How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

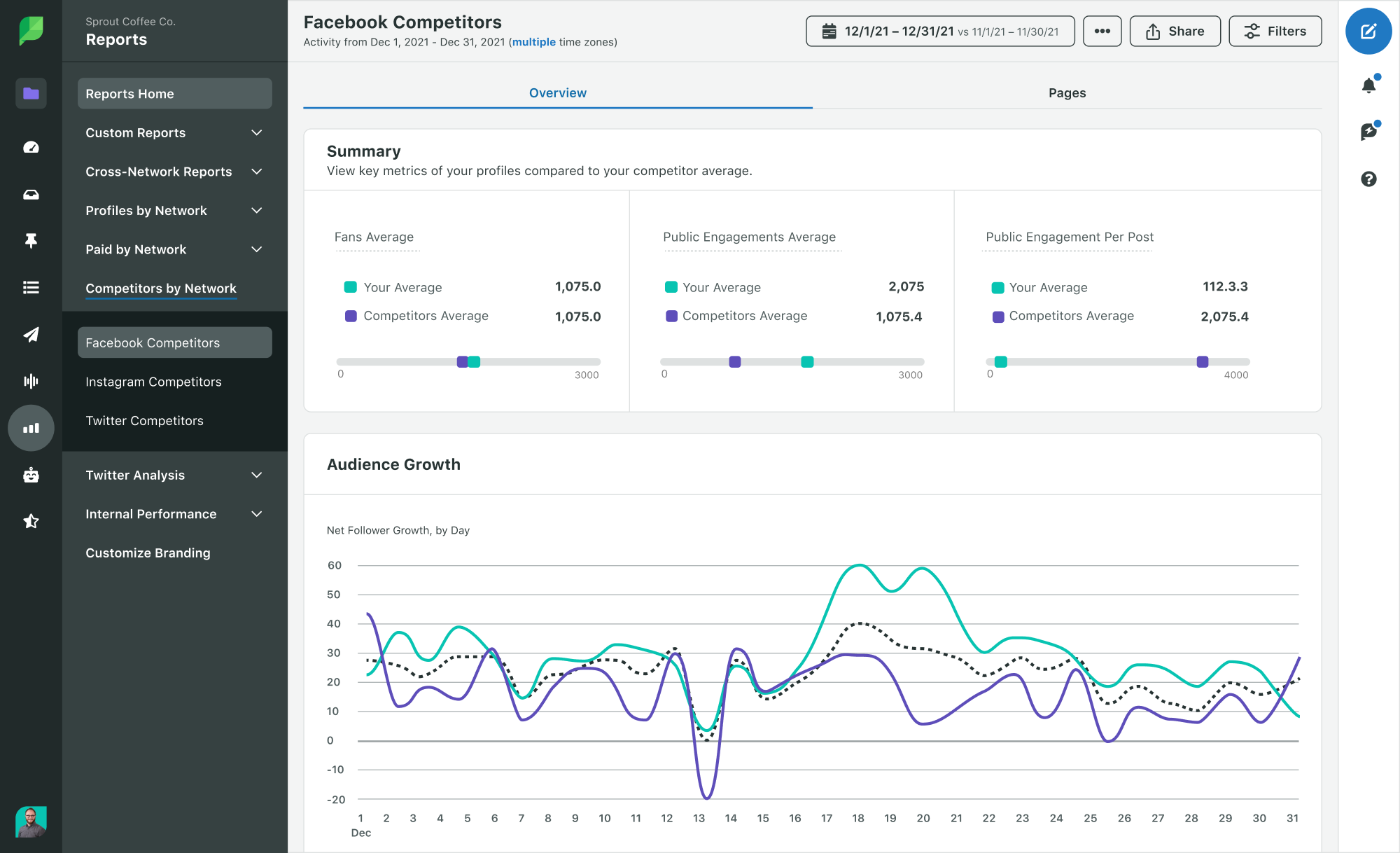

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Market Research: Business Model Canvas Explained

The Business Model Canvas is a strategic management and entrepreneurial tool that allows you to describe, design, challenge, invent, and pivot your business model. It is a visual chart with elements describing a firm's value proposition, infrastructure, customers, and finances. This glossary entry will delve into the intricacies of the Business Model Canvas, its components, and its application in market research.

Understanding the Business Model Canvas is crucial for entrepreneurs, business strategists, and anyone involved in business planning and decision-making. It provides a comprehensive and flexible framework for understanding how a business operates and how it creates, delivers, and captures value. This glossary entry aims to provide a detailed understanding of the Business Model Canvas and its relevance in market research.

Concept and Origin of the Business Model Canvas

The Business Model Canvas was proposed by Alexander Osterwalder based on his earlier work on Business Model Ontology. It was originally proposed as a means to facilitate the understanding of business models among non-specialists who did not have a deep understanding of business concepts and terminologies. The canvas presents business models in a graphical representation, which makes it easier to understand and communicate.

The Business Model Canvas has since evolved into a widely used business tool that helps firms align their activities by illustrating potential trade-offs. The strength of the canvas lies in its flexibility and adaptability. It can be used by any type of business, from startups to large corporations, and across industries.

Components of the Business Model Canvas

The Business Model Canvas is composed of nine basic building blocks that show the logic of how a company intends to make money. These nine blocks cover the four main areas of a business: customers, offer, infrastructure, and financial viability. The blocks are: Customer Segments, Value Propositions, Channels, Customer Relationships, Revenue Streams, Key Resources, Key Activities, Key Partnerships, and Cost Structure.

Each of these components plays a critical role in the overall business model and contributes to the firm's ability to create, deliver, and capture value. Understanding each component and its interrelationships is key to effectively using the Business Model Canvas.

Application of the Business Model Canvas in Market Research

The Business Model Canvas can be a powerful tool in market research . It provides a framework for understanding the business model of a company, which can inform market research strategies. By understanding how a company creates, delivers, and captures value, market researchers can better understand the company's competitive position, target customers, and potential opportunities for growth and innovation.

Moreover, the Business Model Canvas can be used to map out and compare the business models of competitors. This can provide valuable insights into competitive advantages and potential areas for differentiation. By using the canvas as a tool for market research, companies can gain a deeper understanding of their market and make more informed strategic decisions.

Understanding Customer Segments

One of the key components of the Business Model Canvas is Customer Segments. This refers to the different groups of people or organizations a company aims to reach and serve. In market research, understanding customer segments is crucial. It can help companies identify unmet needs, understand customer behavior, and tailor their offerings to meet the needs of specific segments.

By mapping out customer segments on the Business Model Canvas, companies can visualize their target market and gain a deeper understanding of their customers. This can inform market research strategies and help companies identify opportunities for growth and innovation.

Using the Business Model Canvas for Revenue Growth and Innovation

The Business Model Canvas can be a powerful tool for driving revenue growth and innovation. By providing a clear and comprehensive view of a company's business model, it can help identify areas for improvement and potential opportunities for innovation.

For example, by examining the Value Propositions and Customer Segments components, companies can identify gaps in the market and develop new offerings to meet these needs. Similarly, by examining the Channels and Customer Relationships components, companies can identify opportunities to improve customer engagement and loyalty, which can drive revenue growth.

Identifying Opportunities for Innovation

The Business Model Canvas can also be used to identify opportunities for innovation. By examining the Key Activities, Key Resources, and Key Partnerships components, companies can identify areas where they can innovate to create competitive advantage.

For example, a company might identify an opportunity to leverage new technology to improve its Key Activities, or it might identify a potential partnership that could provide access to new resources or markets. By using the Business Model Canvas as a tool for innovation, companies can stay ahead of the competition and drive long-term growth.

The Business Model Canvas is a powerful tool for understanding and communicating business models. It provides a clear and comprehensive view of how a company creates, delivers, and captures value. By using the canvas as a tool for market research, companies can gain a deeper understanding of their market and make more informed strategic decisions.

Moreover, the Business Model Canvas can be used to drive revenue growth and innovation. By identifying opportunities for improvement and innovation, companies can stay ahead of the competition and drive long-term growth. Whether you're an entrepreneur, a business strategist, or a market researcher, understanding and using the Business Model Canvas can provide valuable insights and strategic advantages.

Whenever you are ready - here are a couple of ways how I can help you grow your business:

1. Business Free Training Design Sprint . Join Over 2,000 founders, creators and innovators in our FREE 7-day crash course on growth design. 7 emails delivered to your inbox giving you a flavour of the strategic planning, business growth systems and methods we use.

2. Builder OS - Online Course - If you're looking to grow your business, I share expertise, methods and step-by-step blueprints on finding growth opportunities, building lean offers and acquiring customers.

3. Venture Builder Newsletter - Sign up for the newsletter to receive 1 weekly email with practical tips on finding profitable niches, creating irresistible offers and traffic generating systems.out your business.

Helping designers and strategists turn their boldest ideas into market-leading ventures through Business, Design and Growth.

Whenever you are ready - here is how I can help:

1. Newsletter . Join over 2.000 founders, creators and innovators and get access to the business builder framework.

2. Business Builder OS - Masterclass on finding growth opportunities, building lean offers and acquiring customers - driven by A.I.

3. Builder Toolkit - 30 ideas on how to grow your revenue.

Actionable advice about spotting new opportunities, creating offers & growing revenue.

Find, build and grow new ventures, better and faster.

©2024 Untaylored. All Rights Reserved.

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

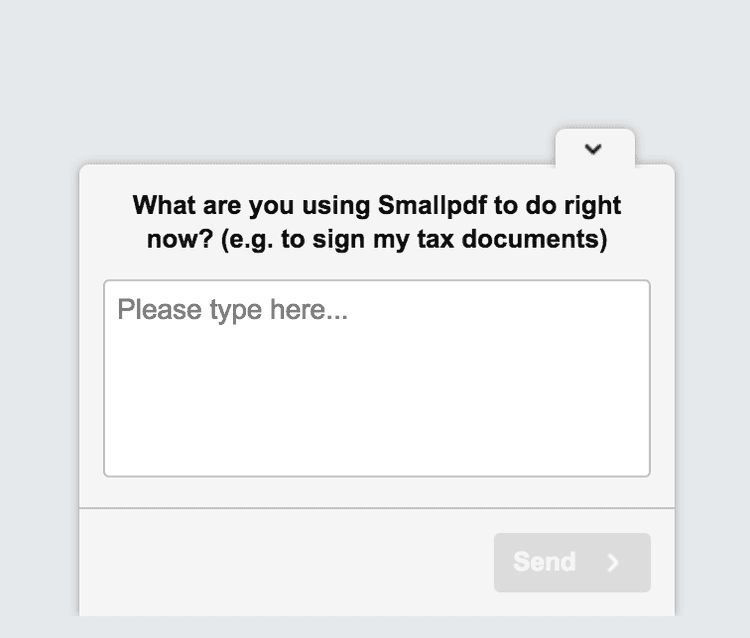

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.

Don’t record identifiable video or audio data without consent. If recording people using your product is helpful for achieving your research goal, make sure all participants are informed and agree to the terms.

Don’t forget to explain why you’d like to observe them (for overt observation). People are more likely to cooperate if you tell them you want to improve the product.

💡Pro tip: while conducting field research out in the wild can wield rewarding results, you can also conduct observational research remotely. Hotjar Recordings is a tool that lets you capture anonymized user sessions of real people interacting with your website.

Observe how customers navigate your pages and products to gain an inside look into their user behavior . This method is great for conducting exploratory research with the purpose of identifying more specific issues to investigate further, like pain points along the customer journey and opportunities for optimizing conversion .

With Hotjar Recordings you can observe real people using your site without capturing their sensitive information

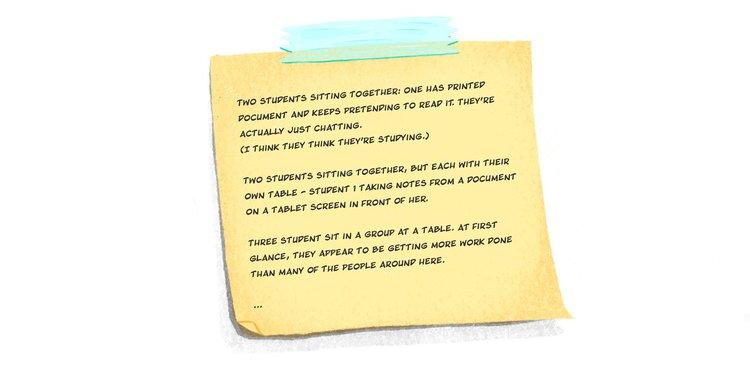

How Smallpdf did it: here’s how Smallpdf observed two different user personas both covertly and overtly.

Observing students (covert): Kristina Wagner, Principle Product Manager at Smallpdf, went to cafes and libraries at two local universities and waited until she saw students doing PDF-related activities. Then she watched and took notes from a distance. One thing that struck her was the difference between how students self-reported their activities vs. how they behaved (i.e, the self-reporting bias). Students, she found, spent hours talking, listening to music, or simply staring at a blank screen rather than working. When she did find students who were working, she recorded the task they were performing and the software they were using (if she recognized it).

Observing administrative assistants (overt): Kristina sent emails to admins explaining that she’d like to observe them at work, and she asked those who agreed to try to batch their PDF work for her observation day. While watching admins work, she learned that they frequently needed to scan documents into PDF-format and then convert those PDFs into Word docs. By observing the challenges admins faced, Smallpdf knew which products to target for improvement.

“Data is really good for discovery and validation, but there is a bit in the middle where you have to go and find the human.”

3. Conduct individual interviews

Interviews are one-on-one conversations with members of your target market. They allow you to dig deep and explore their concerns, which can lead to all sorts of revelations.

Listen more, talk less. Be curious.

Act like a journalist, not a salesperson. Rather than trying to talk your company up, ask people about their lives, their needs, their frustrations, and how a product like yours could help.

Ask "why?" so you can dig deeper. Get into the specifics and learn about their past behavior.

Record the conversation. Focus on the conversation and avoid relying solely on notes by recording the interview. There are plenty of services that will transcribe recorded conversations for a good price (including Hotjar!).

Avoid asking leading questions , which reveal bias on your part and pushes respondents to answer in a certain direction (e.g. “Have you taken advantage of the amazing new features we just released?).

Don't ask loaded questions , which sneak in an assumption which, if untrue, would make it impossible to answer honestly. For example, we can’t ask you, “What did you find most useful about this article?” without asking whether you found the article useful in the first place.

Be cautious when asking opinions about the future (or predictions of future behavior). Studies suggest that people aren’t very good at predicting their future behavior. This is due to several cognitive biases, from the misguided exceptionalism bias (we’re good at guessing what others will do, but we somehow think we’re different), to the optimism bias (which makes us see things with rose-colored glasses), to the ‘illusion of control’ (which makes us forget the role of randomness in future events).

How Smallpdf did it: Kristina explored her teacher user persona by speaking with university professors at a local graduate school. She learned that the school was mostly paperless and rarely used PDFs, so for the sake of time, she moved on to the admins.

A bit of a letdown? Sure. But this story highlights an important lesson: sometimes you follow a lead and come up short, so you have to make adjustments on the fly. Lean market research is about getting solid, actionable insights quickly so you can tweak things and see what works.

💡Pro tip: to save even more time, conduct remote interviews using an online user research service like Hotjar Engage , which automates the entire interview process, from recruitment and scheduling to hosting and recording.

You can interview your own customers or connect with people from our diverse pool of 200,000+ participants from 130+ countries and 25 industries. And no need to fret about taking meticulous notes—Engage will automatically transcribe the interview for you.

4. Analyze the data (without drowning in it)

The following techniques will help you wrap your head around the market data you collect without losing yourself in it. Remember, the point of lean market research is to find quick, actionable insights.

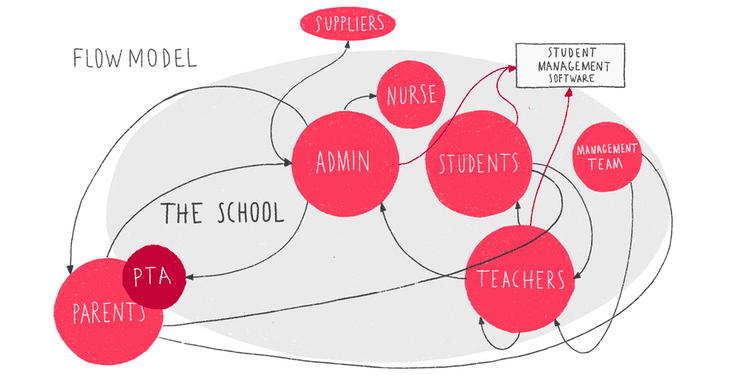

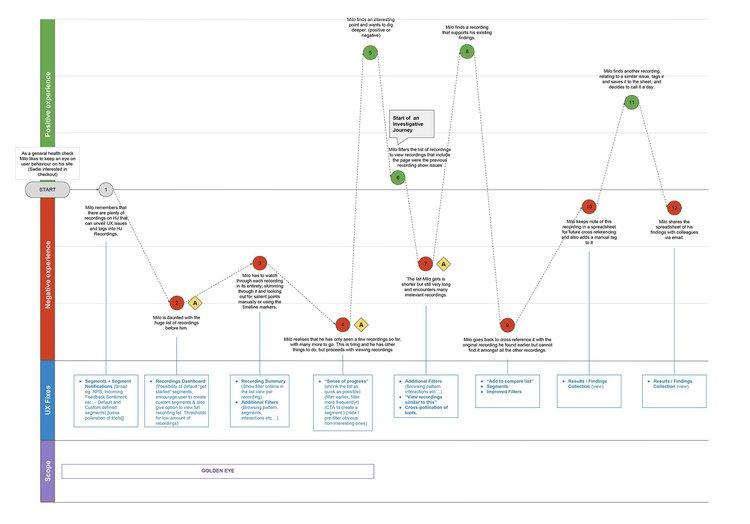

A flow model is a diagram that tracks the flow of information within a system. By creating a simple visual representation of how users interact with your product and each other, you can better assess their needs.

You’ll notice that admins are at the center of Smallpdf’s flow model, which represents the flow of PDF-related documents throughout a school. This flow model shows the challenges that admins face as they work to satisfy their own internal and external customers.

Affinity diagram

An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ. Depending on your needs, you could group them by profession, or more generally by industry.

We wrote a guide about how to analyze open-ended questions to help you sort through and categorize large volumes of response data. You can also do this by hand by clipping up survey responses or interview notes and grouping them (which is what Kristina does).

“For an interview, you will have somewhere between 30 and 60 notes, and those notes are usually direct phrases. And when you literally cut them up into separate pieces of paper and group them, they should make sense by themselves.”

Pro tip: if you’re conducting an online survey with Hotjar, keep your team in the loop by sharing survey responses automatically via our Slack and Microsoft Team integrations. Reading answers as they come in lets you digest the data in pieces and can help prepare you for identifying common themes when it comes time for analysis.

Hotjar lets you easily share survey responses with your team

Customer journey map

A customer journey map is a diagram that shows the way a typical prospect becomes a paying customer. It outlines their first interaction with your brand and every step in the sales cycle, from awareness to repurchase (and hopefully advocacy).

The above customer journey map , created by our team at Hotjar, shows many ways a customer might engage with our tool. Your map will be based on your own data and business model.

📚 Read more: if you’re new to customer journey maps, we wrote this step-by-step guide to creating your first customer journey map in 2 and 1/2 days with free templates you can download and start using immediately.

Next steps: from research to results

So, how do you turn market research insights into tangible business results? Let’s look at the actions Smallpdf took after conducting their lean market research: first they implemented changes, then measured the impact.

Implement changes

Based on what Smallpdf learned about the challenges that one key user segment (admins) face when trying to convert PDFs into Word files, they improved their ‘PDF to Word’ conversion tool.

We won’t go into the details here because it involves a lot of technical jargon, but they made the entire process simpler and more straightforward for users. Plus, they made it so that their system recognized when you drop a PDF file into their ‘Word to PDF’ converter instead of the ‘PDF to Word’ converter, so users wouldn’t have to redo the task when they made that mistake.

In other words: simple market segmentation for admins showed a business need that had to be accounted for, and customers are happier overall after Smallpdf implemented an informed change to their product.

Measure results

According to the Lean UX model, product and UX changes aren’t retained unless they achieve results.

Smallpdf’s changes produced:

A 75% reduction in error rate for the ‘PDF to Word’ converter

A 1% increase in NPS

Greater confidence in the team’s marketing efforts

"With all the changes said and done, we've cut our original error rate in four, which is huge. We increased our NPS by +1%, which isn't huge, but it means that of the users who received a file, they were still slightly happier than before, even if they didn't notice that anything special happened at all.”

Subscribe to fresh and free monthly insights.

Over 50,000 people interested in UX, product, digital empathy, and beyond, receive our newsletter every month. No spam, just thoughtful perspectives from a range of experts, new approaches to remote work, and loads more valuable insights. If that floats your boat, why not become a subscriber?

I have read and accepted the message outlined here: Hotjar uses the information you provide to us to send you relevant content, updates and offers from time to time. You can unsubscribe at any time by clicking the link at the bottom of any email.

Market research (or marketing research) is any set of techniques used to gather information and better understand a company’s target market. This might include primary research on brand awareness and customer satisfaction or secondary market research on market size and competitive analysis. Businesses use this information to design better products, improve user experience, and craft a marketing strategy that attracts quality leads and improves conversion rates.

David Darmanin, one of Hotjar’s founders, launched two startups before Hotjar took off—but both companies crashed and burned. Each time, he and his team spent months trying to design an amazing new product and user experience, but they failed because they didn’t have a clear understanding of what the market demanded.

With Hotjar, they did things differently . Long story short, they conducted market research in the early stages to figure out what consumers really wanted, and the team made (and continues to make) constant improvements based on market and user research.

Without market research, it’s impossible to understand your users. Sure, you might have a general idea of who they are and what they need, but you have to dig deep if you want to win their loyalty.

Here’s why research matters:

Obsessing over your users is the only way to win. If you don’t care deeply about them, you’ll lose potential customers to someone who does.

Analytics gives you the ‘what’, while research gives you the ‘why’. Big data, user analytics , and dashboards can tell you what people do at scale, but only research can tell you what they’re thinking and why they do what they do. For example, analytics can tell you that customers leave when they reach your pricing page, but only research can explain why.

Research beats assumptions, trends, and so-called best practices. Have you ever watched your colleagues rally behind a terrible decision? Bad ideas are often the result of guesswork, emotional reasoning, death by best practices , and defaulting to the Highest Paid Person’s Opinion (HiPPO). By listening to your users and focusing on their customer experience , you’re less likely to get pulled in the wrong direction.

Research keeps you from planning in a vacuum. Your team might be amazing, but you and your colleagues simply can’t experience your product the way your customers do. Customers might use your product in a way that surprises you, and product features that seem obvious to you might confuse them. Over-planning and refusing to test your assumptions is a waste of time, money, and effort because you’ll likely need to make changes once your untested business plan gets put into practice.

Lean User Experience (UX) design is a model for continuous improvement that relies on quick, efficient research to understand customer needs and test new product features.

Lean market research can help you become more...

Efficient: it gets you closer to your customers, faster.

Cost-effective: no need to hire an expensive marketing firm to get things started.

Competitive: quick, powerful insights can place your products on the cutting edge.

As a small business or sole proprietor, conducting lean market research is an attractive option when investing in a full-blown research project might seem out of scope or budget.

There are lots of different ways you could conduct market research and collect customer data, but you don’t have to limit yourself to just one research method. Four common types of market research techniques include surveys, interviews, focus groups, and customer observation.

Which method you use may vary based on your business type: ecommerce business owners have different goals from SaaS businesses, so it’s typically prudent to mix and match these methods based on your particular goals and what you need to know.

1. Surveys: the most commonly used

Surveys are a form of qualitative research that ask respondents a short series of open- or closed-ended questions, which can be delivered as an on-screen questionnaire or via email. When we asked 2,000 Customer Experience (CX) professionals about their company’s approach to research , surveys proved to be the most commonly used market research technique.

What makes online surveys so popular?

They’re easy and inexpensive to conduct, and you can do a lot of data collection quickly. Plus, the data is pretty straightforward to analyze, even when you have to analyze open-ended questions whose answers might initially appear difficult to categorize.

We've built a number of survey templates ready and waiting for you. Grab a template and share with your customers in just a few clicks.

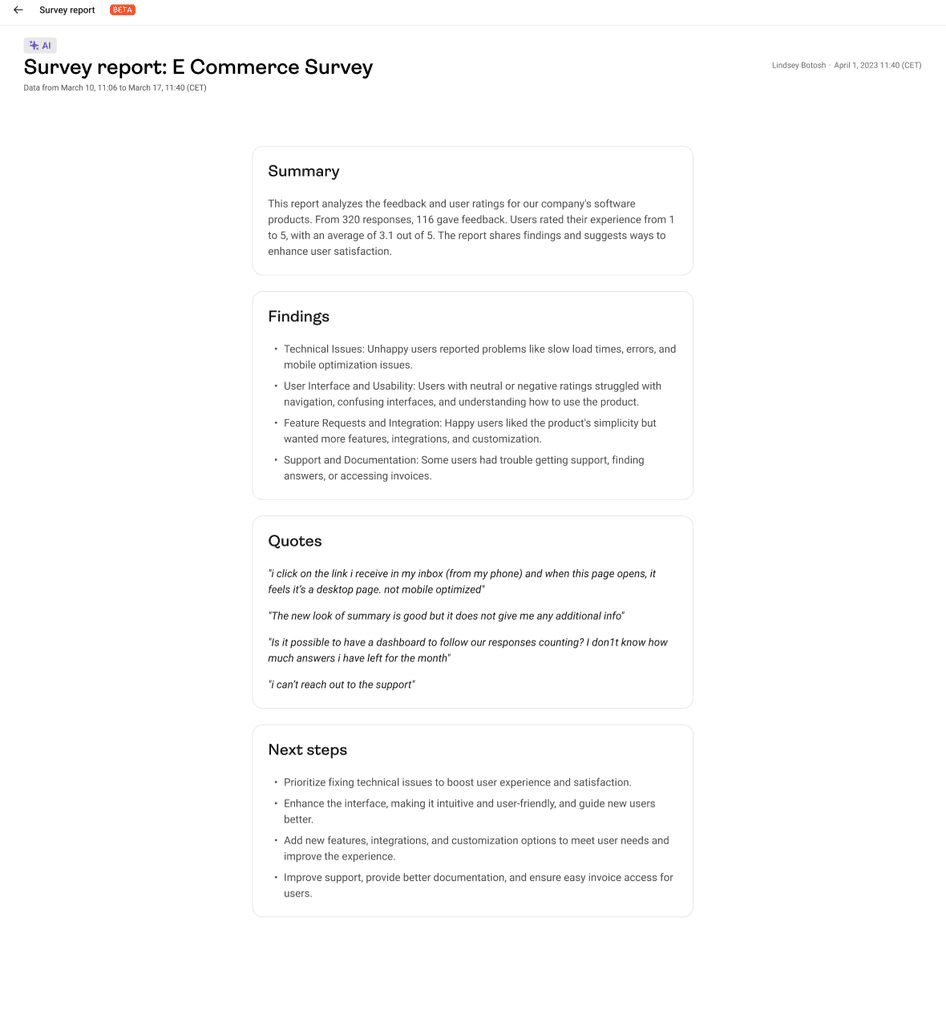

💡 Pro tip: you can also get started with Hotjar AI for Surveys to create a survey in mere seconds . Just enter your market research goal and watch as the AI generates a survey and populates it with relevant questions.

Once you’re ready for data analysis, the AI will prepare an automated research report that succinctly summarizes key findings, quotes, and suggested next steps.

An example research report generated by Hotjar AI for Surveys

2. Interviews: the most insightful

Interviews are one-on-one conversations with members of your target market. Nothing beats a face-to-face interview for diving deep (and reading non-verbal cues), but if an in-person meeting isn’t possible, video conferencing is a solid second choice.

Regardless of how you conduct it, any type of in-depth interview will produce big benefits in understanding your target customers.

What makes interviews so insightful?

By speaking directly with an ideal customer, you’ll gain greater empathy for their experience , and you can follow insightful threads that can produce plenty of 'Aha!' moments.

3. Focus groups: the most unreliable

Focus groups bring together a carefully selected group of people who fit a company’s target market. A trained moderator leads a conversation surrounding the product, user experience, or marketing message to gain deeper insights.

What makes focus groups so unreliable?

If you’re new to market research, we wouldn’t recommend starting with focus groups. Doing it right is expensive , and if you cut corners, your research could fall victim to all kinds of errors. Dominance bias (when a forceful participant influences the group) and moderator style bias (when different moderator personalities bring about different results in the same study) are two of the many ways your focus group data could get skewed.

4. Observation: the most powerful

During a customer observation session, someone from the company takes notes while they watch an ideal user engage with their product (or a similar product from a competitor).

What makes observation so clever and powerful?

‘Fly-on-the-wall’ observation is a great alternative to focus groups. It’s not only less expensive, but you’ll see people interact with your product in a natural setting without influencing each other. The only downside is that you can’t get inside their heads, so observation still isn't a recommended replacement for customer surveys and interviews.

The following questions will help you get to know your users on a deeper level when you interview them. They’re general questions, of course, so don’t be afraid to make them your own.

1. Who are you and what do you do?

How you ask this question, and what you want to know, will vary depending on your business model (e.g. business-to-business marketing is usually more focused on someone’s profession than business-to-consumer marketing).

It’s a great question to start with, and it’ll help you understand what’s relevant about your user demographics (age, race, gender, profession, education, etc.), but it’s not the be-all-end-all of market research. The more specific questions come later.

2. What does your day look like?

This question helps you understand your users’ day-to-day life and the challenges they face. It will help you gain empathy for them, and you may stumble across something relevant to their buying habits.

3. Do you ever purchase [product/service type]?

This is a ‘yes or no’ question. A ‘yes’ will lead you to the next question.

4. What problem were you trying to solve or what goal were you trying to achieve?

This question strikes to the core of what someone’s trying to accomplish and why they might be willing to pay for your solution.

5. Take me back to the day when you first decided you needed to solve this kind of problem or achieve this goal.

This is the golden question, and it comes from Adele Revella, Founder and CEO of Buyer Persona Institute . It helps you get in the heads of your users and figure out what they were thinking the day they decided to spend money to solve a problem.

If you take your time with this question, digging deeper where it makes sense, you should be able to answer all the relevant information you need to understand their perspective.

“The only scripted question I want you to ask them is this one: take me back to the day when you first decided that you needed to solve this kind of problem or achieve this kind of a goal. Not to buy my product, that’s not the day. We want to go back to the day that when you thought it was urgent and compelling to go spend money to solve a particular problem or achieve a goal. Just tell me what happened.”

— Adele Revella , Founder/CEO at Buyer Persona Institute

Bonus question: is there anything else you’d like to tell me?

This question isn’t just a nice way to wrap it up—it might just give participants the opportunity they need to tell you something you really need to know.

That’s why Sarah Doody, author of UX Notebook , adds it to the end of her written surveys.

“I always have a last question, which is just open-ended: “Is there anything else you would like to tell me?” And sometimes, that’s where you get four paragraphs of amazing content that you would never have gotten if it was just a Net Promoter Score [survey] or something like that.”

What is the difference between qualitative and quantitative research?

Qualitative research asks questions that can’t be reduced to a number, such as, “What is your job title?” or “What did you like most about your customer service experience?”

Quantitative research asks questions that can be answered with a numeric value, such as, “What is your annual salary?” or “How was your customer service experience on a scale of 1-5?”

→ Read more about the differences between qualitative and quantitative user research .

How do I do my own market research?

You can do your own quick and effective market research by

Surveying your customers

Building user personas

Studying your users through interviews and observation

Wrapping your head around your data with tools like flow models, affinity diagrams, and customer journey maps

What is the difference between market research and user research?

Market research takes a broad look at potential customers—what problems they’re trying to solve, their buying experience, and overall demand. User research, on the other hand, is more narrowly focused on the use (and usability ) of specific products.

What are the main criticisms of market research?

Many marketing professionals are critical of market research because it can be expensive and time-consuming. It’s often easier to convince your CEO or CMO to let you do lean market research rather than something more extensive because you can do it yourself. It also gives you quick answers so you can stay ahead of the competition.

Do I need a market research firm to get reliable data?

Absolutely not! In fact, we recommend that you start small and do it yourself in the beginning. By following a lean market research strategy, you can uncover some solid insights about your clients. Then you can make changes, test them out, and see whether the results are positive. This is an excellent strategy for making quick changes and remaining competitive.

Net Promoter, Net Promoter System, Net Promoter Score, NPS, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Related articles

6 traits of top marketing leaders (and how to cultivate them in yourself)

Stepping into a marketing leadership role can stir up a mix of emotions: excitement, optimism, and, often, a gnawing doubt. "Do I have the right skills to truly lead and inspire?" If you've ever wrestled with these uncertainties, you're not alone.

Hotjar team

The 7 best BI tools for marketers in 2024 (and how to use them)

Whether you're sifting through campaign attribution data or reviewing performance reports from different sources, extracting meaningful business insights from vast amounts of data is an often daunting—yet critical—task many marketers face. So how do you efficiently evaluate your results and communicate key learnings?

This is where business intelligence (BI) tools come in, transforming raw data into actionable insights that drive informed, customer-centric decisions.

6 marketing trends that will shape the future of ecommerce in 2023

Today, marketing trends evolve at the speed of technology. Ecommerce businesses that fail to update their marketing strategies to meet consumers where they are in 2023 will be left out of the conversations that drive brand success.

Geoff Whiting

START YOUR ECOMMERCE BUSINESS FOR JUST $1

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis