Dell Business Model: Supply chain & Marketing Strategy

Dell Technologies helps organizations build their digital futures and individuals transform how they work, live, and play. Dell provides customers with one of the industry’s broadest and most innovative solutions portfolios for the data era, including traditional infrastructure and extending to multi-cloud environments.

Dell is helping customers accelerate their digital transformations to improve and strengthen business and workforce productivity by offering secured, integrated solutions that extend from the edge to the core to the cloud.

Dell is expanding its IT-as-a-Service and cloud offerings to give customers greater flexibility to scale IT to meet their evolving business needs and budgets. As strategy enthusiasts, we decided to analyze the business model, supply chain strategy, and marketing strategy of Dell.

Marketing Strategy of Dell

Dell’s customers include large global and national enterprises, public institutions, governmental agencies, educational institutions, healthcare organizations, law enforcement agencies, small and medium-sized businesses, and consumers. Hence Dell has a unified global sales and marketing strategy that is customer-focused, collaborative, and innovative.

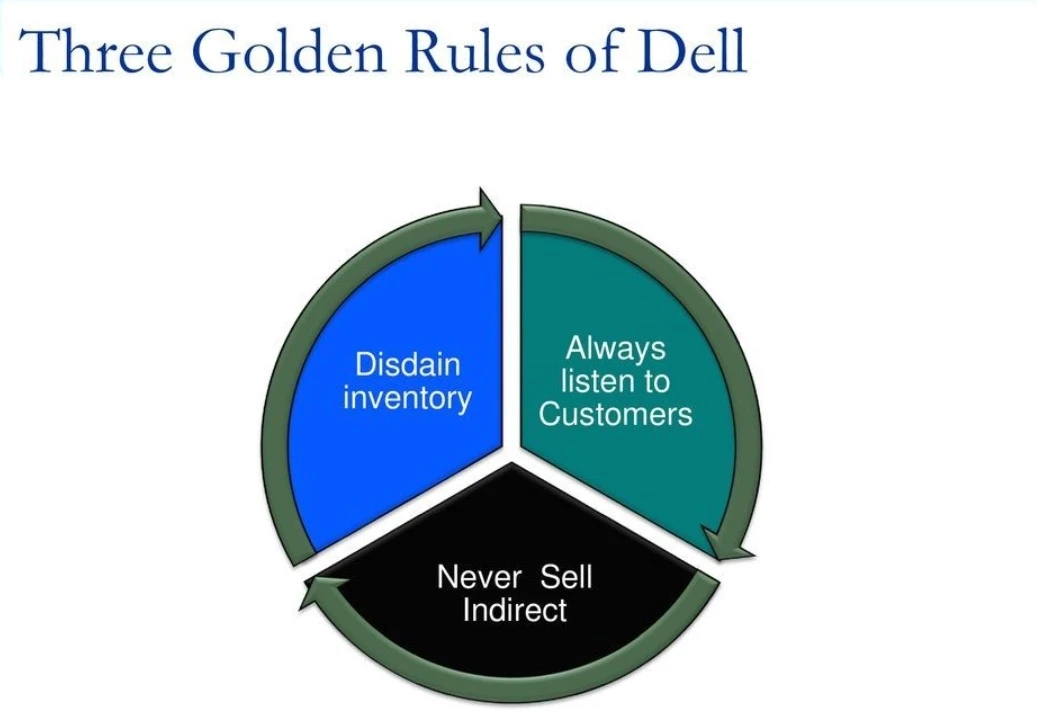

Go-to-market strategy — Dell sells products and services directly to customers and through other sales channels, which include value-added resellers, system integrators, distributors, and retailers. Dell continues to pursue a direct business strategy, which emphasizes direct communication with customers, thereby allowing it to refine Dell’s products and marketing programs and strategy for specific customer groups.

In addition to Dell’s direct business model, Dell uses its network of channel partners to sell Dell’s products and services, enabling it to serve a more significant number of customers efficiently. Dell has a partner program for the development of channel sales, which provides appropriate incentives to encourage sales generation. During Fiscal 2022, Dell’s other sales channels contributed over 50% of Dell’s net revenue.

Dell’s go-to-market engine includes a 32,000-person sales force and a global network of over 200,000 channel partners. Dell Financial Services and its affiliates (“DFS”) offer customers payment flexibility and enable synergies across the business.

Large enterprises and public institutions — Dell maintain a field sales force for large enterprises and public institutions. Dedicated account teams, which include technical sales specialists, form long-term relationships to provide Dell’s most prominent customers with a single source of assistance, develop tailored solutions for these customers, position the capabilities of Dell Technologies, and provide it with customer feedback.

For these customers, Dell offers several programs to provide single points of contact and accountability with dedicated account managers, special pricing, and consistent service and support programs. Dell also maintains specific sales and marketing programs targeting federal, state, and local governmental agencies and healthcare and educational customers.

Small and medium-sized businesses and consumers — As part of its marketing strategy, Dell markets its products and services to small and medium-sized enterprises and consumers through various advertising media. To react quickly to Dell’s customers’ needs, Dell tracks its Net Promoter Score, a customer loyalty metric widely used across multiple industries. Dell also engages with customers through Dell’s social media communities on Dell’s website and in external social media channels.

Supply Chain Strategy of Dell

Dell owns manufacturing facilities in the United States, Malaysia, China, Brazil, India, Poland, and Ireland. Dell also utilizes contract manufacturers worldwide to manufacture or assemble Dell’s products under the Dell Technologies brand as part of Dell’s strategy to enhance Dell’s variable cost structure and to achieve Dell’s goals of generating cost efficiencies, delivering products faster, and enhancing Dell’s supply chain strategy.

Dell’s manufacturing process consists of assembly, software installation, functional testing, and quality control. Dell conducts operations utilizing a formal, documented quality management system to ensure that Dell’s products and services satisfy customer needs and expectations.

Testing and quality control are also applied to components, parts, sub-assemblies, and systems obtained from third-party suppliers. Dell’s quality management system is maintained by testing components, sub-assemblies, software, and systems at various stages in the manufacturing process.

How Dell pioneered the Just in Time to gain market share?

Dell has implemented programs and methodologies to ensure that the quality of Dell’s designs, manufacturing, test processes, and supplier relationships are continually improved. Dell maintains a Supplier Code of Conduct, actively manages recycling processes for Dell’s returned products and is certified by the Environmental Protection Agency as a Smartway Transport Partner.

As part of its supply chain strategy, Dell purchases materials, supplies, product components, and products from many qualified suppliers. The strategy of contracting multiple vendors for procurement needs is called Multi-vendor sourcing.

Dell maintains more than 2,400 vendor-managed service centers. Dell’s supply chain strategy drives long-term growth and operating efficiencies, with approximately $75 billion in annual procurement expenditures and over 750 parts distribution centers. Together, these elements provide a critical foundation for Dell’s success.

How does Dell make money: Business Model

Before we understand how Dell makes money and its business model, let’s understand the structure of offerings from Dell. Dell designs, develops, manufactures, markets, sells, and supports comprehensive and integrated solutions, products, and services. Dell is organized into two business units, Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG).

Infrastructure Solutions Group (“ISG”) — ISG enables customers’ digital transformation through trusted multi-cloud and big data solutions built upon modern data center infrastructure. ISG helps customers simplify, streamline, and automate cloud operations in hybrid cloud deployment. ISG solutions are built for multi-cloud environments and optimized to run cloud-native workloads in public and private clouds and traditional on-premise workloads.

Client Solutions Group (“CSG”) — CSG includes branded hardware (such as desktops, workstations, and notebooks) and branded peripherals (such as displays and projectors), as well as third-party software and peripherals. For customers seeking to simplify client lifecycle management, Dell’s PC-as-a-Service offering combines hardware, software, lifecycle services, and financing into one all-encompassing solution that provides predictable pricing per seat per month. CSG also offers attached software, peripherals, and services, including support and deployment, configuration, and extended warranty services.

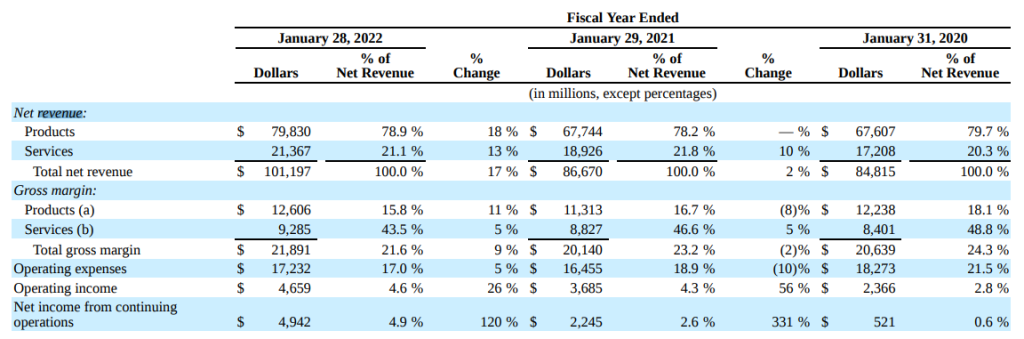

Dell made $102 Billion in 2021 , a 17% growth from 2020. Dell makes money primarily from two revenue streams: products and services. Product revenue includes the sale of hardware products and software licenses. Service revenue includes service offerings and support services related to hardware products and software licenses. Products and Services contribute 70% and 21% to Dell’s revenue, respectively.

In 2021, product revenue increased by 18%, primarily due to an increase in product net revenue for CSG and, to a lesser extent, ISG product net revenue. CSG product revenue increased primarily due to increases in units sold of both commercial and consumer product offerings as a result of continued strength in the demand environment and, to a lesser extent, an increase in average selling price principally related to our commercial offerings. ISG product net revenue increased primarily due to increased sales volumes of server offerings.

At the same time, services revenue increased by 13%, driven primarily by growth in CSG services revenue and, to a lesser extent, growth in both ISG and other businesses’ services revenue. Growth in CSG services revenue was primarily due to increases in services net revenue attributable to both CSG hardware support and maintenance and CSG third-party software support and maintenance. ISG services revenue increased primarily due to growth within hardware support services, while other business services’ net revenue increased due to software support and maintenance growth within VMware Resale.

A passionate writer and a business enthusiast having 6 years of industry experience in a variety of industries and functions. I just love telling stories and share my learning. Connect with me on LinkedIn. Let's chat...

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

In 1984, Dell disrupts the personal computer market with high quality, low-cost machines that are built-to- order and sold directly to customers.

In 1984, Michael Dell launched his company out of his college dorm room. He recognized that sophisticated computer buyers wanted customized, high quality, technical machines at an affordable cost. This is not something they could get from IBM, which dominated the market at the time.

Dell targeted users by offering customized machines that were built-to-order. Customers would simply dial a toll-free number, place a customized order, and wait for their computer to be delivered by mail.

Dell turned the traditional PC sales model on its head with build-to-order and direct sales. He disrupted the PC industry with customized, high quality, affordable PCs by avoiding retail locations, high-touch sales, and minimizing inventory and inventory depreciation costs.

Dell grew from PCs assembled in a dorm room in 1984 to a $300 million business just five years later.

1. Take customized orders and get paid

In 1984 Dell begins to take customized PC orders over the phone. Buyers determine their exact specifications and pick from a variety of PC components. In 1996, the company brings its direct model to the Web and automates build-to-order.

2. Build the product

Dell purchases components from PC equipment wholesalers and builds the customized machine himself (just-in-time production) based on the customer’s order. He is able to keep the cost of his machines under $1,000.

3. Manage your just-in-time supply chain

Contrary to a traditional PC manufacturer, Dell stays away from heavy costs of inventory management, retail, and logistics. Products are built-to-order. This requires Dell to develop excellence around a new set of activities: just- in-time supply chain and production.

4. Pass on cost savings to customers and disrupt the market

Dell’s build-to-order model avoids unsold PCs and value depreciation. In addition, Dell’s direct model and wholesale component purchases further reduce production and distribution costs. This allows him to pass on cost savings in the form of disruptive prices for high quality PCs.

About the speakers

Download your free copy of this whitepaper now, explore other examples, get strategyzer updates straight in your inbox.

Presentations made painless

- Get Premium

Dell: Business Model, SWOT Analysis, and Competitors 2024

Inside This Article

Dell, a renowned multinational technology company, has been a key player in the tech industry for decades. With a focus on providing hardware and software solutions, Dell has established a robust business model that caters to both individual consumers and businesses. In this blog article, we will delve into Dell's business model, conduct a SWOT analysis to evaluate its strengths, weaknesses, opportunities, and threats, and explore its competitors in the year 2024. Stay tuned to gain insights into Dell's strategies, market position, and potential challenges in the evolving tech landscape.

What You Will Learn:

- Who owns Dell and what this means for the company's operations and decision-making processes.

- The mission statement of Dell and how it guides the company's strategic direction and objectives.

- The different revenue streams and business models that Dell utilizes to generate income.

- An overview of the Dell Business Model Canvas and how it helps in understanding the key elements of Dell's business model.

- The main competitors of Dell in the market and how they compare in terms of products, services, and market share.

- A comprehensive SWOT analysis of Dell, highlighting the company's strengths, weaknesses, opportunities, and threats in the industry.

Who owns Dell?

Introduction.

Dell Technologies, a multinational technology company, has been a prominent player in the computer hardware industry for several decades. Founded by Michael Dell in 1984, it has undergone numerous transformations and changes in ownership over the years. In this section, we will explore the current ownership structure of Dell and the key stakeholders involved.

Dell's Privatization

In 2013, Dell underwent a significant ownership change when Michael Dell, in partnership with global technology investment firm Silver Lake Partners, took the company private. This privatization move was aimed at giving Dell more flexibility to pursue long-term goals and strategic initiatives without the pressures of quarterly earnings expectations from public shareholders.

Michael Dell

Michael Dell, the founder of Dell Technologies, is a key figure in the company's ownership structure. He currently serves as the Chairman and CEO of the company and has a significant ownership stake. As part of the privatization deal in 2013, Michael Dell contributed a substantial portion of his personal wealth to maintain a controlling interest in the company.

Silver Lake Partners

Silver Lake Partners, a private equity firm specializing in technology investments, played a pivotal role in Dell's privatization. They partnered with Michael Dell to take the company private and provided substantial financial backing for the transaction. Silver Lake remains a major stakeholder in Dell, with a significant ownership position.

Another crucial component of Dell's ownership structure is its ownership of VMware, a leading provider of virtualization software. Dell acquired a majority stake in VMware when it purchased EMC Corporation in 2016. As a result, Dell indirectly owns a significant portion of VMware's shares. However, VMware remains a separate publicly traded company with its own independent shareholders.

Public Shareholders

Although Dell is a private company, it still has a small number of public shareholders. These shareholders primarily consist of the investors who held Dell's publicly traded shares before the privatization in 2013. While their ownership stake is relatively minor compared to Michael Dell and Silver Lake Partners, they still have a financial interest in the company.

In conclusion, Dell Technologies is primarily owned by Michael Dell and Silver Lake Partners following its privatization in 2013. Michael Dell, as the founder and CEO, has a significant ownership stake and plays a central role in the company's direction. Silver Lake Partners, a private equity firm, is another major stakeholder. Additionally, Dell's ownership of VMware further impacts its ownership structure. While Dell remains a private company, it still has a small number of public shareholders from its pre-privatization days.

What is the mission statement of Dell?

The mission statement of dell: empowering the future through technology.

Dell Technologies, a multinational technology company, has a clear and concise mission statement that reflects its commitment to empowering individuals, organizations, and communities through innovative technology solutions. Dell's mission statement is:

"To drive human progress through technology."

This mission statement encapsulates Dell's dedication to harnessing the power of technology to improve lives, drive innovation, and create sustainable outcomes. By leveraging its expertise in developing and delivering cutting-edge solutions, Dell aims to inspire positive change and enable customers to achieve their full potential.

Fostering Human Progress

Dell's mission statement signifies its focus on driving human progress. The company recognizes that technology has the potential to transform the way we live, work, and interact. Dell believes in leveraging this potential to foster positive change and make a meaningful impact on society.

By providing technology solutions that are accessible, scalable, and reliable, Dell aims to bridge the digital divide and empower individuals and communities. Whether it's through enabling remote education, facilitating remote work, or enhancing healthcare delivery, Dell strives to create a future where everyone has equal opportunities to thrive.

Technology as an Enabler

Dell's mission statement also emphasizes the pivotal role technology plays in enabling progress. The company firmly believes that technology should not be seen as an end in itself but as a powerful tool that can unlock new possibilities, drive innovation, and solve complex challenges.

To fulfill its mission, Dell focuses on developing and delivering advanced technology solutions that cater to various domains, including personal computing, data storage, cloud infrastructure, and cybersecurity. By constantly pushing the boundaries of innovation, Dell aims to empower individuals, businesses, and institutions to achieve their goals and push the boundaries of what is possible.

Sustainability and Responsible Business Practices

In line with its mission, Dell is committed to practicing responsible business and fostering sustainability. The company recognizes the importance of minimizing its environmental impact, promoting ethical practices, and maintaining a diverse and inclusive workforce.

Dell's mission extends beyond technological advancements to incorporate sustainable business practices. Through initiatives like Dell's 2030 Social Impact Plan, the company aims to drive positive change in areas such as environmental sustainability, ethics, and social impact. By aligning its business strategies with its mission, Dell strives to make a lasting difference in the world.

Dell's mission statement reflects its dedication to driving human progress through technology. By fostering innovation, enabling accessibility, and practicing responsible business, Dell aims to empower individuals, organizations, and communities. With a focus on leveraging technology as an enabler, Dell remains committed to creating a future where everyone can thrive and achieve their full potential.

How does Dell make money?

Selling hardware and products.

One of the primary ways Dell makes money is by selling hardware and products to customers. Dell offers a wide range of products including desktop computers, laptops, tablets, servers, storage devices, and peripherals such as monitors, keyboards, and mice. These products are sold both online through Dell's website and through various retail channels.

Dell's hardware sales contribute significantly to its revenue. By developing and manufacturing their own products, Dell can control the quality and specifications of the hardware they sell. This allows them to cater to specific customer needs and offer a variety of options at different price points.

Providing services and solutions

In addition to selling hardware, Dell also generates revenue from providing various services and solutions. These services are designed to help customers with their IT needs and provide them with the necessary support to manage and optimize their technology infrastructure.

Dell offers a range of services including consulting, deployment, support, and managed services. For instance, they provide consulting services to help businesses design and implement IT solutions that align with their goals and requirements. They also offer deployment services to assist customers in setting up and integrating new hardware and software into their existing systems.

Furthermore, Dell provides support services to ensure customers receive timely assistance and troubleshooting for any issues they may encounter. They have a dedicated technical support team that offers both onsite and remote support, helping customers resolve hardware and software problems efficiently.

Moreover, Dell offers managed services, where they take on the responsibility of managing and maintaining customers' IT infrastructure. This allows businesses to focus on their core operations while Dell handles the day-to-day management, monitoring, and maintenance of their technology systems.

Partnering with businesses and organizations

Another way Dell generates revenue is through partnerships with businesses and organizations. Dell collaborates with companies of all sizes, ranging from small businesses to large enterprises, to provide tailored solutions that meet their specific needs.

Through these partnerships, Dell offers customized hardware and software solutions that align with the unique requirements of the businesses they work with. This might involve developing specialized servers, storage solutions, or software applications that cater to specific industry needs.

By partnering with businesses and organizations, Dell not only generates revenue from the sale of its products and services but also builds long-term relationships that can lead to repeat business and referrals.

In summary, Dell makes money through various revenue streams. Selling hardware and products, providing services and solutions, and partnering with businesses and organizations are the key ways Dell generates revenue. By offering a comprehensive range of products and services, Dell caters to the diverse needs of its customers and continues to be a leading player in the technology industry.

Dell Business Model Canvas Explained

What is the business model canvas.

The Business Model Canvas is a strategic management tool that allows businesses to visualize, evaluate, and communicate their business model. It consists of nine key building blocks that help organizations analyze and understand how they create, deliver, and capture value.

Dell's Business Model Canvas

Dell, a renowned multinational technology company, has a well-defined and innovative business model. Let's take a closer look at Dell's business model canvas and understand how it has contributed to the company's success.

Customer Segments

Dell targets both individual consumers and businesses. They have identified specific customer segments such as small and medium-sized enterprises (SMEs), large corporations, and individuals seeking high-performance computers.

Value Proposition

Dell's value proposition is centered around customization, direct sales, and cost-effectiveness. By offering personalized products, direct customer engagement, and competitive pricing, Dell aims to provide customers with tailored solutions that meet their specific needs.

Dell primarily operates through direct sales channels, bypassing traditional retail intermediaries. This direct-to-customer approach enables Dell to maintain closer relationships with their customers, gather valuable feedback, and respond quickly to changing market demands.

Customer Relationships

Dell focuses on building long-term relationships with its customers. They provide excellent customer support, offer warranties, and provide ongoing assistance to ensure customer satisfaction. Additionally, Dell leverages social media and online communities to engage with customers and gather insights for continuous improvement.

Revenue Streams

Dell generates revenue through various channels, including the sale of hardware, software, peripherals, and services. While product sales contribute significantly to their revenue, Dell has also expanded its offerings to include comprehensive service contracts, maintenance, and support packages.

Key Activities

Dell's key activities revolve around product design, manufacturing, logistics, and customer support. Their efficient manufacturing processes and supply chain management allow them to deliver customized products in a timely manner, ensuring customer satisfaction.

Key Resources

Dell's key resources include their strong brand reputation, advanced manufacturing facilities, supply chain partnerships, and a talented workforce. These resources enable Dell to develop and deliver high-quality products while maintaining cost-effectiveness.

Key Partnerships

Dell collaborates with various technology partners, including software developers, hardware suppliers, and service providers. These strategic partnerships allow Dell to enhance its product offerings, expand its market reach, and provide comprehensive solutions to customers.

Cost Structure

Dell's cost structure is optimized through its direct sales approach and efficient supply chain management. By eliminating intermediaries, Dell reduces distribution costs and maintains competitive pricing. Additionally, their extensive use of technology streamlines internal processes, further reducing operational costs.

Dell's business model canvas demonstrates their customer-centric approach, emphasis on customization, and efficiency in operations. By leveraging direct sales, strategic partnerships, and focusing on customer relationships, Dell has successfully positioned itself as a leading technology provider in the market. Understanding Dell's business model canvas provides valuable insights for businesses aiming to enhance their own strategies and drive success in the ever-evolving technology industry.

Which companies are the competitors of Dell?

In today's competitive technology market, it is essential to identify the main competitors of Dell. This section will delve into the key companies that pose a challenge to Dell's position in the industry. Understanding these competitors will provide valuable insights into the current market dynamics and help customers make informed decisions when considering Dell products.

Hewlett-Packard (HP)

Hewlett-Packard, commonly known as HP, is one of the most prominent competitors of Dell. HP offers a wide range of products and services, including personal computers, laptops, printers, and enterprise solutions. With a history spanning several decades, HP has established a strong presence in the technology sector and competes directly with Dell in various market segments.

Lenovo, a Chinese multinational technology company, has rapidly gained recognition as a formidable competitor to Dell in recent years. Known for its innovation and focus on quality, Lenovo offers a diverse portfolio of products, including laptops, desktops, tablets, and smartphones. The company's acquisition of IBM's personal computer division in 2005 further strengthened its position, enabling it to compete head-on with Dell on a global scale.

While primarily recognized for its consumer electronics, Apple also competes with Dell in the computer market. Apple's Mac lineup of desktops and laptops has garnered a dedicated following due to its sleek design, user-friendly interface, and integration with other Apple devices. Although Dell primarily targets the business and enterprise segments, Apple's popularity among consumers poses a significant challenge to Dell's market share.

Acer, a Taiwanese multinational hardware and electronics corporation, is another noteworthy competitor of Dell. Acer offers a wide range of computer products, including laptops, desktops, tablets, and monitors. The company's competitive pricing strategy and focus on delivering affordable yet reliable devices have contributed to its success in the consumer market. Acer's presence in both the consumer and business segments directly competes with Dell's offerings.

As a leading technology company, Dell faces stiff competition from various players in the industry. Hewlett-Packard, Lenovo, Apple, and Acer are among the key competitors that challenge Dell's position in the market. Each of these companies offers unique products, services, and marketing strategies, making the technology landscape dynamic and demanding for Dell. By analyzing the competitive landscape, customers can make informed decisions based on their specific needs and preferences.

Dell SWOT Analysis

- Strong brand reputation: Dell is a well-established and recognized brand in the technology industry. It has built a strong reputation for delivering high-quality products and excellent customer service.

- Wide product portfolio: Dell offers a wide range of products and solutions, including laptops, desktops, servers, storage devices, and networking equipment. This diverse product portfolio allows the company to cater to the needs of various customer segments.

- Strong distribution network: Dell has a strong distribution network that spans across the globe. It has an extensive presence in both online and offline channels, enabling the company to reach customers in different geographical locations.

- Customer-centric approach: Dell has a strong focus on understanding and meeting customer needs. The company emphasizes on customization and personalization, allowing customers to configure their systems according to their specific requirements.

- Dependence on third-party suppliers: Dell relies on third-party suppliers for the components used in its products. This dependence can create challenges in terms of quality control, supply chain disruptions, and pricing negotiations.

- Limited presence in the mobile device market: Dell has a limited presence in the mobile device market, particularly in smartphones and tablets. This weakness hinders the company's ability to tap into the growing demand for mobile devices.

- Lack of innovation: In recent years, Dell has been criticized for its lack of innovation compared to competitors. The company has struggled to introduce groundbreaking products and technologies that can differentiate it from the competition.

Opportunities

- Growing demand for cloud computing: The increasing adoption of cloud computing presents an opportunity for Dell to expand its business. Dell can leverage its expertise in server and storage solutions to offer cloud-based services and solutions to customers.

- Expansion into emerging markets: Dell has the opportunity to expand its presence in emerging markets, such as India, China, and Brazil. These markets offer significant growth potential due to their large populations and increasing technology adoption.

- Focus on sustainability: Dell can capitalize on the growing trend of sustainability by offering environmentally friendly products and solutions. This can attract environmentally conscious customers and differentiate Dell from competitors.

- Intense competition: The technology industry is highly competitive, with numerous players competing for market share. Dell faces intense competition from companies like HP, Lenovo, and Apple, which can impact its market position and profitability.

- Rapid technological advancements: The technology landscape is constantly evolving, with new technologies emerging at a rapid pace. Dell needs to stay ahead of these advancements to remain relevant and competitive in the market.

- Economic uncertainties: Economic uncertainties, such as recessions or fluctuations in currency exchange rates, can impact Dell's business. These uncertainties can affect customer spending patterns and demand for Dell's products and services.

Key Takeaways

- Dell is a privately owned company, with its ownership held by the founder, Michael Dell, and investment firms.

- The mission statement of Dell revolves around providing technology solutions that enable individuals and organizations to achieve their goals.

- Dell primarily makes money through the sales of laptops, desktops, servers, storage devices, and related services.

- The Dell Business Model Canvas highlights key aspects such as customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

- Competitors of Dell include major technology companies like HP, Lenovo, Apple, and IBM, among others. Conducting a SWOT analysis of Dell reveals its strengths, weaknesses, opportunities, and threats in the market.

In conclusion, Dell is owned by its founder Michael Dell, along with other shareholders. The mission statement of Dell is to be the most successful computer company in the world at delivering the best customer experience. Dell makes money through various revenue streams, including selling personal computers, servers, software, and providing IT consulting services.

The Dell Business Model Canvas is a comprehensive framework that explains how Dell creates, delivers, and captures value. It includes key activities such as manufacturing, marketing, and customer support, as well as partnerships and resources that contribute to Dell's success.

As for competitors, Dell faces strong competition from companies like HP, Lenovo, and Apple in the personal computer market. In the server and storage space, competitors include IBM, Cisco, and Hewlett Packard Enterprise. Dell's ability to innovate, provide high-quality products, and deliver excellent customer service is crucial in maintaining its competitive edge.

In a SWOT analysis of Dell, we can see its strengths lie in its strong brand reputation, global presence, and efficient supply chain. However, weaknesses include its dependency on third-party suppliers and potential vulnerability to economic fluctuations. Opportunities for Dell include expanding into emerging markets and diversifying its product offerings, while threats include intense competition and rapid technological advancements.

Overall, Dell has established itself as a prominent player in the technology industry, with a clear mission, well-defined business model, and a strong presence in the market. By constantly adapting to the changing landscape and leveraging its strengths, Dell will continue to thrive and deliver value to its customers in the years to come.

What is Dell SWOT analysis?

Dell SWOT analysis refers to an evaluation of the strengths, weaknesses, opportunities, and threats facing Dell Technologies, an American multinational computer technology company. This analysis provides insights into the internal and external factors that impact the company's strategic planning and decision-making processes.

- Strong brand reputation and customer loyalty.

- Broad product portfolio and innovative technology solutions.

- Efficient supply chain management and direct selling approach.

- Global presence and extensive distribution network.

- Strong customer support and after-sales services.

Weaknesses:

- High dependency on third-party suppliers and manufacturing partners.

- Limited presence in the smartphone and tablet markets.

- Relatively limited marketing and advertising compared to competitors.

- Vulnerable to economic fluctuations and changes in consumer preferences.

- Limited focus on software development and services.

Opportunities:

- Growing demand for cloud computing and data storage solutions.

- Expansion into emerging markets with untapped customer base.

- Increasing adoption of smart home and Internet of Things (IoT) devices.

- Focus on software and services to diversify revenue streams.

- Strategic partnerships and acquisitions to enhance product offerings.

- Intense competition from other technology giants like Apple, HP, and Lenovo.

- Rapid technological advancements and short product life cycles.

- Potential security breaches and cyber threats.

- Economic uncertainties and fluctuations in global markets.

- Changing governmental regulations and trade policies.

What are the weaknesses of Dell?

Some potential weaknesses of Dell include:

Lack of product diversification: Dell is primarily known for its computers and laptops, which can limit its market reach compared to competitors that offer a broader range of products and services.

Strong competition: Dell faces intense competition from other major tech companies like HP, Lenovo, and Apple, which can make it challenging to maintain market share and profitability.

Dependence on the PC market: Dell heavily relies on the PC market, and any decline in PC sales can have a significant impact on its overall revenue and profitability.

Limited retail presence: Dell primarily sells its products online or through direct sales, which can limit its visibility and accessibility to customers who prefer physical retail stores.

Reliance on third-party suppliers: Dell relies on various suppliers for components and parts, making it vulnerable to supply chain disruptions, quality control issues, and fluctuating prices.

Perception of being overpriced: Some consumers perceive Dell products as being relatively more expensive compared to competitors, which can make it challenging to attract price-sensitive customers.

Brand perception: While Dell has a strong reputation for quality and reliability in the business and enterprise markets, it may not have the same level of brand recognition or cachet as some of its competitors in the consumer market.

What challenges is Dell facing?

Some of the challenges Dell is currently facing include:

Intense competition: Dell operates in a highly competitive market, facing competition from other major technology companies like HP, Lenovo, and Apple. This competition puts pressure on Dell to constantly innovate and differentiate its products and services.

Changing market trends: The technology industry is characterized by rapidly changing trends and customer preferences. Dell needs to adapt and stay ahead of these trends, such as the shift towards cloud computing, mobile devices, and AI, to remain competitive.

Supply chain disruptions: Dell relies on a global supply chain to source its components and manufacture its products. Disruptions in the supply chain, such as natural disasters, trade disputes, or political instability, can impact Dell's ability to meet customer demands and lead to delays or increased costs.

Economic uncertainties: Dell's business performance is influenced by macroeconomic factors, including fluctuations in currency exchange rates, trade policies, and global economic conditions. Economic downturns or recessions can affect customer spending and demand for Dell's products and services.

Data security and privacy concerns: As a technology company, Dell faces increasing scrutiny and challenges related to data security and privacy. With the rise of cyber threats and stricter regulations, Dell needs to invest in robust security measures and ensure compliance with data protection regulations like GDPR.

Environmental sustainability: There is a growing emphasis on environmental sustainability and reducing electronic waste. Dell faces the challenge of managing its products' end-of-life, recycling electronic waste responsibly, and minimizing its environmental impact throughout the product lifecycle.

Shift to subscription-based models: The technology industry is witnessing a shift towards subscription-based models, where customers pay for services on a recurring basis. Dell needs to adapt to this shift and develop subscription-based offerings to remain competitive in the market.

Talent acquisition and retention: As a technology company, Dell relies on highly skilled and specialized employees. Attracting and retaining top talent in a competitive job market can be a challenge for Dell, particularly in areas like software development, AI, and cybersecurity.

What are the success factors for Dell?

There are several key success factors for Dell:

Direct Sales Model: Dell's direct sales model, which eliminates intermediaries and sells directly to customers, has been a significant factor in its success. This model allows Dell to customize products according to customer needs, reduce costs, and maintain a close relationship with customers.

Supply Chain Efficiency: Dell has developed a highly efficient supply chain management system, known as the Dell Direct Model, that enables it to deliver products quickly and efficiently. This system allows Dell to minimize inventory, reduce lead times, and respond rapidly to changing customer demands.

Customer Focus: Dell's strong customer focus is another success factor. The company emphasizes understanding and meeting customer needs, offering personalized solutions, and providing excellent customer service. This customer-centric approach has helped Dell build a loyal customer base and maintain a positive brand image.

Innovation and Technology: Dell has consistently invested in research and development to drive innovation and stay at the forefront of technology. The company continuously introduces new products and solutions that cater to evolving customer requirements. Dell's strong focus on technology has allowed it to remain competitive in the rapidly changing IT industry.

Cost Efficiency: Dell's cost-efficient operations are a crucial success factor. The company effectively manages costs throughout its supply chain, manufacturing processes, and operations. By reducing costs, Dell is able to offer competitive prices to customers, which has contributed to its growth and market success.

Strong Partnerships and Alliances: Dell has formed strategic partnerships and alliances with various technology vendors, suppliers, and software developers. These collaborations have allowed Dell to expand its product portfolio, access new markets, and offer comprehensive solutions to customers.

Strong Brand Reputation: Dell has built a strong brand reputation over the years, known for its quality products, customer-centric approach, and reliable customer support. The company's brand image has played a significant role in attracting and retaining customers, as well as differentiating itself from competitors.

Overall, Dell's success can be attributed to its direct sales model, efficient supply chain, customer focus, innovation, cost efficiency, strategic partnerships, and strong brand reputation.

Want to research companies faster?

Instantly access industry insights

Let PitchGrade do this for me

Leverage powerful AI research capabilities

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2024 Pitchgrade

- May 16, 2023

Decoding the Dell Business Model

Do you want to learn how does dell make money in this article, we uncover the secrets of the dell business model to help you learn how the technology company has built an empire..

Founded in 1984 by Michael Dell, Dell Technologies is one of the world’s leading technology companies. Initially named “PC’s Limited”, Dell began its journey in a dorm room at the University of Texas with just $1000. With a vision to directly sell computers to customers and understand their needs, Michael Dell pioneered a unique model of business that focused on direct sales and build-to-order production. His innovative approach revolutionized the PC industry, setting a standard that many others have tried to replicate.

Today, Dell Technologies is an expansive enterprise offering a comprehensive range of technology solutions, including hardware, software, and services. The company’s success and growth have been underpinned by an innovative, resilient, and adaptable business model.

To dissect Dell’s business model, we will use Alexander Osterwalder’s Business Model Canvas, a strategic management template for developing new or documenting existing business models. The model breaks down the core components of a business into nine building blocks: Value Proposition, Customer Segments, Channels, Customer Relationships, Revenue Streams, Key Activities, Key Resources, Key Partnerships, and Cost Structure.

Value Proposition

Dell’s primary value proposition is providing high-quality, reliable, and customized technology solutions at competitive prices. The company’s build-to-order and direct sales approach allows customers to receive tailor-made PCs and related products that suit their specific requirements. The inherent efficiency of this model also enables cost-effectiveness, which Dell passes on to its customers in the form of lower prices.

Over the years, Dell has expanded its value proposition to include end-to-end technology solutions. Through mergers and acquisitions, such as the significant acquisition of EMC Corporation in 2016, Dell now offers a wide range of enterprise solutions, including servers, storage, and networking products, as well as software and services. This diversification has enabled Dell to serve as a one-stop-shop for its customers’ technology needs.

Customer Segments

Dell’s customer segments are divided into three primary categories: individual consumers, small and medium businesses (SMBs), and large enterprises.

Individual consumers are those who buy Dell products for personal use, such as laptops, desktops, and peripheral devices. SMBs purchase a wider range of products, including PCs, servers, storage, and networking products, as well as software and services. Large enterprises are Dell’s most comprehensive customers, often requiring complex, integrated technology solutions that encompass hardware, software, and services.

Dell’s direct sales model, initially carried out over the phone and later through the internet, forms the backbone of its sales channels. By bypassing intermediaries, Dell can maintain a direct line of communication with its customers, enabling better understanding of their needs and more efficient service delivery.

In recent years, recognizing the importance of multi-channel sales, Dell has expanded its presence in retail stores and partnered with various resellers. However, the direct sales channel remains the company’s mainstay.

Customer Relationships

Dell’s customer relationships are built on direct interaction, offering personalized service and support. Customers can specify their requirements, and Dell custom-builds PCs to meet those needs. Post-sales, Dell provides customer support and technical services, including troubleshooting and maintenance.

Additionally, Dell maintains strong relationships with its enterprise customers through dedicated account managers who ensure seamless service delivery and customer satisfaction.

Revenue Streams

Dell generates its revenue through the sale of hardware (PCs, servers, storage, and networking products), software, and IT services. While hardware sales constitute the most substantial portion of Dell’s revenue, the company has been increasing its focus on software and services, which often come with higher profit margins.

Key Activities

Dell’s key activities are centered around designing, manufacturing, and selling a broad range of technology products and solutions.

At the heart of Dell’s operations is its supply chain management. The company’s just-in-time manufacturing and direct-to-consumer sales model requires rigorous supply chain efficiency. Dell has to accurately forecast demand to ensure it has the necessary components on hand to assemble and ship products quickly after an order is placed.

Dell also invests heavily in research and development (R&D). R&D is crucial for maintaining competitiveness in the fast-paced tech industry, and Dell continually innovates to improve its existing products and develop new ones.

Key Resources

Dell’s key resources include its intellectual property, including patents and trademarks, its efficient supply chain and logistics infrastructure, its dedicated workforce, and its brand name, which is recognized and respected worldwide.

Additionally, Dell’s financial resources, backed by strong revenue streams, allow it to invest in R&D, acquisitions, and strategic partnerships, fostering growth and innovation.

Key Partnerships

Dell has formed numerous strategic partnerships to complement its offerings and reach. For instance, the company collaborates with software providers like Microsoft and Intel to ensure its hardware products work seamlessly with leading software.

Dell also partners with various component suppliers worldwide, ensuring a steady supply of parts for its just-in-time manufacturing model. Furthermore, Dell’s partnerships with various resellers, IT consultants, and service providers extend its market reach and enhance its service capabilities.

Cost Structure

Dell’s cost structure primarily includes the cost of manufacturing and delivering products, R&D expenses, sales and marketing costs, administrative expenses, and costs related to after-sales service and support.

The cost of components constitutes a significant portion of the total cost. However, Dell’s efficient supply chain management helps keep these costs under control. Additionally, Dell’s direct sales model helps save costs that would otherwise be spent on distributors and retailers.

Dell’s innovative business model has enabled it to become a significant player in the global tech industry. The company’s focus on direct sales and build-to-order manufacturing, combined with its commitment to understanding and meeting customer needs, has provided a unique value proposition that continues to resonate with a broad range of customers.

In recent years, Dell has successfully expanded its offerings and customer segments, moving from a PC manufacturer to an end-to-end technology solutions provider. The company’s business model, reflected in Osterwalder’s Business Model Canvas, reveals a well-rounded approach to value creation, delivery, and capture.

While Dell’s business model has proven successful so far, the fast-paced nature of the tech industry means the company must continually adapt and innovate to stay ahead. As Dell navigates the future, it will be fascinating to see how its business model evolves to meet new challenges and opportunities.

Did you know? Creators like to use our coworking space in Bangalore

Learn more about our coworking space on YouTube where we talk about a variety of topics including personal finance, entrepreneurship, business and life.

Did you know? We also have a private theatre in Bangalore .

You'll also like this...

A Vivid Summary of The Master Key System

The Master Key System by Charles F. Haanel is a timeless masterpiece that explores the profound connection between the mind

45 Takeaways From The Power of Your Subconscious Mind

The Power of Your Subconscious Mind Summary Joseph Murphy’s seminal work, The Power of Your Subconscious Mind, is more than

Feeling is the secret – 36 key takeaways and summary

Feeling is the secret by Neville Goddard – A book summary In the realm of entrepreneurship, the power of thought

Exploring the 36 Best startups in Bangalore

Explore the best startups in Bangalore with a thorough analysis of their business models in this article. Bangalore has undoubtedly

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Work Theater is a coworking space in Bangalore for startups, individuals, teams and creatives.

© 2024 Work Theater (A unit of Chaitra Ventures )

Terms of service

designed by KatMantra Webdesign

Hey there, We're open for bookings. Do fill in your details and we will get in touch with you soon.

The Business Model and Revenue Streams of Dell Explained

Discover the ins and outs of Dell's business model and revenue streams in this comprehensive article.

Understanding Dell's Business Model

Dell's business model is centered around providing customizable technology solutions to its customers. The company focuses on direct sales, eliminating the need for intermediaries. By selling directly to customers, Dell has been able to reduce costs and deliver tailored products more efficiently.

Key Components of Dell's Business Model

- Direct Sales: Dell reaches customers through its online platform, enabling them to customize and purchase products without any intermediaries.

- Build-to-Order Strategy: Rather than producing products in bulk, Dell assembles computers based on customer specifications, reducing inventory costs and wastage.

- Supply Chain Management: Dell has a highly optimized supply chain, allowing them to keep products in stock and fulfill customer orders promptly.

- Customer Support: Dell places a strong emphasis on customer service, providing post-sales support and maintaining long-term relationships.

Evolution of Dell's Business Model

Over the years, Dell has evolved its business model to adapt to changing market dynamics. Initially, the company focused solely on personal computers, but they recognized the need to diversify their offerings to stay competitive.

Expansion into Enterprise Solutions

Recognizing the growing demand for enterprise solutions, Dell expanded its business model to include a wide range of services and products tailored for businesses. This strategic shift allowed Dell to tap into new markets and establish itself as a key player in the enterprise technology sector.

Investment in Research and Development

To stay ahead of the curve, Dell significantly increased its investment in research and development. By focusing on innovation, Dell was able to introduce cutting-edge technologies and solutions to meet the evolving needs of its customers. This commitment to R&D has been a crucial factor in Dell's continued success and relevance in the ever-changing tech industry.

Dell's Primary Revenue Streams

Dell, a global technology company, has established multiple revenue streams that contribute to its financial success and market leadership. Let's delve deeper into the key sources of revenue for Dell:

Revenue from Personal Computers

One of Dell's primary revenue streams is derived from the sale of personal computers. With a diverse portfolio of desktops, laptops, and workstations, Dell caters to a wide range of consumer and business needs. The company's commitment to innovation and quality has solidified its position as a top player in the PC market.

Analysis of the latest fiscal year's financial data indicates that revenue from personal computers accounted for a significant percentage (X%) of Dell's total revenue. This underscores the importance of this segment to Dell's overall business strategy and financial performance.

Furthermore, Dell's focus on customization and customer-centric approach in designing PCs has been instrumental in attracting and retaining a loyal customer base, driving sustained revenue growth in this segment.

Revenue from Enterprise Solutions

In addition to personal computers, Dell has strategically diversified its revenue streams by offering comprehensive enterprise solutions to businesses worldwide. These solutions encompass a wide array of products and services, including servers, storage systems, and networking equipment, tailored to meet the evolving needs of modern enterprises.

Over the past fiscal year, revenue from enterprise solutions has emerged as a significant contributor (X%) to Dell's total revenue, reflecting the company's success in penetrating the enterprise market and delivering value-added solutions to corporate clients.

Dell's relentless focus on innovation, coupled with strategic partnerships and acquisitions in the enterprise space, has enabled the company to build a robust ecosystem of solutions that drive operational efficiency and digital transformation for businesses across industries.

Revenue from Software and Peripheral Products

Complementing its hardware offerings, Dell also generates revenue through the sale of software and peripheral products. These include essential components such as software licenses, monitors, printers, and various accessories that enhance the overall computing experience for consumers and businesses.

During the previous fiscal year, revenue from software and peripheral products contributed a notable percentage (X%) to Dell's total revenue, underscoring the significance of this diversified revenue stream in bolstering the company's financial performance.

By continuously innovating and expanding its portfolio of software and peripheral products, Dell remains at the forefront of technology trends, catering to the evolving needs of its customers and reinforcing its position as a comprehensive solutions provider in the competitive tech industry.

Dell's Business Model Innovation

Dell has consistently pursued innovation in its business model to enhance its competitive advantage.

One of the key factors contributing to Dell's success is its customer-centric approach. By prioritizing customer needs and preferences, Dell has been able to tailor its products and services to meet the specific demands of its target market. This focus on customer satisfaction has not only helped Dell build a loyal customer base but has also driven continuous improvement and innovation within the company.

Shift towards Direct-to-Customer Model

One significant innovation in Dell's business model was the shift towards a direct-to-customer approach. By eliminating intermediaries, Dell was able to streamline its operations and establish closer relationships with its customers.

This direct engagement with customers allowed Dell to gather valuable feedback and insights, enabling the company to make data-driven decisions and quickly adapt to changing market trends. By cutting out the middlemen, Dell was also able to offer competitive pricing and personalized solutions, further strengthening its position in the market.

Embracing the Circular Economy

In recent years, Dell has focused on sustainability by embracing the circular economy. The company encourages recycling and refurbishment of its products, contributing to both environmental and economic benefits.

Through its commitment to sustainability, Dell has not only reduced its environmental footprint but has also enhanced its brand reputation as a socially responsible organization. By adopting eco-friendly practices and promoting a circular approach to production and consumption, Dell has set a positive example for the industry and inspired other companies to follow suit.

The Impact of Dell's Business Model on its Revenue

Dell's business model has played a crucial role in enhancing its revenue and profitability. Here's how:

How Dell's Business Model Enhances Profitability

By adopting a direct sales model, Dell has been able to reduce distribution costs and eliminate markups from intermediaries. This has contributed to higher profit margins and improved overall profitability.

The Role of Diversification in Dell's Revenue Growth

Dell's venture into enterprise solutions and software has diversified its revenue streams. This diversification has reduced dependency on the personal computer market and provided opportunities for further growth.

Furthermore, Dell's strategic focus on customer service has also significantly impacted its revenue. By providing excellent customer support and after-sales services, Dell has been able to build a loyal customer base that not only makes repeat purchases but also refers Dell to others, thereby increasing its revenue through word-of-mouth marketing.

In addition to this, Dell's emphasis on innovation and continuous improvement has allowed the company to stay ahead of competitors and capture new market segments. By investing in research and development, Dell has been able to launch cutting-edge products that appeal to a wide range of customers, further boosting its revenue and market share.

Future Projections for Dell's Revenue Streams

Looking ahead, Dell is well-positioned to capitalize on various growth areas.

Potential Growth Areas for Dell

Dell anticipates significant growth in emerging technologies such as AI, cloud computing, and edge computing. By leveraging its expertise and customer relationships, Dell aims to capture a substantial share of these expanding markets.

Challenges and Opportunities for Dell's Business Model

While Dell's business model has proven successful, it faces challenges and opportunities. Adapting to rapidly advancing technologies and evolving customer preferences will be critical to maintaining its competitive edge and sustaining revenue growth.

In conclusion, Dell's business model and revenue streams have been instrumental in its success. The company's direct sales approach, build-to-order strategy, efficient supply chain, and customer-centric focus have allowed it to thrive in the technology industry. Dell's revenue streams from personal computers, enterprise solutions, and software/peripheral products have diversified its income sources, enhancing its financial stability. As we analyze Dell's business model, we can learn valuable lessons about the importance of customer-centricity, adaptability, and diversification to grow our revenue in the ever-changing business landscape.

Helping designers and strategists turn their boldest ideas into market-leading ventures through Business, Design and Growth.

Whenever you are ready - here is how I can help:

1. Newsletter . Join over 2.000 founders, creators and innovators and get access to the business builder framework.

2. Business Builder OS - Masterclass on finding growth opportunities, building lean offers and acquiring customers - driven by A.I.

3. Builder Toolkit - 30 ideas on how to grow your revenue.

How Dell’s strategy transformed it from a doomed player to leading the data revolution

Table of contents, here’s what you’ll learn from dell's strategy study:.

- How to sustain your company’s growth beyond its initial success.

- How a sober bet for the future fuels your conviction to win.

- How to think long-term and not sacrifice your future for short-term benefits.

Dell Technologies is a multinational technology company that designs, develops, and sells a wide range of products and services, including personal computers (PCs), servers, data storage devices, network switches, software, and cloud solutions.

The general public owns 58% of Dell Technologies, while private equity firms and institutions own the rest. Michael Dell is the founder, chairman, and current CEO.

Dell's market share and key statistics:

- Brand value of $26,5 billion

- Net Worth of $28.7 billion as of Jan 13, 2023

- Annual revenue of $105.3 billion for 2022

- Total number of employees: 133.000

- Total assets worldwide: $93 billion in 2022

{{cta('e9abffcd-5522-40c9-be83-0e844633a49a')}}

Humble beginnings: How did Dell start?

The story of every company starts with the story of its founder.

Usually, a great company has a great founder story behind it. And Dell Technologies certainly has one. Michael Dell’s story goes hand in hand with the story of the company he founded. By understanding the story of Michael, we can understand the company’s initial advantages and opportunities it pursued.

And like every great tech company story, Dell’s story starts in a college dorm room.

From stamps to startups: Michael Dell's early years and the birth of Dell

Michael Dell founded the company in college, but his entrepreneurial journey started much earlier.

He had an early interest in technology and business, and by the age of 12, he was already buying and selling stamps and coins to make extra money. As a teenager, he worked summer jobs where he learned by trial and error how demand and supply worked, how to be efficient, how to segment the market, and determine the most profitable persona to sell.

By the time he graduated from high school, he had saved up enough money to buy his own BMW and his first personal computer, an Apple and later an IBM.

But he was curious about the inner workings of these machines and, to his parents' horror, he took them apart, learning about the different components and how they worked together. He soon made a crucial discovery. IBM DIDN’T manufacture its own parts. Instead, it sourced them from other companies. This sparked an idea in Michael's mind - he could build his own PCs using the same components but at a lower cost and higher quality.

That idea didn’t come out of the blue.

Michael Dell was constantly educating himself on computers, how to build them, how they worked, and how to code. He followed all computer magazines at the time and attended every event in his neighborhood to network and learn the latest about the industry. In high school, he was already an expert, modifying his own PC and, once the word spread, customizing the PCs of professionals.

His first customers were friends and acquaintances who were impressed by his knowledge and expertise. Michael quickly realized that there was a demand for customized computers that were not available in the market. He began assembling machines with increased storage capacity and memory at a fraction of the cost of buying from big brands like IBM.

Doctors and lawyers were among his early customers, and word-of-mouth about Michael's high-quality and affordable PCs spread quickly.

He eliminated the middleman by buying components directly and assembling the machines himself, which allowed him to offer lower prices and better performance. By the end of his first year in college, Michael had a vendor's license, he was winning bids against established companies in the industry, and he incorporated his first company, “ Dell Computer Corporation .”

Dell’s direct-to-consumer strategy & how its corporate culture was formed

The company was growing frightfully fast, forcing the team to constantly change and evolve its processes.

Before the company had its second birthday, they had moved to bigger offices three times to accommodate its increased inventory, growing telephone needs, and physical or electronic systems. However, the company was still a high-risk venture and had a small capacity for expensive mistakes.

In those early days, the challenges Dell faced formed its processes and the core traits of its culture that are present to this day:

- Practicality and reduced bureaucracy. They did some things unconventionally, like having salespeople set up their own computers. That way, they gained first-hand knowledge of the technology and the customer’s pain problems (customers and salespeople were uneducated on the technology, so they shared the same problems).

- A “can-do” and “I’ll-pitch-in” attitude. Employees took substantial liberties with their “responsibilities.” Engineers would help with the overloaded manufacturing line, everyone would answer phone calls, salespeople would fulfill orders while taking new ones, etc.

- A sense of making a difference. Money was tight, so Dell employees wouldn’t mind solving secondary “needs” with cheap solutions like using cardboard boxes to throw their trash because they didn’t have trash cans.

- Direct relationships with the customers. Maybe one of the most important aspects of Dell’s culture and strategy. The company was talking at the same time with prospects and current customers on the phone. That way, it got first-hand feedback on what the market was currently asking for and was enjoying or not enjoying. That gave birth to Dell’s “Direct Model.”

The company went to great lengths to build and maintain the direct model because it was one of its most important sources of competitive advantage. Where other companies had to guess what to build next, Dell was already on it because their customers were telling them.

There were clear advantages to the Direct model:

- Closed feedback loop. Dell was talking directly to prospects – no dealer costs – and had no need for inventory. Lower costs = lower prices = more customers. And with every new customer, Dell had another finger on the pulse of the market.

- A single salesforce. Focused solely on the end customer. There was no need to have salespeople to sell to dealers and then additional salespeople to sell to the customer.

- Specialization in sales. Dell sold to large corporations, and smaller customers, like SMBs, educational institutions, and individual consumers. But selling to these two different buyers, large corporations and SMBs, was incomparable. So, the company had different salespeople for different customer segments and thus offering the best customer support and experience.

But the model wasn’t without its disadvantages:

- The model wasn’t irreplicable. Dell was making IBM-compatible PCs and selling them directly to customers. This model wasn’t hard to replicate, and the market’s conditions favored the birth of competitors with the same model.

- Lack of credibility. It’s hard to make a $5,000 sale when the customer has never heard of you and you lack a physical store.

- Incompatibility. Dell’s PC had to be compatible with IBM’s. But they had multiple suppliers for their components and sometimes those components were incompatible. Designing high-quality machines that were outperforming and compatible with IBM’s was a challenge.

But these disadvantages didn’t stop the team. The company doubled down on customer support and service and developed a strong reputation around them. It advertised a 30-day money-back guarantee and educated its suppliers to make components based on Dell designs. They even started their first R&D attempts that gave them a 12-MHz that was faster than IBM’s latest model, cheaper, and got them on the cover of the most prestigious magazine in the industry, the PC Week .

Dell’s strategy was so effective that phone calls started coming in, urging them to accept capital and go public.

Only three years after the company’s birth in a college dorm room, Dell went public, raising $30 million with a market valuation of $85 million.

Key Takeaway #1: Build a coherent strategy beyond your initial differentiator to sustain growth

Most companies enjoy initial success due to an untapped opportunity in the market, from addressing a niche market to exploiting the weaknesses of major players.

But no company succeeds at growing beyond the limits of the initial opportunity if it doesn’t evolve and expand its competitive advantage. So when evaluating your next move, ask yourself:

- What is our current competitive advantage?

- How easily can our competition replicate it?

- How can we make it harder (if we can)?

- How can we expand our capabilities to strengthen our current competitive advantage?

- How can we develop new competitive advantages?

- What are the market trends and how can we adapt/take advantage of them before others?

The occasional bold move doesn’t hurt, either.

Recommended reading: 6 Competitive Analysis Frameworks: How to Leave Your Competition In the Dust

How Dell’s privatization led to a strategic triumph

In the first decade of the new millennium, the PC business was growing rapidly.

Computing power followed Moore’s Law and innovation cycles in hardware were less than 12 months long. At the same time, a new generation of software was spreading and the World Wide Web was expanding globally. Being a part of a growing industry, like the PC business back then, was lucrative. So naturally, many companies did well.

Dell was one of them. In 2000, the company became the world’s largest seller of PCs, having enjoyed a decade of skyrocketing sales.

However, in 2011, things changed. The PC global sales reached their peak and the next year was the first of an 8-year streak of decline that lasted until the pandemic hit.

That decline impacted Dell severely.

Navigating decline: Dell's strategy for a shrinking market

Dell was in deep trouble at the start of the previous decade:

- It had lost its position as a top PC seller in the US to its main competitor, HP.

- It came third in the global PC market share, behind HP and ACER.

Many believed that it was a dying company that would perish like Kodak or Motorola.

The PC market was shrinking and some experts were saying it was the beginning of its end. Dell was expected to be among the first casualties. The truth was that the PC industry wasn’t dying, but it was evolving – it was losing some of its traits and gaining new ones. The difference is subtle but also key. In a competitive arena, every alert player is aware of the market changes: declining sales, emerging trends, and other important facts. But how each player interprets them determines whether they’ll formulate a winning strategy or not.

The more substantial the changes, the more important the interpretation.

In 2012, the fact was that the PC business was declining. Every major player could see it with a single glance at their balance sheet. In Dell's case, the decline was even direr since its PC sales were down by double digits. The company desperately needed to turn things around. And only a bold strategic move could do that.

The company tried to bounce back up with some obvious but desperate moves:

- The introduction of the Streak “phablet.” An embarrassing attempt at creating a new product category between tablets and smartphones. Its design was bulky and its Android software unsuitable for the device, while its purpose was unclear to the consumer.

- Making Windows 8 its default operating system. Dell and Microsoft have been longtime partners, to the benefit of both companies. Unfortunately, their growing interdependence meant that when one failed, it dragged the other one down. Windows 8 failure dragged down Dell and further decreased its PC market share.

- Attempts to enter the tablet and smartphone markets: the “Venue” debacle. Dell was always viewed as a PC company, not a technology company, making it harder to expand to new categories. Its first smartphone, the Venue , ran on Windows Mobile and it never got any traction. As a result, the company abandoned the categories and, even today, it has less than negligible presence in these markets.

But where people saw a vulnerable company, Michael Dell saw an opportunity.

He had an assumption, a vision attached to it, and a plan to make it a reality. But he had no way to execute it with the company’s organizational structure at the time.

The obstacles to implementing Dell's competitive strategy

Dell’s strategy was to go on the offensive. He wanted the company to be highly aggressive by:

- Becoming competitive in the PC business again.

- Expanding its services and software solutions.

- Increasing its sales capacity.

Dell aimed to achieve these goals by investing heavily in R&D, gaining tighter control over its PC and server prices, and expanding its sales workforce. The idea was to fund new business capabilities in the software and services space from Dell's PC segment. That was a bold plan that involved a lot of changes and, thus, a lot of risks.

Dell’s strategy was essentially a business transformation proposal.

And although a lot of public companies have successfully gone through a transformation, none did it in such a short period of time without sacrificing the short-term faith of its shareholders. And that was exactly the problem.

The strategy was inherently risky – like every good strategy is – as it promised capital expenditure and an immediate decrease in profitability due to increased operating expenses. Things shareholders hate. And if shareholders aren’t happy with the company’s near-term returns, they start selling their shares, and the company loses its value and a good portion of its funding capabilities.

Short-term risk = lower share prices = less funding for the company

Thus, the strategy was impossible to execute without the support of the shareholders. So the company had only two options: gain the support of the shareholders or go private.

Dell chose to go private.

Dell's game-changing decision was based on a strategic bet

For a gigantic public company with a market cap of nearly $20 billion, going private is a tough decision and a complicated process.