Need a consultation? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Templates

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Sep.10, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

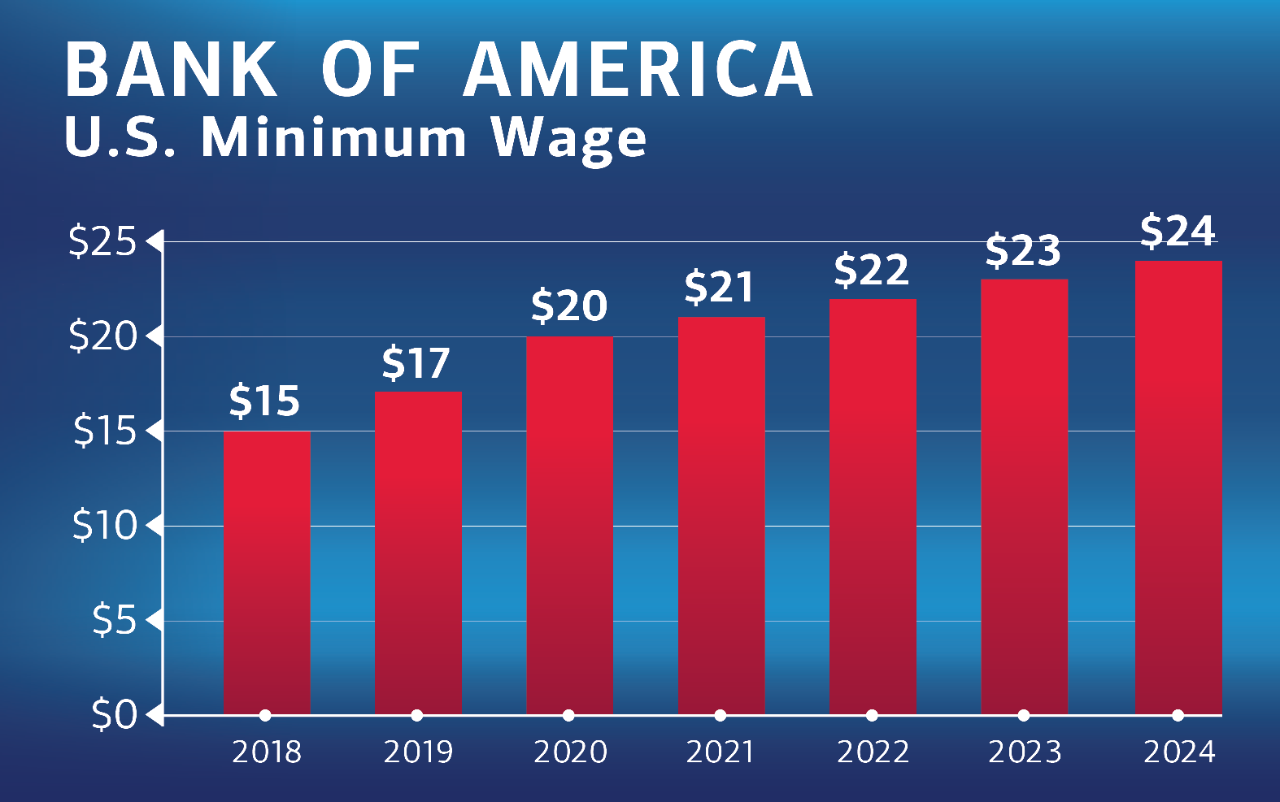

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

We earn commissions if you shop through the links below. Read more

Back to All Business Ideas

How to Start a Bank: Planning, Funding, and Execution

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on June 20, 2022

Investment range

$13,385,150 - $28,710,200

Revenue potential

$7.2 million - $72 million p.a.

Time to build

12 – 18 months

Profit potential

$720,000 - $7.2 million p.a.

Industry trend

Here are the most important factors to consider when starting a bank:

- Licensing — You will need many licenses and approvals to start a bank. The primary one is the Banking License . Next, you will need to apply for regulatory approval from a central bank. In addition, banks must comply with AML and KYC regulations to prevent financial crimes.

- ATMs and Branches — If your bank plans to open branches or install ATMs, depending on local laws, additional permissions may be required for each location.

- Capital — Regulators will require that you maintain certain levels of capital to cover potential losses. These requirements can be quite high and are meant to ensure the bank’s stability and solvency.

- Insurance — In many jurisdictions, banks are required to insure deposits up to a certain amount. This insurance protects depositors in the event of a bank failure.

- Location — Find a location that’s in a busy commercial area or business district.

- Security — Invest in high-quality physical security such as alarm systems, surveillance cameras, secure vaults, and secure doors. In addition, consider robust cybersecurity measures to protect sensitive data such as encryption, storage solutions, and strict access controls.

- Register your business — A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple. Form your business immediately using ZenBusiness LLC formation service or hire one of the best LLC services on the market.

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN .

Interactive Checklist at your fingertips—begin your bank today!

You May Also Wonder:

How profitable are banks?

Banks are very profitable, considering that the U.S. banking industry is worth more than $860 billion. The key is to provide a variety of banking services and offer great customer service.

How do I build relationships with customers and attract deposits to my bank?

You’ll have to spend some time marketing to get the word out. Then, when customers come in, you’ll want them to receive personal service.

How do I develop a business plan for my bank?

A business plan is a detailed document that requires considerable time to develop. It includes various sections such as an executive summary, company overview, descriptions of your products and services, market analysis, competitor analysis, sales and marketing plan, management summary, operations plan, and financial projections.

How do I create a risk management plan for my bank?

A risk management plan for a bank is very complex. Your best bet is to hire an experienced banking consultant to help you. It will be worth the cost.

What is the difference between a commercial bank and a community bank?

Commercial banks generally operate nationally and are subject to federal multi-state banking regulations. Community banks only operate in one state or locality.

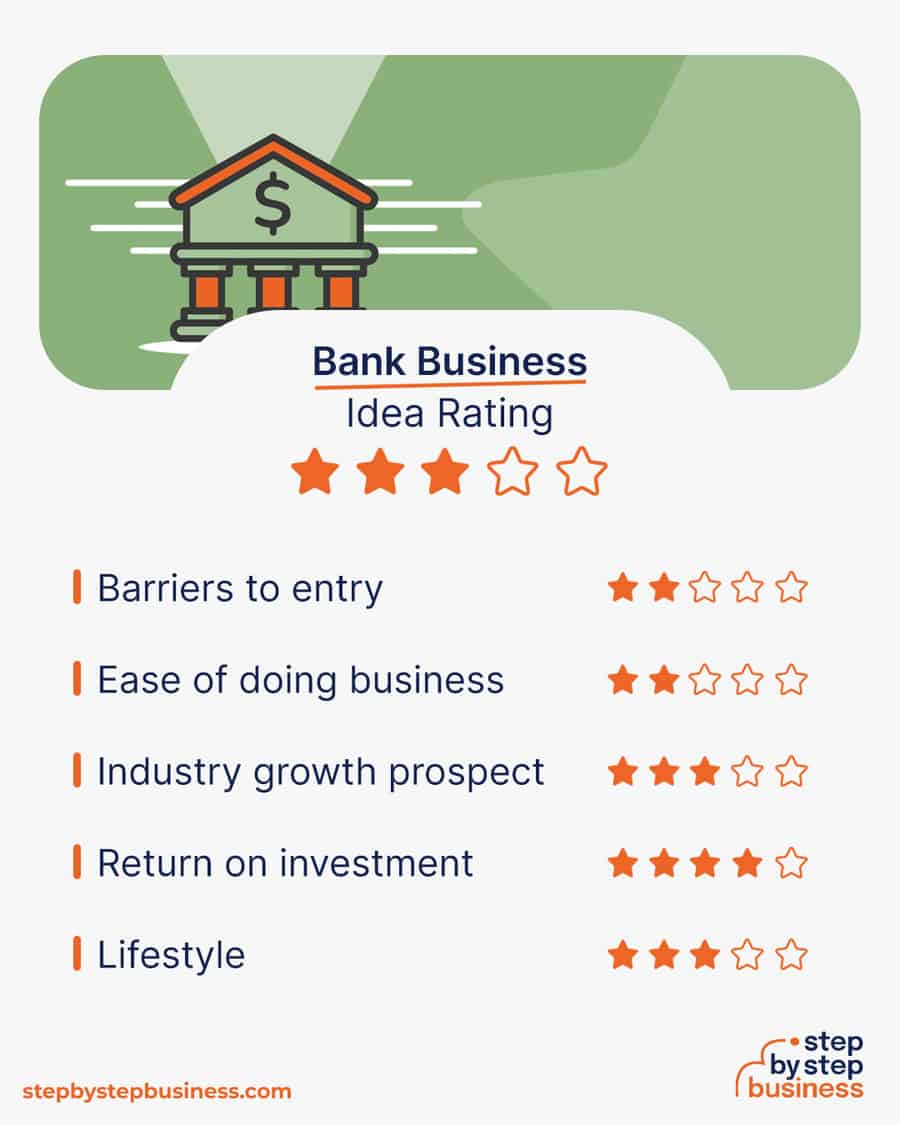

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a bank has pros and cons to consider before deciding if it’s right for you.

- Provide value — Crucial financial services for your community

- Large market — Most people rely on banks

- Good money — Banks are big money makers

- Large investment — Millions in starting capital required

- Highly regulated — Banking is the most regulated industry in the US

Bank Industry Trends

Industry size and growth.

- Industry size and past growth — The US commercial banking industry was worth $1.4 trillion in 2023 after expanding 37.3% since 2022. On average, the industry has grown 5.6% over the last five years.(( https://www.ibisworld.com/industry-statistics/market-size/commercial-banking-united-states/ ))

- Growth forecast — The US commercial banking industry is projected to grow more than 2% yearly by 2029.(( https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market ))

- Number of businesses — In 2023, 4,867 commercial banking businesses were operating in the US.(( https://www.ibisworld.com/industry-statistics/number-of-businesses/commercial-banking-united-states/ ))

- Number of people employed — In 2023, the US commercial banking industry employed 2,595,852 people.(( https://www.ibisworld.com/industry-statistics/employment/commercial-banking-united-states/ ))

Trends and Challenges

- Digital banking is the way of the future, with major banks competing to have the best apps, websites, and digital services, like instant payments.

- Technologies such as Robotic Process Automation and machine learning are helping banks replace manual workflows with cost-efficient, lightning-fast operations.

- For small banks, keeping up with technology to compete with major banks can be expensive.

- Regulations on banks — already the country’s most regulated industry — are continuing to tighten, creating new expenses and operational challenges.

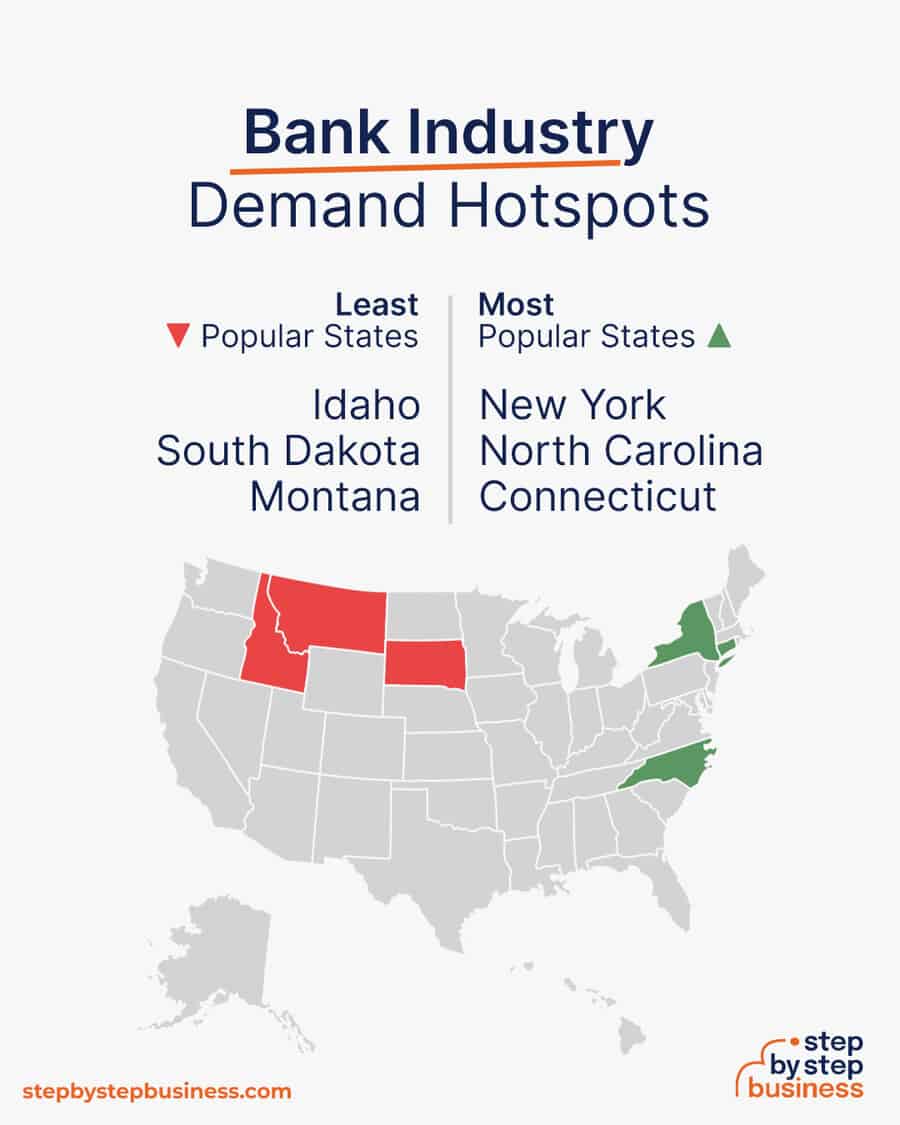

Demand Hotspots

- Most popular states — The most popular states for bank managers are New York, California, and Washington.

- Least popular states — The least popular states for bank managers are Nebraska, Wyoming, and North Dakota.(( https://www.zippia.com/bank-manager-jobs/best-states/ ))

What Kind of People Work in Banks?

- Gender — 51.1% of bank managers are female, while 48.9% are male.

- Average level of education — The average bank manager has a bachelor’s degree.

- Average age — The average bank manager in the US is 45.8 years old.(( https://www.zippia.com/bank-manager-jobs/demographics/ ))

How Much Does It Cost to Start a Bank Business?

Startup costs for a bank range from $13 million to $28 million, with the biggest expense being the startup capital required to meet federal regulations. If you start a digital rather than a physical bank, you could save up to $4 million.

You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) , which is often a laborious process.

You’ll need a handful of items to successfully launch your bank business, including:

- Computer system

- Printers, money counters, other office equipment

- Security system

- Furnishings

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Setting up a business name and corporation | $150–$200 | $175 |

| Business licenses and permits | $10,000–$20,000 | $15,000 |

| Insurance | $25,000–$50,000 | $37,500 |

| Website and app development | $100,000–$150,000 | $125,000 |

| Land plus bank construction | $1,000,000–$4,000,000 | $2,500,000 |

| Computer system | $30,000–$50,000 | $40,000 |

| Starting capital to meet regulations | $12,000,000–$24,000,000 | $18,000,000 |

| Labor and operating budget | $200,000–$400,000 | $300,000 |

| Bank furnishings and equipment | $20,000–$40,000 | $30,000 |

| Total | $13,385,150–$28,710,200 | $21,047,675 |

How Much Can You Earn From a Bank Business?

Banks make money from fees and from the interest on loans that they make. The profit margin of a bank is typically about 10%.

In your first year or two, you might get 10,000 customers and make $100,000 in fees per month and $500,000 in interest, bringing in $7,200,000 in annual revenue. This would mean $720,000 in profit, assuming that 10% margin. As you build your customer base, those numbers might increase tenfold. With annual revenue of $72,000,000, you’d make an outstanding profit of $7.2 million.

What Barriers to Entry Are There?

There are a few barriers to entry for a bank. Your biggest challenges will be:

- A large amount of initial capital

- Understanding the complex administrative processes

- Navigating the regulatory environment

Related Business Ideas

From Capital to Cash Flow: Starting a Money Lending Business

From Advice to Assets: Starting a Financial Coaching Business

The Essentials of Starting a Credit Repair Business

Step 2: hone your idea.

Now that you know what’s involved in starting a bank, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an Opportunity

Research banks in your area to examine their products and services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a community bank that offers free checking accounts or an online bank that offers money market accounts.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as savings accounts and mortgage loans, or business accounts and loans.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine Your Financial Products and Services

Banks offer a variety of products and services, including:

- Checking accounts

- Savings accounts

- Money market accounts

- Mortgage loans and other loans

- Credit cards

- Wealth management services

How Much Should You Charge for Bank Services?

Account fees can range from $5 to $15 per month. Banks also charge fees for overdrafts, ATMs, and other services. Loan rates will be dictated by the current market environment. The profit margin for banks is generally about 10%.

Once you know your costs, you can use our profit margin calculator to determine your markup and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify Your Target Market

Your target market will be basically anyone. You should spread out your marketing to include TikTok, Instagram, Facebook, and LinkedIn.

Where? Choose Your Bank Location

Selecting the right location for your bank is crucial for its success. Look for a location in a high-traffic area, preferably in a commercial district or near other financial institutions. You can find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

Consider the accessibility and convenience for clients, with easy access to parking and public transportation. Additionally, you should analyze the demographics of the surrounding area to ensure there is a demand for banking services.

By choosing a strategic location, you can position your bank to attract a wide range of customers and establish a strong presence in the financial industry.

Step 3: Brainstorm a Bank Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “bank” or “community bank,” boosts SEO

- Name should allow for expansion, for example, “Peak Performance Bank” over “Student Loan Bank”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Discover over 290 unique bank business name ideas here . If you want your business name to include specific keywords, you can also use our bank business name generator. Just type in a few keywords, hit Generate, and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. However, once you start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Bank Business Plan

Here are the key components of a business plan:

- Executive summary — A concise summary highlighting the key points of the business plan, including its mission, goals, and financial projections

- Business overview — An overview of the business, detailing its mission, vision, values, and the problem it aims to solve or the need it fulfills

- Product and services — A detailed description of the products and services offered by the business, emphasizing their unique selling points and value proposition

- Market analysis — A comprehensive analysis of the target market, including demographics, trends, and potential opportunities and challenges

- Competitive analysis — An assessment of the competitive landscape, identifying key competitors, their strengths and weaknesses, and the business’s competitive advantage

- Sales and marketing — A strategy outlining how the business plans to promote and sell its products or services, including pricing, distribution, and promotional activities

- Management team — A brief introduction to the key members of the management team, highlighting their relevant skills and experience

- Operations plan — An outline of the day-to-day operations of the business, covering processes, facilities, technology, and any other critical operational aspects

- Financial plan — A detailed financial forecast, including income statements, balance sheets, and cash flow projections, demonstrating the business’s financial viability and potential for profitability

- Appendix — Supplementary materials such as charts, graphs, and additional information that support and enhance the main components of the business plan

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose Where to Register Your Company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to banks.

If you’re willing to move, you could really maximize your business! Keep in mind that it’s relatively easy to transfer your business to another state.

Choose Your Business Structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your bank will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Banks are typically corporations — they cannot be formed as LLCs by law.

Here are your options:

- C Corporation — Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corporation — An S Corporation refers to the tax classification of the business but is not a business entity. It can be either a corporation or an LLC , which just needs to elect to be an S Corp for tax status. Here, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number or EIN. You can file for your EIN online, or by mail/fax. Visit the IRS website to learn more.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund Your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans — This is the most common method but getting approved requires a rock-solid business plan and a strong credit history.

- SBA-guaranteed loans — The Small Business Administration can act as a guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants — A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital — Venture capital investors take an ownership stake in exchange for funds, so keep in mind that you’d be sacrificing some control over your business. This is generally only available for businesses with high growth potential.

- Angel investors — Reach out to your entire network in search of people interested in investing in early-stage startups in exchange for a stake. Established angel investors are always looking for good opportunities.

- Friends and family — Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Personal — Self-fund your business via your savings or the sale of property or other assets.

Your best bet to finance a bank is to seek out angel investors or venture capital. You’ll have to have an extremely detailed business plan and pitch when seeking the considerable amount of money that you need.

Step 8: Apply for Bank Business Licenses and Permits

Starting a bank business requires obtaining a number of licenses and permits from local, state, and federal governments. You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) .

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN, articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability — The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business property — Provides coverage for your equipment and supplies.

- Equipment breakdown insurance — Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation — Provides compensation to employees injured on the job.

- Property — Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto — Protection for your company-owned vehicle.

- Professional liability — Protects against claims from clients who say they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP) — This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

You will also need FDIC insurance, and then you can use “member FDIC” in your marketing.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential Software and Tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Salesforce , FIS , or Alogent , to manage your operations, insurance, compliance, accounts, and financial processing.

- Popular web-based accounting programs for smaller businesses include Quickbooks , FreshBooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences of filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop Your Website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech savvy, you can hire a web designer or developer to create a custom website for your bank.

However, people are unlikely to find your website unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future bank:

- Local SEO — Regularly update your Google My Business and Yelp profiles to strengthen your local search presence.

- Social media financial education — Utilize platforms like LinkedIn to share financial insights and advice, establishing the bank as a thought leader.

- Digital advertising — Run targeted advertising campaigns for specific financial products and services to reach the right audience.

- Financial literacy campaigns — Distribute newsletters regularly with financial wellness tips and updates on banking products.

- Educational blog — Create content that provides guidance on financial trends, investment strategies, and saving tips.

- Webinars and live Q&As — Host online sessions that address customer financial concerns and recent market changes, enhancing engagement.

- Local sponsorships — Increase your community presence by sponsoring local events and sports teams.

- Financial workshops — Offer free financial planning workshops that cater to various life stages to educate and attract customers.

- Partnerships with local businesses — Collaborate with local businesses to offer banking benefits and host financial seminars.

- Personalized banking services — Provide tailored banking solutions based on customer data to enhance customer satisfaction.

- Rewards program — Develop a rewards program that incentivizes customers to use different banking services.

- Introductory offers — Launch promotions such as new account signup bonuses or reduced rates on loans for a limited time to attract new customers.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Today, customers are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your bank meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your bank business could be:

- A welcoming community bank for all your financial needs

- Free checking accounts and the best loan rates in town

- Digital banking made easy

You may not like to network or use personal connections for business gain but your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a bank, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in banks for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in banks. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a bank business include:

- Bank tellers — handling bank transactions

- Personal bankers — opening accounts, taking loan applications

- Mortgage originators — taking mortgage loan applications

- Bank manager — scheduling, managing branch operations

- Operations manager — managing back-office functions

- Compliance officer — handling regulatory compliance

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Bank — Start Making Money!

Starting a bank takes time and money, and it’s a complicated business to run, but once you get it going, you can make a lot of money and serve your community. If you’re willing to do what it takes, you could even build your community bank into a national powerhouse!

Now that you understand what’s involved in the business, it’s time to find investors, get your bank up and running and start financing people’s dreams.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Bank Name

- Create a Bank Business Plan

- Register Your Business

- Register for Taxes

- Fund Your Business

- Apply for Bank Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Bank — Start Making Money!

Subscribe to Our Newsletter

Featured resources.

10 Unique Security Business Opportunities

David Lepeska

Published on November 4, 2022

The security services industry in the US is estimated to be worth $50 billion and expected to grow steadily in the next five years. Demand forsecuri ...

12 Retirement Business Ideas for a Fulfilling Second Career

Carolyn Young

Published on July 21, 2022

If you’re like many retirees these days, you’re not quite ready to slow down. You want to be productive and of real use. If you’re considering ...

No thanks, I don't want to stay up to date on industry trends and news.

Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

How To Start A Bank Business: Checklist for a Smooth Launch

5-Year Excel

MAC & PC Compatible

Immediate Download

Related Blogs

- Nine Effective Strategies for Boosting Bank Business Profits

- 9 Startup Costs for Starting a Bank Business

- What Are the Seven Key KPIs for Banking?

- The Most Crucial Operating Costs for Banks

- Essential Steps to Prepare a Business Plan for Bank Approval in 9 Steps

Are you dreaming of launching your own bank but feeling overwhelmed by the complexities involved? Opening a bank business can seem daunting, especially when you consider the intricacies of regulations, funding, and customer engagement. Fortunately, we've crafted a concise 9-step checklist that guides you through the essential processes of starting your banking venture. Ready to dive in? Explore the full roadmap to success and discover how you can create a robust business plan by visiting this link .

How Do I Open A Bank Company With No Experience?

Opening a bank company, such as GreenBank , without prior experience may seem daunting, but it is entirely feasible with the right approach. The key is to leverage resources, seek mentorship, and build a strong foundation in banking operations. Here are steps to consider:

- Engage with Industry Experts: Reach out to experienced bankers or consultants who can provide insights into the banking business regulations and operational challenges.

- Educate Yourself: Invest time in understanding the financial sector, focusing on digital banking services, sustainable banking models, and eco-friendly banking solutions.

- Network: Attend industry conferences and workshops to connect with potential partners and investors who share your vision for a sustainable bank.

- Utilize Online Resources: Websites like businessplan-templates.com offer valuable templates and guides for creating a solid business plan.

- Form a Diverse Team: Assemble a team with varied expertise in finance, technology, and sustainability to fill your knowledge gaps and enhance your bank's offerings.

Tips for Getting Started

- Consider taking online courses in banking and finance to build your foundational knowledge.

- Seek mentorship from established bankers who can provide guidance on navigating regulatory requirements for banks.

- Research the market thoroughly to identify gaps that your bank can fill, especially in the eco-conscious sector.

It's important to understand that while starting a bank with no money is challenging, leveraging partnerships and innovative funding options can pave the way. Many successful banks have begun with minimal capital by focusing on niche markets and utilizing technology to reduce overhead costs.

According to recent studies, the time to start a bank company can vary significantly, typically ranging from 6 months to 2 years , depending on regulatory approvals and capital acquisition. Therefore, patience and persistence are crucial.

Finding investors for starting a banking business can be another hurdle. You may consider engaging with potential investors who are interested in sustainable initiatives, as they are more likely to align with the mission of a bank like GreenBank. Presenting a well-researched business plan that highlights the profitability of eco-friendly banking solutions can significantly increase your chances of securing funding.

How Do I Start A Bank Company With No Money?

Starting a bank company like GreenBank , which focuses on sustainability and digital banking, can seem daunting, especially when considering financial constraints. However, it is possible to launch a banking business with little to no capital by leveraging various strategies and resources.

One of the primary ways to start a bank with no money is to utilize a strong business plan that highlights your unique value proposition and targets eco-conscious clients. A well-structured plan can attract investors who are interested in funding a sustainable and innovative banking model.

Tips for Starting a Bank with Limited Funds:

- Utilize your network: Reach out to family, friends, or former colleagues who may be interested in investing in a sustainable bank.

- Identify niche funding opportunities: Many organizations and governments offer grants or funding for eco-friendly initiatives. Research these options thoroughly.

- Consider crowdfunding platforms: Platforms focused on sustainability can be a great way to raise initial capital while building a community around your brand.

Additionally, consider forming partnerships with established financial institutions or fintech companies. This can provide the necessary infrastructure and expertise, allowing you to establish digital banking services without a significant upfront investment. Moreover, many fintech firms are looking for partnerships to expand their service offerings.

Leveraging technology can also help minimize costs. By establishing a 100% digital bank, you can eliminate many of the overhead expenses associated with traditional banks, such as physical branch locations. According to a report, digital banks often operate with costs that are about 50% lower than traditional banks, which can significantly enhance your profit margins even before scaling.

Moreover, focusing on a sustainable model can differentiate your bank in a crowded market. Research indicates that more than 70% of consumers are willing to pay more for sustainable products and services; thus, positioning your bank as an eco-friendly solution can attract a loyal customer base and potentially lead to increased revenue.

In conclusion, while the journey of opening a bank business with no initial capital presents challenges, utilizing innovative funding strategies, forming strategic partnerships, and focusing on a niche market can pave the way for success. Start by drafting a banking business checklist that includes all regulatory requirements, business model development, and marketing strategies.

Example Of Checklist For Opening A Bank Company

When exploring how to open a bank business, adhering to a structured checklist is crucial for ensuring compliance and operational efficiency. Below is a detailed checklist tailored for GreenBank , a digital bank focused on sustainability.

- Research regulatory requirements for banks specific to your location, including licensing procedures.

- Develop a comprehensive business model that emphasizes sustainability and eco-friendly banking solutions.

- Create a strategic marketing plan targeting eco-conscious clients and outlining how to reach this demographic effectively.

- Establish a robust technology infrastructure to support digital banking services, ensuring security and user-friendliness.

- Build a team with expertise in finance, sustainability, and digital banking to drive the bank's mission.

- Design eco-friendly banking products and services that cater to the needs of your target audience.

- Engage with potential clients through surveys or focus groups to validate your offerings and adjust them based on feedback.

- Secure funding through investors or consider green financing options tailored to sustainable businesses.

- Launch your digital bank, ensuring a strong emphasis on customer experience to foster loyalty and satisfaction.

Tips for a Successful Launch

- Regularly update your team on banking business regulations to ensure compliance throughout the operational process.

- Utilize customer feedback loops to continuously improve your digital banking services .

Remember, the time to start a bank company varies, but thorough preparation can streamline the process significantly. A recent survey indicates that planning can reduce the startup phase by as much as 30% . Finding investors for your bank is imperative; consider exploring communities focused on socially responsible investing for better alignment with your goals.

For further insights into the metrics and operational costs involved in starting a bank, resources like this article can provide valuable benchmarks.

| Bank Business Plan ADD TO CART |

How Long Does It Take To Start A Bank Company?

Starting a bank company, such as GreenBank , an innovative digital bank focused on sustainability, is a complex process that varies in duration depending on several factors. On average, the timeline to launch a bank can range from 12 to 24 months or even longer. Each stage of development is crucial and involves meeting various regulations, securing funding, and building a strong team.

The following phases typically define the timeline:

- Research and Planning: This initial phase can take 3 to 6 months . It involves understanding banking business regulations and developing a comprehensive business model.

- Regulatory Approval: Gaining the necessary licenses can take anywhere from 6 months to 2 years depending on jurisdiction and complexity. This step is vital for compliance with banking regulations.

- Funding Acquisition: The search for investors can be time-consuming, often taking 3 to 12 months . This period includes pitching to potential investors and securing the necessary capital, especially if you are looking at funding options like green financing .

- Building Infrastructure: Establishing the technology and operational framework for digital banking can take an additional 3 to 6 months . Ensuring a seamless customer experience through digital banking services is essential.

- Marketing and Launch: Finally, implementing marketing strategies targeting eco-conscious clients and officially launching the bank generally takes another 2 to 4 months .

Overall, while the typical timeframe to start a bank company could be around 12 to 24 months , it is critical to remain adaptable and prepared for possible delays often driven by regulatory hurdles or funding challenges.

Tips for Streamlining Your Timeline

- Engage experienced consultants who specialize in banking business regulations to expedite the licensing process.

- Start networking with potential investors early in the planning phase to shorten the funding acquisition timeline.

- Leverage technology to build banking infrastructure efficiently; consider partnering with fintech companies.

Each of these timelines can vary significantly based on your specific circumstances. As you plan your path to launching GreenBank, it's essential to maintain a detailed checklist for starting a bank to ensure you’re meeting all necessary milestones along the way.

How Can I Find Investors For Starting A Bank Company?

Finding investors for starting a bank company like GreenBank, which emphasizes sustainability and digital solutions, requires strategic planning and networking. Here are various avenues to explore:

- Venture Capitalists: Look for venture capital firms that specialize in fintech and sustainable businesses. In 2021, the global fintech investment reached $105 billion , indicating a growing interest in this sector.

- Angel Investors: Individuals with a passion for green initiatives are often willing to invest in innovative banking solutions. Consider platforms like AngelList to connect with potential investors.

- Crowdfunding: Utilize crowdfunding platforms specifically for financial services or sustainability projects. According to recent reports, crowdfunding can raise an average of $10,000 to $1 million depending on the campaign’s reach and marketing strategy.

- Grants and Competitions: Explore grants from governmental or non-profit organizations supporting sustainable entrepreneurship. Competitions for fintech startups can also lead to significant funding opportunities.

- Networking Events: Attend industry conferences and networking events focused on banking and sustainability. Engaging with peers can create connections that lead to potential investments.

Tips for Finding Investors

- Prepare a compelling pitch deck that outlines the vision of GreenBank, including financial projections and market validation.

- Demonstrate understanding of banking business regulations and how your sustainable model can thrive within them.

- Leverage social media to showcase your business idea and attract eco-conscious investors.

According to the Business Plan Templates , your business plan should highlight your competitive edge in the eco-friendly banking sector as well as your unique offerings, which can significantly influence investors' interest.

Another practical approach is to examine existing funding options for banks, which can vary widely. For instance, banks are increasingly considering green financing options , which encourage investments in renewable energy and sustainable projects. As of late 2022, the global green bond market was valued at over $1 trillion , showcasing the potential for financing green initiatives.

By employing these strategies and staying informed on market trends, you can effectively position GreenBank to attract the right investors committed to sustainable banking solutions.

How Do I Create A Successful Business Plan For A Bank Company?

Creating a successful business plan for a bank company, particularly for an innovative digital bank like GreenBank , involves several critical components. This process will guide you through the intricate landscape of banking business regulations and market expectations while focusing on sustainability.

Here are key components to include in your business plan:

- Executive Summary: Summarize your vision and mission, emphasizing your commitment to eco-friendly banking solutions.

- Market Analysis: Research your target demographic—environmentally conscious individuals and businesses—and demonstrate the demand for sustainable banking. According to recent studies, over 75% of consumers prefer to support companies with sustainability commitments.

- Company Structure: Outline your bank’s legal structure, identifying stakeholders and leadership roles.

- Regulatory Compliance: Clearly outline the banking business regulations you must adhere to, including licensing and capital requirements.

- Sustainable Business Model: Detail how you will achieve profitability while minimizing environmental impact, potentially integrating services like green loans or carbon credit investments.

- Marketing Strategy: Develop a strategic marketing plan targeting eco-conscious clients, utilizing digital channels and eco-friendly initiatives.

- Operational Plan: Define your operational framework, including the technology infrastructure necessary for digital banking services.

- Financial Projections: Provide realistic financial forecasts, including projected income, expenses, and a break-even analysis. A well-prepared document could enhance your chances of finding investors for starting a banking business.

- Funding Strategy: Identify potential funding options for banks, such as venture capital, crowdfunding, or partnerships with eco-conscious investors.

Tips for Structuring Your Banking Business Plan:

- Utilize business plan templates specifically tailored for banks to streamline your process.

- Engage with stakeholders early for feedback to refine your business model and marketing strategies.

- Incorporate data from credible sources to support your claims, as this adds validity to your projections and helps in gaining investor confidence.

Remember, a comprehensive and thoughtfully crafted business plan is essential not only for launching your bank but also for sustaining its growth in the competitive landscape of digital banking. When starting a bank company, ensure that your plan reflects both your commitment to financial success and your dedication to sustainability.

Checklist For Opening A Bank Company