Small Business Trends

How to create a business plan: examples & free template.

Table of Contents

How to Write a Business Plan

Executive summary, overview and business objectives, company description, define your target market, market analysis, swot analysis, competitive analysis, organization and management team, products and services offered, marketing and sales strategy, logistics and operations plan, financial projections plan, income statement, cash flow statement.

| Section | Description | Example |

|---|---|---|

| Executive Summary | Brief overview of the business plan | Overview of EcoTech and its mission |

| Overview & Objectives | Outline of company's goals and strategies | Market leadership in sustainable technology |

| Company Description | Detailed explanation of the company and its unique selling proposition | EcoTech's history, mission, and vision |

| Target Market | Description of ideal customers and their needs | Environmentally conscious consumers and businesses |

| Market Analysis | Examination of industry trends, customer needs, and competitors | Trends in eco-friendly technology market |

| SWOT Analysis | Evaluation of Strengths, Weaknesses, Opportunities, and Threats | Strengths and weaknesses of EcoTech |

| Competitive Analysis | In-depth analysis of competitors and their strategies | Analysis of GreenTech and EarthSolutions |

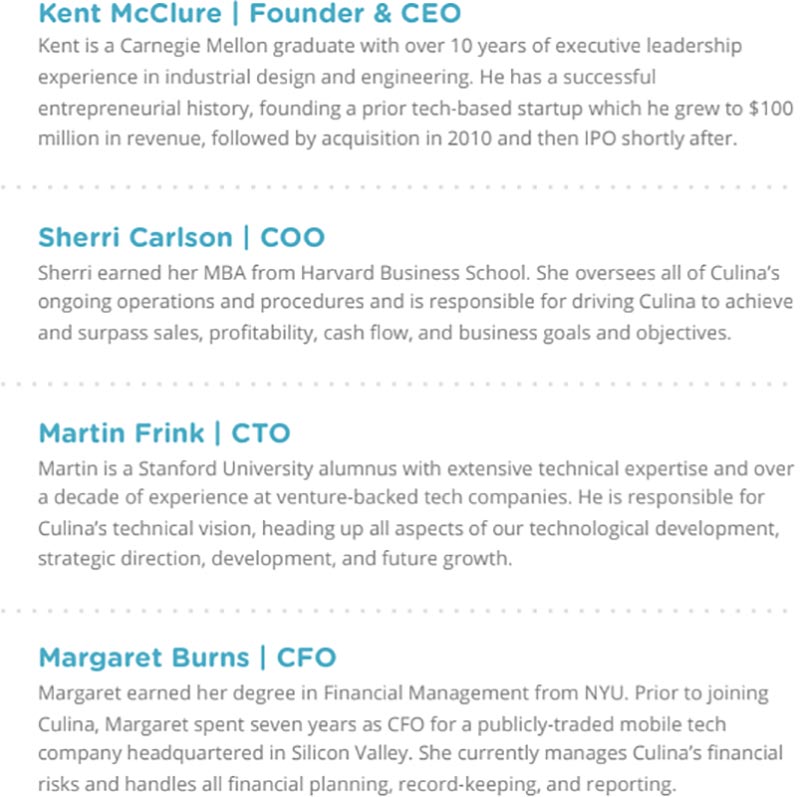

| Organization & Management | Overview of the company's structure and management team | Key roles and team members at EcoTech |

| Products & Services | Description of offerings and their unique features | Energy-efficient lighting solutions, solar chargers |

| Marketing & Sales | Outline of marketing channels and sales strategies | Digital advertising, content marketing, influencer partnerships |

| Logistics & Operations | Details about daily operations, supply chain, inventory, and quality control | Partnerships with manufacturers, quality control |

| Financial Projections | Forecast of revenue, expenses, and profit for the next 3-5 years | Projected growth in revenue and net profit |

| Income Statement | Summary of company's revenues and expenses over a specified period | Revenue, Cost of Goods Sold, Gross Profit, Net Income |

| Cash Flow Statement | Overview of cash inflows and outflows within the business | Net Cash from Operating Activities, Investing Activities, Financing Activities |

Tips on Writing a Business Plan

Free business plan template, what is a business plan, why you should write a business plan, what are the different types of business plans.

| Type of Business Plan | Purpose | Key Components | Target Audience |

|---|---|---|---|

| Startup Business Plan | Outlines the company's mission, objectives, target market, competition, marketing strategies, and financial projections. | Mission Statement, Company Description, Market Analysis, Competitive Analysis, Organizational Structure, Marketing and Sales Strategy, Financial Projections. | Entrepreneurs, Investors |

| Internal Business Plan | Serves as a management tool for guiding the company's growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. | Strategies, Milestones, Deadlines, Resource Allocation. | Internal Team Members |

| Strategic Business Plan | Outlines long-term goals and the steps to achieve them. | SWOT Analysis, Market Research, Competitive Analysis, Long-Term Goals. | Executives, Managers, Investors |

| Feasibility Business Plan | Assesses the viability of a business idea. | Market Demand, Competition, Financial Projections, Potential Obstacles. | Entrepreneurs, Investors |

| Growth Business Plan | Focuses on strategies for scaling up an existing business. | Market Analysis, New Product/Service Offerings, Financial Projections. | Business Owners, Investors |

| Operational Business Plan | Outlines the company's day-to-day operations. | Processes, Procedures, Organizational Structure. | Managers, Employees |

| Lean Business Plan | A simplified, agile version of a traditional plan, focusing on key elements. | Value Proposition, Customer Segments, Revenue Streams, Cost Structure. | Entrepreneurs, Startups |

| One-Page Business Plan | A concise summary of your company's key objectives, strategies, and milestones. | Key Objectives, Strategies, Milestones. | Entrepreneurs, Investors, Partners |

| Nonprofit Business Plan | Outlines the mission, goals, target audience, fundraising strategies, and budget allocation for nonprofit organizations. | Mission Statement, Goals, Target Audience, Fundraising Strategies, Budget. | Nonprofit Leaders, Board Members, Donors |

| Franchise Business Plan | Focuses on the franchisor's requirements, as well as the franchisee's goals, strategies, and financial projections. | Franchise Agreement, Brand Standards, Marketing Efforts, Operational Procedures, Financial Projections. | Franchisors, Franchisees, Investors |

Using Business Plan Software

| Software | Key Features | User Interface | Additional Features |

|---|---|---|---|

| LivePlan | Over 500 sample plans, financial forecasting tools, progress tracking against KPIs | User-friendly, visually appealing | Allows creation of professional-looking business plans |

| Upmetrics | Customizable templates, financial forecasting tools, collaboration capabilities | Simple and intuitive | Provides a resource library for business planning |

| Bizplan | Drag-and-drop builder, modular sections, financial forecasting tools, progress tracking | Simple, visually engaging | Designed to simplify the business planning process |

| Enloop | Industry-specific templates, financial forecasting tools, automatic business plan generation, unique performance score | Robust, user-friendly | Offers a free version, making it accessible for businesses on a budget |

| Tarkenton GoSmallBiz | Guided business plan builder, customizable templates, financial projection tools | User-friendly | Offers CRM tools, legal document templates, and additional resources for small businesses |

Business Plan FAQs

What is a good business plan, what are the 3 main purposes of a business plan, can i write a business plan by myself, is it possible to create a one-page business plan, how long should a business plan be, what is a business plan outline, what are the 5 most common business plan mistakes, what questions should be asked in a business plan, what’s the difference between a business plan and a strategic plan, how is business planning for a nonprofit different.

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

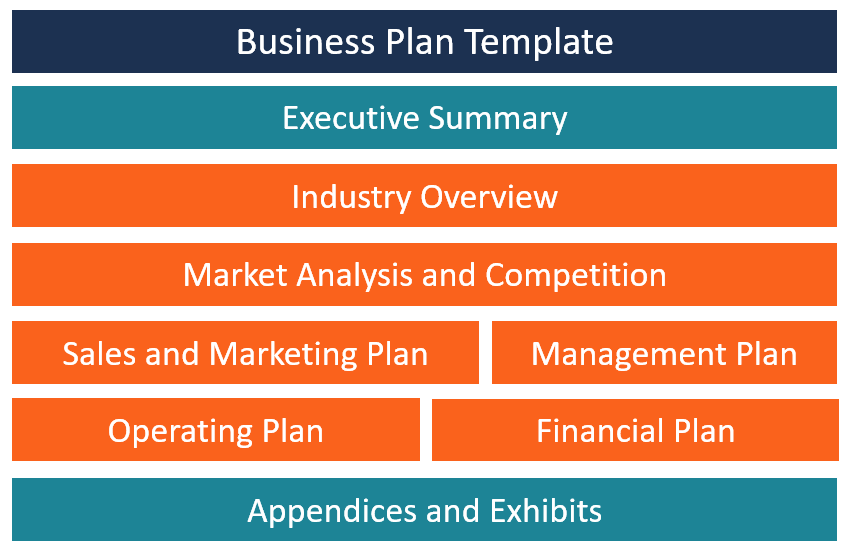

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

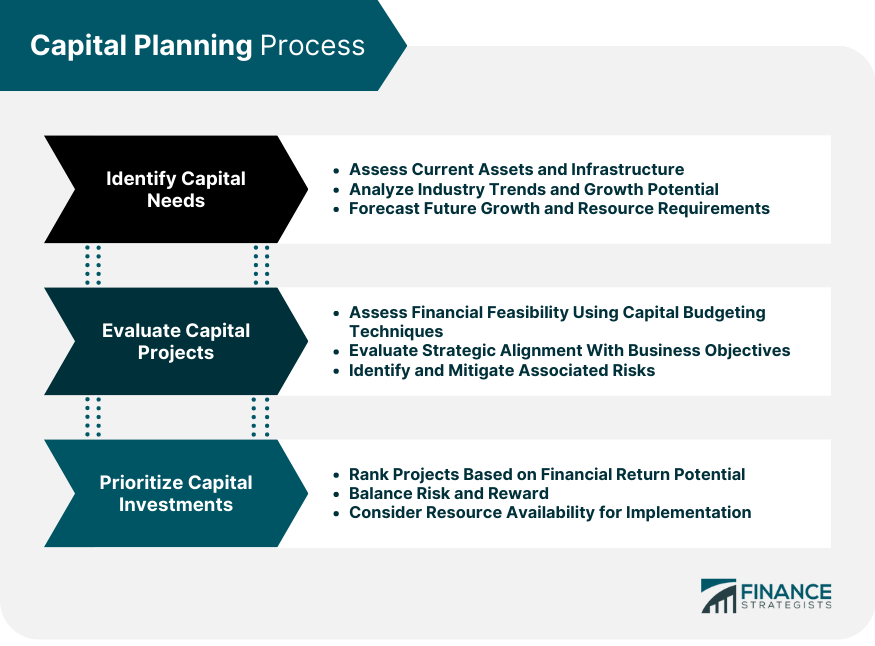

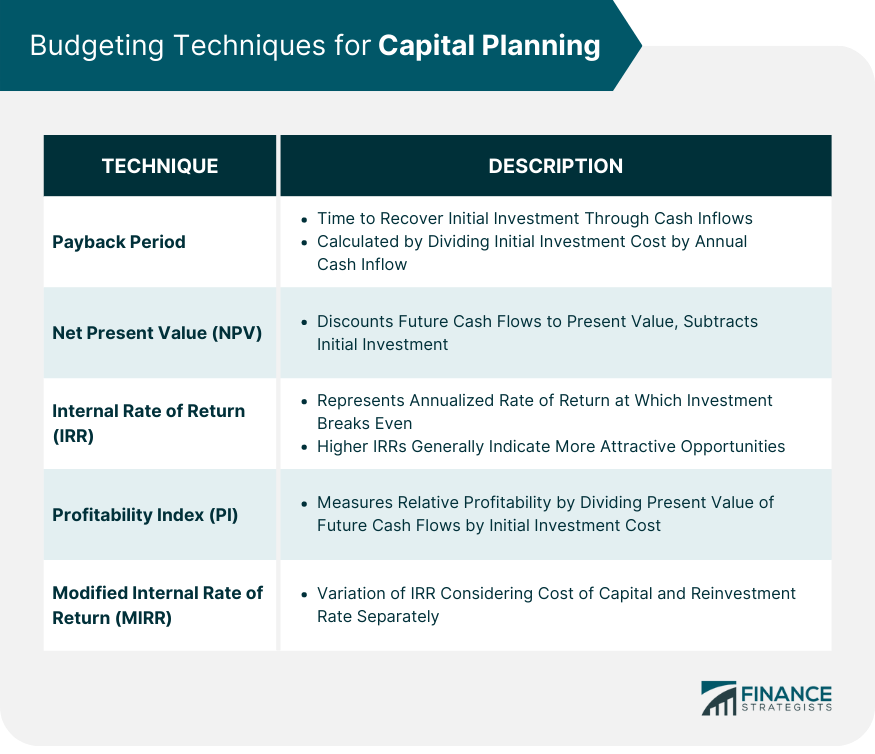

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee + up to $50 Amazon gift card

Varies by State & Package

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

- How To Write An Effective Business Proposal

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

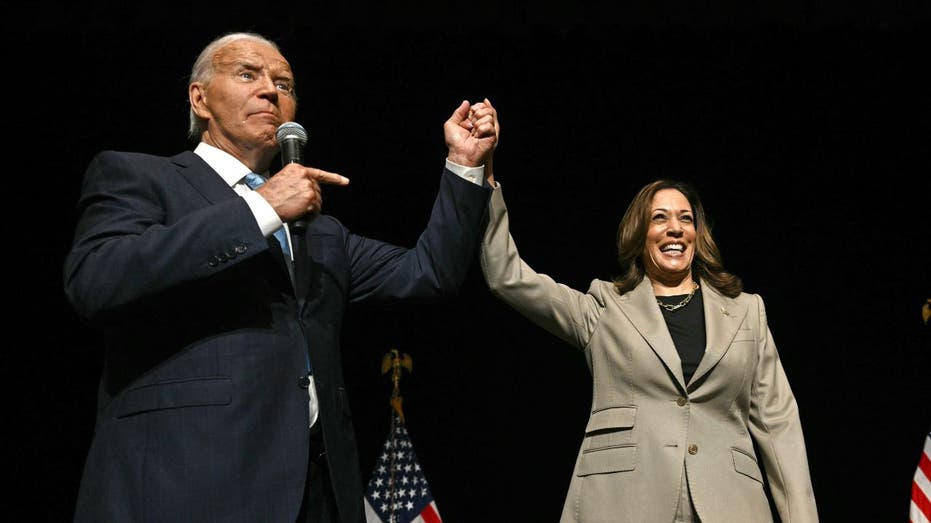

Harris breaks with Biden on capital gains tax in plan to spur small business growth

Vice president provides some details on plan to increase new small businesses.

Vice President and Democratic presidential nominee Kamala Harris on Wednesday unveiled a vastly expanded $50,000 tax benefit for new small businesses and a lower long-term capital gains tax than that was proposed by President Joe Biden in his budget blueprint , one of her clearest breaks yet with Biden.

Speaking to a crowd of supporters in Portsmouth, New Hampshire, Harris said, “And while we ensure that the wealthy and big corporations pay their fair share, we will tax capital gains at a rate that rewards investment in America's innovators, founders, and small businesses,” Harris said before proposing a 28% long-term capital gains tax on people making $1 million a year or more.

Biden previously called for a 39.6% tax rate on capital gains. It is unclear where Harris stands on the additional 5% tax. While Harris' presidential rival former President Donald Trump has not explicitly outlined a position this cycle , in 2016 he supported capping capital gains taxes at 20%, and the Heritage Foundation’s Project 2025 calls for a 15% capital gains tax.

A source familiar with the plan told ABC News that Harris believes a more moderated approach toward capital gains taxes will balance with other measures she supports to crack down on billionaires and big corporations. Harris said on Wednesday that she supported a minimum tax rate on billionaires. The source said she also supports raising the corporate tax rate and quadrupling taxes on stock buybacks.

However, the move comes as Harris and Trump seek to sharpen their economic messages to voters before facing off in their first debate on ABC News in Philadelphia next week. Trump is scheduled to give his own economic policy address on Thursday.

Harris’ announcement is part of a broader effort to generate a record-breaking 25 million new small business applications in her first term if elected, and her tax plan would represent a tenfold expansion of a $5,000 deduction already available to entrepreneurs to help cover startup costs.

An official familiar with Harris' plans said the $50,000 benefit would help offset the $40,000 it costs on average to start a small business. The terms of the proposal would also allow eligible enterprises operating at a loss to delay utilizing the benefit until they turn a profit.

Some profitable businesses could also defer the full benefit, opting to instead use it across multiple years by deducting only earnings from the first year of business and utilizing the remainder of the total $50,000 in future years, according to literature circulated to reporters from the Harris campaign.

MORE: Harris and Biden make pro-labor pitch on Labor Day in Pittsburgh

Harris said her administration would also seek to develop a standard deduction for small businesses to reduce the burden and cost of filing taxes, and remove barriers around occupational licensing, which inhibits workers from working across state lines.

While the literature circulated to reporters did not estimate the program's cost, Harris told the crowd that the the plan would provide access to venture capital, support “innovation hubs and business incubators,” and increase the number of federal contracts with small businesses.

Many aspects of Harris' proposed tax program would likely require congressional approval. The current 2017 Tax Cuts and Jobs Act, signed into law by Trump, is set to expire next year.

Harris also said that her administration would provide low- and no-interest loans to already existing small businesses. The campaign’s literature detailed a fund that would enable community banks and Community Development Financial Institutions to cover interest costs as small businesses expand in historically underinvested regions.

“We will have a particular focus on small businesses in rural communities, like right here in New Hampshire,” she said.

MORE: Can you guess how Americans feel about Harris's platform?

Both Trump and Harris have repeatedly sought to strike populist economic tones in their messaging, promising to provide relief to middle-class earners and even finding agreement on a proposed phase-out of federal income taxes on tipped wages.

Under pressure to define aspects of her policy agenda, Harris unveiled a slew of additional economic priorities last month that included, among other policies, restoring the American Rescue Plan's expanded Child Tax Credit, proposing $25,000 in down payment assistance to qualifying first-time home buyers, capping prescription drug prices and a federal ban on price gouging in the food sector.

Meanwhile, Trump has advocated for broader reforms to U.S. economic policy, which have included tax cuts for businesses and wealthy individuals alongside an across-the-board tariff hike on imports to the U.S., generally, with tax rates as high as 60% to 100% on Chinese goods.

Related Topics

- Kamala Harris

- President Biden

- Economy 2024

Popular Reads

How do Americans feel about Harris’s platform?

- Sep 4, 4:35 PM

Jackson says Harris nomination 'gives people hope'

- Sep 4, 2:07 PM

How early voting has reshaped elections

- Sep 4, 4:11 PM

John McCain's son backs Harris

- Sep 4, 1:55 PM

GOP lawmakers oppose state's trans care ban

- Sep 4, 1:40 PM

ABC News Live

24/7 coverage of breaking news and live events

How to Write a Business Plan for a Small Business

Noah Parsons

24 min. read

Updated September 2, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of writing a business plan

If you’re reading this guide, then you already know why you need a business plan .

You understand that writing a business plan helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your business plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After writing your business plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

When writing a business plan, the produces and services section is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

When writing a business plan, the operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

The last section of your business plan is your financial plan and forecasts.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI to write a business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of writing a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Writing a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of writing a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

Related Articles

7 Min. Read

How to Write a Bakery Business Plan + Sample

1 Min. Read

How to Calculate Return on Investment (ROI)

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

3 Min. Read

What to Include in Your Business Plan Appendix

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Kamala Harris Tax Plan Ideas: Details and Analysis

Topline preliminary estimates.

- 10-Year Revenue (Billions) +$1,697

- Long-run GDP -2.0%

- Long-Run Wages -1.2%

- Long-Run FTE Jobs -786,000

Tax Foundation General Equilibrium Model, September 2024.

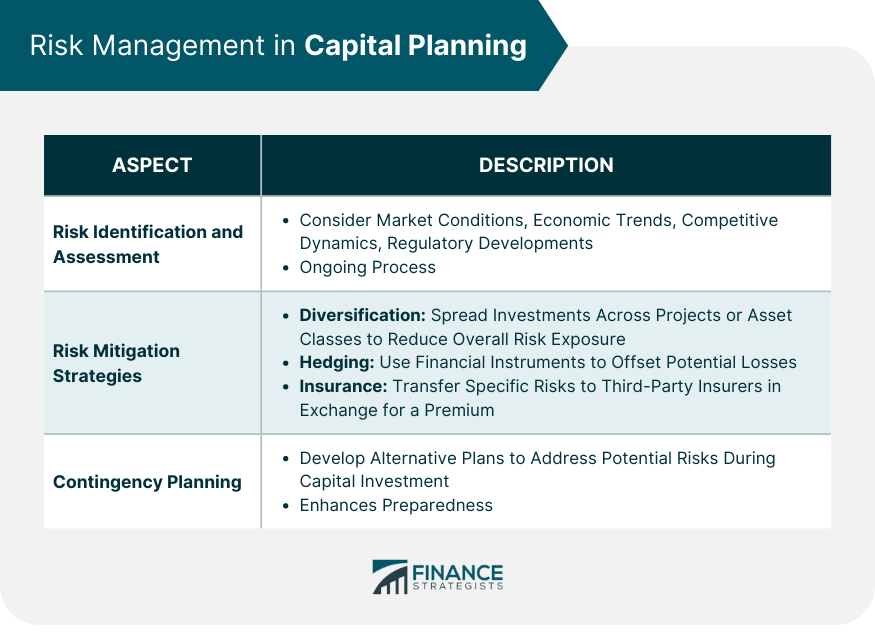

With less than two months left in the 2024 presidential campaign, Vice President Kamala Harris has sketched out sufficient details of her fiscal and economic agenda for us to provide a preliminary analysis of the budgetary, economic, and distributional effects. On tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit A tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. (CTC) and various other tax credits and incentives while exempting tips from income tax.

On a gross basis, we estimate that Vice President Harris’s proposals would increase taxes by about $4.1 trillion from 2025 to 2034. After taking various credits and tax cuts into account, Harris would raise about $1.7 trillion over 10 years on a conventional basis, and after factoring in reduced revenue from slower economic growth, the net revenue increase comes to $642 billion. We estimate the proposed tax changes would reduce long-run GDP by 2.0 percent, the capital stock by 3.0 percent, wages by 1.2 percent, and employment by about 786,000 full-time equivalent jobs.

We find the tax policies would raise top tax rates on corporate and individual income to among the highest in the developed world, slowing economic growth and reducing competitiveness. The tax credits and other carveouts would complicate the tax code, run more spending through the IRS, and, together with various price controls, fail to improve affordability challenges in housing and other sectors.

Many tax policies remain unspecified, including how Harris might deal with next year’s expiration of the Tax Cuts and Jobs Act (TCJA). Harris has not clearly indicated if or how her spending priorities align with the FY 2025 budget proposals. Depending on where she lands on these issues, the deficit impacts could be large.

In a possible scenario in which she extends the TCJA for all those earning under $400,000 and adopts all the spending proposals specified in the FY 2025 budget, we estimate the net effect of her policies would increase deficits by $1.5 trillion over the next decade, measured on a conventional basis. Including the economic impacts of the tax increases, the net effect could increase deficits by roughly $2.6 trillion over the next decade.

The wide range of possibilities reflects considerable uncertainty about her fiscal policy stance at this point, leaving a large void regarding how she might deal with the already unprecedented , dangerous, and unsustainable federal debt trajectory.

| Gross Domestic Product (GDP) | -2.0% |

| Gross National Product (GNP) | -1.8% |

| Capital Stock | -3.0% |

| Wage Rate | -1.2% |

| Full-Time Equivalent Jobs | -786,000 |

Detailed Harris Tax Proposals

Harris’s tax plan relies on higher taxes on businesses and high earners to raise new revenues as outlined in President Biden’s FY 2025 budget with some revisions (to capital gains taxes, as noted), combined with several tax credits. All provisions are modeled as starting in calendar year 2025 unless otherwise noted.

Major business provisions modeled:

- Increase the corporate income tax A corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses , with income reportable under the individual income tax . rate from 21 percent to 28 percent

- Increase the corporate alternative minimum tax introduced in the Inflation Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “ hidden tax ,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act from 15 percent to 21 percent

- Quadruple the stock buyback tax implemented in the Inflation Reduction Act from 1 percent to 4 percent

- Make permanent the excess business loss limitation for pass-through businesses

- Further limit the deductibility of employee compensation under Section 162(m)

- Increase the global intangible low-taxed income (GILTI) tax rate from 10.5 percent to 21 percent, calculate the tax on a jurisdiction-by-jurisdiction basis, and revise related rules

- Repeal the reduced tax rate on foreign-derived intangible income (FDII)

Major individual, capital gains, and estate tax An estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits , at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. provisions modeled:

- Expand the base of the net investment income tax (NIIT) to include nonpassive business income and increase the rates for the NIIT and the additional Medicare tax to reach 5 percent on income above $400,000

- Increase top individual income tax An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment . Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate to 39.6 percent on income above $400,000 for single filers and $450,000 for joint filers

- Tax long-term capital gains and qualified dividends at 28 percent (as opposed to 39.6 percent as in the Biden budget) for taxable income Taxable income is the amount of income subject to tax , after deductions and exemptions . For both individuals and corporations, taxable income differs from—and is less than—gross income. above $1 million and tax unrealized capital gains at death above a $5 million exemption ($10 million for joint filers)

- Limit retirement account contributions for high-income taxpayers with large individual retirement account (IRA) balances

- Tighten rules related to the estate tax

- Tax carried interest as ordinary income for people earning more than $400,000

- Limit 1031 like-kind exchanges to $500,000 in gains

- Exempt tipped income from income taxation for occupations where tips are currently customary

- Expand the Section 195 deduction limit for startup expenses from $5,000 to $50,000.

Major tax credit provisions modeled:

- Revive and make permanent the American Rescue Plan Act (ARPA) child tax credit (CTC) and increase the CTC for newborns to $6,000 in the first year of life

- Permanently extend the ARPA earned income tax credit (EITC) expansion for workers without qualifying children

- Provide a $25,000 tax credit for first-time homebuyers over four years

We also modeled various miscellaneous provisions for corporations, pass-through businesses, and individuals, including several energy-related tax hikes largely pertaining to fossil fuel production. While the Biden budget improperly characterized fossil fuel provisions as subsidies, many are deductions for costs (or approximations of costs) incurred.

Major provisions not modeled by us, but included in total fiscal impacts based on Biden administration estimates:

- Repeal the base erosion and anti-abuse tax (BEAT) and replace it with an undertaxed profits rule (UTPR) consistent with the Organisation for Economic Co-operation and Development (OECD)/G20 global minimum tax model rules

- Replace FDII with unspecified research and development (R&D) incentives

- Create a 25 percent “billionaire minimum tax” to tax unrealized capital gains of high-net-worth taxpayers

- Permanently extend the ARPA premium tax credits (PTCs) expansion (we do include PTCs in our distributional analysis)

- Changes to tax compliance and administration

Long-Run Economic Effects of Vice President Harris’s Tax Proposals

We estimate the tax changes in Harris’s tax proposals would reduce long-run GDP by 2.0 percent, the capital stock by 3.0 percent, wages by 1.2 percent, and employment by about 786,000 full-time equivalent jobs. Harris’s tax proposals would decrease American incomes (as measured by gross national product, or GNP) by 1.8 percent in the long run, reflecting offsetting effects of increased taxes and reduced deficits, as debt reduction reduces interest payments to foreign owners of the national debt.

Raising the corporate income tax rate to 28 percent is the largest driver of the negative effects, reducing long-run GDP by 0.6 percent, the capital stock by 1.1 percent, wages by 0.5 percent, and full-time equivalent jobs by 125,000.

Our economic estimates likely understate the effects of the Harris tax plan since they exclude two novel and highly uncertain yet large tax increases on high earners and multinational corporations, namely a new minimum tax on unrealized capital gains and a UTPR consistent with the OECD/G20 global minimum tax model rules. Nor do we include the proposed unspecified R&D incentives that would replace the lower tax rate on foreign-derived intangible income FDII.

| Provision | Change in GDP | Change in GNP | Change in Capital Stock | Change in Wages | Change in Full-time Equivalent Jobs |

|---|---|---|---|---|---|

| Raise the top tax rate on individual income to 39.6% for those earning $400,000 single or $450,000 joint | -0.1% | -0.1% | -0.1% | 0% | -86,000 |

| Tax unrealized capital gains at death over $5 million and tax capital gains over $1 million at 28% | -0.2% | -0.4% | -0.3% | -0.1% | -75,000 |

| Limit 1031 like-kind exchanges to $500,000 in gain | Less than –0.05% | Less than –0.05% | Less than –0.05% | Less than –0.05% | -2,000 |

| Expand the net investment income tax base to active pass-through business income | -0.2% | -0.2% | -0.3% | -0.2% | -41,000 |

| Raise the net investment income tax rate from 3.8% to 5% and raise the additional Medicare tax from 0.9% to 2.1% | -0.5% | -0.2% | -0.3% | -0.1% | -177,000 |

| Tax carried interest as ordinary income | Less than –0.05% | Less than –0.05% | Less than –0.05% | Less than –0.05% | -4,000 |

| Impose new limits on large retirement account balances and increase minimum required distributions and misc. taxes on saving | Less than –0.05% | -0.1% | Less than –0.05% | Less than –0.05% | -7,000 |

| Tighten estate tax rules | Less than –0.05% | Less than –0.05% | Less than –0.05% | Less than –0.05% | -3,000 |

| Exempt tips from federal income tax | Less than +0.05% | Less than +0.05% | Less than +0.05% | Less than +0.05% | 21,000 |

| Raise the corporate tax rate from 21% to 28% | -0.6% | -0.6% | -1.1% | -0.5% | -125,000 |

| Increase the corporate book minimum tax rate from 15% to 21% | -0.1% | -0.1% | -0.2% | -0.1% | -12,000 |

| Raise the stock buyback excise tax from 1% to 4% | Less than -0.05% | Less than -0.05% | -0.1% | -0.1% | -11,000 |

| Changes to the international tax system | -0.1% | -0.1% | -0.2% | -0.1% | -19,000 |

| Limit executive compensation deductibility under Section 162(m) | -0.1% | -0.1% | -0.1% | 0% | -106,000 |

| Misc. corporate tax increases | Less than –0.05% | Less than –0.05% | Less than –0.05% | Less than –0.05% | -5,000 |

| Make permanent the pass-through loss limitation and misc. pass-through tax increases | Less than –0.05% | Less than –0.05% | -0.1% | Less than –0.05% | -2,000 |

| Make the American Rescue Plan Act EITC expansion permanent, revive and make permanent the ARPA CTC and increase newborn CTC to $6,000 | -0.1% | -0.1% | -0.1% | 0% | -131,000 |

| Impact of spending and budget deficit | 0% | 0.2% | 0% | 0% | 0 |

| Total Economic Effect | -2.0% | -1.8% | -3.0% | -1.2% | -786,000 |

Revenue and Debt Effects of Vice President Harris’s Tax Proposals

Across the major provisions modeled by Tax Foundation, we estimate that Harris’s tax plan would raise $2.2 trillion of tax revenue from corporations and $1.2 trillion from individuals from 2025 through 2034.

For tax proposals from the Biden FY 2025 budget, we relied on estimates from the White House Office of Management and Budget (OMB) for provisions we did not model, including the billionaire minimum tax, UTPR, various international tax changes for oil and gas companies, smaller international tax changes, improvements to tax compliance and administration, and unspecified R&D incentives to replace FDII.

In total, accounting for all provisions, we estimate the budget would raise just over $4.1 trillion in gross revenue from tax changes over the 10-year budget window.

Tax cuts, like the tax exemption A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service ( IRS ), preventing them from having to pay income tax. for tip income, the expanded deduction for startup expenses, and the unspecified incentive to replace FDII, reduce gross revenue by $235 billion, while expanded tax credits reduce the revenue by another $2.2 trillion. This results in a net tax increase of about $1.7 trillion over 10 years on a conventional basis.

On a dynamic basis, factoring in reduced tax revenues resulting from the smaller economy, we estimate Harris’s tax plan would raise about $642 billion over 10 years.

The economic harm from Harris’s tax hikes would also greatly reduce the ability to address an emerging debt crisis. Under current law, the debt-to-GDP ratio will hit 201 percent in 40 years, while the Harris tax plan on a conventional basis would reduce the debt-to-GDP ratio to 189 percent. However, after factoring in reduced tax collections and a smaller economy, the debt-to-GDP ratio would decline only slightly, to 200 percent.

| Individual Revenue Raisers | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2025-2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Raise top tax rate on individual income to 39.6% | $49.6 | $10.9 | $11.9 | $12.3 | $12.8 | $13.3 | $13.7 | $14.2 | $15.5 | $16.2 | $170.5 |

| Tax unrealized capital gains at death over $5 million and impose a 28% tax rate on capital gains over $1 million | -$12.3 | -$0.9 | $7.9 | $18.8 | $22.0 | $23.9 | $25.1 | $25.7 | $29.9 | $31.5 | $171.8 |

| Expand the net investment income tax base to active pass-through income | $23.0 | $22.8 | $24.4 | $24.7 | $25.2 | $25.8 | $26.2 | $25.9 | $29.5 | $30.3 | $257.7 |

| Raise the net investment income tax rate from 3.8% to 5% | $9.5 | $10.1 | $11.3 | $12.4 | $12.8 | $13.0 | $13.2 | $12.9 | $14.9 | $15.3 | $125.3 |

| Raise the additional Medicare tax from 0.9% to 2.1% | $20.3 | $20.5 | $22.6 | $23.6 | $24.9 | $26.3 | $27.7 | $28.9 | $30.7 | $32.6 | $258.2 |

| Make permanent the limit on excess business losses for pass-through firms | $0.0 | $0.0 | $0.0 | $0.0 | $4.0 | $4.6 | $3.8 | $3.2 | $2.6 | $2.7 | $20.9 |

| Limit 1031 like-kind exchanges to $500K in gain | $1.1 | $1.9 | $1.9 | $2.0 | $2.1 | $2.1 | $2.2 | $2.2 | $2.3 | $2.4 | $20.3 |

| Tax carried interest as ordinary income | $0.6 | $0.7 | $0.7 | $0.7 | $0.7 | $0.7 | $0.7 | $0.7 | $0.7 | $0.7 | $6.7 |

| Create new limitations on high-income taxpayers with large retirement account balances and increasing minimum required distributions and miscellaneous tax increases on saving* | $10.3 | $9.1 | $7.0 | $5.9 | $5.4 | $5.2 | $5.1 | $4.8 | $5.6 | $5.7 | $63.9 |

| Tighten estate and gift tax rules | $5.9 | $5.9 | $8.4 | $8.9 | $9.3 | $9.9 | $10.5 | $11.0 | $11.8 | $12.5 | $94.1 |

| Miscellaneous tax increases on pass-through firms** | $4.3 | $5.3 | $3.9 | $2.3 | $1.0 | $0.6 | $0.8 | $0.9 | $1.1 | $1.3 | $21.5 |

| $112.3 | $86.1 | $99.9 | $111.5 | $120.2 | $125.5 | $128.9 | $130.5 | $144.6 | $151.3 | $1,210.8 | |

| Raise corporate tax rate to 28% | $94.4 | $81.2 | $82.2 | $79.1 | $82.7 | $84.2 | $87.5 | $84.9 | $75.8 | $130.9 | $882.8 |

| Raise corporate alternative minimum tax from 15% to 21% | $25.8 | $37.0 | $41.9 | $48.0 | $32.0 | $32.1 | $36.0 | $49.3 | $58.8 | -$14.4 | $346.4 |

| 21% GILTI minimum tax rate and other GILTI changes | $37.5 | $24.8 | $23.6 | $24.7 | $26.0 | $26.6 | $25.7 | $26.6 | $31.5 | $31.4 | $278.3 |

| Repeal FDII | $9.7 | $8.7 | $6.9 | $8.0 | $9.3 | $9.4 | $6.4 | $12.7 | $10.9 | $10.2 | $92.1 |

| Section 265 changes and world interest limitation | $15.7 | $16.0 | $16.3 | $17.5 | $18.4 | $18.9 | $19.7 | $21.0 | $21.6 | $22.3 | $187.3 |

| 4% excise tax on stock buybacks | $7.8 | $6.1 | $5.2 | $7.2 | $9.2 | $7.9 | $8.1 | $9.5 | $9.9 | $8.1 | $79.0 |

| Modification to 162(m) limit on deduction of excessive employee remuneration | $27.9 | $23.6 | $27.6 | $33.8 | $32.3 | $28.9 | $23.6 | $21.0 | $21.9 | $25.2 | $265.7 |

| Miscellaneous corporate tax increases*** | $2.8 | $2.3 | $2.6 | $2.8 | $3.1 | $3.4 | $3.7 | $4.1 | $4.5 | $5.0 | $34.3 |

| $221.6 | $199.5 | $206.3 | $221.1 | $212.8 | $211.2 | $210.7 | $229.0 | $235.0 | $218.7 | $2,166.0 | |

| Impose a 25% minimum tax on unrealized gains for taxpayers with net wealth over $100 million | $12.6 | $51.8 | $57.1 | $59.7 | $60.3 | $59.8 | $57.8 | $52.3 | $51.0 | $54.4 | $516.9 |

| Levy an undertaxed profits rule on large multinational firms | $19.5 | $21.8 | $21.7 | $22.1 | $22.1 | $22.2 | $22.3 | $22.6 | $25.1 | $25.6 | $225.0 |

| Changes to tax compliance and administration | $3.7 | $3.3 | $2.9 | $2.1 | $1.9 | $2.0 | $2.0 | $2.1 | $2.2 | $2.3 | $24.5 |

| $35.8 | $77.0 | $81.7 | $83.8 | $84.4 | $84.0 | $82.1 | $77.0 | $78.4 | $82.3 | $766.4 | |

| Gross Revenue Total | $369.7 | $362.6 | $387.9 | $416.4 | $417.4 | $420.7 | $421.7 | $436.5 | $458.0 | $452.3 | $4,143.2 |

| Exempt tip income from federal income tax | -$10.2 | -$10.6 | -$11.0 | -$11.5 | -$11.9 | -$11.7 | -$12.1 | -$12.5 | -$13.0 | -$13.5 | -$118.0 |