- registration

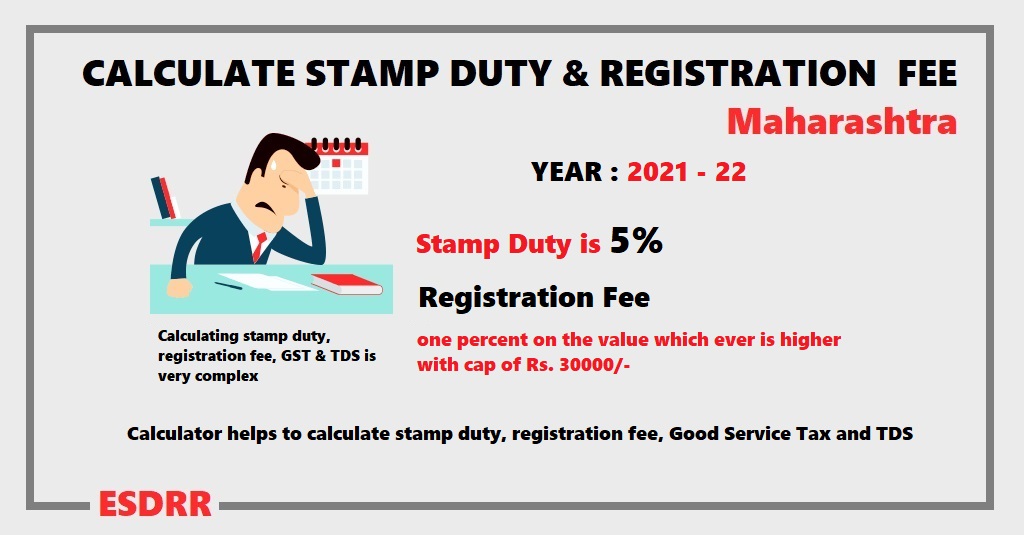

Calculate Stamp Duty, Registration Fee, Rebate for Women, LBT GST, and TDS in just six (6) easy steps

Validity of this calculator is from 1 st April, 2021 up to 31 st Mar, 2022.

Stamp Duty Increased from 3% to 5% w.e.f. 1 st April, 2021.

The unique calculator helps to calculate stamp duty, registration fee, rebate for female buyers, local body tax (LBT), ready possession, under-construction properties with Good Service Tax (GST), or on Under Construction properties, Affordable Housing Schemes, and Tax Deducted at Source (TDS) if PAN card available and PAN card not available when property value exceeds above Rs. 5000000.

How much stamp duty, registration fee, and other Taxes will I need to pay on the Sale Deed/Agreement for Sale in Maharashtra State?

| Select Gender | |||

| Select Appropriate Juridiction | |||

| Local body Tax (LBT) | |||

| Local Body Tax (LBT) is not applicable to Mumbai District and Mumbai Suburban District, but applicable for Rest of Maharashtra State | |||

| Select if applicale or simple dont check it. | |||

| From 01 April 2020: 1% concession is being given in Stamp Duty and related charges applicable during document registration within Mumbai Metropolitan Region, Pune, Pimpri Chinchwad and Nagpur Municipal Corporations for next 2 years up to 31 March 2022 | |||

| Type of Construction | |||

| GST is not applicable for Ready Possesion / Resale Property. From February 2019, The Government reduces the GST rate on under construction immovable property to 5% from 12%, and 1% from 8% on affordable housing, without input tax credit (ITC) | |||

| Tax deduct at source (TDS) is applicable to Vendor / Seller Under Income Tax Act. | |||

| from up to . Transfer of certain immovable property other than agriculture land TDS rate is 1%. It is the resposibilty of Buyer/Purchaser to deduct the TDS amount of total consideration/price as mentioned in the document. Consult you CA for further help. | |||

| Note : T.D.S. is not applicable to agriculture land. | |||

| Area | |||

| Agreement Value | ₹ | ||

| Market Value | ₹ | ||

| Stamp Duty ₹ | |||||

| Registration Fee ₹ | |||||

| Local Body Tax (LBT) ₹ | |||||

| Tax Deducted at Source (TDS) ₹ | |||||

| Goods and Service Tax (GST) ₹ | |||||

Note : The Online Simple Stamp Duty & Registration Fee Calculator for Sale Deed / Agreement for Sale which provides you with an indication of amount you need to pay in form of taxes such as stamp duty and registration fee; your Advocate, Solicitor, Chartered Accountant or Stamp Duty Consultant will be able to provide you with True Market Value of the property with the final amount of the Stamp Duty and Registration Fee and other taxes with its procedures. We always recommend our valuable users to obtain the proper Legal Advice from the professionals in these fields or confirm with the concerned authority Read full Terms and Conditions carefully before using it.

We have explained in details how to calculate Market value of Property, for paying Stamp Duty and Registration Fee, and have explained in details how to calculate Capital Value of property for Municipal Assessment Tax.

- How to calculate Market Value of Property

- How to calculate Capital Value of Property

- What is Stamp Duty in Maharashtra

Maharashtra State Government has provided various types of facilities to the public for the payment of Stamp Duty through various types of mode and has appointed Nationalized Banks, Schedule Banks, Private Banks and the Co-operative Banks which are authorized by Reserve Bank of India. With view that the facility of payment of stamp duty is made easily available to the public therefore different arrangements are in force.

- Online Payment of stamp duty and registration fee through GRAS

- Paying Stamp Duty through Franking in Post Offices

- Paying Stamp Duty through Stamp Vendors

The Department of Registration and Stamp, Maharashtra State Government had appointed Authorised Service Providers to register Leave and License Agreement in Maharashtra.

- e-Registration of Leave and License Agreement.

We have provided the Timeline Events of Registration and Stamp Department, Maharashtra State.

- Department of Registration and Stamps Timeline Events.

- Ready Reckoner Links

- Stamp Duty

- Registration

- Reckoner

- Guide Line

- Acts and Rules

- FAQ's

- About Us

- Contact

- Privacy

- Terms and Conditions

- Online Calculators

- Simple Stamp Duty

- Leave and License

- Gift Stamp Duty, Registration and L.B.T.

- Mortgage Stamp Duty and Registration Fee

- Loan EMI

- Area Converter

© e-Stampdutyreadyreckoner.com 2015-21

- Log in to your account

- Sign up as individual

- Sign up as builder/agent

- Login to add properties to your shortlist

Maharashtra Stamp Act: An Overview On Stamp Duty And Registration Charges

Prahalad singh, maharashtra stamp act introduction.

In India, the Indian Stamp Act, 1899 (ISA) is a central legislation, while states have their own local stamp act to administer with issues rising within that particular state. The Bombay Stamp Act, 1958 which came into force on 16 February 1969 (BSA), is a law for stamp duty within the state of Maharashtra. The Constitution of India permits both the Parliament and the State Legislature to make provisions and legislation for stamp duty within its limits. Accordingly, certain documents specified in the ISA are included. Under the BSA, an instrument is defined to include every document by which any right or obligation is, or is made, transferred, limited, extended, extinguished or recorded while a bill of exchange, checks, promissory notes, etc. is not included. These documents are excluded, as governed under the aforesaid ISA.

What is Maharashtra Stamp Act?

In Maharashtra, stamp papers could be purchased before 1 May 1994 in the names of advocates or by any other name. However, the stamp paper is to be purchased in the name of one of the parties thereafter. In addition, the validity of the stamp paper is restricted for a period of 6 months and if stamp paper is used thereafter, it is assumed that the document is executed on ordinary paper without a stamp.

If an instrument falls into Schedule I of the Bombay Stamp Act (BSA) with several duties rates, the instrument is chargeable with the highest of the prescribed fees. Apart from this, the BSA also prescribes a methodology for adjournment (proper assessment), the refund of duties, grievance procedures and defects, etc. The Collector is usually authorized or vested with the power to authorize. If a document is not stamped or appropriately stamped, it is likely to be affixed.

The Act was recently amended and amendments include revision of stamp duty on gift deeds, e-payment of stamp duty, amendment of penalty sections, and increase in stamp duty under certain instrument clauses.

What Is Stamp Duty?

Stamp duty is a type of tax, such as sales/income tax, etc. and its basic purpose is to raise revenue for the government. Thus, like any other tax, the stamp duty will have to be paid to the government in full and on time, with a delay with penalties. In general, stamp duty is levied on an instrument (and not on a transaction); stamp duty is payable on the property (whether immovable/movable or tangible/intangible) either on a fixed basis or on the basis of the consideration mentioned in the instrument as the case may be. In the case of immovable property, there is an additional theory of valuation of the property, which is also taken into account while deciding the stamp duty payable.

How Is Stamp Duty Calculated?

The stamp duty is calculated based on the ready reckoner rates and the property value mentioned in the buyer-seller agreement. In Maharashtra, stamp duty on the property varies by location. For example, stamp duty for a property located in the municipal limit of urban areas in Mumbai will be 5% of the market value, while a property located within the limits of any gram panchayat will attract stamp duty of 3% of the market value.

Stamp Duty And Registration Charges In Maharashtra

The stamp duty rates on property depend on several measures in the state of Maharashtra. This includes whether the property is located in urban or rural areas, the total cost of the transaction, etc. Recently, the Maharashtra government has reduced the stamp duty on properties for the next two years in areas falling under the Mumbai Metropolitan Region Development Authority. (MMRDA) and the municipal corporations of Pune, Pimpri-Chinchwad, and Nagpur.

This means that stamp duty on properties in Mumbai, Pune, and Nagpur, will be charged at 5% (4% stamp duty + 1% metro cess).

| Mumbai | 5% (Stamp duty 4% + Metro Cess 1%) | |

| Navi Mumbai | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | |

| Thane | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | |

| Pune | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | |

| Pimpri-Chinchwad | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | |

| Nagpur | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | |

Moreover, according to Article 34 of the Maharashtra Stamp Act, which was revised in 2017, stamp duty on gift deeds is 3% of the property’s value. However, if the property in consideration is a residential or agricultural property and is gifted (without any payment) to family members, then, the stamp duty is Rs 200.

Factors that Determine Your Fee on Stamp Duty & Registration

Stamp duty and registration charges are imposed by the state governments on homebuyers. These apply to both freehold and leasehold land (agricultural and non-agricultural) as well as other types of properties such as homes, flats, or commercial properties. There are certain factors that determine how much stamp duty is in Mumbai and registration will be payable:

- Type of property

The fees on residential will be comparatively less than a commercial property.

- The type of location

Properties in rural areas, as well as semi-urban areas, have to pay significantly less than in posh areas.

- Market Value

The market value of the property and the area of the property are taken into account for the calculation of stamp duty charges.

How To Pay Stamp Duty & Registration Charges Online In Mumbai?

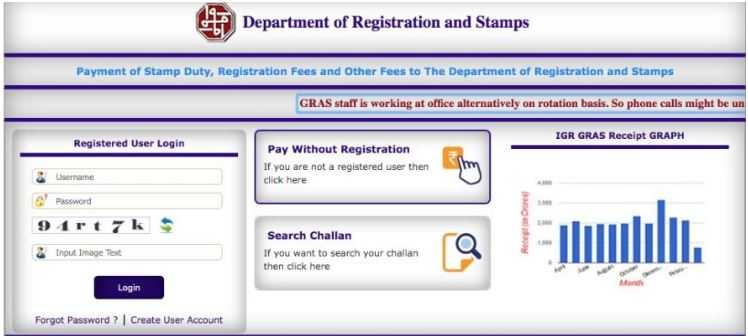

In Mumbai, you can go for payment of these charges through both online and offline mediums. The Government of Maharashtra has a dedicated portal ‘Government Receipt Accounting System’ (GRAS) in which you are required to enter all the necessary details about the property and its documents and make payments accordingly. Homebuyers must follow a few easy steps to pay the stamp duty and registration charges in Mumbai on the purchase of the property.

Step 1: Visit the Maharashtra Stamp Duty Online Payment Portal.

Step 2: If you are not registered with the portal, click ‘Pay without registration’. If you are a registered user, please fill in the login details.

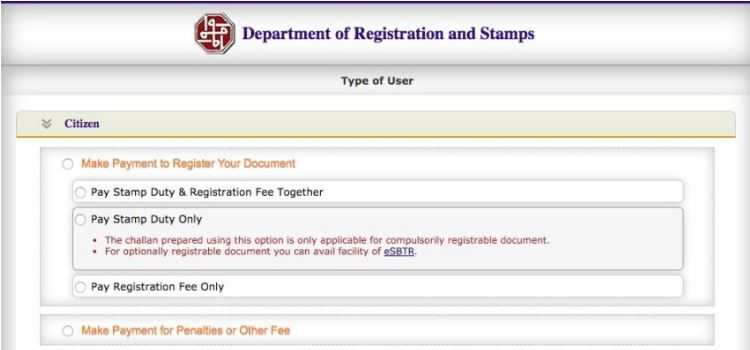

Step 3: If you have selected the option ‘Without Pay Without Registration’, you will be directed to another page, where you will have to select ‘select citizen’ and select the type of transaction you want to do.

Step 4: Select ‘Pay to register your document’. Now, you can choose to pay stamp duty and registration fee together or only stamp duty or registration fee only.

Step 5: Fill in the required details such as District, Sub-Registrar office, Payment details, Party details, Property details, and Property value details.

Step 6: Select the payment option and once completed, generate the challan, which will have to be submitted at the time of execution of the deed.

If you are doubtful or stuck at any step or you want to recreate your invoice, you can leave a mail at [email protected]

Modes of Payment of Stamp Duty in Maharashtra

There are 4 modes of payment of Stamp Duty in Maharashtra:

- Non-judicial Stamp Papers – This is the traditional but cumbersome and time-consuming mode of stamping, and forces one to obtain physical stamp paper by engaging with licensed vendors. The instrument to be executed is printed on such stamp paper. This option is not practicable in cases where stamp duty of larger denominations is required to be paid.

- Franking a document – The process of franking a document requires submitting an application with an authorized bank or franking agency to pay stamp duty and stamp (using the vending machine) by the authorized bank or franking agency on the document denotes value. Franklin can only be done before the execution of the document and the maximum stamp duty cap is Rs. 5000 / document.

- e-SBTR/Electronic Secured Bank Treasury Receipt – E-SBTR is an online payment service for payment of stamp duty through an electronic payment gateway. For this one has to fill the filling ‘input form’ at the branch office with any bank providing e-SBTR facility and pay the required amount of stamp duty. The bank then records these details in the Government Virtual Treasury and creates an e-SBTR on the special government pre-printed secure stationery which serves as proof of payment of stamp duty. Since the e-SBTR is issued on a special government stamp, it is necessary to physically collect an e-SBTR from the respective branch of the bank upon the presentation of the confirmation of online payment for the print of input form and stamp duty.

- GRAS/Government Receipt Accounting System – Like e-SBTR GRAS, there is an online payment of stamp duty through an electronic payment system. However, under an e-SBTR mechanism, there is no need to physically go to the respective branch of the banks as recognition of e-challan generated online under GRAS as an accepted method of payment in sub-registrar offices and other offices of the department. Although a completely online process, GRAS has the limitation that it can only be used for compulsory registrable documents (under Section 17 of the Registration Act, 1908), including, inter alia, the right, title, and interest to or in immovable property. In financing transactions, therefore, this mode of payment will only be available for documents such as mortgages and cannot be used to pay stamp duty on other important but non-mandatory mandatory documents such as loan agreements, security and guarantee documents.

Recent Clarification on Stamp Duty in Maharashtra

Providing some relief to the Office of Inspector General of Registration and Controller General of Maharashtra through a circular dated 27th April 2020 and notified certain relaxations in relation to (a) Some exemptions have been notified in respect of filing of information (in the matter of financing, transactions required for the creation of mortgages on immovable property, through title deeds or deposits of similar mortgages):): and (b) Payment of stamp duty on non-compulsory registrable financing documents executed during the nationwide lockout period. The fee/exemption offered under the circular is summarized in the table below.

| Section 17 of the Maharashtra Stamp Act | Stamp duty on all instruments, banks and other similar organizations cannot be paid for the registration activities related to financing activities and compulsorily registrable, can be paid within one working day of lifting the lockdown in such districts and Payment will be considered within one business day shall be considered to be sufficient compliance of section 17. This one-day exemption is not granted in relation to other means (i.e. for transactions other than financing transactions), thereby limiting the circumstances on the stamping of such other documents. |

| Section 89B of the Registration Act, 1908 | In such districts, information can be given within one day of the lifting of the lockdown. Banks and other agencies can use the online platform available on igrmaharashtra.gov.in for online filing. The circular also clarifies that in light of the COVID-19 epidemic, the administration intends to stop the practice of physical filing of intimation of intimacy from 1st June 2020. |

Stamp Duty News

- On 6 March 2020, the Maha Vikas Aghadi (MVA) government in its landmark decision announced a 1% stamp duty concession and other related charges applicable to the registration of documents in areas falling under the Mumbai Metropolitan Region Development Authority (MMRDA) and Municipal Corporations of Pune, Pimpri-Chinchwad, and Nagpur by 2022.

- On 31st March 2020, the Central Government has extended the applicability of stamp duty by 3 months. The provisions of the amended Indian Stamp Act, which were to come into force from 1 April 2020, will now come into force from 1 July 2020.

- On 11th May 2020, the Maharashtra government has lost Rs 3885 crore in stamp duty in 40 days of lockdown. The state government has earned only Rs 15 crore through stamp duty and registration in the last 40 days – a steep fall in comparison to the Rs 4000 crore it usually generates in such a period.

- On 28th May 2020, the Maharashtra Government has announced 1% concession of stamp duty.

Data Source: Google, Image source: https://gras.mahakosh.gov.in/

Related Articles

You may have seen advertisements for “1 BHK, 2 BHK & 3 BHK homes available”, “spacious 3 BHK residences”, etc. on billboards, newspapers, or social media sites. Though it attracts potential homebuyers, these terms are still confusing for many people. Wondering What is BHK Full form and its meaning? Well, BHK in the real estate […]

A home buyer must know about carpet area, built-up area and super built-up area of a property/flat. If they know the difference between carpet area, built-up area & super built-up area, it becomes easy for them to invest in a property. So, let’s explore this blog to know everything about these: What is the carpet […]

Buying a home requires a lot of planning, looking for the ideal location, and making the decision to buy. After doing all these, your next step would be organizing documentation and registering the property. The property and apartment registration process in Tamil Nadu is important however it is not very complicated. Let’s read this blog […]

Once you have decided to buy a new home, the next big question is the selection between under construction and ready to move in. In both these, you get numerous options as per your budget. But it is confusing to choose any one because each of them has their own set of pros and cons. […]

Trending Article

Decoding BHK: Full Form and Real Estate Meaning

A guide to know- best direction to sleep as per vastu, transforming pune: top 10 construction companies 2024-25, best 10 construction companies in india: 2024-2025 update, latest properties - flats, flats for sale in bangalore, flats for sale in delhi, flats for sale in mumbai, flats for sale in pune, flats for sale in chennai, flats for sale in kolkata, flats for sale in hyderabad, flats for rent in bangalore, flats for rent in delhi, flats for rent in mumbai, flats for rent in pune, flats for rent in chennai, flats for rent in kolkata, flats for rent in hyderabad, projects for sale in bangalore, projects for sale in delhi, projects for sale in mumbai, projects for sale in pune, projects for sale in chennai, projects for sale in kolkata, projects for sale in hyderabad, latest properties - villas, villas for sale in bangalore, villas for sale in delhi, villas for sale in mumbai, villas for sale in pune, villas for sale in chennai, villas for sale in kolkata, villas for sale in hyderabad, villas for rent in bangalore, villas for rent in delhi, villas for rent in mumbai, villas for rent in pune, villas for rent in chennai, villas for rent in kolkata, villas for rent in hyderabad, project for sale in bangalore, project for sale in delhi, project for sale in mumbai, project for sale in pune, project for sale in chennai, project for sale in kolkata, project for sale in hyderabad, luxury properties, luxury properties in bangalore, luxury properties in delhi, luxury properties in pune, luxury properties in chennai, luxury properties in hyderabad.

Area Calculator

- Quick Links

Square Feet

Square meter, square yard, latest videos.

- Browse Cities

- Properties for Sale in Bangalore

- Properties for Rent in Bangalore

- Browse Projects in Bangalore

- Browse Localities in Bangalore

- Agent Directory for Bangalore

- CommonFloor Groups

- Post Your Requirements

- Get Mobile App

- Call Us: 080-67364545

- All India Apartment Directory

Your details has been submitted successfully.

Table of Contents

Introduction to the maharashtra stamp act, key provisions of the maharashtra stamp act, recent amendments and updates, how to pay stamp duty in maharashtra, common transactions requiring stamp duty, impact of stamp duty on real estate market.

The Maharashtra Stamp Act, a crucial legislation in the state of Maharashtra, governs the levy of stamp duty on various legal documents. Understanding its intricacies is essential for anyone involved in real estate transactions, business agreements, or legal documentation in Maharashtra. This article delves into the key aspects of the Maharashtra Stamp Act, offering a comprehensive overview for the current year.

The Maharashtra Stamp Act is a state-specific legislation that prescribes the rates of stamp duty on various legal instruments. Stamp duty is a form of tax collected by the government on legal documents, which is essential for their validity and enforceability. The Act ensures that all transactions are properly documented and taxes are duly paid, contributing to the state's revenue. Here's the website: https://igrmaharashtra.gov.in/Home

- Types of Instruments: The Act covers a wide range of instruments, including agreements, conveyances, mortgages, leases, bonds, and more. Each type of instrument has a specific rate of stamp duty applicable.

- Stamp Duty Rates: Stamp duty rates vary depending on the nature of the document and the transaction value. For instance, the stamp duty on a conveyance deed differs from that on a lease agreement. The government periodically revises these rates, and it's crucial to stay updated with the latest changes.

- Penalty for Non-Compliance: Failing to pay the required stamp duty can lead to severe penalties, including fines and legal repercussions. The Act provides for penalties that can be up to ten times the unpaid duty.

- Adjudication of Stamp Duty: If there is any ambiguity regarding the amount of stamp duty payable on a document, parties can seek adjudication from the Collector of Stamps. The adjudication process ensures that the correct duty is paid, preventing future disputes.

- Refund of Stamp Duty: Under certain circumstances, such as cancellation of a transaction, the Maharashtra Stamp Act allows for the refund of stamp duty. The procedure for claiming a refund involves submitting an application to the concerned authority along with the original stamped document.

In 2024, there were significant updates to the Maharashtra Stamp Act to streamline processes and enhance transparency. Some key changes include:

- Digital Stamping: The government has introduced digital stamping to simplify the payment of stamp duty. This move aims to reduce paperwork, prevent fraud, and make the process more efficient.

- Revised Stamp Duty Rates: The state has revised the stamp duty rates for certain categories of documents to align with current market conditions and economic realities.

- E-Registration of Documents: E-registration of documents has been promoted to expedite the registration process. This initiative is part of the government's push towards digital governance.

1. Real Estate Transactions: Buying and selling property involves significant stamp duty costs. The duty is calculated based on the transaction value or the market value of the property, whichever is higher.

2. Lease Agreements: Lease agreements for commercial and residential properties attract stamp duty. The rate depends on the lease duration and the annual rent.

3. Mortgage Deeds: Mortgage deeds also require stamp duty payment. The duty is based on the loan amount secured by the mortgage.

Stamp duty plays a crucial role in the real estate market. High stamp duty rates can significantly increase the overall transaction cost for buyers, potentially affecting buyer sentiment and reducing the affordability of properties. When stamp duty rates are high, potential buyers might hesitate to proceed with transactions due to the added financial burden, which can lead to a slowdown in the real estate market. This can be particularly impactful in high-value property markets, where even a small percentage of stamp duty translates to a substantial amount.

Conversely, reductions or exemptions in stamp duty can stimulate market activity by making transactions more affordable and attractive to buyers. Lower stamp duty rates reduce the upfront costs associated with purchasing property, thereby encouraging more people to invest in real estate. This can lead to increased transaction volumes, revitalizing the market, and promoting economic growth. Government initiatives that offer temporary reductions or exemptions, especially during economic downturns, have historically shown to boost buyer confidence and stimulate market activity.

The Maharashtra Stamp Act is a vital piece of legislation that ensures the proper documentation and taxation of legal instruments. It plays a crucial role in maintaining the legal validity of various transactions and generating revenue for the state. Staying informed about the latest updates and understanding the various aspects of the Act can help individuals and businesses navigate the legal landscape more effectively, ensuring compliance and avoiding potential penalties.

As we move further into 2024, the emphasis on digital processes and transparency continues to shape the implementation of this important law. The introduction of digital stamping, e-registration, and revised stamp duty rates are steps towards making the system more efficient and user-friendly. By embracing these changes, Maharashtra aims to streamline procedures, reduce fraud, and enhance the overall ease of doing business, thereby fostering a more robust and transparent legal environment.

explore further

Latest from contemporary ideas, more from innovations.

Schedules of stamp duty and registration fees payable on some important instruments under The Maharashtra Stamp Duty Act as amended up to April 2018

| 1. | ||||

| (i) If relating to immovable property situated within the limits of any Municipal Corporation or any Cantonment area annexed to it or any urban area not mentioned in sub-clause (ii). | 5% of True Market Value Of Property | 1% of True Market Value* | ||

| (ii) If relating to immovable property situated within the limits of any Municipal Councils or Nagar Panchayat or Cantonment area annexed to it, or any rural area within the limits of the Mumbai Metropolitan Region Development Authority, or the Influence Areas as per the annual statement of rates published under the Bombay Stamp (Determination of True Market Value of Property) Rules 1995. | 4% of True Market Value of property | 1% of True Market Value* | ||

| (iii) If relating to immovable property situated within the limits of any Gram Panchayat area or any such area not mentioned in sub-clause. | 3% of True Market Value of property | 1% of True Market Value* | ||

| a. Stamp duty is payable on market value of property as per stamp duty ready reckoner or agreement value, whichever is higher. | ||||

| b. Stamp duty is charged for ₹500 or its parts. A registration fee is charged for every ₹1,000 or part thereof. | ||||

| c. For all practical purpose stamp duty must be paid on execution of agreement failure to which penalty @ 2% p.m. (Maximum four times) of deficit stamp duty is payable. | ||||

| 2. | Sale Deed, Transfer Deed. (if Purchased from Investor within 1 year) w.e.f. 05/06/2008 | of Schedule I of The Maharashtra Stamp Act: If relating to purchase of any one or more units in any scheme or project by a person from a developer: Provided that, on conveyance of property by the person, under an agreement under this sub-clause to the subsequent purchaser, the duty chargeable for each unit under this sub- clause shall be adjusted against the duty chargeable under Article 25 [conveyance] after keeping the balance of one hundred rupees, if such transfer or assignment is made within a period of 1 year from the date of agreement. | 5% of True Market Value Less: amount paid as Stamp Duty in previous purchase Agreement/ Deed. Add: ₹ 100/- | 1% of True Market Value* |

| 3. | of Schedule I of the Maharashtra Stamp Act. Same duty as conveyance (Article 25) for giving power to promoter or developer for immovable property. | 5% of True Market Value | 1% of True Market Value* | |

| 4. | of Schedule I of the Maharashtra Stamp Act. Treated as If relating to movable property. | 3% of Consideration | Registration is not compulsory. | |

| 5. | The Maharashtra Stamp Act | ₹ 100/- | ₹ 1,000/- Registration is compulsory. | |

| 6. | The Maharashtra Stamp Act | ₹ 100/- | ₹ 1,000/- Registration is compulsory. | |

| 7. | [Gift of Immovable & Movable property (Instrument of not being a settlement (Article 55) or will or Transfer (Article 59)] to read with Article 25. | of Schedule I of the Maharashtra Stamp Act: Provided, If any immovable property is gifted to a family member being the husband wife, brother or sister of the donor or to any lineal ascendant or descendant of the donor, then the amount of stamp duty will be calculated at 3% of market value w.e.f. 07-09-2017 | 1% of market value or ₹ 30,000 which ever is less. Registration is compulsory. | ₹ 200/- |

| Provided further that, if the residential and agricultural property is gifted to husband, wife, son, daughter, grandson, granddaughter or wife deceased son, the amount of duty chargeable shall be rupees two hundred only w.e.f 24-04-2015. In any other case stamp duty is same as applicable to conveyance deed, under article 25. i.e., 5% at market value. | Registration fees is ₹ 200 Only for the gift to relative on which stamp duty is only ₹ 200. w.e.f. 01-04-2016 | |||

| 8. | [Any instrument (not being instrument as is provided by section 24) whereby a person renounces a claim upon other person or against any specified property]. | of Schedule I of the Maharashtra Stamp Act read with Article 25: (a) If the release deed of an ancestral property or part thereof is executed by or in favour of brother or sister (children of renouncee’s parents) or son or daughter or son of predeceased son or daughter of predeceased son or father or mother or spouse of the renouncee or the legal heirs of the above relations (legal heirs). In other words renouncement by legal heirs of ancestral property. | ₹ 200/- | ₹ 1,000/- |

| (b) In any other case. | 5% of True Market Value | 1% of True Market Value* | ||

| 9. | of Schedule I of the Maharashtra Stamp Act: Stamp duty payable as per Article 25(a), (b) or (c) on the market value of the property exchange of the highest value/ greatest value either of the property exchanged. | 5% of True Market Value of Property with Higher Value | 1% of True Market Value* | |

| 10. | of Schedule I of the Maharashtra Stamp Act: The largest share remaining after the property is partitioned (or, if there are two or more shares of equal value and not smaller than any of the other shares, then one of such equal shares) shall be deemed to be that from which the other shares are separated. Subject to certain specified proviso contained in Article 46. | 2% of market value of the share or share remaining after separating the largest share. In case of equal share then on any one of the share. | 1% of market value of the share or share remaining after separating the largest share or ₹ 30,000/- which ever is lower. | |

| 11. | of Schedule I of the Maharashtra Stamp Act: (i) Where the leave & licence (L&L) agreement purports to be for a term not exceeding sixty months with or without renewal clause | 0.25% of total sum of ‘Taxable Amount of L&L (a) to (c)’ | ₹ 1,000/- in municipal area ₹ 500 in other area. Registration is compulsory. | |

| (a) The licence fees or rent payable under the agreement | ||||

| (b) The amount of non- refundable deposit or money received in advance or premium, by whatever named called, | ||||

| (c) The interest calculated at the rate of 10% p.a. on the refundable security deposit or money advance or to be advance, by whatever name called, | ||||

| (ii) Where the leave & licence agreement purports to be for a period exceeding sixty months with or without renewal clause. | As per Article 36, Lease | 1% of True Market Value* | ||

| 12. | [Including under lease or sub-lease and any agreement to let or sub-let or any renewal of lease]. | of Schedule I of the Maharashtra Stamp Act: r. w. Article 25. Where such lease purport to be (i) For a period not exceeding five years | 5% of 10% share of Market Value of property | 1% of 10% share of Market Value* |

| (ii) For a period exceeding five years but not exceeding ten years, with a renewal clause contingent or otherwise. | 5% of 25%share of Market Value of property | 1% of 25% share of Market Value* | ||

| (iii) For a period exceeding ten years but not exceeding twenty nine years, with a renewal clause contingent or otherwise. | 5% of 50% share of Market Value of property | 1% of 50% share of Market Value* | ||

| (iv) For a period exceeding twenty nine years or in perpetuity, or does not purport for any definite period, or for lease for period exceeding twenty nine years, with a renewal clause contingent or otherwise. | 5% of 90% share of Market Value of property | 1% of 90% share of Market Value* | ||

| 1. Any consideration in the form of premium or money advanced or to be advanced or security deposit by whatever name called shall, for the purpose of market value, be treated as consideration passed on. 2. The renewal period, if specifically mentioned, shall be treated as part of the present Lease. | ||||

| 13. | [Including agreement for surrendering of lease]. | of Schedule I of the Maharashtra Stamp Act: r.w. Article 25 (i) Without any consideration (ii) With consideration | ₹ 200/- 5% of Consideration | ₹ 100/- 1% of Consideration* |

| 14. | of Schedule I of the Maharashtra Stamp Act: | |||

| a) For the purpose of Non-residential use stamp duty is as per Article 36 (iv) i.e. same as lease on 90% of market value of property. | 5% of True Market Value | 1% of True Market Value* | ||

| b) For the purpose of residential use. | ||||

| (i) If area of premises is up to 27.88 sq.mtr. (300 sq. ft); | ₹ 200 per sq. mtr. | 1% of amount arrived by monthly rent multiplied by 120 plus, premium amount if any | ||

| (ii) If area of such premises is more than 27.88 sq. mtr. (300 sq. ft) stamp duty is as per Article 36 (iv) i.e. same as lease r.w. Article 25 on the market value of the property. | 5% of True Market Value | 1% of True Market Value* | ||

| 15. | of Schedule I of the Maharashtra Stamp Act: (Stamp duty as per lease deed) Article 36. Where such lease purport to be for a period exceeding twenty nine years or in perpetuity, or does not purport for any definite period, or for lease for period exceeding twenty nine years, with a renewal clause contingent or otherwise. | The same duty as is leviable on a conveyance under clause (a), (b) [or (c)], as the case may be, of Article 25, on 90 per cent. of the market value of the property.] | 1% of 90% share of Market Value* | |

| 16. | [not being a Proxy]. | of Schedule I of the Maharashtra Stamp Act: r. w. Article 25 & Article 5 (g-a). | ||

| a) When executed for the sole purpose of procuring the registration of one or more documents in relation to a single transaction or for admitting execution of one or more such documents; | ₹ 500/- | ₹ 100/- | ||

| b) When required in suits or proceedings under the Presidency Small Cause Courts Act, 1882 (XV of 1882); | ₹ 500/- | ₹ 100/- | ||

| c) When authorising one person or more to act in a single transaction other than the case mentioned in clause (a); | ₹ 500/- | ₹ 100/- | ||

| d) When authorising one person to act in more than one transaction or generally; | ₹ 500/- | ₹ 100/- | ||

| e) When authorising more than one person to act in single transaction or more than one transaction jointly or severally or generally; | ₹ 500/- | ₹ 100/- | ||

| f) (i) When given for consideration and authorising to sell an immovable property; | 5% of True Market Value [if 5% paid on Agreement, then ₹ 500/-] | 1% of True Market Value* [if 1% paid on Agreement, | ||

| (ii) When authorising to sell or transfer agreement immovable property without consideration or with- out showing any consideration, as the case may be,- | ||||

| (a) if given to the father, mother, brother, sister, wife, husband, daughter, son, grandson, granddaughter or father, mother, brother, sister of the spouse; and | ₹ 500/- | ₹ 100/- | ||

| (b) In any other case (as per Article 25). | 5% of True Market Value [if 5% paid on Conveyance, ₹ 500/-] | 1% of True Market Value* [if 5% paid on Conveyance, ₹ 100/-]. | ||

| g) When given to a promoter or developer by whatever name called, for construction on, development of, or sale or transfer (in any manner whatsoever) of, any immovable property. | ₹ 500/- per person | ₹ 100/- | ||

| h) Irrevocable power of Attorney (Simple). | As per Article 48 of Schedule I of the Act Stamp Duty is ₹ 100/-, for each person authorised. | Registration Fee is ₹ 100/-, and for which is not compulsory. | ||

| Note: Notary Fees for attestation of general or Specific Power of Attorney is ₹ 25/- | ||||

| 17. | It is exempt from Stamp duty-registration is not compulsory. | Nil | ₹ 100/- | |

| 18. | of Schedule I of the Maharashtra Stamp Act: | |||

| a) Where there is no share of contribution in partnership or where such shares of contribution does not exceed ₹ 50,000/-. | ₹ 500/- | ₹ 750/- at Registrar of Firm’s office as fees + copying charges. | ||

| b) Where such share contribution is in excess of ₹ 50,000/- for every ₹ 50,000/- or part thereof. | 1% of share contribution, subject to Maximum ₹ 5,000/- | |||

| c) Where such share contribution is brought in by way of property excluding cash. | 5% of True Market Value. (Stamp duty is as per conveyance Article 25 (a), (b), (c) and (d)) | |||

| 19. | of Schedule I of the Maharashtra Stamp Act: | |||

| a) Where on dissolution of the partnership or on retirement of a partner any property is taken as his share by a partner other than a partner who brought in that property as his share of contribution in the partnership. | The same duty as is leviable on Conveyance under clause (a), (b) or (c), as the case may be, of Article 25, on the market value of such property, subject to a minimum of rupees one Hundred. | ₹ 400/- at Registrar of firm’s office as fees + copying charges | ||

| b) In any other case | ₹ 200/- | |||

| 20. | of Schedule I of the Maharashtra Stamp Act. However State Government has its Notification No. Mudrank 2004/1636/C.R. 436/M-1, dated 1st July, 2004 waived fully the stamp duty on affidavit or declaration made for any purpose of being filed or used before any Government Authority or in Court or before the Officer of any Court/Tribunal. | ₹ 100/- (See note written earlier in This paragraph) | ₹ 100/- (Regn. not compulsory) | |

| 21. | of Schedule I of the Maharashtra Stamp Act. | ₹ 500/- | ₹ 100/- (Regn. not compulsory) | |

| 22. | (1) of the Maharashtra Stamp Act. [The authorities are requested to incorporate a special Article to cover cases for document like Deed of Confirmation, Conducting Agreement, etc.] | ₹ 100/- | ₹ 100/- (Regn. not compulsory) | |

| 23. | of Schedule I of the Maharashtra Stamp Act: | |||

| In any form of Deed, Agreement or Letter. | a) If the amount secured by such Deed does not exceed ₹ 5,00,000/- | 0.1% of amount secured | 1% of loan secured* | |

| b) In any other case | 0.2% of amount secured (Max ₹ 10 lakh) | 1% of loan secured* | ||

| 24. | of Schedule I of the Maharashtra Stamp Act. | As per Article 5(h)(B) of Scheduled I Scheduled I of the Act Stamp Duty is ₹ 100/-. | Registration not compulsory | |

| 25. | of Schedule I of the Maharashtra Stamp Act: | |||

| a) In case where possession of the property is given by the mortgagor stamp duty is as per conveyance as above on the amount of loan. | 5% of True Market Value | 1% of loan secured* | ||

| b) In case of where possession of the property is not given by the mortgagor. | 0.5% of amount secured (Min ₹ 100/-) (Max ₹ 10 lakh) | 1% of loan secured* | ||

| 26. | [on Mortgaged Property] | of Schedule I of the Maharashtra Stamp Act: | ||

| a) When possession is with Bank. | 5% of further charge | 1% of Further Charge* | ||

| b) When possession is given by mortgagor during further charge. | 5% of True Market Value, Less: amount paid on earlier document. | 1% of Further Charge* | ||

| c) When possession is not given by mortgagor during further charge | 0.50% of amount secured (Min ₹ 100/-) (Max ₹ 10 lakh) | 1% of Further Charge* | ||

Note : Registration Fee with (*) is subject to Maximum ₹ 30,000/-

|

| ||||

| / ale | ||

| An Agreement for Sale is an initial basic document that contains the term and conditions between buyer and seller. | ||

| Full Stamp Duty & Registration Fees are applicable on the registration of Agreement for Sale. | ||

| If some amount of the transaction is due from the buyer then Agreement to Sell should be registered. It ensures that there will not be any dispute between the parties until the seller receives the full payment and transfer the ownership to the buyer. | ||

| Agreement to Sell does not transfer the ownership. | The Sale Deed/Assignment Deed transfers the ownership. | |

| If there is no Loan involved, the Sale Deed/Assignment Deed can be done directly. | ||

| By Agreement to Sell the process of property transfer begins. | By Sale Deed/Assignment Deed, the ownership gets transferred. | |

| The Agreement to Sell contains all the promises made by the Buyer and Seller to complete the transaction. | ||

| In the Agreement, parties mention the decided price. | ||

| In the Agreement to Sell usually the seller tries to protect his interest, so the terms and conditions in it would be in favor of the Seller. | , the Buyers interest is more important, so the terms and conditions in this document usually would be in favor of the buyer. | |

| Agreement to Sell is not a Conveyance Deed. | is considered as Conveyance Deed | |

| While doing Agreement to Sell the possession of the property can be under any party. | , usually, the possession is handed over to the Buyer. etc. |

Important Points

Agreement to Sell Meaning –

An Agreement to sell is a document that contains terms and conditions of the sale of a property. It includes token amount detail and the terms and conditions regarding the amount at which the flat to be sold, the time limit for both the parties to complete the sale, and the buyer’s promise to make full payment within a certain time.

Sale Deed/Assignment Deed –

In this document, the ownership/title of the property gets transferred to the buyer.

Benefits of registration of Agreement to Sell–

It obligates the buyer and seller that throughout the sale process they must follow the terms and conditions mentioned in the agreement for sale until the final sale deed gets registered. An agreement for Sale is the base document on which the deed of assignment or sale deed is drafted (Deed of assignment/sale deed is the document prepared at the time of full payment made by the buyer and when the actual transfer of the property takes place).

Stamp Duty and Registration Charges –

In Maharashtra, the Registration Charges are fixed, which are Rs. 30,000/- or 1% of the Transaction Value (whichever is lower).

Stamp Duty gets changed as per the property location, for example – usually, Stamp Duty is less in Rural Areas compared to Corporations.

To check the online Stamp Duty calculator, visit – https://procounsel.in/online-stamp-duty-calculator/

Subscribe to our newsletter

Get latest news delivered straight to you inbox

Select at least 3 categories

You're all set!

Get ready for regular updates and more.

Submit the Form to Get the Guaranteed Lowest Priced Quote

Thanks for Filling the Details

Book Free Consultation

Thanks for your interest our interior expert will contact you immediately

Incorrect Input Fields

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Whatsapp us: +918306003161

Call us: +918306003161

Thank you for submitting the form

Check Your Eligibility Instantly

otp send to 8051288351

Boost Eligibility

Select bank.

for showing your interest.We will get back to you soon

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Maharashtra Stamp Act: Understanding Its Impact and Changes

Updated : May 1, 2024

At any point, if any movable or immovable resource/asset changes ownership, to get it stamped or legalized - a specific amount of tax has to be paid to the state government, which is known as stamp duty. The Maharashtra Stamp Act states such resources and assets on which the stamp obligation must be paid to the state government. The Act additionally specifies the measure of the amount that is to be paid to the state authorities.

The Bombay Stamp Act: A Cornerstone of Revenue Collection in Maharashtra

The Bombay Stamp Act, enacted in 1958, is a pivotal legal framework that governs the collection of stamp duties on document-based transactions within Maharashtra. Originally applied to the greater Bombay region, this act became an integral part of Maharashtra's legislative environment following the state's formation in 1960.

This Act mandates the payment of stamp duty, which is essentially a form of tax, on various documents including transfer deeds, agreements, certificates, bonds, and leases. The primary purpose of this duty is to confer legal authenticity to these documents while generating revenue for state administrative functions.

Over the years, the Bombay Stamp Act has been amended multiple times to respond to the dynamic economic conditions and real estate market of Maharashtra. These amendments ensure that the stamp duty rates are adjusted and practices streamlined to enhance compliance and minimise evasion.

The implementation of this Act is crucial for the state as it not only secures revenue but also supports the maintenance of a robust legal documentation system, which is fundamental to the functioning of both governmental and private sector transactions.

What is the Maharashtra Stamp Act?

The Bombay Stamp Act 1958 now known as the Maharashtra Stamp Act 1958, applies to every one of the agencies that are referenced in Maharashtra Stamp Act Schedule 1, on which the stamp duty is payable to the state. There was an amendment in the Maharashtra Stamp Act recently and the changes are inclusive to the modification of stamp duty on the agreement in Maharashtra on gift deeds, incorporation of electronic payment of stamp duty, an update on penalty clauses, and an increment on the amount of stamp duty under certain instruments provisions.

As of January 25, 2024, there are notable updates regarding the Maharashtra Stamp Act. Firstly, the 1% stamp duty concession for women purchasing residential property continues. This reduction applies to the standard rates, which vary between 2% to 5%, and the previous 15-year lock-in period for beneficiaries was abolished as of May 31, 2023.

Additionally, the Maharashtra government introduced the 'Abhay Yojana' amnesty scheme in December 2023. This scheme, in its second phase until March 31, 2024, allows the regularisation of inadequately stamped documents with reduced penalties. Benefits include a complete waiver of stamp duty and penalties for amounts under Rs. 1 lakh and a 50% waiver on stamp duty with full penalty exemption for amounts over Rs. 1 lakh.

Importantly, the stamp duty rates for the fiscal year 2023-24 remain unchanged from the previous year.

Latest Maharashtra Stamp Act

The Maharashtra Stamp Act latest involves several important changes and continuations of previous policies as of 2024:

- Stamp Duty Concession for Women: Maharashtra continues to offer a 1% stamp duty concession for women purchasing residential property. This initiative aims to encourage property ownership among women. The earlier 15-year lock-in period that restricted the resale of these properties to men has been abolished as of May 31, 2023 (Housing) .

- Stamp Duty Rates: Standard stamp duty rates have been restored to 5% in Mumbai after a temporary reduction during the pandemic. These rates apply from April 2021 onwards, with specific concessions for certain types of properties and transactions .

- Amnesty Scheme: The Maharashtra government has extended the Stamp Duty Amnesty Scheme until June 30, 2024. This scheme provides relief for properties that had incomplete or missing stamp duty payments dating back to 1980. The extension allows property owners to regularise documents with waived penalties under specified conditions .

Maharashtra Stamp Act 2015

On 24 April 2015, the original Maharashtra Stamp Act 1958 received the affirmation for it to be called the Maharashtra Stamp Act 2015. There were a few changes made to the Act – the stamp duty rate of certain instruments under Schedule 1 was increased. Therefore, the Maharashtra Stamp Amendment Act 2015 first came into order.

How is Stamp Duty Payable?

- Stamp Duty can be paid by:

- Using Stamp Paper

- Using Adhesive Stamps

- Online Challan

Stamp Duty Rates in Maharashtra

There are various factors that decide the stamp rate duty on property in the state of Maharashtra (or any state). Naming a few of these factors - the locality of the property - urban or rural, the total cost of the transaction, etc. The Maharashtra stamp duty Act 2020, reduced the stamp duty on properties for the next two years. This is only applicable in the areas falling under the Mumbai Metropolitan Region Development Authority (MMRDA) and municipal corporations of Pune, Pimpri-Chinchwad, and Nagpur. This means that stamp duty on properties in Mumbai, Pune, and Nagpur, was charged at 5% (4% stamp duty + 1% metro cess).

| Mumbai | 5% (includes 1% metro cess) | 2% | 3% | Rs 30,000 (for properties above Rs 30 lakh); 1% (for properties below Rs 30 lakh) |

| Pune | 6% (includes transport surcharge and local body tax) | 3% | 4% | Rs 30,000 (for properties above Rs 30 lakh); 1% (for properties below Rs 30 lakh) |

| Thane | 6% (includes transport surcharge and local body tax) | 3% | 4% | Rs 30,000 (for properties above Rs 30 lakh); 1% (for properties below Rs 30 lakh) |

| Navi Mumbai | 6% (includes transport surcharge and local body tax) | 3% | 4% | Rs 30,000 (for properties above Rs 30 lakh); 1% (for properties below Rs 30 lakh) |

| Pimpri-Chinchwad | 6% (includes transport surcharge and local body tax) | 3% | 4% | Rs 30,000 (for properties above Rs 30 lakh); 1% (for properties below Rs 30 lakh) |

| Nagpur | 6% (includes transport surcharge and local body tax) | 3% | 4% | Rs 30,000 (for properties above Rs 30 lakh); 1% (for properties below Rs 30 lakh) |

Stamp Duty on Hypothecation Agreement in Maharashtra

Stamp Duty on hypothecation agreements in Maharashtra on instruments, pledges and mortgages on home loans in the province of Maharashtra was capped. As per the latest Maharashtra stamp act, the stamp obligation on such instruments is currently covered at a greater stamp duty of Rs. 10,00,000). This revision has been presented with impact from 1 July 2014.

Stamp Duty Charges in Maharashtra on Conveyance Deed

According to the amendments made to the Maharashtra Stamp Act 2015, Article 34 states that 3% of the property’s value is the stamp duty on conveyance deeds (gift deeds). However, if a property – Residential or Agricultural, is gifted without the family having to pay any sum of money, then the stamp duty rate is Rs. 200 as per article 34 of the Maharashtra stamp act.

| Gift deed | 3% |

| Gift deed for residential/agricultural property passed on to family members | Rs 200 |

| Lease deed | 5% |

| Power of attorney | 3% for property located in gram panchayat areas and 5% for property located in municipal areas. |

Stamp Duty on Indemnity Bond in Maharashtra

According to Article 35 of Schedule 1 of the Maharashtra Stamp Act 1958, and then the Maharashtra Stamp (Amendment) Act 2015 - the price of the stamp duty on indemnity bonds in Maharashtra is Rs 500.

Stamp Duty on Guarantee Agreement in Maharashtra

According to Article 5(h) (A)(iv), the stamp duty on bank guarantee agreements in Maharashtra is –

(i) If the loan amount is less than Rupees Ten Lakh - 0.1% of the amount stipulated in the contract, with a minimum of rupees 100.

(ii) If the amount exceeds Rupees Ten Lakh, the stamp duty on the personal guarantee in Maharashtra – 0.2% of the amount agreed in the contract.

Maharashtra Stamp Duty Impact on Property Registration

Property registrations saw a dip of 50% in the month of April as compared to that of the month of March after the Maharashtra government restored the stamp duty rate of 5% from 1 April 2021. According to the state government’s data, before the sanctions were to be lifted – in the month of March, Maharashtra (excluding) Mumbai saw a record-breaking spike of 2.13 lakh registrations. While only 90,500 registrations were made till 29 April. Maharashtra stamp duty had a huge impact on property registrations.

Official announcement of the cut of stamp duty on loan agreements in Maharashtra had seen a boost in property sales, especially in Mumbai (Bombay, as we know, is one of the most expensive cities in India). There were many Bollywood A-listers such as Hrithik Roshan and Jahnvi Kapoor who were seen buying properties. Between September 1 and October 17, 2020, luxurious properties were registered across 25 registration offices in Mumbai that were collectively worth 2200 crores.

Recent Judgements on Maharashtra Stamp Duty

The Bombay High Court in a recent judgement directed the Government of Maharashtra to reimburse excess stamp duty, within about a month from the date of the receipt of the application. If the authorities fail to do so, they are applicable to pay interest at the rate of 12% p.a. The above order was applicable even on the stamp duty on education loan in Maharashtra.

In a landmark ruling, the High Court decided in favour of Macrotech Developers Ltd and Palava Dwellers regarding their land purchase under 'Integrated Township Projects' in Kalyan and Bhiwandi. These projects qualified for a 50% reduction in stamp duty. The state initially rejected the combining of this discount with another waiver on stamp duty for conveyance agreements, but the High Court ruled that both concessions are applicable concurrently. Consequently, the state was ordered to refund any excess stamp duty paid within a specified timeframe.

Maharashtra Stamp Duty Act has seen various amendments through time. Legal matters may seem hard to keep up with and a little hard to understand, but don’t let that stop you. We at NoBroker are here to help you. Click on the link below and we will assist you on legal matters. If you have any queries, leave them below and our experts will get back to you.

Frequently Asked Questions

Ans: No, the rate of stamp duty is not the same across the whole state of Maharashtra. The price depends on the location of the property. The rates are mentioned in the above article.

Ans: Yes, you can pay it online. Visit their site - https://gras.mahakosh.gov.in/echallan/

Ans: The price for the stamp duty is Rs 500, which is also payable online.

Ans: Yes, they are. Earlier the Maharashtra Stamp Act was referred to as the Bombay Stamp Act.

Ans: Ready reckoner state or the market value is how the rate of the stamp duty is calculated.

Ans: The Maharashtra Stamp Act Bare Act is the fundamental legal document outlining the rules and regulations for stamp duty and taxation on property transactions in Maharashtra.

Ans: No simple receipt may be considered genuine unless it is altered within six months of the date of stamp purchase by the registration officer or another officer with the necessary authority.

Recommended Reading

Property Tax: Online Payment, Calculation, and Bill Download 2024

July 15, 2024

3494+ views

BBMP Property Tax: Online, Offline Tax Payment, Bill View, Receipt Download 2024

June 26, 2024

4787+ views

Aurangabad Property Tax: Online Payment, Receipt Download, Status, Rates 2024

June 5, 2024

1357+ views

Stamp Duty and Registration Charges in Pune 2024

May 30, 2024

5558+ views

Stamp Duty and Registration Charges in Bangalore 2024

9184+ views

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

August 24, 2023

835303+ views

Conveyance Deed: Meaning, Importance, Format & More

August 28, 2023

19440+ views

All You Need to Know about Revenue Stamps

December 11, 2021

10181+ views

What is Stamp Duty: Calculation, Charges and Documentation 2024

March 2, 2021

9362+ views

Kruthi is a Chartered Accountant has worked for various Real Estate firms across India, she is well versed with the legal and financial aspects of all real estate transactions. There are numerous documents and plenty of hidden fees that people get lost in, her goal is to shed some light on it all.

Join the conversation!

*Please enter a valid email address

Recent blogs in

Tenant Police Verification Online in Gurugram: Easy Steps & Requirement

August 26, 2024 by Suju

BBMP Property Tax - How to Pay Property Tax in Bangalore Online

August 20, 2024 by Rahul Sahani

July 15, 2024 by Kruthi

Bhopal Property Tax: Online Payment, Bill Download 2024

July 12, 2024 by Nivriti Saha

June 26, 2024 by NoBroker.com

Search bar.

- Legal Queries

- Files

- Online Law Courses

- Lawyers Search

- Legal Dictionary

- The Indian Penal Code

- Juvenile Justice

- Negotiable Instruments

- The 3 New Criminal Laws

- Matrimonial Laws

- Data Privacy

- Court Fees Act

- Commercial Law

- Criminal Law

- Procedural Law

- The Constitutional Expert

- Matrimonial

- Writs and PILs

- CrPC Certification Course

- Criminal Manual

- Execution U/O 21

- Transfer of Property

- Domestic Violence

- Muslim Laws

- Indian Constitution

- Arbitration

- Matrimonial-Criminal Law

- Indian Evidence Act

- Live Classes

- Writs and PIL

Share on Facebook

Share on Twitter

Share on LinkedIn

Share on Email

Kedar Naniwadekar --> 29 October 2015

Calculation of stamp duty for trademark assignment deed

What is the stamp duty for Trademark Assignment Deed and how is the stamp duty calculated for the same? Also what is the procedure for registration of Trademark Assignment Deed? I have been given 2 different advices 1) the stamp duty shall be 0.1% of the total value if the value is below Rs. 10 Lakhs and 0.2% if the total value is above Rs. 10 Lakhs; and 2) the stamp duty shall be 3% of the total value.

1 Replies

Priyanka Kulkarni (Advocate and Intellectual Property Attorney Solicitor (England and Wales) (NP)) --> 30 October 2015

Being lawyer, first you need to check the relevant jurisdiction and decide which stamp Act applies e.g. Maharashtra Stamp Act (previously Bombay Stamp Act) and then read the relevant provision.

You may contact me at [email protected]

Priyanka Kulkarni

IP Attorney and Solicitor of England and Wales( NP)

Leave a reply

Your are not logged in . Please login to post replies Click here to Login / Register

Recent Topics

Related threads.

Popular Discussion

- Third party in partition suit

- Division of shop in 2 co-owner

- Judgement copies

- Is "fundamental breach of contract" supp

- Crminal case

- Status of property which is divided thro

- water supply cut off without notice

- One property of the will was sold. is th

- Ungent help needed for maintenance payme

- Writing and registering the property wil

view more »

Browse by Category

- Business Law

- Constitutional Law

- Labour & Service Law

- Legal Documents

- Intellectual Property Rights

- Property Law

- Forum Portal

- Today's Topic

- Popular Threads

- Post New Topic

- Unreplied Threads

- Top Members

- Share Files

- LCI Online Learning

Member Strength 970257 and growing..

- We are Hiring

- Terms of Service

- Privacy Policy

© 2024 LAWyersclubindia.com. Let us grow stronger by mutual exchange of knowledge.

Lawyersclubindia Search

Whatsapp groups, login at lawyersclubindia.

Alternatively, you can log in using:

- Market Trends

- Current News

- Infrastructure

- Locality Trends

- Seller Corner

- Commercial Realty

- Budget 2022

- Budget 2023

- Budget 2024

- Coronavirus

- Citizen Services

- Personal Finance

- Construction Know-How

- City Transport

- PG / Co-Living

- Celebrity Homes

- Famous Monuments

- Green Homes

- Home Automation

- Home Improvement

- Shopping Hubs

- Rent Receipt Online

- Pay Rent Online

- Rent Agreement Online

- Personal Loan

- Personal Loan EMI Calculator

- Personal Loan Eligibility Calculator

- Web Stories

Home » Must Knows » Legal » When is partition deed used for property division?

When is partition deed used for property division?

Partition deed is that legal document drafted and executed at the time of division of a common property. A partition deed is mostly used by families, to divide members’ shares in inherited properties. After the division through the partition deed, each member becomes the independent owner of his share in the property and is legally free to sell, rent or gift his asset, according to his wishes.

Table of Contents

See also: Coparcener meaning in HUF context

When do you need a partition deed?

The need for a partition deed arises, when it becomes important to create a clear division of shares in a common property.

See also: Partnership deed must be stamped as required by Indian Stamps Act

See also: Can gift deed be revoked

Contents of a partition deed

A partition deed would mentioned the following information:

- Date of partition

- Statement of partition

- Name, age and address of the joint owners

- Description of their share

- Signatures of the joint owners

- Names and signatures of the witnesses

Also read: Stamp duty on property registration in Gujarat

Documents needed for partition deed

To execute a partition deed, the following documents are required:

- Original title document

- Land records

- Valuation of property

- Registration fee

- ID cards of all the parties

- Address proof of all parties

See also: Deemed conveyance meaning

How to register a partition deed?

The procedure of partition deed registration is by and large similar in most states. In our example, we are showing you the process to register partition deed in Delhi:

Step 1: Visit the Delhi Online Registration Information System (DORIS) website.

Step 2: On the homepage you will se the ‘Deed Writer’ option. Click on it.

Step 3: From the options available, select ‘Partition Deed’ option.

Step 4: From the sub deed option, select ‘Partition Deed’.

Step 5: You will now be asked to provide the mobile number of the second party, and property valuation.

Step 6: You will now have to follow a detailed process to provide first party, second party and witness details to start partition deed registration process.

Once you done with that, you will have to pay the e-stamp duty on the Stockholding Corporation of India website. After the payment of stamp duty and registration charges, you can book an online appointment to register the partition deed at the sub-registrar’s office.

Also read all about probate meaning , uses and how to apply for it

Stamp duty on partition deed

To attain legal validity, a partition deed must be registered with the sub-registrar of the area in which the immovable asset is located. This is mandatory under Section 17 of the Indian registration Act, 1908. This means that the parties involved in the partition, will have to pay stamp duty charges (under the provisions of the Indian stamp Act, 1899) and registration charge, to get the partition deed registered.

Stamp duty on partition deed varies from state to state. For example, in Delhi, 2% of the value of the separated share of the property has to be paid as the stamp duty on a partition deed. The same rate is applicable on registration of partition deeds in Maharashtra, along with a 1% registration charge. (However, it is not mandatory for the co-owners to register the partition deed in the state.)

know about: Partnership deed

Income tax on partition deed

Since no transfer has taken place as such through the partition, the beneficiaries are not liable to pay any capital gains tax after the division.

See also: What is a title deed ?

Partition deed: Legal aspects

How is property divided through a partition deed.

If a property is being divided between two people who have invested in the purchase, the division is based on their respective contribution. If two siblings bought a property for, say Rs 1 crore and each contributed Rs 50 lakhs, the property will be divided equally between the two parties through a partition deed. If the ratio of their contribution is 60:40, the division would be in this manner. However, the law assumes each member to have an equal share in an undivided property, unless documentary proof stating otherwise is produced.

In case of inherited property, co-owners would get their share in a property based on their treatment in the inheritance law governing their religion.

See also: Types of joint ownership of property

Application of inheritance laws on partition deed between family members

Partition of any property is subject to the laws of inheritance. This brings into picture inheritance laws governing property division among Hindus, Muslims and Christians. At the time of partition, the share of each member is determined, based on his entitlement under the applicable inheritance laws.

See also: All about property rights of daughters married before 1989

Partition of property under Hindu law

According to the Hindu Succession Act, 1956, a deceased Hindu’s assets are divided among his legal heirs, either according to his will, or under the rules stated in the Act if the person has died without leaving a will – i.e., intestate. While the Hindu Succession Act, 1956, is applicable on the partition in a Hindu Joint Family, the Hindu Partition Act of Property, 1892, is applicable on partition of a property that is jointly owned.

See also: Inheriting assets after death of the owner

What happens to a property after a partition deed is executed?

Once the partition deed comes into effect, each share in the property becomes an independent entity. Each divided share of the asset gets a new title. Also, members surrender their claim in the shares that have been allocated to the other members.

For example, if Ram, Shyam and Mohan divide a property through a partition deed, then, Ram and Shyam would give up their right in the part that has been allocated to Mohan. Similarly, Mohan would give up his right in the shares allotted to Ram and Shyam. Apart from the common areas where easements rights are applicable, each one has an independent property within an estate, after its partition. This also provides them the right to deal with their share in a manner they like.

After the partition, each party must also complete the property mutation process, to make the change legally valid.

See also: What is mutation of property and why is it important?

Is it compulsory to register a partition deed?

In 2018, the Maharashtra government said that the process of partition of properties belonging to a Hindu Undivided Family (HUF) and the receipt thereof by a coparcener, do not fall under the definition of ‘transfer’. Consequently, it is not compulsory to register such partition deeds. Note here that in case the partition has been affected through a partition deed, which has not been registered, the deed will not be admissible as a proof in a court of law.

What if partition deed is not registered?

If the partition deed is not registered by paying the applicable stamp duty and registration charges, it will have no legal validity. Consequently, the unregistered partition deed will not be admissible as an evidence under Section 49 of the Registration Act, 1908.

See also: All about property registration laws in India

Difference between partition deed and partition suit

Under the provisions of the law, a property would be divided, either by way of a partition deed or by a partition suit. The need to go for the second option arises, in case of a dispute or in cases where the co-owners do not mutually agree to the partition. In this case, a partition suit must be filed in an appropriate court of law.

Before one can file a suit, they will have to issue a request to all the co-owners, demanding partition. In case the parties refuse to entertain your request, you are within your legal rights to move court over the matter. Under the Indian laws, the aggrieved party must approach the court within three years, from the date when the right to file a partition suit accrues.

Both the instruments, however, serve the same purpose – they create and extinguish rights of co-owners in a jointly owned property.

See also: All about carpet area

Treatment of verbal partition of property or family settlement under the law

Under the laws governing inheritance among Hindus, Jains, Buddhists and Sikhs, Class-I heirs of a property can enter into a verbal memorandum of family settlement and divide the property on mutually agreeable terms. Since this oral agreement has been reached without using the partition deed as an instrument, the need to register the transaction is entirely avoided.

While delivering its verdict in the case of Nitin Jain versus Anju Jain and others, a division bench of the Delhi High Court, in 2007, ruled that no stamp duty is payable in case of a verbal division of property.

“It’s legally permissible to arrive at an oral family settlement dividing/partitioning the properties and thereafter, record a memorandum in writing, whereby the existing joint owners, for the sake of posterity, record that the property has been already partitioned or divided,” the bench held. “Courts have recognised oral partitions in cases of joint families. An oral partition is not an instrument of partition, as contemplated under Section 2(15) of the Stamp Act. Therefore, as it is not an instrument, no stamp duty is payable on an oral partition,” the HC further said.

However, in the absence of a partition deed, the shares of the co-owners remain undivided in this kind of arrangement. This also means, they are not free to sell, gift or transfer their share in their property on their own.

See also: All about e stamping

Partition deed sample

Provided below is a general partition deed sample . Note here that this partition deed format is only to give the readers a general view of the deed.

This deed of partition made at __________this _________ day of

(1) Mr._________________, S/o._____________, Age ______years, Occupation__________, Residing at__________________________. Hereinafter referred to as the first party.

(2) Mr_________________, S/o._____________, Age ______years, Occupation__________, Residing at__________________________. Hereinafter referred to as the second party.

(3) Miss_________________, D/o._____________, Age ______years, Occupation__________, Residing at__________________________. Hereinafter referred to as the third party.

- The parties are the members and coparceners of their joint and undivided Hindu Family and a house property situated at ________________, the details of which are given in Schedule ‘A’. Each party hereto is entitled to a share in the said property.

- The parties desire to implement a partition of the said properties amongst themselves as they no longer desire to continue as members and coparceners of their joint family property.

- The parties have agreed that the said property will be divided in such a way that:

(a) The property described in the first schedule shall be allotted to the first party exclusively.

(b) The property described in the second schedule shall be allotted to the second party exclusively.

(c) The property described in the said third schedule shall be allotted to the third party exclusively.

- The parties hereto have proposed to effect and record the said partition in the manner following:

Now this deed witnesseth that

- Each party hereto grant and release all his/her undivided share, right, title and interest in the property allotted to the other so as to constitute each party the sole and absolute owner of the property allotted to him/her.

- Each party agrees that they will get the deed executed and registered and will equally share expenses involved in the process.

- Each party agrees that they will not cause any hindrances or claim and right on the share they have agreed to give up through this partition deed.

(Details of Undivided properties belongs to Joint Family)

Description of the property

FIRST SCHEDULE

(Property allotted to the share of Sri.__________________________First party)

SECOND SCHEDULE

(Property allotted to the share of Sri.__________________________Second party)

THIRD SCHEDULE

(Property allotted to the share of Miss_________________________Third party)

- FIRST PARTY

- SECOND PARTY

- THIRD PARTY

See also: All about GST on flat

Deed of partition format in Hindi

To download PDF format, click here .

Legal updates

Consent from all co-owners must for partition deed to be valid: sc.

A partition suit of a joint property will only be legally binding only if it has the written consent of all parties concerned, says the Supreme Court. While adjucating an appeal in the in Prashant Sahu and others versus Charulata Sahu and others, the apex court said that consent of only some co-owners is not enough to give partitions suits a legal status.

Read full coverage here .

Family property received by Hindu woman through partition deed is not inheritance: HC

An ancestral property received by a Hindu woman through a registered partition deed will not qualify cannot be termed inheritance under the Hindu Succession Act, the Karnataka High Court has ruled. Consequently, such a property will not go back to the heirs of the woman’s father upon her demise, the HC added.

Can partition deed be challenged?

Yes, a partition deed can be challenged.

What is partition in a house?

A partition deed can be used as a legal instrument, to divide a property among the co-owners.

Is verbal partition of property legally valid?

The partition will be valid, as long as a written memorandum of agreement has been signed among the family members pertaining to the partition. This document need not be registered.

- 😃 ( 56 )

- 😐 ( 4 )

- 😔 ( 1 )

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel. [email protected]

Related Posts

Property received by woman through partition deed not inheritance: HC.

Rights of a father to sell ancestral property.

Who is a Karta in a Hindu Undivided Family (HUF)?.

Consent from all co-owners must for partition deed to be valid: SC.

Husband buying property in wife’s name not always benami: Calcutta HC.

Do married daughters have a right in parents’ property?.

Recent Podcasts

- Hindu Succession Act

- partition deed

- partition deed registration

- partition deed registration charge

- partition deed sample

- Partition suit

- property division among co-owners