We earn commissions if you shop through the links below. Read more

Repo Business

Back to All Business Ideas

Turning Repossession into Profits: Start Your Repo Business

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on March 25, 2022

Investment range

$4,750 - $9,500

Revenue potential

$65,000 - $325,000 p.a.

Time to build

1 – 3 months

Profit potential

$52,000 - $97,500 p.a.

Industry trend

Consider these crucial factors when launching your repo business:

- Licenses — Many states require a repossession license or permit to operate legally. Check with your state’s regulatory agency for specific requirements.

- State and federal laws : Stay informed about federal, state, and local laws regulating the repossession industry, including the Fair Debt Collection Practices Act (FDCPA) .

- Vehicles — Invest in reliable tow trucks and recovery vehicles suited for various types of repossessions.

- Services — Decide on the types of repossession services you will offer, such as vehicle repossession, equipment repossession, boat repossession, or real estate foreclosure assistance.

- Repossession tools — Equip your team with tools like GPS tracking devices, lockout kits, and camera systems.

- Register your business — A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple. Form your business immediately using ZenBusiness LLC formation service or choose one of the top services available .

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN .

- Partnerships — Build relationships with local law enforcement, towing companies, and financial institutions to enhance your services.

- Repossession software — Use repossession software to manage assignments, track progress, and maintain detailed records.

Interactive Checklist at your fingertips—begin your repo business today!

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a repo business has pros and cons to consider before decided if it’s right for you.

- Good Money – Make $200 to $300 per repossessed item

- Flexibility – Work as much or as little as you want

- High Demand – Banks and lenders always need repo services

- Danger – People will not be happy to see you

- Licensing – States have various licensing requirements

Repo industry trends

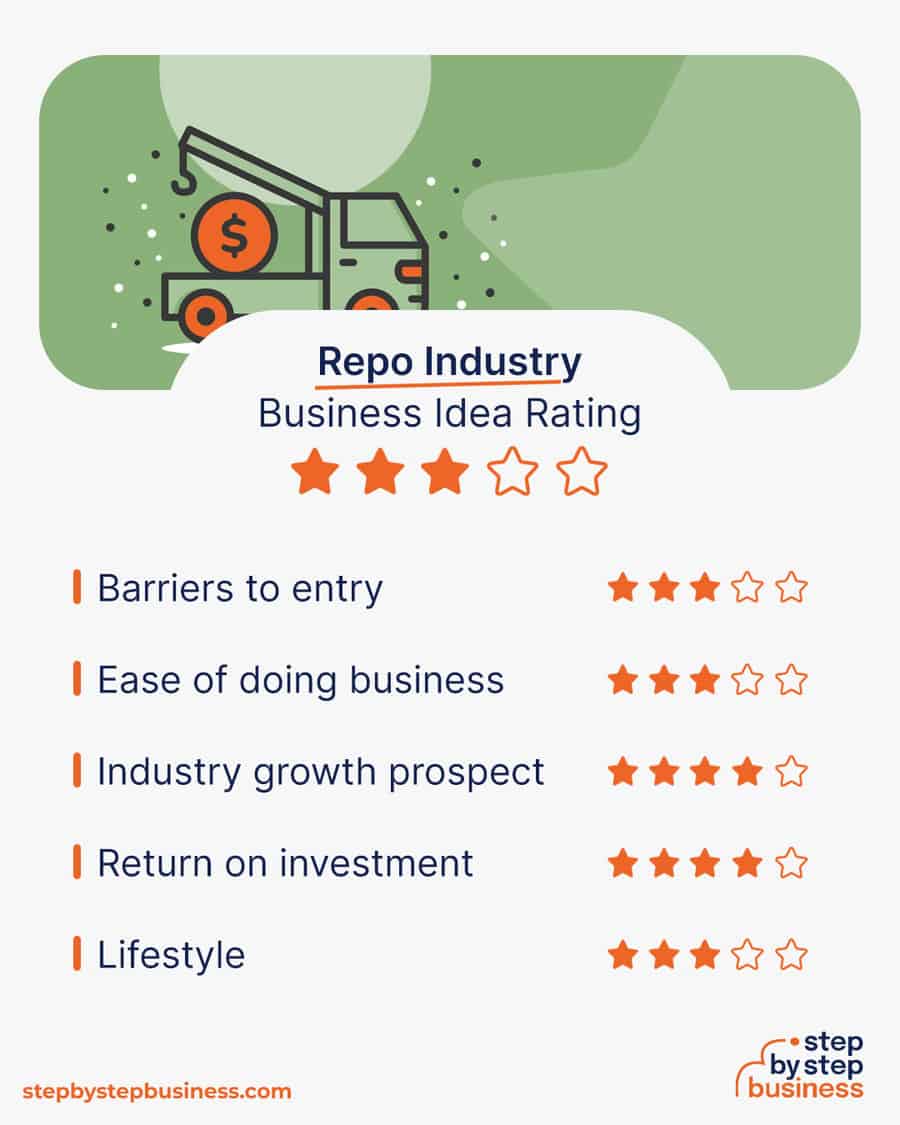

Industry size and growth.

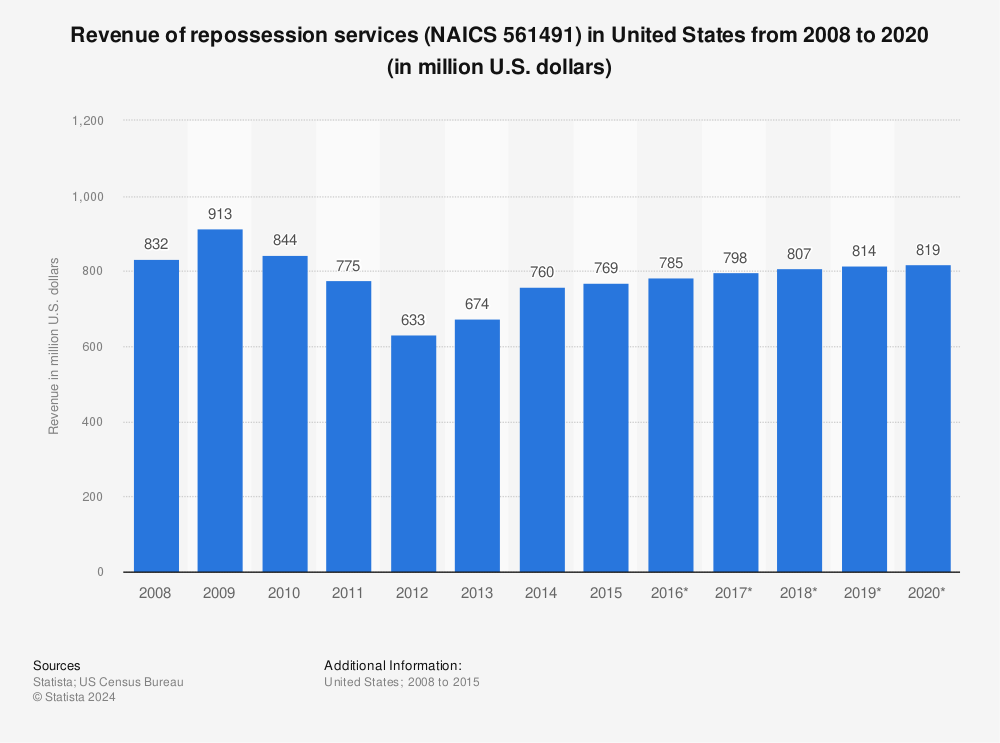

- Industry size and past growth – The US repossession industry was worth $2 billion in 2021 after 4% annual growth the previous five years.(( https://www.ibisworld.com/united-states/market-research-reports/repossession-services-industry/ ))

- Growth forecast – The US repo industry is expected to grow steadily for the next five years.

- Number of businesses – In 2021, 10,065 repossession businesses were operating in the US.

- Number of people employed – In 2021, the US repossession industry employed 18,234 people.

Trends and challenges

Trends in the repo industry include:

- The financial difficulties faced by many during the pandemic are driving up repo demand, particularly as economic relief comes to an end.

- Sharp demand for used cars is driving up the value of repossessed cars, making lenders more likely to repossess to recover their money.

Challenges in the repo industry include:

- Danger is a constant problem for repo workers. Car owners, for instance, often mistake the repo person for a thief and try to stop them by violent means.

- For repo businesses, economic recovery at any given time is bad news for business.

How much does it cost to start a repo business?

Startup costs for a repo business range from $4,500 – $9,500. The main costs are a down payment on a tow truck and a website. You’ll also need to meet the licensing requirements of your state.

In some states, you’ll just need a commercial driver’s license (CDL), while in others you’ll need a repossession license. To get a repo license, states require a certain number of educational hours and some repo experience. Check with your state for specific requirements. You’ll also need to check local repossession business laws.

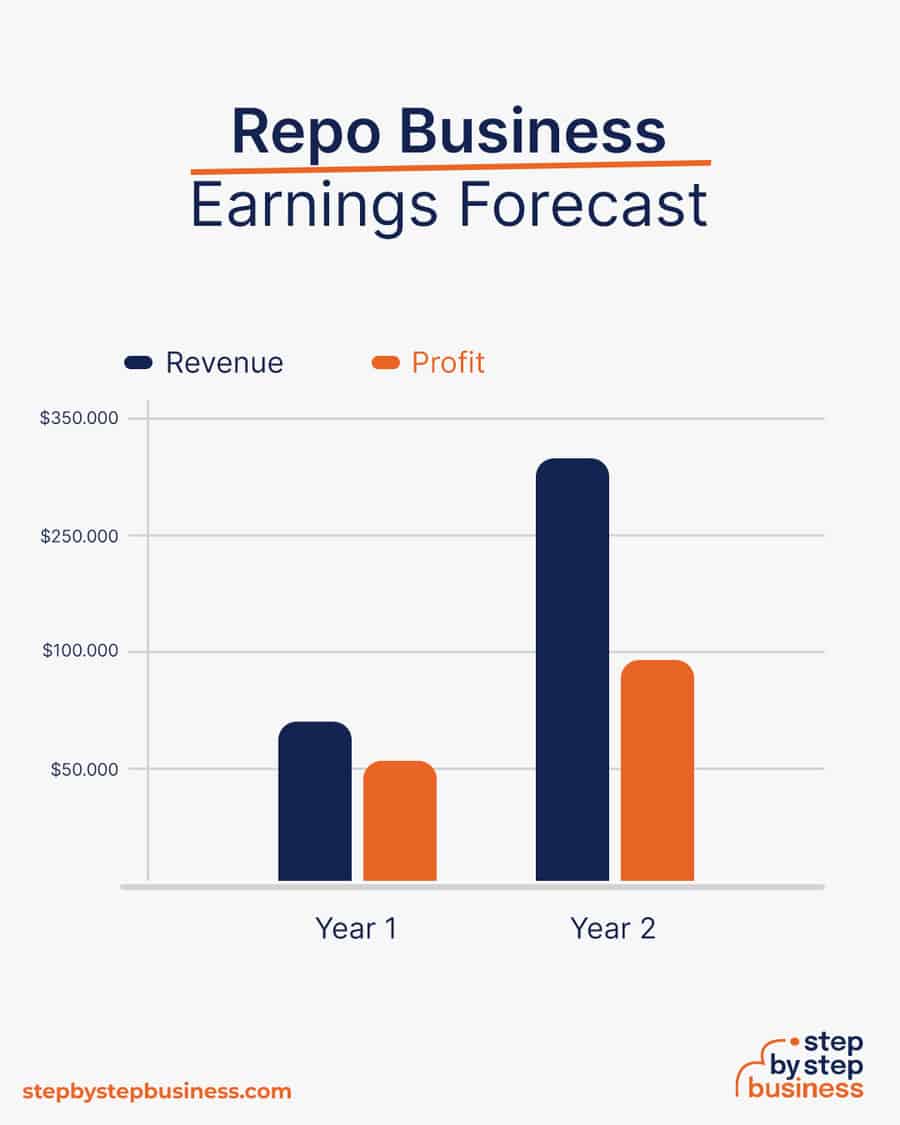

How much can you earn from a repo business?

The average price to repo a car is about $200, and larger, more valuable items can cost more. If you have to track down the person and the items, you can add fees of about $25 per hour. These calculations will assume an average per-repo price of $250. Your profit margin should be about 80%.

In your first year or two, you could work from home and repo five items per week, bringing in $65,000 in annual revenue. This would mean $52,000 in profit, assuming that 80% margin. As you get repeat customers, you could do 25 items per week. At this stage, you’d rent a commercial space and hire staff, reducing your profit margin to around 30%. With annual revenue of $325,000, you’d make a tidy profit of $97,500.

What barriers to entry are there?

There are a few barriers to entry for a repo business. Your biggest challenges will be:

- The licensing requirements of the state

- Connecting with the banks and lenders who will be your clients

Step 2: Hone Your Idea

Now that you know what’s involved in starting a repo business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research repo businesses in your area to examine their services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a repo business that focuses on trucks, boats, or furniture and appliances, or a repo business that offers investigative services to locate buyers.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as repo for car dealers.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your services

In addition to repossession services, you could offer investigation services. Since you’ll have a tow truck, you could also offer tow truck services when you don’t have repo work. You’d be a combination repo/tow truck business, which would bring in more revenue.

To learn more about tow truck services, read this Step By Step article on how to start a towing business .

How much should you charge for repo services?

The average price for a repo is $200 plus $25 an hour for investigative services. When you’re working by yourself, your ongoing costs will be limited to your tow truck payment, fuel, and insurance. You should aim for a profit margin of 80%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will be banks, lenders, and retailers that do their own financing. You can find them on LinkedIn, but your best bet is to call them directly. You can find them on Google or Yelp.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in our area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Repo Company Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “repo” or “repossession”, boosts SEO

- Name should allow for expansion, for ex: “Elite Repo Group” over “RV Repo Pros”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool below. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Repo Business Plan

Here are the key components of a business plan:

- Executive Summary: Provide a concise overview of your repossession (repo) business, highlighting your service model, target market, and competitive edge.

- Business Overview: Outline the primary function of your repo business, focusing on asset recovery services for financial institutions and private lenders.

- Product and Services: Describe the specific types of repossession services you offer, such as vehicles, equipment, or property recovery.

- Market Analysis: Assess the demand for repossession services within the regions you plan to operate and the prevailing economic conditions influencing the market.

- Competitive Analysis: Evaluate other repo companies in the area, identifying your business’s unique approach or services that will provide an advantage.

- Sales and Marketing: Explain your strategy for building relationships with lenders and marketing your services to potential clients.

- Management Team: Highlight the qualifications and experience of your management team, emphasizing expertise in legal procedures and asset recovery.

- Operations Plan: Detail your operational procedures for repossession, including client agreements, asset location, and recovery methods.

- Financial Plan: Outline your startup costs, pricing model, and financial projections, considering the average number of repossessions and operating expenses.

- Appendix: Include any supporting documentation, such as licenses, contracts, insurance policies, or partnership agreements that underpin your business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to repossession businesses.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your repo business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC, which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number, or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best option, other than friends and family, for funding a repo business.

Step 8: Apply for Repo Business Licenses and Permits

Starting a repo business requires obtaining a number of licenses and permits from local, state, and federal governments.

In some states, you’ll just need a commercial driver’s license (CDL), and in others, you’ll need a repossession license. To get a repo license, states will require a certain number of educational hours, and some require repo experience. Check with your state for specific requirements. You’ll also need to check local repossession business laws.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your repo business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Smart Repo , Tracers , or Repo Systems to manage your contracts, invoicing, and payments.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

- Local Partnerships: Collaborate with local auto repair shops, towing companies, and financial institutions to establish referral partnerships, increasing your reach within the community.

- Targeted Direct Mail Campaigns: Utilize direct mail to reach out to car dealerships, banks, and credit unions in your area, emphasizing your expertise in efficient and secure vehicle repossessions.

- Community Events and Sponsorships: Participate in or sponsor local events and community gatherings to raise awareness about your Repo Business, fostering trust and recognition among potential clients.

- Educational Seminars: Host seminars or webinars to educate financial institutions and car dealerships about the repossession process, showcasing your expertise and building credibility.

- Social Media Engagement: Leverage social media platforms to share success stories, industry insights, and engage with your audience, creating a human connection and building trust in your services.

- Discounts and Promotions: Offer special promotions or discounts to financial institutions for bulk services or to clients who refer others, encouraging loyalty and word-of-mouth referrals.

- Vehicle Recovery Success Stories: Showcase real-life success stories on your website and marketing materials to highlight your track record and instill confidence in your ability to recover vehicles efficiently.

- Specialized Marketing Collateral: Design informative brochures and business cards emphasizing your specialized skills, making it easy for potential clients to understand the unique value your Repo Business brings.

- Online Reviews and Testimonials: Encourage satisfied clients to leave positive reviews on online platforms, enhancing your online reputation and serving as social proof for your business’s reliability.

- GPS Technology Integration: Highlight the use of advanced GPS technology in your repossession process in marketing materials, emphasizing your commitment to efficient and precise vehicle recovery.

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism. They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

You can create your own website using services like WordPress , Wix , or Squarespace . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your repo business meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your repo business could be:

- Professional repo services to recover your loan money fast

- Truck repossessions – we can handle the load

- We track down valuables quickly to return your money to you

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a repo business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in repo for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in repossession. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a repo business include:

- Repo Drivers – repo vehicles and other items

- General Manager – scheduling, accounting

- Marketing Lead – SEO strategies, social media

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Repo Business – Start Making Money!

If you want a business that might offer a little excitement, a repo business may be just the ticket. Auto repossession and other large item repossession is a large industry, worth $2 billion and counting. You can make a good living, have some flexibility, and run your business from home for a small investment. You’ll have to jump through a few licensing hoops and get a tow truck, but it will pay off in the end.

Now that you understand the business, you’re ready to get on the road to launching your new repo company!

- Frequently Asked Topics

Is a repo business profitable?

Yes, a repo business can be profitable. You can earn a lot and your ongoing expenses are low. If you prove yourself to be reliable, you’ll get repeat business from the banks and lenders you work with.

How do I find repo clients?

To find repo clients, network with banks, lending institutions, credit unions, and auto dealerships that may require repossession services. Attend industry events, join professional associations, and build relationships with key contacts in the financial and lending industry.

Is repo a safe job?

Repo work can come with inherent risks and challenges, and it is important to prioritize safety in this line of work. While every repossession job may differ, there is potential for encountering difficult or confrontational individuals.

How do banks use repo?

Banks may use repossession businesses as a means to recover collateral when borrowers default on their loans. When a borrower fails to make payments on a financed asset, such as a car or property, the bank may contract with a repossession business to locate and repossess the asset.

How can I handle the documentation and paperwork involved in the repossession process?

Handling the documentation and paperwork involved in the repossession process requires organization and attention to detail. Establish a standardized process for documenting each repossession, including detailed reports, photographs, and inventory of repossessed assets. Ensure compliance with legal requirements and maintain accurate records of repossession notices, contracts, and communications with clients and debtors.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Repo Company Name

- Create a Repo Business Plan

- Register Your Business

- Register for Taxes

- Fund your Business

- Apply for Repo Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Repo Business - Start Making Money!

Subscribe to Our Newsletter

Featured resources.

16 Best Truck Business Ideas for Steady Income

David Lepeska

Published on December 4, 2022

Do you own a truck, or are thinking about buying one, and wondering whether it could help you launch a successful business? You’ve come to the ...

57 In-Demand Service Business Ideas You Can Launch Today

Published on December 1, 2022

The services sector is undoubtedly the biggest economic sector in the US as it accounts for nearly 70% of the country’s gross domestic product. It ...

26 Profitable Automobile/Car Business Ideas

Esther Strauss

Published on July 21, 2022

From car washing to limo services, there are countless lucrative business opportunities related to cars. If you’re looking for a business ideathat ...

No thanks, I don't want to stay up to date on industry trends and news.

Repo Company Business Plan [Sample Template]

By: Author Solomon O'Chucks

Home » Business ideas » Financial Service Industry » Repo Business

A repo company, short for “repossession company,” is a business that specializes in the repossession of assets or property on behalf of creditors or lienholders.

Repossession typically occurs when a borrower fails to make payments on a financed asset, such as a car, boat, or other valuable property, and the creditor has the legal right to take back the asset due to the borrower’s default on the loan or lease agreement.

It’s important to note that repo companies must adhere to strict legal guidelines and regulations when repossessing assets.

Suggested for You

- ATM Business Plan [Sample Template]

- Mobile Money Transfer Agency Business Plan [Sample Template]

- Investment Bank Business Plan [Sample Template]

- Investment Club Business Plan [Sample Template]

- Bitcoin ATM Business Plan [Sample Template]

These regulations vary by jurisdiction, but they generally require that repo agents operate within the bounds of the law and avoid using force or intimidation during the repossession process. Violating these regulations can lead to legal consequences for the repo company.

Steps on How to Write a Repo Company Business Plan

Executive summary.

Jarome Smith® Repo Company, Inc. is a reputable and professional repossession company located in Fort Wayne, Indiana.

Founded in 2005 by Mr. Jarome Smith, our company has been serving financial institutions, lenders, and creditors by providing efficient and legal asset recovery services. With over 18 years of experience in the industry, our team is dedicated to delivering reliable and ethical repo services.

Our seasoned repo agents and staff bring a wealth of experience and professionalism to every repossession case. We employ cutting-edge tracking and skip-tracing technology to locate assets efficiently and effectively.

With a deep understanding of legal requirements, we prioritize compliance to prevent any legal issues for our clients. We provide timely and transparent updates to our clients, ensuring they are well-informed throughout the repossession process.

Company Profile

A. our products and services.

Our company specializes in a wide range of repossession services, including but not limited to:

Automotive Repossession: We have a fleet of well-equipped tow trucks and a team of experienced repo agents ready to handle the safe and efficient repossession of vehicles.

Asset Location: Utilizing modern skip-tracing techniques and technology, we excel in locating hard-to-find assets and individuals.

Storage and Inventory Management: We maintain secure storage facilities to safeguard repossessed assets until they are returned to creditors or sold at auction.

Legal Compliance: Our operations adhere to all federal and state laws governing asset recovery, ensuring a smooth and legally sound process.

b. Nature of the Business

Jarome Smith® Repo Company, Inc. operates a business-to-consumer business model.

c. The Industry

Jarome Smith® Repo Company, Inc. will operate in the broader financial services industry.

d. Mission Statement

At Jarome Smith® Repo Company, Inc., our mission is to provide unparalleled asset recovery solutions that exceed the expectations of our clients. We are committed to safeguarding the interests of financial institutions, lenders, and creditors while upholding the highest standards of professionalism, ethics, and legal compliance.

e. Vision Statement

Our vision at Jarome Smith® Repo Company, Inc. is to be the leading repossession company in Fort Wayne, Indiana, and beyond.

We aspire to set industry standards for excellence, innovation, and client satisfaction. We see ourselves as more than just a repo service provider; we envision being a strategic partner for our clients, helping them navigate the challenges of asset recovery in an ever-changing financial landscape.

f. Our Tagline (Slogan)

Jarome Smith® Repo Company, Inc. – “ Your Road to Financial Freedom Starts Here”

g. Legal Structure of the Business (LLC, C Corp, S Corp, LLP)

Jarome Smith® Repo Company, Inc. will be formed as a Limited Liability Company (LLC).

h. Our Organizational Structure

- Chief Operating Officer (Owner)

- General Manager

- Risk and Compliance Manager

- Administrative Officer

- Repo Operatives

- Customer Service Representatives

i. Ownership/Shareholder Structure and Board Members

- Jarome Smith (Owner and Chairman/Chief Executive Officer) 56 Percent Shares

- Charles Morgan (Board Member) 14 Percent Shares

- Golden Harvey (Board Member) 10 Percent Shares

- Lawrence Bond (Board Member) 10 Percent Shares

- Florence Nevada (Board Member and Secretary) 10 Percent Shares.

SWOT Analysis

A. strength.

- Jarome Smith® Repo Company, Inc. has a team of seasoned repo agents and staff with extensive industry experience, ensuring efficient and professional asset recovery.

- The company utilizes cutting-edge tracking and skip-tracing technology to locate and recover assets effectively.

- A deep understanding of federal and state laws governing asset recovery ensures legal compliance and minimizes legal risks.

- Jarome Smith® Repo Company, Inc. is known for its professionalism, ethics, and transparent operations, earning trust among clients.

- The company provides timely and transparent updates to clients, fostering strong communication and trust.

b. Weakness

- Jarome Smith® Repo Company, Inc. relies heavily on the economic climate and lending practices, making it vulnerable to fluctuations in the financial services industry.

- Evolving regulations in the repossession industry can pose compliance challenges and increase operational complexity.

c. Opportunities

- There’s an opportunity to expand services beyond Fort Wayne, Indiana, tapping into new markets and client segments.

- Exploring related services such as asset remarketing or collateral management can diversify revenue streams.

- Continued investment in technology can enhance efficiency and improve asset location capabilities.

- Collaborating with financial institutions and lenders can lead to long-term partnerships and a stable client base.

i. How Big is the Industry?

The size of the repossession (repo) industry can vary depending on the region, economic conditions, and the specific assets being repossessed. The repo industry includes a mix of large national and regional repo companies, as well as smaller local operators. The competitive landscape can influence the industry’s overall size and growth.

ii. Is the Industry Growing or Declining?

Economic factors, such as unemployment rates, consumer debt levels, and interest rates, have a significant impact on the repo industry. During economic downturns, more borrowers may struggle to make payments, leading to increased repossession activity. Conversely, during economic growth periods, repossession rates tend to decline.

Changes in laws and regulations governing repossession practices can also impact the industry. Stricter regulations or changes in consumer protection laws can affect how repo companies operate.

iii. What are the Future Trends in the Industry?

The repo industry is increasingly incorporating advanced technology, such as GPS tracking, license plate recognition, and skip tracing software, to enhance efficiency and improve asset location. This trend is likely to continue, with further advancements in data analytics and artificial intelligence for more accurate asset tracking.

Regulatory changes are an ongoing concern in the industry. Repo companies will continue adapting to evolving regulations related to privacy, debt collection practices, and consumer protection. Staying up-to-date with and complying with these regulations is crucial.

Repo companies are exploring alternative methods of asset recovery, including negotiation and voluntary surrenders, to avoid confrontational repossessions. These approaches can minimize risks and maintain positive customer relations.

With growing awareness of environmental issues, repo companies may be encouraged to adopt greener practices, such as using fuel-efficient vehicles and reducing their carbon footprint during asset recovery operations.

iv. Are There Existing Niches in the Industry?

No, there are no existing niches when it comes to a repo business because a repo business is a niche idea in the financial services industry.

v. Can You Sell a Franchise of Your Business in the Future?

Jarome Smith® Repo Company, Inc. will not sell franchises in the near future.

- Economic recessions can lead to increased defaults and a challenging operating environment.

- Intense competition in the repossession industry may affect pricing and market share.

- Evolving regulations or legal restrictions can impact operations and require adjustments in business practices.

- Any negative incidents or unethical practices can harm the company’s reputation and client trust.

- Rapid technological advancements may necessitate continuous investment to remain competitive.

i. Who are the Major Competitors?

- Manheim Auto Auctions

- Agero, Inc.

- International Recovery Corporation

- Allied Finance Adjusters

- Reliable Asset Recovery

- American Recovery Association (ARA)

- American Recovery Specialists

- Repo Solutions, Inc.

- International Recovery & Remarketing Group

- Cucollector

- TFA | Time Finance Adjusters

- Certified Asset Recovery

- Repossession Pro

- Loss Prevention Services

- Recovery Database Network (RDN)

- Digital Recognition Network (DRN)

ii. Is There a Franchise for the Repo Business?

No, there are no franchise opportunities for the repo business.

iii. Are There Policies, Regulations, or Zoning Laws Affecting the Repo Business?

Yes, the repossession (repo) business in the United States is subject to various policies, regulations, and zoning laws that govern its operations. These regulations are typically aimed at ensuring the fair and legal conduct of repo activities, protecting consumers’ rights, and maintaining public safety.

Many states require repo companies and repo agents to obtain licenses or permits to operate legally. Licensing requirements often include background checks, training, and surety bonds.

Compliance with the Uniform Commercial Code (UCC) governs secured transactions and the repossession of collateral in many states. Repo companies must adhere to the UCC’s provisions when repossessing assets.vLaws may stipulate the notice that repo companies must provide to borrowers before repossession occurs.

This notice informs the borrower of their rights and the repossession process. Repo companies handle sensitive personal information during skip tracing and asset location.

Privacy laws, such as the Gramm-Leach-Bliley Act, require them to protect this data. While primarily applicable to third-party debt collectors, some aspects of the Fair Debt Collection Practices Act (FDCPA) may apply to repo companies, especially when dealing with consumer debt.

Repo companies often maintain impound lots or storage yards for repossessed assets. Local zoning and land use regulations may govern the location and operation of these facilities.

Repo companies typically use tow trucks to transport repossessed vehicles. Regulations on tow truck operation and licensing vary by state and locality. Repo companies often need to carry specific insurance coverage to protect themselves and their clients in case of damage or liability during the repossession process.

Marketing Plan

A. who is your target audience.

i. Age Range: Primarily adults aged 25 to 65. A focus on individuals in their 30s to 50s who are more likely to have assets requiring repossession, such as vehicles or equipment.

ii. Level of Education: High school diploma or equivalent and above. While the level of education may vary, our target audience may include individuals with a diverse range of educational backgrounds.

iii. Income Level: Our target audience may span various income levels but with a focus on those who have loans, leases, or assets that require repossession. Middle to upper-middle-income individuals and families.

iv. Ethnicity: Diverse representation, reflecting the demographic makeup of our service area, which could include individuals from various ethnic backgrounds.

v. Language: Primarily English-speaking customers, but we may also cater to non-English speakers in your service area.

vi. Geographical Location: Residents and businesses in Fort Wayne, Indiana, and potentially neighboring areas.

vii. Lifestyle: Our target audience includes individuals and businesses facing financial challenges, such as loan defaults or lease terminations. This audience may consist of a mix of urban and suburban dwellers, potentially including homeowners and renters.

b. Advertising and Promotion Strategies

- Use FOMO to Run Photo Promotions.

- Share Your Events in Local Groups and Pages.

- Turn Your Social Media Channels into a Resource

- Host Themed Events That Catch Attention.

- Tap Into Text Marketing.

- Develop Your Business Directory Profiles

- Build Relationships with Other Businesses in our Area

i. Traditional Marketing Strategies

- Broadcast Marketing -Television & Radio Channels.

- Marketing through Direct Mail.

- Print Media Marketing – Newspapers & Magazines.

- Out-of-Home” marketing (OOH marketing) – Public Transits like Buses and Trains, Billboards, Street Furniture, and Cabs.

- Including direct sales, direct mail (postcards, brochures, letters, fliers), tradeshows, print advertising (magazines, newspapers, coupon books, billboards), referral (also known as word-of-mouth marketing), radio, and television.

ii. Digital Marketing Strategies

- Social Media Marketing Platforms.

- Influencer Marketing.

- Email Marketing.

- Content Marketing.

- Search Engine Optimization (SEO) Marketing.

- Pay-per-click (PPC).

- Affiliate Marketing

- Mobile Marketing.

iii. Social Media Marketing Plan

- Create a personalized experience for our customers.

- Create an efficient content marketing strategy.

- Create a community for our audience.

- Start using chatbots.

- Gear up our profiles with a diverse content strategy.

- Use brand advocates.

- Create profiles on the relevant social media channels.

- Run cross-channel campaigns.

c. Pricing Strategy

Jarome Smith® Repo Company, Inc. will adopt the following pricing strategies:

- Cost-Plus Pricing

- Value-Based Pricing

- Competitive Pricing

- Dynamic Pricing

- Bundle Pricing

Sales and Distribution Plan

A. sales channels.

Jarome Smith® Repo Company, Inc. will employ a multi-channel marketing and sales strategy to reach our target audience. This includes engaging with financial institutions, lenders, and creditors directly to secure contracts for repossession services.

Maintaining a professional website that showcases services, contact information, and client testimonials to attract potential clients.

Building relationships within the financial and lending industry, attending industry events, and joining relevant trade associations to connect with potential clients. Collaborating with attorneys, collection agencies, and other professionals who may refer clients in need of repossession services.

Running local advertisements in print, radio, or digital media to raise awareness and attract clients in the Fort Wayne, Indiana area.

b. Inventory Strategy

Jarome Smith® Repo Company, Inc. will operate an inventory strategy that is based on a day-to-day methodology to follow for ordering, maintaining, and processing items in our repo office. We will develop our strategy with the same thoroughness and attention to detail as we would if we were creating an overall strategy for the business.

c. Payment Options for Customers

Here are the payment options that Jarome Smith® Repo Company, Inc. will make available to its clients;

- Bank Transfers

- Credit or Debit Card

- Electronic Payment Systems such as PayPal or Venmo.

d. Return Policy, Incentives and Guarantees

Return policy:.

Jarome Smith® Repo Company, Inc. typically deals with the repossession of assets on behalf of its clients, and the nature of the business may not involve traditional product returns. However, there could be situations where a client may request a return or release of a repossessed asset.

In such cases, the company’s return policy may include:

- Repossession agents will only release a repossessed asset to the client or entity that has authorized the repossession. This ensures that the asset is returned to the rightful owner.

- The company may require proof of ownership or proper authorization before initiating the return process.

- The company may inspect the condition of the asset to ensure it is in the same condition as when it was repossessed.

- There may be fees associated with the return process, such as storage fees, transportation costs, and administrative charges, which the client is responsible for covering.

Incentives:

- Clients who provide a high volume of repossession work may be eligible for discounts or preferential pricing.

- Clients who refer new business to the repo company may receive incentives or referral bonuses.

Guarantees:

- Assuring clients that all repossession activities will be carried out in strict compliance with state and federal laws and industry regulations.

- Ensuring clients receive timely and transparent reporting throughout the repossession process, including updates on asset location and recovery.

- Pledging to protect the confidentiality and security of sensitive client information, especially during skip tracing and asset location.

e. Customer Support Strategy

We will provide multiple communication channels for customers to reach out, including phone, email, and a dedicated customer support portal on our website. Maintain extended business hours to accommodate customer inquiries and concerns outside regular working hours.

Train our customer support team to be knowledgeable about repos, local regulations, and our company’s services. Emphasize empathy and active listening skills to address customer needs and concerns effectively. Strive for prompt response times to customer inquiries, aiming to acknowledge and address their concerns within a reasonable timeframe.

Implement a ticketing system to track and prioritize customer requests efficiently. Develop and maintain a comprehensive FAQ section on our website to provide answers to common customer questions.

Operational Plan

Identify, locate, and repossess assets on behalf of clients in accordance with applicable laws and regulations. Utilize advanced technology and skip-tracing techniques to enhance the efficiency of asset location. Ensure professional and ethical conduct during all repossession activities.

Build and maintain strong relationships with financial institutions, lenders, and creditors as primary clients. Provide transparent communication and reporting to clients throughout the repossession process. Offer customized solutions to meet the unique needs and preferences of each client.

Stay up-to-date with federal and state laws governing asset recovery, including the Uniform Commercial Code (UCC) and other relevant regulations. Ensure all repo agents are properly licensed and trained, and conduct regular compliance checks. Implement strict adherence to legal and ethical standards to protect the company and its clients.

a. What Happens During a Typical Day at a Repo Business?

In a typical day at a repo business, agents and staff engage in a multifaceted process. They begin by reviewing case files, identifying repossession targets, and utilizing advanced technology and skip-tracing techniques to locate assets. Repo agents then execute repossession orders, ensuring compliance with legal and ethical standards.

Assets are securely transported and stored, with detailed records maintained. Communication with clients, reporting, and client relations management are ongoing priorities. Additionally, adherence to industry regulations, training, and maintaining a professional and safe work environment are integral parts of each day in the repo business.

b. Production Process

There is no production process.

c. Service Procedure

Jarome Smith® Repo Company, Inc. will follow a systematic service procedure, starting with client requests for asset recovery. We will then employ advanced technology and skip-tracing methods to locate and verify the assets. Our agents execute repossessions in compliance with legal and ethical standards, ensuring minimal disruption.

Once assets are secured, they are transported and stored securely. Detailed records are maintained throughout the process. Jarome Smith® Repo Company, Inc. prioritizes transparent communication with clients and provides timely updates.

We will also offer customized solutions to meet clients’ unique needs. Adherence to industry regulations, training, and a commitment to professionalism and ethics are central to the service procedure.

d. The Supply Chain

Jarome Smith® Repo Company, Inc. manages a supply chain that primarily involves the procurement and maintenance of repossession equipment, technology, and operational resources. This includes tow trucks, GPS tracking systems, skip tracing software, and secure storage facilities for repossessed assets.

The company also sources office supplies and administrative tools. A streamlined supply chain ensures efficient asset recovery processes and adherence to legal and industry standards, ultimately serving the needs of financial institution clients and asset recovery operations.

e. Sources of Income

Jarome Smith® Repo Company, Inc. generates income primarily through the following sources:

- Repossession Fees

- Storage Fees

- Transportation Fees

- Asset Remarketing

- Additional Services

- Late Payment Charges

- Client Retainers

- Referral Incentives

- Asset Recovery Insurance

- Online Directory Listings

- Technology Solutions.

Financial Plan

A. amount needed to start your repo company business.

Jarome Smith® Repo Company, Inc. would need an estimate of $350,000 to successfully set up our repo company in the United States of America. Please note that this amount includes the salaries of all the staff for the first month of operation.

b. What are the Costs Involved?

- Business Registration Fees – $750.

- Legal expenses for obtaining licenses and permits – $2,300.

- Marketing, Branding, and Promotions – $5,000.

- Business Consultant Fee – $2,500.

- Insurance – $15,400.

- Rent/Lease – $80,000.

- Other start-up expenses include commercial satellite TV subscriptions, stationery ($500), and phone and utility deposits ($2,800).

- Operational Cost (salaries of employees, payments of bills et al) – $60,000

- Tow Trucks and Equipment – $50,000

- Store Equipment (cash register, security, ventilation, signage) – $4,750

- Website: $600

- Opening party: $3,000

- Miscellaneous: $2,000

c. Do You Need to Build a Facility? If YES, How Much Will It Cost?

Jarome Smith® Repo Company, Inc. will not build a new facility for our repo company.

d. What are the Ongoing Expenses for Running a Repo Business?

- Employee Salaries and Benefits (This includes wages, health insurance, retirement contributions, and other employee-related costs.)

- Vehicle Maintenance and Fuel (Expenses include routine maintenance, repairs, fuel, insurance, and vehicle registration fees.)

- Technology and Software (Expenses include the purchase or subscription costs of software, GPS tracking systems, and database access.)

- Storage Facility Costs

- Licensing and Insurance (Expenses include license fees, bond premiums, and insurance premiums.)

- Marketing and Advertising.

e. What is the Average Salary of Your Staff?

- Chief Operating Officer (Owner) – $65,000 Per Year

- General Manager – $45,000 Per Year

- Compliance Officer – $40,000 Per Year

- Accountant – $40,000 Per Year

- Repo Operatives – $35,000 Per Year

- Sales and Marketing Officer – $32,000 Per Year

- Customer Service Representative – $30,00 Per Year

f. How Do You Get Funding to Start a Repo Business?

- Raising money from personal savings and sale of personal stocks and properties

- Raising money from investors and business partners

- Sell shares to interested investors

- Applying for a loan from your bank/banks

- Pitching your business idea and applying for business grants and seed funding from the government, donor organizations, and angel investors

- Source for soft loans from family members and friends.

Financial Projection

A. how much should you charge for your product/service.

Repossession Fee: This is the primary fee and can range from approximately $150 to $400 or more per repossession, depending on factors like location and asset type. More complex repossessions may command higher fees.

Storage Fees: Repo companies often charge daily or monthly storage fees for holding repossessed assets in their secure storage facilities. These fees can range from $25 to $50 or more per day, depending on the size and type of asset.

Transportation Fees: Charges for transporting repossessed assets to storage facilities or auction sites can vary but typically start at around $100 and increase based on distance and the nature of the transport.

Key Cutting or Replacement Fees: If keys need to be cut or replaced to access or secure an asset, repo companies may charge fees for this service.

Skip Tracing Fees: Some repo companies offer skip tracing services to locate assets or individuals, and they may charge separate fees for these services, which can vary widely based on the complexity of the search.

Remarketing Fees: Repo companies may charge a percentage of the proceeds from the sale of repossessed assets, typically around 10% to 15% or more.

b. Sales Forecast?

- First Fiscal Year (FY1): $280,000

- Second Fiscal Year (FY2): $340,000

- Third Fiscal Year (FY3): $400,000

c. Estimated Profit You Will Make a Year?

Jarome Smith® Repo Company, Inc. is projecting to make;

- First Fiscal Year (FY1): (20% of revenue generated)

- Second Fiscal Year (FY2): (25% of revenue generated)

- Third Fiscal Year (FY3): (30% of revenue generated)

d. Profit Margin of a Repo Company Business

The profit margin of a repo company business is not fixed. It could range from 20 percent to 30 percent depending on some unique factors.

Growth Plan

A. how do you intend to grow and expand by opening more retail outlets/offices or selling a franchise.

Jarome Smith® Repo Company, Inc. will grow our repo company by first opening other outlets in key cities in the United States of America, and Canada within the first ten years of establishing the business and then will start selling franchises.

b. Where do you intend to expand to and why?

Jarome Smith® Repo Company, Inc. plans to expand to;

- Charlotte, North Carolina

- New York City, New York

- Dallas, Texas

- Atlanta, Georgia

- Portland, Oregon

- Minneapolis, Minnesota

- Denver, Colorado

- San Diego, California

- Nashville, Tennessee.

Internationally, we plan to expand to Canada.

The reason we intend to expand to these locations is the fact that available statistics show that the cities listed above have a growing market for repo businesses.

The Jarome Smith® Repo Company, Inc. has decided to pass on the business to a family member through succession. We have implemented a structure that will make the transfer of ownership from one generation to another seamless and hassle-free.

Our company has put together a comprehensive transition plan that involves transferring ownership, training key personnel, and informing employees, customers, and suppliers about the change.

- Privacy Policy

- Terms and Conditions

How To Start A Repo Company – Beginner’s Blueprint

July 30, 2024 in Make Money

Starting a repo company taps into an industry that's more than just towing away cars — it’s about reclaiming what lenders are owed when all other options have run out. For many entrepreneurs, the allure of stepping into the vehicle repossession space comes from spotting a steady opportunity for growth and profit amidst the challenges.

With statistics showing a 4.2% industry growth rate from 2016 to 2021, and expected increases through 2025, there's clear evidence this sector is ripe for new entrants.

Our guide lays out essential steps — legal requirements like securing licenses and insurance , grasping local repo laws, managing finances with an eye on startup capital and operational costs, plus tips on building your brand and mastering repossessions safely and efficiently.

Whether you’re aiming to work with banks, credit unions or car dealerships as your potential clients, we've got you covered. Ready to learn how? Keep reading!

Key Takeaways

Know the laws for starting a repo company including getting licenses, insurance, and understanding your state's specific regulations to operate legally.

Plan finances carefully by estimating initial costs for equipment like tow trucks and setting aside money for office space and employee salaries. Budgeting is key to cover startup expenses and future operations.

Build a brand with a great name, professional website, business cards, and flyers to attract potential clients. Marketing helps spread the word about your services.

Network to find contracts with banks, credit unions, and car dealerships. Making connections can secure steady work for your repo company.

Learn how to safely repossess vehicles while handling personal items respectfully. Mastering operations ensures the job is done efficiently within legal guidelines.

Understanding Legal Requirements

Getting your repo business off the ground starts with knowing the law inside and out. You'll need to make sure you have all the right papers in order—like licenses, certifications, and insurance—to legally grab those cars.

Navigate Repo Laws Locally

Repo laws vary from state to state, making it crucial for you as an aspiring business owner to grasp the legal landscape in your locality. States like California have specific licensing requirements overseen by the Bureau of Security and Investigative Services (BSIS) for repossession agencies.

Knowing these details helps ensure that your new repo business starts on solid ground, fully compliant with local regulations.

For example, if you're launching your repo company in Pennsylvania, you must secure a $5,000 bond and obtain insurance that covers both liability and wrongful repossession incidents.

Also, local law enforcement needs to be notified within one business day following a vehicle repossession. This adherence to local statutes not only safeguards your operation but also builds trust within the community and among potential clients.

Next is securing licenses and certifications necessary for running your repo company efficiently...

Secure Licenses and Certifications

After getting familiar with local repo laws, the next critical step involves securing the necessary licenses and certifications . This is where you must pay close attention to detail—every state has its own set of requirements for repossession agencies.

For starters, all repo agents need to be at least 18 years old and have a clean driving record . This basic prerequisite ensures that candidates are responsible enough to handle the challenges of auto repossession work.

To legally operate as a repo agency, obtaining a business license is non-negotiable. In addition, certain states require a specific repossession license or certification ; hence, checking with your state's regulatory body is crucial.

Don't overlook the importance of a commercial driver's license (CDL), especially if you plan on repossessing large vehicles or operating heavy equipment like tow trucks and flatbeds.

Furthermore, attending skip tracing training can significantly boost your skill set by teaching you how to locate hard-to-find vehicles—a key aspect of this line of work.

Finally, bond insurance stands out as a legal necessity for anyone in the repossession business. It protects your company against potential lawsuits or claims related to property damage during operations.

With these licenses and certifications in hand—as well as proper insurance coverage—you’re well-prepared to launch your successful repo company within legal boundaries while ensuring trust and reliability among clients.

Arrange Insurance and Bonding

Securing the right insurance and bonding is a must-have for launching a successful repo business. You need property and equipment insurance to keep your business safe. More importantly, securing a million-dollar liability policy puts you on the map as a serious repossession agent.

This type of coverage costs between $1k and $5k per month, varying with your location and past insurance history. Also, some states require your repo company to be bonded —this acts as an extra layer of trust with clients.

Next comes organizing your finances , which involves estimating how much capital you'll need upfront for things like tow trucks, office space, and employee salaries. Budgeting wisely here sets the foundation for everything else in your repo business journey.

Organizing Your Finances

Getting your finances in order is a key step. You'll need to know how much money you have to start and run your repo company.

Assess Initial Capital Requirements

Starting a repo company means understanding and preparing for the initial capital required . The capital upfront is crucial for covering startup costs such as securing a location, which should include office space and a storage yard.

Besides space, registering your business name and obtaining necessary licenses demand a significant portion of your budget . Financial projections are an essential step in this journey -- you'll want to map out expenses for at least two years in advance.

This foresight helps avoid surprises down the road.

Equipment like chain tow trucks or flatbeds constitutes another large slice of your budget pie. These tools are not just important; they're must-haves for operating efficiently in the repo industry.

You'll also need to consider staffing costs . Hiring employees with great communication skills and the right background checks is vital since they’ll be representing your business in potentially sensitive situations.

Having enough capital ensures that new vehicles, essential equipment , and skilled staff strengthen the foundation of your repo business from day one.

Budget for Equipment and Staff Costs

Planning your budget for equipment and staff costs is crucial for launching a successful repo company. You'll need to decide whether to purchase or lease towing equipment , such as flatbed trucks or tractor-trailers.

Each option has its own set of expenses, but having reliable vehicles is a must-have for the job. Ensure your team of repo officers obtains the necessary licenses , which might involve training courses and exam fees.

Don't forget about hiring drivers and office staff to manage operations efficiently.

Bring independent contractors on board for vehicle hauling if it helps keep initial capital requirements manageable. This strategy can be cost-effective while you're establishing your new business in the reposession industry.

Calculate operating costs carefully, aiming to cover at least six months of expenses before expecting steady income from repo contracts with financial institutions or car lots. Building a solid foundation by budgeting wisely from the start paves the way for success in the competitive world of auto repossession companies.

Building Your Repo Business

Starting your own repo business means setting a strong foundation. You have to pick a catchy name, find the right office space, and decide what you'll charge for your hard work.

Choose and Register Your Business Name

Picking the right name for your repo company is a crucial step. It's not just about finding something catchy; the name needs to clearly align with repossession services, making it easier for potential clients to find and remember you.

After deciding on a perfect name, file for a Doing Business As (DBA) registration. This legal process ensures that you have exclusive rights to use your business’s name across state lines.

Next, secure a central location for both an office and lot space. Your repo business will need a designated spot for operations and storing repossessed vehicles safely. With these foundational steps out of the way—selecting an impactful name , filing it legally through DBA, and pinpointing your base of operations—you set a solid groundwork from which your business can grow and succeed in the auto repossession market effectively.

Establish Office and Set Fees

Finding the right office space is key for launching your repo company. You must have a spot with enough room to manage orders and store repossessed vehicles securely. Often, this means looking for an office paired with a storage yard .

This setup is essential for holding cars and ensuring you can operate efficiently and safely.

Setting fees for your services involves understanding the market rate , which ranges between $200 and $300 per repo job. Don't forget to add charges for extra efforts like tracking down missing borrowers.

Your fees should cover these costs while remaining competitive in the marketplace. Transparent pricing will help build trust with your clients and encourage repeat business in the highly specialized repossession industry.

Develop a Comprehensive Business Plan

Crafting a strong business plan is the backbone of launching a successful repo company. It should lay out your marketing strategy , budgetary needs , and include financial projections for at least two years—five if possible.

Your plan must clearly define your mission statement and detail the operational requirements necessary to achieve it. This roadmap guides your startup phase and attracts potential investors by showcasing how you intend to grow profitability over time.

A solid business plan isn't static; it's a living document that requires annual reviews and updates to adapt to changing market dynamics or internal goals. Consider it an essential tool in tracking progress against your benchmarks, allowing for strategic adjustments along the way.

Including detailed information on repo work —from securing licenses and bonds to managing repossession laws—ensures that every aspect of operations is thoughtfully considered.

Your business plan is more than paperwork; it's your blueprint for success in the highly competitive auto repossession industry .

Developing Your Brand Presence

Crafting a strong brand presence is key—use business cards, flyers, and your website to make a mark. Keep reading to learn how!

Market with Business Cards, Flyers, and Website

Use business cards and flyers to catch the attention of your local area. These tools convey your contact information quickly and effectively. A sleek, professional card leaves a lasting impression.

Distribute them at community events or local businesses related to auto loans and repossession services. Flyers can showcase your services in more detail, perfect for bulletin boards in places like car lots or financial institutions.

Having a well-designed website boosts credibility . It's an online hub where potential clients find everything they need about your repo company – from services offered to how you handle the delicate matter of repossessing property while respecting previous owners' personal possessions.

Choose a reliable web host to ensure that clients searching for vehicle repossession companies online find you easily through search engines or social media links displayed on your site .

Network with Potential Clients for Contracts

Networking is key to securing contracts for your repo company. Start cold calling banks, debt-collection agencies, and auto loan companies —these businesses often need repo contractors.

Make a list of potential clients. Then, reach out through phone calls, emails, or in-person visits to introduce your services. Be ready with a quick pitch that highlights what sets your repo business apart from the competition.

Creating a strong network involves consistent follow-up . After initial contact, keep the conversation going by sending updates about your services or sharing news relevant to their industry.

This persistence shows potential clients you're serious about building a professional relationship with them.

With each successful connection made , you'll be closer to mastering repo operations...

Mastering Repo Operations

Mastering repo operations is key—learn how to take back cars and handle personal items with care, keeping legal and safety issues in check. Keep reading to become a pro at running your repo company.

Repossess Vehicles and Manage Personal Items

Repossessing vehicles requires knowing the repossession process well, including how to safely impound a vehicle . Each step must follow legal guidelines tightly. Once in possession of a car, assess its condition and immediately notify both authorities and lenders.

This step is critical for keeping operations transparent and within the law.

Handling personal belongings left inside repossessed vehicles is also key. Always secure items found in the car, creating a detailed inventory list as part of your condition reports.

Then, inform the previous owner where they can retrieve their possessions and any associated storage fees. This approach respects owners’ rights and helps maintain your repo company's professional reputation.

Address Legal and Safety Issues

Handling legal and safety issues is essential for your repo company. Make sure you comply with all relevant regulations to avoid any trouble. This means getting the right business licenses , understanding local repo laws , and securing a repossession agency license if your state requires it.

Your drivers must have valid licenses that allow them to operate hauling vehicles like flatbed trucks or tractor trailers.

Safety cannot be overlooked either. Dealing with delinquent borrowers brings unpredictable challenges. Some may be psychologically unstable or confrontational when faced with auto repossession .

Train your team how to manage these situations safely. They should know how to calmly repossess property while respecting personal boundaries and avoiding escalation into an auto accident or other dangerous scenarios.

Always aim for a peaceful resolution, but prepare for any outcome by having liability insurance in place to protect your business against claims of damage or misconduct during the repo process.

Launching a successful repo company requires understanding the legalities , organizing finances , and building a strong brand . Practical steps like securing licenses and networking for contracts simplify getting started.

Applying these strategies can significantly boost your business prospects. For continued success, keep learning about industry trends and refining your operations. Chase success - your determination will drive your repo company forward.

1. What are the key steps to launch a successful repo company?

Starting a successful auto repossession company involves important steps like understanding job duties of repo men, conducting due diligence on your state's licensing requirements, and setting up as a limited liability company.

2. Do I need special licensing to become a repo man?

Yes, most states in the United States require you to pass a licensing exam and obtain a repo license before you can legally operate as repossession agents or run repossession businesses.

3. How do I handle car owners when repossessing their vehicles?

Repo men should always seek legal advice about the best way to approach vehicle repossession. This often includes obtaining court orders if necessary, ensuring any personal property is handled correctly, and maintaining professionalism during interactions with car owners.

4. What equipment will my business need for vehicle repossessions?

Your business might need flat bed trucks or other types of motor vehicles for transportations, secured areas like locked garages or storage areas for keeping repossessed cars safe, and possibly even cell phones or credit card machines for handling payments on unpaid items.

5. Can rental cars be considered fair game for repossession by my company?

Usually not! Rental cars aren't typically subject to repossession unless there's an issue with late loan payments from the rental companies themselves—it's always good idea to check local laws regarding this matter.

6. Is there potential growth in starting an auto repossession business?

Absolutely! With years of experience under your belt and following steps diligently could lead your small businesses into becoming one of the leading repo companies offering various services including but not limited to handling late payments issues from car loans holders.

About the author

Serenity Shadow