Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

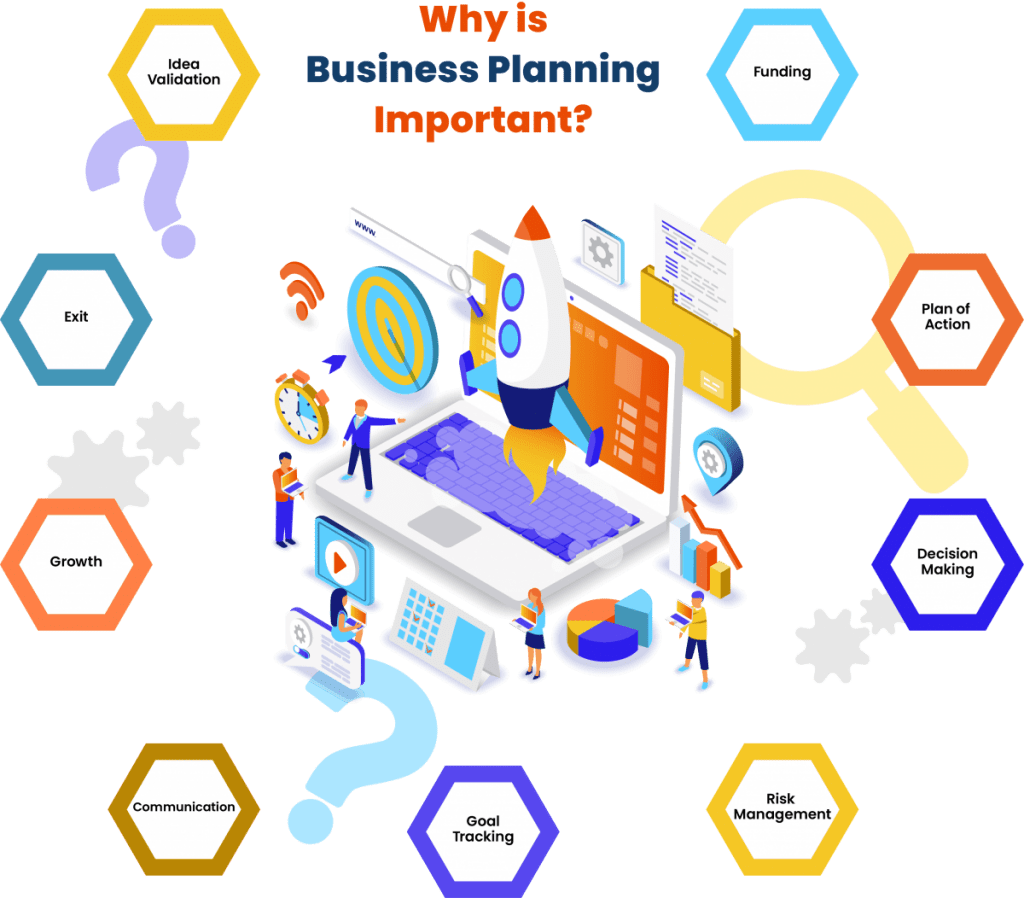

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

12 Reasons You Need a Business Plan In the new book "Write Your Own Business Plan," business expert Eric Butow breaks down how a solid business plan can save your startup during those tough early days.

By Dan Bova Sep 19, 2023

Running a business can be unpredictable, which is why having a solid business plan as a foundation is vital to surviving and thriving in the early days of your startup. Eric Butow, CEO of online marketing ROI improvement firm Butow Communications Group, has teamed up with Entrepreneur Media to write the second edition of our best-selling book Write Your Business Plan , providing you with a roadmap for success.

In the following excerpt, Butow explains how a well-thought-out plan can power your startup and help your vision come to life.

Business plans could be considered cheap insurance. Just as many people don't buy fire insurance on their homes and rely on good fortune to protect their investments, many successful business owners do not rely on written business plans but trust their own instincts. However, your business plan is more than insurance. It reflects your ideas, intuitions, instincts, and insights about your business and its future—and provides the cheap insurance of testing them out before you are committed to a course of action. There are so many reasons to create a business plan, and chances are that more than one of the following will apply to your business.

1. A plan helps you set specific objectives for managers.

Good management requires setting specific objectives and then tracking and following up. As your business grows, you want to organize, plan, and communicate your business priorities better to your team and to you. Writing a plan gets everything clear in your head before you talk about it with your team.

2. You can share your strategy, priorities, and plans with your spouse or partner.

People in your personal life intersect with your business life, so shouldn't they know what's supposed to be happening?

Order Write Your Own Business Plan Now and Get 1 Month of Free Access to Business Planning Software Liveplan Premium

- Easy step-by-step business plan generator

- Built-in financial c alculators

- 500+ sample plans and templates

3. Use the plan to explain your displacement.

A short definition of displacement is, "Whatever you do is something else you don't do." Your plan will explain why you're doing what you've decided to do in your business.

4. A plan helps you figure out whether or not to rent or buy new space.

Do your growth prospects and plans justify taking on an increased fixed cost of new space?

5. You can explain your strategy for hiring new people.

How will new people help your business grow and prosper? What exactly are they going to do?

6. A plan helps you decide whether or not to bring on new assets.

How many new assets do you need, and will you buy or lease them? Use your business plan to help decide what's going to happen in the long term and how long important purchases, such as computer equipment, will last in your plan.

7. Share your plan with your team.

Explain the business objectives in your plan with your leadership team, employees, and new hires. What's more, make selected portions of your plan part of your new employee training.

8. Share parts of your plan with new allies to bring them aboard.

Use your plan to set targets for new alliances with complementary businesses and also disclose selected portions of your plan with those businesses as you negotiate an alliance.

9. Use your plan when you deal with professionals.

Share selected parts of your plan with your attorneys and accountants, as well as consultants if necessary.

Write Your Own Business Plan is available now at Entrepreneur Bookstore | Barnes & Noble | Amazon

10. Have all the information in your plan when you're ready to sell.

Sell your business when it's time to put it on the market so you can help buyers understand what you have, what it's worth, and why they want it.

11. A plan helps you set the valuation of the business.

Valuation means how much your business is worth, and it applies to formal transactions related to divorce, inheritance, estate planning, and tax issues. Usually, that takes a business plan as well as a professional with experience. The plan tells the valuation expert what your business is doing, when it's doing (or will do) certain things, why those things are being done, how much that work will cost, and the benefits that work will produce.

12. You can use information in the plan when you need cash.

Seek investment for a business no matter what stage of growth the business finds itself in. Investors need to see a business plan before they decide whether or not to invest. They'll expect the plan to cover all the main points.

To dig deeper, buy Write Your Own Business Plan and get 1 month of free access to business planning software Liveplan Premium.

Entrepreneur Staff

VP of Special Projects

Dan Bova is the VP of Special Projects at Entrepreneur.com. He previously worked at Jimmy Kimmel Live, Maxim, and Spy magazine. His latest books for kids include This Day in History , Car and Driver's Trivia Zone , Road & Track Crew's Big & Fast Cars , The Big Little Book of Awesome Stuff , and Wendell the Werewolf .

Read his humor column This Should Be Fun if you want to feel better about yourself.

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- I Tried Making an AI-Hosted Podcast with Google's NotebookLM. It Worked Surprisingly Well.

- Lock This 30-Year-Old Started a Business to Stop Food Poisoning in Its Tracks. Now It's Raised Over $20 Million — and Taco Bell Is a Customer.

- How Piff the Magic Dragon Went From a Struggling Performer to Building a Multi-Million-Dollar Magical Empire

- Lock This Serial Founder on Why It's Cheaper Than Ever to Start a Business — and Other Surprising Insights

- Inflation Threatens 87% of Franchisees — Here Are the Ways They're Fighting Back

- Lock 5 Secrets to Growing Your Side Hustle Into a Thriving Business, According to an Expert Entrepreneur Who Sells Multimillion-Dollar Homes

Most Popular Red Arrow

This 52-year-old started a side hustle that brings people joy — and it earns up to $30,000 during wedding season: 'there was real demand'.

When Bay Area resident Shawn O'Connell inherited his dad's Mustang, he didn't want it to sit in the garage.

Kevin O'Leary's Dad Told Him Not to Follow His Passion. He's Glad He Listened.

O'Leary says getting an MBA was ultimately better than following his childhood dream.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

What America's No. 1 Beer Can Teach Entrepreneurs About Effective Marketing

Modelo upended Bud Light's 20-year reign as America's favorite beer. How they did it is a masterclass in marketing — let me explain.

73% of Amazon Corporate Employees Say They're Looking for a New Job After Being Told to Be In-Office 5 Days a Week

Amazon employees are fuming about the company's return-to-office mandate, according to a new survey.

He Started a Multimillion-Dollar Business That Brought Back the Espresso Martini — and Has Some Advice to Save Other Entrepreneurs Time and Money

Tom Baker, co-founder of Mr Black Cold Brew Coffee Liqueur, had a vision for two of Australia's biggest passions.

Successfully copied link

Limited Time Offer:

Save Up to 25% on LivePlan today

0 results have been found for “”

Return to blog home

15 Reasons Why You Need a Business Plan in 2024

Posted august 5, 2024 by noah parsons.

Imagine you’re going on a road trip. You know your final destination, but you haven’t figured out how to get there.

While it might be fun to start driving and figure things out as you go, your trip will likely take longer than expected and end up costing more. But, if you take the time to look at a map and chart the best way to get to your destination—you’ll arrive on time and on budget.

Planning for your business isn’t much different, which is why a business plan is so important to your continued success.

What is the purpose of a business plan?

The primary purpose of a business plan is to help you figure out where you want to go with your business and how you will get there. Writing a business plan helps you set your direction and determine a winning strategy. A solid business plan will set your business up for success and help you build an unbeatable company.

If you start off without a plan, you may go down some interesting detours, but you’re unlikely to grow quickly or stick to your budget.

15 reasons why you need a business plan

“Creating a road map for my business is all well and good, but do I really need a business plan? I’d rather just get started.”

If you’re still thinking like this and decide to skip writing a business plan, you’re making a big mistake and setting yourself up to fail. Even if your business survives, without a plan, you’ll miss valuable growth opportunities and never truly be in control.

Still not convinced? Here are the critical reasons why a business plan is important for small businesses.

1. You’re more likely to start

Documenting your business idea makes it more official. It takes rough ideas and turns them into the making of a real business.

According to a study by the Harvard Business Review , entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don’t.

Even if it’s just notes about your potential business, writing things down will make you more likely to proceed with your business. Without a plan, you can’t prove to yourself, partners, mentors, or investors that you’re serious about starting.

2. Reduce potential risks

Writing a business plan takes some of the risk out of starting a business. It helps you think through every facet of your business to determine if it can truly be viable.

- Does your solution fit the market? Are your startup or operational costs manageable?

- Will your proposed business model actually generate sales?

- What sort of milestones would you need to hit to achieve profitability?

Your business plan can answer these startup questions .

For those already running a business, writing a plan can help you better manage ongoing risk.

- Should you bring on a new employee?

- What does cash flow look like for your next month, quarter, or even year?

- Will you meet your milestones or do you need to change your focus?

Keep your plan up to date, review it regularly and you can easily answer these growth questions and mitigate risk.

3. Test a new business idea and prove it’s viable

When you have a new business idea, it helps to spend time thinking through all the details.

A business plan will help you think about your:

- Target market

- How much money you’ll need to launch

- How your idea will actually work before you spend any real money

A business plan will also help you easily share your idea with other people to get input and feedback before you get started.

There’s no need to create a detailed business plan either.

Instead, I recommend using a one-page business plan to quickly test your ideas and determine if you have a viable business.

4. Understand your market and build a marketing plan

No matter how good your idea is, you have to figure out who your ideal customers are and how you will get the word out to them.

That’s where a marketing plan comes in. It can be an indispensable tool to figure out how you get your first customers as well as your thousandth customer. It can start as a simple bulleted list of potential marketing channels that expands in detail as you need it.

5. Build a better budget and a financial forecast

Without a business plan, it’s impossible to know how much money it will cost to start and run a business. You don’t just need money for your initial purchases; you need enough cash in the bank to maintain your cash runway and keep your business afloat while you get fully up and running.

When you plan, you’ll need to create your expense budget , set sales goals, and identify how much cash is needed to keep your doors open, purchase inventory, and more.

The beauty of incorporating forecasts into your business plan is that you don’t need exact numbers to start. You can work with general assumptions and compare against competitive benchmarks to set a baseline for your business.

As you operate and collect financial data, you can revisit your business plan and update your forecasts to generate a more accurate picture of your business’s future.

6. Attract investors and get funding

Sharing your business idea with investors requires a business plan.

Investors may never actually ask for your full business plan, but they will certainly ask you questions that you’ll only be able to answer if you’ve taken the time to write a plan.

At the very least, they’ll want to see your financial forecasts, so you should be prepared for this. If you pitch your business to investors, having a business plan makes it much easier to translate the right information into a pitch deck.

In short, you’ll have all of the right information ready and available to show why your business is worth investing in.

7. Plan for different scenarios

Things rarely actually go to plan. The world is always changing, customer tastes change, and new competitors arrive.

Having a plan allows you to experiment with different scenarios to see how changes to your business will impact your forecasts, budgets, profitability, and cash flow.

Without a business plan, you’ll be reacting blindly with no way to track if your decisions are making a real impact.

8. Attract employees

Especially if you’re a young startup company, attracting employees can be hard. Without a proven track record, why should someone take a risk to work for you?

Having a business plan can help solve that problem. Your plan can help prospective employees understand your business strategy and growth plans so that they can feel confident joining your team. It’s also incredibly useful in determining when and if it’s feasible for you to hire more employees .

9. Get your team on the same page

A great business strategy can only be successful if your team understands it. By documenting your strategy with a business plan, you can easily get everyone on the same page and working towards the same goals.

It’s even better if you regularly review your plan with members of your team. Have everyone revisit your core strategy, analyze it, and explore how it impacts individual and team goals .

10. Manage your business better

A business plan is all about setting goals for your company — both financial goals and milestones you hope to accomplish.

When you use your business plan to manage your business, you’ll see which parts of your strategy are working and which aren’t.

For example, you may have invested in new marketing efforts to sell one of your products, but that strategy just isn’t working out. With a business plan in hand, you’ll be able to see what’s going to plan and where you need to adjust your strategy, pivoting to new opportunities that will drive profitability.

Regular business plan reviews , ideally monthly, will help you build a strong, resilient business.

11. Effectively navigate a crisis

Having a business plan not only helps you create a roadmap for your business but also helps you navigate unforeseen events. Large-scale economic downturns, supply shortages, payment delays, cash flow problems, and any number of other issues are bound to pop up. But by leveraging your business plan, you can be prepared to face each crisis head-on.

A plan helps you assess your current situation, determine how the crisis will alter your plan, and explore what it will take to recover.

With a little planning, you can even prepare your business for future downturns with this same process. Having the right plan and processes in place will make crisis planning easier and, ideally, recession-proof your business .

12. You’ll be ready to sell

You might decide to sell your business or position yourself for acquisition down the road. Having a solid business plan helps make the case for a higher valuation.

Your business is likely worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Remember, if you were buying a business , you’d likely want to see their business plan and any previous documentation. So, the more organized and professional your plan is, the easier it will be for a buyer to say yes.

13. It’s easier than you think

You may be procrastinating in writing a business plan because it sounds like a lot of work. The truth is that planning is much less complicated than you think.

Start small by writing a simple business plan you can complete in about half an hour. With the emergence of AI business plan generators , getting stuck with a blank page is a thing of the past. Just be sure that you don’t just let AI write your plan for you and keep yourself involved in the planning process.

From there, refine your plan until your idea is solid. At that point, you can invest more time in a more detailed business plan. Just start with the basics and expand from there.

14. You’ll sleep better at night

When you have a plan for your business, you have peace of mind. You know that you’ve invested the time to figure out a business model that works, and you’ve considered different financial scenarios so you can handle the unexpected.

Plus, you have a management tool to run your business better than your competitors.

15. Research shows that business plans work

A Journal of Management Studies study found that businesses that take the time to plan grow 30% faster than those that don’t.

Our own 2021 small business research study found that 58% of small business owners who have or are working on a plan feel confident in their business, even amidst a crisis.

A study in Small Business Economics found that entrepreneurs who write business plans for their ideas are 152% more likely to actually start their businesses.

There’s plenty of additional research linking business planning with success, so it’s a proven fact that you won’t waste time when you write your plan.

Why is a business plan important? Because it sets you up for success

There are plenty of reasons to write a business plan, but they all relate to one thing—increasing the likelihood of success for you and your business.

Taking the time to plan is an investment in yourself and your business that will pay dividends, whether you’re starting a new business or taking your existing business to the next level.

If you’ve been putting off writing a business plan, now is the time to do it. Start by downloading one of the many free business plan templates out there, or for additional guidance, invest in an online business plan builder .

No matter what business planning tool you choose, just deciding to write a business plan will set you up to build, run, and grow your business. So, don’t wait—start planning today.

What is a business plan?

A business plan is a structured document that outlines the goals, strategies, target market, and financial forecasts of a business. It serves as a roadmap for the business, detailing the steps necessary to achieve success.

Why is planning necessary?

Business planning is essential because it helps businesses set clear goals, allocate resources efficiently, identify potential challenges, and develop strategies to overcome them. It also provides a framework for decision-making and helps attract investors by demonstrating the viability of the business.

What happens if a business doesn’t plan?

Without planning, a business may lack direction and clarity, leading to inefficient use of resources, missed opportunities, and an inability to respond effectively to market changes. This can result in financial difficulties, operational challenges, and ultimately, business failure.

Like this post? Share with a friend!

Noah Parsons

Posted in business plan writing, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/Primary-Images-best-startup-business-loans-5112018-438ee29e880843e4a2f5ca6c750f9082.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

6 Reasons You Really Need to Write A Business Plan

Updated: October 14, 2020

Published: October 05, 2020

Starting a busine ss can be a daunting task, especially if you’re starting from square one.

It’s easy to feel stuck in the whirlwind of things you’ll need to do, like registering your company, building a team, advertising, the list goes on. Not to mention, a business idea with no foundation can make the process seem incredibly intimidating.

Thankfully, business plans are an antidote for the new business woes that many entrepreneurs feel. Some may shy away from the idea, as they are lengthy documents that require a significant amount of attention and care.

However, there’s a reason why those who take the time to write out a business plan are 16% more likely to be successful than those who don’t. In other words, business plans work.

What is a business plan, and why does it matter?

In brief, a business plan is a roadmap to success. It's a blueprint for entrepreneurs to follow that helps them outline, understand, and cohesively achieve their goals.

Writing a business plan involves defining critical aspects of your business, like brand messaging, conducting market research, and creating pricing strategies — all before starting the company.

A business plan can also increase your confidence. You’ll get a holistic view of your idea and understand whether it's worth pursuing.

So, why not take the time to create a blueprint that will make your job easier? Let’s take a look at six reasons why you should write a business plan before doing anything else.

Six Reasons You Really Need To Write a Business Plan

- Legitimize your business idea.

- Give your business a foundation for success.

- Obtain funding and investments.

- Hire the right people.

- Communicate your needs.

- It makes it easier to sell your business.

1. Legitimize your business idea.

Pursuing business ideas that stem from passions you’ve had for years can be exciting, but that doesn’t necessarily mean it’s a sound venture.

One of the first things a business plan requires you to do is research your target market. You’ll gain a nuanced understanding of industry trends and what your competitors have done, or not, to succeed. You may find that the idea you have when you start is not likely to be successful.

That may feel disheartening, but you can always modify your original idea to better fit market needs. The more you understand about the industry, your future competitors, and your prospective customers, the greater the likelihood of success. If you identify issues early on, you can develop strategies to deal with them rather than troubleshooting as they happen.

It’s better to know sooner rather than later if your business will be successful before investing time and money.

2. Give your business a foundation for success.

Let's say you’re looking to start a clean beauty company. There are thousands of directions you can go in, so just saying, “I’m starting a clean beauty company!” isn’t enough.

You need to know what specific products you want to make, and why you’re deciding to create them. The Pricing and Product Line style="color: #33475b;"> section of a business plan requires you to identify these elements, making it easier to plan for other components of your business strategy.

You’ll also use your initial market research to outline financial projections, goals, objectives, and operational needs. Identifying these factors ahead of time creates a strong foundation, as you’ll be making critical business decisions early on.

You can refer back to the goals you’ve set within your business plan to track your progress over time and prioritize areas that need extra attention.

All in all, every section of your business plan requires you to go in-depth into your future business strategy before even acting on any of those plans. Having a plan at the ready gives your business a solid foundation for growth.

When you start your company, and your product reaches the market, you’ll spend less time troubleshooting and more time focusing on your target audiences and generating revenue.

3. Obtain funding and investments.

Every new business needs capital to get off the ground. Although it would be nice, banks won’t finance loans just because you request one. They want to know what the money is for, where it’s going, and if you’ll eventually be able to pay it back.

If you want investors to be part of your financing plan, they’ll have questions about your business’ pricing strategies and revenue models. Investors can also back out if they feel like their money isn’t put to fair use. They’ll want something to refer back to track your progress over time and understand if you’re meeting the goals you told them you’d meet. They want to know if their investment was worthwhile.

The Financial Considerations section of a business plan will prompt you to estimate costs ahead of time and establish revenue objectives before applying for loans or speaking to investors.

You’ll secure and finalize your strategy in advance to avoid showing up unprepared for meetings with potential investors.

4. Hire the right people.

After you’ve completed your business plan and you have a clear view of your strategies, goals, and financial needs, there may be milestones you need to meet that require skills you don’t yet have. You may need to hire new people to fill in the gaps.

Having a strategic plan to share with prospective partners and employees can prove that they aren’t signing on to a sinking ship.

If your plans are summarized and feasible, they’ll understand why you want them on your team, and why they should agree to work with you.

5. Communicate your needs.

If you don’t understand how your business will run, it’ll be hard to communicate your business’s legitimacy to all involved parties.

Your plan will give you a well-rounded view of how your business will work, and make it easier for you to communicate this to others.

You may have already secured financing from banks and made deals with investors, but a business’ needs are always changing. While your business grows, you’ll likely need more financial support, more partners, or just expand your services and product offers. Using your business plan as a measure of how you’ve met your goals can make it easier to bring people onto your team at all stages of the process.

6. It makes it easier to sell your business.

A buyer won’t want to purchase a business that will run into the ground after signing the papers. They want a successful, established company.

A business plan that details milestones you can prove you’ve already met can be used to show prospective buyers how you’ve generated success within your market. You can use your accomplishments to negotiate higher price points aligned with your business’ value.

A Business Plan Is Essential

Ultimately, having a business plan can increase your confidence in your new venture. You’ll understand what your business needs to succeed, and outline the tactics you’ll use to achieve those goals.

Some people have a lifetime goal of turning their passions into successful business ventures, and a well-crafted business plan can make those dreams come true.

Don't forget to share this post!

Related articles.

The Best AI Tools for Ecommerce & How They'll Boost Your Business

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

23 of My Favorite Free Marketing Newsletters

![company advantages business plan The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

What is a Business Plan? Definition, Tips, and Templates

![company advantages business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![company advantages business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Business Plan Consultants

- FP&A Consultants

- Interim CFOs

- Market Research Analysts

- Startup Funding Consultants

- Startup Consultants

- Investment Bankers

- Fundraising Consultants

The Undeniable Importance of a Business Plan

We often hear about business plans in the context of early-stage companies; however, constructing excellent business plans is difficult and time-consuming, so many entrepreneurs avoid them. But, is this a mistake?

While most people may be aware of the “soft” arguments for and against writing a business plan, in this article, a Toptal Finance Expert takes a data-driven approach to addressing the debate. In it, he finds strong evidence to support the notion that writing an excellent business plan is time well spent.

By Sean Heberling

Sean has analyzed 10,000+ companies, built complex models, and helped facilitate $1+ billion in investment transactions.

PREVIOUSLY AT

Executive Summary

- Individuals who write business plans are 2.5x as likely to start businesses.

- Business planning improves corporate executive satisfaction with corporate strategy development.

- Angels and venture capitalists value business plans and their [financial models](https://www.toptal.com/finance/tutorials/what-is-a-financial-model).

- Companies who complete business plans are 2.5x as likely to get funded.

- Even if a small-scale early-stage venture seeking just $250,000 in capital spent almost $40,000 on business planning and another almost $40,000 on capital raising, it should still expect to "break even" on a probability-weighted basis.

- Larger early-stage ventures enjoy extraordinary probability-weighted returns on investment from business planning. Because the target net capital so greatly exceeds the money spent on business planning, the prospective ROI is huge.

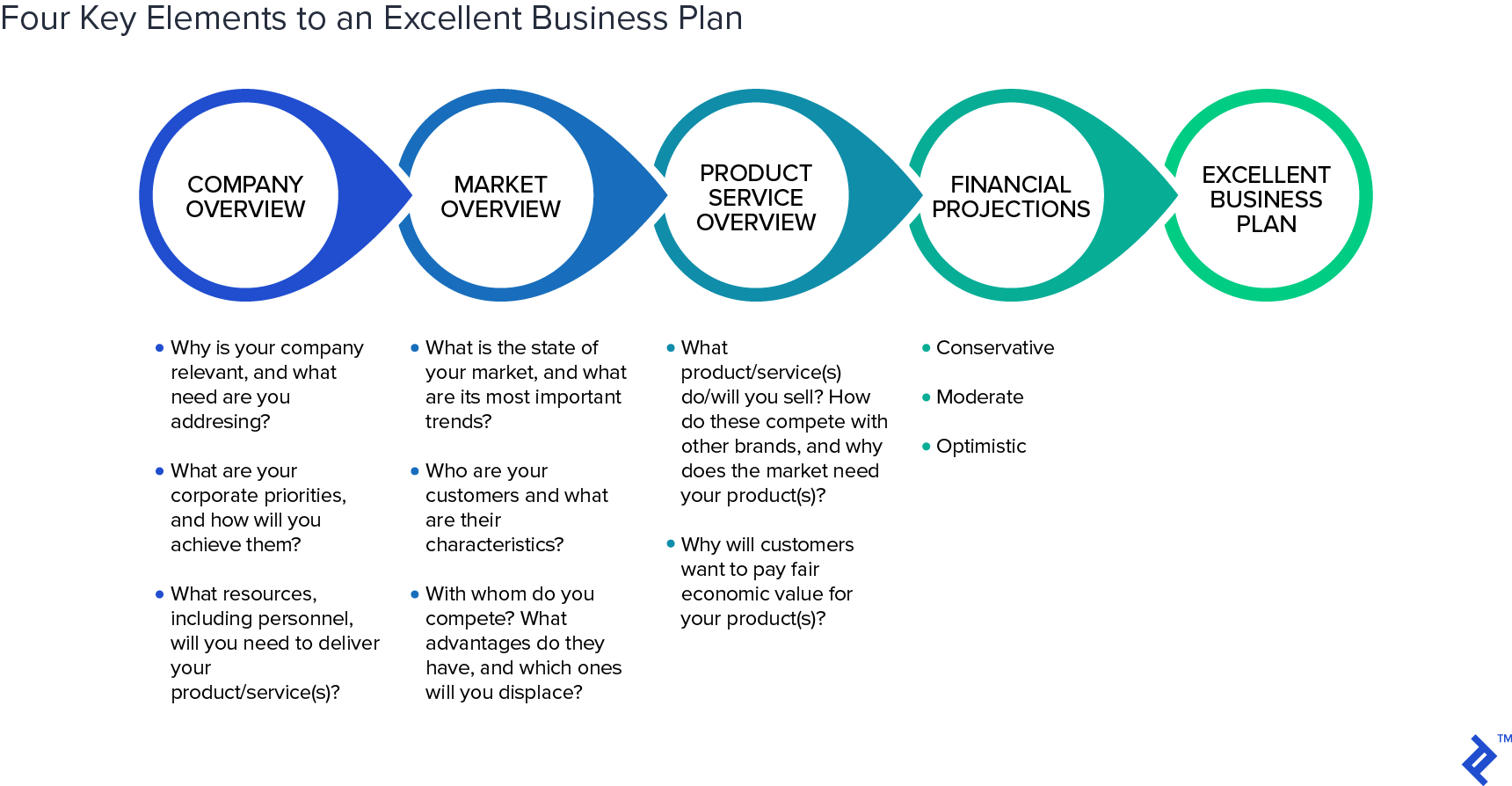

- Company Overview: An explanation of why your company is relevant and the need you are addressing.

- Market Overview: A description of the state of your market and its important trends, a detailed description of your customers, and a description of your current competitors and their advantages.

- Product/Service Overview: A description of your product(s), how they compete with other brands, why they are needed, and why customers will pay a fair economic value for it.

- Financial Projections: Three thorough financial plans with conservative, moderate, and optimistic assumptions.

- The process of writing forces the author to ask introspectively how they reached their conclusions and each of the sub-conclusions along the way because they must explain their logic to a cynical reader.

- The written author needs to support all conclusions with facts and logic to prove that they are not "making it up" or relying upon popular "myths."

- Outlined reports and outlined business plans are not generally subject to the same level of reader scrutiny.

We often hear about business plans in the context of early-stage companies , but constructing excellent business plans is difficult and time-consuming, so many entrepreneurs avoid them. That’s a mistake, as there is strong evidence demonstrating that business plans generate positive returns on time and money invested .

The business world has long debated the importance of business plans, and most involved understand the “soft” arguments. However, this article delves into the data to conclude that writing an excellent business plan is time well spent. I developed a similar view over my 20+ year financial career , during which I have analyzed well over 10,000 different types of companies. I have noticed that while a business plan may not be required for a venture to become successful, having one does seem to greatly improve the probability of successful outcomes.

Expert Opinions Support the Value of Business Planning

Expert opinions support the four following conclusions:

- Angels and venture capitalists value business plans and their financial models.

Individuals Who Write Business Plans Are 2.5x More Likely to Become Entrepreneurs

Many people have business ideas over the course of their careers, but often, these ideas never come to fruition, or they get lost amidst our daily obligations. Interestingly, studies support the notion that those who write business plans are far more likely to launch their companies. Data from the Panal Study of Entrepreneurial Dynamics in fact suggests that business planners were 2.5x as likely to get into business . The study, which surveyed more than 800 people across the United States who were in the process of starting businesses, therefore concluded that “writing a plan greatly increased the chances that a person would actually go into business.”

Of course, causation of this phenomenon is hard to pin down. There are several different possible reasons why this correlation between writing business plans and actually starting a business may exist. But William Gartner, Clemson University Entrepreneurship Professor and author of the Panal Study, believes that “‘research shows that business plans are all about walking the walk. People who write business plans also do more stuff.’ And doing more stuff, such as researching markets and preparing projections, increases the chances an entrepreneur will follow through.”

Research shows that business plans are all about walking the walk. People who write business plans also do more stuff. And doing more stuff, such as researching markets and preparing projections, increases the chances an entrepreneur will follow through.

William Bygrave, a professor emeritus at Babson College, reached a similar conclusion despite having previously shown “that entrepreneurs who began with formal plans had no greater success than those who started without them.” Bygrave does admit, however, that “40% of Babson students who have taken the college’s business plan writing course go on to start businesses after graduation, twice the rate of those who didn’t study plan writing.”

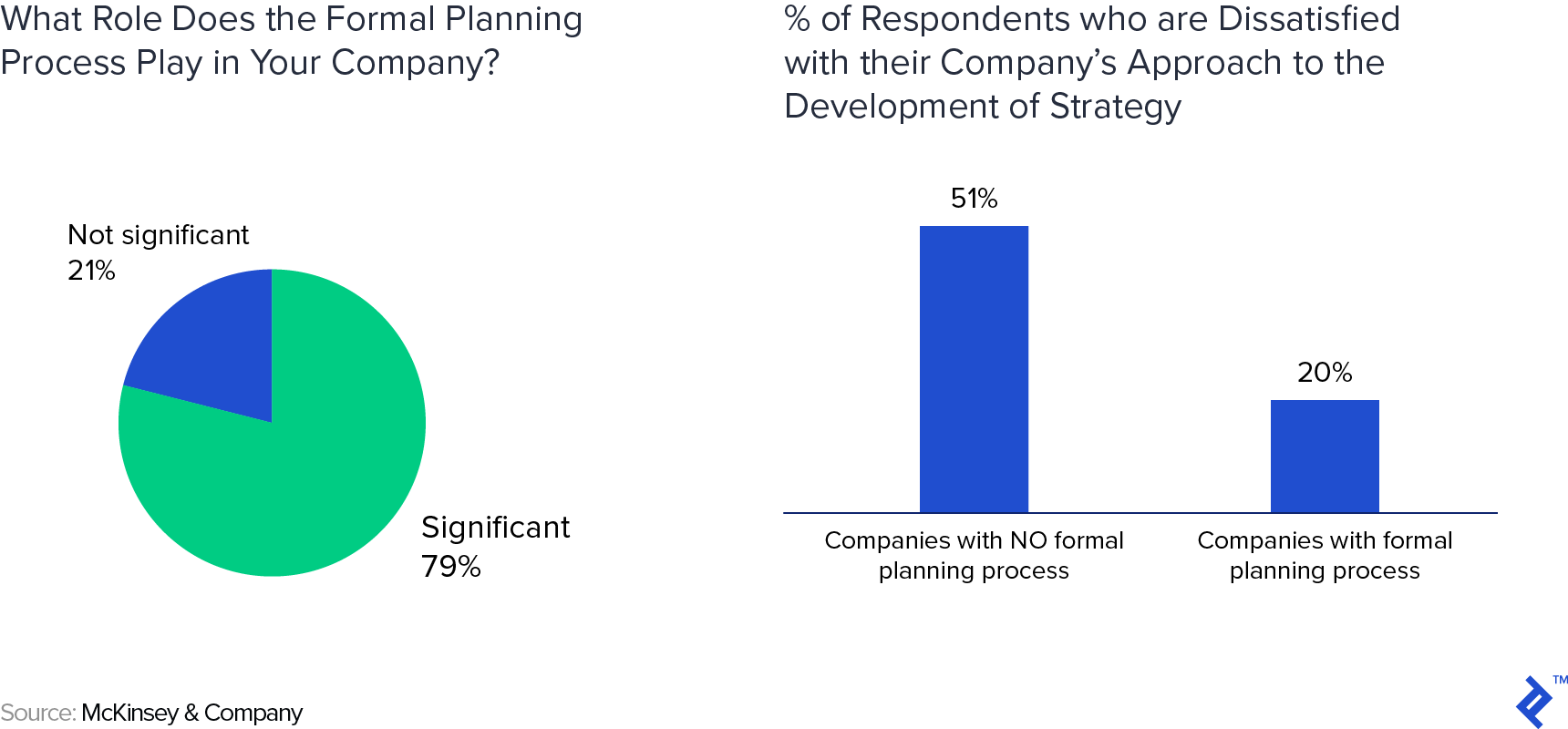

Business Planning Improves Corporate Executive Satisfaction

Another important way in which business plans can provide tangible help is by aligning everyone in an organization with the vision and strategy going forward. And this, in turn, has important ramifications on corporate executive satisfaction. A study by McKinsey & Company which surveyed nearly 800 corporate executives across a range of industries confirms this conclusion. In it, McKinsey found that “formal strategic-planning processes play an important role in improving overall satisfaction with strategy development. That role can be seen in the responses of the 79 percent of managers who claimed that the formal planning process played a significant role in developing strategies and were satisfied with the approach of their companies, compared with only 21 percent of the respondents who felt that the process did not play a significant role. Looked at another way, 51% of the respondents whose companies had no formal process were dissatisfied with their approach to the development of strategy, against only 20% of those at companies with a formal process.”

Of course, not all planning is equal. Planning just for the sake of planning doesn’t have the desired effects. As McKinsey itself noted in their study, “Just 45% of the respondents said they were satisfied with the strategic planning process. Moreover, only 23% indicated that major strategic decisions were made within its confines. Given these results, managers might well be tempted to jettison the planning process altogether.” As such, entrepreneurs and business managers should take the time and effort required to put together a well-written and well-researched business plan. Later in the article, I outline some of the elements of a well-written plan.

Business Plans and Their Financial Models Are Valuable to Angels and Venture Capitalists

Many entrepreneurs will eventually need to raise outside capital to grow and develop their businesses. In my experience, a business plan is a crucial tool in maximizing the chances of raising money from external investors. A well-written plan not only helps investors understand your business and your vision, but also shows them that you’ve taken the time to carefully assess and think through the issues your business will face, as well as the more detailed questions surrounding the economics and fundamentals of your business model.

Nathan Beckford, CFA, is the CEO of FounderSuite, the funding stack used by startups in Y Combinator, TechStars, 500s, and more to raise over $750 million. Nathan illustrates the above point nicely in an email he wrote to me recently: “Prior to starting Foundersuite.com, I ran a startup consulting business called VentureArchetypes.com. For the first few years, our primary business was cranking out bold, bullish, beautifully-written business plans for startups to present to investors. Around the mid-2000s, business plans started to go out of favor as the ‘Lean Startup’ methodology became popular. Instead of a written plan, we saw a huge uptick in demand for detailed financial models. Bottom line, I still see value in taking time to be contemplative and strategic before launching a startup. Does that need to be in the form of a 40-page written document? No. But if that’s the format that best works for you, and it can help you model scenarios and ‘see around the corner’ then that’s valuable.”

Nathan and I have frequently interacted, as I maintain a subscription to FounderSuite, software I use when running capital campaigns for early-stage companies on whose boards I sit, or when raising capital for my own firm’s investment projects. Nathan’s feedback is helpful, as he frequently interacts with thousands of entrepreneurs simultaneously running capital campaigns, providing him with a great perspective on which approaches work and which don’t. Clearly, he sees that financial models and business plans in some form help entrepreneurs raise capital.

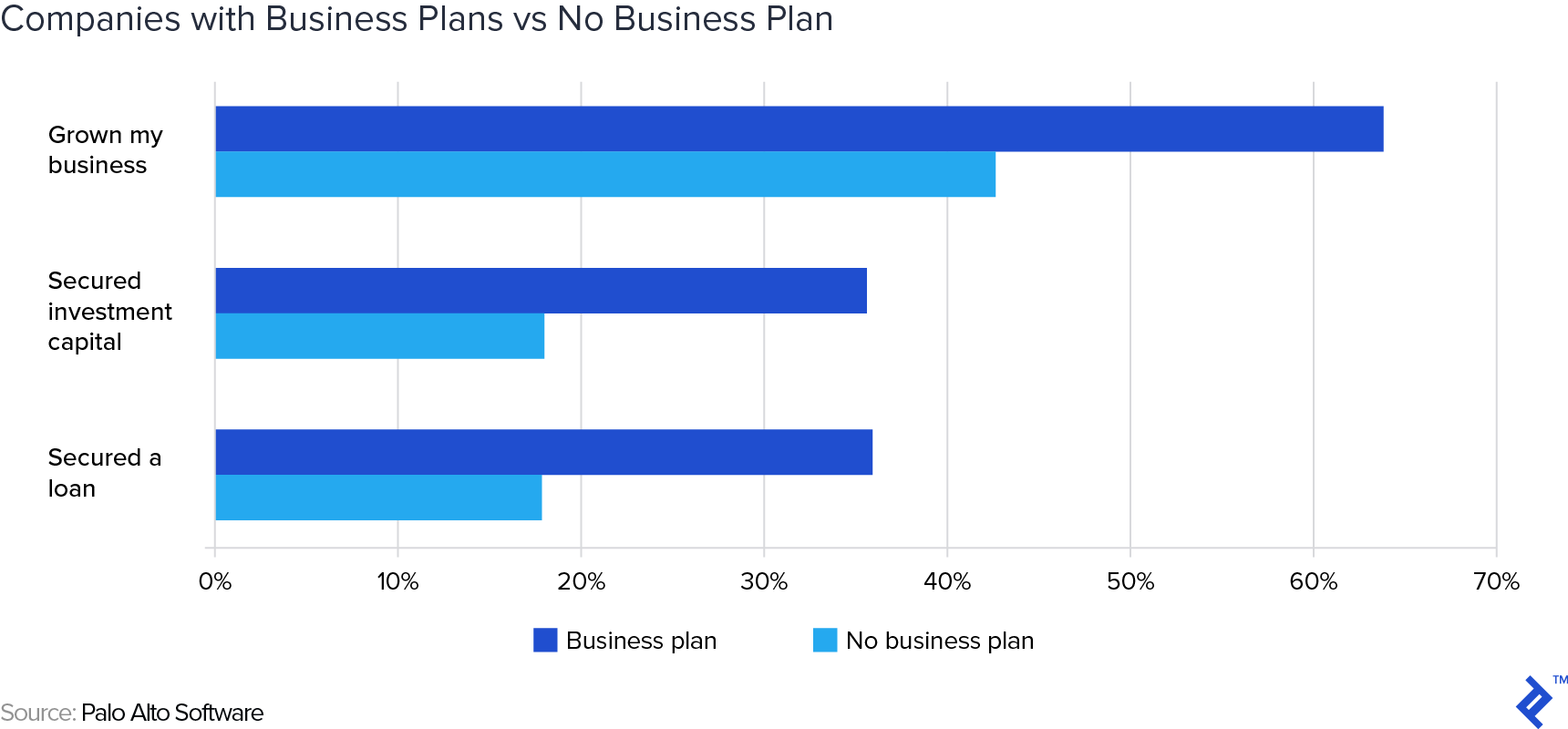

Companies Who Complete Business Plans Are 2.5x as Likely to Get Funded

Following the section above, naturally, if business plans are useful to outside investors, these are therefore likely to also increase one’s chances of successfully raising capital. A study by Palo Alto Software confirms this hypothesis. The study showed that although 65% of entrepreneurs had NOT completed business plans, the ones who had were twice as likely to have secured funding for their businesses.

This study surveyed 2,877 entrepreneurs. Of those, 995 had completed business plans, with 297 of them (30%) having secured loans, 280 of them (28%) having secured investment capital, and 499 of them (50%) having grown their businesses. Contrast these percentages with the results for the 1,882 entrepreneurs who had not completed business plans, where just 222 of them (12%) had secured loans, 219 of them (12%) had secured investment capital, and 501 of them (27%) had grown their businesses. (Note that the percentages among the business plan population sum to over 100% because of some overlap between each of the sub-categories.) These results led the study authors to conclude that “Except in a small number of cases, business planning appeared to be positively correlated with business success as measured by our variables. While our analysis cannot say that completing a business plan will lead to success, it does indicate that the type of entrepreneur who completes a business plan is also more likely to run a successful business.”

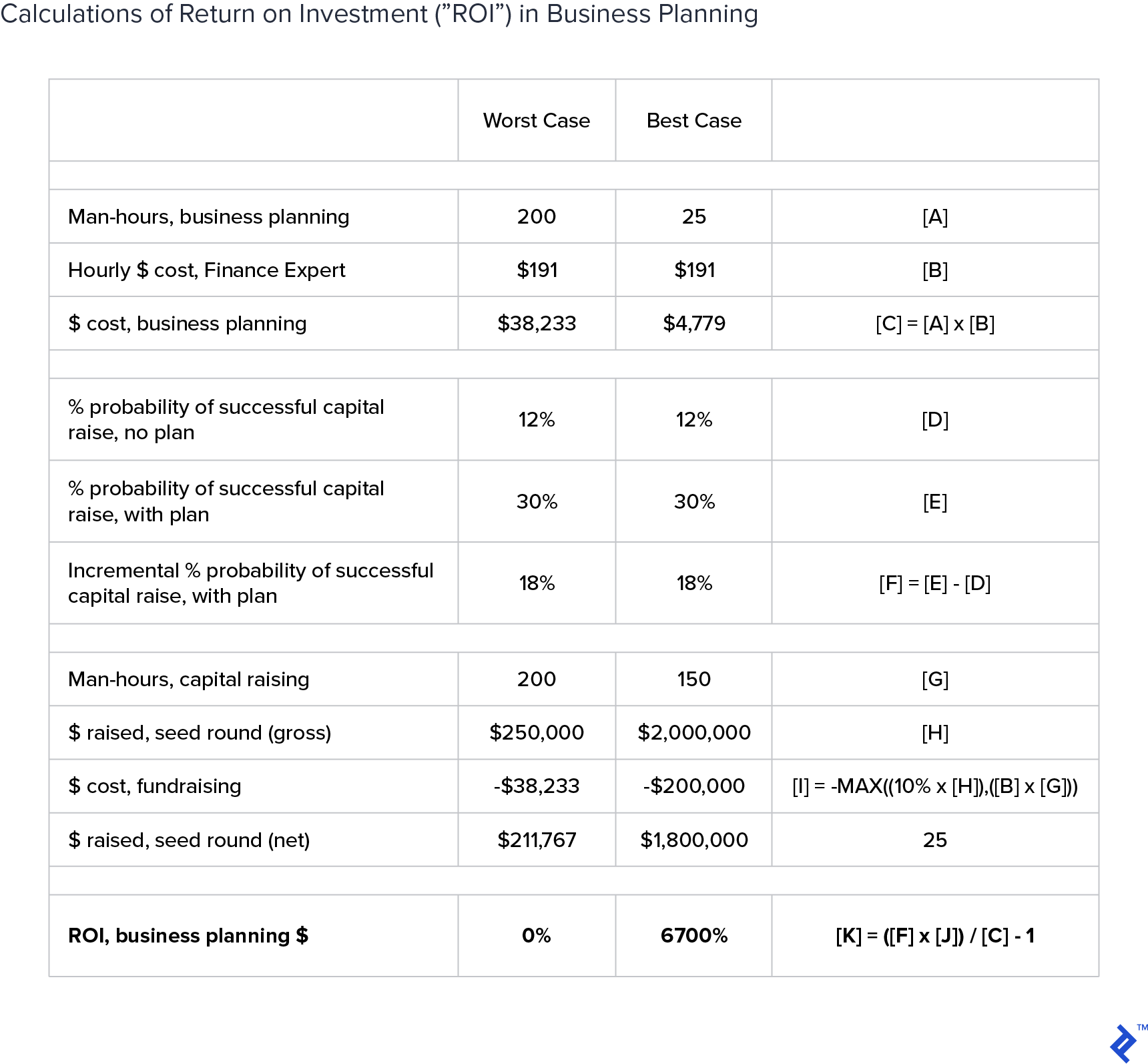

Calculating the Return on Investment for Business Planning

The data and studies outlined above all serve to prove something that I have come to understand very clearly throughout my career. Nevertheless, I still often find that startups struggle with the idea of having to put together a business plan, and in particular with the option of hiring an outside professional to help them do that. As such, I quantified the ROI of such an activity, using data and numbers based on my many years of business consulting. The results of the exercise are summarized in the table at the end of the section, but there are two overarching conclusions:

- Even a small-scale early-stage company can “afford” to pay a finance expert $191 per hour both to create a business plan and to guide the capital raising process, at worst “breaking even” on the investment.

- Larger early-stage companies can expect significant returns on investments in business planning, perhaps as much as 6,700% (67x the amount of money invested).

Diving into the analysis, my inputs included:

- My professional experience with writing business plans. I have spent 25 - 200 hours apiece creating business plans I feel comfortable sharing with founders, advisors, and investors.

- Data from the Palo Alto study discussed earlier in this article. This study showed that 30% of early-stage ventures with business plans had secured funding, 2.5x as great as the 12% of early-stage ventures without business plans who managed to secure funding despite the absence of such plans.

- The hourly rate for a finance expert x (150 to 200 hours) for one round of financing, OR

- 10% of the amount of capital targeted

My analysis illustrates the following:

- Early-stage companies should expect to spend $4,000 - $40,000 on business planning, including the financial modeling associated with it.

- Early-stage companies should expect to spend $30,000 - $200,000 for an initial round of financing between $250,000 and $2 million in size, resulting in net financing of $200,000 - $1.8 million.

- Even if a small-scale early-stage venture seeking just $250,000 in capital spent almost $40,000 on business planning and another almost $40,000 on capital raising, it should still expect to “break even” on a probability-weighted basis. In other words, because the odds of success with a professional business plan are 2.5x greater than without one, small-scale early-stage ventures can justify such a significant investment. This also assumes NO additional odds for success from engaging a professional to coordinate the fundraising effort. I suspect that doing so may push the odds of success from 12% without a business plan and 30% with a business plan to above 50%. It is also likely that a smaller-scale venture may require significantly fewer hours for business planning and capital raising that what is outlined in the “worst case” below.

- Larger early-stage ventures enjoy extraordinary probability-weighted returns on investment from business planning. Because the target net capital so greatly exceeds the money spent on business planning, the prospective ROI is huge, and this analysis just assumes ONE round of equity financing. Most successful startups will experience several rounds of financing.

Thoughts on Writing an Excellent Business Plan

An extensive overview of how to write an excellent business plan is beyond the scope of this article. However, here are two key thoughts that have emerged from my years of experience with startups.

First, there are four common elements to an excellent business plan. In Alan Hall’s Forbes article, “ How to Build a Billion Dollar Business Plan: 10 Top Points ,” he interviews Thomas Harrison, Chairman of Diversified Agency Services, an Omnicom division that has purchased “a vast number of firms,” to share his views on the key elements of a great business plan. Although each of these ten elements is essential, I reorganized the list into four broad categories:

1. Company Overview

- An explanation of why your company is relevant and the need are you addressing

- A description of corporate priorities and the processes to achieve them.

- An overview of the various resources, including the people that will be needed, to deliver what’s expected by the customer.

2. Market Overview

- A description of the state of your market and its important trends.

- A detailed description of your customers.

- A description of your current competitors and their advantages. Which ones will you displace?

3. Product/Service Overview

- A description of your products, how they compete with other brands, and why they are needed.

- An explanation of why customers will pay a fair economic value for your product or service. This element is conspicuously absent from some of today’s most expensive unicorns. Companies such as Uber and Tesla are losing massive amounts of money on rapidly growing sales because these companies may not be selling their services/products for fair economic value. Of course, sales grow rapidly when customers can buy your services/products for far less than their fair economic values!

4. Financial Projections

- Conservative

- Each scenario should have realistic and achievable sales, margins, expenses, and profits on monthly, quarterly, and annual bases. Again, these elements appear to be conspicuously absent from some of today’s most expensive unicorns.

Second, written business plans are superior to those just “outlined.” As an adjunct professor of finance for Villanova University, I require my students to write research reports prior to developing slide decks to present their findings from a full semester of industry research. The process of writing forces the authors to ask themselves how they reached their conclusions and each of the sub-conclusions along the way because they must explain their logic to cynical readers. The written authors need to support their conclusions with facts and logic to prove that they are not “making it up” or relying upon popular “myths.” Outlined reports and outlined business plans are not generally subject to the same level of reader scrutiny. Therefore, written business plans are superior to those just “outlined.” Outlined plans are often kept on 10-12 slide decks, and the slide deck is an important tool in the capital raising process, but the written business plan that stands behind it will differentiate an entrepreneur from their seemingly infinite competition.

Parting Thoughts

Some argue that many public multi-billion-dollar companies such as Apple or Google never had formal business plans before they started, but this argument is flawed because most of these companies likely developed business plans either during the solicitation of venture capital or during the process of going public. Apple and Google were both funded with venture capital, and soliciting venture capital involves business planning. The founders of Apple and Google likely created financial projections and outlined strategic paths.

Moreover, Apple and Google are both public companies, and going public involves business planning. Underwriters employ research analysts creating financial forecasts based on business plans projected by management at the companies going public. Buy-side firms purchasing and holding shares in newly public companies create forecasts based upon the business plans projected by public company management teams.

Admittedly, you don’t need a written business plan to have a successful company. You may not even need a business plan at all to have a successful company. However, the probability of success without a business plan is much lower. Angels and venture capitalists like to know about your business plan, and public companies need to project business plans to persuade underwriters and investors to purchase their securities.

Further Reading on the Toptal Blog:

- Creating a Narrative from Numbers

- Business Plan Consultants: Who They Are and How They Create Value

- Building a Business Continuity Plan

- Building the Next Big Thing: A Guide to Business Idea Development

- Mission Statements: How Effectively Used Intangible Assets Create Corporate Value

Understanding the basics

Why it is important to have a business plan.

Expert opinions and numerous studies show that business plans improve corporate satisfaction, are useful for angel investors and venture capitalists, and increase a company’s chances of raising capital by 2.5x.

What are the benefits of a business plan?

Individuals who write business plans are 2.5x as likely to start businesses. Moreover, business planning improves corporate executive satisfaction with corporate strategy development. Finally, investors value business plans, making the chances of raising capital 2.5x greater.

What does an investor look for in a business plan?

The four key sections of a business plan are: the company overview, a market overview, your product/service overview, and the financial projections.

- BusinessPlan

World-class articles, delivered weekly.

By entering your email, you are agreeing to our privacy policy .

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Process Optimization Consultants

- Certified Public Accountants

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modelers

- Financial Writers

- Fintech Consultants

- Fractional CFOs

- FX Consultants

- Growth Strategy Consultants

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal ® community.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Nine reasons why you need a business plan

Building a great business plan helps you plan, strategize and succeed. Presented by Chase for Business .

Making the decision to create a new business is an exciting yet stressful experience. Starting a business involves many tasks and obstacles, so it’s important to focus before you take action. A solid business plan can provide direction, help you attract investors and ensure you maintain momentum.

No matter what industry you plan on going into, a business plan is the first step for any successful enterprise. Building your business plan helps you figure out where you want your business to go and identify the necessary steps to get you there. This is a key document for your company to both guide your actions and track your progress.

What is the purpose of a business plan?

Think of a business plan like a roadmap. It enables you to solve problems and make key business decisions, such as marketing and competitive analysis, customer and market analysis and logistics and operations plans.