- Majors & Careers

- Online Grad School

- Preparing For Grad School

- Student Life

The 10 Best PhD Programs in Finance

In essence, finance is the study of economics and the claims on resources. The best PhD programs in finance help you develop professionally so you can make difficult decisions around fund allocation, financial planning, and corporate financial management. This qualification will also equip you for a career in teaching or research at top universities.

Which of the 10 best finance PhDs is best for you?

Read on to learn everything you need to know.

Table of Contents

Why Get a Doctorate in Finance?

According to the Bureau of Labor Statistics (BLS), finance managerial professionals have an average salary of $131,710 per year, and jobs are estimated to grow by 17% from 2020 to 2030. This is much more than the average across all occupations. With a PhD in finance, you may work as a finance manager or even become a CEO of a large corporation.

Jobs and Salaries for Doctors of Finance

After earning a PhD in finance, you can find well-paid jobs as a professor or in various corporate finance roles.

Here are some of the most common finance professions with the average annual salaries for each:

- Financial Manager ( $96,255 )

- Financial Analyst ( $63,295 )

- Finance Professor ( $73,776 )

- Chief Financial Officer ( $140,694 )

- Investment Analyst ( $67,730 )

Read More: The Highest Paying PhD Programs

What’s the average cost of a phd program in finance.

The tuition for a PhD in finance can vary depending on the university, with public institutions generally being much more affordable than private ones.

Across all schools, the average tuition is around $30,000 per year.

However, on top of this, you need to factor in other expenses, which could add up to another $30,000 a year. Some top universities offer full funding, including tuition and a stipend for all students who are successfully admitted to the program.

Read Next: The Average Cost of a Master’s Degree in Finance

Top finance phd programs and schools, stanford university, graduate school of business.

PhD in Finance

Stanford University is one of the most prestigious business schools in the world. Its PhD in finance programs has an emphasis on theoretical modeling and empirical testing of financial and economic principles.

- Courses include: Financial markets, empirical asset pricing, macroeconomics, and financial markets.

- Duration: 5 years

- Tuition : Full funding

- Financial aid: Research & teaching assistantship, grants, outside employment, and outside support.

- Delivery: On-campus

- Acceptance rate: 5%

- Location: Stanford, California

The University of Pennsylvania, The Wharton School

The University of Pennsylvania’s renowned Wharton School of Business is home to faculty who are well-known in the field of business research. The school boasts a low student-faculty ratio in an atmosphere that allows you to work with faculty members as peers. This doctor of finance program emphasizes subjects like asset pricing, corporate finance, and portfolio management. This helps students become experts in research and teaching in these areas.

- Courses include: Topics in asset pricing, financial economics, and international finance.

- Credits: 18 courses

- Financial aid: Fellowships, grants, student employment, health insurance, stipend, and loans.

- Acceptance rate: 9%

- Location: Philadelphia, Pennsylvania

The University of Chicago, Booth School of Business

Booth School of Business is a major center for finance education because its faculty includes Eugene F. Fama, Nobel laureate and the father of modern empirical finance. This finance doctoral degree has an option for a joint PhD in collaboration with the university’s economics department.

- Courses: Financial economics, financial markets in the macroeconomy, and behavioral finance.

- Tuition : Refer tuition page

- Financial aid: Grants, stipends, health insurance, scholarships, fellowships, teaching assistantships, research assistantships, and loans.

- Acceptance rate: 7%

- Location: Chicago, Illinois

The University of Illinois at Urbana-Champaign, Gies College of Business

The University of Illinois at Urbana Champaign is one of the best places for studying and conducting research in finance. Its finance research faculty was ranked #4 in the UTD Top 100 Business School Research Rankings between 2016-2019. In this PhD in finance program, students can take the qualifying examination at the end of the first year and, if successful. They’ll be able to start their research project earlier and complete the degree sooner.

- Courses include: Empirical analysis in finance, corporate finance, and statistics & probability.

- Duration: 4-5 years

- Financial aid: Full tuition waiver, stipends, scholarships, grants, student employment, and loans.

- Acceptance rate: 63%

- Location: Champaign, Illinois

Massachusetts Institute of Technology, Sloan School of Management

The Sloan School is one of the top research centers in the world, which aims to transform students into experts who can handle real-world problems in a wide range of spheres, from business and healthcare to climate change. This PhD program in finance gives students the flexibility to choose between a wide range of electives and even study some courses at Harvard.

- Courses include: Current research in financial economics, statistics/applied econometrics, and corporate finance.

- Duration: 6 years

- Financial aid: Full tuition, stipend, teaching assistantships, research assistantships, health insurance, fellowships, scholarships, and loans.

- Location: Cambridge, Massachusetts

Northwestern University, Kellogg School of Management

The Kellogg School of Management allows students to conduct independent research under the supervision of faculty who’ve made significant contributions to the field and have earned numerous prestigious awards. This doctorate of finance program’s admission process has a dual application option. You can also apply to the Economics PhD simultaneously, so if you are not selected for the finance program, you may be considered for economics.

- Courses include: Econometrics, corporate finance, and asset pricing.

- Duration: 5.5 years

- Financial aid: Tuition scholarship, stipends, health insurance, moving allowance, and subsidies.

- Location: Evanston, Illinois

The University of California Berkeley, Haas School of Business

The Haas School of Business in Berkeley is an innovative institution that questions the status quo, takes intelligent risks, and accepts sensible failures in its path to progress. This finance PhD program offers students opportunities to learn about cutting-edge research from faculty from around the world.

- Courses include: Corporate finance theory, stochastic calculus, and applications of psychology & economics.

- Tuition : Refer cost page

- Financial aid: Fellowships, grants, tuition allowance, stipends, teaching assistantships, and research assistantships.

- Acceptance rate: 17%

- Location: Berkeley, California

The University of Texas at San Antonio, Alvarez College of Business

The Alvarez College of Business is one of the forty largest business schools in the USA. It follows a comprehensive and practical approach to education that allows students to apply the knowledge they gain directly in the workplace. This PhD in finance encourages students to do collaborative research with the faculty, which helps them publish their own academic papers before they even complete the program.

- Courses include: Corporate finance, international financial markets, and microeconomic theory.

- Credits: 84 (post-bachelors)

- Financial aid: Scholarships, grants, work-study, teaching assistantships, research assistantships, research fellowships, and loans.

- Acceptance rate: 84%

- Location: San Antonio, Texas

Liberty University, School of Business

Doctor of Business Administration (DBA) in Finance

Liberty University is a non-profit institution among the top five online schools in the USA and has been offering fixed tuition fees for the past seven years. This is one of the best PhD in Finance programs you can do completely online. It aims to prepare students to address issues in business finance through research, best practices, and relevant literature.

- Courses: Managerial Finance, Investments & Derivatives, Business Valuation, etc.

- Credits: 60

- Duration: 3 years average

- Tuition : $595 per credit

- Financial aid: Grants, scholarships, work-study, veteran benefits, and loans.

- Delivery: Online

- Acceptance rate: 50%

- Location: Lynchburg, Virginia

Northcentral University

PhD in Business Administration (PhD-BA) – Finance Management

Northcentral University was founded with the objective of offering flexible, fully-online programs to working professionals around the world. This doctorate degree in finance online is flexible and allows you to design your own schedule. You will also get one-on-one personal mentoring from qualified faculty.

- Courses include: Business financial systems, business statistics, and business leadership & strategy.

- Duration: 84 months average

- Tuition: $1,105 per credit

- Financial aid: Grants, scholarships, and military scholarships.

- Acceptance rate: NA

- Location: Scottsdale, Arizona

Things To Consider When Choosing a Finance PhD Program

The right PhD program for you is a very personal decision and will depend on several individual factors.

However, these general questions will help you to make the right choice:

- Is the university properly accredited?

- Does the university conduct innovative and cutting-edge research?

- Are there renowned faculty members who you’ll want to work with?

- Do they offer subjects or specializations that match your career goals?

- What is the school’s placement history?

- What are the tuition fees, costs, and options for scholarships and financial aid?

- Does the program offer online study options?

It’s also important to consider if you want to pursue a career in academia or work in organizations as a senior finance professional. A PhD degree will generally set you up for a career in research or academia, while a DBA is more suited to a career in business or government.

Preparing for a Finance Doctorate Program

It’s important to start preparing early if you want to be selected for one of the best finance PhD programs.

These handy tips can help you put your best foot forward:

- Research the requirements of the best universities offering PhD in finance degrees, including pre-requisite subjects and qualifying grades. Keep these in mind when completing your bachelor’s or master’s degree.

- Understand your strengths and weaknesses in relation to the program’s requirements. Work on your weaknesses and continue to hone relevant skills.

- Read extensively in the field and keep up-to-date on regional and global developments.

- Join communities of finance professionals to build your network and be exposed to the latest knowledge in the discipline.

Skills You Gain from Earning a PhD in Finance

The most important skills you learn as a doctor of finance include:

- Communication skills, including writing and presentation skills

- Data analytical skills

- Economics and accounting skills

- Critical thinking skills

- Mathematical skills

- Analytical software skills

- Management and leadership skills

- Problem-solving skills

PhD Programs in Finance FAQs

How long does a phd in finance take.

PhD programs in finance usually take between three and eight years to complete.

Is It Worth Getting a PhD in Finance?

A PhD in Finance is a qualification that’s in high demand today. It is a terminal degree and can help you get top-level jobs with lucrative salaries in corporate or large organizations.

How Much Can You Make With a PhD in Finance?

With a finance doctorate, you can expect to earn a salary anywhere from around $45,000 to $150,000, depending on your experience, role, and the organization you work for. According to the BLS, the average salary for finance PhD holders is $131,710 .

What Do You Need To Get a PhD in Finance?

The admissions requirements vary depending on the program, but you’ll typically need a bachelor’s or master’s degree in finance. The programs can take three to eight years of coursework and research.

To apply, you’ll usually need to submit:

- Application

- Academic resume

- Academic transcripts

- Recommendation letters

- GRE or GMAT score

- Personal essay

Final Thoughts

With a doctorate in finance, you can build a rewarding career in academia, research, or the business sector. Like any doctorate, these programs ask for dedication and hard work. By planning early, you’ll set yourself up to pursue one of the best PhD programs in finance.

For more on how to build your career in the field, take a look at our guides to the best master’s degree in finance , the highest paying PhDs , and fully-funded PhD programs .

Lisa Marlin

Lisa is a full-time writer specializing in career advice, further education, and personal development. She works from all over the world, and when not writing you'll find her hiking, practicing yoga, or enjoying a glass of Malbec.

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ 30+ Best Dorm Room Essentials for Guys in 2024

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ 12 Best Laptops for Computer Science Students

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ ACBSP Vs AACSB: Which Business Program Accreditations is Better?

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ BA vs BS: What You Need to Know [2024 Guide]

The 7 Best Student Planner Apps

Most common industries to land a job out of college, related posts.

How New Grads Research Companies to Find Jobs

Experience Paradox: Entry-Level Jobs Demand Years in Field

Grad Trends: Interest in Artificial Intelligence Surges

Applying to Big Tech This Year? Here’s How to Ace It.

73% of job seekers believe a degree is needed for a well-paying role–but is it?

Tech Talent Crunch: Cities with More Jobs Than Workers

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- Last Mile Education Fund Paves the Way for Tech Students, Offers Lifeline Grants

- When to Apply for Grad School: Easy Monthly Timeline [2026-2027]

- 30+ Best Dorm Room Essentials for Guys in 2024

- Best Laptop for Programming Students in 2024

- The Sassy Digital Assistant Revolutionizing Student Budgeting

© 2024 TheGradCafe.com All rights reserved

- Partner With Us

- Results Search

- Submit Your Results

- Write For Us

Jump to navigation

Search form

The Graduate School

- Faculty/Staff Resources

- Programs of Study Browse the list of MSU Colleges, Departments, and Programs

- Graduate Degree List Graduate degrees offered by Michigan State University

- Research Integrity Guidelines that recognize the rights and responsibilities of researchers

- Online Programs Find all relevant pre-application information for all of MSU’s online and hybrid degree and certificate programs

- Graduate Specializations A subdivision of a major for specialized study which is indicated after the major on official transcripts

- Graduate Certificates Non-degree-granting programs to expand student knowledge and understanding about a key topic

- Interdisciplinary Graduate Study Curricular and co-curricular opportunities for advanced study that crosses disciplinary boundaries

- Theses and Dissertations Doctoral and Plan A document submission process

- Policies and Procedures important documents relating to graduate students, mentoring, research, and teaching

- Academic Programs Catalog Listing of academic programs, policies and related information

- Traveling Scholar Doctoral students pursue studies at other BTAA institutions

- Apply Now Graduate Departments review applicants based on their criteria and recommends admission to the Office of Admissions

- International Applicants Application information specific to international students

- PhD Public Data Ph.D. Program Admissions, Enrollments, Completions, Time to Degree, and Placement Data

- Costs of Graduate School Tools to estimate costs involved with graduate education

- Recruitment Awards Opportunities for departments to utilize recruitment funding

- Readmission When enrollment is interrupted for three or more consecutive terms

- Assistantships More than 3,000 assistantships are available to qualified graduate students

- Fellowships Financial support to pursue graduate studies

- Research Support Find funding for your research

- Travel Funding Find funding to travel and present your research

- External Funding Find funding outside of MSU sources

- Workshops/Events Find opportunities provided by The Graduate School and others

- Research Opportunities and programs for Research at MSU

- Career Development Programs to help you get the career you want

- Graduate Educator Advancement and Teaching Resources, workshops, and development opportunities to advance your preparation in teaching

- Cohort Fellowship Programs Spartans are stronger together!

- The Edward A. Bouchet Graduate Honor Society (BGHS) A national network society for students who have traditionally been underrepresented

- Summer Research Opportunities Program (SROP) A gateway to graduate education at Big Ten Academic Alliance universities

- Alliances for Graduate Education and the Professoriate (AGEP) A community that supports retention, and graduation of underrepresented doctoral students

- Recruitment and Outreach Ongoing outreach activities by The Graduate School

- Diversity, Equity, and Inclusion Funding Funding resources to recruit diverse students

- Graduate Student Organizations MSU has over 900 registered student organizations

- Grad School Office of Well-Being Collaborates with graduate students in their pursuit of their advanced degree and a well-balanced life

- Housing and Living in MI MSU has an on and off-campus housing site to help find the perfect place to stay

- Mental Health Support MSU has several offices and systems to provide students with the mental health support that they need

- Spouse and Family Resources MSU recognizes that students with families have responsibilities that present challenges unique to this population

- Health Insurance Health insurance info for graduate student assistants and students in general at MSU

- Safety and Security MSU is committed to cultivating a safe and inclusive campus community characterized by a culture of safety and respect

- Why Mentoring Matters To Promote Inclusive Excellence in Graduate Education at MSU

- Guidelines Guidelines and tools intended to foster faculty-graduate student relationships

- Toolkit A set of resources for support units, faculty and graduate students

- Workshops Workshops covering important topics related to mentor professional development

- About the Graduate School We support graduate students in every program at MSU

- Strategic Plan Our Vision, Values, Mission, and Goals

- Social Media Connect with the Graduate School!

- History Advancing Graduate Education at MSU for over 25 years

- Staff Directory

- Driving Directions

PhD Salaries and Lifetime Earnings

PhDs employed across job sectors show impressive earning potential:

“…[T]here is strong evidence that advanced education levels continue to be associated with higher salaries. A study by the Georgetown Center on Education and the Workforce showed that across the fields examined, individuals with a graduate degree earned an average of 38.3% more than those with a bachelor’s degree in the same field. The expected lifetime earnings for someone without a high school degree is $973,000; with a high school diploma, $1.3 million; with a bachelor’s degree, $2.3 million; with a master’s degree, $2.7 million; and with a doctoral degree (excluding professional degrees), $3.3 million. Other data indicate that the overall unemployment rate for individuals who hold graduate degrees is far lower than for those who hold just an undergraduate degree.” - Pathways Through Graduate School and Into Careers , Council of Graduate Schools (CGS) and Educational Testing Service (ETS), pg. 3.

Average salaries by educational level and degree (data from the US Census Bureau, American Community Survey 2009-2011, courtesy of the Georgetown University Center on Education and the Workforce):

|

|

| |||||||

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| AGRICULTURE and NATURAL RESOURCES | 52000 | 63000 | 79000 | 83000 | 9385 | 2174 | 620 | 571 |

| ARCHITECTURE | 63000 | 71000 | 78000 | 73000 | 3597 | 1470 | 294 | 68 |

| ARTS | 46000 | 55000 | 65000 | 67000 | 17693 | 4257 | 579 | 447 |

| BUSINESS | 62000 | 83000 | 102000 | 94000 | 137905 | 32908 | 5392 | 1201 |

| COMMUNICATIONS and JOURNALISM | 50000 | 61000 | 84000 | 72000 | 28938 | 6479 | 1260 | 473 |

| COMPUTERS and MATHEMATICS | 73000 | 90000 | 90000 | 104000 | 30666 | 11873 | 986 | 1557 |

| CONSUMER SERVICES and INDUSTRIAL ARTS | 63000 | 84000 | 94000 | 83000 | 4204 | 584 | 65 | 33 |

| EDUCATION | 42000 | 56000 | 63000 | 73000 | 39185 | 30819 | 2371 | 1397 |

| ENGINEERING | 79000 | 101000 | 104000 | 107000 | 44297 | 22903 | 2090 | 3831 |

| HEALTH | 63000 | 77000 | 103000 | 98000 | 32807 | 9492 | 4073 | 2051 |

| HUMANITIES and LIBERAL ARTS | 47000 | 59000 | 99000 | 69000 | 38955 | 19013 | 7414 | 3408 |

| LAW AND PUBLIC POLICY | 52000 | 65000 | 89000 | 84000 | 14350 | 3049 | 994 | 192 |

| PSYCHOLOGY and SOCIAL WORK | 43000 | 56000 | 83000 | 78000 | 23192 | 16036 | 2945 | 2624 |

| RECREATION | 45000 | 58000 | 75000 | 73000 | 5004 | 1493 | 310 | 199 |

| SCIENCE--LIFE/PHYSICAL | 54000 | 73000 | 125000 | 89000 | 28075 | 14646 | 13187 | 9868 |

| SOCIAL SCIENCE | 57000 | 75000 | 105000 | 90000 | 32617 | 14167 | 7566 | 1971 |

The Bureau of Labor and Statistics reports higher earnings and lower unemployment rates for doctoral degree holders in comparison to those with master’s and bachelor’s degrees:

According to national studies, more education translates not only to higher earnings, but also higher levels of job success and job satisfaction:

“Educational attainment – the number of years a person spends in school – strongly predicts adult earnings, and also predicts health and civic engagement. Moreover, individuals with higher levels of education appear to gain more knowledge and skills on the job than do those with lower levels of education and they are able, to some extent, to transfer what they learn across occupations.” - Education for Life and Work (2012), National Research Council of the National Academies, pg. 66.

- Call us: (517) 353-3220

- Contact Information

- Privacy Statement

- Site Accessibility

- Call MSU: (517) 355-1855

- Visit: msu.edu

- MSU is an affirmative-action, equal-opportunity employer.

- Notice of Nondiscrimination

- Spartans Will.

- © Michigan State University

Build a Career You'll Love

Phd in finance salary in the united states.

How much does a Phd In Finance make in the United States? The salary range for a Phd In Finance job is from $94,566 to $125,196 per year in the United States. Click on the filter to check out Phd In Finance job salaries by hourly, weekly, biweekly, semimonthly, monthly, and yearly.

- Per semimonth

- Connecticut

- District of Columbia

- Massachusetts

- Mississippi

- North Carolina

- North Dakota

- New Hampshire

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

- San Francisco, CA

- Washington, DC

- Chicago, IL

- New York, NY

HOW SHOULD YOU USE THIS DATA?

Employees: Use this as a guide for salary expectations, but be aware that responsibilities can change across companies for the same job title, so there may be differences between this data, other free site and our subscription products bought by employers.

Employers: This data could be used as reference point in your market pricing, but not the only source, due to differences across jobs locations, and sizes of companies.Consider additional sources like our Employer reported data.

Our consulting team crafts efficient, data-driven solutions using the power of CompAnalyst ® , ensuring your challenges are met head-on.

The trusted data and intuitive software your organization needs to get pay right.

Let our management tool - JobArchitect™ streamline your job description process. Say goodbye to the hassle of crafting job descriptions.

What Should I Pay?

Highest Paying Cities for Phd In Finance in the United States

States with Higher Salaries for Phd In Finance

How much do similar professions get paid in the united states, how much should you be earning, what does a phd in finance do.

The PhD program in Finance at ISCTE is a rigorous program designed to train students to produce high-quality research.

PhD Finance programs cover all areas of finance, often including such topics of study as corporate finance, asset pricing, investments, insurance, security prices, corporate governance, and the management and regulation of financial institutions, to name a few.

A PhD in finance provides a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics.

The PhD in Business Administration (PhD-BA), Concentration in Finance allows students to advance to the highest levels of business education.

There are many universities located all over the world that offer PhD Finance programs, each providing a unique local focus within a global perspective of finance.

Moreover, the job market for finance PhDs has been strong, and in recent years more positions have been available than candidates pursuing jobs.

Graduates holding a PhD Finance degree often go on to careers in Universities, consulting, and other careers in the financial services industry.

View Job Skills and Competency Data for more than 15,000 Job Titles, 18 Industries, and 26 Job Families.

Most Common Benefits for Phd In Finance

Related companies for phd in finance in the united states, frequently asked questions, do i receive fair pay as a phd in finance currently, what are the responsibilities of a phd in finance, how much do similar jobs to phd in finance make.

- Psychologist Phd

- Phd Chemist

- Phd Engineer

- Phd Scientist

- Phd Biology

- Phd Engineering

- Phd Neuroscience

- Phd Physics

- Phd Researcher

Where can I get a higher Phd In Finance salary in the United States?

What is the phd in finance's salary range in the united states, career insights.

- Youth Program

- Wharton Online

PhD Program

- Program of Study

Wharton’s PhD program in Finance provides students with a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics.

The department prepares students for careers in research and teaching at the world’s leading academic institutions, focusing on Asset Pricing and Portfolio Management, Corporate Finance, International Finance, Financial Institutions and Macroeconomics.

Wharton’s Finance faculty, widely recognized as the finest in the world, has been at the forefront of several areas of research. For example, members of the faculty have led modern innovations in theories of portfolio choice and savings behavior, which have significantly impacted the asset pricing techniques used by researchers, practitioners, and policymakers. Another example is the contribution by faculty members to the analysis of financial institutions and markets, which is fundamental to our understanding of the trade-offs between economic systems and their implications for financial fragility and crises.

Faculty research, both empirical and theoretical, includes such areas as:

- Structure of financial markets

- Formation and behavior of financial asset prices

- Banking and monetary systems

- Corporate control and capital structure

- Saving and capital formation

- International financial markets

Candidates with undergraduate training in economics, mathematics, engineering, statistics, and other quantitative disciplines have an ideal background for doctoral studies in this field.

Effective 2023, The Wharton Finance PhD Program is now STEM certified.

- Course Descriptions

- Course Schedule

- Dissertation Committee and Proposal Defense

- Meet our PhD Students

- Visiting Scholars

More Information

- Apply to Wharton

- Doctoral Inside: Resources for Current PhD Students

- Wharton Doctoral Program Policies

- Transfer of Credit

- Research Fellowship

- Concentrations

- Information Technology Management

- Operations Management

- Organizational Behavior

- Strategy and Innovation

A doctoral degree in finance qualifies you to pursue an academic career as a researcher and educator. An academic career provides not only tremendous intellectual freedom but makes it possible to work with bright people throughout your life. You can make a difference through the scholarly research you create, and the lives you shape through your teaching.

The starting salary for finance Ph.D. graduates’ often ranges from $180K to $250K, depending on placement, which is largely determined by performance in the doctoral program. Moreover, the job market for finance Ph.D.s has been strong, and in recent years more positions have been available than candidates pursuing jobs. It is not surprising that the position of a university professor is frequently ranked as one of the most desirable jobs in the world.

Finance Concentration Overview

Narayan Jayaraman, Thomas R. Williams- Wells Fargo Professor of Finance, gives an overview of the Finance concentration within the Scheller Ph.D. program.

“I started my Ph.D. journey at Scheller because its distinguished faculty members are known as the top-tier researchers in my field, and my Scheller experience has far exceeded my expectations. Faculty generously share their expertise and offer robust support for my research work, cultivating a warm and encouraging academic environment. This vibrant research atmosphere provided an ideal backdrop for me to fully commit to my research pursuits.”

– Wendi Du Ph.D. '24 Ph.D. Candidate Finance

Why Finance?

A Ph.D. in finance provides a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics. Students build on this foundation and apply these tools to study frontier issues in asset pricing, corporate finance, financial institutions, international finance, and behavioral finance. We develop the cutting-edge ideas that mutual fund managers, investment bankers, and CEOs use to make their firms more productive.

Why at Georgia Tech?

Georgia Tech Scheller's Ph.D. program is strongly research-oriented and emphasizes the early involvement of our students in research projects with worldwide leading faculty. The finance group has a proven track record of teaching students the skills necessary to conduct original research. Our Ph.D. students have gone on to publish a number of papers in leading finance journals. The Ph.D. program will also help you sharpen your instruction skills as you teach during the final years of the program. Given the small size of the program, the tutorial-mentor model is the primary educational approach employed. Thus, doctoral students experience significant attention and support from a diverse set of world-class faculty.

How Do I Finance the Program?

If admitted to the program, we’ll pay you to go to school to get your degree! Your tuition will be waived and you will receive a monthly stipend.

Tuition and Financing

“I learned various quantitative tools to gain a deeper understanding of financial institutions, corporate finance, and asset pricing, and my co-authored research was published in the Review of Finance. The Ph.D. program at Scheller has been a life-changing experience that has prepared me to pursue roles at the intersection of finance, economics, and programming.”

– Baridhi Malakar Ph.D. '23 Model Risk Analyst, Western Alliance Bank

Application Process

The application deadline is jan. 6 for admission the following fall semester (starting mid-august)., recent student placements.

- Bank of Korea

- Baruch College

- Emory University

- Florida International University

- Georgia State University

- Loyola University - Baltimore

- Loyola University - Chicago

- Rutgers University

- San Jose State University

- Singapore Management University

- University of Central Florida

- University of Connecticut

- University of Georgia

- University of Hawaii

- University of Rhode Island

- University of South Florida

- University of Texas, Dallas

- University of Wyoming

Recent Research Areas

- Monetary policy and financial markets

- Household finance

- Financial econometrics

- International capital markets and corporate finance

- Informational imperfections in capital markets and corporate financial policy, including dividend policy, capital structure theory, the capital acquisition process, corporate restructuring, and entrepreneurial finance

- Portfolio management and asset pricing

- Theory of financial intermediation and analysis of financial services

- Valuation of derivative securities and the expansion of derivative securities markets

Finance News

This website uses cookies. For more information review our Cookie Policy

FellowshipBard

Phd in finance: requirements, salary, jobs, & career growth, what is phd in finance.

A PhD in Finance is a doctoral-level academic degree program in finance that focuses on advanced research and theoretical study. It is intended for people who want to work in academia, research, or advanced positions in the financial industry.

A PhD in Finance usually entails extensive training in finance, economics, statistics, and research methods. It also necessitates the completion of a substantial research project, frequently in the form of a dissertation, in which the student conducts original research and contributes to the body of knowledge in finance.

A PhD in Finance program’s curriculum may include financial theory, investments, corporate finance, financial econometrics, risk management, asset pricing, derivatives, and other specific fields of finance. Quantitative research approaches, such as econometrics, statistical modeling, and data analysis, may also be emphasized in the program.

How much money do people make with a PhD in Finance?

Individuals with a PhD in Finance can earn a wide range of salaries depending on criteria such as their years of experience, location, company, and job duties. PhD holders in Finance typically earn better income than people with less schooling in the industry, as their postgraduate degree denotes knowledge and specialization.

PhD holders in Finance may work in academia as professors or researchers in universities or business schools. According to the US Bureau of Labor Statistics (BLS), the median annual income for postsecondary business teachers (including finance professors) was $83,960 in May 2020.

Salaries, on the other hand, can range from $50,000 to far over $150,000 or more, depending on factors such as rank, experience, and location.

Individuals with a PhD in Finance may work in the private sector as financial analysts, quantitative researchers, risk managers, investment managers, or consultants, among other positions. Salaries in the private sector can vary greatly depending on job title, level of responsibility, and business size and location.

According to Glassdoor data, the average annual pay for a financial analyst with a PhD in Finance in the United States in 2021 was roughly $102,000, while a quantitative researcher with a PhD in Finance may earn $150,000 or more per year.

What is expected job growth with PhD in Finance?

As businesses and organizations rely on financial skills to manage their operations, investments, and risk, the field of finance is projected to evolve and flourish.

Finance experts with extensive education and specialized knowledge, such as those with a PhD in Finance, may be in high demand in academic and research contexts, as well as professions requiring advanced quantitative and analytical skills.

According to the U.S. Bureau of Labor Statistics (BLS), employment of postsecondary teachers, particularly business teachers (such as finance professors), is expected to expand 9 percent from 2020 to 2030, faster than the national average. The need for higher education, as well as the ongoing demand for research and education, are driving this predicted growth.

What can you do with a PhD in Finance?

A PhD in Finance can lead to a variety of professional prospects in a variety of fields. Individuals with a PhD in Finance may pursue the following professional paths:

1. Academia: Many PhDs in Finance go on to become professors or researchers at universities or business schools. They may teach finance classes, conduct research, publish scholarly articles, and contribute to the progress of financial knowledge through their research findings. In addition, they may mentor and advise students, oversee dissertations, and attend academic conferences and seminars.

2. Research: PhD holders in Finance may work in research-related positions in university institutions, government agencies, or private research enterprises. They may perform novel research on financial markets, investments, risk management, corporate finance, or other finance-related topics. Their discoveries can help to build financial theories, models, and regulations, and they may have practical implications in the financial business.

3. Financial Services: PhD holders in Finance may work as financial analysts, quantitative researchers, risk managers, or investment managers in the financial services industry. They may evaluate financial data, design investment plans, manage risks, and provide strategic financial advise to customers or organizations using their sophisticated knowledge of finance and mathematical skills.

4. Consulting: PhD holders in Finance may operate as financial consultants, providing clients with specific experience in areas such as investment management, risk management, financial analysis, or corporate finance. They may operate in consulting firms, financial advisory firms, or specialist consulting practices within bigger corporations, advising clients on strategic financial matters.

5. Policymaking and government: Finance PhD holders may work in government agencies, international organizations, or policy-making institutions, providing knowledge in financial policy, regulations, or economic analysis. They may be involved in the development of financial policies, the assessment of the impact of financial legislation, or the provision of strategic financial advice to government agencies or policymakers.

6. Corporate Finance: PhD holders in Finance may work in corporations, particularly in financial strategy, capital budgeting, risk management, or financial analysis areas. They may offer financial advice in strategic decision-making, financial planning and analysis, investment analysis, or corporate valuation, assisting firms in improving their financial performance.

7. Entrepreneurship and Innovation: PhD holders in Finance may apply their financial skills to entrepreneurial initiatives or professions requiring innovation. They may work at start-ups, venture capital companies, or innovation-focused organizations, where they evaluate business models, assess investment opportunities, manage financial risks, and provide strategic financial advise to assist entrepreneurial activities.

What are the requirements for a PhD in Finance?

The particular criteria for a PhD in Finance can differ depending on the university or educational institution that offers the program, as well as the country or location in which the program is located. However, some common PhD in Finance requirements often include:

1. Educational Qualifications: Most PhD programs in Finance require applicants to have a solid educational background, often a master’s degree in a relevant topic such as finance, economics, business, or a comparable quantitative study. Some schools may accept applicants with a bachelor’s degree, however this is uncommon and sometimes necessitates additional requirements or experience.

2. Graduate Admissions examinations: Applicants to PhD programs in Finance may be required to submit results from standardized graduate admissions examinations such as the Graduate Record Examination (GRE) or the Graduate Management Admission Test (GMAT). (GMAT). These assessments measure applicants’ abilities in areas such as verbal reasoning, quantitative reasoning, and analytical writing.

3. Research Proposal: Because the PhD in Finance program is research-intensive, applicants may be required to submit a research proposal explaining their intended study topic or research interests. Typically, this proposal comprises a summary of the research issue, study aims, methodology, and predicted contributions to the subject of finance.

4. Academic Transcripts: Typically, applicants must produce official transcripts from their previous undergraduate and graduate degrees, demonstrating their academic record and achievements.

5. Letters of Recommendation: Applicants may be expected to present letters of recommendation from academic or professional sources who can speak to their abilities, skills, and prospects for success in a PhD program.

6. Statement of Purpose: Applicants are often required to provide a statement of purpose explaining their rationale for obtaining a PhD in Finance, as well as their professional objectives and research interests. This statement assists the admissions committee in determining the applicant’s fit with the program and their likelihood of success.

7. English Language Proficiency: Many PhD programs in Finance may demand confirmation of English language proficiency for applicants whose native language is not English, such as scores from the Test of English as a Foreign Language (TOEFL) or the International English Language Testing System. (IELTS).

8. Interviews: As part of the admissions process, several PhD programs in Finance may ask applicants to engage in an interview. This interview may take place in person, over the phone, or via video conference, and it will assess the applicant’s research interests, academic abilities, and enthusiasm for pursuing a PhD in Finance.

Looking For Scholarship Programs? Click here

How long does it take to get a phd in finance.

The time it takes to earn a PhD in Finance depends on a number of factors, including the program structure, the student’s progress, and the individual’s dedication to their study. However, it usually takes 4 to 5 years of full-time study to get a PhD in Finance.

The completion of a PhD in Finance can be divided into many stages, which may differ based on the program and the individual’s progress:

1. Coursework: During the first year of a PhD in Finance program, students often do coursework to provide a solid foundation in finance theory, research methods, and other related fields. Coursework time varies, but it normally takes 1 to 2 years to finish.

2. Comprehensive Exams: Some PhD programs in Finance require students to complete comprehensive exams after completing courses to demonstrate their knowledge and expertise in the discipline. Depending on the program’s requirements, comprehensive exam preparation and completion can take several months to a year.

3. Research Proposal: After passing the comprehensive tests, students usually work on writing and defending a research proposal outlining their desired study topic, methodology, and expected contributions to the discipline. The development and defense of the research proposal might take several months to a year or more, depending on the complexity of the research and the student’s progress.

4. Dissertation Research: Following the successful defense of the research proposal, students begin their dissertation research, which is the capstone of their PhD program. The dissertation research stage’s time might vary greatly based on the research topic, methodology, data gathering, and analysis needs. The dissertation research and writing process normally takes two to three years or more.

5. Dissertation Defense: After completing their dissertation, students usually defend their research findings in front of a committee of faculty members. The time it takes to schedule and complete the dissertation defense can vary, although it normally takes several months to a year or more, depending on committee member availability and other practical concerns.

Looking For Fully Funded PhD Programs? Click Here

Do you need a masters in finance to get a phd in finance.

A Master’s degree in Finance or a similar discipline is not always required for entrance to a PhD program in Finance. However, admission requirements may differ based on the program and institution.

Some PhD programs in Finance may require applicants to have a Master’s degree in a relevant discipline, whereas others may allow applicants with only a Bachelor’s degree provided they have additional qualifications or experience.

A Master’s degree in Finance or a closely related discipline can provide a solid foundation in finance theory, research methodologies, and mathematical skills, which can be useful for PhD study in Finance.

It can also reflect a greater degree of academic preparation and may assist applicants in standing out during the difficult admissions process.

Some PhD programs in Finance, however, may provide a combined Master’s and PhD program in which students acquire a Master’s degree while pursuing their PhD. In such instances, admittance may not require a separate Master’s degree.

What are the Best PhD in Finance Degree programs?

1. massachusetts institute of technology (mit) – phd in finance 2. stanford university – phd in finance 3. university of chicago – phd in finance 4. columbia university – phd in finance and economics 5. new york university (nyu) – phd in finance 6. university of pennsylvania (wharton) – phd in finance 7. harvard university – phd in business economics (with a concentration in finance) 8. university of california, berkeley (haas) – phd in finance 9. princeton university – phd in finance 10. northwestern university (kellogg) – phd in finance, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

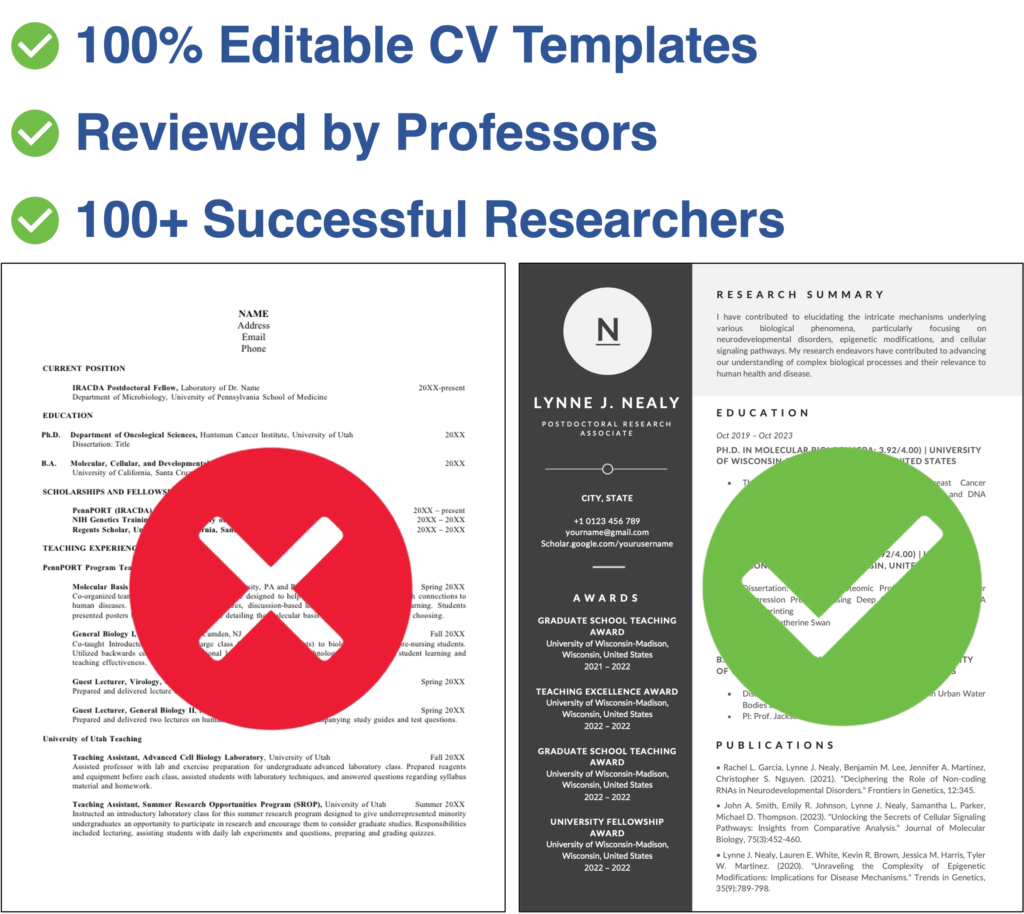

Professors Not Responding? Your CV May Be the Reason.

Try Our Ready-to-Use CV Templates Land You in Harvard, MIT, Oxford, and Beyond!

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

The field of finance covers the economics of claims on resources. Financial economists study the valuation of these claims, the markets in which they are traded, and their use by individuals, corporations, and the society at large.

At Stanford GSB, finance faculty and doctoral students study a wide spectrum of financial topics, including the pricing and valuation of assets, the behavior of financial markets, and the structure and financial decision-making of firms and financial intermediaries.

Investigation of issues arising in these areas is pursued both through the development of theoretical models and through the empirical testing of those models. The PhD Program is designed to give students a good understanding of the methods used in theoretical modeling and empirical testing.

Preparation and Qualifications

All students are required to have, or to obtain during their first year, mathematical skills at the level of one year of calculus and one course each in linear algebra and matrix theory, theory of probability, and statistical inference.

Students are expected to have familiarity with programming and data analysis using tools and software such as MATLAB, Stata, R, Python, or Julia, or to correct any deficiencies before enrolling at Stanford.

The PhD program in finance involves a great deal of very hard work, and there is keen competition for admission. For both these reasons, the faculty is selective in offering admission. Prospective applicants must have an aptitude for quantitative work and be at ease in handling formal models. A strong background in economics and college-level mathematics is desirable.

It is particularly important to realize that a PhD in finance is not a higher-level MBA, but an advanced, academically oriented degree in financial economics, with a reflective and analytical, rather than operational, viewpoint.

Faculty in Finance

Anat r. admati, juliane begenau, jonathan b. berk, michael blank, greg buchak, antonio coppola, darrell duffie, steven grenadier, benjamin hébert, arvind krishnamurthy, hanno lustig, matteo maggiori, paul pfleiderer, joshua d. rauh, claudia robles-garcia, ilya a. strebulaev, vikrant vig, jeffrey zwiebel, emeriti faculty, robert l. joss, george g.c. parker, myron s. scholes, william f. sharpe, kenneth j. singleton, james c. van horne, recent publications in finance, monetary tightening and u.s. bank fragility in 2023: mark-to-market losses and uninsured depositor runs, trading stocks builds financial confidence and compresses the gender gap, expectations and the neutrality of interest rates, recent insights by stanford business, a “grumpy economist” weighs in on inflation’s causes — and its cures, the surprising economic upside to money in u.s. politics, your summer 2024 podcast playlist.

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- RKMA Market Research Handbook Series

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

About / Departments

Finance Department | PhD Program

Phd program.

Our faculty, ranked #1 worldwide based on publications in top finance journals (ASU Finance Rankings), consists of more than 30 researchers who study all major areas of finance, making it one of the largest finance faculty in the country. Stern’s finance faculty is highly rated in terms of research output, and faculty members sit on the editorial boards of all major finance journals.

The finance department offers an exceptionally large range of courses devoted exclusively to PhD students. Apart from core PhD courses in asset pricing and corporate finance, students can choose from a range of electives such as household finance, macro-finance, and financial intermediation. PhD students also enjoy the benefits of Stern’s economics department, NYU’s economics department in the Graduate School of Arts and Science (GSAS), and the Courant Institute of Mathematics.

Graduates of Stern’s Finance PhD program have been placed at leading research institutions such as Harvard, MIT, Chicago, Stanford, Wharton, Yale, and UCLA.

Holger Mueller , Finance PhD coordinator

More information on the Finance PhD

Download the Finance PhD poster (PDF)

Explore Stern PhD

- Meet with Us

This website uses cookies to ensure the best user experience. Privacy & Cookies Notice Accept Cookies

Manage My Cookies

Manage Cookie Preferences

| NECESSARY COOKIES These cookies are essential to enable the services to provide the requested feature, such as remembering you have logged in. | ALWAYS ACTIVE |

| Accept | Reject | |

| PERFORMANCE AND ANALYTIC COOKIES These cookies are used to collect information on how users interact with Chicago Booth websites allowing us to improve the user experience and optimize our site where needed based on these interactions. All information these cookies collect is aggregated and therefore anonymous. | |

| FUNCTIONAL COOKIES These cookies enable the website to provide enhanced functionality and personalization. They may be set by third-party providers whose services we have added to our pages or by us. | |

| TARGETING OR ADVERTISING COOKIES These cookies collect information about your browsing habits to make advertising relevant to you and your interests. The cookies will remember the website you have visited, and this information is shared with other parties such as advertising technology service providers and advertisers. | |

| SOCIAL MEDIA COOKIES These cookies are used when you share information using a social media sharing button or “like” button on our websites, or you link your account or engage with our content on or through a social media site. The social network will record that you have done this. This information may be linked to targeting/advertising activities. |

Confirm My Selections

- MBA Programs

- Specialized Masters Programs

- Other Offerings

- Request Information

- Start Your Application

- Dissertation Areas and Joint PhD Programs

- PhD Career Outcomes

- PhD Proposals and Defenses

- PhD Job Market Candidates

- PhD Research Community

- 100 Years of Pioneering Research

- Rising Scholars Conference

- Yiran Fan Memorial Conference

- Frequently Asked Questions

- PhD in Accounting

- PhD in Behavioral Science

- PhD in Econometrics and Statistics

- PhD in Economics

PhD in Finance

- PhD in Management Science and Operations Management

- PhD in Marketing

- Joint Program in Financial Economics

- Joint Program in Psychology and Business

- Joint PhD/JD Program

Chicago Booth has long been recognized for its PhD in finance. Our finance faculty—which includes Nobel laureates Douglas W. Diamond, Eugene F. Fama, and Lars P. Hansen—sets the course for research in all areas of the field.

As a finance PhD student at Chicago Booth, you’ll join a community that encourages you to think independently.

Taking courses at Booth and in the university’s Kenneth C. Griffin Department of Economics, you will gain a solid foundation in all aspects of economics and finance--from the factors that determine asset prices to how firms and individuals make financial decisions. Following your coursework, you will develop your research in close collaboration with faculty and your fellow students. Reading groups and workshops with faculty, student-led brown-bag seminars, and conferences provide many opportunities to learn from others.

The Finance PhD Program also offers the Joint Program in Financial Economics , which is run by Chicago Booth and the Department of Economics in the Division of the Social Sciences at the University of Chicago.

Our Distinguished Finance Faculty

Chicago Booth finance faculty are leading researchers who also build strong relationships with doctoral students, collaborate on new ideas, and connect students with powerful career opportunities.

Francesca Bastianello

Assistant Professor of Finance and Liew Family Junior Faculty Fellow, Fama Faculty Fellow

Emanuele Colonnelli

Professor of Finance and Entrepreneurship

George M. Constantinides

Leo Melamed Professor of Finance

Douglas W. Diamond

Merton H. Miller Distinguished Service Professor of Finance

Eugene F. Fama

Robert R. McCormick Distinguished Service Professor of Finance

Niels Gormsen

Neubauer Family Associate Professor of Finance and Fama Faculty Fellow

Lars Hansen

David Rockefeller Distinguished Service Professor The University of Chicago Departments of Economics, Statistics and the Booth School of Business

John C. Heaton

Joseph L. Gidwitz Professor of Finance

Steven Neil Kaplan

Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance and Kessenich E.P. Faculty Director at the Polsky Center for Entrepreneurship and Innovation

Anil Kashyap

Stevens Distinguished Service Professor of Economics and Finance

Ralph S.J. Koijen

AQR Capital Management Distinguished Service Professor of Finance and Fama Faculty Fellow

Professor of Finance and Fama Faculty Fellow

Stefan Nagel

Fama Family Distinguished Service Professor of Finance

Scott Nelson

Assistant Professor of Finance and Cohen and Keenoy Faculty Scholar

Pascal Noel

Neubauer Family Professor of Finance and Kathryn and Grant Swick Faculty Scholar

Lubos Pastor

Charles P. McQuaid Distinguished Service Professor of Finance and Robert King Steel Faculty Fellow

Raghuram G. Rajan

Katherine Dusak Miller Distinguished Service Professor of Finance

Bruce Lindsay Distinguished Service Professor of Economics and Public Policy

Quentin Vandeweyer

Assistant Professor of Finance and Fama Faculty Fellow

Pietro Veronesi

Deputy Dean for Faculty and Chicago Board of Trade Professor of Finance

Robert W. Vishny

Myron S. Scholes Distinguished Service Professor of Finance and Neubauer Faculty Director of the Davis Center

Michael Weber

Associate Professor of Finance

Anthony Lee Zhang

Luigi Zingales

Robert C. McCormack Distinguished Service Professor of Entrepreneurship and Finance

Professor of Economics and Finance

Alumni Success

Graduates of the Stevens Doctoral Program go on to successful careers in prominent institutions of higher learning, leading financial institutions, government, and beyond.

Shohini Kundu, MBA '20, PhD '21

Assistant Professor of Finance UCLA Anderson School of Management, University of California, Los Angeles Shohini Kundu's research lies in financial intermediation and macroeconomics, security design and externalities of financial contracts, and emerging market finance. Her dissertation area is in finance.

Jane (Jian) Li, PhD '21

Assistant Professor of Business, Finance Division Columbia Business School, Columbia University Jane's research lies at the intersection of macroeconomics and finance. She is particularly interested in how financial intermediaries affect the real economy and how different types of financial institutions can contribute to financial instability. Her dissertation area is in financial economics.

Spotlight on Research

The pages of Chicago Booth Review regularly highlight the research findings of finance faculty and PhD students.

A Brief History of Finance and My Life at Chicago

Chicago Booth’s Eugene F. Fama describes the serendipitous events that led him to Chicago, and into his monumental career in academic finance.

Climate-Policy Pronouncements Boost 'Brown' Stocks

It was a dramatic example of how White House communications on climate policy can affect asset prices, according to Washington University in St. Louis’s William Cassidy, a recent graduate of Booth’s PhD Program.

With Business Loans Harder to Get, Private Debt Funds Are Stepping In

It’s become harder for many prospective borrowers to access capital. But private debt funds have stepped in to fill the gap, according to Joern Block (Trier University), Booth PhD candidate Young Soo Jang, Booth’s Steve Kaplan, and Trier’s Anna Schulze.

Too Many 'Shadow Banks' Can Limit Overall Access to Credit

While go-betweens can benefit the broader economy by smoothing the flow of credit, there are now probably too many links in the credit chain, argue Zhiguo He and Jian Li (Booth PhD graduate).

A Network of Support

Chicago Booth is home to several interdisciplinary research centers that offer funding for student work, host workshops and conferences, and foster a strong research community.

Fama-Miller Center for Research in Finance Tasked with pushing the boundaries of research in finance, the Fama-Miller Center provides institutional structure and support for researchers in the field.

Becker Friedman Institute for Economics Bringing together researchers from the entire Chicago economics community, the Becker Friedman Institute fosters novel insights on the world’s most difficult economic problems.

Center for Research in Security Prices CRSP maintains one of the world’s largest and most comprehensive stock market databases. Since 1963, it has been a valued resource for businesses, government, and scholars.

Kent A. Clark Center for Global Markets Enhancing the understanding of business and financial market globalization, the Clark Center positions Chicago Booth as a thought leader in the understanding of ever-changing markets and improves financial and economic decision-making around the world.

George J. Stigler Center for the Study of the Economy and the State Dedicated to examining issues at the intersection of politics and the economy, the Stigler Center supports research by PhD students and others who are interested in the political, economic, and cultural obstacles to better working markets.