Re-Assignment (RMA)

Re-Assignment (RMA) Vehicles

The Motor Vehicles Department is regulated by the Government of Kerala in terms of policy formulation and its implementation. The Department is administered by the Transport Commissioner who is the Head of Department.

Visit Old Website

Helpdesk Online Services 0471-2328799 (10:15 AM - 05:00 PM) (Lunch break 01:15 P.M - 2:00 P.M) email: ssgcell[dot]mvd[at]kerala[dot]gov[dot]in

General Enquiry (Public Relation Officer): (10:15 AM - 05:00 PM) (Lunch break 01:15 P.M - 2:00 P.M) Transport Commissionerate: 0471-2333317 e-mail: tcoffice[dot]mvd[at]kerala[dot]gov[dot]in

RTO / JRTO Contact Numbers https://mvd.kerala.gov.in/directory

91 88 96 11 00 (10:15 AM - 05:00 PM) (Lunch break 01:15 P.M - 2:00 P.M) email: complaints[dot]mvd[at]kerala[dot]gov[dot]in

Vahan : Vehicle Registration/Fitness/Tax/Permit/Fancy, Dealer helpdesk-vahan[at]gov[dot]in, +91-120-2459168 6:00 AM-10:00 PM

Sarathi : Licence helpdesk-sarathi[at]gov[dot]in +91-120-2459169 6:00 AM-10:00 PM

eChallan helpdesk-echallan[at]gov[dot]in +91-120-2459171 6:00 AM-10:00 PM

mParivahan helpdesk-mparivahan[at]gov[dot]in +91-120-2459171 6:00 AM-10:00 PM

Kerala Government Call Center

BSNL - 155300 , 0471 2335523

Registration of Vehicle Arrived from other State or Assignment of New Registration Mark (R.M.A):

If vehicle registered in one state is to be kept or used in other state for the period of more than a year then the vehicle needs to be registered in the later state new registration number to be assigned . While doing so, the NOC from original registering authority & consent of financier needed to be furnished.

How to Apply?

Federation address.

All India Federation of Motor Vehicles Department Technical Executive Officer's Association #406, Mythri Apts, Judges colony, R.T.Nagar, Bangalore-560032 Mobile: +91 97411 90000, Fax:+91-80-23516957 Email: [email protected] Website: https://www.rtoaifmvd.in

SOCIAL MEDIA CONNECT

EXPLORE OUR SITE

- Terms of Service

Website Privacy Policy Website Terms of Use

Copyright © Orient Consultancy Services 2024. All rights reserved.

We use cookies to track page analytics and to keep you logged in. By continuing to use this website, you agree to our use of cookies as explained in our Cookie Policy . Please read our Cookie Policy for more information on how we use Cookies and process to disable them.

Easily Organize, Claim and Renew Insurance!

How to Re-Register a Vehicle in India?

Registration is a process of registering the vehicle in some specific person’s name. This is done at the time of purchase of the vehicle. Without a valid vehicle registration, it is illegal to ply the same in India. Once a vehicle is registered, you can officially drive the same anywhere within the geographical boundaries of India.

Registering a motor vehicle in one’s name was quite a tedious process but that seems like a distant past now. The Government of India has launched its official website named “Vahan” as a part of the ‘Digital India’ drive. Now the entire procedure has become simple. Thus, it has become quite easy for you to follow the process without any hassle.

Table of Contents

- Vehicle Registration

What is Re-Registration of the Vehicle?

The procedure involved in re-registration of a vehicle, steps for car registration renewal, list of documents needed for re-registration of a vehicle.

- Fees re-registration of a Vehicle

- Points to keep in mind while applying for a Re-registration of the vehicle

What is Vehicle Registration?

Vehicle Registration is a process whereby you get your car number plate and it is registered under the list and records of the Government. The main motto of registration is to have a linkage between you as the owner and your vehicle through a distinct identification number and therefore shows a car registration number plate. It is of extreme importance to register your vehicle so that the Government can curb any illegal activities in India. One of the main important reasons for registration of the vehicle is to get valid insurance coverage, without which is not possible.

According to the Motor Vehicle Act, 1988, section 39A, a vehicle is permissible to be driven in public roads only after registration by the respective transport authority for registration. Hence, the registration certificate is a certified legal document which acts as a proof that your vehicle is recorded and verified in Government records. In India, registration within 7 days from the delivery date of the vehicle is compulsory.

There are 2 situations under which a vehicle needs to be “RE”-registered, i.e. registered again. Those situations are:

- Situation 1 : It is compulsory for all private vehicles to do the re-registration of the vehicle after 15 years from the date of the initial registration as per the Central Motor Vehicles Act. After this, the registration is renewable at a gap of 5 years till the RTO declares the vehicle to be safe and fit for driving on the roads in India

- As the registered owner of the vehicle will have to put an application to the same RTO where the vehicle was registered

- Then you need to fill in the documents and submit them to the authority of the new RTO in the respective jurisdiction for the assignment or re-registration of the vehicle

- There is a timeframe of 1 year for this entire process to be completed, as mandated by the Central Government.

Steps for re-registering of the vehicle under certain scenarios:

- Properly filled Form Number 25 which is the application of renewal of registration

- Registration Certificate in original

- A valid Pollution Under Control Certificate or the PUC

- Insurance Certificate of the Vehicle

- Vehicle Hypothecation Position: If the vehicle had been taken under finance and it has the hypothecation done by the financer in the Registration Certificate. In this case, you need to get the No Objection Certificate or the NOC from the respective financer beforehand, so that you can register your vehicle in the other required state without any hassles

- Compulsory Road Tax: On transferring the vehicle from one state to another,you may have to pay the road tax of the new state at a depreciated price of the vehicle. If you need to apply for a refund of the Road Tax from the state you are moving for the remaining tenure of the tax validity, you need to apply for the same at the time of obtaining the NOC. Road Tax is levied by the State and the Central Government, and hence each state has its own specifics and basis of road tax calculation which you need to pay accordingly.

Let us now see the 3 broad steps of car registration renewal in details for a better understanding:

- Notary attested self-declaration affidavit has to be furnished by you on an INR 10 stamp paper stating that all relevant documents for the vehicle are original with no outstanding dues for the vehicle

- A No Objection Certificate should be attained from National Crime Record Bureau or NCRB affirming that its not a stolen vehicle

- A No Objection Certificate from the financer in Form Number 35 if the vehicle had been taken on loan and the same hasn’t been repaid yet

- Form No 27, i.e. the application for the assignment of new registration,

- Form number 28, i.e. the application and

- The grant of No Objection Certificate together with

- NOCs from the Traffic Police,

- NCRB as well as

- The financer to obtain the NOC from the respective RTO

- Other vehicle documents like the PUC Certificate, copy of Smart Card, copy of Chassis imprint, proof of identity and proof of address have to be submitted.

The RTO then will issue an interstate automobile transfer NOC within a timeline of 2-3 weeks.

- Documents that need to be shown in the original include Smart Card, Insurance Document, Pollution Under Control or PUC Certificate

- The Original Invoice so that the RTO can compute the road tax basis the depreciation of the vehicle

- Re-registration of the vehiclecan be made in Form Number 20, the application for registration for your vehicle and Form number 33, the application of intimation for address change

- If you have a used vehicle, you must submit the relevant documents for the transfer of title or ownership

- After the vehicle is being registered, you can apply for a refund of tax as appropriate

Here is the exhaustive list of documents that are needed for re-registration of a Vehicle:

- Application Form in Form Number 27 as mentioned above

- Registration Certificate

- No Objection Certificate as mentioned above

- Residence Proof

- Certificate of Insurance

- Form Number 28 as mentioned above

- Form Number 20 as mentioned above

- In the case of commercial vehicles, Challan clearance from the department of traffic police

- Certificate of Fitness

- PAN Card or Form 60 as applicable

- Fee for parking

- Certificate manufactured about emission standards

- Sketch imprint of the Chassis and the Engine

- Your Date of Birth proof

- Proof for the address of the seller

- Sign identification of the seller

Fees for re-registration of a Vehicle

There is a charge for re-registration of the vehicle which must be paid before the process is completed. Here is a list of the required fees that need to be paid for re-registration of a Vehicle :

Points to keep in mind while applying for a Re-registration of the vehicle:

The Registration Certificate can be renewed easily and you need to keep in mind the following points:

- Within 60 days of the Registration Certificate expiry, the fresh application for the renewal of the Registration Certificate has to be made via Form number 25 to the particular authority in registration in the same area the vehicle is registered

- Payment has to be clear for all the taxes which are unpaid if there are any

- Payment has to be made as per in the CMVR Act of 1989

The car registration renewalof a private vehicle is effective for a period of 5 years. You are allowed to renew them every 5 years as mentioned above.

Re-registration is a legal and easy process which can be quite hassle-free if you get the documents beforehand. All you need to do is to follow the process, get the right documents and get the vehicle re-registered.

Comprehensive Vehicle insurance

Transfer of Ownership of a Vehicle

1. Is re-registration and reassignment of registration certificate same?

Yes, re-registration and reassignment of registration certificate are the same and the same applies when you are moving from one state to the other.

2. Is Transfer of ownership related to re-registration?

No, transfer of ownership and re-registration are different. Transfer of ownership happens under the following 3 scenarios:

- Transfer of ownership when you are selling your vehicle to another buyer

As soon as the vehicle is sold off, the name of the buyer is recorded as the registered owner of the vehicle instead of the earlier registered owner and this process is called as the transfer of ownership.

- Transfer of ownership upon the death of the owner of the vehicle

As soon as the registered owner of a vehicle dies, transfer of ownership is effective in the name of the legal heirs of the expired registered owner and the usage of the vehicle can be for a period of 90 days within 30 days from the date of death of the owner.

- Transfer of ownership in auction

When a vehicle is sold in public auction, the name of the buyer is recorded as a registered owner instead of the earlier registered owner and once again this is the process called and named as the transfer of ownership.

3. Is No Objection Certificate mandatory in case of re-registration?

Yes, it is compulsory to get the No Objection Certificate and is a crucial step in the process of re-registration of your vehicle.

4. What documents are needed for address change in the registration certificate?

You can change the address in the RC book once you are shifted to a different state. As an owner of the vehicle to register a new address in case of any change in the address, you need to apply for the same with a certain document which is as follows:

- Form number 33 application form for address change in the RC book

- Your new address proof

- Pollution Under Control Certificate

- No objection certificates

- Fee for the Smart card fee or the registration certificate

- Your attested PAN card copies or form 60 as appropriate

- Your signature proof as an owner

5. What documents are accepted as proof of residence?

Any one of the following documents is accepted as proof of residence.

- Ration card

- Aadhar Card

- Life insurance policy

- Utility bills like telephone bill, electricity, gas bill

- State or Central Government issued payslip

- House Sale or Rent Agreement

Found this post informational?

Browse Turtlemint Blogs to read interesting posts related to Health Insurance , Car Insurance , Bike Insurance , and Life Insurance . You can visit Turtlemint to Buy Insurance Online.

Get Best Insurance Quotes For

Health Insurance

Life Insurance

Car Insurance

Bike Insurance

Related Blogs

Two-Wheeler Renewal is Not only Easy but is also the Right Thing to Do!

Two-wheelers are the most convenient modes of transport, especially in a country like India where traffic jams are the norm and the roads are not in the best shape. If you have not renewed your…

Rupanjali Mitra Basu

Sep 28, 2021

What is IDV in Bike Insurance & Factors Affecting your Bike Insurance IDV?

What’s Inside IDV in Two Wheeler Insurance Understanding the Rate of Depreciation on Two Wheeler 4 Factors affecting the Two Wheeler IDV 1. Age of the Two Wheeler 2. The Make, Model…

May 10, 2021

Complete Information on How to Transfer Two-Wheeler Ownership

Buying a second-hand bike is quite common in today’s age. A second-hand bike is more affordable and it also fulfils your conveyance needs. That is why the used vehicle market is growing as…

Ankita Sejpal

Oct 09, 2020

What is Personal Accident cover in Bike Insurance Plans?

When you buy a bike, you need to buy a valid insurance policy on the bike as well. The Motor Vehicles Act, 1988 governs transportation laws in India and one such rule specified by the Act is the need…

Sep 17, 2020

What Is Insurance all about?

Insurance is an ancient concept. The first form of insurance emerged to limit the loss of goods during inland transit by the Chinese and Babylonian traders. The concept evolved over time to become…

Mar 31, 2020

Difference Between Comprehensive & Third-Party Insurance

Traffic rules and regulations are laid down in the Motor Vehicles Act, 1988. The Act specifies the rules for driving on Indian roads for all types of vehicles. One such rule specified by the Act is…

Mar 06, 2020

Top #5 ways to get discounts on Bike Insurance in 2021

Sale, discounts, offers – who doesn’t love the sound of these words. It actually makes us alive and kicking. Do you know why? It is because these beautiful words imply cost saving. You can purchase…

Sidharth Hampanavar

Dec 30, 2019

How to Transfer Ownership and Bike Insurance

My friend Raj wanted to sell off his existing bike to buy the new trendy model which everyone was talking about. He was a bike enthusiast and his promotion gave him the excuse to splurge on a new…

Dec 02, 2019

Bike Insurance Companies

Policy Cancellation & Refund

Policy cancellation and refund of the premium shall be as per the terms & conditions of the policy. The refunds are processed by the Insurance Company directly. You are requested to contact the toll free number of your Insurance Company or refer the respective section of your Policy terms and conditions. You can also call us at our toll free number 1800-266-0101 or write a mail to us at [email protected] . We shall be available to guide/assist you.

Confused about insurance? Let’s simplify it together!

Submit your details for expert guidance and hassle-free assistance.

IRDAI certified expert advice

Application assistance

Claim support

Get free advice

Now sit back and relax!

Our advisor will reach out to you shortly!

- Thu. May 30th, 2024

TRANSPORT DEPARTMENT HARYANA

R.T.A., HISAR

Reassignment

Assignment of new registration mark on removal of vehicle to another state.

Section 47 of M.V. Act 1988 provides for assignment of new registration mark on removal of vehicle to another.The application for assignment of new registration mark to a motor vehicle shall be made in Form 27 of CMV.Time of 12 months is provided for re-assignment of a vehicle under Section 47 of M.V. Act.

Requirements

- My Dashboard

Currently the video chat timings are 9:30am to 6:30pm from Monday to Saturday.

- Knowledge Center

- Insurance Reads

The process to Re-Register Bike or Car in India

Every vehicle that you own needs to be registered in your name. This process is called registration of the vehicle and it takes place at the time of its purchase. The registration process makes your vehicle legal to be driven on road in India. You can register your vehicle through Vahaan, the official website of the transport department of the GoI. The website was launched as a part of the Digital India initiative.

What is the re-registration of a vehicle?

Essentially, there are two situations, wherein, you need to re-register your vehicle:

1) Mandatory Re-registration of the vehicle after 15 years from the first registration date according to the Central Motor Vehicles Act. After the second renewal, the next Re-registration happens at 5-year intervals, until the Road Transport Department declares the vehicle is fit for Indian roads.

2) If you are moving from one state to another, the re-registration of your vehicle is mandatory. According to the law, if the vehicle is in a different state for 12 months or more, then the vehicle needs to be re-registered.

The procedure involved in the Re-Registration of vehicle

In case you re-register your bike or re-register your car in India after 15 years, you will have to apply with an application form. The RTO will look at your vehicle and charge essential fees. After the scrutiny, fees, and verifying all the documents that are submitted along with the application form, the RTO department then issues a new RC.

In the case of transfer to another state:

a. The re-registration requires the NOC from the financer, and it needs to be submitted with all the other necessary mentioned documents.

b. The Road tax needs to be paid to the new state and a refund of the tax for the remaining life of the vehicle needs to be requested at the RTO from the previous state.

Steps for car registration renewal

1. Involves getting a NOC.

a. Notary attested documents on Rs.10 stamp paper that says all the related documents of the vehicle are original and there are no dues for the vehicle.

b. NOC from the National Crime Record Bureau that states that the vehicle is not stolen.

c. NOC from the bank financer in form 35 if the vehicle loan has not been repaid.

d. Three copies of each of the mentioned documents

- NOC from the traffic department

- NOC from NCRB

- NOC from Financer

- proof of bike insurance/car insurance

e. Documents like PUC, copy of chassis imprint, identity proof.

2. For transferring your vehicle to any other state

- PUC proof, smart card, proof of vehicle insurance should be carried in person at the time of Re-registration.

- The original invoice of the vehicle should also be carried so the road tax is charged according to the current value of the vehicle.

List of documents needed for the Re-registration of a vehicle

The list includes the documents required to re-register a car in India and re-register a bike:

1. Application Form Number 27

2. Registration Certificate

4. Proof of Residence

5. Proof car insurance/bike insurance

9. Commercial vehicles should include a challan clearance from the traffic department

10. Fitness Certificate

11. PAN card

12. Emission Standards Certificate

13. Sketch of the Chassis and Engine number

14. DOB proof

15. Proof of seller

Is NOC compulsory?

Yes, NOC is a compulsory step for the process of re-registration of your vehicle.

What documents are needed for Proof of Address?

1. Aadhaar card

2. Passport

3. Voters ID

Is it necessary to have your vehicle insured during re-registration?

Yes. You are required to submit proof of valid bike insurance or car insurance along with other documents during re-registration.

Other interesting reads!

- Pay Premium

- Become Our Partner

- Assistant VoiceBot

Kerala MVD : Apply for Re-Assignment of Registration Number

Organization : Kerala Motor Vehicles Department Facility : Apply for Re-Assignment of Registration Number

Home Page : http://www.keralamvd.gov.in/index.php/license Apply here : https://smartweb.keralamvd.gov.in/kmvdnew/services/RMA/rmatest.php

Re-Assignment of Registration Number :

Vehicles Registered in other states brought to Kerala State for using more than Six months are to be Re-Assigned in this State

Related : Kerala MVD Issue of Duplicate RC : www.statusin.in/2657.html

Procedure for applying for Re-Assignment : ** Obtain ‘No Objection Certificate’, in the prescribed form, from the state where the vehicle is presently registered. ** Submit application Online by clicking ‘Apply Now’ Button. ** Payment of fees can be done online, if the applicant wishes ** Take printout of the automatically generated applications and produce it directly or send by registered post to the concerned Regional/ Sub Regional Transport Office with

Required documents : ** Registration Certificate of the vehicle in Orginal. ** No Objection certificate in orginal. ** Insurance Certificate. ** Pollution Under Control Certificate. ** Attested copy of Address proof. ** Affidavit with photo in stamped paper duly attested by a Notary Public. ** If the vehicle is 2007 or later model one, Copy of sale certificate issued by the dealer at time of first purchase. ** Prescribed fee receipt. ** The vehicle has to be produced before the Registering Authority for Inspection as and when required.

How To Take Print Out Of Temporary Registration Certificate : 1. On issuing of temporary registration from the RTO/Sub RTO, an e-mail and SMS will be forwarded to the owner’s e-mail address and mobile phone number entered in the vehicle registration data.

2. Visit the official site of Motor Vehicles Department, Click Temp.Registration under Information Services. 3. Enter the temporary registration number received by e-mail or SMS and the characters shown. Click GET.

4. On clicking GET, the details of temporary registration will be displayed. Click PRINT to print the certificate.

5. Enter the PIN number received via e-mail or SMS and click CONTINUE. 6. The Temporary Registration Certificate will be opened in a new window as PDF and print can be taken.

Any Counter Any Service : Any counter any service system is started in some offices ** In which a citizen can approach of any counter for various services like renewal of Driving ** License to Application for a permit. In addition Morning and Evening Counter is functioning

** Some offices which starts 8.00 AM to 7.00 PM. ** A Help Desk is functioning in major offices to assist the public.

About Us : Motor Vehicles Department: The Motor Vehicles Department is regulated by the Government of Kerala in terms of policy formulation and its implementation. The Department is administered by the Transport Commissioner who is the Head of Department.

Services : The main functions of the Department are ** Enforcement of the Motor Vehicles Act and Rules ** Registration of vehicles

** Collection of taxes and fees ** Rendering services like grant of driving licences, issue of certificate of fitness, grant of permits to vehicles, etc.

Contact us : Transport Commissionarate Trans Towers, Vazhuthacaud Thycaud P.O. Thiruvananthapuram – 695 014

Leave a Reply Cancel reply

How to add comment : 1) Type your comment below. 2) Type your name. 3) Post comment.

Save my name, email, and website in this browser for the next time I comment.

Search the site :

Navigate categories :.

Other State Vehicle in Uttarakhand: RTO Rules, NOC, Address Change, Road Tax, Registration [2024]

Uttarakhand RTO Rules for Other State Vehicles

Get noc certificate from other state, how to apply for noc from other state, documents required for noc, how to apply for change of address of vehicle in rc in uttarakhand, documents required for change of address of vehicle in rc in uttarakhand, convert other state vehicle registration to uttarakhand registration, how to apply for reassignment of vehicle registration number in uttarakhand, documents required for reassignment of vehicle, how to pay road tax online in uttarakhand, get road tax refund from other state, how to book appointment on parivahan sewa.

When you take a vehicle from any other State to Uttarakhand, you need to do either or all of the following based on your period of stay in Uttarakhand.

Get NOC Certificate from Other State.

Change of Address of Vehicle in RC in Uttarakhand.

Convert Other State Registration of Vehicle to Uttarakhand Registration .

Pay Road Tax in Uttarakhand.

Get Road Tax refund from Other State.

NOC is a No Objection Certificate issued from the RTO where your vehicle is registered. An NOC certifies that there are no dues of tax on the vehicle.

Follow the below steps to apply for NOC Online from Other State.

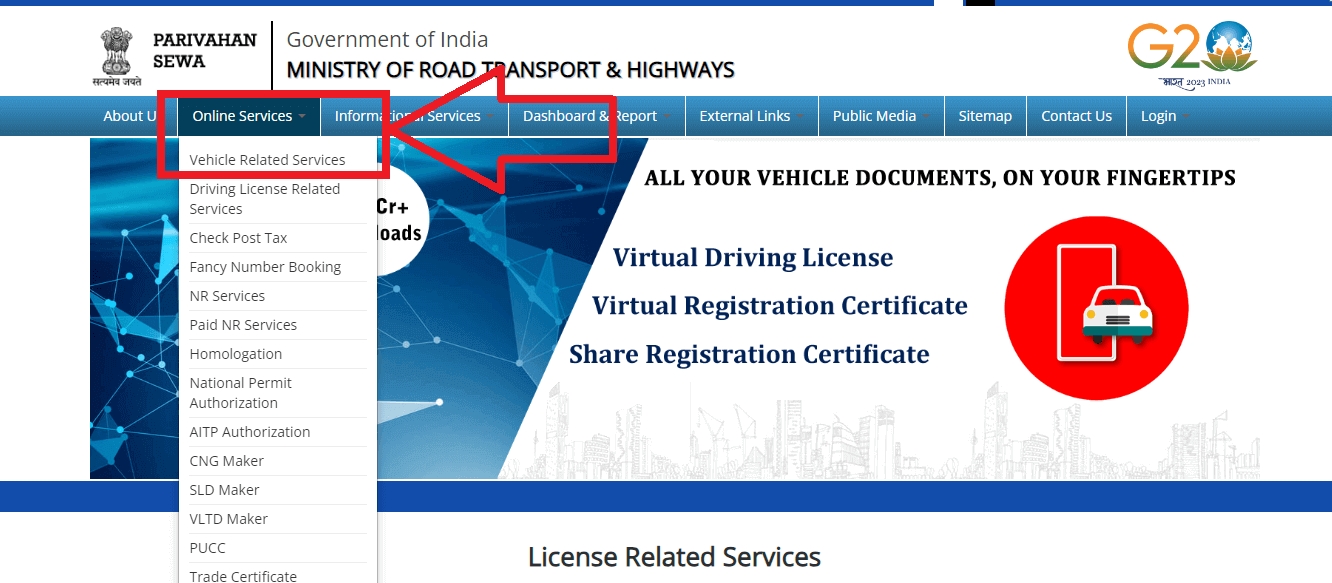

Visit Parivahan Sewa

Click on ‘ Online Service ’

Select ‘ Vehicle Related Services ’.

Select your state.

Select ‘ Application for No Objection Certificate ’

Enter your vehicle registration number and click on ‘ Verify Details’ .

Enter chassis number.

Enter your mobile number and generate OTP.

Enter the generated OTP and click on ‘ Show Details ’.

An application form will be generated.

Check the owner details and enter the vehicle insurance details if not updated)

Enter the NOC Vehicle Details and click on ‘ Save ’.

Click on ‘ Confirm ’.

A fee receipt will be generated, print the fee receipt and visit the RTO alongwith the required documents.

Following documents are required for NOC from Other State. Documents required might vary based on the state.

Application in Form 28

Certified copy of the certificate of registration

Certified copy of the certificate of insurance

Evidence of payment of motor vehicle tax up-to-date

Pollution under control certificate

Chassis & Engine Pencil Print

Signature Identification of owner

Additional Documentary Evidence for Transport Vehicle

Vehicle is not covered by any permit issued by any transport authority.

Sum of money agreed upon to be paid by the holder of the permit, if any, is not pending recovery.

Evidence of payment of tax on passengers and goods under any law for the time being in force up to the date of application for no objection certificate.

Follow the below steps to apply for change of address of vehicle in RC online in Uttarakhand.

Select ‘ Apply for Change of Address ’.

Enter your vehicle registration number and chassis number

Select ‘ Change of Address ’ in Application Selection.

Enter all the required details.

Make the required payment and print the fees receipt.

Book an appointment and visit the RTO along with the fees receipt and documents.

Following documents are required for change of address of vehicle in RC in Uttarakhand.

Application in Form 33

Certificate of registration

Proof of new address

Valid insurance certificate

No Objection Certificate from financier (in case of hypothecation)

Smart card fee

Attested copy of PAN card or Form 60 and Form 61 (as applicable)

As per the Ministry of Road Transport and Highways , when a Motor vehicle registered in one State has been kept in another State for a period exceeding twelve months , the owner is required to obtain a new registration mark to be assigned by the registering authority within whose jurisdiction the vehicle then is in terms of section 47 of the Motor Vehicle Act 1988.

This means, a vehicle is not permitted to ply with other state registration mark in Uttarakhand after the prescribed period. So, you should apply and obtain the Uttarakhand number plate. This process is called Reassignment of Vehicle .

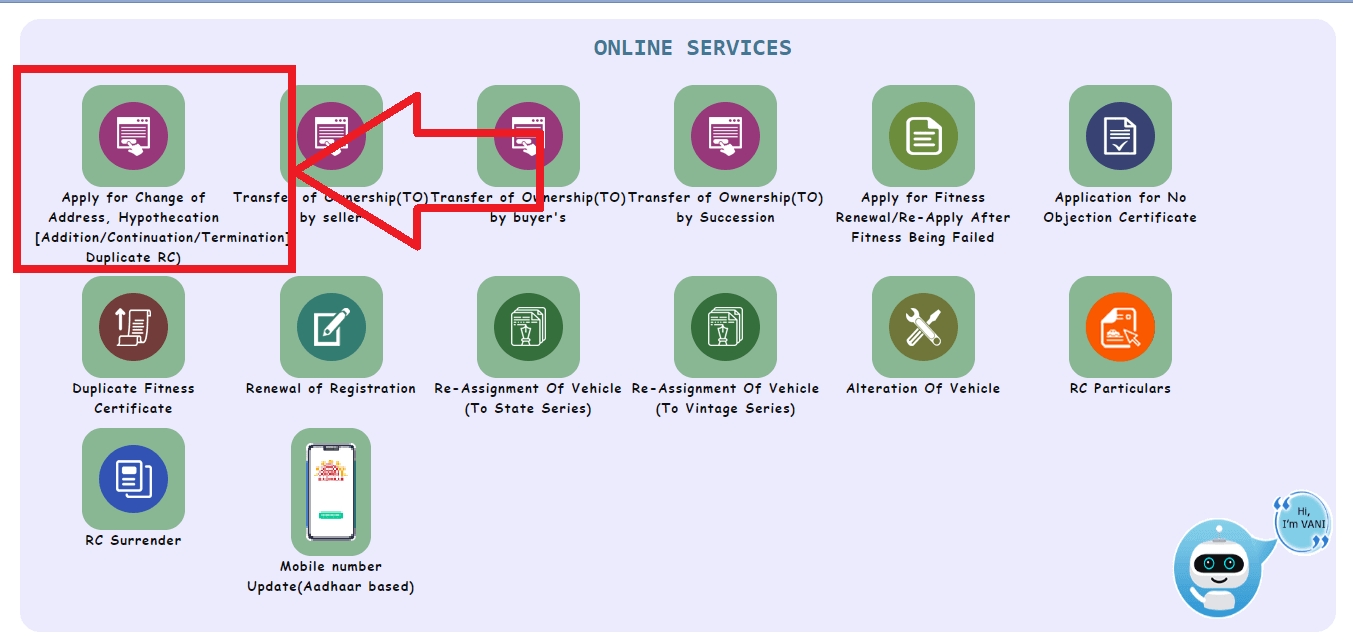

Follow the below steps to apply for the Reassignment of a Vehicle (RMA) in Uttarakhand.

Visit Parivahan Vahan Service .

Enter your " Vehicle Registration Number ".

Click on " Proceed ".

Click on " Online Services ".

Select " Re-assignment of Vehicle ".

Enter last 5 Digit of Chassis No. and click on " Validate Regn_no/Chasi_no ".

Click on ‘ Generate OTP ’.

Enter the OTP received on registered mobile number and Submit.

Enter the required details.

Review the Fee Panel and Proceed.

Pay the Fees, as shown.

Payment Receipt Generated.

After this, the application will be moved to RTO for further processing.

Application in Form 27

Proof of residence

No Objection Certificate

Insurance certificate

Challan clearance from traffic police or enforcement wing of transport department (in case of commercial vehicles)

Fitness certificate

PAN Card or Form 60 and Form 61 (as applicable)

Parking fee

Certificate manufactured regarding emission norms

Proof of Date of Birth

Proof of seller’s address

Signature identification of seller

Follow the below steps to pay road tax online in Uttarakhand.

Visit Parivahan Vahan Service .

Select " Pay Vehicle Tax ".

Update " Insurance Details ".

When you buy a vehicle from any State, you need to pay road tax to the state government. This tax is proportional to the invoice amount of your vehicle.

Now when you move your vehicle from another State to Uttarakhand, you are supposed to pay the lifetime road tax again in Uttarakhand for the remaining age of vehicle.

As you have already paid a road tax at the time of registering your vehicle in another state,you are eligible to receive a refund from them, as you are not using vehicle in that state.

Follow the below steps to book appointment on Parivahan Sewa.

Select ‘ Vehicle Related Services’ .

Select your nearest RTO.

Click on ‘ Proceed ’

Click on ‘ Appointment ’ and select ‘ Book Appointment ’.

Enter your Application Number and book an appointment in the available slots.

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

Parivahan Sewa

Renewal of RC

Address Change

Process Flow Renewal of Registration

Process Flow Change of Address

Process Flow NOC

Related Questions

Suggest an update for "other state vehicle in uttarakhand: rto rules, noc, address change, road tax, registration [2024]", post successful.

Your update is greatly appreciated

Ask question.

Login with your social accounts

New to Tesz? Sign up !

Create Account

Create account with social accounts

Already have an account? Login !

Forget Password

Enter your email id to recover your account

- Ask a Question

Talk to a lawyer

- Sign up as a lawyer

Central Motorvehicle Act Reassignment of Vehicle.

First answer received in 30 minutes .

Lawyers are available now to answer your questions.

Sir if you are continuously residing to banglore and took short trips to different states in between then in that case the relevant date shall be the 1st january only as section 47 doesn't provide of computation of the one year so the day you moved vehicle to new state can be considered.

Though in your case there is break that is long in month of April and may and after.that only a short trip so you can take 15 may also as the relevant date for transfer.

47. Assignment of new registration mark on removal to another State-

(1)When a motor vehicle registered in one States has been kept in another State, for a period exceeding twelve months, the owner of the vehicle shall, within such period and in such form containing such particulars as may be prescribed by the Central Government, apply to the registering authority, within whose jurisdiction the vehicle then is, for the assignment of a new registration mark and shall present the certificate of registration to that registering authority.

Provided that an applicant under this sub-section shall be accompanied-

(i) by the no objection certificate obtained under section 48, or

(ii) in a case where no such certificate has been obtained, by-

(a) the receipt obtained under sub-section (2) of section 48; or

(b) the postal acknowledgement received by the owner of the vehicle if he has sent an application in this behalf by registered post acknowledgement due to the registering authority referred to in section 48,

together with a declaration that he has not received any communication from such authority refusing to grant such certificate or requiring him to comply with any direction subject to which such certificate may be granted.

Provided further that, in a case where a motor vehicle is held under a hire purchase, lease or hypothecation agreement, an application under this sub-section shall be accompanied by a no objection certificate from the person with whom such agreement has been entered into, and the provisions of section 51, so far as may be, regarding obtaining of such certificate from the person with whom such agreement has been entered into, shall apply.

(2) The registering authority, to which application is made under sub-section(1), shall after making such verification, as it thinks fit, of the returns, if any, received under section 62, assign the vehicle a registration mark as specified in sub-section (6) of section 41 to be displayed and shown thereafter on the vehicle and shall enter the mark upon the certificate of registration before returning it to the applicant and shall, in communication with the registering authority by whom the vehicle was previously registered, arrange for the transfer of the registration of the vehicle from the records of that registering authority to its own records.

(3) Where a motor vehicle is held under a hire-purchase or lease or hypothecation agreement, the registering authority shall, after assigning the vehicle a registration mark under sub-section (2), inform the person whose name has been specified in the certificate of registration as the person with whom the registered owner has entered into the hire-purchase or lease or hypothecation agreement (by sending to such person a notice by registered post acknowledgement due at the address of such person of such person entered in the certificate of registration the fact of assignment of the said registration mark).

(4) A State Government may make rules under section 65 requiring the owner of a motor vehicle not registered within the State, which is brought into or is for the time being in the State, to furnish to the prescribed authority in the State such information with respect to the motor vehicle and is registration as may be prescribed.

(5) If the owner fails to make an application under sub-section (1) within the period prescribed, the registering authority may, having regard to the circumstances of the case, require the owner to pay, in lieu of any action that may be taken against him under section 177, such amount not exceeding one hundred rupees as may be prescribed under sub-section (7).

Provided that action under section 177 shall be taken against the owner where the owner fails to pay the said amount.

(6) Where the owner has paid the amount under sub-section (5), no action shall be taken against him under him under section 177.

(7) For the purposes of sub-section (5), the State Government may prescribe different amounts having regard to the period of delay on the part of the owner in making an application under sub-section (1)

- Talk to Advocate Shubham Jhajharia

Have you obtained NOC for moving your vehicle to other state if so from the date of NOC.

- Talk to Advocate Koshal Kumar Vatsa

Since you moved back for more than a month to Punjab, therefore the duration of one year shall be calculated from 15th of May 2018.

- Talk to Advocate Anilesh Tewari

Dear Client,

Effective date will be 15th May 2018.

- Talk to Advocate Yogendra Singh Rajawat

If you have planned to settle down permanently in Bangalore then the date of latest settlement or moving of the vehicle to Bangalore on permanent basis will be taken for computing the required period of 12 months, however you should have a NOC from the RTO office of the previous place.

- Talk to Advocate T Kalaiselvan

Ask a Lawyer

Ask a question

Get legal answers from lawyers. It’s quick, easy, and anonymous!

Schedule a 15-minute call with a lawyer. It’s quick, easy, and confidential!

Hire a lawyer

Send a legal notice, review a legal document, etc.

© 2013-2024 Kaanoon Corporation. All rights reserved.

- Staff Position

- Vehicle Related Services

- Pollution Check Centre

Assignment of new Registration mark on removal of vehicle to another state

Section 47 of M.V. Act 1988 provides for assignment of new registration mark on removal of vehicle to another.The application for assignment of new registration mark to a motor vehicle shall be made in Form 27 of CMV.Time of 12 months is provided for re-assignment of a vehicle under Section 47 of M.V. Act.

Requirements

Do you want to know the details of the vehicle parked just outside your gate for days, check details of an already registered vehicle before buying it using the number plate of the car? 🚘 🔍 How to know who's the owner of the car that drove fast past you? 🚘 🔍 How to know the history of the car before purchasing? 🚘 🔍 How to know RTO owner details of any car? 🚘 🔍 How to know the RTO registration details of any car? 🚘 🔍 How to know the age of the car before buying? 🚘 🔍 How to know if your friend's car is actually his car or not? 🚘 🔍 Yes? Vehicle Info tells you how to search the RTO VAHAN vehicle registration details/info and owner details/info and more with just the license number for free. 🔍 Vehicle Info tells you how to search the following using just the license number of car. • RTO Vehicle Owner name. • RTO Vehicle Registration Date. • RTO Vehicle Age. • RTO Vehicle Registration Authority. • RTO Vehicle Engine Number. • RTO Vehicle Chasi Number. • RTO Vehicle Maker Model. • RTO Vehicle Class. • RTO Vehicle Fuel type. • RTO Vehicle State and City. • RC Status Owner name. • RC Status Registration Date. • RC Status Age. • RC Status Registration Authority. • RC Status Engine Number. • RC Status Chasi Number. • RC Status Maker Model. • RC Status Class. • RC Status Fuel type. • RC Status State and City. You don't need to go to the Regional Transport Office (RTO) to get these details for a car, bike, truck, taxi, scooter or any other Indian Vehicle anymore! Vehicle Info tells you how to search info for all vehicles - cars, motor bikes, trucks, autos, everything and anywhere in India! Do you want to know the details of the car parked just outside your gate for days, check details of an already registered car before buying it using the number plate of the car? 🚘 🔍 How to know who's the owner of the car that drove fast past you? 🚘 🔍 How to know the history of the car before purchasing? 🚘 🔍 How to know RTO owner details of any car? 🚘 🔍 How to know the RTO registration details of any car? 🚘 🔍 How to know the age of the car before buying? 🚘 🔍 How to know if your friend's car is actually his car or not? 🚘 🔍 Yes? Vehicle Info tells you how to search the RTO VAHAN car registration details/info and owner details/info and more with just the license number for free. 🔍 Vehicle Info tells you how to search the following using just the license number of car. • RTO Car Owner name. • RTO Car Registration Date. • RTO Car Age. • RTO Car Registration Authority. • RTO Car Engine Number. • RTO Car Chasi Number. • RTO Car Maker Model. • RTO Car Class. • RTO Car Fuel type. • RTO Car State and City. • RC Details Owner name. • RC Details Registration Date. • RC Details Age. • RC Details Registration Authority. • RC Details Engine Number. • RC Details Chasi Number. • RC Details Maker Model. • RC Details Class. • RC Details Fuel type. • RC Details State and City. Check RC Status Online to get RC Details of a vehicle, with important RC Status Verify with Owner Name and more. You don't need to go to the Regional Transport Office (RTO) to get these details for a car, bike, truck, taxi, scooter or any other Indian Vehicle anymore! Vehicle Info tells you how to search info for all vehicles - cars, motor bikes, trucks, autos, everything and anywhere in India! Find RC Details Online to get RC Status of any vehicle, with important RTO Details and RTO Info to verify owner name and more.

Do it online

- Online Auction

- Customs license management

- EFDMS Public Portal

- Property Registration

- Electronic Tax Stamps Management System

Quick links

- E-Fiscal Devices (EFD)

- Objections & Appeals

- Paying taxes

- Tax calendar

- Starting business

- Interest, Penalties & Offences

- List of EFD Suppliers

- List of tax Consultants

- List of Licensed Customs Agents (CFAs)

- List of Authorized Economic Operators (AEO)

Related Links

Institute of Tax Administration

Ministry of Finance

Ministry of Industry, Trade and Investment

Tanzania Ports Authority

African Tax Administration Forum

Kenya Revenue Authority

Uganda Revenue Authority

Rwanda Revenue Authority

Office Burundais des Recettes

South African Revenue Service

Tax Club Corner

I ntroduction

News & Updates

- You are here:

- Motor vehicle registration

Introduction:

Motor vehicles are used by many and unspecified persons on public roads and they are given social recognition only after been inspected and registered. Motor vehicles are also subject to deterioration and wear of both the structure and equipment and sometimes their shapes and modified.

What are the laws governing registration of motor vehicles?

The registration of motor vehicles in Tanzania Mainland is governed by:

- The Road Traffic Act No. 30 of 1973

- Motor Vehicles (Tax on Registration and Transfer) Act 1972

- Traffic (Foreign Vehicles) Rules 1973

- Road Traffic (Motor Vehicles Registration) (Amendment) Regulations, 2001

Calculators and Tools

- PAYE Mainland

- PAYE Zanzibar

- Calculator & Tool for Motor Vehicles

- Double Taxation Agreements

- Decided tax Cases

- Publications

- Tax collection statistics

- Audited Financial Statements

- System User Guides

Call Us Now: 0860 222 132

Need a form, brochure, report or information? The download section is complete with everything you will need to make your RMA experience easy and hassle free. To download, simply select an option from the sections below.

- Employer Documents

Healthcare Provider Forms

General medical reports.

- Claimant/Pensioner Forms

Integrated Reports

- Government Gazettes & COIDA Tariffs

- RMA Information Videos

- 2019 Annual General Meeting

- 2020 Annual General Meeting

- 2021 Annual General Meeting

- 2022 Annual General Meeting

- 2023 Annual General Meeting

- Protection of Personal Information Act (POPI Act)

- Mining Renewals 2022

- Metals Renewals 2023

- Metals Renewals 2024

Employer Minor Claims Online Submissions(Straight Through Processing)

- STP Updated User Guide for Member or Employer

- User Guide For Member or Employer

- STP Updated - Overview

- Updated - Member Captures Multiple DRG's and ICD10 Codes

- Updated - Member Upload Documents & Capture Multiple ICD10 Codes

- STP Overview

- Capture Accident Notification

- Full Claim Add Event

- Full Claim Add Person and Add Person to Accident

- Full Claim Add Employment Injury and Earnings

- Full Claim Member Submit

- Full Claim Upload and View Documents

2020 Employer Forms

- Accident Claim form

- Disease Claim form

- 2016 Actual Earnings Declaration form

- Record of Employees working in a foreign country

- Letter for Injured Employees

2024 Employer Forms

- Section 51_5 Years Experience

- Section 51_Recently Qualified

- Section 51_Under the age of 26

- Statement of Earnings

Employer Policies

- 2020 COIDA Policy for Class XIII Employers

- 2019 COIDA Policy for Class XIII Employers

- 2018 COIDA Policy for Class XIII Employers

- 2017 COIDA Policy for Class XIII Employers

2020 COID Class XIII Renewals

- Presentation: Class XIII Renewals Roadshow 2020

- Class XIII Earnings Declaration Form 2020

- How To Guide - Submitting Earnings and Actuals

Frequently Asked Questions

2021 coid class xiii renewals.

- Class XIII COIDA Policy 2021

- Class XIII Earnings Declaration Form - 2021

Class XIII Renewals 2022

- Employer Registration Form 2022

- Class XIII COIDA Policy

- How to Guide – Submitting Earnings and Actuals

- Metals Earnings Declaration Form

Video demo - Steps for online registration and administering claims

- Registration process

- First logon

- Login and Case Overview

- Search for a Claim

- Search for a Person

- Search for a Medical Invoice

Healthcare Provider Minor Claims Online Submission (Straight Through Processing)

- Updated User Guide For Healthcare Provider

- User Guide For Healthcare Provider

- Online Demo

- Updated Multiple Reports & ICD10 Capture Overview

- Updated Multiple ICD10 Code Capture on Medical Report

- Multiple ICD10 Code Capture on Upload Medical Report

- Updated Multiple ICD10 Code Capture on Upload Medical Report

- MSP Portal Application and Banking Details

- Pre-authorisation Request Form

- Online Pre-authorisation User Guide

- Online Document Upload Guide

- Orthotic and Prosthetic Online Pre-authorisation Guide

- Chronic Medication Online Pre-authorisation Guide

- Re-opening of a Finalised Claim Application Form

- Notification of Hospital Admission

- Chronic Medicine Application

- Renewal of Chronic Medicine

- First Medical Report – Upper Limb Disorder

- Progress or Final Medical Report – Upper Limb Disorder

- First Medical Report – Occupational Disease

Specialised Medical Reports

- Dermatological Report

- Final Report – Eye Injuries

- Hearing loss questionnaire

- Noise Induced Hearing Loss – Confirmation of Proof of Identity

- Record of Service – Noise Induced Hearing Loss

- Healthcare Provider Guide

- Healthcare Provider Registration and Banking Details Form

- First Medical Report

- Progress Medical Report

- Final Medical Report

- Final or Progress Medical Report – Occupational Disease

- First Medical Report – Post-traumatic Stress Disorder

Impairment Assessment Reports

- Impairment Assessment Report – Hand

- Impairment Assessment Report – Wrist

- Impairment Assessment Report – Elbow

- Impairment Assessment Report – Shoulder

- Impairment Assessment Report – Back

- Impairment Assessment Report – Foot and ankle

- Impairment Assessment Report – Leg and Knee

- Impairment Assessment Report – Hip

Claimant / Pensioner Forms

- Application for extension of child’s pension form

- RMA Pensioner Guide

- Pensioner Calender

- RMA COID Understanding Compensation Brochure

- RMA Guide 2021

- RMA Guide with COID rates 2020

- RMA Guide with COID rates

- RMA Employer Manual 2019

- Employee Benefits Insurance Products

- RMA Company Profile

- Employee Death Benefits

- RMA Annual Integrated Report 2021

- RMA Annual Integrated Report 2020

- RMA Annual Integrated Report 2019

- RMA Annual Integrated Report 2018

- RMA Annual Integrated Report 2017

- RMA Annual Integrated Report 2016

- RMA Annual Integrated Report 2015

- RMA Annual Integrated Report 2014

RMA currently does not have any tenders available.

- Medical Tariffs 2020

- 2020 COID Benefits

- 2019 COID Benefits

- 2018 COIDA Tariffs

- 2017 COIDA Tariffs Dentists

- 2017 COIDA Tariffs Renal Care

- 2017 COIDA Tariffs Private Hospitals

- 2017 COIDA Tariffs Occupational Therapists

- 2017 COIDA Tariffs Doctors

- 2017 COIDA Tariffs Ambulance

- 2017 COIDA Tariffs Wound Care

- 2017 COIDA Tariffs Social Workers

- 2017 COIDA Tariffs Blood Services

- 2017 COIDA benefit increases

Got A Question?

Please look through our list of the most prevalent questions received by RMA, particularly relating to the new Class XIII members joining RMA due to the transfer from the Compensation Fund. For more information about RMA, or if you need support, please contact our Contact Centre on 0860 222 132 or [email protected].

1. Q: How do I qualify as Class XIII?

A: The classification is determined by the Compensation Fund. If you are not sure of your company classification, we will take down you details and follow up for you. A list of the Class XIII classification is available on RMA’s website.

2. Q: What COID benefits does RMA offer?

A: RMA offers the following COID benefits, which are exactly as legislated in the COID act:

Fatal benefits

- Widow lump sums

- Widow monthly pensions

- Minor children’s pensions

- Funeral expenses

Permanent disability benefits

- Permanent disability benefits are paid out when an injured employee has lost either permanent or partial use of a limb. RMA will pay out a lump sum if the disability is between 1% and 30%. If the disability is above 31%, RMA pays out a monthly pension.

Temporary total disability (TTD) benefits

Temporary total disablement is a benefit that is paid to an employee who is off work while recovering from a work-related injury. The employer pays the employee for the first three months that the employee is off work, thereafter RMA takes over the payment. No temporary total disablement benefits are payable if an employee is off work for less than four days as a result of their injury.

Medical treatment

Reasonable medical expenses are covered for the treatment of injuries that are a direct result of an injury on duty.

1. Q: How is my premium calculated by RMA?

A: In 2015, the premium was based on the 2014 estimated earnings that were submitted to the Compensation Fund for the five month period March-July 2015. On receipt of your provisional 2015 earnings declaration and VAT number, your tax invoice was adjusted and reissued with a credit note or adjustment invoice where applicable.

Two additional invoices were sent in July to cover the remaining seven month period, August – December 2015 and January - February 2016 respectively. In 2016, you will receive only one premium invoice which was issued on 1 March 2016 and based on current earnings multiplied by the risk rate.

Please note, however, that while we will only raise one premium invoice, should your company not have submitted actual earnings for 2015, and provisional earnings for 2016/2017, there is the possibility of an adjustment invoice once the return of earnings has been submitted. Based on what is submitted, if your actual earnings are more than your estimated earnings that were billed in 2015, you will receive an additional/ adjustment invoice to correct the premium in line with the actuals received.

When estimated earnings for 2016/2017 are submitted and these are found to be more than the invoice we raised on 1 March 2016 (based on estimated earnings which were declared in 2015/or received from the Compensation Fund) then a second invoice will be issued for the difference.

2015 Invoices (2015 billing period):

Actual adjustments on COID products for both classes IV and XIII include the following information on the 2015 invoice:

- The words "TAX INVOICE"

- Amount will be inclusive of VAT

Actual adjustments for 2015 on non-COID products (Augmentation, Commuting Journey Policy and Riot and Strike) for Class IV, will be different to the above, as follows:

- No VAT number

- Amount is VAT exclusive (RMA Life is not a registered VAT Vendor)

- RMA Life logo

- "INVOICE" instead of "TAX INVOICE"

2016 Invoices (2016 billing period):

In 2016, both COID and non-COID provisional adjustments for both classes IV and XIII are as follows:

- Amount is exclusive of VAT

- As VAT is no longer applied, you will be able to print several copies from our online portal and it will no longer read "COPY INVOICE"

- Logos are relevant to whether it is a COID or non-COID invoice

2. Q: How do I get a copy of my invoice or credit note?

A: There are two options. You can register on C-Filing, RMA’s online portal, and download your invoices or you can request a copy of your invoice by calling 0860 222 132 or sending an email to [email protected].

3. Q: Can I request payment terms?

A: Yes, you would need to make arrangements by providing the following documents to the contact centre:

- Motivational letter from the company's finance officer

- The estimated and actual earnings should have been submitted for an arrangement to be approved

4. Q: Can I make payment via debit order?

A: A debit order facility is available for approved term arrangements with RMA. Please use your RMA member number as a reference. You will need to submit confirmation of banking details and a completed debit order mandate authorising RMA to debit monies from your account.

5. Q: How do I open my invoice?

A: You need to type in the letters INV (all letters in upper case) plus the last four digits of the BP number, for example INV1234.

6. Q: Where do I find my BP number?

A: To find your BP number, please refer to your previous Return of Earnings or Notice of Assessment from the Compensation Fund.

7. Q: Why is my invoice encrypted?

A: RMA is obligated by the Tax Act (section 20 of the Value Added Tax Act, 1991 (Act 89 of 1991) ("the VAT Act") to encrypt electronic invoices.

8. Q: I have been incorrectly classified as Class XIII, I need to be re-classified.

A: Re-classification can be applied for with the Compensation Fund. Once this has been completed, supporting documents must be sent to RMA so that we may update our records.

9. Q: What happens to employers who fall under Class XIII but have employees in the company who fall outside of Class XIII?

A: The same way the Compensation Fund deals with multiple natures i.e. the dominant business will apply. This is also a result of misclassification of employers and such employers will have to be identified and classified correctly.

10. Q: I have not been informed about the change from the CF to RMA.

A: A government gazette was published in September 2014 and the CF conducted extensive media advertising in this regard in addition to a nationwide roadshow. A copy of the gazette is available on the RMA website under the Downloads tab.

11. Q: Where can I find a list of all transferred employers?

A: Employers can visit the RMA website on www.randmutual.co.za for a full list of transferred employers.

12. Q: The invoice that RMA has sent me is incorrect because a number of staff have left.

A: The number of staff on the invoice was a common number, which was used where RMA did not have actual figures. The invoice will be updated when you submit actual earnings.

13. Q: Will employers who are not VAT registered be paid as RMA uses a VAT number to pay invoices?

A: Invoices from employers who are exempted from registering for VAT will be paid by RMA without the VAT number.

14. Q: The RMA financial year runs from January to December. How will this affect the billing period?

A: All Class IV employers are billed from January to December, while Class XIII employers are billed from March to February.

15. Q: What will happen to the credits due to employers (where applicable)?

A: RMA will pay any credits to qualifying employers due on adjustments once the credit validation has been completed. This is only valid for credits due from 1 March 2015. The credit validation process is expedited by members submitting their proof of earnings to RMA.

16. Q: How will employers who are submitting manual documents/ reports to RMA be affected as RMA is doing away with paper?

A: RMA encourages employers to submit online or telephonically for all IODs and ODs. All medical reports can also be submitted online or manually through scan and email or at any of our branches nationwide.

17. Q: What do I do with claims that occurred prior to 1 March 2015?

A: All claims that occurred prior to 1 March 2015 are dealt with by the Compensation Fund. Only claims that occur from 1 March 2015 will be handled by RMA.

18. Q: How will a letter of good standing (LOG) be issued for Class XIII employers?

A: Employers who are fully up to date with their premium payments can either obtain their LOG off the RMA website in the Online Services section, or they can contact the Contact Centre on 0860 222 132.

19. Q: My Company has not been trading since xxxx, how do I get myself off RMA’s books?

A: You will need to furnish RMA with documents in support of the above. Once the documents have been confirmed, RMA will issue the relevant credit to the employer account and remove them from our database.

20. Q: If the company has employees that works outside SA, should I declare for their earnings and will they be covered by RMA in case of an injury on duty?

21. Q: What do I do if the company is under business rescue?

A: Employers will need to provide RMA with the contact details of the business rescue practitioner as well as provide documents supporting the date at which business rescue was implemented.

22. Q: I have paid to the CF. Why should I pay RMA?

A: Employers will need to submit the proof of payment as well as the remittance to show what period was covered in the payment to the CF.

23. Q: Can I deduct the credit that I have with the CF from the payment I make to RMA?

A: All monies due to and from the CF must be dealt with by the CF. RMA is only responsible for credits that were issued by RMA.

24. Q: What documents should I submit if I need to be refunded?

- Banking details (Only a letter from the bank on a bank letterhead, stamped and not older than three months are accepted, no cancelled cheques)

- Proof of payment

- An audited payroll or UIF declaration

25. Q: Why are previous payments not reflected on the statement?

A: The statement generated from our system only reflects what is currently outstanding. The payments received previously have already been allocated and therefore no longer reflect.

26. Q: How is the interest calculated?

A: RMA charges interest in terms of section 86.2 of the Compensation for Occupational Injuries and Diseases Act (COIDA).

The calculation is as follows: Balance due*Prime rate (10.50%)*(number of days in the month)/(number of days per year (365/6))

Healthcare Provider

1. Q: How do I track the progress of my invoices?

A: The status of invoices can be tracked on our medical portal, access to which is available on our website. Remittance advices for invoice payments are emailed on a weekly basis.

2. Q: How long does it take for invoices to be paid?

A: Payment is made within 30 days from date of receipt of electronically submitted invoices provided that all claim requirements have been met e.g. the claim has been completed in full and has been submitted with the required supporting documents where necessary. It is important to always ensure that you keep your details up to date with us.

3. Q: How do I confirm that my invoice/s have been paid?

A: Remittance advices are sent electronically on a weekly basis. Please ensure that you keep your details up to date with us.

4. Q: At what tariff rate does RMA pay healthcare providers?

A: RMA pays COID tariffs, Registered Price List (RPL) rates and a where applicable, a negotiated rate.

5. Q: How do I update my banking details?

A: RMA is currently using the banking details obtained from BHF’s database. To update your details please complete the MSP Portal Application and Banking Details form, which is available on the Downloads – Healthcare Provider forms link.

6. Q: Can we submit a medical invoice through a third party?

A: Yes, invoices can be submitted through various switching houses such as MediSwitch or healthbridge. RMA subscribes to a paperless environment and therefore electronic submissions through switching houses are encouraged.

1. Q: How do I obtain pre-authorisation?

A: The treating doctor is required to complete an authorisation form which must include a treatment plan. This form is available on our website by following the Downloads – Healthcare Provider forms link.

Once the form has been received by RMA, the request is adjudicated by the medical department. If all the necessary requirements have been met, a pre-authorisation is generated and is communicated to both the doctor and the patient. Only on receipt of the authorisation can a patient consult the doctor.

2. Q: Can I go to any doctor when injured or can I only go to a provincial or state facility?

A: You can visit any doctor when injured. The treating doctor is required to complete a First Medical Report, and then followed by a Progress and Final Medical Report for each consultation attended or treatment carried out. These forms are available on our website by following the Downloads – Healthcare Provider forms link.

A: You need to obtain pre-authorisation before consulting a specialist for:

- Specialised investigations such as radiology, MRI scans and isotope studies

- Continued treatment after 1 year but within 2 years of the date of accident

- Any treatment after 2 years or when a case is re-opened for further treatment or investigation

4. Q: Will the medical service provider ask for cash or will he send the invoice to RMA?

A: The doctor should send the invoice directly to RMA. All medical invoices must be submitted electronically through the various switching houses. Payment is made within 30 days from date of receipt provided that all claim requirements have been met and RMA has accepted liability for the claim.

5. Q: The doctor made me pay cash, how do I get reimbursed?

A: You need to submit the invoice from the doctor, with proof of payment, as well as proof of banking details, to [email protected]. The Proof of Banking Details form is available on our website by following the Downloads – Claimant/Pensioner Forms link. RMA will adjudicate the claim and if it is valid, you will be reimbursed.

6. Q: My employer refuses to report my accident, what can I do?

A: COIDA allows you to report the accident to RMA yourself. You will need to complete and submit an affidavit to RMA containing details of the accident (date, time, where and how the accident took place). RMA will thereafter interact with your employer to ensure that the accident is reported.

7. Q: The doctor refuses to treat me because he does not get paid by COID.

A: Please inform your doctor that RMA’s medical invoice payments are made within 30 days from date of receipt of electronically submitted invoices provided that all claim requirements have been met e.g. the claim has been completed in full and has been submitted with the required supporting documents where necessary.

The doctor can also track and check the status of the invoice on our medical portal.

1. Q: When did RMA start accepting Class 13 claims?

A: RMA began administering Class XIII claims in respect of accidents from 1 March 2015 and all employers within this class needed to submit claims to RMA from this date.

2. Q: Is a petrol station considered as part of Class XIII?

A: Yes, petrol garages are classified under Class XIII. A list of the Class XIII classification is available on the RMA website under the Downloads – Employer documents link.

3. Q: Does RMA offer additional products over and above COID?

A: RMA currently only offers non-COID products to Class IV (mining) but we will examine the possibility of offering additional products to Class XIII in future. Please contact us on 0860 222 132 or [email protected].

Complaints Management Procedure

click here to view

Code of Ethics

Making a difference through active citizenship.

Employer Information Video

RMA Claims Cycle Information Video

Healthcare Provider Information Video

- The formal notice of the 125th Annual General Meeting of the Rand Mutual Assurance Company Limited

- The Proxy Form

- The 2018 Annual Integrated Report

- The formal notice of the 126th Annual General Meeting of the Rand Mutual Assurance Company Limited

- The 2019 Annual Integrated Report

- The formal notice of the 127th Annual General Meeting of the Rand Mutual Assurance Company Limited

- Annexure to AGM Notice in respect of special resolution no.1: NED Renumeration Proposal

- RMA AGM Proxy Form

- RMA AGM Electronic Participation Form

- The 2020 Annual Integrated Report

- The formal notice of the 128th Annual General Meeting of the Rand Mutual Assurance Company Limited

- RMA AGM Proxy form

- The 2021 Annual Integrated Report

- Annexure to the 2021 Annual Integrated Report: RMA Consolidated Annual Financial Statements 2021

- The formal notice of the 129th Annual General Meeting of the Rand Mutual Assurance Company Limited

- RMA AGM Proxy form

- RMA AGM Electronic Participation Form

- The 2022 Annual Integrated Report

- Annexure to the 2022 Annual Integrated Report: RMA Consolidated Annual Financial Statements 2022

- Our Privacy Statement

- POPIA & PAIA Manual

- Request for Access to Record

- Outcome of request and of fees payable

- 2022 Actual Declaration Form

- 2023 Budgeted Declaration Form

- 2023 COID Renewals Internal Staff FAQs

- 2023 Metals Renewals FAQ

- Employer Registration Form

- Metals COIDA Policy Wording

- 2024 Renewals FAQ

- 2024 COIDA Policy – Metals

- 2024 Metals Earnings Declaration form

- full screen

- restore screen

IMAGES

VIDEO

COMMENTS

Step 4 Enter Chassis Number and Mobile Number After selecting "Re-Assignment of Vehicle", service applicant has to fill Chassis number and mobile number. Step 5 Click on Generate OTP Click on the "Generate OTP", button and you can proceed further. Step 6 OTP Generation

Guidelines. Apply for assignment of new registration mark to a motor vehicle in Form 27 within 12 months of re-assignment of the vehicle from one state to another. Pay appropriate fee and tax as specified in rule 81 of the Central Motor Vehicle Rules 1989.

Visit Old Website. Helpdesk Online Services. 0471-2328799 (10:15 AM - 05:00 PM) (Lunch break 01:15 P.M - 2:00 P.M) email: ssgcell [dot]mvd [at]kerala [dot]gov [dot]in. General Enquiry (Public Relation Officer): (10:15 AM - 05:00 PM) (Lunch break 01:15 P.M - 2:00 P.M) Transport Commissionerate: 0471-2333317. e-mail: tcoffice [dot]mvd [at]kerala ...

Registration of Vehicle Arrived from other State or Assignment of New Registration Mark (R.M.A): If vehicle registered in one state is to be kept or used in other state for the period of more than a year then the vehicle needs to be registered in the later state new registration number to be assigned . While doing so, the NOC from original ...

Follow the below steps to apply for the Reassignment of a Vehicle (RMA) in Maharashtra. Visit Parivahan Vahan Service. Enter your "Vehicle Registration Number". Click on "Proceed". Click on "Online Services". Select "Re-assignment of Vehicle". Enter last 5 Digit of Chassis No. and click on "Validate Regn_no/Chasi_no". Click on 'Generate OTP'.

Follow the below steps to apply for the Reassignment of a Vehicle (RMA) in Karnataka. Visit Parivahan Vahan Service. Enter your "Vehicle Registration Number". Click on "Proceed". Click on "Online Services". Select "Re-assignment of Vehicle". Enter last 5 Digit of Chassis No. and click on "Validate Regn_no/Chasi_no". Click on 'Generate OTP'.

I/We enclose the certificate of registration and the certificate of fitness (*) of the motor vehicle. I/We enclose a "No Objection Certificate" from the Registering Authority. If the "No Objection Certificate" from the Registering Authority is not enclosed the applicant should file

Step 3: Re-registration of vehicleand Road Tax paymentAfter the above step, you can apply for Re-registration of the vehicleand pay the appropriate road tax with a certain set of documents for the vehicle, your personal documents, NOCs etc. The following documents are to be submitted by you at the RTO.

Assignment of new Registration mark on removal of vehicle to another state. Section 47 of M.V. Act 1988 provides for assignment of new registration mark on removal of vehicle to another.The application for assignment of new registration mark to a motor vehicle shall be made in Form 27 of CMV.Time of 12 months is provided for re-assignment of a vehicle under Section 47 of M.V. Act.

Steps for car registration renewal. 1. Involves getting a NOC. a. Notary attested documents on Rs.10 stamp paper that says all the related documents of the vehicle are original and there are no dues for the vehicle. b. NOC from the National Crime Record Bureau that states that the vehicle is not stolen.

Assignment of new Registration mark on removal of vehicle to another state. Section 47 of M.V. Act 1988 provides for assignment of new registration mark on removal of vehicle to another.The application for assignment of new registration mark to a motor vehicle shall be made in Form 27 of CMV.Time of 12 months is provided for re-assignment of a ...

2. Visit the official site of Motor Vehicles Department, Click Temp.Registration under Information Services. 3. Enter the temporary registration number received by e-mail or SMS and the characters shown. Click GET. 4. On clicking GET, the details of temporary registration will be displayed. Click PRINT to print the certificate.

Follow the below steps to apply for the Reassignment of a Vehicle (RMA) in Uttarakhand. Visit Parivahan Vahan Service. Enter your "Vehicle Registration Number". Click on "Proceed". Click on "Online Services". Select "Re-assignment of Vehicle". Enter last 5 Digit of Chassis No. and click on "Validate Regn_no/Chasi_no". Click on 'Generate OTP'.

Go to the "Service Details" section and click the "Appointment" option to book your appointment at the state RTO. Select the desired date and available time slot. Pay the required fees for the transfer of the old registration number. A slip will be generated by the system with your registration number on it. Complete the rest of the formalities.

The reassignment transaction will cancel the plate and reassign. Make a copy of this form and file it in the customer folder. Attach the original reassignment form to the original Registration and Title Application and submit it to the RMV. Note: There is no need to fax this form to the RMV, however keep this document in your records as the EVR ...

(2) The registering authority, to which application is made under sub-section(1), shall after making such verification, as it thinks fit, of the returns, if any, received under section 62, assign the vehicle a registration mark as specified in sub-section (6) of section 41 to be displayed and shown thereafter on the vehicle and shall enter the ...

Section 47 of M.V. Act 1988 provides for assignment of new registration mark on removal of vehicle to another. The application for assignment of new registration mark to a motor vehicle shall be made in Form 27 of CMV.Time of 12 months is provided for re-assignment of a vehicle under Section 47 of M.V. Act. Procedure for re-registration

Assignment of new Registration mark on removal of vehicle to another state. Section 47 of M.V. Act 1988 provides for assignment of new registration mark on removal of vehicle to another.The application for assignment of new registration mark to a motor vehicle shall be made in Form 27 of CMV.Time of 12 months is provided for re-assignment of a vehicle under Section 47 of M.V. Act.

Do you want to know the details of the vehicle parked just outside your gate for days, check details of an already registered vehicle before buying it using the number plate of th

The registration of motor vehicles in Tanzania Mainland is governed by: The Road Traffic Act No. 30 of 1973. Motor Vehicles (Tax on Registration and Transfer) Act 1972. Traffic (Foreign Vehicles) Rules 1973. Road Traffic (Motor Vehicles Registration) (Amendment) Regulations, 2001. List of articles in category Registration of Motor vehicles. Title.

A: RMA is obligated by the Tax Act (section 20 of the Value Added Tax Act, 1991 (Act 89 of 1991) ("the VAT Act") to encrypt electronic invoices. 8. Q: I have been incorrectly classified as Class XIII, I need to be re-classified. A: Re-classification can be applied for with the Compensation Fund.

I/We hereby declare that the registration is valid up to.....and it has not been suspended or cancelled under the provisions of the Act. I/We enclose the certificate of registration and the certificate of fitness (*) of the motor vehicle. I/We enclose a "No objection certificate" from the registering authority.

Question: Assignment No. 2Course Code: DEMGN578Registration Number:Instructions:a. Attempt all questions given below in your own handwriting. Assignment in typed format will not be considered for evaluation.b. The student has to complete the assignment in the allocated pages only. Any other page in case utilized shall not be considered.Q1.