Insurance Agency Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 3,000 entrepreneurs and business owners create business plans to start and grow their insurance agencies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an insurance agency business plan template step-by-step so you can create your plan today.

Download our Ultimate Insurance Business Plan Template here >

What is an Insurance Agency Business Plan?

A business plan provides a snapshot of your insurance agency as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Insurance Agency

If you’re looking to start an insurance agency or grow your existing insurance agency you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your insurance agency in order to improve your chances of success. Your insurance agency business plan is a living document that should be updated annually as your agency grows and changes.

Source of Funding for Insurance Agencies

With regards to funding, the main sources of funding for an insurance agency are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate the business.

The second most common form of funding for an insurance agency is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund an insurance agency unless it is based on a unique, scalable technology.

Finish Your Business Plan Today!

How to write a business plan for an insurance agency.

Your insurance agency business plan should include 10 sections as follows:

Executive Summary

- Company Overview

Industry Analysis

Customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan.

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of insurance agency you are operating and the status; for example, are you a startup, do you have an insurance agency that you would like to grow, or are you operating multiple insurance agency locations already.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the insurance agency industry. Discuss the type of insurance agency you are operating. Detail your direct competitors. Give an overview of your target market. Provide a snapshot of your marketing strategy. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of insurance business you are operating.

For example, you might operate one of the following types:

- Direct Writer / Captive : this type of insurance agency only sells one insurance company’s products – like Allstate or State Farm

- Independent Insurance Agent : this type of insurance agency is privately-owned, and sells policies with may different insurance companies

In addition to explaining the type of insurance agency you operate, the Company Analysis section of your own business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new location openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

In your industry analysis, you need to provide an overview of the insurance business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the insurance industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards weather-related policy purchases, it would be helpful to ensure your plans call for flood insurance options.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your insurance company business plan:

- How big is the insurance industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key insurance carriers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your insurance agency. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

The customer analysis section of your insurance agency business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, households, businesses, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of insurance agency you operate. Clearly baby boomers would want different pricing and product options, and would respond to different marketing promotions than recent college graduates.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most insurance businesses primarily serve customers living in their same geographic region, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Insurance Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Insurance Business Plan Template you can finish your plan in just 8 hours or less!

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other insurance agencies.

Indirect competitors are other options that customers have to purchase from you that aren’t direct competitors. This includes self pay and public (Medicare, Medicaid in the case of health insurance) insurance or directly working with an insurance carrier. You need to mention such competition to show you understand that not everyone who purchases insurance does so through an insurance agency.

With regards to direct competition, you want to detail the other insurance agencies with which you compete. Most likely, your direct competitors will be insurance agencies located in your geographic region.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What insurance products do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior insurance agency products/services?

- Will you provide insurance agency products that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your products?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an insurance agency, your marketing plan should include the following:

Product : in the product section you should reiterate the type of insurance agency that you documented in your Company Analysis. Then, detail the specific products/services you will be offering. For example, in addition to P&C insurance, will you also offer life insurance?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the menu items you offer and their prices.

Place : Place refers to the location of your insurance agency. Document your location and mention how the location will impact your success. For example, is your insurance agency located next to the Department of Motor Vehicles, or a heavily populated office building, etc. Discuss how your location might provide a steady stream of customers.

Promotions : the final part of your insurance agency marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Making your insurance agency’s front store extra appealing to attract passing customers

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Partnerships with local organizations (e.g., auto dealerships or car rental stores)

- Local radio advertising

- Banner ads at local venues

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your insurance agency such as serving customers, procuring relationships with insurance carriers, negotiating with repair shops, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your 500th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

To demonstrate your insurance agency’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in an insurance agency. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in insurance agencies and/or successfully running small businesses.

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you acquire 20 new customers per month or 50? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your insurance agency location and/or website, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a successful insurance agency:

- Location build-out including design fees, construction, etc.

- Marketing expenses

- Website development

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your store design blueprint or location lease.

Free Insurance Business Plan Template

You can download our insurance business plan PDF .

Insurance Business Plan Summary

Putting together a business plan for your insurance business will improve your company’s chances of success. The process of developing your plan will help you better understand the insurance market, your competition, and your customers. You will also gain a marketing plan to better attract and serve customers, an operations plan to focus your efforts, and financial projections that give you goals to strive for and keep your company focused.

Growthink’s Ultimate Insurance Business Plan Template allows you to quickly and easily complete your Insurance Business Plan.

Additional Resources for Insurance Agents

- How to Write a Marketing Plan for an Insurance Agency

- How to Start an Insurance Agency

- Association for Independent Agents

- Business License Requirements By State For Insurance Agencies

Don’t you wish there was a faster, easier way to finish your Insurance business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to learn about Growthink’s business plan writing services .

Other Helpful Business Plan Articles & Templates

How to build an insurance agency business plan

A great business plan can guide you through every critical early step of building your company. As you start your insurance company , your plan can help you refine your vision, set objectives, and define the details of your business.

Done right, it can help you secure investors, financing, and more. Done poorly or not at all, your new agency may not get off the ground.

Let’s look at the benefits of creating a business plan and what yours should include.

Why do you need a business plan?

Before diving into the details of building a plan, let’s start with why you should write one in the first place.

After all, a good business plan requires careful research, writing, and review. But it’s worth the effort.

Companies that plan grow 30% faster than those who don’t.

A solid plan can help you make sound decisions when you’re first starting out and as you grow. Even down the road, it can help you secure funding from banks and investors. And insurance carriers often want to see your plan before they’ll partner with your agency.

Beyond these benefits and your own peace of mind, creating a business plan can help you:

- Set realistic objectives.

- Allocate resources.

- Streamline workflows.

- Improve communication.

- Grow your business.

Once your business gets off the ground, periodically reviewing your plan is a great way to clarify your goals and refine how you’ll reach them.

A Journal of Business Venturing study has shown that companies that plan grow 30% faster than those who don’t.

How do you write a business plan?

Business plans can be as different as the businesses they describe, but they generally provide highlights of your business in 5,000 words or less.

Your insurance agency plan must define your business strategy if you plan to seek financing. Essentially, your plan needs to be useful to you and intriguing to investors.

Standard business plan templates typically include these sections.

Executive summary

The executive summary is a snapshot of your insurance business.

For an established agency, this section might include its mission statement and detail its past successes. For a startup, the executive summary might highlight the experience of the business owners and their motivation for starting an insurance agency.

For both new and established businesses, you can also include your agency’s general financial information. This might be an overview of your book of business or a list of current investors.

The executive summary is usually the first impression investors have of your business. Make sure it packs a punch and provides a compelling story.

Company description

A company description gets more specific about what your business does on a day-to-day basis.

The company description explains your keys to success. These can be the value you provide to customers and what sets you apart from the competition. Sometimes they’re one and the same. Pinpoint what you bring to the local insurance market, like:

- A prime office location

- Unparalleled expertise

- Unique products

You may want to include a SWOT analysis that details your business’s strengths, weaknesses, opportunities, and threats.

List of products

This section lists every insurance product that your business offers or plans to offer in the future.

Be sure to include product benefits, sales forecasts, and how you plan to acquire and manage the products.

You may also want to explain how independent agents can secure direct appointments with insurance carriers. Many investors may be unfamiliar with this process.

Market analysis

The market analysis shows your understanding of the insurance market in general. And more importantly, where your agency fits in the mix.

If you plan to fill a niche, explain why and how. Either way, describe your target market and the competition.

Potential investors may also want to see specific market goals, such as your target market share along with an explanation of how and when you’ll achieve it.

Marketing strategy

Every insurance agency needs to reach new customers to grow its business and be successful. In this section, outline how you’ll market your business to attract new customers and increase sales to current ones.

Briefly summarize your strategy, including some details like whether you plan to use traditional and/or digital marketing channels. This might also be a good place to share your sales strategy for converting leads into customers.

Organization and management

The organization and management section introduces your executive and management teams, including a summary of their unique qualifications.

Detailing your team’s experience and talent helps establish your agency’s credibility. It also builds trust in your business and leadership team.

You may also want to include an organizational chart that breaks down your business infrastructure and operations.

Financial plan

If your business is looking for funding, you’ll usually need to identify start-up costs and provide five years of prospective financial data. This typically includes:

- Balance sheets

- Income statements

- Cash-flow statements

- Capital expenditure budgets

You may want to include a break-even analysis that delves into the specific profitability of your products. Consider adding a short financial analysis of the most profitable industry trends.

Funding request

If you're seeking investors for your insurance company, add a funding request at the end of your business plan. Typically, a funding request mentions:

- The amount of funding you’re looking to secure.

- An estimate of your future funding needs.

- How you plan to use the funding.

- Your strategy for dealing with developments like a buyout.

If you’re ready to draft your business plan, the Small Business Administration (SBA) provides this business plan template to help you get started.

How to present your insurance agency business plan

Once you’ve completed your business plan, give it a chance to shine in the spotlight.

Presentation matters, so make it professional. Use an easy-to-read font and clear charts and diagrams to illustrate your points. Be prepared to provide both a digital and print version to potential business partners, banks, or investors.

How you present matters, too. Whenever possible, meet in person to build more trust and rapport.

And even though your business plan is full of details, your audience will likely ask you to expand or explain. Come prepared to respond to any potential objections.

Your thorough, compelling business plan can help build the foundation for your success. If you devote the time and energy needed to create a great one, it could pay large dividends for your business.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Hannah Filmore-Patrick, Contributing Writer

Hannah is a contributing writer with a diverse writing and content building background. She's worked on topics from technology to insurance. She's competent with both language and SEO, and continues to work with a variety of business verticals to create engaging, optimized content.

Insurance Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Insurance Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Insurance Agency Business Plan

You’ve come to the right place to create your own business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their insurance companies.

Essential Components of a Business Plan For an Insurance Agency

Below we describe what should be included in each section of a business plan for a successful insurance agency and links to a sample of each section:

- Executive Summary – In the Executive Summary, you will provide a high-level overview of your business plan. It should include your agency’s mission statement, as well as information on the products or services you offer, your target market, and your insurance agency’s goals and objectives.

- Company Overview – This section provides an in-depth company description, including information on your insurance agency’s history, ownership structure, and management team.

- Industry Analysis – Also called the Market Analysis, in this section, you will provide an overview of the industry in which your insurance agency will operate. You will discuss trends affecting the insurance industry, as well as your target market’s needs and buying habits.

- Customer Analysis – In this section, you will describe your target market and explain how you intend to reach them. You will also provide information on your customers’ needs and buying habits.

- Competitive Analysis – This section will provide an overview of your competition, including their strengths and weaknesses. It will also discuss your competitive advantage and how you intend to differentiate your insurance agency from the competition.

- Marketing Plan – In this section, you will detail your marketing strategy, including your advertising and promotion plans. You will also discuss your pricing strategy and how you intend to position your insurance agency in the market.

- Operations Plan – This section will provide an overview of your agency’s operations, including your office location, hours of operation, and staff. You will also discuss your business processes and procedures.

- Management Team – In this section, you will provide information on your insurance agency’s management team, including their experience and qualifications.

- Financial Plan – This section will detail your insurance agency’s financial statements, including your profit and loss statement, balance sheet, and cash flow statement. It will also include information on your funding requirements and how you intend to use the funds.

Next Section: Executive Summary >

Insurance Agency Business Plan FAQs

What is an insurance agency business plan.

An insurance agency business plan is a plan to start and/or grow your insurance business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your insurance agency business plan using our Insurance Agency Business Plan Template here .

What Are the Main Types of Insurance Companies?

There are a few types of insurance agencies. Most companies provide life and health insurance for individuals and/or households. There are also agencies that specialize strictly in auto and home insurance. Other agencies focus strictly on businesses and provide a variety of liability insurance products to protect their operations.

What Are the Main Sources of Revenue and Expenses for an Insurance Agency Business?

The primary source of revenue for insurance agencies are the fees and commissions paid by the client for the insurance products they choose.

The key expenses for an insurance agency business are the cost of purchasing the insurance, licensing, permitting, and payroll for the office staff. Other expenses are the overhead expenses for the business office, utilities, website maintenance, and any marketing or advertising fees.

How Do You Get Funding for Your Insurance Agency Business Plan?

Insurance agency businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Other options for funding are outside investors, angel investors, and crowdfunding sources. This is true for a business plan for insurance agent or an insurance company business plan.

What are the Steps To Start an Insurance Business?

Starting an insurance business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Insurance Business Plan - The first step in starting a business is to create a detailed insurance business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your insurance business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your insurance business is in compliance with local laws.

3. Register Your Insurance Business - Once you have chosen a legal structure, the next step is to register your insurance business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your insurance business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Insurance Equipment & Supplies - In order to start your insurance business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your insurance business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful insurance business:

- How to Start an Insurance Business

Where Can I Get an Insurance Business Plan PDF?

You can download our free insurance business plan template PDF here . This is a sample insurance business plan template you can use in PDF format.

- Sample Business Plans

- Finance & Investing

Insurance Company Business Plan

An insurance agency can become a profitable business if done right. After all, insurance companies as a business help people deal with uncertainties, and that is something all of us want.

And if you have good negotiation skills, are brilliant at planning, and have a thorough knowledge of how insurance works then you might have thought of having your insurance agency.

If yes, then what are you waiting for?

Get started because now is a time as good as any. All you need is a little industry information and an insurance company business plan to help you have a thriving business.

Industry Overview

The global insurance industry stands at a whopping value of 5.3 trillion US dollars in 2022 and is expected to grow at a rapid pace going forward too.

The major reason for the growth of the insurance sector comes from the increasing uncertainty of life, property, and everything else that concerns people.

The increase in disposable income amongst people has also contributed significantly to the growth of the sector.

But as everything good attracts competition, the insurance industry attracts a lot of competition too. And if you want to stand out amongst all of it, you’ll need to be brilliant at what you do. Proper steps to set up your business and planning can help you with that.

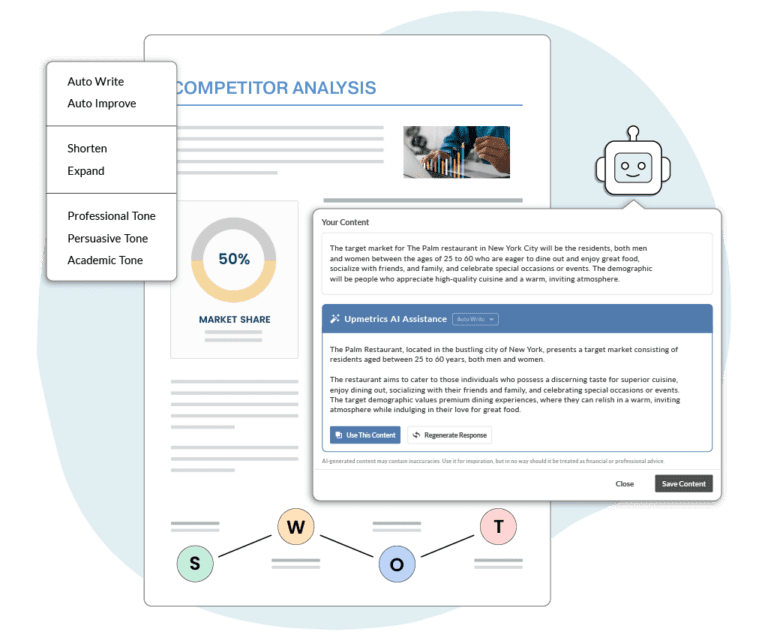

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing Your Insurance Company Business Plan

Know the industry.

The first step towards having a successful business is to research the industry and know what you are getting yourself into. It helps you understand the ins and outs of the business and what steps you should take to help your business succeed. It also helps you stay updated with the latest trends and use them to your advantage.

Get the necessary licenses and permits

As insurance companies are prone to lawsuits, fraud, and other such problems, having all the necessary documents can help you stay on the right side of the law. The licenses and permits act as an assurance for both your clients and your business that you’ll be able to deal with any legal hassle that comes your way. And as you don’t need to worry about the legalities you can focus on what really matters.

Know your audience

Knowing your target audience, their fears, motivations, and preferences can give you the required edge over your competitors. As you know your customers you’re able to serve them better. This eventually makes them return to you and build long-term and mutually beneficial relationships with your customers.

Promote your business

Promoting your business is foundational to success because for your business to work you need to let people know that your business exists. Hence, once you get to know your target audience, it is important to promote your business in a way that speaks to your target audience.

Chalking out Your Business Plan

If you are planning to start a new insurance company, the first thing you will need is a business plan. Use our sample insurance company business plan created using Upmetrics business plan software to start writing your business plan in no time.

Before you start writing your business plan for your new insurance business, spend as much time as you can reading through some examples of insurance-related business plans .

Reading sample business plans will give you a good idea of what you’re aiming for and also it will show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample insurance company business plan for you to get a good idea about what a perfect insurance business plan should look like and what details you will need to include in your stunning business plan.

Insurance Company Business Plan Outline

This is the standard insurance company business plan outline which will cover all important sections that you should include in your business plan.

- Keys to Success

- 3 Year profit forecast

- Startup cost

- Funding Required

- Company Ownership

- Company Locations and Facilities

- Service Description

- Competitive Comparison

- Sales Literature

- Fulfillment

- Future Services

- Market Analysis

- Competition and Buying Patterns

- Business Participants

- Distributing a Service

- Cal Roberts, Patrick C. Johnson, Rob Champlain

- Agents (such as Co-operators)

- Mass Markets

- Group Plans – teachers, public employees

- Promotion Strategy

- Distribution Strategy

- Positioning Statement

- Pricing Strategy

- Sales Programs

- Sales Forecast

- Sales Yearly

- Strategic Alliances

- Service and Support

- Organizational Structure

- Startup Funding

- Important Assumptions

- Brake-even Analysis

- Profit Yearly

- Gross Margin Yearly

- Projected Cash Flow

- Projected Balance Sheet

- Business Ratios

After getting started with Upmetrics , you can copy this sample business plan into your business plan and modify the required information and download your insurance company business plan pdf or doc file. It’s the fastest and easiest way to start writing your business plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Download a sample insurance company business plan

Need help writing your business plan from scratch? Here you go; download our free insurance company plan pdf to start.

It’s a modern business plan template specifically designed for your insurance company business. Use the example business plan as a guide for writing your own.

Related Posts

Holding Company Business Plan

Insurance Agent Business Plan

Financial Plan for Startup Guide

Sample Business Plans Free Template

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

* Mandatory fields

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. Consent.

- Agents Blog

- Running & Growing your Agency

- Upcoming Webinars

- IAA Presentations

- Share this Hub

- EverQuote Pro Blog »

Launch Your New Insurance Agency With This Business Plan Template

Whether you're a brand new agent or one with several decades of experience, the idea of opening a new insurance agency probably seems daunting—where do you start?

One of the first things you’ll need to do is come up with a business plan for your insurance agency. After all, you can walk into a bank or a potential investor’s office looking for funding, but you won’t get very far unless you have a robust insurance agency business plan that proves you’re on the right track toward turning a profit in the near future.

Follow the steps below when building out your insurance business plan to maximize your chances of securing funding and getting your new agency off to a strong start.

7 Steps To Build Your Insurance Agency Business Plan

1. develop your executive and business summaries..

In business plan terms, the executive summary is the driving force behind your other decisions. It should explain why you’re starting your agency. The business summary is similar, but it should narrow down your “why” into a list of “hows.”

Ask yourself:

- Why do you want to open an agency?

- What types of insurance do you wish to sell?

- What do you hope to accomplish?

- What return on investment do you expect to receive?

- How are you going to generate demand and ensure supply for your service?

Jot your answers down so you can refer back to them as you move forward.

2. Decide whether you want to be a captive agent or an independent agent.

Many large agencies, such as Allstate and Farmers, work with captive agents who can only sell insurance for that specific provider. Independent agents, on the other hand, can sell insurance for multiple providers, but they get locked out of working with the big-name captive carriers who only work with captive agents. (Read more about captive agents here and get a seasoned agent’s POV on both types of agents here. )

Before you can nail down the details of the rest of your business plan, you’ll have to make a choice between these two options.

3. Do a market analysis.

Though it might seem like a tedious process, conducting a thorough market analysis is crucial to your success. Analyzing your local market—including the backgrounds, shopping behaviors, and preferences of your target customers—gives you the insights you’ll need to attract these folks to your business.

Your market analysis will look a little different depending on whether you prefer to be a captive or an independent agent. The state you live in is another factor that will affect your analysis—in fact, it may even influence your decision to be captive or independent.

Take a close look at the demographics of your region.

- How many homeowners live in your state?

- What’s the average insurance premium per home?

- How many people live in each home, on average?

- How many drivers live in your state?

- How many vehicles does the average household own?

- Do you live in an area with an aging population ?

- How many families live in your region?

- What insurance carriers do locals in your state gravitate toward?

- In your area, what might be some successful strategies for retaining clients (rather than just acquiring them)?

These questions are all important, but pay particular attention to the last one. If you open an agency without a plan for client retention, you’re going to struggle. And, unfortunately, this is one of the most overlooked aspects of an insurance agency business plan.

4. Identify where you’ll find your first clients.

It’s one thing to know there are X number of potential clients living in your state, but it’s quite another to have a plan that will help you reach out to those folks and land your first policy sales.

Some investors will require a list of leads before they’ll even consider funding your agency. Even if it’s not a requirement, it’s always a good idea to have a pipeline ready to go. This is where getting set-up for purchasing warm leads from EverQuote can put you in a great position for success.

Plus, tackling this step before you even open your doors will help you better understand the costs you’ll incur—and therefore how much startup funding you will need.

You might also consider other options, such as placing ads in local newspapers, going to networking events, investing in digital marketing, sponsoring local Little League teams, or asking for referrals.

5. Create a financial plan.

Many new agencies fail because their owners overlooked something critical during startup. Do your best to look at your financial plans from every angle:

- Where will you find leads, and how much will they cost?

- What is your advertising budget?

- Does this budget line up with the going rates of local newspapers, billboards, or online ads?

- Do you plan to have 1099 employees or W2 employees selling insurance for your agency?

- How will you decide on a commission and benefits structure for these employees?

- What retention and loss ratios (for clients and employees) do you expect based on the numbers of other agencies in your area?

- How will you handle the delay between policy renewals and income hitting your bank account?

- If there are X amount of people shopping for insurance in your area, what percentage of those people are in a niche you can serve?

- From that percentage of potential clients, how many do you think you can successfully land?

- If you sell policies to these customers, how much will you earn from their premiums?

- How do your projected profits compare to your expected advertising costs, the cost to buy leads, office rent, and other expenses?

Take detailed notes of your calculations, and try to run the numbers a few different ways to obtain a conservative outcome, a likely outcome, and a “best case scenario.”

6. Draw up a formal business plan using a proven format.

Your notes will be incredibly valuable as you move forward, but you’ll need a way to present them clearly and concisely in a way that looks attractive to investors.

Loan officers and investors don’t want to read long-form essays detailing your business background and your ideas for the future. Keep your format simple and straightforward, with clear sections that answer the questions investors will want to know.

We recommend a format similar to the following:

Executive Summary Overall mission Primary objectives Keys to success Financial plans Profit forecast for at least three years Business Summary Business overview Summary of startup costs Funding you’ll require Company executives/ownership Services Services you provide Market Analysis Overall business analysis Details of your competition Buying patterns of your competition Your planned buying patterns Market segmentation and analysis Target market strategies Include details for each market segment Strategy Your competitive edge Marketing strategy Sales strategy Yearly sales projections Key milestones Management Your plan for finding staff Financial Plan Funding you have accepted Funding you will need Detailed startup costs Calculations for your break-even point Projected profit Yearly profit Gross and net yearly profit Anticipated losses, if any Cash flow patterns Plans for balance sheet Calculations of important business ratios

7. Revise and adjust your plan over time.

You may not secure funding for your agency immediately. Even if you do, you’ll likely find that your real world numbers don’t match up exactly with your calculated projections. Plus, carriers frequently change their underwriting policies, and the economy itself is always in a state of flux.

Keep your business plan current by updating the information anytime circumstances change.

Start your journey with a full lead pipeline from EverQuote.

One of the scariest parts about starting a new agency is not being certain where and when you’ll be able to start making sales.

Skip the fear and the unknown and go right to making sales with warm real-time leads from EverQuote. Whether you’re still trying to find startup funding or your doors are already open, you can always boost your business and maximize your chances of a steady income by working with EverQuote.

Connect with us today.

Topics: Featured , Insurance Agency Growth

About the Author Chris Durling, VP of P&C Sales

Chris Durling is a visionary leader in P&C insurance sales and distribution, with over 10 years of experience in the industry.

Most Recent Articles

In the grand scheme of digital insurance agency marketing, paid advertisements might seem like a...

If you’re at all familiar with digital marketing—maybe you’ve dabbled in it a bit or even just done...

Scott Grates, insurance agent and co-founder of Insurance Agency Optimization, is renowned for his...

When it comes to nurturing your insurance agency’s online business reputation, there are numerous...

If the year 2023 had a buzzword, that buzzword was definitely AI. Artificial intelligence took off...

Despite current economic complexities, many industries are still hiring at a dependable pace. Among...

If you had to name the most tedious, time-consuming, thankless task in your insurance sales job,...

Creating a new insurance agency is a complex process, just like building any new business from the...

Previous Article

Next Article

Ready to see what partnering with EverQuote can do for you?

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers.

Terms of Use

Privacy Policy

For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers

How To Write an Insurance Agency Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for insurance agencies that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every insurance agency owner should include in their business plan.

Download the Ultimate Insurance Business Plan Template

What is an Insurance Agency Business Plan?

An insurance agency business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Insurance Agency Business Plan?

An insurance agency business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Insurance Agency Business Plan

The following are the key components of a successful insurance agency business plan:

Executive Summary

The executive summary of an insurance agency business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your insurance agency

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your insurance agency business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your insurance agency firm, mention this.

You will also include information about your chosen insurance agency business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an insurance agency business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the insurance agency industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, customers of an insurance agency may include individuals, families and small businesses.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or insurance agency services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your insurance agency may have:

- In-depth knowledge of the insurance industry

- Broad product offering

- Customer focus and commitment to service

- Well-trained and experienced team

- Proven track record

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign.

- Or, you may promote your insurance agency via a mix of all the channels listed.

Operations Plan

This part of your insurance agency business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an insurance agency include reaching $X in sales. Other examples include signing up a certain number of customers, expanding to a new location, or launching a new product or service.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific insurance industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Insurance Agency

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Insurance Agency

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup insurance agency .

Sample Cash Flow Statement for a Startup Insurance Agency

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your insurance agency . It not only outlines your business vision, but also provides a step-by-step process of how you are going to accomplish it. All in all, a business plan is a key to the success of any business.

Finish Your Insurance Agency Business Plan in 1 Day!

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Insurance Agency Business Plan

Start your own insurance agency business plan

Quaestor Services

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Quaestor Services is in the process of being formed as a sole proprietorship owned and operated by Sheila Claflin. This plan is written as a guide for financing, start-up and management of this new business and will also serve as the basis for measurement. The following is a summary of the main points of this plan.

- The objectives of Quaestor are to generate a profit, grow at a challenging and manageable rate, and to be a good citizen in the community.

- The mission of Quaestor is to provide products and services with high quality, protection and value pricing.

- The keys to success for Quaestor are variety of business services and products, personal contact, timely and accurate service, development of one-to-one relationships, and a reputation of honesty and integrity.

- The primary products offered will be from Whelnoan Insurance Company, and the added value to small businesses will be the accounting and financial services offered.

- The local market for this business is wide open. Whelnoan Insurance Company has captured 23% of the market share and is considered the second largest insurance company in Plainstate.

- In the first year of operation, a customer base is being established. Over 85% of the new and established insurance business will renew each year creating compounding growth in sales of over 200% with limited increase in operational expense.

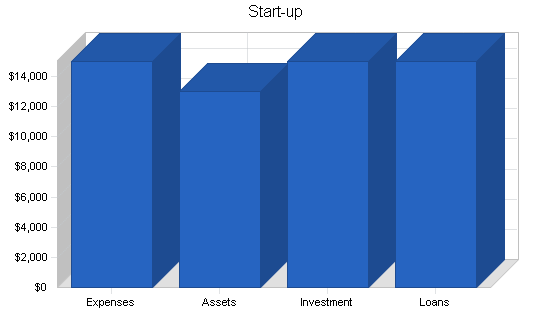

In conclusion, as shown in the highlights chart below, this plan projects rapid growth over the next three years with a profit forecasted in the second year of operation and continuing into future years of operation. Implementing this plan, will ensure that Quaestor Services becomes a profitable venture.

1.1 Objectives

The main objectives of Quaestor Services are:

- Profit – to create enough prosperity for the owner and employees to have a secure and comfortable lifestyle.

- Growth – to grow the business at a rate that is both challenging and manageable.

- Citizenship – to be a social asset to the community and contribute to others who are less fortunate.

1.2 Mission

Quaestor Services is dedicated to providing insurance products and business services that provide high quality, protection, and value pricing. We wish to establish a successful partnership with our clients that respects their interests and goals.

Success will be measured by our clients choosing us because of their belief in our ability to meet or exceed their expectations of price, service, and expertise.

1.3 Keys to Success

The keys to the success for Quaestor Services are:

- A wide variety of business services and insurance products that are affordable, available and understandable.

- Personal contact and service that meets or exceeds the expectations of our clients.

- Services and products that are delivered with accuracy and timeliness.

- Relationships with our clients that fosters renewal business.

- A reputation in the community for it’s honesty and integrity.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Quaestor Services is a start-up company located in Smileyville, Plainstate, a suburb of Niceburg, providing both accounting and full-charge bookkeeping services and insurance and retirement products to individuals, families, and small businesses.

2.1 Company Ownership

Quaestor Services is a sole proprietorship, owned by Sheila Claflin. Born and raised in the Pacific Northwest with Native American Indian heritage, Sheila was relocated to Plainstate in 1994 by her employer.

She has over 30 years of experience in Finance, Accounting, Management, and Consulting and recently received her Plainstate insurance agent license for Life, Health, Property and Casualty insurance.

In the near future she intends to receive her Series 6 Securities license and take H & R Block Income Tax Course.

2.2 Start-up Summary

Quaestor Services start-up costs include:

- Marketing/Lead Services: marketing and lead generation services to establish client base

- Website Development: professionally developed business website on the Internet

- Logo: professionally developed business logo for business recognition in the market place

- Stationary: the printing of letterhead and envelopes with the company logo

- Business Cards: the printing of business cards with company logo

- Brochures: development and printing of brochures for marketing the business

- Cell Phone and Pager: business cell phone and pager for communication with the clients at all times

- Office Supplies: supplies necessary to set up an office

- Training/Licensing: costs associated with the three state licenses required for insurance business

- Business Associations: membership into several business associations such as Chamber of Commerce

Quaestor Services long-term assets include:

- Laptop Computer: used in meetings with clients for printing insurance quotes and on-line applications

- PC Computer/Monitor: used in office for accounting services and record of business transactions

- Printer/Copier/Scanner: used in office for business transactions

Start-up costs come to $30,000 of which $15,000 is being financed by a direct owner investment. In the first six months of operation $15,000 financing is being sought after for the start-up costs. In mid-Year 1 an additional $10,000 in financing will be required to ensure business operations, marketing and stability during the first year of operation.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Marketing/Lead Services | $4,000 |

| Website Development | $1,500 |

| Business Logo | $800 |

| Stationary | $750 |

| Business Cards | $300 |

| Marketing Brochures | $2,500 |

| Cell Phone and Pager | $300 |

| Office Supplies | $350 |

| Training/Licensing | $2,500 |

| Business Associations | $2,000 |

| Miscellaneous | $0 |

| Total Start-up Expenses | $15,000 |

| Start-up Assets | |

| Cash Required | $10,000 |

| Other Current Assets | $0 |

| Long-term Assets | $3,000 |

| Total Assets | $13,000 |

| Total Requirements | $28,000 |

Quaestor Services provides accounting and full-charge bookkeeping services, insurance and retirement products to individuals, families, and small businesses.

As a representative of Whelnoan Insurance Company the following product and services are offered:

- Personal Lines – auto, renters, home, motorcycle, boat/yacht, snowmobile, jet ski

- Commercial Lines – businesses, workers compensation, surety bonds

- Life & Disability Products – term, whole, universal and variable life, long-term care, disability

- Retirement Products – fixed, equity indexed, and variable annuities, mutual funds

- Retirement Plans – IRA, Roth IRA, pension plans, SEP plans, SIMPLE plans

- Life Planning Concepts – mortgage protector, business continuation, buy/sell agreements

- Value Added Products

In the future we intend to offer the following independent products and services:

- Health Insurance

- Pet Care Insurance

Accounting and Full-Charge Bookkeeping Services are available at either the client’s location or in our offices on a regular, permanent basis with a schedule that accommodates the client’s needs. Rates are based on the needs of the business. These services include:

- Accounts Payable

- Accounts Receivable

- Credit/Collection

- Reconciliations

- General Ledger Maintenance

- Financial Statements

In the future we intend to offer the following accounting service:

- Income Tax Preparation

Market Analysis Summary how to do a market analysis for your business plan.">

The market area for Quaestor Services will be focused on three counties, Pleasant, Niceburg and Contented, in Plainstate. These counties are experiencing a combined average growth in population over the 2000 census of 6.45%.

As of 2004, the Whelnoan Insurance Company is the second largest insurance company in Plainstate with 23% of the market share. The overall market for Quaestor is wide open. This business plan has identified over 1.3 million individuals and business as potential clients in the market area.

4.1 Market Segmentation

Quaestor Services has targeted the following market segments:

| – | State | Pleasant | Niceburg | Contented | Total | % |

| YR 2004 Estimate-Total Population | 4,814,628 | 545,991 | 560,265 | 284,032 | 1,390,288 | 28.9% |

| – | – | – | – | – | – | – |

| YR 2004 Estimate-15 to 24 years old | 528,756 | 55,264 | 60,509 | 19,652 | 135,425 | 25.6% |

| YR 2004 Estimate-24 to 74 years old | 2,224,217 | 255,517 | 265,626 | 136,052 | 657,195 | 29.5% |

| Available Market Share 77% | 2,752,973 | 310,781 | 326,135 | 155,704 | 792,620 | 28.8% |

| – | – | – | – | – | – | – |

| YR 2004 Estimate-Total Housing Units | 2,244,113 | 237,308 | 279,912 | 97,555 | 614,774 | 27.4% |

| Available market Share 77% | 1,727,967 | 182,727 | 215,532 | 75,117 | 473,376 | 27.4% |

| Housing Units-Owner Occupied | 1,162,922 | 124,254 | 113,154 | 66,028 | 303,436 | 26.1% |

| Housing Units-Renters | 119,230 | 9,502 | 13,363 | 7,887 | 30,752 | 25.8% |

| – | – | – | – | – | – | – |

| YR 2004 Estimate-Small Bus > 20 Emp | 122,452 | – | – | – | 94,288 | 77.0% |

The available market share of 77% represents the market that Whelnoan Insurance has not captured at this time. Although,the entire state is an available marketing area, the tri-county area will be the focus marketing area at this time. The total population of the tri-county area available for marketing is 29% of the total available population in Plainstate.

The first and most important market segment is population broken down by age groups. This can be used for determining the market for personal lines of insurance such as auto and various recreational vehicles, life and life planning products.

Note that the population of 15 to 24 year olds has been separated from the available population as a market segment in itself for determining the possibility of high risk auto insurance policies.

The second market segment is housing units broken down by owner occupied and renters. This can be used for determining the market for personal lines of insurance such as home, townhouses, condominium, renters and mortgage protection.

The third market segment is small businesses with less than 20 employees. This can be used for determining the market for accounting and bookkeeping services and commercial lines of insurance including property and casualty, retirement and workers compensation.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Focus Population (Ages 15 to 24 years old) | 6% | 135,425 | 144,160 | 153,458 | 163,356 | 173,892 | 6.45% |

| Focus Population (Ages 25 to 74 years old) | 6% | 657,195 | 699,584 | 744,707 | 792,741 | 843,873 | 6.45% |

| Small Business (Less than 20 employees) | 6% | 94,288 | 99,757 | 105,543 | 111,664 | 118,141 | 5.80% |

| Focus Housing Units (Owned) | 12% | 303,436 | 339,059 | 378,865 | 423,344 | 473,045 | 11.74% |

| Focus Housing Units (Rented) | 12% | 30,752 | 34,362 | 38,396 | 42,904 | 47,941 | 11.74% |

| Total | 7.93% | 1,221,096 | 1,316,922 | 1,420,969 | 1,534,009 | 1,656,892 | 7.93% |

Strategy and Implementation Summary

- Emphasize value instead of price . Quaestor is dedicated to working closely with each client and educating them on the importance of value over price.

- Build long term relationships . Quaestor is dedicated to establishing a successful partnership with each client, respecting their interests and goals by cultivating a long term relationship to enhance client retention.

- Focus on increasing market share . Quaestor will focus on personal and business clients that have been identified in the targeted markets.

5.1 Competitive Edge

Quaestor’s competitive edge is our positioning as strategic ally with our clients, who are clients more than customers. By building a business based on long-standing relationships with satisfied clients, we simultaneously build defenses against competition. The longer the relationship stands, the more we help our clients understand what we offer them and why they need it.

5.2 Marketing Strategy

The marketing strategy is the core of Quaestor’s main strategy:

- Develop specific programs for each target market segment

5.3 Sales Strategy

Quaestor’s sales strategy will be based on systematic person-to-person contacts through referrals, direct mail, telemarketing and the Internet. A list of potential prospects has already been compiled and will serve as a launching pad for marketing the products and services.

5.3.1 Sales Forecast

The important elements of the sales forecasts are summarized on three line items, Accounting Services, Insurance Sales, and Miscellaneous Revenue. The summary of the initial sales forecast indicates a first year revenue of $39,500 increasing to over $108,310 by the end of the second year, then $122,110 by the end of the third year. It should be noted that although sales triple in the second year, all revenue has been forecasted very conservatively for the three year forecast. Forecasted sales increases are overstated by the Whelnoan Insurance subsidies or Miscellaneous sales. Actual sales growth for the second year is 160% due to adding a producer for continued sales growth and exponential growth of insurance renewals. The third year of sales reflects an actual growth of 76% due mostly to the increase in insurance renewals. Each element will be discussed separately and in its entirety below:

Accounting Services – it has been determined in order to be conservative for this forecast, that the average accounting client requires services at approximately $500 a month, or 25 hours (x) $20 hour. Obviously this can vary depending on the needs of the client, but for forecasting purposes this is the standard used in determining the monthly revenue. In addition, it is assumed that once our services are sold to the accounting client, they will continue to generate a monthly revenue until replaced. Income tax preparation which will yield a substantial increase in revenue as a future service, but is not considered in this forecast. The illustration below, shows two clients are forecasted for the second year and three clients are forecasted for the third year. Accounting clients can sometimes require substantial time at first, until the clients’ needs are defined and set up. Limited clients are being forecasted due to the time required growing the client base for insurance.

| Month | FY2005 | FY2006 | FY2007 |

| Jan | – | 1,000 | 1,500 |

| Feb | – | 1,000 | 1,500 |

| Mar | 500 | 1,000 | 1,500 |

| Apr | 500 | 1,000 | 1,500 |

| May | 500 | 1,000 | 1,500 |

| Jun | 500 | 1,000 | 1,500 |

| Jul | 1,000 | 1,000 | 1,500 |

| Aug | 1,000 | 1,000 | 1,500 |

| Sep | 1,000 | 1,000 | 1,500 |

| Oct | 1,000 | 1,000 | 1,500 |

| Nov | 1,000 | 1,000 | 1,500 |

| Dec | 1,000 | 1,000 | 1,500 |

| Sales Increase | – | 50% | 50% |

| TOTAL | $8,000 | $12,000 | $18,000 |