Talk to our experts

1800-120-456-456

- Indian Contract Act 1872

An Introduction

I f we look into the history of the Indian contract act 1872, it can be considered as one of the oldest laws related to business in the country. Indian Contract Act 1872 was enacted on 1st September of that year. The law applied to almost all the states of India except Jammu & Kashmir. The Indian contract law is the main law that regulates any contracts signed in India. There are 266 sections in the law. Let us learn some important points related to the IPCC contract act notes.

What is a Contract?

The Indian contract act defines all the important laws related to the contract. Therefore, it is important to know what a contract is. It is an accepted agreement or proposal; that is legally defined, understood, and enforceable by law. It defines the special rights of the party and all the obligations and rules introduced, defined, discussed, and agreed upon by all the signers of the contract.

There are certain essentials related to any contract.

It has to involve at least two parties

The content of the contract must clearly define and discuss the intent of legal obligations.

The contract can also have special provisions, which, when not fulfilled by any of the parties, renders the contract ineffective.

The contract must have clearly defined terms in its list.

The contract might also have specific points related to any performance. The performance has to be executed by either or both parties.

For a successful contract, the consent of both parties is necessary.

All the parties in a contract should be competent enough to sign the contract.

All the signing parties must consider getting something in return in the form of rights, profits, interests, etc.

The contract will be deemed illegal if it is unlawful, can challenge or attack any section of any law, cause harm to any individual, or if the Court considers it to be immoral.

Types of Contracts

From the beginning of the history of the Indian contract act 1872, all the IPCC contract act notes defined different types of contracts. Based on validity, the types of contracts are valid contracts, agreements or void contracts, voidable contracts, illegal contracts, and enforceable contracts. On the basis of formation, the types of contracts are express contracts, quasi-contract, implied contracts, and E-contract. Based on performance, contract types are executed contracts, unilateral contracts, executory contracts, and bilateral contracts.

What is an Offer or a Proposal?

According to Section 2 (a) of the Indian Contract Act, 1872, the proposal is defined as the offer placed by a party for another party to do or abstain from doing an act, where the proposer expects to obtain consent from the other person. The person making the proposal is called the offeror or promisor, while the party accepting the proposal is called the acceptor or the promisee. The offer can be positive or negative.

According to Section 2 (b) of the Indian Contract Act, 1872, acceptance is defined as the act of the receiving party in providing consent to the proposer. The consent from the acceptor turns the proposal into a promise.

Communication of Acceptance and Offer

Any offer after being presented by the offeror cannot be revoked. However, communication is not complete by such an act. Rather it is completed when all the norms of the offer are clearly described and are accepted by the acceptor. The communication is generally completed when it is conducted face-to-face; in terms of business letters and e-communications, the timeline of communication is necessary in this case.

What are the types of offers?

The first step in the formation of a contract is the formulation of an offer. Since acceptance can only be made to an offer that has already been stated, prior acceptance to any offer cannot be provided, therefore, an offer is very important for formulating a valid contract. Offers in a contract can be of different types like

Express offer: these are the offers that are made in the form of words, that is, these offers are in a written form.

Implied offers: these are the offers that are made in any other way but are not in the form of words. For example, a bid made in an auction is a type of implied offer as it is not written in the form of words.

General offer: this is a kind of offer that is made to the world at a large, that is, these offers are not made to any specific person but to the complete world. If the conditions in an offer are such that they can be completed by many, then, in that case, the offer is known as the general offer of continuing nature, but if an offer made is such that only a single person can complete it, for example, offers made to find a missing person, then in such a case the offers are closed as soon as the first information is collected.

Specific offer: these offers are made to only a specific person and, therefore, such offers can be accepted by that specific person only and not by anyone else. In case of specific offers made for a certain personal service, then in that case no other party has the authority to come in and take a stance that he is the party with which the contract has been made.

Cross offer: this is a type of offer in which two parties make a similar offer to each other without any prior information about the offer made by the other. Cross offers are not considered valid offers because there is no mutual acceptance in this case. This is because for an offer to be valid there should be an offer and an acceptance for the same, but in the case of a cross offer, there is only a simultaneous offer and no acceptance.

Counteroffer: this is the form of offer framed by the accepting party with certain modifications in the original offer, that is, you accept the original offer but with certain amendments in the original offer, thereby giving a new offer in response to the original offer. This is known as partial acceptance, that is, the accepting party agrees to certain facts in the offer which are beneficial to them and rejects the other clause of the offer. For an offer to be valid, complete acceptance is required and not partial acceptance.

Revocation of Offers

An offer can be revoked if it is not found to be fruitful by any of the parties. Every offer has a defined revocation period, after which it cannot be revoked. Moreover, it can be revoked before the completion of acceptance. The acceptance can also be revoked by the acceptor.

Section 62 of the Indian Contract Act, 1872

According to Section 62 of the Indian Contract Act, 1872, if any of the parties prefer to propose any new contract or modify the previous one, then the previous contract will not need to be followed. The contractors can rescind the contract as well. However, as per Section 62 of the Indian Contract Act, a new contract will only be allowed to be proposed when all the parties agree to it.

FAQs on Indian Contract Act 1872

1. What is a Contract?

A contract is any offer that is being placed between two or more parties. According to the history of the Indian contract act 1872, the Government of India has defined specific laws to support any contract. According to the law, two or more than two parties have to be involved in any contract. In the contract, any offer will be placed between the parties, when the points mentioned in the offer will be clearly defined. The offer will be placed by the offeror, while the other parties who need to speak about their opinion on the matter are called acceptors.

2. What are the different types of Contracts?

According to the IPCC contract act notes, there are different types of contracts depending on a variety of parameters. On the basis of formation, the types of contracts are express contracts, quasi-contract, implied contract, and E-contract. On the basis of validity, the types of contracts are valid contracts, agreements or void contracts, voidable contracts, illegal contracts, and enforceable contracts. Based on performance, the contract types are executed contracts, unilateral contracts, executory contracts, and bilateral contracts. These different types of contracts are defined in the Indian contract act and have been incorporated from time to time.

3. What is the Proposal, Acceptance and Communication needed for a Contract?

Every contract has some salient points which depict some future action. These are called proposals or offers. The party that offers these proposals are called proposers. All the other parties who react to such offers are called acceptors. The acceptors can accept the proposal, reject it, or put it on hold. Proper communication is necessary for both the proposer and the acceptor. Face-to-face communication is always fruitful. For business letters or e-communications, the timing of the communication is necessary for the success of the communication and the related contract.

4. What are the essentials of a valid contract as provided by the Indian Contract Act, 1872?

There are various elements that are essential for a contract to be considered valid which are:

The contract must involve at least two parties for it to be valid wherein, one party will make the proposal and the other will accept it.

Both the parties involved in a contract are required to have a legal existence like a company or organization or they must be natural persons.

There must be a clear intention of the parties involved in the contract to create a legal relationship between them.

The agreements must be enforceable by the law to consider them as valid contracts.

The case-specific contract must fulfill the special conditions attached to it, in order to declare them as legal and valid.

There should be a certain meaning of the contract and nothing should be left undeclared in a contract.

The agreement or the contract should be framed with clauses and conditions that are possible to perform.

The contract should be signed with the free consent of both the parties involved, that is, neither of the parties should be coerced, influenced, tricked, or misrepresented.

The contract must be designed in a way that the parties involved in the contract gain some rights, profit, or interest.

5. What are the criteria for a party to be competent for a contract according to section 11 of the Indian Contract Act, 1872?

For an individual to be competent for a contract, considerations like their age, mental status, and they shouldn't be disqualified from contracting by any law to which they are a part. The major qualifications for a person to be eligible to sign a contract are:

The person’s age must be at least 18 years or more.

The person or the party into consideration must be able to understand all the terms and promises stated in the contract at the time of framing of the contract itself.

The party or the person into consideration must not be disqualified from any legal ramifications.

Indian Contract Act 1872 | Business Law

- Post last modified: 29 May 2023

- Reading time: 30 mins read

- Post category: Business Law

Indian Contract Act, 1872

The Law of Contract constitutes the most important branch of Mercantile or Commercial Law. It is the foundation upon which the superstructure of modern business is built.

It affects everybody, more so, trade, commerce and industry. It may be said that the contract is the foundation of the civilized world.

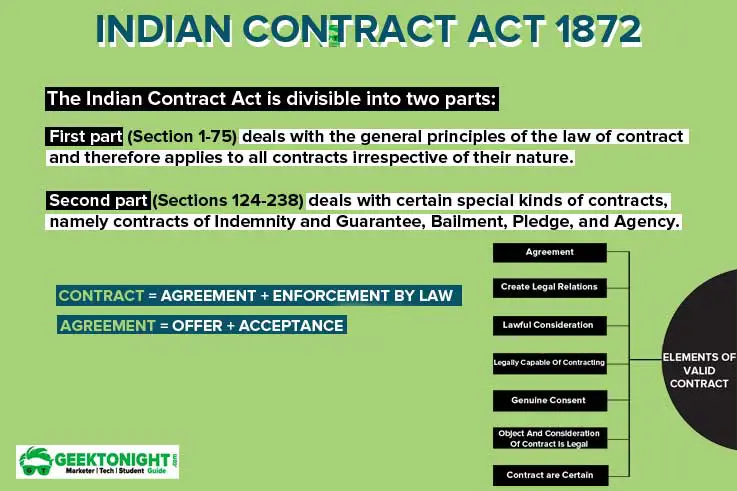

The Indian Contract Act is divisible into two parts.

- The first part (Section 1-75) deals with the general principles of the law of contract and therefore applies to all contracts irrespective of their nature.

- The second part (Sections 124-238) deals with certain special kinds of contracts , namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency.

Table of Content

- 1 Indian Contract Act, 1872

- 2.1 Agreement

- 2.2 Promise

- 3.1 Offer and Acceptance

- 3.2 Consent

- 3.3 Capacity of the parties

- 3.4 Consideration

- 3.5 Not expressly declared to be void

- 6 Business Law Notes

- 7 Business Law Book References

What is Contract?

According to section 2(h) of the Indian Contract Act , 1872 “ An agreement enforceable by law is a contract. “

A contract is a combination of the two elements:

- There must be an agreement

- Agreement must be enforceable by law (obligation)

Contract = Agreement + Enforcement by law

Section 2(e) “ Every promise and every set of promises, forming the consideration for each other, is an agreement. ” Thus it is clear from this definition that a ‘promise’ is an agreement.

Agreement = offer + Acceptance

Section 2(b) “ when the person to whom the proposal is made signifies his assent thereto, the proposal is said to be accepted. A proposal, when accepted, becomes a promise. “

An agreement, therefore, comes into existence when one party makes a proposal or offer to the other party and that other party signifies his assent thereto.

Following are the characteristics of an agreement:

- Plurality of persons : There must be two or more persons to make an agreement because one person cannot enter into an agreement with himself.

- Consensus ad idem : The meeting of the minds is called consensus-ad-idem. It means both the parties to an agreement must agree about the subject matter of the agreement in the same sense and at the same time.

Legal obligation

As stated above, an agreement to become a contract must give rise to a legal obligation i.e. a duty enforceable by law.

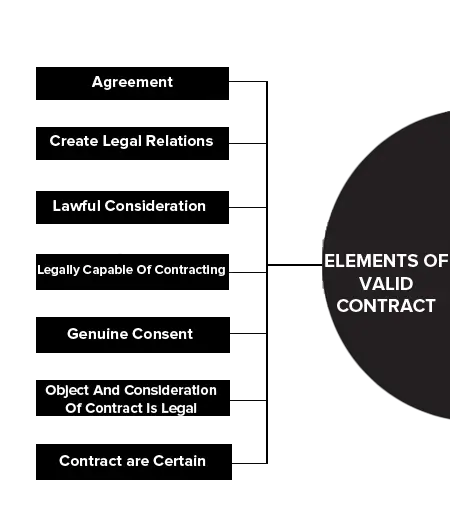

- Elements of a Valid Contract

Section 10 of the Indian Contract Act, 1872 provides that “ all agreements are contracts if they are made by the free consent of parties competent to contract, for a lawful consideration and with a lawful object, and are not hereby expressly declared to be void ”.

Thus, the essential elements of a valid contract are as follows:

- An offer or proposal by one party and acceptance of that offer by another party resulting in an agreement —consensus-ad-idem.

- An intention to create legal relations or intent to have legal consequences.

- The agreement is supported by a lawful consideration .

- The parties to the contract are legally capable of contracting .

- Genuine consent between the parties.

- The object and consideration of the contract is legal and is not opposed to public policy.

- The terms of the contract are certain .

Therefore, to form a valid contract there must be (i) an agreement (ii) based on the genuine consent of the parties , (iii) supported by a lawful consideration , (iv) made for a lawful object , and (v) between the competent parties .

Offer and Acceptance

Firstly, there must be an offer and its acceptance.

Such offer and acceptance should create legal obligations between parties . This should result in a moral duty on the person who promises or offers to do something.

Similarly, this should also give a right to the promise to claim its fulfilment . Such duties and rights should be legal and not merely moral.

Case law : In Balfour v. Balfour , a husband promised to pay maintenance allowance every month to his wife, so long as they remain separate. When he failed to perform this promise, she brought an action to enforce it. As it is an agreement of domestic nature, it was held that it does not contemplate to create any legal obligation.

Consent means ‘ knowledge and approval ’ of the parties concerned.

A contract is made when one person makes an offer while another person accepts the offer. This acceptance of the offer should be made without any force or threat . It means that a consent given should be free and genuine.

Example : A has two Bike – one black and the other white. He offers to sell one of his Bike to B. A intends to sell the black one while B accepts the offer believing that it is for the white Bike. Here, A and B are not thinking in the same sense of a particular thing. In this situation, there is a mistake, so it cannot be said to be free consent.

Capacity of the parties

The third essential element of a valid contract is the capacity of the parties to make a valid contrac t. Capacity or incapacity of a person could be decided only after calculating various factors.

Section 11 of the Indian Contract Act,1872 elaborates on the issue by providing that a person who-

(a) has not attained the age of majority, (b) is of unsound mind, and (c) is disqualified from entering into a contract by any law to which he is subject, should be considered as not competent to enter into any contract.

Therefore, law prohibits

- Persons of unsound mind

- Person who is otherwise disqualified like an alien enemy, insolvents, convicts etc from entering into any contract.

Consideration

Section 2(d) of the Indian Contract Act, 1872 defines consideration thus:

“ when at the desire of the promisor, the promisee or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing something, such act or abstinence or promise is called a consideration for the promise ” .

In simple words ‘ Consideration ’ would generally mean ‘ compensation’ for doing or omitting to do an act or deed . It is also referred to as ‘quid pro quo’ viz ‘ something in return for another thing ’. Such a consideration should be a lawful consideration.

Example : A agrees to sell his toys to B for Rs. 100, B’s promise to pay Rs. 100 is the consideration for A’s promise to sell his toys and A’s promise to sell the toys is the consideration for B’s promise to pay Rs. 100.

Not expressly declared to be void

The last essential elements of a valid contract to clinch a contract are that the agreement entered into for this purpose must not be which the law declares to be either illegal or void .

An illegal agreement is an agreement expressly or impliedly prohibited by law. A void agreement is one without any legal effects.

Example : Threat to commit murder or making/publishing defamatory statements or entering into agreements which are opposed to public policy is illegal in nature.

Similarly, any agreement in restraint of trade, marriage and legal proceedings etc. are classic examples of void agreements.

Contract : A written or spoken agreement, especially one concerning employment, sales, or a tenancy that is intended to be enforceable by law. Promise : In contracts, a promise is essential to a binding legal agreement and is given in exchange for consideration, which is the inducement to enter into a promise. Agreement : An agreement creating obligations enforceable by law. The basic elements of a contract are mutual assent, consideration, capacity, and legality.

The Indian Contract Act mostly deals with the general principles and rules governing contracts. The Act is divisible into two parts. • The first part (Section 1- 75) deals with the general principles of the law of contract, and therefore applies to all contracts irrespective of their nature. • The second part (Sections 124-238) deals with certain special kinds of contracts, namely contracts of Indemnity and Guarantee, Bailment, Pledge, and Agency. According to Section 2 (h) of the Indian Contract Act, 1872 “An agreement enforceable by law is a contract.” A contract, therefore, is a combination of the two elements:

- an agreement

- an obligation

Business Law Notes

( Click on Topic to Read )

- What is Business Law?

- Indian Contract Act 1872

- Types of Contract

- Offer: Types, Elements

Performance of a Contract

- Discharge of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

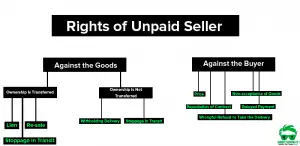

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

Promissory Note

Bill of Exchange

Crossing of Cheque

Business Law Book References

- Goel, P. K. (2006). “ Business Law for Managers ” Wiley

- Sheth, T. (2017). “ Business Law ” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “ Business Legislation for Management ” (2ed.) Vikas Publishing.

Business Law is also known as Commercial law or corporate law, is the body of law that applies to the rights, relations, and conduct of persons and businesses engaged in commerce, merchandising, trade, and sales.

Indian Contract Act 1872 Summary Note

The Indian Contract Act is divisible into two parts .

First part (Section 1-75) deals with the general principles of the law of contract .

Second part (Sections 124-238) deals with certain special kinds of contracts .

It is the duty of the seller to deliver the goods and of the buyer to accept and pay for them, in accordance with the terms of the contract of sale. – Sec. 31, The Sale of Goods Act , 1930

Sales of Goods Act 1930

Sales of Goods Act 1930 came into force on 1st July 1930. It extends to the whole of India. It does not affect rights, interests, obligations and titles acquired before the commencement of the Act. The Act deals with the sale but not with mortgage or pledge of the goods.

The Sale of Goods Act, identifies the terms, “ Conditions and Warranties ” as being of a prime significance in a contract of sale.

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another.

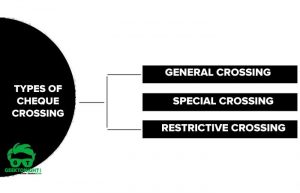

The crossing of Cheque means that the specific cheque can only be deposited straightway into a bank account and cannot be instantly cashed by a bank or any credit institution.

Promissory Note , on the other hand, is a promise to pay a certain amount of money within a stipulated period of time. And the promissory note is issued by the debtor .

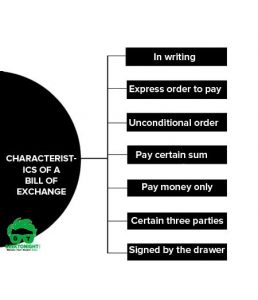

Bill of exchange is an instrument ordering the debtor to pay a certain amount within a stipulated period of time. Bill of exchange needs to be accepted in order to call it valid or applicable. And the bill of exchange is issued by the creditor .

- What is Cheque?

A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’.

Go On, Share article with Friends

Did we miss something in Business Law Note ? Come on! Tell us what you think about our article on Indian Contract Act 1872 Definition, Meaning, Books in the comments section.

- Essential Elements of a Valid Contract

- What is Discharge of Contract?

- Performance of Contract

- What is Promissory Note?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

- What Is Market Segmentation?

- What Is Marketing Mix?

- Marketing Concept

- Marketing Management Process

- What Is Marketing Environment?

- What Is Consumer Behaviour?

- Business Buyer Behaviour

- Demand Forecasting

- 7 Stages Of New Product Development

- Methods Of Pricing

- What Is Public Relations?

- What Is Marketing Management?

- What Is Sales Promotion?

- Types Of Sales Promotion

- Techniques Of Sales Promotion

- What Is Personal Selling?

- What Is Advertising?

- Market Entry Strategy

- What Is Marketing Planning?

- Segmentation Targeting And Positioning

- Brand Building Process

- Kotler Five Product Level Model

- Classification Of Products

- Types Of Logistics

- What Is Consumer Research?

- What Is DAGMAR?

- Consumer Behaviour Models

- What Is Green Marketing?

- What Is Electronic Commerce?

- Agricultural Cooperative Marketing

- What Is Marketing Control?

- What Is Marketing Communication?

- What Is Pricing?

- Models Of Communication

- What is Sales Management?

- Objectives of Sales Management

- Responsibilities and Skills of Sales Manager

- Theories of Personal Selling

- What is Sales Forecasting?

- Methods of Sales Forecasting

- Purpose of Sales Budgeting

- Methods of Sales Budgeting

- Types of Sales Budgeting

- Sales Budgeting Process

- What is Sales Quotas?

- What is Selling by Objectives (SBO) ?

- What is Sales Organisation?

- Types of Sales Force Structure

- Recruiting and Selecting Sales Personnel

- Training and Development of Salesforce

- Compensating the Sales Force

- Time and Territory Management

- What Is Logistics?

- What Is Logistics System?

- Technologies in Logistics

- What Is Distribution Management?

- What Is Marketing Intermediaries?

- Conventional Distribution System

- Functions of Distribution Channels

- What is Channel Design?

- Types of Wholesalers and Retailers

- What is Vertical Marketing Systems?

- What i s Marketing?

- What i s A BCG Matrix?

- 5 M’S Of Advertising

- What i s Direct Marketing?

- Marketing Mix For Services

- What Market Intelligence System?

- What i s Trade Union?

- What Is International Marketing?

- World Trade Organization (WTO)

- What i s International Marketing Research?

- What is Exporting?

- What is Licensing?

- What is Franchising?

- What is Joint Venture?

- What is Turnkey Projects?

- What is Management Contracts?

- What is Foreign Direct Investment?

- Factors That Influence Entry Mode Choice In Foreign Markets

- What is Price Escalations?

- What is Transfer Pricing?

- Integrated Marketing Communication (IMC)

- What is Promotion Mix?

- Factors Affecting Promotion Mix

- Functions & Role Of Advertising

- What is Database Marketing?

- What is Advertising Budget?

- What is Advertising Agency?

- What is Market Intelligence?

- What is Industrial Marketing?

- What is Customer Value

- What is Business Communication?

- What is Communication?

- Types of Communication

- 7 C of Communication

- Barriers To Business Communication

- Oral Communication

- Types Of Non Verbal Communication

- What is Written Communication?

- What are Soft Skills?

- Interpersonal vs Intrapersonal communication

- Barriers to Communication

- Importance of Communication Skills

- Listening in Communication

- Causes of Miscommunication

- What is Johari Window?

- What is Presentation?

- Communication Styles

- Channels of Communication

- Hofstede’s Dimensions of Cultural Differences and Benett’s Stages of Intercultural Sensitivity

- Organisational Communication

- Horizontal C ommunication

- Grapevine Communication

- Downward Communication

- Verbal Communication Skills

- Upward Communication

- Flow of Communication

- What is Emotional Intelligence?

- What is Public Speaking?

- Upward vs Downward Communication

- Internal vs External Communication

- What is Group Discussion?

- What is Interview?

- What is Negotiation?

- What is Digital Communication?

- What is Letter Writing?

- Resume and Covering Letter

- What is Report Writing?

- What is Business Meeting?

- What is Public Relations?

- What is Consumer Behaviour?

- What Is Personality?

- What Is Perception?

- What Is Learning?

- What Is Attitude?

- What Is Motivation?

- Consumer Imagery

- Consumer Attitude Formation

- What Is Culture?

- Consumer Decision Making Process

- Applications of Consumer Behaviour in Marketing

- Motivational Research

- Theoretical Approaches to Study of Consumer Behaviour

- Consumer Involvement

- Consumer Lifestyle

- Theories of Personality

- Outlet Selection

- Organizational Buying Behaviour

- Reference Groups

- Consumer Protection Act, 1986

- Diffusion of Innovation

- Opinion Leaders

- What is Brand Management?

- 4 Steps of Strategic Brand Management Process

- Customer Based Brand Equity

- What is Brand Equity?

You Might Also Like

Sales of goods act 1930 | business law, labour law in india: need, objectives, principles, classification.

What is Promissory Note? Meaning, Characteristics, Parties

What is Crossing of Cheque? Types, Meaning, Dishonoured

What is business law definition, meaning, books, director: definition, disqualification, duties, appointment.

What is Bill of Exchange? Example, Features, Characteristics

Rights of Unpaid Seller | Sale of Goods Act, 1930

Goods & price | contract of sale, performance of a contract | sale of goods act 1930, industrial disputes act 1947: definition, objective, applicability, this post has one comment, leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

Indian Contract Act 1872 Notes [Law of Contracts Notes]

- Contract Act Subject-wise Law Notes

- January 13, 2024

This article provides Contracts Law Notes notes with case laws .

Law of Contracts dealing with matters relating to Contracts. A contract is made when an agreement becomes enforceable by law. There is no legal obligation as long as it is a mere agreement. Once the agreement becomes a contract, there is a legal obligation by the parties involved.

Hello Readers!

As a learner, you can consider this Indian Contract Act 1872 notes as a free, online, and self-paced course.

As a competitive exams aspirant, you will find it perfect for Judicial Service Exams, UPSC CSE Law Optional, etc.

As a reader, this Law of Contracts notes is sufficient for you to learn or research on Indian Contract Act, 1872!

Happy Learning!

Note: For books on Law of Contracts, click here .

Introduction to the Law of Contracts

Agreement under indian contract act (section 2 to 9, indian contract act), capacity to contract under indian contract act (sections: 10, 11, 12, 64, 65, 68), free consent (sections 13 to 22, indian contract act), consideration under indian contract act (sections 23 to 25 indian contract act), lawful object in contracts, void agreements: limitations on freedom of contract (s. 24 – 30, indian contract act), quasi – contracts and unjust enrichment (section 68 to 72, indian contract act), discharge of a contract (section 37 to 67, indian contract act), breach of contract (ss. 73, 74 & 75), contract of indemnity, contract of guarantee under indian contract act, bailment under indian contract act, pledge under indian contract act, agency under indian contract act.

For notes on other subjects, click here .

For case briefs and analysis, click here .

We hope you found Indian Contract Act notes’ on every topic related to the Law of Contracts .

If you think we missed anything, help us by mentioning the details in this form.

Disclaimer:

We have done our best to provide the right information. However, we don’t claim the content to be genuine. We suggest readers to do check it.

You might like

Beneficial Construction in Interpretation of Statutes

Banker’s Lien in Banking Law

The Balance of Convenience: A Detailed Legal Analysis

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Post Comment

Historical Background Of Indian Contract Act 1872

Evolution of contract law different time periods, vedic and medeival period:.

- Contracts formed during the night.

- Contracts entered into the interior compartment of the house.

- Contracts made in a forest

- Contracts made in any other secret place

- There were certain exceptions to clandestine contracts such as

- Contracts made to ward off violence, attack and affray

- Contracts made in celebration of marriage

- Contracts made under orders of government

- Contracts made by traders, hunters, spies and others who would roam in the forest frequently.

Roman period:

- Stipulation (stipulatio): It put into force formalities and dates from a very early time in Roman law. A party could make a binding promise called "stipulation" in which the party observed a prescribed form of question and answer. Though the participation of both parties was required, only one party was bound.

- Real Contracts: These were those that suited to executory exchange of promises. For example, the contract of loan, in which the recipient's promise to restore the subject matter was binding.

- Consensual Contracts: These were more flexible and did not hold a legal basis for enforcing purely executory exchanges of promises. They deviated from the formalities in "stipulation" and in agreement alone, without delivery, sufficed to make the promises binding. Although they were limited to four important types of contracts- sale, hire, partnership and mandate.

- Innominate Contracts: These were agreements under which one party was promised to give or do something in exchange for a similar promise by the other party. Unlike both real and consensual contracts they were not limited to specified classes of transactions and were therefore called in nominate . The enforceability of the promise required some performance given in exchange and was called quid pro quo (i.e. the modern concept of consideration of the contract). But these contracts were limited because they were binding only when one of the parties had completed performance and until that happened either party could escape liability.

- Dotis dictio: This was related to dowry agreement between bride and groom. In this contract, the father of the bride or the bride herself set forth amount and nature of dowry to be governed to be groom and its declared in presence of the groom. Since this was a social agreement. There was not any punishment in case of breach of contract, the only remedy that the groom family has in case of breach is to compel the bride`s family in fulfilling the contract.

- Lex Mancipi: This contract was equivalent to the modern day's contract of transfer of property.

- Fiducia: It was an ancillary contract to the above form of contract.

- Uadimonium: This contract was similar to today`s contract of guarantee.

Islamic period

- Riba Al-Fadl: In this case it's a contract which produced unlawful excess in exchange of counter values in a contemporaneous transaction.

- Riba Al-Nasi`a: Which means contract which produced unlawful gain without completing the exchange of counter values.

- Riba Al-Jahilya: Its also called pre-historic riba. Where the lender asks the borrower whether he will settle the debt or increase the debt.

- for an exchange like sale

- without exchange like giving a simple gift

- to create succession namely request

- In exchange for property, namely Ijara, where the movable and immovable things are given for hire, contracts for giving service like carriage for goods, safe custody of property.

- Not being exchange of property like an accommodate loan(ariat) and deposit (wadiyut)

- Invalidation of mutual agreement

- Cancellation of contract by death of either party or destruction of subject matter or expiry of time period.

- Cancellation by termination by either party

- Dissolution by termination of the contract

Hindu period

British period.

- One, the assumption that promises are generally enforceable, and then create exceptions for promises considered undesirable to enforce. Secondly the assumption that promises are generally unenforceable, and then create exceptions for promises thought desirable to enforce. But in the case where one of the parties is from either of the religion like if one party is Hindu and other is Muslim then, in that case, the law of the defendant is to be used. This was followed in the presidency towns, but in cities outside the presidency towns, the matter was governed by justice, equity and good conscience. This procedure was followed until the time the Indian Contract Act was implemented in India. In the years 1862, the introduction of the High Courts took place in the town of Bombay, Calcutta, and Madras and the charter of these High Courts also contained the same provision as pervious law that High Courts to apply the personal laws of the respective religions before rendering any judgment in respect to the contract cases.

- The Advent of The Indian Contract Act The Indian Contract Act as applied today's was drafted originally by the third Indian Law Commission in the year 1861 in England. The Indian Contract Bill tried to defined laws relating to Contracts, Sale of movable properties, Indemnity, Guarantee, Agency, Partnership and bailment. The bill was not the complete law of contract, but the aim of the bill was to suffice the need of the country for a considerable period of time and during that period, judges of the courts were taking the help of English laws in determining the case when they failed to arrive at the judgments by considering the justice, equip and good conscience. once a person made a promise he has to perform it the last day of your life. Though it may seem that a rigid principle like this would make sense, some exceptions have to be provided or else it would be a gross injustice to the community. Even with the vice-like this, the contract law came into effect. The drafter of the bill knew that different religious people followed personal laws and for them it will be difficult to abide the new rules so that the special customs of the personal laws governing any aspect of the contractual realationship would not be affected by new rules, unless or until they are nit contrary to the new rules. The act came into effect in 1872 but soon afterwards amendments were made in that regard, which repealed section 76 to 123 dealing with the sales of goods act and separate legislations were enacted called Sales of Goods Act 1930' to govern that area. Also, section 239 to 266 dealing with partnership was repealed and new legislation was enacted called Indian Partnership Act 1932.

- https://www.legalbites.in/historical-evolution-of-contract-law-in-india/

- Contract-1 Dr. R.K. Bangia

- Indian High Court Act 1861,

- https://www.jstor.org/stable/43949727?seq=1

Law Article in India

Please drop your comments, you may like.

Doctrine Of Privity Under C...

Continuing Guarantee And It...

Analysis Of Position Of A M...

A Tale of Responsibility an...

Legal Perspectives on E-Con...

Mohori Bibee v/s Dharmodas ...

Legal question & answers, lawyers in india - search by city.

Law Articles

How to file for mutual divorce in delhi.

How To File For Mutual Divorce In Delhi Mutual Consent Divorce is the Simplest Way to Obtain a D...

Increased Age For Girls Marriage

It is hoped that the Prohibition of Child Marriage (Amendment) Bill, 2021, which intends to inc...

Facade of Social Media

One may very easily get absorbed in the lives of others as one scrolls through a Facebook news ...

Section 482 CrPc - Quashing Of FIR: Guid...

The Inherent power under Section 482 in The Code Of Criminal Procedure, 1973 (37th Chapter of t...

The Uniform Civil Code (UCC) in India: A...

The Uniform Civil Code (UCC) is a concept that proposes the unification of personal laws across...

Role Of Artificial Intelligence In Legal...

Artificial intelligence (AI) is revolutionizing various sectors of the economy, and the legal i...

File caveat In Supreme Court Instantly

THE LEGAL WATCH

Trusted Contract Advisory

- Jan 19, 2021

Basics of Indian Contract Act, 1872

Updated: Jun 8, 2023

Written by: Sakshi Shitole

Contracts are indispensable for every field. Contracts are fundamentally a written agreement in which two parties enter into them for accomplishing their respective work. Everyone enters into a number of contracts everyday knowingly or unknowingly. Each contract creates some rights and obligations upon the contracting parties. To deal with every contract and keep an account of it, Indian Contract Act, 1872 was implemented.

Indian Contract Act, 1872 was enforced from 1st September, 1872. It stretches to the whole of India except the state of Jammu and Kashmir. The law of contract is that branch of law which determines the circumstances in which promises made by the parties to a contract shall be legally binding on them. Recording commitments, preventing conflicts, maintaining law and order, increasing efficiency among the parties or organizations are some of the significant components of contracts.

Definitions

Under section 2(h) of Indian Contract Act, 1872, the term “ contract ” has been defined as “an agreement enforceable by law”.

Under section 2(e) of Indian Contract Act, 1872, the term “ agreement ” has been defined as “every promise or set of promises forming the consideration for each other.

Under section 2(d) of Indian Contract Act, 1872, the term “ consideration” is defined as “When at the desire of the promisor, the promisee or any other person has done or abstained from doing something or does or abstains from doing something or promises to do or abstain from doing something”.

Under Section 2(b) of the act, when the offer is accepted, then it becomes a “ promise” . At the point when an individual to whom the offer is made, connotes his consent then we can say that the offer is accepted.

Offer + Acceptance = Promise

Promise + Consideration = Agreement

Agreement + Enforceability by Law = Contract

Essential Elements of Valid Contract Act are

An offer or proposal is made by one party and is accepted by another party converting it into an agreement.

Free consent of both parties.

Parties must be of sound mind.

Intention of Legal Obligations.

Possibility of Performance.

Consideration must be present.

Lawful object and lawful consideration.

Types of Contracts

On the basis of enforceability

Valid Contract: An agreement which can be enforced by law is a valid contract.

Voidable Contract: An agreement which can be enforced by the law at the choice of one or more parties present but not at the option of others is a voidable contract.

Void Contract: An agreement which cannot be enforce by law is a void contract. A valid contract may become void too after a certain stage after entering into the contract.

On the basis of Formation

Express Contract: A contract which is explicitly agreed by both the parties (written or spoken) is an express contract.

Implied Contract: A contract in which an offer or acceptance is made otherwise than in words or by implied actions is an implied contract.

Quasi Contract: A contract which is created by law is a quasi-contract.

On the basis of Execution

Executed Contract: A contract in which both the parties have completed their respective duties is an executed contract.

Executory Contract: A contract in which one party or both the parties have still to perform their duties in future is an executory contract.

Breach of Contract occurs when one of the parties of the contract does not perform his promise resulting in an infringement of the said contract. It tends to be any minor or major violation. Actual breach of contract occurs when one party fails to fulfill his promise in a specific due date. Anticipatory breach of contract occurs when the party declares his intention of not performing the contract before the performance is due.

Remedies for Breach of Contract

Suing for Damages.

Rescind the Contract.

Sue for injunction.

Sue for Specific Performance.

Sue for Quantum Meruit.

Indian Contract Act, 1872 also considers certain special sort of contractual relationships like indemnity, guarantee, bailment, pledge, quasi contracts, contingent contracts, law of agency and so forth. It has many nuances which explain all the relationships of these components.

Monica, an Overview on Indian Contract Act, 8th March 2019 -

https://blog.ipleaders.in/contract-act/#:~:text=Introduction,by%20law%20is%20a%20contract'.&text=According%20to%20Anson%2C%20%E2%80%9C%20the%20law,on%20the%20person%20making%20it%E2%80%9D . Accessed on 11th January 2021

Ironclad, Six essential elements of contract, 5th October 2020 -

https://ironcladapp.com/blog/elements-of-a-contract/ accessed on 11th January 2021

CA Mayur Agarwal, Economic, Business and Commercial Laws, Pg no. 334 (Inspire Academy, Pune.)

Indian Contract Act, 1872 Part 1 -

https://www.toppr.com/guides/business-laws/indian-contract-act-1872-part-i/ accessed on 8th January 2021

Concord Editorial, The Case for Contracts in 7 Reasons, 10th April 2018 -

https://www.concordnow.com/blog/case-for-contracts-7-reasons accessed on 9th January 2021

Will Kenton, Breach of Contract, Nov 19, 2020 -

https://www.investopedia.com/terms/b/breach-of-contract.asp#:~:text=A%20breach%20of%20contract%20is,weight%20if%20taken%20to%20court . accessed on 10th January 2021

The Indian Contract Act, 1872 Notes -

https://cablogindia.com/the-indian-contract-act-1872-notes/#:~:text=A%20proposal%2C%20when%20accepted%2C%20becomes%20a%20promise.&text=An%20agreement%20enforceable%20by%20law%20is%20a%20contract.&text=%E2%80%93%20promises%20to%20do%20or%20abstain,a%20consideration%20for%20the%20promise.&text=An%20agreement%20not%20enforceable%20by%20law%20is%20said%20to%20be%20void . Accessed on 9th January 2021

- Contract Awarenesss - Guest Blog

Recent Posts

CONTRACT BY MINOR

IT ACT PROVISIONS relating to E-CONTRACTS

Quantum Meruit

1 comentário

Hey fellow gamers! I recently joined https://1x-bet-casino.in/ , and I thought I'd share my experience so far. The game variety is impressive – from classic slots to live dealer options, there's something for everyone. The platform's user interface is sleek and intuitive, making navigation a breeze.

I was initially skeptical about online casinos, but India Casino's transparent policies and licensing have eased my concerns. The registration process was quick, and they offer enticing bonuses to kickstart your gaming journey. I particularly enjoy the live dealer games; it adds a real-life casino feel to the experience.

I also appreciate the responsive customer support. I had a minor issue with a withdrawal, and they resolved it promptly, showing their commitment to user satisfaction.…

Home / ailet pg / Introduction to the Indian Contract Act, 1872 for CLAT

Introduction to the indian contract act, 1872 for clat.

The Indian Contract Act was enacted in 1872 and came into force on 1 st September 1872. The word ‘contract’ has been derived from the Latin word ‘ contructus’ which means ‘to work on contract’. The law of contract is based on the principle of ‘ pacta sunt servanda’ which means ‘agreements must be kept’.

Section 2(h) of the Indian Contract Act 1872 defines the term ‘contract’ as an ‘agreement enforceable by law’. As per section 2(e) every promise and every set of promises forming consideration for each other is called an agreement. A promise is an accepted proposal.

An agreement becomes a valid contract when the following essential conditions are satisfied:

- Offer and acceptance

- Intention to create legal obligations

- Lawful consideration

- Contractual capacity

- Free consent

- Lawful object

- Must not be expressly declared as void

- Certain terms of the contract

- Legal formalities

TYPES OF CONTRACT

Contracts may be classified on the basis of enforce-ability, mode of creation, extent of execution or the form of the contract as follows:

- Contracts on the basis of enforce-ability : a contract on the basis of enforce-ability can be of the following kind:

- Valid contract

- Voidable contracts

- Void agreement

- Unenforceable contract

- Illegal agreement

- Contract on the basis of mode of creation : a contract on the basis of mode of creation can be of the following kind:

- Express contract

- Implied contracts

- Quasi contract

- Contract on the basis of extent of execution : a contract on the basis of extent of execution can be of the following kind:

- Executed contracts

- Executory contract

- Unilateral contract

- Bilateral contract

- Contract on the basis of form : a contract on the basis of form can be of the following kind:

- Ordinary contract

- Standard contract

Section 2(a) of the Indian Contract Act 1872 defines proposal as ‘When one person signifies to another his willingness to do or to abstain from doing anything, with a view to obtaining the assent of that other to such act or abstinence, he is said to make a proposal’.

As per section 2(a) an offer or proposal has the following essential ingredients:

- One person signifies to another

- His willingness to do or to abstain from anything

- With a view to obtain an assent thereto

The person who makes the proposal or offer is called the promisor or offeror and the person on whom the proposal is made is called the promisee or offeree.

Following are the essential conditions for a valid offer:

- Intention to create legal obligation

- Express or implied

- Certainty of terms

- Silence as acceptance

- Expression of willingness to do or to abstain from anything

- General or specific: there are two kinds of offers viz. general and specific. A specific offer is made to a specific person or specific group of persons and it can be accepted only by the person(s) to whom it is made. A general offer is made to public or world at large and it can be accepted by a definite person who comes forward and performs the requisite conditions. However, the communication of acceptance is not necessary in such cases.

- Offer must be communicated: communication of a proposal is complete when it comes to the knowledge of the person to whom it is made. This may be express or implied.

- Cross offers: when two parties make identical offers to each other, in ignorance of each other’s offer, the offers are termed as ‘cross offers’. Such offers do not constitute acceptance of one’s offer by the other thus they do not lead to a completed agreement.

- Invitation to offer: in a valid offer there is an expression of willingness to do or abstain from doing an act with a view of obtaining assent from the other while in case of invitation of offer a party without expressing his final willingness proposes certain terms on which he is willing to negotiate. There in an invitation to offer the party does not make an offer but invites the other party to make an offer on those terms.

- Special terms and conditions: the special terms and conditions of the contract must be specifically communicated to the party in order to make him bound by the same.

Section 2(b) of the Indian Contract Act 1872 defines acceptance as ‘When the person to whom the proposal is made signifies his assent thereto, the proposal is said to be accepted. A proposal, when accepted, becomes a promise’.

Following are the essential requirements of a valid acceptance:

- Oferee must signify his assent or communicate the acceptance. Acceptance may be in the form of express words written or spoken or may be signified through conduct i.e. implied.

- Acceptance must be specifically communicated to the offeror himself or his authorized agent

- The communication of acceptance should be from a person who has the authority to accept.

- Acceptance must be made in the manner prescribed by the offeror. Where no mode of acceptance is prescribed it must be made within a reasonable time and manner

- To convert a proposal into a promise the acceptance must be absolute and unqualified i.e. without any qualification and condition.

The communication of a proposal is complete when it comes to the knowledge of the person to whom it is made. The communication of acceptance is complete against the proposer when it is put in course of transmission to him, so as to be out of the power of the acceptor. The communication of acceptance against the acceptor gets complete when the proposer comes to know about the acceptance. A proposal may be revoked at any time before the communication of acceptance is complete as against the proposer but not afterwards. Communication of revocation is complete against the person who makes it when it is put into a course of transmission to the person to whom it is made so as to be out of the power of the person who makes it. The communication of revocation is complete against the person to whom it is made when it comes to his knowledge.

Place of acceptance- When the contract is made through post the place of contract shall be the place of acceptance i.e. from where the letter of acceptance is posted . The place of contract in case of a contract on phone shall be where the acceptance is heard. The communication through e-mail shall follow the same rules as that of communication through post.

CONSIDERATION

Section 2(d) of the Indian Contract Act 1872 defines consideration as ‘ When, at the desire of the promisor, the promisee or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing, something, such act or abstinence or promise is called a consideration for the promise ’

Consideration is a cardinal necessity of the formation of a contract, but no consideration is required for the discharge or modification of contract. It is the price of a promise. Consideration may be present, past or future. Forbearance to sue constitutes a valid consideration provided the plaintiff has a bona-fide belief that he has a reasonably good claim against the defendant.

Under the following situations an agreement made without consideration shall not be void:

- Natural love and affection

- Past voluntary service

- Time barred debt

- Absence of consideration shall not affect the validity of a gift

- No consideration is necessary to create agency.

Privity of contract

The doctrine of ‘privity of contract’ means that a contract is a contract only between the parties and no third person can sue upon it i.e. a stranger to a contract cannot sue. Following are the exceptions to the rule of privity of contract:

- Beneficiaries under trust or charge

- Marriage and family arrangement

- Acknowledgement or estoppel

- Undisclosed principal has the right to sue a third party subject to the rights and obligations subsisting between the third party and agent.

- The assignee of insurance policy is entitled to sue on the contract made between the insurer and insured.

Visit our complete collection of legal reasoning questions and posts.

Read our legal reasoning post on void agreements and the practice questions here.

Read CLATapult’s post on offer and acceptance here. Also, try their mocks for more legal reasoning practice questions.

Visit CLATalogue for more legal reasoning practice questions for CLAT 2022.

First published on November 26, 2020.

Subscribe to our newsletter and get daily news & updates directly to your inbox!

Please provide a valid email address.

Join our WhatsApp Channel

Join our Telegram Group

- Quasi Contract

Can there be a contract without offer, acceptance , consideration, etc? Well, yes there can be such a contract based on social responsibility. We call such contracts quasi contract. Let us take a look.

The word ‘Quasi’ means pseudo. Hence, a Quasi contract is a pseudo-contract. When we talk about a valid contact we expect it to have certain elements like offer and acceptance, consideration , the capacity to contract, and free will. But there are other types of contracts as well.

There are cases where the law implies a promise and imposes obligations on one party while conferring rights to the other even when the basic elements of a contract are not present. These promises are not legal contracts, but the Court recognizes them as relations resembling a contract and enforces them like a contract.

These promises/ relations are Quasi contracts. These obligations can also arise due to different social relationships which we will look at in this article .

The core principles behind a Quasi Contract are justice, equity and good conscience. It is based on the maxim: “No man must grow rich out of another persons’ loss.”

Let’s look at an example of a Quasi contract: Peter and Oliver enter a contract under which Peter agrees to deliver a basket of fruits at Oliver’s residence and Oliver promises to pay Rs 1,500 after consuming all the fruits. However, Peter erroneously delivers a basket of fruits at John’s residence instead of Oliver’s. When John gets home he assumes that the fruit basket is a birthday gift and consumes them.

Although there is no contract between Peter and John, the Court treats this as a Quasi-contract and orders John to either return the basket of fruits or pay Peter.

Features of a Quasi Contract

- It is usually a right to money and is generally (not always) to a liquated sum of money

- The right is not an outcome of an agreement but is imposed by law.

- The right is not available against everyone in the world but only against a specific person(s). Hence it resembles a contractual right.

Sections 68 – 72 of the Indian Contract Act, 1872 detail five circumstances under which a Quasi contract comes to exist. Remember, there is no real contract between the parties and the law imposes the contractual liability due to the peculiar circumstances.

Source: Pixabay

Section 68 – Necessaries Supplied to Persons Incapable of Contracting

Imagine a person incapable of entering into a contract like a lunatic or a minor. If a person supplies necessaries suited to the condition in life of such a person, then he can get reimbursement from the property of the incapable person.

John is a lunatic. Peter supplies John with certain necessaries suited to his condition in life. However, John does not have the money or sanity and fails to pay Peter. This is termed as a Quasi contract and Peter is entitled to reimbursement from John’s property.

However, to establish his claim, Peter needs to prove two things:

- John is a lunatic

- The goods supplied were necessary for John at the time they were sold/ delivered.

Section 69 – Payment by an Interested Person

If a person pays the money on someone else’s behalf which the other person is bound by law to pay, then he is entitled to reimbursement by the other person.

Peter is a zamindar. He has leased his land to John, a farmer. However, Peter fails to pay the revenue due to the government. After sending notices and not receiving the payment, the government releases an advertisement for sale of the land (which is leased to John). According to the Revenue law, once the land is sold, John’s lease agreement is annulled.

John does not want to let go of the land since he has worked hard on the land and it has started yielding good produce. In order to prevent the sale, John pays the government the amount due from Peter. In this scenario, Peter is obligated to repay the said amount to John.

Section 70 – Obligation of Person enjoying the benefits of a Non-Gratuitous Act

Imagine a person lawfully doing something or delivering something to someone without the intention of doing so gratuitously and the other person enjoying the benefits of the act done or goods delivered. In such a case, the other person is liable to pay compensation to the former for the act, or goods received. This compensation can be in money or the other person can, if possible, restore the thing done or delivered.

However, the plaintiff must prove that:

- The act that is done or thing delivered was lawful

- He did not do so gratuitously

- The other person enjoyed the benefits

Section 71 – Responsibility of Finder of Goods

If a person finds goods that belong to someone else and takes them into his custody, then he has to adhere to the following responsibilities:

- Take care of the goods as a person of regular prudence

- No right to appropriate the goods

- Restore the goods to the owner (if found)

Peter owns a flower shop. Olivia visits him to buy a bouquet but forgets her purse in the shop. Unfortunately, there are no documents in the purse to help ascertain her identity. Peter leaves the purse on the checkout counter assuming that she would return to take it.

John, an assistant at Peter’s shop finds the purse lying on the counter and puts it in a drawer without informing Peter. He finished his shift and goes home. When Olivia returns looking for her purse, Peter can’t find it. He is liable for compensation since he did not take care of the purse which any prudent man would have done.

Section 72 – Money paid by Mistake or Under Coercion

If a person receives money or goods by mistake or under coercion, then he is liable to repay or return it.

Let us see an example. Peter misunderstands the terms of the lease and pays municipal tax erroneously. After he realizes his mistake, he approached the municipal authorities for reimbursement. He is entitled to be reimbursed since he had paid the money by mistake.

Similarly, money paid by coercion which includes oppression, extortion or any such means, is recoverable.

Solved Question on Quasi Contract

Q: Peter and Oliver enter a contract under which Peter agrees to deliver a basket of fruits at Oliver’s residence and Oliver promises to pay Rs 1,500 after consuming all the fruits. However, Peter erroneously delivers a basket of fruits at John’s residence instead of Oliver’s. When John gets home he assumes that the fruit basket is a birthday gift and consumes them. Does John have to pay for the goods?

Ans: Yes, John has to pay for the fruit basket. Although there is no contract between Peter and John, the Court treats this as a Quasi contract and orders John to either return the basket of fruits or pay Peter.

Customize your course in 30 seconds

Which class are you in.

Indian Contract Act 1872: Part II

- Who Performs the Contract?

- Expressly Void Agreements

- Legality of Object and Consideration

- Contingent Contracts

- Liquidated Damages and Penalty

- Performance of Reciprocal Promise

- Suit for Damages

- Anticipatory and Actual Breach of Contract

- Discharge of a Contract

4 responses to “Discharge of a Contract”

K and A had entered into a contract where K was to supply 50,000 phones to A within 2 months from the date of signing of contract. K was to procure the phones from China and deliver the same to A. The rate of the phone was Rs. 5000/- a piece (inclusive of all taxes and duties). At the time of the execution of the contract, the duty was at 5% (five percent). Immediately after the execution of the Agreement, India had increased the duties to 1000% (one thousand percent). Therefore, K was finding it difficult to sell the phones at the price agreed earlier. In the circumstances, kindly advise:

a. How can K discharge such a contract?

b. How can A enforce such a contract?

K can “Discharge of Contract” Under Impossibility of performance, during post-contractual impossibility While the following conditions are satisfying The act should have become impossible after the formation of the contract. 2. The impossibility should have been caused by a reason of some event which was beyond the control of the promissory. 3. The impossibility must not be the result of some act or negligence of the promisor himself.

K can discharge the contract by imposibility or frustration due to unseen changes

In light of the case of registered trustees of the cashew nuts industry development fund V cashew nuts board of Tanzania,civil appeal no:18 of 2001 court of appeal of Tanzania at Dar es saalam (unreported) and the cashew nuts industry act no 18 of 2009. Explain the parties to an agency (name of parties) it provided case and the way in which it was created

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Skip to main content

- Select your language English हिंदी

Social Share

The indian contract act, 1872 : model answers to university questions 1940-1956 topically arranged.

Author: Dikshit, K. V.

Keywords: Contracts-India

Publisher: Decan Book Stall, Poona

Description: Brittle condition.

Source: National Library of India, Kolkata

Type: E-Book

Received From: National Library of India

- Dublin Core View

- Parts of PDF & Flipbook

Indian Institute of Technology Bombay

- Phone . [email protected]

- Email . +54 356 945234

Indian Culture App

The Indian Culture Portal is a part of the National Virtual Library of India project, funded by the Ministry of Culture, Government of India. The portal has been created and developed by the Indian Institute of Technology, Bombay. Data has been provided by organisations of the Ministry of Culture.

Email Id : [email protected]

Short essay on The Indian Contract Act – 1872

The law of contract is the foundation upon which the superstructure of modern business is built. It is common knowledge that in business transactions, quite often, promises are made at one time and the performance follows later. In such a situation, if either of the parties were free to go back on its promise without incurring any liability, there would be endless complications and it would be impossible to carry on trade and commerce.

Hence the law of contract was enacted which lays down the legal rules relating to promises: their formation, their performance, and their enforceability. Explaining the object of the law of contract, Sir William Anson observes: “The law of contract is intended to ensure that what a man has been led to expect shall come to pass; that what has been promised to him shall be performed.”

The law of contract is applicable not only to the business community, but also to others. Every one of us enters into a number of contracts almost every day, and most of the time, we do so without even realizing what we are doing from the point of law. A person seldom realizes that when he entrusts his scooter to the mechanic for repairs, he is entering into contract of bailment or when he buys a Packet of cigarettes, he is making a contract of the sale of goods; or again when he goes to the cinema to see a movie, he is making yet another contract; and so on.

Besides, the law of contract furnishes the basis for the other branches of Commercial Law. The enactments relating to sale of goods, negotiable instruments, insurance, partnership and insolvency are all founded upon the general principle of contract law. That is why, the study of the law of contract precedes the study of all other sub-divisions of Commercial Law.

ADVERTISEMENTS:

The Indian Contract Act, 1872:

The law of contract in India is contained in the Indian Contract Act.

Throughout Part I of this book, which deals with the Law of Contract, the references to Sections, unless otherwise specially stated, are references to Sections of the Indian Contract Act, 1872. The word ‘Act’, wherever used, means the Indian Contract Act, 1872. This Act is based mainly on English Common Law which is to a large extent made up of judicial precedents. (There being no separate Contract Act in England).

It extends to the whole of India except the State of Jammu and Kashmir and came into force on the first day of September 1872. The Act is not exhaustive. It does not deal with all the branches of the law of contract. There are separate Acts which deal with contracts relating to negotiable instruments, transfer of property, sale of goods, partnership, insurance, etc. Again the Act does not affect any usage or custom of trade (Sec. 1).

Scheme of the Act :

The Scheme of the Act may be divided into two main groups:

1. General Principles of the law of contract (Sees. 1-75)

2. Specific kinds of contracts, viz:

(a) Contracts of Indemnity and Guarantee (Sees. 124-147).

(b) Contracts of Bailment and Pledge (Sees. 148-181).

(c) Contracts of Agency (Sees. 182-238).

Before 1930 the Act also contained provisions relating to contracts of sale of goods and partnership. Sections 76-123 relating to sale of goods were repealed in 1930 and a separate Act called the sale of Goods Act were enacted. Similarly, Sections 239-266 relating to partnership were repealed in 1932 when the Indian Partnership Act was passed.

Basic Assumptions underlying the Act :

Before we take up the discussion of the various provisions of the Indian Contract Act, it will be proper to see some of the basic assumptions underlying the Act. These are:

1. Subject to certain limiting principles, there shall be freedom of contract to the contracting parties and the law shall enforce only what the parties have agreed to be bound. The law shall not lay down absolute rights and liabilities of the contracting parties. Instead, it shall lay down only the essentials of a valid contract and the rights and obligations it would create between the parties in the absence of anything to the contrary agreed to by the parties.

2. Expectations created by promises of the parties shall be fulfilled and their non-fulfillment shall give rise to legal consequences. If the plaintiff asserts that the defendant undertook to do a certain act and failed to fulfill his promise, an action at law shall lie.

Related Articles:

- Summary of Indian Contract Act 1872

- 100 sample questions on The Indian Contract Act, 1872 for Bihar Judiciary Examination (preliminary)

- Short notes on the Meaning of Sale of Goods

- Notes on the Essential characteristic of a contingent contract

Reciprocal Promises under the Indian Contract Act, 1872: Everything you need to know (Section 51 to 57)

Under the contract act when the proposal is accepted it is known as a promise. The reciprocal promise means promises which form the consideration or a part of it as defined under 2(f) of the Indian Contract Act, 1872. An example of reciprocal promise can be we go to a grocery shop and order some goods here we promise to pay the price of those goods and in return, the shopkeeper promises delivery of those goods on payment this is a reciprocal promise.

In this article, we will discuss Reciprocal promise and its performance in detail.

Table of Contents

1. Promisor not bound to perform, unless reciprocal promisee ready and willing to perform (Section 51)

Section 51 states that a promisor is not bound by his promise until and unless the reciprocal promisee that is the person who made the reciprocal promise is willing to perform the promise. If Mr X and Mr Y sign a contract that X will deliver certain goods to Y and the payment will be made in cash on delivery, there is no need on the part of X to deliver goods unless he sees willingness on the side of Y to make payment in cash.

What will be the consequence of partial default in performance?

This question frequently arises that whether a party loses its right on the failure of performance of a part of the contract. In dealing with such cases it becomes very difficult to ascertain the true intention of the parties. Then we need to see if a particular stipulation goes to the root of the matter, so that failure of a contract by the plaintiff a thing different in substance from what the defendant has stipulated for or whether it merely partially affects it and may be compensated for in damages.

2. Order of performance of a reciprocal contract (Section 52)

When an order has been prescribed in the performance of reciprocal promises then that order should be followed. If it is not mentioned the reciprocal promises should follow the order which the nature of the transaction requires. In a case Edridge v R.D Sethna it was held that the subsequent conduct cannot help to conclude as in how the promises need to be performed. We can also take an example, if A promises B to renovate his cabin at a fixed price the natural order followed will be A renovating the cabin and then receives payment.

3. Liability of party preventing the event on which the contract is to take effect (Section 53)

If X and Y contract that X will do certain work for Y for ten thousand rupees and X is ready to do the same but Y prevents him from doing so the contract becomes voidable at the option of X.

No man can complain of the other not performing the promise when he himself has prevented the party from doing so. The principle is not confined to only direct prevention or the forcible ones. When there is a contract with the government and the government agrees to provide the contractor with necessary supplies but the contractor demanded more like machines. Here Section 53 of the Indian Contract Act would not be any assistance to the contractor when the government refuses to supply him machines.

4 Effect of default as to that promise which should be performed, in contract consisting of reciprocal promises (Section 54)

When the promises are dependent on each other when one fails to perform the first promise he cannot expect the performance of the reciprocal promise. The person who fails to perform the promise is liable to compensate the other party if any such cost arose due to non-performance of the promise. An example can be if a man wanted to shift to a flat on rent promises to make the advance payment, the other party makes a reciprocal promise to give the flat after the payment. Due to some reason if the man fails to make the payment he cannot claim the flat as the reciprocal promise was dependant on his promise which he failed to perform. It might also happen that the man had to pay compensation due to the loss suffered by the other party due to non-performance of the contract.

5 Effect of failure to perform at a fixed time, in contract in which time is essential (Section 55)

In any contract when time is the essence failure to perform in the given time leads or entitles the promisee to avoid the contract. When time is not essential to a contract, it can simply not be avoided giving the reason that time for performance has expired. In such contracts, the promisee has the option to waive the right to void the contract if promisor fails to perform in a reasonable time.

If a father promises his son that he will make the payment for his examination form and there is no date specified in the contract but it is understood that the payment will be made before the examination forms window closes. Here time becomes an essence in the contract and if not followed it might lead to loss to the son.

6 Agreement to do impossible act (Section 56)

When two parties enter into a contract to an impossible act or something that is unlawful it makes the contract void. There can be two aspects to look into this matter first that the subject matter of the promise can be impossible or unlawful at the time the contract was made and second that the matter became impossible or unlawful subsequently. Let us first discuss the two in detail-

1. When the matter is impossible or unlawful at the time of the contract

If both the parties are aware that the contract they are entering into is impossible or unlawful then the contract becomes void. For example, if Mr A contracts with Mr E that he will make delivery of the order through the waterways to Saudi Arabia in 2 days and then take the payment in cash here the contract becomes void as it is impossible to deliver the consignment through waterways to Saudi Arabia within two days. If both the parties are unaware of this fact then the contract stands void.

If one of the parties to the contract is aware of this impossibility of unlawfulness then this party has to sustain the losses of the other party due to non-performance of the contract.

2. When the subject matter of the contract becomes impossible or unlawful subsequently

This is possible when the contract is entered by the two parties the matter is possible and legal but later on becomes unlawful. In such cases, the contract becomes void from the moment it is declared unlawful.

For example, if john promises to deliver harry marijuana which was legal in their country within five days but after they enter the contract the government over there declares marijuana illegal. Here the contract becomes void and John will not be able to perform his promise.

7 Reciprocal of Legal and Illegal Acts (Section 57)

Section 57 of the Indian Contract Act can only apply to cases where there are two sets of promises made and they are distinct in nature so that if required can be separated. There are two sets of such promises on which is legal and second which is illegal and thus void here the first part is performed while the latter becomes invalid.

For example, if A and B contract to sell A’s farmhouse situated in Thane, Maharashtra to B for INR 25,00,00 which B will use later on as a dance bar which is illegal in Maharashtra then here the first part of the contract that is the sale of the farmhouse is legal and possible and the next part that is using it as a dance bar is illegal and therefore becomes invalid.