Written Samples

15 sample cover letters for custodian position.

Are you looking to land a job as a custodian but unsure how to craft a compelling cover letter?

Look no further!

Sample Cover Letters for Custodian Position

In this article, we present 15 sample cover letters tailored specifically for custodian positions.

These examples showcase various approaches and highlight the key skills and experiences that will make you stand out from the competition.

Whether you are a seasoned professional or just starting your career in the custodial field, you will find inspiration and guidance to create a winning cover letter that will increase your chances of securing an interview.

Sample Cover Letter One

Subject: Application for Custodian Position – [Your Name]

Dear Hiring Manager,

I am writing to express my strong interest in the custodian position at [Company Name]. With three years of experience in janitorial services and a proven track record of maintaining clean and orderly facilities, I am confident in my ability to contribute to your team’s success.

In my current role at [Current Company], I have consistently demonstrated a keen eye for detail and a commitment to ensuring a safe and hygienic environment. My responsibilities include cleaning and sanitizing restrooms, offices, and common areas, as well as performing minor repairs and maintenance tasks. I take pride in my work and always strive to exceed expectations.

I am a reliable and hardworking individual who thrives in a team setting. I possess excellent time management skills and can prioritize tasks effectively to meet deadlines. Additionally, I am comfortable working independently and can be trusted to carry out my duties with minimal supervision.

I am excited about the opportunity to bring my skills and experience to [Company Name] and contribute to maintaining a clean and welcoming environment for your employees and visitors. Thank you for considering my application. I look forward to the possibility of discussing my qualifications further in an interview.

[Your Name]

[Contact Information]

Sample Cover Letter Two

Subject: Custodian Position Application – [Your Name]

Dear [Hiring Manager’s Name],

I am pleased to submit my application for the custodian position at [Company Name]. As a detail-oriented and dedicated professional with five years of experience in the custodial industry, I am well-equipped to handle the responsibilities outlined in the job description.

Throughout my career, I have honed my skills in maintaining clean and orderly environments in various settings, including office buildings, schools, and healthcare facilities. I have a thorough understanding of proper cleaning techniques, safety protocols, and the use of industrial cleaning equipment. My experience has taught me the importance of efficiency, attention to detail, and the ability to adapt to changing priorities.

In my previous role at [Previous Company], I received consistent praise from supervisors and clients for my exceptional work ethic and positive attitude. I take pride in my ability to collaborate with team members and communicate effectively with individuals at all levels of an organization. I am also proactive in identifying and addressing potential issues before they escalate, ensuring a consistently high standard of cleanliness.

I am excited about the prospect of joining [Company Name] and contributing to your mission of providing a clean and welcoming environment. I am confident that my skills, experience, and dedication make me an excellent fit for this position.

Thank you for your time and consideration. I look forward to the opportunity to discuss my qualifications in further detail.

Best regards,

Sample Cover Letter Three

Subject: Custodian Position – [Your Name]

I am writing to apply for the custodian position at [Company Name]. As a highly motivated and reliable individual with a strong commitment to maintaining clean and orderly environments, I am confident in my ability to exceed your expectations.

Although I am new to the custodial field, I possess a solid foundation of skills that are transferable to this role. In my previous position as a retail sales associate, I demonstrated a keen eye for detail and a commitment to maintaining a clean and organized sales floor. I consistently received positive feedback from managers and customers alike for my strong work ethic and ability to go above and beyond in ensuring customer satisfaction.

I am a quick learner and am eager to expand my knowledge and skills in the custodial industry. I am comfortable working independently and can follow instructions and procedures with accuracy and efficiency. Additionally, I am a team player and thrive in collaborative environments, always ready to lend a helping hand to my colleagues.

I am excited about the opportunity to bring my enthusiasm, dedication, and strong work ethic to [Company Name]. I am confident that my transferable skills and eagerness to learn make me a strong candidate for this position.

Thank you for considering my application. I look forward to the chance to discuss my qualifications in more detail and learn more about how I can contribute to your organization.

Sample Cover Letter Four

Subject: Application for Custodian Role – [Your Name]

I am writing to express my strong interest in the custodian position at [Company Name]. With over eight years of experience in the custodial industry and a proven track record of maintaining clean, safe, and inviting environments, I am confident in my ability to make a significant contribution to your team.

Throughout my career, I have demonstrated a deep commitment to providing exceptional custodial services in various settings, including educational institutions, healthcare facilities, and corporate offices. I have a thorough understanding of industry best practices, safety regulations, and the proper use of cleaning equipment and products. My attention to detail, strong work ethic, and ability to prioritize tasks have consistently earned me recognition from supervisors and clients alike.

In my current role at [Current Company], I have taken on additional responsibilities, such as training new team members and implementing more efficient cleaning processes. I am proud to have played a key role in improving overall cleanliness and customer satisfaction ratings. I am confident that my leadership skills, problem-solving abilities, and dedication to continuous improvement will be valuable assets to your organization.

I am excited about the opportunity to bring my expertise and passion for excellence to [Company Name]. I am committed to maintaining the highest standards of cleanliness and contributing to a positive and welcoming environment for your employees, customers, and visitors.

Thank you for your consideration. I look forward to the opportunity to discuss my qualifications in more detail and learn more about how I can contribute to your organization’s success.

Sample Cover Letter Five

I am excited to apply for the custodian position at [Company Name]. As a reliable and hardworking individual with three years of experience in the custodial field, I am confident in my ability to maintain a clean, safe, and welcoming environment for your organization.

In my current role at [Current Company], I have consistently demonstrated a strong work ethic and a commitment to excellence. My responsibilities include cleaning and sanitizing restrooms, offices, and common areas, as well as restocking supplies and performing minor maintenance tasks. I take pride in my ability to pay close attention to detail and ensure that all areas are maintained to the highest standards of cleanliness and hygiene.

I am a team player and thrive in collaborative environments. I have excellent communication skills and can effectively interact with colleagues, supervisors, and customers. I am also comfortable working independently and can be trusted to carry out my duties with minimal supervision.

In addition to my custodial experience, I have a strong background in customer service. I understand the importance of creating a positive and inviting atmosphere for all who enter the building. I am always willing to go above and beyond to ensure that the needs of employees and visitors are met.

I am excited about the opportunity to bring my skills, experience, and enthusiasm to [Company Name]. I am confident that I can make a valuable contribution to your team and help maintain a clean and welcoming environment.

Thank you for considering my application. I look forward to the possibility of discussing my qualifications in more detail.

Sample Cover Letter Six

I am writing to express my strong interest in the custodian position at [Company Name]. With five years of experience in the custodial industry and a proven track record of maintaining clean, safe, and orderly environments, I am confident in my ability to make a valuable contribution to your team.

Throughout my career, I have demonstrated a deep commitment to providing exceptional custodial services in various settings, including schools, healthcare facilities, and office buildings. I have a thorough understanding of proper cleaning techniques, safety protocols, and the use of industrial cleaning equipment. My attention to detail, strong work ethic, and ability to prioritize tasks have consistently earned me recognition from supervisors and clients alike.

In my previous role at [Previous Company], I took on additional responsibilities, such as training new team members and implementing more efficient cleaning processes. I am proud to have played a key role in improving overall cleanliness and customer satisfaction ratings. I am confident that my leadership skills, problem-solving abilities, and dedication to continuous improvement will be valuable assets to your organization.

Sample Cover Letter Seven

I am pleased to submit my application for the custodian position at [Company Name]. As a detail-oriented and hardworking individual with two years of experience in the custodial field, I am confident in my ability to maintain a clean, safe, and inviting environment for your organization.

I am a quick learner and am always eager to expand my knowledge and skills in the custodial industry. I am comfortable working independently and can follow instructions and procedures with accuracy and efficiency. Additionally, I am a team player and thrive in collaborative environments, always ready to lend a helping hand to my colleagues.

In addition to my custodial experience, I have a strong background in customer service. I understand the importance of creating a positive and welcoming atmosphere for all who enter the building. I am always willing to go above and beyond to ensure that the needs of employees and visitors are met.

I am excited about the opportunity to bring my enthusiasm, dedication, and strong work ethic to [Company Name]. I am confident that my skills and experience make me a strong candidate for this position.

Sample Cover Letter Eight

I am writing to express my strong interest in the custodian position at [Company Name]. With seven years of experience in the custodial industry and a proven track record of maintaining clean, safe, and inviting environments, I am confident in my ability to make a significant contribution to your team.

Sample Cover Letter Nine

I am excited to apply for the custodian position at [Company Name]. As a reliable and hardworking individual with four years of experience in the custodial field, I am confident in my ability to maintain a clean, safe, and welcoming environment for your organization.

Sample Cover Letter Ten

I am writing to express my strong interest in the custodian position at [Company Name]. With six years of experience in the custodial industry and a proven track record of maintaining clean, safe, and orderly environments, I am confident in my ability to make a valuable contribution to your team.

Sample Cover Letter Eleven

I am pleased to submit my application for the custodian position at [Company Name]. As a detail-oriented and hardworking individual with three years of experience in the custodial field, I am confident in my ability to maintain a clean, safe, and inviting environment for your organization.

Sample Cover Letter Twelve

I am writing to express my strong interest in the custodian position at [Company Name]. With eight years of experience in the custodial industry and a proven track record of maintaining clean, safe, and inviting environments, I am confident in my ability to make a significant contribution to your team.

Sample Cover Letter Thirteen

I am excited to apply for the custodian position at [Company Name]. As a reliable and hardworking individual with five years of experience in the custodial field, I am confident in my ability to maintain a clean, safe, and welcoming environment for your organization.

Sample Cover Letter Fourteen

I am writing to express my strong interest in the custodian position at [Company Name]. With seven years of experience in the custodial industry and a proven track record of maintaining clean, safe, and orderly environments, I am confident in my ability to make a valuable contribution to your team.

Sample Cover Letter Fifteen

I am pleased to submit my application for the custodian position at [Company Name]. As a detail-oriented and hardworking individual with four years of experience in the custodial field, I am confident in my ability to maintain a clean, safe, and inviting environment for your organization.

By tailoring your cover letter to highlight your relevant skills, experience, and passion for the custodial field, you can significantly increase your chances of standing out from other applicants and securing an interview.

Use these sample cover letters as a starting point, and personalize them to reflect your unique qualifications and the specific requirements of the position you are applying for.

With a compelling cover letter and a strong resume, you will be well on your way to landing your dream job as a custodian.

- Skip to Content

- Skip to Sidebar

- Skip to Footer

Resume Genius

The World's Smartest Resume Builder

Monday to Friday, 8AM – 12AM (Midnight) and Saturdays and Sundays, 10AM – 6PM EDT (866) 215-9048

Cover Letter Examples Custodian Cover Letter

Custodian Cover Letter Sample

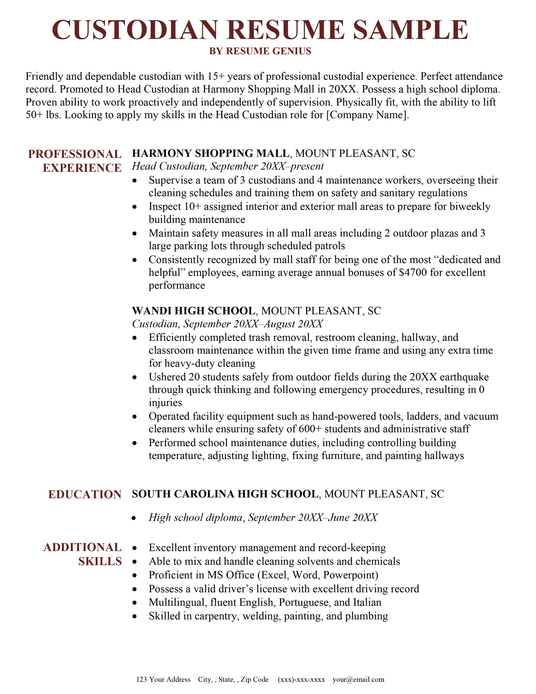

Your resume should have a fantastic custodian cover letter to match it. Use our cover letter writing tips and custodian cover letter sample to produce a cover letter that hiring managers will love.

Want an aesthetic cover letter? Select a new design from our collection of cover letter templates .

Custodian Resume & Related Cover Letters

Custodian Cover Letter Template

Average custodian salaries in the us, how to write a custodian cover letter.

Make sure your cover letter is formatted well to give it a professional appearance.

Copy-paste Custodian Cover Letter (Text Format)

FIRST AND LAST NAME

Email: [email protected]

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

[Today’s Date]

[Hiring Manager’s Name] [Company Address] [Company City, State xxxxx] [(xxx) xxx-xxxx] [[email protected]]

Dear [Mr./Ms./Mx.] [Manager’s Name],

My name is [Custodian Applicant] and I’m delighted to apply for the position of Head Custodian at Laketown University that I found on Indeed.com. With my reliable and respectful nature, perfect attendance record, and 15+ years of custodial experience, I believe I’m the ideal candidate for the role. I’m fully committed to creating a sanitary, safe, and organized environment at Laketown University.

I’m currently the Head Custodian at Harmony Shopping Mall, where I’ve been rewarded annually for my exceptional performance. Foot traffic at this mall reaches over 2 million a month, so following safety and sanitary measures are essential. I manage a team of 7 custodial staff and create a cleaning and maintenance schedule for them every month using Microsoft Excel. I also perform biweekly inspections of the entire mall area for which I’ve written over 1000+ reports for the facility management team. Working at Harmony has been a fantastic experience, and I hope to commit myself in the same way at [Company Name].

At Wandi High School, my daily tasks included trash removal in 55+ rooms, 4 large hallways, and maintaining 20+ classrooms. I’ve learned the importance of working fast and paying attention to even the smallest of details. As a result, I consistently cleaned ahead of schedule and used the extra time to complete other maintenance work, including painting, plumbing, and light carpentry work.

I’d love to have the chance to speak more about this role with you through an interview. My phone number is (xxx-xxx-xxxx), and my email address is [email protected]. Thank you for your time and consideration.

The following table includes information from O*NET Resource Center by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data is presented based on the top states in the USA.

Average custodian annual salaries by state

| State | Salary / Year |

|---|---|

| California | $37,970 |

| New York | $38,710 |

| Florida | $29,800 |

| Texas | $29,640 |

| Pennsylvania | $34,790 |

| Illinois | $36,400 |

| Ohio | $33,840 |

| Georgia | $30,100 |

| North Carolina | $29,780 |

| Michigan | $34,080 |

| National Average | $33,526 |

Learn how to write an excellent custodian cover letter that will impress hiring managers and help you land interviews using these three actionable tips.

1. Refer to the job posting on your cover letter

Custodians are essential workers and are always in demand. Stay ahead of the competition by expertly tailoring your cover letter with the following steps:

1. Include the hiring manager’s information: Address your cover letter directly to the hiring manager by name. You can find out their name through a quick Google search or by calling and asking the company.

At the top of your cover letter, include:

- the hiring manager’s name

- the company’s address

- the phone number

- the email address

Adding these details at the start of your custodial cover letter shows that you’re thorough.

2. Explain what you can do for the company: Write a cover letter introduction that not only highlights your skills but explains your purpose for applying.

Frame your purpose positively by presenting yourself as a capable worker. Always mention how you can help the company, rather than how it can benefit you. Have a look at an extract from our custodian cover letter introduction:

My name is [Custodian Applicant] and I’m delighted to apply for the position of Head Custodian at Laketown University that I found on Indeed.com. With my reliable and respectful nature, perfect attendance record, and 15+ years of custodial experience, I believe I’m the ideal candidate for the role. I’m fully committed to creating a sanitary, safe, and organized environment at Laketown University.

3. Always relate your experiences back to the job position: In your body paragraphs, describe your work history and key achievements , and then mention how these experiences will help you in your new role.

Employers use applicant tracking systems (ATS) to filter out applications, so use job-related keywords from their ad and include them in your custodial cover letter.

Showing that you understand the job requirements of your new employer and have transferable skills will make you stand out. Here’s an example from our custodial cover letter:

I manage a team of 7 custodial staff and create a cleaning and maintenance schedule for them every month using Microsoft Excel. I also perform biweekly inspections of the entire mall area for which I’ve written over 1000+ reports for the facility management team. Working at Harmony has been a fantastic experience, and I hope to commit myself in the same way at Laketown University.

2. Follow the correct cover letter format

Custodians need to pay attention to details when working. The formatting of your cover letter should show that you pay attention to detail.

Keep your cover letter on one page : Employers have limited time, so write a one-page cover letter that illustrates your most relevant skills .

Choose an appropriate font : Use a standard cover letter font like Times New Roman, Arial, or Verdana that matches your resume template and looks professional. Keep your font size between 10.5 and 12 points so employers can easily read your cover letter.

Save your cover letter as a PDF : Always save your resume and cover letter as PDFs . Using PDFs preserves the original formatting and ensures that no one can modify your work.

3. Finish strong with a compelling call to action

Show initiative and confidence by ending your cover letter with a call to action (CTA). A CTA politely requests an interview and invites the employer to contact you.

Include your phone number and email address at the end of your custodian cover letter so that the hiring manager can easily find this information. Make sure your contact details match the details in your resume and cover letter header .

Finally, thank the hiring manager for reading your cover letter and end with an appropriate sign-off like “Sincerely” and your name. Here’s an example from our custodian cover letter sample:

I’d love to have the chance to speak more about this role with you through an interview. My phone number is (xxx-xxx-xxxx), and my email address is [email protected]. Thank you for your time and consideration. Sincerely, Your Name

Make a cover letter in minutes

Pick your template, fill in a few details, and our builder will do the rest.

Click to rate this article

4.3 Average rating

The Resume Genius Team

Related Articles

Cover Letter Help

Conrad Benz

Geoffrey Scott

Corissa Peterson

Rebecca Tay, Ph.D.

Ida Pettersson

Emily Crowley

Thanks for downloading our free template!

Would you leave us a review?

- Resume Templates Simple Professional Modern Creative View all

- Resume Examples Nurse Student Internship Teacher Accountant View all

- Resume Builder

- Cover Letter Templates Simple Professional Modern Creative View all

- Cover Letter Examples Nursing Administrative Assistant Internship Graduate Teacher View all

- Cover Letter Builder

Custodian cover letter example

Cover letter header

Cover letter greeting, cover letter introduction, cover letter middle part (body), how to end a custodian cover letter (conclusion & sign-off).

The word custodian means someone who guards, protects, or maintains property. That means a custodian position requires more than simply cleaning up. A custodian cover letter that won’t get swept into the circular file must convey your sense of responsibility to the buildings and grounds you work.

Within this custodian cover letter guide, you will learn how to craft an application letter that will get you that interview. Keep reading for tips and hints on:

- The structure of a cover letter and the paragraphs the cover letter should include

- Making the most of the space you have in each part of your cover letter (header, greeting, intro, body and conclusion)

- The content of your cover letter

- How to avoid common errors when writing your custodian cover letter.

Resume.io is an expert resource for job seekers in all fields and at all levels of their careers. Check out our collection of 180+ adaptable cover letter examples and writing guides!

Best format for a custodian cover letter

A blank page in which to convince an employer to offer you an interview can be daunting, but never fear because structure will make writing your custodian cover letter much easier. So Before you launch into writing, you need to know what to include in your application document.

The format of a custodian cover letter should contain the following elements:

- The cover letter header

- The greeting / salutation

- The cover letter intro

- The middle paragraphs (body of the letter)

- The ending paragraph of your cover letter (conclusion and call-to-action)

Resume.io offers a general overview on writing cover letters, the comprehensive cover letter guide. Specific advice on optimizing each custodian cover letter paragraph and section can be found below.

This custodian cover letter example will give you an outline for writing your own cover letter:

Dear Mr. Purdew,

After working as a custodian for a range of corporate clients and being responsible for the maintenance of office premises, I am interested in pursuing the custodian position at JB Retailers. While much of the work is at night (which suits my personal circumstances), the changeover as people come into the office is my favorite part of the shift.

I work hard to provide my clients with a clean and fully functioning workplace, as well as dealing with all manner of light maintenance tasks. I am successful when nothing gets in the way of clients doing their best work in the office. Coming in to a freshly polished desk, squeaky-clean meeting room, and fully stocked fridge is a great way to start the working day.

I enjoy working for an office services company as this means that I have a wide variety of work and I can build on my experience. My work over the past two years has included:

- Kitchens and dining areas: cleaning and sanitizing surfaces and equipment

- Meeting rooms & offices: Cleaning duties, managing stationary, tech maintenance

- Floor care & windows: Cleaning, waxing & vacuuming floors, washing windows

- Recycling management: Managing complex recycling requirements

Alongside my custodian duties, I have experience in managing the ongoing repair and maintenance of basic office technology. I have worked with corporate procurement teams to ensure that obsolete tech is replaced in a timely fashion. Every custodian is responsible for the smooth functioning of the office environment.

Having worked for over 30+ companies on an outsourced basis, I have a wealth of references should you wish to investigate further. I look forward to hearing about the needs of your clients and hope that I might be a reliable and skilled addition to your team.

Martin Hillersdon

Neatness is of the utmost importance in your line of work, so start off with a clean custodian cover letter header. The main point of the header is to clearly state your name and contact information so when a hiring manager wants to schedule your interview, they know just how to reach you.

Secondarily, visuals are powerful, so make sure your header leaves the right impression. Legibility comes before cute fonts or overly bright colors. Align the style of your cover letter header with your resume design to create a complete application package.

Get professional with your contact info

Playing around with fun email addresses is common, but is not the way to make a great impression on an employer. Do yourself a favor: If you don’t already, get a Gmail, Outlook or other email account and use one of the following formats:

- [email protected]

Any variation on that theme works. If you have a common name, try adding a middle initial or one or two digits on the end.

The greeting of your custodian cover letter sets the tone for the rest of your content. The standard “Dear [Mr./Ms./Mrs./Dr. Last name]” should be your go-to greeting because it sounds professional, but friendly. Be aware, however, that you need to know the correct honorific to use.

Your best bet, especially if you are unsure of who to address or how, is a quick call to the company. The extra effort may distinguish you from other applicants who did not make that call. Try to avoid the old-fashioned and stiff “To Whom It May Concern.” Instead, opt for “Dear Hiring Manager” if you absolutely cannot find the correct person to address.

There are times when it may be appropriate to start off with “Hello [name of hiring manager].” For instance, if you have a recommendation from a current employee and know that the company is a casual one or if you are already acquainted with the hiring manager.

The first paragraph of your custodian cover letter serves to introduce you to your prospective employer and to give them a preview of what the rest of your letter will contain. Start off strong with a sentence that offers an overview of your work history and a positive description about you.

If you are entering the job market for the first time, use examples from your academic experience to show that you are reliable and trustworthy. Also consider any volunteer activity you have that demonstrates work skills. Remember that employers hiring for entry-level jobs understand that applicants will not have a lot of related work experience. They are looking for the qualities that will make you a good employee.

If you do have work experience, choose an achievement that most closely relates to the custodial position you seek.

The body, or middle part, of your custodian cover letter comprises two or three paragraphs that expand on your introduction. The key to this section is finding the right balance between professionalism and personality.

Employers want to know that you will be able to integrate into the custodial team, so choose an anecdote that illustrates how you worked with others in a previous position, on a committee, or on a school project. Clearly explain your role and achievement.

Mind the ATS

While you may think of the Applicant Tracking System that manages your application for HR departments as a concern for your resume, it may also take keywords in your cover letter into account.

Increase your chances of making it past the ATS by including relevant keywords and phrases in your cover letter as well as your resume. This step also signals to employers that you understand what they are looking for in a custodian.

If you have held custodian positions before, pick one or two examples that best relate to the job you are applying for and detail your main responsibilities. Even better, if you implemented a process that saved time or money or expanded your skills while on the job, write about those successes. Highlight any skills you have that could add value to your employment, such as repair or skilled trades knowledge.

It’s also a good idea to tell your prospective employer why you want to work at their company specifically.

You’ve done the main work in the body of your custodian cover letter. Your conclusion is time to add the finishing touches. The first sentence or two should restate your qualifications so they are fresh in your prospective employer’s mind.

Then, remind them of the point of your letter: You want an interview! Politely suggest that you would love to discuss the opportunity further at their earliest convenience. Finally, sign off with “Sincerely” or “Regards” and your name.

The cover letter example text below shows one method of asking for an interview.

Avoiding basic mistakes in a custodian cover letter

- Don’t get too casual. Every job is a professional job, so keep your cover letter business-like. While you should reveal a bit of your personality to show that you will make a great team member, don’t stray into the irrelevant.

- Keep your stories short. The best work examples to use in your custodian cover letter take only one or two sentences to explain. Hiring managers are busy people, so you need to get your message across quickly.

- Avoid using the same cover letter over and over. Every job is different, so every cover letter should be, too.

- Edit to keep out typos and other errors. Use spellcheck and grammar tools. Then have a friend or colleague look over your letter. Why take the chance of missing out on an opportunity because of a tiny mistake?

- Poor formatting. The layout and design doesn’t need to be complicated, but a simple, organized cover letter template can help.

Key takeaways

- Even if you have no work experience, you can write a custodian cover letter that shows you are an excellent candidate.

- Carefully read the job description and craft your letter to address the needs of each employer instead of sending on generic letters.

- Present a professional visual image with your custodian cover letter as well as your resume.

- Check out our adaptable custodian cover letter sample to begin creating a great layout.

If you’re looking for additional inspiration for cover letter writing, you can check out our related maintenance and repair cover letter examples:

- Housekeeping cover letter sample

- Maintenance and repair cover letter sample

- Construction cover letter sample

- Electrician cover letter example

- Mechanic cover letter sample

Free professionally designed templates

Custodian Cover Letter Guide With Samples & Expert Advice

Craft the perfect Custodian Cover Letter—Get Tips, Examples, and Expert Advice To Kickstart Your Career. Let's Go!

Shaoni Gupta

Read more posts by this author.

Crafting the perfect custodian cover letter can make all the difference in landing your next job.

As a custodian, you play a crucial role in maintaining cleanliness and order, ensuring that environments are safe and pleasant for everyone.

This blog will guide you through the essential elements of a compelling custodian cover letter irrespective of your experience.

Custodian Cover Letter Template for Freshers

[Henry William] [Abc lane] [LA, California, Zip Code] [[email protected]] [123 456 789]

Hiring Manager [Xyz Company] [Company Address] [LA, California, Zip Code]

Dear Hiring Manager,

I'm writing to [Company Name] to express interest in the Custodian role. As a recent graduate with practical experience gained from internships and pertinent certificates, I'm excited to join your team and keep things tidy, safe, and well-organized.

I gained a lot of experience in teamwork, maintenance, and cleaning during my coursework and internships. I have an excellent attention to detail and a strong commitment to efficiency, so I guarantee a high level of cleanliness. My main credentials are listed below:

Certifications:

OSHA Safety Certificate

Certified Custodial Technician (CCT)

First Aid and CPR Certification

Internships:

Custodial Intern at [School/Organization Name]

Assisted with daily cleaning tasks, including sweeping, mopping, and vacuuming.

Sanitized restrooms and replenished supplies.

Performed minor maintenance and reported any repair needs.

Facilities Maintenance Intern at [Company/Organization Name]

Conducted routine inspections to ensure cleanliness and safety.

Collaborated with the maintenance team to address issues promptly.

Used cleaning equipment and chemicals safely and effectively.

I'm sure that my excitement and abilities make me a great fit for this role. The prospect of joining [Company Name] and helping to keep everyone in a nice environment excites me. I appreciate your consideration of my application.

I'm excited about the prospect of talking more about my application. To arrange an interview, don't hesitate to get in touch with me at [Phone Number] or [Email Address].

[Henry William]

Custodian Cover Letter Sample for Freshers

[Samantha Jones] [Abc lane] [LA, California, Zip Code] [[email protected]] [123 456 789]

Hiring Manager

[Xyz Company] [Company Address] [LA, California, Zip Code]

I would like to apply immediately for the [Company Name] Custodian position. I am ready to support your team by keeping a clean and safe atmosphere, as I have the necessary certifications and real-world experience from internships.

Custodial Intern, [School/Organization Name]

Performed daily cleaning tasks and sanitized restrooms.

Assisted with minor maintenance and reported repair needs.

Maintenance Intern, [Company/Organization Name]

Conducted inspections for cleanliness and safety.

Collaborated with the team to address maintenance issues.

I'm prepared to join [Company Name] and contribute to upholding strict safety and hygiene standards because I'm committed and meticulous. I'm excited for the chance to talk about how my abilities can help your team. To schedule an interview, please contact me at [Phone Number] or [Email Address].

Thank you for your time and consideration.

Sincerely, [Samantha Jones]

Custodian Cover Letter Sample for Experienced Candidates

[Emma James] [Abc lane] [LA, California, Zip Code] [[email protected]] [123 456 789]

I'm writing to [Company Name] to express interest in the Custodian role. Having worked in custodial jobs for more than [number] years, I am sure I can make a valuable contribution to your organisation. My commitment to upholding hygienic and secure surroundings renders me an ideal candidate for this position.

Experience:

Over [number] years of custodial experience in various settings, including office buildings, schools, and healthcare facilities.

Expertise in using cleaning equipment such as buffers, scrubbers, and vacuum cleaners.

Proficient in waste disposal and recycling processes.

Skilled in performing minor repairs and reporting major maintenance issues.

Conducted routine inspections and preventative maintenance tasks to ensure a safe environment.

Assisted with setting up and breaking down for events and meetings.

Managed inventory of cleaning supplies and equipment to ensure availability.

Followed all health and safety regulations diligently.

I am highly skilled in using a variety of cleaning tools and chemicals safely and effectively. My proactive approach and ability to work independently or as part of a team ensure that all tasks are completed to the highest standards.

I am excited about the opportunity to bring my skills and experience to [Company Name]. Thank you for considering my application. I look forward to the possibility of discussing how I can contribute to your team. Please contact me at [Phone Number] or [Email Address] to schedule an interview.

Sincerely, [Emma James]

Custodian Cover Letter Template for Experienced Candidates

[Sam Parson] [Abc lane] [LA, California, Zip Code] [[email protected]] [123 456 789]

[Hiring Manager] [Xyz Company] [Company Address] [LA, California, Zip Code]

I am excited to apply for the Custodian position at [Company Name]. With extensive experience in custodial services and a strong commitment to maintaining clean and orderly environments, I am eager to bring my skills to your team.

Over [number] years of professional custodial experience.

Proficient in all aspects of cleaning and sanitation, including floors, windows, and restrooms.

Skilled in operating and maintaining various cleaning equipment.

Expertise in waste management and recycling procedures.

Conducted regular inspections to ensure compliance with safety and cleanliness standards.

Coordinated with team members to efficiently complete large-scale cleaning projects.

Maintained inventory and ordered supplies to ensure adequate stock levels.

Adhered strictly to health and safety guidelines, ensuring a safe environment for all.

I have received recognition for my dependability, efficiency, and attention to detail throughout my work. I'm sure that my proactive demeanour and commitment to maintaining impeccable hygiene standards would make me an invaluable member of your team.

I'm excited for the chance to talk about how [Company Name] can benefit from my expertise and abilities. For a convenient time to schedule an interview, please contact me at [Phone Number] or [Email Address].

Thank you for your consideration.

Sincerely, [Sam Parson]

How To Write a Custodian Cover Letter ? (Step by Step Guide)

Step 1: Header

Include your contact information at the top of the letter.

Follow this with the date.

Include the employer’s contact information below the date.

Step 2: Salutation

Address the hiring manager directly by name if possible.

If the name is unknown, use a general salutation like "Dear Hiring Manager."

Step 3: Introduction

Start with a brief introduction that mentions the position you are applying for.

State where you found the job listing.

Include a strong opening statement that summarizes your relevant experience and enthusiasm for the role.

Step 4: Highlight Certifications

List any relevant certifications you hold.

Mention certifications such as safety certificates, custodial technician certifications, and first aid/CPR certifications.

Step 5: Detail Your Experience

Use bullet points to clearly list your relevant work experience.

Highlight specific responsibilities and tasks you have performed in your previous roles.

Mention your skills, such as using cleaning equipment, waste management, and adherence to safety protocols.

Step 6: Closing Paragraph

Reiterate your interest in the position.

Thank the hiring manager for their consideration.

Mention your availability for an interview.

Provide your contact information again for convenience.

What Should You Include In Custodian Cover Letter?

You can demonstrate your qualifications and fit for the position in a thorough and eye-catching custodian cover letter by utilizing these tips.

1. Professional Experience

Give a thorough account of your relevant work history, highlighting your accomplishments and special duties from prior positions.

Examples include managing waste, operating cleaning equipment, doing little repairs, and cleaning and maintaining a variety of buildings.

2. Hard Skills

Emphasize particular technical abilities that have a direct bearing on cleaning job.

Mastery of cleaning equipment (such as buffers, scrubbers, and vacuum cleaners), acquaintance with cleaning supplies and their safe usage, and the ability to do routine maintenance tasks are a few examples.

3. Soft Skills

Highlight the essential character traits and soft skills that make you a successful career.

Examples include having a keen eye for detail, being dependable and on time, having good time management skills, and being able to work both independently and collaboratively.

4. Dedication to Hygiene and Safety

Demonstrate your commitment to keeping things tidy and safe, which is essential for a custodial position.

As an illustration, consider following health and safety guidelines, carrying out routine inspections, and guaranteeing adherence to cleaning requirements.

5. Communication and Interpersonal Skills

Stress how well you can interact with coworkers, managers, and other stakeholders.

Examples include being transparent about maintenance requirements in reports, working with colleagues to finish tasks, and being quick to answer questions and provide comments.

Here's a collection of cover letters for different jobs that you can explore:

Cover Letter for Office Manager

Cover Letter for Paralegals

Cover Letter for Graphic Designers

Cover Letter for Esthetician

Cover Letter for Customer Service Agent

Contact Tracer Position Cover Letter Guide

Mistakes to Avoid

Here are few key mistakes you should avoid while write your cover for the role of a custodian:

1. Being Too Generic

A one-size-fits-all cover letter should be avoided. Tailor each cover letter to the particular position and business, demonstrating that you have done your homework and are aware of their requirements.

2.Ignoring the Job Description

The preferences and requirements specified in the job description should not be disregarded. Make your cover letter unique by emphasizing how your qualifications and experience meet the job's requirements.

3. Using a Weak Opening

Don't begin with a lifeless or general introduction. Draw the reader in with a compelling introductory paragraph that expresses your interest in the position and your most pertinent credentials.

4.Not Including Contact Information

Make sure your contact details are current and accessible. Verify again that the phone number and email address you provided are accurate.

5.Omitting a Call to Action

Don't forget to end your paragraph with a call to action. Tell the hiring manager how excited you are about the job and ask them to get in touch with you to arrange an interview.

Key Takeaways

A well-crafted custodian cover letter is essential for making a strong first impression and securing an interview.

Remember to highlight your relevant certifications, professional experience, and key skills, both technical and interpersonal.

Avoid common mistakes such as being too generic, ignoring the job description, and using a weak opening.

By following these tips, you can demonstrate your qualifications and enthusiasm for the role, increasing your chances of landing the custodian job you desire.

This article has been written by Shaoni Gupta. She works as a content writer at Vantage Lens . Her areas of interest range from art to astronomy. When she's not writing, she is daydreaming about stepping into the worlds of high fantasy novels.

Join for job search assistance, workplace tips, career guidance, and much more

Professional Custodian Cover Letter Examples for 2024

Your custodian cover letter must immediately highlight your dedication to maintaining cleanliness and order. Display your understanding of effective cleaning techniques and safety protocols right from the start. Showcase your reliability and ability to work independently with minimal supervision. Your cover letter should also reflect your adeptness in handling cleaning equipment and managing waste disposal efficiently.

Cover Letter Guide

Custodian Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Custodian Cover Letter

Key Takeaways

Writing a custodian cover letter can be a daunting task, especially when you've just begun your job hunt and realized a standout cover letter is a must. Unlike your resume, it's your chance to narrate the story of your proudest professional achievement. Striking the perfect balance between formality and originality, without falling into the trap of clichés, can be challenging. Additionally, keeping it concise within one page adds to the pressure. Here's how you can craft a letter that shines.

- Create a custodian cover letter to persuade the recruiters you're the best candidate for the role;

- Use industry-leading custodian cover letter templates and examples to save time;

- Dedicate your custodian cover letter space to your best achievement;

- Make sure your custodian cover letter meets recruiters' expectations and standards.

Avoid starting at the blank page for hours by using Enhancv's AI - just upload your resume and your custodian cover letter will be ready for you to (tweak and) submit for your dream job.

If the custodian isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Custodian resume guide and example

- Handyman cover letter example

- Facilities Manager cover letter example

- Maintenance Manager cover letter example

- Homemaker cover letter example

- Housekeeping Manager cover letter example

- Cleaning Manager cover letter example

- Electronic Technician cover letter example

- Resident Assistant cover letter example

- Housekeeping Supervisor cover letter example

- Electrician Apprentice cover letter example

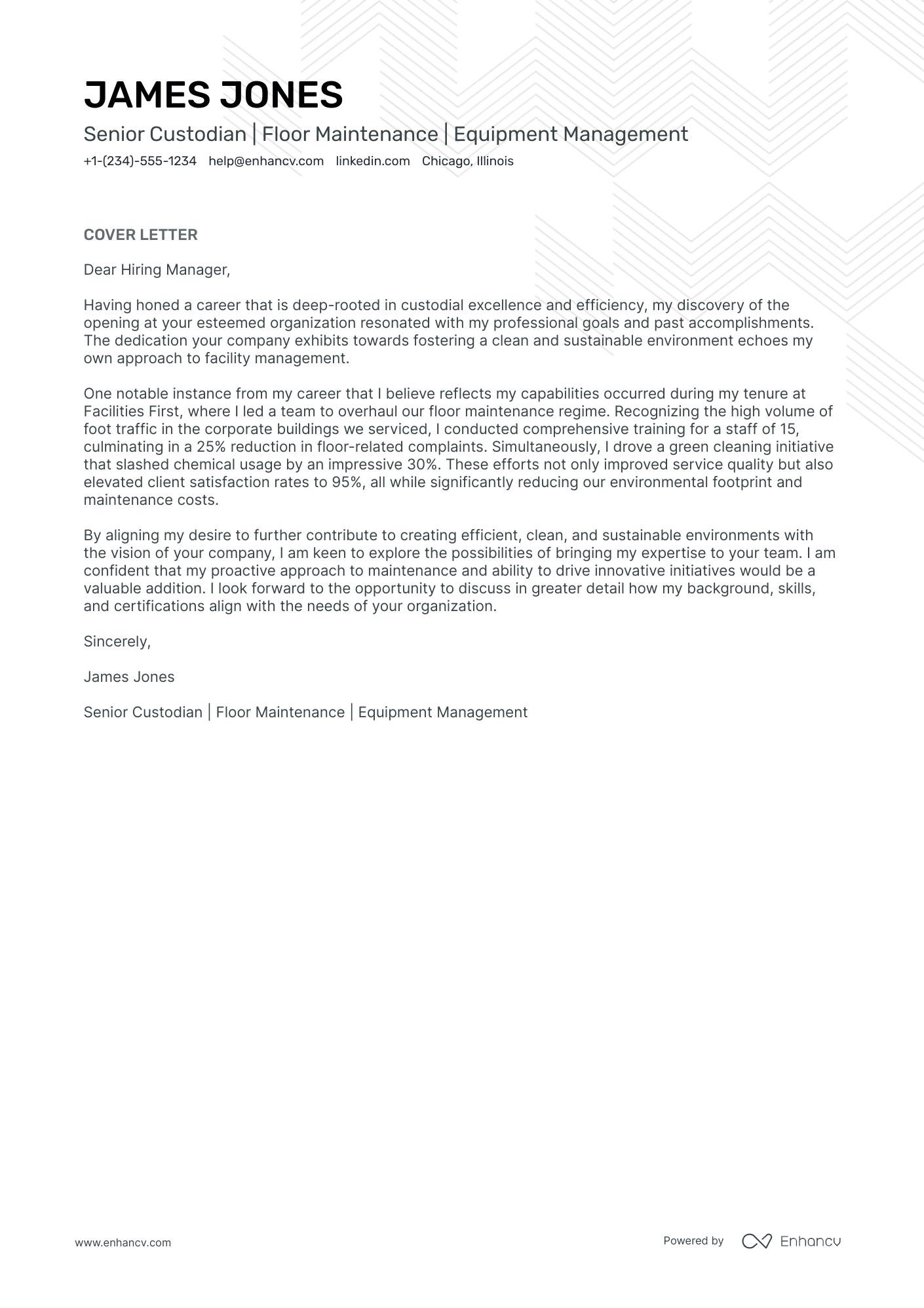

Custodian cover letter example

James Jones

Chicago, Illinois

+1-(234)-555-1234

- Emphasize relevant experience, such as leading a team to overhaul a maintenance regime, which showcases leadership and initiative taken in past roles.

- Highlight achievements, like reducing floor-related complaints by 25% and cutting chemical usage by 30%, to demonstrate the impact of your work on operations and sustainability.

- Align personal values with company values, showing a shared commitment to clean and sustainable environments, which suggests a good culture fit.

- Mention client satisfaction rates (in this case, 95%), to provide quantifiable results that back up your claims of service quality improvement.

Five tips on formatting your custodian cover letter

Do you want to make a good impression on recruiters and, at the same time, follow the best industry advice on writing your custodian cover letter?

Make sure to include the following:

- Header and Salutation;

- Introductory paragraph;

- Body paragraph;

- Closing paragraph;

- Signature (this one is up to you).

Remember to use the same modern, simple font for your custodian cover letter as you did for your resume (e.g. Lato, Rubik, etc.)

Ensure your custodian cover letter is single-spaced and is wrapped around a one-inch margin, like in our cover letter templates .

Once completed, use our cover letter builder to export your custodian cover letter in the best format to keep your information intact - PDF.

At the end of the day, your custodian cover letter won't be assessed by the Applicant Tracker System (ATS) software, but by the recruiters. Your information should thus be legible, organized, and follow a structured logic.

The top sections on a custodian cover letter

- Header: The header should include your name, address, contact information, and the date, ensuring that the hiring manager can easily identify you and know how to reach you for an interview.

- Greeting: Use a professional salutation (e.g., "Dear Hiring Manager") to show respect and to personalize your cover letter, indicating that you've taken the time to address the potential employer directly.

- Introduction: Introduce yourself and express your enthusiasm for the custodian position, mentioning where you found the job listing and why you're interested in this specific opportunity.

- Body: Highlight your relevant experience, skills such as attention to detail, ability to follow safety procedures, and capacity for maintaining cleanliness across various facilities, showcasing why you are an ideal fit for the custodian role.

- Closing: Close your cover letter with a call to action, such as requesting an interview, and a thank you to the employer for their time and consideration, leaving them with a professional final impression.

Key qualities recruiters search for in a candidate’s cover letter

- Attention to Detail: Demonstrates thoroughness and accuracy in cleaning and maintenance tasks, appealing to employers who prioritize quality and meticulousness.

- Physical Stamina and Mobility: Essential for performing tasks that require bending, lifting, and prolonged periods of standing or walking, which are often part of a custodian's job description.

- Reliability and Punctuality: Important for custodians who frequently work unsupervised and must adhere to strict schedules to avoid disruptions in the workplace or institution.

- Knowledge of Cleaning Chemicals and Equipment: Shows capability in the safe and effective use of various cleaning products and machinery, which is vital for efficiency and maintaining a safe environment.

- Problem-Solving Skills: Helpful for identifying and addressing maintenance issues quickly and effectively, minimizing the potential for larger problems or safety hazards.

- Experience in Cleaning and Maintenance: Directly relevant previous work experience shows that the candidate can hit the ground running and has a practical understanding of the expectations and routines associated with custodial work.

Personalizing your custodian cover letter salutation

Always aim to address the recruiter from the get-go of your custodian cover letter.

- the friendly tone (e.g. "Dear Paul" or "Dear Caroline") - if you've previously chatted up with them on social media and are on a first-name basis;

- the formal tone (e.g. "Dear Ms. Gibbs" or "Dear Ms. Swift") - if you haven't had any previous conversation with them and have discovered the name of the recruiter on LinkedIn or the company website;

- the polite tone (e.g. "Dear Hiring Manager" or "Dear HR Team") - at all costs aim to avoid the "To whom it may concern" or "Dear Sir/Madam", as both greetings are very old-school and vague.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Employer's Name],

- Dear [Department] Team,

- Dear [Company Name] Recruiter,

- Dear [Job Title] Hiring Committee,

- Dear [Mr./Ms./Dr.] [Last Name],

First introductions in your custodian cover letter

Within your custodian cover letter introduction , genuinely state what you like about the organization.

Research the latest company projects, honorary awards, company updates, etc.

Write up to two sentences to let recruiters know what impresses you about the company,

This would help you to set a good tone for the rest of the communication.

Choosing your best achievement for the middle or body of your custodian cover letter

Now that you have the recruiters' attention, it's time to write the chunkiest bit of your custodian cover letter .

The body consists of three to six paragraphs that focus on one of your achievements.

Use your past success to tell a story of how you obtained your most job-crucial skills and know-how (make sure to back these up with tangible metrics).

Another excellent idea for your custodian cover letter's middle paragraphs is to shine a light on your unique professional value.

Write consistently and make sure to present information that is relevant to the role.

Two ideas on how to end the final paragraph of your custodian cover letter

Closing your custodian cover letter , you want to leave a memorable impression on recruiters, that you're a responsible professional.

End your cover letter with how you envision your growth, as part of the company. Make realistic promises on what you plan to achieve, potentially, in the next six months to a year.

Before your signature, you could also signal hiring managers that you're available for the next steps. Or, a follow-up call, during which you could further clarify your experience or professional value.

What to write on your custodian cover letter, when you have zero experience

The best advice for candidates, writing their custodian cover letters with no experience , is this - be honest.

If you have no past professional roles in your portfolio, focus recruiters' attention on your strengths - like your unique, transferrable skill set (gained as a result of your whole life), backed up by one key achievement.

Or, maybe you dream big and have huge motivation to join the company. Use your custodian cover letter to describe your career ambition - that one that keeps you up at night, dreaming about your future.

Finally, always ensure you've answered why employers should hire precisely you and how your skills would benefit their organization.

Key takeaways

Winning at your job application game starts with a clear and concise custodian cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the custodian resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

What to Name Your Resume File?

How to include your relevant coursework on a resume, 200+ hard skills for your resume in 2024, a guide to leaving your job on your terms, should i mention lack of experience in cover letter, how (and when) to add your 2024 promotions to your linkedin profile.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Resume Builder

Create resume in a few steps - done in minutes.

Cover Letter Builder

Create custom cover letters based on your experience.

Draft five essential sections and add more CV sections.

Most Popular Resume Examples

Most Popular Cover Letter Examples

Most Popular CV Examples

- Resources Job Description Career Guides

- Cover Letter

Custodian Cover Letter Examples

Custodians are in charge for cleaning, maintenance, and security in a building. Typical cleaning duties of a Custodian include: sweeping, dusting, vacuuming, mopping, cleaning restrooms, and completing special cleaning projects. Other responsibilities of these employees are making inspections, handling maintenance, identifying needs for repairs, collaborating with other departments, replenishing cleaning supplies, and adhering to health and safety regulations.

RATE THIS TEMPLATE:

- Featured in:

More Custodian Cover Letter Examples

Use these Custodian samples as a guideline, or visit our extensive library of customizable cover letter templates .

Want a strong Cover Letter?

Use our extensive library of professional cover letter examples as practical starting guides. You’ll also find ready-made content with our helpful Cover Letter Builder — simply click, customize and download.

Find More Janitorial Cover Letter Examples

See more janitorial cover letter examples

Free Custodian cover letter example

Dear Mr. Headrick:

When I learned of Thermo’s need for a new Custodian, I was eager to submit the attached resume. As an experienced and personable professional with nine years of solid experience performing a broad range of building maintenance and upkeep duties, I am prepared to surpass your expectations.

As a physically fit worker and a motivational team leader, I am highly skilled in managing all facet of building custodianship, including cleaning, maintenance/repair, and heavy equipment usage. My excellent time management skills—combined with my ability to move efficiently to complete tasks on or ahead of schedule—prepares me to make a strong contribution to your team in this position.

The following demonstrate my qualifications for this opportunity:

Performing a variety of custodian responsibilities’such as cleaning kitchen and bathrooms, removing trash and debris, setting up for special events, and operating large cleaning machines—in consecutive custodian positions with Harbringer Systems in Tucson and Beekeeper Elementary School in Phoenix.

Delegated tasks and coordinated work schedules across all personnel for optimal efficiency.

Maintaining regulatory compliance with safety policies and procedures pertaining to chemical usage.

Excelling within physically demanding environments while ensuring accurate completion of necessary tasks.

With my experience in providing superior custodian service, I am ready to provide outstanding building maintenance and upkeep for the customers served by Thermo Building Services. I look forward to discussing the position with you further. Thank you very much.

Lester Olcott

Include These Custodian Skills

- Physical fitness

- Cleaning experience and knowledge of cleaning chemicals

- Stamina and resilience

- Teamworking abilities

- Working without supervision

- Effective communication

- Attention to details

- Being able to follow instructions

Janitorial Resume Examples

See more janitorial resume samples.

A professional cover letter is the first step toward your new job!

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Custodian Cover Letter Examples Landing Jobs in 2024

- Custodian Cover Letter

- Custodian Cover Letters By Experience

- Custodian Cover Letters By Role

- Write Your Custodian Cover Letter

As a custodian, you have an incomparable eye for detail, and juggling multiple tasks simultaneously is second nature. You’re not just responsible for keeping things clean—oftentimes, your responsibilities range from sanitation to repairs and inventory management.

With such a vast range of daily tasks, creating a cover letter and complementary custodian resume that adequately cover your particular background can be challenging. How do you decide what to discuss when your role is so diverse?

We’re here to help you select the right qualities to highlight. With our custodian cover letter examples and tips, coupled with our free AI cover letter generator you’ll land more interviews and get the job you want!

Custodian Cover Letter Example

USE THIS TEMPLATE

Microsoft Word

Google Docs

Block Format

Copy this text for your Custodian cover letter!

123 Fictional Avenue Houston, TX 77001 (123) 456-7890

December 12, 2023

Olivia Jones Memorial Hermann Health System 123 Fictional Lane Houston, TX 77001

Dear Ms. Jones:

When news broke of Memorial Hermann Health System’s remarkable 11th rank among large companies in the Houston Chronicle’s Top Workplaces 2023, it rekindled my desire to pursue a custodian role at your esteemed establishment. My OSHA certification and dedication to health and safety align seamlessly with your institution’s unwavering commitment to quality healthcare, further fueling my desire to contribute to your organization as your custodian.

At Houston Methodist, I led a custodial team responsible for managing an inventory of sanitation supplies for over 40 hospital departments. We minimized stockouts by incorporating an efficient inventory management system using Oracle’s NetSuite software, ensuring an uninterrupted supply chain and facilitating a 26% annual cost savings.

Moving on at Houston Community College, I was entrusted with building maintenance for an occupancy of 2,300+ students. Remarkably, I implemented robust occupational health and safety standards, reducing workplace hazards by 33%. I drew on my proficiency in CleanTelligent software to streamline janitorial tasks, which, in turn, improved the efficiency of routine inspections by 22%.

My stint at Baylor College of Medicine involved extensive chemical handling, a critical skill in biomolecular labs. Using LabSolutions Management Software to dispose of and manage chemicals safely, I averted potential risks and improved safety standards. As a result, we witnessed a 32% decrease in chemical-related incidents during my tenure.

I’m thrilled to bring this custodial expertise and adaptability to Memorial Hermann Health System. Your organization’s reputation as the metro area’s top-ranked hospital emphasizes my enthusiasm to contribute to your goals. Thank you for considering my application; I would be excited to discuss further how my skills could meet Memorial Hermann’s needs.

Olga Ivanova

Enclosures Resume Transcript OSHA Certification

Why this cover letter works

- Simply browse the company website’s news page and pick one outstanding achievement. It could be recognition as a top employer in the region or an award for an outstanding project. Or even a groundbreaking innovation in the industry. Whichever the case, spotlight it in your piece for an added dash of pizzazz and enthusiasm.

Level up your cover letter game

Relax! We’ll do the heavy lifting to write your cover letter in seconds.

Custodian No Experience Cover Letter Example

Copy this text for your Custodian No Experience cover letter!

123 Fictional Avenue Phoenix, AZ 85001 (123) 456-7890

Noah Brown Arizona State University 123 Fictional Avenue Phoenix, AZ 85001

Dear Mr. Brown:

As an enthusiast of creating clean and inviting spaces, I’m thrilled by the chance to elevate Arizona State University’s cleanliness standards as a janitorial trainee. I’m confident in employing my experience in floor care techniques, chemical handling, and waste management, all honed from experiences during my past roles and academic learning.

I volunteered at CBN Building Maintenance, where I handled the maintenance of a 1,694-square-foot building and fostered a 17% reduction in cleaning time, utilizing efficient floor care techniques and appropriate chemicals. In addition, I had the privilege of collaborating with fellow team members to develop an environmentally friendly cleaning method that improved chemical dilution ratios by 27%.

While taking a course in environmental science and waste management at GateWay Community College, I contributed to a project promoting sustainable waste management practices within our community. This experience launched a fruitful collaboration with local businesses and helped reduce waste going to landfills by 12%.

Recently, I supported my uncle’s plumbing business in Phoenix, AZ, for over six months. During this period, I successfully implemented and maintained inventory management systems for cleaning tools and supplies, which significantly improved accessibility and reduced misplacement by 23%.

I’m thrilled by the prospect of bringing my skills and commitment to cleanliness to Arizona State University’s janitorial team. I look forward to discussing how my experience in floor care techniques, chemical handling, waste management, and tool maintenance can contribute to maintaining the university’s high standards. Thank you for considering my application.

Isabella Rossi

- If seeking inspiration, see how Isabella’s custodian no experience cover letter narrates mastering inventory management when helping her uncle in his plumbing business. Moments like this can be as punchy as professional experiences.

School Custodian Cover Letter Example

Copy this text for your School Custodian cover letter!

123 Fictional Avenue Philadelphia, PA 19101 (123) 456-7890

Ava Davis Temple University 123 Fictional Lane Philadelphia, PA 19101

Dear Ms. Davis:

My first experience with Temple University occurred during a tour around the beautifully maintained Philadelphia campus. As I observed the pristine conditions, I whispered to myself that I’d one day work there. Today, this vision compels me to apply for the school custodian position. While with the Community College of Philadelphia, I helped reduce the number of accidents by 37% by executing top-tier safety protocols and conducting regular drills. In addition, I’m well-versed in using safety software like EHS, which has facilitated my understanding and implementation of safety standards at multiple levels.

Taking center stage in my former role at Central High School was maintaining waste management protocols. Overseeing a 2,300+ student institution, I facilitated multiple systematic waste recycling programs, leading to a 17% reduction in overall waste.

Drawing upon my basic plumbing skills, I worked with a team of three junior custodians to ensure the optimal operation of Chestnut Hill Hospital’s plumbing system. Our contribution helped curb water waste by approximately 21%. I believe these skills will also be instrumental in maintaining the pristine condition of Temple University.

Having proven my commitment to facility maintenance, I readily anticipate contributing to Temple University. I look forward to discussing how my qualifications could contribute to your team.

Miguel Fernandez

- You want to recount that previous workplace where you excelled in enforcing safety protocols. Infusing numbers here (cue reducing the number of accidents by maybe 37%) goes a long way to make your narration believable and impactful. Even better, talk about your proficiency in using safety software like EHS to enhance efficiency in implementing safety standards.

Building Custodian Cover Letter Example

Copy this text for your Building Custodian cover letter!

August 21, 2024

Isabella Martinez General Motors 123 Fictional Lane Detroit, MI 48127

Dear Ms. Martinez:

Driving cleanliness and operational excellence aligns seamlessly with General Motors’ commitment to innovation and efficiency. Having witnessed firsthand the importance of a well-maintained environment, I understand how crucial it is to ensure that spaces are clean, safe, and efficiently managed. With three years of experience in custodial services, I’m eager to bring my skills and dedication to General Motors and support the high standards of your facilities.

My tenure at Hackensack Meridian Health Plan was groundbreaking, ushering in a QR code system to monitor cleaning supplies in real-time and trimming inventory inaccuracies to a slim 2%. I also harnessed technology platforms like EZOfficeInventory, InspectAll, and Monday.com, elevating staff responsibility and harmonizing workflows.

My stint at Great Lakes Financial Group was marked by my initiation of predictive maintenance using ServiceChannel analytics. This proactive approach led to a dramatic decrease in unexpected equipment downtime. By predicting and addressing maintenance issues before they could escalate, we saved over 102 hours per year that would have been lost to equipment failures, translating to a quarterly cost saving of $4,082.

My role at Marriott International underlined a dedication to pristine cleanliness and hygiene, fortified by the Kaivac CleanCheck system and its exhaustive checklists. This initiative boosted room readiness by 16%, ensuring that all safety issues were promptly addressed with the help of the maintenance team. The position honed my skills in conducting thorough inspections, rapid problem reporting, and consistently meeting the pinnacle of cleanliness and guest contentment.

With my background in efficiently managing facilities and implementing innovative solutions to common maintenance challenges, I believe I can be a valuable asset to your team. I look forward to discussing how my efforts can help maintain the high standards General Motors is known for. Thank you for considering my application.

Enclosures: Resume Application Transcript

- Why not kick things off with a little charm instead? It could be as simple as complimenting the company’s ambitions and detailing how well you mesh with their culture. Samuel, for instance, goes with “driving cleanliness and operational excellence aligns seamlessly with General Motors’ commitment to innovation and efficiency.”

Janitorial Custodian Cover Letter Example

Copy this text for your Janitorial Custodian cover letter!

123 Fictional Avenue Denver, CO 80201 (123) 456-7890

Emily Lewis UCHealth 123 Fictional Lane Denver, CO 80201

Dear Ms. Lewis:

As a janitorial custodian at UCHealth, my goal is to ensure a clean, safe, and welcoming environment for every patient. Your success stories about maintaining high standards of cleanliness and safety convinced me that your hospital upholds the values of equity, safety, and integrity.

As the head custodian at Cherry Creek School District, I supervised a team of nine custodial staff, ensuring a sanitized space for nearly a thousand students and faculty members. I introduced Fishbowl Inventory for streamlined inventory management, which led to a 22% reduction in supply costs, and CleanTelligent for enhanced cleaning schedules, increasing our cleanliness ratings by 29%. In addition, developing a preventive maintenance program using Fiix demonstrated proactive management of equipment.

My budget management and team communication skills were further refined at ABM Industries. By implementing Microsoft Excel and Google Docs, we witnessed a 26% decrease in operational expenses and a 21% enhancement in task efficiency. I also harnessed iAuditor for regular safety inspections, fostering a 12% drop in workplace accidents.

Moreover, while at Honeywell, I upheld strict sanitation standards and managed facility spaces using IBM TRIRIGA, achieving a substantial 37% savings in operational costs. Not to mention I employed EnergyCAP to reduce utility expenses by 53%, demonstrating my ability to integrate technical solutions with strategic decision-making.

Confident that my extensive experience and proactive approach in custodial and facility management would make me a valuable addition to the UCHealth team, I look forward to our conversation about my qualifications. Thank you.

Nathan Brown

- Something like “As a janitorial custodian at UCHealth, my goal is to ensure a clean, safe, and welcoming environment for every patient” makes for a great example here. You get your point across, and the potential employers see your goals are in sync with their needs, nudging them a step closer to giving you that interview call.

Related cover letter examples

- Custodian Resume

- Housekeeping

- Property Manager

- Maintenance Technician

How to Write a Custodian Cover Letter That Gets You the Job

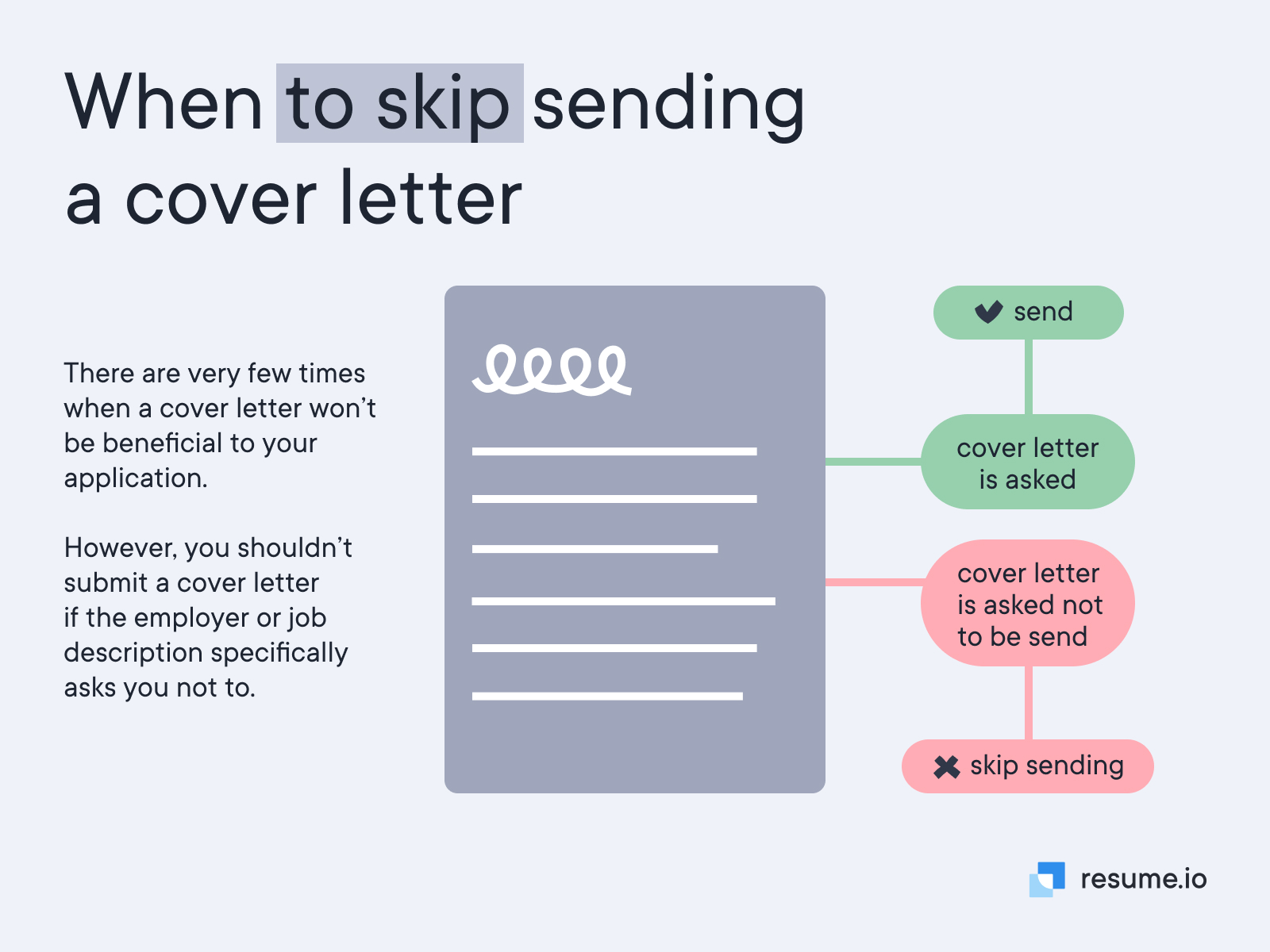

Whether you have loads of work experience in custodial roles or you’re just starting , you’re probably aware that the term “custodian” is often used for a variety of different roles. In some jobs, you might work in a huge facility, such as a school or a hospital, with a team of other custodians. In others, you’ll be the lone wolf in charge of a whole building.

To show employers that you fully grasp what the job is all about, the key is to study each job description carefully. Then, get familiar with the company or institution you want to work for to find a connection that shows you care.

Start strong with a customized greeting and intro

Unfortunately, hiring managers often skim or, worse yet, use AI-based systems to scan job applications. The good thing is that if you’re able to grab their attention right away with your custodian cover letter, your chances of landing the job increase exponentially.

Start by addressing the recipient by name. To do this, research the facility or company you’re applying to, be it through LinkedIn, its website, or a quick phone call. Next, personalize your intro.

Use this one short paragraph to draw a connection to the company and showcase how your background makes you a solid candidate. For instance, mention how your previous role in a massive hospital prepared you for the demands of keeping a medical facility running smoothly.

This opener does the opposite of what you’d want. It’s generic, meaning the cover letter will likely be discarded immediately.

I need a job and I saw that you’re hiring. I hope you can give me a chance.

This opener is a dream come true. There’s no stronger connection to an employer than showing that you’ve previously dreamed of working there!

My first experience with Temple University occurred during a tour around the beautifully maintained Philadelphia campus. As I observed the pristine conditions, I whispered to myself that I’d one day work there. Today, this vision compels me to apply for the school custodian position.

Show off your dedication in the body paragraphs

The role of a custodian covers a lot of ground—often literally! You must follow various sanitation standards, efficiently manage cleaning supplies and other resources, and even contribute to repairs.

With such a long list of tasks to tend to, it’s important to use your cover letter to highlight the ones that are most relevant to a given role. Pick some of your most impactful achievements that align with the job, and add some metrics to make them pop.

As an example, if the job description highlights the need for minor repairs, talk about how, in a past role, you completed an average of 30 repairs per week, increasing facility uptime by 29%.

This is how you get a new job!

Get yourself hired with a strong closer

The final paragraph at the end of your custodian cover letter is just as important as that strong opener we discussed above. This is where you can drive home that you’re the right candidate for the job.

The best way to do this is to find a connection between you, your job skills , and the company. For example, if you’re applying to work at a company known for its eco-friendly approach, that’s a great hook!