- Basic Package

- Privacy Package

- Privacy Plus Package

- Fully Inclusive Package

- Non-Residents Package

- Multiple Share Class Package

- Guarantee Company Packages

- LLP Package

- Charity Company Package

- Right to Manage Company Package

- Property Company Packages

- PLC Package

- View all Packages

- Registered Office

- Service Address

- Business Address

- Address Services Guide

- Business Telephone Services

- Full Company Secretary Service

- Confirmation Statement

- Dormant Company Accounts

- VAT Registration

- Apostilled Documents

- Company Dissolution

- Company Name Change

- Certificate of Good Standing

- Director Appointment & Resignation

- Transfer of Shares

- Issue of Shares

- Corporate Services

- Barclays Business Account

- Cashplus Business Account

- Anna Business Account

- Information Required to Set Up a Company

- Company Formation in 4 Easy Steps

- Client Portal

- Scholarships

- About Company Formation

- About Limited Companies

- Company Addresses

- Company Name Guidance

- Company Owners and Directors

- Keeping Business and Accounting Records

- Limited Company Shares

- Meetings and Resolutions

- Memorandum and Articles of Associations

- Reporting Requirements

- Taking Money out of a Limited Company

- Tax and HMRC Requirements

The QCF blog

Search blog:

How to transfer assets from one company to another.

There are various reasons why it may be necessary to transfer assets between two companies. In this blog, we will consider how this can be done, and some of the reasons for doing so, from the perspective of company restructuring (as opposed to acquisition).

Why would I want to transfer assets between companies?

Company assets can include money, goods, real estate, and intellectual property. Other than acquisitions (where these assets will normally be transferred to the purchasing company as part of the sale), reasons for transferring assets between companies include:

Creating a holding structure

Creating a parent-subsidiary (group) company structure can help mitigate risks by cushioning the holding company from the liabilities incurred by their actively trading subsidiaries.

Normally the key assets in a group of companies are transferred to a non-trading holding company to protect them from risks incurred by the trading subsidiaries.

Diversification

Company owners who wish to diversify their products and services, or go in a new direction, may decide to set up a secondary company. In this case, it may be necessary to transfer some assets to the new company to provide it with the necessary investment (e.g., before it starts generating revenues).

Pre-sale preparation

Company owners who are looking to sell their businesses may want to hold on to certain assets (e.g., intellectual property) to prevent them from being included in the sale. If they intend to start trading again in the future, it may be sensible to set up a new company and transfer these assets.

How to transfer assets between two companies

The transfer process itself can take the form of a contract for the transfer/purchase of business assets.

In the case of money transfers, these can be done as a loan or by purchasing shares in the other company, or through dividend payments if shares in the transferor company are owned by the recipient company.

However, depending on whether or not the companies are both part of the same group, there can be taxes to pay.

Non-group companies

Assets can be transferred between two separate limited companies (i.e., which do not form part of a group), but it should be noted that Capital Gains Tax (CGT) will be payable by the recipient company if the assets are transferred free of charge or below the fair market price.

There are a variety of rules which apply to CGT , and different rates that relate to the disposal (sale or transfer) of assets. In this scenario, the best option will generally be to sell the assets to the new company at a fair market value to avoid CGT.

Group companies

Assets can be transferred between companies that form part of a ‘group’ structure without being liable for CGT. This is part of the “ no gain/no loss rule ” in the Taxation of Chargeable Gains Act 1992 s 171 (1) , which ensures that “ assets can generally be moved around a group of companies without any immediate capital gains consequences. This recognises that business activities carried on within the overall economic ownership of a corporate group, within the charge to corporation tax, should, in broad terms, be tax neutral. ”

To meet the CGT exemption rules that apply to group companies, it will be necessary for there to be (i) at least one subsidiary company and (ii) one parent company that owns at least 75% of each subsidiary.

Parent companies and subsidiary companies can be set up in exactly the same way as any other limited company is formed, as long as the parent owns the requisite shares in the subsidiary.

Author: Nicholas Campion

Nicholas Campion, is a Director and a Chartered Secretary. He has attained considerable experience in the field after working in client-facing roles for leading international providers of corporate services. In his spare time, Nicholas enjoys writing, painting, and aviation, and is also a fair-weather supporter of Derby County.

Related posts

18 Comments

If my client plans to transfer, few assets to its group CO. We have the Fair Value share of the transferring Co. , as on 31 Dec 2022 in the Investments proposed to be transferred.

We have the details of the COST of these Investments proposed to be transferred (from clients Finance team) and CARRYING VALUE as on date of transfer.

As we are transferring the Investments to a related CO. Should we consider either COST / Carrying Value for computing the Goodwill?

Will there be Goodwill involved in this case and whether it needs to be computed, as the Investment assets re getting transferred from one Co. to its Sister concern. Please advise

Thank you for your enquiry, Jignesh.

I’m afraid we are unable to provide advice on tax considerations on specific scenarios, and we would strongly suggest you seek the advice of an accountant on this matter.

Having said that, in relation to your query regarding goodwill, you may find the information (which has been quoted form the ACCA website) helpful:

Goodwill arises when one entity (the parent company) gains control over another entity (the subsidiary company) and is recognised as an asset in the consolidated statement of financial position. Under IFRS 3, Business Combinations, goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognised. Goodwill is not amortised but must be tested annually for impairment.

For your benefit and understanding we include an explanation from BDO of IFRS 3 Business Combinations and IAS 36 Impairment of Assets, which will assist you in the preparation of the assessment when testing for impairment at each reporting date.

IFRS 3 Business Combinations: https://www.bdo.global/getmedia/c0df84a6-d172-465a-8346-7559f4ecbfa1/IFRS-3-AAG.pdf.aspx IAS 36 Impairment of Assets: https://www.bdo.global/getmedia/fd3078e0-d4a0-4ddf-be7c-9143adc0401b/IAS-36-AAG.pdf.aspx ACCA website: https://www.accaglobal.com/gb/en/student/exam-support-resources/fundamentals-exams-study-resources/f7/technical-articles/accounting-for-goodwill.html

We trust this information is of use to you.

Kind regards, The QCF Team

There is well established partnership (or Society in Mauritian context – same characteristics of a partnership) – but the partners have made a valuation and has proposed to sell a percentage to a new person – as a new partner

A valuation has been made and accepted by the parties and the proposed % share in the partnership to the newcomer has been accepted.

But in the meantime – before making the changes and to amend the partnership deed % holding structure – the existing partners have decided to set a limited company

And to absorb the fixed assets of the partnership and to carry on with the same business line which is : a care home for the elders and persons who are in need of special care after an operation or other medical issues

They are using same valuation – done for the partnership and the proposed percentage shareholding in the new set up limited company to the new person.

My question is;

IS IT LEGAL TO USE THE SAME VALUATION DONE FOR THE PARTNERSHIP AND APPLY SAME TO THE NEW COMPANY – WHICH IS NOT IN OPERATION YET.

BUT THE NEW COMPANY WILL DO SAME BUSINESS OPERATIONS

Thank you for your kind enquiry, Asif.

Unfortunately, we only specialise in UK company law, and we cannot provide advice relating to companies based in Mauritius.

We are sorry we cannot be of more assistance in this instance.

Hi , Can a parent company transfer its share it has in the other company to its subsidiary?

Thank you for your kind enquiry, Thomas.

From a company secretarial perspective, there’s nothing wrong with transferring shares held by a parent to one of its subsidiary companies. Restructures like this are common and can take place for a variety of reasons. A standard transfer of shares procedure is usually sufficient to achieve this.

Hi, If a subsidiary has been set up for the purposes of separating trading (of the parent company) from investments, is it right to say that the parent would be able to move an asset such as an existing share dealing account portfolio to the subsidiary without creating a tax liability for either entity ? Thanks

Thank you for your message.

Please note that we are not accountants and cannot provide advice on specific scenarios. However, if the transfer is between two entities that form part of the same group, then any usual capital gains tax liabilities here may still be exempt. Having said that, we would strongly encourage you to seek professional advice from an accountant to make sure.

I am sorry we cannot be of more assistance on this occasion.

Hello, we are wanting to sell all of our assets to a new company.. Do we use fair market value cost, and do the new company start a new asset depreciation list? What other information will I we need to sell the assets?

Thank you for your kind enquiry.

Generally speaking, and assuming the two entities are not a part of the same group, it is usually best to sell the assets at fair value costs, due to its impact on Capital Gains Tax.

Whether you require an asset depreciation list will largely depend on the actual type of assets being sold.

With regard to other information you may need as part of the contract, we really cannot give advice on specific scenarios. Also, because of the potential tax and accounting considerations involved in this process, we would suggest you seek the advice of an accountant.

Kind regards The QCF Team

Hi, We want to move some assets from Japan to India and these are calibration Kits developed in Germany. Can we move these as the transfer of an asset as we are the same companies of Group in a different country with the Same business?

I’m very sorry but we can’t advise on specific scenarios such as this.

We hope you are able to find an answer to your question.

Regards, The QCF Team

Hi, Please can you advise. Me and my brother have a limited company together with equal shares, we are looking at dividing the property’s within the company and transferring my share to another company which I will own in my name only, and the original company will be kept in his name. What are the implications regarding tax. Thanks

Thank you for the question.

I’m very sorry but we can’t advise on specific scenarios such as this.

We recommend discussing this with an accountant.

My UK company has a wholly owned subsidiary company that has property and other assets. I wish to transfer all assets to the UK company and have the property registered in the name of the UK company. Who can I employ to complete the formalities.

Thanks for getting in touch.

It sounds like a contract will need to be put in place to transfer the assets from one entity to the other – we recommend contacting a solicitor to assist with this.

The article is very helpful and you have prompted the following question about the CGT position for a company owning the freehold for leasehold properties. When ‘group’ companies have been set up, can one company be limited by guarantee and the holding company limited by shares? If this is permitted, can assets comprising the freehold interest in 66 leasehold flats be transferred to the company limited by guarantee without incurring a CGT liability? If the freehold company then allows lease extensions to take place, can they be at a nil premium?

Thanks for the question!

There’s nothing in the Companies Act 2006 to say that a company of different forms (including a limited by shares and limited by guarantee) can’t be within the same group.

Indeed, in large structures, it is not uncommon to find different corporate entities under one group. The key point is that, as separate legal entities, a limited by shares company can be a member of a limited by guarantee company, and vice versa.

In regards to your question on Capital Gains Tax liability, I’m afraid we are unable to provide advice on specific scenarios. If you are unsure, I recommend seeking advice from an accountant.

Leave a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Post comment

Original text

When you form an LLC, you will need to transfer assets into the company in order to properly capitalize the business. If you have business partners, they too will contribute assets in exchange for an ownership percentage.

Capitalization is critical to your LLC. Bank loans are nearly impossible to receive for business owners with no equity in their company. In addition, members of an under-capitalized LLC may be found ineligible for the liability protection generally provided by an LLC.

Let's look at how transferring assets works.

Capital contributions.

A capital contribution is an asset given to your LLC in exchange for equity (the value of your ownership percentage). An asset can be cash, property, or professional services.

Most capital contributions are tax-free . If you initially invest $10,000 in your LLC as a capital contribution, you would receive $10,000 of equity. You would not be required to pay a capital gains tax on your new equity. This same rule applies to your LLC, which would not pay a tax on the $10,000 of new working capital.

Cash is simple. More complicated is the transfer of property, such as computers, vehicles, or real estate. When transferring property, you must properly record the Fair Market Value (FMV) of the property, what you paid for it originally, as well as any depreciation . FMV and depreciation affect both the equity you receive as well as the company's tax basis.

Capital contributions must be carefully recorded in your Operating Agreement. Undocumented contributions often lead to significant tax concerns later on.

The following information should be recorded in your Operating Agreement:

- Name, address, and SSN/EIN of the member and LLC

- Description of asset

- Value of asset

- Date of contribution

- Ownership percentage received

- All liabilities assumed with the asset

- Written transfer document (if applicable)

- Adjusted basis of asset (if applicable)

Sale & Purchase

Instead of transferring assets as a capital contribution, you can also sell assets directly to your LLC. The most significant difference between a contribution and a sale is that the sale creates no equity in the company.

For example, if you sold a chunk of land to McDonald's and a drive-in was later built on the property, you would not receive shares of McDonald's stock in return for the land.

Sales are also not without certain tax implications, both for you, the seller, and your LLC, the purchaser.

Let's say you sell a car for $10,000 to your LLC. The cash you receive is now a taxable gain which must be reported on your income tax return. As well, your LLC has received an asset with a depreciable basis ($10,000 which will depreciate over time).

Asset purchases should be as carefully recorded as capital contributions, although there is no reason to record purchases in your Operating Agreement . Instead, you should keep careful records of each purchase and ensure that all titles and deeds are properly transferred into the name of the LLC.

Filing an Asset Transfer Document

Certain assets come with deeds or titles proving ownership. With these assets, correct transfer requires that a Transfer Document be filed and a new deed or title issued.

You can obtain a Transfer Document from the agency where the original deed/title is filed. For example, a vehicle title is generally filed with your local Department of Licensing. You can fill out the Transfer Document and then bring it to a notary. Once the document is notarized, you can file the original deed/title and the Transfer Document with the filing agency. A new deed/title will be issued showing that your LLC is now the owner.

If you are transferring an asset with a lien or mortgage, you will need written permission from the bank or lender in order to complete the transfer. The lender will want to assess the creditworthiness of your LLC before allowing the transfer.

Fraudulent Transfer of Assets

Not all asset transfers are legal. A fraudulent transfer or fraudulent conveyance is a transfer that is undertaken to hide assets from or put assets out of the reach of creditors. It can also, however, be done by mistake by new entrepreneurs not fully aware of how asset transfers work.

When examining asset transfers, a court will look for three primary elements:

- Was the transfer made with the intent to defeat creditors?

- Was the debtor insolvent at the time of the transfer or made insolvent by the transfer?

- Was the transfer without reasonably equivalent value?

Reasonably equivalent value refers to the value you receive in return for transferring an asset to your LLC. Let's say you transfer a piece of property valued at $100,000 to your LLC, and in return, you received $50,000 cash. While you received value through the transfer, you did not receive reasonably equivalent value, because the LLC paid you far less than the asset was worth. In this instance, the court may rule that the transfer was fraudulent and thus voidable.

To evaluate the reasonable equivalent value, a court will examine Fair Market Value; whether or not a transfer was made in good faith in the ordinary course of business; value of competitive bids; and the net effect on the debtor's estate with respect to funds available to unsecured creditors.

Pros and Cons of the Popular Business Entities: Sole Proprietorship, LLC, S Corp and C Corp This webinar will discuss the most common business entities to help you navigate this important decision, and what changes you need to know for this year.

What Should Your LLC's Operating Agreement Include? In addition to filing your articles of organization with the state, you should also set internal ground rules for how you manage and run your LLC.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

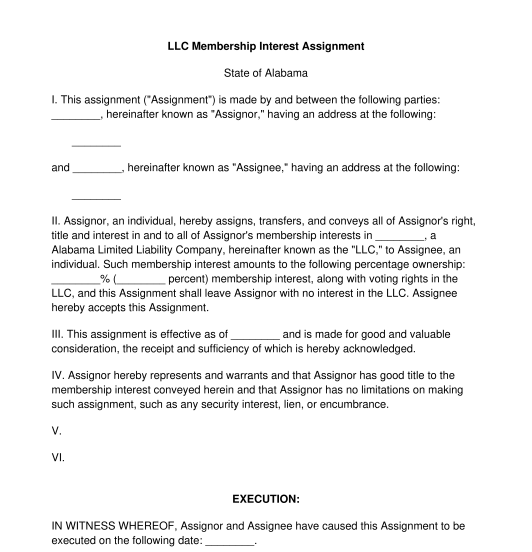

LLC Membership Interest Assignment

Rating: 4.8 - 951 votes

An LLC Membership Interest Assignment is a document used when one member of an LLC, also known as a limited liability company, wishes to transfer their interest to another party entirely. LLC Membership Interest Assignments are often used where a member in an LLC is leaving or otherwise wants to relinquish the entirety of their interest in the company.

An LLC Membership Interest Assignment normally happens well after the LLC has already been operating . To form a limited liability company in most states, any party must begin with Articles of Organization (sometimes called Certificates of Formation or other varying names). These documents will get the LLC formed and in compliance with state laws.

A limited liability company can operate and be formed for any reason (except illegal ones). For example, even if it is a small business, like dog-walking, the owners might want to have an LLC to protect themselves. If so, and if any owner decided to one day relinquish their interest in the LLC , that owner could use this LLC Membership Interest Assignment to assign it to another person.

LLC Membership Interest Assignments are short, relatively easy documents which contain all the information needed to transfer an interest in an LLC.They contain a place for both the person transferring the interest (called the Assignor) and the person receiving the interest (called the Assignee) to execute the document.

How to use this document

This document can be used when any party would like to transfer the ownership of an interest in an LLC or when any party would like a membership interest in an LLC transferred to them, as long as the current owner of the membership interest agrees. It should be used it when both parties understand that the membership interest will be completely assigned and wish to create a record of their agreement, as well as a document that the LLC will likely keep on file.

This document will allow the form-filler to input details of the identities of both parties, as well as the details of the membership interest, such as percentage and whether or not it comes with voting rights . It also has an optional addendum at the end, in case full consent is needed from all the rest of the members of the LLC .

Please keep in mind that this form requires both signatures , from the party assigning the interest and the party receiving it.

Applicable law

LLC Membership Interest Assignments are subject to the laws of individual states . There is no one federal law covering these documents, because each individual state governs the businesses formed within that state.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Percentage in an LLC

- How to Sell your Business

- How to Transfer Business Ownership

Other names for the document:

Assignment of Interest for LLC Member, Interest Assignment for LLC Membership, LLC Interest Assignment Agreement, Member Interest Transfer for LLC, Membership Assignment for LLC

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- Partnership Agreement

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

- Other downloadable templates of legal documents

Sale and Assignment of LLC Membership Interests

Transfers from Member to Member or to Non-Member Third Parties by David J. Willis J.D., LL.M.

Introduction

This article addresses legal points to consider when conveying a membership interest in a limited liability company from one individual to another. It does not address the initial issuance of such interests when the LLC is formed, nor sales of membership interests by an existing LLC to incoming members.

Additionally, this article addresses absolute assignments (full and final transfers) rather than collateral assignments (made only as security for a loan) which are a different topic entirely.

Assignments of this type may follow the execution of a letter of intent which provides for a due-diligence period. This article does not cover the contents of such an LOI but does address issues that should be considered by a prospective assignee in conducting due diligence. An LOI will often make reference to specific due diligence steps that a buyer will be permitted to take.

After covering definitions and applicable law, we will turn to principal points that should be considered in negotiating and drafting an assignment of LLC membership interest.

APPLICABLE LAW

Relevant statutory definitions.

Applicable law is found in the Business Organizations Code (BOC):

Bus. Orgs. Code Section 1.002. DEFINITIONS

(7) “Certificated ownership interest” means an ownership interest of a domestic entity represented by a certificate issued in bearer or registered form.

(32) “Fundamental business transaction” means a merger, interest exchange, conversion, or sale of all or substantially all of an entity’s assets.

(35)(A) “Governing authority” means a person or group of persons who are entitled to manage and direct the affairs of an entity under this code and the governing documents of the entity, except that if the governing documents of the entity or this code divide the authority to manage and direct the affairs of the entity among different persons or groups of persons according to different matters, “governing authority” means the person or group of persons entitled to manage and direct the affairs of the entity with respect to a matter under the governing documents of the entity or this code.

(41) “Interest exchange” means the acquisition of an ownership or membership interest in a domestic entity as provided by Subchapter B, Chapter 10. The term does not include a merger or conversion.

(46) “Limited liability company” means an entity governed as a limited liability company under Title 3 or 7. The term includes a professional limited liability company.

(53) “Member” means: (A) in the case of a limited liability company, a person who has become, and has not ceased to be, a member in the limited liability company as provided by its governing documents or this code. . . .

(54) “Membership interest” means a member’s interest in an entity. With respect to a limited liability company, the term includes a member’s share of profits and losses or similar items and the right to receive distributions, but does not include a member’s right to participate in management.

(64) “Ownership interest” means an owner’s interest in an entity. The term includes the owner’s share of profits and losses or similar items and the right to receive distributions. The term does not include an owner’s right to participate in management.

(69-b) “Person” means an individual or a corporation, partnership, limited liability company, business trust, trust, association, or other organization, estate, government or governmental subdivision or agency, or other legal entity, or a protected series or registered series of a domestic limited liability company or foreign entity.

(87) “Uncertificated ownership interest” means an ownership interest in a domestic entity that is not represented by an instrument and is transferred by: (A) amendment of the governing documents of the entity; or (B) registration on books maintained by or on behalf of the entity for the purpose of registering transfers of ownership interests.

A well-drafted assignment of LLC membership interest will be mindful of and consistent with these statutory terms.

Statute Authorizing LLC Membership Assignments

Foundational to the idea of a sale and assignment of LLC membership interest is the legal authority to enter into such a transaction in the first place:

Bus. Orgs. Code Sec. 101.108. ASSIGNMENT OF MEMBERSHIP INTEREST

(a) A membership interest in a limited liability company may be wholly or partly assigned.

(b) An assignment of a membership interest in a limited liability company: (1) is not an event requiring the winding up of the company; and (2) does not entitle the assignee to: (A) participate in the management and affairs of the company; (B) become a member of the company; or (C) exercise any rights of a member of the company.

Consent by other members is required. BOC Section 101.103(s) states that a “person who, after the formation of a limited liability company, acquires directly or is assigned a membership interest in the company or is admitted as a member of the company without acquiring a membership interest becomes a member of the company on approval or consent of all of the company’s members.” BOC Section 101.105 states that a “limited liability company, after the formation of the company, may: (1) issue membership interests in the company to any person with the approval of all of the members of the company. . . .”

An additional consent requirement is found in BOC Section 101.356(c) which provides that, for the most part, “a fundamental business transaction of a limited liability company, or an action that would make it impossible for a limited liability company to carry out the ordinary business of the company, must be approved by the affirmative vote of the majority of all of the company’s members.”

Accordingly, it is advisable to accompany an assignment of membership interest with a special meeting of members that approves and ratifies the change. One or more LLC resolutions may be produced as well. All affected parties (and their spouses, even if non-members) should sign off.

What category of property is an LLC membership interest?

Regardless of the type of property owner by a limited liability company, a membership interest in the LLC is personal property:

Bus. Orgs. Code Sec. 101.106. NATURE OF MEMBERSHIP INTEREST

(a) A membership interest in a limited liability company is personal property.

(a-1) A membership interest may be community property under applicable law.

(a-2) A member’s right to participate in the management and conduct of the business of the limited liability company is not community property.

(b) A member of a limited liability company or an assignee of a membership interest in a limited liability company does not have an interest in any specific property of the company.

The characterization of an LLC membership interest as personal property is important because it also signifies what it is not . For instance, it is not a real property interest even though the LLC may own real estate. It is not a negotiable instrument subject to the Uniform Commercial Code (found in Texas Business & Commerce Code Section 3.201 et seq.). Nor is a small-business LLC membership interest usually considered to be a security subject to state and federal securities laws: “An interest in a partnership or limited liability company is not a security unless it is dealt in or traded on securities exchanges or in securities markets, [and the company agreement] expressly provide[s] that it is a security . . . or it is an investment company security.” Tex. Bus. & Com. Code Sec. 8.103(c).

The foregoing applies regardless of whether the membership interest is considered certificated or uncertificated.

Statutory Qualifications for LLC Membership

Qualifications and requirements for membership in an LLC are found in the BOC:

Bus. Orgs. Code Sec. 101.102. QUALIFICATION FOR MEMBERSHIP

(a) A person may be a member of or acquire a membership interest in a limited liability company unless the person lacks capacity apart from this code.

(b) A person is not required, as a condition to becoming a member of or acquiring a membership interest in a limited liability company, to:

(1) make a contribution to the company; (2) otherwise pay cash or transfer property to the company; or (3) assume an obligation to make a contribution or otherwise pay cash or transfer property to the company.

(c) If one or more persons own a membership interest in a limited liability company, the company agreement may provide for a person to be admitted to the company as a member without acquiring a membership interest in the company.

Rights and Duties of an Assignee

BOC Sec. 101.109. RIGHTS AND DUTIES OF ASSIGNEE OF MEMBERSHIP INTEREST BEFORE MEMBERSHIP

(a) A person who is assigned a membership interest in a limited liability company is entitled to:

(1) receive any allocation of income, gain, loss, deduction, credit, or a similar item that the assignor is entitled to receive to the extent the allocation of the item is assigned; (2) receive any distribution the assignor is entitled to receive to the extent the distribution is assigned; (3) require, for any proper purpose, reasonable information or a reasonable account of the transactions of the company; and (4) make, for any proper purpose, reasonable inspections of the books and records of the company.

(b) An assignee of a membership interest in a limited liability company is entitled to become a member of the company on the approval of all of the company’s members.

(c) An assignee of a membership interest in a limited liability company is not liable as a member of the company until the assignee becomes a member of the company.

BOC Sec. 101.110. RIGHTS AND LIABILITIES OF ASSIGNEE OF MEMBERSHIP INTEREST AFTER BECOMING MEMBER

(a) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is:

(1) entitled, to the extent assigned, to the same rights and powers granted or provided to a member of the company by the company agreement or this code; (2) subject to the same restrictions and liabilities placed or imposed on a member of the company by the company agreement or this code; and (3) except as provided by Subsection (b), liable for the assignor’s obligation to make contributions to the company.

(b) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is not obligated for a liability of the assignor that:

(1) the assignee did not have knowledge of on the date the assignee became a member of the company; and (2) could not be ascertained from the company agreement.

It is important to note that these statutory rights and duties are subject to “restrictions and liabilities” that may be imposed by the company agreement.

PRELIMINARY CONSIDERATIONS

The company agreement.

When considering a transfer of LLC membership, it is important to first check the company agreement (operating agreement) to determine if there are buy-sell provisions or a right-of-first-refusal clause that must be worked through before the membership interest can be assigned. company agreements often require that before a sale and assignment of a membership interest can occur, the interest must first be offered pro rata to the other members, and/or to the company itself, before a transfer may be made to a person who is not currently a member. Unless waived, such provisions may be accompanied by an offer period of (for example) 10, 30, or 60 days.

Buy-sell and right-of-first-refusal provisions exist so that existing LLC members do not unwillingly find themselves in business with someone they do not know.

Non-Member Spouses

Are non-member spouses involved? Like real estate, personal property in Texas is presumed to be community property. A frequent error in transfers of LLC membership interest is failure to secure the signature of an assignor-seller’s non-member spouse. The result is that the entire interest may not have been conveyed, at least not in Texas. This is no different than if a grantee in a deed accepts the conveyance without requiring execution by the grantor’s spouse; since community property is presumed, the transfer may be incomplete if the spouse does not sign off, at least in a pro forma capacity.

To say that omitting the signature of a non-member spouse can drive subsequent disputes would be an understatement. Even though BOC Section 101.108 provides that a non-member spouse of an assignee may not assert control over the company, the potential for awkward and potentially disastrous disruption remains. Consider the case of a withdrawing member who is contemplating divorce but has not yet revealed this to other members who may want to buy his LLC membership interest. Will the assignment get tangled up in the parties’ divorce?

As is the case in transfers of real estate, it is common for sellers of an LLC membership interest to argue that the spouse should not be required to sign the assignment because the property transferred is a business asset rather than a part of the homestead. Real estate lawyers hear such excuses all the time. Other reasons may be given (“My wife is in China”). None of these excuses should be allowed to carry any weight unless the membership interest has been lawfully converted into separate property by a written partition agreement according to Section 4.102 et seq. of the Family Code.

What will be the accounting consequences? Is timing an issue?

There will likely be accounting consequences as a result of transferring an LLC membership interest. BOC Section 101.201 partially addresses this issue, stating “The profits and losses of a limited liability company shall be allocated to each member of the company on the basis of the agreed value of the contributions made by each member, as stated in the company’s records. . . .” This rule will apply unless the members collectively agree otherwise.

Attention should be given to the effective date of the assignment, since the transfer date may have more than one level of significance. It is advisable to select an effective date or record date for the assignment that facilitates easier calculation of profits and losses, or at least does not unduly complicate that calculation.

Will the membership interest pass a due-diligence inspection?

The issues referred to above are part of a larger group of due-diligence considerations that may concern a prospective buyer, which brings us to the due-diligence checklist in the next section.

DUE DILIGENCE BY THE ASSIGNEE-BUYER

Due diligence checklist.

The following is a partial list of items that should be of concern to a prospective assignee-buyer of an LLC Membership Interest:

(1) Valuation . Most small-business assignments of LLC membership interest occur among insiders who are already acquainted with the company’s assets, liabilities, management, and operations. For potential assignees who do not fall in this category, the question of valuation arises—not just valuation of the membership interest itself but valuation of the LLC as a whole, since the two are effectively inseparable.

Several articles could be written on how to evaluate and appraise a business; suffice it to say that there should be some rational basis for the asking price that can be independently confirmed by looking at the company’s finances and assets. Certain numbers will be hard (real property and bank accounts) and others will be soft (marketing strategy, proprietary information, and value of the brand).

If assets include real properties, an evaluation of value may include appraisals by licensed appraisers or the less-formal alternative of a broker price opinion (BPO). It is impressive if a real estate investment firm has an inventory of 30 rental properties; it is less so if half the properties are drowning in deferred maintenance. Numbers guys may be satisfied with financials and a spreadsheet; traditionalists will want to physically inspect the properties as part of the due-diligence process.

(2) Good Standing . It is important to verify that the LLC and the assignor (if a registered entity) are in good standing with the secretary of state and the comptroller. If not, they do not have the legal capacity to do business, which could potentially make execution of an LLC membership assignment invalid.

(3) Core LLC Documents . A prospective assignee-buyer will want to see core LLC documents including the certificate of formation; the certificate of filing (the secretary of state’s approval); the minutes of the first organizational meeting of members along with subsequent minutes of special meetings (if any) and annual meetings; company resolutions or grants of authority; the company agreement, as currently amended or restated; and any membership certificates that may have been issued (or at least a record of same).

Also: where are the official LLC records kept? Who is responsible for keeping them, and is access readily available? Is there a company book, i.e., a binder containing these? Failure of an LLC to keep organized and complete records is a warning sign for a potential assignee. This is true regardless of and aside from any statutory requirements for LLC record keeping.

A vital object of an assignee’s investigation should be the company agreement. The company agreement is essentially a partnership agreement among LLC members, so it will directly bind a prospective assignee . Is it valid? Is it a legal document of substance or is it a three-page printout from the internet that is not even relevant to Texas? Are provisions of the company agreement compatible with the intentions and goals of the assignee? What limitations does the company agreement impose (for example, restrictions on transfer of membership interests)? Can one easily re-sell the membership interest or are there hoops to jump through?

(4) Managers . It is operationally important to determine if the LLC is member-managed or manager-managed and, if the latter, to identity of the managers. Can the assignee work with these persons? Are they professional and competent? What is their track record?

(5) Member List . LLCs are required to keep current lists of members, their respective interests in the company, and a list of all contributions to the company. BOC Sections 101.501(a)(1)-(7). Fellow members of a smaller LLC are effectively your partners in the enterprise. It is good to know to know something about them.

(6) Contracts and Agreements with Third Parties . Any agreements with third parties that affect control, management, or operation of the LLC should be examined. Examples would be contracts with vendors or a property management agreement with a third-party management company. Is the LLC currently part of a joint venture with a different group of investors?

(7) Voting Agreements . These may or may not exist. Any one or more of the members may enter into voting agreements (including but not limited to proxies and pledges) that can affect control of the entity.

(8) Federal Tax Returns. Tax returns are important to verify how the LLC is taxed and how ownership is reported to the IRS. Tax returns and LLC records should be consistent in this respect. It is a good idea for a prospective assignee to have a CPA review the company’s tax returns.

(9) Texas Annual Filings . A prospective assignee should review the franchise tax returns and public information reports (PIRs) that must be annually filed with the comptroller’s office. Do these accurately reflect the LLC’s affairs? Are they diligently prepared and timely filed?

(10) Transactional Records . What property does the LLC own? Are warranty deeds in the name of the LLC duly recorded in the real property records? How are properties managed and who is responsible for doing so? What do the files and records look like—are they orderly or are they a mess? And what about completeness? Do files for rental properties contain all essential documents like warranty deeds, notes and loan agreements, deeds of trust, leases, appraisals, maintenance records, and so on? A specific person should be responsible for keeping such records at a designated location.

(11) Salaries, Draws, and Distributions. These should be examined to discover if there is a pattern of excessive or erratic compensation to managers or distributions to members. Is there a coherent schedule or plan? Are measures in place to insure that the LLC maintains sufficient working capital to fund existing and planned operations?

(12) Bank and Depository Accounts . Current and recent copies of account statements should be examined. Look for any unusual withdrawals or capital flows. Is the LLC adequately capitalized? Does it have an adequate capital reserve? Inadequate capitalization is the number one cause of small business failure.

(13) Records of Pending, Prospective, and Resolved Legal Actions . Is the LLC being sued? Has it been sued in the past? Do the managers have a history of shoddy or deceptive dealings? Is the LLC continually receiving DTPA notice letters from attorneys? Default letters from HOAs or appraisal districts? Does the company charter get periodically revoked (and then have to be reinstated) because the LLC fails to timely file its franchise tax return or PIR? Consider meeting with the LLC’s attorney and CPA. Require that confidentiality be waived in order to get a frank assessment of the situation.

(14) Best Practices Generally . It is important to ascertain whether or not the LLC is run with diligence, integrity, and in compliance with applicable law. What is the company culture with regard to best practices? Does the LLC have a regular business attorney and CPA to advise the managers? Or do the managers wing it on a DIY basis most of the time, counting on a surging market to cover their mistakes?

(15) Reputational Evidence . A prospective assignee may want to do some digging in order to evaluate the business and personal reputations of the managers and members. What is their professional history? The personal lives of the existing members may also be relevant: are any of them getting a divorce from a spouse who might turn into a hostile party? Was one of them just expelled from the country club for non-payment of dues? An internet search is, of course, the bare minimum but it may also be prudent to consider a private investigator (These are not just for the movies).

(16) Company Performance . How have the LLC’s investments fared, particularly over the last three years? What do the company accounts show and are these numbers verifiable? Does the spreadsheet match up with the checkbook?

Trends are an important part of value analysis. Try to reduce the LLC’s quarterly and annual results to line graphs for income and costs. Which way are these factors trending?

(17) Business Plan . Do the managers and members have specific goals or is their strategy more built around finding targets of investment opportunity? Is their plan realistic or pie-in-the-sky? What will the company likely look like in three years? Five years? Is a change in direction required?

The importance of thorough due diligence conducted during an adequate inspection period cannot be understated. Knowledge, as they say, is power. If one must sign a confidentiality or non-disclosure agreement in order to get relevant information on the LLC and its members, then that is what should be done.

CLAUSES AND PROVISIONS OF THE ASSIGNMENT

Assignments of interest generally.

All assignments of interest (regardless of the interest assigned) include—or should include—certain common clauses and provisions. After identifying the parties and the exact interest to be assigned, the document should state the consideration being paid; whether the consideration is nominal, cash, or a financed amount (secured or unsecured); recite both transfer and acceptance language; state whether the assignment is made entirely “as is” or instead with representations and warranties; state whether the assignee will have any recourse in the event certain post-assignment conditions are not met and identify the recourse mechanism; recite covenants and agreements of both parties that will result in the implementation of the transfer along with remedies for default if these measures are not carried out; a mutual indemnity clause; any special provisions agreed to by the parties; an alternative dispute resolution (mandatory mediation) clause; and conclude with various miscellaneous provisions that identify applicable law and venue, advise all parties to consult an attorney, set an effective date, and so forth.

A “Consent of Non-Member Spouses” should be appended if applicable. Exhibits to the assignment (pertaining to company assets and liabilities, for instance) may also be needed.

Representations and Warranties

An assignment may include a full set of representations and warranties (“reps and warranties”), limited reps and warranties, or no reps and warranties at all—in which case the assignment is made entirely as is and (in such cases) is almost always without recourse, meaning there is no defined remedy against the assignor-seller if the LLC membership goes sour for some reason. Representations and warranties may be made by assignor, assignee, both, or neither.

Core reps and warranties are basic assurances to which no reasonable party should object. Reps and warranties can get much more detailed and extensive from there. If attorneys are involved, the reps and warranties section of a contract may be heavily negotiated.

The assignor-seller’s goal is to minimize post-closing liability by transferring the membership interest “as is” to the maximum extent by including only a minimum number of reps and warranties. It should be noted that inclusion of the above-mentioned core items does not impair the ability of an assignor to assign an interest “as is.” For this reason, it is always somewhat suspicious when an assignor refuses to give any reps or warranties at all.

The assignee-buyer instead prefers a longer and more specific list of reps and warranties on the part of the assignor-seller. One of the goals of the assignee in the due diligence process is to ascertain, to the greatest extent practicable, the accuracy of reps and warranties that have been or will be made by the seller.

Examples of Reps and Warranties

Examples of basic reps and warranties would include assurances that each party, if a registered entity, is in good standing; the party has power and authority to enter into the transaction without joinder of others; and there exists no condition or circumstance that would render the transaction illegal or invalid or place the party in breach of an existing contract. Additional near-core items would include assurances that each party has performed adequate due diligence and has consulted an attorney before signing.

Both assignor and assignee should also want to include a statement that neither party is making or relying upon any reps or warranties that are not expressly set forth in the assignment. The goal is to prevent anyone from assuming anything or alleging that certain assurances were oral or implied.

Reps and Warranties: Duration and Default

Once reps and warranties are negotiated, it must be determined how long they will survive closing—if at all. 30 days? 90 days? Indefinitely?

A final issue in this area has to do with remedies for default in the event of breach. Attorneys frequently include a clause requiring that such default be a material (rather than a trivial) breach in order to be legally actionable. The issue is then raised, how does one define material ? One method is to impose a monetary floor, e.g., by confining assignor liability to issues that result in a loss or cost of (say) $10,000 or more.

Assignments Made “As Is”

As noted, an assignor-seller can include basic (limited) representations and warranties and still convey an LLC membership interest “as is.” Many business persons, including lawyers, do not adequately understand this. For example, stating that one has sufficient power and authority to enter into a transaction does not suggest any representation or warranty as to the item being conveyed. It is a core representation that should probably be included in every assignment.

The key to protecting the assignor is a thorough “as is” clause. Just as is true with real estate conveyances, the more thorough and extensive the “as is” clause, the better. One-liners will generally not do. This is particularly true if there have been oral or email negotiations over a period of weeks or months. The goal should be not only to convey the interest “as is” but also to entirely exclude any statement that cannot be expressly found in writing within the four corners of the assignment instrument.

Covenants and Agreements of the Parties

Covenants and agreements address the legal obligations of the parties going forward—specifically what actions they are required to take in order to implement the assignment. Covenants and agreements of the assignor-seller would include, for example, an obligation to promptly endorse and deliver to the assignee-buyer any certificates evidencing the membership interest in question.

The assignee-buyer should also covenant and agree to abide by the company agreement and other governing documents. Since Texas is a community property state, the spouse of a new assignee should also be asked to sign off on this commitment. The best practice is to secure the signatures of both the new assignee and any non-member spouse not only on the assignment but on the company agreement itself.

Additional covenants and agreements of the parties may be (and usually are) included. This is another area that is subject to extensive negotiation and customization to the circumstances.

Recourse by Assignee upon Occurrence of Specified Conditions

The option for some form of limited or conditional recourse may be included in any assignment of interest. In the case of an LLC membership interest, the assignment could provide that, upon occurrence of certain conditions, the assignee would have the right to re-convey the membership interest and receive return of all or part of the consideration. Examples of such conditions would be any adverse event—a negative outcome in a pending lawsuit or zoning proceeding; condemnation of certain LLC property; failure of a pending joint venture; or the discovery that any representations or warranties of assignor were materially false or deceptive when made. The availability of a recourse mechanism is generally time-limited, say for 90 days after closing. Some assignments might also refer to this recourse mechanism as a right to rescind.

In any assignment instrument, the alternative to full or limited recourse is no recourse at all by the assignee-buyer. For example, real estate notes are often sold without (either full or limited) recourse against the assignor-seller in the event that the borrower on the note defaults. In such a case, absent any provision for recourse, the assignee-buyer of the note would then be in possession of a non-performing asset. The remedy is not against the assignor, but to pursue the debtor directly.

Mutual Indemnity

Ideally, and unless there are special circumstances, the assignor and assignee should release and indemnify one another for LLC-related actions, claims, liabilities, and obligations occurring before and after (respectively) the effective date of the assignment. Indemnity provisions are useful and worthwhile, but one needs to clearly understand their limitations. They are not a covenant not to sue.

Non-Compete and Non-Disclosure Provisions

Sale by a departing LLC member to another member may raise concerns that the departing member will utilize proprietary and confidential information in order to compete with the company in the same line of business within the same geographical area. Agreements regarding intellectual property and non-competition are typically stand-alone full-length contracts; nevertheless, it is possible to include compact and enforceable IP and non-compete provisions that fit smoothly and purposefully into a sale and assignment of LLC membership interest. Failing to do this can be an error with serious consequences.

Corporate Transparency Act and FinCEN Reporting

The Financial Crimes Enforcement Network (FinCEN), an arm of the Treasury Department, is charged with rulemaking to enforce the Corporate Transparency Act which was passed in 2021. The CTA contains sweeping requirements regarding the reporting of beneficial interests in LLCs and corporations.

To the extent that a sale and assignment of LLC membership interest constitutes a change in beneficial ownership, then a report to FinCEN will likely be required. The assignment instrument should expressly address the applicability of the CTA and designate which party (usually the assignee) will be responsible for filing a supplemental FinCEN report.

If the burden of FinCEN reporting falls on the assignee, then the assignor may want to include an indemnity clause for added protection. The assignor may also want to limit liability for past FinCEN reporting.

Alternative Dispute Resolution: Mandatory Mediation

Since we live in a litigation nation, it is highly advisable to include a provision that requires mediation prior to commencing legal action. Approximately 80% of mediations result in a settlement. In other words, mediation works, at least most of the time.

A mediation clause should require the conflicting parties to first confer in good faith and attempt to resolve the dispute in a way that accommodates the legitimate interests of both sides. If agreement is reached, it should be reduced to a signed writing and implemented. If not, the parties should then agree to formally mediate the dispute before a certified mediator prior to resorting to litigation or filing any complaint with a governmental or administrative agency.

A mandatory mediation provision should also state where the mediation will be held (which city or county) and for how long (mediations are usually either a half-day or a full day). Each party should commit to bearing its own fees and costs until the mediation is concluded.

Special Provisions and Stipulations

It is useful to include a catch-all special provisions section that allows room for terms that may be specific to the subject transaction and its unique circumstances. These special agreements and provisions frequently arise and this is the place to insert them.

Stipulations are a slightly different concept. For example, an assignment of LLC membership interest may involve a new list of members. It may also require a re-allocation of percentage interests among the remaining members. So it may be beneficial to include a stipulation that after conclusion of the assignment, the new membership list (with accompanying revised percentage interests) will be as described in Exhibit A. This usefully erases any doubt as to the overall final outcome of the transaction.

As previously noted, a special meeting of members is an important companion document to the assignment of LLC membership interest. The meeting, signed by all affected parties, can not only approve the assignment but mention issues such as record date, a general ratification of the assignment and the new member list, and also authorize issuance of new membership certificates.

No Reliance and No Representation Clauses

The assignor-seller (in particular) may want to make it clear that the assignment is made and accepted by the assignee-buyer only after a proper due-diligence investigation and without reliance on any statements or assurances (especially oral ones) made by the assignor-seller or its agents.

Wrap-Up Provision Relating to Execution and Delivery of Documents and Records

It would be an oversight if an assignment of LLC membership interest failed to mention possession and delivery of company books and records, an omission that has resulted in more than a few lawsuits. An agreement to execute and deliver such additional and further documents as may be reasonably necessary to effectuate the purposes of the assignment should cover and include any affected LLC records, including the company book and accounting records. These may need to be transferred to a new assignee-owner or returned to the assignor-seller after due-diligence inspection.

Clients often do not understand why a sale and assignment of LLC membership interest cannot be a simple, one-page document. It is hoped that this article will clarify the answer to that question.

Information in this article is provided for general informational and educational purposes only and is not offered as legal advice upon which anyone may rely. The law changes. No attorney-client relationship is created by the offering of this article. This firm does not represent you unless and until it is expressly retained in writing to do so. Legal counsel relating to your individual needs and circumstances is advisable before taking any action that has legal consequences. Consult your tax advisor as well.

Copyright © 2024 by David J. Willis. All rights reserved. Mr. Willis is board certified in both residential and commercial real estate law by the Texas Board of Legal Specialization. More information is available at his website, www.LoneStarLandLaw.com .

Share this entry

- Share on Facebook

- Share on LinkedIn

- Share on Reddit

- Share by Mail

Consumer Notices:

State Bar of Texas Notice to Clients TREC Consumer Protection Notice TREC Information about Brokerage Services (IABS) Policies Applicable to All Cases and Clients Policies Regarding Copying of Website Content

Office Meeting Address:

Lucid Suites at the Galleria 5718 Westheimer, Suite 1000 (Westheimer at Bering Drive) Houston, TX 77057

Hours: 8 am – 6pm M-F Phone: 713-621-3100 Fax: 832-201-5321 Contact Us Vacation Schedule

© 2024 David J. Willis – LoneStarLandLaw.com

Design and Marketing – Advanced Web Site Publishing

Transferring Assets to an LLC: Everything You Need to Know

Transferring assets to an LLC is a fairly simple process. It's much like transferring ownership to another person. 3 min read updated on January 01, 2024

Transferring assets to an LLC is a fairly simple process. Because LLCs (limited liability companies) are viewed as entities that can own property just like individuals, transferring assets to an LLC is much like transferring ownership to another person.

How to Transfer Assets to an LLC

LLCs can acquire assets just like corporations and limited partnerships can. There are some differences between these three types of business structures, but, with few exceptions, they have property ownership rights in common. Corporations have officers and directors, limited partnerships have limited and general partners, and LLCs have members and managers.

Assets with titles will require a bill of sale and new title work filed. You'll also need to refile for deeds of trust at the DMV in the appropriate county. Other, simpler items without titles, like cash just require a bill of sale.

Steps for Transferring Assets to an LLC

First, you'll need to hire an attorney to draft a deed that conveys the property to the LLC from the selling party. All LLCs are legally allowed to purchase and sell property in various forms, including real estate. Some LLCs may not be able to own property, but that's only if their operating agreement prohibits it.

In the event that the LLC is also taking over the insurance coverage for the property, the insurance company might need you to provide copies of the LLC's formation documents and a certificate of consent signed by the LLC's members. This will prove that all of the LLC members are on board with the acquisition of the asset.

Next, prepare a bill of sale. If an LLC is purchasing personal assets from another business, the bill of sale should be drafted by the selling party and given to the LLC. You'll want to include the following information in a bill of sale:

- An itemized list of everything transferred in the sale (equipment, vehicles, etc.)

- Date of sale

Other specific rules might apply depending on the type of assets being transferred. Create a checklist to make sure you don't miss any requirements.

After drafting a bill of sale, you'll need to obtain a leasehold interest on the asset if it's real estate property. If tenant rights are being assigned or transferred to another party, you'll need consent from the owner of the property.

If you're looking to convert your partnership into an LLC by transferring your assets to it, you'll want to complete the process by filing the forms required for this change by the state in which you plan to conduct business. Some states will automatically transfer all of the partnership's assets to the LLC without requiring you to do all of this leg work. You'll still want to make sure that all of the appropriate documents are filed with the county records office.

What Is a Fraudulent Transfer of Assets?

Individuals who are not defaulting on any loans or agreements with normal debts should have no problem conducting an asset transfer to an LLC. But, if an individual tries to transfer assets to get out of paying debts or following through on contracts, this could be considered a fraudulent transfer of assets.

As long as the assets are transferred for legitimate reasons, it's likely that the transfer will be fine in the eyes of the courts. Many business owners are simply restructuring their company or starting a new business . These are good reasons to transfer assets. However, some business owners have tried to transfer assets in an attempt to defraud others. The best way to make sure that your transfer goes off without a hitch and is viewed as legal is to hire an experienced business attorney to help you handle the process.

Thorough documentation is another great way to avoid any issues. Get any bills of sale notarized with a certified date of sale. This will ensure that any future questions regarding the legitimacy or intentions of the sale can be clearly answered. Notaries are easy to find and the notarization process is relatively easy. You'll be thankful that you covered all of your bases if an issue ever comes up in the future.

If you need help with transferring assets to an LLC, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Transferring Property Into a Company

- How to Transfer Property Title to LLC

- Transferring Rental Property to LLC

- Should I Put My Investment Property in an LLC

- What Does Sale of Assets Mean

- How to Transfer LLC Membership Interest

- Sale of Membership Interest in LLC Form

- Asset Sale Agreement

- Sale of Corporation

- Investment Property LLC

Partnership

Sole proprietorship, limited partnership, compare businesses, employee rights, osha regulations, labor hours, personal & family, child custody & support, guardianship, incarceration, civil and misdemeanors, legal separation, real estate law, tax, licenses & permits, business licenses, wills & trusts, power of attorney, last will & testament, living trust, living will.

- Share Tweet Email Print

How to Transfer Assets to an LLC

By Marie Murdock

- How to Transfer a Deed to an LLC

Transferring assets to an LLC, or limited liability company, is not as difficult as you may think. Even though there may be legal or procedural differences between them, an LLC is an entity that may acquire property in the same manner as a corporation or limited partnership. A corporation consists of officers and a board of directions, a limited partnership consists of general and limited partners, while a limited liability company is comprised of a member or members and sometimes a manager. The method for transferring assets into the various entities is essentially the same.

Prepare or have your attorney prepare a deed conveying real property from the seller to the limited liability company. Unless prohibited by its formation documents, a limited liability company may buy and sell real estate. If the LLC is acquiring title insurance , the title insurance company may require copies of all organizational documents of the company, as well as a certificate or resolution signed by all members of the LLC reflecting their consent to the acquisition of the property by the company. Read More: How to Convert a Partnership Into an LLC

Convey some types of personal property with a bill of sale. If the LLC is buying the personal property assets of a business, a bill of sale may be executed from the seller to the LLC. Bills of sale may convey equipment, rights to the name of the business, automobiles or any other items of personal property. In the case of automobiles, the certificate of title must also be executed by the seller conveying the vehicle to the LLC, and the LLC must register the vehicle in its name. There may be other applicable rules and regulations depending on the type of property.

Acquire a leasehold interest in property. If the asset being acquired is the lease of a building, then an assignment of leasehold interest may be executed from the current lessee, or tenant, to the LLC. Assigning or transferring a tenant's rights in a lease from one party to another will often require the consent of the original lessor, or person who actually owns the building being leased.

Convert your partnership to an LLC. In the event you are one of the partners in a partnership and you, along with other partners, desire to form an LLC, some states will allow you to file forms converting the partnership to an LLC. Depending on the state, conversion may mean that all assets of the partnership now belong to the LLC without the necessity of transferring a title. Appropriate conversion documents, however, should be filed in the county records office to ensure that the transfer of any real estate formerly owned by the partnership will be located in a search of the public records .

The services of an attorney may be required to prepare legal documents of transfer.

Seek the advice of an accountant to discuss any tax issues involved when acquiring property in an LLC. The LLC to which you transfer assets must be formed according to laws of the state where the LLC is located.

- First American: Who Signs the Papers at the Closing Table

- SubmitYourArticle: A Practical Guide to Assigning and Subletting a Commercial Lease

- Limited Liability Company Center: Converting a General Partnership to a Limited Liability Company

Marie Murdock has been employed in the legal and title insurance industries for over 25 years. Murdock was first published in print in 1979 and has been writing online articles since mid-2010. Her articles have appeared on LegalZoom and various other websites.

Related Articles

- Difference Between Dissolution & Winding Up

- How to Transfer Property to an LLC

- What Is Legal Proof of Property Ownership?

- Partners/ Vendors

- Customers/Partners

- Services Subscriptions

- Account Settings

- File Cabinet

- Intellectual Property

- Help Center

What should you think about before assigning IP or assets from one entity to another?

There are several legal and tax implications that may get triggered when you assign ip or assets..

An assignment or transfer of assets, rights, or contracts may occur in several scenarios, including:

- Assigning all or part of a company's assets, technology and intellectual property to a different entity as part of a corporate restructuring;

- Assigning all or part of a company's assets, technology and intellectual property to a different entity as part of an "asset sale" acquisition;

- Assigning just a few contracts or intellectual property assets to another entity in a spin-out transaction, or just to change who has the right/obligation to collect on or fulfill those contracts/rights; or

- Assigning the obligation to fulfill debts to another entity when one entity decides to wind-down operations.

So, what kind of legal implications should you keep in mind before going down this road? Consider the following:

- Some entities may require board or managerial consent before assigning or transferring assets or intellectual property, especially if it is a major assignment (such as a corporate restructuring, acquisition or spin-out transaction).

- Some contracts may have Non-Assignment provisions that would prohibit transfer or assignment. In fact, one of the biggest pieces of "legal due diligence" that the acquiring party will engage in (and also one of the biggest pieces of legal expense incurred) is reviewing assigned contracts to make sure they can be assigned. If there are Non-Assignment provisions in any contracts, then you need to execute a "Third-Party Consent" with the other parties to such contracts to approve the assignment.

- If the contracts or intellectual property being assigned have any value associated with them, then an assignment of those assets may trigger taxable gain for the recipient, depending on what the consideration is.

- Receiving consideration for the assignment of any assets (including intellectual property) may trigger taxable gain for the assignor, depending on the tax basis of those assets.

- Companies should always work with tax and accounting advisors during any asset or IP assignment to make sure assigned assets have the proper accounting allocations, otherwise end-of-year bookkeeping and taxes can become much more complicated.

Because of all of this, Savvi recommends that anybody going through any sort of IP or asset transfer or assignment should talk with legal counsel and tax advisors to understand all of the implications of this sort of transaction.

Related Articles:

- Assignment and Assumption Agreement Workflow

Savvi Technologies, Inc. is not an attorney or a law firm, and can only provide self-help services at your specific direction. Do not rely on any documents or information from Savvi without consulting an attorney. Savvi may partner with or refer clients to licensed attorneys, but such referral does not constitute an attorney-client relationship until the attorney is officially engaged by the client.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

How can I transfer assets from one of my corporations to another?

By Ryan Himmel • Sep 16, 2010

Opinions expressed by Entrepreneur contributors are their own.

Head of Financial Partnerships, Xero Americas

Ryan Himmel is a CPA and financial technology executive who has dedicated over a decade of his work toward providing solutions to help accountants and small-business owners better run their firms. Himmel currently leads financial partnerships in the Americas for Xero.

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- James Clear Explains Why the 'Two Minute Rule' Is the Key to Long-Term Habit Building

- They Designed One Simple Product With a 'Focus on Human Health' — and Made $40 Million Last Year

- Lock Younger Americans Don't Necessarily Want to Retire in Florida — and the 2 Affordable States at the Top of Their List Might Surprise You

- I Tried Airchat , the Hottest New Social Media App in Silicon Valley — Here's How It Works

- Lock This Side Hustle Is Helping Farmers Earn Up to $60,000 a Year While Connecting Outdoor Lovers With Untouched Wilderness

- Are Franchises in the Clear After the Expanded Joint Employer Rule Was Struck Down? Industry Experts Answer 2 Critical Questions About What's Next.

Most Popular Red Arrow

Her 'crude prototype' and $50 craigslist purchase launched a side hustle that hit $1 million in sales — now the business generates up to $20 million a year.

Elle Rowley experienced a "surge of creative inspiration" after she had her first baby in 2009 — and it wasn't long before she landed on a great idea.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Franchising Is Not For Everyone. Explore These Lucrative Alternatives to Expand Your Business.

Not every business can be franchised, nor should it. While franchising can be the right growth vehicle for someone with an established brand and proven concept that's ripe for growth, there are other options available for business owners.

There Are 4 Types of Managers. Take This Quiz to Find Out Which You Are, and If You're In the Right Line of Work.

Knowing your leadership style, and whether it suits the work you're doing and the team you have, is the first step in living up to your leadership potential.

Passengers Are Now Entitled to a Full Cash Refund for Canceled Flights, 'Significant' Delays

The U.S. Department of Transportation announced new rules for commercial passengers on Wednesday.

The TikTok Ban Bill Has Been Signed — Here's How Long ByteDance Has to Sell, and Why TikTok Is Preparing for a Legal Battle

TikTok has nine months to cut ties with its China-based parent company ByteDance.