Financial Tips, Guides & Know-Hows

Home > Finance > How Is Treasury Stock Shown On The Balance Sheet?

How Is Treasury Stock Shown On The Balance Sheet?

Published: December 27, 2023

Learn how treasury stock is presented on the balance sheet and its significance in finance.

- Balance Sheet

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Table of Contents

Introduction, definition of treasury stock, purpose of treasury stock, accounting treatment of treasury stock, presentation of treasury stock on the balance sheet, example of how treasury stock is shown on the balance sheet, importance of disclosing treasury stock.

Treasury stock is a term commonly used in finance and accounting that refers to shares of a company’s own stock that have been repurchased by the company. This stock is usually held by the company itself rather than being retired or canceled, and it is therefore considered as “outstanding” stock but not actively traded in the market. The treatment of treasury stock on the balance sheet is an important aspect of financial reporting, as it reflects the company’s financial position and provides insights into its capital structure.

The concept of treasury stock may seem counterintuitive at first, as companies typically issue shares of stock to raise capital from investors. However, there are various reasons why a company might decide to repurchase its own stock. It could be a strategic move to return excess cash to shareholders, to increase the company’s earnings per share, or to thwart a potential hostile takeover by reducing the number of shares available for trading.

In this article, we will explore the accounting treatment of treasury stock and how it is presented on the balance sheet. We will also discuss the importance of disclosing treasury stock information to investors and other stakeholders.

Treasury stock is a term used to describe shares of a company’s own stock that has been repurchased by the company. When a company buys back its own shares, those shares are no longer considered to be outstanding in the market. Instead, they are held by the company itself, which is why they are referred to as treasury stock.

Unlike shares that are retired or canceled, treasury stock remains part of the company’s total capital stock but is not available for trading or voting purposes. It is essentially considered “inactive” stock and is typically held by the company in its own treasury account.

It’s important to note that treasury stock is different from authorized, issued, and outstanding shares. Authorized shares are the maximum number of shares that a company is allowed to issue, while issued shares are the number of shares that have been actually issued by the company. Outstanding shares, on the other hand, are the issued shares that are currently held by investors in the market.

Treasury stock can be acquired in a number of ways, including open market purchases, direct repurchases from shareholders, or through stock buyback programs. The decision to repurchase shares of its own stock is typically made by a company’s management and board of directors, based on various factors such as the company’s financial position, strategic objectives, and market conditions.

The main purpose of acquiring treasury stock is to provide the company with more flexibility in managing its capital structure and utilizing its available cash. It can also be seen as a way to enhance shareholder value by reducing the number of shares outstanding, which may increase earnings per share and potentially boost the stock price.

The repurchase of a company’s own stock, known as treasury stock, serves various purposes and can be driven by strategic, financial, and regulatory considerations. Let’s explore some of the main purposes behind companies acquiring treasury stock:

- Capital Structure Management: By repurchasing its own stock, a company can adjust its capital structure and optimize its financial position. This can be done by reducing the number of shares outstanding, which may increase earnings per share and enhance shareholder value. It can also allow the company to redistribute its excess cash to shareholders or reissue the treasury stock for other purposes, such as employee stock option plans.

- Market Manipulation and Defensive Measures: Acquiring treasury stock can be a defensive tactic to prevent hostile takeovers or counteract the influence of activist investors. By reducing the number of shares available for trading, the company can make it more difficult for external parties to gain control or influence over the company’s decision-making processes.

- Undervaluation and Investment Opportunity: Companies may repurchase their stock when they believe it is undervalued in the market. By buying back shares at a lower price, the company can potentially generate long-term value for shareholders when the stock price eventually appreciates. This can also signal to investors that the management has confidence in the company’s future prospects.

- Tax Efficiency: Repurchasing treasury stock can be a tax-efficient way for companies to distribute excess cash to shareholders. Instead of paying dividends, which may be subject to higher tax rates, the company can utilize its cash to buy back stock and increase the value of the remaining shares.

- Employee Stock Incentives: Treasury stock can be used to support employee stock incentive plans such as stock options or restricted stock units. By issuing treasury stock to employees, the company can align their interests with those of the shareholders and provide them with a sense of ownership and participation in the company’s success.

It’s important to note that while treasury stock can have various benefits, there are also potential drawbacks and risks. Companies need to carefully evaluate their financial resources, market conditions, and regulatory requirements before engaging in treasury stock transactions to ensure they are acting in the best interests of their shareholders and maintaining transparency in their financial reporting.

The accounting treatment of treasury stock involves recording the repurchase of shares on the company’s balance sheet and making appropriate adjustments to the equity section of the financial statements. Here are the key aspects of the accounting treatment of treasury stock:

- Cost Method: The most commonly used method for accounting for treasury stock is the cost method. Under this method, the treasury stock is recorded at its acquisition cost, which is the price paid to repurchase the shares. The cost of the treasury stock is debited to the treasury stock account, a contra-equity account that reduces the shareholders’ equity on the balance sheet.

- Reduction in Shareholders’ Equity: The repurchase of treasury stock reduces the total shareholders’ equity of the company. This reduction is reflected on the balance sheet as a deduction from the company’s total common stock and additional paid-in capital. Treasury stock is reported as a negative amount in the equity section of the balance sheet to indicate that it is a reduction in shareholders’ equity.

- Treatment of Dividends and Voting Rights: Treasury stock does not have voting rights and is not entitled to receive dividends or participate in shareholder meetings. Therefore, companies do not include treasury stock when determining the total number of shares for voting or dividend calculations.

- Disclosure in Financial Statements: The accounting treatment of treasury stock requires clear disclosure in the company’s financial statements. This includes providing information on the number of shares repurchased, the cost of the treasury stock, and any changes in the treasury stock account. These details are typically disclosed in the notes to the financial statements to ensure transparency for investors and other stakeholders.

It’s important for companies to adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) when accounting for treasury stock. Following the proper accounting treatment ensures accurate financial reporting and helps investors make informed decisions about the company’s financial health and performance.

It’s worth noting that the accounting treatment of treasury stock can vary depending on local regulatory requirements and specific company circumstances. Companies should consult with their accountants or financial advisors to ensure compliance with applicable accounting standards and regulations.

When it comes to presenting treasury stock on the balance sheet, it is important for companies to follow specific guidelines to accurately reflect their financial position. Here’s how treasury stock is typically presented on the balance sheet:

- Shareholders’ Equity Section: Treasury stock is reported as a negative amount within the shareholders’ equity section of the balance sheet. It is deducted from the common stock and additional paid-in capital accounts. This deduction reflects the reduction in shareholders’ equity due to the repurchase of shares.

- Separate Line Item: Treasury stock is commonly presented as a separate line item within the shareholders’ equity section. It is labeled as “Treasury Stock” or “Stock Repurchased” to clearly indicate that it represents shares that the company has bought back from the market.

- Carrying Value: The carrying value of treasury stock is typically stated as the cost of the shares repurchased. This is the amount at which the shares were originally bought back from the market or shareholders and is recorded as a negative number beneath the “Treasury Stock” line item.

- Net Equity Impact: The presentation of treasury stock on the balance sheet has a net impact on shareholders’ equity. The deduction of treasury stock from the common stock and additional paid-in capital accounts reduces the overall equity value, reflecting the decrease in outstanding shares due to the repurchase.

- Detailed Disclosure: Companies often provide additional disclosure in the footnotes to the financial statements regarding their treasury stock activities. This includes information about the number of shares repurchased, the average cost per share, and any changes in the treasury stock account balance over the reporting period.

By presenting treasury stock as a separate line item on the balance sheet, companies provide transparency and clarity to stakeholders regarding the repurchase of shares and its impact on the shareholders’ equity. This allows investors, creditors, and analysts to assess the company’s capital structure and make informed decisions about its financial health and performance.

It’s important for companies to adhere to applicable accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), when presenting treasury stock on the balance sheet. This ensures consistency and comparability in financial reporting across different companies and industries.

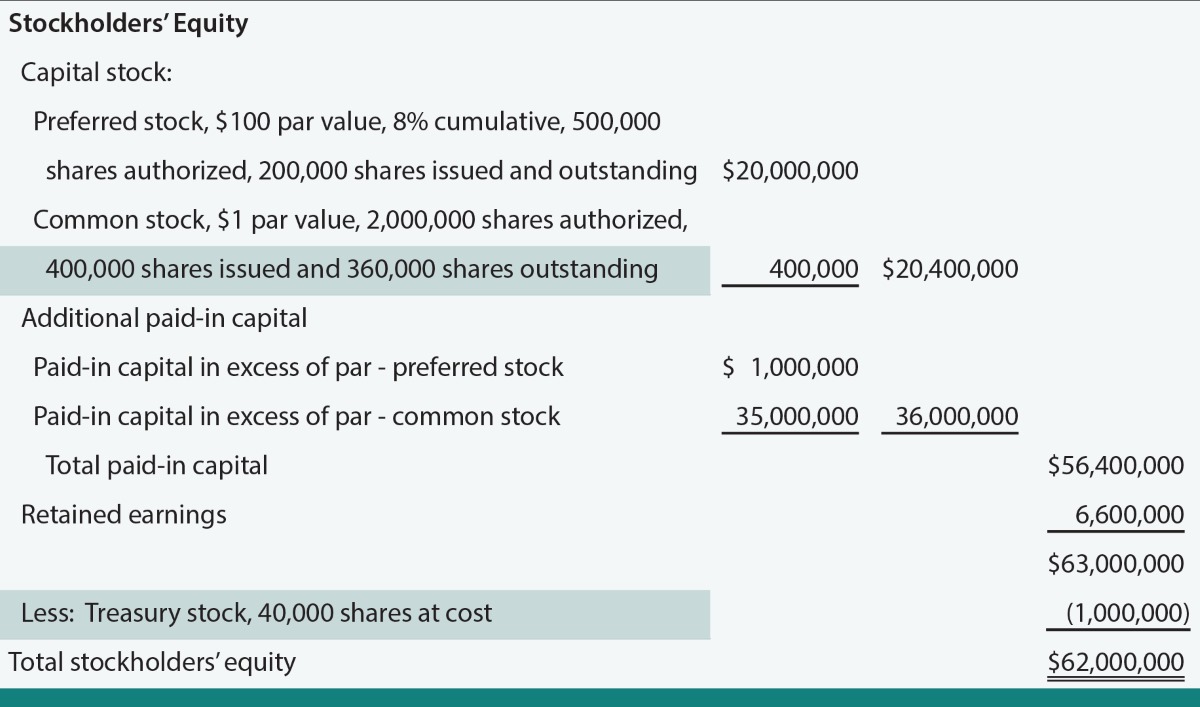

To illustrate how treasury stock is presented on the balance sheet, let’s consider a hypothetical example:

Company XYZ repurchases 10,000 shares of its own common stock at a cost of $20 per share. The company’s common stock was originally issued at $30 per share, and it has additional paid-in capital of $200,000.

On the balance sheet, the presentation of treasury stock would look as follows:

- Common Stock: 1,000,000 shares x $30 = $30,000,000

- Additional Paid-in Capital: $200,000

- Treasury Stock: (10,000 shares x $20) = ($200,000)

In this example, the common stock and additional paid-in capital represent the initial equity raised by the company through the issuance of shares. The treasury stock is presented as a separate line item, indicating the shares repurchased by the company.

The value of the treasury stock is calculated by multiplying the number of repurchased shares (10,000) by the cost per share ($20), resulting in a negative value of ($200,000). This deduction from the shareholders’ equity section reflects the reduction in the overall equity due to the repurchase of shares.

It’s worth noting that the presentation of treasury stock on the balance sheet may vary depending on the specific accounting standards followed and the reporting requirements of the jurisdiction in question. However, the overall concept remains consistent: treasury stock is shown as a separate line item within the shareholders’ equity section, with a negative value representing the cost of the repurchased shares.

By clearly presenting treasury stock on the balance sheet, companies provide transparency to stakeholders regarding their capital structure and the impact of stock repurchases on shareholders’ equity. This information enables investors, creditors, and analysts to better assess the financial health and performance of the company.

Disclosing treasury stock information is of significant importance as it provides transparency and insights into a company’s capital structure and stock repurchase activities. Here are some reasons why disclosing treasury stock is essential:

- Accuracy of Financial Statements: In keeping with accounting principles and regulations, disclosing treasury stock ensures the accuracy and completeness of a company’s financial statements. By including treasury stock as a separate line item, stakeholders can clearly see the reduction in shareholders’ equity resulting from stock repurchases, allowing for more accurate analysis of the company’s financial health.

- Investor Decision-Making: Investors rely on accurate and comprehensive information to make informed investment decisions. When a company discloses treasury stock, it provides investors with a clear picture of the company’s capital structure and any potential impact on key financial metrics, such as earnings per share (EPS). This information helps investors assess the company’s performance and evaluate its long-term growth prospects.

- Protection of Shareholders’ Interests: Disclosing treasury stock is crucial for protecting the interests of shareholders. When a company repurchases its own stock, it may affect ownership rights, voting power, and entitlement to dividends. Transparent disclosure ensures that shareholders are aware of the company’s actions and can assess the potential impact of stock repurchases on their investment.

- Corporate Governance and Accountability: By disclosing treasury stock, a company demonstrates its commitment to transparency and accountability. This fosters trust among stakeholders, including shareholders, employees, lenders, and regulatory authorities. It also indicates the company’s adherence to sound corporate governance practices, which are highly valued in today’s business environment.

- Use in Financial Analysis: Disclosed treasury stock information can be utilized for financial analysis purposes. Analysts can examine the trends of stock repurchases over time and assess their impact on various financial ratios and metrics, such as return on equity (ROE) and price-earnings (P/E) ratio. This analysis helps in evaluating the efficiency and effectiveness of a company’s share repurchase strategy.

It is worth noting that the disclosure of treasury stock may be required by accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Companies should comply with these standards and provide comprehensive and accurate disclosure in their financial statements and related footnotes.

Overall, the disclosure of treasury stock is crucial for maintaining transparency, protecting shareholder interests, and facilitating informed decision-making by investors and other stakeholders. By providing clear and complete information, companies demonstrate their commitment to sound financial reporting practices and foster trust among the investing community.

Treasury stock plays a significant role in a company’s financial reporting and capital structure. Understanding the definition, purpose, accounting treatment, and presentation of treasury stock is essential for investors, analysts, and other stakeholders. By accurately disclosing treasury stock information, companies can provide transparency and insights into their stock repurchases, enabling stakeholders to make informed decisions.

Treasury stock is a term used to describe shares of a company’s own stock that have been repurchased by the company and are held by the company itself. The repurchase of treasury stock can serve various purposes, such as capital structure management, market manipulation, undervaluation opportunities, tax efficiency, and support for employee stock incentives.

In terms of accounting treatment, treasury stock is typically recorded at cost and deducted from the shareholders’ equity section of the balance sheet. It is presented as a separate line item, indicating the repurchased shares and their negative value. Disclosing treasury stock information ensures accurate financial reporting, helps investors assess the financial health of the company, and protects shareholders’ interests.

Disclosing treasury stock is important for the accuracy of financial statements, investor decision-making, protection of shareholders’ interests, corporate governance, and financial analysis. By providing transparency and comprehensive disclosure, companies demonstrate their commitment to accountability and promote trust among stakeholders.

In conclusion, treasury stock is a key aspect of a company’s financial landscape and understanding its treatment and presentation on the balance sheet is crucial for financial analysis and investor confidence. Companies should adhere to accounting standards, disclose treasury stock information accurately, and ensure transparency in their reporting practices to maintain credibility and facilitate informed decision-making.

20 Quick Tips To Saving Your Way To A Million Dollars

Our Review on The Credit One Credit Card

Bottomry Definition

How Does Tax Credit Work On Car Trade-In

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/how-is-treasury-stock-shown-on-the-balance-sheet/

- Search Search Please fill out this field.

- Portfolio Management

Treasury Stock on the Balance Sheet

Thomas Barwick / Getty Images

When you are thinking about buying stocks in a company, you will want to look at its balance sheet. When you are looking over a balance sheet , you will run across an entry under the shareholders' equity section called treasury stock. The dollar amount of treasury stock shown on the balance sheet refers to the cost of the shares a firm has issued and then taken back at a later time, either through a share repurchase program or other means.

These shares may be re-issued in the future, unlike retired shares that no longer have value. If shares no longer have value, a company removes them from its balance sheet.

Key Takeaways

- Treasury stock is the cost of shares a company has bought back.

- When a firm buys back stock, it may resell them later to raise cash, use them in an acquisition, or retire the shares.

- Opinions differ on whether treasury stock should be carried on the balance sheet at historical cost or at the current market value.

What Happens to Buyback Stock

Companies buy back their stock to boost their share price, among other reasons. When the firm buys back its shares, there are a few things that can be done with them. One choice is to sit on those buyback shares and later resell them to the public to raise cash. They can also be used in the purchase of other firms.

The company could also retire those shares and reduce the active share count for good. This would cause each active share to represent a greater ownership stake in the firm for investors. This means they would get a bigger cut of the dividends and profits as tallied by basic and diluted EPS .

The Good and Bad of Share Buybacks

Neither course of action shown above is better than the other. For the most part, either route can be good if the allocation of stock is managed well.

A real-world example of wise share buybacks is that of Teledyne Technologies. The founder and CEO, Henry Singleton, used treasury stock very well during his tenure. He increased the true value of the stock for long-term owners who stuck with the firm. Singleton bought back stock when the shares of the company were low cost. He also issued it liberally when he felt the stock was overvalued. These actions brought in cash to spend on useful assets and projects.

Treasury stock buyback schemes can sometimes destroy value. This might happen if a firm pays too much for its own shares or issues shares to pay for acquisitions when those shares are undervalued.

Though not entirely related to treasury stock, one of the most famous ill-timed examples to come out of corporate America in recent years was a 2010 deal in which the former Kraft Foods, spun out of Philip Morris, acquired Cadbury PLC. Kraft sold undervalued stock to pay for its overvalued $19.6 billion acquisition.

Real-World Examples

One of the largest examples you'll ever see of treasury stock on a balance sheet is Exxon Mobil Corp., one of the few major oil firms and the main offspring of John D. Rockefeller's Standard Oil empire.

At the end of 2018, Exxon had a stunning $225.553 billion in treasury stock on the books that it had bought back but not canceled.

Exxon Mobil has a policy of giving back surplus cash flow to owners through a mixture of dividends and share buybacks and keeping the stock with plans to use it again. Every decade or two, it buys a major energy firm. Exxon pays for the deal with stock. It dilutes stockholders' ownership percentages by reselling those shares, then using cash flow to buy that stock back, undoing the dilution.

It's a win-win for all parties involved. The owners of the acquisition target those who want to stay invested and don't have to pay capital gains tax from the merger. The owners of Exxon Mobil end up with the economic equivalent of an all-cash deal, and their ownership percentage gets restored. Exxon uses the cash flow from its older and newly gained earnings streams to rebuild its treasury stock position.

The Future of Treasury Stock

From time to time, certain talks take place in the finance industry as to whether or not it would be a good idea to change the rules for how firms carry treasury stock on the balance sheet. At present, treasury stock is carried at historical cost.

Some think it should reflect the current market value of the firm's shares. At least, in theory, the firm could sell the shares on the open market for that price or use them to buy other firms, converting them back into cash or useful assets. This thinking has yet to prevail.

Some states limit the amount of treasury stock a firm can carry as a cut in shareholders' equity at any given time. Limits are placed because it is a way of taking assets out of the business by the people who own shares, which in turn may threaten the legal rights of creditors. At the same time, some states don't allow firms to carry treasury stock on the balance sheet at all. Instead, they must retire shares. California, for instance, does not support treasury stocks, though some firms in the state do have them.

AccountingforManagement.org. " Treasury Stock - Cost Method ."

Corporate Finance Institute. " Share Repurchase ."

GuruFocus. " Henry Singleton: A Man Even Buffett Envied ."

SEC. " Offer by Kraft Foods Inc. for Cadbury PLC ."

Exxon Mobil. " Our History ."

Exxon Mobil. " 2018 Summary Annual Report ." Page 38.

SEC. " Form S4 Registration Statement ."

The National Law Review. " Four Decades After Being Demolished, Some California Corporations Continue to Refer to 'Treasury Stock .'"

Understanding Treasury Stock on the Balance Sheet

Treasury stock is a term used to describe a company’s own shares that have been repurchased and are held by the company.

It is important to understand where treasury stock appears on a balance sheet and how it impacts the financial statements of a business. Let’s discuss treasury stock and what it means for your business.

What Is Treasury Stock?

Treasury stock refers to shares of a corporation that were issued but then bought back by the corporation itself.

These are not outstanding shares and will not appear among the total number of shares owned by outside shareholders, however, they do have an impact on the balance sheet of a business.

The goal for companies when purchasing their own stocks is usually to reduce their share count, which can result in an increase in earnings per share (EPS) if all other factors remain constant. Companies may also reissue their treasury stocks if they believe it will be beneficial for them at a later date.

Where Does Treasury Stock Appear on the Balance Sheet?

On the balance sheet, treasury stock will usually appear under either “share capital” or “additional paid-in capital” as a negative value or liability.

This negative value indicates that there is less equity available than before due to the repurchase of shares and should be taken into account when looking at other parts of the balance sheet, such as total assets and liabilities.

The amount of treasury stock also affects EPS because it decreases the number of outstanding shares used in calculating this metric, which can lead to higher reported EPS values if all else remains equal.

How Does Treasury Stock Affect Financial Statements?

Treasury stock has an effect on both your income statement and balance sheet because it decreases both retained earnings and common stock balances while increasing cash levels on your balance sheet.

On your income statement, treasury stock reduces net income since you are paying out money from retained earnings in order to buy back your own stocks.

This can also decrease dividends paid out since fewer people will have access to them if there are fewer outstanding shares after purchasing treasury stocks.

A company’s decision to purchase its own stocks will have an impact on its financial statements, so it is important for business owners to understand where treasury stock appears on their balance sheets and how it affects their overall financial health.

By understanding where treasury stocks belong on their financial statements, businesses can more accurately gauge their performance and make decisions accordingly.

Additionally, they can also be aware of how these purchases might affect certain metrics such as EPS or dividends paid out—which could ultimately influence investor decisions going forward.

Ultimately, understanding where treasury stocks appear on your financial statements can help you make more informed decisions about managing your assets now and in years to come.

Related Posts

Debit vs. credit: what you need to know about accounting terms.

Accounting can be a complicated and daunting task, especially when…

Read More »

Understand the Benefits of Incorporation

Incorporating your business is a big decision, but it can…

Navigating the Disadvantages of Purchasing Processes (3 Points You Should Know

The purchasing process is essential for any business as it…

An Overview of the 6 Types of Investment Accounts

Blog Introduction: When you’re looking to diversify your portfolio and…

principlesofaccounting.com

Treasury Stock

- Goals Achievement

- Fill in the Blanks

- Multiple Choice

Treasury stock is the term that is used to describe shares of a company’s own stock that it has reacquired. A company may buy back its own stock for many reasons. A frequently cited reason is a belief by the officers and directors that the market value of the stock is unrealistically low. As such, the decision to buy back stock is seen as a way to support the stock price and utilize corporate funds to maximize the value for shareholders who choose not to sell back stock to the company.

Other times, a company may buy back public shares as part of a reorganization that contemplates the company “going private” or delisting from some particular stock exchange. Further, a company might buy back shares and in turn issue them to employees pursuant to an employee stock award plan.

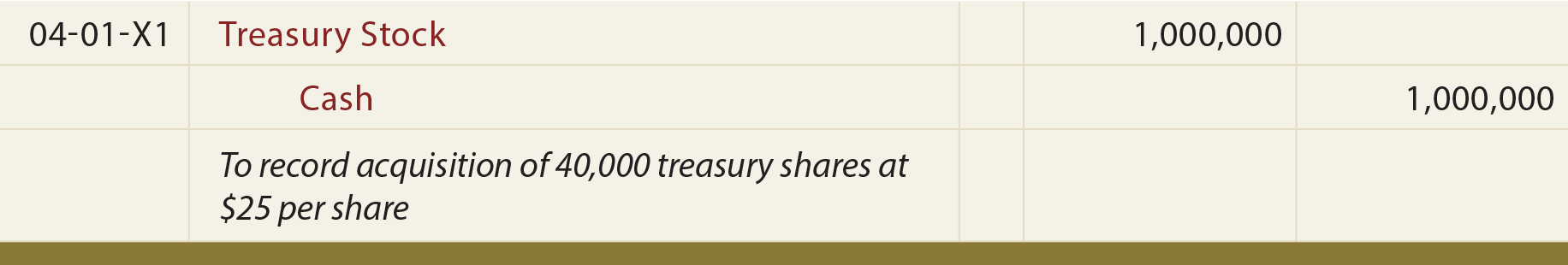

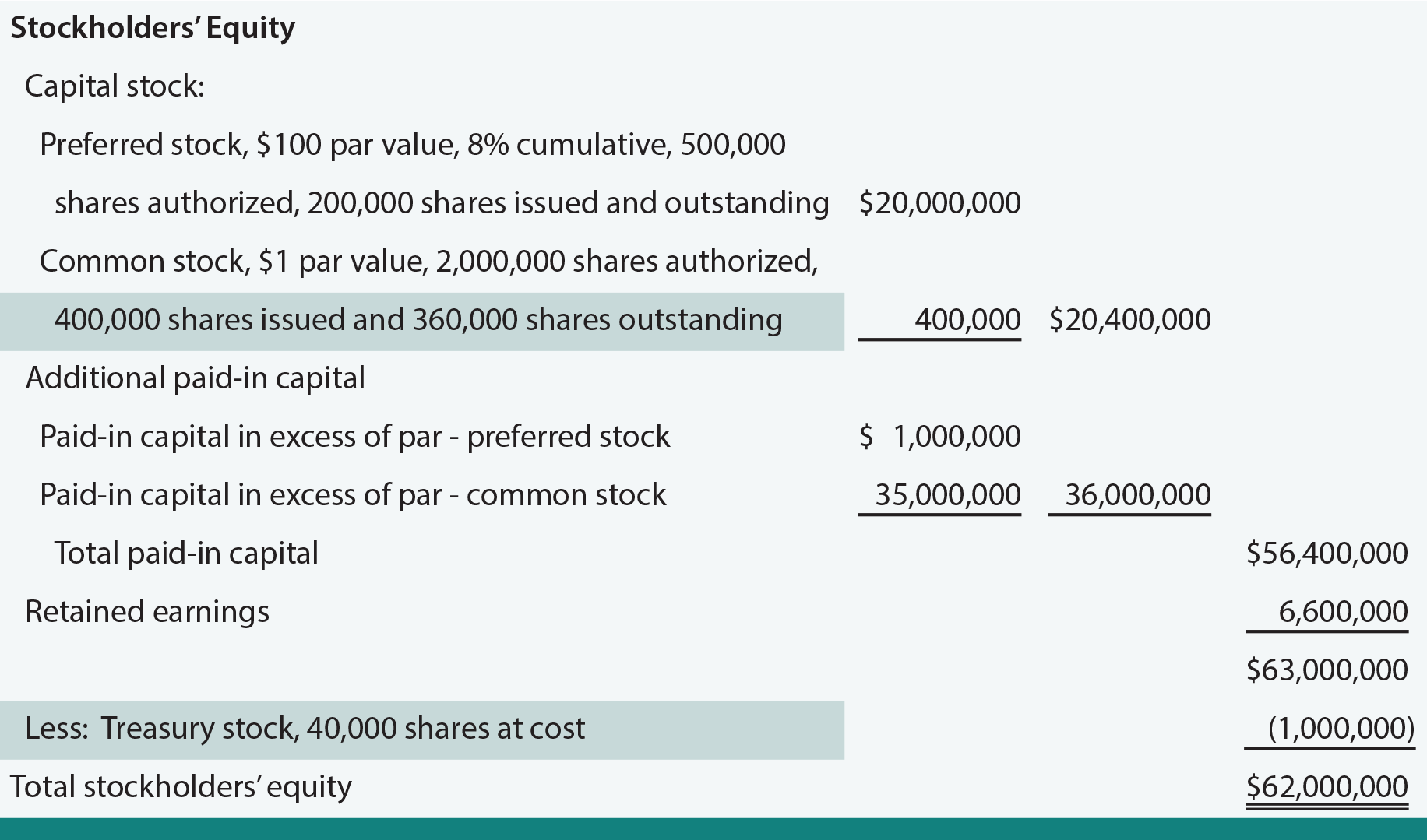

Whatever the reason for a treasury stock transaction, the company is to account for the shares as a purely equity transaction, and “gains and losses” are ordinarily not reported in income. Procedurally, there are several ways to record the “debits” and “credits” associated with treasury stock, and the specifics can vary globally. The “cost method” is generally acceptable. Under this approach, acquisitions of treasury stock are accounted for by debiting Treasury Stock and crediting Cash for the cost of the shares reacquired:

The effect of treasury stock is very simple: cash goes down and so does total equity by the same amount. This result occurs no matter what the original issue price was for the stock. Accounting rules do not recognize gains or losses when a company issues its own stock , nor do they recognize gains and losses when a company reacquires its own stock . This may seem odd, because it is certainly different than the way one thinks about stock investments. But remember, this is not a stock investment from the company’s perspective. It is instead an expansion or contraction of its own equity.

Treasury Stock is a contra equity item. It is not reported as an asset; rather, it is subtracted from stockholders’ equity. The presence of treasury shares will cause a difference between the number of shares issued and the number of shares outstanding. Following is Embassy Corporation’s equity section, modified (see highlights) to reflect the treasury stock transaction portrayed by the entry.

If treasury shares are reissued, Cash is debited for the amount received and Treasury Stock is credited for the cost of the shares. Any difference may be debited or credited to Paid-in Capital in Excess of Par.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

5.9 Treasury Stock

Sometimes a corporation decides to purchase its own stock in the market. These shares are referred to as treasury stock. A company might purchase its own outstanding stock for a number of possible reasons. It can be a strategic maneuver to prevent another company from acquiring a majority interest or preventing a hostile takeover. A purchase can also create demand for the stock, which in turn raises the market price of the stock. Sometimes companies buy back shares to be used for employee stock options or profit-sharing plans.

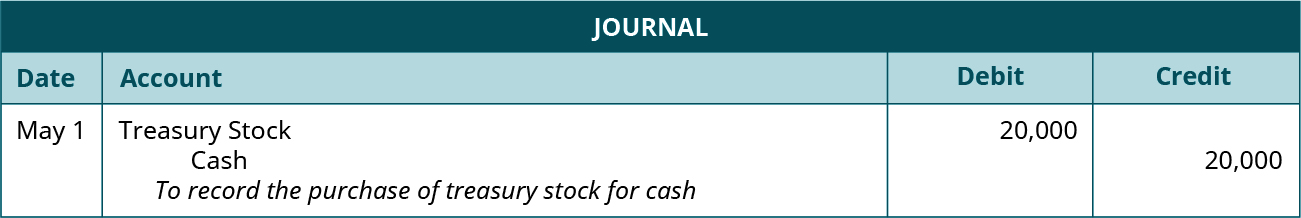

Acquiring Treasury Stock

When a company purchases treasury stock, it is reflected on the balance sheet in a contra equity account. As a contra equity account, Treasury Stock has a debit balance, rather than the normal credit balances of other equity accounts. The total cost of treasury stock reduces total equity. In substance, treasury stock implies that a company owns shares of itself. However, owning a portion of one’s self is not possible. Treasury shares do not carry the basic common shareholder rights because they are not outstanding. Dividends are not paid on treasury shares, they provide no voting rights, and they do not receive a share of assets upon liquidation of the company. There are two methods possible to account for treasury stock—the cost method, which is discussed here, and the par value method, which is a more advanced accounting topic. The cost method is so named because the amount in the Treasury Stock account at any point in time represents the number of shares held in treasury times the original cost paid to acquire each treasury share.

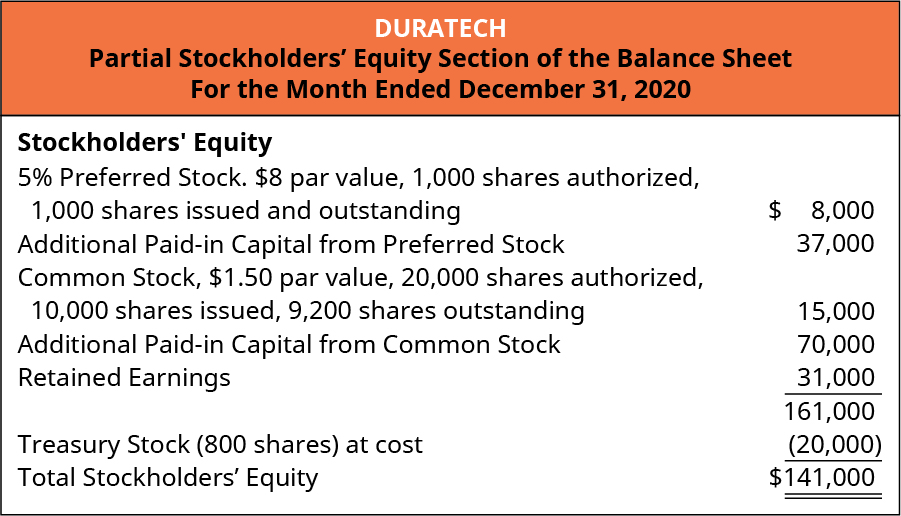

Assume Duratech’s net income for the first year was $3,100,000, and that the company has 12,500 shares of common stock issued. During May, the company’s board of directors authorizes the repurchase of 800 shares of the company’s own common stock as treasury stock. Each share of the company’s common stock is selling for $25 on the open market on May 1, the date that Duratech purchases the stock. Duratech will pay the market price of the stock at $25 per share times the 800 shares it purchased, for a total cost of $20,000. The following journal entry is recorded for the purchase of the treasury stock under the cost method.

Even though the company is purchasing stock, there is no asset recognized for the purchase. An entity cannot own part of itself, so no asset is acquired. Immediately after the purchase, the equity section of the balance sheet ( Figure 5.62 ) will show the total cost of the treasury shares as a deduction from total stockholders’ equity.

Notice on the partial balance sheet that the number of common shares outstanding changes when treasury stock transactions occur. Initially, the company had 10,000 common shares issued and outstanding. The 800 repurchased shares are no longer outstanding, reducing the total outstanding to 9,200 shares.

CONCEPTS IN PRACTICE

Reporting treasury stock for nestlé holdings group.

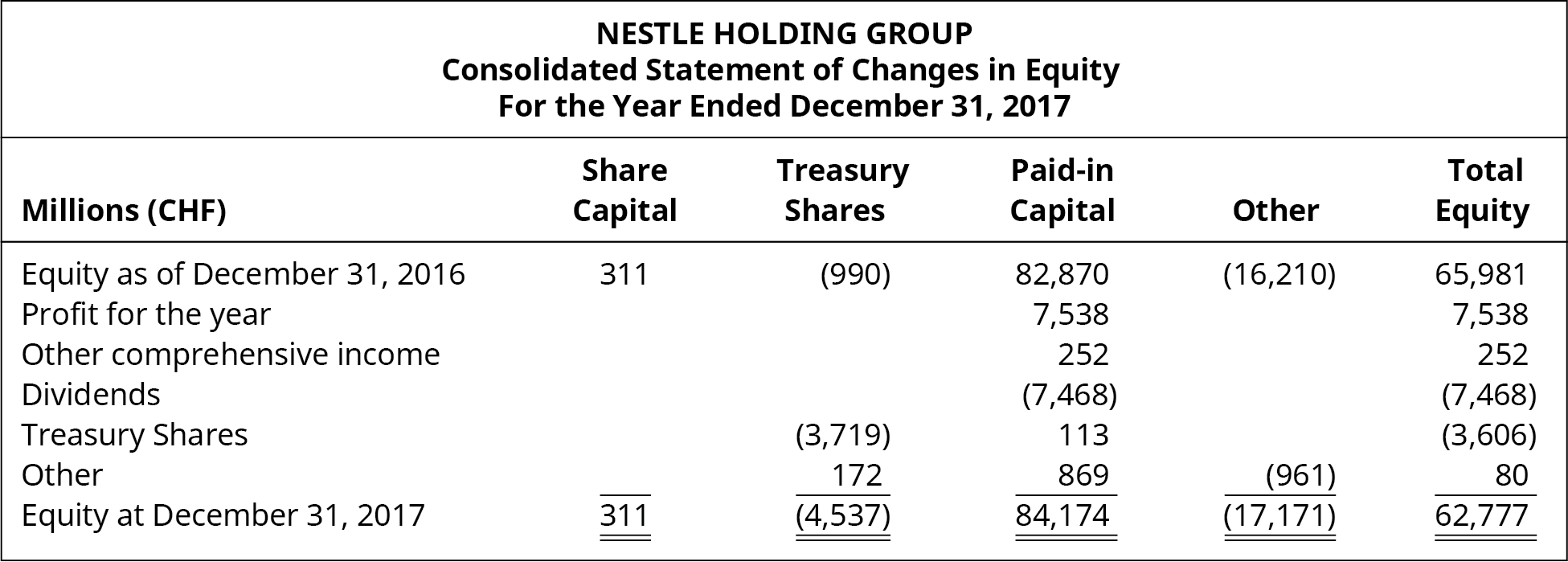

Nestlé Holdings Group sells a number of major brands of food and beverages including Gerber , Häagen-Dazs , Purina , and Lean Cuisine . The company’s statement of stockholders’ equity shows that it began with 990 million Swiss francs (CHF) in treasury stock at the beginning of 2016. In 2017, it acquired additional shares at a cost of 3,547 million CHF, raising its total treasury stock to 4,537 million CHF at the end of 2017, primarily due to a share buy-back program. 15

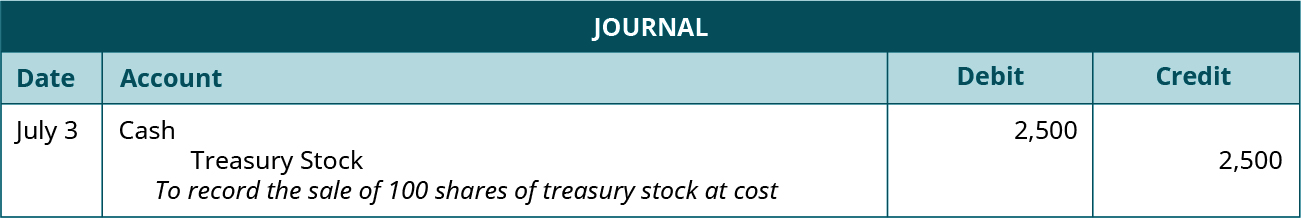

Reissuing Treasury Stock above Cost

Management typically does not hold treasury stock forever. The company can resell the treasury stock at cost, above cost, below cost, or retire it. If La Cantina reissues 100 of its treasury shares at cost ($25 per share) on July 3, a reversal of the original purchase for the 100 shares is recorded. This has the effect of increasing an asset, Cash, with a debit, and decreasing the Treasury Stock account with a credit. The original cost paid for each treasury share, $25, is multiplied by the 100 shares to be resold, or $2,500. The journal entry to record this sale of the treasury shares at cost is:

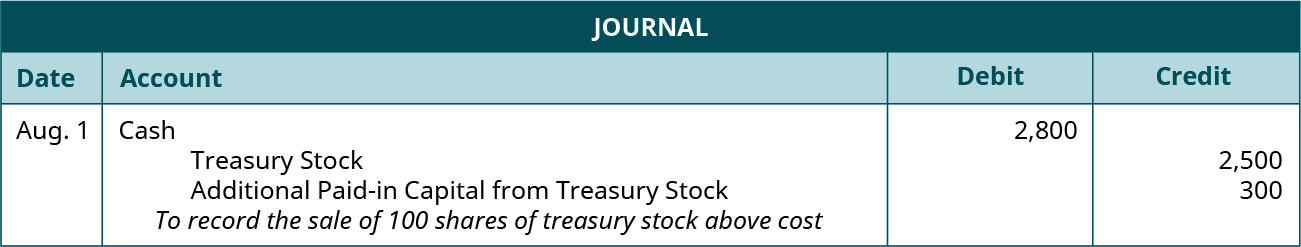

If the treasury stock is resold at a price higher than its original purchase price, the company debits the Cash account for the amount of cash proceeds, reduces the Treasury Stock account with a credit for the cost of the treasury shares being sold, and credits the Paid-in Capital from Treasury Stock account for the difference. Even though the difference—the selling price less the cost—looks like a gain, it is treated as additional capital because gains and losses only result from the disposition of economic resources (assets). Treasury Stock is not an asset. Assume that on August 1, La Cantina sells another 100 shares of its treasury stock, but this time the selling price is $28 per share. The Cash Account is increased by the selling price, $28 per share times the number of shares resold, 100, for a total debit to Cash of $2,800. The Treasury Stock account decreases by the cost of the 100 shares sold, 100 × $25 per share, for a total credit of $2,500, just as it did in the sale at cost. The difference is recorded as a credit of $300 to Additional Paid-in Capital from Treasury Stock.

Reissuing Treasury Stock Below Cost

If the treasury stock is reissued at a price below cost, the account used for the difference between the cash received from the resale and the original cost of the treasury stock depends on the balance in the Paid-in Capital from Treasury Stock account. Any balance that exists in this account will be a credit. The transaction will require a debit to the Paid-in Capital from Treasury Stock account to the extent of the balance. If the transaction requires a debit greater than the balance in the Paid-in Capital account, any additional difference between the cost of the treasury stock and its selling price is recorded as a reduction of the Retained Earnings account as a debit. If there is no balance in the Additional Paid-in Capital from Treasury Stock account, the entire debit will reduce retained earnings.

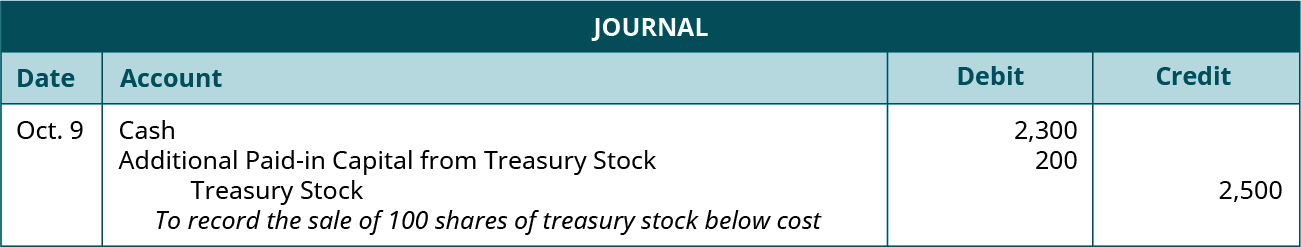

Assume that on October 9, La Cantina sells another 100 shares of its treasury stock, but this time at $23 per share. Cash is increased for the selling price, $23 per share times the number of shares resold, 100, for a total debit to Cash of $2,300. The Treasury Stock account decreases by the cost of the 100 shares sold, 100 × $25 per share, for a total credit of $2,500. The difference is recorded as a debit of $200 to the Additional Paid-in Capital from Treasury Stock account. Notice that the balance in this account from the August 1 transaction was $300, which was sufficient to offset the $200 debit. The transaction is recorded as:

Treasury stock transactions have no effect on the number of shares authorized or issued. Because shares held in treasury are not outstanding, each treasury stock transaction will impact the number of shares outstanding. A corporation may also purchase its own stock and retire it. Retired stock reduces the number of shares issued. When stock is repurchased for retirement, the stock must be removed from the accounts so that it is not reported on the balance sheet. The balance sheet will appear as if the stock was never issued in the first place.

Understanding Stockholders’ Equity

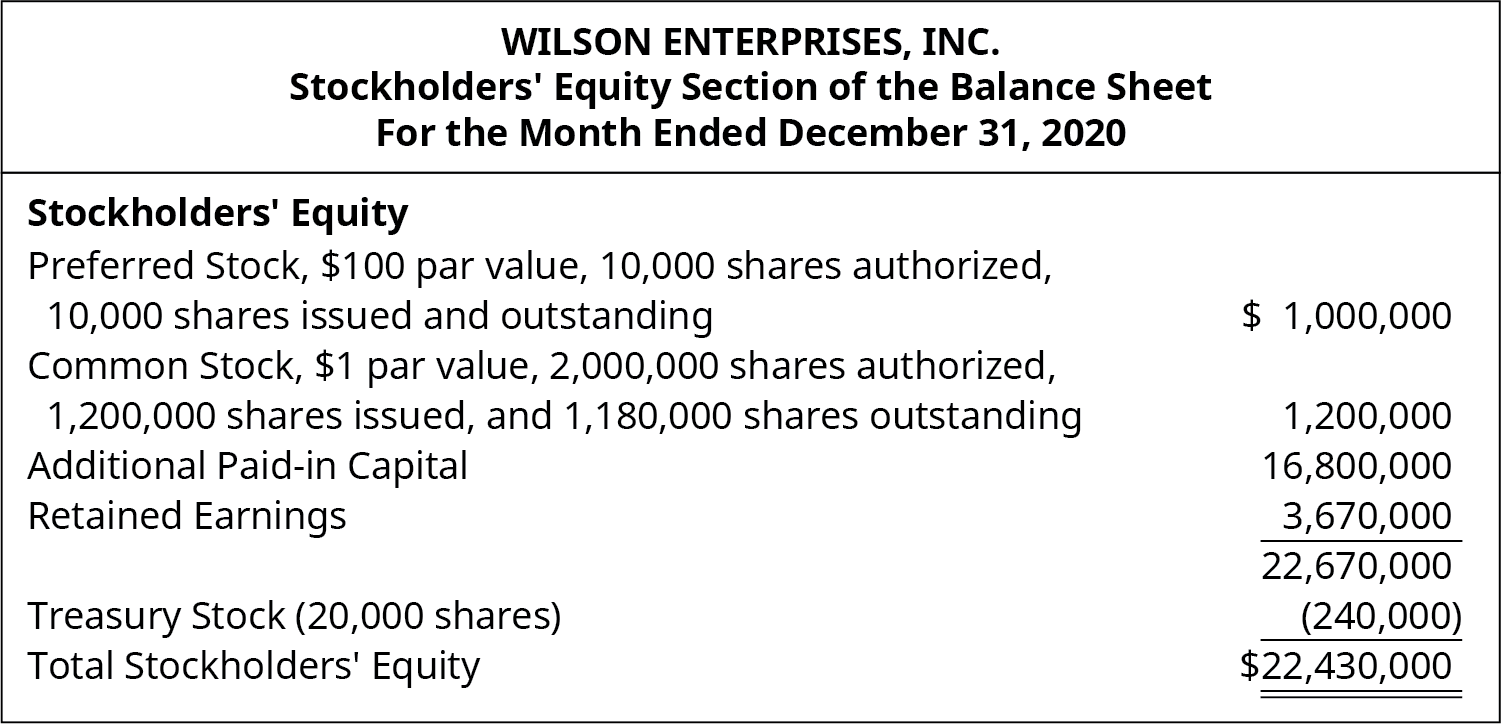

Wilson Enterprises reports the following stockholders’ equity:

Based on the partial balance sheet presented, answer the following questions:

- At what price was each share of treasury stock purchased?

- What is reflected in the additional paid-in capital account?

- Why is there a difference between the common stock shares issued and the shares outstanding?

A. $240,000 ÷ 20,000 = $12 per share. B. The difference between the market price and the par value when the stock was issued. C. Treasury stock.

Long Descriptions

La Cantina, Partial Stockholders’ Equity Section of the Balance Sheet, For the Month Ended December 31, 2020. Stockholders’ Equity: 5 percent Preferred stock, $8 par value, 1,000 shares authorized, 1,000 shares issued and outstanding $8,000. Additional paid-in capital from preferred stock 37,000. Common Stock, $1.50 par value, 20,000 shares authorized, 10,000 issued and outstanding $15,000. Additional Paid-in capital from common 70,000. Retained Earnings 31,000. Total 161,000. Treasury stock (800 shares) at cost 20,000. Total stockholders’ equity $141,000. Return

Nestle Holding Group, Consolidated Statement of Changes in Equity, For the Year Ended December 31, 2017. Millions (CHF), Share Capital, Treasury Shares, Paid-in Capital, Other, Total Equity (respectively): Equity as of December 31, 2016, 311, (990), 82,870, (16,210) 65,981. Profit for the year, -, -, 7,538, -, 7,538. Other comprehensive income, -, -, 252, -, 252. Dividends, -, -, (7,468), -, (7,468). Treasury shares, -, (3,719), 113, -, (3,606). Other, -, 172, 869, (961), 80. Equity at December 31, 2017, 311, (4,537), 84,174, (17,171), 62,777. Return

Preferred stock, $100 par value, 10,000 shares authorized, 10,000 shares issued and outstanding $1,000,000. Common Stock, $1 par value, 2,000,000 shares authorized, 1,200,000 issued and 1,180,000 outstanding $1,200,000. Additional Paid-in capital 16,800,000. Retained Earnings 3,670,000. Total 22,670,000. Treasury stock (20,000 shares) (240,000). Total Stockholders’ Equity $22,430,000. Return

- 15 Nestlé. “Annual Report 2017.” 2017. https://www.nestle.com/investors/annual-report

Financial and Managerial Accounting Copyright © 2021 by Lolita Paff is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

- Skip to primary navigation

- Skip to content

Great things in business are never done one. They're done by a team of people.

Email us directly

[email protected]

Call us directly

(123) 567 8901, social network, send a message..

We’re here to answer any question you may have.

Would you like to join our growing team?

Have a project in mind? Send a message.

I am bound by the terms of the Service I accept Privacy Policy

- Blessing Peter Titus

- Bongdap Nansel Nanzip

- Joy Sunday Zaleng

- Obotu Agape Oguche

- Privacy Policy

- Terms and Conditions

Treasury Stock Accounting and Examples

What is treasury stock accounting, treasury stock in accounting.

Treasury stock is referred to as the shares that the company (issuer) buys back from its shareholders. It is also known as treasury shares or reacquired stock . The result of this is that the total number of outstanding shares in the open market decreases, that is, shares owned by others, thereby returning their ownership to the company. These shares are issued but they are no longer outstanding and the company does not include them in the distribution of dividends or the calculation of earnings per share (EPS). It also does not have a vote at a shareholders’ meeting.

The issuer may then retire the stocks or resell the treasury shares at a later date. When determining the number of issued and outstanding shares reported in the company’s financial statements, treasury stock falls under the category of issue. The amount of cash a company pays to buy back treasury shares is recorded in a contra equity account and this appears in the equity section of the balance sheet. Treasury shares can either be common stock or preferred stock that the company reacquires.

The amount of treasury shares that a company should buy back is usually governed by the Securities and Exchange Commission of a nation or in other words, a nation’s regulatory body. Since public shareholders no longer possess these shares, they are not included in dividend payments or earnings per share calculations. Dividends are part of a company’s profit that is being paid out to stockholders in cash or stock. The earnings per share reflect the profitability of a company.

As earlier stated, treasury shares can be retired or resold in the open market. When shares are retired, they are permanently canceled and cannot be reissued in the future . Once these shares are retired, they are no longer recorded as treasury shares on the company’s financial statements. On the other hand, non-retired treasury shares can be reissued through stock dividends, employee compensation, or capital raising.

Treasury stock accounting

When a company initially issues stock, the equity section of the balance sheet is increased through a credit to common stock as well as the additional paid-in capital accounts. The common stock accounts reflect the par value of shares while the additional paid-in capital account shows the excess value received over the par value. Because of the double-entry bookkeeping, the offset of this journal entry is a debit to increase cash or other assets in the amount of the consideration that the shareholders received.

As earlier stated, treasury shares reduce the total equity of shareholders and are generally named treasury stock or equity reduction. There are two methods by which one can account for treasury shares. These methods are the cost method and the par value method .

Cost method of accounting for treasury stock

The cost method makes use of the value that the company paid during the repurchase of the shares and does not take into account their par value. Here, the cost of the treasury stock is included within the stockholders’ equity portion of the balance sheet. It is common for stocks to have a minimum par value such as $1 or $2, but sell and be repurchased for more. The cost method is the most widely used and it is a very simple accounting method for the repurchase of stock.

Par value method for treasury stock accounting

Under the par value method, at the time of repurchase of shares, the treasury stock account is debited to decrease the total shareholders’ equity in the amount of the par value of shares that the company repurchased. The common stock additional paid-in capital account is also debited to reduce it by the amount originally that the shareholders paid in excess of par value.

The cash account is then credited to the total amount that the company paid out for the share repurchase. The account includes the net amount as either a debit or credit to the treasury additional paid-in capital account which depends on whether the company paid more when repurchasing the stock than the shareholders did initially. The par value method is oftentimes under the assumption that the treasury shares have either been or will be retired. Here, the treasury stock’s par value is subtracted from the paid-in capital.

Treasury stock example

A company had initially sold 5,000 shares of common stock with a $1 par value of $41 per share. It had $5,000 common stock which is 5,000 shares multiplied by $1 par value, and $200,000 common stock which is 5,000 shares x ($41 – $1) paid in excess of par on its balance sheet. This company has excess cash and feels that its stock is trading below its intrinsic value. Because of this, it decided to repurchase 1,000 shares of its stock at $50 for a total value of $50,000.

The repurchase of stocks brought about a treasury stock contra equity account. Under the cash method, the treasury account will be debited for $50,000, and the cash account credited for $50,000. Under the par value method, treasury stock will be debited for $1,000, that is, 1,000 shares multiplied by $1 par value. The common stock additional paid-in capital will be debited for $49,000 which is 1,000 shares x ($50 repurchase price – $1 par value) and cash will be credited for $50,000.

Under both the cash and the par value methods, the equity of the total shareholders is decreased by $50,000. Assuming that the total sum of this company’s equity accounts including common stock, additional paid-in capital, and retained earnings was $500,000 before the share buyback , the repurchase will bring the total shareholders’ equity down to $450,000.

Treasury stock on the balance sheet

The shareholders’ equity section has two major headings. These headings are the paid-in capital and retained earnings. Treasury stock is posted under its own heading in the stockholders’ equity section, which is below the retained earnings heading.

If there is a significant change in the company’s financial status from when the stock was initially sold, there may be a need for the stock to be revalued in order to accurately reflect the current value. The treasury stock account is debited while the cash account in the asset section is credited.

Are dividends paid on treasury stock?

Is a treasury stock an asset, how does treasury stock affect equity, where is treasury stock on the balance sheet, what is the benefit of treasury stock, is treasury stock the same as dividends, you may also like.

Tax Implications of Perpetuities

How to Measure Market Efficiency

Adding {{itemName}} to cart

Added {{itemName}} to cart

How Treasury Stock Influences the Balance Sheet

Explore the impact of treasury stock on a company's financial health and shareholder equity, including its effect on key financial ratios.

Treasury stock represents a company’s own shares that have been reacquired. It is a significant element in corporate finance, influencing the balance sheet and overall financial health of an entity.

Understanding how treasury stock impacts a company’s financial statements is crucial for investors, analysts, and other stakeholders. These repurchased shares can affect shareholder equity and various financial ratios, which in turn play a role in investment decisions and market perceptions.

Treasury Stock: Definition and Balance Sheet Presentation

Treasury stock consists of shares that were once part of the float and outstanding shares but were subsequently repurchased by the issuing company. These shares are held in the company’s treasury and are not considered when calculating earnings per share or dividends. On the balance sheet, treasury stock is listed under shareholders’ equity as a contra equity account. This means it has a debit balance, unlike the typical credit balance of other equity accounts.

The method of accounting for treasury stock is either the cost method or the par value method. Under the cost method, the repurchased shares are recorded at the price paid to acquire them. The par value method, less common, involves recording the shares at their par value, with the excess of the purchase price over par value deducted from additional paid-in capital or retained earnings.

When a company buys back its shares, the total shareholders’ equity is reduced because treasury stock is subtracted from the total equity. This transaction decreases the number of shares outstanding, which can lead to a higher earnings per share since the same amount of earnings is spread over a smaller number of shares.

Effects of Treasury Stock on Financial Ratios

Treasury stock transactions can influence a company’s financial health as reflected in its ratios, which are used by stakeholders to assess performance and stability. For instance, the return on equity (ROE) ratio, which measures a company’s profitability in generating profits from its equity, is affected by treasury stock purchases. When a company acquires its own shares, the denominator in the ROE calculation, which is average shareholders’ equity, decreases. Assuming net income remains constant, this leads to an increase in the ROE ratio, potentially signaling more efficient equity use to stakeholders.

Liquidity ratios, such as the current ratio and quick ratio, may also be impacted by treasury stock transactions. These ratios measure a company’s ability to meet short-term obligations with its most liquid assets. The repurchase of shares using cash reduces the company’s cash reserves, which can result in a lower liquidity ratio. This indicates a reduced buffer for the company to cover immediate liabilities, which could be a concern for creditors and investors alike.

The debt-to-equity ratio, which compares a company’s total liabilities to its shareholders’ equity, can be influenced by the repurchase of shares as well. As treasury stock reduces total shareholders’ equity, this ratio may increase, suggesting that the company is financing more of its operations through debt. A higher debt-to-equity ratio can be interpreted as a company taking on more risk, which might affect the cost of borrowing and the perception of the company’s financial stability.

Disclosure Requirements for Treasury Stock

Financial reporting standards mandate that companies provide specific disclosures regarding treasury stock to ensure transparency and allow stakeholders to fully understand the impact of these transactions on the financial statements. The disclosures typically include the number of shares repurchased, the average cost paid, and the total amount spent on buybacks. This information is often found in the notes to the financial statements, which accompany the balance sheet, income statement, and statement of cash flows.

Additionally, companies must disclose the method used for accounting for treasury stock, whether it is the cost method or the par value method, as this affects how the transactions are reflected in the financial statements. The rationale behind share repurchase decisions, such as excess cash or a strategy to increase earnings per share, is also commonly provided in the management’s discussion and analysis (MD&A) section of annual reports. This narrative gives context to the numbers and can influence investor sentiment and decision-making.

The impact of treasury stock transactions on the company’s share repurchase program, if one exists, is another disclosure requirement. Details such as the remaining authorized amount for future repurchases and any changes to the program provide investors with insights into the company’s future capital allocation strategies. This information can be crucial for forecasting and valuing the company’s stock.

Treasury Stock Transactions and Shareholder Equity

The interplay between treasury stock transactions and shareholder equity is a nuanced aspect of corporate finance. When a company repurchases its shares, the action is reflected as a reduction in the total equity on the balance sheet because treasury stock is a contra equity account. This reduction directly affects the retained earnings component, which is the cumulative amount of profit that has been reinvested in the business rather than distributed to shareholders as dividends. The repurchase of shares, therefore, signals a redirection of funds that could have been available for dividends or reinvestment in company operations.

The alteration in shareholder equity composition also has implications for the book value per share, a metric that represents the net asset value of a company divided by the number of outstanding shares. As treasury stock transactions decrease the number of outstanding shares without changing the net assets, the book value per share increases. This can make the company appear more attractive to investors who use this metric as a gauge for stock valuation.

Understanding Normal Costing: A Guide to Its Components, Application, and Variance Analysis

Understanding and recording small stock dividends: a comprehensive guide, you may also be interested in..., fifo accounting: principles, impact, and applications, effective overhead calculation and management for businesses, double declining balance method for efficient depreciation, understanding and managing temporary accounts in financial reporting.

How Is Treasury Stock Shown on the Balance Sheet?

- Small Business

- Money & Debt

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Do I Need to Pay Tax When I Sell Gold Jewelry?

How to add a dividend with a reinvested cost basis, the differences between an s corporation shareholder basis and a partnership.

- How to Calculate Business Market Cap

- What Is the Journal Entry if a Company Pays Dividends With Cash?

Under Securities and Exchange Commission regulations, privately held companies can sell shares of stock without going public by making a private placement. Because the stock is not traded publicly, the company must derive the per share value by other means. Accountants use several methods to determine a value that is acceptable to the stock buyer and seller. The stock may need to be revalued if the company decides to buy its stock shares back.

Treasury Stock

Authorized shares are the stock shares a company can legally sell. When stock shares sell, they go from being authorized to being issued. The money collected from the stock sale is shown in the asset section of the balance sheet as a debit to cash and in the stockholders' equity section as a credit to common stock. In the stock buyback, the repurchased shares are no longer classified as issued shares but as treasury stock.

Treasury Stock Account Classification

The stockholders' equity section has two main headings: paid-in capital and retained earnings. Treasury stock is listed under its own heading in the stockholders' equity section below the retained earnings heading. If the company’s financial status has changed significantly from when the stock was first sold, the stock may need to be revalued to accurately reflect the current value. To record the repurchase, the treasury stock account is debited and the cash account in the asset section is credited.

Treasury Stock Reissued

If a company decides to reissue treasury stock for a new private placement, the treasury stock basis is the share price as of the repurchase date. If the treasury stock is revalued and sold above the basis, the balance sheet shows a debit to cash for all the money received. In the stockholders' equity section, the treasury stock account is credited with the total basis price, and the additional paid-in capital account is credited with the gain.

Treasury Stock Reissue Loss

If the treasury stock revalue amount is less than the basis, the money received is debited to the cash account, and the loss is debited to the additional paid-in capital account. The cash amount received and the loss amount are added together and credited to the treasury stock account.

Treasury Stock Retirement

If a company decides to retire its treasury stock, it uses the share price as of the repurchase date as the basis. If the retirement stock revaluation price is higher than the basis, the balance sheet shows the transaction as a debit to common stock at the basis price and a debit to paid-in capital for the amount over the basis. Treasury stock is credited for the full amount.

Treasury Stock Retirement Loss

If the retirement stock revaluation price is lower than the basis, the transaction is shown as a debit to common stock at the basis price. A credit is made to paid-in capital for the amount under the basis and a credit is made to treasury stock at the basis price.

- Securities and Exchange Commission: Can My Company Legally Offer and Sell Securities Without Registering With the SEC?

- Financial Web: Authorized Stock vs. Issued Stock

- Accounting Coach: Treasury Stock

- Principles of Accounting: Treasury Stock Reissued Above Cost

- Principles of Accounting: Treasury Stock Reissued Below Cost

- Accounting Simplified: Treasury Stock Retirement

Based in St. Petersburg, Fla., Karen Rogers covers the financial markets for several online publications. She received a bachelor's degree in business administration from the University of South Florida.

Related Articles

Once an s-corp is formed, how is the transaction of shares recorded on the balance sheet, accounting calculations when issuing stock, the tax advantage of an asset purchase, how does the repurchase of s corporation stock affect taxes, what is the effect of a declared and issued stock dividend, tax consequences of giving a business to a family member, why would a company use liquidating dividends, how to account for issuance of par value shares, basic bookkeeping for an s corporation, most popular.

- 1 Once an S-Corp Is Formed, How Is the Transaction of Shares Recorded on the Balance Sheet?

- 2 Accounting Calculations When Issuing Stock

- 3 The Tax Advantage of an Asset Purchase

- 4 How Does the Repurchase of S Corporation Stock Affect Taxes?

- Search Search Please fill out this field.

What Is a Balance Sheet?

How balance sheets work, special considerations.

- Why Is It Important?

- Limitations

- Balance Sheet FAQs

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Balance Sheet: Explanation, Components, and Examples

What you need to know about these financial statements

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

- Valuing a Company: Business Valuation Defined With 6 Methods

- Valuation Analysis

- Financial Statements

- Balance Sheet CURRENT ARTICLE

- Cash Flow Statement

- 6 Basic Financial Ratios

- 5 Must-Have Metrics for Value Investors

- Earnings Per Share (EPS)

- Price-to-Earnings Ratio (P/E Ratio)

- Price-To-Book Ratio (P/B Ratio)

- Price/Earnings-to-Growth (PEG Ratio)

- Fundamental Analysis

- Absolute Value

- Relative Valuation

- Intrinsic Value of a Stock

- Intrinsic Value vs. Current Market Value

- Equity Valuation: The Comparables Approach

- 4 Basic Elements of Stock Value

- How to Become Your Own Stock Analyst

- Due Diligence in 10 Easy Steps

- Determining the Value of a Preferred Stock

- Qualitative Analysis

- Stock Valuation Methods

- Bottom-Up Investing

- Ratio Analysis

- What Book Value Means to Investors

- Liquidation Value

- Market Capitalization

- Discounted Cash Flow (DCF)

- Enterprise Value (EV)

- How to Use Enterprise Value to Compare Companies

- How to Analyze Corporate Profit Margins

- Return on Equity (ROE)

- Decoding DuPont Analysis

- How to Value Private Companies

- Valuing Startup Ventures

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure .

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios.

Key Takeaways

- A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

- The balance sheet is one of the three core financial statements that are used to evaluate a business.

- It provides a snapshot of a company's finances (what it owns and owes) as of the date of publication.

- The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.

- Fundamental analysts use balance sheets to calculate financial ratios.

Investopedia / Katie Kerpel

The balance sheet provides an overview of the state of a company's finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own. For this reason, the balance sheet should be compared with those of previous periods.

Investors can get a sense of a company's financial well-being by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio , along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out:

Assets = Liabilities + Shareholders’ Equity \text{Assets} = \text{Liabilities} + \text{Shareholders' Equity} Assets = Liabilities + Shareholders’ Equity

This formula is intuitive. That's because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account ) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.

Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

As noted above, you can find information about assets, liabilities, and shareholder equity on a company's balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance , hence the name. If they don't balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations.

Each category consists of several smaller accounts that break down the specifics of a company's finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. Companies might choose to use a form of balance sheet known as the common size , which shows percentages along with the numerical values. This type of report allows for a quick comparison of items.

There are a few common components that investors are likely to come across.

Theresa Chiechi {Copyright} Investopedia, 2019.

Components of a Balance Sheet

Accounts within this segment are listed from top to bottom in order of their liquidity . This is the ease with which they can be converted into cash. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

Here is the general order of accounts within current assets:

- Cash and cash equivalents are the most liquid assets and can include Treasury bills and short-term certificates of deposit, as well as hard currency.

- Marketable securities are equity and debt securities for which there is a liquid market.

- Accounts receivable (AR) refer to money that customers owe the company. This may include an allowance for doubtful accounts as some customers may not pay what they owe.

- Inventory refers to any goods available for sale, valued at the lower of the cost or market price.

- Prepaid expenses represent the value that has already been paid for, such as insurance, advertising contracts, or rent.

Long-term assets include the following:

- Long-term investments are securities that will not or cannot be liquidated in the next year.

- Fixed assets include land, machinery, equipment, buildings, and other durable, generally capital-intensive assets.

- Intangible assets include non-physical (but still valuable) assets such as intellectual property and goodwill. These assets are generally only listed on the balance sheet if they are acquired, rather than developed in-house. Their value may thus be wildly understated (by not including a globally recognized logo, for example) or just as wildly overstated.

Liabilities

A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year.

Current liabilities accounts might include:

- Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. For example, if a company has a 10 years left on a loan to pay for its warehouse, 1 year is a current liability and 9 years is a long-term liability.

- Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes.

- Wages payable is salaries, wages, and benefits to employees, often for the most recent pay period.

- Customer prepayments is money received by a customer before the service has been provided or product delivered. The company has an obligation to (a) provide that good or service or (b) return the customer's money.

- Dividends payable is dividends that have been authorized for payment but have not yet been issued.

- Earned and unearned premiums is similar to prepayments in that a company has received money upfront, has not yet executed on their portion of an agreement, and must return unearned cash if they fail to execute.

- Accounts payable is often the most common current liability. Accounts payable is debt obligations on invoices processed as part of the operation of a business that are often due within 30 days of receipt.

Long-term liabilities can include:

- Long-term debt includes any interest and principal on bonds issued

- Pension fund liability refers to the money a company is required to pay into its employees' retirement accounts

- Deferred tax liability is the amount of taxes that accrued but will not be paid for another year. Besides timing, this figure reconciles differences between requirements for financial reporting and the way tax is assessed, such as depreciation calculations.

Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

Shareholder Equity

Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends.

Treasury stock is the stock a company has repurchased. It can be sold at a later date to raise cash or reserved to repel a hostile takeover .

Some companies issue preferred stock , which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued.

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company's market capitalization . The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price.

Par value is often just a very small amount, such as $0.01.

Importance of a Balance Sheet

Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet.

First, balance sheets help to determine risk. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands.

Balance sheets are also used to secure capital. A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts.

Managers can opt to use financial ratios to measure the liquidity, profitability, solvency, and cadence (turnover) of a company using financial ratios, and some financial ratios need numbers taken from the balance sheet. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company.

Last, balance sheets can lure and retain talent. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. For public companies that must disclose their balance sheet, this requirement gives employees a chance to review how much cash the company has on hand, whether the company is making smart decisions when managing debt, and whether they feel the company's financial health is in line with what they expect from their employer.

Limitations of a Balance Sheet

Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. Because it is static, many financial ratios draw on data included in both the balance sheet and the more dynamic income statement and statement of cash flows to paint a fuller picture of what's going on with a company's business. For this reason, a balance alone may not paint the full picture of a company's financial health.

A balance sheet is limited due its narrow scope of timing. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to look more favorable. Pay attention to the balance sheet's footnotes in order to determine which systems are being used in their accounting and to look out for red flags .

Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet.

Example of a Balance Sheet

The image below is an example of a comparative balance sheet of Apple, Inc . This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior.

In this example, Apple's total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple's assets shows that their cash on hand decreased, yet their non-current assets increased.

This balance sheet also reports Apple's liabilities and equity, each with its own section in the lower half of the report. The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder's equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple's total liabilities increased, total equity decreased, and the combination of the two reconcile to the company's total assets.

Why Is a Balance Sheet Important?

The balance sheet is an essential tool used by executives, investors, analysts, and regulators to understand the current financial health of a business. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement.

Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. The balance sheet can help users answer questions such as whether the company has a positive net worth, whether it has enough cash and short-term assets to cover its obligations, and whether the company is highly indebted relative to its peers.

What Is Included in the Balance Sheet?

The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable , or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

Who Prepares the Balance Sheet?

Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses , the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant.

Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. The balance sheets and other financial statements of these companies must be prepared in accordance with Generally Accepted Accounting Principles (GAAP) and must be filed regularly with the Securities and Exchange Commission (SEC).

What Are the Uses of a Balance Sheet?

A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day.

A bank statement is often used by parties outside of a company to gauge the company's health. Banks, lenders, and other institutions may calculate financial ratios off of the balance sheet balances to gauge how much risk a company carries, how liquid its assets are, and how likely the company will remain solvent.

A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity).