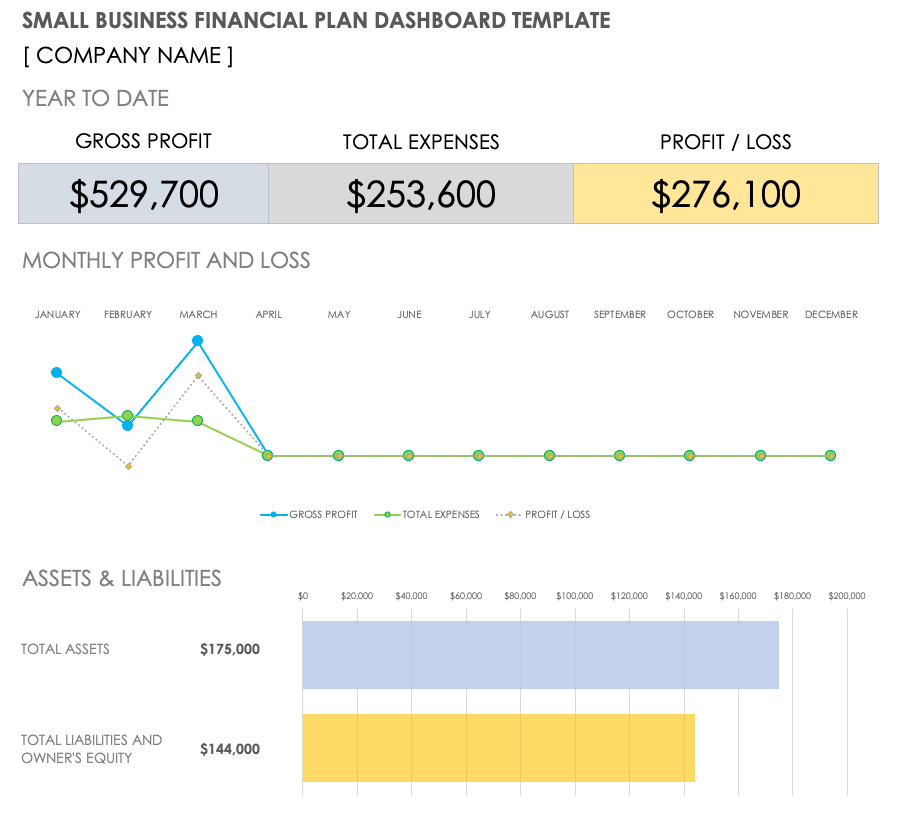

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan for your small business, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

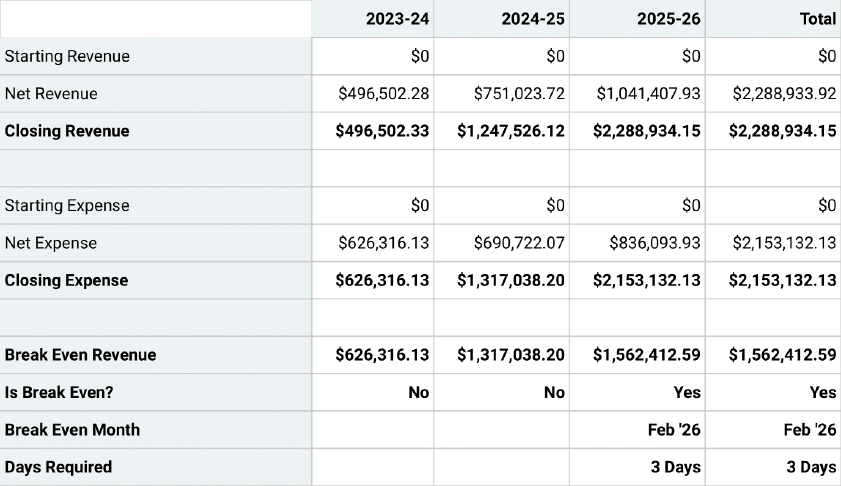

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

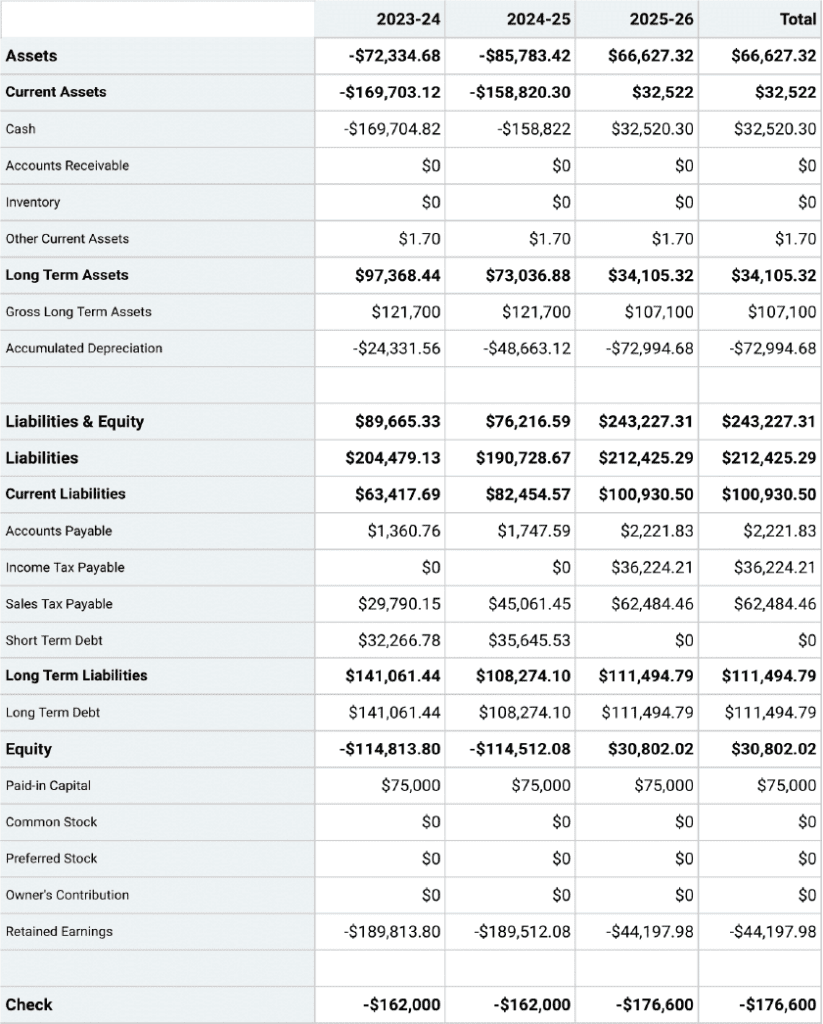

Projected Balance Sheet

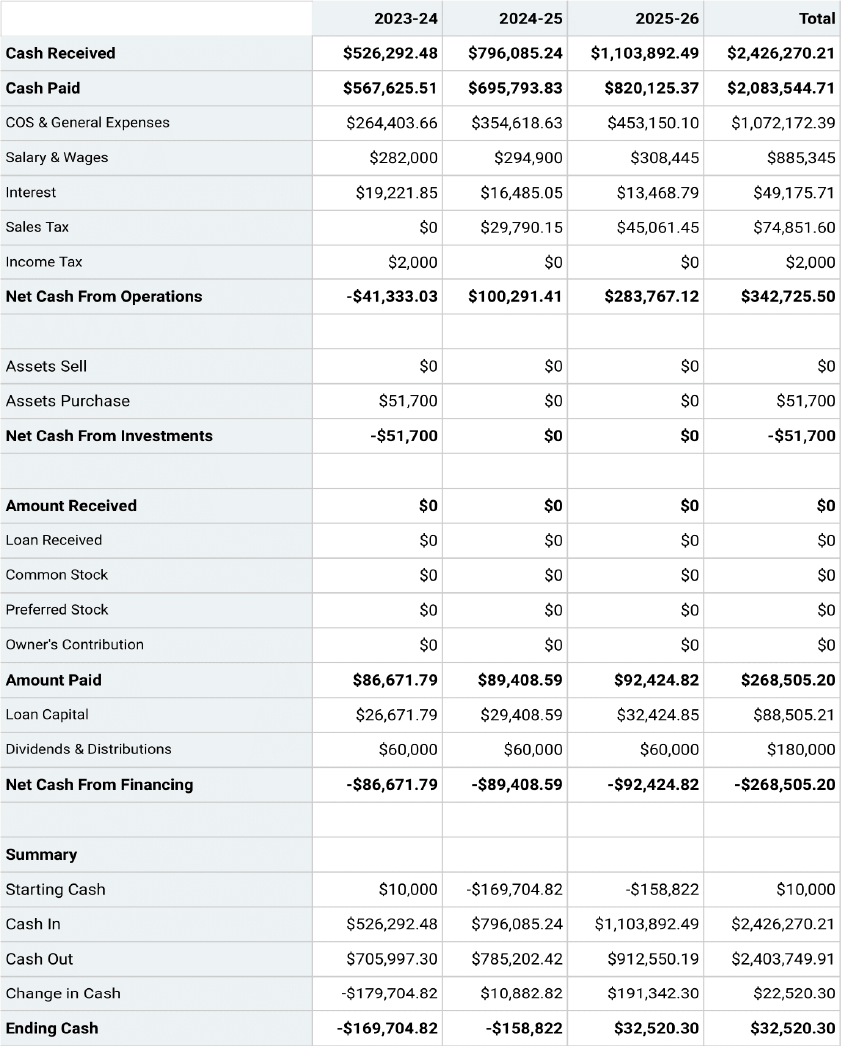

Projected Cash-Flow Statement

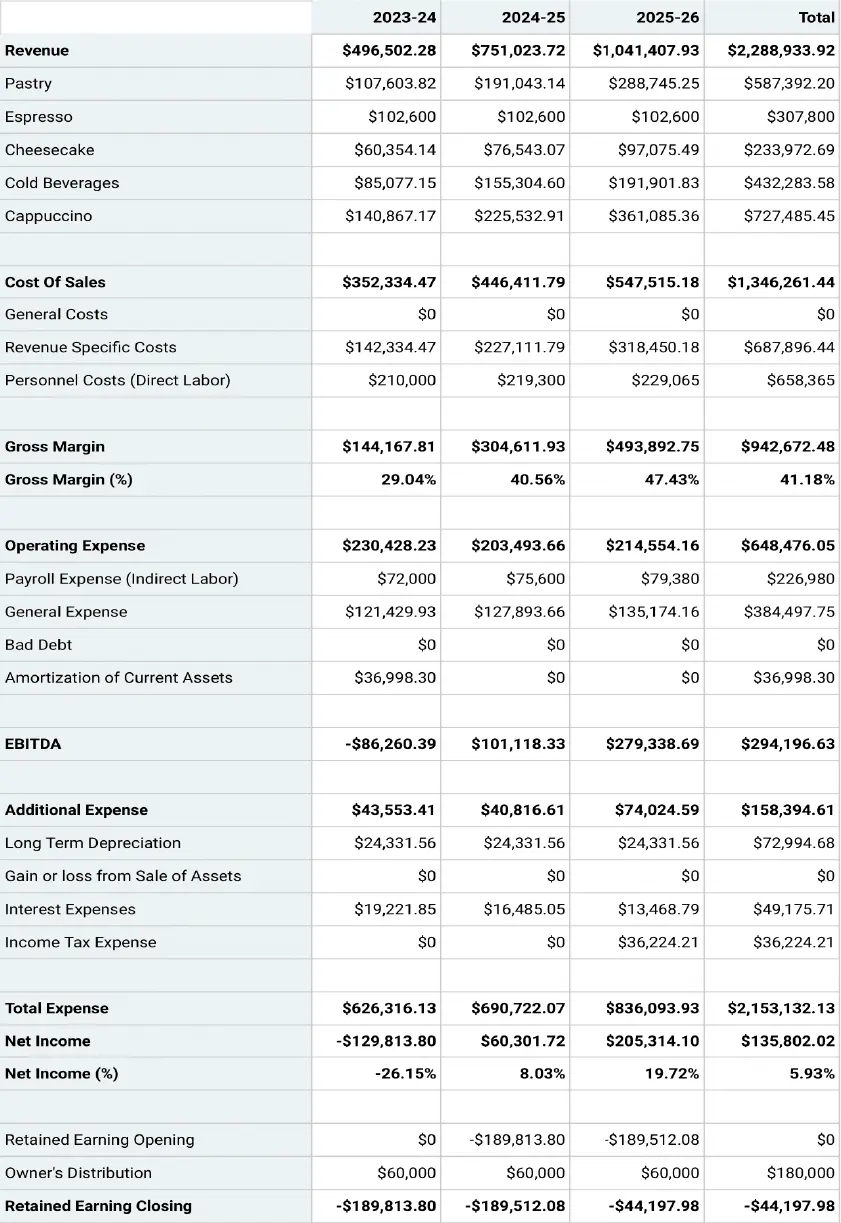

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or small businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is the Head of Content at Upmetrics. Before joining our team, he was a personal finance blogger and SaaS writer, covering topics such as startups, budgeting, and credit cards. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

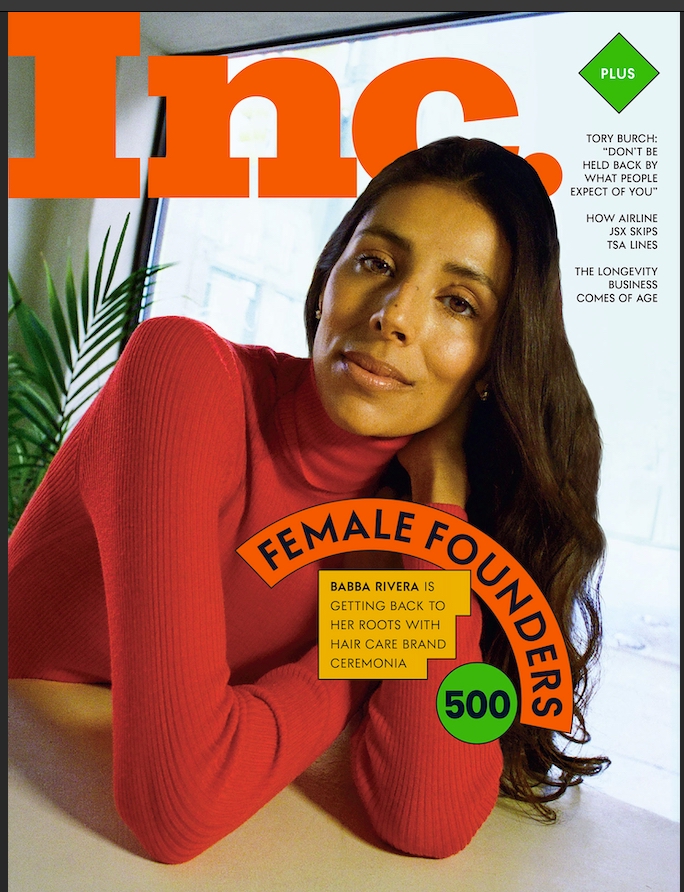

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.

- Breakeven analysis. The breakeven point, Pinson says, is when your business's expenses match your sales or service volume. The three-year income projection will enable you to undertake this analysis. "If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest." This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit strategy.

Dig Deeper: How to Price Business Services

How to Write the Financial Section of a Business Plan: How to Use the Financial Section One of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. "I like to quote former President Dwight D. Eisenhower," says Berry. "'The plan is useless, but planning is essential.' What people do wrong is focus on the plan, and once the plan is done, it's forgotten. It's really a shame, because they could have used it as a tool for managing the company." In fact, Berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the future. Pinson also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. Part of this is a ratio analysis. She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. "This is all for your benefit," she says. "That's what financial statements are for. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours." If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. This is a summary of your business from its start to the present. Sometimes a bank might have a section like this on a loan application. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities. All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. "It's a pretty well-known fact that if you are going to seek equity investment from venture capitalists or angel investors," Pinson says, "they do like visuals."

Dig Deeper: How to Protect Your Margins in a Downturn

Related Links: Making It All Add Up: The Financial Section of a Business Plan One of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely. Persuasive Projections You can avoid some of the most common mistakes by following this list of dos and don'ts. Making Your Financials Add Up No business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible. How many years should my financial projections cover for a new business? Some guidelines on what to include. Recommended Resources: Bplans.com More than 100 free sample business plans, plus articles, tips, and tools for developing your plan. Planning, Startups, Stories: Basic Business Numbers An online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers. Out of Your Mind and Into the Marketplace Linda Pinson's business selling books and software for business planning. Palo Alto Software Business-planning tools and information from the maker of the Business Plan Pro software. U.S. Small Business Administration Government-sponsored website aiding small and midsize businesses. Financial Statement Section of a Business Plan for Start-Ups A guide to writing the financial section of a business plan developed by SCORE of northeastern Massachusetts.

Editorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means editors and reporters research and write on these products free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site.

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

How to Set and Use Milestones in Your Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee + up to $50 Amazon gift card

Free expedited filing (within 48 hours)

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

- How To Write An Effective Business Proposal

Best Pennsylvania LLC Services In 2024

Best Florida LLC Services In 2024

Best Maryland LLC Services In 2024

Best Texas LLC Services In 2024

Best Arizona LLC Services In 2024

Best California LLC Services In 2024

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

How to Develop a Small Business Financial Plan

By Andy Marker | April 29, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

Financial planning is critical for any successful small business, but the process can be complicated. To help you get started, we’ve created a step-by-step guide and rounded up top tips from experts.

Included on this page, you’ll find what to include in a financial plan , steps to develop one , and a downloadable starter kit .

What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos , shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust , the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates .

What Does a Small Business Financial Plan Include?

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity .” Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says.

- Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.

- Break-Even Analysis: A break-even analysis is a projection of how long it will take you to recoup your investments, such as expenses from startup costs or ongoing projects. In order to perform this analysis, Yüzbaşıoğlu explains, “You need to know the difference between fixed costs and variable costs. Fixed costs are the expenses that stay the same, regardless of how much you sell or don't sell. For example, expenses such as rent, wages, and accounting fees are typically fixed. Variable costs are the expenses that change in accordance with production or sales volume. “In other words, [a break-even analysis] determines the units of products or services you need to sell at least to cover your production costs. Generally, to calculate the break-even point in business, divide fixed costs by the gross profit margin. This produces a dollar figure that a company needs to break even,” Yüzbaşıoğlu shares.

- Personnel Plan: A personnel plan is an outline of various positions or departments that states what they do, why they are necessary, and how much they cost. This document is generally more useful for large businesses, or those that find themselves spending a large percentage of their budget on labor.

- Sales Forecast: A sales forecast can help determine how many sales and how much money you expect to make in a given time period. To learn more about various methods of predicting these figures, check out our guide to sales forecasting .

How to Write a Small Business Financial Plan

Writing a financial plan begins with collecting financial information from your small business. Create income statements, balance sheets, and cash flow statements, and any other documents you need using that information. Then share those documents with relevant stakeholders.

“Creating a financial plan is key to any business and essential for success: It provides protection and an opportunity to grow,” says Yüzbaşıoğlu. “You can use [the financial plan] to make better-informed decisions about things like resource allocation on future projects and to help shape the success of your company.”

1. Create a Plan

Create a strategic business plan that includes your business strategy and goals, and define their financial impact. Your financial plan will inform decisions for every aspect of your business, so it is important to know what is important and what is at stake.

2. Gather Financial Information

Collect all of the available financial information about your business. Organize bank statements, loan information, sales numbers, inventory costs, payroll information, and any other income and expenses your business has incurred. If you have not already started to do so, regularly record all of this information and store it in an easily accessible place.

3. Create an Income Statement

Your income statement should display revenue, expenses, and profit for a given time period. Your revenue minus your expenses equals your profit or loss. Many businesses create a new statement yearly or quarterly, but small businesses with less cash flow may benefit from creating statements for shorter time frames.

4. Create a Balance Sheet

Your balance sheet is a snapshot of your business’s financial status at a particular moment in time. You should update it on the same schedule as your income statement. To determine your equity, calculate all of your assets minus your liabilities.

5. Create a Cash Flow Statement

As mentioned above, the cash flow statement shows all past and projected cash flow for your business. “Your cash flow statement needs to cover three sections: operating activities, investing activities, and financing activities,” suggests Hewitt. “Operating activities are the movement of cash from the sale or purchase of goods or services. Investing activities are the sale or purchase of long-term assets. Financing activities are transactions with creditors and investments.”

6. Create Other Documents as Needed

Depending on the age, size, and industry of your business, you may find it useful to include these other documents in your financial plan as well.

- Sales Forecast: Your sales forecast should reference sales numbers from your past to estimate sales numbers for your future. Sales forecasts may be more useful for established companies with historical numbers to compare to, but small businesses can use forecasts to set goals and break records month over month. “To make future financial projections, start with a sales forecast,” says Yüzbaşıoğlu. “Project your sales over the course of 12 months. After projecting sales, calculate your cost of sales (also called cost of goods or direct costs). This will let you calculate gross margin. Gross margin is sales less the cost of sales, and it's a useful number for comparing with different standard industry ratios.”

7. Save the Plan for Reference and Share as Needed

The most important part of a financial plan is sharing it with stakeholders. You can also use much of the same information in your financial plan to create a budget for your small business.

Additionally, be sure to conduct regular reviews, as things will inevitably change. “My best tip for small businesses when creating a financial plan is to schedule reviews. Once you have your plan in place, it is essential that you review it often and compare how well the strategy fits with the actual monthly expenses. This will help you adjust your plan accordingly and prepare for the year ahead,” suggests Janet Patterson, Loan and Finance Expert at Highway Title Loans.

Small Business Financial Plan Example

Download Small Business Financial Plan Example Microsoft Excel | Google Sheets

Here is an example of what a completed small business financial plan dashboard might look like. Once you have completed your income statement, balance sheet, and cash flow statements, use a template to create visual graphs to display the information to make it easier to read and share. In this example, this small business plots its income and cash flow statements quarterly, but you may find it valuable to update yours more often.

Small Business Financial Plan Starter Kit

Download Small Business Financial Plan Starter Kit

We’ve created this small business financial plan starter kit to help you get organized and complete your financial plan. In this kit, you will find a fully customizable income statement template, a balance sheet template, a cash flow statement template, and a dashboard template to display results. We have also included templates for break-even analysis, a personnel plan, and sales forecasts to meet your ongoing financial planning needs.

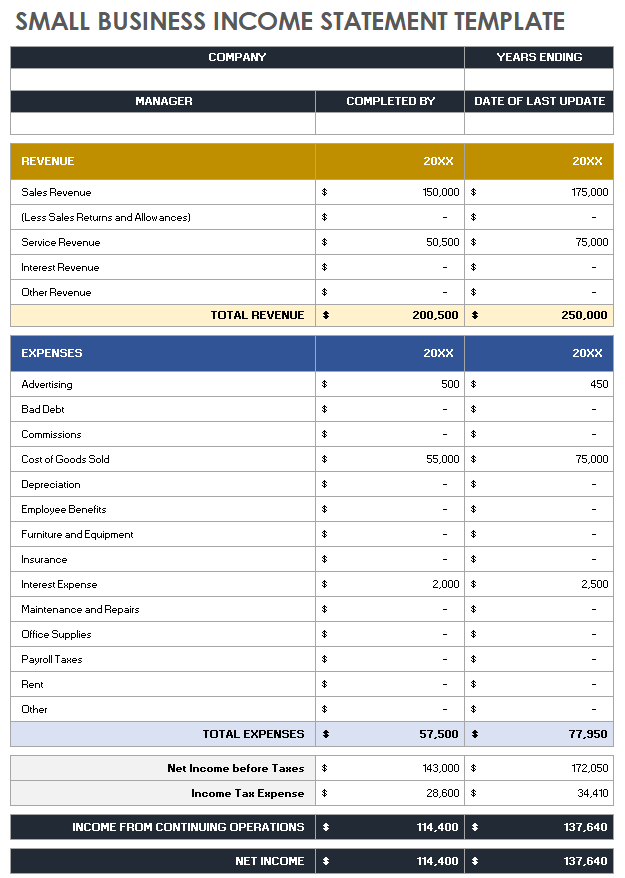

Small Business Income Statement Template

Download Small Business Income Statement Template Microsoft Excel | Google Sheets

Use this small business income statement template to input your income information and track your growth over time. This template is filled to track by the year, but you can also track by months or quarters. The template is fully customizable to suit your business needs.

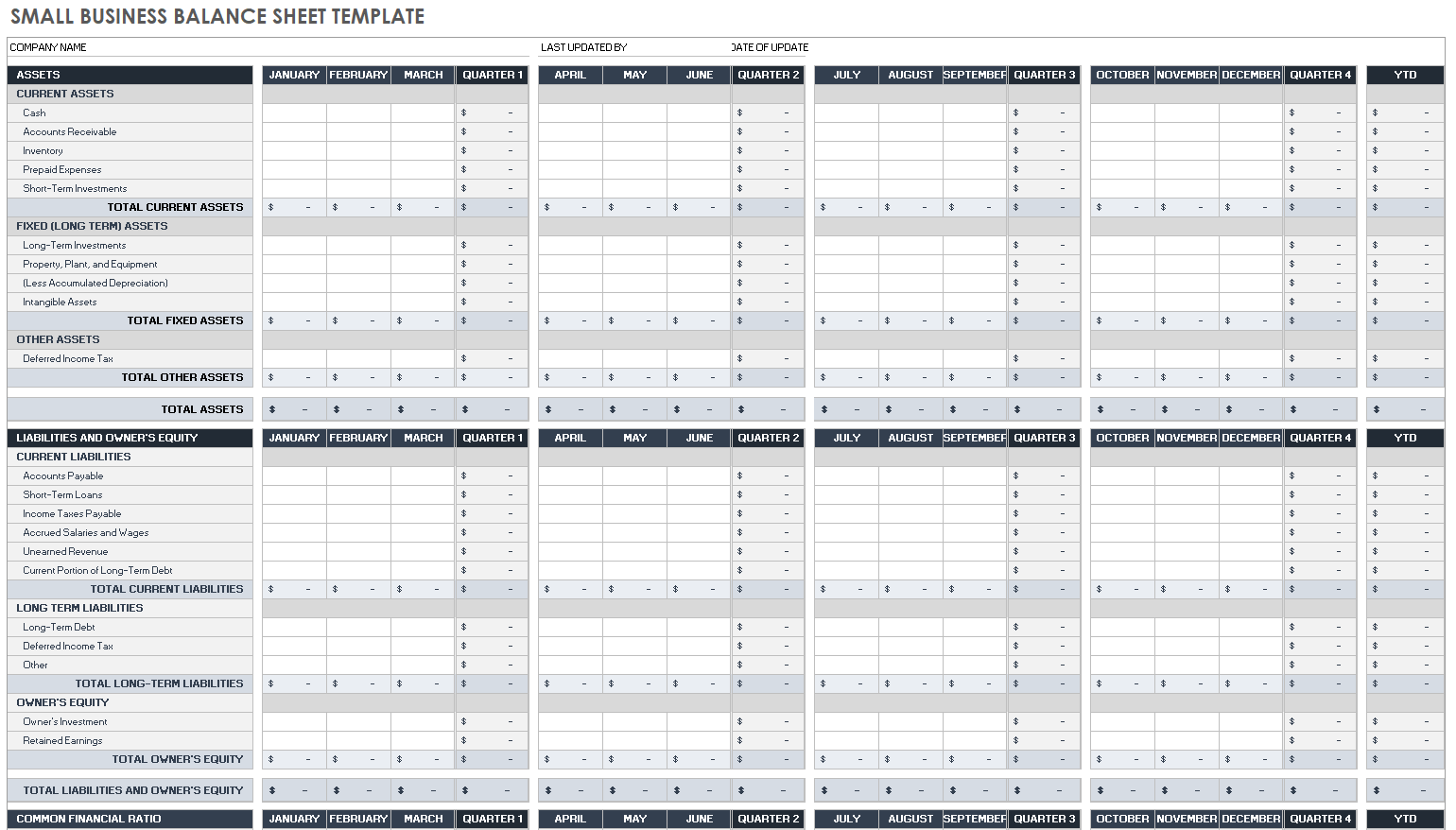

Small Business Balance Sheet Template

Download Small Business Balance Sheet Template Microsoft Excel | Google Sheets

This customizable balance sheet template was created with small businesses in mind. Use it to create a snapshot of your company’s assets, liabilities, and equity quarter over quarter.

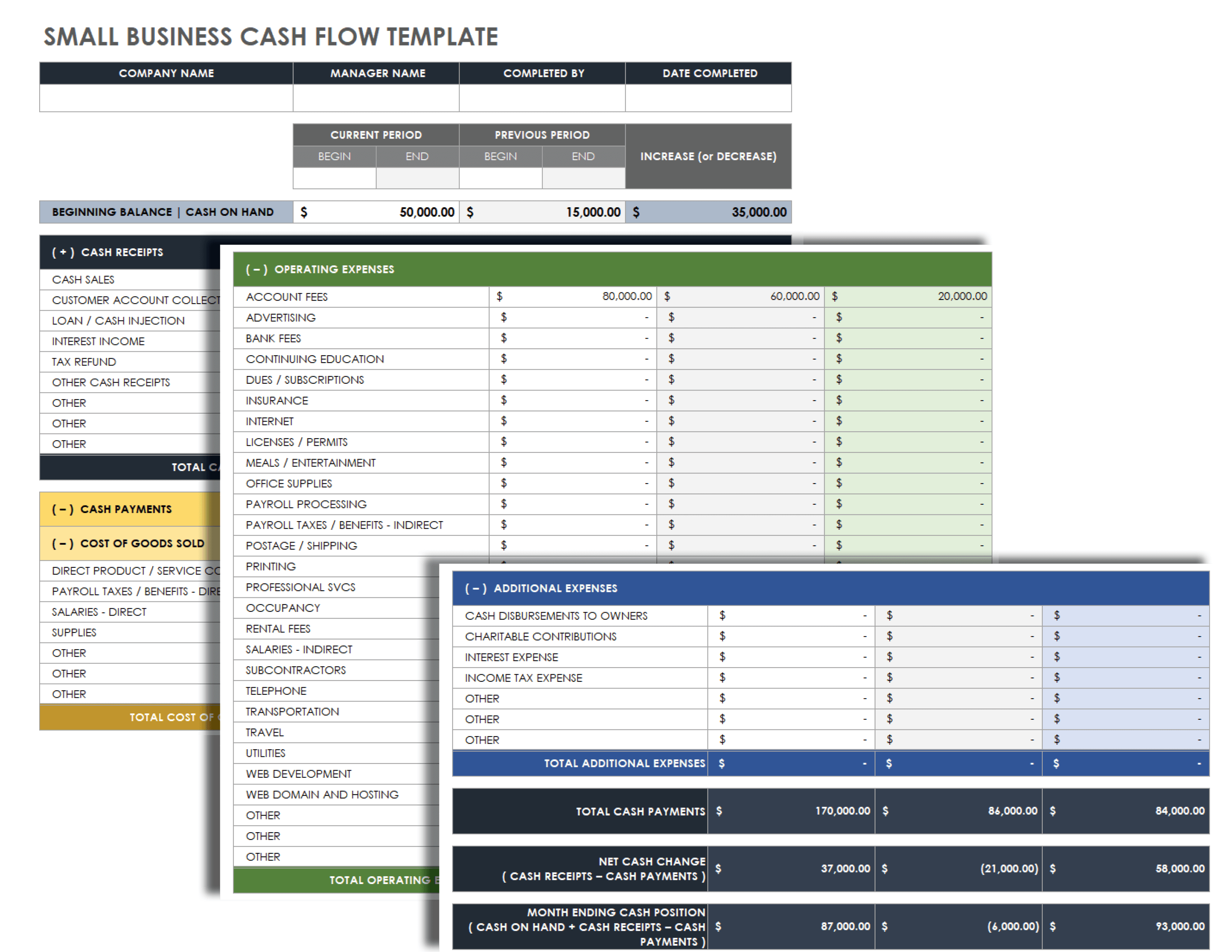

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Template Microsoft Excel | Google Sheets

Use this customizable cash flow statement template to stay organized when documenting your cash flow. Note the time frame and input all of your financial data in the appropriate cell. With this information, the template will automatically generate your total cash payments, net cash change, and ending cash position.

Break-Even Analysis Template

Download Break-Even Analysis Template Microsoft Excel | Google Sheets

This powerful template can help you determine the point at which you will break even on product investment. Input the sale price of the product, as well as its various associated costs, and this template will display the number of units needed to break even on your initial costs.

Personnel Plan Template

Download Personnel Plan Template Microsoft Excel | Google Sheets

Use this simple personnel plan template to help organize and define the monetary cost of the various roles or departments within your company. This template will generate a labor cost total that you can use to compare roles and determine whether you need to make cuts or identify areas for growth.

Sales Forecast Template

Download Sales Forecast Template Microsoft Excel | Google Sheets

Use this customizable template to forecast your sales month over month and determine the percentage changes. You can use this template to set goals and track sales history as well.

Small Business Financial Plan Dashboard Template

Download Small Business Financial Plan Dashboard Template Microsoft Excel | Google Sheets

This dashboard template provides a visual example of a small business financial plan. It presents the information from your income statement, balance sheet, and cash flow statement in a graphical form that is easy to read and share.

Tips for Completing a Financial Plan for a Small Business

You can simplify the development of your small business financial plan in many ways, from outlining your goals to considering where you may need help. We’ve outlined a few tips from our experts below:

- Outline Your Business Goals: Before you create a financial plan, outline your business goals. This will help you determine where money is being well spent to achieve those goals and where it may not be. “Before applying for financing or investment, list the expected business goals for the next three to five years. You can ask a certified public accountant for help in this regard,” says Thé. The U.S. Small Business Administration or a local small business development center can also help you to understand the local market and important factors for business success. For more help, check out our quick how-to guide on writing a business plan .

- Make Sure You Have the Right Permits and Insurance: One of the best ways to keep your financial plan on track is to anticipate large expenditures. Double- and triple-check that you have the permits and insurances you need so that you do not incur any fines or surprise expenses down the line. “If you own your own business, you're no longer able to count on your employer for your insurance needs. It's important to have a plan for how you're going to pay for this additional expense and make sure that you know what specific insurance you need to cover your business,” suggests Daost.

- Separate Personal Goals from Business Goals: Be as unbiased as possible when creating and laying out your business’s financial goals. Your financial and prestige goals as a business owner may be loftier than what your business can currently achieve in the present. Inflating sales forecasts or income numbers will only come back to bite you in the end.

- Consider Hiring Help: You don’t know what you don’t know, but fortunately, many financial experts are ready to help you. “Hiring financial advisors can help you make sound financial decisions for your business and create a financial roadmap to follow. Many businesses fail in the first few years due to poor planning, which leads to costly mistakes. Having a financial advisor can help keep your business alive, make a profit, and thrive,” says Hewitt.

- Include Less Obvious Expenses: No income or expense is too small to consider — it all matters when you are creating your financial plan. “I wish I had known that you’re supposed to incorporate anticipated internal hidden expenses in the plan as well,” Patterson shares. “I formulated my first financial plan myself and didn’t have enough knowledge back then. Hence, I missed out on essential expenses, like office maintenance, that are less common.”

Do Small Business Owners Need a Financial Planner?

Not all small business owners need a designated financial planner, but you should understand the documents and information that make up a financial plan. If you do not hire an advisor, you must be informed about your own finances.

Small business owners tend to wear many hats, but Powell says, “it depends on the organization of the owner and their experience with the financial side of operating businesses.” Hiring a financial advisor can take some tasks off your plate and save you time to focus on the many other details that need your attention. Financial planners are experts in their field and may have more intimate knowledge of market trends and changing tax information that can end up saving you money in the long run.

Yüzbaşıoğlu adds, “Small business owners can greatly benefit from working with a financial advisor. A successful small business often requires more than just the skills of an entrepreneur; a financial advisor can help the company effectively manage risks and maximize opportunities.”

For more examples of the tasks a financial planner might be able to help with, check through our list of free financial planning templates .

Drive Small Business Success with Financial Planning in Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today .

Connect your people, processes, and tools with one simple, easy-to-use platform.

IMAGES

VIDEO

COMMENTS

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives. It’s a key element of your business plan for winning potential investors.

The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid, and free templates. Key components of a financial plan in business plans

In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we'll...

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

When writing a business plan, it's important to put together a comprehensive financial plan detailing your expenses, revenue and cash flow. Learn more here.