- St. Mary's University Institutional Repository

- Thesis and Dissertation

- Masters Program

- Accounting and Finance

| Title: | THE EFFECT OF INCOME TAX ON SMALL BUSINESSES: THE CASE OF ADDIS KETEMA |

| Authors: | |

| Issue Date: | Jun-2023 |

| Publisher: | ST. MARY’S UNIVERSITY |

| Abstract: | This thesis examines the effect of income tax on small businesses based in mainly in Addis Ketema sub city, Addis Ababa, Ethiopia. The research is based on a comprehensive review of literature on income tax and small businesses in Ethiopia, including academic articles, government reports, and policy documents. The findings suggest that income tax has a significant effect on the profitability and growth of small businesses in Addis Ababa. Specifically, the study shows that high tax rates and complex tax regulations can discourage entrepreneurship and reduce the willingness of small business owners to invest in their ventures. The research also finds that tax compliance costs can be a significant burden for small businesses, particularly for those with limited resources and inadequate access to information and support. The study also highlights the need for policymakers in Ethiopia to design tax policies that promote entrepreneurship and support the growth of small businesses. This includes simplifying tax regulations and procedures, providing more accessible and affordable tax services, and offering targeted tax incentives to encourage investment and innovation. The research contributes to the understanding of the effect of income tax on small businesses in Addis Ababa and provides recommendations for improving the tax system for these critical engines of economic growth. |

| URI: | |

| Appears in Collections: | |

| File | Description | Size | Format | |

|---|---|---|---|---|

| 1.28 MB | Adobe PDF |

Items in DSpace are protected by copyright, with all rights reserved, unless otherwise indicated.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

1Full Thesis -Mohamed Burci- THE ROLE OF SMALL BUSINESS IN ECONOMIC GROWTH IN PUNTLAND-libre 11

Related Papers

Scholarly Journal of Arts & Humanities

Dama Academic Scholarly & Scientific Research Society

This study, the role of small business in economic growth in Puntland, was undertaken to find out the role of small business in Puntland and its impact on the economic growth of Puntland. Small Enterprises are accepted globally as a tool for empowering the citizenry and economic growth. It has been associated with rapid economic growth of the well developed countries across the world. In Somalia since the government was collapsing in 1992 efforts have been made by the citizens of the country to establish their own small scale businesses and therefore step by step they succeeded their dreams and established lot of small businesses, employed lots of people invented new buildings and infrastructure and later on established companies. A total of 90 small business owners were randomly selected from the cities; Bosaso, Galkaio and Garowe. A questionnaire was constructed and distributed to the selected people. The responses were collected and analyzed using Excel sheet 2013 for analytical tool.

Krzysztof Wach

The objective of this chapter is to present and discuss various criteria enabling to define the size of the business unit, distinguishing, micro, small, medium-sized and large enterprises, as well as to outline the importance and role of the SME sector in the modern economy. The chapter is based on the literature review and its critics, what is else, statistical data were used to illustrate the elaborated themes.

Jelena Mićić

Small enterprises, within the market economy, are initiators of economic development and an important part of every national economy. Due to the nature of private property, entrepreneurial spirit, flexibility and adaptability, as well as their potential to react to the challenges and turbulences in the environment, small businesses give a special contribution to economic growth and higher employment. Entrepreneurship and small business represent a significant and fundamental source for creation of new jobs and expansion of new business practices by providing a significant contribution to economic growth. This applies both to small businesses in the Republic of Srpska and the ones that are located anywhere in the world. The role of small enterprises is especially important in transition countries. During the global economic crisis, small businesses have, both in developed economies, and in the Republic of Srpska and BiH as a whole, proved to be resilient, although this period was cha...

RePEc: Research Papers in Economics

Kelly D Edmiston

Djamel Ouinas

Journal of Management and Corporate Governance

Rasak Bamidele

ABSTRACT The emergence of small and medium scale enterprises (SMEs) is a major catalyst and a key success factor for the development, growth and sustenance of the Nigerian economy. Most government and business circles have come to recognize the importance of small and medium scale enterprises (SMEs) and have consequently agreed that their growth constitutes one of the corner stones of economic developmen., It is on the basis of this that the study of financing of small and medium scale enterprises (SMEs) in Amuwo Odofin Local Government of Lagos state is being embarked upon. The study also examines how government and other agencies finance SMEs in Amuwo Odofin Local Government area of Lagos State.. The study was guided by network theory. The major concern of the theory is the objective pattern of ties linking the agencies, individual and group of the society. The agencies in this study include banks, cooperative societies, and government, among others.Quatitative and qualitative method was used to collect data for the study. Fifty(50) samples of respondents were selected from the Local Government Area. The data gathered was analyzed using descriptive statistics such as frequency distribution, while the qualitative data was subjected to content and descriptive analysis. Key words: Small and Medium Scale Enterprises, micro and macro structures, agencies and Economy development.

Hazelyn Maranan

This term paper, which is entitled “The Significance of Micro and Small Enterprises in our Domestic Economy”, discusses the impact that small businesses do to the economy of the Philippines. It will cover both the positive and negative impacts of Micro and Small Enterprises to weigh its actual significance to the domestic economy. This paper will explain whether or not small businesses have a small or big contribution in developing the local economy, and to suggest courses of actions in stimulating economic growth. Through this, Filipinos will know if it’s good to invest, support and encourage small businesses.

Brychan Thomas

The International Journal of Business & Management

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

African Economic Research Consortium, …

musty ibrahim

Emilio Zevallos

Mohammed Dauda

Journal of Small Business …

Shameem Ali

Zvinavashe Hilary

Richard Asante

Kibere Gebeyehu

IAEME Publication

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Science News

Epidurals may lower risk of complications after birth, study hints

By Miriam Bergeret published 8 June 24

Getting an epidural during labor was linked to a 35% reduction in severe maternal health complications in a new study, with even higher protective effects in people with preterm births.

Viking Age 'treasure' discovered by metal detectorist on Isle of Man

By Jennifer Nalewicki published 8 June 24

The silver ingot would have been used during the Viking Age in exchange for goods and services.

Pacific Hagfish: The ancient deep-sea creature that can can choke a shark by spewing slime

By Melissa Hobson published 8 June 24

This eel-like fish lives on the seabed over 300 feet below the surface where it feasts on dead animals and protects itself from attack using a suffocating slime.

What could aliens look like?

By Sarah Wells published 8 June 24

The search for alien life is one of humanity's greatest missions, but it may look nothing like anything we've seen on Earth.

Rare fungal STI spotted in US for the 1st time

By Nicoletta Lanese published 7 June 24

A difficult-to-treat form of ringworm can spread via sex and has now been seen in the U.S.

James Webb telescope finds carbon at the dawn of the universe, challenging our understanding of when life could have emerged

By Ben Turner published 7 June 24

The James Webb Space Telescope has found carbon in a galaxy just 350 million years after the Big Bang. That could mean life began much earlier too, a new study argues.

Neanderthals and humans interbred 47,000 years ago for nearly 7,000 years, research suggests

By Charles Q. Choi published 7 June 24

DNA from prehistoric and modern-day people suggests that humans interbred with Neanderthals 47,000 years ago for a period lasting 6,800 years.

Epigenetics linked to the maximum life spans of mammals — including us

By Kamal Nahas last updated 7 June 24

Some chemical tags on DNA, called epigenetic factors, that are present at a young age can affect the maximum life spans of mammal species.

Salmonella outbreak tied to cucumbers sickens 162

A company that ships whole cucumbers from Florida has recalled potentially contaminated produce.

'The difference between alarming and catastrophic': Cascadia megafault has 1 especially deadly section, new map reveals

By Stephanie Pappas published 7 June 24

The Cascadia subduction zone is more complex than researchers previously knew. The new finding could help scientists better understand the risk from future earthquakes.

Explosive 'devil comet' grows seemingly impossible 2nd tail after close flyby of Earth — but it's not what it seems

By Harry Baker published 7 June 24

Comet 12P/Pons-Brooks, also known as the devil comet, recently made its closest approach to Earth for more than 70 years. During this close encounter, astrophotographers spotted a seemingly impossible "anti-tail" coming off the comet thanks to an extremely rare optical illusion.

New contest lets you name Earth's 1st 'quasi-moon' for free. Here's how to enter.

A new public competition will allow a lucky astronomy enthusiast to name one of Earth's tiny "quasi-moons." Here's everything you need to know about how to enter the competition for free.

Shigir Idol: World's oldest wood sculpture has mysterious carved faces and once stood 17 feet tall

By Jennifer Nalewicki published 7 June 24

Crafted out of the trunk of a larch tree, this towering figure features several human faces.

Bear vs tiger: Watch 2 of nature's heavyweights face off in the wild in India

By Sascha Pare published 7 June 24

Visitors at a tiger reserve in India recently filmed an encounter between a tigress and a bear, with the bear charging after the tigress but deciding at the last minute it was not worth the fight.

Arctic 'zombie fires' rising from the dead could unleash vicious cycle of warming

By Sebastian Wieczorek, Eoin O'Sullivan, Kieran Mulchrone published 7 June 24

Zombie fires that burn underground over winter may be a case of climate change-driven spontaneous combustion, new research reveals.

Vivid nightmares precede lupus diagnosis by over a year in some patients

By Michael Schubert published 7 June 24

Some lupus patients report having nightmares just before a flare, and of these, some report starting to have bad dreams long before their actual lupus diagnosis.

Quantum internet breakthrough after 'quantum data' transmitted through standard fiber optic cable for 1st time

By Drew Turney published 7 June 24

The study used a specialized photon source to transmit, store and retrieve quantum data, a major component of quantum data transmission.

Blood Falls: Antarctica's crimson waterfall forged from an ancient hidden heart

Iron-rich waters buried beneath Taylor Glacier in East Antarctica are sporadically released in what looks like a bloody mess — but the so-called Blood Falls aren't as gruesome as they first appear and sound.

Giant viruses discovered living in Greenland's dark ice and red snow

By Patrick Pester published 7 June 24

The giant viruses might infect algae that are increasing Greenland's ice melt. These viruses could help kill off the damaging algal blooms, helping to reduce some of the impacts of climate change.

'Jackpot' of 2,000 early-medieval coins discovered by hiker in Czech Republic

By Tom Metcalfe published 7 June 24

The coins must have amounted to a huge sum when they were buried about 900 years ago.

- View Archive

Sign up for the Live Science daily newsletter now

Get the world’s most fascinating discoveries delivered straight to your inbox.

- 2 32 of the loudest animals on Earth

- 3 100-foot 'walking tree' in New Zealand looks like an Ent from Lord of the Rings — and is the lone survivor of a lost forest

- 4 Shigir Idol: World's oldest wood sculpture has mysterious carved faces and once stood 17 feet tall

- 5 A telescope on Earth just took an unbelievable image of Jupiter's moon

- 2 Shigir Idol: World's oldest wood sculpture has mysterious carved faces and once stood 17 feet tall

- 3 What is the 3-body problem, and is it really unsolvable?

- 4 Razor-thin silk 'dampens noise by 75%' — could be game-changer for sound-proofing homes and offices

- 5 Neanderthals and humans interbred 47,000 years ago for nearly 7,000 years, research suggests

Our experts bring you unbiased investing platform reviews, answer readers' most pressing questions, and provide the latest investing news. From cryptocurrency to stocks, compare the best options for you.

The best products and services

Our experts did the research so you don’t have to., best investment apps, best stock trading apps, best online brokers, best real estate investing apps, best robo-advisors, best online financial advisors, best roth iras, best gold iras, best custodial accounts, get the answers you need..

- Are we in a recession? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

- What is an NFT? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

- What is the prime rate? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

- What is a brokerage account? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

- What is cryptocurrency? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

- What are I bonds? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

- What is a financial consultant? Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

Expert reviews

Pros, cons, and everything in between., popular articles, see our readers’ top picks..

Latest coverage

We have money on our minds..

International Flavors & Fragrances: Acquisitions Not Yet Pulling Weight

- International Flavors & Fragrances operates in the specialty chemicals industry.

- IFF has four divisions: Nourish, Health and Biosciences, Sent, and Pharmaceutical Solutions.

- The company's financials show a small investment runway and limited opportunities for capital appreciation, but it offers steady dividends for income-oriented investors.

Matteo Colombo

Investment Summary

Avid readers of this channel will know that we have been scouring the basic materials sector for 1) well-priced compounders, with 2) mouth-watering economics, and 3) throwing off piles of free cash flow. So far, there have been several names that fit this mould.

It is not all rainbows and butterflies, however. Finding companies that fit this strict economic criteria is tremendously difficult and compounded by the fact that, oftentimes, all of a business's "good news" is fully embedded into current market expectations.

In the search for selective opportunities in the material sector, we turn to the specialty chemicals industry. Here, International Flavors & Fragrances Inc. ( NYSE: IFF ) has become a potential candidate for the equity bucket.

Tradingview via Seeking Alpha

The question is whether IFF is an investment-grade company at the time of writing, and, if the price/value equation is skewed to the upside. Based on the facts pattern presented here, I do not believe the company is a compelling buy on a risk/reward basis, compared to similar opportunities with a similar level of risk. In that regard, I rate the company a hold for reasons stated here today.

Background fundamentals

IFF is in the business of manufacturing and distributing ingredients for consumer health and cosmetic products. Its sales footprint is global. It completed a merger with the Nutrition & Biosciences ("N&B") segment of chemical giant DuPont in 2018. This was seconded by the acquisition of Frutarom Industries in the same year.

The company serves the food and beverage markets alongside the health, personal care, and wellness markets. It also has niche exposure to enzymes, cultures, taste texture, additives, and probiotics, making it a highly specialized operator in my view.

It operates across four segments, namely:

Nourish - this is the company's natural ingredient line, which sells to the food & beverage, dairy, and bakery markets. You can think of things like flavours and ingredients as the key outcome for its customers here.

Health and biosciences - this segment produces a portfolio of enzymes, food cultures and probiotics for the food and beverage industry. These end up in products like fermented foods, yoghurts, cheeses, and so forth.

Scent- The scent business produces fragrances and fragrance compounds, which are then used as ingredients in "the world's finest perfumes and best-known household and personal care products, " per the 2023 10-K . A part of this business was the cosmetic ingredient operation, which management divested from as of April 2024.

Pharmaceutical solutions - finally, the pharmaceutical solutions business is in the operation of seaweed-based pharmaceutical excipients . These are used to unlock the delivery of pharmaceutical compounds - for example, in the use of extended-release formulations.

Founded in 1909, the company has not created substantial value for its shareholders over the last 10 years or so, beyond its impressive dividend growth. I am not surprised to see the company of this age trading sideways. Moreover, companies in this maturity cycle can still have mouthwatering economics.

In 2014, the company produced around $3.1 billion in sales on $601 million in operating income. It had stretched this to $$3.9 billion in revenue by 2018, on roughly $607 million in operating earnings. After completing the N&B merger, the top line has expanded substantially. Operating earnings haven't. For instance, in 2021, sales were $11.7 billion - almost 3x that in 2018 - but this was against operating earnings of $660 million, in-line. Last year, it printed $11.5 billion at the top line, on operating earnings of $612 million. Based on this record, I question if the restructuring has added economic value for the company's investors.

Q1 2024 financials

1. key insights.

The company put up $3 billion in quarterly revenues in Q1 2024 , down 400 basis points year over year. It pulled this to adj. EBITDA of $503 million, down 15%. This compressed operating margins by 300 basis points. Despite the pullback, management retained full-year guidance and is projecting $10.8 billion to $11.1 billion in revenues this year. It also suggests that product volumes will lift 300 basis points at the upper end of the range, coupled with a circle 1% lift in pricing. This result also bakes in a 3% to 4% forex headwind. Management is eyeing $2.1 billion in adjusted pre-tax earnings on this.

As to the divisional breakdown, the nourish segment clipped 3% sales growth to $1.5 billion on adj. operating income of $216 million (up 13%). Health and biosciences revenues grew 6% to $531 million, lifting pre-tax earnings by 21% to around $160 million. This was underscored by both volume and productivity gains.

Meanwhile, the scent and pharmaceutical solutions were up 16% and down 11%, respectively. Management noted that inventory stocking in the pharmaceutical solutions business continues to be a headwind that compressed adjusted operating earnings by 22% year over year to $46 million. Finally, it left the period with total debt of $10.3 billion against cash on hand of $764 million.

2. Appraisal

My view of the first quarter results from IFF was mixed. Management's language on the call was fairly muted, in my opinion, despite noting the "improved financial and operating performance" of the company. In the slides, the forward outlook says that "it is still early, and uncertainty remains" concerning 2024.

This could be management being correctly cautious, but I would still like to see some conviction regarding where it intends to allocate capital moving forward. Thankfully, it has been clear on recent uses of cash. It mentioned that it has reduced debt by ~$1 billion over the past 12 months, bringing the leverage ratio to 4.4x by the end of Q1. Meanwhile, capital expenditures ran at 4% of sales in the quarter at $118 million, and it returned $207 million of capital to shareholders through its dividend.

Based on this appraisal, it would appear 1) the investment runway for IFF is relatively small, 2) opportunities exist only to mine the acquisition pipeline, or 3) to reinvest into current operations for things like efficiencies and production advantages.

Business economics underlying hold thesis

One advantage IFF enjoys being in the fragrance and biopharmaceutical space is that these are highly differentiated domains. This means the company should typically be able to sell its offerings higher than industry averages and enjoy some form of consumer advantage (especially in the fragrance space).

We see this when comparing IFF to the specialty chemicals industry. The company has around 350 basis points higher gross margins (indicating the higher selling prices) but has higher than average operating margins too (Figure 2).

This would suggest it has lower operating costs as a percentage of revenues and, in my opinion, squares off with the economics of the business: (i) It is a diversified operation conducting business across distinct segments, (ii) acquisitions are one primary means to growth, meaning (iii) it can amalgamate operating costs of its various assets through "synergies".

Given the highly intangible nature of the business's invested capital, I am not surprised to see a competitive advantage in free cash flow margin either - 17.4% compared to the industry median of 6.8% - incremental capital requirements should be relatively low, with investments reserved for things like acquisitions and maintenance expenditures.

In that respect, it is quite surprising that this company produces such small post-tax earnings relative to the capital employed in the business. This is an industry where substantial capacity exists, and many operators incur the commodity-like economics I like to avoid. Presumably, IFF would benefit from this, given its different differentiated products in fragrances and so forth. At least, this is what I had assumed originally.

Company filings, Author

This is a classic case of why one simply cannot assume in capital markets and equity analysis. I wanted to understand why FF runs such an intensive, unprofitable enterprise (profitability is measured here, not in terms of net margins, earnings per share, or growth - it is measured in the context of net operating profit against invested capital, otherwise, return on invested capital).

Figure 4 illustrates the net operating profit after tax IFF has produced on capital invested in the business and free cash flow left over after considering all reinvestment needed to maintain its competitive position. It does this on a rolling 12-month basis.

As observed, the company has wound back total capital at risk in the business from $142 per share in September 2021 to $102 per in the last 12 months. Against this, the company has grown post tax earnings from $4.90 per share up to $5.12 per share in the trailing 12 months, a 5% ROIC. All dividends paid up; this tallies $9.80 per share, a trailing yield of 10.2% as I write.

The result has been less than 5% to 6% rolling returns on capital each period. Analysis of the drivers of this slack return is revealing. It enjoys reasonably high post-tax margins of 10%. This squares off with the economics I outlined earlier, in the consumer advantages it has with branding and specialty products with relatively short product cycles.

However, on the $26.1 billion of capital employed into this business, the ratio of sales to capital is just 0.43x, indicating that for every $1 invested into the business, only $0.43 in revenues return.

Said another way, the investment required to produce one dollar of revenues is tremendously high, indicating this is a capital intensive exercise.

Objectively, the current trailing free cash flow is attractive. It is also one that the company is likely to maintain, in my opinion. Figure 5 shows the trailing free cash for yield IFF has conducted business on over the last three years, on a rolling 12-month basis. Investors have been able to purchase the company at multiple points along this horizon at a >6% trailing free cash for yield.

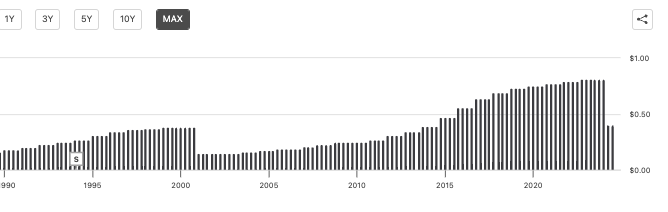

Here is where the value is in this name in my opinion. This cash flow supports a steady stream of dividends which have increased consecutively for 21 years, and been paid consecutively for 34 years (Figure 6).

This is certainly one for consideration for income-oriented investors. In my opinion, with the combination of 1) incremental capital requirements and 2) IFF's sheer size, investors can expect hearty dividends in years to come. This is a balancing factor in the investment debate.

Company filings, author

Seeking Alpha

As for the economic value - that is, the propensity for capital appreciation - my views flat for IFF. This is built on the premise management is not creating economic value for shareholders in the first place.

I measured this as the return on invested capital relative to a hurdle rate, in this instance, 12%, measuring the long-term market averages. Anything above this 12% rate is an economic profit, and vice versa. Applying this benchmark to the company's earnings shows it has not elicited economic profit across the testing period (Figure 7).

For instance, in the 12 months to March 2024, we needed net operating profit after tax of $3.1 billion on invested capital of $26.1 billion. The company produced $1.3 billion instead, causing an economic loss of $1.8 billion, or $7.15 per share. Over the period shown, management has produced an economic loss of $23.8 billion. At the same time, IFF's market value has decreased by $14.5 billion - unsurprising when benchmarked against economic value added.

Company filings, author calculations

Projections of value at steady state of operations

To understand the intrinsic value of IFF and the business assets' worth, I am going to analyse how management has been running and growing the business over the past three years. Figure 8 illustrates management's capital allocation decisions from 2021 to 2024 on a rolling 12-month basis. It then compares this against the financial performance over this time. I have also included all acquisition activity under the investment drivers.

As observed, to create a new dollar of revenues, the company has invested most of its available funds towards working capital, but reduced capital density in acquisitions, fixed assets and intangibles. This has followed key divestment over the recent years. In my opinion, it would be unreasonable to assume this trend might continue over a five or ten-year period. The company does shed capital through dividends, but it does need operating assets to produce free cash flow in the first place. I have subsequently revised my assumptions to those shown in Figure 9.

Here, I presume that a new dollar in revenues will require a $0.05 investment to fixed capital and acquisitions. I believe this is a fair set of assumptions as it aligns with more recent trends of incremental investment observed in the last 12 months, and factors in expenditures at a rate of 4% of sales (in line with Q1 2024).

Author's calculations

The projections built from this model are shown in Figure 10, below. I have carried the average tax rate of 16.3% forward through the series as well.

My numbers have the company to produce around $11.8 billion in sales this year, ahead of consensus estimates of $11.16 billion. These estimates have the company to throw off anywhere from $1.12 billion to $1.17 billion in free cash flow over this time, with capital turnover of 0.4x and tax margins above 10%. Under these assumptions, I estimate the company could compare its intrinsic valuation at around 140 basis points each quarter. As discussed in more views on valuation below, this is not a compelling picture.

Author's estimates

The stock sells quite expensively to the sector at 26x trailing non-GAAP earnings and 55x EBIT. It also sells at 1.7 times the net assets employed in the company, and this tight multiple is correct in my opinion, given the negligible returns on tangible capital. Immediately, I am suspicious of this valuation, as I haven't identified management as creating substantial economic value - only through the persistent stream of dividends. This is not reflected in multiples of earnings or assets.

Moreover, you would have just seen the company sells at a higher price relative to the earnings of the business, but a low price relative to the assets of the business, telling me there is a dislocation in the market's views on productivity of the firm's capital.

To get a sense of whether these multiples are fair or not, I have projected my estimates of free cash flow out over the next 10 years and discounted them back at the 12% rate to arrive at a present value today. I have blended this with a view on intrinsic valuation that looks at the estimated return on capital and reinvestment rates. I have done this across two scenarios, one with the steady state of operations, and one with the revised assumptions listed earlier. Here, I get a valuation range of $78-$82 per share, ranging from 18-20x earnings. This supports a neutral view, in my opinion.

Author's assumptions

I also wanted to assess the sensitivity of the valuation to changes in the P/E multiple and earnings growth.

If management does hit the projected growth numbers of 20% in EPS this year, and the P/E multiple does not change, then the company is worth $108 to us today, a marginal upside on where it sells as I write.

The issue is, however, if the multiple contracts down to, say, the sector median of 16x, even if it hits the stipulated growth rates, implied valuation drops to $64 per share. Similarly, if it misses, but investors continue to pay this multiple, it is worth around what we pay for it today, illustrating how much the valuation is tight up to the P/E multiple versus the company's fundamentals. This supports a neutral rating, in my view.

IFF has an extensive history of increasing dividends and expanding its footprint in the specialty chemicals industry. It enjoys a few competitive advantages relative to peers in pricing and on the consumer side. However, these are balanced by the business economics at show, producing less than 5% returns on capital. The free cash flows it can throw off are, therefore, not of a great enough magnitude to warrant the current valuation, in my opinion. Rate hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About iff stock.

| Symbol | Last Price | % Chg |

|---|

More on IFF

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| IFF | - | - |

Trending Analysis

Trending news.

IMAGES

VIDEO

COMMENTS

Abstract Business Strategies for Small Business Survival by Betty W. Lum MBA, Kaplan University, 2014 BS, Kaplan University, 2012 Doctoral Study Submitted in Partial Fulfillment

Second, we present a way to examine small business management practices more holistically, as a set of activities by applying a recently-expanding methodological approach, fsQCA, to small business study. Three sections follow: a description of the SMPs explored in the present study, a review of the methods employed and our results, and a ...

Some small businesses have slower growth as they age and have limited strategies to maximize profit, productivity, and job creation. The purpose of this qualitative study was to explore the strategies small business managers use to capitalize on growth opportunities. Area small business managers and support program stakeholders could

The impact of COVID-19 on small business outcomes and expectations*. Alexander W. Bartik, Marianne Bertrand, Zoe Cullen, Edward L. Glaeser, Michael Luca, and Christopher Stanton. Abstract To explore the impact of COVID on small businesses, we conducted a survey of more than 5,800 small businesses between March 28 and April 4, 2020.

of small business, identified and selectedusing the theory and the most relevant models of life cycle of small business growth. The theoretical and practical implications of this research refer to identifying and stressing important aspects of performance that can stimulate the growth of small business, and to apply the model of research on growth

Human resources, when. utilized properly and strategically, can be an influential competitive advantage when it comes to. the growth and development of a small enterprise. This thesis aggregates and analyzes studies. that find that human resources can reap many benefits; the implementation of human resource.

To explore the impact of coronavirus disease 2019 (COVID-19) on small businesses, we conducted a survey of more than 5,800 small businesses between March 28 and April 4, 2020. Several themes emerged. First, mass layoffs and closures had already occurred—just a few weeks into the crisis. Second, the risk of closure was negatively associated ...

as a thesis mentee and guiding me throughout this journey. I would also like to thank the Management Department's Chairperson, Dr. John Angelidis, Ph.D, and the faculty of The Peter J. Tobin College of Business of St. John's University for imparting the knowledge and skills I needed not just to complete this thesis, but to excel in the real

RESEARCH PARTICIPANT INFORMATION SHEET Social Media Marketing in Small Business: Case Studies Mihaela Vorvoreanu, Ph.D. Purdue University Computer Graphics Technology. Purpose of Research. This research project aims to understand the strategies that aid small businesses' use of social media to engage consumers.

Between 2008 and 2014, the Top 4 banks sharply decreased their lending to small business. This paper examines the lasting economic consequences of this contraction, finding that a credit supply shock from a subset of lenders can have surprisingly long-lived effects on real activity. 31 Jul 2017. HBS Case.

small businesses, but there is very little early evidence on impacts. This paper provides the first analysis of impacts of the pandemic on the number of active small businesses in the United States using nationally representative data from the April 2020 CPS - the first month fully capturing early effects from the pandemic.

total loans to SMEs from the small banks, micro counties have $11 million, and. rural counties have $3.4 million in total loans. However, the median level of loan amount in metro counties is $9.7 million, in micro counties it is $4.7 million, in. rural counties it is $0.36 million.

A Thesis Submitted to The W.A. Franke Honors College In Partial Fulfillment of the Bachelors degree With Honors in Business Management THE UNIVERSITY OF ARIZONA ... by the Small Business Association (SBA) found that in 2017, there were roughly 12 million women-owned businesses, and in 2019 women-owned businesses employed 10.1 million

ASSESSMENT OF BUSINESS ENVIRONMENT OF WOMEN INVOLVED IN MICRO, SMALL, AND MEDIUM ENTERPRISES (MSMES) IN THE PHILIPPINES: A COMPARATIVE STUDY WITH SELECT ASEAN COUNTRIES Thesis/Dissertation Adviser: Prof. Carolyn Sobritchea, Ph.D. Faculty of Management and Development Studies Date of Submission 29 August 2020 ...

Here are the five. biggest challenges for small businesses. Client Dependence. If a single client makes up more than half of your income, you are more of an. independent contractor than a business ...

The purpose of this research is to examine the impact of factors, related to important strategic characteristics, affecting growth of small business, particularly considering a specific economic ...

This thesis examines the effect of income tax on small businesses based in mainly in Addis Ketema sub city, Addis Ababa, Ethiopia. The research is based on a comprehensive review of literature on income tax and small businesses in Ethiopia, including academic articles, government reports, and policy documents.

As the study shows most of the small business 37% employ other people so this can support the thesis statement of this study. 4.2.4 The Profit in your business is increasing compared to other players in the market Chart 4.2.4 shows whether respondent's business profit is increasing This chart is pointing that 43% of the respondents agree that ...

The latest science news and groundbreaking discoveries, with expert analysis and interesting articles on today\'s most important events and breakthroughs.

Small business manufacturing enterprises represent viable means of creating employment, stimulating economic growth, and accelerating development. Many newly formed small business enterprises do not continue beyond 5 years after formation. The purpose of this multiple case study was to explore the strategies used by small business

Investing. Our experts bring you unbiased investing platform reviews, answer readers' most pressing questions, and provide the latest investing news. From cryptocurrency to stocks, compare the ...

The company produced $1.3 billion instead, causing an economic loss of $1.8 billion, or $7.15 per share. Over the period shown, management has produced an economic loss of $23.8 billion. At the ...