Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Data Descriptor

- Open access

- Published: 24 June 2023

Comprehensive green growth indicators across countries and territories

- Samuel Asumadu Sarkodie ORCID: orcid.org/0000-0001-5035-5983 1 ,

- Phebe Asantewaa Owusu 1 &

- John Taden ORCID: orcid.org/0000-0002-3038-1831 2

Scientific Data volume 10 , Article number: 413 ( 2023 ) Cite this article

6949 Accesses

14 Citations

4 Altmetric

Metrics details

- Environmental economics

- Interdisciplinary studies

- Sustainability

A sustainable transition to green growth is crucial for climate change adaptation and mitigation. However, the lack of clear and consistent definitions and common measures for green growth implies a disagreement on its determinants which hampers the ability to proffer valuable guidance to policymakers. We contribute to the global debate on green economic development by constructing green growth measures from 1990 to 2021 across 203 countries. The pillars of green growth are anchored on five dimensions namely natural resource base, socio-economic outcomes, environmental productivity, environmental-related policy responses, and quality of life. Contrary to the aggregated methods used in constructing indices in the extant literature, we employ a novel summary index technique with generalized least squares attributed-standardized-weighted index that controls for highly correlated variables and missing values. The constructed indicators can be used for both country-specific and global data modeling on green economic development useful for policy formulation.

Similar content being viewed by others

Green finance, renewable energy development, and climate change: evidence from regions of China

Shades of green growth scepticism among climate policy researchers

Perceptions of degrowth in the European Parliament

Background & summary.

Policies to promote green growth should be anchored on thorough knowledge and understanding of the concept. Likewise, tools to monitor green growth must have a reliable and comprehensive framework upon which progress can be recorded and compared across multiple entities. Yet, no two studies have a common measure or definition of green growth despite its widespread application in the scholarly and public policy discourse 1 . Not only does the lack of a common green growth measure stifle policymaking but also, hinders investments in its success 2 . The discourse on green growth is fairly new within international institutional development programs. As a multilateral agenda, green growth was first adopted in 2005 by 52 Asia-Pacific countries at Seoul’s 5 th Ministerial Conference on Environment and Development (MCED). The UN Economic and Social Commission for Asia and the Pacific (UNESCAP) then described the concept as a focus on sustained economic progress driven by environmental sustainability while improving low-carbon society and socially inclusive development (UNDESA, 2012, p. 35). The OECD in 2009 defined the term as achieving sustained economic development while reducing the negative environmental externalities including climate change, loss of biodiversity, and natural resource exploitation 3 . The organization also became the first to provide a cross-country ranking and comparative framework of green growth indicators for its industrialized economies in 2011 4 . The UN Environment Program (UNEP), under Towards Green Growth: Monitoring Progress program, also presented its first set of indicators in 2011. Per its definition, green economic growth improves well-being and social justice while reducing environmental risks and ecological footprint 5 . This infers that achieving green economic growth should prioritize green innovation, decarbonization, green trade, resource efficiency, and social inclusion 6 . Other international bodies such as the Global Green Growth Institute (GGGI), European Commission, and World Bank have all since proffered their definitions of the concept. In the wake of the discrepancies and unwieldy growth of the discourse surrounding green growth, the World Bank, UNIDO, OECD, and UNEP created the Green Growth Knowledge Platform (GGKP) in 2012. The GGKP is entrusted with the responsibility of collaboratively generating, managing, and sharing knowledge and data on green growth 7 . The GGGI produced the green growth index in 2019 aimed at preparing a measure that will enhance efforts to track the implementation of the Aichi Biodiversity Targets, Paris Accord, and SDGs 8 . At a country level, South Korea is widely recognized as the first to incorporate a comprehensive national strategy of green growth into its development plan in 2008 9 . Today, myriad countries across the globe have adopted various strategies to achieve green growth, even outside the frameworks of the SDGs and the Paris Climate Accord. Noticeably, developing countries such as Rwanda, Ethiopia, Vietnam, and Morocco have recently been commended for their track records on the incorporation of green growth into national development programs 10 .

In light of the growing adoption of green growth development into national development plans, researchers have recently focused on assessing performances and prospects of a green future across countries, but mostly relying on varied measures of the concept. For example, Houssini and Geng 10 assessed Morocco’s green growth performance between 2000 and 2018 using a self-derived green growth measure developed with a data envelopment (D.E) analysis technique. The assessment proceeded to score Morocco positively on several variables, commending the government on its conscious effort to promote green growth. Wang and Shao 11 developed the “Hybrid Global ML Index” to assess the effect of formal and informal national green growth performance among G20 economies. The study found that most countries in the G20 have achieved green growth benchmarks in the entire sample period, except from 2008 to 2009 11 . Several other studies used D.E analysis techniques but derived different green growth measures even when applied to the same units of analysis 12 , 13 , 14 , 15 , 16 . In related studies, Acosta, et al . 8 assessed and ranked 115 countries in 2019 after using composite (C.O) analysis to develop a green growth index that strayed significantly from what its member partners such as the OECD and the UNEP historically relied upon. Their measure particularly paid attention to the inclusivity of green growth by being one of the first and only known two [with Kararach et al . 17 ] to incorporate a gender dimension into the impacts of green growth policies. Though, using C.O analysis, other researchers 2 , however, arrived at measures that capture different sets of indicators for the same or different countries in their analyses.

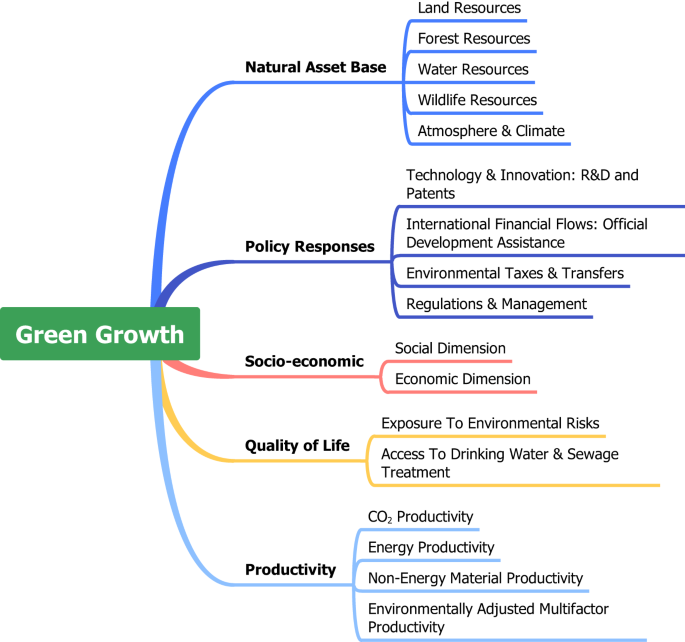

Patently, the lack of clear and consistent definitions and common measures for green growth imperils attempts to compare findings across multiple studies 1 , discourages investments in its success 2 , and forces the “comparison of apples to oranges” when analyzing the extant literature 1 . Likewise, the lack of a common understanding of the meaning of green growth and the utilization of myriad varying sets of indicators implies a lack of agreement on its determinants 2 , which hampers the ability to proffer valuable guidance to policymakers. In this study, we propose a new set of green growth indicators that is founded on a thorough assessment of a wider range of factors contributing to green growth. Theoretically, we portend that the dynamic shift from brown to green growth entails strategic multifaceted actions that are informed by economic endowments, political choices, socio-economic capabilities, and environmental outcomes. Accordingly, we define green growth as a sustained economic development approach decoupled from negative environmental consequences but thrives on eco-technological efficiency, reduces poverty, and increases social inclusion. Empirically, we construct green growth measures whose pillars are anchored on the five dimensions of (i) natural asset base, (ii) policy responses, (iii) socio-economic outcomes, (iv) quality of life, and (v) environmental productivity (see Fig. 1 ). Contrary to the aggregated methods used in constructing indices, we employ a novel summary index technique with generalized least squares attributed-standardized-weighted index that control for highly correlated variables and missing values.

Dimensions of green growth. Data source: OECD ( https://buff.ly/43cKbKU ).

We analyze the frameworks and several indicators adopted by existing studies measuring green growth. For brevity, we analyze the indicators in light of our theoretical and empirical framework. Our empirical framework covers the dimensions of (i) natural asset base, (ii) policy responses, (iii) socio-economic outcomes, (iv) quality of life, and (v) environmental productivity (Fig. 1 ). To the best of our knowledge, these dimensions subsume the differing frameworks in the extant literature and, thus, allow us to review and analyze the individual indicators espoused in most studies. While not all studies in the extant literature are analyzed, Tables 1 , 2 describe all known studies, their measurement frameworks, and other applications.

Natural asset base

Natural resources are central to the purpose of all green growth or sustainable development initiatives under the Aichi Biodiversity Targets, Paris Climate Accord, and SDGs 8 . The Green Growth Performance Measurement (GGPM) Program, for instance, developed in 2019 utilizes data from 115 countries and relies on 36 sampled indicators categorized under four dimensions. The dimensions include sustainable and efficient resource utilization, economic opportunities, natural capital protection, and social inclusion. Within the dimension of natural capital protection, for example, the authors discussed 12 indicators that reflect components such as the proportion of forests, biodiversity cover, and marine protected areas. However, the authors also incorporated measures such as the share of non-carbon agricultural emissions, mean annual air pollution, and the level of recreation and tourism in marine areas. By this calibration, the authors developed factors such as ecosystem, environmental quality, GHG reductions, and the cultural value of resources useful in measuring green growth under natural capital protection.

To design a novel tool to measure the complete impacts of green growth policies, Kim et al . 4 synthesized a pool of 78 indicators in the extant literature down to what they describe as the 30 core and the 12 international indicators pertinent to assessing and comparing green growth across countries. Among the final 12 international indicators, two were used to measure the natural capital assets and environmental quality dimension which are: the inverse of domestic material consumption and the share of forest coverage per total land size. The authors’ omission of other non-forest resources in measuring natural capital is puzzling—as they offer no theoretical justification for the decision. However, the authors admit that by placing more weight on forest resources, the measure unfairly punishes countries with low forest cover such as Iceland. Baniya, et al . 18 utilized six indicators to analyze green growth in Bangladesh and Nepal from 1985 to 2016—and to project its 2030 prospects in both countries. Natural capital was measured using the share of land with forest coverage. The authors argued that the six indicators chosen for analyses are the most frequently used in the extant literature from the OECD (2017) framework. However, similar to Kim et al . 4 , the omission of indicators capturing non-forest resources poses a challenge to the generalizability of the final measure of green growth.

Kararach, et al . 17 developed the African Green Growth Index using data from 22 African countries. They featured 48 indicators representing five different dimensions including, socioeconomic context, productivity of resources and environment, natural asset base monitoring, gender, and governance. While natural assets include the usual measures of forests, land, agriculture, water, and aquatic resources, they also incorporated a disaster risk component. This measure tracks all disaster events from 1900 to 2014 and the population affected by disasters. Nonetheless, attempts to derive variables as far back as 1900 meant that the authors had to statistically impute a significant portion of the missing data, which admittedly leads to model uncertainties and affects the accuracy 17 . Inspired by the need to design a green growth index that accounts for the connection among society, economy, and nature, Li, et al . 19 employed factor analysis to design an inclusive green growth indicator covering four unique dimensions, viz. social inclusion, economic security, resource use, and sustainability. However, the design failed to provide a stand-alone measure for natural capital. Instead, the authors created a resource use dimension that is measured by a derivation of energy consumption and variables of natural capital including arable land holdings, forest cover, land yield efficiency, and freshwater resources.

Environmental productivity

The productivity dimension of green growth entails the efficient ways by which economic growth is decoupled from resource use. An existing study focused on both ecosystem services and the productive use of resources such as energy, water, and land 8 . The authors reinforced this dimension with eight indicators ranging from measures such as the share of primary energy provision to GDP to total material footprint per capita. Kim, et al . 4 dedicated two of the five dimensions of their framework to measuring productivity. The first dimension labeled as environmental efficiency of production is proxied by two indicators namely GHG emissions per GDP as well as the share of GDP from services. The second dimension labeled as environmental efficiency of consumption is proxied by three indicators including energy utilization per GDP, the share of renewable energy consumed, and withdrawal of both surface and groundwater out of total available water. The authors argued that their framework aligns with that of the OECD and purposely adopts the growth-accounting approach to reach a broader context of global decision-making. However, this also implies that unique country characteristics of certain measures are glossed over for the sake of generalizability. Similarly, four of the six indicators that constitute Baniya, et al .’s 18 framework have productivity connotations. These include the productivity of carbon, energy, materials, and the share of renewables. The authors, however, do not account for other crucial dimensions seen in other studies such as policy responses, quality of life, and social inclusion.

Socio-economic dimension

New and sustainable economic opportunities are crucial to the success of green growth strategies. Thus, some authors incorporated socio-economic variables of green growth into their frameworks. For instance, Acosta, et al . 8 employed a dimension termed green economic opportunities—that capture the share of economic opportunities that arise as investments shift from traditional activities to green sectors. They integrated this dimension with four indicators that capture environmental technology (i.e., number of patent publications), green employment, environmental goods exports, and net savings minus resource and pollution damages. On the other hand, Kararach, et al . 17 introduced an entire dimension for gender, into which seven different indicators are fed. They argued that green growth must be assessed by its impact on societal inequalities. However, it is unclear why such indicators (i.e., female HIV prevalence, female labor force, female literacy, parliamentary seats, and ministerial positions held by women) were used to measure the gender dimension. Li, et al . 19 argued that a green growth measure must quantitatively incorporate the themes of social equity, stability, and happiness. The authors provided an extensive set of indicators incorporated into the measure of social inclusion. However, unlike other studies that specifically addressed opportunities for women and minorities, Li, et al . 19 does not specify what constitutes fair opportunities and what specific group of people development must consciously cater for.

Quality of life

The quality-of-life dimension of green growth tracks individuals’ social well-being attributed to resources extracted for economic growth. The existing studies that incorporated aspects of quality of life conceptualize the measures with different but similar and overlapping terminologies. For example, Acosta, et al . 8 combined variables that track economic and social well-being into a single dimension described as social inclusion. They argued that inequality and poverty are directly affected by the availability of resources and crucial basic services. Conversely, people rely heavily on the environment such as forests, wildlife resources, and among other natural assets for livelihoods. They postulated that the social performance of green growth should be measured because sustained economic growth requires reduced inequality 8 . Consequently, they classified concepts such as “access to basic services and resources, gender balance, social equity, and social protection” under the social inclusion dimension. The authors supported this dimension with 12 indicators ranging from “access to safe drinking water and sanitation” to “proportion of urban population living in slums”. While theoretically cogent, this dimension does not distinguish traditional economic conditions such as income levels from social conditions or quality of life such as health. Kim et al . 4 measured the quality-of-life dimension with only one indicator, viz. the public transportation modal split. They justified the selection of this measure among other dimensions on a criterium of policy relevance, analytical soundness, and measurability.

Policy responses

The policy response dimension of green growth is represented in fewer studies. Although the OECD framework incorporates a policy response dimension, the Green Growth Index developed by Acosta, et al . 8 omits it. Among studies that justify the policy response dimension, Kim et al . 4 measured the response with four indicators: environmental expenditure, environmental patents, green ODA per GDP, and green R&D per government budget. While Kararach, et al . 17 does not incorporate a precise dimension for policy responses, they accentuated the distinct role of governance in their equation. Their “governance” dimension spells out four political indicators pertinent to measuring green growth. These indicators include “violence and/or terrorism, control of corruption, government effectiveness, political stability, rule of law, and regulatory quality”. Nonetheless, these variables primarily capture institutional quality and could have been complemented by other deliberate governmental efforts to promote green growth, such as eco-innovation R&D and environmental taxes.

Analysis of the literature

No two studies in the extant literature have the same or directly comparable measures of green growth 1 . From our review, no two studies have a common understanding of what set of indicators constitutes green growth or dimensions of green growth. In other scenarios, indicators used as proxies for one dimension in a study—for example, resource productivity—might be adopted as proxies for an entirely different dimension (such as economic opportunities) in another study. Consequently, their differential weightings in different dimensions imply they feature at different levels of importance in different studies. In such scenarios, comparing findings in the literature using these different measures might be tantamount to comparing apples to oranges 1 .

A few existing studies introduced distinct dimensions in their frameworks for various reasons. For instance, Li, et al . 19 utilized GDP as a measure of economic growth and termed as “economic prosperity”. They proceeded to introduce an economic prosperity dimension using indicators such as trade volumes, R&D expenditure, urbanization, and inflation in addition to GDP and GDP per capita. They argued that economic prosperity should be the primary criterion of green and inclusive growth, stating further that more focus must be placed on the growth, development, and stability potentials of the economy. Notably, these indicators were captured in different studies, even under different dimensions and for different conceptual purposes. Contrary to studies that employed C.O. analysis to measure green growth, a large share of the extant literature relies on D.E. analysis to derive the green growth index. Studies that used C.O. analysis adopted a range of diverse inputs. For instance, whereas Song, et al . 14 used labor and capital as inputs in their model, Cao, et al . 13 relied on capital, labor, technological innovation, and energy consumption. Tables 1 , 2 provide more information on the variability of datasets (used as inputs) and techniques in the existing studies.

Beyond studies utilizing C.O analysis and D.E techniques to measure green growth, a few other studies insist on simplifying the discourse further by adopting a single indicator out of the larger literature as a proxy for green growth. Accordingly, some researchers measure green growth using single indicators such as environmental and resource productivity 20 , carbon productivity 21 , and environmentally-adjusted-multifactor productivity 22 . In earnest, while these measures simplify analyses of green growth, they risk revealing only a portion of the picture. For instance, the use of carbon emissions as a sole indicator for green growth does not reveal any information beyond the pollution levels of the set of tools applied to achieving a certain level of growth 23 . Consequently, the contributions of other factors such as economic opportunities, policy responses, and resource protection to green growth are untenably omitted.

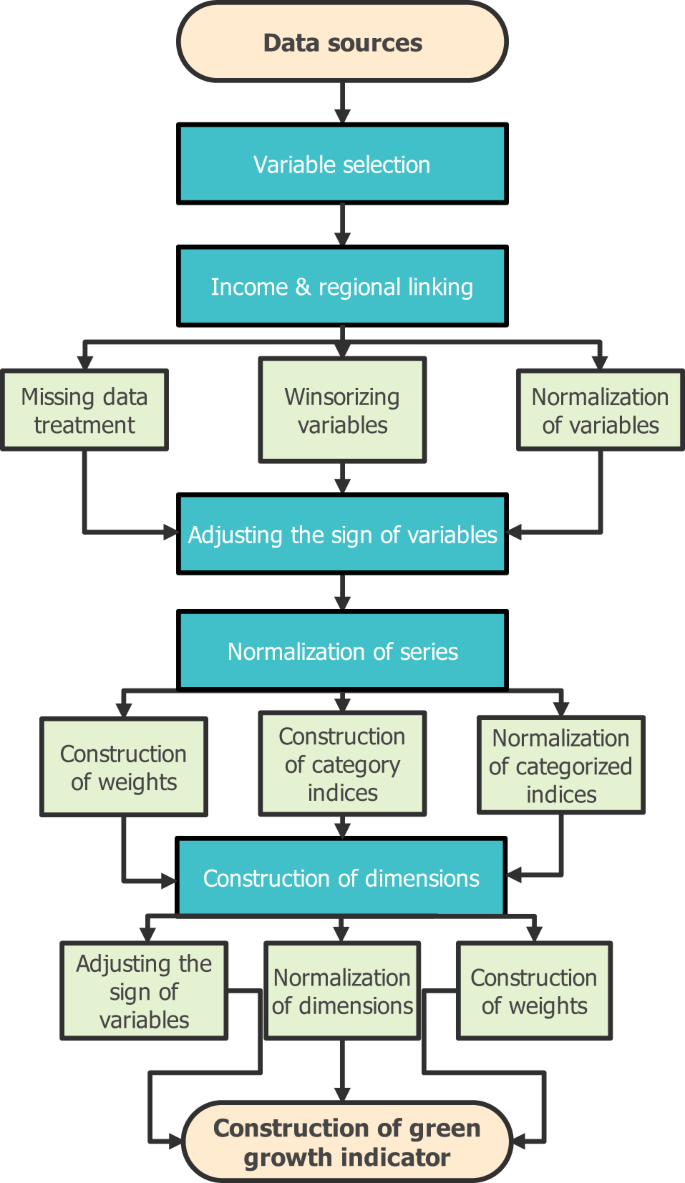

Index-making model

The schematic representation depicted in Fig. 2 shows the green growth index-making methodological structure used in this study. The steps include variable selection—used for categorization and classifying dimensions, income group & regional classifications, treatment of missing data, winsorization & normalization of data, adjusting the sign of variables where applicable, construction of weights, and construction of summary indices. While missing observations are often problematic in panel data, the estimation technique ignores missing outcomes (but also receives low weight) in creating new indices but utilizes all available data. Following the normalization procedure in developing the summary indicator, the technique further controls for missing data by fixing the values of the missing indicator to zero (0) — the mean of the reference group. This strategy further improves estimation efficiency by assigning lower weights to categories and dimensions with missing values 24 . The winsorizing technique entails generating new data by trimming 1 st and 99 th percentiles across countries and territories to treat extreme outliers 25 . Normalization \(\left[{\rm{norm}}=\left({y}_{i}-{y}_{min}\right)/\left({y}_{max}-{y}_{min}\right)\right]\) involves the generation of new data by normalization of scores ranging between 0 and 1 using the minimum ( y min ) and maximum ( y max ) observations while accounting for periodic data frequency across countries and territories. The summary index approach used to construct the green growth indicators can be expressed as 24 :

Where \({\bar{s}}_{i,j}\) is the constructed index (i.e., the outcomes can be categories, dimensions, and green growth indicators) with a weighted average W i,j . w j,k denotes the weight of the normalized output \([({y}_{i,j,k}-{\bar{y}}_{j,k})/{{\sigma }}_{j,k}^{y}]\) from inverse covariance matrix \({\widehat{\Sigma }}_{j}^{-1}\) , \({\widetilde{y}}_{i,j,k}\) is the inputs for individual i , indicators k , and country j . The normalized output is generated via effect sizes by dividing demeaned indicators \(({y}_{i,j,k}-{\bar{y}}_{j,k})\) by the standard deviation \({\sigma }_{j,k}^{y}\) of the reference group, whereas \({{\mathbb{K}}}_{i,j}\) represents non-missing outcomes for indicators k and country j . The summary index combines several variables into categories and several categories into dimensions and subsequently develops the green growth indicators. This test involves: (1) adjusting the sign of variables to indicate a better result, thus, a positive direction of the series always has positive consequences on the environment. (2) normalizing indicators into similar scales (3) constructing weights (4) constructing indices using weighted average and (5) normalizing indices. Thus, the winsorized and normalized dataset was classified into categories, dimensions, and green growth indicators. Contrary to the aggregated methods used in constructing indices 26 , the novel summary index technique with generalized least squares (GLS) attributed-standardized-weighted index used in this study controls for highly correlated variables and missing values.

Green growth index-making methodological structure.

Category indices of green growth

Our empirical assessment began with a panel-based descriptive statistical analysis of 152 raw data series spanning over 30 years. The descriptive statistical metrics led to the identification of several missing and extreme distributions requiring winsorizing. The winsorized and normalized dataset was classified into 18 category indices with a composition of the estimated weight of 152 variables. As the rule of the GLS summary index algorithm presented in Schwab, et al . 27 , highly-correlated variables were apportioned offsetting or small constructed weights whereas less-correlated or unique variables were apportioned higher constructed weights (Tables 3 , 4 ). Positive weights signify a higher contribution to the summary index whereas negative weights signify factors that decrease the summary index. For example, demand-based CO 2 emissions (CO2_DBEM) contribute the highest weight (1.447) to the summary emission index whereas production-based CO 2 emissions (CO2_PBEM) show the highest weight (−0.865) that negatively enter the summary emission productivity index (Table 3 ). Energy consumption in other sectors (NRGC_OTH) and biomass (DMC_BIO) contribute the highest weights (0.350 and 0.278, respectively) to the energy productivity and non-energy material productivity indices whereas environmentally-adjusted multifactor productivity growth (EAMFP_EAMFPG) and relative advantage in environment-related technology (GPAT_DE_RTA) have the lowest weights (0.280 and 0.124, respectively) in the multifactor productivity and patents summary indices. Similarly, marine protected areas (PA_MARINE), allocable ODA to the environment sector (ODA_ENVSEC), and Petrol tax (FTAX_DIE_S) are assigned larger weights (0.520, 0.312, and 0.548, respectively) for environmental regulations, taxes & transfer, and official development assistance summary indices while purchasing power parity (PPP), environmentally-related R&D expenditure (ENVRD_GDP), and welfare costs of premature mortalities from exposure to PM 2.5 (PM_SC) are assigned offsetting or small weights (−0.011, 0.079, and −1.859, respectively) for the economic dimension, environmental risks, and R&D summary indices. Besides, the population connected to public sewerage (ASEW_POP), permanent surface water (SW_PERMWAT), threatened vascular plant species (WLIFE_PL), and net migration (POP_NETMIGR) show the lowest weights (−0.144, −0.044, −0.025, and 0.070, respectively) assigned for the summary indices of access to drinking water & sanitation, water resources, wildlife resources, and social dimension (Table 4 ).

Constructing green growth Indicators

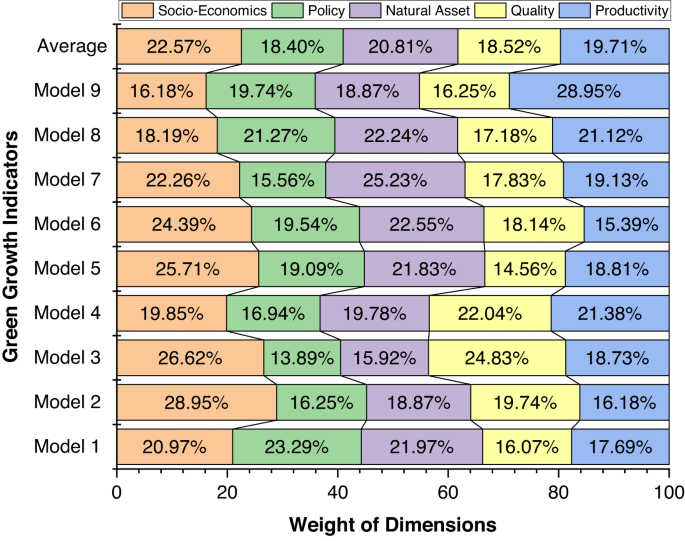

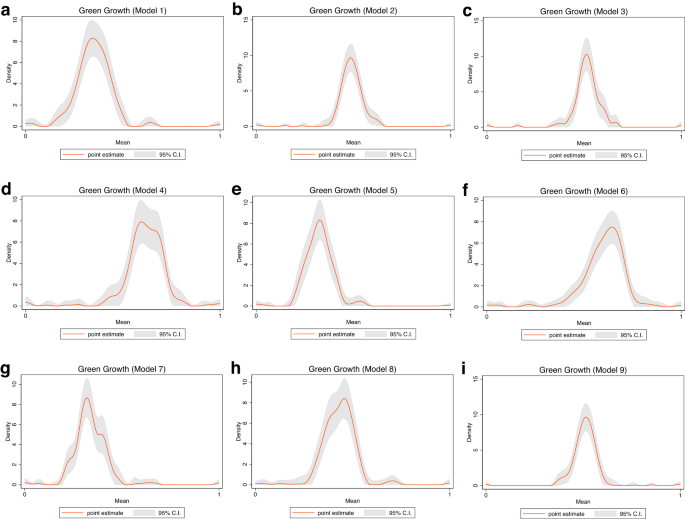

We constructed 10 green growth indicators (Models 1–10) using all five dimensions in Fig. 1 but with varying input characteristics for users to choose from. In Model 2, the characteristics of all five dimensions (i.e., environmental productivity, environmental quality, natural asset base, policy response, and socioeconomics) show better environmental performance. In Model 1, the characteristics of policy response, and socioeconomics dimensions show better environmental impacts but environmental productivity, environmental quality, and natural asset base worsen the environment. In Model 3, the characteristics of environmental quality, natural asset base, policy response, and socioeconomics improve the environment but environmental productivity declines environmental sustainability. In Model 4, the characteristics of environmental productivity, natural asset base, policy response, and socioeconomics improve the environment but the environmental quality dimension spurs environmental degradation. In Model 5, the characteristics of environmental productivity, environmental quality, policy response, and socioeconomics promote sustainable environment whereas natural asset base is detrimental to the environment. In Model 6, the characteristics of natural asset base, policy response, and socioeconomics reduces environmental degradation whereas environmental productivity and environmental quality increase pollution. In Model 7, environmental quality, policy response, and socioeconomics improve sustainability while environmental productivity and natural asset base hamper clean environment. In Model 8, environmental productivity, policy response, and socioeconomics decline environmental threats whereas environmental quality and natural asset base escalate environmental consequences. In Model 9, the characteristics of environmental productivity, environmental quality, natural asset base, policy response, and socioeconomics deteriorate the environment and thwart sustainable transition. Model 10 incorporates all conditions in Models 1–9 except that the average weights of all indicators was used for its construction.

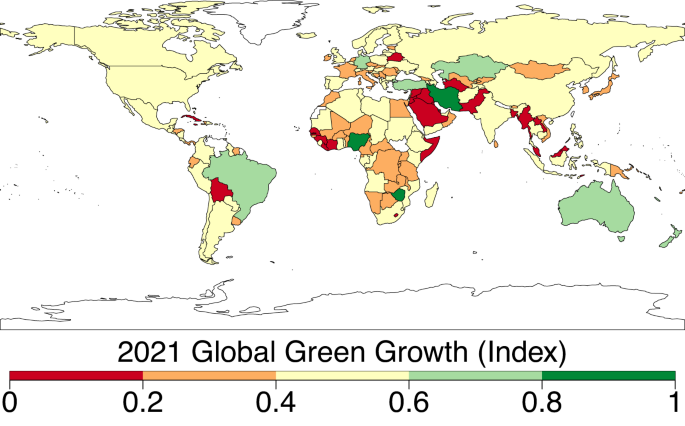

The negative characteristics of dimensions in Models 1–10 (used to construct the 10 green growth indicators) were determined using the flipping scenarios. The flipping scenarios used in calculating the ten green growth indicators are presented in Table 5 . The parenthesis (…%) denotes the percentage weight of dimensions (in Fig. 3 ) from the model used to construct green growth indicators. Model 1 covers the role of policy response (23.29%), natural asset base (21.97%), socioeconomics (20.97%), environmental productivity (17.69%), and environmental quality (16.07%) while altering the sign (i.e., flipping implies altering the sign to move in the opposite direction) of environmental productivity, environmental quality, and natural asset base. Model 2 captures socioeconomics (28.95%), environmental quality (19.74%), natural asset base (18.87%), policy response (16.25%), and environmental productivity (16.18%) with no flipping option. Model 3 comprises socioeconomics (26.62%), environmental quality (24.83%), environmental productivity (18.73%), natural asset base (15.92%), and policy response (13.89%) while altering the sign of environmental productivity. Model 4 encompasses environmental quality (22.04%), environmental productivity (21.38%), socioeconomics (19.85%), natural asset base (19.78%), and policy response (16.94%) while altering the sign of environmental quality. Model 5 includes socioeconomics (25.71%), natural asset base (21.83%), policy response (19.09%), environmental productivity (18.81%), and environmental quality (14.56%) while altering the sign of natural asset base. Model 6 captures socioeconomics (24.39%), natural asset base (22.55%), policy response (19.54%), environmental quality (18.14%), and environmental productivity (15.39%) while altering the sign of environmental productivity, and environmental quality. Model 7 entails natural asset base (25.23%), socioeconomics (22.26%), environmental productivity (19.13%), environmental quality (17.83%), and policy response (15.56%) while altering the sign of environmental productivity, and natural asset base. Model 8 covers natural asset base (22.24%), policy response (21.27%), environmental productivity (21.12%), socioeconomics (18.19%), and environmental quality (17.18%) while altering the sign of environmental quality, and natural asset base. Model 9 includes environmental productivity (28.95%), policy response (19.74%), natural asset base (18.87%), environmental quality (16.25%), and socioeconomics (16.18%) while altering the sign of socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity. Finally, the weight of dimensions used to construct green growth indicators reveals an average weight contribution (Model 10) of 22.57%, 20.81%, 19.71%, 18.52%, and 18.40% in the order of dimensions: socioeconomics > natural asset base > environmental productivity > environmental quality > policy response (Fig. 3 ). Figure 4 presents the optimal green growth index across countries for the period 2021. Score 0 implies economies have low performance in transitioning toward green growth whereas Score 1 infers countries have high performance toward green growth. The comparisons between countries for other green growth indicators are presented in Supplementary Fig. 1 .

Weight of dimensions used to construct green growth indicators. Legend: Model 1- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign (i.e., flipping implies altering the sign to move in the opposite direction) of environmental productivity, environmental quality, and natural asset base. Model 2- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity with no flipping. Model 3- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental productivity. Model 4- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental quality. Model 5- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of natural asset base. Model 6- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental productivity and quality. Model 7- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental productivity, and natural asset base. Model 8- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of environmental quality, and natural asset base. Model 9- Comprise socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity while altering the sign of socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity. Model 10 (Average)- Comprise the average weight of socioeconomics, policy response, natural asset base, environmental quality, and environmental productivity in Models 1–9.

Global distribution of green growth (Index, Reference year: 2021, Model 2). Legend: Score 0 implies low green growth performance whereas Score 1 infers high green growth performance. The optimal green growth indicator (i.e., Model 2) captures 28.95% weight of socioeconomics dimension, 19.74% weight of environmental quality, 18.87% weight of natural asset base, 16.25% weight of policy response, and 16.18% weight of environmental productivity.

Data Records

We employed 152 variables (“OriginalData.xlsx” 28 ) for 203 economies (see sampled countries with ISO3 code in Supplementary Table 1 ) based on the theoretical and empirical framework presented in Tables 1 , 2 and Fig. 1 while integrating the sustainable development goals. We collected our global dataset spanning the period from 1990 to 2021 from OECD 29 with an initial 16,184 observations. The data were sorted into 17 categories (see Fig. 2 ) namely emissions (12 variables), energy (12 variables), non-energy (10 variables), multifactor productivity (3 variables), environmental risks (11 variables), access (5 variables), water (10 variables), land (17 variables), forest (5 variables), wildlife (4 variables), temperature (1 variable), patents (4 variables), research & development [R&D] (5 variables), official development assistance [ODA] (9 variables), taxes (27 variables), regulations (2 variables), economic (10 variables), and social (5 variables) [see details of the 152 variables in Supplementary Table 2 ]. The 17 categories are subsequently classified into 5 dimensions, viz. natural assets (5 categories—water, land, forest, wildlife, and temperature), policy responses (5 categories—patents, R&D, ODA, taxes, and regulations), socio-economic (2 categories—social, and economic), quality of life (2 categories—environmental risks, and access), and environmental productivity (4 categories—emissions, energy, non-energy, and multifactor productivity). Finally, we use permutation and combination strategies detailed in subsequent sub-sections to construct 10 global indicators of green growth labeled as Model 1 (GreenGrowth1), Model 2 (GreenGrowth2), …, and Model 10 (GreenGrowth10). Table 6 shows the data description of constructed categories, dimensions, and green growth indicators—which are publicly available in the Figshare repository 28 .

Technical Validation

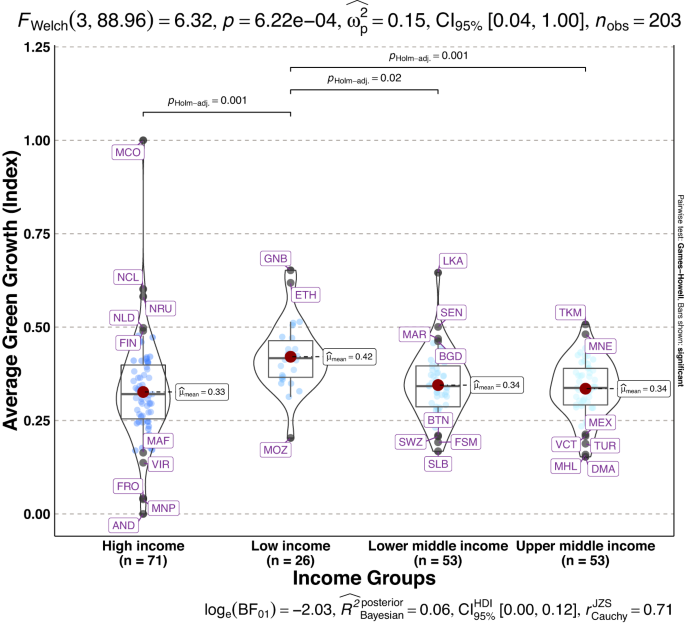

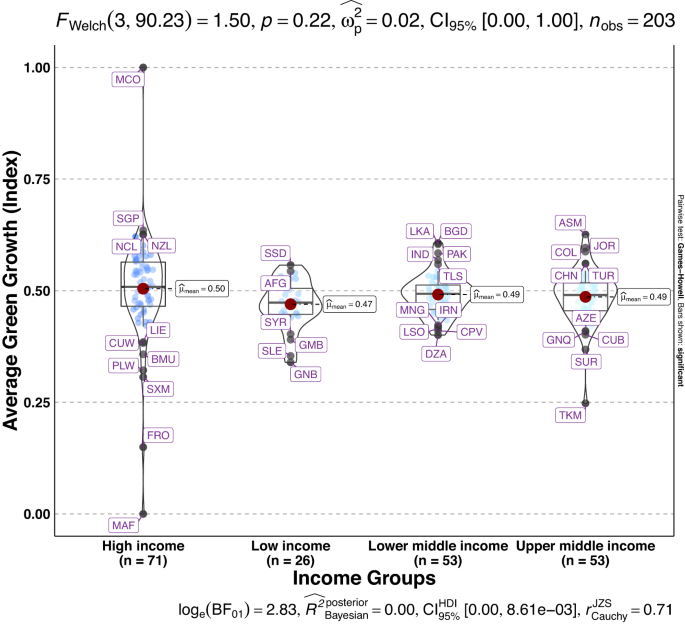

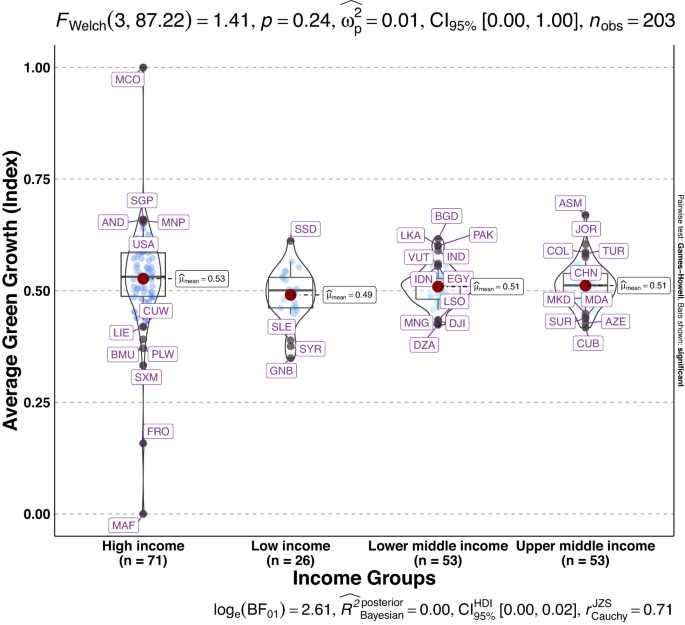

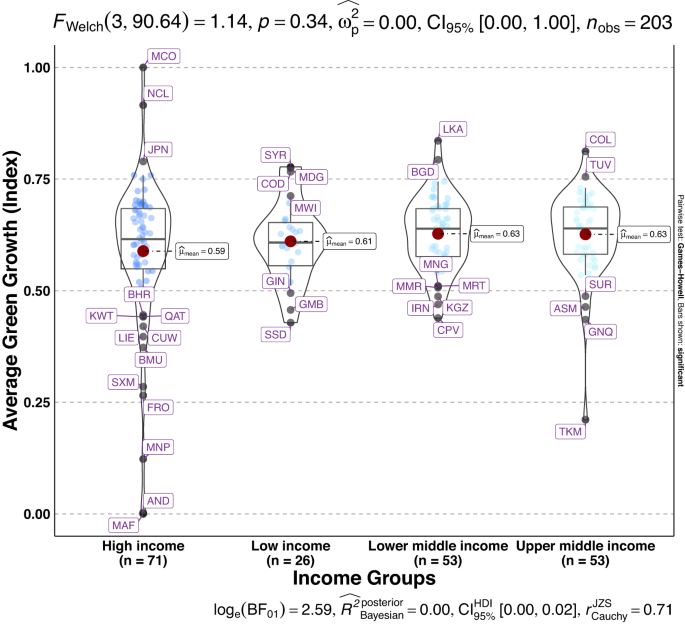

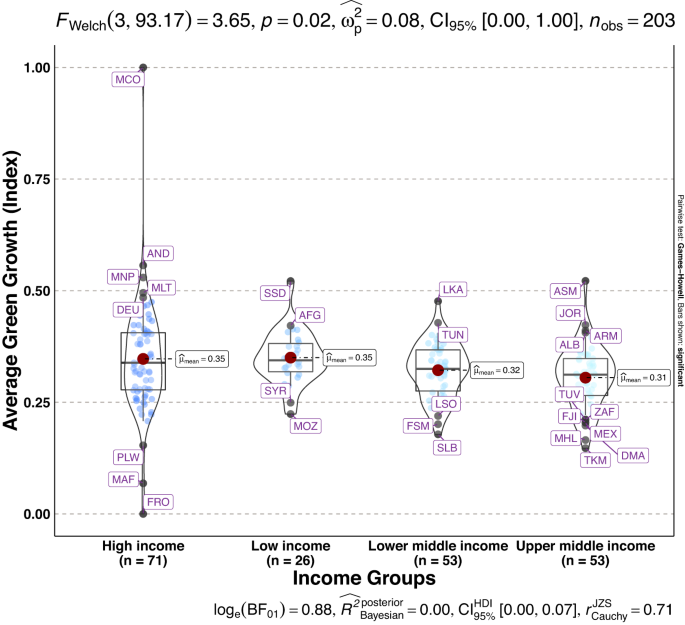

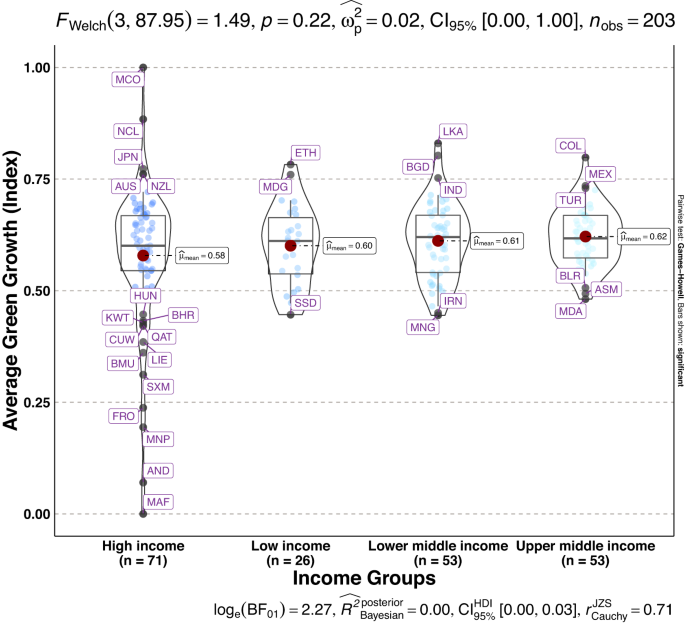

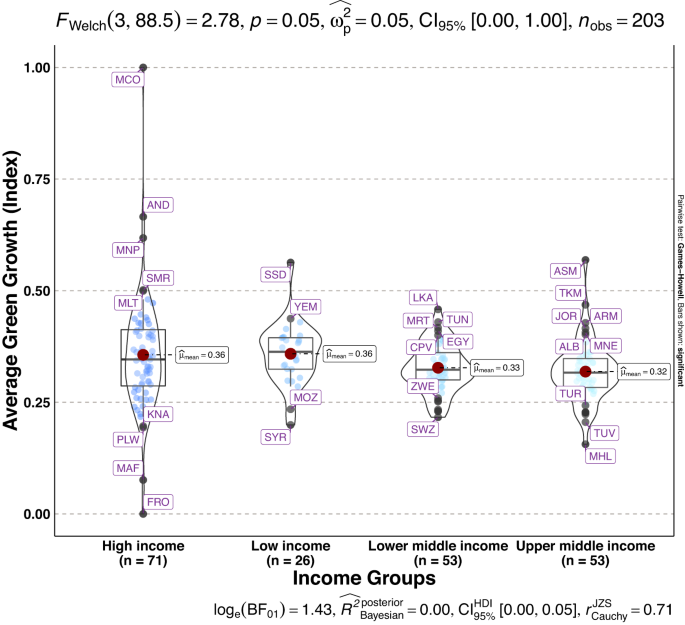

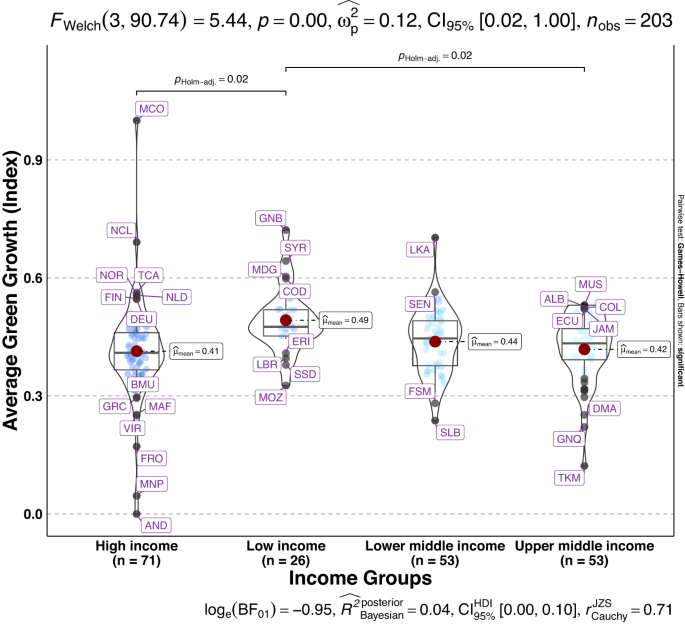

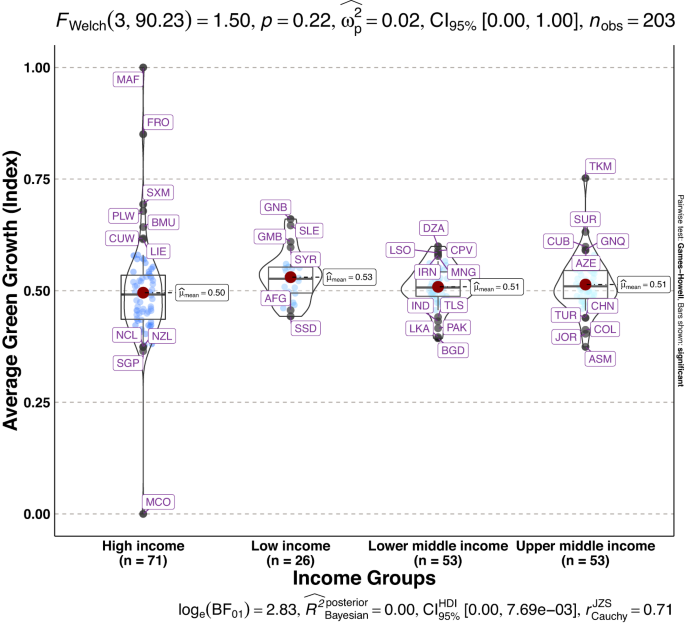

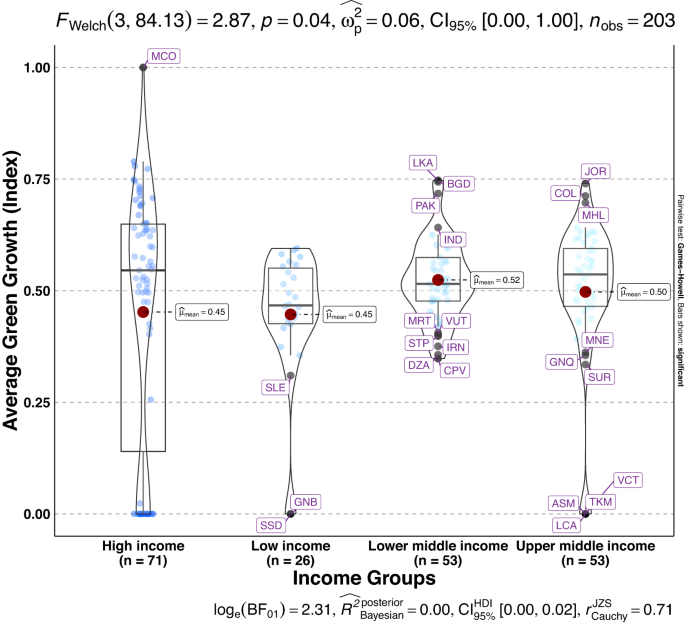

To validate the quality of the dataset, we employed permutation and combination scenarios to construct 9 green growth indicators aside from the optimal indicator (labeled as Model 2). We further used statistical distribution 30 to examine variations across income groups. The Games-Howell test shows that the pairwise distribution in Figs. 5 – 14 (excluding Figs. 5 , 12 ) is not significantly different across groups, however, the mean of the optimal green growth (Fig. 6 ) indicator across income groups is in the descending order of high-income > upper-middle-income > lower-middle-income > low-income. This order is consistent with the environmental Kuznets curve (EKC) hypothesis 31 which underscores improved environmental performance with rising income. Changes in the order across income groups in Figs. 5 – 14 (excluding Fig. 6 ) can be explained by the scenarios presented in Fig. 3 . Yet, all constructed green growth indicators are heterogeneous across countries and territories (Fig. 15 ).

Statistical distribution of green growth indicator (Model 1) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 2) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 3) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 4) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 5) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 6) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 7) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 8) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 9) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Statistical distribution of green growth indicator (Model 10) across income groups. Note: The country names with corresponding ISO3 codes are presented in Supplementary Table 1 .

Panel heterogeneous effects of green growth indicators across economies ( a ) Model 1 ( b ) Model 2 ( c ) Model 3 ( d ) Model 4 ( e ) Model 5 ( f ) Model 6 ( g ) Model 7 ( h ) Model 8 ( i ) Model 9. Model 10 was ignored due to missing values with the function returning as an error.

Usage Notes

We developed 10 green growth indicators to examine the progress toward achieving a sustainable transition from a brown economy to a green economy. Each of the green growth indicators has underlying conditions and assumptions presented in Table 5 and Fig. 3 . However, Model 2 (GreenGrowth2) is the most optimal green growth indicator showing economies with high scores have better performance and sustainable transition to green economic development. Evidence from Fig. 15 shows that future research that employs our datasets for panel data modeling should control for heterogeneous effects across economies. The caveat: there may be an underestimation of the standard errors of constructed dimensions and indicators because the GLS-derived weights are inclusively estimated parameters.

Code availability

No custom code was used to generate or process the data described in the manuscript—however, we used the “swindex” package in Stata [Stata/SE 17.0 for Mac (Intel 64-bit)] software to execute the steps detailed in the Methods section.

Leth, N. E. The complications of measuring green growth: Current pitfalls, further developments, and impact on cross-country longitudinal analyses , Lund University (2022).

Ates, S. A. & Derinkuyu, K. Green growth and OECD countries: measurement of country performances through distance-based analysis (DBA). Environment, Development and Sustainability: A Multidisciplinary Approach to the Theory and Practice of Sustainable Development 23 , 15062–15073, https://doi.org/10.1007/s10668-021-01285-4 (2021).

Article Google Scholar

OECD. Declaration on Green Growth. (2009).

Kim, S. E., Kim, H. & Chae, Y. A new approach to measuring green growth: Application to the OECD and Korea. Futures Complete , 37–48, https://doi.org/10.1016/j.futures.2014.08.002 (2014).

UNEP. Towards a Green Economy Pathways to Sustainable Development and Poverty Eradication. UNEP - UN Environment Programme (2011).

UNEP. Green Economy and Trade: Trends, Challenges and Opportunities . (2013).

Green Growth Knowledge, P. About Us | Green Growth Knowledge Partnership. (2023).

Acosta, L. et al . Green growth index: Concepts, methods and applications. Report No. 5, (Global Green Growth Institute, Republic of Korea, 2019).

Kamal-Chaoui, L., Grazi, F., Joo, J. & Plouin, M. The Implementation of the Korean Green Growth Strategy in Urban Areas. (OECD, Paris, 2011).

Houssini, K. & Geng, Y. Measuring Morocco’s green growth performance. Environ. Sci. Pollut. Res. 29 , 1144–1154, https://doi.org/10.1007/s11356-021-15698-1 (2022).

Wang, X. & Shao, Q. Non-linear effects of heterogeneous environmental regulations on green growth in G20 countries: Evidence from panel threshold regression. Sci Total Environ 660 , 1346–1354, https://doi.org/10.1016/j.scitotenv.2019.01.094 (2019).

Article ADS CAS PubMed Google Scholar

Zhu, S. & Ye, A. Does foreign direct investment improve inclusive green growth? Empirical evidence from China. Economies 6 , 44 (2018).

Cao, Y., Liu, J., Yu, Y. & Wei, G. Impact of environmental regulation on green growth in China’s manufacturing industry-based on the Malmquist-Luenberger index and the system GMM model. Environ. Sci. Pollut. Res. 27 , 41928–41945 (2020).

Article CAS Google Scholar

Song, M., Zhu, S., Wang, J. & Zhao, J. Share green growth: Regional evaluation of green output performance in China. International Journal of Production Economics 219 , 152–163 (2020).

Sun, Y., Ding, W., Yang, Z., Yang, G. & Du, J. Measuring China’s regional inclusive green growth. Sci Total Environ 713 , 136367 (2020).

Qu, C., Shao, J. & Cheng, Z. Can embedding in global value chain drive green growth in China’s manufacturing industry? Journal of Cleaner Production 268 , 121962 (2020).

Kararach, G. et al . Reflections on the Green Growth Index for developing countries: A focus of selected African countries. Development Policy Review 36 , O432–O454, https://doi.org/10.1111/dpr.12265 (2018).

Baniya, B., Giurco, D. & Kelly, S. Green growth in Nepal and Bangladesh: Empirical analysis and future prospects. Energy Policy 149 , https://doi.org/10.1016/j.enpol.2020.112049 (2021).

Li, M., Zhang, Y., Fan, Z. & Chen, H. Evaluation and Research on the Level of Inclusive Green Growth in Asia-Pacific Region. Sustainability-Basel 13 , 7482, https://doi.org/10.3390/su13137482 (2021).

Fotros, M. H., Ferdosi, M. & Mehrpeyma, H. An examination of energy intensity and urbanization effect on environment degradation in Iran (a cointegration analysis). J. Environ. Stud. 37 , 13–22 (2012).

Google Scholar

Stoknes, P. E. & Rockström, J. Redefining green growth within planetary boundaries. Energy Research & Social Science 44 , 41–49, https://doi.org/10.1016/j.erss.2018.04.030 (2018).

Fernandes, C. I., Veiga, P. M., Ferreira, J. J. M. & Hughes, M. Green growth versus economic growth: Do sustainable technology transfer and innovations lead to an imperfect choice. Business Strategy and the Environment 30 , 2021–2037, https://doi.org/10.1002/bse.2730 (2021).

Sarkodie, S. A. The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ. Sci. Pollut. Res. 25 , 21993–22022, https://doi.org/10.1007/s11356-018-2347-x (2018).

Anderson, M. L. Multiple Inference and Gender Differences in the Effects of Early Intervention: A Reevaluation of the Abecedarian, Perry Preschool, and Early Training Projects. Journal of the American Statistical Association 103 , 1481–1495, https://doi.org/10.1198/016214508000000841 (2008).

Article MathSciNet CAS MATH Google Scholar

Barnett, V. & Lewis, T. Outliers in statistical data . Vol. 3 (Wiley New York, 1994).

Svirydzenka, K. Introducing a new broad-based index of financial development . (International Monetary Fund, 2016).

Schwab, B., Janzen, S., Magnan, N. P. & Thompson, W. M. Constructing a summary index using the standardized inverse-covariance weighted average of indicators. The Stata Journal 20 , 952–964 (2020).

Sarkodie, SA., Owusu, PA. & Taden, J. Comprehensive green growth indicators across countries and territories, figshare , https://doi.org/10.6084/m9.figshare.22291069.v2 (2023).

OECD. Green Growth Indicators https://stats.oecd.org/Index.aspx?DataSetCode=GREEN_GROWTH (2023).

Patil, I. Visualizations with statistical details: The’ggstatsplot’approach. Journal of Open Source Software 6 , 3167 (2021).

Article ADS Google Scholar

Sarkodie, S. A. & Strezov, V. A review on Environmental Kuznets Curve hypothesis using bibliometric and meta-analysis. Sci Total Environ 649 , 128–145, https://doi.org/10.1016/j.scitotenv.2018.08.276 (2019).

Huang, Y. & Quibria, M. G. Green growth: Theory and evidence. UNU-WIDER 2013/56 , 25 (2013).

Guo, L. L., Qu, Y. & Tseng, M.-L. The interaction effects of environmental regulation and technological innovation on regional green growth performance. Journal of Cleaner Production 162 , 894–902, https://doi.org/10.1016/j.jclepro.2017.05.210 (2017).

Jha, S., Sandhu, S. C. & Wachirapunyanont, R. Inclusive Green Growth Index: A New Benchmark for Quality of Growth . (Asian Development Bank, 2018).

Lee, C.-M. & Chou, H.-H. Green growth in taiwan — an application of the oecd green growth monitoring indicators. Singapore Econ. Rev. 63 , 249–274, https://doi.org/10.1142/S0217590817400100 (2018).

Šneiderienė, A., Viederytė, R. & Ābele, L. Green growth assessment discourse on evaluation indices in the European Union. Entrepreneurship and Sustainability Issues 8 , 360–369 (2020).

Gu, K., Dong, F., Sun, H. & Zhou, Y. How economic policy uncertainty processes impact on inclusive green growth in emerging industrialized countries: A case study of China. Journal of Cleaner Production 322 , 128963, https://doi.org/10.1016/j.jclepro.2021.128963 (2021).

Jadoon, I. A., Mumtaz, R., Sheikh, J., Ayub, U. & Tahir, M. The impact of green growth on financial stability. Journal of Financial Regulation and Compliance 29 , 533–560 (2021).

Liu, Z. et al . Inclusive Green Growth and Regional Disparities: Evidence from China. Sustainability-Basel 13 , 11651, https://doi.org/10.3390/su132111651 (2021).

Wu, Y. & Zhou, X. Research on the Efficiency of China’s Fiscal Expenditure Structure under the Goal of Inclusive Green Growth. Sustainability-Basel 13 , 9725, https://doi.org/10.3390/su13179725 (2021).

Zhang, X., Guo, W. & Bashir, M. B. Inclusive green growth and development of the high-quality tourism industry in China: The dependence on imports. Sustainable Production and Consumption 29 , 57–78, https://doi.org/10.1016/j.spc.2021.09.023 (2022).

Chen, G., Yang, Z. & Chen, S. Measurement and Convergence Analysis of Inclusive Green Growth in the Yangtze River Economic Belt Cities. Sustainability-Basel 12 , 2356, https://doi.org/10.3390/su12062356 (2020).

Download references

Acknowledgements

Open access funding provided by Nord University.

Author information

Authors and affiliations.

Nord University Business School (HHN), Post Box 1490, 8049, Bodø, Norway

Samuel Asumadu Sarkodie & Phebe Asantewaa Owusu

Pepperdine University, Malibu, California, USA

You can also search for this author in PubMed Google Scholar

Contributions

S.A.S. and P.O.A. designed the dataset; S.A.S. collated the data, S.A.S., P.O.A. and J.T. wrote the manuscript, and S.A.S. supervised the research.

Corresponding authors

Correspondence to Samuel Asumadu Sarkodie or Phebe Asantewaa Owusu .

Ethics declarations

Competing interests.

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary information, rights and permissions.

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Sarkodie, S.A., Owusu, P.A. & Taden, J. Comprehensive green growth indicators across countries and territories. Sci Data 10 , 413 (2023). https://doi.org/10.1038/s41597-023-02319-4

Download citation

Received : 28 March 2023

Accepted : 19 June 2023

Published : 24 June 2023

DOI : https://doi.org/10.1038/s41597-023-02319-4

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

This article is cited by

A double machine learning model for measuring the impact of the made in china 2025 strategy on green economic growth.

- Shucheng Liu

Scientific Reports (2024)

The Dynamic Relationship Between Education and Green Growth in BRICS Countries

- Qasim Raza Syed

- Raja Fawad Zafar

Journal of the Knowledge Economy (2024)

Economic complexity and inclusive green growth: the moderating role of public expenditure on education

- Idrys Fransmel Okombi

- Niclaige Elion Lebomoyi

Journal of Environmental Studies and Sciences (2024)

New data and descriptor for crowdfunding and renewable energy

- Dario Salerno

- Andrea Gatto

- Simona Russo

Quality & Quantity (2024)

The impact of domestic materials and renewable energy consumption towards environmental sustainability: evidence from green growth policy across regional and global levels

- Jean Pierre Namahoro

- Wu Qiaosheng

Environment, Development and Sustainability (2024)

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

- < Previous

Home > USC Columbia > HONORS_COLLEGE > SENIOR_THESES > 523

Senior Theses

Green growth or degrowth the economics of climate change.

Cadence Tomlinson , University of South Carolina Follow

Date of Award

Spring 2022

Degree Type

Director of thesis.

Douglas P. Woodward

First Reader

Carol E. Harrison

Second Reader

The paradigm dominating how American policymakers currently approach the climate crisis issue is green growth, positing that the global economy can maintain desirable levels of persistent economic growth while also effectively reducing carbon emissions and slowing the process of global warming, all by means of market-spurred technological innovation and green production processes. Some environmental thinkers dispute the sustainability potential of green growth, urging green growth economists and policymakers to think beyond the ostensibly “limiting” economic growth paradigm. Among this dissent, a new paradigm has emerged, one de-centering goals of economic growth and instead advocating for a reduction in economic throughput, consumption, and – by extension – a reduction in energy and resource usage. This movement, called “degrowth”, seeks a balance between environmental health and human well-being.

After careful review of the research and literature supporting both methods of economic strategy, I find that the growth imperative has limited potential for sustainable environmental transformations. In the short amount of time our economies have left to transition to renewable energy sources and effectively avert an irreversible 1.5 degrees of global warming, the degrowth perspective is more promising. There has been no significant historical evidence that green growth can effectively decouple economic growth from greenhouse gas emissions, and because of this, a more radical solution is needed. The degrowth strategy propounds a period of economic degrowth, observing lower output and consumption rates, with the goal of reaching an environmentally sustainable steady state that compounds lower throughput with much more availability for leisure and work-sharing.

The necessary approach to a post-degrowth sustainable steady state must account for the vast differences in economic development levels across the globe. I advocate for green growth in developing countries who have yet to grow into an ecologically sustainable steady state and degrowth for wealthy countries who have surpassed the sustainable economic state, with the goal of moving the global economy towards a sustainable steady state in the long run.

Recommended Citation

Tomlinson, Cadence, "Green Growth or Degrowth? The Economics of Climate Change" (2022). Senior Theses . 523. https://scholarcommons.sc.edu/senior_theses/523

© 2022, Cadence Tomlinson

Since May 03, 2022

Included in

Economic Theory Commons , Political Economy Commons

Advanced Search

- Notify me via email or RSS

- Collections

- Disciplines

Submissions

- Submit Research

- Give us Feedback

- University Libraries

Home | About | FAQ | My Account | Accessibility Statement

Privacy Copyright

Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

Green economy and green growth—opportunities for sustainable development †.

1. Introduction

2. the european framework of the green economy, 3. the national framework of the green economy: actualities and perspectives, 4. final conclusions.

- Kahle, L.R.; Gurel-Atay, E. Communicating Sustainability for the Green Economy , 1st ed.; Sharpe, M.E., Ed.; Routledge: New York, NY, USA, 2014; pp. 22–24. [ Google Scholar ]

- Grima, S. Eleftherios Thalassinos. In Contemporarry Issues in Business and Financial Management in Eastern Europe ; Contemporary Studies in Economic and Financial Analysis; Emerald Publishing House: Bingley, UK, 2018; Volume 100, pp. 1–141. [ Google Scholar ]

- Loiseau, E.; Saikku, L.; Antikainen, R.; Droste, N.; Hansjürgens, B.; Pitkänen, K.; Leskinen, P.; Kuikman, P.; Thomsen, M. Green Economy and Related Concepts: An Overview. J. Clean. Prod. 2016 , 139 , 361–363. [ Google Scholar ] [ CrossRef ]

- Barbier, E.; Markandya, A. A New Blueprint for a Green Economy ; Routledge: New York, NY, USA, 2013; pp. 141–145. [ Google Scholar ]

- Pollin, R.; Garrett-Peltier, H.; Heintz, J.; Hendricks, B. Green Growth: A U.S. Program for Controlling Climate Change and Expanding Job Opportunities, Center for American Progress ; Center for American Progress and Political Economy Research Institute, University of Massachusetts: Amherst, MA, USA, 2014; p. 2. [ Google Scholar ]

- Albekov, A.U.; Parkhomenko, T.V.; Polubotko, A.A. Green Economy: A Phenomenon of Progress and a Concept of Environmental Security ; Contemporary Studies in Economic and Financial Analysis; Emerald Publishing Limited: Bingley, UK, 2018; Volume 100, pp. 51–59. [ Google Scholar ]

- Scott, M. Green Growth ‘Tigers’ Can Help The Global Economy To Roar Once More ; Forbes Media LLC: New York, NY, USA, 2020; pp. 3–5. [ Google Scholar ]

- Galli, A.; Wackernagel, M.; Iha, K.; Lazarus, E. Ecological Footprint: Implications for Biodiversity ; Biological Conservation; Elsevier: Amsterdam, The Netherlands, 2014; Volume 173, pp. 121–132. [ Google Scholar ]

- Bina, O. The Green Economy and Sustainable Development: An Uneasy Balance? Environment and Planning C: Politics and Space. SAGE J. 2013 . [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Vinuesa, R.; Azizpour, H.; Leite, I.; Balaam, M.; Dignum, V.; Domisch, S.; Felländer, A.; Langhans, S.D.; Tegmark, M.; Nerini, F.F. The role of artificial intelligence in achieving the Sustainable Development Goals. Nat. Commun. 2020 , 11 , 233. [ Google Scholar ] [ CrossRef ] [ PubMed ] [ Green Version ]

- Kajcsa, A. The Influence of Compliance with Environmental Requirements on Commercial Competition. Curentul Jurid. Jurid. Curr. Courant Jurid. 2011 , 44 , 143–150. [ Google Scholar ]

- Dalhammar, C. Promoting Energy and Resource Efficiency through the Eco-Design Directive ; Scandinavian Studies in Law: Stockholm, Sweden, 2014; pp. 162–176. [ Google Scholar ]

- Stahel, W.R. The Performance Economy , 2nd ed.; Palgrave MacMillan: London, UK, 2010; 350p. [ Google Scholar ]

- Howels, G.; Ramsay, I.; Wilhelmsson, T. Handbook of Research on International Consumer Law , 2nd ed.; Edward Elgar Publishing: Cheltenham, UK, 2016; pp. 7–12. [ Google Scholar ]

- Sharma, H.B.; Vanapalli, K.R.; Cheela, V.S.; Ranjan, V.P.; Jaglan, A.K.; Dubey, B.; Goel, S.; Bhattacharya, J. Challenges, Opportunities, And Innovations For Effective Solid Waste Management During And Post COVID-19 Pandemic ; PMC Elsevier Public Health Emergency Collection: Amsterdam, The Netherlands, 2020; Volume 162. [ Google Scholar ] [ CrossRef ]

- Diab, F.A.; Molinari, C. Interdisciplinarity: Practical approach to advancing education for sustainability and for the Sustainable Development Goals. Int. J. Educ. Manag. 2017 , 15 , 73–83. [ Google Scholar ] [ CrossRef ] [ Green Version ]

| MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

Share and Cite

Dogaru, L. Green Economy and Green Growth—Opportunities for Sustainable Development. Proceedings 2020 , 63 , 70. https://doi.org/10.3390/proceedings2020063070

Dogaru L. Green Economy and Green Growth—Opportunities for Sustainable Development. Proceedings . 2020; 63(1):70. https://doi.org/10.3390/proceedings2020063070

Dogaru, Lucreția. 2020. "Green Economy and Green Growth—Opportunities for Sustainable Development" Proceedings 63, no. 1: 70. https://doi.org/10.3390/proceedings2020063070

Article Metrics

Article access statistics, further information, mdpi initiatives, follow mdpi.

Subscribe to receive issue release notifications and newsletters from MDPI journals

Green through finance: The impact of monetary policy uncertainty on inclusive green growth

- Research Article

- Published: 24 August 2023

- Volume 30 , pages 99913–99929, ( 2023 )

Cite this article

- Lianqing Li 1 ,

- Shuming Ren 1 &

- Zhiyuan Gao 2 , 3

450 Accesses

3 Citations

Explore all metrics

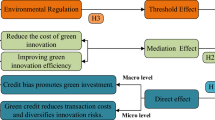

For high-quality development, inclusive green growth (IGG) is a crucial strategic option. Given the deceleration in economic growth, monetary policy has several obligations, including stabilizing growth, changing structure, and mitigating risks. However, frequent revisions of monetary policy may diminish its regulatory efficacy due to resulting uncertainty. Accordingly, this study reveals the mechanism of the impact of monetary policy uncertainty (MPU) on IGG. Research suggests that MPU significantly inhibits IGG in the region, as demonstrated by robustness tests. Mechanism test reveal that MPU inhibits IGG by reducing green finance, ecological innovation, media attention, and employment levels. These four transmission mechanisms all show a masking effect. Additionally, further tests show that under different levels of green finance, ecological innovation, media attention, and employment, the impact of MPU on IGG is nonlinear. Heterogeneity analyses also indicate that the inhibition of MPU is weaker in cities with high scientific and technological progress and local fiscal expenditure. Finally, quantile regression demonstrates that the restraining effect of MPU diminishes before rising. This study contributes to the advancement of MPU research, provides a solid foundation for formulating, modifying, and executing monetary policy, and serves as a valuable resource for promoting IGG.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Paths to sustainable development in China: why green finance and green technology matter?

Relationship between green credit and high-quality development of green and green economy—"pull effect" or "capricorn effect"

Green finance, environmental pollution and high-quality economic development—a study based on China’s provincial panel data

Explore related subjects.

- Environmental Chemistry

Data availability

The datasets and materials used in this study are available from the corresponding author on reasonable request.

The report of the 19th National Congress of the Communist Party of China.

https://worldwide.espacenet.com/classification?locale=en_EP.#!/CPC=Y02

https://www.ceicdata.com/zh-hans

https://www.epsnet.com.cn/index.html

http://www.gov.cn/guowuyuan/baogao.htm

https://www.wind.com.cn/en/edb.html

http://www.incopat.com

Alos-Simo L, Verdu-Jover AJ, Gomez-Gras JM (2020) Does activity sector matter for the relationship between eco-innovation and performance? Implications for cleaner production. J Clean Prod 263:121544. https://doi.org/10.1016/j.jclepro.2020.121544

Article Google Scholar

Arranz N, Arroyabe M, Li J, Fernandez De Arroyabe JC (2020) Innovation as a driver of eco-innovation in the firm: An approach from the dynamic capabilities theory. Bus Strateg Environ 29(3):1494–1503. https://doi.org/10.1002/bse.2448

Atri H, Kouki S, ImenGallali M (2021) The impact of COVID-19 news, panic and media coverage on the oil and gold prices: An ARDL approach. Resour Policy 72:102061. https://doi.org/10.1016/j.resourpol.2021.102061

Balcilar M, Gupta R, Jooste C (2017) South Africa’s economic response to monetary policy uncertainty. J Econ Stud (bradford) 44(2):282–293. https://doi.org/10.1108/JES-07-2015-0131

Bhowmik R, Syed QR, Apergis N, Alola AA, Gai Z (2021) Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ Sci Pollut Res Int 1–15. https://doi.org/10.1007/s11356-021-16716-y

Born B, Pfeifer J (2014) Policy risk and the business cycle. J Monet Econ 68:68–85. https://doi.org/10.1016/j.jmoneco.2014.07.012

Cai W, Li G (2018) The drivers of eco-innovation and its impact on performance: Evidence from China. J Clean Prod 176:110–118. https://doi.org/10.1016/j.jclepro.2017.12.109

Chai J, Hao Y, Wu H, Yang Y (2021) Do constraints created by economic growth targets benefit sustainable development? Evidence from China. Bus Strategy Environ 30(8):4188–4205. https://doi.org/10.1002/bse.2864

Chen K, Ren J, Zha T (2018) The Nexus of Monetary Policy and Shadow Banking in China. Am Econ Rev 108(12):3891–3936. https://doi.org/10.1257/aer.20170133

Chen S, Zhang H, Wang S (2022) Trade openness, economic growth, and energy intensity in China. Technol Forecast Soc Change 179:121608. https://doi.org/10.1016/j.techfore.2022.121608

Cheng CCJ, Shiu EC (2020) Leveraging open innovation strategies for fueling eco-innovation performance in dynamic environments. Sustain Account Manag Policy J (Print) 11(7):1245–1270. https://doi.org/10.1108/SAMPJ-04-2018-0103

Cieplinski A, D’Alessandro S, Distefano T, Guarnieri P (2021) Coupling environmental transition and social prosperity: a scenario-analysis of the Italian case. Struct Chang Econ Dyn 57:265–278. https://doi.org/10.1016/j.strueco.2021.03.007

Colombo LA, Pansera M, Owen R (2019) The discourse of eco-innovation in the European Union: An analysis of the Eco-Innovation Action Plan and Horizon 2020. J Clean Prod 214:653–665. https://doi.org/10.1016/j.jclepro.2018.12.150

Cui X, Wang C, Liao J, Fang Z, Cheng F (2021) Economic policy uncertainty exposure and corporate innovation investment: Evidence from China. Pac-Basin Financ J 67:101533. https://doi.org/10.1016/j.pacfin.2021.101533

Fethi S, Rahuma A (2020) The impact of eco-innovation on CO2 emission reductions: Evidence from selected petroleum companies. Struct Chang Econ Dyn 53:108–115. https://doi.org/10.1016/j.strueco.2020.01.008

Fu B, Luo D (2021) Monetary policy uncertainty and bank leverage: Evidence from China. Econ Lett 203:109866

Fu XM, Bao Q, Xie H, Fu X (2021) Diffusion of industrial robotics and inclusive growth: Labour market evidence from cross country data. J Bus Res 122:670–684. https://doi.org/10.1016/j.jbusres.2020.05.051

Gao K, Yuan Y (2021) The effect of innovation-driven development on pollution reduction: Empirical evidence from a quasi-natural experiment in China. Technol Forecast Soc Chang 172:121047. https://doi.org/10.1016/j.techfore.2021.121047

Ge T, Qiu W, Li J, Hao X (2020) The impact of environmental regulation efficiency loss on inclusive growth: Evidence from China. J Environ Manag 268:110700. https://doi.org/10.1016/j.jenvman.2020.110700

Ghosal V, Ye Y (2015) Uncertainty and the employment dynamics of small and large businesses. Small Bus Econ Group 44(3):529–558. https://doi.org/10.1007/s11187-014-9614-0

Green A, Parke C, Hoole C, Sevinc D (2021) Unlocking inclusive growth by linking micro assets to anchor institutions: The case of skilled overseas migrants and refugees and hospital jobs. Eur Urban Reg Stud 28(4):450–465. https://doi.org/10.1177/09697764211014231

Gu K, Dong F, Sun H, Zhou Y (2021) How economic policy uncertainty processes impact on inclusive green growth in emerging industrialized countries: A case study of China. J Clean Prod 322:128963. https://doi.org/10.1016/j.jclepro.2021.128963

Hafezi M, Zolfagharinia H (2018) Green product development and environmental performance: Investigating the role of government regulations. Int J Prod Econ 204:395–410. https://doi.org/10.1016/j.ijpe.2018.08.012

Han L, Qi M, Yin L (2016) Macroeconomic policy uncertainty shocks on the Chinese economy: a GVAR analysis. Appl Econ 48(51):4907–4921. https://doi.org/10.1080/00036846.2016.1167828

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

He Q, Du J (2021) The impact of urban land misallocation on inclusive green growth efficiency: evidence from China. Environ Sci Pollut Res Int 1–12. https://doi.org/10.21203/rs.3.rs-421869/v1

Herro N, Murray J (2013) Dynamics of monetary policy uncertainty and the impact on the macroeconomy. Econ Bull 33(1):257–270

Google Scholar

Huang Y, Chen C (2021) The spatial spillover and threshold effect of green finance on environmental quality: evidence from China. Environ Sci Pollut Res Int 1–12. https://doi.org/10.1007/s11356-021-16892-x

Husted L, Rogers J, Sun B (2020) Monetary policy uncertainty. J Monet Econ 115:20–36. https://doi.org/10.1016/j.jmoneco.2019.07.009

Jia R, Fan M, Shao S, Yu Y (2021) Urbanization and haze-governance performance: Evidence from China’s 248 cities. J Environ Manag 288:112436. https://doi.org/10.1016/j.jenvman.2021.112436

Karhade PP, Dong JQ (2020) Information Technology Investment and Commercialized Innovation Performance: Dynamic Adjustment Costs and Curvilinear Impacts. MIS Q. https://doi.org/10.25300/MISQ/2021/14368

Lakdawala A, Moreland T, Schaffer M (2021) The international spillover effects of US monetary policy uncertainty. J Int Econ 133:103525. https://doi.org/10.1016/j.jinteco.2021.103525

Lee N, Sissons P (2016) Inclusive growth? The relationship between economic growth and poverty in British cities. Environ Plan A 48(11):2317–2339. https://doi.org/10.1177/0308518X16656000

Li L, Tang Y, Xiang J (2020) Measuring China’s monetary policy uncertainty and its impact on the real economy. Emerg Mark Rev 44:100714. https://doi.org/10.1016/j.ememar.2020.100714

Li Y, Zhang J, Yang X, Wang W, Wu H, Ran Q et al (2021) The impact of innovative city construction on ecological efficiency: a quasi-natural experiment from China. Sustain Prod Consum 28:1724–1735

Liu J, Xia Y, Fan Y, Lin S, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Lu X, Jiang X, Gong M (2020) How land transfer marketization influence on green total factor productivity from the approach of industrial structure? Evidence from China. Land Use Policy 95:104610. https://doi.org/10.1016/j.landusepol.2020.104610

Lv C, Shao C, Lee C (2021) Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ 98:105237. https://doi.org/10.1016/j.eneco.2021.105237

Munasib A, Rickman DS (2015) Regional economic impacts of the shale gas and tight oil boom: A synthetic control analysis. Reg Sci Urban Econ 50:1–17. https://doi.org/10.1016/j.regsciurbeco.2014.10.006

Naveau P, Hannart A, Ribes A (2020) Statistical methods for extreme event attribution in climate science. Annu Rev Stat Appl 7:89–110. https://doi.org/10.1146/annurev-statistics-031219-041314

Ociepa-Kubicka A, Pachura P (2017) Eco-innovations in the functioning of companies. Environ Res 156:284–290. https://doi.org/10.1016/j.envres.2017.02.027

Article CAS Google Scholar

Ren S, Hao Y, Xu L, Wu H, Ba N (2021) Digitalization and energy: How does internet development affect China’s energy consumption? Energy Econ 98:105220. https://doi.org/10.1016/j.eneco.2021.105220

Ren S, Li L, Han Y, Hao Y, Wu H (2022) The emerging driving force of inclusive green growth: Does digital economy agglomeration work?. Bus Strategy Environ 1–23. https://doi.org/10.1002/bse.2975

Sanni M (2018) Drivers of eco-innovation in the manufacturing sector of Nigeria. Technol Forecast Soc Chang 131:303–314. https://doi.org/10.1016/j.techfore.2017.11.007

Schettino F, Gabriele A, Khan HA (2021) Polarization and the middle class in China: A non-parametric evaluation using CHNS and CHIP data. Struct Chang Econ Dyn 57:251–264. https://doi.org/10.1016/j.strueco.2021.04.002

Segal G, Shaliastovich I, Yaron A (2015) Good and bad uncertainty: Macroeconomic and financial market implications. J Financ Econ 117(2):369–397. https://doi.org/10.1016/j.jfineco.2015.05.004

Sohag K, Begum RA, Abdullah SMS, Jaafar M (2015) Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy (oxf) 90:1497–1507. https://doi.org/10.1016/j.energy.2015.06.101

Sohail MT, Xiuyuan Y, Usman A, Majeed MT, Ullah S (2021) Renewable energy and non-renewable energy consumption: assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environ Sci Pollut Res Int 28(24):31575–31584. https://doi.org/10.1007/s11356-021-12867-0

Song M, Zhu S, Wang J, Zhao J (2020) Share green growth: Regional evaluation of green output performance in China. Int J Prod Econ 219:152–163. https://doi.org/10.1016/j.ijpe.2019.05.012

Song M, Xie Q, Shen Z (2021) Impact of green credit on high-efficiency utilization of energy in China considering environmental constraints. Energy Policy 153:112267. https://doi.org/10.1016/j.enpol.2021.112267

Sun Y, Ding W, Yang Z, Yang G, Du J (2020) Measuring China’s regional inclusive green growth. Sci Total Environ 713:136367. https://doi.org/10.1016/j.scitotenv.2019.136367

Sun C (2021) The correlation between green finance and carbon emissions based on improved neural network. Neural Comput Appl 1–15. https://doi.org/10.1007/s00521-021-06514-5

Tang C, Xu Y, Hao Y, Wu H, Xue Y (2021) What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Econ 103:105576. https://doi.org/10.1016/j.eneco.2021.105576

Ugurlu Yildirim E, Kocaarslan B, Ordu Akkaya BM (2021) Monetary policy uncertainty, investor sentiment, and US stock market performance: New evidence from nonlinear cointegration analysis. Int J Financ Econ 26(2):1724–1738. https://doi.org/10.1002/ijfe.1874

Ulucak R (2020) How do environmental technologies affect green growth? Evidence from BRICS economies. Sci Total Environ 712:136504. https://doi.org/10.1016/j.scitotenv.2020.136504