This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Accountants as Problem Solvers

August 01, 2020

By: Linda McCann , DBA, CMA, CPA ; David Horn , CPA ; Jennifer Dosch , CMA

Managers often complain that accounting graduates aren’t prepared for today’s business environment. The complexity of our global economy and the increasing influence of, and reliance on, technology leads to practitioners and instructors questioning if undergraduate accounting programs focus on the right curriculum to prepare students for careers.

One soft skill that can help prepare accounting students for their careers is problem solving. Management accountants need to be able to work cross-functionally to solve problems and provide meaningful analyses. Many colleges, universities, and accrediting bodies in academia incorporate strategic goals requiring curriculum that facilitates problem-solving skills.

As instructors, we teach technical accounting skills by demonstrating and providing practice with accounting concepts and structured problems, which we assess via homework and exams. Teaching soft skills, such as unstructured problem solving, poses greater challenges that are more difficult to incorporate into the curriculum. How can students learn and approach unstructured problem solving?

A SLOW-THINKING APPROACH

Recent scientific discoveries into the brain reveal that humans employ fast and slow thinking to solve problems. The brain especially prefers making decisions and solving problems quickly based on recognized patterns, visual and verbal cues, prior knowledge, routines, familiar preferences, prejudices, and emotions.

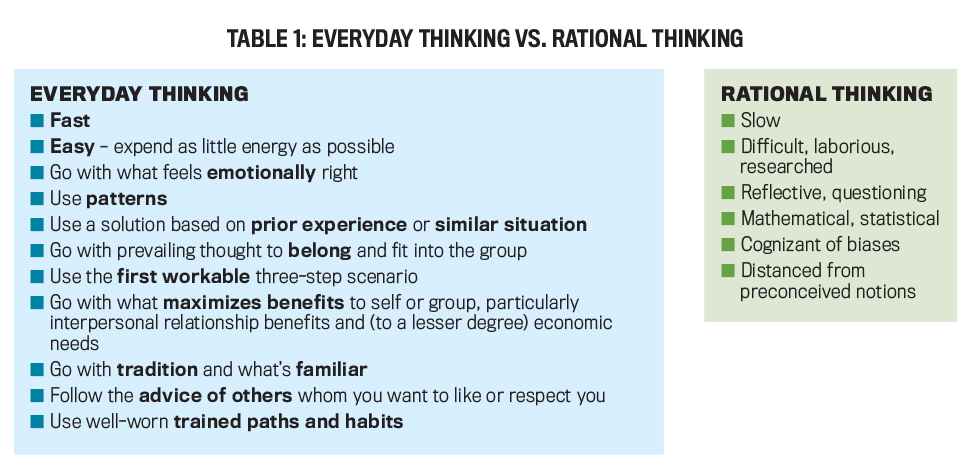

In contrast, decision making and problem solving often require slow thinking to digest new information, hypothesize alternatives, employ quantitative mathematical and statistical analysis, overtly recognize and break free from cognitive biases, challenge preconceived notions, synthesize ideas, and create new knowledge. To support this kind of slow, rational thinking, accountants can learn a methodical process for problem solving (see Table 1).

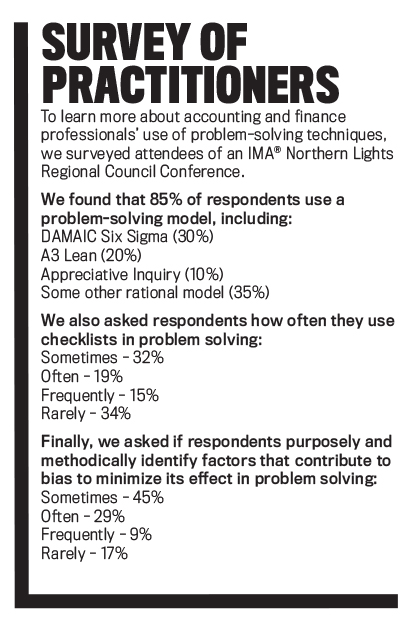

Many common business models—such as Six Sigma, A3 Lean, and Appreciative Inquiry—and the Association of American Colleges and Universities value problem solving, and critical-thinking grading rubrics describe specific steps for rational (i.e., slow thinking) problem solving. Business students, however, learn and apply these models in various courses, typically with no thread that ties them specifically to the accounting profession. Students learn bits and pieces of rational thinking throughout their undergraduate coursework, but instructors often don’t teach a common framework to apply these skills in a relevant and value-added way (see “Survey of Practitioners”).

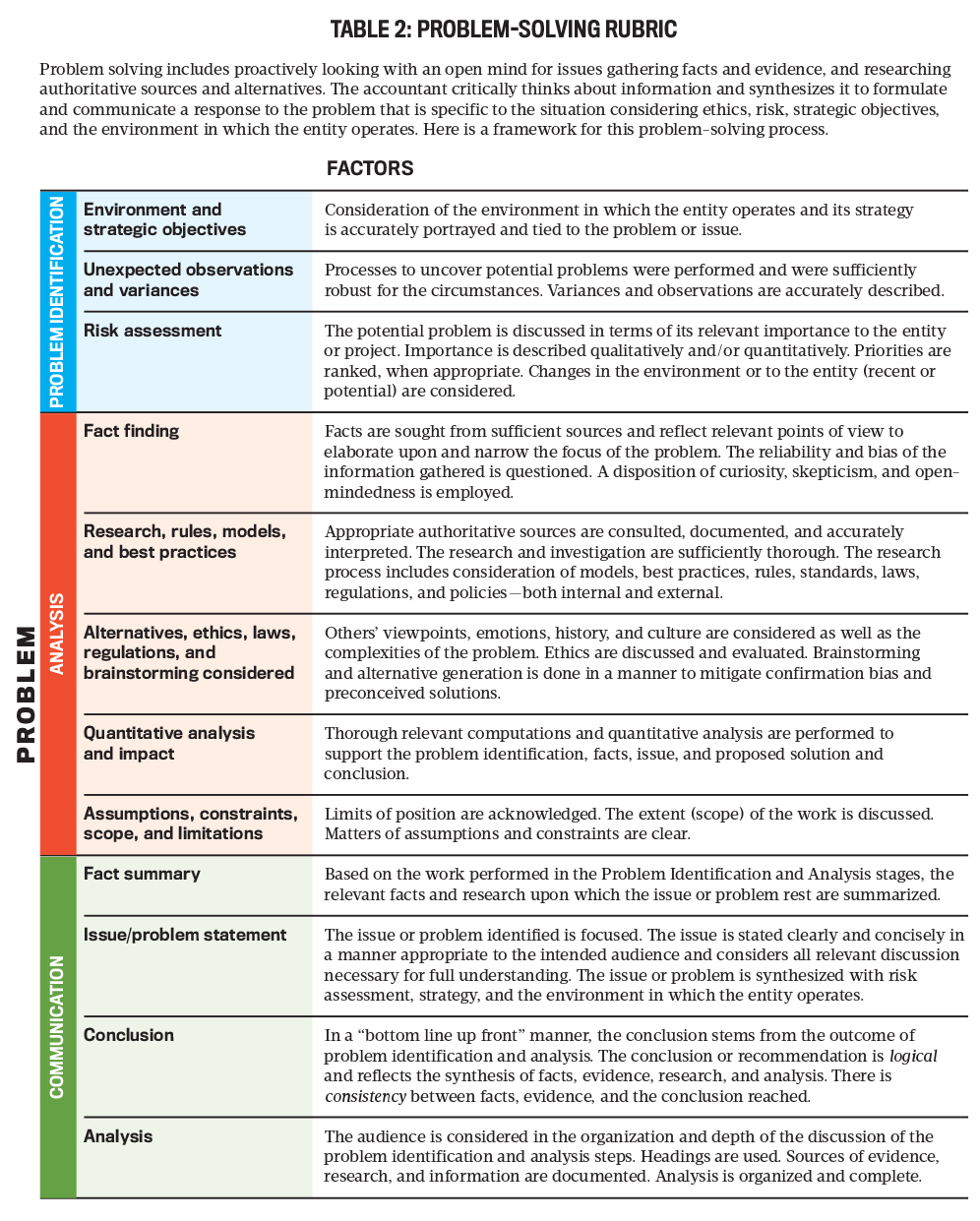

To help address this issue, we developed a problem-solving rubric for accounting students (see Table 2). The three of us are faculty members from Metropolitan State University in Minneapolis/St. Paul, Minn., and represent three different parts of the curriculum (auditing, business taxation, and management accounting), so it was important that it could be used across the entire accounting program.

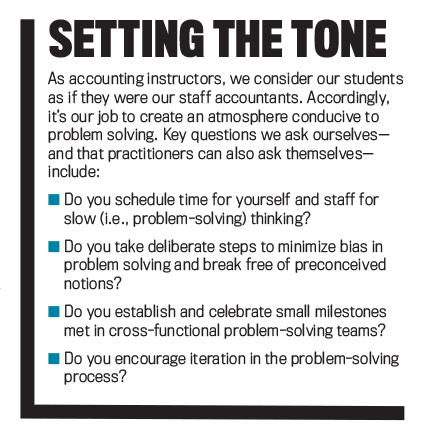

The rubric assesses learning in an organized way, providing a common framework (criteria) for students to consistently approach problem solving. The criteria include problem identification, analysis, and communication of results. It guides students through a series of problem-solving steps using terms and vocabulary specific to the accounting profession. The rubric also reminds us, as instructors, to create a learning environment where problem solving can occur (see “Setting the Tone”).

STEP 1: PROBLEM IDENTIFICATION

The iterative and looping nature of problem solving confounds inexperienced accountants. Where does one begin? Students tell us using a rubric provides a starting point.

To implement the rubric, we assign students projects with unclear goals, incomplete information, and more than one possible solution. Assignment topics vary. It could have students develop a cost-benefit analysis between adding employees or adopting Lean manufacturing techniques, analyze tax outcomes of business decisions, create a risk assessment and audit response for a fictitious client, or some other accounting-related issue.

Students begin by developing one or several hypotheses as to the nature of the problem. To generate ideas, we assist students in their brainstorming discussions. The rubric leads students to consider the environment, strategy, unexpected observations, overall importance, and risk assessment. At this stage, the identified problem may change, but the original hypothesized problem gives direction for next steps. Upon completing the assignment, we assess students on how they identified the problem.

Metropolitan State University’s business taxation course used the rubric in a case study that involves assessing the implication of the Wayfair v. South Dakota U.S. Supreme Court decision on a company’s sales tax collection. Prior to Wayfair , companies operated under a physical presence nexus established in Quill v. North Dakota . The Quill decision required companies to have a physical presence in a taxing jurisdiction in order to require collection and remittance of sales taxes on transactions.

In Wayfair , the U.S. Supreme Court overturned Quill in favor of an economic nexus standard, where companies only needed to have a certain level of economic activity. For example, in South Dakota, the threshold economic activity is 200 transactions or $100,000 in sales. The change from Quill to Wayfair was a major development in how companies operate and collect sales tax. It required companies to assess all jurisdictions in which they operate and evaluate how the change in the nexus standards impact its operations.

To apply this rubric to the change, students learn about a fictitious company that sells inventory to multiple states and collects and remits sales tax under the Quill physical presence nexus standard. We give students a subledger with all sales data for the given year. The rubric leads students to ask about implications of the Wayfair decision on the company, how the ruling impacts the company’s strategic objectives, and risks to the company because of the change in the law. Using the rubric, students are guided to discover the issue at hand, which is whether the company will have a significant number of new sales tax jurisdictions requiring collections and remittance from its customers.

Students tell us that without the rubric, they often feel like they have no road map at the beginning of a project or case study; identifying the problem seems too big and undefined to tackle. Many students initially resist engaging with unstructured problem-solving assignments because they differ from past assignments. Similar to what one might find in cross-functional teams opposed to change, students show their displeasure with crossed arms and distant body language.

Many college courses still rely on testing facts and use formulas and calculations, an approach that doesn’t put the student in the decision-making role but is familiar to them. With a rubric, students see smaller doable steps, where the assignment is heading, and how they can move forward and loop backward, when necessary. The rubric breaks down the initial intimidation students feel with unstructured problems.

STEP 2: ANALYSIS

Next, the rubric guides students through analyzing the problem using accounting-specific skills they’ve acquired in each course. For example, students consider tax laws, financial reporting and audit principles, or cost accounting techniques.

Continuing the sales and use tax example, at this stage, students apply the rubric to perform a complete analysis, enabling them to form a conclusion to communicate. What are the relevant facts to determine Wayfair ’s impact? What facts are irrelevant? What primary and secondary tax authority is needed to conduct research? Are there alternatives and exceptions to applying Wayfair ? Have all states adopted an economic nexus standard? Have all states adopted South Dakota’s transactional thresholds? What’s the quantitative impact to the company? Are there financial accounting implications to the Wayfair decision? What’s the scope of the necessary research, and are there limitations, constraints, and so on? Through the rubric, students formulate and answer questions and perform analysis to solve the problem at hand.

We assess students on their ability to gather and identify relevant facts, research any applicable rules and laws, assess alternatives, and perform any needed qualitative and quantitative analyses. At this stage, students apply theories and best practices learned in specific course fields, such as management accounting, taxation, and auditing.

To encourage elaboration, the rubric uses words such as curious, skeptical, model, assumption, authoritative, best practices, relevant, and sufficient sources. Like many accountants, students want to get their work done quickly, but problem solving takes time and slow thinking. Thanks to the rubric, more students turned in papers with greater depth, less “cut and paste,” and more relevant supporting details.

As in the real world, students often discover their original hypothesis or identified problem is incorrect, incomplete, or irrelevant. They confront the iterative nature of problem solving as they work through the analysis stage and build evidence to support their hypothesis. When evidence doesn’t support an identified problem, students go back and redefine their problem, gather new evidence, explore new alternative solutions, and build a case for their conclusion.

STEP 3: COMMUNICATION

Finally, students present their results in a memorandum to a hypothetical manager or audit partner. The memorandum mirrors common styles, such as IFRAC (issues, facts, rules, analysis, and conclusion) and BLUF (bottom line up front). Students state the problem and include the conclusion (i.e., solution) up front along with a summary of relevant facts and assumptions. Supporting documentation presents additional in-depth analysis.

This format familiarizes students with a presentation style that allows management to quickly understand conclusions while also providing more depth to support the up-front conclusion. We expect students to write and present findings in a clear and concise manner as if in a professional accounting setting. The rubric grading criteria helps students solve problems using rational thinking and delivering a memorandum that directly supports management decision making.

In the Wayfair case study, students draft a memorandum to management addressing the implications of the sales tax nexus precedence change. The facts section should discuss the company’s current sales and use tax policies. Students identify the issue as the change from physical presence nexus to economic nexus. The up-front conclusion should identify new jurisdictions from which the company needs to register and collect sales tax and quantify the volume of sales tax it expects to collect. Finally, the analysis provides an in-depth discussion of the change from Quill to Wayfair . Students should discuss how they determined new jurisdictions, limitations, and further required resources for the company.

PREPARING STUDENTS FOR THEIR CAREERS

We use the rubric format for projects or cases at different stages throughout the accounting curriculum. The problem-solving rubric measures student learning and reinforces rational thinking with each assignment. The projects that use the rubric vary in length, depth, and complexity as students move from management accounting to tax and then finally to audit. We find the rubric flexible enough to adapt to an instructor’s needs, yet it provides consistent core steps—identify the problem, analyze, and communicate—to solve problems.

The rubric helps students organize their communication through the memorandum. Setting up a memorandum so the problem and solution appear “up front” highlights mismatches between the problem, evidence, and conclusion. Further, it encourages students to decide—rather than ramble and include information that isn’t relevant. We find students often get to the communication stage and realize that their analysis doesn’t support their conclusion or identified problem. Fortunately, the rubric allows them to loop back and redefine and reanalyze.

By using the same grading criteria in multiple courses, we provide students with a familiar approach to problem solving that turns fast thinking to slow, rational thinking. The process and steps become routine and less daunting for the student. While each step still requires arduous thinking, the approach itself is a recognized pattern for students.

From our point of view as accounting instructors, the rubric helps provide consistent and fair grading. We provide separate points for milestones in problem identification, analysis, and communication, which further encourages students to go through each step of the process. Metropolitan State University plans to expand the use of this rubric in the accounting curriculum. This common framework provides students with a process to identify problems, research and investigate facts, conduct analyses, and communicate results across all accounting disciplines.

This process reinforces the problem-solving skills that students will need in their professional careers. These capabilities will help them perform their roles in today’s strategic, fast-paced business environment. Solving problems is critical for today’s management accountant. Through implementing the rubric, instructors can help students systematically apply a problem-solving process that they can take with them as they move from student to management accountant.

About the Authors

August 2020

- Strategy, Planning & Performance

- Decision Analysis

- Negotiation

- Metropolitan State University

Publication Highlights

Call for Ethics Papers: Sept. 1 Deadline

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

Accounting Problems (& Answers): How to Avoid Accounting Issues

Keeping up with technology and regulatory changes are significant concerns of 51% and 24%, respectively, of CPA and accounting firm survey participants, according to Accounting Today’s survey, The Year Ahead: 2022 in Numbers .

Delays in advanced software technology adoption and failures in regulatory compliance can lead to accounting challenges and problems for businesses. These accounting issues include errors in financial statements, fraud and security risks, and the potential for massive fines and imprisonment for regulatory non-compliance.

Trained business finance teams using advanced software technology that also automates regulatory compliance can overcome typical (and new) accounting problems.

What are Accounting Problems?

Accounting problems are issues resulting in material financial statement errors, undetected fraud due to inadequate internal control, misapplication of generally accepted accounting principles (GAAP accounting standards), regulatory noncompliance, and cybersecurity risks. Accounting problems may have unfavorable cash flow impacts and misstate business profitability.

What Causes Accounting Problems?

Some accounting problems are caused by using outdated software technology for accounting. Intentional fraud due to greed and poor internal control causes other financial issues. Low staffing levels can cause accounting problems. Not training the financial team causes accounting problems related to improperly applying GAAP.

The business must defend itself against cybersecurity attacks and stay up-to-date on changing regulatory compliance issues.

How do Businesses Solve Accounting Problems?

Financial professionals in businesses should use software with advanced technology capable of handling current accounting standards, including revenue recognition and lease accounting, and regulatory requirements to avoid or solve significant accounting problems.

Requiring CPA employees and accountants to take relevant continuing education courses regularly can also help businesses solve accounting problems. Adequate staffing levels help accountants solve accounting issues.

Top management must communicate an ethical tone, corporate values, employee empowerment, and key expectations.

11 Common Accounting Problems

In its fiscal year 2021, the SEC received 1,913 whistleblower complaints relating to corporate disclosures and financials, signaling possible accounting problems in these publicly-held businesses. The SEC also received whistleblower complaints related to the Foreign Corrupt Practices Act.

11 common accounting problems are:

- Revenue recognition

- Lease accounting

- Missing impairment write-downs

- Payroll errors

- Cash flow statement

- Outdated accounting software technology

- Not enough financial analysis

- Inadequate internal control

- Regulatory non-compliance

- Inadequate security

1. Revenue Recognition

Improperly applying GAAP revenue recognition standards, creating fraudulent revenue schemes, including improper accounting for consignments and third-party inventory shipments beyond the level of possible usage, and using unreasonable estimates, are revenue recognition problems.

CFODive published an article on August 20, 2020 (based on an Accounting Today analysis) titled Improper revenue recognition tops SEC fraud cases . This article highlights the significance of revenue recognition as an accounting problem.

Find an accounting software or ERP solution that helps your company achieve proper revenue recognition. Your accounting and finance teams need adequate training on FASB accounting standards to comply with GAAP revenue recognition. Excel spreadsheets are popular. But spreadsheets are error-prone and inefficient. If possible, seek a different software solution.

2. Lease Accounting

Changes to GAAP lease accounting standards require lessee companies to capitalize their operating leases with tenant right of use (ROU) and a term of over twelve months. Shorter operating leases (including office space leases) can still be recorded monthly as rent expenses. The leases are amortized over time.

Accounting standards are codified by the Financial Accounting Standards Board (FASB). Accountants must also follow other changes to the Lease accounting standard.

Business accounting teams need adequate training to follow the latest GAAP standards on Lease accounting. And they will benefit greatly by using specialized lease accounting software.

3. Impairment Write-downs and Fair Market Valuation

Accountants may miss making impairment write-downs or required adjustments for recording required assets or liabilities at a fair market valuation.

Changing economic and business conditions require accountants to periodically assess whether asset valuations have been impaired (to recognize the loss of value). Accountants must also consider adjustments to the fair value of certain assets and liabilities. Accounting professionals make adjustments through journal entries and financial statement disclosures when GAAP requires.

Supply chain backlogs and economic conditions resulting from the COVID-19 pandemic triggered accounting issues to watch for, including impairment and fair value accounting, according to EY, a top-tier accounting firm.

Examples of asset impairment include:

- Assessing goodwill from M&A transactions annually for impairment

- Considering capitalized lease asset impairment

- Recording inventory at the lower of cost or market (LCM), where market value is constrained by an upper range not exceeding net realizable value and a lower range of net realizable value less a normal profit margin.

Examples of fair market valuation include:

- Trading securities (debt and equity) held as short-term investments; gains or losses on trading securities flow to Net Income on the income statement

- Available-for-sale securities (debt and equity) held as investments to be sold before maturity; net gains or losses are included in Shareholders’ Equity as Other Comprehensive Income (Loss), listed below Retained Earnings

- Liabilities measured under ASC 820 Fair Value Measurements and Disclosures

Accountants must have adequate training to properly record asset impairments and fair market valuation when required by GAAP and make necessary financial statement disclosures. Research financial statement areas subject to accounting issues with impairment.

4. Payroll Errors

If a small business decides to calculate its own payroll, payroll taxes, and benefits, it’s possible that payment errors and accounting problems will occur. Payroll problems like miscalculating paychecks for salary expenses and hourly wages hurt employee morale and productivity.

Outsource payroll to a very experienced company providing those services, like ADP or Paychex. If the right number of hours and payroll information is provided, payments and taxes withheld should be correctly computed and compliant with tax laws. You can expect accurate reports to account for those items. Your business can make payroll tax remittances on time when due.

5. Cash Flow Statement

The cash flow statement may include errors in classification by activity type and may not include restricted cash, a newer GAAP requirement.

Cash flow statement classification errors may include misclassifying the type of activity for interest and dividends received and paid. Interest received and paid is an operating activity in the cash flow statement. Dividends received are an operating activity, and dividends paid are a financing activity in the cash flow statement.

The CPA firm, RSM, summarizes U.S. GAAP (vs IFRS) classification for certain items in the cash flow statement, including interest and dividends and restricted cash.

Cash flow statement problem solving requires keeping up to date with FASB updates and training topics related to cash flow statement preparation to understand the basics.

6. Outdated Accounting Software Technology

Outdated accounting software technology isn’t efficient, doesn’t provide real-time results for visibility in managing the company or its sales & marketing processes, relies on manual data entry and paper documents for business transaction processing and recording, and doesn’t automate regulatory compliance.

Outdated ERP systems may not be cloud-based. On-premises software systems cause inefficiencies in accessing the software and require more IT department resources to update the system and address software and hardware problems at the company’s location. These ERP systems not deployed on the cloud aren’t ideal for the changed reality of remote or hybrid work situations.

Upgrade outdated software technology in accounting software or ERP systems by changing to modern cloud-based software. If you don’t have the budget for an ERP system overhaul, consider integrating third-party add-on software to meet your needs for:

- AP automation and global mass payments software, also automating regulatory compliance

- Subscription billing (applicable to a SaaS , publishing, or utilities business model)

- Forecasting, planning, and cash management software

- Customer relationship management (CRM) software to increase efficiency and better track the sales and marketing process

- Lease accounting specialty software

- Revenue recognition software functionality, if not included in your ERP

- Data visualization software for data analytics and business intelligence

7. Not Enough Financial Analysis

An accounting team without efficient accounting systems is spending too much time closing the books, leaving less time for value-added work. Financial analysis adds value by calculating ratios, spotting and managing business trends, and providing decision support for new opportunities.

Use enhanced cloud-based ERP systems and third-party add-on software with built-in artificial intelligence/machine learning that automates accounting processes and financial analysis to the extent possible. You need real-time dashboards with your company’s KPIs (key performance indicators), including trend analysis that all functional areas with authorization privileges can access.

Supplement these systems with data visualization software like Tableau or Microsoft Power BI for data analytics with real-time capabilities and periodic automated report runs for data your company follows as timeline trends. Data visualization software embeds machine learning tools to deliver business intelligence.

8. Inadequate Internal Control

Small businesses may not have enough staffing to attain the separation of duties needed for adequate internal control. Their accounting systems may be inadequate to prevent fraud and duplicate payment errors.

When segregation of duties isn’t being achieved, get the business owner involved in the approval process as a matched vendor invoice document reviewer and second signature.

The finance and accounting department needs the human capital and software resources required to perform its duties and achieve results. Is the accounting department getting its fair share of company resources?

Custody of Assets

Custody of assets includes recorded balance sheet assets and assets not yet recorded in the books like undeposited cash.

Inventory needs controls for proper receiving, custody, secured storage with controlled access, and physical inventory in full annually and via periodic cycle counts. Office equipment should also be tagged upon receipt and subject to a physical inventory. As stated earlier, inventory should be tested for any loss in value requiring a write-down.

Discrepancies in the balance of fixed assets may result from a physical fixed asset count. Set a proper cutoff for recording fixed asset purchases.

If a fixed asset isn’t recorded, look for the purchase documents and invoice to record it. If another fixed asset isn’t counted, investigate where it may be or if it was sold. For accounting purposes, record the difference between the book value of fixed assets net of accumulated depreciation and sale proceeds, computing gain or loss on the sale of fixed assets. Write off missing fixed assets if necessary after your investigation.

Fraud, including embezzlement, may result from inadequate internal control and employee collusion.

Use modern cloud-based automation software that helps you find fraud and errors like duplicate payments. Use variance analysis and followup on significant differences for budget vs actual expenses. Review vendor master files, perform 3-way document matching for invoices, and validate vendors for authenticity before paying them.

Strive to achieve adequate segregation of duties with employee task assignments. Control or custody of assets and recording transactions in the books need to be performed by different employees.

10. Regulatory Non-Compliance

Regulatory compliance covers different areas, including taxation, data privacy and security, sanctions lists like OFAC, and the Foreign Corrupt Practices Act (FCPA).

The Foreign Corrupt Practices Act covers not making bribes in foreign countries. And the FCPA’s scope goes far beyond preventing bribes.

Violations of the Foreign Corrupt Practices Act and other regulations could result in:

- Massive fines for companies and convicted individuals

- Imprisonment

- Tarnishing a company’s and convicted individual’s business reputation and ethics

Familiarize your company, including the financial and accounting staff, with regulatory issues applying to your industry and company. Perform a project to document regulatory concerns and distribute the results widely. Hold a training session for company employees. Emphasize company values that include being ethical and empowering employees to act as the “conscience of the company.”

Find an automation software solution handling regulatory compliance. Tipalti AP automation software includes automated regulatory compliance features.

11. Inadequate Security

Cybersecurity is a significant issue that can compromise business intellectual property and customer data and employee records in your system.

Implement the most advanced cybersecurity software. Create and distribute an up-to-date company policy on required steps for achieving adequate cybersecurity. Train employees on how to avoid email and other scans that can result in hacks compromising company security.

Using Automation to Solve Accounting Problems

You can solve some accounting problems and become more efficient by applying accounting automation software. AP automation will provide significant benefits for your business.

Accounting Automation Software Applications

Businesses can deploy accounting automation in several areas to improve accounting processes and results. Accounting systems automation includes efficient financial technology (FinTech) applied to vendor invoice processing and payments and customer billing and accounts receivable.

Automate subscription billing, if applicable to your business model. Use automated customer credit decision solutions to decide which customers will be offered accounts receivable instead of requiring cash payments upfront.

Integrate CRM and marketing automation software like Salesforce and Marketo to improve sales & marketing processes and convert more new customers.

Automate forecasting, budgeting, business planning, and cash flow management.

AP Automation Software Benefits

Gain time to perform financial analysis by closing the books sooner. You can accomplish this by automating routine accounting processes like accounts payable and global mass payments with add-on AP automation software accessed via ERP integration.

Automated systems provide outsized benefits in the areas of payables automation and global mass payments to suppliers, vendors, and payouts to independent contractors, including freelancers and affiliates, and royalty recipients. Automated systems improve cash flow . They increase efficiency to let your company process vendor invoices and pay in time to take lucrative early payment discounts .

The best add-on AP automation and global mass payments software:

- Automates supplier onboarding and tax compliance

- Scans with OCR technology or uploads invoices and supporting documents electronically

- Improves your company’s expense management

- Makes efficient batch payments using a choice of payment methods

- Automates payments reconciliation and adds more accounts payable reports

- Lets your company close its books faster during the accounting cycle

- Reduces fraud and errors

- Automates regulatory compliance

Using electronic documents instead of paper-based documents:

- Ends paper-based data entry, invoice matching, and processing costs

- Creates a relevant document repository through the supplier portal

- Creates an audit trail

- Enables automatic approvals with notifications and follow-up

- Makes efficient batch payments (or single payments)

- Ends the inefficient, unsafe, and costly use of paper checks

- Automatically reconciles batch payments

The level of resources required in accounting and bookkeeping can be leveraged by efficiencies provided by AP automation software. Efficiency is improved by up to 80%. Books are closed much more quickly, letting the finance team spend more time on value-added financial analysis and decision support.

Cloud-based AP automation software using AI/ML and RPA and tools for regulatory compliance work in combination with ERP systems.

Real-time SaaS automation software and ERP systems with modern technology can prevent or solve several types of accounting problems and issues, including fraud, accounting errors related to vendor invoices and payments, GAAP compliance in financial reporting, and regulatory compliance.

And adequate training of the finance and accounting team prevents or solves accounting problems.

About the Author

Barbara Cook

RELATED ARTICLES

10 Accounting Problem Solving Skills and How To Improve Them

Discover 10 Accounting Problem Solving skills along with some of the best tips to help you improve these abilities.

Accounting is an important skill for anyone who wants to be financially successful. Without a basic understanding of accounting, it can be difficult to make sound financial decisions. However, even if you have a strong understanding of accounting principles, you may still encounter occasional accounting problems.

When these problems arise, it is important to have strong problem solving skills in order to find a resolution. In this guide, we will discuss some tips for solving accounting problems. We will also provide an overview of some common accounting problems so that you can be prepared in the event that one arises.

Financial Statements

Regulatory filings, revenue projections, account reconciliation, general ledger, business knowledge, problem solving.

Financial statements are important because they provide a snapshot of a company’s financial health. They can be used to make decisions about whether or not to invest in a company, and they can also be used to track a company’s performance over time. Financial statements include the balance sheet, income statement, and cash flow statement.

Payroll is an important skill for accountants because it allows them to process and manage employee compensation and benefits. Payroll processing includes calculating gross wages, deductions, and net wages; preparing payroll tax returns; and managing benefits such as health insurance, retirement plans, and paid time off.

Accountants who can effectively manage payroll can help businesses save time and money. They can also help businesses comply with federal and state tax laws and regulations.

Regulatory filings are important because they are required by law. Companies must file certain documents with government agencies in order to operate. These filings include tax returns, annual reports, and shareholder communications. Failure to file these documents can result in penalties or even the closure of a company.

Regulatory filings are important because they provide transparency. By law, companies must file certain documents with government agencies. These filings are public, which means that anyone can access them. This transparency allows investors and other stakeholders to see how a company is operating.

Revenue projections are important for businesses because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Revenue projections are important because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Account reconciliation is the process of ensuring that all transactions in a company’s books are accurate. This process is important because it helps ensure that the company’s financial statements are accurate and can be relied upon by investors, creditors and other stakeholders.

Account reconciliation involves comparing the company’s books with the records kept by its banks, vendors and other parties with whom it does business. If there are any differences, they need to be investigated and resolved. This process can be time-consuming, but it is important to ensure that the company’s books are accurate.

Compliance is the process of ensuring that you are in compliance with the laws and regulations that apply to your business. It is important for businesses to be compliant because it helps to protect them from penalties and fines. Compliance also helps to build trust with customers and regulators.

To be compliant, businesses need to understand the laws and regulations that apply to them and then take the necessary steps to ensure that they are following the rules. For example, businesses that sell products to consumers need to be aware of the consumer protection laws that apply to them. Businesses that operate in certain industries, such as healthcare, need to be aware of the regulations that apply to them.

General ledger is an important accounting problem solving skill because it is used to track and report financial information for a business. The general ledger is a summary of all of the accounts that make up the financial statements, and it is used to keep track of the money coming in and going out of the business. The general ledger is also used to prepare financial statements, and it is important that the information in the general ledger is accurate and up to date.

Quickbooks is an important skill for anyone in the accounting field. Quickbooks is a software program that helps accountants and business owners keep track of their finances. Quickbooks can help you track invoices, manage payroll, and create financial reports. Quickbooks is a valuable skill because it can save you time and make your job easier.

Business knowledge is important for accounting problem solving because it helps accountants understand the context of the problem they are trying to solve. It also helps them identify the root cause of the problem and develop a solution that will be effective in the real world.

Accounting problem solving often involves looking at a company’s financial statements and trying to identify where the company is spending too much money or where it is making mistakes in its accounting practices. To do this, accountants need to understand the company’s business and the industry in which it operates. They also need to be familiar with the latest accounting standards and best practices.

Problem solving is an important skill for accountants because they often have to solve complex problems. Problem solving requires the ability to identify the problem, gather information, develop a plan and implement the plan. Accountants must be able to think critically and creatively to solve problems.

Problem solving often requires good communication skills. Accountants must be able to explain the problem, gather information and develop a plan with the client. They also need to be able to follow up to make sure the plan is working and to troubleshoot if there are any issues.

How to Improve Your Accounting Problem Solving Skills

1. Understand the basics of accounting If you want to improve your accounting problem solving skills, it is important to have a strong foundation in accounting principles. You should be able to read and understand financial statements, as well as have a working knowledge of payroll, regulatory filings, revenue projections and account reconciliation.

2. Be well-versed in accounting software In order to be an effective problem solver, you need to be well-versed in accounting software. This will allow you to quickly and efficiently find solutions to accounting problems.

3. Stay up-to-date on accounting news and changes It is also important to stay up-to-date on accounting news and changes. This will help you anticipate problems and find solutions more quickly.

4. Be proactive in solving problems When you encounter an accounting problem, it is important to be proactive in solving it. This means taking the time to understand the problem and researching potential solutions.

5. Communicate effectively with your team When you are working on a team, it is important to communicate effectively. This means being clear about what you need from your team members and keeping them updated on your progress.

6. Be organized and efficient When solving accounting problems, it is important to be organized and efficient. This means having a system in place for tracking your progress and keeping your work area tidy.

7. Practice problem solving One of the best ways to improve your accounting problem solving skills is to practice. This can be done by working on practice problems or by taking on small projects in your personal life.

8. Seek out feedback When you are working on solving accounting problems, it is important to seek out feedback. This can be done by asking for feedback from your team members or by seeking out feedback from a mentor.

10 Linguistic Skills and How To Improve Them

10 stakeholder management skills and how to improve them, you may also be interested in..., what does a maintenance director do, what does a market development manager do, what does a wells fargo phone banker do, what does a personal driver do.

Questions & Answers (Q&A)

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Read more →

Author: Harold Averkamp, CPA, MBA

- 01. Accounting Basics Q&A

- 02. Debits and Credits Q&A

- 03. Chart of Accounts Q&A

- 04. Bookkeeping Q&A

- 05. Accounting Equation Q&A

- 06. Accounting Principles Q&A

- 07. Financial Accounting Q&A

- 08. Adjusting Entries Q&A

- 09. Balance Sheet Q&A

- 10. Income Statement Q&A

- 11. Cash Flow Statement Q&A

- 12. Financial Ratios Q&A

- 13. Bank Reconciliation Q&A

- 14. Accounts Receivable and Bad Debts Expense Q&A

- 15. Accounts Payable Q&A

- 16. Inventory and Cost of Goods Sold Q&A

- 17. Depreciation Q&A

- 18. Payroll Accounting Q&A

- 19. Bonds Payable Q&A

- 20. Stockholders' Equity Q&A

- 21. Present Value of a Single Amount Q&A

- 22. Present Value of an Ordinary Annuity Q&A

- 23. Future Value of a Single Amount Q&A

- 24. Nonprofit Accounting Q&A

- 25. Break-even Point Q&A

- 26. Improving Profits Q&A

- 27. Evaluating Business Investments Q&A

- 28. Manufacturing Overhead Q&A

- 29. Nonmanufacturing Overhead Q&A

- 30. Activity Based Costing Q&A

- 31. Standard Costing Q&A

- 32. Accounting Careers Q&A

- 33. Calculations Q&A

- 34. Cost and Managerial Accounting Q&A

- 35. Working Capital and Liquidity Q&A

Advance Your Accounting and Bookkeeping Career

- Perform better at your job

- Get hired for a new position

- Understand your small business

- Pass your accounting class

Featured Review

"I am currently employed as a senior accountant. I became a PRO user back when I was seeking a new job, many years ago. Since I only obtained an associate degree in accounting, I wanted to use all the tools on your site to give me the edge to be able to learn more than ever before. Now my skill set is more advanced, and I was able to apply for my current role. I learned so much more than I have in 2 years of college. The readings and tutorial are easy to follow, and explain the ins and outs of everything. I previously had financial statements in my background, yet now I truly have a better understanding of how each account affects the TB. I continue to go back any time you offer new topics; it's my personal refresher. Just think how great it is to be able to go back and continue to learn, for a much cheaper price than a college course, for sure. I am so glad I purchased my subscription! Thank you, AccountingCoach!" - Victoria

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

About the Author

Certificates of Achievement

We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping:

- Debits and Credits

- Adjusting Entries

- Financial Statements

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Working Capital and Liquidity

- Financial Ratios

- Bank Reconciliation

- Payroll Accounting

Badges and Points

- Work towards and earn 30 badges

- Earn points as you work towards completing our course

- 01. Accounting Basics 0%

- 02. Debits and Credits 0%

- 03. Chart of Accounts 0%

- 04. Bookkeeping 0%

- 05. Accounting Equation 0%

- 06. Accounting Principles 0%

- 07. Financial Accounting 0%

- 08. Adjusting Entries 0%

- 09. Financial Statements 0%

- 10. Balance Sheet 0%

- 11. Working Capital and Liquidity 0%

- 12. Income Statement 0%

- 13. Cash Flow Statement 0%

- 14. Financial Ratios 0%

- 15. Bank Reconciliation 0%

- 16. Accounts Receivable and Bad Debts Expense 0%

- 17. Accounts Payable 0%

- 18. Inventory and Cost of Goods Sold 0%

- 19. Depreciation 0%

- 20. Payroll Accounting 0%

- 21. Bonds Payable 0%

- 22. Stockholders' Equity 0%

- 23. Present Value of a Single Amount 0%

- 24. Present Value of an Ordinary Annuity 0%

- 25. Future Value of a Single Amount 0%

- 26. Nonprofit Accounting 0%

- 27. Break-even Point 0%

- 28. Improving Profits 0%

- 29. Evaluating Business Investments 0%

- 30. Manufacturing Overhead 0%

- 31. Nonmanufacturing Overhead 0%

- 32. Activity Based Costing 0%

- 33. Standard Costing 0%

Article Categories

Book categories, collections.

- Business, Careers, & Money Articles

- Business Articles

- Accounting Articles

- General Accounting Articles

1,001 Accounting Practice Problems For Dummies Cheat Sheet

Sign up for the Dummies Beta Program to try Dummies' newest way to learn.

Accounting, as you may guess, involves a lot of math. As you practice various types of accounting problems, and when you begin doing accounting work for real, you will need to utilize various formulas to calculate the information you need.

10 useful accounting formulas

The following are some of the most frequently used accounting formulas. This list is not comprehensive, but it should cover the items you’ll use most often as you practice solving various accounting problems.

Balance sheet formula

Assets – liabilities = equity (or assets = liabilities + equity)

This basic formula must stay in balance to generate an accurate balance sheet. This means that all accounting transactions must keep the formula in balance. If not, the accountant has made an error.

Retained earnings formula

Beginning balance + net income – net losses – dividends = ending balance

Income statement formula

Revenue (sales) – expenses = profit (or net income)

Keep in mind that revenue and sales may be used interchangeably. Profit and net income may also be used interchangeably. The income statement is also referred to as a profit and loss statement.

Gross margin

Sales – cost of sales

Gross margin is not a company’s net income or profit. Other expenses, such as selling, general, and administrative (SG and A) expenses, are subtracted to arrive at net income.

Operating income (earnings)

Gross profit – selling, general, and administrative (SG and A) expenses

Statement of cash flows formula

Beginning cash balance + cash flow sources (uses) from operations + cash flow sources (uses) from financing + cash flow sources (uses) from investing = ending cash balance

This formula adds cash sources and subtracts cash uses.

Inventory formula

Beginning inventory + purchases – cost of sales = ending inventory (or beginning inventory + purchases – ending inventory = cost of sales)

Net sales formula

Gross sales – sales discounts – sales returns and allowances

Book value of fixed (depreciable) assets

Original cost – accumulated depreciation

Straight line depreciation

(Original cost – salvage value) / number of years in useful life

Salvage value is the dollar amount that the owner can receive for selling the asset at the end of its useful life.

Financial statement formulas

After you create financial statements, you need some tools to analyze a company’s results. Following are the most frequently used formulas to analyze financial statements. Get familiar with them so that you can analyze statements with confidence.

Components of work-in-process

Direct materials + direct labor + factory overhead applied

Work-in-process (WIP) represents cost incurred in production for partially completed goods. WIP is a subaccount within inventory. When goods are completed, they are moved to finished goods (another inventory account).

Current ratio

Current assets ÷ current liabilities

The current ratio illustrates how easily a company can cover its current bills.

Quick ratio

(Current assets less inventory) ÷ current liabilities

The quick ratio excludes inventory from current assets. The rationale is that inventory is the current asset that will take the longest time to convert into cash. Other current assets, such as collecting accounts receivable, may be converted into cash more quickly.

Asset turnover ratio

Revenue (or sales) ÷ assets

This ratio explains how much profit a company generates for every dollar of assets.

Return on equity

Net income ÷ equity

This ratio explains how much profit a company generates for every dollar of equity.

Debt to equity ratio

Debt ÷ equity

This ratio measures what percentage of a firm’s total capitalization is debt. Capitalization refers to all funds raised by the company to operate the business.

Contribution margin

Sales less variable costs

Contribution margin represents the amount that will be used to cover fixed costs. Any dollars remaining after paying fixed costs is considered profit.

Return on capital

Operating profit ÷ capital

Capital is similar to equity. It represents funds raised to operate a business. Operating profit refers to profit generated from normal business activity.

Break-even formula

Sales – variable costs – fixed costs = $0 profit

The break-even formula calculates the level of sales that will generate a profit of $0.

Formula to assign overhead costs

Total overhead costs incurred ÷ activity level

Overhead costs, such as a factory’s utility costs, can’t be directly traced to a product. Instead, overhead costs are allocated based on an activity level. The activity level chosen should impact the amount of overhead costs incurred. For example, the number of machine hours used drives machinery repair costs. Machine hours should be the activity level for machine repair costs.

More financial analysis formulas

After you create financial statements, you need some tools to analyze the company’s results. Following are some additional formulas accountants use to analyze financial statements. Become familiar with these formulas, and use them as you practice various accounting problems.

Burden rate

Fixed manufacturing costs ÷ units produced

Fixed costs can’t be directly traced to a unit produced. For example, a $50,000 monthly factory lease must be paid, regardless of the number of units produced in a given month. To assign fixed cost to each unit of product, companies used the burden rate.

Cost of idle capacity

Percentage of available capacity unused × fixed manufacturing overhead costs

Idle capacity refers to unused capacity. Assume you could produce 20% more baseball gloves this month, using your existing factory costs (materials, labor, and overhead). Say that the factory pays a foreman $50,000 in salary and benefits to supervise production. The cost of idle capacity is 20% multiplied by $50,000, or $10,000. The firm is paying an extra $10,000 for production capacity it’s not using.

Calculating loan interest

Interest rate for period × principal amount of loan

Interest can be compounded (computed) annually, monthly, or even daily. Pay attention to the stated annual interest rate on the loan and how often interest is compounded. If a 12% loan is compounded monthly, the monthly interest rate is 12% ÷ 12 months, or 1%.

Effective interest rate

Interest paid ÷ principal amount owed

Because of the effects of compounding, the actual interest paid on a loan may be different from the stated interest rate on the note multiplied by the principal.

Present value and future value factors

Present value factor less than 1; future value factor more than 1

A present value factor discounts a cash flow to its present value. To calculate the present value, you multiply the factor times the cash flow amount. A present value factor will be less than 1. The future value of a cash flow adjusts the cash flow to its future value, given an interest rate. A future value factor will always be more than 1.

Return on investment (ROI)

Profit (net income) from investment ÷ cost of investment

A more complex version of the formula is operating income divided by operating assets. Operating assets represent an investment in a project or business. The purpose of this formula is to determine the profitability of a given project.

Return on investment (DuPont model)

Profit margin × asset turnover

This is a more complex formula that’s used for ROI. Profit margin is operating profit divided by sales. Asset turnover is calculated as sales divided by average assets. Average assets refers to assets at beginning of period + assets balance at end of period ÷ 2.

Return of investment to shareholders

Retained earnings balance – payments to shareholders

A dividend is a payment of retained earnings to shareholders (investors). If a company makes payments to shareholders that are greater than the balance of retained earnings, those payments are a return of the investors’ original investment.

72 ÷ rate of return on investment

The rule of 72 states how many years it will take for a sum of money to double, given a rate of return that is compounded each year. If, for example, the rate of return is 8%, a sum of money will double in 72÷8, or 9 years.

Weighted average cost of capital (WACC)

Annual cost to obtain financing ÷ capital balance

Companies can raise funds by issuing debt or equity. Outstanding debt requires annual interest payments. Shareholders who purchase equity may also insist on required annual dividend payments. Interest payments on debt and dividend payments to shareholders are both considered financing costs. The annual cost of financing divided by the funds raised to operate the business (capital) is WACC.

About This Article

This article is from the book:.

- Accounting ,

About the book authors:

Kenneth Boyd is the owner of St. Louis Test Preparation (www.stltest.net). He provides online tutoring in accounting and finance. Kenneth has worked as a CPA, Auditor, Tax Preparer, and College Professor. He is the author of CPA Exam For Dummies . Kate Mooney has been teaching accounting to both undergraduates and MBA students at St. Cloud State University since 1986, after earning her PhD from Texas A & M University. She is a licensed CPA in Minnesota and is a member of the State Board of Accountancy.

This article can be found in the category:

- General Accounting ,

- 10 Useful Accounting Formulas

- Financial Statement Formulas

- More Financial Analysis Formulas

- Straight-Line Depreciation — Practice Questions

- Total Manufacturing Costs — Practice Questions

- View All Articles From Book

- Contract Management

Supplier Management

Savings Management

- Data & Security

FAQ’s

oboloo Articles

Mastering Accounting Practice Problems: Tips and Tricks for Success

Introduction

Are you ready to dive into the world of accounting practice problems ? Whether you’re a seasoned accountant or just starting out in your financial journey, these practice problems are an essential tool for sharpening your skills and expanding your knowledge. But don’t worry, we’ve got you covered! In this blog post, we’ll explore what accounting practice problems are all about and share some valuable tips and tricks that will help you conquer them with confidence. So grab your calculator and let’s get started on the path to mastering accounting practice problems!

What are accounting practice problems?

What are accounting practice problems ?

Accounting practice problems are exercises or scenarios that are designed to test your understanding and application of accounting principles and concepts. These problems typically involve analyzing financial data, preparing financial statements, and applying various accounting methods and techniques.

Solving accounting practice problems is an essential part of mastering the subject. They help you develop critical thinking skills, improve your problem-solving abilities, and enhance your overall understanding of accounting principles.

These problems can cover a wide range of topics, such as journal entries, adjusting entries, trial balances, income statements, balance sheets, cash flow statements , inventory valuation methods, depreciation calculations, and more. They require you to apply the rules and guidelines set forth by generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS).

By solving these practice problems regularly and effectively engaging with them through analysis and interpretation of financial data sets or case studies will enable you to gain confidence in tackling real-world accounting challenges. So don’t shy away from embracing these opportunities for growth!

Tips for solving accounting practice problems

Tips for Solving Accounting Practice Problems:

1. Understand the question: Before diving into solving accounting practice problems, it is crucial to fully comprehend what is being asked. Take your time to read and analyze the problem carefully. Look for keywords or specific instructions that can guide you in finding the appropriate solution.

2. Review relevant concepts: Accounting practice problems often require a solid understanding of fundamental accounting principles and concepts. Make sure you are familiar with topics such as balance sheets , income statements, debits and credits, and financial analysis techniques. If needed, refer back to your textbooks or online resources to refresh your knowledge.

3. Break down complex problems: Sometimes accounting practice problems may appear overwhelming due to their complexity or lengthiness. To tackle these challenges effectively, break them down into smaller manageable tasks . Identify each step required to reach the final answer and approach them one at a time.

4. Utilize real-world examples: Linking theoretical concepts with practical examples can enhance your understanding of accounting principles while solving practice problems . Try relating the given scenario with real-life situations or business operations to grasp how different transactions impact financial statements.

5. Practice regularly: The key to mastering any skill is consistent practice! Set aside dedicated study sessions where you solve various types of accounting practice problems regularly. The more exposure you have to different scenarios and calculations, the better equipped you will be during exams or when facing actual accounting challenges in professional settings.

Remember that solving accounting practice problems requires both technical knowledge and critical thinking skills. Stay patient, focused, and determined throughout the process as mastery comes through continuous efforts rather than overnight success!

Tricks for solving accounting practice problems

Tricks for Solving Accounting Practice Problems

When it comes to mastering accounting practice problems, having a few tricks up your sleeve can make all the difference. These tricks can help you approach complex scenarios with confidence and accuracy. Here are some tips to help you solve accounting practice problems more effectively .

1. Break it Down: When faced with a challenging problem, break it down into smaller, manageable parts . This will not only make the problem seem less daunting but also allow you to focus on each component individually.

2. Use Visual Aids: Sometimes, visualizing the problem can provide clarity and help identify patterns or relationships. Utilize charts, graphs, or diagrams to organize information visually and gain a better understanding of the situation at hand.

3. Apply Concepts: Always refer back to fundamental accounting concepts when solving practice problems. Understanding how different principles apply in specific scenarios will guide your decision-making process and ensure accurate solutions.

4. Practice Time Management: Time management is crucial when tackling accounting practice problems that have time constraints attached to them (such as exams). Allocate appropriate time for each question based on its complexity so that you can complete all tasks within the given timeframe.

5. Develop Problem-Solving Strategies: Over time, develop your own problem-solving strategies by analyzing past mistakes and learning from them. Identify common pitfalls or areas where you tend to get stuck and devise techniques specifically tailored to overcome these challenges.

6. Collaborate with Peers: Engaging in group study sessions or collaborating with peers who are also studying accounting can be beneficial for problem-solving skills development. Through discussions and sharing insights, you may discover alternative approaches or perspectives that enhance your abilities.

Remember that becoming proficient at solving accounting practice problems takes time and effort—there’s no substitute for regular practice! By implementing these tricks into your study routine, you’ll increase your efficiency in handling complex scenarios while building a solid foundation of knowledge in procurement accounting practices .

Resources for accounting practice problems

Resources for Accounting Practice Problems

When it comes to mastering accounting practice problems, having access to the right resources can make all the difference. Luckily, there are plenty of tools and materials available that can help you sharpen your skills and improve your problem-solving abilities. Here are a few resources worth exploring:

1. Online Tutorials: There are numerous websites and platforms that offer comprehensive tutorials on various accounting topics. These tutorials often include detailed explanations of concepts, step-by-step solutions to practice problems, and interactive quizzes to test your understanding.

2. Textbooks and Study Guides: Investing in a good accounting textbook or study guide can provide you with a wealth of practice problems. Look for books that offer clear explanations along with worked-out examples so you can learn from both correct and incorrect approaches.

3. Accounting Forums: Participating in online forums dedicated to accounting can be incredibly helpful when it comes to solving practice problems. You can post questions, seek guidance from experienced professionals or students, and engage in discussions about different problem-solving strategies.

4. Practice Exam Prep Books: Many publishers release specialized exam preparation books tailored specifically for accounting exams such as the CPA or CMA exams. These books typically include sets of practice problems designed to mimic real exam questions.

5. Educational Apps: Mobile apps have become increasingly popular tools for learning and practicing accounting concepts on-the-go. Look for apps that offer a wide range of practice problems with varying levels of difficulty.

Remember, consistently working through practice problems is essential if you want to excel in accounting . By utilizing these resources effectively , you’ll be well-equipped on your journey towards mastering accounting principles and becoming a proficient problem solver!

Mastering accounting practice problems is an essential skill for any aspiring accountant. By following the tips and tricks outlined in this article, you can improve your problem-solving abilities and gain confidence in tackling complex accounting scenarios.

Remember to start by understanding the basics of accounting principles and concepts. This foundation will provide you with a solid framework to approach any practice problem. Practice regularly using real-life examples or online resources specifically designed for accounting practice problems.

When solving these problems, be systematic and organized. Break down the question into smaller parts, identify relevant information , apply appropriate formulas or techniques, and double-check your work for accuracy. Utilize shortcuts and time-saving strategies where applicable to streamline your problem-solving process .

Additionally, take advantage of various resources available to enhance your learning experience. Online tutorials, textbooks, video lectures, and study groups can all contribute to sharpening your skills in solving accounting practice problems.

By adopting these strategies consistently over time, you will notice significant improvement in your ability to tackle even the most challenging accounting practice problems confidently.

So don’t let these problems intimidate you! Embrace them as opportunities for growth and mastery of this fundamental aspect of the field. With dedication and persistence, you’ll soon find yourself acing those tricky accounting questions with ease!

Happy problem-solving!

Want to find out more about procurement?

Access more blogs, articles and FAQ's relating to procurement

The smarter way to have full visibility & control of your suppliers

Contract Management

Partnerships

Charities/Non-Profits

Service Status

Release Notes

Feel free to contact us here. Our support team will get back to you as soon as possible

Sustainability

INSIGHTS + Info

- All Insights

- By Resource

- Ask the CFO

- eBooks/Guides

- Interactive Tools

- Case Studies

- Infographics

- White Papers

- By Role / Industry

- CFO / Corporate Finance

- Investor / PE Firm

- CPA / Accounting Firm

- Corporate Operations

- By Solution

- General Finance & Accounting

- Accounts Payable

- Accounts Receivable

- Back Office

- Why Outsourced Accounting?

- Data & Automation

- Managing Human Capital

- Accounting Staffing

- Cost Containment

- Streamlining Private Equity

- Personiv's Virtual Accounting Solution

- CFO Weekly Podcast

Problem Solving in Accounting

- Share this Article

Problem-solving in accounting is a critical skill that can always be improved upon. Master problem-solver and CFO at Musselman & Hall Contractors LLC, Adam Porter, shares his insight and experience with us in the latest episode of CFO Weekly.

What Makes a Great Problem-solver?

If you know, you know, right? Adam instinctively knew he was a problem-solver when he was younger. Something as simple as going from point A to point B became an opportunity to experiment with which route got him to his destination quicker. And his quest for discovery hasn't stopped.

“If we don’t understand the ‘why’ behind the actions we take, how do we know if we’re really doing the right thing,” Porter said.

To solve is to correct or optimize, and none of us can do that if we don’t first recognize an opportunity to get involved. Problem-solving goes hand in hand with the willingness to roll up your sleeves and get stuck in, take an active role in, and see through the potential outcome. Adam empowers each of his team members to become (and grow as) problem-solvers, by recognizing them and their contributions to identifying and solving issues.

Involving people in the problem-solving process and connecting the dots for them, showing them how they make the business a better organism, is how you create more great problem-solvers and amplify your ability to tackle problems as they appear.

Accounting Problem-solving in Action

Problem-solving is a term that gets thrown around in interviews and on resumes quite a bit. When the time comes, real problem-solvers like Adam approach things in a specific way.

System Upgrades

If you’ve navigated a system change and survived to tell the tale, some would say you have superpowers. Upgrading something like an ERP system is a mammoth task, even for a seasoned team of executives. During a project like this, you’re reviewing and possibly amending every single organizational process.

You’re also required to identify how everything you do during this project starts to affect other areas of the business: finance, accounting, HR, IT and so on.

Adam’s own experience with one such project led him through a GL restructure. At the end of a six-month series of efforts, with the support of a Controller whom he had brought it to, Adam succeeded and was able to present information back to the business, which could be used to inform business decisions.

The domino effect: once more information became available, and it was clear how it related to each portion of the business, the people in charge of those respective portions became more engaged and more curious and more willing to work with that information.

Problem-solving is just one of those skills where nobody needs to formally identify the need for it. It’s the problem-solvers who are constantly on the lookout for opportunities to apply themselves.

The result is that everybody benefits.

The Problem-solving Process in Accounting

Adam’s very first step in his problem-solving process is to absorb as much information from as many sources as he can. Whether it’s listening to the news every day or speaking with different people inside the business, there’s this ongoing effort to find out more, learn about topical challenges that others might be facing, and use that to drive questions internally about further opportunities to solve problems.

It doesn’t necessarily need to reach the state of being a ‘problem’ to receive attention for optimization. You just need to listen and pay attention to where things might be slower, costing more than usual or requiring manual input from too many people.

Once you have this information, you can gather the right people into the room to start looking at that information, gathering more of it from different sources.

One of the key components of fully resolving any issue is to understand the full scope and depth of its current and future impact: What happens if you leave it alone, or if it gets worse, or if it’s completely resolved? Who gets more time in a day when you resolve something? Whose budget gets some breathing room? Can you reduce the amount of manual input that everybody’s required to give?

Finding the Right People to Solve the Problem in Your Accounting Department

So, once you know what the problem is, you need to get the right people in to solve it.

How do you know who that is? The team behind your solution is critical. As a CFO, you have the responsibility of setting your team up for success when they’re working on solving problems. All execs have this responsibility.

In any organization, cross-functional training is the quickest way to widen perspectives when approaching any problems. If your execs are regularly making time to get down to the operational level, and understand how and why things work a certain way, it becomes so much easier to strategically recommend a resolution when one is needed.

Problem-solving isn’t a one-way road.

Solve the Problem, Not the Symptom

How do you know when you’re solving the right thing? So many times, we see something blatantly creating a bottleneck in an operation and we’ll head right toward that point to clear the blockage. Is that really solving the problem, though?

Most times, it isn’t. Once you clear the blockage, if you don’t look a little deeper or follow it upstream, it’s probably going to reappear not long after you put in all that effort.

Adam explains that sometimes, you already know what the real root cause is, of one or more bottlenecks in the business. Sometimes it’s trial and error. Always, though, it requires you to dig deeper, uncover more detail, more links and connections to other parts of the business operation or the stakeholder network.

Adam goes on to say that getting to the root of the issue can also be achieved by just getting the right people in the room with you. Musselman & Hall Contractors does a great job of this, getting executives together at least once weekly, to just help others on the team evaluate elements, ask more questions, different questions, and gain a different perspective on things that can be missed during the daily routine.

Dealing with Resistance

Resistance is natural. Inertia affects every company in the world to some degree. When problem-solving, it’s likely that this will occur too.

You need to follow the process and listen as much as you convey messages. Cultivate the mindset within your business that someone else learning about your job is a positive thing. Take the time to explain that it’s because a fresh pair of eyes and a fresh mind might ask a different question that can enable you to work faster, reduce manual input, take on more responsibility, and actually achieve a promotion.

The right mindset about problem-solving enables it to benefit everyone on the team. No matter who is working on which problem or when, another major benefit to your business is to thoroughly document your procedures and changes thereto. It enriches the context of every issue that gets identified and resolved now and in the future, creating even greater efficiency for you as time passes.

Overcoming resistance is made possible by including and involving the right people, and enabling regular two-way communication with them through the problem-solving process.

For more interviews from the CFO Weekly podcast, check us out on Apple or Spotify or your favorite podcast player.

Previous Article

Not all accounting tasks are created equal. Before you automate, explore some of the top accounting automat...

Next Article

Uncover the hidden profit drain! Learn the top mistakes plaguing your accounting process and discover prove...

Most Recent Articles

Overwhelmed by accounting tasks? Outsourcing accounting services can be your secret weapon! Discover 3 unexpected benefits to streamline your finances and free up your time today.

Let's talk about gender imbalance in finance! Join the conversation and learn how we can create a more equitable financial industry.

The key to growth you might be missing! Learn about the power of cross-department collaboration and how to foster a winning team. Click to learn more!

Cut costs, and boost efficiency! Learn the top 5 ways companies leverage outsourcing to significantly reduce accounting expenses and achieve success. Discover how much you can save today!

Unlock the secrets of financial team efficiency! Dive deep into strategies for making finance accessible and achieving streamlined operations within your business.

Learn how machine learning in accounts payable can enhance efficiency and reduce costs. Learn how businesses can do more with less by leveraging innovative technology for smarter financial management.

Understanding the evolving role of the pharma CFO. Discover how the CFO is becoming a crucial partner in driving strategic decision-making for growth and expansion within the pharmaceutical industry.

Become an accounts receivable outsourcing expert! Our in-depth guide walks you through every step of the process, from understanding and developing a strategic AR plan to successful implementation.

Modern CFOs are more than number crunchers! Learn how a CFO navigates the shift from bookkeeping to becoming a strategic partner, aligning financial leadership with organizational goals and more.

The CFO role in early-stage startups: Balancing growth, structure, and financial health. Discover essential skills, get expert insights, and learn strategies for thriving in the early stages.

Explore insights from an expert on cash flow forecasting for CFOs. Discover key strategies to improve cash management, optimize financial planning, and support business growth. Read now!

Explore the key differences between accounts payable outsourcing and AI automation in this in-depth comparison. Discover which approach is best for your business today!

Explore the power of systemized decision-making and how it's transforming business decisions. Discover the benefits and see why many companies are adopting this innovative method to drive success.

Unlock the secrets to scaling your startup! Hear from a leading financial strategist as he shares proven strategies for explosive growth. Propel your startup to success.

Explore the exciting world of technological innovation in finance! We chat with a leading expert about the impact of technological innovation in finance. Discover how these advancements affect you.

Unleash the power of your finance department! Learn how effective communication can transform operations, unlock insights, and drive financial success. Get expert tips now!

The logistics industry is booming, and M&A activity is red hot! Learn how mergers and acquisitions can reshape your supply chain, unlock growth potential, and position your company for success.

Discover how Tech-Savvy CFOs harness innovation and AI to reshape finance, driving value and security while freeing up time for strategic initiatives. Read now!

Level up your finance game with tools like Power BI & Tableau! Unleash the power of data to solve business problems, make smarter decisions, and unlock new opportunities.