- ABAP CDS Views

- HANA XS OData

- SAP HANA Modeling

- ABAP In Cloud

- S/4HANA Guide

SAP FI Bank Accounting Tables

Sap fi account receivable tables, sap fi down payment chain tables, sap fi asset accounting tables (2023).

There are thousands of different transaction codes available in SAP, and each one serves a specific purpose. With the right knowledge and understanding, you can use transaction codes to carry out any task imaginable in SAP. The complete list of SAP TCodes

- SAP ABAP TCodes

- SAP ABAP Language TCodes

- SAP Batch Input TCodes

- SAP Selection Screen & Variants TCodes

- SAP Transaction Variant TCodes

- SAP ABAP XML Processing TCodes

- SAP Business Workflow TCodes

- SAP Flexible Workflow TCodes

- SAP Workflow Error Analysis TCodes

- SAP CCMS Archive TCodes

- SAP CCMS Background Processing TCodes

- SAP CCMS Data Aging TCodes

- SAP CCMS Monitoring TCodes

- SAP CCMS Configuration TCodes

- S/4 HANA tables

SAP Tables for Cost Center: Helpful List (2023)

SAP ERP contains numerous tables that store data related to cost centers. Understanding the key SAP tables for cost centers is critical for any SAP analyst or consultant working with cost center planning, reporting, and analysis. This article provides an overview of the most important sap tables for cost center data, including CSKS, CSKT, CSKU, and more.

What is a Cost Center?

A cost center is an organizational unit that represents the location where costs are incurred. The cost center data is stored in different SAP tables and very important to track the efficiency of the cost centers. In this blog post we will provide a comprehensive list of SAP Tables for Cost Center and its related information.

SAP Tables for Cost Center

Cost Center is used to analyze the costs incurred with in organization. CSKS (Cost Center Master Record) is the cost center master data table and CSKT (Cost Center Texts) is the cost center text table, which store cost center texts.

Cost Center cab be of different types and there are two main types of cost centers: Operational and Support cost centers and this information is stored in TKA05 (Cost Center Types).

Below is the list of other cost center tables in SAP Cost Center Accounting.

Cost Center Concur S/4HANA Financial Integration Tables

Following is the list of 6 cost center tables in SAP which are relevant if you have SAP S/4HANA and Concur integration.

Joint Venture and Production Sharing Accounting Tables

Following is the list of 7 cost center tables in SAP which are relevant if you have configured JVA.

Cost Center Overhead Cost Controlling Table

Following is the list of 16 cost center tables in SAP which are relevant to Overhead Cost Controlling.

Cost Center SD Output Determination Tables

Cost center business planning tables.

Following is the list of 30 SAP table for cost center which are relevant to Business Planning.

Cost Center Industry Specific (IS-OIL) Tables

Following is the list of 5 SAP table for cost center, if IS-OIL is configured in SAP S/4HANA system.

Others Cost Center Tables

Following is the other list of SAP table for cost centers.

RELATED ARTICLES MORE FROM AUTHOR

20 SAP Purchase Order Tables – Most Important

Important SAP Financial Accounting Tables

Editor picks, popular posts.

MOVE CORRESPONDING for Internal Tables in ABAP 7.4

Function Import in SAP OData Service

$filter query in SAP OData Service

Popular category.

- Basic Functions 152

- Application Interface Framework 132

- ALE Integration Technology 112

- Analyzer 96

- Profit Center Accounting 86

- Financials Israel 72

- Asset Accounting 51

- Basic Settings 51

Blog about all things SAP

ERProof » SAP CO » SAP CO Training » SAP Activity Type

SAP Activity Type

SAP activity types are planned and allocated by recording the quantities which are measured in units known as activity units. These units are valuated using an allocation price. The calculation of the prices can be done using actual cost or planned cost and they can be entered manually or the system can calculate the prices on the basis of costs allocated to the activities.

SAP activity types are used in production orders to determine the cost of machine, labor, etc. And, also in product costing for determination of production overheads. Below are some examples of SAP activity types for cost centers:

- Machine hours

- Units produced

- Labor charges

You can assign single, many or no activity types to a cost center. SAP activity types with similar activities can be grouped into activity type groups for internal reporting purposes. SAP activity type groups are used for assessment and planning and can be processed with a single business transaction in a cost center.

Activity type groups can be created and administered in parallel. For example, you can create the same activity type group for planning and for actual results which can be used in variance analysis.

The transaction codes used for creation, change or display of activity types are as follows:

- KL01 – Create

- KL02 – Change

- KL03 – Display

You can always display and delete the activity types collectively with the transaction codes KL13 and KL14 .

Creation of SAP Activity Types

Creation of activity types has the following prerequisites:

- The controlling area has been created and assigned to the company code.

- Secondary cost elements with cost element category 43 have been created.

How to Create SAP Activity Type?

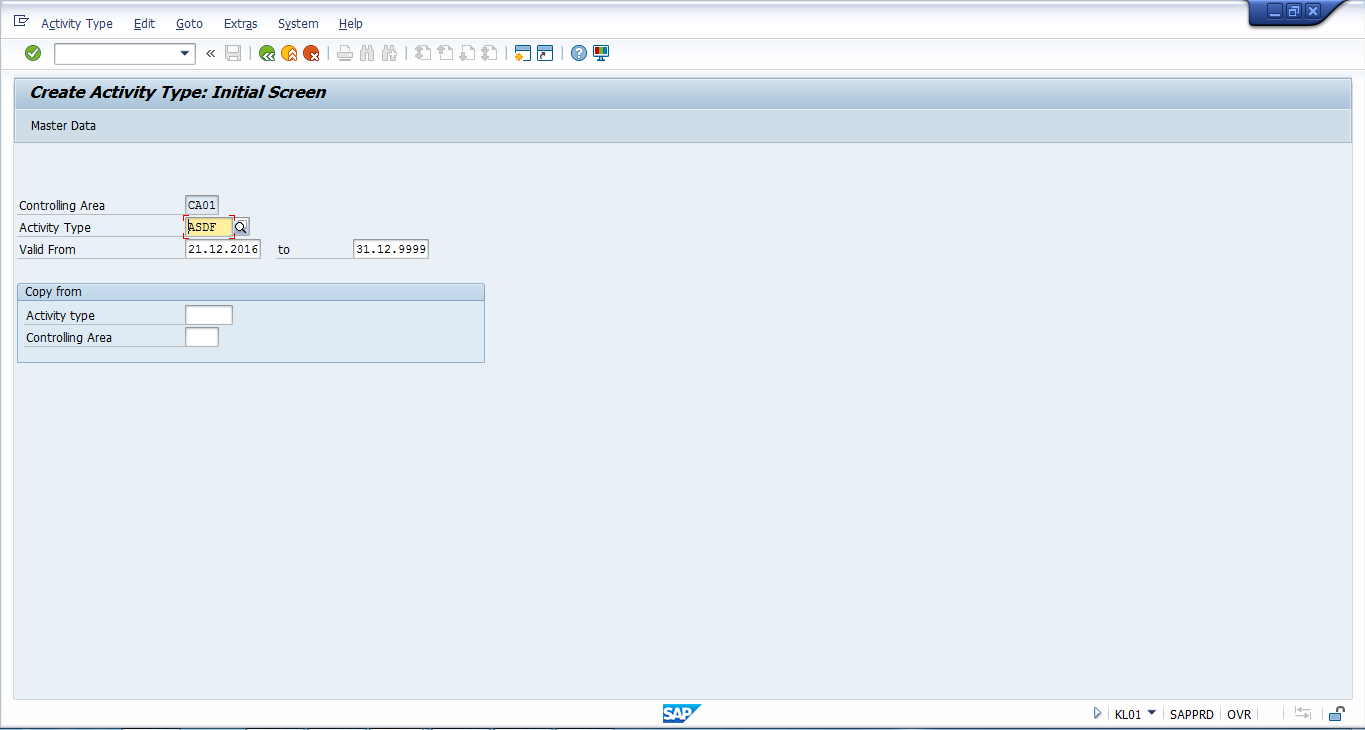

If you want to create a new SAP activity type, start the transaction KL01 from the transaction bar or navigate to the following path in SAP menu:

SAP Menu – Accounting – Controlling – Cost Center Accounting – Master Data – Activity type – Individual Processing – KL01

On the initial screen of create activity type transaction enter the following data:

- Activity type that you want to create (it can be alphanumeric).

- Date from when it is valid and to the date until it will be valid.

- You can also enter a previous activity type in the “Copy from” section to copy all the details from the existing activity type.

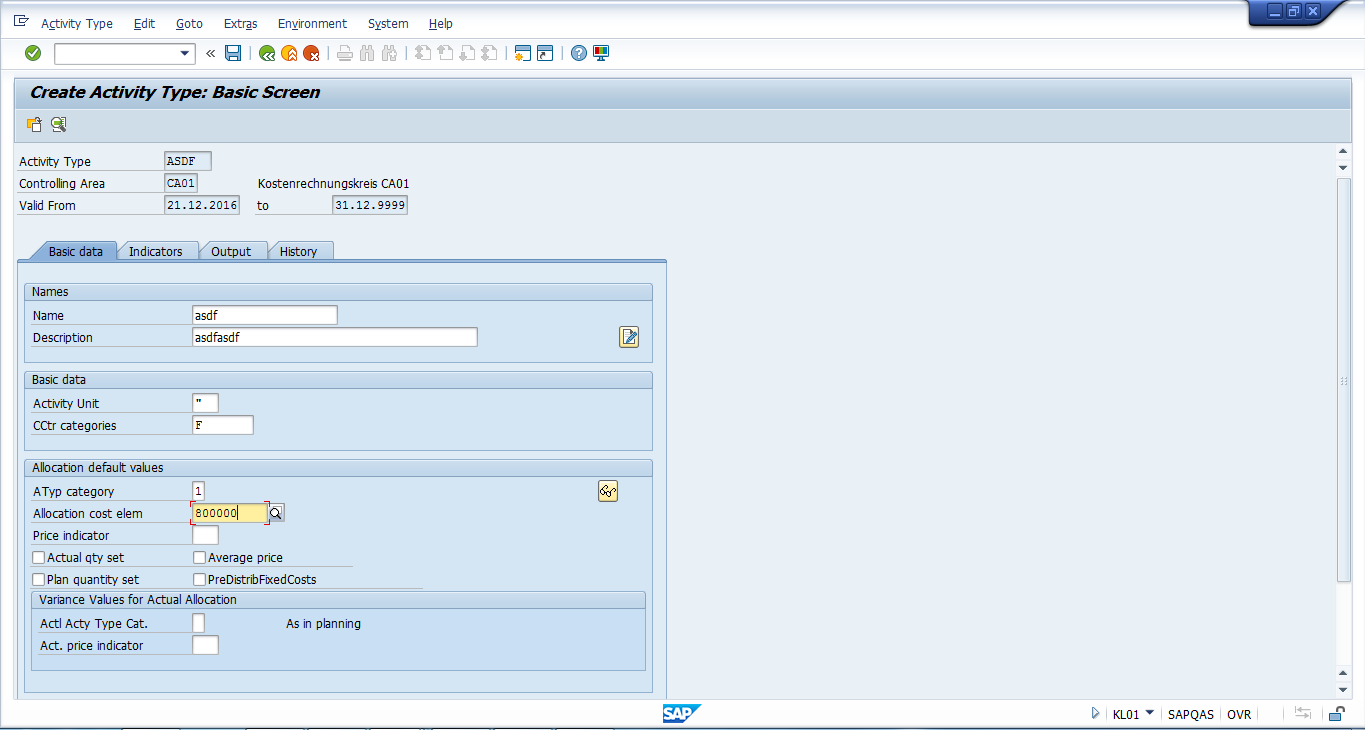

Next, click on Master Data button. The system will take you to the next screen of this transaction. Here, you need to work with Basic data tab and enter the following details:

- Name of the activity type

- Description of the activity type

- Activity unit of measure

- Cost center categories

- Activity type categories

There are the following options for activity type categories:

- Manual entry, manual allocation

- Indirect determination, indirect allocation

- Manual entry, indirect allocation

- Manual entry, no allocation

Please note that activity type categories determine how allocation of activity type is to happen in the SAP system.

Next, you need to specify Allocation Cost Element and Price Indicator. Price Indicator is used for determination of how prices will be calculated for the activity type. These are of two types of price indicator: actual and planned.

1 Planned price, automatically based on activity

2 Planned price, automatically based on capacity

3 Determined manually

5 Actual price, automatically based on activity

6 Actual price, automatically based on capacity

7 Manually determined for actual allocations

Please note that changes in master data of SAP activity types should always be avoided in the middle of a year and should be done only when it is absolutely necessary. These changes are normally done during the beginning of a new financial year to ensure consistency of data in the SAP system.

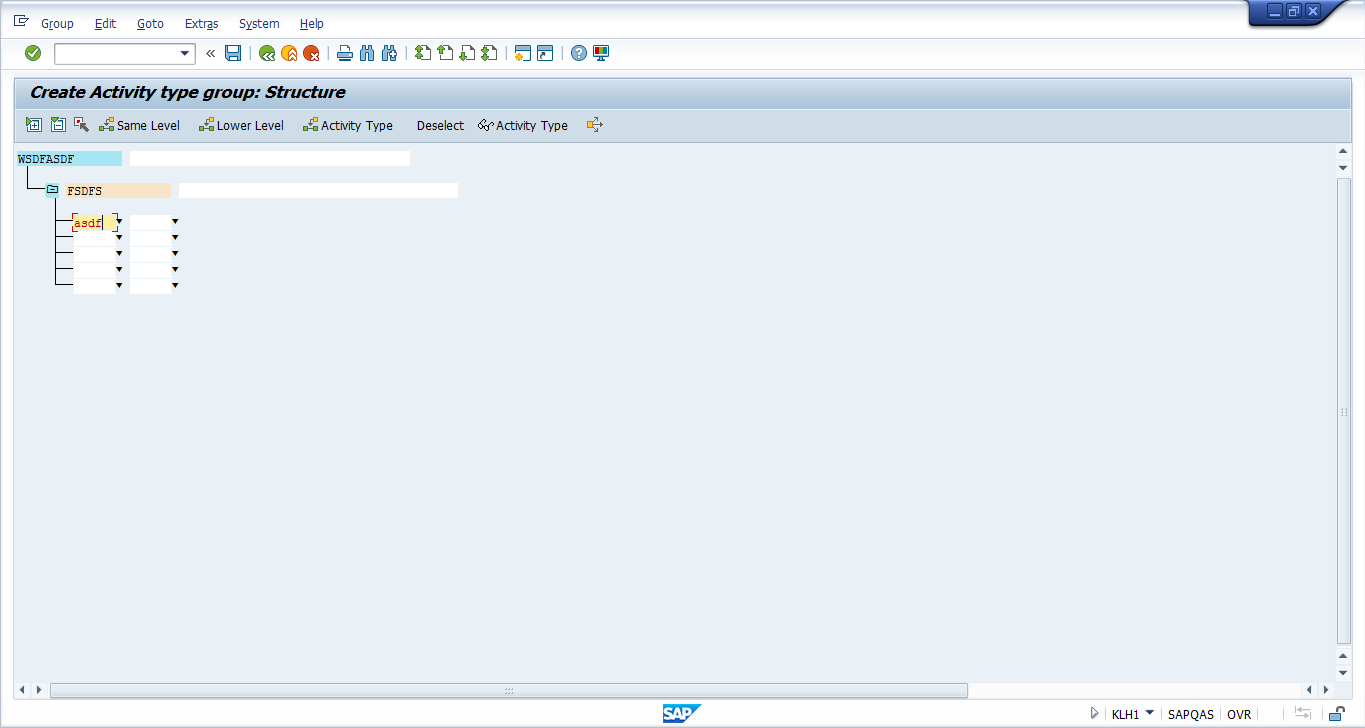

How to Create SAP Activity Type Groups?

Now, let’s discuss how to create new activity groups in SAP. To do this, please start the transaction KLH1 from the transaction bar or navigate to the following path in SAP menu:

SAP Menu – Accounting – Controlling – Cost Center Accounting – Master Data – Activity Type Group – Create

On the initial screen of KLH1 transaction it is necessary to enter information in the following fields:

- Controlling area

- Name of the activity type group

- (Optional) Reference to an existing activity type group

On the next screen you should define the structure of your activity type group. Under the main activity type group, you can create sub groups (if you want) or enter activity types that should be present in this group.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Statistical Key Figures

Go to previous lesson: SAP Cost Elements

Go to overview of the course: Free SAP CO Training

6 thoughts on “SAP Activity Type”

Hi, Your course is good. What can improve is provide a list of the codes and their definitions e.g. KLH1 and subsequent ones.

Also, the screen shots are great, however, you need to make them bigger as the images are faded. All in all, I am still able to learn, just would learn better with the above recommendations.

Dear I have a problem: CKMLCP / WIP: C + 237

You can help me out?

Is it possible to create juste on activity type in the system?

hi, could you let me know how to get a material list with activity type. what t-code i can use ? much thanks

Very good explanations to understand the Functional constants. Anyone can easily identify the purpose of activity types.

Thanks for your service.

Nice basics, thank you. But I need more, especially about interlinks between ATs, CCs, MGs or SKU – how can we extract mapping tables to get to be bottom of it? This is what matters. Thanks.

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

In this topic, we described about the below sections -

- Creating Activity Types

- Assigning Rates to activity

Classifies the activities in the cost centers within a controlling area. Activity Types is an activity performed to classify the activities produced in cost center. Activity Type classifies the activities to be performed within a company by one or several cost centers.

Activity types are used to determine the quantity-based output of a cost center. System records quantities measured in activity units to plan and allocate the activities. The activity types divide the specific activities which are produced in a cost center.

Setting up Activity Types: -

Activity type setup involves two steps.

- Creating Activity Type.

- Assigning rates to activity.

Creating Activity Types: -

Step-1: Go to transaction KL01 .

Step-2: It opens Create Activity Type: Initial Screen . Enter Controlling Area and click on tick mark to proceed.

Step-3: Enter the new Activity Type, Valid From and click on Master Data .

Step-4: Enter Name, Description, Activity Unit, CCtr categories, ATyp category and Price indicator .

Step-5: Go to Output tab to enter the output unit .

Step-6: Click on the Save button to save the Activity Type.

Step-7: Once the activity type saved successfully, the below message displayed on status bar.

Assigning Rates to activity: -

Step-1: Go to KP26 to assign rates for an activity type and cost center.

Step-2: Enter Version, From Period, To Period, Fiscal year, Cost Center details.

Step-3: Click on overview screen icon to assign hourly rate.

Step-4: Enter per hour Rate under Fixed price, distribution key as 2 and plan price indicator as 3.

Once the details entered, click on save button assign the rates to activity.

Describing the Cost Center Scenario

After completing this lesson, you will be able to:

- Outline the cost center scenario

The Cost Center Scenario - Embedded in the Cost Accounting System

Introduction.

To comply with management reporting in Overhead Cost Accounting, there is sometimes a need to create reports for the cost center managers that are not covered by the delivered business content.

Which reports and key figures required by the Cost Center Management can be referred to as the underlying cost accounting system?

In the public cloud edition of the SAP S/4HANA system , rigid standard costing is delivered, whereas flexible standard costing and marginal costing are often used in industry companies.

If a cost center manager wants to report target costs and cost center variances regarding variance categories , there is no delivered functionality available in any of the content queries of the public cloud edition of the SAP S/4HANA system .

For such cases, you have to set up Analytical Queries for the cost center managers that contain target costs and variance categories.

To be able to do the setup, you need to understand the reporting architecture of SAP S/4HANA as a first step.

Getting into the different types of CDS Views as a basis for reporting and understanding which type to use is also important.

In this context you also need to get into tools like the View Browser and the Query Browser .

The main focus is to get practical knowledge about the creation of reports, called Analytical Queries in order to be able to fulfill the business requirements.

Positioning of the Cost Accounting System used in this course

Standard costing.

The typical characteristic of standard costing is that independent of the actual costs of previous periods for the upcoming planning periods.

Standard costing requires that the value structure (prices for material, external activities, and so on) is compared with a corresponding quantity structure in the form of material quantities and activity quantities.

The result of multiplying quantity and costs calculated for a price are not transferred to variable (employment-dependent) and fixed (employment-independent) costs.

Internal activity allocation is based on a full cost rate (total activity price).

In fixed standard costing, the plan price is calculated for activity allocation by dividing the activity-based planned costs and the planned activity quantity.

It can be determined whether the actual costs match the allocated fixed plan costs or whether variances occur.

Valuation of the Standard Costing

A separation of cost variances according to different categories (causes of variance)is not possible when using full costs.

Utility companies that work with long-term price specifications (predefined prices) and with relatively constant input quantities can, if necessary, meet their requirements for a cost accounting system with rigid standard costing fulfilled.

However, this cost accounting system is not sufficient for companies with a high proportion of variable cost elements, which have to pay attention to the economic viability of their cost centers under hard conditions for competition this cost accounting system is not sufficient.

Flexible Standard Costing

Flexible standard costing is based on a split into fixed and variable costs. This assignment results from the combination of cost center, activity type, and G/L Account of type Cost Element.

The employment of a cost center results from the activity quantities of the cost center.

The planned employment corresponds to the total of planned activity quantities, the actual employment corresponds to the total of allocated actual activity quantities. The following applies:

Capacity utilization level = actual employment / planned employment

The fixed planned costs of a cost center are costs of operating readiness and are therefore also to be planned for an employment of zero hours.

In particular, depreciation costs for fixed assets, rents, imputed interest, preventive maintenance, salaries, and personnel costs for scheduled activities are to be planned as fixed costs.

Variable planned costs in a cost center are not incurred until the actual activity quantity is allocated. These are, for example, direct material costs and direct labor costs. Certain cost elements are sometimes incurred as fixed costs and partly as variable costs, for example, Energy costs.

Target costs are now the actual costs expected for a utilization level (actual costs that are acceptable from a business point of view and indicate cost efficiency of the cost center) and result from:

Target costs = fixed plan costs + variable plan costs * capacity utilization level

Fixed plan costs are equal with fixed target costs.

If the actual activity quantity of the cost center is zero, the variable target costs are also zero.

On the basis of fixed and variable costs, it is possible to differentiate the cost variances according to individual variance categories. The input factors of a cost center result in a price variance due to a difference in factor prices.

E. g. the prices for material (price variance in the procurement costs for material) or prices for purchased activities did change between planning and actual posting.

Consumption variances occur if the actual consumption quantities differ from the planned consumption quantities.

On the activity side of a cost center, you can differentiate between the employment variance and the output price variance of the activities delivered to other cost centers.

The employment variance results from the multiplication of the Capacity Utilization Level with the plan fixed cost.

Example: If the capacity utilization level is 80%, only 80% of the fixed planned costs could be allocated using activity allocation. 20% of the fixed planned costs are employment variances.

The output price variance is as follows:

The plan price of the activity type is the result of dividing the plan costs by the plan activity.

An actual price of the activity type is calculated by dividing the actual costs by the allocated activity quantity.

The difference between the actual price and the plan price is the output price variance.

Valuation of Flexible Standard Costing

Flexible standard costing is a more efficient cost accounting system than rigid standard costing.

Since the target/actual variance is the basis of the variance analysis, individual variance categories can be calculated and examined for their cause.

However, in addition to the costs, you must also enter quantities (for example, activity quantities, material quantities, and so on). For production enterprises, only flexible standard costing provides the required explanatory power.

The business scenario we will describe in the following aims for reporting actual, target, and plan data as well as for reporting variance categories that will be set up with the help of the Embedded Analytical Queries tool of SAP S/4HANA.

Cost center planning is used to define plan figures for costs, activities, prices, or statistical key figures at the cost center level for a specific planning period.

Variances can be determined by comparing the actual events with the planning.

You can use the planning of costs and activity quantities to determine transfer prices (prices). You use these prices to evaluate the internal activities during the current period, that is, before the costs are known.

In the following planning scenario, the required activity quantities of the cost center and the planned costs to be expected for this are planned.

Cost center BIKEA-### has planned costs for fiscal year 2025 of about EUR 200,000 with a planned quantity of about 20,000 pieces for material consumption. This results in a planned price for the material of EUR 10 per unit.

Cost center BIKEA-### only offers one activity type, which is PR-###. This means that the fixed plan amounts don‘t have to be split in order to be assigned to the activity type!

Furthermore, the same cost center has planned 1000 hours for its activity PR-### in 2025. The price per hour for this activity is EUR 150.

Actual costs are also incurred for the resources that the cost center requires for the activity output when the cost centers are performed. This is usually done using the integration of corresponding logistics postings into Financial (FI).

The postings can also be made directly in the general ledger using a general journal entry.

Either way, the following account assignment logic applies: For each FI document item, only one CO object can be assigned to an actual account, that is, with an effect on net income.

Other statistical account assignments, such as profit centers, are possible.

The account assignment affecting net income to a cost center is only possible with costs, not with revenues.

In the following business scenario, actual material costs are assigned to the cost center.

It is important that, in addition to the costs, the actual material quantities are also entered during posting.

This is the only way to calculate the variance categories quantity variance and price variance separately.

The actual price for the actual account assignment of material costs results from the division of the actual costs by the actual material quantity entered at the same time.

Another actual posting of the cost center scenario is actual activity allocation.

For an event-based allocation, the plan cost rate of the cost center activity type is always used.

It is possible to calculate an actual cost rate from the division of actual costs and actual allocated activity, but only in period-end closing, not in a process-related posting during the fiscal month.

In 2025, the same cost center has a debit posting for material consumption of about EUR 180,000 and 9000 pieces, which leads to an actual price for the material of EUR 20 per piece. This actual price can be compared with the planned price as part of the variance calculation. Additionally, the cost center allocated 500 hours of activity type PR-### to cost center BIKEB-###. The calculated actual times are the basis for determining the so-called target costs, which are explained in the following lesson.

Log in to track your progress & complete quizzes

Source object (cost center/activity type) Table in SAP

- A061 Table for Controlling Area/Cost Center Type/Cost Center Table Type : POOL Package : VKON Module : AP-PRC-PR

- ONRKL Table for Object Number Index, Cost Center/Activity Type Table Type : TRANSP Package : DONR Module : CRM-CIC

- CRCO Table for Assignment of Work Center to Cost Center Table Type : TRANSP Package : CR Module : CRM

- IDCN_ZJFPRCTR Table for Assignment of Cost Center to Profit Center Table Type : TRANSP Package : ID-FI-CN Module : FI-LOC

- SMOWRKCNT Table for Work Center to Cost Center Allocation Table Type : TRANSP Package : SMO3 Module : CRM-MSA

- CRMC_TOOL_CO Table for CRM Service: Cost Center / Activity Type for Tool Table Type : TRANSP Package : IAOM_CRMSERVICE_EXEC Module : CO

- CSSL Table for Cost Center/Activity Type Table Type : TRANSP Package : KBAS Module : CRM

- KCR_T_CCAT Table for Data Model for Cost Center/Activity Type Table Type : TRANSP Package : DI_KCR Module : CO-OM

- KCR_T_CCAT_TD Table for Data Model for Cost Center/Activity Type - Time-Dependent Table Type : TRANSP Package : DI_KCR Module : CO-OM

- SMOACTTYP Table for Cost Center to Activity Type Allocation Table Type : TRANSP Package : SMO3 Module : CRM-MSA

- TKZU4 Table for Surcharge Base - Cost Center / Activity Type Table Type : TRANSP Package : KAUC Module : CRM

- CSSK Table for Cost center /cost element Table Type : TRANSP Package : KBAS Module : CRM

- OIFOCSKS Table for Object links - CO cost center (IS-Oil MRN) Table Type : TRANSP Package : OIF Module : CRM

- OIRBOCSKS Table for Object links - CO cost center (IS-Oil SSR) Table Type : TRANSP Package : OIR_B Module : IS-OIL-DS-SSR

- ONRKS Table for Object Number Index, Cost Center Table Type : TRANSP Package : DONR Module : CRM-CIC

- UPB_CW_ED Table for Cost Center Wizard: Economic Description (Economic Object) Table Type : TRANSP Package : UPB Module : FIN-SEM-BPS-BP

- A058 Table for Controlling Area/Cost Center Type Table Type : POOL Package : VKON Module : AP-PRC-PR

- A123 Table for Discount Type/Resp. Cost Center Table Type : TRANSP Package : VKON Module : AP-PRC-PR

- T8J5E Table for JV cost center type for supplemental detail Table Type : TRANSP Package : GJV2 Module : CA-JVA

- TKT05 Table for Cost center type texts Table Type : TRANSP Package : KBAS Module : CRM

- CRMC_UI_WC_A Table for Assign Work Center Link Groups To Work Center Table Type : TRANSP Package : CRM_BSP_UI_FRAME_CORE Module : CA-WUI-APF

- CRMC_MKTPL_COS2 Table for CRM Marketing: cost category to cost type association Table Type : TRANSP Package : CRMC_MKTPL_KPI_INTEGRATION Module : CRM-MKT-MPL

- A026 Table for Controlling Area/Cost Center Table Type : POOL Package : VKON Module : AP-PRC-PR

- A062 Table for Controlling Area/Company Code/Cost Center Table Type : POOL Package : VKON Module : AP-PRC-PR

- A063 Table for Controlling Area/Business Area/Cost Center Table Type : POOL Package : VKON Module : AP-PRC-PR

- A132 Table for Price per Cost Center Table Type : TRANSP Package : KBAS Module : CRM

- B066 Table for Cost center Table Type : POOL Package : VKON Module : AP-PRC-PR

- CFICR0C Table for FIN Objects for Cost Center/Resource Pool Table Type : TRANSP Package : CON_ACC Module : FIN-BAC-INV

- CMDT_CC Table for Generic Master Data: Cost Center Enhancements Table Type : TRANSP Package : KBAS Module : CRM

- CRMD_AC_ASSF4_05 Table for Search Help Values for Cost Center AC_ASSIGN Table Type : TRANSP Package : CRM_AC_ASSIGN Module : CRM-BTX-COI-SRV

- CSKS Table for Cost Center Master Data Table Type : TRANSP Package : KBAS Module : CRM

- CSKT Table for Cost Center Texts Table Type : TRANSP Package : KBASCORE Module : CO

- FMDERIVE002 Table for Derivation rule:Cost Center/CE to Commitment Item/Funds Ctr/ Table Type : TRANSP Package : FMFS_E Module : PSM-FM

- FMDERIVE003 Table for Derivation rule:Cost Center to Commitment Item/Funds Ctr/Fun Table Type : TRANSP Package : FMFS_E Module : PSM-FM

- KBEROBJ Table for Settings for authorization objects in Cost Center Accounting Table Type : TRANSP Package : KBAS Module : CRM

- MPO_CCMON_RULES Table for Cost Center Monitor: Rule Definition for Exception Reporting Table Type : TRANSP Package : MPO_COST_CENTER_MONITOR Module : CA

- NO2K Table for IS-H: Assign OU to Cost Center for Revenue Acct Asgmt Table Type : TRANSP Package : NBAS Module : CRM

- NOEK Table for IS-H: Assign Org. Unit to Cost Center Table Type : TRANSP Package : NBAS Module : CRM

- OFIC_COSTCTR_SRV Table for Orgfinder Customizing: Assign Cost Center to Service Org. Table Type : TRANSP Package : CRM_OFI_APPLICATION Module : CRM-BF-OFI

- OIUH_RV_GLCC Table for Cross Reference GL to Cost Center Table Type : TRANSP Package : OIU_H Module : IS-OIL-PRA-REV

- SETHANAHIER0101 Table for Hierarchy table for Cost Center Groups Table Type : TRANSP Package : GBSE_HANA Module : FI-SL-SL-MD-SE

- T8J_SUS_CC Table for JV Cost Center in Suspense Table Type : TRANSP Package : GJVA Module : CRM

- TKA05 Table for Cost Center Types Table Type : TRANSP Package : KBASCORE Module : CO

- TKAR2 Table for CO Resource Prices Per Cost Center Table Type : TRANSP Package : KBAS Module : CRM

- TKSA0 Table for Administration for Cost Center Accrual Table Type : POOL Package : KSA Module : CO-OM-CCA

- TKSR5 Table for Field transfers for cost center summarization Table Type : TRANSP Package : KSRO Module : CO-OM-CCA

- TKSRT Table for Texts for cost center summarization Table Type : TRANSP Package : KSRO Module : CO-OM-CCA

- TOIGS1 Table for TD Intransit Store Location/Cost Center Determination Table Type : TRANSP Package : OIG Module : CRM

- TVAUK Table for Cost Center Determination Table Type : TRANSP Package : VA0C Module : CRM-BF

- UPB_CCP_CUST Table for SEM Cost Center Planning: Customizing Table Table Type : TRANSP Package : UPB Module : FIN-SEM-BPS-BP

- UPB_CW_ANSWER Table for Cost Center Wizard: Answers Table Type : TRANSP Package : UPB Module : FIN-SEM-BPS-BP

- USPOB Table Data element for Source Object (Cost Center/Activity Type)

- RPM_TV_PS_GROUP Table Data element for Group (Cost Center/Activity Type/Cost Element Group)

- CK_UPDTC Table Data element for Update to Cost Center/Activity Type

- UKOST Table Data element for Source Cost Center

- CCA_TEMPL_SCI Table Data element for Template: Activity-Independent Allocation to Cost Center

- CCA_TEMPL_SCD Table Data element for Template: Activity-Dependent Allocation to Cost Center

- ISH_LVAKS Table Data element for IS-H: Activity allocation orders and cost center

- ISH_LVAKSA Table Data element for IS-H: Activity allocation orders and cost center

- UPB_Y_CW_EP_FW_TYPE Table Data element for Cost Center Wizard: Type of a BPS Object

- AD04PAKLGR Table Data element for partner object cost center group

- AD04PAKLFR Table Data element for Partner object Cost center

- AD04PAKLTO Table Data element for Partner object cost center to

Source object (cost center/activity type) related terms

Definitions.

SAP is the short form of Systems, Applications & Products in Data Processing. It is one of the largest business process related software. This software focused on business processes on ERP & CRM.

Like most other software, SAP also using database tables to store the data. In SAP thousands of tables are there to store different data. A table contains several fields and some of the fields will be key fields.

Popular Table Searches

Latest table searches.

COMMENTS

SAP Tables for Cost Center. Cost Center is used to analyze the costs incurred with in organization. CSKS (Cost Center Master Record) is the cost center master data table and CSKT (Cost Center Texts) is the cost center text table, which store cost center texts. Cost Center cab be of different types and there are two main types of cost centers ...

Cost Centers and Activity Types; Controlling (CO) 2023 Latest. Available Versions: 2023 Latest ; 2023 (Oct 2023) ... If you do not have an SAP ID, you can create one for free from the login page. Log on ... Share. Table of Contents ...

Rates Planning. The activity type classifies the activities performed within a company by one or several cost centers. If a cost center provides services for other cost centers, orders, and processes, this means that the resources of the cost center are used. The costs of these resources need to be allocated to the receivers of the activity.

Create SAP Activity Type - Initial Screen. Next, click on Master Data button. The system will take you to the next screen of this transaction. Here, you need to work with Basic data tab and enter the following details: Name of the activity type; Description of the activity type; Activity unit of measure; Cost center categories; Activity type ...

During activity type planning, the SAP system creates a credit record (unspecified credit) that is posted using a secondary cost element. This credit record is always based on the planned activity quantity of an activity type and its price on the corresponding cost center. You can store this default value for the cost element in the master ...

Activity Types. Activity types can be entered by the administrator when Customizing the planning service or be determined automatically when planning is run using personalization. A combination of these alternatives, using the intersection or union of cost elements from entry or personalization, is possible.

Statistical Key Figure Category. CDS Views for Product Cost Controlling. Product Cost Estimate. CDS Views for Profitability Analysis. CDS Views for Predictive Accounting. CDS Views for Organizational Changes. CDS Views for Billing and Revenue Innovation Management.

Activity Type, Cost Center Database Tables in SAP (30 Tables) Login; Become a Premium Member; SAP TCodes; SAP Tables; ... Activity Type, Cost Center Tables Most important Database Tables for Activity Type, Cost Center ... Transparent Table 26 : CRCO Assignment of Work center to cost center: PP - Work Center: Transparent Table 27 :

Activity types serve as tracing factors for this cost allocation. Activity output quantities are measured in activity units such as hours, pieces, kilowatt-hours, for example. You can post plan activity unit quantities as well as post the actual consumed for a period. Usually once a year you maintain activity type cost rates for cost centers.

Creating Activity Types: -. Step-1: Go to transaction KL01. Step-2: It opens Create Activity Type: Initial Screen. Enter Controlling Area and click on tick mark to proceed. Step-3: Enter the new Activity Type, Valid From and click on Master Data. Step-4: Enter Name, Description, Activity Unit, CCtr categories, ATyp category and Price indicator.

Assign the activity type to cost center using T code KP26. In the input screen of T code KP26 ,enter version as 0, from period 1 and to period as 12 and the Fiscal Year as 20xx. Click on Overview tab on top and key in costing details in this screen. After performing this ,while creating the work center ,this combination of activity type & cost ...

Cost Centers and Activity Types. Home; SAP ERP; Product Cost Planning (CO-PC-PCP) ... If you do not have an SAP ID, you can create one for free from the login page. Log on Download PDF. The following PDF options are available for this document: Create Custom PDF Share. Table of Contents ...

Activity type cost center Table in SAP. Here is a list of possible Activity type cost center related tables in SAP. You will get more details about each SAP table by clicking on the table name. A061. Table for Controlling Area/Cost Center Type/Cost Center. Table Type : POOL. Package : VKON.

Target costs = fixed plan costs + variable plan costs * capacity utilization level. Fixed plan costs are equal with fixed target costs. If the actual activity quantity of the cost center is zero, the variable target costs are also zero. On the basis of fixed and variable costs, it is possible to differentiate the cost variances according to ...

Activity price cost center Table in SAP. Here is a list of possible Activity price cost center related tables in SAP. You will get more details about each SAP table by clicking on the table name. Table Data element for Condition Cat.: Frt, Tax, Basic Price=Revenue, Price, Cost. Table Data element for Condition Cat.:

Activity Type. Home; SAP S/4HANA; Controlling (CO) Overhead Cost Controlling (CO-OM) Cost Center Accounting (CO-OM-CCA) Master Data in Cost Center Accounting (CO-OM-CCA) Activity Type; Controlling (CO) 2023 Latest. Available Versions: 2023 Latest ; 2023 (Oct 2023) 2022 Latest ; 2022 FPS02 (May 2023) 2022 FPS01 (Feb 2023) ... If you do not have ...

Here is a list of possible Source object (cost center/activity type) related tables in SAP. You will get more details about each SAP table by clicking on the table name. A061. Table for Controlling Area/Cost Center Type/Cost Center. Table Type : POOL.