Remarkable Recovery: Samsung Crisis Management Case Study

Have you ever wondered how a global tech giant like Samsung managed to navigate a major crisis and bounce back stronger?

In the world of corporate governance, effective crisis management can be the difference between irreparable damage to a company’s reputation and a successful recovery.

In this blog post, we delve into a Samsung crisis management case study to learn about exploding batteries to the intricate strategies employed to restore trust.

Samsung’s journey offers valuable insights into the intricacies of crisis management in the digital age.

Join us as we explore the key lessons learned and best practices from this high-stakes situation, shedding light on the remarkable recovery efforts that propelled Samsung forward.

Let’s learn about sailing through tough times through Samsung crisis management case study

Background of Samsung History and growth of Samsung as a global conglomerate

Samsung, founded in 1938 by Lee Byung-chul, started as a small trading company in South Korea. Over the years, it steadily expanded into various industries, such as textiles, insurance, and retail.

In the 1960s, Samsung ventured into electronics, marking the beginning of its transformation into a global conglomerate.

With a focus on technological innovation and a commitment to quality, Samsung rapidly gained recognition for its consumer electronics products, including televisions and appliances.

Throughout the 1980s and 1990s, Samsung significantly diversified its business portfolio, entering the semiconductor, telecommunications, and shipbuilding industries.

This diversification strategy helped Samsung become a key player in multiple sectors, solidifying its position as a global leader. Notably, Samsung’s semiconductor division became one of the largest chip manufacturers in the world, supplying components to various electronic devices worldwide.

Samsung’s ascent continued in the 2000s, driven by its successful expansion into the mobile phone market. The introduction of the Galaxy series, powered by the Android operating system, catapulted Samsung to the forefront of the smartphone industry.

The company’s innovative designs, cutting-edge features, and aggressive marketing campaigns contributed to its rise as a major competitor to Apple’s iPhone.

With its global reach, Samsung has consistently ranked among the world’s largest technology companies, epitomizing South Korea’s economic prowess and technological advancements.

Samsung has also been considered one the best companies that successfully managed and implemented change initiatives.

Overview of Samsung’s position in the technology industry

In the consumer electronics segment, Samsung has established itself as a dominant force. Its diverse product lineup encompasses televisions, smartphones, tablets, wearables, home appliances, and audio devices.

The Galaxy series of smartphones, in particular, has enjoyed immense popularity and has emerged as a fierce competitor to other industry giants. Samsung’s televisions are also highly regarded for their cutting-edge display technologies, such as QLED and MicroLED.

The company’s advancements in semiconductor technology have contributed to faster computing speeds, increased storage capacities, and improved energy efficiency.

Samsung’s influence extends beyond consumer electronics and semiconductors. The company is actively involved in telecommunications infrastructure, including the development of 5G networks and the production of network equipment.

Samsung has also made notable strides in the realm of software solutions, including its own mobile operating system, Tizen, and various software platforms for smart devices.

Samsung Galaxy Note 7 Crisis

The Note 7 battery issue marked a significant crisis for Samsung, leading to a widespread recall of the flagship smartphone and causing considerable damage to the company’s reputation.

The crisis began in September 2016 when reports emerged of Note 7 devices catching fire or exploding due to faulty batteries. These incidents raised concerns about consumer safety and triggered a wave of negative publicity for Samsung.

Upon receiving initial reports of battery-related incidents, Samsung initially responded by issuing a voluntary recall of the Note 7 in September 2016. The company acknowledged the problem and expressed its commitment to addressing the issue promptly and effectively.

Samsung attributed the battery malfunctions to a manufacturing defect, specifically a flaw in the design that caused a short circuit.

To ensure customer safety, Samsung advised Note 7 owners to power down their devices and refrain from using them. The company swiftly implemented measures to exchange the affected devices, offering customers the option to either replace their Note 7 with a new unit or receive a refund.

Samsung also collaborated with mobile network operators and retail partners to facilitate the recall process.

In its initial response, Samsung took steps to communicate with customers and the public about the issue. The company published official statements expressing regret for the inconvenience caused and assuring customers of its commitment to resolving the problem. Samsung emphasized its dedication to quality and safety, promising to conduct thorough investigations and implement necessary improvements to prevent similar incidents in the future.

Media coverage and public perception during the crisis

During the Note 7 crisis, media coverage played a significant role in shaping public perception and amplifying the negative impact on Samsung’s brand.

The crisis received extensive coverage from both traditional media outlets and online platforms, leading to widespread awareness and public scrutiny. Here’s an overview of media coverage and its influence on public perception:

- News Outlets: Major news organizations across the globe reported on the Note 7 battery issue, highlighting incidents, the recall, and subsequent developments. Television news segments, newspapers, and online news articles extensively covered the crisis , emphasizing the potential safety risks and consumer concerns. The constant media attention contributed to the widespread dissemination of information and increased public awareness of the issue.

- Online Platforms and Social Media: Social media platforms played a pivotal role in the crisis, enabling the rapid spread of information and user-generated content. Users took to platforms such as Twitter, Facebook, and YouTube to share their experiences, express concerns, and criticize Samsung’s handling of the situation. Viral videos, photos, and personal accounts of Note 7 incidents gained traction, further fueling negative sentiment and influencing public perception.

- Expert Analysis and Opinions: Alongside news coverage, experts and industry analysts provided their insights and opinions on the crisis. Their assessments of Samsung’s response, the potential causes of the battery issue, and the implications for the company’s brand reputation contributed to the overall narrative. Expert opinions had the power to sway public perception and shape the understanding of the crisis.

- Consumer Forums and Discussion Platforms: Online forums and discussion boards dedicated to technology and consumer experiences became hubs for discussions surrounding the Note 7 crisis. Consumers shared their frustrations, exchanged information, and warned others about potential risks. These platforms served as gathering places for individuals affected by the crisis and amplified the negative sentiment surrounding Samsung’s brand.

Financial implications and losses incurred by Samsung

The Note 7 crisis had significant financial implications for Samsung, resulting in substantial losses for the company. Here are some of the key financial impacts experienced by Samsung as a result of the crisis:

- Recall and Replacement Costs: The recall and replacement process incurred significant costs for Samsung. The expenses involved in collecting and replacing over 2 million of Note 7 devices, including logistics, shipping, and refurbishment, were substantial. The costs also encompassed the testing and certification of replacement devices to ensure their safety. The total recall cost was estimated at $5.3 billion.

- Decline in Sales and Market Share: The crisis had a detrimental impact on Samsung’s sales and market share in the smartphone industry. As consumer confidence in the Note 7 and Samsung’s brand reputation declined, potential buyers shifted their preferences to alternative smartphone options. The decline in sales of the Note 7, coupled with the negative impact on the perception of other Samsung products, led to a loss of market share for the company.

- Stock Price Decline: The Note 7 crisis had an immediate impact on Samsung’s stock price. News of the battery issue, recalls, and subsequent negative media coverage led to a decline in Samsung’s stock value. Samsung shares fell approximately to 7 percent right after 2 months of the crisis.

Crisis Management Strategy Employed by Samsung

Following are the key aspects of Samsung Galaxy Note 7 crisis management strategy:

Immediate actions taken by Samsung to address the crisis

In the face of the Note 7 crisis, Samsung swiftly implemented a range of immediate actions to address the situation and mitigate the impact on consumers and the company’s brand reputation. Here are some of the key actions taken by Samsung:

- Voluntary Recall: As soon as reports of battery issues emerged, Samsung initiated a voluntary recall of the Note 7. This proactive step demonstrated the company’s commitment to consumer safety and willingness to take responsibility for the problem.

- Temporary Production Halt: To address the root cause of the battery issue, Samsung temporarily halted production of the Note 7. This decision aimed to prevent further distribution of potentially defective devices and allow for thorough investigations and corrective measures.

- Transparent Communication: Samsung made efforts to communicate openly and transparently about the crisis. The company issued official statements and press releases acknowledging the problem, expressing regret for the inconvenience caused, and reassuring customers of its commitment to resolving the issue. Transparent communication was crucial in maintaining trust and providing timely updates to affected consumers.

- Collaboration with Authorities: Samsung collaborated closely with regulatory authorities and industry experts to investigate the battery issue comprehensively. By engaging external expertise, the company aimed to identify the root cause and develop effective solutions. This collaboration demonstrated Samsung’s commitment to finding the best possible resolution.

- Customer Support and Safety Guidelines: Samsung provided clear instructions to consumers regarding the use of Note 7 devices, emphasizing the importance of safety. The company advised customers to power down their devices, participate in the recall, and utilize alternative devices in the interim. This approach prioritized customer safety and aimed to prevent further incidents.

- Increased Battery Testing and Safety Measures: Samsung implemented enhanced battery testing procedures and stringent safety measures to prevent similar incidents in the future. The company adopted more rigorous quality control processes, including additional safety certifications and testing standards, to ensure the highest levels of product safety.

Communication strategies employed by Samsung

Samsung employed various communication strategies to address the Note 7 crisis and manage the impact on its brand reputation. Effective communication was crucial in maintaining transparency, addressing consumer concerns, and rebuilding trust. Here are some of the communication strategies employed by Samsung:

- Official Statements and Press Releases: Samsung issued official statements and press releases to provide updates on the progress of the recall, investigations, and corrective actions. These statements expressed remorse for the inconvenience caused and reiterated the company’s commitment to customer safety. Clear and concise communication helped keep customers informed and reassured them that Samsung was actively working to resolve the issue.

- Direct Customer Communication: Samsung directly communicated with customers to provide instructions and updates on the recall process. The company utilized various channels such as email, SMS messages, and notifications through its official website and smartphone apps. This direct communication ensured that customers received important information and guidance regarding the recall and replacement program.

- Social Media Engagement: Samsung actively engaged with customers and the public on social media platforms, including Twitter, Facebook, and YouTube. The company responded to customer queries, addressed concerns, and provided updates on the progress of the recall. By engaging in two-way communication, Samsung demonstrated its willingness to listen, respond, and provide assistance to affected customers.

- Collaboration with Industry Experts: Samsung collaborated with industry experts, battery manufacturers, and regulatory authorities to investigate the root cause of the battery issue. This collaboration was communicated to the public, showcasing Samsung’s commitment to finding solutions and ensuring that the necessary expertise was involved in resolving the crisis.

- Advertisements and Marketing Campaigns: Samsung launched advertising and marketing campaigns focused on rebuilding trust and emphasizing its commitment to quality and safety. These campaigns highlighted Samsung’s dedication to addressing the issue and regaining consumer confidence. Advertisements often emphasized the company’s rigorous testing procedures and quality control measures to assure customers of the safety of its products.

- CEO Apology: Samsung’s CEO issued a public apology, taking personal responsibility for the crisis and expressing regret for the inconvenience and concern caused to customers. The CEO’s apology aimed to convey sincerity, empathy, and a commitment to rectifying the situation, while also reinforcing the company’s accountability and determination to regain trust. The apology was published on a full page in 03 major US newspapers – the Wall Street Journal, The Washington Post and The New York Times.

Collaborations with regulatory authorities and industry experts

Samsung worked closely with government agencies and regulatory bodies in various countries where incidents related to the Note 7 were reported. The company shared information, conducted investigations, and cooperated with authorities to ensure compliance with safety regulations and guidelines. Collaboration with government agencies helped align efforts to address the crisis and establish industry-wide safety standards.

In the United States, Samsung collaborated with the CPSC, an independent federal agency responsible for ensuring the safety of consumer products. Samsung worked together with the CPSC to investigate the battery issue and coordinate the recall process. This collaboration ensured that the recall efforts followed established safety protocols and provided consumers with accurate information.

Samsung collaborated with battery manufacturers to investigate the specific manufacturing defects that caused the battery issue. The company worked closely with these partners to analyze the battery designs, manufacturing processes, and quality control measures. By involving battery manufacturers in the investigation, Samsung aimed to identify the root cause and implement corrective actions to prevent similar issues in the future.

Samsung engaged independent testing labs to conduct thorough assessments of the Note 7 batteries and verify the effectiveness of corrective measures. These labs specialized in battery testing and certification, providing expertise and unbiased evaluation of the battery performance and safety. Collaboration with independent testing labs helped validate Samsung’s efforts to address the battery issue and instill confidence in the effectiveness of the solutions.

Post-Crisis Recovery and Rebuilding

Samsung implemented more stringent quality control measures across its product development and manufacturing processes. This included enhanced battery testing protocols, increased inspections, and stricter quality assurance standards. By demonstrating a commitment to producing reliable and safe products, Samsung aimed to rebuild customer trust.

Extended Warranty and Customer Support: Samsung extended warranty periods for existing and new devices, including the Note 7, to provide customers with added assurance. The company also enhanced its customer support services, ensuring that customers could easily access assistance, product information, and technical support. These initiatives aimed to demonstrate Samsung’s commitment to customer satisfaction and support.

Launch of subsequent product lines and their impact on brand perception

Following the Note 7 crisis, Samsung launched subsequent product lines, including flagship smartphones like the Galaxy S8 and subsequent iterations. These launches played a crucial role in shaping brand perception and rebuilding trust. Key factors that influenced brand perception and the recovery process include:

- Emphasis on Safety and Quality: Samsung placed a strong emphasis on safety and quality in its subsequent product launches. The company implemented rigorous testing procedures and introduced new safety features to ensure the reliability and safety of its devices. By highlighting these improvements, Samsung aimed to regain customer trust and reassure them of its commitment to producing high-quality products.

- Positive User Experience: Samsung focused on delivering positive user experiences with its new product lines. This included improvements in design, performance, and functionality to enhance customer satisfaction. By providing users with exceptional products, Samsung aimed to rebuild its reputation and generate positive word-of-mouth, contributing to brand recovery.

- Brand Messaging and Marketing: Samsung’s marketing efforts during subsequent product launches were carefully crafted to reinforce positive brand associations and regain customer trust. The company emphasized innovation, customer-centricity, and the commitment to quality and safety. Marketing campaigns highlighted features, benefits, and technological advancements to create a positive brand image and overcome the negative perceptions associated with the Note 7 crisis.

Final Words

Samsung’s handling of the Note 7 crisis serves as a case study in crisis management. Despite the significant financial and reputational setbacks, the company took proactive steps to address the crisis, regain customer trust, and prevent similar incidents in the future.

The Samsung crisis management case study highlights the importance of swift and transparent communication, customer-centric actions, and continuous improvement in product safety and quality. By effectively addressing the crisis, Samsung was able to navigate the challenging situation and rebuild its brand, reaffirming its position as a leading global technology company.

Overall, the Samsung crisis management case study provides valuable insights into how a company can recover from a major setback, restore customer trust, and strengthen its position in the market through strategic actions and a relentless commitment to customer satisfaction and product excellence.

About The Author

Tahir Abbas

Related posts.

06 Steps to Create Risk Register for Change Management

How to Get Employees’ Buy-in during Change Management

Advantages and Disadvantages of an Agile Organization

How Samsung Became a Design Powerhouse

The electronics manufacturer now emphasizes design over efficiency. by Youngjin Yoo and Kyungmook Kim

Summary .

Until 20 years ago, South Korea’s Samsung Electronics manufactured inexpensive, imitative electronics for other companies. Its leaders valued speed, scale, and reliability above all. The few designers working for the company were dispersed in engineering and new-product units, and they had little status in an organization that emphasized efficiency and engineering rigor.

Then, in 1996, Lee Kun-Hee, the chair of Samsung Group, grew frustrated by the company’s lack of innovation and concluded that in order to become a top brand, Samsung needed expertise in design, which he believed would become “the ultimate battleground for global competition in the 21st century.” He set out to create a design-focused culture that would support world-class innovation. But shifting to an innovation-focused culture without losing an engineering edge is not a simple matter. It involves managing a number of very real tensions.

Samsung’s success in making this shift stems from a single early decision—to build design competency in-house rather than import it. The authors describe how the company created a committed, resourceful corps of designers who overcame internal resistance by deploying the same tools they use in pursuing innovation: empathy, visualization, and experimentation in the marketplace.

HBR Reprint R1509E

Until 20 years ago, South Korea’s Samsung Electronics manufactured inexpensive, imitative electronics for other companies. Its leaders valued speed, scale, and reliability above all. Its marketers set prices and introduced features according to what original-equipment manufacturers wanted. Its engineers built products to meet prescribed price and performance requirements. At the end of the process designers would “skin” the product—make it look nice. The few designers working for the company were dispersed in engineering and new-product units, and individual designers followed the methods they preferred. In a company that emphasized efficiency and engineering rigor, the designers had little status or influence.

Partner Center

Samsung Electronics: Global strategies

This case study describes how Samsung Electronics transformed into a world-class company and the strategic challenges it faces as it looks to sustain its success in both developed and emerging markets. It has been 20 years since Lee Kun-Hee announced the New Management initiative that played a crucial role in transforming Samsung from a second-tier Korean firm producing low-quality products to a first-rate global electronics firm. In less than two decades, Samsung has become a leading global brand known for innovative products. In 2012, Samsung achieved $188 billion in sales, had the leading global market share in the mobile phone and TV businesses, and was the 9th most valuable brand in the world according to Interbrand. A key factor in Samsung’s growth was its push into emerging markets: while other multinational firms were reluctant to enter emerging markets due to risky business environments, Samsung created strong positions in many emerging markets, including the priority markets of China and India. The case provides a platform for exploring how Samsung was able to achieve success in both developed and emerging markets at the same time – a feat that its main competitors such as Nokia and Apple did not achieve. A closer look at the strategic approaches in the key emerging markets of India and China illustrates how Samsung’s performance varied across products and regions. The case also provides an opportunity to discuss the topic of innovation and how multinational companies (MNCs) such as Samsung can come up with solutions to the unique challenges faced by price-sensitive emerging market consumers having to deal with institutional voids. Even though the context is consumer electronics, the lessons that this case provides should appeal to other companies and industries as they seek to strategically position themselves for future challenges and opportunities in both developed and emerging markets.

Our objective in this case is to stimulate discussion and reflection on the following key issues: 1) Organizational transformation: Lee and his top management team led Samsung to prosperity through the New Management initiative that created a more focused, efficient and international organization. 2) Strategic innovation: Samsung achieved success in emerging markets by importing innovations from developed markets and focusing on local innovations and adaptations. 3) Competing in emerging markets: Samsung’s advantages in speed have contributed to its success in developed markets. Can its strengths in speed be helpful in both emerging markets and developed markets at the same time? 4) Sustaining success: Samsung is a leader in key product categories in both developed and emerging markets – can it remain on top in the fast-moving consumer electronics industry in the face of strong global and local competition?

The Case Centre

Cranfield University

Wharley End Beds MK43 0JR, UK Tel +44 (0)1234 750903 Email [email protected]

Harvard Business School Publishing

60 Harvard Way, Boston MA 02163, USA Tel (800) 545-7685 Tel (617)-783-7600 Fax (617) 783-7666 Email [email protected]

Asia Pacific Case Center

NUCB Business School

1-3-1 Nishiki Naka Nagoya Aichi, Japan 460-0003 Tel +81 52 20 38 111 Email [email protected]

IMD retains all proprietary interests in its case studies and notes. Without prior written permission, IMD cases and notes may not be reproduced, used, translated, included in books or other publications, distributed in any form or by any means, stored in a database or in other retrieval systems. For additional copyright information related to case studies, please contact Case Services .

Research Information & Knowledge Hub for additional information on IMD publications

In this study, we analyze how the performance-aspiration gap influences strategic change in family firms, providing evidence of the moderating role...

The case highlights the significant role played by the International Olympic Committee (IOC) in reducing its environmental footprint and promoting ...

To restore Rio Tinto's social license and direct its decarbonization activities, CEO Jakob Stausholm places a strong emphasis on developing relatio...

With half the world going to the polls this year, how do businesses manage political risk? IMD’s David Bach suggests businesses must look beyond th...

The former Italian premier and ECB president’s call for massive EU investment is a wake-up call to Europe’s economic stagnation. But can the contin...

Innovation is a core element in the business toolbox. A new framework is helping corporate leaders integrate social sustainability in their innovat...

There is a Chinese saying that wealth does not last beyond three generations, and the reality is that sustaining family businesses is a significant...

Julia Binder and Manuel Braun delve into why a circular approach to business can help build more resilience and boost profitability.

Peter Lorange explains how artworks support his decision-making process and can also help new businesses thrive.

Demand Planning Key Performance Indicators (KPIs) are frequently criticized for being too complex or irrelevant. However, an emerging approach is g...

- SMB Technology

- Mobile Productivity

- Mobile Security

- Computing & Monitors

- Memory & Storage

- Digital Signage

- Trending Tech

- Hospitality

- Manufacturing

- Transportation

- Food & Beverage

- Live Events & Sports

- Spectaculars & DOOH

- Gaming & Esports

- White Papers

- Infographics

Case Studies

- About Samsung Insights

- Our Experts

Subscribe to Insights

Get the latest insights from Samsung delivered right to your inbox.

See our Privacy Policy

Samsung Business Insights

All Case Studies

Good American seamlessly bridges online and in-person commerce with Samsung displays and VXT software

When opening its first stores, Good American partnered with Samsung to create a dynamic, interactive shopping experience with displays.

Convoy of Hope uses Samsung displays to build in-depth connections

At the newly constructed Convoy of Hope headquarters, a Samsung outdoor LED wraparound board shares the nonprofit’s message to the community.

Houston Astros up the score at Minute Maid Park with state-of-the-art Samsung displays

The Houston Astros recently upgraded with a state-of-the-art Samsung LED scoreboard and video displays at Minute Maid Park to enhance fan experience and engagement.

Millard Public Schools level up their technology game with Samsung digital displays

At Millard Public Schools in Omaha, Nebraska, Samsung displays with ScorevisionLE (SVLE) software amplify the middle school experience, in both competitive programming and fan engagement.

The Wall powers collaborative design at Lucid Motors

While reviewing new designs, the design team at Lucid Motors benefits from the high-definition image quality and color resolution on Samsung’s The Wall.

Hilton Waikiki Beach welcomes and wows guests with The Wall All-in-One

Located above the main lobby bar, Samsung’s The Wall in the Hilton Waikiki enhances the experience for both guests and locals. Hospitality TVs in guest rooms and other Samsung displays throughout the property elevate the property.

Buona Beef selects Samsung Kiosk for its digital transformation

Buona Beef, a renowned Chicago brand, added Samsung Kiosks to their locations to increase sales and efficiency of service.

West Sayville Fire Department leads the way with interactive displays

Samsung digital signage throughout the West Sayville Fire Department improves operations, communications, and productivity for all its members.

Miami high school’s connected campus elevates education and engagement

College preparatory Christopher Columbus High School recently outfitted their campus with Samsung display technology to create a connected campus. Interactive whiteboards in the classroom promote effective, collaborative learning, while digital signage throughout the campus streamline communication for all.

The Wall brings digital excellence to Syracuse University

The S.I. Newhouse School of Public Communications at Syracuse University installed Samsung's The Wall to provide a wow factor to current and prospective students.

My Business Courses

Learn Digital Marketing, Sales and Business

Samsung Electronics: Quality Improvement Case Study

Samsung Electronics, a global leader in consumer electronics, has long been recognized for its commitment to innovation and quality. However, like any industry giant, the company has faced its share of quality improvement challenges.

In this case study, we will explore how Samsung Electronics identified opportunities for quality enhancement, implemented robust quality control measures, and leveraged technology to achieve excellence in their products.

By delving into the strategies and outcomes of their quality improvement initiatives, we can gain valuable insights into the complex world of quality management in the electronics industry and the lessons that can be applied to various business contexts.

Samsung Electronics: A Legacy of Innovation

Samsung Electronics has forged a legacy of innovation through its commitment to continuous technological advancement and groundbreaking product development. The company's journey towards innovation began with its inception, and it has consistently pushed the boundaries of what is possible in the tech industry.

Samsung's relentless pursuit of technological advancement is evident in its diverse range of products, from semiconductors and smartphones to home appliances and beyond. The company has consistently invested in research and development, driving progress in areas such as AI, 5G technology, and IoT. Samsung's ability to anticipate and meet the evolving needs of consumers has solidified its position as a global leader in innovation.

Furthermore, Samsung's legacy of innovation extends beyond product development. The company has actively contributed to shaping industry standards and technological ecosystems, driving progress and fostering collaboration within the tech community. By consistently delivering groundbreaking solutions, Samsung has cemented its reputation as a trailblazer in the global tech landscape.

This commitment to innovation not only sets Samsung apart but also paves the way for future advancements in technology.

Identifying Quality Improvement Opportunities

To identify quality improvement opportunities, Samsung Electronics must first analyze defects in production to pinpoint areas for enhancement.

Additionally, a comprehensive analysis of process efficiency is crucial to identify bottlenecks and inefficiencies.

Furthermore, a detailed examination of customer complaints can reveal valuable insights into areas that require improvement.

Defects in Production

Identifying and addressing defects in the production process is crucial for Samsung Electronics to continually improve the quality of its products. Effective defects management and production optimization are essential for ensuring customer satisfaction and maintaining a competitive edge in the market. The table below outlines key areas for identifying defects and optimizing production processes:

| Defects Management | Production Optimization |

|---|---|

| Root cause analysis | Automation |

| Quality control measures | Lean manufacturing |

| Defect tracking systems | Supply chain management |

| Continuous improvement | Technology integration |

| Employee training | Process standardization |

Process Efficiency Analysis

In the context of ensuring high-quality production, an essential aspect involves conducting a comprehensive analysis of process efficiency to identify opportunities for quality improvement. This entails a detailed examination of the manufacturing processes to streamline operations and enhance overall product quality. The analysis focuses on identifying areas for improvement and implementing changes to optimize efficiency and minimize waste.

Key elements of the process efficiency analysis include:

- Value Stream Mapping: Visualizing the production process to identify areas of improvement.

- Root Cause Analysis: Investigating the underlying reasons for inefficiencies or defects.

- Performance Metrics Tracking: Monitoring key performance indicators to assess process effectiveness.

- Standard Operating Procedures Review: Evaluating and updating procedures to ensure efficiency and quality.

- Continuous Improvement Initiatives: Implementing ongoing efforts to enhance processes and drive quality improvements.

This analytical approach enables Samsung Electronics to continuously enhance its operational efficiency and product quality.

Customer Complaints Analysis

Regularly monitoring and analyzing customer complaints is a crucial step in identifying opportunities for quality improvement at Samsung Electronics. By effectively addressing customer dissatisfaction, Samsung can enhance customer satisfaction and loyalty. The table below illustrates an example of a customer complaints analysis, outlining the types of complaints and their root causes.

| Type of Complaint | Root Cause |

|---|---|

| Product Defects | Manufacturing errors |

| Service Delays | Inadequate staffing levels |

| Technical Issues | Software glitches |

Analyzing customer complaints allows Samsung to pinpoint areas for improvement, such as streamlining manufacturing processes, optimizing service operations, and enhancing product development. This approach is essential for maintaining high-quality standards and continuously improving customer satisfaction. Identifying and addressing the root causes of complaints can lead to sustained quality enhancement and increased customer loyalty.

Implementing Robust Quality Control Measures

As Samsung Electronics aims to fortify its quality control measures, the focus will be on implementing process improvement strategies to enhance product quality and reliability.

This will involve the meticulous integration of robust quality control processes throughout the production cycle, ensuring that performance metrics are continuously tracked and analyzed to identify areas for improvement.

Ultimately, the goal is to establish a comprehensive framework that safeguards product quality and customer satisfaction.

Process Improvement Strategies

Implementing robust quality control measures is a critical component of Samsung Electronics' process improvement strategies, ensuring the consistent delivery of high-quality products to customers.

To achieve this, the company employs the following strategies:

- Continuous Improvement : Samsung Electronics focuses on constantly refining its processes to enhance product quality and customer satisfaction.

- Quality Assurance : The company utilizes stringent quality assurance protocols to detect and rectify any deviations from established quality standards.

- Data-Driven Approaches : Samsung Electronics leverages data analytics to identify trends and potential areas for improvement within its manufacturing processes.

- Employee Involvement : The company encourages active participation from employees at all levels to contribute ideas for process enhancement and quality control.

- Supplier Collaboration : Samsung Electronics collaborates closely with its suppliers to ensure the quality of incoming components, thereby maintaining high standards throughout the production process.

Quality Control Implementation

Employing a comprehensive framework of stringent quality control measures, Samsung Electronics ensures the consistent delivery of high-quality products to its discerning customer base.

The company has implemented a multifaceted approach to quality control, encompassing thorough testing at every stage of production, stringent adherence to industry standards, and a robust feedback mechanism from customers and market data.

Samsung Electronics emphasizes continuous improvement in quality control through the use of advanced technologies, such as automated inspection systems and machine learning algorithms to detect and address potential defects proactively.

Furthermore, the company has established a culture of quality consciousness among its employees, ensuring that every individual is committed to upholding the highest standards.

Performance Metrics Tracking

A meticulous tracking of performance metrics is essential for ensuring the efficacy and success of robust quality control measures within Samsung Electronics. To achieve this, the company utilizes a comprehensive approach to performance metrics tracking, encompassing various key aspects:

- Quality Control: Samsung Electronics focuses on tracking quality control metrics such as defect rates, customer complaints, and product returns to identify areas for improvement.

- Productivity Tracking: The company also diligently tracks productivity metrics, including production yield, cycle times, and equipment downtime, to optimize operational efficiency.

- Data Analysis: Utilizing advanced data analysis tools, Samsung Electronics examines performance metrics to identify trends, root causes of issues, and opportunities for enhancing product quality and productivity.

- Continuous Improvement: The company emphasizes the continuous monitoring and tracking of performance metrics to drive ongoing quality improvements and operational enhancements.

- Benchmarking: Samsung Electronics employs benchmarking techniques to compare performance metrics against industry standards and best practices, facilitating a proactive approach to quality control and productivity tracking.

Overcoming Quality Improvement Challenges

Samsung Electronics faced significant hurdles in overcoming quality improvement challenges, requiring a comprehensive and strategic approach to drive meaningful change.

One of the primary challenges was integrating quality control measures across diverse product lines and manufacturing processes. Samsung addressed this by implementing a unified quality management system that standardized quality control protocols, enabling the company to consistently monitor and improve product quality.

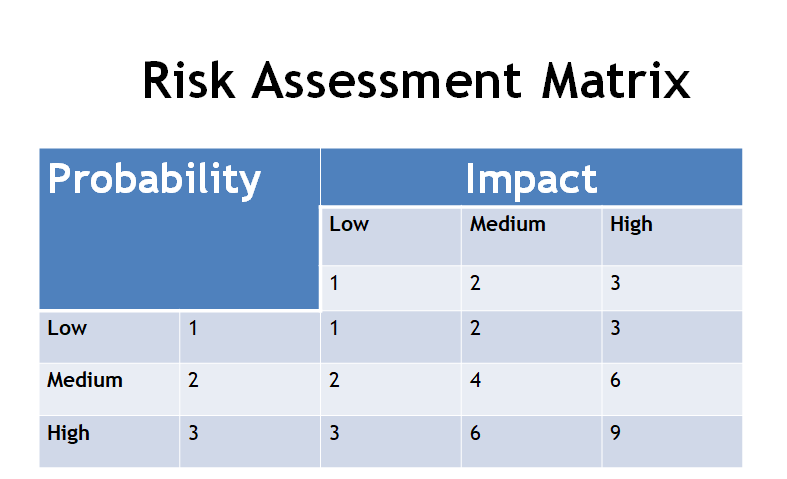

Additionally, risk management posed a significant challenge due to the global scale of Samsung's operations. To mitigate this, Samsung developed a robust risk assessment framework that identified potential quality risks at various stages of production and supply chain, allowing for proactive intervention to prevent quality issues.

Another obstacle was fostering a quality-centric culture across all organizational levels. Samsung tackled this by instituting extensive training programs and incentivizing employees to prioritize quality. Furthermore, the company established clear quality improvement goals and regularly communicated progress to drive accountability and motivation.

Leveraging Technology for Quality Enhancement

Leveraging advanced technological solutions has become imperative for achieving significant enhancements in product quality across diverse industry sectors. For Samsung Electronics, technology integration and quality assurance techniques have played a pivotal role in driving continuous quality improvement.

The following approaches highlight how leveraging technology has led to quality enhancement at Samsung Electronics:

- Implementation of advanced data analytics tools for real-time quality monitoring

- Integration of Internet of Things (IoT) for predictive maintenance and quality control

- Utilization of artificial intelligence (AI) for automated quality inspection and defect detection

- Adoption of virtual reality (VR) for immersive quality testing and training simulations

- Deployment of blockchain technology for transparent supply chain management and quality tracking

Monitoring and Evaluating Quality Performance

The implementation of advanced data analytics tools, integration of Internet of Things (IoT), and utilization of artificial intelligence (AI) have significantly influenced the monitoring and evaluating of quality performance at Samsung Electronics. Quality measurement at Samsung Electronics involves the continuous collection and analysis of data from various sources, such as production processes, customer feedback, and supply chain operations. This data is then used to assess the performance of products and processes in real-time, enabling prompt corrective actions when deviations from quality standards are identified.

Continuous improvement is a key focus in Samsung Electronics' quality monitoring and evaluation processes. Through the use of advanced analytics, the company is able to identify trends, patterns, and potential areas for improvement. Furthermore, AI algorithms are employed to predict and prevent quality issues before they occur, contributing to proactive quality management.

The integration of IoT allows for real-time monitoring of equipment and processes, providing valuable insights into the production environment. This comprehensive approach to quality performance monitoring and evaluation enables Samsung Electronics to consistently enhance the quality of its products and processes, thus maintaining its position as a leader in the electronics industry.

Achieving Excellence: Quality Improvement Outcomes

Consistently delivering high-quality products and processes is the ultimate goal of Samsung Electronics' commitment to continuous improvement and proactive quality management. The company has implemented various quality improvement strategies and continuous improvement initiatives to achieve excellence in its outcomes.

Some of the key outcomes of these efforts include:

- Enhanced Product Quality : Through rigorous quality control measures and continuous monitoring, Samsung Electronics has significantly improved the overall quality of its products, leading to higher customer satisfaction and loyalty.

- Streamlined Processes : The implementation of lean manufacturing principles and process optimization techniques has resulted in streamlined operations, reduced waste, and improved efficiency across the organization.

- Improved Supplier Relationships : Samsung Electronics has focused on building strong partnerships with its suppliers, fostering collaboration, and ensuring that high-quality standards are maintained throughout the supply chain.

- Enhanced Employee Engagement : By promoting a culture of continuous improvement and providing employees with the necessary training and resources, Samsung Electronics has seen increased employee engagement and contribution to quality enhancement efforts.

- Market Leadership : As a result of its relentless pursuit of quality excellence, Samsung Electronics has solidified its position as a market leader, setting industry benchmarks for quality standards and innovation.

Through robust quality control measures, Samsung Electronics has been able to achieve excellence in quality improvement.

By leveraging technology and continuously monitoring and evaluating quality performance, the company has established a legacy of innovation in the industry.

Like a master craftsman refining a diamond, Samsung has honed its quality improvement processes to achieve brilliance in its products, setting a standard for others to follow.

Similar Posts

Danaher Corporation: Strategic Growth Case Study

Danaher Corporation has garnered attention in the business world for its strategic growth efforts. The company's approach to expansion, encompassing both organic growth strategies and strategic acquisitions, has positioned it as a force to be reckoned with in various industries. However, what truly sets Danaher apart is its ability to not only acquire companies but…

Bombas: Social Impact and Business Case Study

Bombas, the sock company known for its one-for-one donation model, has gained significant attention for its unique approach to social impact and business. The brand's journey from a simple idea to a thriving business with a strong commitment to social responsibility is both inspiring and thought-provoking. As we explore the case study of Bombas, we…

Olay (Procter & Gamble): Brand Revitalization Case Study

Procter & Gamble's Olay has been a prominent name in the beauty and skincare industry for decades. However, as market dynamics shifted and consumer preferences evolved, the brand faced challenges in maintaining its relevance. The case study of Olay's brand revitalization offers a compelling narrative of strategic repositioning, product innovation, and a digital transformation that…

Id Fresh Food: Fresh Success Case Study

Id Fresh Food has been making waves in the food industry with its remarkable success story. The company's journey from its early beginnings to becoming a household name is nothing short of inspiring. It all began with a simple idea and a commitment to using quality ingredients, but what really set them apart was their…

L.L. Bean, Inc.: Inventory Management Case Study

L.L. Bean, Inc. has long been recognized for its iconic outdoor gear and apparel. Behind the scenes, lies a complex and finely tuned inventory management system that is worth exploring. As the retail landscape continues to evolve, the case study of L.L. Bean's inventory management provides valuable insights into the strategies and technologies that have…

Aspire Food Group: Innovative Food Solutions Case Study

Aspire Food Group's innovative approach to sustainable food solutions has garnered attention in the global food industry. By focusing on edible insects as a protein source and implementing innovative production strategies, the company has been able to address critical challenges in the food supply chain. The case study delves into Aspire Food Group's founding vision,…

- Open access

- Published: 21 October 2019

Planting and harvesting innovation - an analysis of Samsung Electronics

- Seung Hoon Jang ORCID: orcid.org/0000-0001-7984-7383 1 ,

- Sang M. Lee 2 ,

- Taewan Kim 3 &

- Donghyun Choi 4

International Journal of Quality Innovation volume 5 , Article number: 7 ( 2019 ) Cite this article

23k Accesses

1 Citations

2 Altmetric

Metrics details

This study explores how firms manage the entire life cycle of innovation projects based on the framework of harvesting and planting innovation. While harvesting innovation seeks new products in the expectation of financial performance in the short term, planting innovation pursues creating value over a long time period. Without proper management of the process of planting and harvesting innovation, firms with limited resources may not be successful in launching innovative new products to seize a momentum in high tech industries. To examine this issue, the case of Samsung Electronics (SE), now an electronics giant originated from a former developing country, is analyzed. SE has shown to effectively utilize co-innovation to maintain numerous planting and harvesting innovation projects. Both researchers and practitioners would be interested in learning about how SE shared risks of innovation investment with external partners at the early stage of innovation cycles.

Introduction

Globalization and advances in technologies have made the global market extremely dynamic and competitive. While companies like Apple have created new customer value by introducing such products as iMac computer and iPhone, many other firms have failed to adapt to the fast-changing environment. Kodak, the creator of the film camera, became history since it failed to adapt to the digital era in a timely fashion. To compete successfully in the dynamic global market, organizations must continuously innovate ways to create value [ 1 ]. Thus, innovation has been an important topic to both management researchers and practitioners [ 2 ]. Many studies have explored the relationship between innovative activities and organizational performance [ 3 , 4 ]. The firm’s ability of managing innovative projects has been considered as a key dynamic capability, resulting in new product development [ 5 ]. Innovative activities of the firm have generally shown to positively impact organizational outcome.

Although a number of studies in this research stream have introduced various types of innovation based on learning styles [ 6 , 7 ] or objects [ 3 ], few have paid attention to the timing of financial return from innovation. Given the importance of financial payoff from innovation for firm survival and sustained competitive advantage, research on how a real business should manage both innovation and cash flow is critical. Thus, in this study, we intend to answer the following two research questions.

RQ1: Which classification of innovation can best explain the heterogeneous timing of financial payoff realization?

To answer this question, we applied a classification scheme of planting and harvesting innovation [ 8 , 9 ]. Planting innovation involves pursuing potential sources of competitive advantage, including original technology, which may create value in a long term perspective. In contrast, harvesting innovation aims to develop new ways to monetize planted innovation, including new products for market launching, in the expectation of commercial success in a relatively short term. The aim of this research stream is to determine how to implement planting and harvesting innovation and measure the results of ensuing innovative activities. From this perspective, this study examines how a real global firm manages both types of innovation.

RQ2: How are planting and harvesting activities of innovation actually implemented in a successful global business firm?

To answer this question, we focus on Samsung Electronics (SE) which has become the world’s largest electronics firm through successful planting and harvesting of innovation. While SE has developed many innovative new commercial products, it has focused on fundamental breakthrough technologies as the source of future growth momentum. This case may provide valuable implications for firms from developing economies. To compete in high tech industries, these businesses need to invest a large amount of capital to risky innovation projects. Otherwise, they may remain low value added entities, like assemblers or fast followers. The case of SE, like many other success stories, exhibits a possibility that multinationals originated from developing countries can become leading global firms based on their efforts and vision for breakthrough innovations.

Given the current turbulent global business environment, as observed by trade disputes between the USA and China and the recently disrupted supply of critical input resources from Japan to Korea, it is imperative for firms to develop core competences based on innovation. In the digital age, businesses must rely on innovation to enhance their dynamic capabilities [ 10 ] to enhance agility, flexibility, and resilience for value creation [ 1 ]. Thus, this study which focuses on the effective management of planting and harvesting innovation is expected to make important contributions to the literature.

This study examines how firms can implement innovation projects for both short- and long-term perspectives. For this purpose, we first reviewed the literature for major research streams of innovation. Then, a case method is used to examine how planting and harvesting of innovation have helped SE became a dominant global electronics firm, around 2012. In addition to secondary data, executive interviews reported in media also describe how SE employees implemented planting and harvesting innovation. The results of qualitative analyses are presented and articulated. Finally, the implications and limitations of this research are presented. The framework of planting and harvesting innovation provides a theoretical background on how firms can strive for both short-term cash flow and a long-term momentum despite their limited resources. Furthermore, the study results provide insights to practitioners through the case study of SE which struggled initially to save the cost of innovation by collaborating with external partners for planting and harvesting innovation.

Innovation under resource constraints

Planting versus harvesting innovation.

Researchers in various fields, including economics, sociology, and technology management, have been interested in innovation [ 11 ]. The characteristics of innovative outcomes have been investigated as a major research agenda [ 12 , 13 ]. As Damanpour and colleagues [ 14 ] suggested, the introduction of novel ideas or technologies is the core of innovation. According to Van de Ven [ 15 ], innovation can be described as “the development and implementation of new ideas by people who over time engage in transactions with others within an institutional order ([ 15 ], p590).” Several definitions of innovation have focused on how to apply creativity to business operations and processes [ 15 , 16 ]. These studies imply that the main focus of innovation research has been on whether the firm creates new tangible or intangible values.

However, innovation has shown to lead to varied results. The meta-analysis by Rosenbusch et al. [ 17 ] reported that different contexts explain heterogeneous outcomes resulting from innovation. Even if firms implement similar innovation projects, the result can be different due to environmental factors. In addition, innovation sometimes improves the value of marketing skills rather than creating new technical capabilities [ 18 , 19 ]. What these results imply is that characteristics of innovative activities are complex. Since a single concept cannot explain the nature and outcome of innovation, researchers need to consider diverse classifications to explain the phenomena of innovation. Given the importance of cash flow in business, a greater focus is required on the influence of innovation on the survival and prosperity of the firm. Even when firms obtain breakthrough technologies, they may not survive when they fail to create new products/services and resulting cash flow as discussed by Jang [ 8 ] and Jang and Grandzol [ 9 ]. Furthermore, the large amount of investment needed for innovative activities requires firms to prioritize and manage their projects based on the commercial potential. Thus, there is a need to search for a new framework that can provide better explanations on innovation with respect to this issue. The most existing classifications of innovation are not based on the timing of financial outcomes of innovative activities.

One of the typologies regarding this topic is the categorization of radical and incremental innovation based on the sharpness of change in innovative practices [ 20 ]. A more drastic transformation can be expected from radical innovation projects while a relatively slight newness can be added to existing technologies during the incremental innovation process. Since radical innovation can pursue both drastic breakthrough and immediate commercialization, there exists the disparity between the distinction of radical and incremental innovation, the main focus of this paper. Space shuttle can be considered as an example of radical innovation as the realization of reusable spacecraft but it is generally considered as a product for immediate use rather than a long-term growth momentum. Such discrepancy leads researchers to develop a new categorization of innovation based on the expected timing of financial outcome.

The Code-Division Multiple Access (CDMA) wireless technology is an interesting case for this point. The CDMA technology was developed by Qualcomm ( www.qualcomm.com ), but the commercial CDMA phones were first created and produced by Korean manufacturers, including SE and LG. While Qualcomm was interested in developing CDMA as planting innovation, SE and LG focused on commercializing the technology for harvesting that innovation. Qualcomm could benefit from licensing fees in the long term with the success of commercial products based on CDMA. In contrast, the short-term cash flow was derived by SE and LG as they sold more CDMA phones to individual consumers.

From this perspective, innovation can be categorized based on its relatedness to the firm’s performance in the short or long term [ 8 , 9 ]. While certain types of innovative activities may result in an increase of the firm resources engaged in the current competition, others can create value that has long-term potential. This approach modifies the definition of innovations by Gumusluoglu and Ilsev [ 21 ] as described in Jang [ 8 ] and Jang and Grandzol [ 9 ]. First, harvesting innovation can be described as the development of a new resource that can help launch new products/services in the short term. New products, such as Toyota Prius, would be a good example of this type of innovation. Planting innovation refers to the creation of potential firm resources that are based on the state-of-the-art innovation in the expectation of long-term financial benefits. For instance, the invention of hybrid engine technology “plants” potential for future value while the creation of a hybrid car like Prius “harvests” the results of the planting of that innovation.

There are several reasons why planting innovation may not result in new commercial products/services in the short term. First, there may be social constraints that would not allow the use of innovative technology, resulting in no market for new products/services. The commercial use of human stem cell research in the USA has been prohibited by the Food and Drug Administration [ 22 ]. Firms initiating planting innovation in this area cannot expect commercial success due to this regulation, except perhaps in other countries. Second, firms may need to wait for the advent of other complementing technologies for the commercialization process. Thus, firms face a high degree of uncertainty about the financial outcome of planting innovation in the long term, especially in the biotech industry. The development of a new technology usually has a high probability of failure. Therefore, planting innovation may not lead to financial gains in the short term even if firms succeed in developing a technology.

The characteristic of planting innovation makes it distinct from invention. Innovation requires entrepreneurial utilization of technological newness by definition, while invention includes scientific and/or technological breakthrough for discovery purposes [ 23 ]. Firms invest in planting innovation projects in the expectation of long-term profits. Although the result of planting innovation may directly create cash flows in the form of patent fee, firms usually wait until finding out how to apply the result of planting innovation. In contrast, harvesting innovation pursues short-term profits by launching new products or services. In the 1970s, the Palo Alto Research Center (PARC) at Xerox initiated the development of innovative technologies such as Ethernet (or LAN technology) and copper wire-based Ethernet communication [ 24 ]. Due to the lack of commercial intention of Xerox both short and long term, these developments can be classified as examples of invention rather than planting innovation.

Given the heterogeneous characteristics of planting and harvesting innovation, ambidexterity can be important in balancing such innovative activities. Studies on exploitative and explorative innovations have examined this issue [ 6 , 7 , 25 ]. Since pioneering efforts for new processes or technology involve much risk, firms need to optimize the return of their investment in both types of innovation. One possible approach is to utilize external capabilities through M&A, alliances, or industry-academia collaborations through open innovation. Such arrangements would allow firms to share the risk of innovation with other participants [ 1 ].

In addition, convergence has played a major role in explaining value added activities in modern firms [ 1 , 26 ]. Globalization has encouraged the convergence revolution which allows value creation from the synergy of diverse disciplines, industries including IT, biotechnology, and nanotechnology [ 26 ]. The co-innovation platform helps converge diverse types of innovations for value creation [ 1 ]. Multinationals participating in co-innovation are expected to collaborate with stakeholders, including suppliers, customers, partners, and outsiders. Therefore, outside stakeholders can be active partners who co-create shared goals.

Overall, the classification of innovation can contribute to research by providing clearer guidelines related to the timing of financial outcome of innovation. While planting innovation can result in potential resources for long-term value creation, harvesting innovation is intended to generate continuous cash flows to those engaged in the current market. Following the case of exploitative and explorative innovation, researchers in this field should also consider ambidexterity of the organization. By doing so, firms under resource constraints can be prepared for an optimal portfolio of innovation projects, resulting in better organizational performance in the long term.

- Case analysis

In this study, the case of Samsung Electronics (SE), now the largest electronic firm in the world from a former emerging economy, is examined to unveil the processes of harvesting and planting innovation and their results. Innovative activities have been the core strength of SE and are expected to continue creating value for SE. The Mission 2020 of Samsung ( http://www.samsung.com ) states that it will “inspire the world, create the world” through creative and innovative solutions. This implies that the firm intends to pursue innovation over time beyond the development of commercial products for short-term returns.

Several qualitative techniques are employed to investigate the SE case. First, we collected articles including executive interviews from 2000 to 2012. The articles were manually coded into planting and harvesting innovation frameworks after a careful review of contents. News reports were analyzed via local portal sites, including Lexis-Nexis ( http://www.lexisnexis.com ) and Naver ( www.naver.com ). Particularly, we searched Naver, the major Korean portal website, to collect news articles concerning SE research topics from 2002 to 2012. We chose this period, 2002 and 2012, to collect data for this study as this is when SE made the significant transformation to become a dominant global IT leader. The search keywords used were “Samsung Electronics” and “Innovation.” The search using the keywords assured the study to verify that all related articles are captured. After removing duplicates, we investigated the contents of 183 related news articles. Based on the analysis, all the key interviews of executives and managers at SE were collected and examined. In addition, the other secondary data sources like the websites of companies, universities, and local governments were examined.

Samsung Electronics

SE has been a major global player in electronics and related industries for over three decades. Hoovers ( www.hoovers.com ), a leading corporate information provider on large businesses, describes the overall state of this firm as the new “Electronics Samson.” In year 2015, it reported $171 billion revenue and $16 billion net profit. Its major products include digital electronics, semiconductors, and DVD players. Financial Times ranked Samsung Electronics as 19th in their 2015 FT Global 500 ( www.ft.com/ft500 ). It is beyond doubt that this firm has been successful in creating value for its customers.

The webpage of Samsung Electronics ( www.samsung.com ) and Samsung C&T ( www.samsungcnt.co.kr ) describes the history of Samsung Group and Electronics as follows. Samsung group was founded in 1938 as a small retail firm in Daegu, Korea. The founding chairman, Lee Byung-Chull, established Samsung-Sanyo Electronics to diversify the business in 1969. As the name implies, the firm collaborated with Japan’s electronics giant Sanyo. It began production of black-and-white TV sets for the first time in 1970, as an outsource manufacturer. After changing its name to Samsung Electronics, the firm began to produce color TV sets, video recorders, microwaves, and personal computers. It has rapidly developed as a global firm since it entered the semiconductor industry in the early 1980s. Since South Korea has recently been accepted as a developed economy [ 27 ], it can be said that SE began as an emerging market firm.

Given the fact that SE was founded only about five decades ago, the current performance and growth are astonishing. Despite the current status, the firm used to be considered as a fast follower [ 28 ]. SE had focused on producing existing products with better quality at lower prices than other global firms. It is an interesting research topic to examine how and why SE has evolved into a global giant in the electronics industry.

To provide an explanation on this issue, we investigated how SE has implemented innovation to achieve strategic objectives. In 2001, President of Booz Allen and Hamilton Korea stated that Korean firms need to pursue breakthrough innovations to adapt to new market environments [ 29 ]. In other words, SE as well as other major Korean manufacturers began to pursue innovation rather than continue to follow market leaders to survive in the dynamic global marketplace.

Harvesting innovation at Samsung Electronics

SE has engaged in various innovation activities to gain global competitive advantage. By doing so, the firm has been able to create value and benefit from new markets with expectations of stable cash inflows. For instance, SE developed new products like Rambus DRAM and Nand flash memory rather than increasing the accumulation rate of semiconductors [ 28 ]. Since these new products reflect the needs of customers, including PC or smartphone manufacturers, the innovation brought a large amount of profit in the short term. Given the astonishing results that SE has accomplished, its process of harvesting innovation has drawn much attention.

SE has continued implementing innovative activities steadily. The Value Innovation Program (VIP) Centre, setup in 1998, has played a key role in developing innovative new products at SE [ 28 , 30 , 31 ]. This Centre has shown to nurture creativity and broaden the ideas of R&D staff. As the chief researcher at SE stated, the introduction of value innovation methods has contributed to the creation of many new ideas [ 28 ]. Through this system, all participants were expected to overcome the trap of past success syndrome, leading to what is possible.

Blue Ocean Strategy (BOS) [ 32 ] has been the backbone of the harvesting innovation process at SE [ 30 ]. SE invited W. Kim, the main author of BOS, to train its executives. Senior executives have encouraged the dissemination of value innovation at SE based on the BOS approach [ 33 ]. SE strives to create value which its customers never even expected through value innovation for new products. SE’s value innovation includes value management and value creation [ 33 ]. While the former focuses on cost reduction and efficiency improvement, the latter aims to generate added value. Therefore, the firm searches for creative ideas rather than implementing traditional continuous improvement type programs.

SE has found practical tools to implement harvesting innovation based on BOS [ 31 ]. First, the VIP Centre has utilized the strategy canvas, a framework of implementing BOS [ 32 , 34 ]. In the Centre, managerial decisions on important projects have been made based on the value curve of each unit against competitors, resulting in new products like 40-inch LCD TV. In addition, the “7 Tools Method” practiced in Japan, which enables firms to empirically recognize value factors of their customers, was introduced [ 35 ]. For instance, a survey of 226 Japanese employees triggered the production of a laptop that works well even in a bad wireless environment. These types of techniques have helped SE create new products successfully by reflecting innate needs and requirements of individual and business customers.

It has been reported that all of the creative ideas from the VIP Centre have been reflected in the design and development of new products of SE [ 36 ]. As a result, innovativeness of the firm’s new products has been globally recognized as the numerous Innovation Awards of the Consumer Electronics Association (CEA) attest (see Table 1 ). These achievements prove that the innovative results of SE have been widely recognized by professionals in the field as well as ordinary customers. SE has succeeded in developing new products through harvesting innovation activities.

Planting innovation at Samsung Electronics

SE has also focused on the creation of innovative ideas which may not realize any meaningful revenue in the short term. The major results of planting innovation are original technologies which can result in competitive advantage and lead to future business success. The CEO of SE stressed the importance of “technology preparation management,” pursuing core technologies in order to respond to the convergence across technologies and products [ 37 ]. This statement exhibits the strong will of top management of SE to implement the planting innovation strategy.

The Samsung Advanced Institute of Technology (SAIT) has played a critical role in developing original technologies. The website ( www.site.samsung.com ) describes the research efforts currently in place. The Future IT and Convergence domain seeks technologies across real 3D processing, communication theory and network, multicore processing, data intelligence, and medical imaging. The New Materials and Nanotechnology domain aims at developing flexible electronics, solid state lighting, film ceramic crystal composite materials, micro-system integration, oxide materials and devices, spintronics, and nanostructure and materials research. The Energy and Environment domain focuses on energy storage, energy conversion, and environment fields. The Bio and Health domain explores gene analysis and point of care testing (POCT). Indeed, SE has encouraged researchers to create a broad range of intellectual capital for the purpose of leading future technologies.

Furthermore, it seems likely that SE seeks Chesbrough’s [ 2 , 38 ] open innovation to improve efficiency and effectiveness of planting innovation. By doing so, the firm can create innovative results with less burden in time and resources. The CEO mentioned that open innovation needs to be encouraged to shorten the technology life cycle and to enable convergence in the electronics industry [ 37 ]. Thus, SE senior managers have aggressively focused on the utilization of external ideas and capabilities [ 39 ].

M&A has been a major instrument to acquire external intellectual capital. SE has acquired several firms, including SanDisk, Amica (a Polish electronics firm) in 2009, and Transchip (a non-memory semiconductor manufacturer in Israel) in 2008 [ 40 ]. SE informed the board of directors of SanDisk about its intention of collaborative innovation orientation and human resource retention in SanDisk [ 41 ]. Such M&A activities have enabled SE to obtain proven and complimentary intellectual capital and dynamic capabilities, including R&D employees.

SE has also managed a broader range of intellectual capital without much investment by sharing their proprietary technologies with partners. For example, SE and IBM, two top US patent firms, established a cross-licensing agreement which allows the participants to utilize each other’s patents for innovation in 2011 [ 42 ]. These firms can share their patents without additional investment, resulting in a more stable basis for innovative activities. This type of contract enables SE to implement planting innovation with finite capabilities. Executives of SE and IBM also announced that the objective of cross-licensing lies in sharing intellectual capital in the expectation of continuous innovative outputs. In sum, SE has implemented planting innovation through SAIT internally and has utilized external capabilities through M&A and licensing for significant financial gains in the long run. SAIT has implemented several major research projects independently as well.

Ambidexterity and co-innovation

Since SE is implementing planting and harvesting innovation simultaneously, one major task is balancing both types of innovative activities. Otherwise, the firm may suffer from lack of financial cash flows or future leadership in the industry. Despite their brand image, major manufacturers of wristwatch had to overcome the loss of sales volume in the 1970s due to the revolutionary quarts movement technology [ 43 ]. Although US electronic giants initiated the transistor technology, Japanese manufacturers like Sony harvested the lion’s share of its benefits with their transistor radios [ 44 ].

The significance of inter-organizational cooperation in attaining competitive advantage cannot be ignored [ 45 ]. Thus, any organization, however large or global it may be, cannot be competitive for long without collaboration with other world-class partners. From this perspective, the success or failure of firms today lies in managing the relationships with other value chain partners and stakeholders [ 4 ].

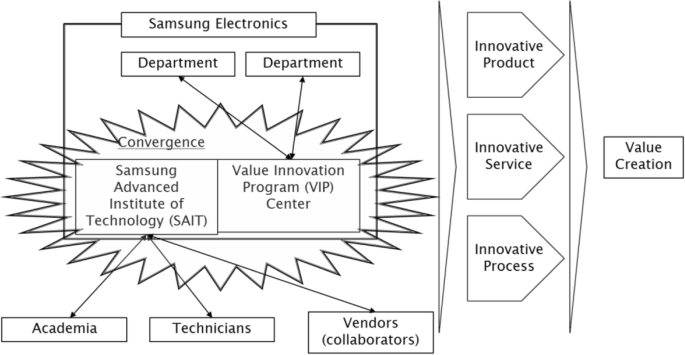

Beyond the conventional exploration and open innovation focusing on the use of external resources, SE has been searching for the best way to simultaneously implement planting and harvesting innovation through co-innovation with stakeholders [ 1 ] (see Fig. 1 ). The main focus of the VIP Centre has been on how to encourage collaboration among internal departments. Resulting convergence across departments has enabled the firm to recognize the diverse viewpoints other than the opinions of core engineers. The VIP Centre director stated that those firms interested in value innovation need to adopt the cross-functional team (CFC) concept with a separate space to promote inter-departmental collaboration for value innovation [ 34 ]. This process is expected to encourage formal and informal sharing of ideas, opinions, and viewpoints since participants have more opportunities to communicate with many people. For instance, the CFC team consisting of marketers, designers, and engineers developed a new slim style laptop which caught the fancy of Japanese consumers [ 35 ]. Furthermore, the members of the Centre frequently collaborate with external partners [ 35 ].

Co-innovation at Samsung Electronics. Based on the information from SAIT ( www.SAIT.samsung.com ) and Kim’s [ 35 ] study

SAIT has played a significant role in connecting SE with external entities ( http://www.sait.samsung.co.kr ), such as universities, through the Global Research Outreach (GRO) program and other collaborators via the Collaborative Open Research Expert (CORE) program. These efforts have allowed the firm to share the risks inherent in planting innovation. Thus, the firm has been able to reduce the uncertainty involved in innovative practices and maximize its value with finite organizational resources.

Another example of collaboration lies in its value-chain management beyond the use of external capabilities. An association of Samsung’s collaborating vendors, Hyup-Sung-Hoe, has played a key role in co-innovation processes [ 46 ]. SE and collaborating vendors have participated in innovation activities, including sectional committee meetings. It is evident that SE’s innovation activities cover not only its own value chain but also that of its partners. Given the fact that current business activities must include vendors, the improvement of innovation capabilities of the entire value chain is essential for gaining competitive advantage. SE also considers the creation of new ventures with excellent technologies as another outcome of its open innovation strategy [ 47 ]. The firm manages its entire value chain to compete successfully, as opposed to conducting business with partners for short-term monetary rewards. Figure 1 presents SE’s value chain convergence activities.