In accordance with international sanctions, the Semrush platform is no longer accessible to businesses registered or based in Russia. We’re sorry for the inconvenience and if you believe there is a mistake, please send us an email to [email protected] so our team can review.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Top 11 Market Research Trends in 2024 to Keep an Eye Out for

Market research is a continually evolving sector that has helped brands, organizations, individual researchers, the market research industry, and academicians stay above the curve. Research functions only grew in a global economy that took a significant hit in 2020.

If anything, focusing on conducting smarter, more efficient, and impactful research has been on the rise. No longer has research stayed primitive with long boring surveys sent to thousands of respondents hoping for a response. Market research has evolved because the importance of insightful data is now evident to everyone.

From transactional data to customer data, position metrics to consumer research, and opinion research to academic research, differentiating between the right data and noise has become extremely important.

Therefore, conducting smarter research is now the need of the hour. In a mostly open-ended ecosystem, it is tough to get a consensus. Still, surprisingly enough, most researchers, brands, and facilitators of research agree on emerging trends to keep an eye out for in 2023 and beyond.

LEARN ABOUT: Market research vs marketing research

We have listed the research trends that we think will be the most defining factors for the global market research market in 2023 and beyond.

Top 11 Market Research Trends in 2023 to Keep an Eye Out for

Data can be construed differently by different people. What’s unchallengeable is that there is now a technological advancement in collecting and analyzing data.

Social media plays a vital role in gathering sentiments; there is an advancement in psychological, economic, and scientific knowledge in data collection. These factors have led to market research evolution, and 2023 will see a marked shift in collecting transactional data.

In no particular order you should keep an eye out for these research trends in 2023 and beyond to fortify your decision-making ability.

Smarter, shorter surveys

This trend gets talked about a lot, but the truth is that most researchers and research tools do not allow the ability to conduct smarter surveys. However, at the turn of 2020 and beyond, collecting the right data with good survey response rates and honest feedback is becoming increasingly important.

Capturing transactional data at the point of experience with a smart, short, and efficient survey helps with better data collection and consumer insights. Negating demographic data collection when that information is already available and using smarter research questions at the point of experience will help reduce survey fatigue and collect data that matters.

For example, to collect choice-based data that is a cornerstone of most research projects, adding an anchored MaxDiff question in your choice-based scaling will allow you to get deeper insights without having to conduct multiple follow-up studies.

Similarly, deploying omnichannel surveys at various touchpoints helps you collect the correct transactional data without compromising data quality.

DIY in-house research

For a long time, research has been considered a complex and labor-intensive process requiring extreme special qualifications to get right. In 2023, there will be a marked shift towards DIY in-house research with smarter research tools .

Simple to understand and deploy platforms without the need for complex scripting and powerful research questions is the way forward.

Conducting market research tools is the ability to collect quantitative and qualitative data with the bonus of having a good respondent base in one location. Gone are the days when each component required going to different platforms.

This will make the management of market research easier for all the stakeholders. DIY research and do-it-together (DIT) research, where the research tool provider chips with specialized research service

Longitudinal tracking

One of the biggest market research trends going into 2023 and beyond will be longitudinal studies and tracking. For far too long, research has relied on broken-down respondent sets that do not help gather a macro-level view of data and insights.

With the help of community management platforms , longitudinal research helps track behavior changes and derive market research industry trends in between external and internal factors on research and insights.

LEARN ABOUT: Market research industry

Not just that, longitudinal tracking also helps with quicker and faster turnaround research from members who matter the most to you and insights you can trust and co-create with. Having a ready set of opt-in research-ready respondents can help with ongoing monitoring studies and expedite your experience transformation initiatives.

Online qualitative research

One market research trend that has been a definite by-product impact of COVID-19 is online qualitative research. With limitations on in-person focus groups and other qualitative research methods, migrating this model online for continued tracking is the only option.

LEARN ABOUT: Qualitative Interview

But now that online focus groups are making an in-road in research models for research managers globally, there is a definite shift in understanding its value and importance. From using the right tool to manage data collection to gamification and digital rewards, moving your offline focus groups online has multiple benefits.

The ability to moderate video discussions while collecting data from a diverse target audience limited by geographical boundaries is a huge bonus.

Quality data collection

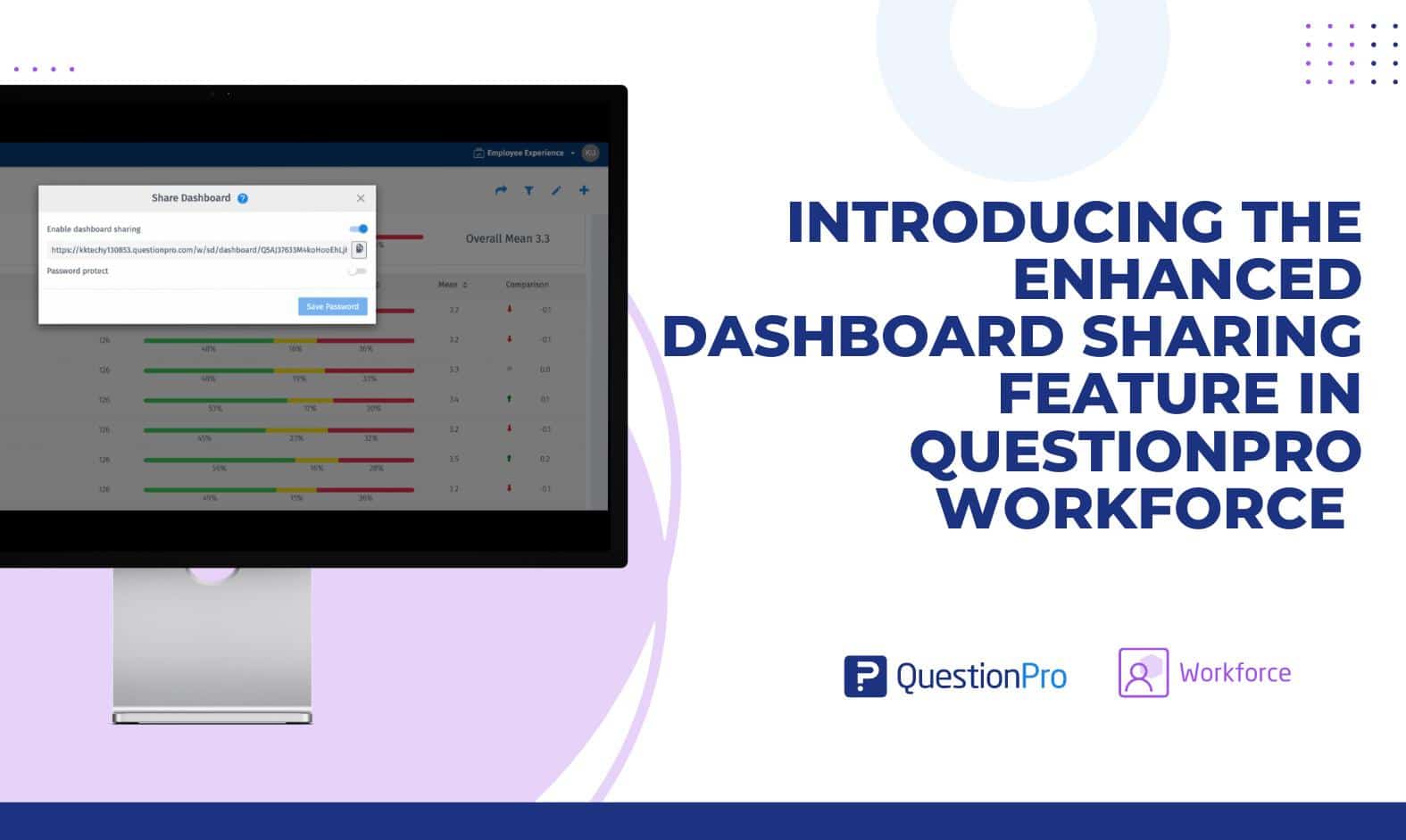

In a recent live video I did with the VP of Products at QuestionPro, Anup Surendran, we spoke about how hyper-personalization will help with better-quality data and insights. Going into 2023 and beyond, with the increase in the number of surveys a person is expected to respond to, standing out and collecting quality data will be challenging.

Personalizing data collection at the point of experience with intercept studies and smarter shorter surveys helps with data collection.

High-quality survey data reduces the time to market and aids insights management at costs that don’t cost an arm and a leg. Putting together studies that aid with high-frequency research and non-intrusive hyper-personalization will see higher levels of success going into 2023 and beyond.

Instant responses

Heading to a meeting and want some quick insights? Cannot choose between two names for a new product line and want quick responses?

Who wouldn’t like immediate insights from a group of respondents when you are stuck somewhere? In 2023, there will be a marked shift towards high-cadence, high-frequency studies with very high turnaround times.

Small surveys or polls that are set up and deployed within minutes and answers and analysis within minutes are the future of market research. Using a smart product that allows you to tap into a pre-defined and mobile-ready respondent population, the scope for quick turnaround studies is very high.

Using your existing technology stack and internal communication tools, and CRM, the use cases would be limitless if you could create and push out studies that offer you responses representing a larger population.

We at QuestionPro are building a mechanism that provides you with quick turnaround response times for short studies using our proprietary global panel of respondents to help you go from perceptions to decisions within minutes.

Non-intrusive transactional studies

The biggest pet peeve of people not wanting to participate in research studies and respond to surveys is the many pointless questions and many such surveys.

But what if you could gather customer delight with a customer experience platform that leverages non-intrusive transactional studies that are highly engaging, short, and compelling to respond to?

There will be a marked shift towards smarter customer engagement and monitoring studies that do not require respondents to fill in pointless surveys that include demographic data and repetitive information and can help manage customer satisfaction and legitimate NPS scores.

With the help of smart intercept studies, scores from across various touchpoints help draw a better understanding of customer delight and help show vectors and factors that could lead to customer churn.

Emotive surveys

One of the biggest trends in market research that I am most excited about is the added use of technology to capture respondent behavior and data with various factors like facial recognition and contactless surveys .

Surveys that help you capture customer insights where respondents do not have to interact with an external device and sentiments directly are captured just by facial and visual cues will be extremely important going into 2023 and beyond.

A simple question, for example, at a point of experience where facial recognition captures respondent sentiments will go a long way in offering mature insights for brands.

Crowdsourced research

Crowdsourcing in market research helps solve problems at scale with lower costs and makes it to our top 11 market research trends to keep an eye out for 2023. Since crowdsourcing uses the quali-quant method, the insights you can get from a diverse audience base are tremendous.

Not only can it help solve problems, but it also helps to get an idea of a more extensive and varied population. The only drawback of this method is that for a brand to effectively leverage this model, there has to be an advantage of scale, which increases crowdsourcing’s success and feasibility.

Social listening

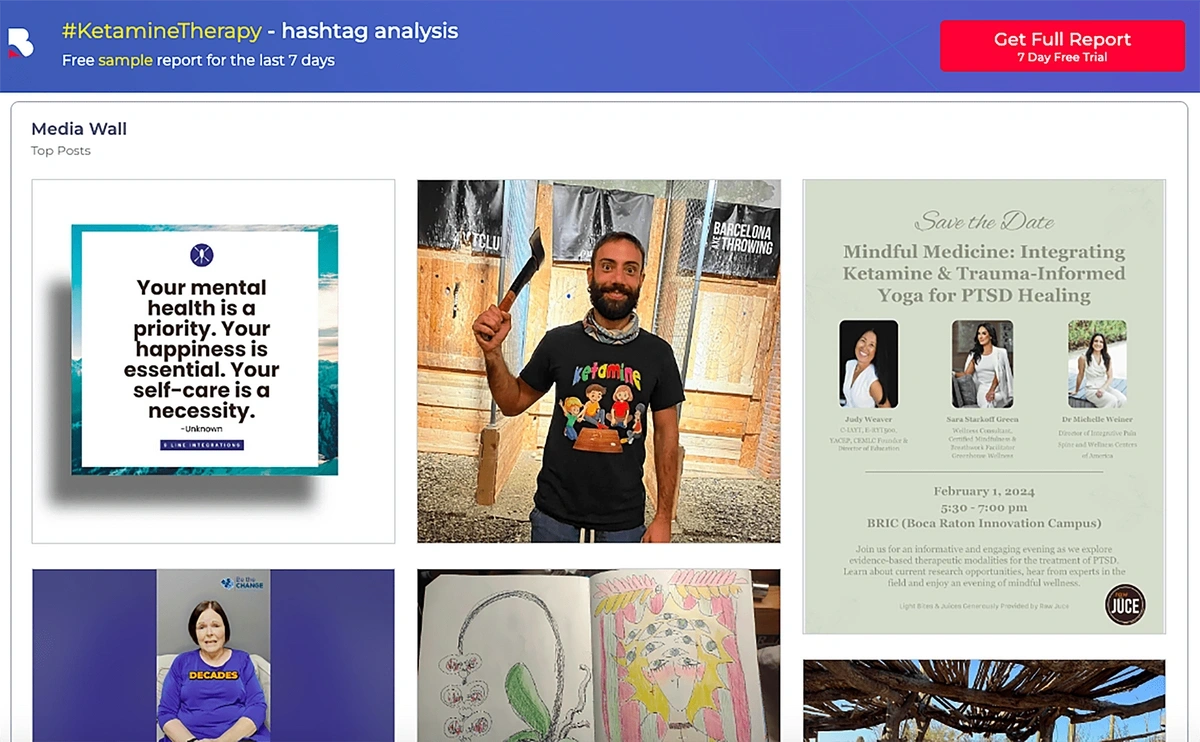

Due to a large social media footprint, it is becoming increasingly important to listen to social media’s happening and derive sentiments from conversations. Since social media is highly emotive, there is a broader scope to get to the root of ideas, complaints, purchase behavior, macro, and micro trends, etc.

Using social listening, you can isolate the data you care about and look for short-term indicators around consumer research. This is the future of ethnographic research. While social listening doesn’t make sense for all market researchers and brands, if done well, it can help to identify actionable vectors at a very early stage.

AI-assisted data collection

Two common themes arose from market research in 2020 – personalization and convenience. Using AI-assisted data collection helps in advancing research for brands and researchers. The right data going to the right stakeholders in real time define the success metrics of market research.

By limiting human interactions but increasing milestones and points of experience-based smart research, there is greater success in collecting the right data. This helps focus on deriving insights from the data and not on the data collection itself.

For long-form data and open-ended data, AI-based research and sentiment analysis help derive insights from text-based data without intervening and manually interpreting it.

How QuestionPro helps in market research trends?

QuestionPro is a comprehensive online survey and market research platform that provides a variety of features and tools to help organizations remain ahead of market research trends. Here’s how QuestionPro can assist you:

Advanced survey creation

QuestionPro makes developing surveys with skip logic, several question kinds, and advanced customization easy. This flexibility lets researchers build surveys that follow market research trends and best practices.

Mobile-friendly surveys

QuestionPro lets researchers design mobile surveys. Given the rising trend of mobile survey participation, this assures a smooth and easy survey experience for respondents.

Automated survey distribution

QuestionPro distributes surveys via email, social media, and embedded surveys. These distribution choices help researchers to contact more respondents through digital media.

Advanced analytics and reporting

QuestionPro has comprehensive analytics and reporting tools that allow researchers to examine survey data and provide actionable insights. Researchers can use trend analysis, cross-tabulations, and statistical analysis tools to find patterns, trends, and correlations in data.

2023 will be a huge year for market research, and we are excited to play a pivotal role in making research easy and accessible to everyone. What market research trends are you looking forward to, and are you keeping an eye out for going into 2023 and beyond?

FREE TRIAL RICHIEDI DEMO

Frequently Asking Questions (FAQ)

By examining market trend data, investors can have a better understanding of how various assets have performed over time and make more informed decisions about where to put their money.

Artificial intelligence is the market research trend. It saves time and money and may increase data quality. In fact, 31% of researchers and brands believe an automated data quality solution can alleviate multiple business difficulties.

MORE LIKE THIS

When You Have Something Important to Say, You want to Shout it From the Rooftops

Jun 28, 2024

The Item I Failed to Leave Behind — Tuesday CX Thoughts

Jun 25, 2024

Feedback Loop: What It Is, Types & How It Works?

Jun 21, 2024

QuestionPro Thrive: A Space to Visualize & Share the Future of Technology

Jun 18, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

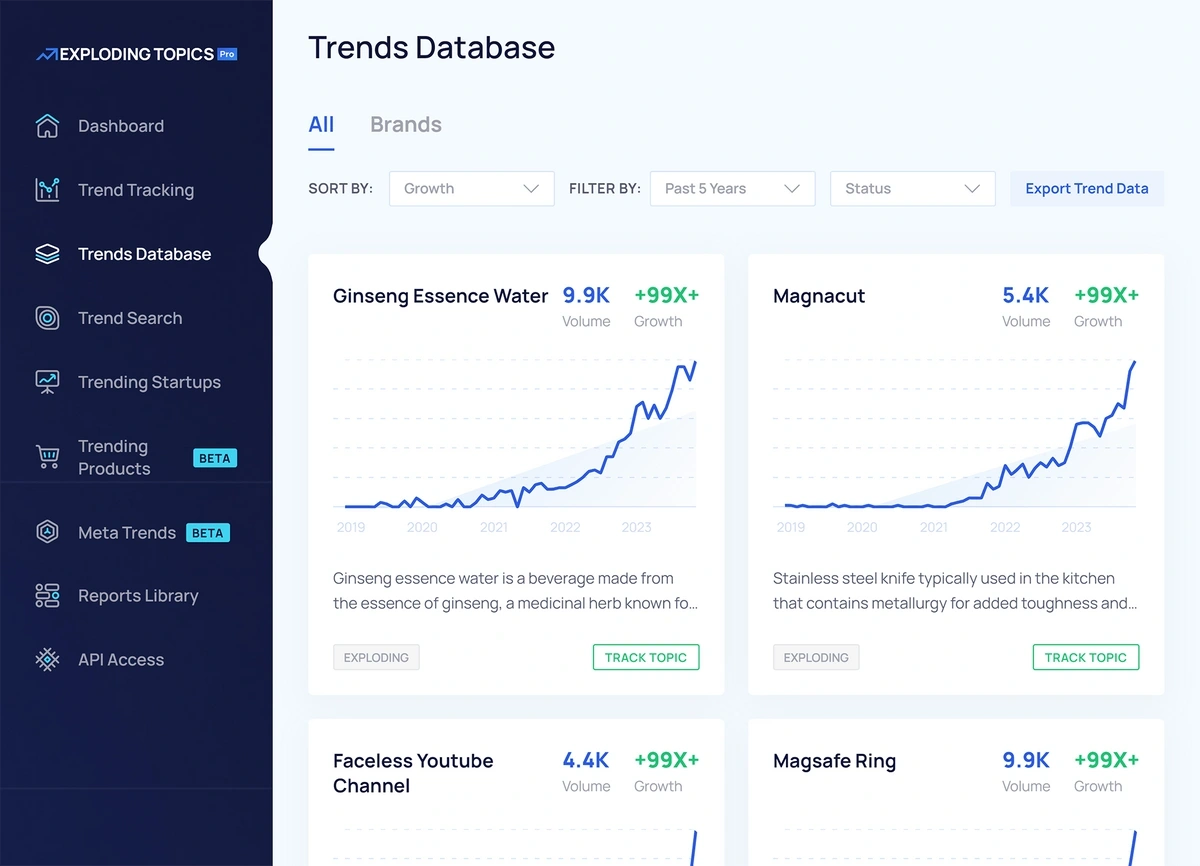

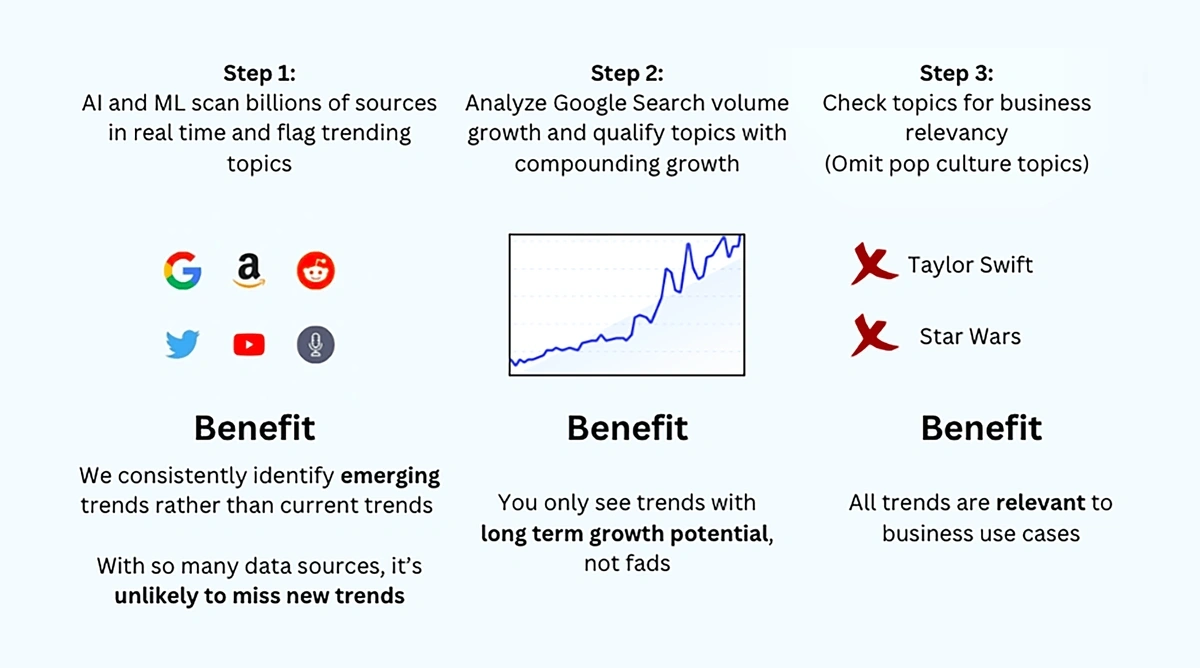

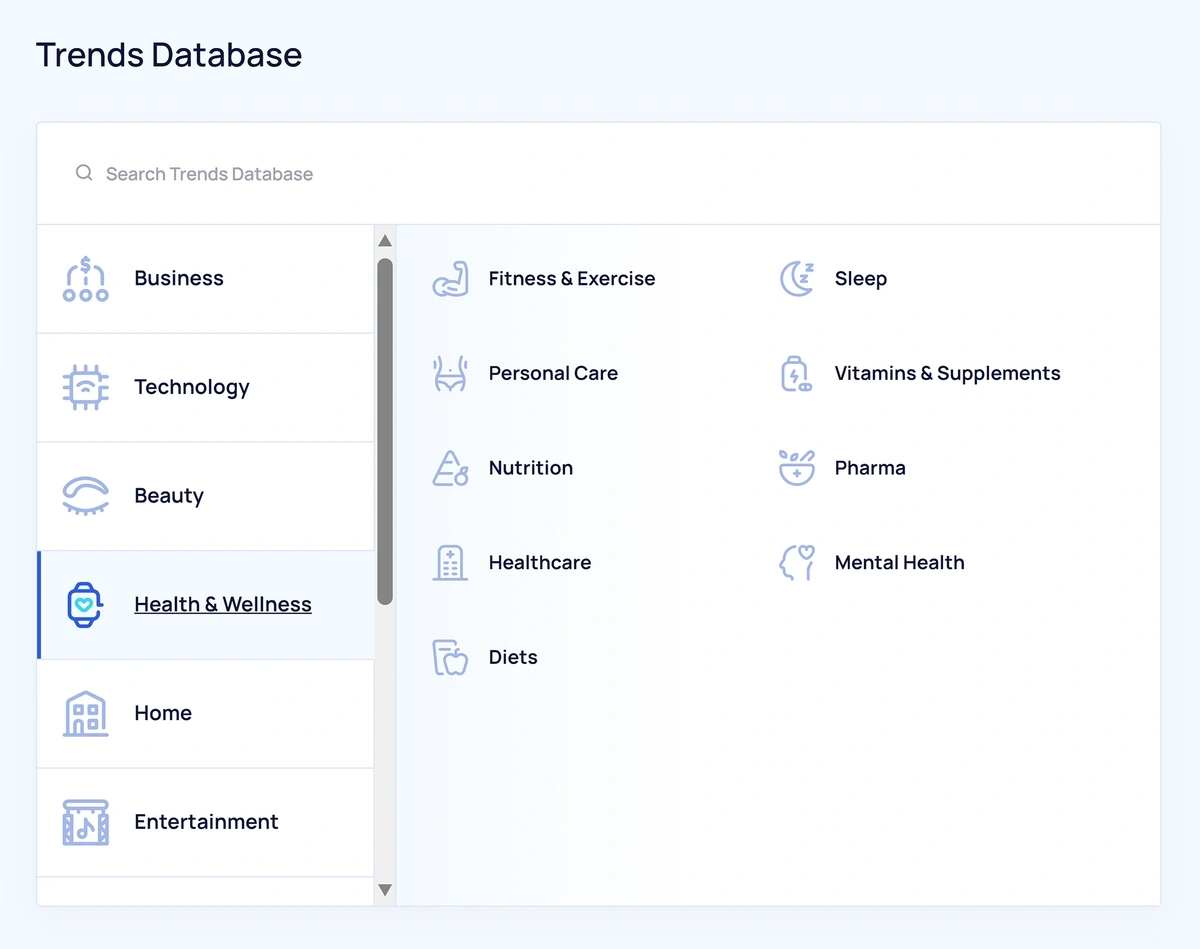

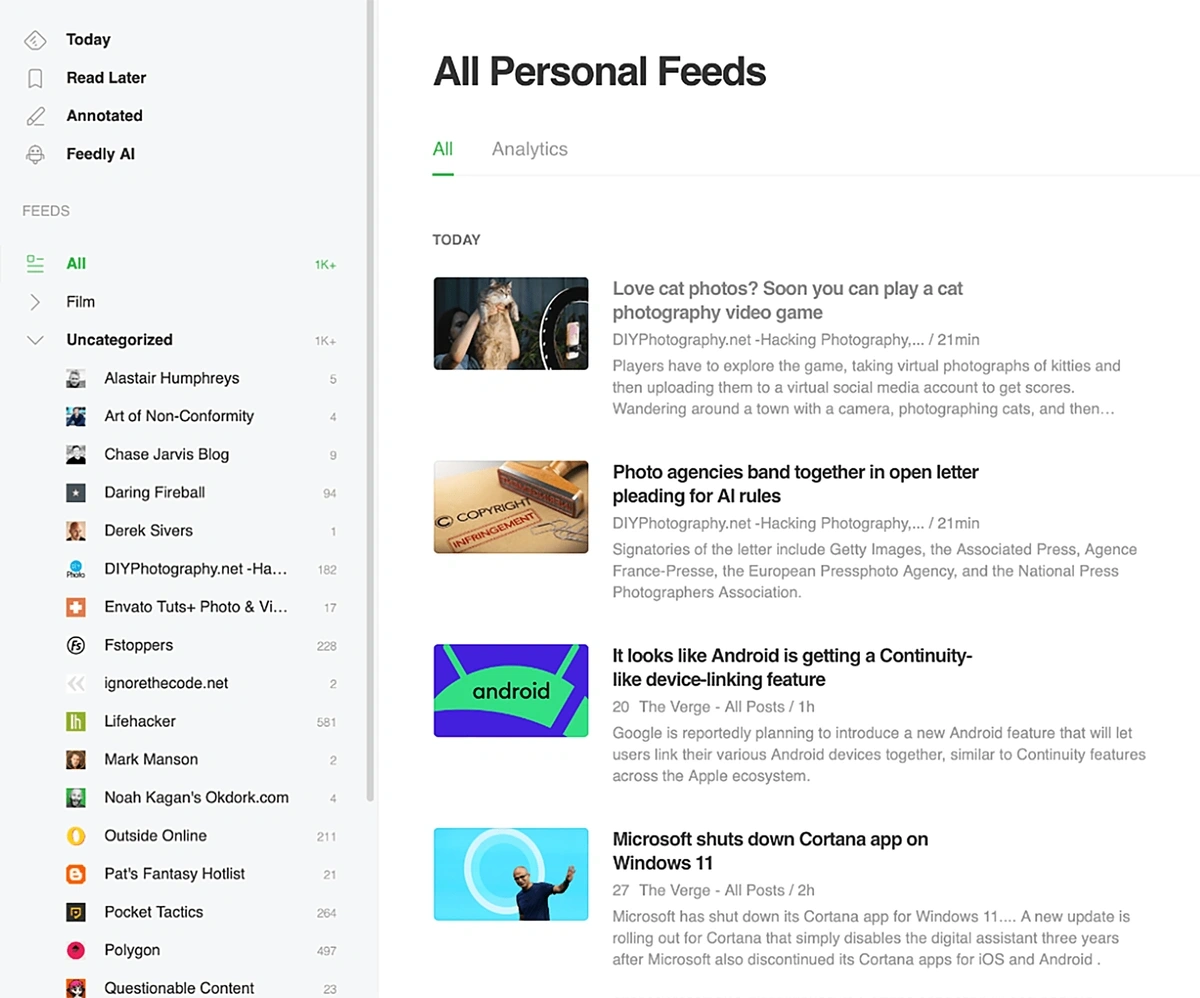

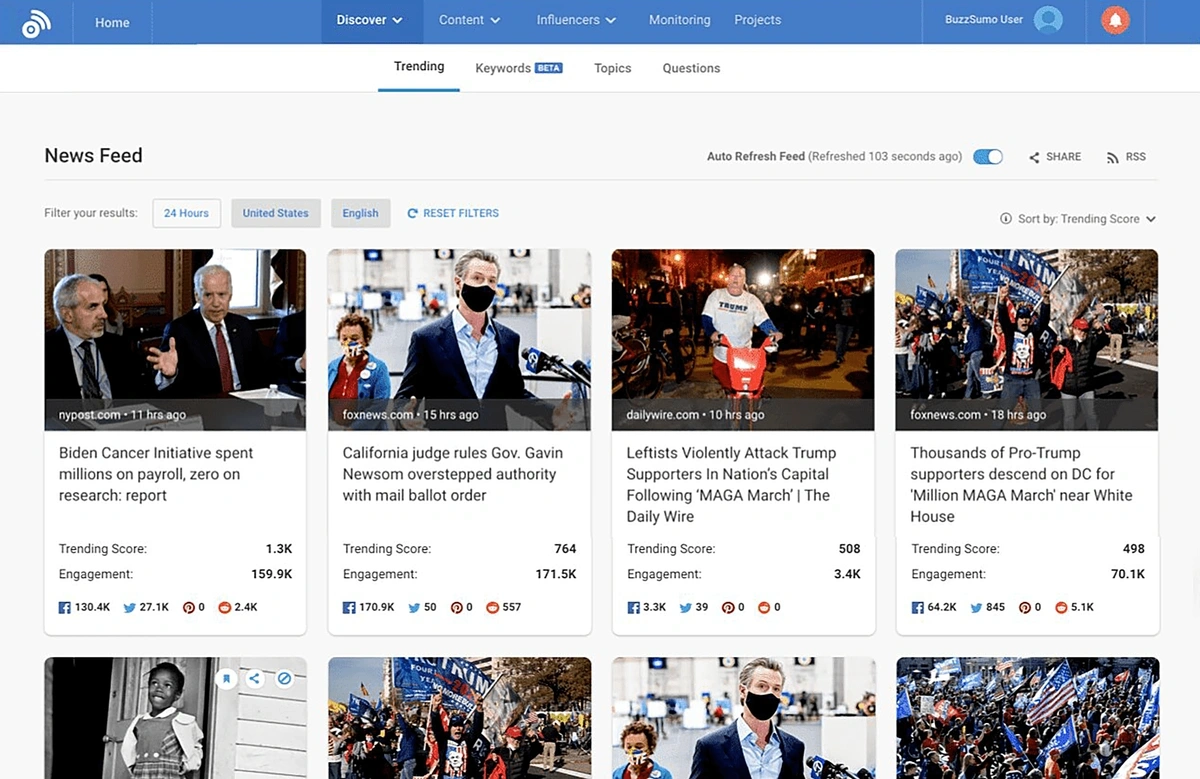

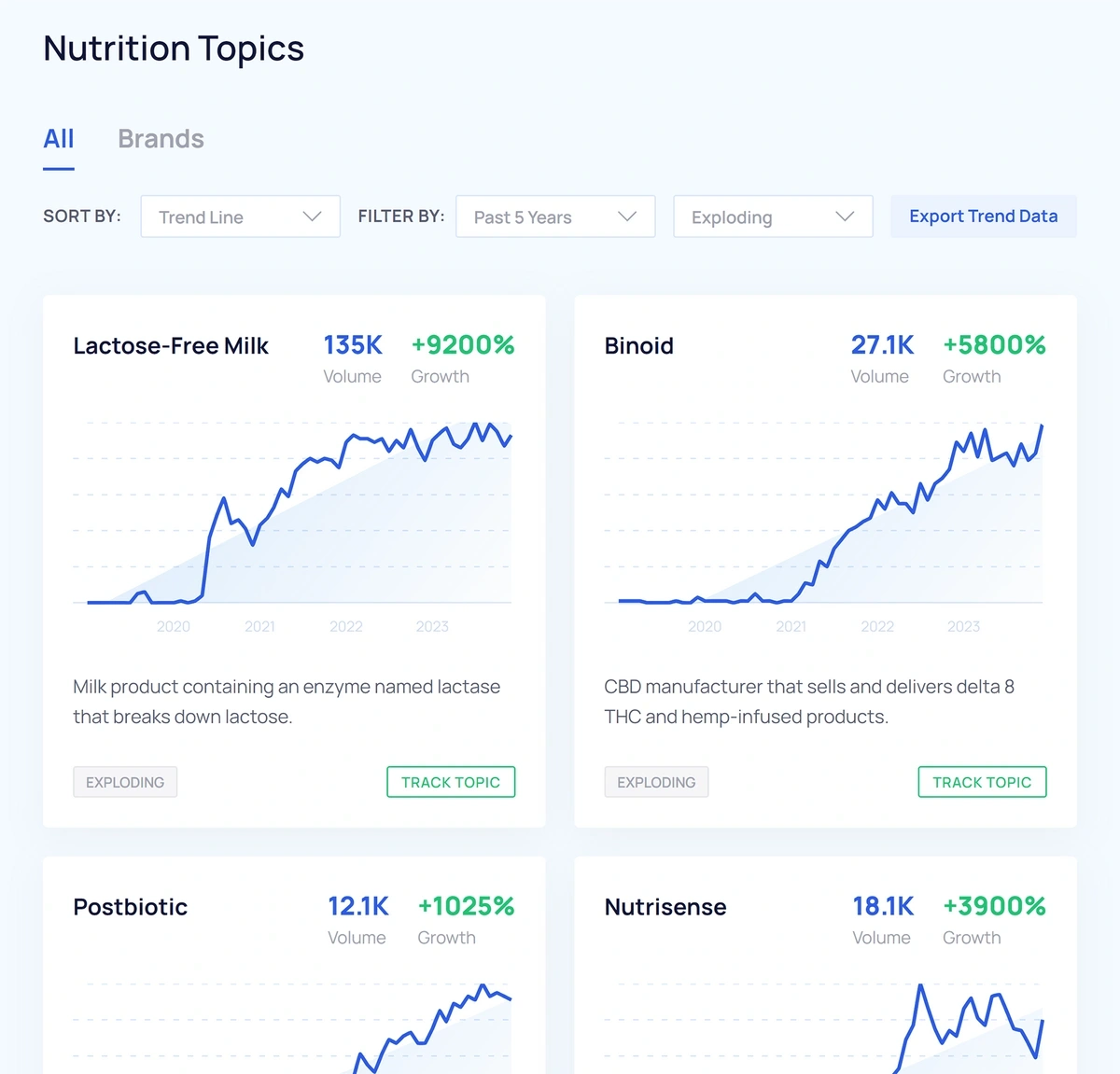

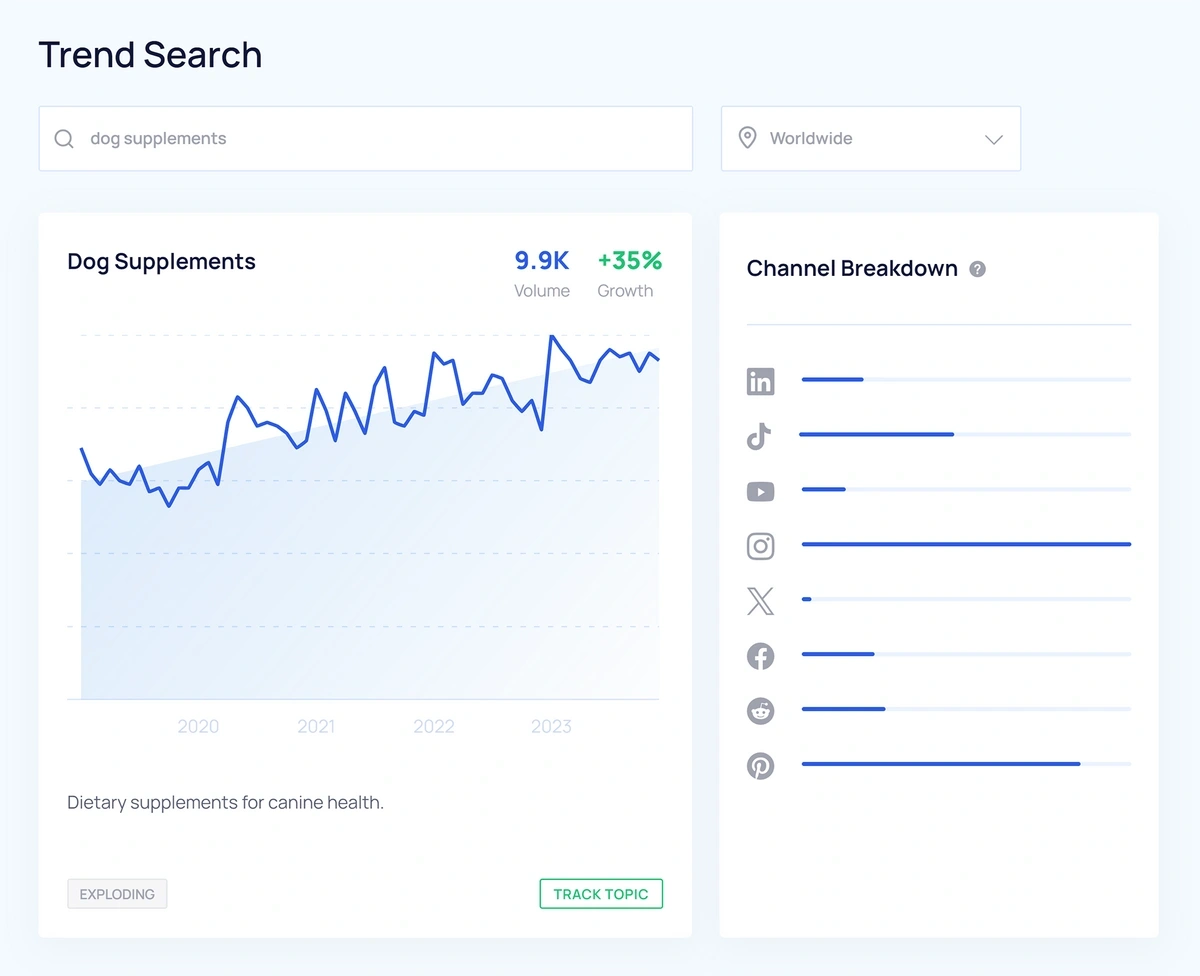

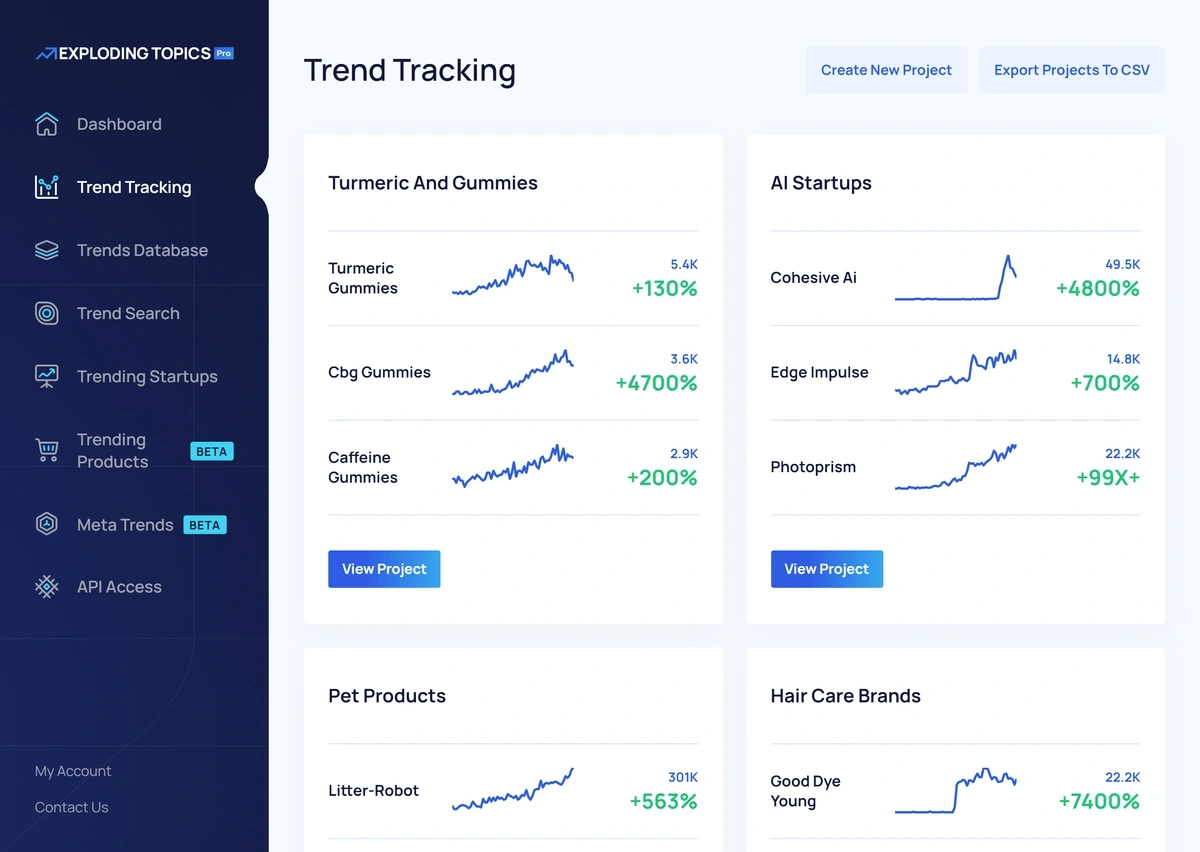

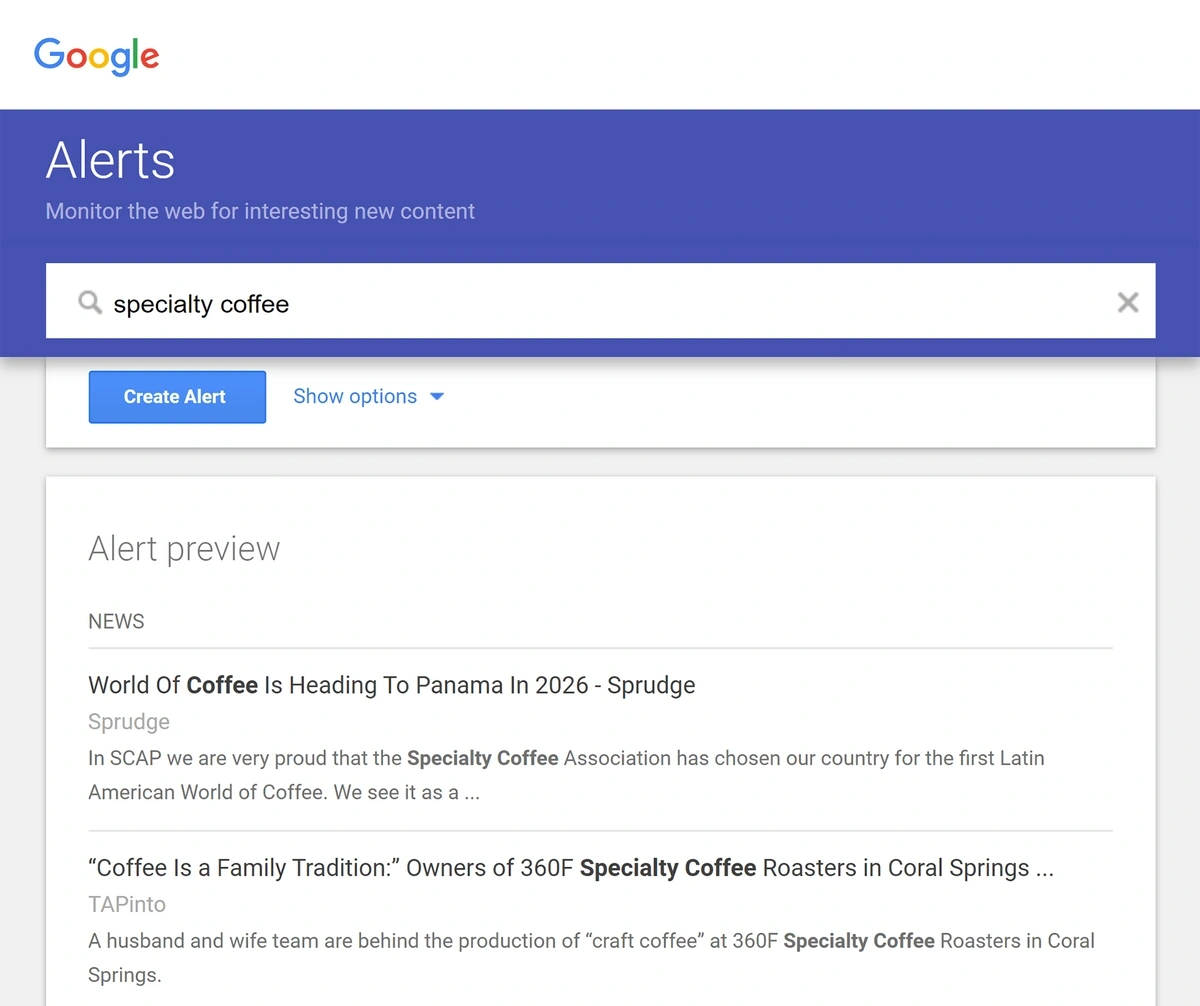

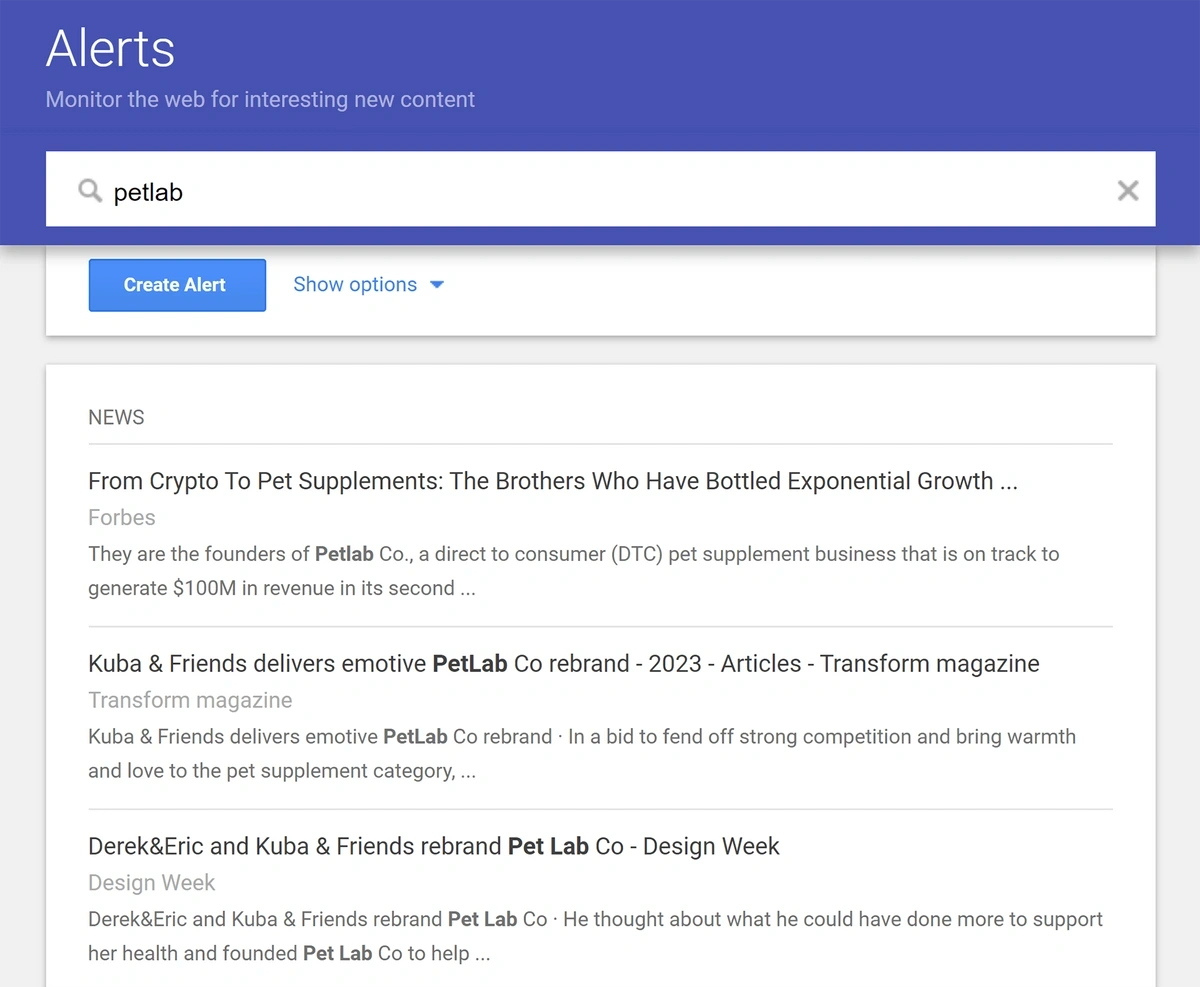

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

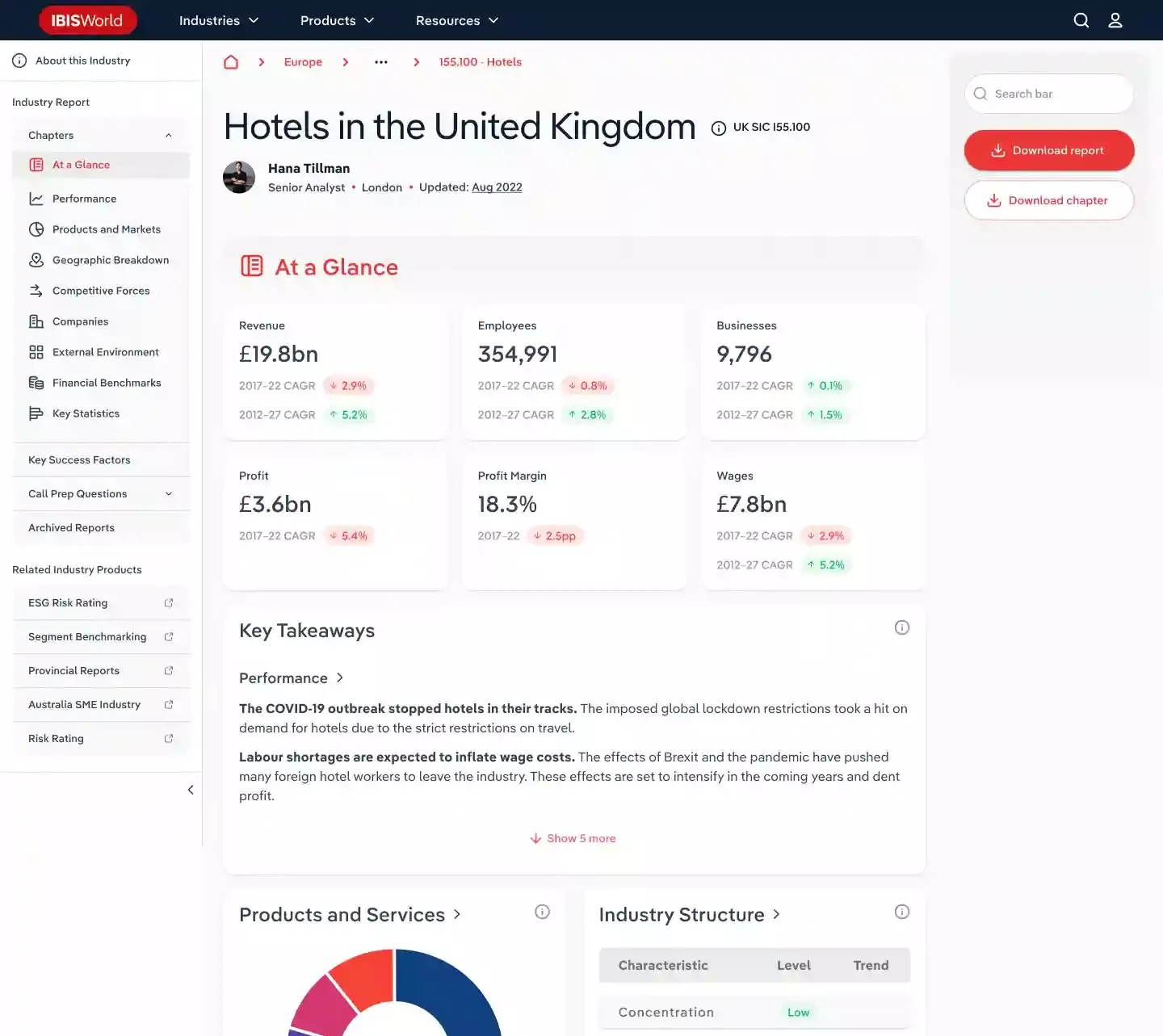

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

106+ Market Research Statistics: Market Size, Trends & Growth

Dive into the power of market research statistics, your compass in a dynamic business world. Learn how data-driven insights transform challenges into opportunities, guiding your path to resilience and growth.

Top Stats At A Glance

- The global market research industry generates more than $118 billion in annual revenue. 1

- Pharmaceutical companies account for 16.6% of global market research spending . 1

- 89% of market research suppliers and clients regularly use online surveys. 2

- 23% of organizations don’t have a clear market research strategy. 3

- 71% of market researchers are investing in CX software. 3

In the fast-paced realm of business, where change is constant and competition is fierce, market research statistics serve as the guiding stars for successful enterprises.

These statistics are the pulse of consumer behavior, industry trends, and strategic opportunities, providing businesses with the insights needed to navigate complexities and make informed decisions. This article explores the pivotal role of market research statistics in today's dynamic landscape.

Do you know? 👇🏻

What market share does the United States hold for market research?

The United States has a 53% market share in the market research industry.

From decoding consumer preferences to staying ahead of competitors, we'll uncover how leveraging statistical data can be a game-changer for businesses aiming not just to survive but to thrive in the modern marketplace. Join us as we unravel the transformative potential of data-driven decision-making.

General Market Research Industry Statistics 💨

Market research trends 📈, market research approaches 📝, wrapping up 🎁.

This section delves into the overarching trends, shifts, and dynamics that shape the global market research industry. Beyond the numbers, it unravels the intricate tapestry of challenges, successes, and the pivotal role market research plays in guiding business decisions.

- The global market research industry boasts an annual revenue exceeding $118 billion , with the United States alone contributing $62.64 billion to this total. 1

- Demonstrating a remarkable upward trajectory, global market research revenue has surged by 358% since 2009. 1

- Nielsen, securing its position as the leading market research company for the 6th consecutive year, reported $5.24 billion in revenue. 1

- Following closely, IQVIA secured a strong position as a top performer with $5.21 billion in revenue. 1

- Gartner demonstrated impressive financial performance, reporting $4.73 billion in revenue. 1

- SalesForce performed well, achieving a revenue of $3.9 billion . 1

- Adobe Systems also stood out as a top performer, with reported revenue of $3.87 billion . 1

| Company 💼 | Revenue 💸 |

|---|---|

| Nielsen | $5.24 billion |

| IQVIA | $5.21 billion |

| Gartner | $4.73 billion |

| SalesForce | $3.9 billion |

| Adobe Systems | $3.87 billion |

- The United States dominates the market research industry with a substantial 53% market share, leaving the United Kingdom as its closest competitor with a 9% market share. 1

- Notable global market shares include China ( 3% ), India ( 2% ), and Australia ( 2% ), while the rest of the world collectively contributes 31% to the overall market. 1

- A significant portion, 20% of global market research spending , is allocated to CRM and customer satisfaction surveys. 1

- The majority, over 70% , of market research spending focuses on five key areas. 1

- The largest portion, 20.7% , is allocated to CRM and customer satisfaction surveys.

- User experience surveys account for 14.2% of market research spending .

- Audience research is a significant focus, representing 13.4% of the total spending .

- Usage and behavioral studies contribute significantly, comprising 11.7% of market research spending .

- Market measurement is also a priority, accounting for 11.6% of the overall spending .

Key Areas Of Market Research Spending

- Pharmaceutical companies take the lead, accounting for 16.6% of global market research spending . 1

- The primary contributors to market research spending are pharmaceutical companies ( 16.6% ), media and entertainment groups ( 15.5% ), and consumer goods producers ( 14.9% ). 1

- Other contributors include research institutes ( 1.8% ), tourism and recreation ( 1.6% ), and non-profit organizations ( 0.9% ). 1

In the realm of market research

70% of buyers prioritize business knowledge as a top skill for development, a sentiment shared by 56% of suppliers.

- Despite the industry's dynamism, 23% of organizations lack a clear market research strategy, and 26% of market researchers identify budget constraints as a hindrance to their strategies. 3

What is the global annual revenue of the market research industry, and how has it evolved over the years?

The global market research industry generates over $118 billion in annual revenue, reflecting a remarkable 358% increase since 2009.

Which country holds the largest market share in the market research industry, and what is the significance of its dominance?

The United States commands a substantial 53% market share in the market research industry, surpassing its closest competitor, the United Kingdom, which holds a 9% market share .

How is market research spending allocated across different sectors, and what are the key areas that attract the majority of investment?

Over 70% of all market research spending is directed towards five key areas: CRM and customer satisfaction surveys ( 20.7% ), user experience surveys ( 14.2% ), audience research ( 13.4% ), usage and behavioral studies ( 11.7% ), and market measurement ( 11.6% ).

Embarking on an exploration of Market Research Trends opens a window into the ever-evolving landscape where insights are gleaned and strategies are honed. In this section, we delve into the dynamic shifts that shape the methodologies and approaches within the market research sphere.

A substantial 90% of market researchers express regular utilization of online surveys. 4

- Industry experts predict a steady annual growth of 16% in the popularity of the online survey market until 2026. 4

- In contrast, only 60% of market researchers report regular use of mobile surveys. 4

- A significant 80% of market researchers express interest in acquiring best practice solutions for multicultural insights, research, and strategy. 5

of market researchers indicating increased usage of online/video focus groups compared to three years ago.

- Moreover, 90% are utilizing consumers' online video submissions and in-depth video interviews more frequently than in the past three years. 6

- A noteworthy shift is observed, with over half of market researchers estimating a decrease in their reliance on full-service research vendors. 7

- The inclination toward Do-It-Yourself (DIY) tools is prominent, as 70% of market researchers express a likelihood of transitioning to more DIY tools in the coming year. 7

- Despite a continued demand for market research, 56% of companies grapple with limited or shrinking budgets. 7

- The industry undergoes transformation as 60% of market researchers acknowledge that automation accelerates result delivery. 8

- Cost reduction benefits are reported by 50% of market researchers as a direct outcome of automation integration. 8

- A strong consensus of 80% of market researchers predicts the continued growth of automation as a prominent trend in the industry. 8

How prevalent are online surveys in current market research practices, and what is the projected growth of the online survey market?

Online surveys are extensively utilized, with nearly 90% of market researchers reporting regular use. The online survey market is expected to experience a robust 16% annual growth through 2026.

What level of interest exists among market researchers regarding multicultural insights, and how is this reflected in current industry trends?

A significant 80% of market researchers express interest in learning best practice solutions for multicultural insights, research, and strategy, indicating a growing focus on diverse perspectives within the industry.

How is the industry responding to the trend of increasing automation in market research, and what benefits do market researchers associate with this shift?

Automation is reshaping market research, with 60% of researchers leveraging it to deliver results faster, 50% experiencing cost reduction benefits, and an overwhelming 80% foreseeing continued growth in this transformative trend.

As technology evolves, so do the tools at the disposal of market researchers, and this journey through approaches illuminates the varied paths they navigate in the pursuit of comprehensive understanding.

- A significant 89% of both market research suppliers and clients regularly employ online surveys in their methodologies. 2

- Mobile surveys emerge as a widely adopted approach, with 60% of both clients and suppliers incorporating them into regular use. 2

- Proprietary panels gain prominence, with 45% of clients and suppliers reporting regular utilization of this market research approach. 2

- Online communities play a significant role, with 31% of clients and suppliers regularly employing them as part of their market research strategies. 2

| Approaches 🙋🏻♂️ | Regular Use Percentage 👁🗨 |

|---|---|

| Mobile Surveys | 60% |

| Proprietary Panels | 45% |

| Online Communities | 31% |

- Online in-depth interviews conducted via webcam are a prevalent choice, with 41% of both clients and suppliers routinely employing this method.

- Online focus groups conducted through webcam interactions are widely used, with 40% of clients and suppliers regularly engaging in this qualitative market research approach.

- Online communities play a significant role, with 35% of clients and suppliers routinely utilizing them for qualitative market research.

- Telephone in-depth interviews constitute a notable approach, with 31% of both clients and suppliers incorporating them into their qualitative research strategies.

- In-person focus groups remain relevant, with 31% of clients and suppliers regularly opting for this traditional qualitative research method.

Utilization Of Qualitative Market Research Approaches

- The emergence of mobile-first surveys is noteworthy, with 64% already incorporating this technology, and an additional 13% considering its adoption in the near future. 2

- Customer surveys exhibit a 33% average response rate, with in-person surveys leading with the highest response rates at 57% . Conversely, in-app surveys perform less favorably with just a 13% response rate. 9

- A substantial 56.6% of global survey responses originate from mobile devices, surpassing the 40.2% from non-mobile users. 9

- Post the peak in May 2020, less than 2% of contemporary surveys make mention of the COVID-19 pandemic. 8

- A significant 71% of market researchers are investing in Customer Experience (CX) software, with other top investment areas including online consumer panels ( 69% ), market research online communities ( 63% ), and product testing software ( 62% ). 3

What is the prevalence of online surveys in market research, and how do they compare to other approaches?

Online surveys dominate market research approaches, with 89% of both suppliers and clients regularly utilizing them. Additional noteworthy approaches include mobile surveys ( 60% ), proprietary panels ( 45% ), and online communities ( 31% ).

How do different survey types vary in terms of response rates, and what are the preferred methods among respondents?

In-person surveys exhibit the highest response rates at 57% , outperforming other types such as mail surveys ( 50% ), email surveys ( 30% ), online surveys ( 29% ), and telephone surveys ( 18% ). In-app surveys have the lowest response rate at 13% .

What emerging trends are shaping market research, and how are researchers adapting to technological advancements?

A notable trend is the rise of mobile-first surveys, with 64% already incorporating this technology. Additionally, 56.6% of global survey responses come from mobile devices. Beyond survey methods, 71% of market researchers are investing in Customer Experience (CX) software, indicative of the industry's embrace of technological advancements.

In the dynamic world of market research statistics, the prevalence of online surveys, the rise of mobile-first approaches, and strategic investments in Customer Experience (CX) software paint a picture of an industry navigating consumer trends and technological shifts.

These numbers aren't just data; they signify an adaptable industry shaping the strategies of the future. As we wrap up this exploration, market research stands as a powerful tool, continuously innovating in the ever-evolving landscape of business decision-making.

- Market Research Services Global Market Report by Globenewswire

- BUSINESS & INNOVATION by Greenbook

- Market Research Trends by Qualtrics

- Market Research Industry by Statista

- A Diversity Tool for Market Research and Insights Professionals by Medium

- Market Research Transcription Services by Verbit

- Market Research Survival Guide by Surveymonkey

- Marketing Research And Automation Can Co-Exist by Quirks

- What’s The Average Survey Response Rate? by Pointerpro

Subscribe to our newsletter

Subscribe to be notified of new content on marketsplash..

- Services ›

- Business Services

Market research industry - statistics & facts

Global powerhouses in the market research industry, which sector spends the most on market research, key insights.

Detailed statistics

Revenue of the market research industry worldwide 2008-2023

Annual growth in market research revenue worldwide by region 2022

Market research: research services contributing the most to revenues 2022, by type

Editor’s Picks Current statistics on this topic

Market Research

Market share of the market research industry worldwide by country 2022

Further recommended statistics

Industry overview.

- Premium Statistic Revenue of the market research industry worldwide 2008-2023

- Premium Statistic Revenue of the market research industry worldwide by country or region 2009-2022

- Premium Statistic Distribution of global market research revenue by region 2022

- Premium Statistic Market research revenue worldwide by client sector 2022

- Premium Statistic Annual growth in market research revenue worldwide by region 2022

- Premium Statistic Market share of the market research industry worldwide by country 2022

- Premium Statistic Countries with the largest established research revenue worldwide 2022

- Premium Statistic Leading market research companies worldwide by global research revenue 2016-2022

Revenue of the market research industry worldwide from 2008 to 2023 with a forecast for 2024 (in billion U.S. dollars)

Revenue of the market research industry worldwide by country or region 2009-2022

Revenue of the market research industry worldwide from 2009 to 2022, by country or region (in billion U.S. dollars)

Distribution of global market research revenue by region 2022

Distribution of global market research revenue in 2022, by region

Market research revenue worldwide by client sector 2022

Distribution of market research revenue worldwide in 2022, by client sector

Annual growth in market research revenue worldwide in 2022, by region

Market share of the market research industry worldwide in 2022, by country

Countries with the largest established research revenue worldwide 2022

Countries with the largest established research sectors worldwide in 2022, by revenue (in billion U.S. dollars)

Leading market research companies worldwide by global research revenue 2016-2022

Leading market research companies worldwide from 2016 to 2022, by global research revenue (in billion U.S. dollars)

Global leaders

- Premium Statistic Revenue of Kantar worldwide 2006-2023

- Premium Statistic Research revenue of IQVIA worldwide 2013-2023

- Premium Statistic Number of IQVIA employees worldwide 2014-2023

- Premium Statistic Revenue of Ipsos worldwide 2000-2023

- Basic Statistic Number of Ipsos employees worldwide 2000-2023

- Premium Statistic Annual revenue of Gartner 2012-2023 by segment

- Premium Statistic Number of employees in Gartner worldwide 2010-2023

- Premium Statistic Research and development expenditure of Salesforce worldwide from 2015-2024

- Premium Statistic Number of employees at Salesforce worldwide from 2015-2023

Revenue of Kantar worldwide 2006-2023

Revenue of Kantar worldwide from 2006 to 2023 (in billion U.S. dollars)

Research revenue of IQVIA worldwide 2013-2023

Research revenue of IQVIA worldwide from 2013 to 2023 (in billion U.S. dollars)

Number of IQVIA employees worldwide 2014-2023

Number of IQVIA employees worldwide from 2014 to 2023

Revenue of Ipsos worldwide 2000-2023

Revenue of Ipsos worldwide from 2000 to 2023 (in billion euros)

Number of Ipsos employees worldwide 2000-2023

Number of Ipsos employees worldwide from 2000 to 2023

Annual revenue of Gartner 2012-2023 by segment

Annual revenue of Gartner from 2012 to 2023, by segment (in million U.S. dollars)

Number of employees in Gartner worldwide 2010-2023

Number of Gartner employees worldwide 2010 to 2023

Research and development expenditure of Salesforce worldwide from 2015-2024

Salesforce's research and development expense worldwide from 2015 to 2024 fiscal year* (in billion U.S. dollars)

Number of employees at Salesforce worldwide from 2015-2023

Salesforce's number of employees worldwide from 2015 to 2023 fiscal year* (in thousands)

Research methods

- Premium Statistic Market research: research services contributing the most to revenues 2022, by type

- Premium Statistic Sectors concentrating the most spending on market research 2022, by client's sector

- Premium Statistic Global spending on market research services in 2022, by survey type

- Premium Statistic Most used qualitative methods used in the market research industry worldwide 2022

- Premium Statistic Emerging market research approaches used worldwide 2022

- Premium Statistic Distribution of global market research spend by project type 2022

Services contributing the most to the global revenue of market research companies in 2022, by type of service

Sectors concentrating the most spending on market research 2022, by client's sector

Breakdown of the spending on market research services worldwide in 2022, by client's sector

Global spending on market research services in 2022, by survey type

Global distribution of the spending in market research services by method of survey in 2022

Most used qualitative methods used in the market research industry worldwide 2022

Share of traditional qualitative methods used in the market research industry worldwide in 2022

Emerging market research approaches used worldwide 2022

Emerging research approaches used in the market research industry worldwide in 2022

Distribution of global market research spend by project type 2022

Distribution of market research spending worldwide in 2022, by research project type

Further reports

Get the best reports to understand your industry.

- Advertising worldwide

- Mobile advertising and marketing in the U.S.

- Email marketing worldwide

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

6 Market Research Industry Trends to Watch in 2022

Market researchers are experienced at studying trends to uncover customer preferences and needs, both current and future. But what about trends in the market research industry itself? We decided to turn the figurative camera around and ask six market research and insights leaders what trends they think will shape their industry in 2022 and beyond.

While each professional offered a different perspective, it was interesting to see several commonalities emerging. One thing that became clear across predictions was that while technology is enabling market research professionals to work more efficiently, analyze larger volumes of data, and make data-backed recommendations, the industry is still highly focused on the human –on both the employee and customer side.

You can check out the six predictions for 2022 market research trends below.

Taking Action: Inclusivity and Sustainability

Over the past several years, many market research teams have been taking a critical look at the ways they approach diversity, equity, and inclusion (both in their research and the workplace) as well as environmental sustainability. Zontziry ‘Z’ Johnson , co-host of the podcast MRXplorer , predicts that 2022 is the year these teams start putting DE&I and sustainability plans into action:

I think–and hope–2022 is the year we see the shift from talking about how to be more inclusive in our research and how to be more environmentally friendly in the ways we do business, to taking actions to improve. This includes putting better research practices into place, such as expanding the panel providers client-side researchers work with to improve the representativeness of their research; changing the way we ask demographic questions so they are more inclusive and therefore more reflective of our world; and maybe even seeing a balance of in-person events and the far more accessible virtual events to reduce the carbon footprint we create at the industry level.

Empathy in Designing and Delivering Insights

As businesses shifted to working remotely and research teams recalibrated their priorities and methodologies in response to the covid-19 pandemic, the need to practice empathy came into sharp focus. Now, as many organizations shift to hybrid work models and in-person research slowly starts to come back, empathy must remain a priority. Danielle Todd , Head of Client Strategy at Relish , says:

Working at home blurred the line between professional and personal, and put a fresh lens on the importance of taking care of our whole selves, our families and communities, and our businesses. Whether that be through how we approach client challenges, or how we collaborate and work, or the pace we work at; the foundational driver in what we do should always be empathy. Empathy in the workplace is positively linked to employee happiness and performance , and (unsurprisingly) the associated positive impact on the bottom line is well appreciated and established. I imagine, after a particularly trying year, 2022 will focus on rebuilding businesses, brands, and teams with a well-deserved focus on empathy in how we design and deliver insight.

Social Listening Takes Center Stage

Social listening–the practice of monitoring and analyzing social media conversations about a brand or industry–is not new in the world of market research, but it may become an increasingly popular approach to understanding customers at a time when the average internet user spends almost two and a half hours on social media every day. Patrick Casey, Director of Growth Marketing at Felix Health , says:

In 2022, I forecast a greater demand in market research for social listening tools. Billions of people are creating and consuming content for social media on a daily basis. With the unveiling of the Metaverse, the lines between ‘real’ and ‘virtual’ may continue to be blurred even further. This could create a cornucopia of new, uncharted consumer insights and behavior metrics for marketers to research and discover as users explore a heavily augmented virtual reality. For the market research industry, this means that monitoring the popularity of search terms, brands, and phrases is a must if you wish to create relevant, multi-modal content for your target audience. With social listening tools, you can get an overview of these online conversations from a bird’s eye view, giving you an idea of market sentiment, short-term trends, and actionable opportunities.

User-Generated Content as a Data Source

With data privacy becoming an increasingly bigger concern for consumers, market researchers must focus on obtaining data from users who have actively opted in. Paul Sherman, CMO at Olive , believes that one of the ways market researchers will do this is by encouraging the sharing of user-generated content:

The defining trend of market research and customer insights in 2022 will be figuring out different ways to obtain customer data. Now that Google has cracked down on third-party cookies in Chrome and Apple has increased app-tracking privacy on their devices, companies have to find new and less intrusive ways to obtain web user data. I expect user-generated content to be the primary solution to this because customers give the data to you voluntarily while also having fun creating their own content (e.g. videos, written stories, etc.).

DSIGHT: Decision as Connected to Insight

It’s not just the ways that insights professionals collect data and conduct research that are evolving: it’s also the ways they share their findings with stakeholders and drive decisions. Dr. Eugene Roytburg, Co-Founder and CEO of Clearbox Decisions , believes the biggest trend we’ll see in 2022 is what he calls DSIGHT:

DSIGHT, a concatenation of D ecisions based on in SIGHT , will revolutionize how decisions will be made in the future with technology and AI to automate the bottom of the insights value chain (connecting and synthesizing data points via decision trees). This will free up and also guide insights professionals to drive insights creation, implications, recommendations and eventually, business decisions. Stronger and better conclusions and decisions will be more cost-effective and efficient by leveraging decision trees and cutting-edge AI technology.

Source: Clearbox Decisions

Balancing People and Technology

AI, technology, and automation are helping market research teams process large volumes of data, cut down on research project timelines, democratize insights across stakeholder groups, and drive decisions, but AI also provides insights professionals the ability to influence more than just marketing decisions across the business. In 2022, insights leaders will drive insights adoption across functional areas, and evolve into a truly insights- and marketing-led culture. According to Larisa Mats, Head of Consumer Insights at Brunswick (a Bloomfire customer):

In my experience, businesses are always trying to do more with the same (or fewer) people. The role of insights professionals continues to evolve with technological advances, but you still need human capital to think strategically and program machines. Developing deep consumer insights and applying them to the business in a strategic, thoughtful, carefully considered way to optimize brand growth will continue to rely on insights partners and thought leaders in the consumer research space. New tools, data streams, and technologies are a great start, but deep-rooted culture change requires work: finding insights champions on the brand/business teams, immersing them in the latest research and where to find it, brainstorming ways to build strategic action plans based on this new information, demonstrating the value of insights so it becomes embedded in their decision-making process. To maximize the utility of a knowledge platform like Bloomfire, business leaders across all levels and functional areas need to use the platform to share information and best practices, exchange ideas and collaborate–that is the power of democratizing knowledge.

Keeping an Eye on Market Research Trends in 2022

From an increasing focus on inclusivity and empathy to the adoption of insights sharing technologies that can be leveraged across teams, the trends that we’re seeing in market research now have the power to transform the industry. We’re excited to see what 2022 and the years to come bring, and we want to thank the market research professionals who shared their predictions with us.

We first published our annual blog post on market research trends in 2020. We updated it with all new trends and predictions in December 2021.

Benefits of Change Management in an Organization

How to Avoid Employee Burnout

How to Implement Change Management Effectively

Start working smarter with Bloomfire

See how Bloomfire helps companies find information, create insights, and maximize value of their most important knowledge.

Take a self guided Tour

See Bloomfire in action across several potential configurations. Imagine the potential of your team when they stop searching and start finding critical knowledge.

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

Market Research Report

2021 market research global trends.

For market researchers, COVID-19 accelerated a transformation that’s been a decade in the making — and it will completely reshape the industry in the coming years.

In our first annual study into the state of the market research industry, we surveyed more than 2,000 market research professionals from 16 countries to better understand how the industry reacted to COVID-19 in 2020 and how the dynamics of market research have changed.

Explore how organizations are adapting their approach to market research and what their top priorities and challenges are for 2021 as they look to design the experiences people want next.

Download Now

In this report you’ll learn:.

- Key priorities for research leaders in 2021

- How technology is transforming how researchers work

- Market research’s role in helping organizations move forward

12,000+ brands and the top 100 business schools have switched to Qualtrics

Request demo.

Ready to learn more about Qualtrics?

Table of Contents

30 market research statistics, facts and trends for 2024.

June 3, 2024

Key Market Research Statistics for 2024

- 23% of organizations lack a clear market research strategy. (Source: Qualtrics )

- 22% of market researchers face challenges with data quality, despite having access to the right tools. (Source: Qualtrics )

- Only 1 in 3 customer surveys receive a response. (Source: Pointerpro )

- Market research clients prioritize business knowledge as the most demanded skill. (Source: GreenBook )

- Roughly 47% of researchers worldwide report regular use of AI in their market research activities. (Source: Backlinko )

- In market research, a large number of survey respondents doesn’t guarantee high-quality data. (Source: AIMultiple )

- 70% of market research spending is allocated to 5 key areas: CRM and customer satisfaction surveys (20.7%), user experience surveys (14.2%), audience research (13.4%), usage and behavioral studies (11.7%), and market measurement (11.6%). (Source: Exploding Topics )

Market Research Industry Growth Statistics

- The global market research industry grew by 8.4% annually. (Source: Statista )

- The revenue of the US Market Research Industry has increased at a 2.9% CAGR over five years, reaching an estimated $30.9 billion in 2023. (Source: IBISWorld )