The Essential Guide to Capital Raising

Kison Patel is the Founder and CEO of DealRoom, a Chicago-based diligence management software that uses Agile principles to innovate and modernize the finance industry. As a former M&A advisor with over a decade of experience, Kison developed DealRoom after seeing first hand a number of deep-seated, industry-wide structural issues and inefficiencies.

In many respects, there has never been a better time for companies to raise capital.

Interest rates are hovering close to zero for a longer period than at any stage of history, the government has just made a historic cash injection into the economy, and there is an ever-growing number of funding sources to choose from.

DealRoom works with hundreds of companies both seeking and providing capital on an ongoing basis, providing them with a virtual deal room that is designed to smoothen the process of raising funds, whichever side of the transaction they’re on.

In this article, we share some of the insights we’ve gathered from helping companies through their capital raise process.

What is Capital Raising?

Capital raising definition refers to a process through which a company raises funds from external sources to achieve its strategic goals, such as investment in its own business development, or investment in other assets, for example, M&A, joint ventures, and strategic partnerships.

Types of Capital Raising

In broad terms, there are 3 ways how companies can raise capital: debt, equity, or a combination of the two, otherwise known as hybrids.

Debt Raising

Debt raising involves raising funds through loans provided by third parties. The lenders of the debt have traditionally been banks and public debt markets (i.e. the bond markets) but now include a host of financial institutions and increasingly private equity funds. In its simplest form, debt raising involves paying the lender back its principal and an agreed amount of interest over the duration of the loan.

The size of the debt market (in 2021, the global debt market was valued at $303 trillion) means that anyone debt raising can avail of multiple forms of debt. Lenders can include a range of terms and conditions on their loan that protect them on the downside in the event that your company cannot (or will not) repay the money.

In broad terms, there are four forms of debt that companies can avail of:

- Secured debt: Where collateral is used to secure the loan, thus enabling the company to avail of lower interest rates (as the risk is lower for the lender);

- Unsecured debt: This form of debt includes no borrower collateral, so the interest rate depends on the company’s credit history;

- Tax-exempt corporate debt: Some debt may be eligible for tax exemption. For example, projects related to sustainability;

- Convertible debt: Usually considered a hybrid (i.e. a mixture of debt and equity), whereby the debt can be converted into equity if the borrower prefers.

Which type of debt a company raises depends on a number of different factors - primarily the condition of their financial statements (and in particular, the amount of debt outstanding on the balance sheet), their credit (rating) history, quality of the collateral, and borrowers’ and lenders’ own appetite for risk. At most points of an economic cycle, debt is possible for a company to raise, but the cost of interest is not always attractive.

Pros and Cons of Debt Raising

- Relatively fast access to cash for companies that require it;

- In low interest rate environments, debt offers a cheap way to access liquidity;

- Debt repayments (in interest) can be forecasted accurately for budgeting purposes;

- The interest paid is tax deductible

- Generally, raising debt reduces a company’s credit rating;

- There mere availability of debt may induce managers to raise it when it is not required;

- The money has to be repaid, even if the business isn’t performing well;

- Debt on a balance sheet reduces management’s strategic options.

Equity raising

Equity raising occurs when a company seeks to raise funds through the sale of its equity - i.e. a share in the ownership of the company. The equity investors can generally be anyone that possesses the cash required and is willing to meet the company’s owners on its valuation. A company that overvalues its equity risks alienating most investors, who will fear not seeing an adequate return on their investment.

Most companies with positive outlooks (i.e.their equity is attractive to investors) can avail of equity funding. Like debt raising, certain equity raising agreements can have different conditions attached, and when this happens, it is usually referred to as ‘preferred equity.’ The stock market is the largest and most well-known method of equity raising, where publicly listed companies sell their equity to raise funds and maintain liquidity.

Pros and Cons of Equity Raising

- Access to the management advice of seasoned equity investors;

- No requirement for regular interest repayments(as with debt raising);

- Possibility for company management to set the company valuation;

- Technically, a lower risk solution than debt raising.

- Company management is giving up (some) controlling the business;

- The equity may come with some provisions on consulting the investors on big decisions;

- The presence of external investors may lead to friction within the company;

- The upside potential of the company now has to be shared with outsiders.

Equity Raising Examples

There are several kinds of raising equity, with the big differentiator between them being the stage of a company’s evolution to which it applies to. In broad terms, the different types of equity raising - in chronological order, from early companies to mature companies, are:

- Crowdfunding

- Seed financing

- Angel financing

- Venture Capital

- Private Equity

- Public Capital Markets

Hybrids of debt and equity

A hybrid of debt and equity gives the advantages(and disadvantages) of debt and equity raising and tends to be seen as a compromise between the two. Depending on how the hybrid capital raising agreement is written up, it could benefit either the company or the owner moreover the course of the debt. In essence, if the company thrives and the debt is convertible to equity, investors win. Otherwise, the benefits tend to be derived by the company.

Pros and Cons of Hybrids of Debt and Equity

- More flexible arrangements are possible for the company and investors;

- Can provide both sides of the transaction with a lower risk proposition;

- May give companies access to a broader range of investors;

- May enable investors to diversify across a broader number of companies by combining fixed income (debt) with equity investments.

- Hybrid capital raising tends to be more complex than either debt or equity raising;

- Tends to favor investors at the expense of companies.

How to Raise Capital for Your Business

Whether a company is raising debt or equity capital, it essentially faces a sell-side investor equation similar to that faced by owners looking to divest their companies (ultimately, what is equity raising aside from selling a part of a business).

On this basis, company managers face many of the same challenges as they would in M&A: providing investors with the right documentation, valuing the company correctly, and getting their house in order.

For this same reason, managers at these companies would be well advised to use data room due diligence software like DealRoom or an alternative.

Not only does DealRoom enable companies to efficiently organize their capital raising process, but it can also show where weaknesses in the company’s value proposition might exist before making the initial approach to investors for their debt or equity raise.

Here is a step-by-step approach to raising capital for your business:

Step 1: Clean up your financials

Most lenders will focus on two things: The executive summary of your business plan (see next bullet point) and your financial statements. Ensure both are as good as they can be. That means paying off credit card debt so that it’s not on the balance sheet, becoming more aggressive in the short term about credit terms so that your receivables are lower, and maybe even cutting back on some operating expenses.

Step 2: Write a business plan

Whether the funds are coming from a financial institution, a private equity-style fund, independent investors, or even the SBA, it pays to have a strong business plan that shows exactly why you need to raise capital, and why the lender can be sure that they’ll receive the principal with interest within an agreed timeframe.

Step 3: Emphasize the sources and uses

As part of the business plan, know exactly where the funds will be used. If you’re acquiring a new piece of equipment, make it explicit. If you’re hiring for sales and marketing, show how the funds will be used (what percentage on social media, what percentage on a sales team, etc.). Show as much detail as possible - this also serves to give you insight into your own business.

Step 4: Make a long-list

When looking to raise capital, it’s useful to keep in mind that you’re not the only one. Everybody wants more money. People who are providing it are typically overrun with requests for capital. Most businesses will be trying to convince them that theirs is better than all the others, so don’t be surprised when the first ten companies don’t jump. The capital raising process can take a significant amount of time. Buckle up.

"From data storage and sharing to investor communication and progress reports, DealRoom helped readily execute Pax8’s entire investor management process." -- Jefferson Keith SVP, Corporate Development at Pax8

The process of raising funds is easier said than done, however.

Interested in learning more about the capital raising process? Utilize the Capital Raise Playbook tailored to outline and walk you through the process of raising capital for your specific business.

Why do Companies Raise Capital?

Growth is, for all intent and purposes, the major reason why companies raise capital.

Whether it’s a younger firm looking to raise capital with a venture capital firm to hire more programmers, a mature industrial firm looking to acquire an industry rival, or a distressed company looking to restructure in some manner, the underlying motive in almost all cases for raising capital is growth.

Growth being the implicit motive, the explicit motives for raising capital are as follows:

Read also: Venture Capital Deal Structures: Complete Guide

Who Does the Capital Come From?

Traditionally, banks were the go-to destination for companies looking for debt but the universal need to raise capital has led to a plethora of options for companies of all sizes.

Most of the following outlets for raising capital will cater to both debt and equity raising, with specifics depending on the institution in question.

Banks remain one of the most common sources of capital for companies, particularly when a company has a good track record with the bank. Equity raises can also occur with banks but tend to be far less common.

Private debt

Private debt - that is, debt-funded by non-public financial institutions - has seen huge growth over the past decade, with the caveat for businesses that interest rates on loans usually begin at the 6-7% mark.

Listen to private equity podcasts to improve your understanding of how private equity firms operate.

Private equity

With private equity companies sitting on an estimated $2 trillion of ‘’dry powder’ (funds waiting to be used), private equity currently offers an excellent way for companies of all sizes to raise equity capital.

Angel Investors/Seed Investors/Venture Capital

These funds usually seek an equity share of a small, fast-growing business and can build in a debt component. A major advantage here is the ability to tap into their network and expertise. Learn more about how venture capital work here.

Public markets

The main reason that companies go public is to raise equity capital: Selling off slices of the company on a publicly traded index to fund the company’s expansion.

Small Business Association (SBA)

SBA loans are a hugely popular means for small companies to access significant amounts of capital at very attractive rates, the only drawback being the time it can take to access funds.

Ways of Capital Raise for Different Business Sizes

Depending on the size of your business, there are different ways you can raise capital. The process of raising capital for a private company will for example be different than for a public company.

Following are typical routes of capital raising for different business sizes:

- Friends and family

- Public or private business incubators

- Seed investors

Small and medium-sized enterprises (SMEs)

- Private equity investors (those aimed at SMEs)

- Family offices

Large Companies

- Initial Public Offering (IPO)

- Private equity investors (those aimed at larger companies)

- Wealth funds and asset managers

How To Get Ready for the Capital Raising Process?

The capital raising process can be complex and overwhelming, especially if it's your first time.

To raise capital, at the very least, a company will require a business plan or pitch deck .

The aim of these documents is to show investors that the cash flows generated by the company are sustainable enough to ensure that it will get its money back with interest (in the case of a debt raise) or achieve what they deem to be an attractive return on investment (in the case of an equity raise).

Offering Memorandum

Offering memorandums are used by companies seeking to raise equity capital. It has to comply with securities laws designated by the SEC.

This formal document provides registered investors with a detailed overview of the company’s financials and operations.

This process is called venture capital due diligence .

This document also invariably features a subscription agreement that defines the terms of the investor’s participation in the company’s equity offering.

To streamline this otherwise complex process, we put together a Capital Raising Playbook that helps you tick all the boxes. Grab your copy now!

There have never been as many options for companies seeking to raise debt or equity capital.

At the time of writing, private equity funds hold close to $2 trillion in ‘dry power’ (capital ready to be distributed to companies either through debt or direct equity investments). But the fact that they’re not distributing it says something about companies - primarily, that they’re not adequately prepared in these investors’ eyes.

Talk to DealRoom today about the essential role that our lifecycle management tool plays in enabling companies to take this leap.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

- Entrepreneurs

- News About Crunchbase

- New Features

- Partnerships

Raising Capital: The Best Ways to Raise Money for a Business

- 11 min read

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Capital is the lifeblood of business. Without capital, you cannot continue to fund your daily operations. Raising money for a business is just the first step to get it off the ground. Beyond that, you’ll need to raise funds to keep it moving.

According to the U.S. Bureau of Labor Statistics , lack of capital is one of the leading reasons businesses fail to survive, with just 25 percent of businesses lasting past 15 years.

Raising capital for your new venture is the initial order of business, so let’s dive into what it means and how to do it.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

What is capital?

Capital is technically anything that can be quantified with a dollar figure within a business setup. A factory’s machinery counts as capital. Intellectual property could also be classified as a type of capital.

However, most people use the capital for business in terms of the money they have in the bank. Financial capital is often the difference between success and failure, so let’s talk about how to go about raising funds.

Types of capital for business

Raising capital begins with understanding your options for injecting that vital liquidity into your business.

Capital raising can come from a variety of sources. The right option for your company largely depends on your current circumstances and weighing the pros and cons of each option. Here are a few different types of capital.

Debt capital

Debt capital is the most common way startups get the money together to launch their businesses. The concept of debt capital is that you borrow money to raise the necessary funds.

Traditional bank loans, credit cards, online lenders and Federal loan programs are just some of the ways you can start raising capital via debt.

The average small business needs $10,000 to get started, but it depends on your industry and how ambitious you happen to be. Existing businesses will need to ensure they have a positive credit history to secure loans. In contrast, new business owners may use their personal credit scores to secure a loan.

The way debt capital is used depends on the size of the business. Although a small business may use debt capital by taking out a loan, corporations often choose to issue bonds, especially if national interest rates are low.

If looking at capital for business by taking out debt, watch your debt-to-income ratio to ensure you aren’t drowning in debt.

- It doesn’t dilute your ownership

- No lender claims on future profits

- Interest is tax-deductible

- Potentially higher interest rates

- May make it difficult to secure third-party equity investment

Equity capital

Equity capital comes in two forms: private and public equity capital.

Private and public equity capital comes in the form of shares in the company. The distinction is that a publicly traded company can be bought on the open market by anyone, whereas private equity is strictly traded among a closed group of investors.

When someone purchases a share in your company, they’re providing capital in the form of ownership. How much each share is worth depends on how many total shares you’ve got.

For example, if you have 100 shares and sell one share, each share is worth 1 percent of your company. Stock splits also allow you to create more shares to sell while diluting everyone’s ownership in the company.

It’s how small and growing companies can make a big splash.

- No repayment requirements

- Bring in partners with expertise and talent

- You no longer own 100 percent of your company

- Time and effort required to secure equity investors

Net earnings capital

The final way to raise the funds is by increasing your net earnings. In other words, rather than giving away part of your company or taking on debt, you’re working to improve your output and profitability.

Net earnings capital is harder to come by because it’s typically powered by raising money in other ways to up your capacity and increase your reach.

However, if you’ve already got money from investors and are looking to expand even further, net earnings capital is a great way to drive your business forward.

- No lost ownership

- Powered by genuine company growth

- Difficult to come by

- Higher taxes

How to raise money for a business

How do you go about raising capital if you are going into business for yourself? A complete understanding of capital raising is crucial to getting the funding needed to launch your new venture.

Determine your capital need

Before you can determine capital need, you’ll need to develop a long-term business plan and your company’s strategic goals. If you’re already operating, you have a leg up in understanding what it costs to run your business. If you’re just starting out, some of the expenses you need to take into account include:

- Office space

- Hiring new employees

- Purchasing technology/other hardware and software tools

- Marketing budget

You must strike a balance between having enough capital and not taking out too much capital. A lack of capital could indicate a broader weakness in your plan and the wider market. On the other hand, too much capital and you may find yourself giving away more equity than you intended or facing high monthly debt repayments.

Choose a funding type

You’ll almost certainly be choosing between equity capital and debt capital. When approaching venture capitalists, you will most likely need to give away a portion of the company, as well as a degree of control over business decisions.

With non-institutional investors, you’ll be taking on debt. Match up the potential debt repayments with your projected monthly revenue.

What works for one business may not work for another, so make sure you carefully think through your funding type.

Business valuation

The fundraising process begins with determining a rough value for the company. The entrepreneur needs to estimate how much their company is worth based on its potential. Equally, your assumptions need to be rational.

When seeking private equity or venture capital fundraising, you’ll need a pre-money and post-money valuation of the business. These estimates will determine how much of your company you’ll be giving away to investors.

Your post-money business valuation is the pre-money valuation plus any new money. Investors will ask probing questions regarding how you came to your pre-money valuation, so make sure you can show your rationale.

Connect with investors

It’s time to begin pitching your idea to investors. Keep this as condensed as possible because the more time you spend meeting with investors, the less time you have to manage the day-to-day operations of your business.

The easiest way to seek out investors is to leverage your professional network. Getting introductions in this way can be a launchpad for connecting with other interested parties.

The investor will present you with a term sheet if you receive an offer. This short document covers the primary points of the deal, such as how much is being invested, the amount of equity given in return, and any other high-level conditions.

You’ll have the opportunity to negotiate, but negotiation becomes significantly harder the moment you sign the term sheet.

Following funding rounds

Most successful companies don’t have just a single round of funding. A single round of funding may just be the jumping-off point for approaching more prominent investors.

Before embarking on your subsequent funding rounds, your pre-money value should be higher than the post-money value of the last round of funding. Why does this matter? New investors want to see that you’ve put your capital to good use and that this is a growing business.

Throughout each round of funding, you should be looking to fund anywhere from 12 to 18 months of operations before moving on to the next round.

Later rounds are traditionally more challenging to secure funding because investors who buy-in at later stages want to see proven business growth and momentum.

What’s the key to securing investment?

What investors want is simple: a positive (ideally outsized) return on their investment. Some may expect this return quickly, while others may be willing to stick it out for long-term growth.

Focus on the hard numbers and demonstrate that you’ve carried out meticulous research into your target market and the competition. Give accurate projections without exaggerating for effect. Experienced investors are well aware of business valuations, and being too ambitious could curtail your chance to raise money.

Condense your pitch and focus on the hard numbers that demonstrate to investors that they’re highly likely to see a positive return on their money.

9 things to know about raising capital

Figuring out how to raise funds can be intimidating the first time. There’s an art and a science to successful fundraising and a little bit of luck.

Follow these tips to increase your chances of securing the funding your new venture requires.

1. Get your material ready for investors

Focus not on what appeals to you but on what appeals to investors. All venture capitalists have a way they like to see businesses presented. Generally, your documentation should be well-structured and in an easy-to-read format.

Never tell an investor to visit your website to check you out. Investors are busy people and don’t have time to look you up themselves.

Give them everything they need right in front of them during your initial round of fundraising.

2. Create a strong business plan

The most important part of your pitch is your business plan. It should be a complete roadmap to success and a blueprint for how your organization will make money.

Investors don’t just want to see the financial figures. They want to know how you intend on operating your business, your marketing studies, as well as risk management, investment offering, and even an exit strategy.

Think like a chess player. Show that you’ve thought four moves ahead and planned for every eventuality.

3. Be clear on your competitive edge

What makes your business special?

No equity investor is interested in investing in one of a thousand other businesses. They’re searching for the movers and shakers that are about to change the game. If you’re just starting an accountancy business, no venture capitalist will show any interest because it’s nothing special.

Equity capital is different because investors want a piece of the next big revolution within your industry.

4. Concentrate on investors with niche experience

Some investors will indeed have fingers in many industry pies, but investors often come with more than money. Experienced business owners provide expertise to younger entrepreneurs. Talent and expertise come with the package because you’re not just getting capital. You’re getting a new owner.

Look for investors with experience within your niche. If you’re also providing them with influence over business decisions, you need the confidence that they know what they’re doing.

You should be looking to bring on investors only in a nonexecutive role if they don’t.

5. Talk about your management team

Remember, investors don’t know who you are. They don’t know if you’re a great entrepreneur in the making or a kid with an inheritance from mommy and daddy. You need to show that you’ve got the chops to make it.

Venture capitalists pay massive attention to the management team running the company. They want to know about their experience and personalities. There’s a reason many investors admit they give money to the entrepreneur rather than the business idea itself.

Don’t underestimate the value of your human capital because even the best business idea in the world won’t get far if the management team doesn’t meet the appropriate standard.

6. Know what the investor brings to the table

Inexperienced entrepreneurs tend to make the mistake of assuming that an investor is just someone who’s going to give them money. Investors form a valuable part of where your business can go.

Some investors can help you scale by having connections in emerging markets. If you’re looking to expand your business into Europe, India or China in the future, it makes sense to look for an investor with these types of connections. Investors may also sit on your board, playing a huge part in critical business decisions and the direction of your company, so ensure you’re aligned with the investor’s long-term vision for your company.

As already mentioned, an investor with technical expertise in your industry can also be helpful. Not every investor is hands-off, so make sure you question what they can bring to your emerging company.

7. Get your valuation independently certified

Where does one start when it comes to certifying a business? Unless you’ve had specific training or experience, the chances are you don’t know how to value your business.

Some entrepreneurs will pluck a figure out of thin air and run with it using a convoluted explanation. That’s not good enough for raising capital. Any investor with a degree of experience will see right through it.

Show your professionalism and credibility by enlisting the help of a professional valuator who can comb through your business plan and provide a realistic valuation.

Do this as early as possible so you know how much capital to ask for and which investors to approach.

8. Pitch with two essential documents

There are two critical documents you need when securing funding for your company. They are:

- Investor Pitch Deck : These presentations are roughly 10 pages/slides in length. It’s your first impression, so make it count. Investors scan through your pitch deck and decide whether they want to look at your formal business plan.

- Business Plan : If an investor wants to see your business plan, they’ll ask for it. This document is where you get into the nuts and bolts of your company.

Maintain a copy of these documents at all times when looking for capital. If investors like what they see in these two documents, they will ask for a formal in-person meeting.

9. Be persistent

Remember that many investors won’t reply to you at all. It doesn’t mean there’s anything wrong with your pitch, venture capitalists are busy people and don’t have the time to reply to everybody.

As long as you’ve meticulously combed through your documentation, you’ll find the right investor match sooner or later. What’s important is patience and maintaining focus on the critical operations of your business.

Debt and equity capital are the two primary ways you’re going to get a significant injection of cash into your business. If you’re strategizing and researching how to find investors for a startup , be sure you can clearly articulate your business plan and support that plan with relevant market research before you reach out to investors.

Crunchbase enables you to conduct market research, find and connect with the right decision-makers all in one platform.

- Originally published February 26, 2022

You may also like

- 10 min read

AI for Small Businesses: Benefits and Tools to Drive Growth

Rebecca Strehlow, Copywriter at Crunchbase

28 Best AI Tools to Use in 2024

How to Find Private Company Data

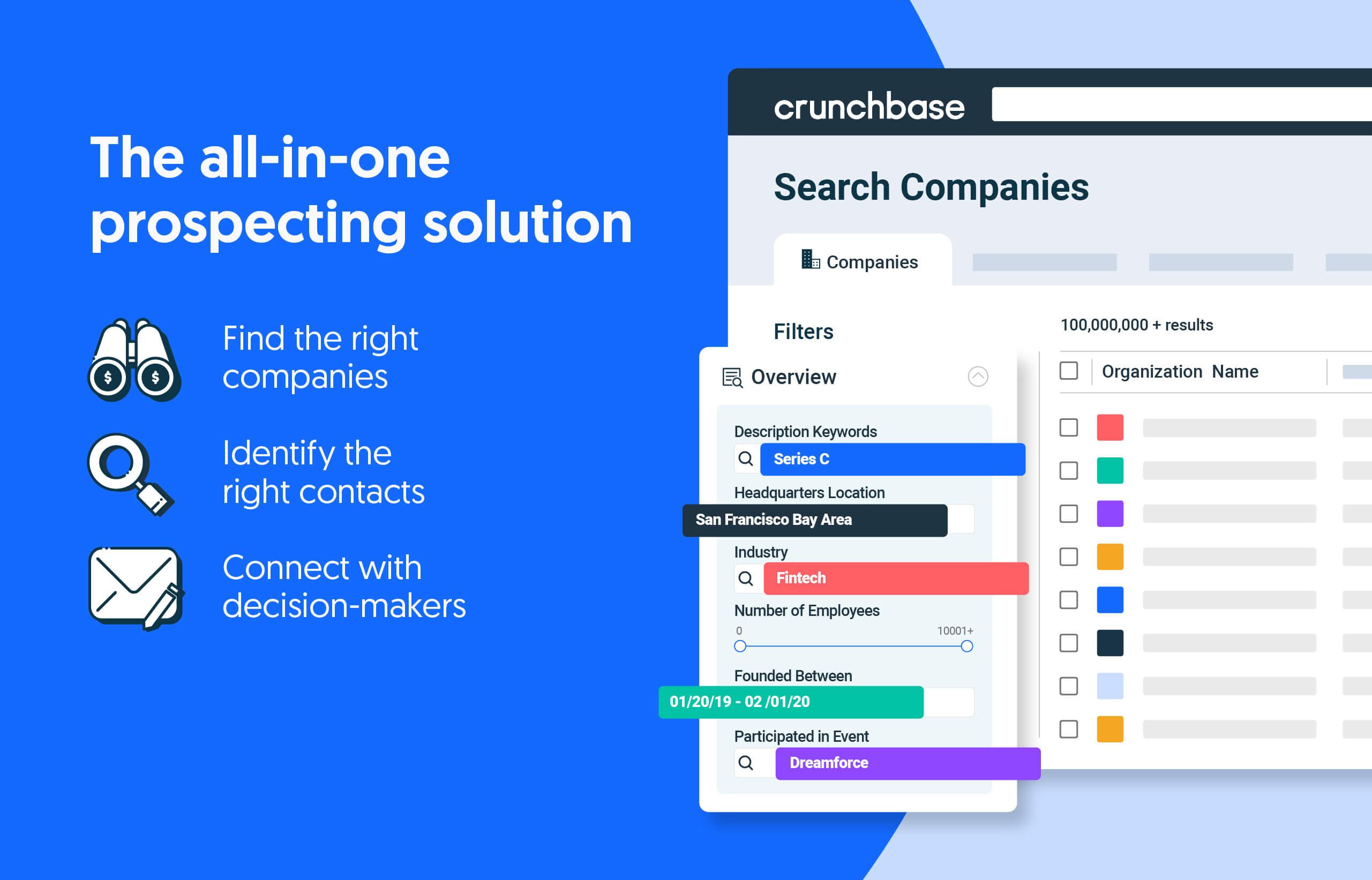

The all-in-one prospecting solution.

- Find the right companies

- Identify the right contacts

- Connect with decision-makers

Female Blogpreneur

Empowering Bloggers & Entrepreneurs

FEMALE BLOGPRENEUR

- Search Engine Optimization (SEO)

- Entrepreneurship

- Social Media

- Blogging Newbies

- Content Creation

- Blog Monetization

- Email Marketing

- SEO For Beginners

- How To Become An Author

- Book Writing- Free 5 Day Email Course

- SEO Decoded -10 Day Email Course

- Animated Templates

- Brown Theme Viral Templates

- Collaborations

How to Raise Capital for Your Small Business (10 Effective Ways)

- August 13, 2023

- by Epifania

If you’re running a small business or nurturing a fresh startup, you’re likely all too familiar with the trials and tribulations of raising capital. It’s not unlike scaling a mountain: daunting at first glance, demanding in execution, but spectacularly rewarding when you finally reach the summit. As you’re scrambling for funds, the seemingly monumental task of raising capital can sometimes feel like the ‘Everest’ of entrepreneurship.

Small businesses are the engine room of economies worldwide. They’re nimble, innovative, and driven by ambitious dreamers. However, as any seasoned entrepreneur will tell you, dreams alone won’t keep the lights on or the production line humming. That’s where capital comes into play.

Capital is the lifeblood of any business. It’s the fuel that keeps the entrepreneurial engine purring, the essential resource that turns the gears of commerce. In the world of small business, securing enough capital can mean the difference between steady growth and being stuck in the startup blocks. It’s the crux of your business, allowing you to purchase inventory, invest in equipment, pay staff, fund marketing efforts, and cover the multitude of other expenses that inevitably crop up.

Yet, the paradox is clear: while capital is crucial for small businesses to thrive, it’s often the most challenging thing to secure. Traditional lenders can be hesitant to invest in new, untested ventures, and the complexities of navigating venture capital can be mind-boggling. Moreover, the rise of the digital era has brought a whole new set of opportunities – and obstacles – for small businesses seeking capital.

In short, raising capital is a multifaceted challenge, but don’t let the task deter you. It may be one of the most strenuous stages of running a small business, but remember – every successful business that exists today once faced the same uphill climb. In this blog post, we’re going to share the ropes, the routes, and the crucial gear you’ll need to scale your own capital-raising mountain. Let’s embark on this ascent together!

Table of Contents

Self-Funding: The Art of Bootstrapping

Considered the entrepreneurial equivalent of learning to swim by jumping in the deep end, self-funding, also known as ‘bootstrapping’, is the first stop on our capital-raising journey. Bootstrapping is where it all begins for many business owners, who dip into their savings or reinvest profits to fund their ventures.

Self-funding presents an attractive alternative to traditional funding sources, primarily because it allows you to maintain control. You get to call the shots, make decisions, and steer your ship without external interference or pressure to provide immediate returns to investors.

However, the journey of bootstrapping is not without its bumps. The financial risks rest squarely on your shoulders, and your personal savings can quickly evaporate if things don’t go as planned.

5 Pros of Self-Funding a Business

- Full Control: You retain full ownership and decision-making authority in your business. There’s no need to compromise with investors or lenders.

- No Equity Dilution: You won’t have to share your business’s profits with external investors since there are none.

- No Repayment Obligation: Unlike loans, self-funding doesn’t need to be repaid, freeing you from debt obligations.

- Flexibility: You have more flexibility to pivot your business direction as you’re not bound by investor expectations or loan conditions.

- Privacy: You can maintain privacy about your business operations and financial status since there are no external parties involved.

5 Cons of Self-Funding a Business

- Limited Resources: Your funding is limited to your personal savings or the business’s profits, which may not be enough for larger investments or expansion.

- Personal Financial Risk: You’re putting your own money on the line. If the business fails, you could lose your personal savings.

- Slow Growth: Due to limited funds, growth might be slower compared to businesses with external funding.

- Missed Opportunities: You may miss out on valuable networks, advice, and market credibility that investors can provide.

- Stress: Self-funding can cause significant stress, as the financial success of your business directly impacts your personal financial security.

10 Tips on Saving and Budgeting for Self-Funding

- Detailed Budgeting: Establish a comprehensive and detailed budget. Keep track of every expense, no matter how small, and plan for both fixed and variable costs.

- Separate Personal and Business Finances: Maintain a clear distinction between your personal and business finances to avoid confusion and ensure accountability.

- Prioritize Necessary Costs: Prioritize your spending on necessary costs that will help generate revenue or reduce other costs, such as essential equipment or marketing.

- Reduce Non-Essential Expenses: Eliminate or reduce non-essential expenses. This may include anything from unnecessary subscriptions to expensive office spaces.

- Automate Savings: If possible, set up automated savings transfers to a separate account designated for business expenses. This helps to build your business fund consistently over time.

- Negotiate with Vendors: Try to negotiate better deals with your suppliers and vendors. Every dollar saved is a dollar that can be reinvested into your business.

- Monitor Cash Flow: Keep a close eye on your cash flow to ensure you always have enough funds to cover your expenses and any unexpected costs.

- Invest in Growth: When you do spend, focus on areas that can drive growth, such as marketing or product development.

- Review and Adjust Regularly: Regularly review your budget and make adjustments as necessary. Your business’s needs will change over time, and your budget should reflect this.

- Stay Disciplined: Above all, stay disciplined. It may be tempting to splurge on non-essentials or bypass your budget, but the success of self-funding relies heavily on disciplined financial management.

The key to successful bootstrapping is smart budgeting and saving. Treat your business funds like a frugal squirrel treats its acorns. Prioritize essential expenses, cut back on non-essentials, and always be on the lookout for cost-effective alternatives. Remember, the goal of bootstrapping is not just to stay afloat, but to generate enough profits to reinvest in your business’s growth.

This scrappy, resilient approach to business can be as rewarding as it is challenging. As you venture into the world of self-funding, remember to paddle before you dive. Plan wisely, spend judiciously, and embrace the thrill of steering your own ship.

Friends and Family: A Closer-to-Home Funding Solution

From the historical pages of famous enterprises like Walmart and Amazon to your local bakery, friends and family have often played the part of financial fairy godmothers (and godfathers). Their willingness to support your entrepreneurial dream can provide the critical initial push needed to move your business from concept to reality.

10 Tips for Preserving Relationships When Borrowing from Family and Friends

Approaching those closest to you for funding might feel like tiptoeing through a minefield of potential misunderstandings and damaged relationships. However, there are ways to ease the process while keeping the bond intact. First and foremost, be transparent about your business plans, risks involved, and the likelihood of repayment. Remember, honesty is the best policy when it comes to money and relationships.

- Transparency: Be clear about your business plans, how the funds will be used, and the risks involved. Honesty can help avoid misunderstandings and build trust.

- Formal Agreement: Treat the loan like a business transaction. Create a written agreement detailing the terms of the loan, including the amount, repayment schedule, and interest.

- Open Communication: Maintain open lines of communication throughout the lending period. Regular updates about your business’s progress and financial status can reassure your lenders and keep them involved.

- Professionalism: Always behave professionally. Respect the transaction as a business agreement, not just a personal favor.

- Realistic Expectations: Only borrow what you genuinely believe you can repay and establish a realistic repayment plan. Over-promising and under-delivering can lead to resentment.

- Fair Interest: If you agree on interest, ensure it’s fair. It shouldn’t be so high it strains your finances or so low it devalues their contribution.

- Prioritize Repayment: Make repaying the loan a priority. Even if your business faces financial difficulties, show that you are committed to honoring your agreement.

- Gratitude: Show appreciation for their support. A simple thank you can go a long way in maintaining positive relationships.

- Legal Consultation: Consult with a lawyer to ensure your agreement aligns with local laws and regulations, which can help avoid legal complications down the line.

- Plan for the Worst: Discuss what happens if you can’t repay the loan. It’s tough but necessary to address this scenario upfront to avoid future conflicts.

Necessary paperwork and legalities involved

It’s essential to treat the funding arrangement as you would with a formal lender. Draft an agreement outlining the loan terms, such as the amount, repayment schedule, interest, and what happens if you can’t repay the loan. This document will help avoid any potential misunderstanding and keep everyone on the same page.

When it comes to legalities, consider seeking advice from a lawyer to ensure your agreement abides by applicable laws and regulations. They can help you navigate issues like potential tax implications, or the transition from a loan to equity if the circumstances change.

Keep in mind, borrowing from friends and family is about more than just securing funds; it’s about honoring their faith in you by putting their hard-earned money to good use and striving for the success of your business. Always approach these transactions with the utmost respect, professionalism, and intention to repay. As the adage goes, “borrowed bread is sweet, but it’s better to return the loaf.”

When done correctly, raising capital from friends and family can be an effective, and often more flexible, way to fund your small business, while also strengthening your support network for the challenging entrepreneurial journey ahead.

Crowdfunding: Harnessing the Power of the Crowd

Crowdfunding is a unique and democratic approach to raising funds, enabling entrepreneurs to turn their ideas into reality. It functions as a digital marketplace where creators meet supporters, presenting business proposals or projects with set financial goals.

The success of a crowdfunding campaign relies on a compelling narrative that resonates with potential backers, who can range from local enthusiasts to global philanthropists. Supporters contribute funds, sometimes receiving rewards such as early access to products or equity in the business.

Crowdfunding not only generates capital, but it also validates business ideas, creates a supportive community, and builds brand awareness.

However, crowdfunding is not a straightforward process of setting up a page and awaiting fund influx. It demands careful planning, an appealing pitch, rewarding returns, and regular communication with backers. This tool can be a catalyst for small businesses, transforming ideas into profitable realities.

Multiple types of crowdfunding exist, each offering unique benefits and risks. For instance, donation-based crowdfunding is typically for social causes, while rewards-based crowdfunding allows backers to pre-order a product or service.

Equity-based crowdfunding gives supporters shares in the company, whereas debt-based (or peer-to-peer lending) involves lending money to businesses for interest and loan amount returns.

Finally, revenue and royalty-based crowdfunding see backers receiving a percentage of ongoing gross revenues or product/service profits, respectively.

4 Pros of Crowdfunding

- Validation: It’s a great way to test the viability of your business or idea in the market. If people are willing to contribute to your campaign, it’s a good indication that there’s interest and demand for what you’re offering.

- Marketing: A crowdfunding campaign can act as a promotional tool. By spreading the word about your campaign, you’re also creating awareness for your business.

- Customer Base: You can build an early customer base who are emotionally invested in your product or service. These early backers can become your brand ambassadors and provide valuable feedback.

- Funding Without Debt: Unlike loans, you don’t have to repay the money raised through crowdfunding (unless it’s debt-based crowdfunding). This can make it a more attractive option for new businesses.

4 Cons of Crowdfunding

- All-or-Nothing: Many platforms follow an all-or-nothing model where if you don’t meet your funding goal, you won’t receive any funds. This can be risky if you rely heavily on this method for capital.

- Public Exposure: Your business plan and operations are in the public domain, which can be a double-edged sword. While it increases visibility, it also exposes you to potential copycats.

- Time-Consuming: Running a successful crowdfunding campaign can be a full-time job. It requires significant time and effort in marketing, customer service , reward fulfillment, etc.

- Potential Damage to Reputation: If your campaign fails to deliver on promises, it can damage your reputation. It’s essential to keep backers updated about any challenges or changes in plans to maintain trust.

In summary, crowdfunding provides entrepreneurs with an opportunity to validate their ideas, engage with potential customers, and garner necessary funds. It emphasizes the importance of community building, transparency, and effective communication. Proper planning, realistic goal setting, crafting an appealing story, and building a strong marketing strategy are critical to success. Therefore, crowdfunding is not just a fundraising tool; it’s a stepping stone to turning dreams into thriving businesses.

Angel Investors

Imagine if you had a guardian angel who not only believed in your business idea but also had the resources to finance it. In the business world, these guardian angels exist and are known as angel investors.

Angel investors are typically high-net-worth individuals who provide financial backing for small startups or entrepreneurs, often in exchange for ownership equity or convertible debt. They are “angels” in the sense that they are willing to invest in businesses when other potential investors might see too much risk. Angel investors often have a personal interest in the industry or technology behind the business they’re investing in, and they may provide value beyond capital, such as industry connections or mentorship.

Angel investors are different from venture capitalists, who invest other people’s money rather than their own. They often support businesses in early stages, taking more significant risks in the hope of gaining substantial returns when the business succeeds.

6 Steps to Attract Angel Investors

- Build a Strong Business Plan: Angels want to see a comprehensive business plan that includes details about your market, products or services, business model, and strategies for growth.

- Show a Proven Track Record: If you can demonstrate past successes, even on smaller projects, you’ll be more attractive to angel investors.

- Have a Unique Value Proposition: Angel investors are often looking for businesses that offer something new or different. Make sure your business stands out.

- Assemble a Skilled Team: The strength of your team is often as important as the strength of your idea.

- Network: Angel investors often rely on referrals, so attending business events and joining entrepreneurial communities can increase your chances of meeting the right people.

- Show Potential for High Returns: Angel investors are looking for businesses that can grow quickly and deliver a high return on investment.

But, before you engage with an angel investor, it’s essential to understand that they may expect a degree of control in your business, depending on the terms of the investment. This could range from a board seat to decision-making powers in certain aspects of the business. While their experience and advice can be valuable, you must consider whether you’re comfortable with this level of involvement.

In conclusion, angel investors can provide not only the much-needed capital but also valuable expertise and connections to turbocharge your small business. With a compelling business plan, proven track record, unique value proposition, and a strong team, you can attract the right angels who can help your business take flight.

Venture Capitalists

Venture Capitalists (VCs) may sound like explorers on a quest for lucrative business ventures, and that’s not far from the truth. They are financial explorers, searching for the next big business idea to fund and, in turn, to gain a considerable return on their investment.

Venture capitalists are typically firms or funds that invest other people’s money in startups or small businesses that have the potential for high growth. Unlike angel investors who often invest their own money, VCs manage the pooled money of others in a professionally-managed fund. They usually invest in exchange for equity, intending to exit their investment via an IPO or sale of the business further down the line.

Before we delve into how to pitch to and negotiate with venture capitalists, let’s consider the pros and cons of VC funding:

Pros of Venture Capitalism:

- Large Funding Amounts: VCs often invest large sums, allowing businesses to accelerate their growth quickly.

- Expertise and Connections: VCs often bring industry knowledge, experience, and extensive networks to the table.

- Long-term Investment: Venture capitalists generally take a long-term view of their investments, often several years.

Cons of Venture Capitalism:

- Loss of Control: To protect their investment, VCs often demand a degree of control in the business, which may involve decision-making power or board seats.

- High Expectations: VCs invest with the expectation of substantial returns, which means intense pressure for the business to perform.

- Complex and Time-consuming: The process of obtaining VC funding can be complicated and lengthy.

If you think VC funding is the right path for your business, you need to make an effective pitch. This process begins long before you’re in the meeting room. Do your homework, understand the VC’s investment preferences, their portfolio, and how your business fits in.

When you’re pitching, remember that it’s not just about your product or service. Venture capitalists invest in the team as much as the idea. Show them you have the skills, drive, and adaptability to make the business successful. Make sure you have a robust business plan, and be ready to answer detailed questions about your market, competition, financial projections, and growth strategies.

Negotiating with venture capitalists can be complex. It’s not just about the amount of money they’re willing to invest, but also about the value of your company, the percentage of equity they will hold, and the degree of control they will have. Remember that it’s okay to negotiate, but also be realistic about what you can achieve.

Venture Capital funding isn’t for every business, but if you’re looking for significant investment and are willing to share control to supercharge your company’s growth, it could be the perfect match.

Bank Loans: A Traditional Path to Business Financing

When it comes to funding your small business, one of the first options that may spring to mind is a traditional bank loan. Banks have been financing businesses for centuries, and while there are many other types of funding available today, bank loans remain a popular choice. Why? They often offer lower interest rates and can provide substantial capital for various business needs, such as working capital , equipment purchases, or expansion.

Understanding Interest Rates and Repayment Plans

To make the most of a bank loan, it’s essential to understand interest rates and repayment plans. The interest rate is the cost of borrowing money and is typically expressed as a percentage of the loan amount per year. A lower interest rate means you’ll pay less back in addition to your loan amount.

Repayment plans outline how you’ll pay back the loan, including the amount of each payment and the frequency of payments. This could range from monthly to quarterly or annual payments, depending on the loan terms. Understanding these elements is crucial to ensure you can meet your repayment obligations without straining your business’s cash flow.

Making Your Business Appealing to Banks

Just like you would pitch to an investor, you need to present a compelling case to the bank to secure a loan. Here’s how to make your business appealing to banks:

1. Strong Business Plan: A well-crafted business plan is a must. It should clearly outline your business’s nature, market research, financial projections, and strategies for growth.

2. Good Credit History: Banks will check both your business and personal credit history. A good credit score can increase your chances of securing a loan and potentially get you a better interest rate.

3. Collateral: Banks often require some form of collateral for the loan. This could be business assets, personal assets, or both. Having collateral reduces the risk for the bank and can make your loan application more appealing.

4. Financial Statements: Up-to-date, well-organized financial statements can show the bank that your business is financially healthy and capable of repaying the loan. This includes income statements, balance sheets, and cash flow statements.

Remember, while bank loans can be a great way to fund your small business, they do come with obligations and risks. Be sure to thoroughly evaluate your business’s financial situation and consider all your financing options before deciding on the best path forward.

Small Business Grants and Their Benefits

If you’ve ever dreamed of receiving money to help your small business grow without the stress of repayment, then small business grants might be your golden ticket. Unlike loans, grants provide funds for your business that you typically do not have to pay back, making them an attractive option for business financing.

The benefits of grants extend beyond the financial aspect. Winning a grant can significantly enhance your business’s credibility, opening doors to more opportunities. Additionally, the process of applying for a grant can help you fine-tune your business plan and better understand your business’s objectives and goals.

How To Find and Apply for Suitable Small Business Grants

Small business grants are often highly competitive and come with specific eligibility requirements. To improve your chances of securing a grant, you’ll need to know where to look and how to apply effectively. Many grants are industry-specific or targeted towards businesses owned by individuals of specific demographic groups.

Start by searching for grants on local, state, and federal government websites. Additionally, numerous private companies and nonprofits offer grants. Be thorough in your research, and create a list of potential grants that align with your business and personal circumstances.

When it comes to applying, attention to detail is crucial. Ensure your business meets all the eligibility criteria, follow the application instructions to the letter, and submit your application by the deadline. Take your time to craft compelling, concise answers to any questions or prompts, focusing on how your business aligns with the grant’s purpose and the impact the grant funds would have on your business.

Real Examples of Small Business Grants Available

There are numerous grants available for small businesses across various sectors. Here are a few examples:

Federal Small Business Innovation Research (SBIR) Program: This competitive grant program encourages domestic small businesses to engage in federal research and development that has the potential for commercialization.

National Association for the Self-Employed (NASE) Growth Grants: NASE members can apply for these grants to finance a particular small business need.

Eileen Fisher Women-Owned Business Grant Program: This program supports innovative, women-owned companies that are beyond the start-up phase and ready to expand their business and their potential for positive social and environmental impact.

FedEx Small Business Grant Contest: FedEx awards grants and services to innovative small businesses in an annual competition.

These are just a few examples. The availability of grants can change, so it’s crucial to continually research and apply to maximize your chances of receiving a grant. Remember, each grant application takes time and effort, but the potential rewards can be substantial.

Business Credit Cards: A Flexible Source of Capital

In the fast-paced world of small business, having a flexible source of capital at your fingertips can be invaluable. This is where business credit cards come into play. Similar to personal credit cards, they provide a line of credit that you can use for various business expenses. This can include everything from office supplies and software subscriptions to travel expenses and even small equipment purchases.

One of the main benefits of business credit cards is their flexibility. Unlike loans, which are typically one-off lump sums that you repay over time, credit cards give you continuous access to a set amount of funds, as long as you’re paying off your balance. They can be particularly useful for handling cash flow gaps and unexpected expenses.

Understanding Credit Card Terms and Conditions

Before applying for a business credit card, it’s crucial to understand the terms and conditions. One of the most critical aspects is the interest rate, which can vary widely between cards. While most cards offer a grace period during which you can pay off your balance without incurring interest, if you carry a balance from month to month, you’ll be charged interest.

Other critical terms include the card’s credit limit, any annual or monthly fees, and the penalties for late or missed payments. Additionally, many business credit cards offer rewards programs, such as cashback or points for certain types of purchases, which can provide additional value.

6 Tips for Managing Credit and Avoiding Debt Pitfalls

While business credit cards can be a handy tool, it’s essential to use them responsibly to avoid potential debt pitfalls. Here are some tips:

1. Keep business and personal expenses separate: This makes it easier to track your business expenses and can simplify your accounting.

2. Pay off your balance each month: If possible, avoid carrying a balance from month to month to minimize interest charges.

3. Regularly review your statements: This can help you spot any errors or fraudulent charges and keep track of your spending.

4. Don’t exceed your credit limit: Going over your limit can result in fees and could negatively impact your credit score.

5. Make payments on time: Late payments can result in penalties and can harm your credit score.

6. Use rewards wisely: If your card offers rewards, make sure you’re using them to your advantage, whether that’s by strategically making certain purchases with your card or regularly redeeming your rewards.

Remember, while business credit cards can provide a valuable source of capital, they should be part of a broader financial strategy that also includes other funding sources and good financial management practices.

Microloans: Small Sums with Big Impact

In the landscape of business financing, sometimes smaller is better. This is the philosophy behind microloans, small loans that are often used by startups and small businesses that need access to a modest amount of capital. Microloans can range from a few hundred dollars up to $50,000, but are typically in the $500 to $10,000 range. These loans can provide essential funding for equipment purchases, inventory, or working capital, often at competitive interest rates.

One of the key benefits of microloans is their accessibility. Unlike traditional bank loans, which often require a solid business history and significant collateral, microloans are often more flexible in their requirements, making them ideal for newer businesses or those with less traditional business models.

Microloan Programs for Small Businesses

There are various microloan programs designed to support small businesses. Here are a few:

1. The U.S. Small Business Administration (SBA) Microloan Program: The SBA offers microloans up to $50,000 through intermediary lenders, often non-profit organizations. These loans can be used for working capital, inventory, supplies, and equipment .

2. Kiva: Kiva is a non-profit that offers microloans up to $15,000 at 0% interest for U.S. entrepreneurs . These loans are crowdfunded by a community of supporters worldwide.

3. Accion Opportunity Fund: This non-profit lender provides loans ranging from $300 to $100,000 to underserved business owners, including minorities, women , and businesses in low-income communities.

Applying for a Microloan: A Step-by-Step Guide

Before diving into the application process, remember that each lender will have its specific requirements. However, here are general steps you can expect:

Step 1: Assess Your Needs and Eligibility

Determine how much you need to borrow and what you’ll use the funds for. Research different lenders to see if you meet their eligibility criteria.

Step 2: Prepare Your Business Plan

Most lenders will want to see a comprehensive business plan that details your business model, market research, financial projections, and how you plan to use the loan funds.

Step 3: Gather Necessary Documents

This typically includes financial statements, tax returns, and legal documents like your business license. It may also include personal financial information.

Step 4: Submit Your Application

You’ll usually need to fill out an application form detailing your business information, loan request, and how you plan to repay the loan. Some lenders allow online applications.

Step 5: Interview and Negotiation

Some lenders may require an interview or meeting to discuss your application. If approved, you’ll then discuss the terms of the loan, including interest rate and repayment schedule.

Step 6: Loan Disbursement

If everything goes well, you’ll sign a loan agreement, and the funds will be disbursed. You can then start using them as planned.

Remember, while microloans can provide a valuable source of capital for small businesses, they are still loans and need to be repaid. Be sure to understand the terms and only borrow what you can afford to repay.

Equipment Financing: A Practical Route to Capital

When we speak about raising capital for your business, it doesn’t always have to come in the form of cash. Instead, equipment financing provides you with the machinery, technology, or other necessary tools you need to grow and enhance your operations. Essentially, equipment financing is a loan or lease that helps you purchase or rent business equipment, from computers to construction machinery.

One of the most significant advantages of equipment financing is that it allows you to get your hands on vital business tools without the significant upfront costs. Plus, the equipment itself serves as collateral, which means you typically don’t need to put additional assets on the line. This opens doors to businesses that may not have extensive credit histories or additional collateral.

How to Secure Equipment Financing

Here’s a basic roadmap to secure equipment financing:

Step 1: Evaluate Your Needs

Define the specific equipment you need, its cost, and how it will contribute to your business.

Step 2: Shop Around

Compare terms and rates from various lenders. Be sure to look beyond interest rates and examine the total cost of financing.

Step 3: Check Your Credit

While the equipment serves as collateral, lenders will still look at your credit history. Ensure your credit report is accurate and up-to-date.

Step 4: Gather Your Documents

Lenders may require your financial statements, tax returns, and a detailed business plan.

Step 5: Apply

Once everything is in order, submit your application.

Mitigating Risks in Equipment Financing

While equipment financing can be a valuable resource, it also comes with potential risks. One such risk is that the equipment may become outdated before you finish paying it off, leaving you paying for equipment that’s no longer competitive. To mitigate this, consider the lifespan of the equipment and align it with the term of your loan.

You also need to account for the total cost of the loan, including interest and fees, which can add up over time. Be sure to thoroughly read and understand the loan agreement before signing.

Lastly, remember that failure to repay the loan can result in the lender seizing the equipment. Therefore, it’s essential to realistically assess your ability to repay the loan within the set timeline. If in doubt, consider consulting with a financial advisor to help make the most suitable decision for your business circumstances.

In essence, while equipment financing may not boost your bank balance, it does boost your business’s capabilities, which can be just as valuable when it comes to driving growth and success.

Conclusion: Multiple Avenues to Capital

Over this journey, we’ve explored an extensive range of paths that lead to the same destination – raising capital for your small business. We’ve delved into the nuts and bolts of self-funding, embraced the warmth of friends and family, and surfed the waves of crowdfunding. We’ve met the angel investors with their keen eyes and open checkbooks, and stepped into the fast-paced world of venture capitalists.

We’ve understood the dependable steadiness of bank loans and the buoyant promise of business grants. We’ve wielded the power of business credit cards, discovered the humble yet potent microloans, and equipped ourselves with the understanding of equipment financing. In essence, the road to capital is vast and varied, and understanding these various routes is the first step towards your destination.

Yet, the important takeaway isn’t just the sheer variety of options available, but rather the understanding that each option comes with its own set of benefits, requirements, and potential challenges. Therefore, it’s crucial to not just seek out capital, but to carefully analyze your business’s specific needs, risk tolerance, and long-term objectives before identifying the most suitable funding strategy.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

How to Raise Capital for Business Growth

- Growth capital can help businesses significantly increase their value, but be clear on how these funds will drive growth.

- Once a business has a clearly-defined growth strategy, there are several financing strategies to evaluate.

- We’ll finish with some best practices and key questions for teams as they move forward raising growth capital.

“Begin with the end in mind” is an axiom made famous by Stephen Covey, author of “The 7 Habits of Highly Effective People.” Nowhere is this advice more important than when you’re planning to raise capital for business growth. Taking the time to make sure you really understand what you’re hoping to achieve with the capital you plan to raise provides clarity and direction.

At the highest level, there are only three main reasons to raise growth capital. They come down to funding one or more of the following growth strategies:

- Faster core growth than the business’s cash flow supports;

- Inorganic growth, such as M&A or adjacent-market entry, to complement the existing core business; or

- Innovative new projects.

That’s it. Too many entrepreneurs make the mistake of viewing raising capital as a marker of success. It’s not! You don’t need to raise capital to be successful — for instance, in many situations, raising venture capital isn’t wise . Yes, raising capital can be a smart strategic decision to enable or accelerate growth when the business has a clear opportunity to do so and a strong plan to make it happen. But an outside financing event, of itself, won’t make your business successful.

Importantly, the three main growth strategies lend themselves to different financing strategies. Before we get to that, let’s discuss the growth strategies and their different potential outcomes. Because the details of your business may be nuanced, I’ll unpack each growth strategy with a few quick examples to help you think through which are applicable to your business.

Then, I’ll finish with a few key questions to help leadership teams think through the growth strategy they’re contemplating before starting to raise capital.

Growth Strategy 1: Enabling Faster Core Growth Than the Business’s Cash Flow Supports

Sometimes this strategy is about operational efficiency or scaling up production. More typically, it’s about increasing sales, marketing and/or core product development investments; these may have a meaningful impact on growth but slower payback period. All of this often requires investment in more comprehensive business management systems, much of which is addressed in our Project $50M series .

Here, we’ll focus on the capital implications of such investments.

A simple case in point: new customer acquisition. The lifetime value of a customer is significantly greater than the cost to acquire the customer, but that lifetime of revenue is paid out over months or years. Meanwhile, incremental new-customer acquisition costs negatively impact short-term cash flow. Long-term, of course, those customers may contribute significantly to the bottom line. So the business needs to raise capital to cover the short-term hit in expectation of long-term profitability.

Management should pay close attention as it makes these investments that neither of the following are happening:

- Acquisition costs per customer are increasing as the business scales, and/or

- New customers are different in some way that may cause them to have a lower lifetime value — for example, maybe they churn faster.

Monitoring both of these are important when using growth capital for customer acquisition costs, because if either or both don’t track to your projections you can end up with a growing customer base but lower profits or, in extreme cases, losses.

Regardless of whether the growth capital is being used for acquiring customers, increasing operational efficiency or scaling up production, it’s important to make sure that spending eventually translates to milestones that make the investment worthwhile.

Unfortunately, there are many companies that don’t have a reasonable path but keep consuming growth capital. Companies in this situation achieve what some growth equity investors call “profitless prosperity.” Eventually they will run out of investors to fund this “prosperity” and be forced to make dramatic reductions in expenses or face bankruptcy.

Sometimes a business has already funded prior growth with outside capital but needs more capital to continue growing. It isn’t profitable today, but it has a clear path to profitability and doesn’t want to make the necessary expense adjustments to get the business profitable right now because that would diminish growth. This is very common for tech and life science startups given their significant early fixed costs.

Alternatively, a business may be profitable and growing but see a clear opportunity to accelerate growth with outside capital. It may have started with a small investment or even bootstrapped to profitability. For example, consider a small consumer packaged goods (CPG) food brand that started by selling organic snacks to a few local retailers. After a successful trial in the local Whole Foods store, it has the opportunity to sell in all locations nationwide. The business scaled to this point using the owners’ capital and cash flow, but getting to the next level will require outside capital.

Two warnings: Businesses sometimes grow to this stage without needing the financial rigor that helps them accurately see all their costs, or their customer lifetime value. Investors will demand better financial management. Second, once businesses start raising capital for growth it often becomes hard to stop; many future financing rounds become necessary. Venture investors often describe this phenomenon as the “VC treadmill.” Think about these issues carefully before starting down this path.

Growth Strategy 2: Inorganic Growth to Complement the Existing Core Business

Adjacent market expansion.

Sometimes the strategy is to grow a business by expanding to a new market with similar customers and offering the same or a very closely related solution to those new customers. If the business has captured a significant percentage of its current target customers, then expanding the market may be the easiest way to continue growing.

A simple example: Imagine you run a very successful Greek restaurant that’s busy through the week and has long waits on Friday and Saturday nights. As you contemplate growth options, you may decide that you have captured most of the target market in your town. Therefore, instead of finding a larger location in your existing town (Growth Strategy 1), you decide to open a second location in a neighboring town. You are choosing Growth Strategy 2, expanding to a new market with similar customers instead of trying to continue growing your current market.

Management should pay close attention as it explores this strategy to ensure that new customers in the adjacent market are behaving similar to existing customers. This often can be done by conducting small-scale tests ahead of making a significant investment.

Too many businesses push into opening new markets without validating that customers really are like those in their existing market, often because leaders don’t think creatively enough about how to validate a concept. In the context of a restaurant, lack of such validation could result in opening that second location in a community with significantly different demographics and, therefore, food preferences.

So imagine our restaurant’s new target town is a 30-minute drive away from the current location. Management might initially argue there is no way to “prove” customers will order from their Greek restaurant without signing a lease and opening a location. But if pushed not for “proof” but merely to increase their confidence, they might do one or more of the following experiments:

- Analyze their customer loyalty program to find the small percentage of existing customers from the planned new town who are traveling to their existing location. Conduct qualitative research — say, interviews over a free meal — to get these customers’ feedback on the new location.

- Set up a limited-menu offering at the local farmer’s market or similar “pop-up” location for a few weekends to test demand.

- Do targeted marketing to the new town with a coupon offering 10% off your meal with a unique code and then track the conversion of those campaigns.

An important point about this strategy is that in each of the three example tests above, you are doing an experiment for the purpose of validating or invalidating your assumptions about that new market. You aren’t investing in marketing to efficiently acquire customers; you’re investing to learn about a potential new market.

Expansion via M&A

Often, companies will explore inorganic growth via acquisition. For example, if you run a service business with 10 plumbers in your city, you may decide to acquire another similar service business in a neighboring city to enter that market.

On the surface, this can be really appealing. It can feel like a way to accelerate the speed at which you can scale in this new market. But keep in mind the advice of Roger Martin, former Dean of the Rotman School of Management at the University of Toronto. Martin pointed out in the Harvard Business Review that most acquirers focus on the wrong thing and, therefore, M&A fails up to 90% of the time. His advice:

Companies that focus on what they are going to get from an acquisition are less likely to succeed than those that focus on what they have to give it.

This insight applies to businesses large and small and is particularly important when thinking about leveraging an acquisition to accelerate inorganic growth. Don’t think about the acquisition target’s ability to get you into a new market. Instead, think about how your company can bring unique resources, expertise and systems to make the acquiring company a stronger and better entity after the merger.

In the case of the plumbing business, instead of focusing only on the customers it’s buying, the acquiring company could consider how it can bring efficiencies through, perhaps, its route management software and simplified mobile sales system.

After all, if the acquisition target is already successful and growing, you have to ask: Why is the owner letting you acquire it for a good price? On the other hand, if you can step in and truly make it a much better business, that could be a great way to enter an adjacent market.

Growth Strategy 3: New Innovation Projects

Here, the focus is on innovation to develop new products or services. In some cases, a new product or service will be incremental innovation developed for existing customers. For example, consider a very successful moving business with a fleet of 20 trucks. Instead of trying to grow to 50 trucks (Growth Strategy 1), you may develop other logistics solutions to sell into your existing market.