- Business plans

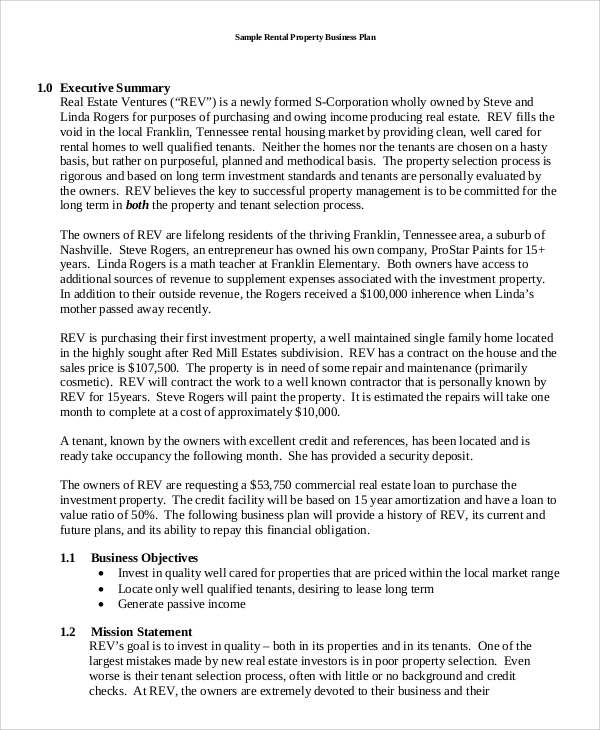

Rental Property Business Plan

Used 4,872 times

Develop a rental property business plan tailored to serve as a valuable resource for entrepreneurs to organize their rental business.

e-Sign with PandaDoc

Created by:

[Sender.FirstName] [Sender.LastName]

[Sender.Company]

Prepared for:

[Recipient.FirstName] [Recipient.LastName]

[Recipient.Company]

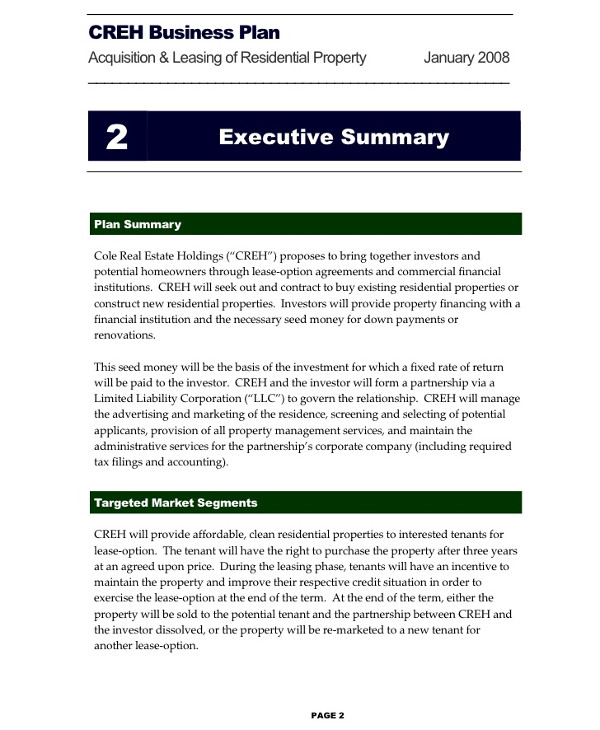

Executive Summary

[Sender.Company] is a reputable rental business located in [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] (Company Location), specializing in property management, rental, and leasing.

Through expert knowledge and technological innovation, [Sender.Company] strives to make the property rental journey as straightforward as possible. The online platform, in particular, serves as a user-friendly hub where clients can effortlessly navigate and find properties that precisely align with their unique preferences and requirements. This emphasis on simplification ensures clients enjoy a hassle-free and tailored experience throughout their rental process.

[Sender.Company] 's commitment to enhancing the rental experience underscores its mission to provide clients with a seamless and customized journey, setting it apart as a leader in the industry.

Company Description

Who is [sender.company] .

[Sender.Company] is located in [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] and operates as a rental property agency specializing in providing short-term and long-term rentals and leased properties to the local community. The rental properties offered by [Sender.Company] are distinguished by their clean and modern aesthetics, perfectly aligned with the preferences of today's renters.

All properties managed by [Sender.Company] are fully furnished and equipped with high-end technology and modern accessories, ensuring tenants a hassle-free and comfortable living experience.

[Sender.Company] is under the ownership of (Owner Name), a seasoned professional in the rental property industry. [Sender.FirstName] [Sender.LastName] (Founder's Name) decided to launch [Sender.Company] in (month, date), driven by a recognition of the growing demand from students, working professionals, and individuals relocating from overseas.

With a keen focus on meeting the diverse housing needs of the local community, [Sender.Company] is committed to delivering outstanding rental property services. Under (Owner Name)'s guidance, the company is well-positioned to thrive and make a lasting impact in the rental property industry.

[Sender.Company] ’s Products

Some of the offerings available through [Sender.Company] include:

(Company Product/Option): (Insert description)

Industry Analysis

Customer analysis, profile of target market.

The target market of [Sender.Company] includes consumers from all demographics. The market [Sender.Company] serves value-conscious, with a preference for excellent comfort and basic amenities aimed at families, students, and the working population.

The following are the exact demographics of (Location) where the business is located:

Localities:

Economic levels:

Customer Segmentation

[Sender.Company] will target the following customer segments:

Working Professionals

High-Income Earners

Competitive Analysis

Main competitors.

(Competitor Name 1) – (Brief Overview of Competitor 1)

(Competitor Name 2) – (Brief Overview of Competitor 2)

(Competitor Name 3) – (Brief Overview of Competitor 3)

Competitive Advantage

[Sender.Company] has several competitive edges over its competitors. These edges are the following:

(Competitive Advantage 1)

(Competitive Advantage 2)

(Competitive Advantage 3)

Marketing and Strategy Implementation

[sender.company] ’s branding and positioning.

[Sender.Company] places a strong emphasis on its unique value proposition, which encompasses several key aspects:

Rental Offerings

[Sender.Company] specializes in offering various rental properties designed to meet different customer segments' specific needs and preferences. From spacious family homes to budget-friendly options for students, upscale residences for working professionals, and welcoming accommodations for international migrants.

Strategic Location

[Sender.Company] is dedicated to offering a broad range of rental homes in carefully selected areas. This variety in locations means that residents can enjoy different amenities and services and choose the lifestyle that best suits their preferences and requirements.

Exceptional Customer Service

Exceptional customer service is the cornerstone of the [Sender.Company] . Their dedicated team is always available to assist with inquiries, property viewings, lease agreements, and maintenance requests.

Innovative Technology Integration

[Sender.Company] stays at the forefront of technology trends by integrating smart home solutions and digital platforms to enhance convenience and security for their tenants. This includes keyless entry systems, remote property management tools, and online rent payment options.

Promotions Strategy

[Sender.Company] anticipates its primary target audience to consist of students, international migrants, the working population, and local families residing primarily in the [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] . To effectively engage with these potential clients, the company has developed a comprehensive promotion strategy, which encompasses the following key elements:

Referrals: (Description).

Advertisement: (Description).

Public Relations: (Description).

Social Media Marketing: (Description).

Print Advertising: (Description).

Website/SEO Marketing: (Description).

Pricing Strategy

[Sender.Company] is dedicated to offering a variety of flexible payment alternatives tailored to accommodate diverse customer preferences. The following list provides a comprehensive overview of these payment options, which can be customized as necessary:

(Payment Option 1)

(Payment Option 2)

(Payment Option 3)

By offering these flexible payment choices, [Sender.Company] aims to ensure that its valued customers have a range of selections to suit their financial requirements and preferences, thus enhancing their overall satisfaction.

Operations Plan

Organizational structure.

At [Sender.Company] , the rental property management team is composed of a diverse and skilled group of individuals, each contributing their unique talents to drive the success of the company's property ventures.

CEO/Founder

As the visionary leader of the rental property management team, (Mr./Mrs./Ms.) (Name) is deeply committed to excellence. He/she lays the foundation for the creative journey while guiding everyone towards new heights of achievement in the rental property sector.

Office Manager

(Mr./Mrs./Ms.) (Name) is the creative force behind [Sender.Company] 's property management efforts, ensuring rental properties provide exceptional living experiences. He/she meticulously oversees property details, from maintenance to tenant satisfaction.

Maintenance Director

(Mr./Mrs./Ms.) (Name) leads maintenance and property improvement initiatives, consistently exceeding industry standards in property upkeep, repairs, and enhancement.

Additional Team Members

Beyond the core team, [Sender.Company] has a dedicated group of professionals, including property managers, maintenance staff, leasing agents, and administrative personnel, who work cohesively to deliver exceptional rental property management services.

Over the following (Number of Months) months, [Sender.Company] has set ambitious milestones to accomplish in its journey toward establishing a strong and prosperous presence in the (Industry Name).

Date | Milestone |

|---|---|

(MM/DD/YY) | (Milestone 1) |

(MM/DD/YY) | (Milestone 2) |

(MM/DD/YY) | (Milestone 3) |

Financial Plan

Source and use of funds.

[Sender.Company] will get (Amount) from (Source of Fund) to start its rental property business.

[Sender.Company] will use the funds to secure the initial rental and office space and purchase supplies and equipment. The proposed startup costs are shown in the table below:

Name | Price | QTY | Subtotal |

|---|---|---|---|

| Item 1 Description of first item | $35.00 | 5 | $175.00 |

| Item 2 Description of second item | $55.00 | $55.00 | |

| Item 3 Description of third item | $200.00 | $200.00 |

Subtotal | $230.00 |

Discount | -$115.00 |

Tax | $23.00 |

Total | $138.00 |

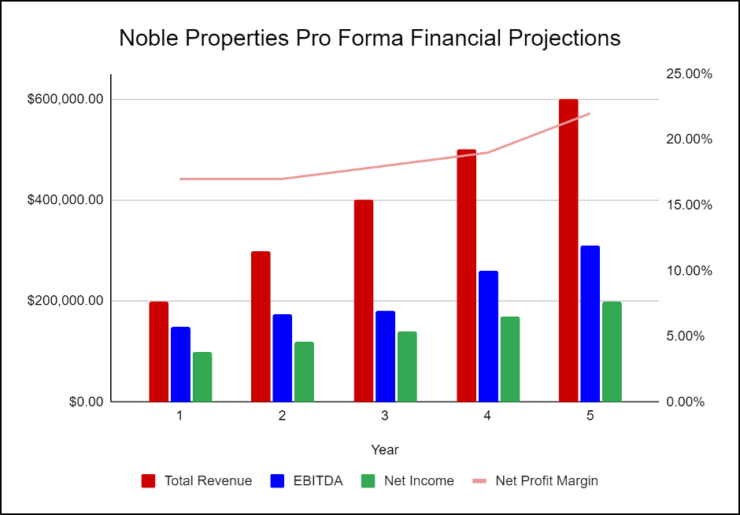

Financial Projections

These are [Sender.Company] 's pro forma financial statements for the next five (5) years. It contains the business's income statement, balance sheet, and cash flow statement.

[Recipient.FirstName] [Recipient.LastName]

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured Templates

- Sales Proposals

- NDA Agreements

- Operating Agreements

- Service Agreements

- Sales Documents

- Marketing Proposals

- Rental and Lease Agreements

- Quote Templates

- Business Proposals

- Agreement Templates

- Purchase Agreements

- Contract Templates

Property Rental Business Plan Template & PDF Example

- July 24, 2024

- Business Plan

Creating a comprehensive business plan is crucial for launching and running a successful property rental business. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your property rental business’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a property rental business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the real estate industry, this guide, complete with a business plan example, lays the groundwork for turning your property rental business concept into reality. Let’s dive in!

Our property rental business plan is structured to cover all essential aspects needed for a comprehensive strategy. It outlines the rental operations, marketing strategy, market environment, competitors, management team, and financial forecasts.

- Executive Summary : Offers an overview of the property rental business’s concept, market analysis , management, and financial strategy.

- Properties, Amenities & Services: Describes the diverse range of properties, from urban apartments to countryside cottages, each equipped with customized amenities and services to cater to various guest preferences.

- Properties Deep Dive: Offers a detailed look into each property, including design style, location, key features, and financials related to purchase and renovation.

- Key Stats: Shares industry size , growth trends, and relevant statistics for the short-term rental market.

- Key Trends : Highlights recent trends affecting the short-term rental sector, such as the rise of eco-friendly properties, technology integration, and the shift towards local experiences.

- Key Competitors: Analyzes main competitors and differentiates the business based on unique property offerings and guest experiences.

- SWOT : Strengths, weaknesses, opportunities, and threats analysis.

- Marketing Plan : Strategies for marketing the properties to maximize occupancy and revenue.

- Timeline : Key milestones and objectives from property acquisition and planning through launch and operational optimization.

- Management: Information on who manages the property rental business and their roles.

- Financial Plan : Projects the business’s financial performance, including revenue, profits, and expected expenses, with a focus on achieving profitability and sustainable growth.

Property Rental Business Plan (Airbnb / VRBO)

Fully editable 30+ slides Powerpoint presentation business plan template.

Download an expert-built 30+ slides Powerpoint business plan template

Executive Summary

The Executive Summary introduces your property rental business plan, providing a succinct overview of your rental operation and its offerings. It should detail your market positioning, the variety of properties you manage, their locations, sizes, and an overview of day-to-day management practices.

This section should also discuss how your property rental business will fit into the local real estate market, including the number of direct competitors in the area, identifying who they are, along with your business’s unique selling points that set it apart from these competitors.

Moreover, it’s important to include information about the management and co-founding team, detailing their roles and contributions to the business’s success. Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be presented here to provide a clear picture of your property rental business’s financial plan.

Property Rental Business Plan Executive Summary Example

Business Overview

The business overview should define the key characteristics of your rental business, including your approach to property selection, design, furnishing, and the tailored guest experiences you offer. Highlighting what sets your properties apart in the competitive short-term rental market is key to attracting interest and investment.

Example: “StayUnique Rentals,” a dynamic property rental business, has a portfolio of 7 unique properties, ranging from urban apartments to countryside cottages. Each property is meticulously designed and furnished to create a distinctive living experience. Beyond standard rentals, StayUnique offers personalized guest services like a 24/7 concierge, local experience packages, and tailored amenities, enhancing the overall guest experience.

Market Analysis

This section should analyze the short-term and vacation rental market’s size, growth trends, and competitive landscape . It positions your business within the industry and underscores its potential in meeting the growing demand for unique and flexible lodging options.

Example: StayUnique Rentals enters a US market valued at $19 billion, with a 1.49% CAGR. The business differentiates itself amidst various competitors by offering properties that provide unique, localized experiences, catering to a trend where travelers increasingly value authenticity and personalized services over traditional hotel stays.

Management Team

Detailing the management team’s background and roles is essential. This part of the summary should emphasize their experience in real estate, hospitality, and operational management, highlighting their capability to lead the business to success.

Example: The CEO of StayUnique, with 15 years of experience in real estate and hospitality, leads the business strategy and expansion. The COO, an expert in hospitality management, focuses on operational efficiency and guest experience, ensuring each property maintains high standards of service and guest satisfaction.

Financial Plan

Clearly outlining the financial goals and projections is crucial. This section should include revenue targets and profit margins, offering insight into the business’s financial health and growth prospects.

Example: StayUnique Rentals aims to achieve $800,000 in yearly revenue with a 5% EBIT margin by 2028. Supported by a strategic approach to property management and marketing, coupled with exceptional guest experiences, the company is positioned for significant growth in the evolving short-term rental market.

For a Property Rental Business, the Business Overview section can be effectively divided into 2 main sections:

Properties & Locations

Describe the range and types of properties within your portfolio, such as apartments, single-family homes, vacation rentals, or commercial spaces. Emphasize the diversity and quality of your properties, including any unique features or high-demand attributes they may have. Discuss the locations of your properties, stressing their accessibility and the convenience they offer to tenants.

Highlight properties that are strategically located near key amenities, such as public transport, business districts, schools, or recreational areas. Explain why these locations are beneficial in attracting and retaining your target tenants.

Amenities & Services

Detail the amenities and features available with your properties, such as in-unit laundry, security systems, fitness centers, communal spaces, or eco-friendly installations. Highlight how these amenities meet the needs and preferences of your target tenant demographic.

Outline your leasing terms and pricing strategy , ensuring they align with the value provided by your properties and the competitive market landscape. Discuss any flexible leasing options, promotional offers, or loyalty incentives you provide to enhance tenant retention and attract new tenants.

Market Overview

Industry Size & Growth

In the Market Overview of your property rental business plan, begin by examining the size of the property rental industry and its growth potential. This analysis is vital for understanding the market’s breadth and pinpointing opportunities for expansion.

Key Market Trends

Next, discuss recent trends in the property rental market, such as the growing demand for flexible leasing options, the rise of smart home technology in rental properties, and the increasing preference for properties with green, sustainable features. Highlight the shift towards more personalized tenant experiences and the popularity of properties that offer unique amenities, such as co-working spaces or pet-friendly environments.

Competitive Landscape

A competitive analysis is not just a tool for gauging the position of your property rental business in the market and its key competitors; it’s also a fundamental component of your business plan.

This analysis helps in identifying your property rental’s unique selling points, essential for differentiating your business in a competitive market.

In addition, competitive analysis is integral to laying a solid foundation for your business plan. By examining various operational aspects of your competitors, you gain valuable information that ensures your business plan is robust, informed, and tailored to succeed in the current market environment.

Identifying Your Competitors in the Property Rental Market

The first step to a comprehensive competitive analysis is to identify who your competitors are. Start by listing out local property rental agencies, including those that specialize in the same type of properties as you, such as luxury apartments, family homes, or vacation rentals. For example, if your focus is on high-end luxury rentals, your direct competitors would include other high-end rental agencies as well as luxury hotels offering extended stays. It’s also important to consider indirect competitors, like budget hotels or Airbnb hosts, which could offer alternative accommodation options to potential tenants.

Utilize online platforms like Zillow, Airbnb, and Booking.com to understand the geographical spread and concentration of competitors. Websites like Yelp and TripAdvisor, although more commonly associated with restaurants and travel, can also provide customer reviews and ratings for vacation rentals and long-term stays, offering insights into what tenants value or dislike about their experiences.

Property Rentals Competitors’ Strategies

When analyzing your competitors’ strategies, consider the following:

- Property Offerings: Evaluate their portfolio of rental properties. If a competitor like “CityView Rentals” is successfully attracting young professionals with its modern, tech-enabled apartments in the city center, this indicates a trend and a potential gap in your offerings.

- Rental Pricing: Compare your pricing with that of your competitors. Are your properties priced competitively with those offered by “Affordable Living Spaces,” or do they align more with the upscale properties managed by “Luxury Living Rentals”?

- Marketing Approaches: Observe how competitors market their properties. Do they rely heavily on digital marketing and platforms like Instagram and Facebook, or do they engage more with local community events and traditional advertising methods?

- Tenant Experience: Consider the overall tenant experience offered. A property management company known for its exceptional tenant service and community building, like “Happy Homes,” might provide insights into how to enhance your own tenant relations.

- Operational Efficiencies: Note if competitors are using technology or innovative methods to improve their operations, such as online rental payments, virtual property tours, or efficient maintenance request systems through “SmartRent Solutions.”

What’s Your Property Rental Business Unique Selling Point?

Reflect on what makes your property rental business unique. Perhaps you offer properties that come with unmatched amenities, or maybe your service is highly personalized, catering to the specific needs of each tenant.

Identify opportunities by listening to tenant feedback and observing industry trends. For instance, an increasing demand for pet-friendly accommodations or properties with green, sustainable features might represent a niche market that is underserved by your competitors.

Location Strategy: Consider how your properties’ locations influence your business strategy. A property rental business in a bustling city center might focus on convenience and proximity to amenities, while one in a more scenic or secluded area might emphasize the peace, privacy, and unique experiences available to tenants.

First, conduct a SWOT analysis for your property rental business, identifying Strengths (like diverse property portfolio and prime locations), Weaknesses (such as maintenance costs or vacancy rates), Opportunities (for instance, the growing demand for flexible housing and rental spaces), and Threats (like market saturation or regulatory changes impacting rental operations).

Marketing Plan

Then, devise a marketing strategy that details how to attract and retain tenants through strategic online listings, virtual tours, referral incentives, a strong online presence, and engagement with the local community.

Marketing Channels

Utilize various marketing channels to effectively showcase your rental properties and entice prospective tenants.

Digital Marketing

Establish a strong online presence:

- Property Listing Websites: Advertise your properties on popular rental listing platforms, providing detailed descriptions, high-quality images, and virtual tours.

- Social Media : Establish a robust online presence by listing properties on renowned rental platforms, providing detailed descriptions, high-quality images, and engaging virtual tours. Leverage social media platforms like Facebook, Instagram, and LinkedIn to showcase property highlights, share tenant testimonials, and offer insights into the local community.

- Email Marketing: Build an email list of potential tenants and send regular newsletters featuring available properties, leasing specials, and local community updates.

Local Advertising

Connect with the local community:

- Real Estate Publications: Advertise in local real estate magazines, newspapers, and online forums to reach a wider audience.

- Community Engagement: Participate in local events, sponsor community initiatives, and collaborate with neighborhood associations to increase visibility and credibility.

Promotional Activities

Entice potential tenants with attractive offers:

- Special Rental Deals: Introduce limited-time promotions such as ‘Move-in Specials’ with reduced security deposits or ‘Refer-a-Friend’ programs offering incentives for tenant referrals.

- Tenant Incentives: Offer incentives like a month of free rent for longer lease commitments or complimentary amenities for new tenants.

Sales Channels

Sales channels in property rental encompass diverse methods through which you promote and offer rental services to potential tenants, playing a pivotal role in revenue generation and ensuring tenant satisfaction.

- Property Tours and Open Houses: Organize captivating property tours and open houses showcasing unique property features and benefits to prospective tenants. Engaging and informative tours significantly impact tenant interest and engagement. Informative tours significantly influence tenant interest and contribute to successful lease agreements.

- Online Leasing Platforms: Implement user-friendly online leasing platforms that simplify the application process, enable digital lease signing, and facilitate secure rental payments. Seamless online platforms enhance tenant convenience and streamline the leasing process. Offer digital lease signing and secure payment options, enhancing tenant convenience and expediting lease finalization.

Tenant Retention Strategies

Focus on retaining existing tenants:

- Exceptional Tenant Service: Focus on exceptional tenant service, providing timely responses and personalized experiences to build strong tenant-landlord relationships. Superior service enhances tenant satisfaction and loyalty.

- Renewal Incentives: Offer attractive lease renewal incentives such as rent discounts, property upgrades, or exclusive amenities to encourage existing tenants to extend their leases. Rewarding loyalty reinforces tenant retention and ensures prolonged occupancy.

Strategy Timeline

Lastly, establish a comprehensive timeline that marks key milestones for the launch of your rental operations, marketing initiatives, tenant engagement plans, and growth or diversification goals, ensuring the business progresses with a focused and strategic approach.

The Management section focuses on the property rental business’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the property rental business towards its financial and operational goals.

For your property rental business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your property rental business’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs and capital expenditures.

For your property rental business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here _ Profit and Loss _ Cash Flow Statement _ Balance Sheet _ Use of Funds

Related Posts

Real Estate Broker Business Plan PDF Example

- June 17, 2024

Home Inspection Business Plan PDF Example

Competitive Analysis for a Real Estate Broker Business (Example)

- May 14, 2024

- Business Plan , Competitive Analysis

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Properties Business Plan

You’ve come to the right place to create your Rental Property business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their rental property business.

Rental Property Business Plan Example

Below is a template to help you create each section of your rental property business plan.

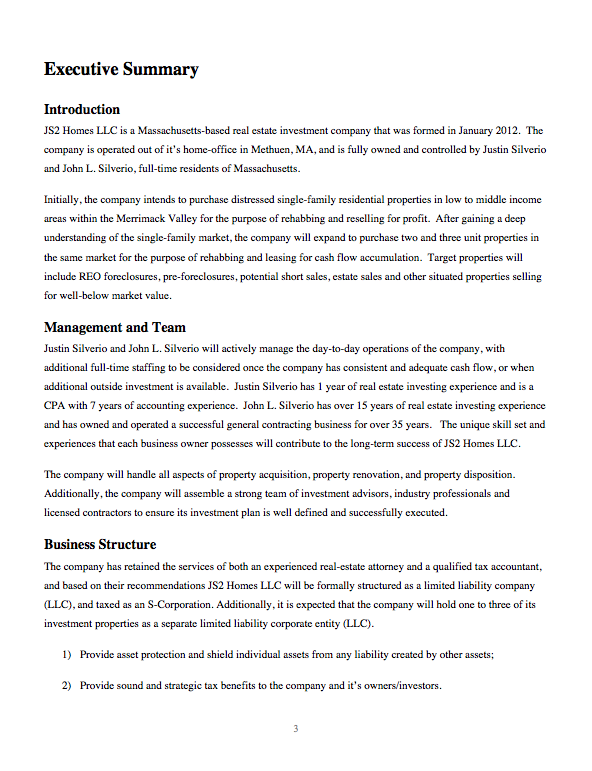

Executive Summary

Business overview.

Noble Properties is a rental property agency in Seattle, Washington, that specializes in managing, renting, and leasing properties. Our mission is to provide luxury rentals that tenants can call home for years to come. Noble Properties rents out hundreds of homes across the Seattle area, including apartments, single-family homes, and trailers. To help prospective tenants find the perfect home, the company has created an online platform that allows them to search by their specific criteria (number of bedrooms, amenities, rent, etc.). We aim to be one of the most popular rental agencies in the area that customers can depend on again and again for their housing needs.

Noble Properties is founded and run by Joseph Pierce. He has worked in the industry for decades and has extensive knowledge of all aspects of the business. He will be in charge of most of the operations but will hire other staff to help with marketing, accounting, and managing the rentals.

Product Offering

Noble Properties offers a variety of properties for prospective tenants to choose from. Some of the options we provide include:

- 1-3 bedroom apartments

- Single-family homes

- Multi-unit buildings

- Short-term rentals

- Mobile homes or trailers

Customer Focus

Noble Properties will target renters located throughout the Seattle area. Most renters are under the age of 40 and earn about the median income. This means that we will primarily market to younger demographics and those who earn around the local median income or more.

Management Team

Noble Properties is led by Joseph Pierce, who has been in the rental property industry for 20 years. Throughout that time, he worked in various positions in local rental property agencies but is now eager to start a rental property business of his own. During his extensive experience in the rental property industry, he acquired an in-depth knowledge of the local area, local regulations, facilities, and the characteristics of different neighborhoods. He also has extensive experience in handling business management activities.

Karen Miller has been Joseph Pierce’s loyal administrative assistant for over ten years at his former rental agency. Joseph relies strongly on Karen’s diligence, attention to detail, and focus when organizing his clients, schedule, and files. Karen has worked in the rental agency industry for so long that she has a thorough knowledge of all aspects required to run a successful rental agency. She will help out with administrative tasks and some of the initial marketing efforts.

Success Factors

Noble Properties will be able to achieve success by offering the following competitive advantages:

- The founder, Joseph Pierce, has decades of extensive experience and knowledge of the industry that will prove invaluable for the company.

- The company will purchase rentals in popular areas around the city, putting our rentals in high demand.

- Noble Properties offers reasonable and affordable rates for all our rentals. Our pricing will be far more cost-effective than the competition.

Financial Highlights

Noble Properties is seeking $1,100,000 in debt financing to launch its rental property agency. The funding will be dedicated to securing initial rental spaces, securing an office space, and purchasing office equipment and supplies. Funding will also be dedicated toward six months of overhead costs, including payroll, rent, and marketing costs. The breakdown of the funding is below:

- Purchasing initial rentals: $600,000

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $20,000

- Six months of overhead expenses (payroll, rent, utilities): $350,000

- Marketing costs: $50,000

- Working capital: $60,000

Company Overview

Who is noble properties, noble properties’ history.

After decades of working for other rental agencies, Joseph Pierce decided to launch an agency of his own. He conducted extensive research on the rental market in the Seattle area. This helped him determine the best spots to find in-demand rentals and how much he should rent them out for. He also did extensive marketing research to determine the best customer segments to market to. After conducting this research and finding a potential office location, Joseph Pierce incorporated Noble Properties as an S-Corporation.

Noble Properties’ operations are currently being run out of Joseph Pierce’s home office but will move to the office location once the lease is finalized.

Since incorporation, Noble Properties has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined rent/leasing and financing requirements

- Found a potential office location and signed a Letter of Intent to lease it

- Began recruiting key employees with experience in the rental homes/apartment industry

Noble Properties’ Products

Industry analysis.

The rental market is expected to continue to grow over the next five years. According to RentCafe, the average rent for a Seattle apartment is around $2,300 per month. This value is only expected to increase as the demand for apartments and other rentals skyrockets. Furthermore, Seattle’s vacancy rate is incredibly low and expected to decrease further, meaning there aren’t enough rentals to keep up with demand.

The growth is primarily driven by increasing housing prices. Now that housing prices have increased substantially, fewer and fewer people can afford to buy a home. Therefore, many people seek out rentals to live in since they are far more affordable.

Another factor that will help the Seattle rental market is the increasing population. More people are moving to the city, meaning the demand for homes and rentals will continue to soar. This will only push rental prices even higher, which will increase the local rental market’s value substantially.

This is a great market to start a rental agency in. By capitalizing on these trends, Noble Properties is expected to have great success.

Customer Analysis

Demographic profile of target market.

Noble Properties’ target market includes people of all demographics. We are open to offering rentals to people of all ages and groups as long as they can afford to pay their rent. From our initial market research, we expect most of our marketing efforts will target young adults, medium and high-income individuals, and families.

The precise demographics for Seattle, Washington, are:

Customer Segmentation

Noble Properties will primarily target the following customer profiles:

- Young adults

- Individuals who earn the region’s median income or more

Competitive Analysis

Direct and indirect competitors.

Noble Properties will face competition from other companies with similar business profiles. A description of each competitor company is below.

Leasing Inc.

Leasing Inc. is a marketplace for finding rental homes and apartments in multiple metropolitan areas around the country. It originally started more than a decade ago as a networking tool for real estate agents, but today it is a fully searchable online database of homes for both sale and rent. Leasing Inc. offers ideal rental properties, all with different amenities that can best suit the tenant’s requirements. Leasing Inc.’s properties are well furnished with all modern accessories and priced competitively.

Rental Barn

Rental Barn is the most visited rental agency website in the United States. Rental Barn and its affiliates offer customers an on-demand experience for selling, buying, renting, and financing with transparency and nearly seamless end-to-end service. The company’s rental property portfolio provides multiple rental apartments according to the customer’s needs and requirements.

Seattle Properties

Seattle Properties is a local rental property business that has dominated the market since 1982. The company manages and rents out hundreds of properties all across the city, including apartments, single-family homes, and mobile homes. All prices are competitive, and some rentals qualify for government programs to help low-income individuals. The company also utilizes a well-designed website to help prospective tenants find their perfect home based on rent, location, and accessories.

Competitive Advantage

- The company will purchase rentals in popular areas around the city, making our rentals in high demand.

Marketing Plan

Brand & value proposition.

The Noble Properties brand will focus on the company’s unique value proposition:

- Offering homes/apartments for rent suited for families and working professionals.

- Offering a diverse range of rental homes in a prime location for a competitive rate.

- Providing excellent customer service.

Promotions Strategy

The promotions strategy for Noble Properties is as follows:

Print Advertising

Noble Properties will invest in professionally designed print ads to display in programs or flyers at industry networking events and relevant local establishments.

Website/SEO Marketing

Noble Properties has designed a website that is well-organized and informative, and lists all our available properties. The website also lists the company’s contact information and other services it provides. We will utilize SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Seattle rental properties” or “rentals near me,” Noble Properties will be listed at the top of the search results.

Referrals

Noble Properties understands that the best promotion comes from satisfied tenants. The company will encourage its tenants to refer other individuals by providing economic or financial incentives for every new tenant produced. This strategy will increase effectiveness after the business has already been established.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand the changing customer needs.

The real estate industry fluctuates, and therefore, rental prices, for the most part, are usually out of a company’s control. However, Noble Properties will market its properties at a competitive rate to ensure we do not have vacant properties. We will also keep tight control of costs in order to maximize profits.

Operations Plan

The following will be the operations plan for Noble Properties.

Operation Functions:

- Joseph Pierce will be the Owner and President of the company. He will oversee all staff and manage tenant relations. Jay has spent the past year recruiting the following staff:

- Karen Miller will serve as the Office Manager. She will manage the office administration, client files, and accounts payable. She will also handle much of the marketing efforts until the agency becomes large enough to hire a marketing team.

- Tim Johnson will be the Maintenance Director, who will provide all maintenance at the properties.

- Joseph will outsource professionals to handle the accounting and human resources aspects of the business.

- Joseph will also hire Rental Managers for the various properties as the agency continues to grow.

Milestones:

Noble Properties will have the following milestones completed in the next six months.

5/1/202X – Finalize contract to lease office space.

5/15/202X – Finalize personnel and staff employment contracts for the Noble Properties team.

6/1/202X – Begin moving into Noble Properties office.

7/1/202X – Finalize purchases of initial properties that will be rented.

7/15/202X – Begin networking and marketing efforts.

8/1/202X – Noble Properties opens its office and rentals for business.

Financial Plan

Key revenue & costs.

Noble Properties’ revenue will come from rental income, property management fees and deposits received from tenants.

The major costs for the company will be staff salaries and property maintenance. In the initial years, the company’s marketing spending will be high to establish itself in the market.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Number of Managed Properties Per Month: 10

- Average Rent Per Month: $2,300

- Office Lease per Year: $100,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Rental Properties Business Plan FAQs

What is a rental property business plan.

A rental property business plan is a plan to start and/or grow your rental properties business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your rental properties business plan using our rental properties Business Plan Template here .

What are the Main Types of Rental Property Businesses?

There are a number of different kinds of rental property companies , some focus on Single family homes, Multi-family properties and others on Short-Term Rental properties.

How Do You Get Funding for Your Rental Property Business Plan?

Rental Property Businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding. This is true for a real estate rental business plan or a rental property business plan.

A well-crafted rental property business plan is essential to securing funding from any type of potential investor.

What are the Steps To Start a Rental Properties Business?

Starting a rental property business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Rental Property Business Plan - The first step in starting a business is to create a detailed business plan for a rental property that outlines all aspects of the venture. This should include a market analysis, information on the services you will offer, marketing strategy, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your rental properties business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your rental properties business is in compliance with local laws.

3. Register Your Rental Properties Business - Once you have chosen a legal structure, the next step is to register your rental properties business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your rental properties business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Rental Properties Equipment & Supplies - In order to start your rental properties business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your rental properties business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful rental properties business:

- How to Start a Rental Properties Business

Rental Properties Business Plan Template [Updated 2024]

Rental Properties Business Plan Template

If you want to start a Rental Property business or expand your current Rental Property business, you need a business plan.

The following Rental Property business plan template gives you the key elements to include in a winning Rental Properties business plan.

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

Rental Property Business Plan Example

Below are the key sections of a successful rental property business plan. Once you create your plan, download it to PDF to show banks and investors.

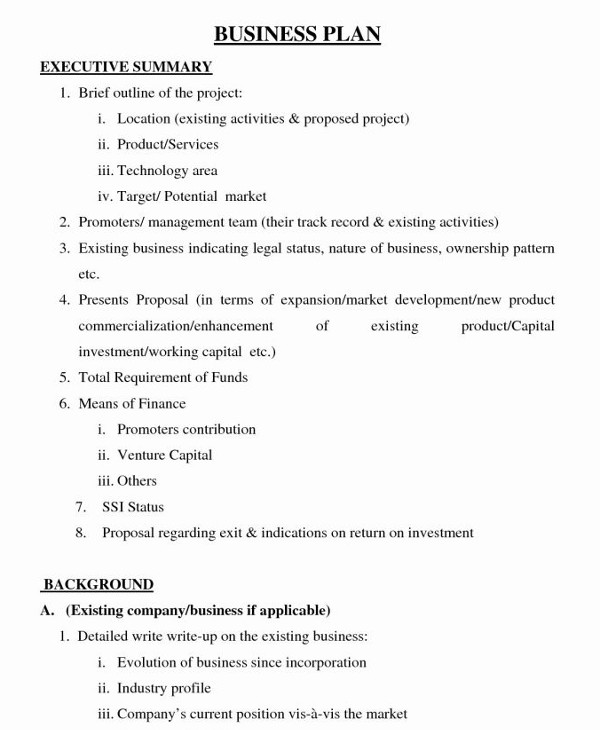

I. Executive Summary

Business overview.

[Company Name] is a rental property agency in [location name] that specializes in managing, renting and leasing properties. [Company Name] rents homes in dozens of markets across the country and has an online platform that allows customers to search by their specific criteria (number of bedrooms, region, amenities, etc.) to find a property that’s right for them in their preferred location.

Products Served/Service offering

The Company offers a variety of rental properties, listed below:

- 1-3 bedroom apartments

- Single family homes

- Multi-unit buildings

- Short-term rentals

- Rental of mobile homes or trailers

Customer Focus

[Company Name] will primarily provide its offerings to local renters, students and local professionals. The demographics of the customers are given as below:

- First time renters-29%

- Young adults-21%

- Perma – renters-16%

- Middle income boomers-11%

- Families-14%

Management Team

[Company Name] is led by [Founder’s name], who has been in the rental property industry for [x] years. During his extensive experience in the rental property industry, he [founder] acquired an in-depth knowledge of the local area, local regulations, facilities, and the characteristics of different neighborhoods. He also holds rich experience in handling business management activities (i.e., staffing, marketing, etc.).

Success Factors

[Company Name] is qualified to succeed due to the following reasons:

- There is currently a high demand for rental property services in the community. In addition, the company surveyed the local population and received highly positive feedback pointing towards an explicit demand for the products, supporting the business after launch.

- The Company’s online marketplace offers a high-volume traffic area and will thus be highly convenient to a significant number of residents living anywhere.

- The management team has a track record of success in the rental property business.

- The rental property business has proven to be a successful industry in the United States.

Financial Highlights

[Company Name] is currently seeking $370,000 to launch its rental property business. Specifically, these funds will be used as follows:

- Website design/build and startup business expenses: $120,000

- Working capital: $250,000 to pay for marketing, salaries, and lease costs until [Company Name] reaches break-even

| Financial Summary | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Revenue | $965,742 | $1,878,611 | $2,718,300 | $3,477,900 | $4,285,228 |

| Total Expenses | $390,241 | $630,018 | $931,935 | $1,171,906 | $1,429,992 |

| EBITDA | $575,501 | $1,248,593 | $1,786,365 | $2,305,994 | $2,855,237 |

| Depreciation | $8,720 | $8,720 | $8,720 | $8,720 | $8,720 |

| EBIT | $566,781 | $1,239,873 | $1,777,645 | $2,297,274 | $2,846,517 |

| Interest | $5,077 | $4,442 | $3,807 | $3,173 | $2,538 |

| PreTax Income | $561,705 | $1,235,431 | $1,773,838 | $2,294,101 | $2,843,978 |

| Income Tax Expense | $196,597 | $432,401 | $620,843 | $802,935 | $995,392 |

| Net Income | $365,108 | $803,030 | $1,152,995 | $1,491,166 | $1,848,586 |

| Net Profit Margin | 38% | 43% | 42% | 43% | 43% |

II. Company Overview

Who is [company name].

[Company Name], located in [insert location here], is a rental property agency focusing on providing short-term and long-term rentals, as well as leased properties to the local community. [Company Name’s] rental properties have a clean and modern appearance that appeals to the current renter’s market. The [Company]’s properties will be fully furnished and include high-end technology and modern accessories.

[Company Name] is owned by [Founder’s Name]. While [Founder’s Name] has been in the rental property industry for some time, it was in [month, date] that he decided to launch [Company Name]. He evaluates that the growing number of students, working professionals, and overseas relocations create a need and expects growth in the country’s rental property market.

[Company Name]’s History

Upon surveying the local customer base and finding the potential retail location, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

[Founder’s Name] has selected an initial office location and is currently undergoing due diligence on each property and the local market to assess the most desirable location for additional offices.

[Company’s Name] operations are currently being run out of [Founder’s Name] home office.

Since incorporation, the company has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined rent/leasing and financing requirements

- Began recruiting key employees with experience in the rental homes/apartment industry

[Company Name]’s Products

Iii. industry analysis.

You can download our Rental Property Business Plan Template (including a full, customizable financial model) to your computer here. The market size of the rental property industry in the US increased immensely, and the market size, measured by revenue, of the rental property industry, is $174.2 billion. Rental income units are an increasingly important part of the US housing market. The return on expenditure in the property market is much better than in many economic sectors.

With tenant demand in the US increasing last year, this is thought to be related to tenants looking to downsize or move further out to save money. Most rental housing in the US is developed, financed, and owned by a diverse group of private, for-profit companies.

As the economy of the US began to grow and demand for rental apartments rose, industry revenue grew at a rapid pace, hence opening vast opportunities for rental property companies.

Another obvious trend that is common with rental property companies in the US is that most of them are improvising on more means of making money in the apartment rental industry; they are also acting as property developers and home staging agents, amongst other things.

IV. Customer Analysis

Demographic profile of target market.

[Company Name’s] target market include people of all demographics. The market [Company Name] serves is value-conscious and desires high comfort and basic amenities geared towards families, students, and the working population.

| Springdale | Wyndham | |

|---|---|---|

| Total Population | 26,097 | 10,725 |

| Square Miles | 6.89 | 3.96 |

| Population Density | 3,789.20 | 2,710.80 |

| Population Male | 48.04% | 48.84% |

| Population Female | 51.96% | 51.16% |

| Target Population by Age Group | ||

| Age 18-24 | 3.68% | 3.52% |

| Age 25-34 | 5.22% | 4.50% |

| Age 35-44 | 13.80% | 13.91% |

| Age 45-54 | 18.09% | 18.22% |

| Target Population by Income | ||

| Income $50,000 to $74,999 | 11.16% | 6.00% |

| Income $75,000 to $99,999 | 10.91% | 4.41% |

| Income $100,000 to $124,999 | 9.07% | 6.40% |

| Income $125,000 to $149,999 | 9.95% | 8.02% |

| Income $150,000 to $199,999 | 12.20% | 11.11% |

| Income $200,000 and Over | 32.48% | 54.99% |

Customer Segmentation

The Company will primarily target the following three customer segments:

- High-Income Individuals: The Company will attract individuals with higher incomes who are looking for a rental property with modern furnishings and technology.

- Families: The Company will attract families looking for turn-key properties that are furnished and offer an array of amenities to suit their busy family life.

- Working Professionals: [Company name] is located along a well-traveled commute route, by offering a smart property to working professionals with walking distance (not more than 10 minutes) to a means of transport.

V. Competitive Analysis

Direct & indirect competitors.

Leasing Inc Leasing Inc is a marketplace to find rental homes in the country. It originally started more than a century ago as a networking tool for real estate agents, but today it is a fully searchable online database of homes for both sale and rent. Leasing Inc offers an ideal rental property with different amenities that can best suit the customer’s requirements. Leasing Inc’s properties are well furnished with all modern accessories.

Rental Barn Rental Barn is the most visited real estate website in the United States. Rental Barn and its affiliates offer customers an on-demand experience for selling, buying, renting, and financing with transparency and nearly seamless end-to-end service. The Company provides multiple rental apartments according to the customer’s needs and requirements.

Homewood Properties Homewood Properties is a leading digital marketing solutions company that empowers millions nationwide to find apartments and houses for rent. Customers can click on the items that are important to them, from hardwood floors to walk-in closets, and select the property which they are looking for according to their needs.

Competitive Advantage

[Company Name] enjoys several advantages over its competitors. These advantages include:

- Client-oriented service: [Company Name] will have a full-time sales manager to stay in contact with clients and answer their everyday questions. [Founder’s Name] realizes the importance of accessibility to his clients and will further keep in touch with his clients through newsletters.

- Robust clientele base: Another possible competitive strategy for winning the competitors in this particular industry is to build a robust clientele base and ensure that the company’s properties are top-notch and trendy. The Company is well-positioned, key members of its team are highly competent, and can favorably compete with some of the best players in the industry.

- Management: The Company’s management team has X years of business and marketing experience that allows them to market and serve customers in an improved and sophisticated manner than the competitors.

- Relationships: Having lived in the community for xx years, [Founder’s Name] knows all leaders, newspapers, and other influencers, including the local leaders who fought the [Competitor] opening xx years ago. It will be relatively easy for the company to build branding and awareness of the rental property industry.

VI. Marketing Plan

The [company name] brand.

The [Company Name] brand will focus on the company’s unique value proposition:

- Offering homes/apartments for rent suited for families, students, working professionals, landowners, foreign investors, and international migrants.

- Offering a diverse range of rental homes in a prime location.

- Providing excellent customer service.

Promotions Strategy

[Company Name] expects its target market to be students, international migrants, the working population, families mainly from surrounding locations in the [Location]. The Company’s promotions strategy to reach these individuals includes:

Phone Prospecting [Company Name] will assign salespeople to contact and work with clients to help them buy, sell or rent real estate properties. Salespeople will use their in-depth knowledge of the real estate market to help clients find rental properties and execute all the required formalities.

Advertisement Advertisements in print publications like newspapers, magazines, etc., are an excellent way for businesses to connect with their audience. The Company will advertise its offerings in popular magazines and news dailies. Obtaining relevant placements in industry magazines and journals will also help in increasing brand visibility.

Public Relations [Company Name] will hire an experienced PR agency/professional(s) to formulate a compelling PR campaign to boost its brand visibility among the target audience. It will look to garner stories about the company and its offerings in various media outlets like newspapers, podcasts, television stations, radio shows, etc.

Referrals [Company name] understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase effectiveness after the business has already been established. Additionally, [company name] will aggressively network with useful sources such as home contractors, real estate development companies, and businesses. This network will generate qualified referral leads.

Social Media Marketing Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The Company will use social media to develop engaging content that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand the changing customer needs.

Pricing Strategy

Part of the [Company Name’s] business strategy is to ensure that it will work within the budget of its clients to deliver excellent properties. The real estate industry fluctuates and therefore, rental prices, for the most part, are usually out of a company’s control. However, the company will market their properties at a competitive rate to ensure they do no have vacant properties. They will also keep a tight control on costs in order to maximize profits.

VII. Operations Plan

Functional roles.

To execute on [Company Name]’s business model, the company needs to perform many functions, including the following:

Administrative Functions

- General & administrative functions including legal, marketing, bookkeeping, etc.

- Hiring and training staff

Service and Operations Functions

- Rental property maintenance

- Website maintenance, updates, and bug-fixing

- Ongoing search engine optimization

| Date | Milestone |

|---|---|

| [Date 1] | Finalize lease agreement |

| [Date 2] | Design and build out [Company Name] |

| [Date 3] | Hire and train initial staff |

| [Date 4] | Kickoff of promotional campaign |

| [Date 5] | Launch [Company Name] |

| [Date 6] | Reach break-even |

VIII. Management Team

Management team members.

[Company Name] is led by [Founder’s Name], who has been in the rental property business for xx years. He has worked in the industry most recently as a [Position Name] and has held various different positions in the management chain over the last xx years. As such, [Founder] has an in-depth knowledge of the rental property business, including operations and business management.

[Founder] has also worked as a real estate consultant on a part-time basis over the past xx years.

[Founder] graduated from the University of ABC and has done Master of Professional Studies in Real Estate.

Hiring Plan

[Founder] will serve as the [Position Name]. In order to introduce the rental property business, the company needs to hire the following personnel:

- Real estate agent (should have real estate sales experience in residential and commercial property)

- Property Manager

- Marketing and Sales Executive

- Part-Time Bookkeeper (will manage accounts payable, create statements, and execute other administrative functions)

- Customer Service Manager

IX. Financial Plan

Revenue and cost drivers.

[Company Name]’s revenue will come from the renting properties. The major costs for the company will be staff salaries and property maintenance. In the initial years, the company’s marketing spend will be high to establish itself in the market.

Capital Requirements and Use of Funds

[Company Name] is currently seeking $370,000 to launch its rental property business. The capital will be used for funding capital expenditures, workforce costs, marketing expenses, and working capital. Specifically, these funds will be used as follows:

Key Assumptions

| Annual Number of Rented Properties | |

|---|---|

| Year 1 | 20 |

| Year 2 | 30 |

| Year 3 | 40 |

| Year 4 | 50 |

| Year 5 | 60 |

| Average annual growth rate | 5% |

| Monthly mortgage/lease | $3000 |

5 Year Annual Income Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Product/Service A | $151,200 | $333,396 | $367,569 | $405,245 | $446,783 | |

| Product/Service B | $100,800 | $222,264 | $245,046 | $270,163 | $297,855 | |

| Total Revenues | $252,000 | $555,660 | $612,615 | $675,408 | $744,638 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $57,960 | $122,245 | $122,523 | $128,328 | $134,035 | |

| Lease | $60,000 | $61,500 | $63,038 | $64,613 | $66,229 | |

| Marketing | $20,000 | $25,000 | $25,000 | $25,000 | $25,000 | |

| Salaries | $133,890 | $204,030 | $224,943 | $236,190 | $248,000 | |

| Other Expenses | $3,500 | $4,000 | $4,500 | $5,000 | $5,500 | |

| Total Expenses & Costs | $271,850 | $412,775 | $435,504 | $454,131 | $473,263 | |

| EBITDA | ($19,850) | $142,885 | $177,112 | $221,277 | $271,374 | |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 | |

| EBIT | ($56,810) | $105,925 | $140,152 | $184,317 | $234,414 | |

| Interest | $23,621 | $20,668 | $17,716 | $14,763 | $11,810 | |

| PRETAX INCOME | ($80,431) | $85,257 | $122,436 | $169,554 | $222,604 | |

| Net Operating Loss | ($80,431) | ($80,431) | $0 | $0 | $0 | |

| Income Tax Expense | $0 | $1,689 | $42,853 | $59,344 | $77,911 | |

| NET INCOME | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 | |

| Net Profit Margin (%) | - | 15.00% | 13.00% | 16.30% | 19.40% |

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $21,000 | $23,153 | $25,526 | $28,142 | $31,027 | |

| Total Current Assets | $37,710 | $113,340 | $184,482 | $286,712 | $423,416 | |

| Fixed assets | $246,450 | $246,450 | $246,450 | $246,450 | $246,450 | |

| Depreciation | $36,960 | $73,920 | $110,880 | $147,840 | $184,800 | |

| Net fixed assets | $209,490 | $172,530 | $135,570 | $98,610 | $61,650 | |

| TOTAL ASSETS | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $317,971 | $272,546 | $227,122 | $181,698 | $136,273 | |

| Accounts payable | $9,660 | $10,187 | $10,210 | $10,694 | $11,170 | |

| Total Liabilities | $327,631 | $282,733 | $237,332 | $192,391 | $147,443 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| Total Equity | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| TOTAL LIABILITIES & EQUITY | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 |

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | |||||

| Net Income (Loss) | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 |

| Change in working capital | ($11,340) | ($1,625) | ($2,350) | ($2,133) | ($2,409) |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 |

| Net Cash Flow from Operations | ($54,811) | $118,902 | $114,193 | $145,037 | $179,244 |

| CASH FLOW FROM INVESTMENTS | |||||

| Investment | ($246,450) | $0 | $0 | $0 | $0 |

| Net Cash Flow from Investments | ($246,450) | $0 | $0 | $0 | $0 |

| CASH FLOW FROM FINANCING | |||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 |

| Cash from debt | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| Net Cash Flow from Financing | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| SUMMARY | |||||

| Net Cash Flow | $16,710 | $73,478 | $68,769 | $99,613 | $133,819 |

| Cash at Beginning of Period | $0 | $16,710 | $90,188 | $158,957 | $258,570 |

| Cash at End of Period | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 |

Comments are closed.

ZenBusinessPlans

Home » Sample Business Plans » Real Estate

How to Write a Rental Property Business Plan (Sample Template)

Are you about starting a rental property business? If YES, here is a complete sample rental property business plan template & feasibility report you can use for FREE . The Apartment Rental industry is a very vast industry and there are loads of businesses opening up in the industry. There are several business opportunities an aspiring entrepreneur who has good capital base can start and one of such opportunities is a rental property business.

If you want to start a rental property business, then you need to write your own business plan. The essence of writing a business plan before starting any business is for you to have a blueprint of how you want to setup, manage and expand your business. Below is a sample rental property company business plan template that will help you to successfully write yours with little or no stress.

A Sample Rental Property Business Plan Template

1. industry overview.

Rental property business is grouped under the Apartment Rental industry and this industry is made up of companies that rent one-unit structures, two- to four-unit structures, five- to nine-unit structures, 10- to 19-unit structures, 20- to 49-unit structures and 50- or more unit structures.

In the united states, states such as Texas, New York, and Colorado, make it mandatory for rental property companies to be licensed real estate brokers if they are going to be involved in collecting rent, listing properties for rent, helping to negotiate leases and doing inspections as required by their business.

Although a property manager may be a licensed real estate salesperson but generally, they must be working under a licensed real estate broker. A few states such as Idaho, Maine, and Vermont do not require property managers to have real estate licenses.

Other states such as Montana, Oregon, and South Carolina, allow property managers to work under a property management license rather than a broker’s license. Washington State requires property rental companies to have a State Real Estate License if they do not own the property.

Landlords who manage their own property are not required by the law to have a real estate license in many states; however, they must at least have a business license to rent out their own home. It’s only landlords who do not live close to the rental property that may be required, by local government, to hire the services of a property management company.

Statistics has it that in the United States of America alone, there are about 518,271 licensed and registered apartment rental companies scattered all across the country and they are responsible for employing about 769,588 employees.

The industry rakes in a whooping sum of $154 billion annually with an annual growth rate projected at 2.4 percent within 2013 and 2018. Please note that the Apartment Rental industry has no companies with major market shares in the United States of America.

A recent research conducted by IBISWorld shows that operators in the Apartment Rental industry have performed strongly over the five years to 2018; however, industry performance softened in 2017 and 2018 as vacancy increased in those years.

Since the subprime mortgage crisis, the industry has undergone structural change. Leading up to the crisis, most investment in real estate was carried out by institutional investors (those who own 10 properties or more), whereas today, most properties for rent are single-investor owned and nonowner occupied.

Historic lows in homeownership, decreasing rental vacancy rates and surging demand for rental units have enabled landlords to increase rents, aiding revenue growth. Therefore, IBISWorld expects industry revenue to climb at an annualized 2.4 percent to $153.9 billion. In the same timeframe, the number of businesses has grown by 0.5% and the number of employees has grown by 0.4 percent.

No doubt, if an entrepreneur who intends starting his or her own property rental business has the right connections, networks, managerial skills, and takes delight in managing real estate for clients, then he or she is going to find property rental business very rewarding and lucrative.

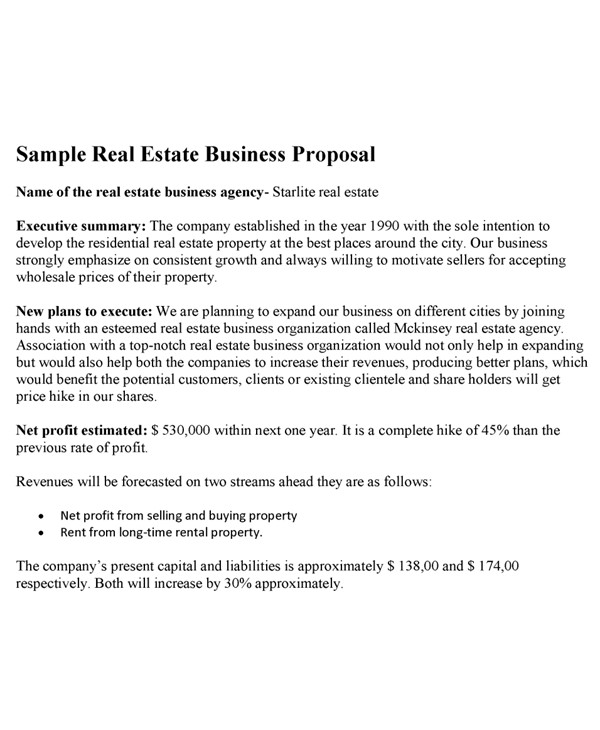

2. Executive Summary

John Johnson & Co® Property Rental Agency, LLP is a real estate agency that will operate in all the West Coast of the United States of America but will be headquartered in San Diego – California. We intend to become specialists in owning, developing, acquiring, managing, selling and renting/leasing and disposing student accommodation, residential apartments, office apartments and hall facilities et al.