- Corporate Structure & Information

- Board of Directors and Profiles

- Our History

- Products & Services

- Notable Deals

- Personal Data Protection Notice

- Corporate Information

- Corporate Governance

- Stock Information

- Company Announcements

- Bursa Announcements

- Quarterly Reports

- Annual Reports

- Press Release

- Mercury In The News

- Contact Info

- Download Forms

- Mercury Gold

Daily Market Reports

02-07-24 Market Watch

01-07-24 Market Watch

28-06-24 Market Watch

27-06-24 Market Watch

26-06-24 Market Watch

25-06-24 Market Watch

24-06-24 Market Watch

21-06-24 Market Watch

20-06-24 Market Watch

19-06-24 Market Watch

Technical Reports

02-07-24 Technical Watch

01-07-24 Technical Watch

Companies Reports

20-06-24 Go Hub - IPO Note

19-06-24 Ocean Fresh - IPO Note

07-06-24 UUE Holdings - IPO Note

30-05-24 KTI Landmark - IPO Note

13-05-24 Kawan Renergy - IPO Note

07-05-24 Feytech - IPO Note

29-04-24 Farm Price - IPO Note

26-04-24 Sin-Kung Logistics - IPO Note

12-04-24 MKH Oil Palm - IPO Note

07-03-24 QES Group - Update Report

Our team of Research Analysts conduct in-depth research on the economy, companies, industry fundamentals and technical analytics in order to generate sound investment ideas and comprehensive research reports for our clients. Clients at Mercury Securities are always kept abreast of the latest market developments in order to make the best informed financial decisions.

Our research reports are available and published in Bursa Malaysia, Bloomberg, and FactSet website. In addition, our Senior Analysts are frequently interviewed by English and Chinese media (Business Times, The Star, The Edge, Focus Malaysia etc.) to comment on industry and company developments as well as major economic issues.

Currently, we conduct research on small and medium cap companies listed on Bursa Malaysia to improve their visibility and share liquidity through CMDF Bursa Research Scheme (CBRS). Our partnership with Bursa strives to improve capital market efficiency and to build a comprehensive trading and investment platform for both domestic and foreign investors.

Download research reports, financial statements and more.

“Malaysian Industrial Development Finance” history book

Fund Fact Sheets

Annual/Semi Annual/Quarterly Reports (UTFs/WSFs)

MIDF Fund Return

Financial Statements

Terms & Conditions for Equity Markets

Education Assistance & Scholarships

Oriental 1936 Berhad

Research reports..

Economic Reports

Sector Reports

Equity Strategy Reports

Equity Reports

Ask Us Anything.

Write to us and we will strive to address your queries.

Popular Searches

Investment Advice

We provide independent unbiased investment recommendation on stocks and economic outlook

Corporate Finance

We provide advisory services in corporate finance acting in capacity such as independent adviser, independent valuer or financial adviser in corporate transactions.

Valuation Reports Purchase Price Allocation Reports

in accordance to IFRS 3 / MFRS 3 Business Combinations, supported by Bloomberg snapshots as evidences for key inputs.

Excellence in Services

We specialise in advisory services in corporate finance and investment advice, supported by research capabilities in specific sectors namely mining, renewable energy, infrastructure, patented / digital technologies, agriculture and plantation in selected emerging economies by ongoing research, analytical tools such as Bloomberg and analysis of public information.

Compliance related

independent advice letters, purchase price allocation reports, independent valuation report

Fund Advisory

fund advisory services on energy, infrastructure, plantation and mining sectors.

Financial Advisory

Asia equity research sdn bhd.

AER is a company licensed to perform advisory services in corporate finance and investment advice, by the Securities Commission Malaysia. We are supported by a team of qualified professionals with background in finance qualifications and industry experiences. We provide corporate finance services namely in the compliance related aspects with the local regulations for listed companies in Malaysia. We provide independent research reports, covering a broad range of sectors covering both stocks and regional macro and micro economics. We also provide fund advisory services in assisting our clients in structuring and arranging funding for the energy and infrastructure sector in Indonesia and other emerging markets.

Lorem ipsum dolor sit amet consectetur adipiscing elit.

Certificate

Team of Experts

We are committed and passionate with our work. We believe with our in-depth technical knowledge and industry experiences, we are able to add value in any corporate activities that we participate

ONG TEE CHIN, CFA, FRM, CAIA

Director, corporate finance.

FARIS AZMI ABDUL RAHMAN

Director, investment advice.

Prasenjit K Basu

Our past credentials.

STRAITS ENERGY RESOURCES BERHAD

PART B - INDEPENDENT ADVICE LETTER FROM AER TO THE NON-INTERESTED SHAREHOLDERS OF STRAITS IN RELATION TO THE PROPOSED ACQUISITION OF 49% EQUITY INTEREST IN SMS FOR A PURCHASE CONSIDERATION OF RM 3,324,902 TO BE PAID BY VIA THE ISSUANCE OF 1,188,543 NEW TMDEL SHARES BASED ON AN ISSUANCE PRICE OF RM2.7976 (equivalent to USD0.6002) PER TMDEL SHARE

BOUSTEAD HEAVY INDUSTRIES CORPORATION BHD

INDEPENDENT ADVICE LETTER FROM ASIA EQUITY RESEARCH SDN BHD TO THE NON-INTERESTED SHAREHOLDERS OF BHIC IN RELATION TO THE PROPOSED DISPOSAL AND PROPOSED INTERCOMPANY TRADE RECEIVABLES SETTLEMENT AGREEMENT

Hextar Capital Berhad

FAIRNESS OPINION LETTERS BY AER IN RELATION TO PROPOSED DISPOSAL OF 400,000 ORDINARY SHARES IN UNIGEL (UK) LIMITED REPRESENTING 40.00% EQUITY INTEREST FOR A CASH CONSIDERATION OF GBP1.30 MILLION AND PROPOSED DISPOSAL OF 400 ORDINARY SHARES IN UNIGEL IP LIMITED REPRESENTING 40.00% EQUITY INTEREST FOR A CASH CONSIDERATION OF GBP0.40 MILLION

EFFICIENT E-SOLUTIONS BERHAD

VI. INDEPENDENT FAIR VALUATION CERTIFICATE FOR REGALIA

CLASSIC SCENIC BERHAD

APPENDIX I - FAIRNESS OPINION REPORT ON THE PURCHASE PRICE

BY AER

HEKTAR REAL ESTATE INVESTMENT TRUST

INDEPENDENT ADVICE LETTER TO THE NON-INTERESTED UNITHOLDERS OF HEKTAR REIT IN RELATION TO THE PROPOSED ACQUISITION AND LEASE

Get in Touch

We will respond to your message as soon as possible.

- +603-7493 5094

- +603-7493 5097

- [email protected]

L-2-1 & L-3-1, Plaza Damas, No. 60 Jalan Sri Hartamas 1, Sri Hartamas, 50480 Kuala Lumpur, Malaysia.

Compliance-related Service

We provide independent advice to advise on the fairness and reasonableness of a proposed transaction, independent advice letters in relation to Chapter 10.08 of the Main / ACE market listing requirements, purchase price allocation reports, and independent valuation reports for various types of financial instruments such as equity, debt, and derivatives in compliance with accounting standards.

We also provide evidence of values for listed companies that wish to determine equity discount rates supported by the beta computations measured at specified intervals based on selected benchmarks, for purpose of the year-end impairment assessment test.

We also provide the services to act as a continuing adviser for companies listed on the LEAP market.

Fund Advisory Service

AER focuses on fund advisory services on renewable energy and infrastructure assets, in Malaysia.

Fund Management Service

Atlantis Capital Ltd focuses on fund management services in mining and infrastructure assets, in DRC Africa and Indonesia.

Executive Director, Corporate Finance

Ong Tee Chin (“Ong”) has a Bachelor of Pharmacy, majoring in Pharmaceutical Science from University Science Malaysia and a Bachelor of Laws from University of London. A Fellow Member of Association of Chartered Certified Accountants (“ACCA”), member of Malaysian Institute of Accountants (“MIA”), Associate Member of Chartered Institute of Management Accountants (“CIMA”), a graduate member of Malaysian Institute of Certified Public Accountants (“MICPA”), is a CFA® charter holder, a certified Financial Risk Manager (“FRM”) by the Global Association of Risk Professionals and a charter holder of the Chartered Alternative Investment Analyst (“CAIA”) Association. He was also the prize winner for Advance Taxation, Malaysian variant conducted by ACCA in December 2002. Also, he possesses a capital market representative license from Securities Commission Malaysia required for conducting advisory work on corporate finance.

Ong’s previous experience include an attachment with one of the Big Four International Accounting Firm and was a finance director for a number of listed companies with operations in Malaysia and Asia Pacific. His past eight years of experience was heading a licensed corporate finance company in Malaysia, providing corporate finance advisory functions in relation to equity valuation, expert report, independent advice letters and feasibility reports for a diverse range of industries such as energy, plantation, mineral, property development, manufacturing, aviation and insurance sector.

Faris Azmi Abdul Rahman (“Faris”) has obtained Bachelor of Commerce majoring Applied Accountancy from Bond University, Queensland Australia. He is a fellow member of Certified Practicing Accounts (“CPA”), Australia. He is currently pursuing the Chartered Islamic Professional Certificate with INCEIF.

He was attached to Arthur Andersen conducting statutory audit, analytical review and conducting risk analysis on clients. Thereafter, he has taken regulatory and compliance role in Securities Commission from 2002 to 2004, where Faris is involved in vetting corporate proposals for applicants seeking for Initial Public Offer (“IPO”), fund raising, restructuring of listed and unlisted public companies in line with the requirements of the SC Guidelines, and vetting of prospectuses for public offering. Thereafter, he has moved into commercial practices taking senior management role in Finance. He was a Finance Director in Coal FE Resources Ltd, a position he held from August 2006 until July 2014, where Faris was responsible for the IPO on the Australian Stock Exchange.

Prasenjit K Basu was Chief Economist for South-east Asia and India at Credit Suisse First Boston and Chief Asia Economist at Daiwa Securities for 5 years each. He had briefer stints (1.5-4 years each) as Global Head of Research at Maybank Kim Eng, Head of Malaysia research and Chief ASEAN Economist at Macquarie Securities, Director of Asia Macroeconomics at UBS Securities, and Director of the Asia Service at Wharton Econometrics.He currently runs an economics consultancy (Real-Economics) and is an Insight Provider at Smartkarma (Singapore) and OHM Research (Brazil). He is also a consultant to the ADB’s independent evaluation department. PK has taught Macroeconomics at the SPJain School of Global Management in Singapore and Dubai, and a course on Asia’s economies for 2 years at ESSEC Asia Pacific Business School (Singapore). He has dual Masters degrees in Public Administration and International Relations from the University of Pennsylvania and a BA (Hons) in Economics from St Stephen’s College, Delhi. His book on the modern economic and political history of the whole of Asia, “Asia Reborn” won the Best First Book award at the Tata Literature Live! Mumbai LitFest (2018h and a bronze award at Singapore’s Golden Door awards for non-fiction writing.

The Role of Equity Research in Stock Market Investing

Source: BURSA MALAYSIA | Published: April 2024

Equity research plays a crucial role in the world of stock market investing. It provides investors with valuable insights, analysis, and recommendations that can significantly impact their investment decisions. This article aims to shed light on the importance of equity research and how it empowers investors to make informed choices. By understanding the role of equity research, investors can navigate the complex landscape of the stock market with confidence and increase their chances of achieving favourable investment outcomes.

The Purpose of Equity Research

Equity research serves two primary purposes: providing fundamental analysis and identifying investment opportunities. Fundamental analysis involves evaluating a company's financial statements, assessing its performance, and determining its intrinsic value. This process helps investors understand the financial health, growth potential, and competitive position of a company.

Equity researchers also identify investment opportunities through sector analysis and company-specific research. Sector analysis involves examining industries and their growth prospects, regulatory environment, and market trends. Company-specific research delves into a particular company's operations, management team, competitive advantages, and prospects. By conducting thorough research, investors can uncover hidden gems and make informed investment decisions.

Equity Research Process

| Process Step | Description | Tools / Techniques |

|---|---|---|

| Accessing company reports, annual statements, quarterly earnings releases, and news articles. | Financial databases like Bloomberg, Thomson Reuters, and company-specific websites. | |

| Analysing balance sheets, income statements, and cash flow statements to assess financial health, profitability, liquidity, and cash flow. | Key financial ratios like Return on Equity (ROE), Earnings Per Share (EPS), and Debt-to-Equity Ratio. | |

| Determining the fair value of a company's stock. | Discounted Cash Flow (DCF) models, Comparable Company Analysis, and combination of various valuation techniques to arrive at a comprehensive valuation range. |

Key Components of Equity Research Reports

Equity research reports are comprehensive documents that provide a holistic view of a company's investment potential. These reports typically include the following key components:

- Executive summary: A concise overview of the company and its investment prospects.

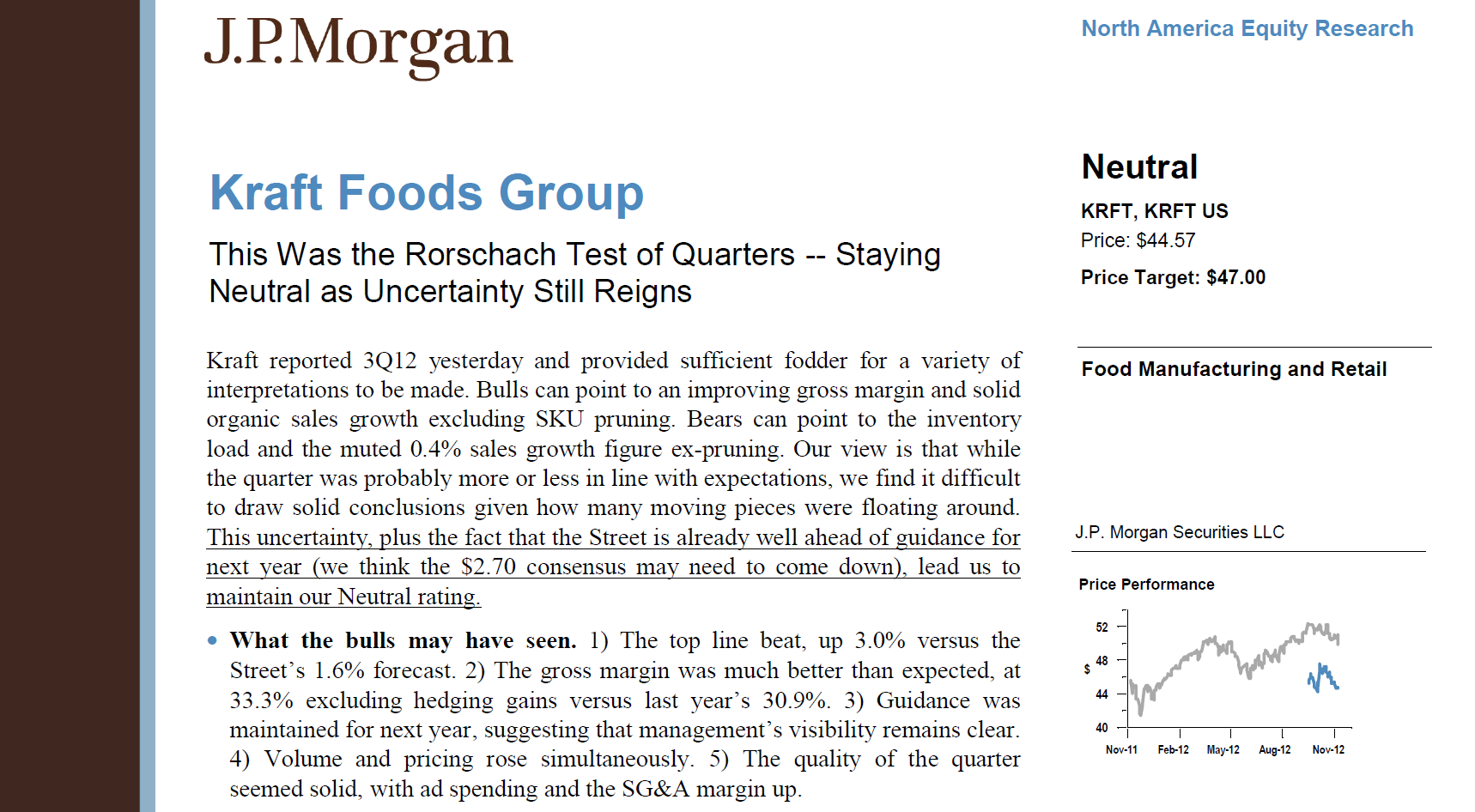

- Investment thesis: A well-defined thesis statement that presents the rationale for investing in the company.

- Industry analysis: An examination of the industry's dynamics, growth drivers, and competitive landscape.

- Company overview: A detailed description of the company's business model, products or services, target market, and competitive advantages.

- Financial analysis and valuation: An in-depth analysis of the company's financial statements, key financial ratios, and valuation models.

- Risks and challenges: A discussion of the potential risks and challenges that investors should consider.

- Conclusion and recommendation: A summary of the research findings and a clear recommendation on whether to buy, sell, or hold the stock.

Benefits of Equity Research for Investors

Equity research offers a multitude of advantages to investors, enabling them to make well-informed investment decisions and elevate the performance of their portfolios.

a) Making informed investment decisions

Equity research provides investors with comprehensive and objective analysis, enabling them to understand the investment potential of different companies. Armed with this knowledge, investors can make informed decisions that align with their investment objectives and risk tolerance.

For example, a retail investor interested in the technology sector can leverage equity research reports to evaluate various technology companies and identify those with robust growth prospects, solid financials, and competitive advantages..

b) Mitigating risks

Equity research helps investors mitigate risks by providing insights into the potential pitfalls associated with specific investments. Researchers highlight factors such as regulatory changes, industry disruptions, and company-specific risks that may impact the investment's performance. For instance, equity research may reveal that a company heavily reliant on a single product faces significant risks if that product becomes obsolete or faces fierce competition. Armed with this information, investors can adjust their portfolio allocation or decide to avoid such high-risk investments.

c) Enhancing portfolio performance

Equity research can contribute to enhancing portfolio performance by identifying undervalued stocks and uncovering investment opportunities that may not be apparent to the broader market. Research-backed investment decisions based on thorough analysis and valuation models have the potential to generate favourable returns over the long term.

Challenges and Limitations of Equity Research

While equity research offers numerous benefits, it also faces certain challenges and limitations that investors should be aware of.

a) Availability of reliable data

Researchers heavily rely on accurate and up-to-date data to conduct their analysis. However, data availability can sometimes be limited, especially for smaller companies or those operating in less transparent markets. This can impact the quality and depth of research coverage.

b) Bias and conflicts of interest

Equity research may be influenced by bias or conflicts of interest, particularly when it is produced by brokerage firms that also engage in investment banking activities. Such conflicts can potentially impact the objectivity of research reports and recommendations.

c) Regulatory constraints

Regulatory requirements, such as the Chinese Wall, which mandates a separation between research and investment banking divisions within financial institutions, can limit the flow of information and collaboration among teams. These constraints can affect the quality and independence of equity research.

The role of equity research in stock market investing cannot be overstated. It serves as a valuable tool that empowers investors to make informed decisions, mitigate risks, and enhance portfolio performance. Through thorough analysis of financial statements, industry dynamics, and company-specific factors, equity research provides investors with valuable insights and recommendations that can shape their investment strategies.

By leveraging the expertise and research-backed information provided by equity research, investors can navigate the complexities of the stock market with greater confidence and increase their chances of achieving favourable investment outcomes. It is crucial for investors to recognize the benefits of equity research while being mindful of its limitations and potential biases. By incorporating equity research into their decision-making process, investors can optimise their investment strategies and pursue their financial goals with greater precision and success.

For investors seeking to obtain equity research reports in Malaysia, Bursa Malaysia’s website is a valuable resource. These reports can be especially useful for understanding the Malaysian stock market. To access these reports, visit Bursa Malaysia's research coverage page .

About Bursa Malaysia

Bursa Malaysia is an exchange holding company incorporated in 1976 and listed in 2005. One of the largest bourses in ASEAN, Bursa Malaysia helps over 900 companies raise capital – whether through the Main Market for established large-cap companies, the ACE Market for emerging companies of all sizes, or the LEAP Market for up-and-coming SME companies. Bursa Malaysia’s diverse product range includes equities, derivatives, offshore and Islamic assets as well as Exchange Traded Funds (ETFs), Real Estate Investment Trusts (REITs) and Exchange Traded Bonds and Sukuk (ETBS). Find out more here

* Some financial products and services may not be classified as Shariah-compliant. Please research carefully before making any financial decisions

Ascentrik. (n.d.). Role of Equity Research and Reporting in Financial Markets. Retrieved January 5, 2024, from

Picardo, E. (2022, October 19). Equity Research vs. Investment Banking: What’s the Difference? Investopedia.

Powell, S. (n.d.). Equity Research Overview. Corporate Finance Institute.

Wallstreetmojo. (n.d.). What Is Equity Research? WallStreetMojo.

Wayman, R. (2022, September 1). How Has Equity Research Changed. Investopedia.

Tags: Equities

Recommended

Why choose Leveraged & Inverse ETFs

Learn more about the product characteristics and benefits.

Investment Portfolio for the Next Bull Market

The markets have not had it easy with the COVID-19 pandemi...

Evaluating Market Performance Over Multiple...

Of the many things to study about the market, a good...

Your Selected Content Has Been Stored Here

To Add More Bookmarks Please Register/Login

It seems that you have not completed "Introduction to Islamic Equities Market".

You will need to complete "Introduction to Islamic Equities Market" before you may proceed to "An Intermediate Explanation of Islamic Equities Market".

You will need to complete "Introduction to Islamic Equities Market" and "An Intermediate Explanation of Islamic Equities Market" before you may proceed to "Advancing Your Knowledge of Islamic Equities Market".

We use cookies to give you the best experience on our Website. By continuing to use our Website, you agree to the use of cookies to help us understand how you use the Website. You may change your cookie settings through your browser.

What is an Equity Research Report?

Contents of an equity research report, buy side vs sell side research, why do banks publish equity research reports, equity research report recommendations, different types of reports, equity research report example, additional resources, equity research report.

A recommendation to buy, sell, or hold shares of a public company

An equity research report is a document prepared by an Analyst that provides a recommendation on whether investors should buy, hold, or sell shares of a public company . Additionally, it provides an overview of the business, the industry it operates in, the management team, its financial performance , risks, and the target price.

To learn more, check out CFI’s Valuation Modeling Classes .

Let’s take a closer look at what’s included in an equity research report. Below is a list of the main sections you’ll find in one of these reports.

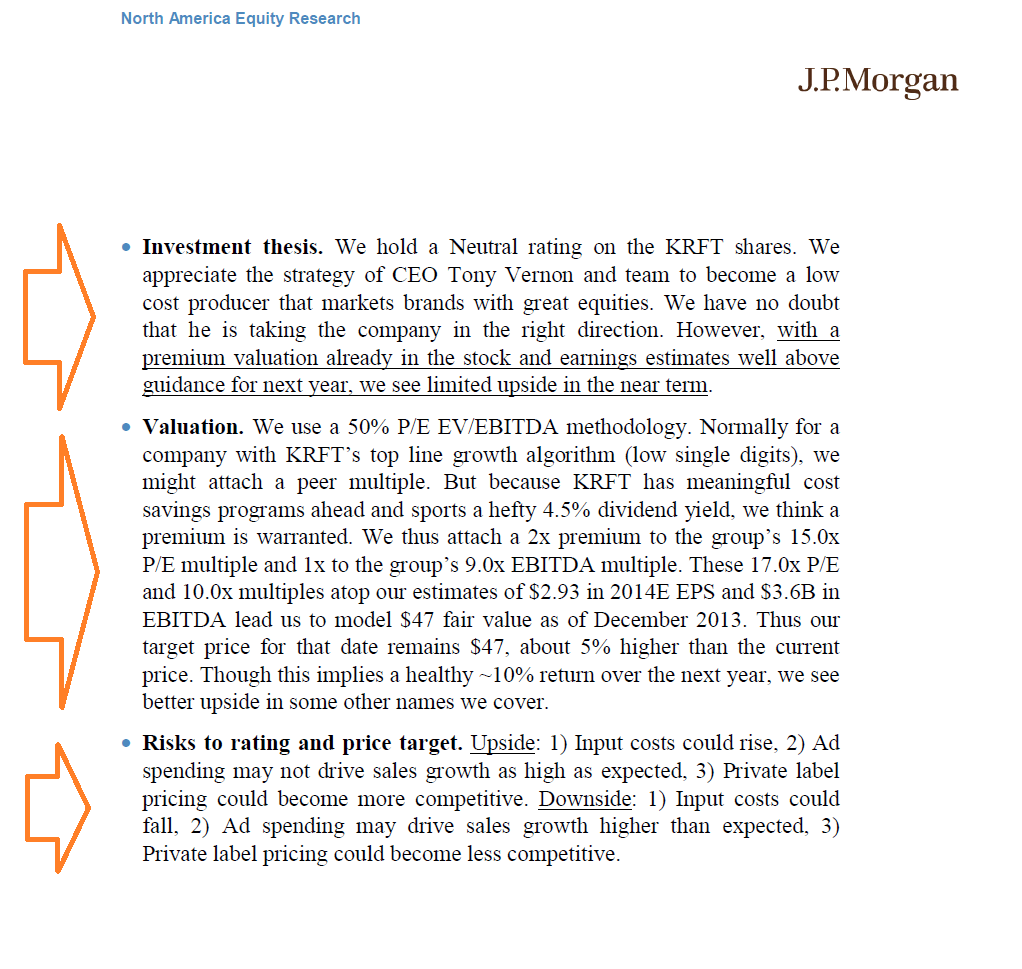

- Recommendation – Typically to either buy, sell, or hold shares in the company. This section also usually includes a target price (i.e., $47.00 in the next 12 months).

- Company Update – Any recent information, new releases, quarterly or annual results , major contracts, management changes, or any other important information about the company.

- Investment Thesis – A summary of why the analyst believes the stock will over or underperform and what will cause it to reach the share price target included in the recommendation. This is probably the most interesting part of the report.

- Financial Information & Valuation – A forecast of the company’s income statement , balance sheet, cash flow , and valuation. This section is often an output from a financial model built in Excel.

- Risk & Disclaimers – An overview of the risks associated with investing in the stock. This is usually a laundry list that includes all conceivable risks, thus making it feel like a legal disclaimer. The reports also have extensive disclaimers in addition to the risk section.

It’s important to distinguish between buy side and sell side research reports.

Buy side firms (asset management companies) have their own internal research teams that produce reports and recommendations on which stocks the firm and its portfolio managers should buy and sell. The reports are only used for internal investment decision making and not distributed publicly.

Sell side firms such as investment banks produce equity research reports to be disseminated to their sales and trading clients and wealth management clients. These reports are distributed for free for a variety of reasons (explained below) and have a specific recommendation to buy, sell, or hold as well as an expected target price.

Learn more about buy side vs sell side jobs.

The sell side publishes reports to generate fees, both directly and indirectly.

Direct: Trading Commissions

When an investment bank publishes valuable equity research for an institutional client, that client is then likely to use the bank to execute their trades for that stock. While there no actual agreement to do so, it’s an unspoken rule. The bank may also use the report to persuade the client to buy more shares in a holding they already have, to therefor further increase commissions.

Indirect: Investment Banking Relationships

All banks have a Chinese Wall between their investment banking teams and research departments, but there still remains an indirect incentive for research to be supportive of stocks the bank may provide investment banking services to. The fees that investment bankers earn on underwriting and mergers and acquisitions (M&A) are huge, and a bank would never want to miss out an opportunity to work with a CEO of a public company because the bank had a “Sell” rating on their stock.

For this reason, sell side research typically includes a disclaimer along the lines of, “Bank X seeks and does business with companies that are covered in its research reports. Because of this, investors should be aware that the firm may have a conflict of interest (due to these investment banking relationships) that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.”

Each bank has their own set of recommendations (terms) they use to rate a stock. Below is a list of the most common recommendations or rating analysts issue.

Ratings include:

- Buy, Outperform, Overweight

- Hold, Neutral, Marketweight

- Sell, Underperform, Underweight

To learn more, check out CFI’s Valuation Modeling Courses .

This guide has focused on a “typical” equity research report, but there are various other types that can take slightly different forms. Below is a list of other types.

Types of reports:

- Initiating Coverage – A long report (often 50-100+ pages long) that is released when a firm starts covering a stock for the first time.

- Industry Reports – General industry updates about a few companies in a sector.

- Top Picks – A list and summary of a firm’s top stock picks and their targeted returns.

- Quarterly Results – A report that focuses on the company’s quarterly earnings release and any updated guidance.

- Flash Reports – Quick 1-2 page report that comments on a new release from the company or other quick information.

Below is an example of an equity research report on Kraft Foods. As you can see in the images below, the analyst clearly lays out the recommendation, target price, recent updates, investment thesis, valuation, and risks.

Thank you for reading CFI’s guide on Equity Research Report. To learn more, these additional resources will be helpful:

- Investment Research

- Types of Valuation Multiples

- DCF Modeling Guide

- Finance Salary Guides

- See all valuation resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

PWB : Research Report

MI : Research Report

Equity market investment research, t3bb : research report, benefits to the investor, 6tt : research reports, economic viewpoint, market strategy, sector reports, company reports, equity derivatives reports, technical analysis, info : get started 6, get started.

Become a KenTrade client today

Open an Account

or call us at 1800-88-2274

View My Following List

AskListing@Bursa

Anda akan dialihkan ke AskListing@Bursa, adakah anda pasti untuk meninggalkan halaman ini?

Anda akan dialihkan ke Help Desk, adakah anda pasti untuk meninggalkan halaman ini?

Anda akan dialihkan ke Bursa Link, adakah anda pasti untuk meninggalkan halaman ini?

Bursa Marketplace

Anda akan dialihkan ke Bursa Marketplace, adakah anda pasti untuk meninggalkan halaman ini?

LFX Listing Sponsor

Anda akan dialihkan ke LFX Listing Sponsor, adakah anda pasti untuk meninggalkan halaman ini?

Tadbir Urus Korporat dan Kelestarian

Anda akan dialihkan ke laman web BursaSustain, adakah anda pasti untuk meninggalkan halaman ini?

Bursa Academy

Kenyataan Media

BURSA MALAYSIA LAUNCHES BURSA IN-DEPTH EQUITY ANALYSIS RESEARCH COMPETITION

Total of RM10,000 cash prizes to be won

Kuala Lumpur, 9 October 2023 – Bursa Malaysia Berhad (“Bursa Malaysia” or the “Exchange”) has launched the Bursa In-Depth Equity Analysis Research Competition (Bursa IDEA) that aims to stimulate research interest and nurture research skills, while promoting a deeper understanding of the financial landscape among the public. For the competition, participants are invited to submit a research report on the theme ‘Market Trends and Sector Analysis’. This can cover topics related to the equity market and economic factors that may affect market trends. The submission may also include research on sectoral trends and analysis. The competition period runs from 9 October to 3 November 2023, and is open to all Malaysians aged 18 years and above. A total amount of RM10,000 in cash prizes will be awarded. Datuk Muhamad Umar Swift, Chief Executive Officer of Bursa Malaysia remarked, “This competition provides a platform for up-and-coming researchers, analysts, and market enthusiasts to showcase their prowess in equity analysis and report writing. This aligns with Bursa Malaysia’s efforts in nurturing talent and fostering growth in the capital market. Initiatives like these have the added benefit of sparking the generation of investment ideas, drawing inspiration from current economic developments and industry advancements, ultimately injecting greater vitality into the market." In the preparation of their submissions, participants can leverage on tools like Bursa Digital Research, Bursa RISE reports, Refinitiv data, Screener, heatmap and other educational content that are available on Bursa Malaysia’s websites. A webinar will also be held during the competition period to help interested participants understand how to craft a good research report. The submissions will be evaluated by a panel of expert judges following specific assessment criteria, which include the research methodology, coherence of ideas and analysis, structure as well as report presentation. Interested participants may visit https://www.bursamarketplace.com/idea for more information and to register for Bursa IDEA.

Proton makes cheeky fun of Tesla’s Cybertruck in X50 social media ad (VIDEO)

Court allows Najib to object to Malaysian Bar’s bid to challenge reduction of his jail time, fine

Thursday, not Tuesday: PM Anwar raps home minister for batik blunder in Parliament

Malaysia Airlines, AirAsia among top in the world for losing the least luggage

Now you can invest in digital gold from just RM10 with your TNG eWallet

Following backlash, OCM reveals new Olympic kit with 'fiercer-looking' tiger stripes

Citigroup: Malaysia’s spending in first five months of 2024 makes fuel subsidy cuts urgent

Trump cautious as calls for Biden to withdraw ahead of election grows

Singapore says could recognise Palestinian state ‘in principle’ only if it accepts Israel’s right to exist

Sabah brings back Brenndon Soh as AG after ‘blunder’ on SLS bid to win back state’s revenue

PM Anwar: Perak river can supply 1,500 million litres of water per day to northern part of state and Penang, meeting essential needs

PM Anwar proposes economic adjustment with new cost-of-living indicator, set to improve on CPI

Selangor’s RM406b contribution to Malaysia’s 2023 GDP a new record, says MB

DoSM: Selangor top contributor to Malaysia’s 2023 GDP

Fund with 24pc returns bets on Malaysia’s tech and AI stock surge

Midf research: malaysia’s equity market to continue positive momentum in 2h2024 .

KUALA LUMPUR, June 26 — MIDF Research anticipates Malaysia’s equity market will continue its positive momentum in the second half of this year (2H2024).

In its market report for 2H2024 today, MIDF Research said that the local equity market has performed relatively well thus far this year with its main benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) recording a gain of 9.3 per cent year-to-date (until June 21).

“We expect the local equity market to gain further ground driven by the inflow of foreign funds, and premised on healthy macro and corporate earnings outlook,” it said

MIDF Research said that the positive market momentum was driven by foreign funds, which arguably played a major role in driving up the local equity market this year.

“From early January to February 27, the local equity market recorded net foreign purchases of RM2.4 billion while the FBM KLCI rose 104 points.

“From April 23 to May 23, the local equity market recorded net foreign purchases of RM3.7 billion and the FBM KLCI rose 82 points to its highest daily close thus far this year at 1,629 points,” said the report.

MIDF Research said it expects to see a resumption of foreign fund inflows as early as in third quarter of this year.

It said that the positive market momentum premised on healthy fundamentals and the boost driving up the local equity market thus far this year were premised on healthy macro and corporate earnings performance.

“Malaysia’s economic growth accelerated to 4.2 per cent year-on-year (y-o-y) in 1Q2024 (4Q2023: +2.9 per cent y-o-y), surpassing expectations.

“Meanwhile, corporate earnings expanded in 1Q2024 with the aggregate normalised earnings of FBM KLCI growing both quarter-on-quarter and y-o-y at 11.3 per cent and 15.8 per cent, respectively,” MIDF Research said.

Meanwhile, it said that macro and earnings growth is expected to continue.

“We expect Malaysia’s economy to see continued expansion in domestic demand and benefit from the recovery in external trade.

“We believe the positive momentum will continue in the coming quarters; therefore, we forecast that Malaysia’s GDP growth this year will be faster at +4.7 per cent (2023: +3.6 per cent),” said MIDF Research.

It also noted that local corporate earnings remain healthy going forward against the backdrop of a broader (both domestic and external demand) rise in macroeconomic activities amidst declining price pressure and a stable interest rate environment.

“In this regard, the consensus earnings of FBM KLCI are expected to grow by +5.3 per cent this year and +7.9 per cent next year,” MIDF Research added. — Bernama

You May Also Like

Related articles.

Report: Philippine’s Jollibee to acquire 70pc stake in Korea’s Compose Coffee

The fortunes of a country’s equity or stock market are closely aligned with its economic well-being, and Malaysia is no exception. Similar to its global peers, Bursa Malaysia been enduring much turbulence in the last few years. Buffeted by strong external and internal headwinds, the market capitalisation of the local bourse had moderated further to RM1.74 trillion as at end-2022 (end-2021: RM1.79 trillion).

Bursa Malaysia has the distinction of being among the biggest bourses in ASEAN with well over 900 listed companies. Investors can choose from a variety of listed products, including equities, derivatives, exchange-traded funds (ETFs), real estate investment trusts (REITs), and exchange traded bonds and sukuk (ETBS). Notably, 789 (81.2%) of the 972 listed entities on the local bourse were Shariah-compliant securities as at end-December 2022. These accounted for RM1.139 trillion or 65.6% of Bursa Malaysia’s overall market capitalisation as at the same date. Despite the tumultuous global markets, a total of RM26.0 billion was raised from the Malaysian equity market in 2022. Of this amount, RM3.5 billion originated from the primary market, i.e., via 35 initial public offering (IPOs). The other RM22.6 billion stemmed from secondary fundraising. The sturdier performance in 2022 was driven by a 52% y-o-y surge in IPOs and a 58% spike in secondary issuances.

Bursa Malaysia operates through three markets – the Main Market, the ACE Market and the LEAP Market. Each has a different set of listing criteria for aspiring candidates. The following represents some of the most salient points of the respective marketshe Main Market is the primary market for larger companies with strong operating and profit track records, with a minimum required market capitalisation of RM500 million upon listing, among other things.

- The Main Market is the primary market for larger companies with strong operating and profit track records, with a minimum required market capitalisation of RM500 million upon listing, among other things.

- The ACE Market is a sponsor-driven alternative market designed for smaller companies that exhibit strong growth potential. No minimum profit or operating track record is required for listing.

- The LEAP Market is a fundraising platform for what are perceived as underserved SMEs, which do not need to demonstrate any operating or financial track record. This adviser-driven market is only available to sophisticated investors.

In 2022, the Main Market hosted the listing of five companies while the ACE Market welcomed 25 and the LEAP Market contributed another five – bringing the total to 35 IPOS for the year. Together, these newly listed entities raised RM3.49 billion.

The listing process (from the time the candidate engages an adviser to the day of listing) usually takes four to nine months, depending on the structure and complexity of the listing scheme. Upon approval, the entity will be given six months to complete its IPO exercise.

Bursa Malaysia also offers an end-to-end Shariah-compliant investing platform, along with the world’s first end-to-end Shariah-compliant commodities-trading platform. In recognition of the importance of sustainable and responsible investment, Bursa Malaysia launched the FTSE4Good Index in 2014. This index permits investors to measure domestic companies’ performance based on ESG standards. In July 2021, the local bourse introduced the FTSE4Good Bursa Malaysia Shariah Index – the Shariah-compliant version of the former. This new index will assist fund managers to develop new investment products constituting a portfolio of Shariah-compliant equities, guided by sustainable investing principles.

The Malaysian stock market benefits from a diverse pool of investors, underscored by sturdy support from local institutional and retail investors. Domestic institutions remained net sellers in 2022, to the tune of RM6.53 billion (2021: RM9.1 billion). Meanwhile, local retail investors infused RM2.31 billion of net funds into the equity market, which paled in comparison to the previous year’s RM12.2 billion. Interestingly, foreign investors pumped in RM4.40 billion net (2021: RM3.15 billion) after four consecutive years as net sellers. Against this backdrop, the participation rate of retail investors declined to an average of 25.7% in terms of transaction value, relative to 34.6% in 2021. Nonetheless, this is still higher than the five-year pre-pandemic average of 18.8%

To invest in shares in Malaysia, one must be over the age of 18, open a Central Depository System (CDS) account and a trading account at a stockbroking firm. There are specific steps to follow pursuant to this, as detailed on Bursa Malaysia ’s website.

The Securities Commission Malaysia (SC) is the ultimate regulator of the Malaysian capital markets, including the equity market. As the front-line regulator, Bursa Malaysia, is tasked with safeguarding a fair and orderly market for the trading of securities and derivatives. The SC supervises and monitors Bursa Malaysia on listing, trading, clearing, settlement, and depository operations – to ensure the latter effectively performs its regulatory duties and obligations. Brokers and regulated entities must comply with the various rules set by Bursa Malaysia.

- Why Malaysia

- Fixed Income

- Private Equity & Venture Capital

- Success Stories

- Equity Crowdfunding (ECF)

- Peer-to-Peer (P2P) Financing

- Digital Investment Managers (DIM)

- Digital Asset Exchange (DAX)

- Islamic Fintech

- Conventional

- Sustainable and Responsible Investment (SRI)

- Transition Strategy Toolkit

- Simplified ESG Disclosure Guide

- Elevate Programme 2.0

- Malaysian Sustainable Finance Initiative

- Sustainable Investment Platform

- Centre for Sustainable Corporations

- Publications and Research

- Board Members

The Institute for Capital Market Research Malaysia undertakes research topics relevant to Malaysia’s capital market development. Through a collaborative approach, insights and best practices from both global and local stakeholders will be harnessed to bridge the gap between theory and practice and to further promote sustainable market development.

Knowledge Sharing Session: Behavioural Insights

On June 14, 2024, ICMR hosted a knowledge-sharing session titled “Sharing Experiences with Behavioural Experiments” . This event brought together leading experts from Research For Impact (RFI) Singapore, the Thailand Development Research Institute (TDRI) and ICMR – each sharing invaluable insights on leveraging evidence-based approaches and behavioural insights to formulate effective policy interventions.

OUR LATEST RESEARCH

The Case for A Social Exchange in Malaysia

An Experimental Investigation of Online Investor Education for Youths in Malaysia

Our research partners.

| |

OTHER LINKS

- Maybank2u Online Stocks

- Powerbroking2u Online

- Events Calendar

- In The News

- Sustainable Financing

- Sustainable Investing

- Best of Invest ASEAN

- Invest ASEAN 2023

- Invest ASEAN 2022

- Invest ASEAN 2021

- Our Mission

- Our Sustainability Journey

- Our Leadership

- Global Presence

- Annual Reports & Financials

- Annual Corporate Disclosures

- Institutional

- Mergers & Acquisitions

- Debt Capital Markets

- Equity Capital Markets

- Strategic Advisory

- Equity and Commodity Derivatives

- Institutional Broking

- Private Client Services

- Remisier Services

- Ways to Trade

Extensive, Full-Fledged, On-Ground, In-Country Teams

As the wholly-owned investment banking arm of Maybank, Malaysia's flagship financial services brand, we have a strong regional presence across ASEAN and beyond. We are able to deliver rich insights for the ASEAN region through our full-fledged, in-house, in-market research teams and their extensive experience with regional companies, stocks, economies, sectors and trends. We are also uniquely positioned as one of the few investment banks that cover small-cap, mid-cap as well as large-cap companies.

Maybank Investment Bank Berhad (Maybank IB) is the wholly-owned investment banking arm of Maybank, Malaysia's flagship financial services brand. The acquisition of Kim Eng Holdings Limited (Kim Eng) by Maybank Group in 2011 had resulted in the combined entity of Maybank IB and Kim Eng known regionally as Maybank Investment Bank (Maybank IBG). We are ASEAN's leading home-grown investment bank and an unrivalled thought leader on the region.

We provide clients with research reports from 11 markets on Maybank Trade - Malaysia, Hong Kong, India, Korea, Philippines, Singapore, Taiwan, Thailand, and US. Research reports include Company, Economics, Global, Sector, Strategy, Technicals, and Macro reports. We have won several Thomson Reuters' Starmine and Asiamoney awards for excellence. These awards span multiple industry sectors, bearing testament to the quality of our research and assets.

The team comprises both senior and junior analysts. The senior analysts have more than 30 years of industry experience collectively, and bring insight, stability, and guidance to the team. The younger analysts add energy, vitality, and a fresh perspective to the mix. The team provides analyses and strives to identify themes and generate ideas that are unconventional and ahead of the curve. Our objective is not just to forecast corporate earnings and target prices accurately, but also to identify and highlight catalysts, events, and corporate actions that can be translated into profitable investment ideas.

Daily Reports

Look out for our morning and midday guides to the day's events, as we share ideas and market feel for each trading day.

Wide Range of Reports

We provide a wide range of research reports including Strategy, Company, Economics, Global, Sector, Technicals, and Macro reports. Our Strategy reports offer traders unique investment ideas that shed light on regional and global markets. For Company reports, in addition to providing critical insights into blue chip names under its customary big-cap coverage, we distinguish ourselves from our peers with our focus on mid and small-cap stocks and have a good track record of uncovering relatively unknown, but promising companies.

Global Research Reports

We offer research reports on 11 markets - Malaysia, Hong Kong, India, Indonesia, Korea, Philippines, Singapore, Taiwan, Thailand, Vietnam, and US. Clients can also receive these research reports via e-mail.

Research Videos

Go to our YouTube channel to watch our analysts share their ideas, talk strategy, and give insights into the market.

Make an enquiry

We are here to help

Stay ahead of the curve

Never miss an opportunity even when on the move

Malaysia: Shifting Into Higher Gear

Invest ASEAN 2023 Conversations

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Research Coverage

Bursa Malaysia's performance is covered by the following analyst. Please be informed that any views, forecasts or recommendations made by these certified professional analysts does not represent Bursa Malaysia's opinions or recommendations and we also do not endorse any of their views, forecasts or recommendations.

| No. | Research House | Analyst | E-mail Address | Contact No. |

|---|---|---|---|---|

| 1. | AFFIN HWANG CAPITAL | Tan Ei Leen | 03-2142 4159 | |

| 2. | Quah He Wei | 03-2604 3974 | ||

| 3. | Kelvin Ong Toh Meng | 03-2036 2294 | ||

| 4. | Winson Ng | 03-2084 9686 | ||

| 5. | Tan Yong Hong | |||

| 6. | Lim Sue Lin | 03-2056 7875 | ||

| 8. | ||||

| 7. | Jeremy Goh | 03-2083 1716 | Linda Koh | 03-7721 8060 | -->

| 8. | Nurzulaikha Azali | 03-2171 0502 | ||

| 9. | Clement Chua | |||

| 10. | Ben Shane Lim | 03-2059 8868 | ||

| 11. | Wong Chew Hann | 03-2297 8686 | ||

| 12. | Imran Yassin Md Yusof | 03-2173 8395 | ||

| 13. | Tushar Mohata | 03-2027 6895 | ||

| 14. | Nabil Thoo | 03-9280 8890 | ||

| 15. | TA Research | 03-2072 1277 ext. 1626 | ||

| 16. | Nicole Goh | 03-2781 1133 | ||

| 17. | Keith Wee | 03-2147 1992 |

- List of analyst is subject to change.

- Bursa Malaysia does not distribute copies of analysts' reports and will only do so on selective basis.

Penn Libraries FAQ

- Penn Libraries

Q. How do I find analyst reports (investment bank research)?

- Exhibitions

- Fisher Fine Arts

- General Information

- Phased Library Services

- Rare Books & Special Collections

- Systematic Reviews

- University Archives & Records Center

Answered By: Lippincott Library Last Updated: Apr 21, 2024 Views: 174953

Use LSEG Workspace (formerly Refinitiv).

- To find analyst reports (also known as sell-side, broker, or equity research reports) for a specific company, search for that firm's ticker symbol or name in the top search box. Then, on the News & Research menu, click on Company Research . Use filters near the top of the page to refine your search.

- To screen for analyst reports based on a set of criteria, type ADVRES in the search bar and select the Research Advanced Search app, or click on Research in the main menu. then, click on Advanced Research . You can filter for reports by industry, geography, contributor, keywords, and more.

Note: LSEG Workspace has a 150-page daily limit for viewing and downloading research content. This limit is in lieu of retail prices listed on reports and resets at 12:00 AM Eastern Time daily.

Bloomberg (see access details ) contains some analyst reports.

- Type your company's ticker symbol, then hit the yellow EQUITY key, then type DSCO and hit the green GO key.

- To find reports by industry or keyword, type RES and hit the green GO key.

Morningstar equity research reports and analyst cash flow models can be found in PitchBook .

Hoovers contains some analyst reports as well.

- Type in a company name and select the company you want.

- Scroll down the screen; if available, analyst reports appear under Advanced on the left side.

- Share on Facebook

Was this helpful? Yes 0 No 0

- Publishing Policies

- For Organizers/Editors

- For Authors

- For Peer Reviewers

Corporate Social Responsibility And Brand Equity Of Malaysian Top 100 Brand Companies

In the recent economic systemic shifts perceived by the company value system from tangible to intangible assets, interest in brand equity receives growing attention from both practitioners and academics. Nevertheless, since most of these organisations accept these activities as part of their corporate social responsibility (CSR), corporations are also gradually implementing more ethical behaviours in relation to their communities. They are also acknowledging their crucial role in social, environmental and economic issues and the way in which they can enhance their companies’ brand equity. Having acknowledged the significance of CSR activities, the purpose of this paper is to provide a greater insight into how CSR practices affect company brand equity. Very few studies have examined this relationship in the context of Malaysian public listed companies (PLCs). Secondary data obtained through content analysis of Malaysian PLCs’ 2016 Annual Reports and a sample of Malaysia’s Top 100 Brands (whose names and brand equity values are set out on The Brand Finance website) was used to cover the assessment. The results showed that companies aggressively involved in CSR operations, especially environmental, community and workplace operations, found that this involvement enhanced their brand value. Reasonable CSR activities can effectively achieve high brand value. The findings are pertinent to both practice and theory. Keywords: Corporate social responsibility environmental community workplace brand equity

Introduction

The notion of good works or corporate social responsibility (CSR) was originally described as the accountability of management for the community from which their profit derived. The concept has evolved over time and led to a multitude of ideas such as corporate social efficiency, corporate social responsiveness, corporate philanthropy, accountable businesses, accountable entrepreneurship and corporate citizenship ( Kim et al., 2017 ; Pakseresht, 2010 ). CSR activities are essential for businesses today, not just to meet the interests of their investors and society ( Tuan, 2012 ), company strategies (Pakseresht, 2010; Ding et al. (2016) and environmental or social goals (Rhoua et al., 2016). CSR practices benefit companies by improving brand equity (BE) and gaining a strong brand reputation and image that could result in a competitive advantage and positive economic results (Pakseresht, 2010; Rhoua et al. 2016; Bajic & Yurtoglu, 2018). In addition, prior studies (Chomvilailuk & Butcher, 2010; Hoeffler & Keller, 2002) recognised CSR as one of the enablers that influence brand building. Thus, many companies have participated in CSR activities such as employee benefits and environmental protection to persuade and attract new and loyal clients while at the same time strengthening their brand confidence (Rhoua et al., 2016). Ultimately, the CSR activities of many businesses address the many requirements of the stakeholders of the firm.

The stakeholder principle enlightens us that an organisation is not only obligated to satisfy the interests of shareholders, but also the wants of a variety of people or businesses and is thus responsible for creating and maintaining good relations (Jones, 2005). These responsibilities can be defined as legal, moral or fiduciary responsibilities for their stakeholders (Clarkson, 1995). Therefore, this theory validates the concept of corporate citizenship (Clarke & Clegg, 1998). Additionally, past research has proven that weak or conversely strong moral responsibility developed by a company for its stakeholders, can have a huge effect on the company’s performance in a positive or negative way (Greenley & Foxall, 1997). Previous studies have found that stakeholders can have a major effect on CSR activities and should be made operational (Godfrey & Hatch, 2006; Piercy & Lane, 2009), especially in view of the marketing benefits of CSR for stakeholder relations (Hult et al., 2011; Maignan & Ferrell, 2004; Russo & Perrini, 2009). As a result, CSR practises are now regarded as extremely significant by individuals with authority in business (Pivato et al., 2008; Piercy & Lane, 2009). In the meantime, Sen et al. (2006) asserted that CSR are influencing stakeholders to buy products and improve their overall relationship with the firm.

The brand definition became well known and an important instrument for business success in the 1980s (Aydin & Ulengin, 2015; Pakseresht, 2010) as it conveyed and told a product to both company managers and customers. The product name became a sign of a commitment by following a product brand that the expectation of the consumer would be fulfilled and served as a protection against rivals copying or imitating the product (Aydin & Ulengin, 2015). Brands are to generally add benefits and the figure of these values forms equity (Pakseresht, 2010), a point completely endorsed by Wang (2010), who defined the additional economic value that a brand provides to a business, specifically from an economic perspective, as a result of BE. As a well-recognized brand can also bring tremendous corporate value and have a positive impact on clients' minds, it is advisable to perceive brand growth as an opportunity for future returns (Aydin & Ulengin, 2015). Furthermore, in the long term, a brand offers a valuable intangible financial asset that allows a company to build trust and loyalty among its customers (Pakseresht, 2010). As a result, it is anticipated that a business with a strong brand and high BE would have improved corporate results (Aydin & Ulengin, 2015; Bajic & Yurtoglu, 2018).

Nowadays, companies are facing considerable pressure from the government and the public to do good works and therefore, the majority of global companies has concentrated on CSR activities. In marketing literature (Bhattacharya, 2017; Golob & Podnar, 2018; Yang & Basile, 2019), CSR activities are clearly connected to BE and this relationship has forced companies to put more effort into CSR activities. Importantly, since strong brands are often related to marketing performance and is applied to assess the premium value that a customer can pay during a merger or acquisition process, the degree of rivalry has also forced businesses to control their brands (Campbell, 2002; Tiwari, 2010). A good brand is useful for corporate decision makers to achieve better financial terms and add value to the organisation in different crises, dynamic markets and adverse business circumstances (Tiwari, 2010; Dutordoir et al., 2015). It clearly demonstrates, therefore, that brands are one of the most significant intangible assets for a business. Importantly, one of the products of CSR operations is BE. Importantly, BE is one of the outcomes of CSR activities and with this in mind, this research is to investigate the impact of CSR activities on BE among Malaysia’s Top 100 Brands using a financial-based BE approach.

Problem Statement

Many past studies have proven that, in general terms, CSR affects BE (Benoit-Moreau & Parguel, 2007; 2011, Wang, 2010; Tuan, 2012, Wang et al., 2015; Singh & Islam, 2017; Lv et al., 2019) and specific CSR activities on BE (Fatma et al., 2015; Lv et al., 2019). Empirical studies have also revealed that a company employing CSR practices is able to strengthen its brand (Iqbal et al., 2013). In fact, many past studies by Pakseresht (2010), Torres et al. (2012), Iqbal et al. (2013), Fatma, Rahman and Khan (2015), Bhattacharya and Kaursar (2016) and Woo and Jin (2016) have evaluated the link between CSR and BE in both developed and developing countries. In developing countries like Malaysia, however, there has been minimal study into the relationship between CSR activities and BE (Choongo, 2017; Yang & Basile, 2019; Tilt, 2016). Therefore, in the Malaysian context, a limited research on the impact of CSR activities on BE motivated the authors to undertake this present study.Malaysia offers a unique business background to conduct research unravelling the relation between CSR and BE. Very few studies have delved into this relation in emerging economies that are characterized by high degree of inequality information and lower disclosure level.

Research Questions

This research aims to answer the questions as below:

Is there an effect of corporate social responsibility activities (environmental, community and workplace) on brand equity?

Purpose of the Study

This investigation is to analyse the impact on brand equity among Malaysia's Top 100 Brands in 2016 of CSR activities, namely environmental, community and workplace activities. The findings of this study could help the management of PLCs in Malaysia to engage, strategize and communicate their CSR activities and their benefits for BE. Indirectly, stakeholders will also benefit from CSR activities undertaken by these companies. Therefore, this study proposes the following hypothesis to explore more on this specific element of CSR:

H1: There is a relationship between environment and brand equity.

H2: There is a relationship between community and brand equity.

H3: There is a relationship between workplace and brand equity.

Research Methods