Undergraduate Accounting Major

Build a future you can count on..

Eller prepares you to lead in a rapidly changing business world, so you can help organizations transform their decision-making processes and their bottom-line profits.

As an accounting major, you’ll hone your ability to collect, organize and present financial information that is crucial to the success of any business.

Accounting Major Overview

Accounting involves the collection, organization, and presentation of financial information for effective decision making. Accounting services often include independent auditing, tax advice and tax return preparation, financial and management consulting and entrepreneurial services.

All accounting is characterized by compiling, analyzing and reporting on the financial conditions of the many functions for companies, nonprofit organizations, government agencies and individuals.

Accounting Advising

Work with your Accounting academic advisor to get questions answered and plan for your goals.

School of Accountancy

The Accounting major falls within the School of Accountancy, where highly respected, research-active faculty push their field further while preparing students for real-world careers in accounting.

Why Choose Eller Accounting?

Interested in pursing a degree in accounting? Some of our undergraduate students share what they enjoy most about the program, what they plan to do after graduation and why the career opportunities with an accounting degree are endless.

Accounting Sample Coursework Plan

How your Eller Accounting experience can play out:

Sample Four-Year Plan for Accounting Majors

This sample plan is based on 14-17 credits per semester , but each student and their academic plan is unique. Please meet with your Academic Advisor to create a custom plan for you. Please note that your General Education requirements, including second language, are determined by when you were admitted to the university. Your Academic Advisor can help you navigate the requirements relevant for you. For a full list of official degree requirements, check out the University General Catalog .

Sophomore Year

In order to take the following upper-division courses, students must be admitted to the major through a competitive and selective Professional Admission process. Once admitted into the upper division, students must maintain at least a 2.0 major GPA to continue in the Accounting major.

Professional Phase

ACCT 400A First Semester Track

ACCT 420 First Semester Track

400A First Semester Track

ACCT 420 First Semester Track (beginning Fall 2024)

Note: This is only a sample plan and requirements are subject to change and may vary based on catalog year, placement tests, AP/CLEP credit, transfer work, summer school, etc.

All students enter as Foundational Business Managements majors, and must go through a competitive and selective Professional Admission process to gain entry to the upper-division professional majors. The above plan is designed on the assumption that a student tests into College Algebra on the PPL Math Placement Exam; students who test lower than College Algebra should refer to the Five-Semester Plan and work with their academic advisor to learn how they can adjust their schedule to meet their educational goals.

* Eller Foundation Courses: You need to take these classes before you apply for admission into the professional program. Professional Admission is required before enrolling in 300- and 400-level core and major courses. Students transferring directly into the upper division who do not have a BCOM 214 equivalent completed will be required to take BCOM 315 before graduation instead.

** Business Emphasis Areas: You must take one ethics course to complete your degree. This class does not need to be completed before applying for Professional Admission.

Students can meet the Second Language requirement by demonstrating second semester proficiency through examination or taking any of a variety of second semester language courses. Each student needs to meet a minimum of 120 total credits. Students are strongly encouraged to take BNAD 100 and BNAD 200 to develop their professional knowledge and competencies required for success in the upper division. Please consult with your Advisement Report and your academic advisor .

Accounting Cohort Schedules

View Accounting major cohort schedules by semester:

Accounting First-Semester Cohort Schedule

Accounting sage cohort, accounting silver cohort.

* Students will take BCOM 314R at one but not both times. ** Students will not be automatically enrolled but can enroll through UAccess. A T/R 8:00 - 9:15am section is also available for students that do not have BCOM during that time.

Accounting Second-Semester Cohort Schedule

*A required lab for FIN 360 will be offered on Wednesdays. Please contact your advisor for more information.

Accounting Third-Semester Cohort Schedule

Accounting sage cohort, accounting silver cohort.

** All third semester Accounting students will be required to take a ENTR 485 course that will be held one day a week either Tuesday, or Thursday at 8 a.m., 9:30 a.m, 3:30 p.m. or 5:00 p.m for 1 hour and 15 minutes. Additionally, students will need to take MGMT 402, which will be held fully online.

- Prior to graduation Accounting Majors will take ACCT430 and ACCT310

Accounting Fourth-Semester Cohort Schedule

- ECON 300 is pre-enrolled for all students

Accounting Elective Course Options

The following Accounting electives may be available:

ACCT 440 Financial and Managerial Accounting in Healthcare

This course covers financial and managerial accounting topics relevant to the healthcare industry. Concepts covered include the financial and operational implications of changes in healthcare reimbursement; understanding and analyzing external financial statements for taxable and tax-exempt healthcare entities; usefulness of capital and operating budgets; practical applications of managerial accounting; and decision making tools for managers within healthcare enterprises.

Units: 3 Offered: Spring ( when resources are available )

ACCT 472A Accounting for Non-For-Profit Entities

Accounting concepts and procedures for governmental and other not-for-profit entities, including financial analysis and reconciliation to for-profit accounting principles.

Units: 3 Offered: Fall ( when resources are available )

View All Undergraduate Accounting Courses

Accounting Major Career Resources

Accounting careers.

Your Accounting degree translates to in-demand roles in the field of accounting, whether you want to pursue your Master’s in Accounting, CPA license or go on to work as a financial consultant, tax accountant or CFO.

Meet the Accounting Career Coach

Eller students have a world of options in front of them—which is why a dedicated career coach is so valuable. Get professional coaching on internship and job opportunities awaiting you.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Online Business Certificate Courses

- Business Strategy

- Leadership, Ethics, and Corporate Accountability

Financial Accounting

Key concepts, who will benefit, college students and recent graduates, those considering an mba, mid-career professionals.

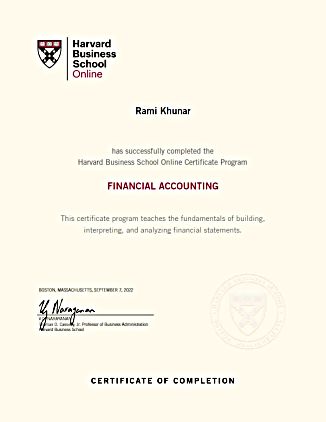

What You Earn

Certificate of Completion

Boost your resume with a Certificate of Completion from HBS Online

Earn by: completing this course

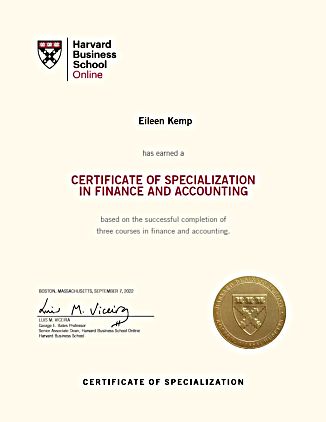

Certificate of Specialization

Prove your mastery of finance and accounting

Earn by: completing any three courses within this subject area to earn a Certificate of Specialization

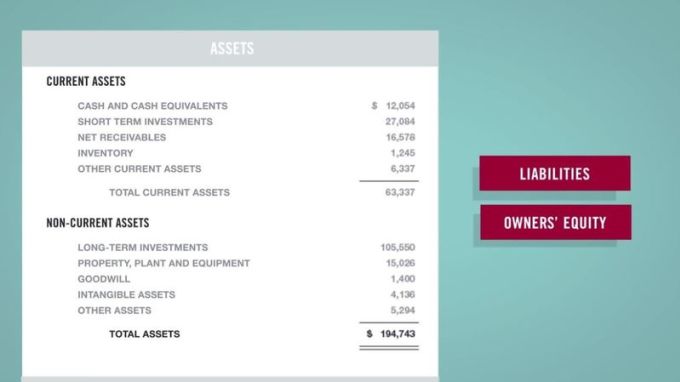

The Accounting Equation

- Accounting Equation Components

- Basic Transactions and the Equation

- Accounting Principles and Rules

- Formal Definitions of Accounting Terms

Featured Exercise

Recording transactions.

- Journal Entries and T-Accounts

- Advanced Journal Entries

- The Trial Balance

Featured Exercises

Financial statements.

- The Balance Sheet

- The Income Statement

Adjusting Journal Entries

- Accruals and Deferrals

- Long-Lived Assets

- Credit Risk Management

- Deferred Taxes

The Statement of Cash Flows

- Operating: Direct Method

- Operating: Indirect Method

- Investing and Financing

Analyzing Financial Statements

- Profitability

- Other Ratios

- Impact of Policy Differences

Accounting for the Future

- Pro Forma and Free Cash Flows

- Lease Accounting

A Manager's Guide to Finance & Accounting

Our difference, about the professor.

V.G. Narayanan Financial Accounting

Dates & eligibility.

No current course offerings for this selection.

All learners must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the course.

Learn about bringing this course to your organization .

Learner Stories

Financial Accounting FAQs

How does the financial accounting certificate program relate to the credential of readiness program.

In addition to being a standalone certificate program, Financial Accounting is also one component course of the Credential of Readiness (CORe) program , which also includes Economics for Managers and Business Analytics . Designed for those interested in learning business fundamentals more broadly, CORe program participants progress through the three courses in tandem, and the program concludes with a final exam.

What are the learning requirements in order to successfully complete Financial Accounting, and how are grades assigned?

Participants are expected to fully complete all coursework in a thoughtful and timely manner. This will mean meeting each week’s course module deadlines and fully answering questions posed therein, including satisfactory performance on the quizzes at the end of each module (earning an average score of 50% or greater). This helps ensure your cohort proceeds through the course at a similar pace and can take full advantage of social learning opportunities. A module is composed of a series of teaching elements (such as faculty videos, simulations, reflections, or quizzes) designed to impart the learnings of the course. In addition to module and assignment completion, we expect participation in the social learning elements of the course by offering feedback on others’ reflections and contributing to conversations on the platform. Participants who fail to complete the course requirements will not receive a certificate and will not be eligible to retake the course.

More detailed information on individual course requirements will be communicated at the start of the course. No grades are assigned for Financial Accounting. Participants will either be evaluated as complete or not complete.

Are there grants for Financial Accounting? How do I qualify?

Financial Accounting participants may be eligible for financial aid based on demonstrated financial need. To receive financial aid, you will be asked to provide supporting documentation. Please refer to our Payment & Financial Aid page .

What materials will I have access to after completing Financial Accounting?

You will have access to the materials in every prior module as you progress through the program. Access to course materials and the course platform ends 60 days after the final deadline in the program. At the end of each course module, you will be able to download a PDF summary of the module’s key takeaways. At the end of the program, you will receive a PDF compilation of all of the module summary documents.

How should I list my certificate on my resume?

Harvard Business School Online Certificate in Financial Accounting [Cohort Start Month and Year]

List your certificate on your LinkedIn profile under "Education" with the language from the Credential Verification page:

School: Harvard Business School Online Dates Attended: [The year you participated in the program] Degree: Other; Certificate in Financial Accounting Field of Study: Leave blank Grade: Complete Activities and Societies: Leave blank

For the program description on LinkedIn, please use the following:

Financial Accounting is an 8-week, 60-hour online certificate program from Harvard Business School. This course teaches the fundamentals of financial accounting from the ground up. Participants learn how to prepare and interpret financial statements—the balance sheet, income statement, and cash flow statement—and calculate and interpret critical ratios. The course concludes with an introduction to forecasting and valuation. Financial Accounting was developed by leading Harvard Business School faculty and is delivered in an active learning environment based on the HBS signature case-based learning method.

Can I take CORe if I've taken Financial Accounting?

By enrolling in the Financial Accounting certificate program, participants will be ineligible to enroll in the CORe program. By enrolling in the CORe program, participants will be ineligible to enroll in Financial Accounting.

Related Programs

Credential of Readiness (CORe)

Designed to help you achieve fluency in the language of business, CORe is a business fundamentals program that combines Business Analytics, Economics for Managers, and Financial Accounting with a final exam.

Leading with Finance

Build an intuitive understanding of financial principles to better communicate with key stakeholders, drive business performance, and grow your career.

Economics for Managers

Gain economic insights and learn how markets work and firms compete to craft successful business strategies.

IMAGES

VIDEO

COMMENTS

Ratio analysis is fundamental to finance accounting because of it allows us to gain insight into a firm’s financial and operational details. Profitability ratios are used in order to judge whether a …

This free, online accounting course breaks down basic accounting topics like accounting principles, debits and credits, the accounting equation, and more accounting concepts into …

Accounting for an annual inflation rate of 1%, this level of turnover amounts to £522,210 (Appendix H) at the end of year five. After redecorating the store, it …

Accounting Coursework Sample. List of Tables. TABLE 1: FINANCIAL RATIOS OF NUTTALL PLC ............................................................................................1. TABLE 2: COMPARISON OF …

Accounting Coursework Examples & Study Documents. Get access to our online database of Accounting Coursework writing samples. Get inspired with 750,000+ our samples

Learn the fundamentals of accounting with easy to follow examples and explanations. This section covers the basic topics of financial accounting such as accounts, journals, ledgers, …

Accounting Sample Coursework Plan. How your Eller Accounting experience can play out: Sample Four-Year Plan for Accounting Majors. Accounting Cohort Schedules. View …

Financial Accounting is an 8-week, 60-hour online certificate program from Harvard Business School. This course teaches the fundamentals of financial accounting from the ground up. Participants learn how to prepare and interpret …

Topics include: integration of firm strategy with accounting information content, effects of alternative accounting principles, and how accounting measures can be used as …