More From Forbes

Understanding market research for your business plan.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

When you’re building a business plan, market research needs to happen pretty early in the process. It’s where you learn about your audience’s wants and needs and the financial trends in your industry, and where you combine the data, and uncover trends that tell you what customers want and how to provide it most effectively.

The results of that research and analysis will shape aspects of the rest of your business plan. Assessments of your market and competition inform critical decisions in areas such as product design or service offerings, price, marketing methods, and business location.

That means accurate and comprehensive market research matters. To be comprehensive, your information and analysis should answer every possible question about the market you plan to enter and the consumers you believe will buy your product or service, including (but not limited to):

• Demand: Do consumers want what you’re offering?

• Economic indicators: Do they have the money to buy your product/service?

• Pricing: How much will they pay for your product/service?

• Location: Where do they live, and where are they likely to make their purchases?

• Saturation: How many other options do they currently have for that product/service?

First Steps: Budget

You can spend a lot answering these questions. Many large businesses hire firms to do the research and analysis, employing large-scale surveys, focus groups and statistical models, among other methods. However, for entrepreneurs just starting out, marketing budgets are typically too slim to cover that kind of research.

So, the work needs to stay in-house and fit a small marketing budget. Affordable, effective market research is possible. It may not be as specific to your market as the big-budget stuff, but it can get you the information you need to work out a solid understanding of your market.

First Steps: Market-Research Objectives

Before you start your research and analysis, determine your objectives. Decide what you want to learn from the process. It will guide the data you search for and how you use it, so be specific. Write down actual goals – what would give you the most accurate, comprehensive and useful picture of your market? This could include areas such as demographics, competitor offerings and customer pain points.

First Steps: Research Terminology

In market research, you’re basically dealing with two types of research and two types of data:

• Primary research: This is research you perform yourself in order to get very specific insights into your very specific business. It includes methods such as surveys, interviews and direct observations (by visiting competitor locations, for instance). It can help you gather qualitative data. This is data that goes beyond statistics and market trends. It can tell you what your consumers want, what they don’t want and how they feel about your offerings.

• Secondary research: This is research other people have performed and analyzed. To conduct secondary research, you can visit government websites such as the U.S. Census Bureau and the Bureau of Labor Statistics, as well as private data collectors such as Google and market-research companies. It can help you gather quantitative data. This is generally statistical data and can reveal insights on consumer demographics, spending patterns, market trends and earnings projections.

Where To Start Your Market Research

There’s a ton of existing research out there, and a lot of it is totally free. The Small Business Administration website has a list of free government sources for various types of quantitative data, such as industry statistics, consumer demographics, consumer demand and spending, and sales indicators. Much of it comes from the U.S. Census Bureau and the Bureau of Labor Statistics. A simple search will turn up enough places to start gathering secondary research to build a picture of your market.

With a good understanding of your market from secondary sources, you’re in a good position to know which types of primary research, if any, would be worth an investment of your time and energy. Maybe a well-designed survey completed by everyone you know could help fill in some holes.

You can also conduct primary research by visiting and speaking with your would-be competition and their customers; through crowdsourcing forums such as Quora, where you can glean raw data from comments and responses and post questions related to your product, service and market; on social-media websites such as Facebook, where you can parse conversations in relevant interest groups; and by reading product and service reviews on sites such as Amazon or Yelp.

Analyzing Your Market Research

Armed with all your data, you’ll draw conclusions that will help guide many of your business decisions.

But first, make sure all of your data will benefit those decisions. Don’t start analyzing until you weed out extraneous information that will waste your time and hinder focused insights. If it doesn’t relate directly to your business and your market, set it aside.

Then organize the relevant data into tables, graphs, lists and pie charts, and see what trends emerge. What do those trends mean for your business? Your product? Your location? Your planned promotions?

Be open to whatever the data tells you. Even if your research findings are unexpected, embrace them, and make any necessary adjustments. Listening to good market research can save you a lot of headaches down the road: The better you know your consumers, the better your chances of successfully selling to them.

- Editorial Standards

- Forbes Accolades

Market Research for a Business Plan: How to Do It in a Day

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Whether it’s your first time using market research for a business plan or this isn’t exactly your first rodeo: a quick refresh on the topic can do no harm.

If anything, it’s the smart route to take. Particularly when you consider modern-day market research data can be obtained quicker than ever – when the right tools are used.

Today, I’m going to explain exactly how to conduct market research for a business plan, and how to access that key data and juicy intel without hassle.

The importance of market research in business planning

They say knowledge is power, and where your rivals and your market are concerned, there’s nothing quite like it. By looking at things like consumer behavior , the competitive landscape , market size, and the digital strategies of others; companies at any stage in their lifecycle can stay relevant, maintain a competitive edge, set strategic direction, and experience growth. Doing periodic market research also helps businesses develop a deeper, more informed understanding of a market, its audience, and key players. If you’re seeking financial backing, doing market research is essential to show credibility and build confidence in your plans.

How to conduct market research for a business plan

Good market research for a business plan should be contextualized with information about your company, its goals, products, pricing, and financials. Sounds like a lot of work, right? Read on to learn how to conduct all the market research for a business plan you’re going to need – quickly, using the most up-to-date data there is. I’ll show you how to:

- Understand your audience

- Identify target personas

- Size your market

- Research the competition

- Discover your unique sales proposition

- Define marketing priorities

Before you start, make sure your business planning document includes the following 10 headings:

This format is considered best practice, so I’ve indicated the specific sections that each element of your market research fits into.

Sound good? Then let’s get started.

1. Understand your audience

What it is – A target audience is a social segment of people who are likely to be interested in your products or services. It’s a snapshot of your target customer base, sorted by certain characteristics. It’s also known as audience demographics and can contain data like age, gender, location, values, attitudes, behaviors, and more.

Where to use this market research in a business plan – Demographical data can help determine the size of your market, which slots into the executive summary, marketing plan, market sizing, and financial sections of the plan. What’s more, when you use it to identify groups of people to target, it can also be used in the products and services, competitive research tools , and SWOT analysis sections.

Bonus: Audience demographics can also help you develop stronger branding by choosing imagery that appeals most to your ideal customers.

How to do a quick audience analysis

Similarweb Research Intelligence gives you the ability to view almost any industry in a few seconds; you can also create a custom industry based on specific players in your market. Here’s how to see relevant audience demographics in a market. For this example, I chose the airline industry.

View typical audience relevant to your sector with gender and age distribution, along with geographical data . You can see which companies are experiencing growth and at what rate. Audience loyalty is also key to understanding how people behave, if they tend to shop around and what search terms they use to discover sites in any niche.

Read more: Learn more about how to do a demographic analysis of your market’s audience .

2. Identify target personas

What it is – An audience or target persona is a typical customer profile. It starts with audience demographics, and then zooms into a much deeper level. Most organizations develop multiple target personas, based on things like pain points, location, gender, background, occupation, influential factors, decision-making, likes, dislikes, goals, ideals, and more.

Pro Tip: If you’re in B2B, your target personas are based on the people who make purchasing decisions, not the business itself.

Where to use this market research in a business plan – Creating target personas for your business shows you know whom you’re targeting, and how to market to them. This information will help you complete market sizing, product or service overview, marketing plan , and could fit into the competitive research section too.

How to create a buyer persona in five steps

Guesswork does not equal less work – there’s no place for shortcuts here. Your success depends on developing the most accurate representation of who your customers are, and what they care about.

1. Research: If you’re already in business, use market research surveys as a tool to collect information about your customers. If you’re a startup or pre-startup, you can use a platform like Similarweb to establish a typical customer profile for your market. Don’t forget to use mobile app intelligence and website analytics in tandem to build a complete picture of your audience.

Pro Tip: Secondary market research is another good source of intel for startups. You might be able to find published surveys that relate to your products or market to learn more.

2. Analysis: Here, you’re looking to answer key questions to fill in the blanks and build a complete picture of your ideal customer. Tools like Similarweb Digital Research Intelligence, Google Analytics, and competitors’ social media channels can help you find this out. Typical questions include:

- Where is your audience coming from?

- What channels do they use to find your site?

- Do they favor access via mobile site, app, or desktop?

- What are their demographics? Think age, job, salary, location, and gender.

3. Competitive market research: This shows you what marketing channels, referral partners, and keywords are sending traffic to businesses similar to yours When you combine this data with what you learned in sections 1 + 2, you are ready to build your personas.

4. Fill in a buyer persona template: We’ve done the hard work for you. Download a pre-made template below .

Further reading: The complete guide to creating buyer personas

3. Size your market

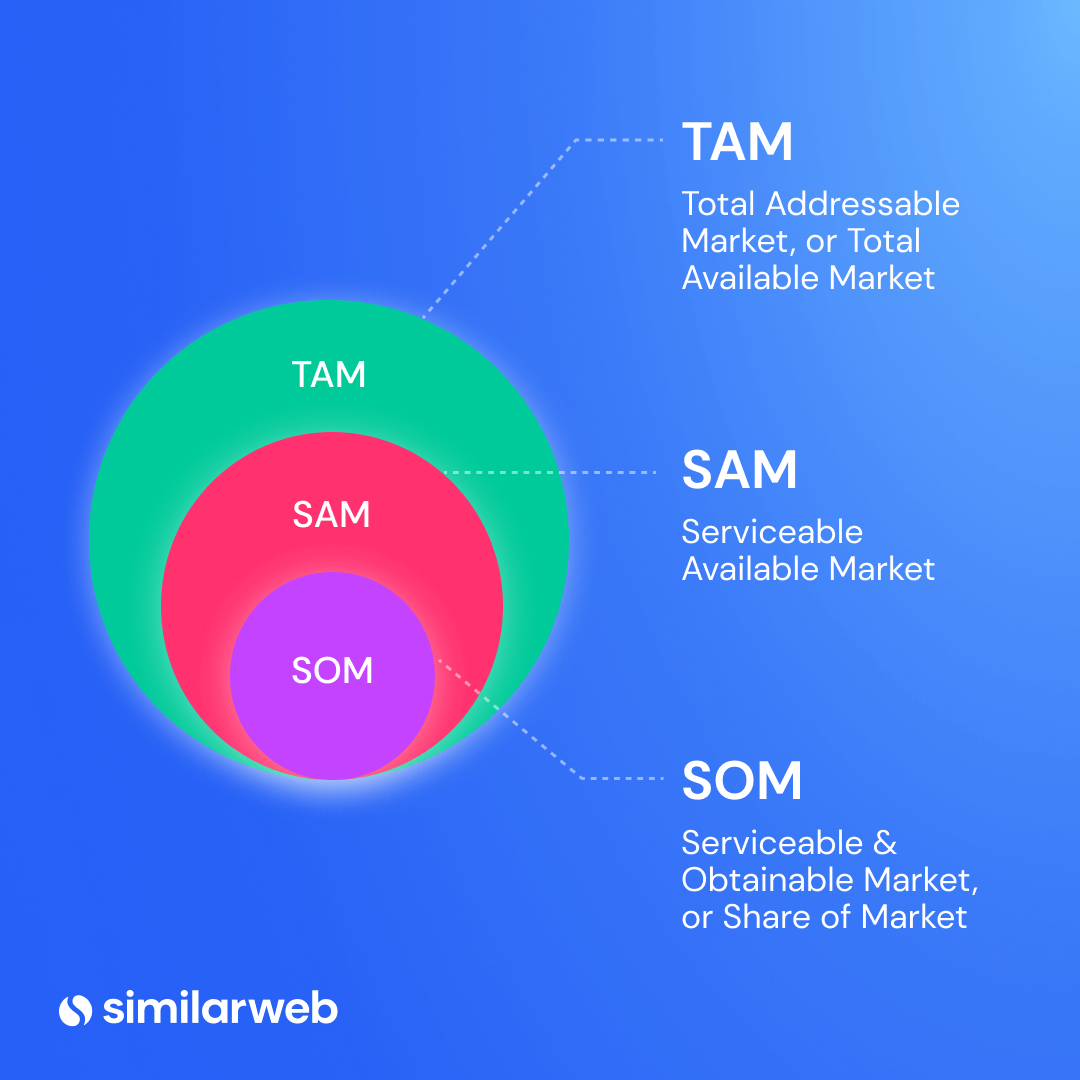

What it is – Market sizing is a way to determine the potential size of a target market using informed estimation. This is how you find out the potential revenue and market volume applicable to your business . There are three key metrics: total addressable market (TAM), service addressable market (SAM), and service obtainable market (SOM).

Where to use this market research in a business plan – Knowing how big the slice of the pie you’re going after is crucial. It can inform any goal setting and help with forecasting too. This data can be used in your executive summary, marketing plan, competitive research, SWOT analysis, market sizing, operations, and financial sections.

Further reading: How to do market sizing shows you how to calculate the TAM, SAM, and SOM for your business.

4. Research the competition

What it is – Competitive landscaping shows who you’re up against and how your offering stacks up vs others in your space. By evaluating rivals in-depth and looking at things like features, pricing, support, content, and additional products, you can form a detailed picture of the competition.

Where to use this market research in a business plan – The information you gain from performing a competitive analysis can transform what you offer and how you go to market. In business planning, this market research supports the executive summary, product or service overview, marketing plan, competitive research, SWOT analysis, and operation sections.

How to do competitive landscaping

Using the industry overview section of Similarweb Digital Research Intelligence, competitor research is made quick and easy. Access key metrics on an industry or specific players, then download raw data in a workable excel file or get a PNG image of charts in an instant. Most data can be downloaded via excel or as an image and included in the resource section of your plan.

Here, you can see a summary of a market, yearly growth, and top sites. A quick click to industry leaders shows you market leaders and rising stars. Select any name for a complete picture of their digital presence – use this to spot potential opportunities to gain a competitive advantage.

Read more: See how to do a competitive analysis and get a free template to help you get started.

5. Discover your unique sales proposition

What it is – Not all businesses have them, and that’s OK. A unique selling proposition (USP) is something distinctive your business offers but your rivals don’t . It can be anything that’s unique to a product, service, pricing model, or other.

Why it’s useful – Having a compelling USP helps your company stand out in a market. It can make your business more valuable to a customer vs the competition, and ultimately help you win and retain more customers.

Where to use this market research in a business plan – Your USP should be highlighted in the executive summary, the product and service overview, and the SWOT analysis.

How to find your USP

Unless you’ve developed a unique product or service, or you’re planning to sell to the market at a lower-than-average price point, you’re going to have to look for some kind of service differentiator that’ll help you stand out. In my experience, the quickest way to discover this is through competitive benchmarking. Here, I’m talking about evaluating your closest rivals to uncover things they’re not doing, or looking for gaps that your business can capitalize on.

A competitive review of their site should look at things like:

- Customer support: do they have live chat, email support, telephone support, etc.?

- Content: do they produce additional content that offers value, free resources, etc.?

- Offers: what promotions or offers do they run?

- Loyalty or referral programs: do they reward loyalty or referrals?

- Service level agreements: what commitments do they make to their customers?

- Operations: consider delivery methods, lead times, returns policy etc.

- Price promises: what satisfaction or price promises do they offer, if at all?

Go easy on yourself and create a basic template that details each point. Once complete, look for opportunities to provide something unique that nobody else currently offers.

6. Define marketing priorities

What it is – A detailed plan showing how you position and market your products or service. It should define realistic, clear, and measurable goals that articulate tactics, customer profiles, and the position of your products in the market.

Where to use this market research in a business plan – Relevant intel you uncover should inform the marketing plan first and foremost. However, it can also be used in the SWOT analysis, operation, and financial sections.

How to do it – with a market research example

Using the marketing channels within Similarweb Digital Research Intelligence, you can short-cut the lengthy (and often costly) process of trial and error when trying to decide which channels and activities work best.

Let me show you how.

Using Similarweb Digital Research Intelligence, I can hone in on any site I like, and look at key marketing intel to uncover the strategies they’re using, along with insights into what’s driving traffic, and traffic opportunities.

In less than 60 seconds, I can see easyJet’s complete online presence; its marketing and social channels, and a snapshot of every metric that matters, like referrals, organic and paid ads, keywords, and more. Expand any section to get granular data, and view insights that show exactly where key losses, gains, and opportunities exist.

You can take this a step further and add other sites into the mix. Compare sites side-by-side to see who is winning, and how they’re doing it. While this snapshot shows a comparison of a single competitor, you can compare five at any one time. What’s more, I can see industry leaders, rising players, and any relevant mobile app intelligence stats, should a company or its rivals have an app as part of their offering.

Best practice for market research data in business plans

When doing any type of market research , it’s important to use the most up-to-date data you can get your hands on. There are two key factors for data are timeliness and trustworthiness.

For any market, look for data that applies to any period over the last 12 months. With how fast markets evolve and how quickly consumer behaviors change, being able to view dynamic data is key. What’s more, the source of any data matters just as much as its age.

To emphasize the importance of using the right type of data in a business plan, here’s some timely advice from SBA commercial lending expert and VP of Commerce National Bank and Trust, Steve Fulmer. As someone who, in the past 15 years, has approved approximately $150 million in loans to SMBs; his advice is worth paying attention to.

“ For anybody doing market research for a business plan, they must cite sources. Most new or small businesses lack historical performance data, which removes substantial confidence in their plans. As a lender, we cannot support assumptions in their business plan or their projections if their data hasn’t come from a trustworthy source.”

Wrapping up…

Now you know the six ways to do market research for a business plan, it’s time to knuckle down and get started. With Similarweb, you’ve got access to all the market intel you’re going to need to conduct timely, accurate, and reliable market research. What’s more, you can return to the platform anytime to benchmark your performance , get fresh insights, and adapt your strategies to focus on growth – helping you build a sustainable business that can withstand the test of time.

How do I do market research for a business plan?

By using Digital Research Intelligence tools like Similarweb, you can quickly conduct audience research, company research, market analysis, and benchmarking from a single place. Another method is secondary market research, but this takes more time and data isn’t always up to date.

Why does a business plan need market research?

Doing market research for a business plan is the quickest and easiest way to validate a business idea and establish a clear view of the market and competitive landscape. When done right, it can show you opportunities for growth, strategies to avoid, and effective ways to market your business.

What is market research in a business plan?

Market research in business planning is one of the most powerful tools you can use to flesh out and validate your company or its products. It can tell you whether there’s a market for your product, and how big that market is – it also helps you discover industry trends, and examine the strategies of the rising stars and industry leaders in detail.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

Market Opportunities: How to Identify and Analyze Them

Competitive Benchmarking: Crack the Code to Your Competitors’ Success

Importance of Market Research: 9 Reasons Why It’s Crucial for Your Business

Audience Segmentation: Definition, Importance & Types

Geographic Segmentation: Definition, Pros & Cons, Examples, and More

Demographic Segmentation: The Key To Transforming Your Marketing Strategy

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here .

How to Create a Market Research Plan

Before starting a business, you want to fully research your idea. A market research plan will help you understand your competition, the marketplace and more.

Table of Contents

While having a great idea is an important part of establishing a business, you’ll only get so far without laying the proper groundwork. To help your business take off, not only do you need to size up the competition, but you also need to identify who will buy your product, how much it will cost, the best approach to selling it and how many people will demand it.

To get answers to these questions, you’ll need a market research plan, which you can create yourself or pay a specialist to create for you. Market research plans define an existing problem and/or outline an opportunity. From there, the marketing strategy is broken down task by task. Your plan should include objectives and the methods that you’ll use to achieve those objectives, along with a time frame for completing the work.

What should a market research plan include?

A market research plan should provide a thorough examination of how your product or service will fare in a defined area. It should include:

- An examination of the current marketplace and an analysis of the need for your product or service: To know where you fit in the market, it’s important to have a broad understanding of your industry — covering everything from its annual revenue to the industry standards to the total number of businesses operating within it. Start by gathering statistical data from sources like the U.S. Bureau of Labor Statistics and BMI Research and consider the industry’s market size, potential customer base and how external factors such as laws, technology, world events and socioeconomic changes impact it.

- An assessment of the competition: By analyzing your competitors, you can discover strategies to fill market gaps. This involves identifying well-known competitors and noting trends they employ successfully, scrutinizing customer feedback about businesses in your sector, such as through online reviews, and understanding competitors’ product or service offerings. This knowledge can then guide the refinement of your own products or services to differentiate them from others in the market.

- Data about customers: Identify which segment of potential customers in your industry you can effectively target, considering their demographics — such as age, ethnicity, income and location and psychographics, including beliefs, values and lifestyle. Learn about the challenges your customers face in their daily lives and determine how the features and benefits of your offerings address their needs.

- The direction for your marketing in the upcoming year: Your plan should provide a clear roadmap for your marketing strategies for the next year, focusing on approaches to distinguish your brand from competitors. Develop marketing messages that resonate with and display empathy toward your target market and find ways to address customers’ needs and demonstrate value.

- Goals to be met: Outline goals your business would like to achieve and make these goals clear to all employees on your team. Create goals that are realistic and attainable while also making a meaningful impact on the business’s growth. Consider factors including your target number of products or services, the expected number of units to sell based on market size, target market behavior, pricing for each item and the cost of production and advertising.

How to create your market research plan

Doing business without having a marketing plan is like driving without directions. You may eventually reach your destination, but there will be many costly and time-consuming mistakes made along the way.

Many entrepreneurs mistakenly believe there is a big demand for their service or product but, in reality, there may not be, your prices may be too high or too low or you may be going into a business with so many restrictions that it’s almost impossible to be successful. A market research plan will help you uncover significant issues or roadblocks.

Step 1. Conduct a comprehensive situation analysis.

One of the first steps in constructing your marketing plan is to create a strengths, weaknesses, opportunities and threats (SWOT) analysis , which is used to identify your competition, to know how they operate and then to understand their strengths and weaknesses.

Strengths | Strengths to include in your plan should encompass competitive advantages. These advantages can include the talent, proficiency and expertise of you and/or your executive team that can help improve the position of your company in the marketplace. |

|---|---|

Weaknesses | Weaknesses are factors that reduce the ability of your company to independently achieve its objectives, such as outdated production tools, unreliable delivery and a lack of planning. |

Opportunities | Opportunities are ways that your business can grow and become more profitable. |

Threats | Threats would be things that prevent you from entering into a primary market, such as political developments or a labor shortage. |

Step 2: Develop clear marketing objectives.

In this section, describe the desired outcome for your marketing plan with realistic and attainable objectives, the targets and a clear and concise time frame. The most common way to approach this is with marketing objectives, which may include the total number of customers and the retention rate, the average volume of purchases, total market share and the proportion of your potential market that makes purchases.

Step 3: Make a financial plan.

A financial plan is essentia l for creating a solid marketing plan. The financial plan answers a range of questions that are critical components of your business, such as how much you intend to sell, what will you charge, how much will it cost to deliver your services or produce your products, how much will it cost for your basic operating expenses and how much financing will you need to operate your business.

In your business plan, be sure to describe who you are, what your business will be about, your business goals and what your inspiration was to buy, begin or grow your business.

Step 4: Determine your target audience.

Once you know what makes you stand out from your competitors and how you’ll market yourself, you should decide who to target with all this information. That’s why your market research plan should delineate your target audience. What are their demographics and how will these qualities affect your plan? How do your company’s current products and services affect which consumers you can realistically make customers? Will that change in the future? All of these questions should be answered in your plan.

Step 5: List your research methods.

Rarely does one research avenue make for a comprehensive market research plan. Instead, your plan should indicate several methods that will be used to determine the market share you can realistically obtain. This way, you get as much information as possible from as many sources as possible. The result is a more robust path toward establishing the exact footprint you desire for your company.

Step 6: Establish a timeline.

With your plan in place, you’ll need to figure out how long your market research process will take. Project management charts are often helpful in this regard as they divide tasks and personnel over a timeframe that you have set. No matter which type of project management chart you use, try to build some flexibility into your timeframe. A two-week buffer toward the home stretch comes in handy when a process scheduled for one week takes two — that buffer will keep you on deadline.

Step 7: Acknowledge ethical concerns.

Market research always presents opportunities for ethical missteps. After all, you’ll need to obtain competitor information and sensitive financial data that may not always be readily available. Your market research plan should thus encourage your team to not take any dicey steps to obtain this information. It may be better to state, “we could not obtain this competitor information,” than to spy on the competitor or pressure their current employees for knowledge. Plus, there’s nothing wrong with simply feeling better about the final state of your plan and how you got it there.

Using a market research firm

If the thought of trying to create your own market research plan seems daunting or too time-consuming, there are plenty of other people willing to do the work for you.

Pros of using a market research firm

As an objective third party, businesses can benefit from a market research firm’s impartial perspective and guidance, helping to shape impactful brand strategies and marketing campaigns. These firms, which can help businesses with everything from their marketing campaigns to brand launches, deliver precise results, drawing on their expertise and experience to provide in-depth insights and solutions tailored specifically to your company’s needs.

Even more, working with a market research firm can elevate a brand above the competition, as they provide credible and unique research that is highly valued by the media, enhancing brand credibility and potentially increasing website traffic, social media shares and online visibility.

Cons of using a market research firm

Although hiring a firm can provide businesses with tremendous results, certain downsides can lead a business toward the do-it-yourself route. Most notably, market research firms can be a costly expense that some businesses can’t afford. However, businesses that can allocate the funds will likely see a positive return on investment, as they are paying for the expertise and proficiency of seasoned professionals in the field.

Additionally, finding the right market research firm for your business’s needs can take some time — and even longer, ranging from weeks to months, for a market research firm to complete a plan. This lack of immediate results can be detrimental for businesses that don’t have the time to wait.

Market research firms can charge into the thousands of dollars for a market research plan, but there are ways to get help more affordably, including:

- Outline your plans carefully and spell out objectives.

- Examine as many sources as possible.

- Before paying for any information, check with librarians, small business development centers or market research professors to see if they can help you access market research data for free.

- You may think you’ll need to spend a hefty sum to create a market research plan, but there are plenty of free and low-cost sources available, especially through university business schools that will guide you through the process.

Miranda Fraraccio contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 03/30/16

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![business plan market research → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

Identifying Content Competitors

Search engines are your best friends in this area of secondary market research.

To find the online publications with which you compete, take the overarching industry term you identified in the section above, and come up with a handful of more specific industry terms your company identifies with.

A catering business, for example, might generally be a “food service” company, but also consider itself a vendor in “event catering,” “cake catering,” or “baked goods.” Once you have this list, do the following:

- Google it. Don't underestimate the value in seeing which websites come up when you run a search on Google for the industry terms that describe your company. You might find a mix of product developers, blogs, magazines, and more.

- Compare your search results against your buyer persona. If the content the website publishes seems like the stuff your buyer persona would want to see, it's a potential competitor, and should be added to your list of competitors.

5. Summarize your findings.

Feeling overwhelmed by the notes you took? We suggest looking for common themes that will help you tell a story and create a list of action items.

To make the process easier, try using your favorite presentation software to make a report, as it will make it easy to add in quotes, diagrams, or call clips.

Feel free to add your own flair, but the following outline should help you craft a clear summary:

- Background: Your goals and why you conducted this study.

- Participants: Who you talked to. A table works well so you can break groups down by persona and customer/prospect.

- Executive Summary : What were the most interesting things you learned? What do you plan to do about it?

- Awareness: Describe the common triggers that lead someone to enter into an evaluation. (Quotes can be very powerful.)

- Consideration: Provide the main themes you uncovered, as well as the detailed sources buyers use when conducting their evaluation.

- Decision: Paint the picture of how a decision is really made by including the people at the center of influence and any product features or information that can make or break a deal.

- Action Plan: Your analysis probably uncovered a few campaigns you can run to get your brand in front of buyers earlier and/or more effectively. Provide your list of priorities, a timeline, and the impact it will have on your business.

Within a market research kit, there are a number of critical pieces of information for your business‘s success. Let’s take a look at these elements.

Pro Tip: Upon downloading HubSpot's free Market Research Kit , you'll receive editable templates for each of the given parts of the kit, instructions on how to use the kit, and a mock presentation that you can edit and customize.

The Beginner's Guide to the Competitive Matrix [+ Templates]

What is a Competitive Analysis — and How Do You Conduct One?

![business plan market research 9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]](https://www.hubspot.com/hubfs/marketing-research-methods-featured.png)

9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]

![business plan market research SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

28 Tools & Resources for Conducting Market Research

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![business plan market research How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![business plan market research 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects: