- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

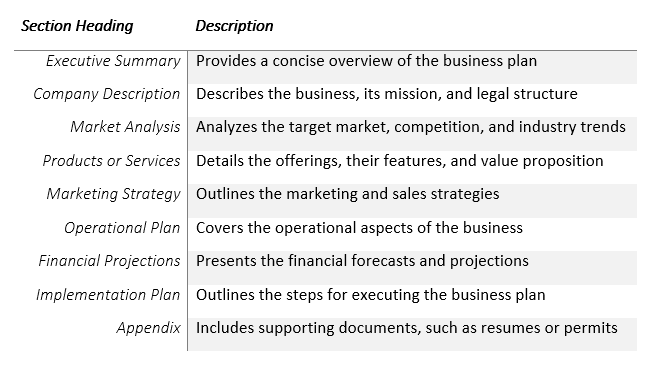

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

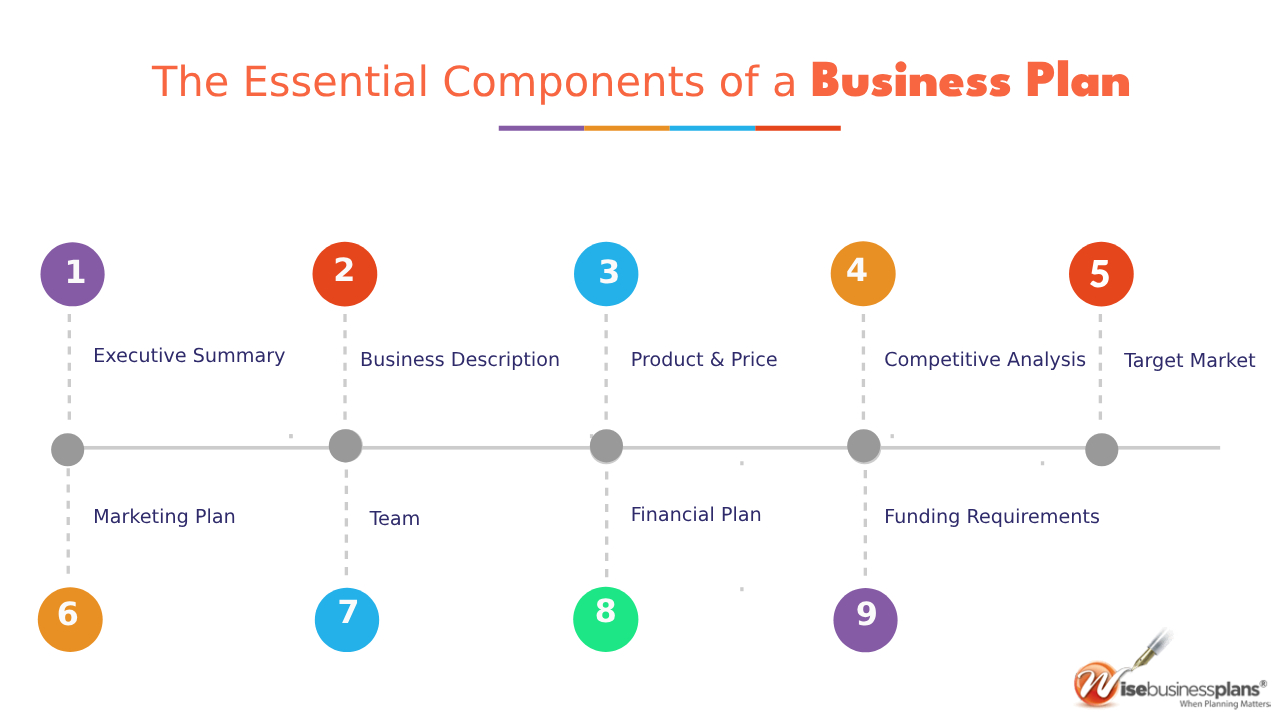

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

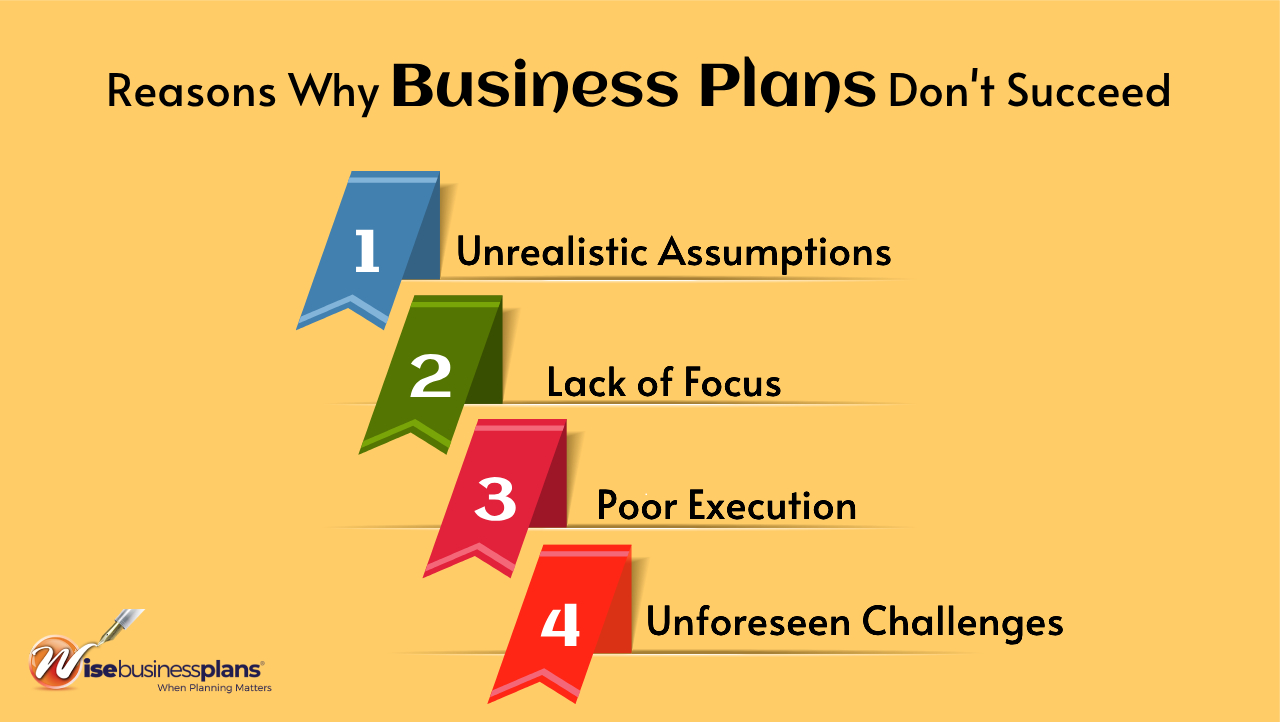

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a Business Plan? Definition, Tips, and Templates

Updated: June 28, 2024

Published: August 04, 2020

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

In an era where 48% of businesses survive half a decade on, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Here’s why I think a business plan is important:

1. Securing Financing From Investors

Since its contents revolve around how businesses succeed, break-even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

I’ve seen that all banks, investors, and venture capital firms will want to see a business plan before handing over their money. Therefore, these investors need to know if — and when — they‘ll be making their money back (and then some).

Additionally, they’ll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a Company's Strategy and Goals

I think a business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

3. Legitimizing a Business Idea

I’ve seen that everyone‘s got a great idea for a company — until they put pen to paper and realize that it’s not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures you have everything in order before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in Your Business Class

Speaking from personal experience, there‘s a chance you’re here to get business plan ideas for your Business 101 class project.

If that's the case, might I suggest checking out this post on How to Write a Business Plan , which provides a section-by-section guide on creating your plan?

5. Identifying Potential Problems

Business plans act as early warning systems that identify potential problems before they escalate into major obstacles.

How? When you conduct thorough market research, analyze competitor strategies, and evaluate financial projections, your plan pinpoints vulnerabilities and risks. This allows you to develop contingency plans and risk mitigation strategies.

This helps you prevent costly mistakes and shows investors and lenders you’re well-prepared and have considered various scenarios.

6. Attracts and Retains Talent

A well-articulated plan outlines your company's vision, mission, and values, showcasing a clear direction and purpose. People who want meaningful work that aligns with their ambitions will love this.

Also, it shows the company's potential for growth and stability. This instills confidence in employees and assures them of a secure future and opportunities for career advancement.

When you show growth potential and highlight a positive work culture, your business plan becomes a magnet for top talent.

7. Provides a Roadmap

A business plan provides a detailed roadmap for your company's future. It outlines your objectives, strategies, and the specific actions you need to achieve your goals.

When you define your path forward, a business plan helps you stay focused and on track, even when you face challenges or distractions. It’s a great reference tool that allows you to make smart decisions that align with your overall vision.

This way, having a comprehensive roadmap in the form of a business plan provides direction and clarity at every stage of your business journey.

8. Serves as a Marketing Tool

A business plan is not only an internal guide but also serves as a powerful marketing tool. Your business plan can showcase your company‘s strengths, unique value proposition, and growth potential when you’re looking for investors, partnerships, or new clients.

It provides a professional and polished overview of your business, which shows your commitment and strategic thinking to potential stakeholders.

Your business plan helps you attract the right people by clearly articulating your target market, competitive advantages, and financial projections. In summary, it acts as a persuasive sales pitch.

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read.

The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement.

You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can.

This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition.

In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan, will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy?

This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees. Even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section.

Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful additions here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results?

The “team” section of your business plan answers that question by providing an overview of the roles responsible for each goal.

Don’t worry if you don’t have every team member on board yet. Knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill.

Considering that global funding fell 61% from 2021 to 2023 , it’s very important to be clear in this section. Include the amount your business needs, for what reasons, and for how long.

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

I think the biggest challenge with the startup business plan is that it's written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

Eric Heckstall , the founder and CEO of EDH Signature Inc ., which offers premier grooming products, also suggests keeping your startup business plan short.

“The traditional business plan can be 40+ pages, which is too large of a document to really be useful, can be difficult for staff to understand, and have to dig for information which most people won’t do,” Heckstall says.

Conversely, a one-to-two-page business plan improves clarity and focus. Heckstall says this format “is easy to use on a day-to-day basis, teams as well as potential investors can understand the purpose and direction of the company, and can easily be incorporated into team meetings.”

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description.

- Market analysis.

- Technology needs.

- Production needs.

- Financial sources.

- Production operations.

Startups can fail because of a lack of market need and mistimed products. Plus, nearly half of entrepreneurs , founders, CEOs, and COOs report that price sensitivity and evolving market conditions are the number one prospect and customer challenges they face right now.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then, the feasibility plan centers on that one product or service.

Zach Dannett , co-founder at rug company Tumble highlights how some business owners take a very idealistic approach too. And forget barriers to entry like regulatory issues in the process.

He adds how considering this aspect in their business plan helped.

Before launching the team, Dannett first took time to understand regulatory requirements in our industry, checking to make sure we needed to secure any certifications or licenses.

Then, “we reviewed financial requirements, which would cover initial investments, operational costs, and potential expenses. We then conducted thorough market research to understand our market, how saturated this market is, and identify major competitors with significant market share,” Dannett says

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets.

- Target demographic analysis.

- Market size and share of voice analysis.

- Action plans.

- Sustainability plans.

Most external-facing business plans focus on raising capital and support for a business. But, an internal business plan helps keep the business mission consistent in the face of change.

You can also reduce your workload by using a free business template that helps you get a headstart on what to include.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis.

- Assessments of company resources.

- Vision and mission statements.

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in.

David Sides , marketing specialist at The Gori Law , highlights how it’s important not to create this plan in isolation and involve key stakeholders from across the organization in the planning process.

“We make a point of bringing together attorneys, paralegals, and support staff to discuss our long-term goals and how we can work together to achieve them. This not only helps ensure buy-in and alignment, but it also allows you to tap into a wider range of perspectives and ideas,” Sides says.

This way, the strategic business plan can add value by outlining how your business plans to reach specific goals and considering a holistic perspective from the most important stakeholders. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

I recommend including costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model.

- What will stay the same under new ownership.

- Why things will change or stay the same.

- Acquisition planning documentation.

- Timelines for acquisition.

Ilia Tretiakov , owner and lead strategist, at So Good Digital , a marketing agency suggests adding a Day Zero Plan. This is a thorough plan outlining the steps you will take the moment the acquisition is completed.

It consists of stakeholder communication plans, critical system integration, quick operational adjustments, and cultural alignment initiatives.

Here’s why Ilia believes it’s important.

“A Day Zero Plan establishes the framework for the integration process and guarantees a seamless transition. This comprehensive strategy goes above and beyond the typical post-acquisition integration plan, taking care of urgent issues and laying the groundwork for long-term success,” Tretiakov says,

Apart from this, I believe the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around.

- Historic business metrics.

- Sales projections after the acquisition.

- Justification for those projections.

6. Business Repositioning Plan

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis.

- Growth opportunity studies.

- Financial goals and plans.

- Marketing plans.

- Capability planning.

These types of business plans will vary by business, but they can help you quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

I personally recommend using the feasibility business plan template. It helps me assess the viability of my business idea before diving in head-first.

By completing a feasibility plan, I feel more confident and prepared to tackle the full business plan. Plus, it saves me time and effort in the long run by ensuring I'm pursuing an idea with real potential.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

![definition for business plan What Is a Risk Assessment? My Complete Guide [+ Free Template]](https://www.hubspot.com/hubfs/image5-Nov-15-2024-05-33-59-7062-PM.png)

What Is a Risk Assessment? My Complete Guide [+ Free Template]

The Best AI Tools for Ecommerce & How They'll Boost Your Business

23 of My Favorite Free Marketing Newsletters

![definition for business plan The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

![definition for business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![definition for business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

21 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

2 Essential Templates For Starting Your Business

The weekly email to help take your career to the next level. No fluff, only first-hand expert advice & useful marketing trends.

Must enter a valid email

We're committed to your privacy. HubSpot uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time. For more information, check out our privacy policy .

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

You've been subscribed

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

What is a business plan? Definition, Purpose, and Types

Table of Contents

What is a business plan?

Looking for someone to write a business plan, purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, need guidance with your business plan, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan, what are some of the reasons why business plans don't succeed.

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Related Posts

Why Experienced Legal Consultation is Crucial for New Businesses

Creating a ‘Second Brain’ to Manage Information Overload and Enhance Focus

What Are Mobile App Development Services? Guide for Businesses and Startups

Quick links.

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- Business Credit Cards

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- A Comprehensive Guide to Venture Capitalists

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

Trending Courses

Course Categories

Certification Programs

Free Courses

Management Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

ALL COURSES @ADDITIONAL 50% OFF

Business Plan

Last Updated :

Blog Author :

WallStreetMojo Team

Edited by :

Susmita Pathak

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What Is A Business Plan?

A business plan is an executive document that acts as a blueprint or roadmap for a business. It is quite necessary for new ventures seeking capital, expansion activities, or projects requiring additional capital. It is also important to remind the management, employees, and partners of what they represent.

Creating a business plan is an indispensable part of any business. The main purpose of creating such a document is to attract prospective investors to provide capital to the enterprise. Therefore, the plan should cover all the important perspectives of a business - financial, operational, personnel, competition, etc.

Table of contents

Business plan explained, business plan vs business model, frequently asked questions (faqs), recommended articles.

- A business plan is a critical document for any business – whether a start-up or a well-established one. It can be considered a self-written bible for the company.

- The purpose of this plan should not just be restricted to convincing investors, but it should also extend to the company's morals and ethics, and every stakeholder should be aware of it.

- It can communicate the business idea's viability and, most importantly, the entrepreneurs' dedication to the business. As this dedication keeps them going, the investors are generally motivated to approve a venture when it is evident from the plan.

Business plan writers are responsible for crafting the face of a business organization they hope to build. It cannot be easy because a business plan should be a versatile document that covers various perspectives and aspects of the business that the readers might expect.

The business plan objective is to talk about the company's unique selling proposition ( USP ), business culture, and what the company is. Finally, and most importantly, it is not a static document. With the company's growth, it needs to change by incorporating more relevant information and goals.

The outline of a business plan should be prepared from three perspectives - first, the market; second, the investors; and finally, the company. However, most plans tend to become business-oriented rather than focusing on the market and the investors. This might create a negative impression on the investors.

First, the entrepreneurs must understand a demand-supply gap from the market's perspective. This gap can be the perfect opportunity for the company. Or maybe the company has an innovative product or service idea, which they believe will have a high demand. Either way, the market should accept the product.

According to the Massachusetts Institute of Technology (MIT) Enterprise Forum, 1978, investors are more likely to approve market-driven businesses rather than technology or service-driven ones.

Also, the plan should address the investors' needs. What is in it for the investor? Since they invest a lot of money, they expect higher returns. Of course, no investor would demand profits upfront. But it's important to tell them when they can expect returns and how much. So the business should provide them with the data on the estimated payback period .

There are many types of business plans based on the size of the document and its scope.

#1 - Size-based plans

First, depending on the size of the plan, there are traditional and lean start-up plans. The traditional plan is a lengthy document with more than 20 pages. It covers various facets of the business in such a way as to answer the different questions that may arise in the readers' minds. But the disadvantage of this plan is that it might hold the readers' concentration only for a limited time.

The lean start-up plan is a concise and brief version of an actual plan, usually consisting of a single page. The demerit of this plan is that it might be too small and not include all the important and relevant information. But the entrepreneurs must be ready to provide the investors with a detailed document if required.

#2 - Scope-based plans

The second classification is based on the scope of the plan. It can be a start-up plan for new businesses seeking capital or an internal plan to communicate with different departments on a new project. Other types based on scope include strategic, feasibility, operations, and growth.

A strategic plan can communicate how the business will achieve its goal, while a feasibility plan can focus on the feasibility of the company's offerings. For example, the operations plan focuses on production and supply operations. In contrast, a business prepares the growth plan for its aspiring expansion projects, focusing on additional investments and financial projections .

The outline of a business plan should be carefully designed to incorporate all the focus points deemed essential by the audience. The following are the elements of any business plan sample:

- Executive summary – Also known as the elevator pitch , the business plan executive summary is the most important element of any business plan, best fitted in a page or two. A business should draw its plan from the mission and vision, which are the founding principles of any business. Next, it provides an idea and an overview of the company. It also introduces the product or service the company aims to offer. Finally, it is a summary of the plan.

- Business description – This is an elaboration of the company goals and objectives. It includes the market or industry the business belongs to, its target audience, etc. It can also provide information on the company structure and how it operates.

- Market research and analysis – Market research is the concrete floor on which the business plan stands. It should include facts and figures and give the readers an understanding of the market, its preferences, classifications, and the number and size of competitors. Analyzing the market lets businesses identify a gap and fill it. The plan should also inform the market's acceptance of the product or service.

- Competitive analysis – Competitors can make or break any business. Therefore, before entering the market, the businesses must evaluate how the competitors operate, their profits and costs, their offerings, etc. This will give the enterprise an idea of what it can do differently from the competitors to have the edge over them. This should be effectively communicated to the investors, as it might convince them of the venture's success.

- Marketing and sales plan – The whole point of any business is to make sales. For this, they need marketing campaigns and strategies targeting the right audience with minimal cost but maximum returns. For example, a firm selling study tools and materials will target students, especially through social media. Like this, businesses should plan their campaigns and decide their advertising channels.

- Operating plan – As the term implies, it talks about how the business is operated. The manufacturing and supply patterns, strategies like agile or lean, inventory approach, etc., decided by the management come under this. In addition, the expected quantity to be produced and supplied in a given period and the reverse logistics plan are good additions to the operating plan .

- Organization description – This gives information on the total employees, departments, management qualifications, job description, and total skill set of the organization's human resources. The decided salary and wages, HR policies, etc., are also part of an organization's description.

- SWOT analysis – SWOT analysis helps the business identify its strengths, weaknesses, opportunities, and threats, which will help them choose the critical approach. The business should take advantage of its strengths and opportunities while simultaneously working on the weaknesses and finding the best strategy to deal with the threats. This will balance the company and its internal and external environment.

- Financials – These refer to the financial projections, including the budget , estimated costs , payments, expected break-even point, payback period, etc. Forecasts on expected revenue and costs for at least one year or until the business breaks will be necessary. Also, the net capital requirements with proper accounting calculations must be part of the plan.

- Appendices – This can include other important or relevant documents to prepare the plan. For example, financial documents, proof of people's acceptance of products, resumes of the management, study on competition, etc.

Presentation is as important as the content when firms draft the business plan. Therefore, it is best to add graphs, pie charts, 3D models, and other visuals, which will enhance the presentation and understandability of the plan. In addition, factual data and simple statistical tools can make the plan look genuine and instill investor confidence.

Let us consider the following instances to understand the concept better:

Jack wants to establish a toy manufacturing business for which he requires considerable funding. However, to make sure the business idea is convincing enough for investors for them to take interest in the project, he designs a business plan. In the plan, he includes everything from the requirements to the sales promotion measures he would be using to make people, especially parents and kids, be aware of the products.

As a special mention, he specified that the material that would be used for manufacturing the toys will be kids-friendly and will have no chemical included that could harm kids even in a minute way. Given the features of the business, Jack tries to mention the strongest points that could help him get the funding from investors.

Sixteen experts from Forbes Business Council collectively listed a few ways in which entrepreneurs can leverage their business plans for making expansion decisions. The main components of preparing such plans range from conducting thorough research to setting realistic standard and ensuring regular reviews to check the progress status from time to time.

This example guides the entrepreneurs with no prior experience of how to write a business plan to understand the basics and accordingly present their ideas to the authorities/investors.

Creating a business plan is more important due to the negative impression its absence can cause rather than the benefits it might provide. The impression is what matters when it comes to a plan. So, let's understand the importance of making a good impression.

Perhaps the reason why most businesses make a plan is for the investors. These investors can be venture capitalists or financial institutions . For these investors, new ventures are like investments. Hence, before putting in money, they want to be sure if the investment will be worth it.

Therefore, presenting all the important details in an understandable format helps them realize the clarity and the level of commitment the entrepreneurs have towards their business. The business plan writer should also give due to the executive summary and financials while creating the plan.

Secondly, every business needs a blueprint based on which it operates. It should govern the functions of a business and especially in decision-making. Usually, when a plan is created before the enterprise starts functioning, it speaks about the business and what it stands for. Even after the business takes off and expands, it should stick to its roots, which would evolve with the company's growth.

Making every stakeholder – employees, partners, suppliers, investors, etc. - aware of the plan would increase commitment and sense of belonging to the enterprise. This, too, is important to improve the productivity and contribution of everyone.

Business plan and business model are terms that are considered to be similar, but then, they differ in various aspects from what the emphasis is on to who they target.

Let us have a look at the differences between the two below:

- While a business plan is the document that details every aspect of the business to give investors or readers a complete and clear picture of what the business is or would be all about, a business model defines and describes the channel to be adopted to deliver products and services to consumers.

- The focus of the former is to cover information about every department, section, and services of the business and specify the functions, including sales and marketing, advertising, revenue predictions, etc. On the contrary, the business model emphasize sales funnels, marketing approach to be used, etc.

- Business plans are formulated for investors and other stakeholders of the business, while business models are created for the internal members of the business who have to take care of the distribution of products and services to customers.

- The plans of a business focus on defining and describing the products and services that a company is aiming to produce. On the other hand, the models discuss the ways in which the products and services can be delivered to consumers.

The elements of a business plan comprise an executive summary, company description, market research, competitive analysis, SWOT analysis, marketing strategy, operating plan, financial projections, etc.

Businesses create plans on their own by putting relevant content on paper and using their basic computer skills to make it look attractive. Ideally, plans are not expenses. Instead, they are created from the effort of the entrepreneurs.

All plans need not be highly visual. However, adequate data charts, graphs, 3-D models, etc., can make the document look attractive and creates an impression about the effort that has gone into furnishing the plan. It also increases the understandability of the document.

Businesses can draft plans for any period - maybe a year, three years, or just three months. Some plans are also created until the payback period. But it doesn't mean that the plan is rendered useless after the expiry of the period. On the contrary, a company should always have a constantly updated plan better suited to evolving needs.

This article is a guide to what is a Business Plan. Here, we explain the concept along with examples, components, importance, types, and vs business model. You can also go through our recommended articles on corporate finance –

- Business Strategy

- Business Plan Template

- Business Continuity Planning

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

What is a Business Plan? Definition and Resources

9 min. read

Updated July 29, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template . These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

8 Min. Read

How to Write a Business Plan in One Day [2024 Guide]

10 Min. Read

How to Write a Small Restaurant Business Plan + Free Sample Plan PDF

5 Min. Read

How to Run a Productive Monthly Business Plan Review Meeting

7 Min. Read

How to Write an Assisted Living Business Plan + Free Sample Plan PDF

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

Our biggest savings of the year

Black Friday Save 60%

for life on the #1 rated business plan software

on the #1 rated business plan software

on the #1 Business Planning Software

From Idea to Foundation

Master the Essentials: Laying the Groundwork for Lasting Business Success.

Funding and Approval Toolkit

Shape the future of your business, business moves fast. stay informed..

Discover the Best Tools for Business Plans

Learn from the business planning experts, resources to help you get ahead, business plan, table of contents.

A Business Plan is a detailed document that outlines a company’s objectives, strategies, market position, and financial projections. It acts as both a roadmap for the business’s future growth and a persuasive tool for securing investment and guiding the management team.

The business plan provides a comprehensive overview of all aspects of the business, from operational and marketing strategies to financial planning and organizational structure. It is crucial for aligning a company’s vision with practical execution steps and for demonstrating the business’s potential to stakeholders.

Business Plan Sections

- Executive Summary : Provides a succinct outline of the business, its goals, and plans for success. It often acts a stand-alone document for a concise overview of the company. If applicable, the executive summary specifies funding needs, future funding plans, and repayment or exit strategies.

- Company Description : Includes detailed information about what the company does, including the products or services offered and their unique value propositions.

- Market Analysis : Offers insights into the industry, market trends, target demographics, and competitive landscape.

- Management : Details the company’s organizational structure, management team, and human resource plans.

- Strategy and Implementation : Outlines plans for customer acquisition, retention, and overall sales strategy.

- Financial Projections : Provides detailed forecasts for profit and loss, cash flow, and balance sheets. Often a business plan will include both annual and monthly breakdowns of the financial projections.

- Appendix : Any supporting documents or additional information that may be relevant.

The business plan’s primary function is to articulate a clear vision and strategy for the company, setting specific benchmarks and goals for business growth and operation.

The plan is designed for various stakeholders including potential investors, financial institutions, business partners, as well as the company’s management team and employees.

Frequently Asked Questions

- Why is a business plan important?

For startups, a business plan is crucial for laying out a clear path for growth and success. It helps in clarifying the business idea, setting realistic goals, and providing a roadmap for business development. Additionally, it is essential for attracting investors and securing financing, as it demonstrates the viability and potential of the business.

- How often should a business plan be updated?