Profitability Cases

There are several common case types that occur in case interviews for management consulting roles. Profitability cases are some of the most frequent ones. These cases require a structured approach , analytical thinking, and a deep understanding of business fundamentals. Let’s take a look at what profitability cases actually are and how you can approach them successfully.

Profitability Cases – The Number 1 Reason for Most Consulting Projects

One of the most common reasons why firms instruct consulting firms with their projects is that they struggle with their profitability. As a consultant you will have to diagnose the underlying issues, come up with potential solutions and recommend actions to improve profitability.

As a candidate in a case interview, the task is pretty much the same, but on a smaller scale. The good news is: Once you have understood the basic structure of profitability cases, you can solve them no matter the industry or concrete business scenario. The underlying concept is always the same and not very difficult.

Profitability issues always stem from falling revenues , rising costs , or both . It is as simple as that. Your task will be two-fold: Perform a structured and quantitative analysis of the data to isolate the problem, and then find a promising solution. In most cases, you can use the profitability framework to structure the problem, but make sure to not blindly apply it, but to really understand the problem at hand and make adjustments as needed in the concrete business scenario.

The Profitability Framework – A Basic Tool to Structure Your Profitability Case

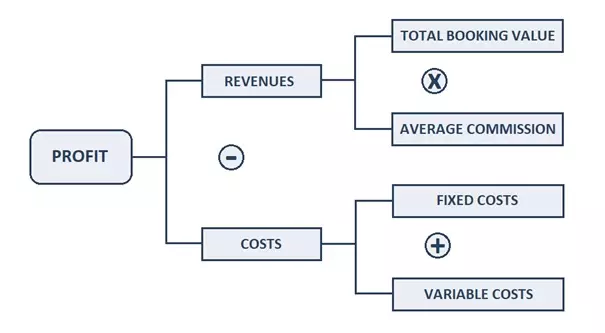

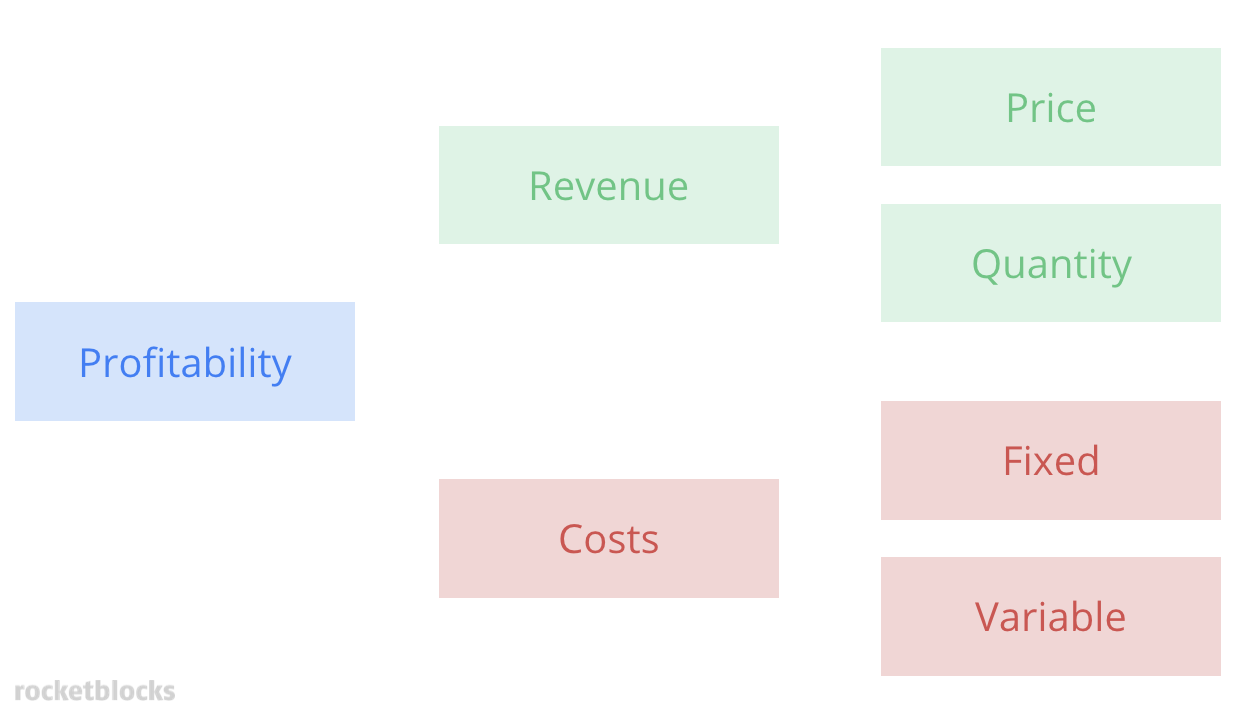

The Profitability Framework is a fundamental tool for approaching profitability cases. It is basically an issue tree that breaks down profitability into its key components: revenues and costs.

In the first place, this equation is pretty straightforward and not complicated at all. Next, it is your task to understand each side of the equation and identify the cause for declining profitability. There could be three reasons:

- Revenues have been declining.

- Costs have been increasing.

- Revenues have been declining and costs have been increasing. (Always make sure to remember this option. It happens pretty easily that candidates identify either revenue or cost issues as the problem, completely focus on one side of the issue tree and forget to zoom out again, take a look at the big picture and consider the other side of the equation as well.)

So, the first question to get an answer to is “Have revenues been declining?”, “Have costs been increasing?”, or “Have revenues been declining and costs been increasing? And if so, which one is the bigger problem?”. Whenever you get the information that something has changed: quantify it! Ask by how much and in what time period. Depending on the answer, you will know on which side of your profitability tree you need to start your analysis. Always start with the most relevant driver ( Pareto Principle ).

💡 Pro Tip: When trying to find out where to start your analysis, keep in mind to communicate like a consultant. A Bainie would not go to the client and bluntly ask “Have your revenues been declining?”, but rather formulate a question like “How have your revenues been developing over the past five years?”. It may be possible that your interviewer will then share an exhibit with you that not only contains revenue information, but also valuable insights on product lines, geographies or other relevant data, which you can use throughout the case.

Scenario 1: Revenues Have Been Declining

Let’s assume, the profitability problem stems from declining revenues. There are many potential reasons for this and you need to find out which one applies in order to come up with a solution. Most important for your analysis is to stay structured at all times .

1. Understand How the Business Makes Revenue

To structure your analysis of declining revenues, you need to understand the business model of the company you advise. So basically answer the questions:

- How does this company make revenue?

- What does the revenue consist of?

- Which component of the revenue has been declining?

Understanding your client’s business model is absolutely crucial for your revenue analysis. Only when you know which products the company sells and which customers it serves, will you be able to give solid advice on how to solve profitability problems.

2. Break Down the Revenue into its Single Components

Once you have understood the general business model of your client, you can go on and break down the revenue into its components. Depending on the business model of the company, the equation can differ.

Let’s take a look at some examples depending on different industries:

Revenue = Number of Units Sold × Selling Price per Unit Number of Units Sold: The total quantity of products manufactured or sold to customers. Selling Price per Unit: The price at which each unit of product is sold to distributors, retailers or customers. Subscription-Based Services (e.g., Streaming Services, Software as a Service)

Revenue = Number of Subscribers × Monthly Subscription Fee Number of Subscribers: The total number of customers who subscribe to the service. Monthly Subscription Fee: The amount charged to each subscriber on a monthly basis. E-commerce Industry

Revenue = Number of Transactions × Average Transaction Value Number of Transactions: The total number of orders placed by customers. Average Transaction Value: The average amount spent by customers per transaction.

Advertising Industry (e.g., Digital Advertising, Print Media)

Revenue = Impressions or Clicks × Cost per Impression or Click Impressions or Clicks: The total number of times an ad is viewed or clicked by users. Cost per Impression or Click: The cost charged to advertisers for each impression or click generated.

Hospitality Industry (e.g., Hotels, Restaurants)

Revenue = Number of Rooms or Seats Occupied × Average Room Rate or Meal Price Number of Rooms or Seats Occupied: The total number of rooms booked or seats occupied by guests. Average Room Rate or Meal Price: The average price charged per room or meal.

It becomes obvious that there is no one-size-fits-all-solution for a revenue analysis. You need to adjust your approach according to the client’s business model and needs.

3. Analyze the Single Components of the Revenue Model

Once you have a clear picture of what the revenue of your client is composed of, you can go on with your analysis by focusing on the component of the equation that appears to be the problem. For example, if your client is a manufacturer with declining revenues, you should find out if the number of units sold has been decreasing or the selling price per unit has been lowered (or a combination of both).

If the number of units sold has decreased, you go on with a further analysis on the reasons behind. These can be manifold, so make sure to stay structured and use segmentation to get to the root cause of the problem.

The segmentation you use needs to be customized to the case at hand. Make sure to let your interviewer know your thoughts and guide him or her through the case. That way, you will usually get valuable hints on which direction to go.

Examples for segmentations are:

- Product segmentation: Product types? Price ranges? Packaging sizes?

- Customer segmentation: Small / medium-sized / large businesses? Age groups? Sex? Income groups?

- Market segmentation: Geographies? Industry verticals?

- Channel segmentation: Distribution channels?

If you’ve found the biggest driver of the problem, you oftentimes have to switch to a more qualitative framework (for example the 4 Cs) to find the underlying root cause. For example: when you have less revenue, but the price is the same and units sold dropped, you have to find out why. Is there a new competitor on the market? Do you have quality problems, or did you just stop a marketing initiative that you ran for years prior to this drop?

The same procedure applies if pricing seems to be the issue for declining revenues. “Let’s increase prices” might be an easy recommendation to give, but most likely too easy to be valuable. It is crucial to understand first, why prices have decreased and again, the reasons might be diverse. Make sure to use a structured approach in order to pinpoint the exact problem.

Possible reasons and forces for decreasing prices may be:

- Increased Supply: Overproduction or excess inventory can lead to discounted pricing to clear out stock.

- Competitive Pricing: Aggressive pricing strategies by competitors can force companies to lower prices to remain competitive.

- Price Sensitivity of Customers: Changes in customer price sensitivity and purchasing behavior can influence demand and pricing strategies.

- Market Saturation: Increased competition and market saturation can lead to price wars and downward pressure on prices.

- Economic Conditions: Economic downturns or recessions can impact consumer purchasing power and demand for products.

- Exchange Rates: Fluctuations in exchange rates can affect import/export prices and overall cost structure.

It may not be surprising that when looking out for the reasons of the client’s revenue problem, staying structured is most important. Come up with solid hypotheses and validate or neglect them in the dialogue with your interviewer and based on the data that will be provided to you throughout the conversation. This requires flexibility and spontaneity, so learning frameworks by heart will not help you here. It is important to internalize the way of thinking a consultant uses and solve cases with peers to put it into practice.

👉 To find like-minded candidates for mock interviews , take a look at our Meeting Board and simply accept one of the open invitations.

4. Recommend Actions to Get Revenues Back on Track

Once you have successfully narrowed down the problem, there is one last thing for you to do: Come up with actions that get your profitability back on track. Most likely these will be actions to improve your revenues (also increasing the total value of your business), but there is a slight chance that at this point of your case, you may have to take a look at the big picture again and consider cost cutting measures as well.

Whatever you do, don’t get too excited before you have crossed the finish line. Even at this final stage of your case interview, one thing is absolutely crucial. You might have guessed it: Structure!

Don’t come up with a random list of possible solutions. Prioritize them based on their impact and categorize them, for instance by short-term or long-term actions or according to the difficulty of implementation.

Last but not least, remember to communicate your outcome of the analysis answer-first. Start with what the client should do and then go on with the reasons behind.

Scenario 2: Costs Have Been Increasing

If revenues have been flat or increasing, but profitability is going down, your client might have a cost problem. The task for you as a consultant (or candidate in a case interview) is the same as for scenario 1: Identify the cause(s) and come up with recommendations to solve the problem. Use a structured approach for your analysis and communicate clearly what you are doing while working through your case.

1. Understand the Business Model and General Cost Structure of Your Client

Before you can start to analyze the cost issue(s) of your client in detail, you need to understand what the business is actually doing and which business model is behind. The question of how the company makes money and which industry it is in, already implies which cost structure may be behind. For example, a service company will most likely have labor costs as its main cost driver while a manufacturing company will most likely have high spendings on raw materials. So, before you dig deeper into the cost structure of your client, get a better understanding of its business model first.

2. Break Down the Costs into its Single Components

To start off with your cost analysis, you need to develop a structured approach first. Segment your costs into different categories (and remember the MECE principle while doing so). A common way to break down the costs is to differentiate between fixed and variable costs . Fixed costs do not vary with production or sales volume while variable costs change in proportion to the sold goods or services.

3. Analyze the Single Components of Your Cost Structure

Once you know which component of your total costs has increased, you can go one step further down your issue tree and focus on that component first. But always remember to stay structured and segment as you go on identifying the root cause of your profitability issue.

If your fixed costs appear to be the problem, you would go on by separating different cost categories (e.g. rent or lease expenses, salaries , utilities etc.) and taking a closer look at each one of them. Based on the business you are advising, you should make educated guesses on which cost categories may be the most relevant ones and start with these ones first. Let your interviewer know your thoughts and he or she will guide you in the right direction.

If your variable costs appear to be the problem, you would go on with splitting these costs into its components. The equation is the following:

Variable Costs = Number of Units × Cost per Unit

Number of Units is the total quantity of units produced or sold. Cost per Unit is the cost incurred to produce one unit of product, excluding fixed costs.

Remember to adjust the equation to the business model of your client. Which units are we talking about? Which kind of cost per unit do we need to consider? The equation might look different depending on whether your client is a manufacturer or service company, so it is important to internalize these basic approaches and adjust them flexibly to your case.

Once the composure of the variable costs is clear, you will go on by analyzing either side of the equation. Start with the one that seems to be more relevant first. Let your interviewer know why you would want to focus on that and receive feedback if you are on the right track.

At this point, you will most likely be able to quantify the cause of your rising costs and need to get more qualitative in the identification of possible reasons. Don’t make random guesses, but think before you speak and stay structured. For example, you could start off by differentiating internal or external reasons. If the problem seems to be internal, you could go on by working through the value chain. It is important that each of your steps follows a comprehensible logic.

Your procedure highly depends on the case you were given and there is no standard framework that will help you out at this point. But don’t worry: With a good amount of practice, you can develop the mindset of a consultant and significantly improve your performance. We recommend at least 10-15 mock interviews with peers before the final day, so check out our Meeting Board and schedule meetings with like-minded candidates.

4. Recommend Actions to Improve Profitability

As a last step, identify actions that help your client get its profitability back on track. If rising costs are your main issue, cost cutting measures may seem obvious. However, there may be cases where rising costs are your main problem, but there is not much you can do about it (e.g. if the prices for necessary raw materials increase due to climate changes), so remember to keep the big picture in mind, zoom out and do not forget that measures to increase revenues might also be a good solution to your profitability issue.

Categorize, structure and prioritize your recommendations. What are the most important measures and why? Make sure to communicate the outcome of your analysis and the corresponding recommendations clearly. You have made it this far, so stay concentrated until the end of the case and leave a lasting impression.

Scenario 3: Revenues Have Been Decreasing and Costs Have Been Increasing

This is the worst scenario your client could possibly face. Profitability is going down, because revenues have been decreasing and costs have been increasing. How can you approach this case in a case interview?

It is actually quite simple. First, you need to understand which one is the bigger problem or the problem you have more scope of action to address: Decreasing revenues or increasing costs. Focus on that problem first and follow the procedure you have learned in scenario 1 and 2. If you notice, you are going down the wrong path, go up your issue tree again and take the other branch. Not validating your initial hypothesis is always fine as long as you communicate it clearly to your interview and stay structured in everything you do.

Profitability Case Example

Let’s take a look at a profitability case example just like the ones you might encounter in your case interview:

Your client is a chewing gum manufacturer. The CEO of the manufacturing company is concerned because her company is experiencing declining profitability. Please investigate the reasons for the decline and give suggestions for improvement.

👉 Do you want to solve the case yourself? Find it here .

1. Clarify the Problem

Start off by making sure you have understood the question correctly. A good way to do so restating the problem: “Just so we are on the same page, our main objective is to determine the reasons behind the decline in profitability for a chewing gum manufacturer and provide recommendations to improve the profitability of the business, is that correct?”

You can then go on and ask further questions to better understand the structure of the company and industry. What is the size of the company? Which kind of chewing gum do they sell? Who are the customers? What is the price of the product and how does it compare with competitors? Who are the key players in the industry?

Ask what you need to know to understand the situation of the customer and take notes . Summarize your findings, collect feedback from the interviewer if you have understood everything correctly and go on with the preparation of your structure.

2. Prepare your Structure

“Thank you, may I take a minute to prepare my structure?”

Based on the term “declining profitability” in the case prompt (“falling sales” or “rising costs” can also be hints), it is valid to assume a profitability case and work the corresponding framework as a basis for your structure. But be careful: Don’t jump to conclusions too fast and make sure in step 1 that you have really understood the situation of your client and prepare a structure that is customized for it. Off-the-shelve-frameworks are never a good idea - neither in case interviews nor in the real consulting world.

Here, we do have a profitability case that can be analyzed by using the profitability equation to isolate and quantify the problem:

When profits go down, you either have a decline in revenue, rising costs, or both. The best way to find the root cause is to sketch the problem as an issue tree. Start with the more promising part, for instance, revenues - because the market is highly competitive. Obviously, you would share that thought with your interviewer and be on the lookout for hints. For example: “ I am going to look at revenues first, since in a competitive market like the market for chewing gums, I’d expect this to be a big driver.”

You can further break down the profit tree like below:

Now you can start with one of the branches. Let's take the revenue side.

Try to start with the branch of the tree that also has the biggest impact on the case solution. Share your hypothesis with the interviewer and watch out for hints if you are on the right track.

3. Analyze the Revenue Side

To understand the revenue side of the chewing gum manufacturer, segment the revenue streams. You can ask the interviewer whether you can segment the revenues into its component parts. If the interviewer prompts you to do the segmentation, you can think about different customer segments (small business / large business, etc., age group, sex, etc…), product lines, or regions (South America, Asia, etc.). This segmentation will help you isolate the root of the problem. You'll be able to develop better and more targeted analyzes.

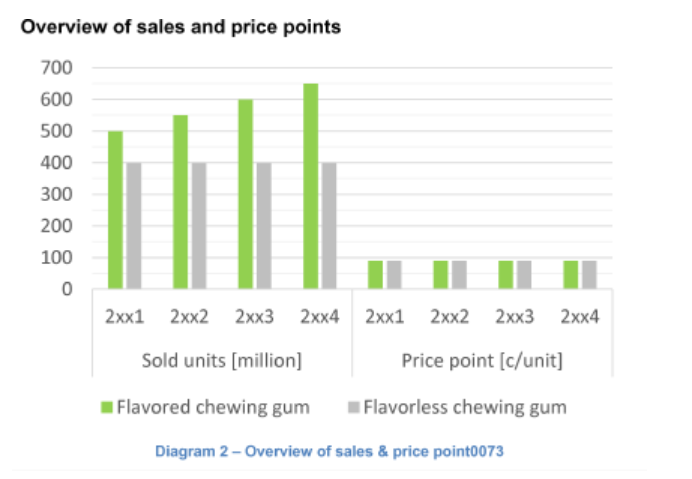

To help the chewing gum manufacturer improve her profitability, you may ask: “What are the revenue sources?”. The interviewer tells you that all revenue comes from two products: Flavored and non-flavored chewing gums. At this point, you might want to know the development of sales over the past couple of years. “How have sales figures developed over the years for both products?” She shares the following diagram with you:

It now becomes clear that revenue is not the problem because it has grown steadily in recent years. Therefore, it must be costs that rose significantly, leading to a drop in profitability.

4. Analyze the Cost Side

Now explore the cost side. You know that costs can be broken down into fixed and variable costs. You can then inquire about the breakdown of costs: "Please tell me about the direct/indirect cost split for the products.” The interviewer hands you the following graph:

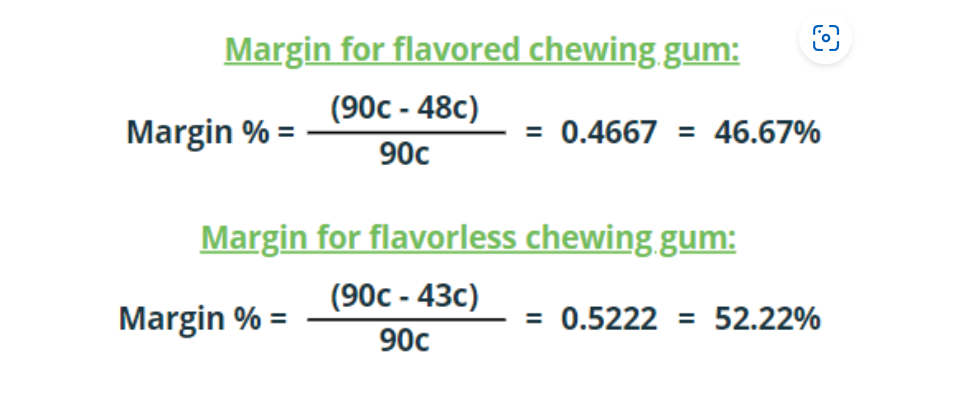

As we know that there are two different product lines, it is advisable to calculate their margins to check if there is a more profitable product line.

“I'd like to calculate the margins for both products; do you have information on the different prices and costs for each of them?” The interviewer hands you the following graph:

You calculate the margin for both products based on the following formula:

The root cause of the profitability problem becomes clear: “Analyzes show that the product whose sales have increased (flavored chewing gum) is also the one with lower margins due to the added flavor. Therefore, total profit margins have decreased while sales have increased.”

5. Close the Profitability Case

After you have determined the root cause, you must develop a good logical solution (e.g., developing a competitive response , starting a marketing initiative, etc.)

It is important to stay structured even if you think you have reached the final stage. Therefore, categorize your approaches, for instance on a timeline:

- Negotiate with current suppliers.

- Look for other suppliers (form partnerships or buy greater amounts with batch discounts).

- Vertical integration.

- Release new products with better margins (e.g., low-calorie flavor gum or tooth cleaning gum).

- The client could also increase the price of the flavored gum, risking decreasing sales if customers do not see any added value with the price rise (high price sensitivity).

Key Takeaways - 7 Tips to Ace Your Profitability Case with Confidence

Profitability problems are frequent in consulting case interviews and nothing to worry about. We have summarized the 7 most important tips to keep in mind when solving profitability cases:

- Understanding the business model of your client and adjusting your approach according to the company’s needs is crucial to success. The standard profitability framework can be a good base to structure your case, but needs to be customized individually.

- Profitability equals revenues minus costs. Use this profit formula to build an issue tree and tackle down the root cause of your problem (but don’t forget about tip 1).

- Quantify your problem and look for trends. Locate the biggest driver of your profitability issue and prioritize it in your analysis.

- Combine quantitative and qualitative analysis to not only identify facts, but also understand the reasons behind.

- Keep the big picture in mind when recommending actions to improve the client’s profitability. The most obvious may not always be the most sustainable and best solution in the long run.

- Stay structured in everything you do and make sure you communicate your thoughts clearly to the interviewer. This applies to all cases and is the most important skill to master prior to your interviews (and the actual consulting job as well).

- Practice makes perfect: Solve one or two profitability cases on your own and then make sure to connect with peers and practice together. There is no better way to not only get into the habit of thinking like a consultant, but communicating like one as well. You will receive valuable feedback and improve your abilities much faster than with self-study only. Find plenty of case partners on our interactive Meeting Board and get started now!

You are looking for profitability cases to practice with?

Check out our recommended resources or browse the Case Library for all cases on this topic.

👉 Company Case by Bain & Company : BeautyCo – Where Did the Profits Go?

👉 Expert Case by Ian (incl. video solution): Hot Wheels

👉 PrepLounge Case: Fashion mail order

Questions on This Article

Excise tax to be dealt properly, elaborate on the total profit margin.

How did we get to 90c?

Related Cases

Bain Case: Old Winery

Oliver Wyman Case: Setting up a Wine Cellar

Oliver wyman case: on the right track.

zeb case: Quo vadis, customer?

EY-Parthenon Case: Virtual Marketplace

- Select category

- General Feedback

- Case Interview Preparation

- Technical Problems

Profitability: in-depth analysis of a recurring theme in case studies

- Estimates and segmentation

- Profitability

- Competitive interaction

- Segmentation as a tool to approach profitability differently

- The typical problem

- See profitability problems differently

- A very real problem

Going further...

The ultimate goal of any normal business is to maximize profits - nobody does a day's work to lose money! As such, issues around profitability are understandably a recurring theme for working consultants and are the subject of many case interviews . We generally don’t advise using pre-planned frameworks, but knowing how to tailor a profitability framework to your specific case can help you in your interviews.

The subject of profitability is dealt with in detail in the MCC Academy course in a one hour video lesson which you can check out below:

Depending on your background knowledge, parts of this lesson might feel a little like being thrown in at the deep end - it is from around halfway through the MCC Academy course and builds on the content which has gone before it. Being able to crack profitability cases every time will require you to bring a fully developed skill set to interview. For instance, you will need a familiarity with basic finance theory and the ability to interpret accounting information. All of this is covered in depth by the MCC Academy .

In this article, rather than try to go through all the background, we will focus in on one of the main ways candidates go wrong when tackling profitability questions and how they can approach these cases more effectively.

Throughout the article, and again at the end, we point you towards resources to help get to grips with the relevant background material and develop the skills you will need to get through the analysis. Soon, you'll be ready for whatever profitability question your interviewer might throw at you!

Segmentation as a consulting tool to approach profitability differently

Candidates are often tempted to tackle profitability cases too hastily by employing a generic profitability framework - looking simply at high-level "aggregate" figures for incoming revenue and outgoing costs. This can seem sensible and will serve to generate some reasonable-sounding client recommendations.

Prep the right way

However, in cases of any real complexity, taking this aggregate-level approach will mean you completely miss the underlying issue which is actually causing the client's problems.

At best, the "solutions" you generate will be superficial "sticking plasters", which might ameliorate a few symptoms of low profitability in the short term, but will not address the underlying problem causing the company to lose money. At worst, these "solutions" might inadvertently reduce profits and could bankrupt your client.

So, what do we need to do help a company get back to a healthy bottom line? The answer is that we need to start pulling apart headline "aggregate" figures to get into the nuts and bolts of how each different aspect of the company's activity contributes to revenues and costs.

This is to say that we need to "segment" different components of what our client does . Segmentation is one of the most powerful means by which practicing consultants deliver solutions to their clients, and is particularly useful in profitability cases.

If you would like some background on how to segment before getting into the specifics of profitability, we have a general article on segmentation , which you should check out. You should also look at our article on the MECE rule , which needs to be applied to make any successful segmentation.

Now, though, let's get a feel for the kind of problem that tends to come up, before working through an example case, which we solve via segmentation.

The typical problem in consulting

Consultants will often encounter some variation of the same scenario - a company has been relatively profitable over the last few years, but recent financial turmoil has created serious concerns. What to do? What a basic profitability framework tells you is to look at revenue and costs at an aggregate level.

From this start, you will likely arrive at recommending typical cost saving measures - such as improving procurement or marginally reducing the workforce. If you are lucky, these "sticking plaster" recommendations might achieve a small uptick in profits in the short term. However, this approach does not get to core of the problem .

The key is understanding how much each part of the business or product line contributes to profitability . It is here that segmentation can be so revealing. Segmentation lets us get to the heart of the root cause - and thus find the real solution to the fundamental problem.

An industry example

Let's work through an example of this kind of case. Say your interviewer gives you the following prompt:

A travel agency makes a 10% commission on all of its travel bookings. Their current profit before taxes is $3m, while the industry average ranges from $4-6m. Why are they making less than the industry average?

We will go step-by-step through a standard analysis using our Priority Driven Structure approach , showing both where many candidates might go wrong and how you can avoid making the same mistake.

1. Identify the problem

You respond with a few questions about the business model. Quickly, you gather that the Travel Agent’s job is pretty straightforward: they sell hotel rooms and get a fixed commission from the sale price.

Competitors do exactly the same. The industry appears fairly commoditized so, in principle, it is hard to understand why there should be large differences in profitability. Now you have enough information to begin to tackle the case.

Join thousands of other candidates cracking cases like pros

2. modify your profitability framework guided by the priority driven structure.

This is a fairly straightforward profitability case. The main aims are:

- Understanding why we make less than our competitors

- Identifying the cost structure (fixed vs. variable). The figures in themselves are not that important - what really matters is how costs vary with changing volume

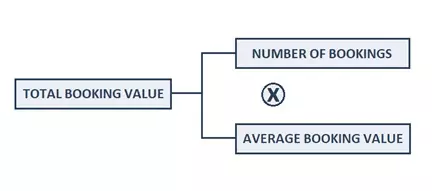

First, profit should be broken down into revenues and costs as usual. For our travel agent, profit is the product of:

- Total booking value

- Average Commission

The total booking value can be further broken down into:

- Number of bookings

- Average booking value

As usual, costs are separated into fixed and variable components. At this stage, for this simple case, our structure is similar to a common profitability framework and the tree structure is like most other profitability trees.

3. Lead the cost analysis

With our basic tree structure complete, we can start to move towards a solution. We will deal with the revenue and costs parts of the structure sequentially.

3.1. Revenue side

After asking a few more questions, you find out that our company's commission is at the same level as that of our competitors and that our total booking value is actually higher. Hence, our revenue is higher than that of our competitors.

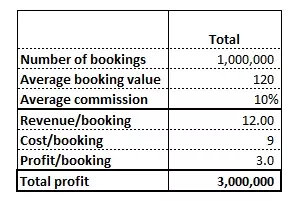

Breaking down the total booking value (as shown below) into average booking value and number of bookings, we find out that we have more bookings than our competitors, but our average booking value is lower. The specific profitability tree would look like this:

3.2. Cost side

After some further questions, it turns out that the costs side is quite straightforward. Fixed costs are identical between us and our competitors, so we can safely ignore them for the purpose of this exercise and don’t have to include them in our profitability trees. Variable costs per booking are also constant across the industry at $9, though our total is obviously higher due to our higher number of bookings.

3.3. The typical mistake...

The usual response to this kind of typical profitability problem is to make the same, typical mistake. At first sight, the key takeaway from our structure seems to be that our problem is with average booking value - especially considering the fact that increasing commissions beyond the competition in a commoditized market is likely going to be counter-productive. It looks like the best solution to our problem is to be found in simply convincing our current customers to spend more. At this point you may come up with a list of potential initiatives incentivizing our customers to spend more and the case looks complete. Unfortunately, this is only a partial - and misleading - solution .

3.4. The power of segmentation

Rather than making this predictable mistake and ending up with an unsatisfactory answer, we should instead use segmentation to get at the root of the problem . This is a key component of Leading the Analysis, as explained in our Case Academy .

When the cause of lower profitability is unclear at an aggregate level, segmentation enables us to assess how profitable each customer is. We can reasonably expect different customers to bring different levels of profitability , but it could also be the case that some customers are actually draining profit.

Looking for an all-inclusive, peace of mind program?

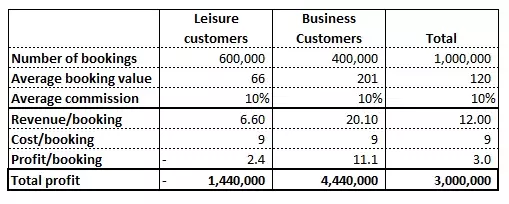

Using business intuition and a hypothesis-driven approach, we can immediately see that the average booking value is the most relevant bucket to investigate: costs are standard and our market share is likely to be difficult to increase drastically when that market is so competitive. As you communicate this to your interviewer and go on to segment further, you are given the information in the table below, which tells us that there are two types of customers: leisure and business travellers.

The average booking value of $120 is an average of:

- $66 spent by leisure travellers

- ~$200 spent by business travellers

Your first move here might be to calculate the total profit for each category. However, this is not necessary and would actually represent a sizable waste of time in an interview. Instead, it is quicker and more enlightening to simply calculate the profit per booking .

For every leisure traveller, then, we get an average of $6.60 in commission, but spend $9 in variable costs. This means that for each leisure traveller, we lose an average of $2.40!

4. Provide specific recommendations

If we only served business customers, our total profit would increase by almost 50% overnight . We can achieve this simply by turning down leisure customers, so our client can actually make more money by doing less!

Forget outdated, framework-based guides...

A different way to view profitability problems.

So, we have seen how we can use segmentation to boost our travel agent's bottom line. A case that could apparently be solved using a standard profitability framework turned out to be slightly more complex. This is true for most, if not all, MBB cases.

As such, it's important to be familiar with all the fundamental consulting ideas to build solutions from first principles. In this case (and in most other cases) having a solid understanding of segmentation is fundamental . This knowledge will allow you to draw customized profitability trees and not rely on a generic profitability framework.

As we noted, the most intuitive way of looking at a basic profitability problem is simply by considering the overall difference between total revenue and total costs. After all, it is easy to calculate total profit:

profit = revenue - cost

However, thinking a little more deeply, it is much better to transition to considering overall profit as the sum of individual profit generated by each customer. Each specific customer will be generating some revenue and causing some costs. This transition from an aggregate to a more "particulate" mode of thought is key.

At the aggregate level:

profit = (average revenue per customer - average cost per customer) × number of customers

The fact that the average revenue per customer is higher than the average cost per customer means that the average profit per customer is positive - and so the company as a whole is profitable. However, this does not provide any specific information about different customers.

There might well be customers (or segments of customers) generating negative average profits , whilst other segments are making up for them by generating a positive average profit. If the company is profitable, all we know is that customers contributing positively are more than compensating for any who are contributing negatively.

As with our example here the key to profitability will thus often lie in finding out which customer segments are more or less beneficial , or even detrimental, to sell to.

It is important to note that segmentation is not limited to breaking down different groups of customers, as we have seen so far. Exactly the same method can be applied by dividing up the different kinds of products sold by a company. Once you understand the method, you should have no trouble drawing up specific profitability trees.

Thus, a fashion brand like Hermes might find that it makes a loss on high-end leather goods like handbags and luggage due to very high costs associated with those products' raw materials and manufacture. However, that same brand might still turn a profit overall by virtue of hefty positive contribution from relatively cheap-to-manufacture but high-price accessories like ties and scarves.

Such a brand might want to adjust its product mix if it wishes to increase profits (though, particularly for fashion houses, these products are often intentionally kept on as " loss leaders ").

Impress your interviewer

Whichever way segmentation is carried out, the goal is the same: segmentation helps you to discern customers or products which might be contributing less to profitability or even generating losses . Once you have this information, it should be relatively straightforward to come up with ways to increase profit (as with recommending our travel agent ceases to serve leisure customers).

These recommendations can then be given to the client in the knowledge that they target the underlying problem faced by the company rather than just representing an attempt to paper over the cracks.

A very real business problem

Our travel agent's case reveals what is in fact an extremely common problem for companies today : some products, business lines, or customers are actually generating losses.

This means companies incur extra costs just by persisting with these aspects of the business, and that their profitability can be boosted by a significant amount just by axing loss-making business lines. As we have explained, the key to solving this problem is evaluating the profit contribution of one additional product or customer in each segment.

Doing so will enable us to understand whether that segment is actually creating or draining value for the company. This is the kind of work consultants do every day and thus the kind of scenario that is likely to come up in a case interview.

Following the Problem Driven Approach, together with a solid understanding of segmentation, should help to set you ahead of the competition when it comes to profitability cases. However, you should not forget that your analysis has to be grounded in a wider set of skills . Many of the other articles on this site will be relevant, especially those on costs , the MECE concept . You will also benefit from improving your mathematics skills , both to interpret data and to get through calculations quickly and accurately.

The MCC Academy has all the material you need to excel in profitability cases: besides a video dedicated to profitability, you will find videos on the fundamentals of finance and accounting, consulting thinking, including "differential reasoning" which was used to tackle this case and much more!

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.

Discover our case interview coaching programmes

Discover our career advancement programme

Account not confirmed

Case Study: Integrated Profit and Loss Accounting at Natura &Co

Presentation by Alessandra Segatelli, Controllership Director - LatAm, Natura &Co

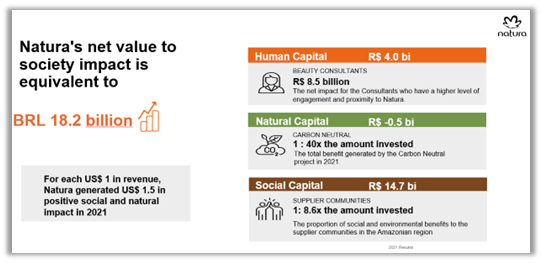

- This case study article highlights Natura &Co’s Integrated Profit and Loss (IP&L) approach and methodology, as well as the role of the finance team in its development.

- Natura is a leader in impact accounting, using its IP&L and underlying methodology to quantify the impacts and net value of its corporate performance on environmental, social, and human capital.

- The IP&L captures the impacts of Natura’s business activities across its full value chain, ranging from Natura’s supplier chain and extractive communities in the Amazon region, through direct Natura operations, its beauty consultants, to product use and product end of life.

- Natura implemented the IP&L model as a strategic management and decision-making tool, as the results can be compared directly with the financial results, which helps in risk management and reporting to investors, and contribute to the operationalization of stakeholder capitalism.

- The controller and finance team are involved in the development of the IP&L methodology, including data collection, measurement and valuation. They support the measurement of key impacts linked to business activities and quantify these to enable decisions that achieve a balance between positive impacts and profitability.

- In terms of policy, to help develop the connectivity with financial statements, financial reporting standards could usefully develop common methodologies and accounting treatments for some ESG areas including carbon credits. International standards for measuring and valuing impacts would also help drive a more common approach to impact accounting that would lead to integrated reports being more quantitative.

Natura &Co Key Facts

- Founded in 1969, Natura is a Brazilian global cosmetics company headquartered in São Paulo. Since 2020, Natura is part of Natura &Co group, comprised of four purpose-led beauty companies: Avon, Natura, The Body Shop and Aesop.

- A pioneer within the beauty sector among B Corps, Natura obtained its certification in 2014, becoming the first publicly traded company in the world to earn it. In 2021, Natura &Co became the world’s largest certified B-Corp.

- Natura &Co’s consolidated net revenue is R$ 40.16 billion and net income R$1 billion, and has 35,000+ employees,7.7 million consultants and representatives, and 3,700 stores and franchises.

- Natura &Co issued a US$ 1 billion sustainability-linked bond related to selected sustainability targets, which is the largest single issuance of this type by a Brazilian company.

- Sustainability is an integral part of Natura’s purpose, strategy and business model across natural, social and human capital dimensions.

- Natura was highly commended at the 2022 Finance for the Future Awards in the category for embedding an integrated approach and recognizing the finance team’s critical role in delivering this integration.

Natura’s purpose: To nurture beauty and relationships for a better way of living and doing business

Natura Integrated Profit & Loss Accounting

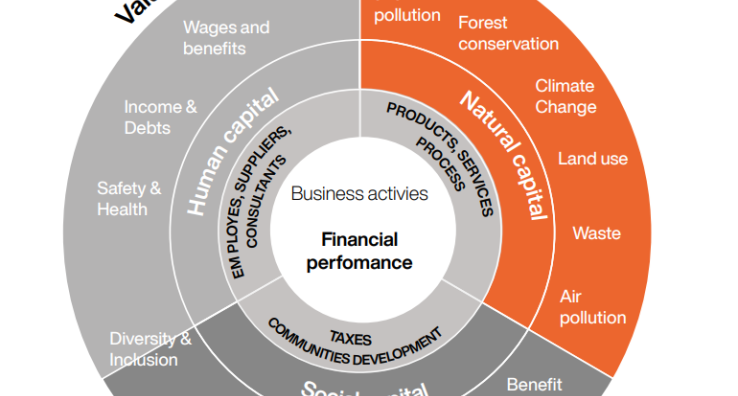

Natura &Co believes that the value and longevity of a company are directly linked with its capacity to contribute to the evolution of society and its sustainable development. To collaborate with the wide-reaching change our world needs, it is fundamental for us to measure our legacy or, in other words, the impact we generate through our operation.

Natura’s leadership in impact accounting has culminated in its IP&L and underlying methodology to account in monetary values for the impacts of its corporate performance on environmental, social and human capital.

The IP&L methodology connects business activities to impacts and allows the attribution of value to impacts be they positive or negative. This provides quantitative information that permits better strategic decision-making aimed at leveraging positive impacts and mitigating negative ones, for example, in improving supply chain processes and vendor selection, and operations. It also allows decisions to be made to balance profitability at the same time as achieving sustainability goals.

Natura has a cross-functional committee responsible for the development and strategy of the IP&L methodology, which includes the controllership and technical accounting team, as well as members of the financial planning and analysis (FP&A) team and Sustainability Center of Expertise.

The development and publication of the IP&L started in 2010 with Natura’s efforts to understand its supplier network and key raw materials such as palm oil. Between 2014-16, Natura developed an Environmental Profit & Loss and expanded it to social impacts in 2017-19, particularly to measure and enhance the contribution of its approximately 2 million beauty consultants in Brazil, Argentina, Chile, Colombia, Mexico, Peru and Malaysia to their communities. A full IP&L model was issued in 2021 and is now included in internal decision-making and public disclosure with external assurance. The IP&L has become Natura’s Integrated Report .

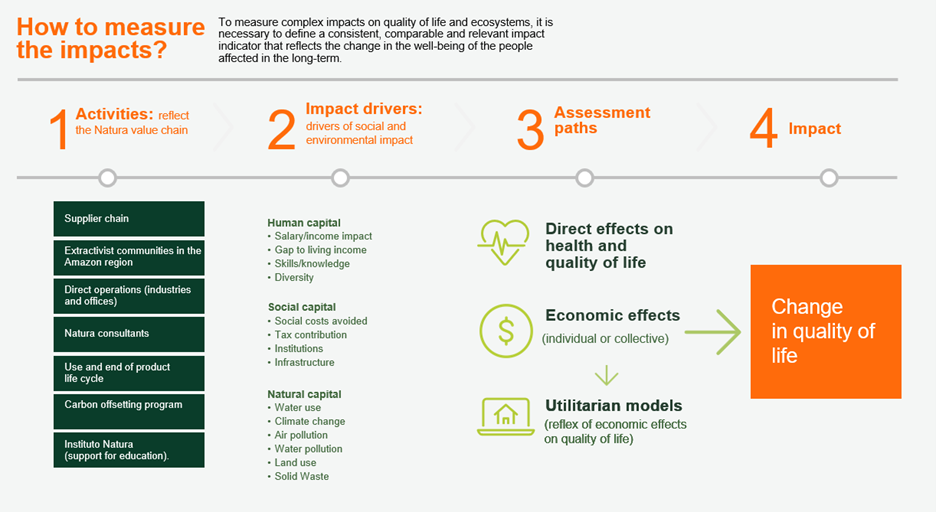

The IP&L methodology relies mostly on the Natural Capital Protocol and the Human and Social Capital Protocol (Capitals Coalition, 2016, 2019). The methodology involves

- Collecting data

- Identifying and measuring impacts

- Taking decisions to leverage positive impacts and mitigate negative impacts.

IP&L Methodology

The Natura &Co IP&L methodology is available at Natura Integrated Profit & Loss Accounting 2021, Technical Executive Summary and Insights . A summary is provided here.

- Natura’s sustainability strategy and IP&L address three material sustainability topics covering natural, human and social capital:

- Living Amazon Forest : Movement to transform the Pan-Amazon region into a global example of a new society that integrates people, the forest and cities in a sustainable manner, creating more shared value;

- More Beauty, Less Waste : Offers the most, using the least, and reducing excesses. Natura has used recycled materials and materials of renewable origin, as well as refills, for over 30 years and strives to do more;

- Every Person Matters : Each person in Natura’s relationship network matters a great deal to the company. With each one, the focus is on making a social pact that decreases inequality and intolerance and promotes social inclusion with effective transformational actions. Each person is a world. And the whole world matters.

- Figure 1 captures the business impacts from activities across Natura’s full value chain, from its suppliers and extractive communities in the Amazon region to its direct operations (manufacturing and offices), the Natura sales consultants, the products used by customers, and the product end-of-life.

- Measuring impacts involves identifying key activities in the value chain, relevant impact drivers across human, social and natural capital, and assessment paths to understand direct and indirect economic effects. This means that impacts can be monetized, allowing, for example, the value of nature or wellbeing to be expressed in monetary terms.

- Methodologies and calculations to convert resources into economic value are based on two main possible pathways: Direct effects on health and quality of life or economic effects that are calculated through utilitarian models, which reflect a change in the quality of life of an individual or collective. Some examples of valuation factors considered for measuring IP&L outcomes are:

- Social cost of carbon, which reflects the current and future economic damage per ton of carbon ($97/tCO 2 based on PwC’s Total Impact Measurement and Management Framework);

- The value of ecosystem services and wellbeing of Amazon supplier communities for the sustainable use of the forest, and other sources for plastic ($760/ha of forest based on substitution or mitigation costs); and

- Factors that translate income or taxes into changes in well-being and quality of life, such as HUI (Health Utility of Income) which determines the utility of money in different socio-economic contexts, or HUT (Health Utility of Taxes), which values quality change of life and well-being of a population through the collection of taxes.

- Ultimately, the IP&L methodology provides an overview of Natura’s net value delivered across human, social and natural capital. In 2021, the IP&L showed a net positive societal value created by Natura of approximately R$18 billion (around US$3.5 billion), mostly driven by social and human capital. For each $1 in revenue, Natura generated $1.5 in positive social and natural impact. The impact of Natura's natural capital is still negative (as it is for most companies), mainly due to the final stages of disposal of products by the consumer and subsequent recycling. It is important to see this indicator reflected in the IP&L precisely to direct and prioritize actions.

- To address these issues, Natura follows the targets and 40 sustainability key performance indicators (KPIs) set out in its Commitments in its 2030 Vision - Commitment to Life - which covers topics such as net zero, regenerative initiatives, circularity and sustainable materials. Natura has been reducing its natural capital impact for many years. Through its sustainability strategy, it will continue to reduce its negative impact and increase the positive. The KPIs enable performance management and track the company’s sustainability strategy in conjunction with strategic planning.

The Role of the Finance Team

Natura’s Finance Team plays an important role in the measurement of impacts, supporting necessary data collection, monitoring the progress of socio-environmental issues and combating climate change through key indicators, supporting the establishment of tangible and relevant goals, and encouraging the creation of action plans to leverage all the company's results, whether economic, social, human or environmental.

Now, the integrated assessment that IP&L generates guarantees the implementation of ESG policies embedded in the day-to-day strategy of the group's companies, and ensures decisions always combine both the search for profitability and return to all stakeholders.

In terms of the external reporting and assurance process,

- Currently, IP&L is disclosed in the Annual Report, separate from Natura’s financial statements. However, the IP&L was structured in the same format as the traditional financial statement, making it possible to identify which activity generates which level of impact and to link the financial statement line to a range of non-financial metrics, such as carbon emissions and offsetting, and supply chain indicators.

- All sustainability-related KPIs are externally assured since 2001 and by PwC in 2022, and some are outputs then used in the IP&L measurement.

Through its controllership function, Natura also engages and influences external groups that are establishing standards, frameworks, and guidance including the IFRS Foundation and ISSB, the Capitals Coalition, Impact Management Project, Value Balancing Alliance, and World Business Council for Sustainable Development. To help develop the connectivity with financial statements, financial reporting standards could usefully develop common methodologies and accounting treatments for some ESG areas including carbon credits. International standards for measuring and valuing impacts would also help drive a more common approach to impact accounting that would lead to integrated reports being more quantitative.

This was a presentation to the IFAC Professional Accountants in Business Advisory Group during their September 2022 meeting. Read more insights from IFAC’s Professional Accountants in Business Advisory Group’s report: Professional Accountants as Finance and Business Leaders.

- SaaS Company

- Small Business

- Developer Portal

- Documentation

- Help & Support

- Small Business Resources

- News & Events

- Integrated Payments

- Credit Cards

- Recurring Billing

- Online Invoicing Payments & Billing Software

- Customer Portal

- Manage Customers

- Business Insights

- Franchise Solutions

How to Analyze a Profit & Loss (P&L) Statement

The profit and loss statement (P&L) is one of the main financial statements that businesses produce. This guide will help you better understand your financial position by analyzing your profit and loss (P&L) statement.

What is a Profit and Loss (P&L) Statement?

A profit and loss statement shows whether a business is profitable or not. According to Investopedia , “a profit and loss statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time, usually a fiscal quarter or year.”

This statement goes by many names, including P&L, income statement, earnings statement, revenue statement, operating statement, statement of operations, and statement of financial performance.

Cash vs. Accrual Basis

One important thing to know before you get started analyzing your profit and loss statement is whether you are on a cash or accrual basis of accounting.

With a cash basis , revenue and expenses are recognized when there’s movement of cash (for example, if you agree to pay a vendor $50 for a service in a month, you don’t account for that until the $50 leaves the bank).

The accrual method accounts for revenue when it is earned (before the money reaches the bank) and expenses when they are incurred (but before the vendors have been paid).

How are you accepting payments?

Analyzing a p&l statement.

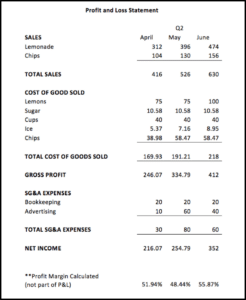

How do you analyze a P&L statement? Let’s look at an example:

Many people get overwhelmed by the numbers, but a few quick tips and tricks on where to look and why will have you feeling confident and analyzing statements like a pro.

Below are some of the easier things to analyze in your profit and loss statement:

This may seem obvious, but you should review your sales first since increased sales is generally the best way to improve profitability. If you see a month was particularly good, try to remember why so you can duplicate what you did in the future.

In this example, we see that June was the best month in terms of sales, gross profit, net income, and profit margin. Upon review of the other numbers, we see that this might have been due to seasonality (see more below) and/or increased marketing.

2. Sources of Income or Sales

Another factor related to sales that you should analyze are your sources of income.

Ask yourself if all of your sources of income make sense and are profitable for your business. Are any of them overly time-consuming with very low margins? In this example, the sources of income include selling lemonade and chips. Neither of these are negatively impacting the business, but if the chips weren’t selling, they should be eliminated or changed to a different type of chips, ones that are more popular, perhaps.

3. Seasonality

Seasonality is the fact that things change based on the season. This can be seen in many parts of a business including but not limited to both sales and expenses.

In the lemonade example, you see seasonality in sales. As the summer months approach and the temperatures rise, so do the sales. This example does not show seasonality in expenses, but if it were to show up it could be in increased prices of lemons because of heightened demand and lower production in the summer months. You might also see seasonality in decreased cost of lemons in the fall and winter quarters due to increased production of lemons and lower demand.

4. Cost of Goods Sold

Next you should review your cost of goods sold. It would make sense for cost of goods sold to go up as revenue goes up since these expenses are directly related to your product. The opposite would not make sense and should be a red flag.

Additionally, when you review cost of goods sold you can ask yourself questions like, “Is there a way I can reduce these expenses?” Finding ways to decrease your cost of goods sold will ultimately increase your bottom line and profit margin.

In this example, the business owner may want to consider purchasing items that won’t go bad (chips, cups, and sugar) in bulk to reduce costs throughout the year and increase their yearly profit margin.

5. Net Income

Net income is your profit and is one of the most important parts of your business if you want it to succeed and be sustainable over time.

You want to see your profit positive (also known as “in the black”) in most cases. Some exceptions where it’s acceptable to see a loss is when the company made a strategic investment during one period to decrease costs or increase sales in a later period.

In our lemonade stand example, the business owner could’ve bought chips, sugar and cups in bulk for the entire year in the month of April. If this was done it could bring the company into a loss for the month, but that expense would be recouped with savings and higher margins throughout the rest of the year.

6. Net Income as a Percentage of Sales (also known a profit margin)

Net income is simply your bottom line, but it’s important to do a quick calculation to determine your net income percentage so that you create a baseline and compare “apples to apples” across time periods and across other companies in your industry.

To determine net income as a percentage of sales simply divide net income by net revenue then multiple your result by 100. Use the lemonade stand as an example. Take $206.07 (net income in April) and divide it by $416 (total sales in April) to get 0.4954. Once you multiple that number by 100 you get 49.54%.

Once you have your net income as a percentage of sales figured out for each period you can use that information to assess if your profit margins are going up (usually a good thing), going down (usually a bad thing), or staying the same.

Additionally, once you have your profit margin figured out you can use this data to compare your profit margin to other companies in your industry. To compare your profit margin to others in your industry simply try a Google search to find that data, or review a profit and loss statement (and do the calculation discussed above) for a public company in your industry since they publish their financial statements.

Now that you feel comfortable with this simple example, you can start analyzing your profit and loss statement and even look at the financial statements of public companies to gain insight into their operations.

Visit PaySimple.com to learn more or start your free trial today:

Start My Free Trial

Recommended Reading

Understanding Payments: How to Remain Competitive in a Changing Market

Proactivity in Payments: 7 Tips Merchants Can Use for Higher Conversions

Managing Demographic Payment Changes with the Cloud

Profitability case interview questions

An overview of profitability cases, the key framework and an example case.

Case types | Key framework | Example case

While consulting cases rarely fit into textbook frameworks, there are several common types of cases that are brought up in interviews frequently enough that it's useful to get familiar with them. Market entry cases are one example, and profitability cases, which we'll focus on in this post, are another.

Profitability cases are important because they get to the root of a business's success or downfall; they focus on how much money is made after accounting for costs to run the business. Understanding the components that go into calculating profitability is a crucial first step to cracking these cases, and in showing your business acumen during interviews.

We'll explain how to recognize a profitability case below, then go through one framework that can be used to solve them, as well as a detailed example that illustrates the framework in action. Remember, these frameworks are not meant to be copy-paste templates to solving cases, rather they should provide an example of a structured way of thinking about a certain type of problem.

Common types of profitability cases (Top)

Profitability cases are fairly easy to recognize, as they'll typically reference one or more of the following scenarios in the problem statement:

Changing revenue, cost, or profitability "Frank's restaurant chain has seen profits stagnate recently despite an increase in customers, they want to understand why?"

Launching a new product or growing into a new market "Main St. Outdoors store is looking into expanding their current footprint by launching in a nearby city, how would you evaluate if this move would be profitable?"

Performing a cost/benefit analysis or presenting a business case "Anne launched an apparel company that does all their manufacturing in the US. She's now considering outsourcing to a lower cost country. Is this a good idea?"

Profitability framework (Top)

Once you've identified the type of problem you're being asked to solve, the next step is approaching it in a structured way. We'll go through the 4 main steps below:

Get comfortable with your levers

Profitability cases are generally focused on drilling down to uncover the lever that's driving a change in the business. For this reason, you'll want to be very comfortable with the components of profitability and how they impact each other. If you haven't already, we'd recommend memorizing the following relationships:

- Profit = Revenue - Costs

- Revenue = Price x Volume of Units

- Costs = Fixed Costs + Variable Costs

- Variable Costs = Cost per Unit x Volume of Units

Fixed costs don't vary based on sales. Examples include rent, salaried personnel and annual dues or fees. Variable costs are tied directly to sales. Examples include costs of materials and hourly labor.

You can nicely map profitability into a simple, MECE framework (see below).

In an actual interview, you'll want to go beyond the basics and specify the key revenue and cost drivers for the case problem at hand. For example, if you're working on a case in the restaurant industry, you might write down (and voice over) that revenue would be calculated using avg. table bill x avg. number of tables served per day x days open.

Drill down to the components

- Identify which of the levers are given to you in the problem statement, and which one(s) you'll be trying to find.

- Take an educated guess about which lever is driving the change, and begin working out the numbers to prove or disprove your hypothesis.

- Work through the remaining levers as you learn additional information throughout the case.

- By the end of the case, you should have an understanding of each component and how they collectively impact each other.

💡 Shameless plug: Our consulting interview prep can help build your skills

De-average & customize the components

Before suggesting any recommendations based on your findings from the component break-down, see if it's possible to segment the cost or revenue components further in order to uncover any additional insights around profitability that are unique to the company you're looking at. This step may be done concurrently with the previous step, as you collect additional information.

Common segmentations on the revenue side include:

- By type of customers e.g. business vs. leisure, or free users vs. subscription users

- By geography e.g. east coast vs. west coast store locations

- By product e.g. printers vs. ink

- By business model e.g. selling a product (car) vs. selling a service (maintenance on the car)

Segmentation is an important step because it can lead to key findings that otherwise might remain hidden. For example, at a high-level, revenues for a company may look stable, however you might segment by product line and see that one product actually has negative profit margins e.g. it's being sold at a loss. This is an insight you wouldn't uncover without de-averaging.

Provide a recommendation

Once you've developed a view on what's driving the profitability problem, suggest steps the company could take to solve it. These recommendations could take many forms, from adjusting the cost structure, to investing in marketing for a specific segment, to changing the price of a product.

Describe what impact you might expect to see if your recommendations were implemented and how the other profitability components could vary. For example, if you're suggesting a company outsource their manufacturing to variabilize more of their costs, note that this could have a negative impact on quality, leading to a decrease in sales.

Example profitability case (Top)

Now that you've seen the framework, let's go through a profitability case so you can see it in action. We'll go through each of the steps to explain how the framework might be applied to a real case. Don't forget that frameworks are just one tool you can use to crack a case. Make sure you use your business acumen as well and think through the unique aspects of any problem.

“Our client, 24 Hour Fitness, has experienced decreasing profits over the past year. How would you approach this problem and what recommendations would you make?”

We're given that profits are decreasing. From Profits = Revenues - Costs, we know that either revenues have gone down or costs have gone up.

We're looking at the fitness industry, so we might write down that revenues = avg. # of monthly members x monthly rate x 12.

On the cost side, we note that fixed costs would include rent, salaries for full-time staff and workout machines. Variable costs could include laundry and cleaning, amenities, and any hourly fitness instructors.

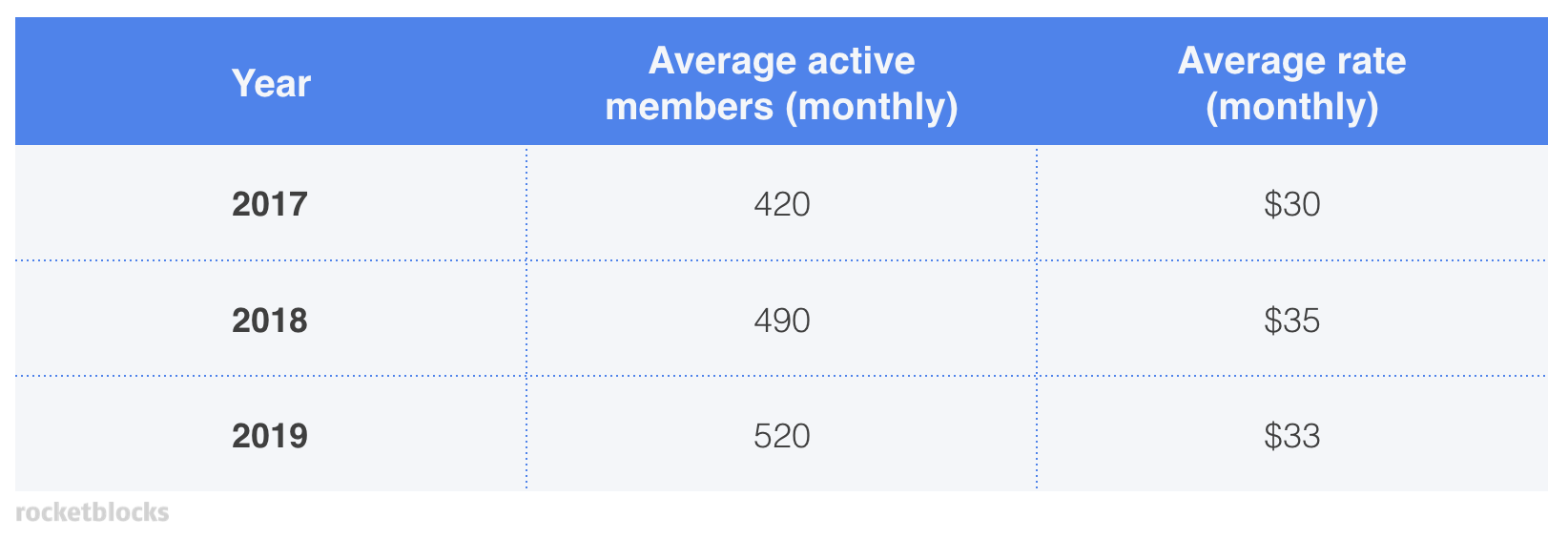

At this point, we might guess that revenues have been decreasing, so we ask for data about memberships over the past few years and are given the following information:

From a quick look at this table, we can see that revenues don't appear to be the issue. Membership and fees have been fairly stable over the past few years.

Next, we'll turn our attention to the costs, as these must have been increasing at a faster rate than the revenues were. We could ask if there is any data around historical costs. We're given the following:

From this data, we see that rent and personnel have been increasing, but personnel especially has ballooned over the past few years. We need to find out what's driving this big jump.

To dig into the personnel cost bucket, we'll want to think about the industry a bit. As we mentioned at the beginning of the case, personnel costs could fall into two categories - full-time and hourly. It would be interesting to see which type this cost increase is tied to.

Applying what we know about gyms, we might think about the customers. At the gym, there's a portion of customers who sign up and never go, there's a portion that go and do their own thing on the equipment, and there's a portion that go to the instructor-led workout classes. What if our normal ratio of these customer segments has shifted over the past few years, and this is somehow leading to higher costs?

In order to test our hypothesis, we'd want to ask for additional data. For example, if there is any historical information around the average gym or workout class attendance of members. This data is shared:

Now we've found something interesting. We see that the average number of workout classes held per month has increased by a factor of 4 in the past 2 years.

It turns out that the gym has been offering members classes for free (included in their monthly rate), yet as they've gained in popularity and added more to the schedule, they've had to add a large number of expensive hourly instructors to the payroll, which are driving up the personnel cost. Despite attracting more customers with their packed class schedule, they haven't increased prices to account for the higher cost.

By this point, we've figured out that higher costs have been driving the decrease in profitability - rent and personnel costs have increased by $5K per month ($3,000 + $2,000) between 2017-2019, however revenues only increased by $4,560 ((520*$33) - (420*$30)) during the same period.

Alternatively, they could change their pricing structure to lower the fee for using equipment but charge a drop-in price for attending a class. This might be a way to prevent losing customers that don't attend classes. Finally, they could take a look at hourly instructors' rates and see if transitioning a couple to full-time employees, or finding personnel that could both run the desks and teach classes would be cheaper options.

This case shows how our profitability framework could be used to work through a case in a structured way. However, you can also see the importance of critical thinking and creative problem solving in coming to a tailored solution - two skills consulting firms will be looking to test. Make sure to practice these until you feel comfortable enough with the framework that it becomes second nature - allowing you to spend your time cracking the case itself.

Read this next:

- Full cases from RocketBlocks

- 29 full cases from consulting firms

- Market entry case interviews

- M&A case interviews

- Weird and unusual case interviews

- Pricing case interviews

- Market sizing case interviews

- PE due diligence interviews

- Supply chain case interviews

- Digital transformation consulting cases

See all RocketBlocks posts .

Get interview insights in your inbox:

New mock interviews, mini-lessons, and career tactics. 1x per week. Written by the Experts of RocketBlocks.

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.

Launch your career.

- For schools

- Expert program

- Testimonials

Free resources

- Behavioral guide

- Consulting guide

- Product management guide

- Product marketing guide

- Strategy & BizOps guide

- Consulting case library

Interview prep

- Product management

- Product marketing

- Strategy & Biz Ops

Resume advice

- Part I: Master resume

- Part II: Customization

- Focus: PM resumes

- Focus: Consulting resumes

- Focus: BizOps resumes

IMAGES

VIDEO

COMMENTS

Learn how to solve profitability cases in consulting case interviews. Use the profitability framwork, benefit from tips, and check out our case examples.

Profitability: in-depth analysis of a recurring theme in case studies. Fundamentals. Problem-driven structure. Building blocks. The ultimate goal of any normal business is to maximize profits - nobody does a day's work to lose …

This case study article highlights Natura &Co’s Integrated Profit and Loss (IP&L) approach and methodology, as well as the role of the finance team in its development.

Analyzing P&L involves understanding revenue streams, cost structures, and profit metrics. Comparative financial analysis and integration with other financial reports provide valuable …

By analyzing P&L statements, managers can identify trends in sales, expenditures and operating costs, allowing them to make informed decisions about resource allocation and cost-cutting …

An overview of profitability consulting case interview questions, including types of profitability cases, the key framework and an example case.

Analyzing a Profit and Loss (P&L) statement alongside the balance sheet provides a holistic view of your business’s financial health. The P&L statement shows profitability over a period, while the balance sheet offers a snapshot of …