Published In: Applications

How to Write a Loan Application Letter (with Samples)

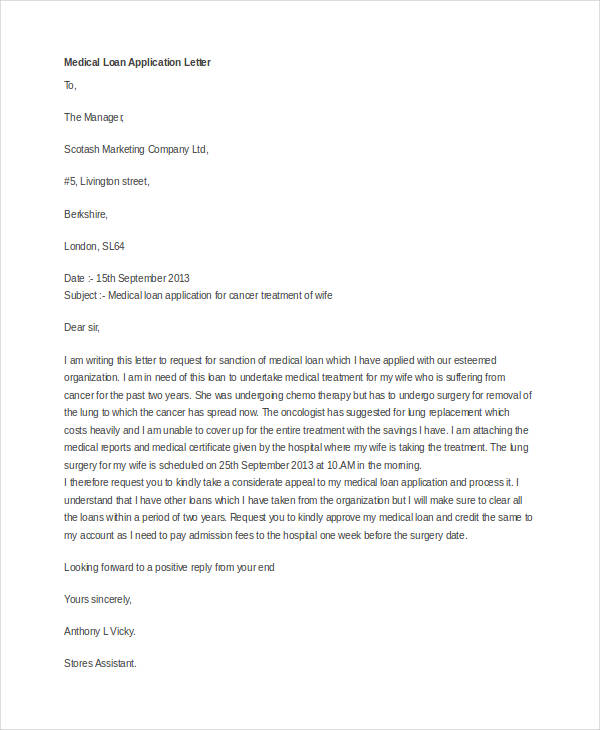

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

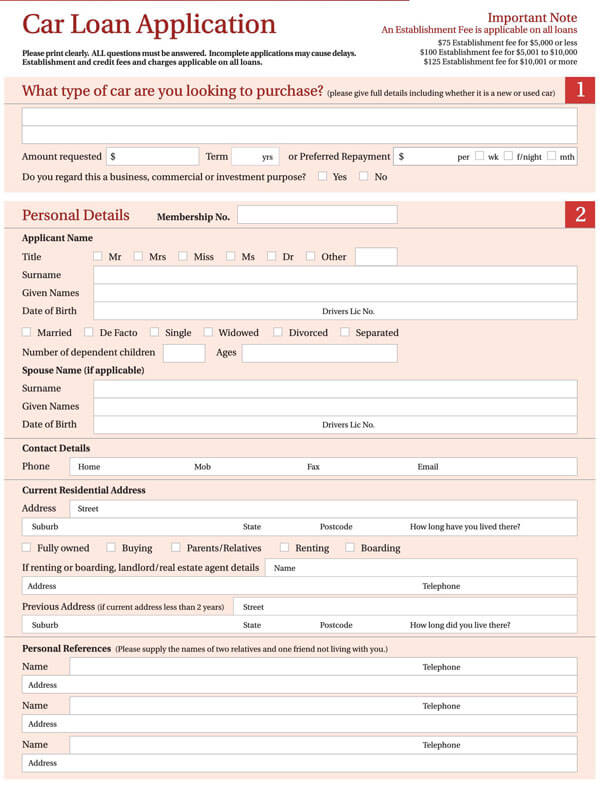

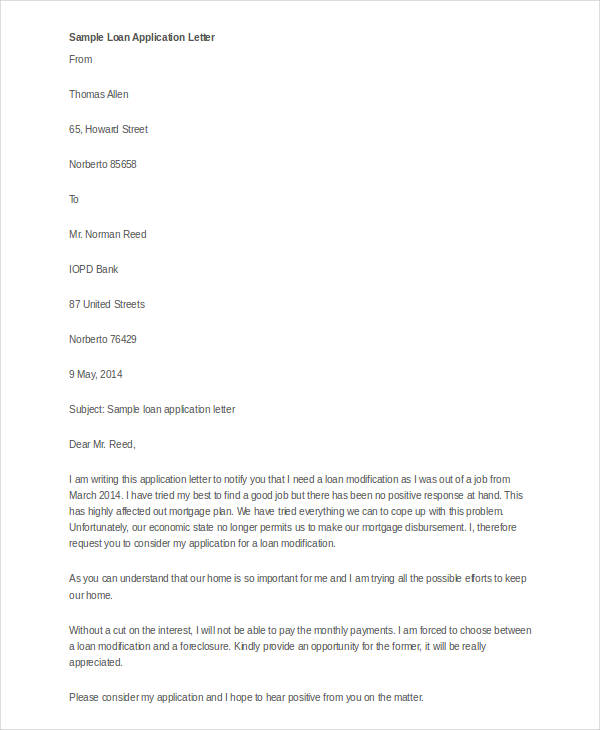

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

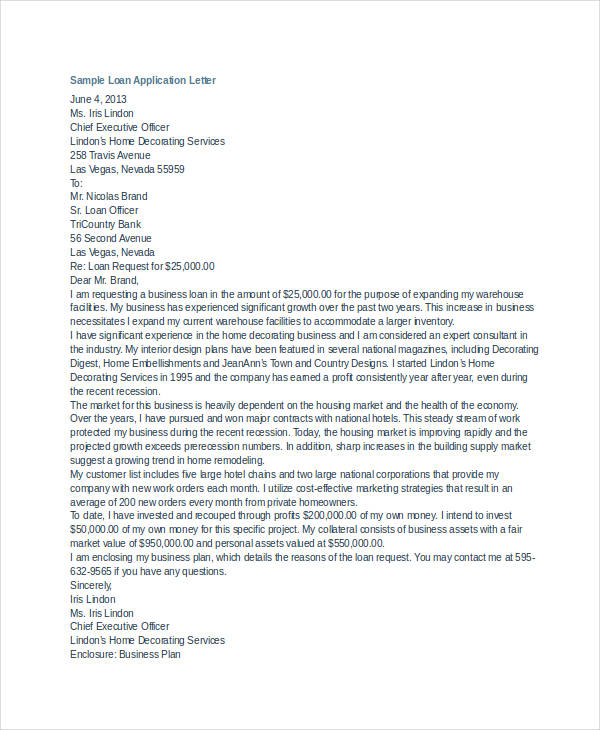

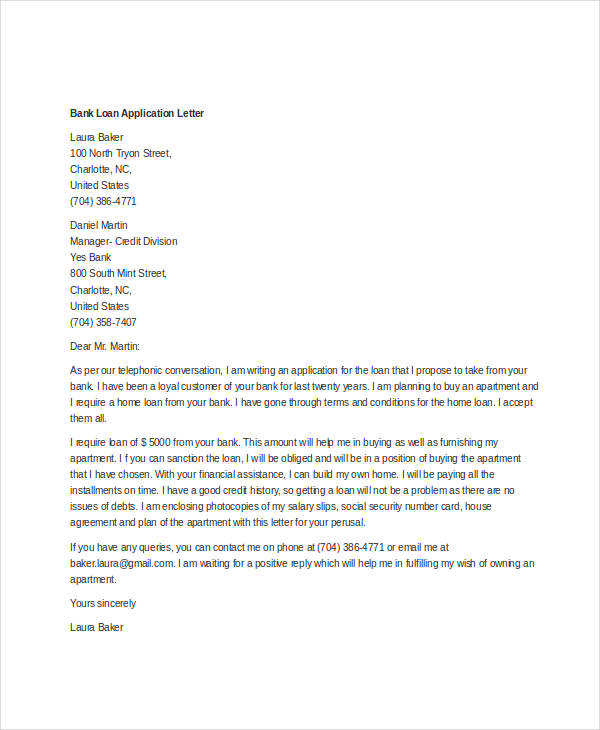

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

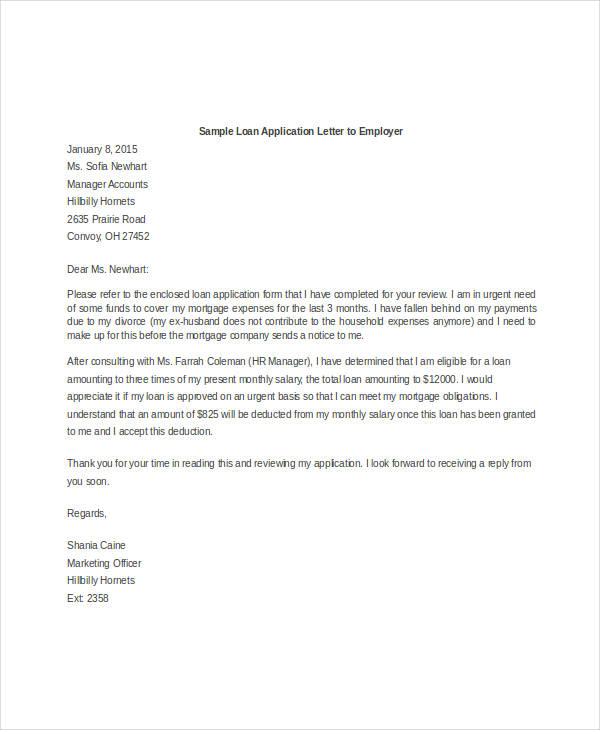

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Bank Loan Request Letter Sample: Free & Effective

In this article, I’ll share my insights and provide a step-by-step guide, including proven templates , to help you write an effective bank loan request letter.

Key Takeaways

- Understanding Loan Request Letters: Gain insight into the purpose and structure of effective bank loan request letters.

- Step-by-Step Guide: Follow a simple, structured approach to craft your loan request letter.

- Templates Included: Use the provided templates to create a personalized loan request letter.

- Real-Life Examples: Learn from actual experiences and examples to better understand what banks look for.

Understanding the Purpose of a Loan Request Letter

A bank loan request letter is your opportunity to present a compelling case to the lender. It’s not just about stating your need for funds but about showcasing your financial responsibility, business acumen, and planning skills.

Key Points:

- First Impression: The letter is often the first interaction with the lender.

- Information Conveyance: It conveys crucial information about your financial need and repayment plan.

- Persuasion Tool: A well-written letter can significantly influence the lender’s decision.

Crafting Your Letter: A Step-by-Step Guide

1. gather necessary information.

- Understand the loan requirements.

- Prepare financial statements and business plans.

2. Start with a Professional Format

- Use a formal business letter format.

- Include your contact information and the date.

3. Introduce Yourself and Your Business

- Briefly describe who you are and what your business does.

- Highlight your experience and achievements.

4. State the Purpose of the Loan

- Clearly define why you need the loan.

- Explain how the loan will benefit your business.

5. Detail Your Financial Information

- Include relevant financial statements.

- Showcase your ability to repay the loan.

6. Conclude with a Call to Action

- Politely request the bank to consider your loan application.

- Indicate your availability for further discussions.

7. Proofread and Edit

- Ensure there are no errors or omissions.

- Maintain a professional tone throughout.

Real-Life Example: Success Story

In my experience, one of my clients successfully secured a significant loan by clearly outlining their business growth plan, demonstrating past successes, and providing a detailed repayment strategy. The key was clarity, precision, and a touch of personal storytelling.

Loan Request Letter Template

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date]

Trending Now: Find Out Why!

[Lender’s Name] [Bank’s Name] [Bank’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to request a loan of [Amount] for [Purpose of the Loan]. As the owner of [Your Business Name], I have outlined a detailed plan for how these funds will be used and the projected growth they will facilitate.

[Insert a brief description of your business, its history, and any notable achievements.]

The loan will be utilized for [specific use of the loan funds]. This investment is crucial for [reason for the loan], and I have attached a detailed business plan and financial projections to illustrate the potential return on investment.

[Include information about your financial situation, any collateral you are offering, and your plan for repayment.]

I am committed to the success of [Your Business Name] and have a robust plan in place to ensure the timely repayment of the loan. I am available to discuss this application in further detail at your convenience.

Thank you for considering my request. I look forward to the opportunity to discuss this further.

[Your Signature (if sending a hard copy)] [Your Printed Name

Writing a bank loan request letter is a critical step in securing funding. It’s about presenting a clear, concise, and compelling narrative that aligns your needs with the lender’s requirements. Remember, it’s not just about the numbers; it’s about the story behind them.

I’d love to hear your thoughts and experiences with loan request letters. Have you tried writing one? What challenges did you face? Share your stories in the comments below!

Frequently Asked Questions (FAQs)

Q: What is the Most Important Aspect of a Bank Loan Request Letter?

Answer: The most crucial aspect of a bank loan request letter is clarity in communicating the purpose of the loan.

In my experience, a well-defined objective, backed by a solid business plan and clear financial projections, significantly increases the chances of approval. It’s essential to concisely convey why you need the loan, how you plan to use it, and how you intend to repay it.

Q: How Detailed Should Financial Information Be in the Letter?

Answer: Financial details should be comprehensive yet succinct. From my experience, including key financial statements like income statements, balance sheets, and cash flow projections is vital.

However, the trick is to balance detail with brevity. You want to provide enough information to assure the lender of your financial stability without overwhelming them with data.

Q: Is Personal Information Relevant in a Business Loan Request Letter?

Answer: Yes, to some extent. In my dealings, I’ve noticed that including a brief background about yourself, your experience, and your role in the business helps build a connection with the lender.

It adds a personal touch and can boost your credibility, especially if your personal journey reflects your business acumen and commitment.

Q: How Formal Should the Tone of the Letter Be?

Answer: The tone should be formally professional. In all my letters, I maintain a balance between professionalism and approachability. You want to come across as respectful and serious about your request, yet accessible and personable.

Avoid overly technical jargon or casual language; aim for clear, straightforward communication.

Q: Can Including a Repayment Plan Improve Chances of Loan Approval?

Answer: Absolutely. In my experience, outlining a clear and realistic repayment plan in your letter can significantly improve your chances of approval.

It demonstrates responsibility and foresight, showing the lender that you’ve thought through the financial implications of the loan and have a plan to manage your debts effectively.

Q: Should I Mention Collateral in the Loan Request Letter?

Answer: Yes, mentioning collateral can be beneficial. In my practice, I’ve found that specifying collateral not only increases the credibility of your loan request but also provides the lender with added security, making them more inclined to approve your loan. However, be clear and precise about what you are offering as collateral.

Q: How Long Should a Bank Loan Request Letter Be?

Answer: Ideally, keep it to one page. Throughout my career, I’ve learned that brevity is key. Lenders are busy, and a concise, well-organized letter is more likely to be read and appreciated.

Stick to the essentials and avoid unnecessary details. If more information is needed, the lender will ask for it.

Related Articles

Loan repayment letter sample: free & effective, sample letter to bank for name change after marriage, request letter for cancelling auto debit: the simple way, sample letter informing change of email address to bank: free & effective, sample letter for cheque book request, sample letter to creditors unable to pay due to death, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Application for a Personal Loan (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional application for a personal loan.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Request for Personal Loan Application Approval

First, find the sample template for application for a personal loan below.

To, The Branch Manager, [Bank’s Name], [Bank’s Address], [City Name], [Pincode].

Subject: Application for Personal Loan

Respected Sir/Madam,

I, [Your Name], am a resident of [Your Residential Address] and have been a valued customer of [Bank’s Name] for the past [Number of years/months you have an account with the bank].

I am humbly writing this letter to apply for a personal loan of INR [Loan Amount] due to some urgent personal needs. I understand that the bank offers personal loans at an interest rate of [Interest Rate] which suits my budget and repayment capacity.

I am currently employed at [Your Company’s Name] for the past [Number of years/months you have been working] and my monthly income is INR [Your Monthly Income]. I am confident that I can repay the loan amount in [Number of Years/Months to Repay Loan] without any difficulty, through equal monthly installments.

I assure you that I will comply with all the terms and conditions set by the bank for this loan. I am enclosing the necessary documents required for the loan application process, including proof of income, proof of residence, and other relevant papers.

I kindly request you to process my loan application at the earliest. Please let me know if any further information or documentation is required from my side. I would be glad to provide the same.

Thank you for considering my application. Looking forward to a positive response.

Yours faithfully, [Your Name] [Your Contact Number] [Your Email ID]

Below I have listed 5 different sample applications for “application for a personal loan” that you will certainly find useful for specific scenarios:

Application for a Personal Loan for Medical Emergencies

To, The Branch Manager, [Your Bank’s Name], [Your Bank’s Branch Address],

Subject: Application for Personal Loan for Medical Emergencies

I, [Your Full Name], a long-standing account holder in your esteemed bank with the account number [Your Account Number], am writing this letter to request a personal loan due to a medical emergency.

My family member, [Relative’s Name], has been recently hospitalized and needs immediate medical attention for [Relative’s Health Condition]. The estimated cost of the treatment, as informed by the hospital, is about [Required Amount in INR]. Unfortunately, the sum is beyond my immediate financial capability.

In light of this, I humbly request your good office to grant me a personal loan of [Required Amount in INR] to cover the medical expenses. I assure you that I will adhere to the repayment terms and conditions as dictated by the bank. I am ready to provide any further information or documents that might support my loan application.

I hope for your understanding and positive response at the earliest, considering the urgency of the situation. I understand that your bank values its customers and their needs, and I am confident that you will provide me with the necessary financial assistance in this critical moment.

Thank you for your kind consideration.

Yours faithfully, [Your Full Name] [Your Contact Number] [Your Email ID] [Your Residential Address]

Date: [Current Date] Place: [Your City]

Application for a Personal Loan to Finance Home Renovations

To, The Branch Manager, [Bank Name], [Bank Address],

Subject: Application for a Personal Loan to Finance Home Renovations

Dear Sir/Madam,

I, [Your Full Name], am a customer of your reputed bank holding a savings account with the number [Your Account Number]. I am writing this letter to apply for a personal loan of INR [Loan Amount] for the purpose of renovating my home.

The house where my family and I reside is in need of significant repairs and improvements to ensure its livability and safety. The renovations include repairing the roof, painting, changing the plumbing system, and upgrading the electrical wiring. These renovations are of utmost importance to ensure the well-being and comfort of my family.

I have been an account holder of [Bank Name] for the last [Number of Years] years and have maintained a good banking record. My monthly income is INR [Your Monthly Income], and I believe I am capable of repaying the loan amount in easy monthly installments over a period of [Loan Tenure].

Attached with this letter are the necessary documents including proof of income, property documents, and a detailed estimation of the renovation costs. I kindly request you to consider my application and approve my loan request at the earliest possible.

Thank you for your understanding and consideration in this matter. I look forward to your positive response.

Yours faithfully, [Your Full Name] [Your Contact Number] [Your Email Address] [Your Residential Address]

Application for a Personal Loan for Higher Education Expenses

To, The Branch Manager, [Bank Name], [Bank Address], [City], [State], [Pin Code]

Subject: Application for Personal Loan for Higher Education Expenses

I, [Your Full Name], a resident of [Your Address], am writing this letter to apply for a personal loan to cover my higher education expenses. I have been accepted into [Name of the University], which is a prestigious institution recognized worldwide, for pursuing my [Type of Degree] in [Field of Study].

The total cost of my education, including tuition fees, living expenses, and other related costs is approximately INR [Total Cost]. I have managed to secure INR [Your Savings] through my savings and financial aid. However, I require an additional amount of INR [Required Loan Amount] to fully cover my expenses for the duration of my study, which is [Duration of Course] years.

I am confident that this investment in my education will result in a bright future, enabling me to secure a well-paying job and repay the loan in due time. I have always been a responsible individual and I assure you that I will adhere to the repayment schedule diligently.

Attached herewith are the necessary documents including, Proof of Admission, Cost Breakdown, Residential Proof, and Identification Proof for your kind perusal.

I humbly request you to consider my application favorably. If any additional documents or information is required, I would be more than happy to provide them.

Thanking you in anticipation of your positive response.

Yours faithfully, [Your Signature] [Your Full Name] [Your Contact Number] [Your Email ID] [Date]

Application for a Personal Loan to Consolidate Debt

To, The Branch Manager, [Bank Name], [Branch Address], [City], [Postal Code]

Subject: Application for a Personal Loan to Consolidate Debt

I, [Applicant’s Full Name], a resident of [Applicant’s Address], am writing this letter to formally apply for a personal loan. I am a loyal customer of your bank for the past [number of years] years and hold a savings account with the account number [Account Number].

My purpose for this loan is to consolidate my existing debts. I currently have multiple loans which include a home loan, car loan, and some credit card debts, the total of which amounts to INR [Total Debt Amount]. The interest rates on these loans are quite high, and it has become a financial burden to manage these multiple debts simultaneously.

Therefore, I humbly request a personal loan of INR [Requested Loan Amount], which I plan to use to pay off all these outstanding debts. By doing this, I will only have one loan with a single interest rate to manage, thus easing my financial strain.

I am a [Your Occupation] at [Your Company’s Name] and my monthly income is INR [Your Monthly Income]. I am confident in my ability to repay the loan in a timely manner and am willing to provide any further financial information or documents that may be required to process this loan application.

I hope you will consider my application favourably and help me streamline my financial situation. I am looking forward to a positive response from you at your earliest convenience.

Thank you for your time and consideration.

Yours sincerely,

[Your Name] [Your Contact Number] [Your Email Address] [Date]

Application for a Personal Loan for a Vacation Trip

To, The Branch Manager, [Name of the Bank], [Branch Name and Address],

Subject: Application for Personal Loan for Vacation Trip

I, [Your Full Name], have been a loyal customer of [Bank’s Name] for the past [number of years] years. I hold a savings account in your esteemed bank, account number [Account Number]. I am writing this letter to formally request a personal loan of INR [loan amount] for the purpose of financing a vacation trip.

I have planned a family vacation trip to [Destination Name], which is a much-needed break for us. However, the total cost of the trip is slightly beyond my current financial capacity. Hence, I am seeking financial assistance in the form of a personal loan.

I have a stable job with [Your Company Name], where I have been working for the past [Number of years/months] years/months. I am confident in my ability to repay the loan amount along with the interest in a timely manner. I am ready to comply with any terms and conditions put forth by the bank in sanctioning this loan.

I kindly request you to process this application at the earliest and provide the necessary details regarding the loan approval process. I am ready to provide any further details or documents required for the same.

Thank you for considering my application. I hope to receive a positive response at the earliest.

Yours faithfully,

[Your Full Name] [Your Contact Number] [Your Email Address]

How to Write Application for a Personal Loan

Some writing tips to help you craft a better application:

- Start with your full name and contact details.

- Specify the loan amount you need and the purpose of the loan.

- Explain your current financial situation and income source.

- Highlight your credit history and score, if it’s good.

- Describe your plan to repay the loan.

- Mention any collateral you have, if applicable.

- Include references, like your bank, if you’ve got any.

- End with a polite appeal for loan approval.

- Proofread your application for errors.

- Sign and date the application.

Related Topics:

- Application for a Marriage License

- Job Application for Class 12 Students

- Job Application for Class 11 Students

View all topics →

I am sure you will get some insights from here on how to write “application for a personal loan”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Home » Letters » Bank Letters » Loan Application Letter | Sample Application Letter to Bank Manager for Loan

Loan Application Letter | Sample Application Letter to Bank Manager for Loan

To, The Loan Officer, __________ (Bank Name), __________ (Branch Address)

Date: __________ (Date)

Subject: Loan Application

Dear Sir/Madam,

I am writing to apply for a loan from __________ (Bank Name) to __________ (state the purpose of the loan, e.g., purchase a home, start a business, etc.).

I am __________ (Your Name), and I have been a loyal customer of __________ (Bank Name) for __________ (mention duration, if applicable). I believe that with your financial assistance, I will be able to achieve my goals and fulfill my financial obligations.

I am requesting a loan amount of __________ (mention loan amount) with a repayment period of __________ (mention repayment period). I have attached all the necessary documents, including proof of income, identification, and any other relevant documents required for the loan application process.

I assure you that I am capable of repaying the loan amount in a timely manner, as per the agreed terms and conditions. I am open to discussing the details of the loan application and providing any additional information if required.

Thank you for considering my loan application. I look forward to a favorable response from your end.

Yours sincerely,

__________ (Your Name) __________ (Your Contact Information)

By lettersdadmin

Related post, complaint letter to bank for amount deduction as processing charge – sample complaint letter regarding unexplained deduction from bank account, letter to bank for non-payment of loan – sample explanation letter for delay in loan payment, kyc confirmation letter – sample request for processing submitted kyc confirmation, sample letter to hospital for discharge, request letter for free medical treatment – sample letter requesting free medial treatment, sales letter, business order letter, privacy overview.

Letter Solution

Welcome to "Letter Solution" Everything is about letter and application writing.

Bank Loan Application Letter Sample 8+ With Format

One format and 8 sample on bank loan letter.

Table of Contents

Bank Loan Application Letter Sample: Naturally, we take a loan from a bank when we fall into a money crisis. We talk to the branch manager about it. After that, he discussed everything and instructs us on all terms and conditions. Some bank managers tell to submit a request letter with the required documents. And then many people can not write a proper request letter. So I have written the post with a format and six samples that will clear your confusion and create a good idea about any type of bank loan application letter sample. Then you can write a new application in your own way. A well-written request letter for the loan can help you to be approved your application at the time of applying for a loan.

There are different types of loans in the bank. For example

- Business loan

- Personal loan

- Educational loan

- Two-wheeler loan

- Loan against property

When you will apply for a personal loan, eligibility is a must for you.

Personal loan eligibilit:

- You should be salaried person.

- You should have a job under government, public company.

- Your age should be between 25-50 years.

- You need to be an Indian citizen.

- The minimum salary should be 25000 but it depends on the city.

Application Format

Bank loan application letter.

The Bank Manager

[Name of the bank]

[Name of the branch]

[Address of the branch]

Date: …../ …../ ……

Sub: [Application for home loan]

Respected Sir/Madam,

I am ___________ [Your name]. I am a [savings/current] account holder with your branch for _____ years. I am a ______ service man. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for _____________ [Purpose of the loan].

I am requesting you for an amount Rs. __________ as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and condition of the bank.

I am waiting for positive response from you.

Thanking you

Yours sincerely

[Name of the applicant]

Contact details

Bank Loan Application Letter Sample

Bank of India

[Branch Name]

[Branch Address]

Date: 00/00/00

Sub: [Request for business loan]

Dear Sir/Madam,

With due respect, I beg to state that I have a current account with your branch. I am a businessman and run three restaurants. I need an amount of Rs. 100000/- as a loan for my business purpose.

I will be thankful to you if you will consider my request as early as possible.

Write A Letter To Bank Manager For Educational Loan

Gabgachi Branch

Delhi-700 071

Date: 12/11/2021

Sub: Application for educational loan

I, Ashutosh Kumar Saha, a permanent resident of Sukanta More, Gabgachi, would like to apply for an education loan for further studies. I have just appeared for my higher secondary board exams and would like to complete a course in B.TEC from a reputed institution in Delhi.

I can come to the branch at your convenience to discuss it required to get a loan in my favor. I will always be grateful to you if you look into the matter and approve my loan.

Ashutosh Kumar Saha

Application For Home Loan

Name of the bank

Name of the branch

Address of the branch

I am prakash saha. I am a savings account holder with your branch for ten years. I am a government serviceman. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for building my house.

I am requesting you for an amount of Rs. 200000/- [Two Lakh] as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and conditions of the bank.

I am waiting for a positive response from you.

Application For Personal Loan

It is stated that I would like to request you for a personal loan of Rs. 200000/-. I have a savings account for 15 years with your branch and save a good balance in the first week of the month. I have been working in an I.T company for 20 years and my salary is 25,000/-. I will pay the loan by deduction money by a savings account. I have read the term and conditions and got it. I have enclosed the necessary document as the instruction.

I am waiting for your positive response of hearing.

Yours faithfully

Sample of Bank Loan Application Letter

Sub: [Application for __________________ ]

With a lot of respect, I beg to state that I am an old account holder in your branch. My account number is XXXXXXXXX. Now I am a serviceman. I am doing my job in Malda Sonoscan Nursing Home. My salary is 12000/-. I need a loan amounting to Rs. 80000/- for buying a car. The deduction should be from my salary account.

Therefore I request you to grant me the loan and then I will be obliged to you.

Business Proposal For Bank Loan Sample

Sub: [Application of proposal of the business loan]

I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch. I am an account holder for ten years and maintain a good balance in this account.

My company name is [XYZ]. It is a growing business that serves furniture to customers. You can follow our success online at [website name]. 25 workers work here daily.

I have attached all the required documents along with this application as you instructed earlier. So I earnestly request you for a small loan.

I am looking forward to hearing at your convenience.

FAQ’s On Requesting Loan

How do I write a letter requesting a loan?

Answer: It is not a hard matter. Just follow the structure and fill up the place with your right information.

Sub: [Application for_______ ]

Write first paragraph following the format.

Second paragraph

Third paragraph

That is enough for a letter of requesting loan.

What is the difference between application and letter?

Answer: There is a difference between application and letter. A letter is written for communication or giving information to anyone. On the other hand, an application is written to request for something.

How do you end an application letter?

Answer: You end an application letter with “Yours faithfully or your sincerely”. Besides it nowadays to write contact details at the end is very important.

Should I write thank you in advance?

Answer: Yes. You should write “Thank you” in advance for close connotation. It will express your politeness.

- Closing your bank account

- A new pass book

- New check-book

- Transfer bank account

- Opening a joint account

- Bank statement

- Hire a locker

- Change specimen signature

- Renewal of fixed deposit account

- Complaining non-receipt of pass-book

- Stop payment of a lost check

- Reopen account

- Change registered mobile number

I hope you have got the right information and chosen bank loan application letter sample . If you like the post, you can do a little help by sharing it with your friends, relatives and do comment in the below comment box.

- Stop Payment Cheque Letter With Format And Sample

Closing Bank Account Letter With 20+ Sample

You may also like.

Application For Current Account Opening With 3 Samples

Application For Transfer Of Bank Account 8+ Sample

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Apply for a Personal Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

How to Apply for a personal loan

- What is a REIT?

- What is innocent spouse relief?

- » This page is out of date

- What is a put option?

- What is bill pay?

- What is a rollover IRA?

- Bizee: Easily form your new business

- What is an FHA loan?

- What is Schedule K-1?

- What is a payday loan?

- Can you borrow from an IRA?

- » This card is not accepting new applications

- What is Upwork?

- Still deciding on the right carrier? Compare Medigap plans

- Checking account vs. savings account

- Good credit utilization follows the 30% rule

- What is Planet Fitness?

- Super Bowl season

- What is consumer sentiment?

- What is a utility bill?

- What are dividend stocks?

- How to make money in stocks

- What are non-custodial crypto wallets?

- What is a money market account?

- What is value-added tax (VAT)?

- What is a 529 college savings plan?

- What is Etsy?

- What is a spot Bitcoin ETF?

- What is a Roth 401(k)?

- How much does a Disney+ subscription cost per month?

- How to make money as a kid

- High-yield savings accounts defined

- What are health care stocks?

- Explore free options first

- 7 best-performing AI stocks

- Solar loan calculator

- Getting around the Honolulu airport

- How much are taxes on lottery winnings?

- How to find a passport number on your passport

- The definition of a recession

- 1. Certificates of deposit (CDs)

- About Carnival cruises

- Can you refinance a home equity loan?

- Men’s soccer games typically cost more than twice as much as women's

- Georgia state income tax rates and tax brackets

- Pros & Cons

- Online marketplace and auction sites

- $0 annual fee

- Halal investing definition

- How the Hilton Grand Vacation Club works

- Microsoft Office Excel budget templates

- Mortgage options

- Estimated Hawaii trip cost

- What to expect flying American Airlines Main Cabin Extra

- What is debt service coverage ratio?

- What you need to open a bank account

- What is a SIMPLE IRA?

- How do stocks work?

- What are Vanguard index funds?

- What is a vasectomy?

- What is Form 5498?

- 1. Formalize your LLC

- What is a savings account?

- Can you gift stock?

- How much does the Babbel app cost?

- Is Upwork a legit way to make money?

- What's the tax rate for bank interest and bonuses?

- What is Amazon Prime?

- How to get TSA PreCheck for free

- Ways to prevent getting sick on a plane

- Best stocks by one-year performance

- Gross income vs. net income

- What are checking and savings accounts used for?

- Getting to New York City

- What are EV stocks?

- What is cryptocurrency?

- Do you tip in Japan?

- Preparing to buy tips

- 1. Hands-on or hands-off investing?

- Calculate your debt-to-income ratio

- What is SPY?

- Why is having a low credit utilization important?

- You should feel good about buying a house if …

- Best-performing REIT stocks: May 2024

- A Potentially Problematic Catch-Up Provision

- 1. There are actually two clubs

- 1. You have to be invited to apply

- 6 ways to save money on Delta flights

- Average car loan interest rates by credit score

- How does capital gains tax on real estate work?

- Start with an emergency fund

- California state income tax brackets and rates

- The best budget apps

- What qualifies for innocent spouse relief?

- How to find AAdvantage award tickets

- How life insurance commissions work

- 1. Decide between checked luggage and carry-on

Step 1: Check your credit

- How much does a Planet Fitness membership cost?

- Deciding factors

- 1. Set your budget

- What information is on a utility bill?

- Brace for another year of high interest rates — and prices

- 50/30/20 budget calculator

- What is a HELOC?

- Know what you qualify for

- 1. It comes with double-digit interest rates

- Toll passes to use in rental cars

- Working with National Debt Relief

- What is long-term care insurance?

- Tell your insurer about your renovation

- Auto insurance

- What is credit insurance?

- Who files a Schedule K-1?

- 'File and suspend' loophole

- What is the child tax credit?

- What is the child and dependent care tax credit?

- Best-performing U.S. equity mutual funds

- 2023 Arizona state income tax rates and tax brackets

- 5 ways to get free flights

- Working with an auto lender

- What does this value mean?

- Covered: Accidents

- 1. Get help with utility bills and groceries

- How startup funding works

- What are credit freezes and credit locks?

- How a balance transfer works

- Comparing the Chase Sapphire Preferred® Card vs. the Chase Sapphire Reserve®

- 1. Make extra payments toward the principal

- Reasons to get life insurance in your 40s and 50s

- The well-known benefits

- 5 great vacation cities that frequently host professional conferences

- How does the SALT deduction work?

- What to expect flying economy with Emirates

- Holding Bitcoin

- Best ETFs as of May 2024

- 1. Clean up your credit

- The best time to book rental cars

- Research coding bootcamp job placement

- Our picks for the best life insurance companies in May 2024

- 1. Expect to pay lower prices than for peak season travel

- Key findings

- Understanding your solar loan calculator results

- Average savings account rate: 0.46%

- 1. It only works for Big Lots purchases

- How to spot origination fees

- Gambling activity

- You’ll be notified or see a $0 balance

- The difference between cancellation and non-renewal

- Best ways to consolidate credit card debt

- SBA loan down payment requirements by loan type

- How does bill pay work?

- How to consolidate your debt

- What is a home equity loan?

- What is home equity?

- Financial advisor fees

- How do down payment assistance programs work?

- Stop using the card

- When airline credit cards are worth it

- How to get Chase Freedom rental car insurance

- Flight options

- How value-added tax (VAT) works

- Unsecured cards that are OK options

- What is card lock?

- 1. Know your bank’s mobile check deposit requirements

- Why your credit score is equally important

- How do payday loans work?

- How do credit union loans work?

- What is Costco?

- How much is a personal loan origination fee?

- How much does an Amazon Prime membership cost?

- Top credit cards for online travel-booking websites

- 1. Only some purchases are eligible for promotional financing

- 1. PayPal Honey

- Business cash management accounts

- In this issue

- Beef up your emergency fund

- 8 places with alcohol in the Magic Kingdom

- Top cards for Uber and Lyft

- What is the average credit score by age?

- Guide to tipping hotel housekeeping staff

- 9 best health care stocks by one-year performance

- Late winter and early spring

- In this article

- How to make money online

- Plastiq: The basics

- 1. Understand asset allocation

- When cardholders pay

- What is PE ratio?

- What the lawsuits are about

- How does QuickBooks for Nonprofits work?

- What is whole life insurance?

- 4 ways to maximize the Blue Cash Preferred® Card from American Express

- Table of Contents

- Cash bonuses on cards with no annual fee

- Pay With Miles vs. Miles + Cash

- What's the difference between a HELOC and a home equity loan?

- How to invest in stocks in 6 steps

- Options for an old 401(k)

- Netflix subscription cost

- What is IRS Free File?

- Find out how much your car is worth

- Be flexible and pack light

- What are the advantages of a sole proprietorship?

- Top credit cards for sports fans and athletes

- How does a business budget work?

- What is the standard deduction?

- About the lounges

- Why the Chase Sapphire Preferred® Card is better for most people

- Conceptualize and research your Etsy idea

- Top 11 spot Bitcoin ETFs by fee

- Business account types eligible for FDIC coverage

- Steps to transfer money from one bank to another

- Can I contribute to both a 401(k) and a Roth 401(k)?

- 1. Consumer discretionary

- Banks that offer joint business accounts

- The best whole life insurance companies of May 2024

- Breakdown of central air costs

- Your own insurance usually comes first

- Which banks have the best savings interest rates?

- Start by checking your home equity

- Is a joint bank account a good idea?

- Maximum debt-to-income ratio to buy a house

- Who can invest in private equity?

- How to lower your credit utilization

- TransUnion credit freeze online

- Terminal 1: Hawaiian Airlines lounges

- What are some smart money moves to consider ahead of a possible recession?

- When will home equity loan rates come down?

- Valuable perks of the Chase Freedom Flex℠

- What is the 50/30/20 rule?

- Average costs by project

- How halal investing can help build wealth

- Chase Freedom Unlimited®

- 2. The minimum payments will take you years to pay off the balance in full

- What are the pros and cons of money market accounts?

- Costco membership price

- Why you need a savings account

- The benefits of gifting stocks

- How to get Upwork jobs

- Why you should get preapproved for an auto loan

- 2. Find money for child care

- Are these the best stocks to buy now?

- Credit freeze vs. lock

- How to choose a checking account

- How does a home equity loan work?

- 1. W Melbourne (Marriott Bonvoy)

- Ways to earn money as a younger kid

- How will the Student Aid Index be calculated?

- How to buy the SPY ETF

- Best-performing REIT mutual funds: May 2024

- 2. It’s inexpensive to carry

- How to calculate your credit utilization ratio

- How we ranked the top life insurers

- Lean on investments or savings, if you have them

- How the home sale tax exemption works

- Narrow your financial goals

- Lottery tax calculator

- YNAB, for hands-on zero-based budgeting

- The Fed is pushing to slow the economy

- Details of the new American Express® Green Card

- How put options work

- The timeline to lower inflation

- 20 high-dividend stocks

- SBA 7(a) loan down payment

- Best car insurance in Florida overall: Travelers

- Google Sheets budget templates

- Where do I cash in a savings bond?

- Is there VAT in the U.S.?

- How much is the child tax credit worth?

- How much does a vasectomy cost?

- 2. Choose a bank for your LLC business account

- Do I have to pay Arizona state income tax?

- How much does Babbel Live cost?

- 1. It’s not available to new applicants

- 529 plan benefits

- New York state income tax rates

- Hotels.com® Rewards Visa® Credit Card

- AI-assisted investing: a good idea or no?

- Who is Warren Buffett?

- Best-performing EV stocks

- The underrated benefits

- What does Disney+ include?

- 2. Think about your tolerance for risk

- Student loan debt is an intergenerational issue

- How to apply for a solar loan

- 2. Cardholder rewards and discounts run small

- How to compare lender fees and rates

- Check your number online

- 2. Cash management accounts

- TV release cycle

- How to transfer a 401(k) to IRA

- Financial advisor fees by service

- How to choose the best crypto wallet

- Capital One SavorOne Cash Rewards Credit Card

- Why lock a card?

- 2. Confirm the check amount is within mobile deposit limits

- How much is the child and dependent care credit worth?

- What you need to know about savings accounts

- Priority Pass options at Seattle-Tacoma

- What's the tax difference between bank bonuses and credit card bonuses?

- How to convert Skywards miles to dollars

- 2. Rakuten Cash Back Button

- What are the Roth 401(k) contribution limits?

- When to use a credit freeze

- It’s not how many cards, but how you use them

- 2. Refinance if you have good credit and a steady job

- Review your estate plan

- Wells Fargo Active Cash® Card

- How about Bitcoin ETFs?

- ETF advantages and disadvantages

- 2. Pinpoint your goal

- Pros of joint bank accounts

- Types of healthcare stocks

- How private equity investing works

- How much is car insurance?

- American Express Membership Rewards: The basics

- Best-performing REIT ETFs: May 2024

- 2. You won't compete as much for coveted reservations

- Are auto loan interest rates rising?

- Innocent spouse relief form

- Why agent commissions matter

- PE ratio example

- 2. Shop for a loan

- How does cash value in a whole life insurance policy work?

- What's the difference between a HELOC and a cash-out refinance?

- Who is eligible for Free File?

- Credit card options for students

- Trading in a car with positive equity

- Who can get down payment assistance?

- Camping cools down

- How do Vanguard index funds work?

- Types of credit insurance

- Who gets Form 5498?

- Best credit union personal loans for 2024

- Are there free or discounted Costco memberships?

- No, the Apple Card doesn't 'completely rethink everything'

- 2. The APR, once charged, is sky-high

- Usually covered: Illness

- 7 best stocks to buy now, according to analysts

- Types of startup business funding

- Can you upgrade the Chase Sapphire Preferred® Card to the Chase Sapphire Reserve® ?

- How to choose the best life insurance for people over 40 or 50

- What is the SALT deduction?

- Why do people invest in cryptocurrencies?

- Home equity loans and HELOCs vs. cash-out refinances: Understanding your options

- Holiday weekends

- Evaluate coding bootcamp length

- 2. It includes private concierge service

- How do lottery taxes work?

- 2. Pack for multiple climates

Step 2: Pre-qualify and compare offers

- You could get a refund

- How to get homeowners insurance after a non-renewal

- QuickBooks discounts for nonprofits

- Why you may want to refinance

- How to get Public Service Loan Forgiveness

- Debt consolidation calculator

- Book flights that you can easily cancel

- How to book Main Cabin Extra

- The pros and cons of a life insurance trust

- Why should you own stocks?

- Avoid home renovation insurance pitfalls

- 3. Endorse the check

- FHA vs. conventional loans

- How much do payday loans cost?

- How to choose the best mutual funds for you

- Neobanks: Their role, disadvantages and benefits

- Key terms to know how car loans work

- What are the benefits of Amazon Prime?

- 3. Recover unclaimed money

- FDIC insurance limits for business accounts

- What are the benefits of a Roth 401(k)?

- How to choose a savings account

- 2. The Tasman, a Luxury Collection Hotel, Hobart (Marriott Bonvoy)

- Examples of three high-interest online savings accounts

- How debt-to-income ratio is calculated

- 3. The card earns cash back

- Other solar panel financing options

- Terminal 2: Admirals Club, Delta Sky Club, United Club and more

- How innocent spouse relief works

- How long do recessions last?

- The value of attending a women’s soccer game

- 2024 Georgia state income tax changes

- Investing for income: Dividend stocks vs. dividend funds

- Hilton Honors points vs. Hilton Grand Vacation Club points

- 3. It doesn't represent an investment

- Reevaluate your budget

- 8 best hot wallets

- Debt service coverage ratio formula

- SIMPLE IRA contribution limits for 2024

- How to get a VAT refund

- Ways to build credit without an income

- Now that the old loophole doesn’t work, what are my options?

- Does insurance cover vasectomies?

- When is Form 5498 issued?

- What is the difference between Costco memberships?

- How the standard deduction works

- 2. The card includes Visa benefits

- How can I be smart with my bank account interest and bonuses?

- How do I find the best 529 plans?

- How does the value of Skywards miles change when booking business class?

- Traditional automakers making EVs

- Using a credit card with Bitcoin rewards

- Where to look for information

- Why invest in private equity?

- 2. Rebalance your debts and income

- Another Problematic Provision: Last-Minute Catch-Ups

- Use a credit utilization calculator

- Best life insurance companies: Pros and cons

- How to use average car interest rates

- Prioritize repairs and small updates

- Historical national rates

- 3. Special financing terms are a big risk

- Sports gamblers

- Buyers would set their agents' pay

- Blue Cash Preferred® Card from American Express

- NerdWallet’s budget planner

- What documents do I need to cash a savings bond?

- When to choose a money market account over a savings account

- Why buy long-term care insurance?

- Why is a business budget important?

- Savings accounts with strong APYs can help your money grow

- Am I a resident for Arizona state income tax purposes?

- How much does Babbel for Business cost?

- 3. The Camelizer

- AmEx Platinum vs. Chase Sapphire Reserve: Deciding factors

- What is Berkshire Hathaway?

- 2. Information technology

- About withholding

- Buy great health insurance

- How is the Student Aid Index used?

- Cons of joint bank accounts

- Consider coding bootcamp cost

- TransUnion credit freeze by postal mail

- How do REITs work?

- How it works

- When merchants or banks pay

- 3. You won't see as many offseason closures

- Who qualifies for the home sales tax exclusion?

- Can you negotiate mortgage origination fees?

- 3. High-yield money market accounts (MMAs)

- Buying a put option

- Black Friday

- How to set up bill pay

- Halal investing tenets

- Best car insurance in Florida for your budget: Geico

- What’s covered by Chase Freedom rental car insurance

- What’s going on with layoffs in tech?

- Cards to avoid

- Which transactions are locked?

- Are Vanguard index funds a good investment?

- The cost of credit insurance

- Requirements: Who qualifies for the child tax credit?

- What do you do with Form 5498?

- 3. Apply for an LLC bank account

- Who is a qualifying dependent?

- 3. You’ll have access to an informational FICO score

- What is a Bitcoin strategy ETF?

- 3. The card isn’t accepted everywhere

- More money now vs. later

- Should I choose a home equity loan or a HELOC?

- EV stock ETFs

- Does Disney+ allow password sharing?

- Best whole life insurance policies for 2024

- Mortgage selection tips

- Choose the least expensive high-interest debt

- What are AI stocks?

- How to be a smart customer

- How to get car insurance quotes

- PE ratio formula

- 3. Determine other ownership costs

- What is the cost of whole life insurance?

- Do I have to pay Georgia state income tax?

- When debt consolidation is a smart move

- Is a HELOC a good idea?

- How does the IRS Free File program work?

- Trading in a car with negative equity

- Glamping heats up — despite high costs

- Should you pay a personal loan origination fee?

- Your auto loan needs to work for your situation

- 4. Get down payment assistance for a home

- How to find the best stocks to buy now

- Credit-building strategies

- 3. Marriott Melbourne Hotel Docklands (Marriott Bonvoy)

- Costs of life insurance for those in middle age

- 3. If you have a 401(k), get your match

- Get a secured credit card

- 3. There’s an exclusive lounge

- 4. The app provides helpful tools

- Types of innocent spouse relief

- Your credit score could dip slightly

- Negotiations would be more complex

- Full Review

- Pay With Miles: How it works

- House size, style and features

- How long will your mortgage loan last?

- How to find down payment assistance programs

- How to cut your Hawaii vacation costs

- 4. Open the mobile deposit function in your bank app

- One more option: Borrow from a 401(k)

- For credit and savings

- 529 plans by state

- When is the best time to book with points on Emirates?

- 4. You won’t earn any ongoing rewards

- Usually not covered: Pre-existing conditions

- When to use a credit lock

- Balance transfer: How to choose a card

- The value of high APYs

- Joint bank accounts and marriage

- REITs' average return

- 3. Consider mutual funds

- Average interest checking account rate: 0.08%

- California state income tax deadlines and extensions

- Do I have to pay state tax on lottery winnings?

- Getting ready for a recession

- For those worried about layoffs, what is your advice about starting a side hustle and ensuring long-term job security?

- 3. Bring your prescription (and regular) medicine

- Other perks that come with a membership

- What you want in a credit card while studying abroad

- Know what to do if the airline cancels your flight

- ITIN: What it is and how to get one

- How does a life insurance trust work?

- What does it mean when you own stocks?

- Make an inventory of your property

- FHA loan requirements

- How you can affect each other's credit scores

- Understanding Schedule K-1

- How to claim the child tax credit

- Are vasectomies reversible?

- How a savings account works: withdrawal limits

- 4. You can request a credit limit change

- Top 8 Bitcoin strategy ETFs by fee

- 4. CouponCabin Sidekick

- Hit retirement savings goals early

- Why is Bitcoin still popular?

- Does age affect your credit score?

- TransUnion credit freeze by phone

- Is per-card or overall utilization more important?

- Things to know before booking American Airlines award tickets

- Pros and cons of refinancing a home equity loan

- What can I use a home equity loan for?

- How do streaming services fit into your budget?

- The Federal Trade Commission’s budget worksheet

- Is it worth it to cash a savings bond?

- Pay more than the minimum, if possible

- Why is DSCR important?

- Reliability

- How to choose a money market account

- How much does it cost to buy Vanguard index fund shares?

- How to create a business budget in 6 steps

- Do I need credit insurance?

- Standard deduction 2023

- Average mutual fund return

- How does Babbel fit into your budget?

- Priceline VIP Rewards™ Visa® Card

- Who can open a joint business account

- How to buy EV stocks

- Can Disney+ fit my budget?

- Lending Bitcoin

- What to ask your credit card issuer

- 4. Max out an IRA

- How to get started investing in private equity

- 3. Don’t ask for too much cash

- How much are American Express Membership Rewards points worth?

- Company Matches Could Cost you

- 5. Beware of the interest rate

- Best life insurance company overall: MassMutual

- Compare financing options

- Goodbudget, for hands-on envelope budgeting

- Request your passport number from the State Department

- 4. Peer-to-peer lending

- 4. Find the right car for you

- Where to watch soccer

- Local sales

- Discover it® Cash Back

- Where you can use your Hilton Grand Vacation Club points

- How to apply for mortgage down payment assistance

- American Airlines premium economy vs. Main Cabin Extra

- National Debt Relief at a glance

- Which issuers offer credit card locks?

- 5. Take clear pictures of the check with your mobile device

- New York state supplemental income tax

- 5. Pre-qualify without affecting your credit score

- Usually not covered: Preventive care

- Don't forget to check the limits to savings withdrawals

- Your tax rates now vs. later

- How to choose the best high-yield savings accounts

- Lifting a TransUnion credit freeze

- 4. There’s a private check-in line

- 4. Weather is generally pretty good

- Gambling and finances

- 4. Think about international appliance compatibility and pack accordingly

- 2024 IRS Free File: Participating tax software providers

- Best car insurance in Florida for having few customer complaints: Auto-Owners

- Benefits of a SIMPLE IRA

- Other credit cards for bad credit

- How flexible are Emirates Skywards miles?

- 5. Capital One Shopping

- 5. Find tax credits for health insurance

- An alternative to chasing the best stocks

- 3. Enroll in autopay

- How to get a home equity loan

- 4. Kimpton Margot Sydney (IHG One Rewards)

- Simplify your money life

- How to open a joint account

- Types of REITs

- When networks pay

- Innocent spouse relief vs. injured spouse relief

- What is a good PE ratio?

- What it means for buyers and sellers this spring

- TV-buying tips

- What is my Georgia residency status for state income tax purposes?

- Consider alternative travel arrangements

- How to improve your debt service coverage ratio

- Why should I open a bank account if I'm undocumented?

- Money market accounts vs. other accounts

- What to know about National Debt Relief

- Eligible child and dependent care expenses

- Why you might want The Platinum Card® from American Express

- 5. There’s a path to upgrading to an unsecured card

- Other personal loan fees to consider

- So what is new about the Apple Card ?

- Prepaid 529 plans by state

- Which stocks is Warren Buffett buying?

- 3. Utilities

- What about independent contractors?

- How home equity loans, HELOCs and cash-out refinances are similar

- How much should you spend on a mattress?

- Some using would-be student loan payments for basic needs, paying down other debt

- Do I have to pay California state tax?

- 4. Carrying a balance is a big expense

- What does this mean for your financial decisions?

- SBA 504 loan down payment

- Is it a good idea to consolidate credit cards?

- Home equity loan rates in 2023

- Final steps

- Do I pay taxes when I cash in savings bonds?

- Using card lock strategically

- Standard deduction 2024 (taxes filed 2025)

- Open your Etsy shop

- The Bitcoin ETF price war

- What is a business cash management account?

- 6. Apply for college grants

- How to insure excess business deposits

- Set up automatic transfers to boost your savings yields

- How to apply for a joint business bank account

- How to lower debt-to-income ratio

- 5. Food and alcohol are included

- What about the thieves?

- Should I take a lump sum payment or annuity payments?

- Tax implications are unlikely

- What is consumer sentiment like right now?

- Benefits of QuickBooks for Nonprofits

- What you’ll need before refinancing

- Is whole life insurance worth it?

- How are HELOC payments calculated?

- More ways to take charge of your budget

- Consider your get-out-of-debt options

- All-inclusive glamping trips

- What to consider before getting credit insurance

- Additional child tax credit

- How do you sign up for a Costco membership?

- How to gift stock

- Not covered: Pre-deductible costs

- Downsides to upgrading the Chase Sapphire Preferred® Card to the Chase Sapphire Reserve®

- Alternatives to regular savings accounts

- Check your life and disability coverage

- What is a good credit score for your age?

- Is my money safe in a high-yield savings account?

- How much to tip housekeeping

- The Takeaways

- 5. You could more likely experience unique, local events

- Consider delaying to save money

- 5. Bring the right debit and credit cards

Step 3: Choose your lender and loan

- 5. Online savings accounts

- 5. Contact the seller or visit a dealership

- Clothes, vintage and crafts

- How to invest in dividend stocks

- The bottom line

- Get more help with monthly budget planning

- How does a debt consolidation loan work?

- What is American Airlines Main Plus?

- How to make a rental car insurance claim

- Types of life insurance trusts

- 6. Confirm the check details and complete the deposit

- How do payday loans affect credit?

- 4. Set up your LLC bank account

- How much to keep in your savings account

- How much of your fee goes to Upwork?

- Cards that earn Emirates Skywards miles

- Auto loan preapproval vs. pre-qualification

- From income to budgeting

- 5. Crowne Plaza Sydney Darling Harbour (IHG One Rewards)

- Accepting payments or tips in Bitcoin

- How home equity loans and HELOCs are different from cash-out refinances

- Mattress-buying tips

- Get a credit-builder product or a secured loan

- 4. Consider a co-signer

- How does credit utilization affect my credit score?

- How to invest in AI stocks

- Condition and needed repairs

- Blue Cash Everyday® Card from American Express

- Drawbacks of SIMPLE IRA plans

- How long-term care insurance works

- How to save money on Babbel

- For credit building

- Chase Sapphire Preferred® Card

- Do spot Bitcoin ETFs have custodianship risk?

- Are home equity loans a good idea?

- Should you insist on leaving a tip in Japan?

- Ways to earn money as a teenager

- Types of private equity investments

- How much is car insurance in my state?

- You should probably postpone buying a house if …

- Why you might still book rental cars in advance

- 4. Know when to leave it to the pros

- Best life insurance company for applicants with HIV: Guardian

- What’s different with debit card fraud?

- 5. The free rewards program is the bigger win

- New American Express® Green Card vs. the previous version

- PE ratio example calculator

- Refinancing your primary mortgage with a home equity loan

- How to handle these bills

- Do debt consolidation loans hurt your credit?

- What are IRS Free File Fillable Forms?

- Should I join the Hilton Grand Vacation Club?

- Be prepared to extend your trip

- Risks of debt settlement

- 7. Keep the check until it's processed

- How do you pay for purchases at Costco?

- And what is just rare or interesting?

- When are New York state income taxes due?

- How to avoid surprises

- Benefits of a business cash management account

- Managing expectations

- How to send money to others

- Which stocks is Warren Buffett selling?

- Should I do a balance transfer?

- 4. Make biweekly payments

- Dining reservations

- How does cryptocurrency work?

- Do the math on high-yield savings

- 5. Select your investments

- Should I tip housekeeping if they don’t enter the room?

- FAQ comparing home equity loans, HELOCs and cash-out refinances

- Average certificate of deposit rate: 1.81% for one-year CDs

- What is California's standard deduction?

- What's your investment strategy for 2023?