- How to check shares transferred to IEPF ( Investor Education Protection Fund )?

By IEPFZoneAdmin

Let us first describe why your shares were moved to IEPF before we discuss the procedure for how to check shares transferred to IEPF.

In the following circumstances, shares can be transferred to the IEPF (Investor Education and Protection Fund):

1) Unclaimed dividends: If a shareholder fails to claim their unclaimed dividend for seven years in a row, the dividend is transferred to the IEPF.

2) Unclaimed shares: If a shareholder does not claim his or her shares or rights for seven years in a row, the shares are transferred to the IEPF.

3) Inactive accounts: If a shareholder’s account has been inactive for seven years in a row and the company has been unable to contact the shareholder or their nominee, the shares are transferred to the IEPF.

4) Dormant companies: If a company has been dormant for seven years and has failed to meet legislative requirements such as having annual general meetings and filing financial statements, its shares may be transferred to the IEPF.

The Indian government formed the IEPF to protect the interests of investors and to encourage investor education. When shares are transferred to the IEPF, the shareholder loses ownership of the shares and the IEPF becomes the legal owner. Nonetheless, the shareholder can still claim their shares from the IEPF by following the IEPF’s procedures.

Now let us know how to check shares transferred to IEPF.

It is possible that the procedure for examining shares that have been transferred to the Investor Education and Protection Fund (IEPF) will change in accordance with the particular circumstances surrounding the transfer. Nevertheless, the following is a list of some generic measures you can follow:

Procedure A

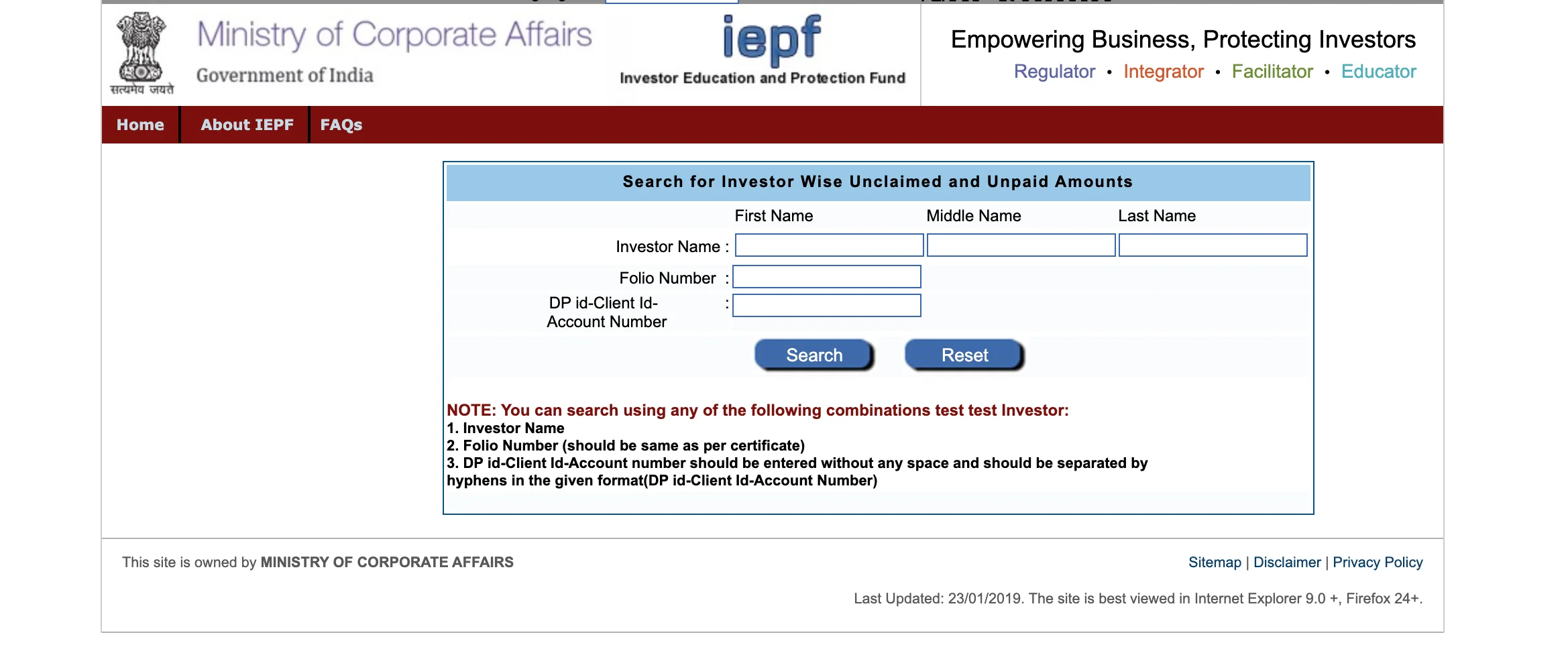

In order to know how to check shares transferred to IEPF and the IEPF refund process, you can go to the website of the Ministry of Corporate Affairs (MCA), which can be found at https://www.iepf.gov.in/IEPF/refund.html.

1. Click on the “Search IEPF Refund Claims” button on the homepage.

2. Provide the necessary information, which may include your company’s name, the Permanent Account Number (PAN), the folio number, and/or the Investor Name.

3. Click on the “Search” button to see the results.

Procedure B

Another way to know how to check shares transferred to IEPF, You can have the option of checking with the company whose shares you own, the company’s registrar, or the company’s transfer agent. These are your other options. You can contact via email or phone.

It is possible that they will be able to give you information regarding the transfer of shares to the IEPF. It is crucial to note that shares are normally only transferred to the IEPF in situations when the dividends or other corporate advantages associated to the shares remain unclaimed for a particular amount of time. This is a condition that must be met before shares may be transferred. If you believe that your shares have been transferred to the IEPF but you have not yet claimed them, you can claim your shares by following the process that is detailed on the IEPF website. If you have any questions, please contact the IEPF.

In case your shares have been transferred to IEPF and you are facing difficulty in claiming them, you can contact iefpzone.com .

Recent Posts

- Understanding the Rights and Benefits

- How to check Reliance Industries folio number?

- How to transfer shares from one demat account to another?

- How to Claim Mahindra and Mahindra Limited Unclaimed Shares and Dividend from IEPF

Other Services

- Demat of Shares

- How to convert physical shares into demat Form?

- Transmission of Shares

- Conversion of Physical Shares to Demat

- Recovery of Mutual Funds

- Recovery of Insurance Claim

- Unclaimed Dividends and Shares

- IEPF Refund

Group Websites

- InvestorZone

- UnlistedZone

iZuZ Consultancy Private Limited 832, Sector 2B, Vasundhara, Ghaziabad, India PIN - 201012

© 2023 iZ uZ Consultancy Pvt. Ltd.

- Popular Courses

- More classes

- More Courses

Transfer and disclosure to Investor Education and Protection Fund

[As per Newly introduced "Investor education and protection fund authority (accounting, audit, transfer and refund) rules, 2016"]

Ministry of corporate Affairs has issued Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 and also implemented the provisions of Section 124 and 125 (remaining provisions) of the Companies Act, 2013 relating to the Investor Education and Protection Fund. These rules have been effective w.e.f. 7th September, 2016.

Further the Ministry has also issued Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Amendment Rules, 2017 which has revised the procedure related to transfer of Shares to the Investor Education and Protection Fund (IEPF) under Section 124(6) and 125 of the Companies Act, 2013

Transfer to the IEPF (the Fund):

As per the provisions of Section 124 any amount which remained unpaid or unclaimed within 30 days of from the date of the declaration to any shareholder, the Company shall within 7 days from the expiry of said period of 30 days transfer the total amount of dividend which remains unpaid or unclaimed to a special account to be opened by the Company in that behalf in any scheduled bank to be called as Unpaid Dividend Account;

The Company shall within a period of 90 days of making any transfer to Unpaid Dividend Account, prepare a statement containing the names, their last known address and the unpaid dividend to the paid to each person and place it on the website of the Company, and also on any other website as approved by the Central Government for this purpose;

If any default is made in transferring the total unpaid or unclaimed amount to Unpaid Dividend Account, the Company shall pay, from the date of such default, interest on so much of the amount as has not been transferred to the said account, at the rate of 12% per annum and the interest accruing on such amount shall ensure to the benefit of the members of the Company in the proportion to the amount remaining unpaid to them;

Any amount transferred to Unpaid Dividend Account and amount as prescribed under Section 125(2) (a) to (n), which remained unclaimed or unpaid for a period of 7 years from the date of such transfer shall be transferred by the company along with the interest accrued, if any, thereon to the Investor Education and Education Fund;

Any amount required to be credited to the Fund shall be remitted into the specified branches of Punjab National Bank, which is the accredited bank of the Pay and Accounts office, Ministry of Corporate Affairs and other authorized banks engaged by the MCA-21 system, within a period of thirty days of such amounts becoming due to be credited to the Fund;

The amount shall be tendered by the Companies along with the challan in triplicate to the specified bank branches who will return two copies of the challan, duly stamped in token of having received the amount, to the Company.

The Company shall file, along with the copy of the challan as required furnish a statement in form no. IEPF 1 containing details of such transfer to the Authority within thirty day of submission of challan;

The amount may also be remitted by Electronic Fund Transfer in such manner as may be specified by the Central Government;

The Company shall maintain record consisting of name, last known address, amount, folio number, or client ID, certificate number, beneficiary details etc. of the person in respect of whom unpaid or unclaimed amount has remained unpaid or unclaimed for a period of seven years and has been transferred to the fund and the authority shall have the powers of inspect such records;

Every company shall within a period of 90 days after the holding of Annual General Meeting every year till the completion of seven years period, identify the unclaimed amounts, as referred in sub section 2 of Section 125 of the Companies Act, 2013 as on the date of the AGM, and separately furnish and upload on its own website and also on website of Authority or any other website as may be specified by the Government, a statement or information through form no. IEPF 2, separately for each year, containing following information namely;

- The name and last known addresses of the persons entitled to receive the sums;

- The nature of the amount;

- The amount to which each person is entitled;

- The due date for transfer into the Investor Education and Protection Fund; and

- Such other information as may be considered relevant for the purpose.

Manner of transfer of shares Under Section 124(6): Pursuant to Section 124(6) a new concept has been introduced. All shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the Company in the name of Investor Education and Protection Fund along with a statement containing such details as may be prescribed.

The claimant of shares transferred to IEPF shall be entitled to claim the transfer of shares from IEPF in accordance with such procedure and on submission of such documents as may be prescribed.

For this purpose in case any dividend is paid or claimed for any year during the said period of seven consecutive years, the shares shall be transferred to IEPF.

For the purpose of effecting transfer of shares, the Board shall authorize the Company Secretary or any other person to sign the necessary documents;

The company shall inform at the latest available address, the shareholder concerned regarding transfer of shares three months before the due date of transfer to shares and also simultaneously publish a notice in a leading newspaper in English and regional language having wide circulation that the name of such shareholders and their folio number / DP-ID / Client Id are available on their website giving details of such email id;

Where the seven years have been completed or are being completed within three months from the date of coming into force of these rules, the Company shall initiate the aforesaid procedure immediately and the due date of such transfer of the shares has been fixed to 31st May, 2017;

In case where there is a specific order of the Court of Tribunal or Statutory Authority restraining any transfer of such shares and payment of dividend, the Company shall not transfer such shares to the Fund. However, the Company shall furnish the details of such shares and unpaid dividend to the IEPF Authority in Form no. IEPF 3 within thirty days from the end of financial year;

For effecting transfer of shares held in demat mode: The Company shall inform the depository by way of corporate action, where the shareholders have their account for transfer in favour of the authority. On receipt of such information the depository shall effect the transfer in favour of the demat account of the Authority;

For effecting transfer of shares held in physical mode the Company Secretary or the person so authorized by the Board shall make an application on behalf of concerned shareholders for issue of duplicate share certificates;

- On receipt of application a share certificate for each such shareholder shall be issued and it shall be stated on the face of it and be recorded in register maintained for the purpose, that the duplicate certificate is "issued in lieu of share certificate no for transfer to IEPF" and the word "Duplicate" shall be stamped or punched in bold letters across the face of the share certificate;

- Particulars of every share certificate issued as above shall be entered forthwith in a register of renewed and duplicate share certificates as specified in the Companies (Share Capital and Debentures) Rules, 2014;

- After issue of duplicate share certificate, the Company shall inform the depository by ways of corporate action to convert the duplicate share certificate into Demat form and transfer in favour of the Authority.

- The shares shall be credited to the Demat Account of the Authority to be opened by the Authority for the said purpose, within a period of 30 days of such shares becoming due to be transferred to the fund.

The Company shall make such transfer through corporate action and shall preserve the copies for its record;

All benefits accruing on such shares e.g. bonus shares, split, consolidation, fraction shares etc. shall also be credited to demat account of the Authority.

The company shall send a statement to the fund inform IEPF 4 containing details of such transfer;

The voting rights on such shares shall remain frozen until the rightful owner claims the shares. However, for the purpose of SEBI( Substantial Acquisition of Shares and Takeover) Regulations, 2011, the shares which have been transferred to the Authority shall not be excluded while calculating the total voting rights;

The shares held in such IEPF Suspense account shall not be transferred or dealt with in any manner whatsoever except for the purpose of transferring the shares back to the claimant as and when he approaches the Authority;

If the Company is getting delisted / would up,the Authority shall/may surrender shares on behalf of shareholders and the proceeds realized shall be credited to the Fund;

Any further dividend received on such shares shall be credited to the Fund;

Refund of Claimants form the IEPF Authority:

- Any person, whose shares, unclaimed dividend, matured deposits or debentures, application money due for refund, or interest thereon, sales proceeds of fractional shares, redemption proceeds of preference shares etc. has been transferred to the Fund, may claim the shares or apply for refund as the case may be to the Authority by making an application in form IEPF 5 online available on the website www.iepf.gov.in along with fee, as decided by the Authority from time to time.

- The claimant shall after making an online application, send the same duly signed by him along with requisite documents as enumerated in form IEPF 5 to the concerned company at its registered office for verification of his claim;

- The Company shall, within fifteen days of receipt of claim form, send a verification report to the Authority in the format specified along with the documents so received;

- electronically pay the amount so claimed;

- credit the shares to the demat account of the shareholder; or

- In case, claimant is the legal heir or successor or administrator or nominee of the registered shareholder, he has to ensure that the transmission process is completed by the Company before filing any claim to the Authority.

- In case the Company has received the transmission request as above after transfer of shares to the Authority, the Company shall verity all requisite documents and shall issue letter to the claimant indicating his entitlement of the said shares and furnish the copy of the same to the Authority while verifying the claim of such claimant.

- The claimant shall file one consolidated claim in respect of a company in a financial year.

Disclosure of amount due to be transferred to the Fund:

The company shall furnish a statement to the Authority in form IEPF 6 within 30 days of the end of financial year stating therein the amounts due to be transferred to the Fund in the next financial year;

The company shall also furnish a statement to the authority within 30 days of the closure of its accounts for the financial year stating therein the reasons of deviation, if any, of amount so disclosed and actual amount transferred to the Fund.

Summary of Actions under New Regime of IEPF:

The Company shall file, along with the copy of the challan as required furnish a statement in form no. IEPF 1 containing details of such transfer to the Authority within thirty days of submission of challan;

Every company shall within a period of 90 days after the holding of Annual General Meeting every year till the completion of seven years period, identify the unclaimed amounts, as referred in sub-section 2 of Section 125 of the Companies Act, 2013 as on the date of the AGM, and separately furnish and upload on its own website and also on website of Authority or any other website as may be specified by the Government, a statement or information through form no. IEPF 2.

All shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the Company in the name of Investor Education and Protection Fund along with a statement containing such details as may be prescribed in form IEPF 4.

Published by

CS Ankur Srivastava (Company Secretary & Compliance Officer) Category Corporate Law Report

Related Articles

Popular articles.

- New Rule 47A - Time limit for Self-Invoice under RCM

- Concept of TDS under GST in the Metal Scrap Sector

- Safari Supreme Court Decision and ITC

- Time Limits for Income Tax Notices and Assessments: Quick Guide

- PAS 6 Applicability in 2024: Changes and New Guidelines for Unlisted Companies

- All about Direct Tax Vivad Se Vishwas Scheme (DTVSV), 2024

- Udyam Registration: Benefits, Eligibility and Application Process

- Waiver of Interest and Penalty in terms of Section 128A of CGST Act

Trending Online Classes

Landmark Judgments: Important Provisions of the EPF & ESI Act interpreted by the Honorable Supreme Court of India

GST Live Certification Course (40th Batch)(With Certificate)

Certification Course on Chat GPT and AI Tools for Professionals

CCI Articles

You can also submit your article by sending to [email protected]

Browse by Category

- Corporate Law

- Info Technology

- Shares & Stock

- Professional Resource

- Union Budget

- Miscellaneous

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

Shareholder's Services

Transfer of equity shares to the Investor Education and Protection Fund

All shares of the Company in respect of which dividends have remained unclaimed or un-encashed for seven consecutive years or more, are required to be transferred by the Company to the Investor Education and Protection Fund (‘IEPF’) established by the Government of India.

The company sends periodic communication to the respective shareholders to claim/encash the dividend.

Details of Equity Shares transferred to the IEPF

The shares on which dividends were due for seven consecutive years were transferred to the IEPF Authority. The details are hereunder:

Shareholders may input the following to check the number of shares transferred to IEPF authority:

1. Shares held in Physical mode - Folio No. (Eg: ITL000000) 2. Shares held in Dematerialised Mode:

NSDL - 6 digit/character DP ID and 8 digit client ID (Eg: IN30000010000000)

CDSL - 16 digit client ID (Eg: 1200000000002000)

Shareholders may note that the shares/dividend transferred to IEPF can be claimed by making an application to the Authority in Form IEPF 5 (to be filed online) at the following link http://www.iepf.gov.in/IEPF/refund.html

(to be used by shareholders/claimants whose shares and/or dividend have been transferred by the Company to Investor Education and Protection Fund)

Details of Equity Shares liable to be transferred to the IEPF

The Company will be transferring the underlying shares pertaining to Interim dividend declared for the financial year 2017-18 on which dividend is unclaimed/un-encashed for seven consecutive years.

Shareholders are requested to claim the Interim dividend of the financial year 2017-18 by submitting the required details to company’s RTA KFin Technologies Limited (email- [email protected] ) on or before November 18, 2024. Kindly note that all requests received between August 17, 2024 and November 18, 2024 will be processed only through electronic credit. The dividend payment will be processed if the request is found appropriate in all respects.

Shareholders may input the following to check the number of shares liable to be transferred to IEPF authority:

NSDL - 6 digit/character DP ID and 8-digit client ID (Eg: IN30000010000000)

CDSL - 16-digit client ID (Eg: 1200000000002000)

How to claim shares and dividends from Investors Education and Protection Fund (IEPF)

Dividend and shares claim process from ipef: the process of claiming the unpaid or unclaimed shares/dividend amount from iepf authority has been streamlined.

By Sanchit Garg

The Investors Education and Protection Fund (IEPF) was conceptualized to spread investor awareness and protect investor interests from any financial scams. Its mandate was also to refund to the investors, unpaid dividends and shares which have been transferred to the Fund. The IEPF Authority had recently come out with the “Consultation Paper on refund process at IEPF Authority“ to seek views from all stakeholders to ease the process of refund of shares and dividends to the investors. It is startling to see that the corpus of unclaimed dividends and other maturity amounts for the listed companies stood at a staggering Rs 5685 crores and total number of ~117 crore unclaimed shares have been transferred to the IEPF.

According to Rule 7 (1) of the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, shareholders can claim amounts transferred to the IEPF by submitting the IEPF-5 Form for unclaimed dividends, matured debentures, matured deposits, shares, refundable application fees, interest on fractional share sale proceeds, preference share redemption proceeds, etc.

The primary objective of the Government to create the IEPF Authority a few years back was to curb the misuse of shares lying unclaimed and promote and protect the shareholders’ interests; thereby providing safe and secure custody to unclaimed shareholder’s fund.

Also Read: How salaried persons should invest in mutual funds to maximise returns

Securities were transferred to the IEPF due to issues concerning transfer of shares, transmission of shares, corporate actions and unclaimed dividends. According to a recent reply by the IEPF Authority in Parliament, less than two per cent of the unclaimed shares only have been credited to the concerned shareholders by the IEPF in the last 6 years.

Presenting the Union Budget 2023 in Parliament on 1 February, the Finance Minister asserted that to further ease the process through which investors can reclaim their unclaimed shares and unpaid dividends, an integrated IT portal will be established.

The process of claiming the unpaid or unclaimed shares/dividend amount from IEPF Authority has also been streamlined and shareholders need to follow some easy procedures like logging into the MCA portal, then filling Form IEPF – 5 online, uploading all documents as required, after submission of the online form, printing the form and sending the copy of the same with all documents in an envelope labeled ‘Claim for refund from IEPF Authority’ to the company’s IEPF Nodal Officer/Registrar. The Nodal Officer after verification will upload an Approved Verification Report to the IEPF Authority which will in turn process the claim and release the shares within 60 days.

Also Read: Know how to set off and carry forward capital losses

However, recovery of shares/dividend from IEPF can be challenging for some shareholders, specially senior citizens, NRIs or legal heirs of deceased shareholders and to address these issues some companies and professionals are now providing shares and dividend recovery services to investors in the form of advisory on recovery of shares from IEPF.

However, only a few are providing end-to-end assistance in document filing and application submission with the concerned authorities, companies and registrars. Companies and their registrars on the other hand are also helping their shareholders with doubts and queries about issues concerning the transmission of shares, lost shares, name deletion, claims from IEPF etc.

(The author is Co-Founder of GLC Wealth)

- Stock Market Stats

- Assembly Elections

- Budget 2024

- Stock Market Quotes

- Mutual Fund

- Stock Stats

- Top Gainers

- CaFE Invest

- Investing Abroad

- Gold Rate in India

- Silver Rate in India

- Petrol Rate in India

- Diesel Rate in India

- Express Mobility

- Banking & Finance

- Mutual Funds

- Travel & Tourism

- Brand Wagon

- Entertainment

- Web Stories

- Auto Web Stories

- Infographics

- Today’s Paper

- Personal Finance Print

- PRIVACY POLICY

- TERMS AND CONDITIONS

- IPO’s Open and Upcoming 4

- Top Indices Performance

- Stock Analysis

- Financial Literacy

- Gold Rate Today

- NSE Top Gainers 2307

- NSE Top Losers 371

- BSE Top Gainers 3980

- BSE Top Losers 1170

- NSE 52-Week High 0

- NSE 52-Week Low 0

- BSE 52-Week High 0

- BSE 52-Week Low 0

- NSE Price Shocker

- NSE Volume Shocker

- BSE Price Shocker

- BSE Volume Shocker

- NSE Sellers

- BSE Sellers

- Silver Rate Today

- Petrol Rate Today

- Diesel Rate Today

IMAGES

VIDEO

COMMENTS

The IEPFA Authority is entrusted with the responsibility of administration of the Investor Education Protection Fund (IEPF), making refunds of shares, unclaimed dividends, matured deposits/debentures etc. to investors, promoting awareness among investors, and …

All shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the Company in the name of Investor Education and Protection Fund along with a …

After the IEPF Form are filled and uploaded on the MCA21 portal, you are required to provide the details in excel file for investor wise details of shares transferred to IEPF/amounts credit to …

All shares of the Company in respect of which dividends have remained unclaimed or …

2016 expressed its intention to revise the aforesaid Rules with respect to transfer of shares. Accordingly, the Ministry on 28th February, 2017 has amended certain portion of the Principal …

Purpose: Application to the Authority for claiming unpaid amounts and shares out of Investor Education and Protection Fund (IEPF) Due Date of Filing: Not Applicable. Processing Type: Non-STP. The e-Form will be …

According to Rule 7 (1) of the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, shareholders can claim amounts transferred to the IEPF by...