10 Accounting Problem Solving Skills and How To Improve Them

Discover 10 Accounting Problem Solving skills along with some of the best tips to help you improve these abilities.

Accounting is an important skill for anyone who wants to be financially successful. Without a basic understanding of accounting, it can be difficult to make sound financial decisions. However, even if you have a strong understanding of accounting principles, you may still encounter occasional accounting problems.

When these problems arise, it is important to have strong problem solving skills in order to find a resolution. In this guide, we will discuss some tips for solving accounting problems. We will also provide an overview of some common accounting problems so that you can be prepared in the event that one arises.

Financial Statements

Regulatory filings, revenue projections, account reconciliation, general ledger, business knowledge, problem solving.

Financial statements are important because they provide a snapshot of a company’s financial health. They can be used to make decisions about whether or not to invest in a company, and they can also be used to track a company’s performance over time. Financial statements include the balance sheet, income statement, and cash flow statement.

Payroll is an important skill for accountants because it allows them to process and manage employee compensation and benefits. Payroll processing includes calculating gross wages, deductions, and net wages; preparing payroll tax returns; and managing benefits such as health insurance, retirement plans, and paid time off.

Accountants who can effectively manage payroll can help businesses save time and money. They can also help businesses comply with federal and state tax laws and regulations.

Regulatory filings are important because they are required by law. Companies must file certain documents with government agencies in order to operate. These filings include tax returns, annual reports, and shareholder communications. Failure to file these documents can result in penalties or even the closure of a company.

Regulatory filings are important because they provide transparency. By law, companies must file certain documents with government agencies. These filings are public, which means that anyone can access them. This transparency allows investors and other stakeholders to see how a company is operating.

Revenue projections are important for businesses because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Revenue projections are important because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Account reconciliation is the process of ensuring that all transactions in a company’s books are accurate. This process is important because it helps ensure that the company’s financial statements are accurate and can be relied upon by investors, creditors and other stakeholders.

Account reconciliation involves comparing the company’s books with the records kept by its banks, vendors and other parties with whom it does business. If there are any differences, they need to be investigated and resolved. This process can be time-consuming, but it is important to ensure that the company’s books are accurate.

Compliance is the process of ensuring that you are in compliance with the laws and regulations that apply to your business. It is important for businesses to be compliant because it helps to protect them from penalties and fines. Compliance also helps to build trust with customers and regulators.

To be compliant, businesses need to understand the laws and regulations that apply to them and then take the necessary steps to ensure that they are following the rules. For example, businesses that sell products to consumers need to be aware of the consumer protection laws that apply to them. Businesses that operate in certain industries, such as healthcare, need to be aware of the regulations that apply to them.

General ledger is an important accounting problem solving skill because it is used to track and report financial information for a business. The general ledger is a summary of all of the accounts that make up the financial statements, and it is used to keep track of the money coming in and going out of the business. The general ledger is also used to prepare financial statements, and it is important that the information in the general ledger is accurate and up to date.

Quickbooks is an important skill for anyone in the accounting field. Quickbooks is a software program that helps accountants and business owners keep track of their finances. Quickbooks can help you track invoices, manage payroll, and create financial reports. Quickbooks is a valuable skill because it can save you time and make your job easier.

Business knowledge is important for accounting problem solving because it helps accountants understand the context of the problem they are trying to solve. It also helps them identify the root cause of the problem and develop a solution that will be effective in the real world.

Accounting problem solving often involves looking at a company’s financial statements and trying to identify where the company is spending too much money or where it is making mistakes in its accounting practices. To do this, accountants need to understand the company’s business and the industry in which it operates. They also need to be familiar with the latest accounting standards and best practices.

Problem solving is an important skill for accountants because they often have to solve complex problems. Problem solving requires the ability to identify the problem, gather information, develop a plan and implement the plan. Accountants must be able to think critically and creatively to solve problems.

Problem solving often requires good communication skills. Accountants must be able to explain the problem, gather information and develop a plan with the client. They also need to be able to follow up to make sure the plan is working and to troubleshoot if there are any issues.

How to Improve Your Accounting Problem Solving Skills

1. Understand the basics of accounting If you want to improve your accounting problem solving skills, it is important to have a strong foundation in accounting principles. You should be able to read and understand financial statements, as well as have a working knowledge of payroll, regulatory filings, revenue projections and account reconciliation.

2. Be well-versed in accounting software In order to be an effective problem solver, you need to be well-versed in accounting software. This will allow you to quickly and efficiently find solutions to accounting problems.

3. Stay up-to-date on accounting news and changes It is also important to stay up-to-date on accounting news and changes. This will help you anticipate problems and find solutions more quickly.

4. Be proactive in solving problems When you encounter an accounting problem, it is important to be proactive in solving it. This means taking the time to understand the problem and researching potential solutions.

5. Communicate effectively with your team When you are working on a team, it is important to communicate effectively. This means being clear about what you need from your team members and keeping them updated on your progress.

6. Be organized and efficient When solving accounting problems, it is important to be organized and efficient. This means having a system in place for tracking your progress and keeping your work area tidy.

7. Practice problem solving One of the best ways to improve your accounting problem solving skills is to practice. This can be done by working on practice problems or by taking on small projects in your personal life.

8. Seek out feedback When you are working on solving accounting problems, it is important to seek out feedback. This can be done by asking for feedback from your team members or by seeking out feedback from a mentor.

10 Linguistic Skills and How To Improve Them

10 stakeholder management skills and how to improve them, you may also be interested in..., 16 cargo agent skills for your career and resume, what does a spokesperson do, what does a primary care physician do, what does a principal consultant do.

This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Accountants as Problem Solvers

August 01, 2020

By: Linda McCann , DBA, CMA, CPA ; David Horn , CPA ; Jennifer Dosch , CMA

Managers often complain that accounting graduates aren’t prepared for today’s business environment. The complexity of our global economy and the increasing influence of, and reliance on, technology leads to practitioners and instructors questioning if undergraduate accounting programs focus on the right curriculum to prepare students for careers.

One soft skill that can help prepare accounting students for their careers is problem solving. Management accountants need to be able to work cross-functionally to solve problems and provide meaningful analyses. Many colleges, universities, and accrediting bodies in academia incorporate strategic goals requiring curriculum that facilitates problem-solving skills.

As instructors, we teach technical accounting skills by demonstrating and providing practice with accounting concepts and structured problems, which we assess via homework and exams. Teaching soft skills, such as unstructured problem solving, poses greater challenges that are more difficult to incorporate into the curriculum. How can students learn and approach unstructured problem solving?

A SLOW-THINKING APPROACH

Recent scientific discoveries into the brain reveal that humans employ fast and slow thinking to solve problems. The brain especially prefers making decisions and solving problems quickly based on recognized patterns, visual and verbal cues, prior knowledge, routines, familiar preferences, prejudices, and emotions.

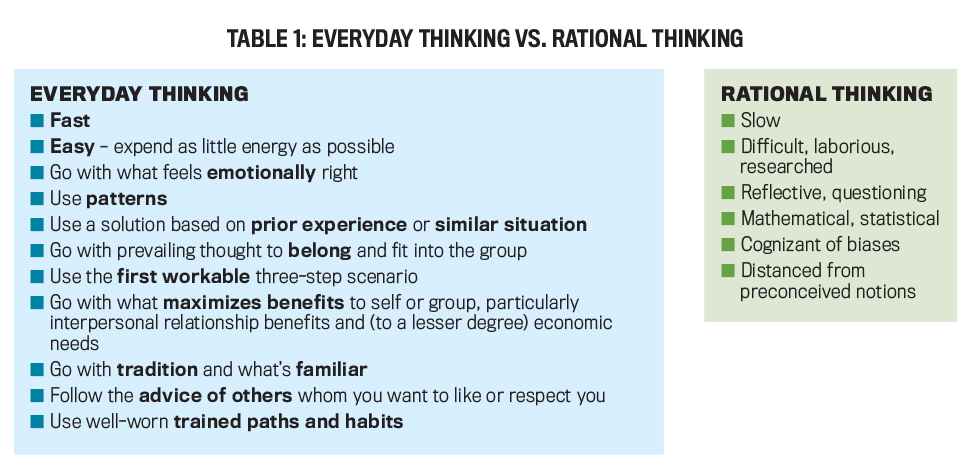

In contrast, decision making and problem solving often require slow thinking to digest new information, hypothesize alternatives, employ quantitative mathematical and statistical analysis, overtly recognize and break free from cognitive biases, challenge preconceived notions, synthesize ideas, and create new knowledge. To support this kind of slow, rational thinking, accountants can learn a methodical process for problem solving (see Table 1).

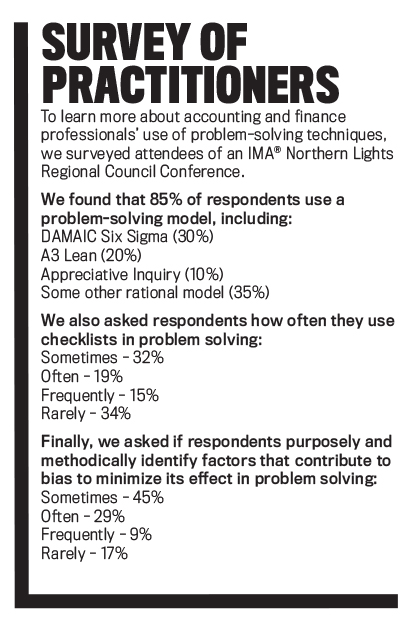

Many common business models—such as Six Sigma, A3 Lean, and Appreciative Inquiry—and the Association of American Colleges and Universities value problem solving, and critical-thinking grading rubrics describe specific steps for rational (i.e., slow thinking) problem solving. Business students, however, learn and apply these models in various courses, typically with no thread that ties them specifically to the accounting profession. Students learn bits and pieces of rational thinking throughout their undergraduate coursework, but instructors often don’t teach a common framework to apply these skills in a relevant and value-added way (see “Survey of Practitioners”).

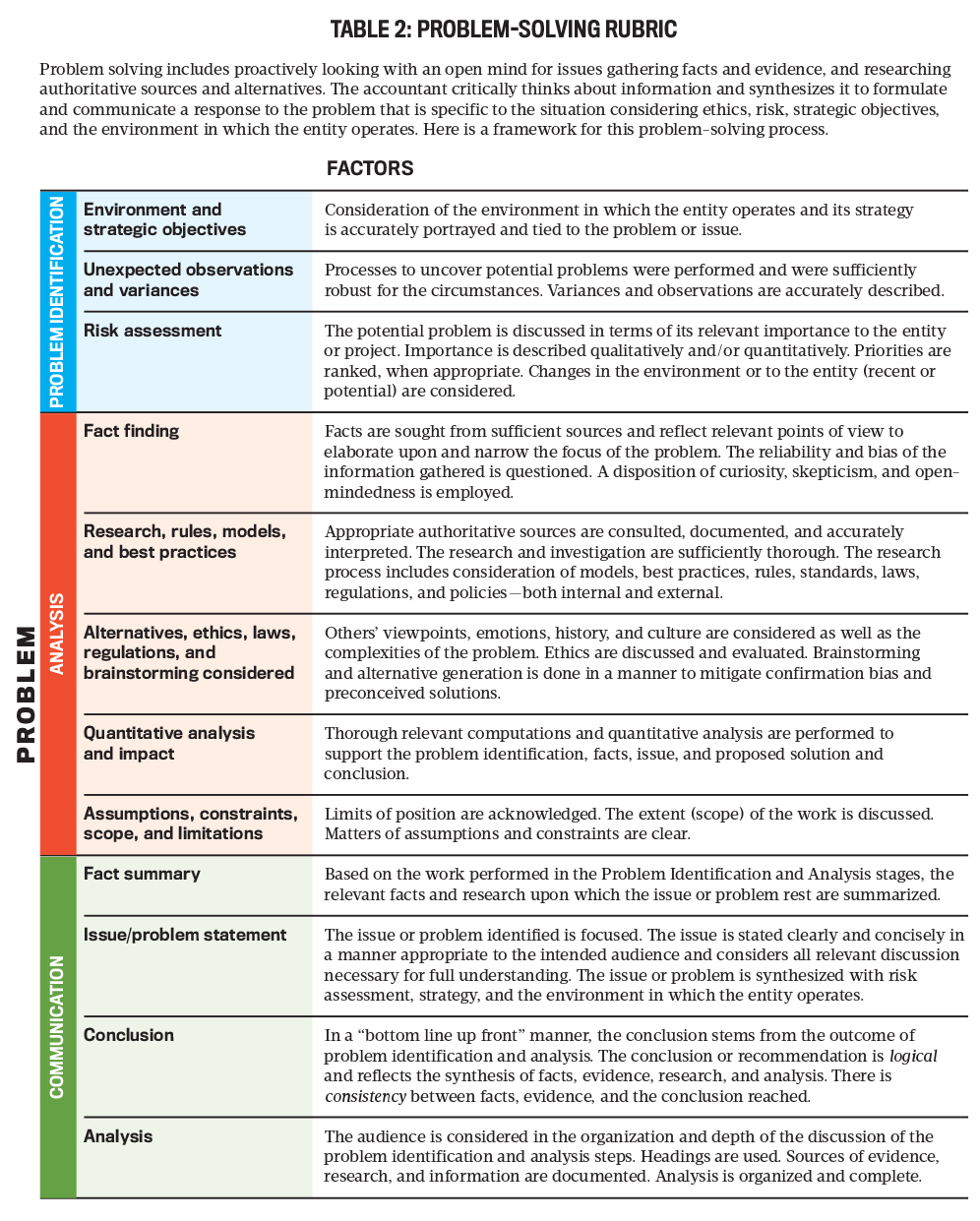

To help address this issue, we developed a problem-solving rubric for accounting students (see Table 2). The three of us are faculty members from Metropolitan State University in Minneapolis/St. Paul, Minn., and represent three different parts of the curriculum (auditing, business taxation, and management accounting), so it was important that it could be used across the entire accounting program.

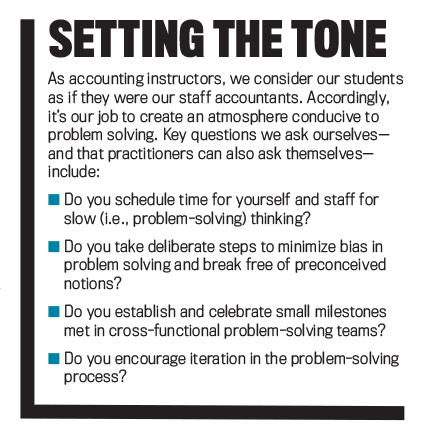

The rubric assesses learning in an organized way, providing a common framework (criteria) for students to consistently approach problem solving. The criteria include problem identification, analysis, and communication of results. It guides students through a series of problem-solving steps using terms and vocabulary specific to the accounting profession. The rubric also reminds us, as instructors, to create a learning environment where problem solving can occur (see “Setting the Tone”).

STEP 1: PROBLEM IDENTIFICATION

The iterative and looping nature of problem solving confounds inexperienced accountants. Where does one begin? Students tell us using a rubric provides a starting point.

To implement the rubric, we assign students projects with unclear goals, incomplete information, and more than one possible solution. Assignment topics vary. It could have students develop a cost-benefit analysis between adding employees or adopting Lean manufacturing techniques, analyze tax outcomes of business decisions, create a risk assessment and audit response for a fictitious client, or some other accounting-related issue.

Students begin by developing one or several hypotheses as to the nature of the problem. To generate ideas, we assist students in their brainstorming discussions. The rubric leads students to consider the environment, strategy, unexpected observations, overall importance, and risk assessment. At this stage, the identified problem may change, but the original hypothesized problem gives direction for next steps. Upon completing the assignment, we assess students on how they identified the problem.

Metropolitan State University’s business taxation course used the rubric in a case study that involves assessing the implication of the Wayfair v. South Dakota U.S. Supreme Court decision on a company’s sales tax collection. Prior to Wayfair , companies operated under a physical presence nexus established in Quill v. North Dakota . The Quill decision required companies to have a physical presence in a taxing jurisdiction in order to require collection and remittance of sales taxes on transactions.

In Wayfair , the U.S. Supreme Court overturned Quill in favor of an economic nexus standard, where companies only needed to have a certain level of economic activity. For example, in South Dakota, the threshold economic activity is 200 transactions or $100,000 in sales. The change from Quill to Wayfair was a major development in how companies operate and collect sales tax. It required companies to assess all jurisdictions in which they operate and evaluate how the change in the nexus standards impact its operations.

To apply this rubric to the change, students learn about a fictitious company that sells inventory to multiple states and collects and remits sales tax under the Quill physical presence nexus standard. We give students a subledger with all sales data for the given year. The rubric leads students to ask about implications of the Wayfair decision on the company, how the ruling impacts the company’s strategic objectives, and risks to the company because of the change in the law. Using the rubric, students are guided to discover the issue at hand, which is whether the company will have a significant number of new sales tax jurisdictions requiring collections and remittance from its customers.

Students tell us that without the rubric, they often feel like they have no road map at the beginning of a project or case study; identifying the problem seems too big and undefined to tackle. Many students initially resist engaging with unstructured problem-solving assignments because they differ from past assignments. Similar to what one might find in cross-functional teams opposed to change, students show their displeasure with crossed arms and distant body language.

Many college courses still rely on testing facts and use formulas and calculations, an approach that doesn’t put the student in the decision-making role but is familiar to them. With a rubric, students see smaller doable steps, where the assignment is heading, and how they can move forward and loop backward, when necessary. The rubric breaks down the initial intimidation students feel with unstructured problems.

STEP 2: ANALYSIS

Next, the rubric guides students through analyzing the problem using accounting-specific skills they’ve acquired in each course. For example, students consider tax laws, financial reporting and audit principles, or cost accounting techniques.

Continuing the sales and use tax example, at this stage, students apply the rubric to perform a complete analysis, enabling them to form a conclusion to communicate. What are the relevant facts to determine Wayfair ’s impact? What facts are irrelevant? What primary and secondary tax authority is needed to conduct research? Are there alternatives and exceptions to applying Wayfair ? Have all states adopted an economic nexus standard? Have all states adopted South Dakota’s transactional thresholds? What’s the quantitative impact to the company? Are there financial accounting implications to the Wayfair decision? What’s the scope of the necessary research, and are there limitations, constraints, and so on? Through the rubric, students formulate and answer questions and perform analysis to solve the problem at hand.

We assess students on their ability to gather and identify relevant facts, research any applicable rules and laws, assess alternatives, and perform any needed qualitative and quantitative analyses. At this stage, students apply theories and best practices learned in specific course fields, such as management accounting, taxation, and auditing.

To encourage elaboration, the rubric uses words such as curious, skeptical, model, assumption, authoritative, best practices, relevant, and sufficient sources. Like many accountants, students want to get their work done quickly, but problem solving takes time and slow thinking. Thanks to the rubric, more students turned in papers with greater depth, less “cut and paste,” and more relevant supporting details.

As in the real world, students often discover their original hypothesis or identified problem is incorrect, incomplete, or irrelevant. They confront the iterative nature of problem solving as they work through the analysis stage and build evidence to support their hypothesis. When evidence doesn’t support an identified problem, students go back and redefine their problem, gather new evidence, explore new alternative solutions, and build a case for their conclusion.

STEP 3: COMMUNICATION

Finally, students present their results in a memorandum to a hypothetical manager or audit partner. The memorandum mirrors common styles, such as IFRAC (issues, facts, rules, analysis, and conclusion) and BLUF (bottom line up front). Students state the problem and include the conclusion (i.e., solution) up front along with a summary of relevant facts and assumptions. Supporting documentation presents additional in-depth analysis.

This format familiarizes students with a presentation style that allows management to quickly understand conclusions while also providing more depth to support the up-front conclusion. We expect students to write and present findings in a clear and concise manner as if in a professional accounting setting. The rubric grading criteria helps students solve problems using rational thinking and delivering a memorandum that directly supports management decision making.

In the Wayfair case study, students draft a memorandum to management addressing the implications of the sales tax nexus precedence change. The facts section should discuss the company’s current sales and use tax policies. Students identify the issue as the change from physical presence nexus to economic nexus. The up-front conclusion should identify new jurisdictions from which the company needs to register and collect sales tax and quantify the volume of sales tax it expects to collect. Finally, the analysis provides an in-depth discussion of the change from Quill to Wayfair . Students should discuss how they determined new jurisdictions, limitations, and further required resources for the company.

PREPARING STUDENTS FOR THEIR CAREERS

We use the rubric format for projects or cases at different stages throughout the accounting curriculum. The problem-solving rubric measures student learning and reinforces rational thinking with each assignment. The projects that use the rubric vary in length, depth, and complexity as students move from management accounting to tax and then finally to audit. We find the rubric flexible enough to adapt to an instructor’s needs, yet it provides consistent core steps—identify the problem, analyze, and communicate—to solve problems.

The rubric helps students organize their communication through the memorandum. Setting up a memorandum so the problem and solution appear “up front” highlights mismatches between the problem, evidence, and conclusion. Further, it encourages students to decide—rather than ramble and include information that isn’t relevant. We find students often get to the communication stage and realize that their analysis doesn’t support their conclusion or identified problem. Fortunately, the rubric allows them to loop back and redefine and reanalyze.

By using the same grading criteria in multiple courses, we provide students with a familiar approach to problem solving that turns fast thinking to slow, rational thinking. The process and steps become routine and less daunting for the student. While each step still requires arduous thinking, the approach itself is a recognized pattern for students.

From our point of view as accounting instructors, the rubric helps provide consistent and fair grading. We provide separate points for milestones in problem identification, analysis, and communication, which further encourages students to go through each step of the process. Metropolitan State University plans to expand the use of this rubric in the accounting curriculum. This common framework provides students with a process to identify problems, research and investigate facts, conduct analyses, and communicate results across all accounting disciplines.

This process reinforces the problem-solving skills that students will need in their professional careers. These capabilities will help them perform their roles in today’s strategic, fast-paced business environment. Solving problems is critical for today’s management accountant. Through implementing the rubric, instructors can help students systematically apply a problem-solving process that they can take with them as they move from student to management accountant.

About the Authors

August 2020

- Strategy, Planning & Performance

- Decision Analysis

- Negotiation

- Metropolitan State University

Publication Highlights

Call for Ethics Papers: Sept. 1 Deadline

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- The joys of problem solving

- Student e-magazine

Many accountants enjoy problem solving more than number crunching. So what typical problems can you look forward to cracking at work? Iwona Tokc-Wilde reports

Problem solving is something that accountants and finance professionals deal with virtually every working day. In fact, a recent survey by Robert Half shows it is this part of working in the profession that they like best: 41% of accountants say solving problems gives them the most job satisfaction, compared to just 22% who prefer working with numbers.

‘Accountants are usually excellent at dealing with detail and spotting patterns, which makes them good at – and enjoy – problem solving,’ comments Andi Lonnen, founder and director of Finance Training Academy.

If you are at the beginning of your journey into the profession and enjoy tackling problems, you have a head start. Problem solving is also a skill that is one of the 10 most sought-after trainee skills globally (see 'Related links').

Why problem-solving skills are so important

‘The role of accountancy and finance has shifted from a pure focus on fiscal control to one where it has an impact on the business,’ says Phil Sheridan, managing director at Robert Half.

‘The requirement for problem-solving skills is part of this transition as, by mining data and analysing trends, accountants are now translating numbers into actionable insights for the business and are increasingly being seen as strategic partners.’ By putting their data skills and their problem-solving skills to work together, they also help uncover potential areas for concern.

It is vital for accountants in practice to correctly identify, analyse and solve problems too.

‘As trusted advisers, it’s our role to look at everything in detail to pick-up anomalies, patterns and correlations in order to advise our clients on how to take things forward,’ says Shahzad Nawaz of AA Accountants. If they fail to pick up and analyse problems correctly, the accounts could be wrong.

‘This means the business owner would be relying on incorrect data, which could have a detrimental effect on the future of the business. And, of course, if external stakeholders are relying on the data, then we could potentially be misleading them too.’

Incorrect accounts could also have other serious knock-on effects.

‘If the accounting figures are incorrect, then the tax payments relating to the company will be incorrect too. Later on, the client could find themselves with additional tax to pay – with interest,’ says Tanya Addy of BHP Chartered Accountants.

‘Inaccurate accounting can also land businesses in serious commercial difficulties especially if, as a result, directors/owners have been taking more salary or dividends from the business than they were entitled to. In the worst case scenario, it could even lead to closure of the business.’

Problem solving at work

There are many areas where trainee and new accountants can practise solving problems, depending on the job you are doing.

‘If it’s accountancy, you’ll be looking at helping a business with cash flow, debtors and improving their record-keeping,’ says Nawaz.

At the nitty-gritty level, you will be reconciling control accounts, trying to understand why an account might not be balancing and investigating and clearing old items on reconciliations.

‘The work to balance an account involves finding out what the problem is and then resolving it, for example identifying and correcting transposition errors,’ says Lodden.

If you work in tax, you’ll be involved in advising a client on how much tax they will need to pay (and how much tax they can save) in a particular year.

‘This will require a review of the information provided by the client, such as bank statements and expenses, analysing which expenses incurred are allowable and disallowable for taxation, quantifying the results and communicating them to the client and to tax authorities,’ explains Carolyn Napier, senior ACCA tutor at London School of Business and Finance.

You will also be dealing with tax implications, and tax cost for both employer and employee, of providing benefits.

‘You will need to ascertain which benefits are taxable and which are tax-free, and then you’ll need to "solve the problem" of which tax or taxes are due and payable, and by what date,’ says Napier.

In industry, you may be given the opportunity to help analyse projects, and communicate your findings to various parts of the business.

‘This is where new and trainee accountants will need to be prepared to utilise their problem-solving skills – noting anomalies and seeking clarification on areas of uncertainly will ensure that a clearer picture can be obtained,’ says Sheridan.

Deborah Adigun-Hameed is an accountant and junior financial analyst at BlueBay Asset Management. By utilising her problem-solving aptitude and skills, she has been involved in major decisions that shape the company she works for.

‘I’ve contributed to key strategic discussions about which market and products are profitable, what we should be selling and how we compare with our competitors,’ says Adigun-Hameed.

‘I may be newly qualified, but my informed opinions and advice are really valued by the management.’

Both in practice and in industry, accountants are also increasingly called upon to help solve technology problems – for example, when a business intends to implement new business software solutions. They help with the evaluation and selection of a solution, and with planning and execution of the implementation process. They also assist in testing the new system and facilitate going live when the system is ready.

Hone your problem-solving skills

Problem solving is about using logic and your technical expertise to assess a situation and to come up with a workable solution. It is connected to other skills such as level-headedness and resilience, analytical skills and good teamworking skills.

It also requires creativity, which is best learnt through collaboration – brainstorming with others to clarify the problem, generate ideas and create as many potential solutions as possible. When putting forward ideas, be confident in your contributions.

‘Everyone, including those newly-qualified, has something to offer,’ says Adigun-Hameed. ‘Always think outside of the box, as cliché as that may sound. No new idea is insignificant. Innovation can be incremental; change can be small or radical.’

Improving your listening and communication skills will also make you a better problem solver.

‘Learning to communicate well is vital as you need to build rapport with clients. If you have a good rapport with someone, you are confident to ask questions, which is how you can pin down problems and find answers to those problems,’ says Nawaz.

Above all else, getting practical on-the-job experience is how you can get really good at problem solving.

‘The first control account a trainee tends to tackle and perfect is the bank control account; every trainee accountant has had to look for that 1p difference – as painful as that sounds, it certainly helps you learn,’ says Lauren Burt, client manager at EST Accountants and Tax Advisers.

"Everyone, including those newly-qualified, has something to offer. Always think outside of the box, as cliché as that may sound. No new idea is insignificant. Innovation can be incremental; change can be small or radical" Deborah Adigun-Hameed - BlueBay Asset Management

Related Links

- Top 10 global in-demand skills

- Student Accountant hub

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- Business Partner

- Strategic Partner

- Problem Solving

- Communication

- Strategic Thinking

- Influencing

Problem Solving Skills For Accountants

Problem solving skills for accountants are so valuable because businesses are full of problems that need solving – and almost all business problems have some kind of financial impact.

Therefore accountants with problem solving skills are highly valuable.

As a technically proficient accountant you understand many technical solutions to finance problems and issues.

You know what complies with the rules, what is possible and what is not.

However there comes a time when you are faced with problems that are difficult, eiether because they aren’t well-formed, are ambiguous or complex.

Complex problems

These are problems where there is no right answer and the issues span multiple disciplines and departments.

Developing problem-solving skills will set you apart from your colleagues, as you will be able to help solve these complex problems.

For instance, you will be a vital resource for developing the finance function.

You’ll also become a valued partner to other non-financial managers.

You will be able to propose solutions that work for you and them.

You can also ensure that they work within the financial constraints that you understand well.

Understanding business problems

The first step is to understand the problem thoroughly. To examine it from every relevant angle and understand it in context.

This means understanding the business, what is important and what would be right for the business – not just finance.

Lateral thinking for problem solving

Solving a business problem often requires lateral thinking – coming at things from a new perspective.

With your financial and analytical mind you can bring a valuable perspective that your colleagues may lack.

If you are able to develop lateral thinking skills you can make a significant contribution to the debate. Particularly when you use these alongside and combined with your technical and analytical approach.

Creative ideas

Accountants aren’t always noted for their creative thinking. Therefore being able to suspend judgement and think creatively and imaginatively can give you an edge over others. Because this enables you to bring something unique and different to the discussion.

Learning to think creatively can be liberating and fun. But it can also produce some new insights and innovations.

These can make everyone’s lives more productive and set you apart from your colleagues.

Proposing solutions

Having great ideas is one thing, but arguing the case for them and presenting your proposed solutions to your colleagues and decision-makers is another.

Being able to see – and sell – the benefits of a solution requires an insight into the business, your colleagues and the office politics that inevitably exist.

Why are problem solving skills for accountants so important?

Most business problems have a financial dimension and as accountant you have unrivalled expertise.

An accountant who can proactively solve business problems will be a highly valuable asset for any business..

Being a creative problem-solver may not be your natural strength, but these skills can be learnt and developed.

You have a huge opportunity to become a highly valued member of the team if you can develop your problem solving skills.

How are you developing your problem solving skills?

Do you have sufficient understanding of the business to propose solutions that will be accepted, how adept are you at persuading others of the merits of your solution, which of the other key soft skills for accountants do you need to develop, discover the seven essential soft skills for accountants download the report now.

There are some key soft skills to focus on as your finance career progresses.

Find out which they are by downloading the free report.

Never see this message again.

- Career Management Skills

The Top Soft Skills Accountants Should Cultivate for the Future

Search SkillsYouNeed:

Personal Skills:

- A - Z List of Personal Skills

- Personal Development

- Career Options for School Leavers

- Careers for Graduates

- Developing Your Super-Strengths

- Discovering Your Career Values

- Creating and Exploring Career Possibilities

- Improving Your Career Confidence

- Building A Personal Brand

- Job Crafting and Job Enrichment

- Choosing and Changing Jobs

- Negotiating Within Your Job

- Networking Skills

- Top Tips for Effective Networking

- Personal SWOT Analysis

- Continuing Professional Development

- Setting Up a ‘Side Hustle’

- Career Sectors

- Careers in Business

- Careers in Administration and Management

- Careers in Retail

- Careers in Hospitality and Personal Care

- Careers in Information Technology and Computing

- Careers in Construction

- Careers in Manufacturing

- Careers in Engineering

- Creative Careers: Arts, Crafts and Design

- Creative Careers: Media and Advertising

- Careers in Healthcare

- Careers in Social Work and Youth Work

- Careers in Life Sciences

- Careers in the Third Sector

- Careers Involving Animals, Farming and the Natural World

- Careers in Education

- Careers in Physical Sciences

- Careers in Financial Services, Insurance and Banking

- Careers in Law and Law Enforcement

- Careers in the Armed Forces, Security and Emergency Services

- Careers in Politics and Government

- Careers in Sports

Check out our eBook:

The Skills You Need Guide to Personal Development

- Creative Thinking Skills

- Personal Skills for the Mind

- Emotional Intelligence

- Stress and Stress Management

- Anger and Aggression

- Assertiveness

- Living Well, Living Ethically

- Understanding Sustainability

- Caring for Your Body

Subscribe to our FREE newsletter and start improving your life in just 5 minutes a day.

You'll get our 5 free 'One Minute Life Skills' and our weekly newsletter.

We'll never share your email address and you can unsubscribe at any time.

Accountancy is often viewed as a profession built on hard skills. After all, aspiring accountants must pass a number of exams and undergo extensive training before launching their careers. However, just because it’s important to have an in-depth understanding of financial statements and be proficient in using accounting software, doesn’t mean that soft skills don’t come into play.

The future of accounting is changing and hard skills like mathematical aptitude are not as important as they once were. This is all because of the way that accounting and accounts payable software is automating many calculations and administrative procedures. As a result, accountants must cultivate their soft skills to secure their careers in the future, as it’s these skills that can’t be replicated by technology and are therefore more valuable to employers.

Here are some of the most important soft skills an accountant can have:

People Skills

Because accountants work so closely with numbers, communication and people skills sometimes fall by the wayside. However, accountants need to be able to work effectively with other members of the business, employees within their team, and clients.

Accountants are increasingly stepping into advisory roles and may need to give presentations or provide suggestions to the executive board of a company. In these situations, having an in-depth understanding of tax calculations and spreadsheets is of very little use if you can’t communicate your ideas coherently to others.

It’s important for accountants to be able to explain complicated terms clearly to executives who may not have a background in accounting. They must also be able to draw conclusions from datasets and present them in a way that makes sense to everyone.

Accountants must also demonstrate the ability to:

Listen carefully to the goals of relevant stakeholders before providing solutions.

Empathetically respond to clients’ worries while guiding them through their options.

Sensitively work alongside their co-workers, being mindful of everyone’s needs and backgrounds.

Approachability and Openness

Customer-facing accountants need to know not only how to communicate effectively, but how to appear approachable and open as well. Creating a safe space for clients to open up, ask questions and share their concerns is a key part of effective customer service. Accountants can cultivate this environment by encouraging clients to share their views and thoughts, always answering questions in full, never seeming hurried or irritated by simple queries, and having a friendly, welcoming persona.

Teamwork and Leadership

Accountants that are looking to further their careers by securing more senior positions must demonstrate strong leadership qualities . While once it may have been possible for accountants to work in isolation, that’s largely impossible in modern-day corporations. Accountancy often revolves around collaboration and the sharing of ideas, so all accountants should know how to both take instruction and delegate tasks to others.

A competent leader is one that is confident and self-assured while simultaneously being open to feedback and listening to the ideas of their team. Senior accountants must be able to provide guidance to more junior members of staff and train new hires, but they must also be open to correcting issues raised by their team in order to work synergistically.

Problem Solving

Creative problem solving is a valuable skill for an accountant. Problem solving isn’t necessarily something that can be taught, and while some people have a natural aptitude for it, it is a skill that can be developed with practice. Typically, more experienced accountants will be able to solve problems more quickly, as they’ll have past experiences to draw upon and base their solutions around. However, even newer accountants can begin changing their mindset and looking at problems from a new perspective.

Some of the biggest challenges accountants can expect to face include:

Cash Flow : Many businesses will encounter some kind of cash flow issue at one point or another, particularly during economic hardship. Accountants are often responsible for identifying why cash flow issues are occurring and proposing solutions that will solve the problem without hindering business growth.

Changes to Tax Laws : Most of the time, tax calculations are handled by accounting software, but accountants are responsible for understanding the law so that businesses can make the most of various thresholds and exemptions. When the law changes, accountants may be forced to move money around, reassess budgets and find new ways of saving money.

Financial Forecasting : While accountants use every resource they have available to create financial forecasts, the business world can be unpredictable and sometimes those forecasts don’t reflect reality. This may cause financial difficulties for businesses that expected to make more money than they did and it’s up to accountants to try and remedy the situation and understand what went wrong.

Ultimately, the type of problem an accountant encounters shouldn’t matter. Once you’ve developed your problem solving skills, you will be able to circumvent any manner of obstacles.

Growth Mindset

As mentioned before, the accounting industry is constantly evolving and moving forward thanks to technology. Therefore, accountants must be open to continuous learning and be willing to develop their skills even once they’re established as senior professionals. From becoming familiar with new types of software to adjusting to remote working practices, accountants will need to be open to all kinds of change in today’s economic climate.

One of the key parts of having a growth mindset is being able to learn from mistakes and failures – and being able to recognize them as such. Employers value accountants that can identify issues before they become a bigger problem and have a knock-on effect on the business.

Further Reading from Skills You Need

The Skills You Need Guide to Interpersonal Skills eBooks.

Develop your interpersonal skills with our series of eBooks. Learn about and improve your communication skills, tackle conflict resolution, mediate in difficult situations, and develop your emotional intelligence.

How to Develop Your Soft Skills Today

The best way to develop your soft skills is to put your newfound knowledge into practice. Once you’ve understood which skills you need to work on , spend some time researching the ways you can improve. If you don’t have many opportunities in your current role to practice some of the skills listed above, try to take on some new challenges that will force you to leave your comfort zone and test unchartered waters.

About the Author

Aislinn Carter is a freelance writer and small business owner living in Hallandale, Florida. She has extensive experience in writing across a number of different verticals, with a specialism for business management and professional development related content.

Continue to: Continuous Professional Development The Skills You Need to Build a Career in Finance

See also: 11 Key Skills Every Accountant Needs to Succeed 10 Accounting Skills You Need to Succeed on the Job Key Soft Skills for Accountants and Bookkeepers

Accountant Skills

Learn about the skills that will be most essential for Accountants in 2024.

Getting Started as a Accountant

- What is a Accountant

- How To Become

- Certifications

- Tools & Software

- LinkedIn Guide

- Interview Questions

- Work-Life Balance

- Professional Goals

- Resume Examples

- Cover Letter Examples

What Skills Does a Accountant Need?

Find the important skills for any job.

Types of Skills for Accountants

Technical accounting proficiency, technological adaptability, analytical and critical thinking, regulatory and ethical standards, communication and interpersonal abilities, business acumen and strategic insight, top hard skills for accountants.

Equipping accountants with analytical prowess and technological fluency for precision in financial stewardship and strategic decision-making.

- Advanced Excel and Spreadsheet Proficiency

- Financial Reporting and GAAP Compliance

- Tax Preparation and Planning

- Auditing and Internal Controls

- Financial Forecasting and Analysis

- Accounting Software Proficiency (e.g., QuickBooks, SAP)

- Regulatory Compliance and Tax Law

- Cost Accounting and Inventory Management

- Business Intelligence and Data Analytics

- Blockchain Fundamentals and Cryptocurrency Accounting

Top Soft Skills for Accountants

Empowering accountants with the interpersonal finesse and critical acumen essential for dynamic financial stewardship and client trust.

- Communication and Interpersonal Skills

- Client Relationship Management

- Adaptability and Flexibility

- Problem-Solving and Critical Thinking

- Attention to Detail and Accuracy

- Time Management and Organization

- Integrity and Trustworthiness

- Teamwork and Collaboration

Continuous Learning and Professional Development

- Emotional Intelligence and Empathy

Most Important Accountant Skills in 2024

Advanced data analysis and interpretation, technological proficiency, regulatory compliance and risk management, strategic financial planning, effective communication and reporting, business acumen and industry knowledge, leadership and team collaboration.

Show the Right Skills in Every Application

Accountant skills by experience level, important skills for entry-level accountants, important skills for mid-level accountants, important skills for senior accountants, most underrated skills for accountants, 1. active listening, 2. critical thinking, 3. cultural competence, how to demonstrate your skills as a accountant in 2024, how you can upskill as a accountant.

- Master Advanced Data Analysis Tools: Develop proficiency in data analytics software and tools such as Power BI, Tableau, or advanced Excel features to interpret financial data more effectively and provide strategic insights.

- Stay Current with Regulatory Changes: Regularly update your knowledge of accounting standards, tax laws, and compliance regulations through webinars, courses, and professional publications.

- Expand Expertise in Financial Technologies: Familiarize yourself with the latest fintech innovations, including blockchain, cryptocurrencies, and digital payments, to understand their impact on accounting practices.

- Enhance IT Skills and Cybersecurity Awareness: Improve your understanding of information systems and cybersecurity to protect sensitive financial data and understand the IT controls within your organization or client businesses.

- Obtain Specialized Certifications: Pursue additional certifications such as CMA, CGMA, or CPA specializations to demonstrate advanced competencies and dedication to your field.

- Embrace Automation and AI: Learn how to work with accounting automation tools and artificial intelligence to streamline processes and focus on more strategic tasks.

- Develop Soft Skills: Strengthen communication, leadership, and problem-solving skills to better manage teams, lead projects, and consult with clients on complex financial matters.

- Participate in Professional Accounting Networks: Join accounting forums, associations, and online communities to exchange knowledge, stay informed about industry trends, and build a professional network.

- Focus on Sustainability Accounting: Gain expertise in environmental, social, and governance (ESG) reporting and sustainable finance to meet the growing demand for accountability in corporate sustainability.

- Practice Continuous Learning: Set aside regular time for self-study, reading industry literature, and attending training to ensure your skills remain sharp and relevant.

Skill FAQs for Accountants

What are the emerging skills for accountants today, how can accountants effectivley develop their soft skills, how important is technical expertise for accountants.

Accountant Education

More Skills for Related Roles

Driving financial success by overseeing accurate, efficient accounting operations

Ensuring financial accuracy and compliance, safeguarding business integrity and growth

Balancing financial accuracy with efficiency, ensuring fiscal health and transparency

Navigating complex tax landscapes, ensuring compliance while maximizing savings

Steering financial success with strategic oversight, ensuring fiscal integrity and growth

Driving financial strategies, analyzing market trends for business profitability

Start Your Accountant Career with Teal

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

The Accounting Skills You Need For A Successful Career

Expert Reviewed

Updated: Mar 5, 2024, 3:07pm

The skills needed to become an accountant may not be what you think. Yes, spreadsheets are vital, as is knowledge of Excel functions. But you need more than that if you want to stand out among the competition and get an accounting job—soft skills like communication and organization are critical as well.

Accountants enjoy steady demand, and this evolving field is only becoming more competitive to enter. Read on to learn the top accounting skills you’ll need to succeed in this field.

Why You Can Trust Forbes Advisor Education

Forbes Advisor’s education editors are committed to producing unbiased rankings and informative articles covering online colleges, tech bootcamps and career paths. Our ranking methodologies use data from the National Center for Education Statistics , education providers, and reputable educational and professional organizations. An advisory board of educators and other subject matter experts reviews and verifies our content to bring you trustworthy, up-to-date information. Advertisers do not influence our rankings or editorial content.

- 6,290 accredited, nonprofit colleges and universities analyzed nationwide

- 52 reputable tech bootcamp providers evaluated for our rankings

- All content is fact-checked and updated on an annual basis

- Rankings undergo five rounds of fact-checking

- Only 7.12% of all colleges, universities and bootcamp providers we consider are awarded

Top Technical Skills for an Accountant

Employers look for accounting candidates who can help them advance their businesses and meet their clients’ needs. As a prospective accountant, you must demonstrate proficiency in basic technical accounting skills.

Every accountant, auditor and financial analyst should stay up to date with current best practices in the field. To go the extra mile, consider reading up on emerging trends, such as how cloud computing and blockchain technologies affect accounting.

Using Accounting Software

Knowing the ins and outs of accounting and office software such as QuickBooks, Excel and Google Workspace is crucial to your future as an accountant. Technological advances continue to bring changes to the accounting field. As your career advances and you seek positions of greater responsibility, you may wish to get familiar with process automation, artificial intelligence and financial modeling software.

Each accounting firm and organization has its own software preferences as well. How do you know which ones to learn? Here’s an expert tip:

Preparing and Reporting on Financial Statements

Financial statements are the bread and butter of accounting firms and business operations. Knowledge of how to prepare and report on financial statements is critical to becoming an accountant. An accountant’s everyday responsibilities include creating, tracking and reporting on balance sheets, income statements and cash flow statements.

To prepare a financial statement, you must be comfortable gathering, verifying and classifying financial data. Reporting on financial statements requires its own set of skills. The best financial reports communicate complex data in a way that is understandable to all stakeholders. These reports can then be used to evaluate clients’ financial health and vulnerabilities.

Knowledge of Spreadsheet Software.

Excel continues to be one of the most valuable tools for accountants to know. Before you pursue an accounting career, you should understand how to use Excel to organize and manipulate data.

If you don’t know your way around an Excel spreadsheet, take some time to practice. You might even take an online course to ensure you’re at the top of your game before applying for accounting jobs or a graduate program.

Top Soft Skills for an Accountant

Anyone can learn the technical skills required to become a successful accountant. What’s more difficult to teach, however, are the soft skills. Forging strong working relationships with your colleagues, peers and clients is as important as your ability to perform complex financial analyses.

Soft skills also set you apart from other applicants in the accounting job market.

Communication

Effective communication is essential to all business roles, accountants included. The stereotypical idea of an accountant may bring to mind a person who’s glued to a computer screen full of datasets, but in reality, the job involves much more than that.

Accountants spend time in meetings with clients, stakeholders and fellow employees. They often need to communicate financial updates. You may also find accountants collaborating with each other, particularly in larger firms and businesses with more involved accounting needs.

Expert communication skills are essential to advance in your accounting career. Accounting managers spend most of their time communicating with direct reports, controllers, finance directors and colleagues from other departments who may be less familiar with accounting terms.

Oral communication is important in accounting, but don’t neglect your writing skills. As CPA Logan Allec notes, “Written documentation/communication provides a paper trail and is often requested by clients and bosses alike.”

Along with preparing this documentation, accountants must communicate with coworkers and clients in writing via email and workplace communication tools such as Slack. Allec adds,

Time Management and Organization

Careful organization and effective time management are two soft skills needed to become an accountant. During the early part of the year, known as “tax season,” the volume of work for accountants increases. As you juggle various spreadsheets, clients and reports, you must keep track of your time and remain aware of strict deadlines to file taxes and reports.

In the accounting world, there are consequences for not filing on time or preparing accurate financial statements. It’s vital to maintain self-awareness and discipline to stay on top of your tasks.

Critical Thinking

Accounting skills go beyond sorting through numbers and relying on automated processes to create financial statements. To succeed as an accountant, you need strong critical thinking skills. Ethical dilemmas, reporting errors and unbalanced spreadsheets require careful thought and investigation to arrive at the best solutions. Accountants must take an active approach to each task to make predictions and assess risk.

Problem-Solving

Technological advances do not negate the need for accountants to predict trends and make financial forecasts. Problem-solving remains one of the top required skills for accountants.

Remember, employers aren’t looking for robots who can spout off a string of numbers or only analyze data. Rather, they are seeking creative problem-solvers who can help meet their needs and identify innovative ways to move their organization forward.

Strong Attention to Detail

As a highly regulated field, accounting necessitates strong attention to detail. There is little margin for error when you’re responsible for someone else’s finances.

Accountants must follow Generally Accepted Accounting Principles and stay aware of industry-specific rules, regulations and deadlines. A keen eye for irregularities and errors is an essential skill for accountants.

How To Develop the Right Skills To Become an Accountant

Take inventory of your strengths and any gaps in your accounting skill set. It’s a good idea to highlight the areas in which you need to deepen your knowledge or abilities. There are ample accounting courses and learning opportunities available both online and in person at local community colleges or training centers.

Developing soft skills takes time and patience. Practice by incorporating them into your daily routines, such as by using a task management app for better organization. You can also reach out to potential mentors in your field to work on your communication skills and learn about the latest trends in accounting. Removing distractions from your workspace can also help you improve your focus and attention to detail.

Frequently Asked Questions (FAQs) About Skills for Accounting Careers

What skills do accounting firms look for.

When it comes to hiring, accounting firms look for a mix of hard and soft skills. Job applicants should be familiar with spreadsheets and standard accounting software. They should also have a strong understanding of Generally Accepted Accounting Principles and basic industry practices such as the double-entry system. Firms also want to hire accountants with nontechnical skills like communication, time management and attention to detail.

How do you know if accounting is for you?

As with any career path, consider your strengths, goals and interests. Accounting tends to suit organized, methodical individuals with strong analytical and communication skills. It also helps to have an interest in mathematics, including algebra and statistics, but you don’t necessarily need deep mathematical knowledge beyond lower-level college math courses.

Is accounting a good career path?

Many professionals in the field would say yes. If you like numbers and have a detail-oriented outlook, accounting can provide a satisfying career with a comfortable salary and strong job security. The U.S. Bureau of Labor Statistics reports a 2022 median salary of $78,000 for accountants and auditors. As fewer students graduate with accounting degrees, a looming nationwide accountant shortage may create a favorable hiring climate for accounting professionals.

- Best Online Accounting Degrees

- Best MBA In Finance Online

- Best Online Finance Degrees

- Best Online Master’s In Accounting Degrees

- Best Online Master’s In Finance

- Best Online MBA Programs

- Best Ph.D. In Leadership Online Programs

- How To Become A CPA

- How To Become A Financial Advisor

- How To Become An Accountant

- How To Become An Investment Banker

- Possible Jobs With A Business Management Degree

- How To Choose A Career In Marketing

- What Can You Do With An Accounting Degree?

- Alternatives To An MBA

- Earning A Business Administration Bachelor’s Degree

- Earning A Bachelor’s In Marketing

- Bookkeeping vs Accounting

- Should You Get An MBA In Finance?

- Earning A Finance Degree

- Earning An Online MBA In Accounting

Best Online Associate Degrees In Business Management Of 2024

Where To Earn An Online Ph.D. In Marketing In 2024

Best Online Ph.D. In Management Of 2024

Best Online Ph.D. In Finance Programs Of 2024

Best Online Ph.D. In Business Administration Programs Of 2024

Meghan Gallagher is a Seattle-based freelance content writer and strategist. She has a B.S. in Marketing Management and a background in digital marketing for healthcare, nonprofit, and higher education organizations.

Veronica Beagle is the managing editor for Education at Forbes Advisor. She completed her master’s in English at the University of Hawai‘i at Mānoa. Before coming to Forbes Advisor she worked on education related content at HigherEducation.com and Red Ventures as both a copy editor and content manager.

- User Manager

- Saved for Later

Developing your problem-solving skills

Problem Solving has emerged as one of the key skills that accountants will need in the future. As we are increasingly called upon to help solve problems, both in business and in practice, so it's vital that we hone our skills in this area so that we can continue to add value to our organisations in the future. In this extract from his new course, Problem Solving for Accountants , Alan Nelson describes how we can develop our problem-solving skills.

Before we elaborate on why accountants should be interested in developing their problem-solving skills, let's go back to basics.

The most obvious sign of a problem is that something is not working as well as you would like it to be.

What is a problem?

What are the signs that there is a problem? A downturn in reported sales for the period?

Whether it is a financial reporting issue, a timing issue, a sales issue or a business performance problem, the most obvious sign of a problem is that something is not working as well as you would like it to be.

What are examples of typical accounting problems?

Accountants and finance professionals deal with problems on a daily basis. You might:

- Spot that some creditors are taking longer to pay

- Reconcile accounts

- Notice that an important KPI is off target

- Identify an increase in production costs

- Uncover errors in tax returns

- Foresee a cash shortage before it becomes critical

As accountants, it's vital that you notice the finer details, meaning you are able to spot errors and patterns with figures. Not only do you have the skills to identify these kinds of problems, but you have the technical knowledge to make the numbers right.

How is the nature of problem-solving changing in accounting?

Emerging technologies are causing the accounting industry to change. Computer programmes are starting to rectify the nitty-gritty numbers issues that accountants traditionally dealt with, meaning you will be faced with new problems to solve.

As those of you in practice attempt to move towards becoming trusted business advisers, and those in business towards being finance business partners, rather than being asked to solve problems to do with the accounts, you will be asked to seek out � and provide solutions to � issues in the wider business.

How will I need to develop my problem-solving skills then?

With the rise of automation, accountants of the future will be required to focus less on highlighting these sorts of issues with the numbers, and become much better at thinking up alternative solutions to a range of issues across the organisation.

Your job will be to bring problems to senior management and highlight how they present an opportunity for the business to improve � provide a better service, make better products, satisfy more customers, make more money... the list goes on.

And there are two different sets of skills that you can develop to help you do this.

Traditionally, the strategies used to get to the cause of a problem can be seen as being either creative or analytical. So it's developing your problem-solving skills in these areas that the new course focuses on.

Alan Nelson is an author for accountingcpd. To see his courses, click here .

You need to sign in or register before you can add a contribution.

INSIGHTS + Info

- All Insights

- By Resource

- Ask the CFO

- eBooks/Guides

- Interactive Tools

- Case Studies

- Infographics

- White Papers

- By Role / Industry

- CFO / Corporate Finance

- Investor / PE Firm

- CPA / Accounting Firm

- Corporate Operations

- By Solution

- General Finance & Accounting

- Accounts Payable

- Accounts Receivable

- Back Office

- Why Outsourced Accounting?

- Data & Automation

- Managing Human Capital

- Accounting Staffing

- Cost Containment

- Streamlining Private Equity

- Personiv's Virtual Accounting Solution

- CFO Weekly Podcast

Problem Solving in Accounting

- Share this Article

Problem-solving in accounting is a critical skill that can always be improved upon. Master problem-solver and CFO at Musselman & Hall Contractors LLC, Adam Porter, shares his insight and experience with us in the latest episode of CFO Weekly.

What Makes a Great Problem-solver?

If you know, you know, right? Adam instinctively knew he was a problem-solver when he was younger. Something as simple as going from point A to point B became an opportunity to experiment with which route got him to his destination quicker. And his quest for discovery hasn't stopped.

“If we don’t understand the ‘why’ behind the actions we take, how do we know if we’re really doing the right thing,” Porter said.

To solve is to correct or optimize, and none of us can do that if we don’t first recognize an opportunity to get involved. Problem-solving goes hand in hand with the willingness to roll up your sleeves and get stuck in, take an active role in, and see through the potential outcome. Adam empowers each of his team members to become (and grow as) problem-solvers, by recognizing them and their contributions to identifying and solving issues.

Involving people in the problem-solving process and connecting the dots for them, showing them how they make the business a better organism, is how you create more great problem-solvers and amplify your ability to tackle problems as they appear.

Accounting Problem-solving in Action

Problem-solving is a term that gets thrown around in interviews and on resumes quite a bit. When the time comes, real problem-solvers like Adam approach things in a specific way.

System Upgrades

If you’ve navigated a system change and survived to tell the tale, some would say you have superpowers. Upgrading something like an ERP system is a mammoth task, even for a seasoned team of executives. During a project like this, you’re reviewing and possibly amending every single organizational process.

You’re also required to identify how everything you do during this project starts to affect other areas of the business: finance, accounting, HR, IT and so on.

Adam’s own experience with one such project led him through a GL restructure. At the end of a six-month series of efforts, with the support of a Controller whom he had brought it to, Adam succeeded and was able to present information back to the business, which could be used to inform business decisions.

The domino effect: once more information became available, and it was clear how it related to each portion of the business, the people in charge of those respective portions became more engaged and more curious and more willing to work with that information.

Problem-solving is just one of those skills where nobody needs to formally identify the need for it. It’s the problem-solvers who are constantly on the lookout for opportunities to apply themselves.

The result is that everybody benefits.

The Problem-solving Process in Accounting

Adam’s very first step in his problem-solving process is to absorb as much information from as many sources as he can. Whether it’s listening to the news every day or speaking with different people inside the business, there’s this ongoing effort to find out more, learn about topical challenges that others might be facing, and use that to drive questions internally about further opportunities to solve problems.

It doesn’t necessarily need to reach the state of being a ‘problem’ to receive attention for optimization. You just need to listen and pay attention to where things might be slower, costing more than usual or requiring manual input from too many people.

Once you have this information, you can gather the right people into the room to start looking at that information, gathering more of it from different sources.

One of the key components of fully resolving any issue is to understand the full scope and depth of its current and future impact: What happens if you leave it alone, or if it gets worse, or if it’s completely resolved? Who gets more time in a day when you resolve something? Whose budget gets some breathing room? Can you reduce the amount of manual input that everybody’s required to give?

Finding the Right People to Solve the Problem in Your Accounting Department

So, once you know what the problem is, you need to get the right people in to solve it.

How do you know who that is? The team behind your solution is critical. As a CFO, you have the responsibility of setting your team up for success when they’re working on solving problems. All execs have this responsibility.

In any organization, cross-functional training is the quickest way to widen perspectives when approaching any problems. If your execs are regularly making time to get down to the operational level, and understand how and why things work a certain way, it becomes so much easier to strategically recommend a resolution when one is needed.

Problem-solving isn’t a one-way road.

Solve the Problem, Not the Symptom

How do you know when you’re solving the right thing? So many times, we see something blatantly creating a bottleneck in an operation and we’ll head right toward that point to clear the blockage. Is that really solving the problem, though?

Most times, it isn’t. Once you clear the blockage, if you don’t look a little deeper or follow it upstream, it’s probably going to reappear not long after you put in all that effort.

Adam explains that sometimes, you already know what the real root cause is, of one or more bottlenecks in the business. Sometimes it’s trial and error. Always, though, it requires you to dig deeper, uncover more detail, more links and connections to other parts of the business operation or the stakeholder network.

Adam goes on to say that getting to the root of the issue can also be achieved by just getting the right people in the room with you. Musselman & Hall Contractors does a great job of this, getting executives together at least once weekly, to just help others on the team evaluate elements, ask more questions, different questions, and gain a different perspective on things that can be missed during the daily routine.

Dealing with Resistance

Resistance is natural. Inertia affects every company in the world to some degree. When problem-solving, it’s likely that this will occur too.

You need to follow the process and listen as much as you convey messages. Cultivate the mindset within your business that someone else learning about your job is a positive thing. Take the time to explain that it’s because a fresh pair of eyes and a fresh mind might ask a different question that can enable you to work faster, reduce manual input, take on more responsibility, and actually achieve a promotion.

The right mindset about problem-solving enables it to benefit everyone on the team. No matter who is working on which problem or when, another major benefit to your business is to thoroughly document your procedures and changes thereto. It enriches the context of every issue that gets identified and resolved now and in the future, creating even greater efficiency for you as time passes.

Overcoming resistance is made possible by including and involving the right people, and enabling regular two-way communication with them through the problem-solving process.

For more interviews from the CFO Weekly podcast, check us out on Apple or Spotify or your favorite podcast player.

Previous Article

Not all accounting tasks are created equal. Before you automate, explore some of the top accounting automat...

Next Article

Uncover the hidden profit drain! Learn the top mistakes plaguing your accounting process and discover prove...

Most Recent Articles

Cut costs, and boost efficiency! Learn the top 5 ways companies leverage outsourcing to significantly reduce accounting expenses and achieve success. Discover how much you can save today!

Unlock the secrets of financial team efficiency! Dive deep into strategies for making finance accessible and achieving streamlined operations within your business.

Learn how machine learning in accounts payable can enhance efficiency and reduce costs. Learn how businesses can do more with less by leveraging innovative technology for smarter financial management.

Understanding the evolving role of the pharma CFO. Discover how the CFO is becoming a crucial partner in driving strategic decision-making for growth and expansion within the pharmaceutical industry.

Become an accounts receivable outsourcing expert! Our in-depth guide walks you through every step of the process, from understanding and developing a strategic AR plan to successful implementation.

Modern CFOs are more than number crunchers! Learn how a CFO navigates the shift from bookkeeping to becoming a strategic partner, aligning financial leadership with organizational goals and more.

The CFO role in early-stage startups: Balancing growth, structure, and financial health. Discover essential skills, get expert insights, and learn strategies for thriving in the early stages.

Explore insights from an expert on cash flow forecasting for CFOs. Discover key strategies to improve cash management, optimize financial planning, and support business growth. Read now!

Explore the key differences between accounts payable outsourcing and AI automation in this in-depth comparison. Discover which approach is best for your business today!

Explore the power of systemized decision-making and how it's transforming business decisions. Discover the benefits and see why many companies are adopting this innovative method to drive success.

Unlock the secrets to scaling your startup! Hear from a leading financial strategist as he shares proven strategies for explosive growth. Propel your startup to success.