- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Banks and Financial Institutions

How to Assume a Car Loan

Last Updated: February 6, 2024 References

This article was co-authored by Ryan Baril . Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing. There are 11 references cited in this article, which can be found at the bottom of the page. This article has been viewed 36,290 times.

Both car owners and potential buyers can benefit from assuming a car loan. Buyers who are unable to make payments can find someone else who can. Potential buyers can get a car without having to make a down payment or paying other fees. [1] X Research source However, the lender must agree to the assumption of any loan. If you happen to hold a loan and can’t get someone to assume it, then consider other options.

Applying to Assume a Loan

- Look on your credit card statement. Many credit card issuers provide free credit scores. Also look at your online account.

- Use a free online service, such as Credit.com. Some online companies charge, so make sure to use only a free service.

- Buy your FICO score from myfico.com.

- Meet with a credit or housing counselor. They should be able to get your credit score for free.

- Be careful, as there are many versions of your credit score. Be sure to ask lenders what model they use.

- Of course, a potential buyer might not need to assume a loan if they have a cosigner. Instead, they can get their own car loan directly. [6] X Research source

Completing the Assumption

- If you’re assuming a loan, ask about anything you don’t understand and meet with a lawyer if necessary.

- Be sure also to check the loan’s balance and term and that it is no longer or higher than the person you are assuming it from has told you.

- You can obtain a referral to a lawyer by contacting your local or state bar association.

- If you’re the former owner of the car, you’ll need to cancel your insurance policy. [11] X Research source There’s no reason to keep making payments.

Considering Other Options If You Can’t Transfer Your Loan

- Find your lender’s contact information on your monthly statement.

- Have a reason why you can’t make the payment. For example, you might have had a medical emergency that used up your extra money that month.

- One huge pitfall is that you put your home at risk if you can’t make payments. [15] X Research source However, this might be less of a concern if you don’t owe much money.

- Your HELOC’s interest rate is also variable, so you might pay more in interest than you would on the car loan. You should talk to a lender to see if HELOC interest rates would benefit you.

- 3 Ask a friend or family member for a small loan. Keep on top of your car payments by asking someone close to you if you can borrow money. They might be willing to lend to you with little or no interest, which will help you manage your car loan while you straighten out your finances.

- Also check the loan terms for your new car. Ideally, you’ll have a much lower monthly payment that you can afford. [16] X Research source

Expert Q&A

You might also like.

- ↑ http://www.loan.com/car-loans/the-basics-of-assuming-a-car-loan.html

- ↑ http://www.dmv.org/buy-sell/auto-loans/taking-over-an-auto-loan.php

- ↑ https://www.consumerfinance.gov/askcfpb/316/where-can-i-get-my-credit-score.html

- ↑ https://www.credit.com/blog/transfer-car-loan/

- ↑ https://www.clearpoint.org/blog/cant-make-your-car-payments-try-these-strategies/

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

About This Article

- Send fan mail to authors

Did this article help you?

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Don’t miss out! Sign up for

wikiHow’s newsletter

Auto Loan Amortization Calculator

See how much buying a new car will cost you with our easy auto loan calculator! Whether you're looking to buy a new car, refinance your existing vehicle, or buy out a lease, this calculator will help you make the right decision. All you'll need is some necessary information, and you'll see the monthly payment, how much you'll spend in interest, and the total cost of your car, including all taxes and fees. Before you sign on the dotted line at a dealership, try different loan terms, rates, and down payments on our calculator to see what will work best for your finances!

Amortization Schedule

Frequently asked questions, how to get a car loan, how to refinance a car loan, how to get out of a car loan, what is a good apr for a car loan, how to get a car loan with bad credit, how to pay off a car loan faster, definitions, vehicle price, down payment, interest rate, trade-in value.

- What is Auto Loan Assumption?

- Auto Credit Express

- Jun 20, 2018

- By Amy Fortune

When you assume an auto loan, you take over the car payments of the original buyer and gain ownership of the vehicle. However, not every lender will allow auto loan assumption, and not every buyer will be approved to enter into an existing contract.

How to Assume a Car Loan

Auto loan assumption is appealing to some buyers because many of the fees that are associated with new loan contracts have already been paid by the initial buyer. But, assuming a loan requires more than just picking up where someone else left off. In fact, the requirements are similar to what is necessary to initiate a new auto loan .

- The lender must allow the loan to be assumed. Not every loan provider is willing to do this, so make sure that assuming the loan for the car you want is even an option. Otherwise, you will need to engage in the process of buying a car with a lien on it .

- You must be approved to take over the loan. Your credit report will be pulled by the lender, and your income will be weighed against your existing debt in order for the lender to determine whether or not you will be able to make the necessary payments.

- You will sign a loan agreement. Make sure that all of the terms are acceptable, and that you understand all of the details of the contract. Pay careful attention to when your first payment is due. Because the billing cycle probably won't change, the next installment may be due very quickly.

- Proof of insurance must be provided. Before you can assume car ownership, you must show that you have whatever coverage is required by your state. A good guideline to follow is to get premium quotes from at least 3 different providers so that you can be sure you're getting the best possible rate .

- Make your payments on time, every time. As mentioned before, these payments will start immediately. If you ever foresee difficulty in making a payment on time, contact your financial institution to see if they can provide an extension or some other kind of assistance. Otherwise, your credit could be negatively impacted.

If you have moderately to severely damaged credit, you may not be able to assume an auto loan. Fortunately, there are car buying options specifically for buyers with credit issues.

Buying a Car with Less Than Perfect Credit

If you need to purchase a new or used car, but are afraid that your bad credit will prevent you from being approved for financing, Auto Credit Express can help. We will connect you with a dealer who is qualified to handle your unique situation. All you have to do to get started is fill out one simple, fast and secure online application .

Get your credit score now, and get a copy of your most recent credit report!

Refinance your car or truck now. Get a better interest rate and lower payment.

Protect your vehicle and you could save thousands on auto repairs.

Suggested Posts For You

Receive Free Updates

Get the latest credit tips, resources and advice delivered straight to your inbox.

Can You Trade in a Car When You’re Behind on Payments?

How Much Negative Equity Can I Roll Over on a Car Loan?

Best Memorial Day Car Deals and Military Discounts

Can I Trade In a Car That's Not in My Name?

How the Repo Man Can Find Your Car

- Bad Credit Auto Loans 371

- Bankruptcy 143

- Car Buying 465

- Car Insurance 68

- Car Maintenance 66

- Cosigner 105

- Credit Repair 100

- Credit Tips 165

- Dealer Services and Car Warranty 42

- Down Payment 101

- General 114

- Income and Employment 117

- Refinance 55

- Repossession 92

- Trade In 118

Connect with ACE

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

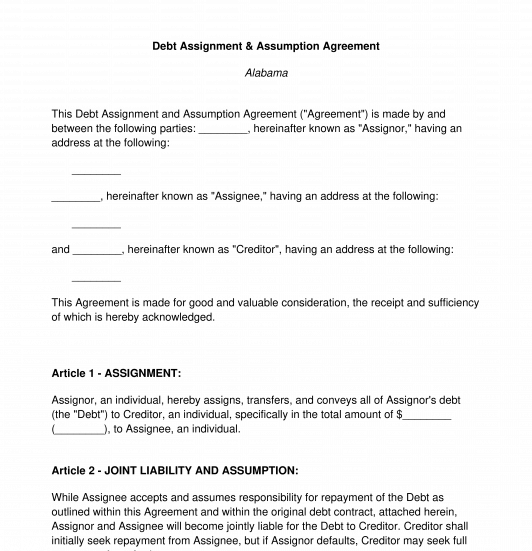

Debt Assignment and Assumption Agreement

Rating: 4.7 - 23 votes

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt Agreement, Debt Assignment Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

Assuming a Car Loan or Lease

The assumption of a car loan or lease is a way for people to get out from under payments by having someone take over the financial obligation of the car. The person assuming may do so for two reasons: perhaps helping a friend out of a financial jam or to be able to get a car for themselves without the hassles and high upfront costs of buying or leasing directly. The steps to assuming a loan or lease are not necessarily complicated, and the procedure for doing either is similar.

How it’s Done

Whether you are assuming a loan or having someone else assume yours, the steps are the same. Step one is to examine the loan or lease agreement carefully to determine if an assumption is even a possibility. As documents of this sort are often filled with legalese, it may do you well to speak to the lender directly. Once it has been determined that the transaction is possible, The lender will then check the credit of the person assuming the loan. If approved, a new loan agreement will be structured. At this point, the new “owner” of the car will need to provide proof that full coverage insurance on the car is being provided. Then, of course, the person assuming the loan will take over payments on the vehicle.

Sounds Simple, Right?

Loan assumption is easy if you have a lender or Leasing Company willing to work with you. It is when handshake deals are made between friends or family (or even strangers) that problems can arise. With a little looking, a person can find individuals attempting to have their loan assumed. Some people assume loans thinking the arrangement will be mutually beneficial, but unless the deal is structured through the lender, the title remains in the name of the first person. This means that even after the car is paid off it is technically owned by this first person. The net effect of such a transaction could ultimately have you paying for a car and never owning it. If the arrangement is set up where the second person simply gives the original lien holder cash to make the payments, there is always the chance that those payments will not be made. If this turns out to be the case, the car will eventually be repossessed. While the repossession will severely damage the credit of the first party, you will still be out the cash and have no car to show for it.

Is This the Best Option for You?

If structured correctly, assuming a car loan will allow a person to get into a car with far less upfront money. Again it should be stressed that the deal should be done through the lender and not simply through a friendly agreement. Otherwise, the person assuming the loan also assumes the possibility of severely damaging a relationship, entering into an agreement with a dishonest person, or finding themselves out of much money with nothing to show for it.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

What Does "Without Recourse" Mean in the Assignment Area of an Auto Contract?

February 20, 2016 — 12:01 pm EST

Written by The Motley Fool ->

It is common practice for lenders to sell their loans after closing on them -- and this is especially true when it comes to mortgages and auto loans. If your loan contract has an "assignment without recourse" clause, it means that this could happen to you.

What an "assignment without recourse" clause means to you, the borrower

Essentially, an assignment clause in your auto loan contract means that you are giving the lender permission to either sell or transfer your loan to another finance company.

Lenders sell loans for a variety of reasons -- for example, many lenders simply act as originators and don't like to hold many outstanding loans on their books. Or if a lender finds itself with too much outstanding auto loan debt, it could decide to sell a portion of its loan portfolio.

Whatever the reason for selling, the "without recourse" part of the clause means that you can no longer hold the initial lender responsible for any errors or other loan-related issues. Upon sale of the loan to a new lender, the borrower's relationship with their original lender is automatically terminated.

The borrower must deal with a new lender for all issues regarding the loan and must make payments to the new lender. The new lender cannot change the loan's terms, such as the interest rate or loan length, but may have different policies in regards to issues like late payments. If your loan does get sold, it's important to thoroughly read any information you receive from the new lender so you're familiar with any changes that may take place.

The bottom line on "without recourse" clauses

If you want an auto loan that will be maintained by a specific lender for the duration of the loan, be sure to thoroughly read your contract (you should be doing this anyway), and make sure there is no "assignment without recourse" clause. If you're not sure if there is or not, this is a question to specifically ask your lender, so you'll know whether or not your loan can be sold without any responsibility remaining on your lender's shoulders.

The $15,978 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. In fact, one MarketWatch reporter argues that if more Americans knew about this, the government would have to shell out an extra $10 billion annually. For example: one easy, 17-minute trick could pay you as much as $15,978 more... each year! Once you learn how to take advantage of all these loopholes, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how you can take advantage of these strategies.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us at [email protected] . Thanks -- and Fool on!

The article What Does "Without Recourse" Mean in the Assignment Area of an Auto Contract? originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days . We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .

Copyright © 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

More Related Articles

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Auto Loan Calculator

Use our free Auto Loan Calculator to estimate the overall cost of purchasing a car, including the sales price, sales tax, and the many charges and fees that creep up on you when you finally decide to make the purchase. The worksheet calculates the total Loan Amount , taking into account your down payment, trade-in, or cash rebate. You can then use the Auto Loan Payment Calculator (another worksheet within the Excel workbook) to create an amortization schedule and analyze different types of loans by changing the loan amount , interest rate , term of the loan (years) , and the payment frequency .

Our Auto Loan Calculator gives you complete flexibility in how you make additional payments, in case you want to pay off your loan early and avoid paying so much interest.

IMPORTANT : Many auto loans are actually " Simple Interest Loans " that accrue interest daily. Our Auto Loan Calculator is great for running quick calculations, but if your loan is actually a simple interest loan , then you may get more accurate numbers by using our Simple Interest Loan Calculator .

License : Personal Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

This Microsoft Excel workbook contains three different worksheets ...

1. Use the Auto Loan Calculator worksheet to calculate the amount you will need to finance, based on the sales price of the car, destination charge, fees, sales tax, down payment, cash rebate, and trade-in value of an older auto.

2. Use the Payment Calculator worksheet (the featured image above) to create an amortization table based on the auto loan amount, annual interest rate, term of the loan, and payment frequency. See how making extra payments can help you pay off your car loan early and reduce the amount of total interest paid.

3. The third worksheet (Loan Comparisons) takes the inputs from the loan payment calculator and creates graphs showing you how different interest rates , number of payments, or the amount of down payment affect the monthly payment and total amount of interest.

Using the Auto Loan Calculator

Information about how to use the loan calculators are contained within the spreadsheet itself, mostly as cell comments. Basically, you just enter values in the white-background cells, and see what happens to the other numbers. In the Payment Calculator, you can also enter values in the yellow cells (the Extra Payments column). The spreadsheet has been left unlocked, to give you complete freedom to modify it as needed for your personal use. However, make sure you know how the equations and formulas work before you try to branch out on your own. We don't provide technical support for creating custom spreadsheets, but if you have some suggestions or comments, please let us know.

Buying vs. Leasing Calculators

Our auto loan calculator spreadsheet does not contain a calculator for comparing leasing vs. buying. However, there are a few online calculators that you could use:

- Lease Calculator at Edmunds.com

- Lease vs. Buy a Car at BankRate.com

Cash Back vs. Low-Interest Financing

Sometimes, the auto manufacturer offers incentives in the form of a cash rebate or lower interest rate, but usually not both at the same time. The auto loan calculators in our spreadsheet let you specify a cash rebate and the annual interest rate. You can save (or print out) two different versions of the spreadsheet in order to make comparisons.

Check out the Low APR vs. Cash Back Calculator at Edmunds.com .

- Vehicle Maintenance Schedule

- Gas Mileage Calculator

- Balloon Payment Loan Calculator

- Home Equity Loan Calculator

- Extra Payment Mortgage Calculator

- ARM Loan Calculator

- Amortization Calculation Formula

- Amortization Formulas in Excel

- Amortization Calculator (web-based)

References & Resources

- Online Auto Loan Calculator at Bankrate.com : A very nice online loan calculator that creates an amortization table, too.

Follow Us On ...

Related Templates

Financial Calculators

Mortgage calculators, loan calculators, amortization, retirement & savings, debt calculators, business tools.

Vehicle Promissory Note: Everything You Need to Know

A vehicle promissory note is a legally binding document that functions as a written promise to pay someone for a car loan. 3 min read updated on February 01, 2023

Vehicle Promissory Note Overview

A vehicle promissory note is a legally binding document that functions as a written promise to pay someone for a car loan. It also functions as a transaction record with essential details of the loan transaction, making it useful if the IRS audits you or if a legal judgment is needed regarding the loan. This document should be signed and dated by both parties and then notarized in order to make it legally binding. The copies should be kept by both parties as well as a third party, and the original should be kept in a safe place, like a safe deposit box.

That said, there are some instances in which a vehicle promissory note will not be considered legally binding, such as:

- If the note was signed under duress.

- If a signature for the note was made on a blank page with terms yet to be added.

- If the note includes an interest rate considered usurious.

- If the note contains penalties that are not clearly expressed.

- If the auto sale includes taking over a pre-existing auto loan (only applicable in some states).

You should carefully review all pertinent local, state, and federal laws before making or signing any promissory note.

Essential Vehicle Promissory Note Details

Information contained in a basic vehicle promissory note should include:

- The amount of the loan.

- How payment will be made.

- What the interest rate will be.

- What the payment schedule will be.

- What the grace period on payments is, if any.

- What defaulting and missed payment penalties will be.

- The name, address, phone number, and/or email address of the borrower and lender.

- Certification that the vehicle owner has the right to sell it.

- The vehicle’s make, model, year, and VIN number.

- A vehicle odometer statement, as per state law requirements.

- If the vehicle’s title will be transferred to the borrower once the loan is paid.

Early Payoff Clauses

Sometimes a borrower may wish to pay off their loan early. If so, there should be provisions in the vehicle promissory note that address this. If a borrower can pay back the loan before it is due, whether repayment penalties or additional fees will be levied should be stated, as well as how much those penalties or additional fees should be. If there will not be penalties or fees, this should also be stated.

On the flip side, if a borrower breaches the terms of the loan, including by failing to make vehicle or insurance payments, then you may choose to add an acceleration clause , which will make the loan due immediately. Such a clause may read: “Upon the event of [list events causing acceleration], this vehicle promissory note will be due and payable immediately.”

Collateral is another asset that the borrower puts up for possession by the lender should they default upon their payments, and you might want to add a provision for this in your vehicle promissory note, especially if the borrower has bad credit or displays other reasons to doubt their reliability. Assets could include the vehicle itself, as well as another vehicle, jewelry, furniture, or any other piece of tangible property agreed upon by both parties.

Collecting on a Promissory Note

Promissory notes are meant in part to guard against failure of payment, but sometimes this happens, at which point you will have to attempt to collect the payment or the collateral put up against failure of payment. Should events occur that trigger collection, the following steps should be taken:

- Ask for repayment in writing. You can do this by sending past-due notices, usually at 30, 60, and then 90 days after the payment due date.

- Talk to the borrower. During this time, you should also attempt to engage the borrower, finding out what their situation is and if they can make a partial payment or if they need a new payment plan.

- Create a debt settlement agreement. If a partial payment is accepted, a debt settlement agreement will allow both parties to formalize this.

- Engage a debt collector. If your efforts to collect or otherwise resolve the situation fail, you can then hire a debt collector to work to regain the unpaid funds or promised property. You can also sell the note to such a collector, who will then own the loan and be able to collect it in full.

- Pursue legal action. As a final resort, the borrower can be sued for full repayment.

If you need help understanding how a vehicle promissory note works, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Promissory Note

- Default On Promissory Note

- Promissory Note Collection Demand Letter

- Cancel Promissory Note

- Do Promissory Notes Hold up in Court?

- Can You Assign a Promissory Note

- Demand Note vs Promissory Note

- Promissory Note Payable on Demand

- Unsecured Promissory Note

- How to Write a Contract for Money Owed

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Get your assignment of agreement

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3 min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

May 20, 2024 · 11min read

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

May 16, 2024 · 22min read

Loan Assumption Agreement

Jump to section, what is a loan assumption agreement.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

The agreement is made between the original lender and a new borrower, who will take over mortgage payments on the property. This allows for a smooth transition with no interruption in mortgage payments to be due, as well as avoiding penalties that may have been incurred by the borrower if they were to default or prepay their loan through refinancing or another means.

The original lender typically requires an appraisal before approving this type of loan transfer, which ensures that there is enough equity in the property for both parties involved. In addition, lenders will often require some kind of documentation from those seeking to assume responsibility for paying off the mortgage so they can confirm income levels and creditworthiness before agreeing.

Common Sections in Loan Assumption Agreements

Below is a list of common sections included in Loan Assumption Agreements. These sections are linked to the below sample agreement for you to explore.

Loan Assumption Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.29 28 dex1029.htm LOAN ASSUMPTION AGREEMENT , Viewed September 27, 2021, View Source on SEC .

Who Helps With Loan Assumption Agreements?

Lawyers with backgrounds working on loan assumption agreements work with clients to help. Do you need help with a loan assumption agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate loan assumption agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Loan Assumption Agreement Lawyers

Led by Tamla N. Lloyd, Esquire, our firm prioritizes a client-centered approach and aim to provide comprehensive, personalized services to help clients achieve their legal goals.

Born and raised in St. Louis, MO. Bachelors Degree from the University of Iowa. Masters Degree from the University of Melbourne. J.D. from the University of Kansas. Licensed to practice law in Missouri and Kansas. Tennessee currently pending.

I graduated from Wayne State University in 1992 and was admitted to practice in Michigan the same year. I've been practicing in Traverse City since 1993. My goal is for clients to feel that I am accessible and prompt, while providing quality and affordable legal services.

With more than twenty years of experience, Attorney Paul Petrillo has written contracts, business agreements, wills, trusts and the like. Licensed in both New Hampshire and Massachusetts, Attorney Petrillo is regular user of remote and virtual communications and document exchanges, such as DocuSign, Adobe e-sign, as well as virtual meetings using Zoom and Webex, to make drafting contracts and communicating with clients quick and easy.

Stephen is a graduate of Nova Southeastern University - Shepard Broad College of Law, Stephen is licensed to practice in New Jersey and New York. He focuses on Morris, Passaic, and Bergen County, New Jersey, but services all of New Jersey. Before graduating, Stephen did an externship in Denver, Colorado with a focus on land use and development. Upon returning to New Jersey, he focused on Condominium and Home Owner Association. He also worked with Residential Real Estate Transactions and Estate Planning clients.

Admitted in NC in 1994. Law degrees from English and US law schools. Civil and criminal litigation experience as well as in house corporate attorney. Recipient of the highest civilian honors from 14 states, the Ellis Island Medal of Honor, a papally blessed knighthood and listed in NLJ as a recipient of on of their Pro Bono Attorney of the Year Award winners and the NLJ top 40 trial lawyers in the USA under 40 years old.

Hello! I have been working in commercial real estate for about 20 years. My experience is mainly in-house with real estate developers. I enjoy doing commercial real estate transactional work, including leasing, acquisitions and dispositions. I can also lead due diligence efforts for a potential purchase of a real estate asset and review and resolve title issues.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Loan Assumption Agreement lawyers by city

- Austin Loan Assumption Agreement Lawyers

- Boston Loan Assumption Agreement Lawyers

- Chicago Loan Assumption Agreement Lawyers

- Dallas Loan Assumption Agreement Lawyers

- Denver Loan Assumption Agreement Lawyers

- Houston Loan Assumption Agreement Lawyers

- Los Angeles Loan Assumption Agreement Lawyers

- New York Loan Assumption Agreement Lawyers

- Phoenix Loan Assumption Agreement Lawyers

- San Diego Loan Assumption Agreement Lawyers

- Tampa Loan Assumption Agreement Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Kreyòl Ayisyen

Auto loans know your rights

Showing 19 results within know your rights

What should I do if I think an auto dealer or lender is breaking the law?

What is covered under the Military Lending Act?

Can a lender or dealer ask me about the alimony, child support, or separate maintenance payments that I receive when I apply for an auto loan?

Can a lender or dealer consider my sex, marital status, or dependents when deciding whether to give me an auto loan?

Where can a member of the military or a spouse/dependent of a servicemember go for emergency funding or financial assistance?

I am in the military, are there limits on how much I can be charged for a loan like a mortgage, student loan, auto loan, or credit card balance?

I am in the military and may be stationed overseas. How can I handle my auto lease or auto loan?

I’m in the military and having trouble paying my auto loan. What should I know about auto repossession and protections under the Servicemembers Civil Relief Act (SCRA)?

Can I return a car that I bought if it has mechanical problems?

Should I agree to co-sign someone else’s car loan?

Why would I need a co-signer for an auto loan?

Is a lender allowed to consider my age or where my income comes from when deciding whether to give me a loan?

Can I prepay my loan at any time without penalty?

Am I required to purchase credit insurance from a lender or dealer to get an auto loan?

Am I required to purchase an extended warranty, Guaranteed Asset Protection (GAP) insurance, or credit insurance from a lender or dealer to get an auto loan?

What is Guaranteed Asset Protection (GAP) insurance?

What is credit insurance for an auto loan?

What is a Truth-in-Lending disclosure for an auto loan?

Can the dealer increase the interest rate after I drive the vehicle home?

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/investor-viewing-company-share-price-market-data-on-a-laptop-computer-713768437-c4eda9ee28224ad6be4f6912822227af.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How long can you finance a new car?

Here's what you should know about long-term car loans, and why it matters.

This is part of a series breaking down all the terms you need to know if you're buying a new or used car from a dealership . Check out the rest of the series at our Car Buyer's Glossary .

Few people pay for a new-car purchase with a 100-percent up-front cash payment, so the two most often-used methods of getting a new car are leasing it, or financing a new car via a loan from either a bank or a financing company. Both the lease and the payment plan are structured to last through a certain amount of time, often several months or years. That agreed-upon length is called the term of the lease or the term of the loan.

What's the difference between a lease and a loan term?

Essentially, a lease is paying money over an extended time period to rent a car , while a loan is slowly paying money toward eventually owning the car. All other things being equal, a lease will cost less per month because you're only paying for what you use, and you don't retain ownership in the car after the lease term is over. The term of a lease is usually 24 to 36 months. The average new car loan in the United States now stretches to just under 70 months.

A payment plan for a loan can range from short to long, as the customer largely has the say in the length of the loan. The most common loan term is 72 months, but even longer loans are becoming common. For example, 84-month (and even 96-month) loans are being offered more often these days as vehicle prices go up. These loans offer smaller monthly payments, which are attractive to many shoppers, and usually require smaller down payments. However, it could very well be a poor financial decision depending on your interest rate.

A lease has certain perks. There will likely be a lower up-front down payment, lower monthly payments, and as the lease will coincide with the vehicle's warranty , maintenance and repair costs will be limited. It also allows for easy turnover to a new vehicle after a short time. However, downsides often include mileage limits, excess wear charges and other fees and conditions that can add hundreds of dollars at the end of the lease. And, of course, you don't get to keep the car (unless you exercise a clause in the lease agreement to purchase it) or make any money back when it's time to return it.

How do you finance a car?

You can finance a car by obtaining a loan through a bank or financing company. When buying new, dealerships will typically steer you into financing with them, but you're not required to do so. It's recommended that you shop around (specifically with your bank) to see what sort of terms you can negotiate ahead of stepping foot into the dealership.

Can I trade in a financed car?

Yes, when you finance a car, you're paying to own it, so once you've reached the end of the term, you own the car and can trade it in for whatever else you might want. Or you can keep driving it as long as you'd like. There are no mileage limits, of course, but it's not strictly yours until the loan is paid off and you get the title. You can trade the car in while you're still paying money toward your loan, too, but keep in mind that whatever you trade it in for, the cash you're offered will first need to go toward paying off your loan in full before you pocket (hopefully) any extra money.

Can you return a financed car back to the dealer?

Dealerships typically don't allow you to return a car after purchasing it, but there could be some extenuating circumstances that would allow for such an action to be taken directly after purchasing it. If something about the deal runs counter to laws or a dealership as a policy allowing you to return a car after a certain time period, then it may be possible, but in most cases, you won't be able to return a brand-new car that you just financed.

What's better: short-term or long-term?

In practical terms, all loans are short-term, lasting two to three years. A loan can occasionally extend up to five years, but it is unusual.

Longer loans tend to be costlier in the long run since you'll be paying more in interest. Those interest rates also tend to be higher. A shorter loan will mean a higher down payment and larger monthly payments, but will cost less in the long run.

What is a fair term for a customer?

One might think it's better to go with a plan that has cheaper monthly payments, but it's actually best to keep loans short. Less time owing anybody money for anything is always a good move – it usually reduces the interest rate, lowers the total amount of interest paid, and lets you own it outright (and perhaps sell it) sooner. It's therefore best to aim for a 36- to 60-month loan as it should deliver the best overall deal – lower total interest payments, a lower interest rate, and a term that better fits the length of time most people own a car. Frankly, if you can't afford the resulting monthly payment, that car is probably too expensive.

Now, if you think you'll be ready for a different car within a few years, you'll want to do a few things. First, consider a lease. If you're the type of person who likes a new car every two or three years, you're exactly the type of person for whom leasing makes the most financial sense. That said, before choosing a lease, consider if you might have any upcoming life changes. You'd hate to be in year two of a sports car lease when the triplets are born. There are some ways to get out of a lease , but none are ideal or particularly easy.

Yet, even if you're sure you'll keep the car longer than average and get every penny's worth out of it, consider a shorter-loan term and the total costs rather than focusing on monthly payments. It'll put what you can actually afford in more realistic terms.

Related video:

- Car Dealers

- License License

- Facebook Share

- Twitter Share

- Tumblr Share

- Twitch Share

- Flipboard Share

- Instagram Share

- Newsletter Share

- Youtube Share

- Feeds Share

Popular Vehicles

Popular new vehicles.

- 2023 Ford Bronco

- 2024 Lexus GX 550

- 2024 Toyota Tacoma

- 2023 Toyota Camry

- 2024 Toyota RAV4

- 2024 Ford Bronco

- 2023 Toyota Tacoma

- 2023 Jeep Wrangler

- 2024 Toyota Camry

- 2023 Ford F-150

Popular Used Vehicles

- 2022 Ford F-150

- 2021 Jeep Grand Cherokee

- 2014 Honda Civic

- 2014 Honda Accord

- 2022 Honda Accord

- 2020 Honda Civic

- 2022 Toyota 4Runner

- 2014 Chevrolet Silverado 1500

- 2017 Chevrolet Camaro

- 2018 Chevrolet Camaro

Popular Electric Vehicles

- 2023 Tesla Model 3

- 2017 Tesla Model S

- 2016 Tesla Model S

- 2024 GMC HUMMER EV Pickup

- 2024 Rivian R1T

- 2023 Lucid Air

- 2023 GMC HUMMER EV Pickup

- 2022 Tesla Model 3

- 2023 Rivian R1T

- 2024 BMW i5

Popular Truck Vehicles

- 2024 Ford F-150

- 2024 Chevrolet Silverado 1500

- 2024 Chevrolet Colorado

- 2023 Toyota Tundra

- 2024 Chevrolet Silverado 2500HD

Popular Crossover Vehicles

- 2024 Chevrolet Trax

- 2024 Chevrolet Traverse

- 2024 Subaru Outback

- 2023 Ford Bronco Sport

- 2023 Toyota RAV4

- 2022 Toyota RAV4

- 2024 Honda CR-V

- 2024 Honda Pilot

Popular Luxury Vehicles

- 2024 Mercedes-Benz GLC 300

- 2024 Porsche 911

- 2019 Chevrolet Corvette

- 2022 Lexus IS 350

- 2024 Land Rover Defender

- 2014 Mercedes-Benz C-Class

- 2024 Lexus RX 350

- 2023 Mercedes-Benz G-Class

- 2015 Mercedes-Benz C-Class

Popular Hybrid Vehicles

- 2024 Toyota Sienna

- 2023 Ford Explorer

- 2024 Ford Explorer

- 2022 Ford Explorer

- 2024 Toyota Tundra Hybrid

- 2023 Toyota Sienna

- 2024 Toyota Venza

Popular Makes

Featured makes, product guides.

- The Best Electric Bikes

- The Best Car Covers

- The Best Portable Air Compressors

- The Best Car GPS Trackers

Choose a Display Name

Please enter a display name

Sign in to post

Please sign in to leave a comment.

- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 13,821+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

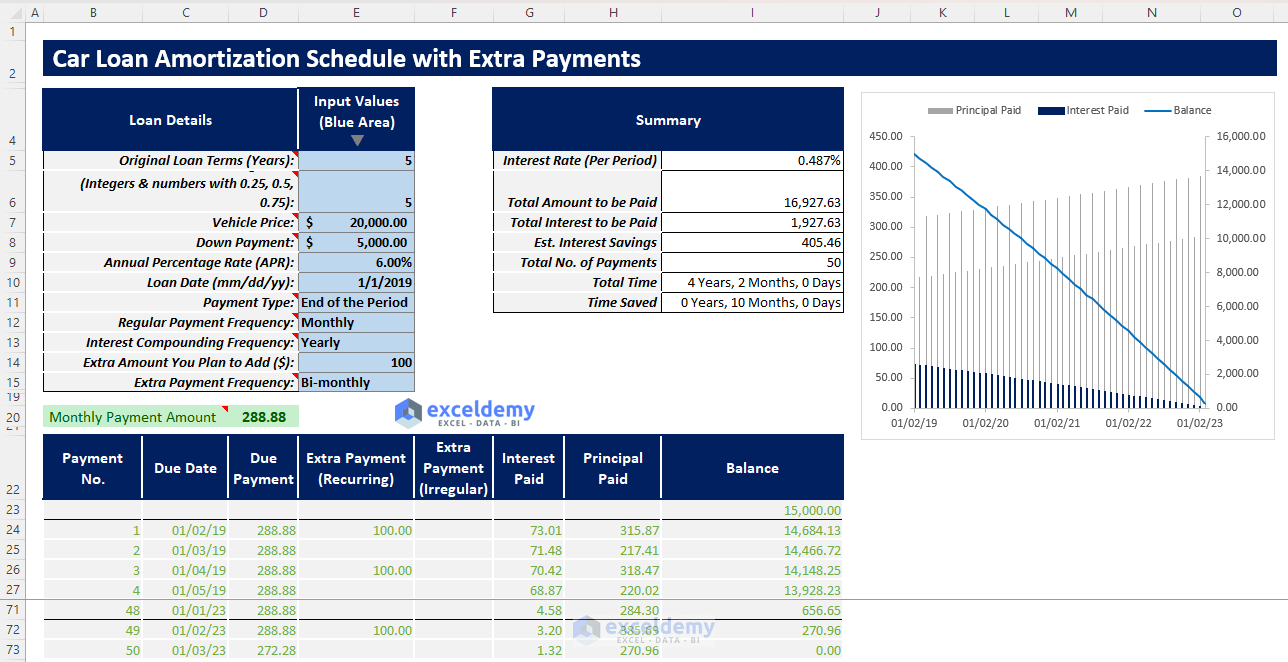

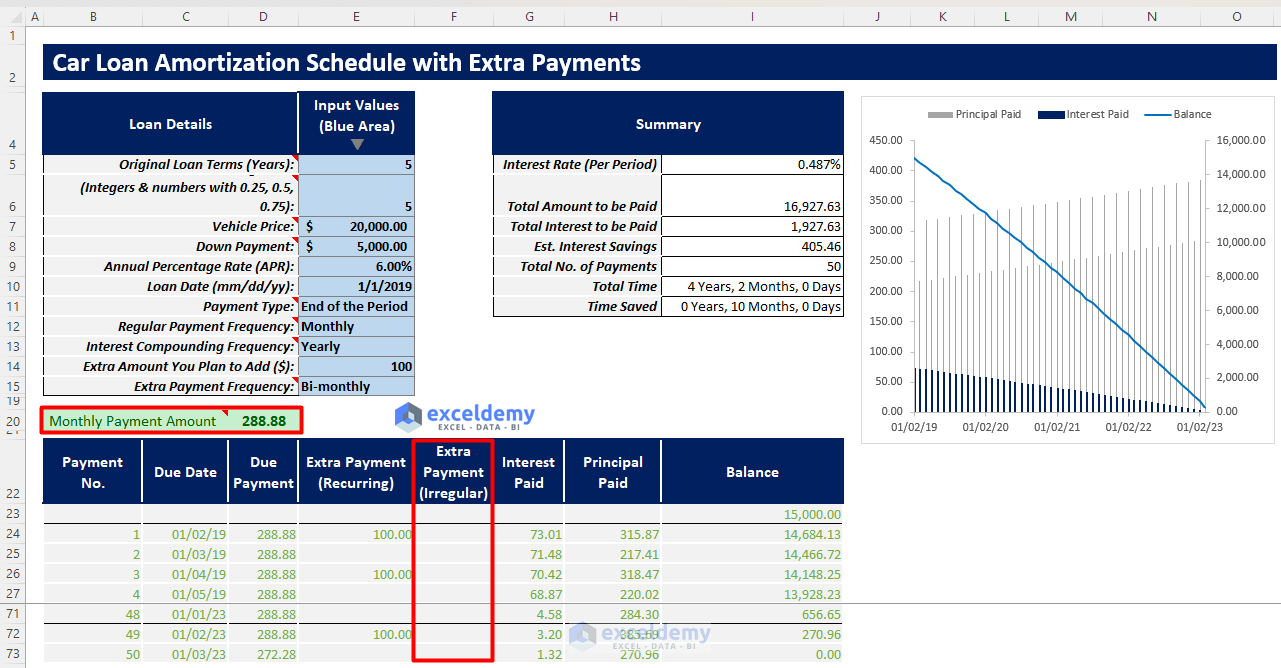

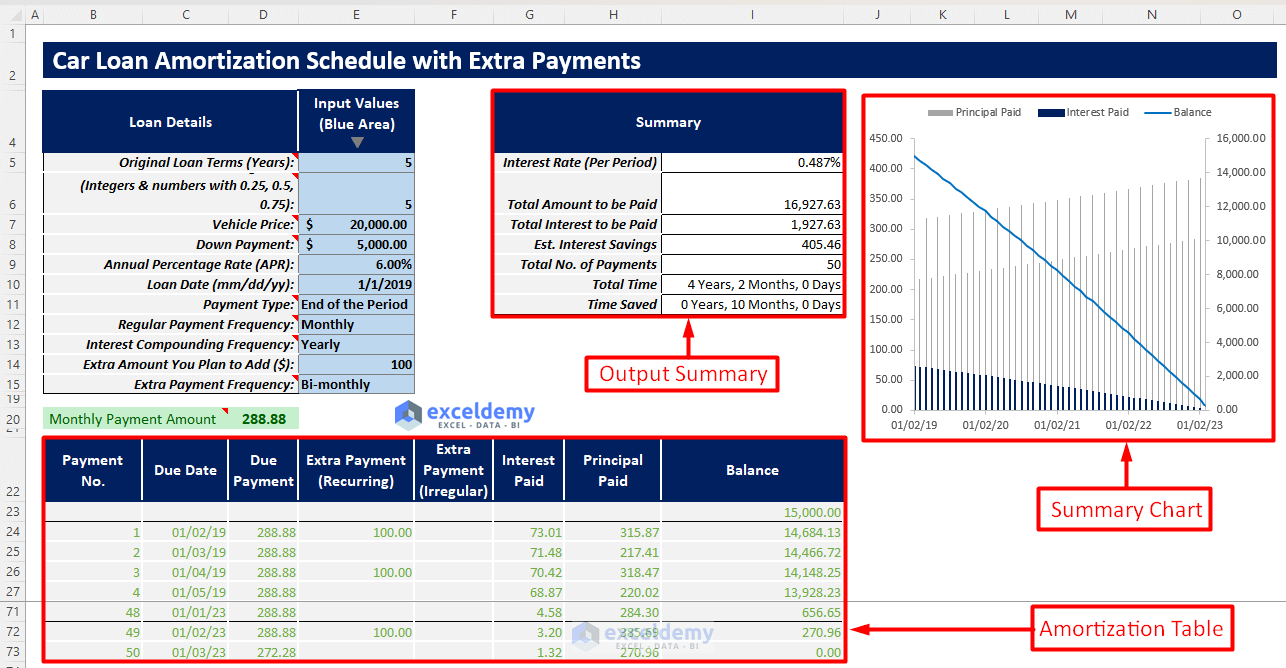

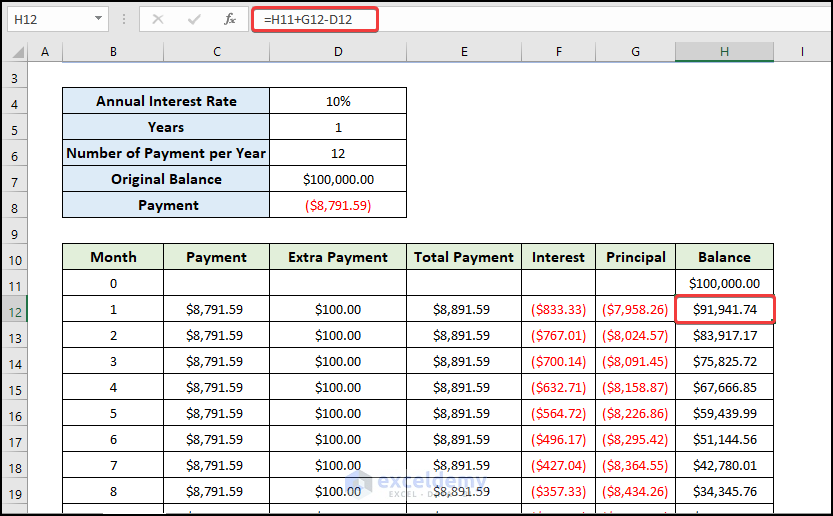

Excel Car Loan Amortization Schedule with Extra Payments Template – Free Download

A car loan amortization schedule with extra payments is an essential tool to visualize the car loan over the loan term.

In this template, you will be able to insert all your inputs and get the necessary outputs along with an amortization table and a summary chart to visualize balance trends.

You can also compare the results by inserting extra payments and calculating the estimated interest savings and time saved.

Click here to enlarge the image

Download Excel Template

For: Excel 2007 or later License: Private Use

Read More: Excel Car Loan Amortization Schedule Template

Excel Car Loan Amortization Schedule with Extra Payments Template

How to use this template.

Instructions:

- Open the template and insert your inputs in the blue shaded area.

- You will get your regular payment amount. If you want to make extra irregular payments, enter your data in the Extra Payments (Irregular) column.

- You will get an amortization schedule along with an output summary. You will also get a summary chart to visualize balance trends.

Read More: Amortization Schedule Excel Template with Extra Payments

Car Loan Amortization Schedule with Extra Payments Tips

- You have to choose interest compounding frequency as equal to or greater than regular payment frequency. Otherwise, it will return an error.

- You have to choose the extra payment frequency as a multiple of the regular payment frequency. Otherwise, the dates won’t match and an error might occur.

Related Articles

- Preparing Bond Amortization Schedule in Excel

- Interest Only Amortization Schedule with Balloon Payment Template Excel

- Amortization Schedule with Balloon Payment and Extra Payments in Excel

- Multiple Loan Amortization Schedule Excel Template

- Excel Student Loan Amortization Schedule

- ARM Amortization Schedule Excel Template

- Amortization Schedule with Irregular Payments in Excel

<< Go Back to Amortization Schedule | Finance Template | Excel Templates

What is ExcelDemy?

Tags: Amortization Schedule Excel Template

Md. Tanjim Reza Tanim, a BUET graduate in Naval Architecture & Marine Engineering, contributed over one and a half years to the ExcelDemy project. As an Excel & VBA Content Developer, he authored 100+ articles and, as Team Leader, reviewed 150+ articles. Tanim, leading research, ensures top-notch content on MS Excel features, formulas, solutions, tips, and tricks. His expertise spans Microsoft Office Suites, Automating Finance Templates, VBA, Python, and Developing Excel Applications, showcasing a multifaceted commitment to the... Read Full Bio

Your formula above does not apply the extra payment to the balance. How would I change the formula to account for that extra payment being applied?

Hi MICHELLE, Greetings and thank you for your inquiry.

Leave a reply Cancel reply

ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems.

Contact | Privacy Policy | TOS

- User Reviews

- List of Services

- Service Pricing

- Create Basic Excel Pivot Tables

- Excel Formulas and Functions

- Excel Charts and SmartArt Graphics

- Advanced Excel Training

- Data Analysis Excel for Beginners

Advanced Excel Exercises with Solutions PDF

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (May 2024)

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies