Mastering Bond Paper: Sizes, Uses, and History Explained

In the world of paper, one of the most commonly used types is bond paper. From office printouts to important documents, bond paper finds a variety of uses due to its adaptability and durability. Let’s dive into the fascinating world of bond paper and explore its different sizes, uses, and origins.

Understanding the Sizes of Bond Paper

Short bond paper size.

Short bond paper, often used for a variety of purposes including academic tasks and office documents, typically measures 8.5 inches by 11 inches, or 215.9 mm x 279.4 mm.

Long Bond Paper Size

Long bond paper, on the other hand, is slightly longer and measures 8.5 inches by 13 inches, or 215.9 mm x 330.2 mm. It should not be confused with legal-size paper, which is 8.5 inches by 14 inches.

Comparing Bond Paper Sizes

| Short Bond Paper (US Letter) | 8.5″ x 11″ | 21.59 cm x 27.94 cm | 215.9 mm x 279.4 mm |

| Long Bond Paper | 8.5″ x 13″ | 21.59 cm x 33.02 cm | 215.9 mm x 330.2 mm |

| A4 Paper | 8.27″ x 11.69″ | 21 cm x 29.7 cm | 210 mm x 297 mm |

| Legal Paper | 8.5″ x 14″ | 21.59 cm x 35.56 cm | 215.9 mm x 355.6 mm |

| F4 Paper | 8.27″ x 13″ | 21 cm x 33.02 cm | 210 mm x 330.2 mm |

Setting Paper Size in Word and Google Docs

Microsoft word.

Whether you are drafting an essay or creating a report, setting up your document to the correct paper size is crucial. In Microsoft Word , to set up a long bond paper size, you can click on the “Page Layout” tab, then the “Size” button, and choose the 8.5″ x 13″ size from the list.

Google Docs

In Google Docs , you can adjust the paper size by clicking on “File” and then “Page setup” in a new or existing document. In the “Page Setup” dialog, you can select the appropriate paper size.

Uses of Bond Paper

Bond paper is a versatile material that finds widespread use in various sectors. Here are some of its most common uses:

- Printing : Bond paper’s smooth texture and durability make it ideal for everyday printing tasks.

- Letterheads and Official Documents : Owing to its high-quality appearance and feel, bond paper is often used for letterheads and official documents.

- Drawing : Uncoated bond paper is perfect for everyday drawing, as its lack of coating provides a less porous surface for the inks, leading to sharper text and images.

Origins of Bond Paper

The history of bond paper is as interesting as its uses. The name “bond paper” comes from its original use for creating government bonds , hence the term “bond”.

Interestingly, the standard size of bond paper is 17 by 22 inches, and it is often sold in a 20-pound weight. This refers to the weight of a 500-sheet ream of this size. However, before the paper is sold to consumers, it’s cut to the standard letter size of 8.5 by 11 inches.

It’s also worth noting that there’s a variety of bond paper known as “ rag paper ,” which is more durable and cloth-like, distinguishing it from the regular wood-pulp variety.

Whether it’s for printing your next report or crafting a stunning piece of art, bond paper is a versatile and reliable choice. Understanding its different sizes, uses, and the history behind it can help you appreciate this essential everyday material even more.

- Newspaper Parts Explained: Dissecting Key Sections & Terms

- How to Write an Analytical Essay: The Beginner’s Guide

- How to Write a Personal Essay: The Ultimate Guide

- Difference Between Paraphrasing and Summarizing

You May Also Like

- 350+ Good Morning Messages for Him (Boyfriend or Husband)

- 101 Hilarious Pick-Up Lines That Actually Work

- 220+ Adorable Baby Shower Messages and Wishes

- Stuart Woods Books in Order

- 60 Good Reasons to Work from Home

Impact of RBI’s monetary policy announcements on government bond yields: evidence from the pandemic

- Published: 20 May 2023

- Volume 58 , pages 261–291, ( 2023 )

Cite this article

- Aeimit Lakdawala 1 ,

- Bhanu Pratap ORCID: orcid.org/0000-0003-2047-0715 2 &

- Rajeswari Sengupta 3

2492 Accesses

4 Altmetric

Explore all metrics

We investigate how the bond market responded to the Reserve Bank of India’s (RBI) monetary policy actions undertaken since the start of the pandemic. Our approach involves combining a narrative analysis of the media coverage together with an event-study framework around RBI’s monetary policy announcements. We find that the RBI’s actions early in the pandemic were helpful in providing an expansionary impulse to the bond market. Specifically, long-term bond interest rates would have been meaningfully higher in the early months of the pandemic if not for the actions undertaken by the RBI. These actions involved unconventional policies providing liquidity support and asset purchases. We find that some of the unconventional monetary policy actions had a substantial signaling channel component where the market perceived the announcement of an unconventional monetary policy action as representing a lower future path for the short-term policy rate. We also find that the RBI’s forward guidance was more effective in the pandemic than it had been in the couple of years preceding the pandemic.

Similar content being viewed by others

Unconventional monetary policy in the euro zone.

The impact of monetary policy interventions on banking sector stocks: an empirical investigation of the COVID-19 crisis

The European Monetary Policy Responses During the Pandemic Crisis

Avoid common mistakes on your manuscript.

1 Introduction

Major central banks all over the world resorted to a wide variety of policy actions to provide much-needed support to their respective economies that were severely impacted by the Covid-19 pandemic. These ranged from conventional monetary policy (CMP) actions such as reductions in the short-term interest rates to unconventional announcements such as extended lending programmes, asset purchases and forward guidance. The primary objective of these actions was to inject liquidity into the system and maintain the orderly flow of credit from financial intermediaries to the real economy. With the pandemic having subsided and the same central banks trying to exit the policies of abundant liquidity injection, it is now worthwhile to investigate the impact of these monetary policy actions on the financial markets. Against this background, in this paper, we empirically analyze the bond market impact of the conventional and unconventional monetary policy actions announced by the Reserve Bank of India (RBI) since the beginning of the pandemic. We focus on the bond market as it is one of the most important links in the overall monetary transmission mechanism. Footnote 1

India offers an interesting case study to examine this issue for two main reasons. While in the developed countries, governments announced massive fiscal stimulus packages in the wake of the pandemic to stimulate demand, in India, much of the heavy lifting was done by the RBI. Given the limited fiscal space (fiscal deficit of the central and state governments in the pre-pandemic period was close to 10 percent of GDP), the fiscal responses of the government were mostly restricted to providing relief measures to the disadvantaged sections of the Indian population. This led to considerable expectations in the financial markets that the RBI would provide the necessary support to the formal sector of the economy including both financial and non-financial firms.

Second, the RBI which had formally adopted inflation targeting in 2016, had not resorted to unconventional monetary policy (UMP) actions in as big a way as for example the US Federal Reserve or the European Central Bank at any point of time in the pre-pandemic period. Footnote 2 This makes a study of the RBI’s pandemic-time actions even more interesting. Footnote 3 Not only did the RBI undertake different types of UMP actions they also provided explicit forward guidance during the pandemic to anchor the expectations of the market participants. The objective of the conventional as well UMP actions was manifold including, aiming to improve monetary policy transmission, facilitating credit flow from banks to the rest of the economy, easing liquidity constraints in specific sectors, reducing financial stress in markets and maintaining financial stability (Patra & Bhattacharya, 2022 ).

Moreover, anecdotally another important goal seemed to be to keep the government’s borrowing costs in check. During the pandemic the Indian government’s debt-to-GDP ratio reached close to 90 percent of GDP implying unprecedented levels of borrowing by the government from the bond market. As a result, one of the main objectives of the RBI’s UMP announcements arguably was to lower the bond yields to support the government borrowing program. This was alluded to several times in the RBI’s official statements as well. Footnote 4

Our paper makes three main contributions in studying the bond market response to RBI’s pandemic-era monetary policy announcements. First, we study the media reactions to some of the major monetary policy announcements during our sample period which runs from March 2020 to June 2022. While using the change in financial market prices is a natural alternative to study the response to central bank announcements (and we also do this later in the paper), the narrative analysis using media articles allows us to provide more context in understanding the impact of these announcements. This is a novel aspect of our paper relative to the existing literature that analyzes the pandemic policy announcements of the RBI (see for example Patra & Bhattacharya, 2022 ; Talwar et al., 2021 ). Overall, we find that the narrative in the media is consistent with the financial market price changes. Both sources suggest that only a handful of the UMP actions and especially those in the early part of the pandemic took the markets by surprise. For instance, the market seems to have been more surprised by the first announcement of the Targeted Long-Term Repo Operations (TLTRO) (both in March and April) and the Operation Twist (OT) announcement in April. However, we do not find much of an effect of the GSAP (Government security acquisition program) announcements that happened more than a year into the pandemic in April and June 2021. For the conventional announcements, the markets seem to have been most surprised when the RBI began tightening monetary policy by raising the policy interest rates in the period from April to June 2022 in response to elevated inflation levels.

Second, we undertake a systematic investigation of how and why RBI announcements moved government bond yields since the start of the pandemic, focusing on both conventional and UMP announcements. Footnote 5 The total effect of the RBI’s surprise announcements in the first one and a half years of the pandemic was to reduce the yield on 10-year government securities (GSec) by at least 40 basis points. This accounts for the total fall in the 10-year GSec during that time. This effect was driven both by conventional and UMP actions. Consistent with the narrative analysis, we find that only 5 announcement dates, all in the first few months of the pandemic were responsible for the cumulative 40 bps fall in the 10-year yield. Four of these dates contained UMP announcements, such as TLTRO and Operation Twist (OT). Notably, the GSAP measures announced by the RBI in April and June 2021, during the second wave of the pandemic did not have any discernible impact on the bond yields. In other words, much of the impact of the RBI’s announcements was front-loaded in the first six months of the pandemic.

We also investigate if there are any indirect effects of the UMP announcements. We find evidence of the TLTRO announcements working through a signaling channel (see for eg., Bauer & Rudebusch, 2014 ). The idea behind this channel is that markets perceive the announcement of an unconventional monetary policy by the central banks as a signal to keep short-term interest rates lower in the future. We explore this channel using data from Overnight Indexed Swap (OIS) rates. While TLTRO announcements had a pronounced signaling channel effect of lowering short to medium-term interest rates, we do not find this for the other UMP actions.

Finally, we assess the potential impact of the RBI’s forward guidance on the bond markets. The RBI traditionally did not offer forward guidance (Lakdawala & Sengupta, 2021 ; Mathur & Sengupta, 2019 ) as part of its monetary policy statements. However, during the pandemic forward guidance gained prominence in the RBI’s communication strategy (Talwar et al., 2021 ) primarily to reiterate the accommodative stance of monetary policy. We use OIS rates and the approach of Gürkaynak et al., ( 2005 ) to construct target and path factors which captures surprise changes to the short-term policy rate and surprise movements in the medium-term rates, respectively. Specifically, the path factor moves in response to surprise changes in the RBI’s forward guidance. We find that forward guidance shocks continued to have an expansionary effect on longer term rates not only in the first year of the pandemic but through early 2022. The biggest path factor movements however came about in 2022 when the RBI began tightening monetary policy to tackle high and rising inflation. Footnote 6 We also find that while in the pre-pandemic period, the target factor was the main driver for bond yields, in the pandemic period, the path factor was more important. This underscores the importance of the RBI’s forward guidance over the last two years.

While there exist by now several studies that analyze the impact of monetary policy actions particularly UMP announcements on bond markets (for e.g., Rebucci et al., 2022 ), to the best of our knowledge there is only a limited literature on this topic for emerging economies like India especially for the pandemic period (notable exceptions are Das et al., 2020a , Patra & Bhattacharya, 2022 and Talwar et al., 2021 ). We address this gap and contribute to this nascent literature by conducting a narrative analysis using media reports which enables us to study market’s reactions to the announcements and also by looking at both expansionary and contractionary announcements by the RBI. Our paper is also related to the broader strand of India-focused empirical literature that analyses the impact of the RBI’s announcements on financial markets. Footnote 7 The rest of the paper is organized as follows. In Sect. 2 , we describe various monetary policy actions undertaken by the RBI during the pandemic and discuss the media coverage around some of the major announcements. We analyze the bond market response to both unconventional and conventional monetary policy announcements in Sect. 3 followed by an analysis of RBI's forward guidance policies during the pandemic in Sect. 4 . We conclude the paper in Sect. 5 by drawing policy implications for the design and conduct of monetary policy in the future.

2 Monetary announcements during pandemic and market reactions

The RBI announced a slew of conventional and unconventional monetary policy (UMP) measures during the pandemic. Conventional measure refers to changes in the short-term policy rate (i.e., repo rate). According to the inflation targeting mandate of the RBI the monetary policy committee (MPC) is responsible for deciding the policy repo rate. As per the RBI’s liquidity management framework, the repo rate lies in a corridor (referred to as the Liquidity Adjustment Facility or LAF corridor) whose floor is decided by the reverse repo rate and the ceiling is decided by the marginal standing facility (MSF) rate (Dua, 2020 ). This corridor used to have a fixed width in the pre-pandemic period implying that once the MPC decided the repo rate, the other two rates were automatically determined. Till the pandemic, the reverse repo rate had never been changed in isolation by the RBI. However, during the pandemic, on April 17, 2020 the RBI cut the reverse repo rate by 25 basis points (bps) without changing the repo rate, as a result of which the LAF corridor became asymmetric with a downward bias. This was done predominantly to discourage the banks to park their excess liquidity with the RBI. However, this move would be considered an UMP action because it was not part of the conventional monetary policy statement of the MPC and did not entail a change in the policy rate.

In addition to this, the RBI announced several other UMP actions during the pandemic which we have described in the Appendix in Table 6 and Table 7 . The rationale and the nature of the policy actions, the transmission channels and the scale of operations are considered the main distinguishing features of UMP announcements (BIS, 2019 ; Patra & Bhattacharya, 2022 ). RBI undertook three main types of UMP actions, namely TLTRO, Operation Twist and G-SAP. TLTRO was introduced to provide liquidity to specific sectors and entities experiencing liquidity stress (Talwar et al, 2021 ). Operation Twist (OT) was aimed at compressing the term premium and flattening the yield curve. G-SAP was an upfront commitment by the RBI on the size of GSec purchases in contrast to the regular discretionary purchases through open market operations (Patra & Bhattacharya, 2022 ).

In this section, we describe a few of the major announcements and analyze the financial market’s reaction to these announcements as understood from articles published in the Economic Times (henceforth ET), a leading financial daily in India. We list some of the major announcement dates during our sample period in Table 1 .

The announcement of the nationwide lockdown on March 27, 2020 was followed by the Finance Minister announcing a fiscal package of Rs. 1.7 lakh crore on March 26, 2020. The market viewed this mostly as a relief package for the country’s poor in the wake of lockdown, without any demand stimulus per se, or any relief for the industry, including the hardest hit sectors such as aviation, and hospitality among others. This created some expectation that the RBI would announce some major policy actions to provide much needed support to the economy.

The RBI preponed its scheduled monetary policy meeting from April to March 2020. On March 27, 2020, in keeping with the expectations, in an unscheduled monetary policy announcement, the RBI announced a big expansion in monetary policy. This included a 75 basis points (bps) cut in the policy repo rate, a 90 bps cut in the reverse repo rate, and a 1 percent reduction in the cash reserve ratio (CRR). Simultaneously, the RBI announced an unconventional monetary policy in the form of the TLTRO (Targeted Long-Term Repo Operation or repurchase operation in government securities). While the RBI had been doing LTRO (Long-term repo operations) since February 2020 to improve monetary policy transmission, this was the first time it announced a targeted version of this program. The idea was that the banks would use the liquidity available under this scheme to invest in corporate bonds or commercial paper or debentures, and this would keep credit flowing in the economy. These announcements together were meant to inject Rs 3.74 lakh crore liquidity in the system, which amounted to about 1.8 percent of India’s GDP.

The RBI’s announcement came at a time when the market was already expecting a considerable monetary policy support given the shock of the pandemic and the lockdown. At the same time, in some quarters, the magnitude and variety of measures announced may have led to some element of surprise. For example, some analysts noted that “The RBI has surpassed expectations by delivering more than what the market anticipated, and its promise to 'do whatever it takes' has come good.” Footnote 8

Over the next couple of weeks, the RBI announced more TLTRO auctions. While these announcements were lauded by the analysts and markets in general, the overarching sentiment seemed to be that the government was not going to announce a sizeable fiscal stimulus because of constrained fiscal space, and hence the RBI would have to do much of the heavy lifting; however, the measures announced by the RBI did not seem adequate or appropriately targeted. For example, market expected the RBI to follow the footsteps of the US Federal Reserve, and directly start buying corporate bonds. The ET reported on April 15, 2020: “ RBI, which has been reluctant in following the sweeping actions of Federal Reserve, could use Sec 17 of the RBI Act to extend bond purchases to include corporate bonds with sufficient haircuts .” Footnote 9

There were also fears that given the high fiscal deficit of the government on account of reduction in tax revenues triggered by the lockdown, the government would need to significantly increase its borrowing from the market and this could push up bond yields. This led to expectations that the RBI would need to do more to keep the bond yields in check and support the government’s borrowing program. “ The RBI should consider another package of wide ranging measures…….The growth impact from Covid-19 due to required measures such as the lockdown, will require active support from the RBI to ensure that Government borrowing for the current financial year is conducted smoothly (ET, April 15, 2020)”.

Almost in response to the market’s concerns, the RBI announced TLTRO 2.0 on April 17, 2020 along with a 25 bps reduction in the reverse repo rate, in yet another unscheduled announcement. The disruptions caused by the pandemic, severely and perhaps disproportionately, impacted the small and mid-sized corporations, including non-banking financial companies (NBFCs) and microfinance institutions (MFIs), in terms of access to liquidity. Yet majority of the funds available by the banking sector through TLTRO 1.0 (announced on March 27, 2020) was deployed to buy bonds issued by public sector entities and large corporations. Hence, to support the more disadvantaged sections of the economy, the main idea behind TLTRO 2.0 was that the funds availed by banks under this scheme were to be invested in bonds issued by NBFCs, with at least 50 per cent of the total amount availed going to small and mid-sized NBFCs and MFIs.

This unscheduled announcement came as a surprise. ET reported on April 17, 2020: “ In a surprise second media briefing in a month, RBI Governor Shaktikanta Das on Friday noted that the deployment of targeted TLTRO 1.0 largely went to large PSUs (public sector undertakings) or large corporations. To begin with, the central bank will conduct TLTRO 2.0 worth Rs 50,000 crore.” Footnote 10 This announcement also led to expectations that the RBI would undertake further interest rate reductions in the next meeting. “India’s central bank governor laid the ground for more interest rate cuts as he took a number of steps to boost liquidity and support lenders” (ET, April 17, 2020). Footnote 11

The other major UMP announcement by the RBI in April 2020 was that of the Operation Twist (OT). This specific type of UMP, which was a variant of the quantitative easing used by the US Fed in 2012, had been done earlier by the RBI in December 2019. During the pandemic period, RBI announced the first OT on April 23, 2020. The objective of this UMP action was to alter the slope of the yield curve through targeted intervention at specific maturities (Patra & Bhattacharya, 2022 ), and primarily to lower the yields on long-term GSecs. This announcement led to nearly 16 bps drop in the 10-year GSec yield, the biggest drop since March 27, 2020. Bond markets interpreted this announcement as an indirect signal of the RBI’s intention to monetise part of the government’s fiscal deficit. Given that the RBI had not engaged in deficit monetisation for decades, the nature of this specific OT announcement seemed to surprise the markets. “ While the RBI earlier this year conducted similar "twist operations", Thursday's announcement raised eyebrows as the RBI will now be selling T-bills it sold in an auction a day earlier, in what traders say is a clear indication the RBI itself bought a large chunk of that offering.” Footnote 12

The next set of conventional monetary policy announcements were done on May 22, 2020 when the RBI slashed the policy repo rate by another 40 bps to bring it down to the lowest ever rate of 4 percent; accordingly, the reverse repo rate came down from 3.75 percent to 3.35 percent. With this, the RBI cut the repo rate by 115 bps and the reverse repo rate by 155 bps in the first two months of the lockdown. This marked the end of the rate cutting cycle during the pandemic. Given the continuing troubles in the economy amidst the protracted and severe lockdown, the reaction of the market to this round of monetary expansion was lukewarm. ET reported on May 22, “ However, while the monetary policy measures announced today are certainly necessary, they can hardly be deemed to be sufficient, in the face of severely weakened demand conditions economy-wide, following two entire months of severe economic lockdown.” Footnote 13

The next significant UMP announcement by the RBI took place on October 9, 2020 when the RBI unveiled the on-tap TLTRO scheme. The focus of this scheme was revival of activity in specific sectors that have both backward and forward linkages, and multiplier effects on growth. Initially, this scheme was meant for five sectors; subsequently 26 stressed sectors were brought under this ambit by December 2020, and by February 2021 the NBFCs were also included i.e., liquidity availed by banks through this scheme was to be deployed to buy bonds from entities in these sectors as well as lend to these specified sectors. The market expectation in the run-up to this monetary policy meeting was that status quo would be maintained. “ The newly-constituted Monetary Policy Committee (MPC) of the Reserve Bank began its three-day deliberations on Wednesday, amid expectations that the central bank will maintain status quo on the benchmark lending rates in view of hardening inflation. Industry bodies are of the view that the RBI should maintain its accommodative stance on the policy interest rates in the wake of serious challenges in limiting contraction in the economy due to COVID-19 pandemic” (ET, October 7, 2020) . Footnote 14

There was no expectation per se of further liquidity injection measures and hence the market reaction in general was that the RBI had done more than what was expected. This was also when the RBI and the monetary policy committee (MPC) gave an explicit forward guidance about the future path of monetary policy. We discuss this in greater detail in the next section.

The RBI announced G-SAP on April 7, 2021 marking the first time the central bank pre-committed to a specific size of GSec purchases. This was on the lines of US Fed’s Large-Scale Asset Purchases (L-SAP) programme after the implosion of Lehman Brothers. Between April and June 2020, the central bank said it would aim to buy Rs. 1.0 lakh crore bonds under G-SAP. To a large extent, this was expected by the financial markets. After the Finance Minister announced a massive borrowing (Rs. 12.05 lakh crore) plan for 2021–22 in the Union Budget of February 01, 2021, bond yields began hardening. There was widespread expectation in the market that the RBI would provide some clarity about its GSec purchase plan for the rest of the year and maybe even come out with an OMO calendar, to lower the yields. ET reported on April 5, 2021: “ But investors would need clarity in communication from Governor Shaktikanta Das on his agenda for the bond markets, which have lately been roiled by hardening yields.” Footnote 15

In other words, it seems that compared to the UMP announcements towards the first half of our sample, such as TLTRO 2.0 or OT of April 23, 2020, the market was much less surprised by the G-SAP announcements of 2021.

Finally, from April 2022 onwards, the RBI began tightening monetary policy in a series of conventional announcements which entailed an increase in the policy repo rate. While the market had begun expecting from December 2021 onwards that the RBI would start the policy normalization in 2022, yet when the announcements were made the market seems to have been surprised to a considerable extent. We discuss this more in the next section.

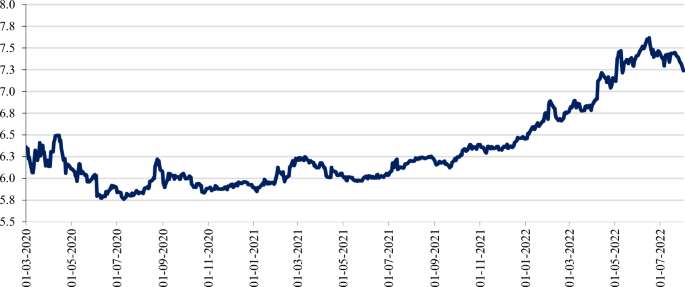

3 Analyzing the bond market response to monetary policy announcements

Appendix Figure 6 plots the yield on the 10-year GSec from March 2020 to June 2022. This interest rate started at 6.3% in March 2020 and drifted down toward 5.8% by June 2020. Then it hovered around 6% for rest of the year before beginning its gradual rise over the next year and a half to finish around 7.3%. What were the effects of the RBI’s actions on this trend in long-term term interest rates? We aim to shed light on this question in this section.

We will focus our attention on the announcement dates where RBI released a statement on their regularly scheduled meeting dates and also include days when the RBI made any unscheduled announcements about conventional or unconventional monetary policy actions. Our sample runs from March 2020 to June 2022. There were 10 conventional RBI announcement days, 29 unconventional announcement days and five days when there were both conventional and unconventional announcements.

We categorize the announcements into “only CMP” which are days when only conventional monetary policy announcements pertaining to the policy repo rate were made. For instance, the MPC announcement of August 06, 2020 to keep the policy repo rate unchanged at 4.00 per cent is classified as an only CMP date. Further, days on which only announcements related to unconventional monetary policy measures, such as the TLTRO, GSAP and OT, were made are classified as “only UMP” dates. The announcement of simultaneous sale-purchase OMOs under Operation Twist programme on April 23, 2020 or GSAP 2.0 on July 05, 2021 can be considered only UMP dates. Lastly, days on which unconventional measures were announced alongside conventional policy announcements by the MPC correspond to “CMP + UMP” days. The historic policy package announced on March 27, 2020—reduction in policy repo rate, reverse repo rate, CRR and announcement of TLTROs—is an example of such dual announcement dates. Footnote 16

While news about RBI actions can potentially be released outside of these dates, it is difficult to disentangle this information from general information about Indian macroeconomy. This motivates our approach of focusing on RBI announcement dates to more clearly identify the causal effect of monetary policy on the bond market.

We start by studying whether RBI announcements moved bond yields more than news coming out on a generic day. Table 2 shows the mean and standard deviation of the daily change in 3-month, 1 year and 10-year government bond yields on the three different categories of RBI announcement days compared with all other days. The daily change is calculated as the change in yields from end of day (t) minus yields from end of day (t – 1) . We have checked that the results are very similar when using a two-day window.

The table shows that bond markets are clearly responding more to RBI announcements compared to all other days. For both conventional and unconventional policy announcements, the standard deviation of short-term and long-term yields are higher as compared to all other days. The standard deviation at the shorter end is substantially higher on announcement days, especially when a conventional announcement is involved. It is interesting to note that bond yields move more on announcement days with only conventional announcements relative to days with only unconventional announcements. As we will discuss later, this is consistent with the idea that there were many days with unconventional announcements that were not surprising to the market and most of the “action” in financial markets happened in the early period of the pandemic.

Table 8 in the Appendix shows similar summary statistics for the pre-pandemic sample with only conventional announcements. Those results show that the pandemic response of bond yields has been similar to the pre-pandemic sample, suggesting that transmission to financial markets is still an important first step in the overall monetary transmission mechanism. Overall, this evidence provides support for our event-study framework that there is some novel information being released on RBI announcement dates.

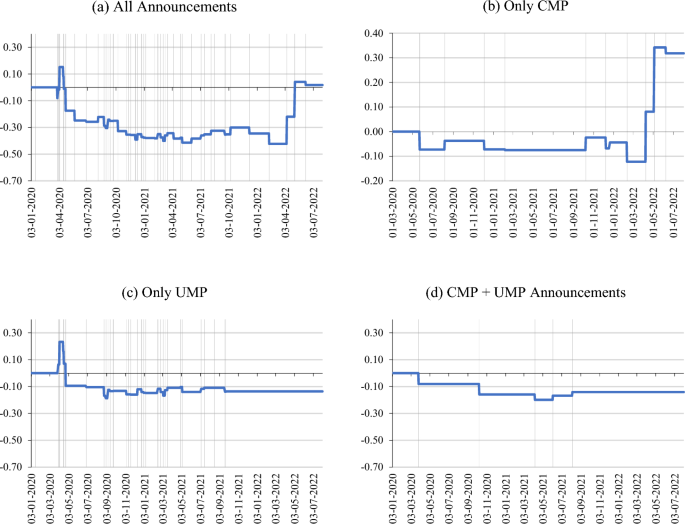

To better understand how bond yields were affected by each RBI announcement, we next plot the cumulative change in 10-year Gsec on RBI announcement days separating again by only conventional, only unconventional and conventional plus unconventional actions.

Figure 1 shows this cumulative change with the top left panel clubbing all RBI announcements together. In the first few weeks of the pandemic, RBI actions surprised markets in both directions, i.e., 10-year GSec went up in late March and then down in early April. After this, the 10-year GSec fell on RBI announcement days from April all the way until mid-2021. The total effect of RBI announcements in the first year and a half of the pandemic was to reduce the 10-year GSec rate by around 40 bps. In other words, long-term interest rates would have been 40 bps higher if not for the surprise monetary policy actions announced by the RBI. From mid-2021 to early 2022, there is no discernible trend in the movement of 10-year GSec on RBI announcement days: interest rates went up on some announcements and went down on others. Starting in April 2022, the RBI started raising interest rates to combat inflation and we can see the corresponding increase in the 10-year GSec.

Source: Authors’ calculations

Cumulative Effect of RBI Announcements on Long-term Interest Rates during the Pandemic. The above plots show the cumulative daily change in the yield on 10-year GSec on a all policy announcement days; b only CMP days; c only UMP days; and d CMP + UMP days during the pandemic sample. The daily change refers to the difference between yields on ‘ t ’ and ‘ t – 1’ day around the policy announcement. The graphs are from January 2020 to July 2022.

The remaining three panels show this cumulative change broken down into the three categories of announcements. Up until then, RBI announcements with only unconventional actions contributed roughly 12 basis points in the 40 basis points mentioned above. CMP only dates contributed roughly 8 basis points and CMP + UMP dates contributed the remaining 20 basis points. Next, we will shed more light on which specific dates and RBI announcements had the biggest impact on the bond market. But we wrap up this discussion by noting that the rise in 10-year yields was driven completely by conventional announcements as the last unconventional policy action in the pandemic occurred on September 2021.

3.1 Impact of the UMP announcements

We explored the yield data, meeting by meeting, and found that there are about 5 announcement days that are responsible for almost the full cumulative 40 basis point change in the 10-year GSec in the first year and a half of the pandemic. Four of these five dates correspond to the announcement of major unconventional actions, two of them correspond to cuts in the repo rate, with one date which saw both unconventional and conventional actions. The unconventional actions include TLTRO 1.0 announcements on March 27 and March 30, 2020, TLTRO 2.0 on April 17 and Operation Twist announcement on April 23. We report these dates in Table 3 together with the two GSAP dates since combined this includes all the major unconventional announcements. See Table 1 for more details of the policy actions announced on these dates.

Table 3 shows the change in the 3-month Treasury Bill (TBill) and the 1-year GSec in addition to the 10-year bond yields. The main purpose of the LTRO was to inject liquidity into the financial system and preserve the orderly flow of credit to households and firms. While this policy was not directly targeting GSec yields, Table 3 shows that it had substantial effects on these yields, especially the first TLTRO 1.0 and first TLTRO 2.0 announcements. The repo operations were of tenors 1 and 3 years. Thus, we would expect the biggest effect around that maturity. But we instead see that there are bigger effects on 3-month (and 6-month which is not shown for brevity) than the 1-year GSec. What could explain this effect?

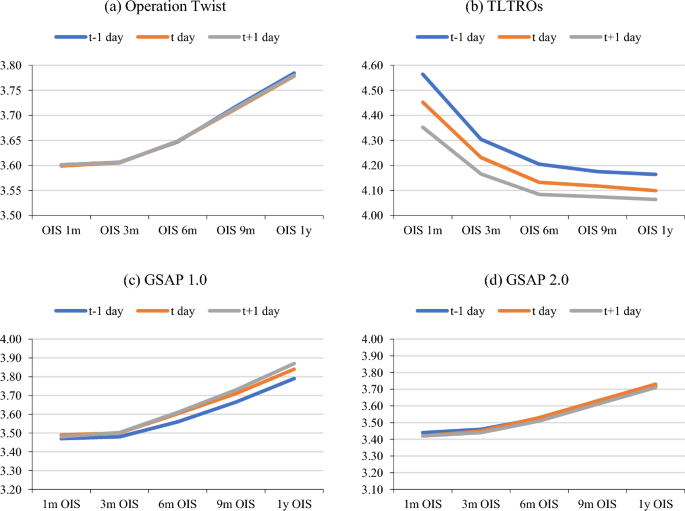

One potential mechanism through which this could have happened is the so-called signaling channel of monetary transmission (see e.g., Bauer & Rudebusch, 2014 ; Krishnamurthy & Vissing-Jorgensen, 2012 ). The idea is that an unconventional monetary policy action is taken by the market as a signal of a more expansionary path for the future path of the policy interest rate. To further investigate whether this channel is more broadly prevalent for all the TLTRO announcements (there were 6 in total), we use data from Overnight Indexed Swaps. OIS interest rates have been shown to be a good proxy for capturing the market’s expectations about future RBI actions (see Lloyd, 2018 ; Rituraj, & Kumar., 2021 ; Talwar et al., 2021 ; Lakdawala & Sengupta, 2021 ).

The top right panel of Appendix Figure 7 shows the average effect of the TLTRO dates on OIS rates of maturity 1 month to 1 year. We show both the 1-day and the 2-day changes. The figure shows that OIS rates of all maturities fell on average on TLTRO dates. This is suggestive evidence of the signaling channel of monetary policy affecting government bond yields through expectations of future interest rate changes. Moreover, we find that the average fall in 1-month OIS rates is roughly 20 basis points while that for 1-year OIS is roughly 10 basis points. This provides further evidence for the signaling channel because absent the signaling channel we would expect the bigger effect to happen around the maturity of the loans that were targeted (i.e., 1 to 3 years). Finally (in results not reported here), we find that the 1-month OIS rate fell more on TLTRO 2.0 announcement relative to the TLTRO 1.0 announcements even though TLTRO 2.0 had a much lower offered amount and subsequent fulfillment. Patra & Bhattacharya ( 2022 ) report that TLTRO 1.0 announcement of Rs. 1 lakh crores were fully availed but that TLTRO 2.0 announcement of Rs. 50,000 crores were only availed to the tune of Rs. 12,850 crores.

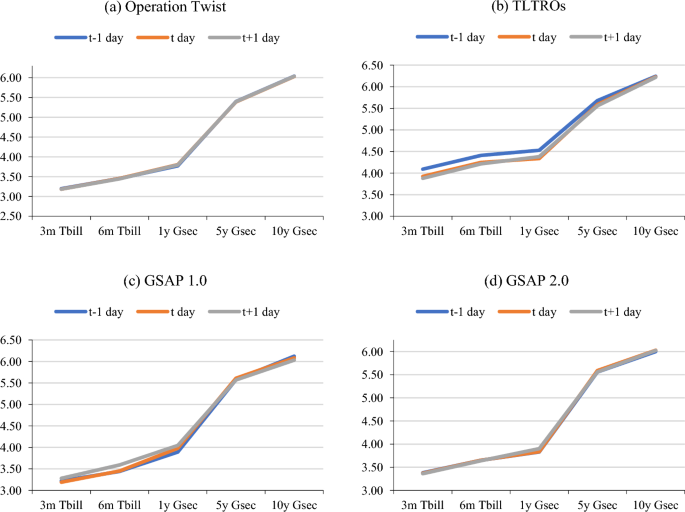

Appendix Figure 7 also investigates whether the signaling channel is present for the other unconventional policy actions. The three other panels show the effect of Operation Twist, GSAP 1.0 and GSAP 2.0. The figure shows that unlike TLTRO, neither OT nor GSAP had any discernible signaling channel effect. Overall, our results point to the signaling channel being an important component of the transmission mechanism of TLTRO but not the other unconventional actions.

Operation Twist (OT) involves the simultaneous open market purchase of government securities at the long-end of the yield curve and open market sales at the short-end. The goal is to lower long-term interest rates while remaining net neutral in terms of liquidity injection into the financial system. Table 3 shows that the first OT announcement on April 23, 2020 was successful in this regard. 10-year GSec yields fell by 16 basis points while there was an increase in 3-month T-bill of about 1 basis point. We might have expected the short end to go up more than just a basis point but here we want to point out that there is a possibility that the direct effect of open market sales at the short end (which would put upward pressure) are being neutralized by the signaling effect of the announcement (which would put downward pressure).

To explore whether all the subsequent OT announcements had similar effects, we plot the average change in GSec yields across all OT announcements in the pandemic sample (there were 22 of these) in Appendix Figure 8 . The figure shows that on average OT announcements did not have the desired effect as there is essentially zero change in the long or the short end of the yield curve on average.

Finally, we note that GSAP 1.0 and 2.0 had negligible effects on the yield curve as seen in Table 3 . Overall, these results suggest that unconventional monetary policy actions undertaken by the RBI had substantial effects in lowering government bond yields. But these effects were mostly clustered toward the beginning of the pandemic.

3.2 Impact of conventional MP announcements

In our analysis so far, we have relied on studying the impact on the bond market exclusively on RBI announcement days. As we argued above, in principle, expanding this analysis to a broader sample is desirable so that we can capture the full effect of RBI actions. However, the downside is that it is difficult to disentangle effects of RBI actions from other factors affecting the economy. We next turn to an analysis that tries to get an idea of how much “action” is going on in between the RBI announcements. In doing this analysis we will also focus on conventional policy actions of changes in short-term interest rates and forward guidance and the role these have played in the RBI’s toolkit since the pandemic.

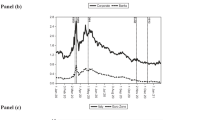

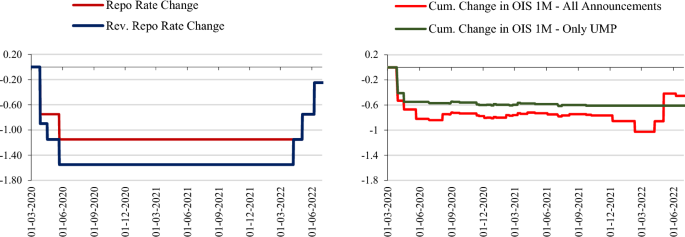

In the first year and a half of the pandemic, the RBI reduced the repo rate cumulatively by 115 basis points (first by 75 basis points on March 27, 2020 and then by 40 basis points on May 22, 2020). The reverse repo rate was cumulatively reduced by 155 basis points (90 bps on March 27, 2020 followed by 25 bps on April 17, 2020 and another 40 bps on May 22, 2020). All these rate decreases actually happened by May 22, 2020. This is shown in the left panel of Fig. 2 . The right panel of the figure shows the cumulative change in the 1-month OIS rate for all RBI announcements in the pandemic in the red line. The figure shows that by the end of May 2020, the 1-month OIS rate had decreased cumulatively by around 82 bps. This means that 82 bps out of the total 115 bps was a surprise to the market (at least in terms of its timing). In other words, around 40 basis point reduction was cumulatively priced in by markets going into RBI meetings. This is evidence that RBI had effectively communicated their future policy stance, in one form or another, to the market. As argued in recent work by Ahmed et al., ( 2022 ) and Lakdawala & Sengupta, ( 2021 ), the RBI’s forward guidance has been an effective tool in the transmission of monetary policy actions to financial markets. Moreover, Garga et al., ( 2022 ) show that since the adoption of flexible inflation targeting, the RBI has been able to credibly commit to the market that it is serious about inflation. Specifically, they show that markets expected RBI to respond more aggressively to respond to inflation since the adoption of inflation targeting.

Cumulative Effect of Policy Announcements on Policy and OIS Rates during the Pandemic. The above plot shows the cumulative daily change in the ( a) policy repo rate and reverse repo rate; and ( b) 1-month OIS rate during the pandemic sample. The daily change refers to the difference between yields on ‘ t ’ and ‘ t – 1’ day around the policy announcement. The graphs are for the period from January 2020 to June 2022.

4 Forward guidance by RBI

The RBI officially described its stance on forward guidance in a document titled “Communication policy of RBI” as follows Footnote 17 :

“ The RBI’s approach to communicating the policy stance is to explain the stance with rationale, information and analysis but to refrain from explicit forward guidance with a preference for market participants and analysts to draw their own inferences. ”

In July 2021, during the pandemic, the RBI updated their communication policy (calling it “Version 2.0”) where they removed the line about “refrain from explicit forward guidance” and replaced it with “ The Reserve Bank explains the monetary policy measures and stance with the rationale, information and analysis to enable market participants and other stakeholders to provide clarity about its assessment of the evolving situation. ” Footnote 18

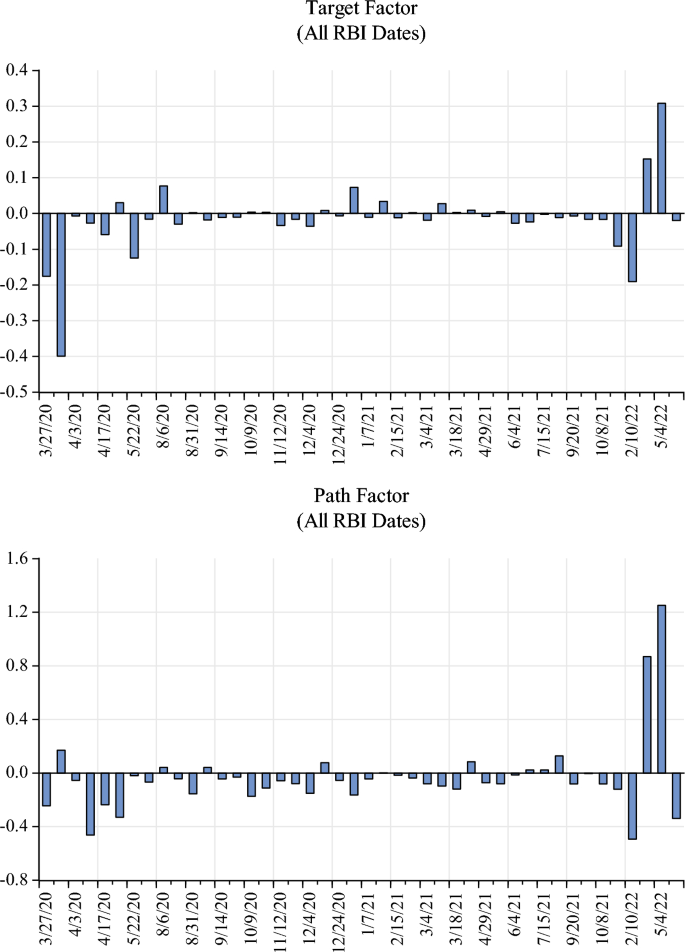

To further understand the role of forward guidance and RBI communication in the pandemic, we follow the approach of Lakdawala and Sengupta ( 2021 ) and use OIS rates to construct the target and path factors in the spirit of Gurkaynak et al., ( 2005 ). The target factor captures surprise changes to the short-term policy rate. This is very similar to the raw changes in the 1-month OIS rates. The path factor is supposed to capture surprise movements in medium-term rates (up to 1-year ahead) over and above the effect coming from short-term rate surprises. This is very highly correlated with the residual from regressing the 1-year OIS rate on the 1-month OIS rate. Figure 3 plots the target and path factor realizations for our pandemic sample from March 2020 to June 2022.

Monetary Policy Surprises during the Pandemic. The above plots show the movement of the target and path factor, constructed using the approach of Lakdawala and Sengupta (2022), on the day of central bank policy announcements. Our sample period is from March 2020 to June 2022.

We conduct a narrative analysis similar to the one described in Sect. 2 , for the top target and path factor dates, wherein we study media reports from the Economic Times to understand whether the biggest changes in the factors during our sample indeed reflected market surprise, either in response to RBI’s policy rate surprises or in response to a change in RBI’s communication or forward guidance. We also read through RBI’s official statements to do a validation check. Our analysis reveals that typically there is a clear and intuitive link between the target/path factor shocks and RBI decisions, communication and related media coverage.

We look at the notable path factor dates to help us understand how the market reacted to the communication from the RBI. For example, the biggest path factor realization in our sample period was on May 4, 2022, when the RBI hiked the policy repo rate by 40 bps in an unscheduled announcement for the first time since it had reduced the rate to 4.0 percent in May 2020. The RBI mentioned in the monetary statement: “Core inflation is likely to remain elevated in the coming months…All these factors impart significant upside risks to the inflation trajectory… the risks to the near-term inflation outlook are rapidly materialising… the MPC expects inflation to rule at elevated levels, warranting resolute and calibrated steps to anchor inflation expectations and contain second round effects.” The substantially positive path factor (1.252) captures this contractionary shock. The unscheduled announcement clearly took the market by surprise as reported by ET: “ the RBI’s decision to act before its scheduled policy meet in June came as a bolt from the blue to markets. ” Footnote 19

Another notable date was October 9, 2020 when over and above announcing on-tap TLTRO (as discussed in the previous section) the RBI gave explicit forward guidance in its monetary policy statement. Instead of the usual reiteration of monetary policy stance (for example, “The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth” as in the August 2020 statement), the October statement mentioned the following:

“The MPC also decided to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis…”

There was no rate action and hence the target factor was almost zero whereas the path factor for this date was – 0.174 reflecting the expansionary shock.

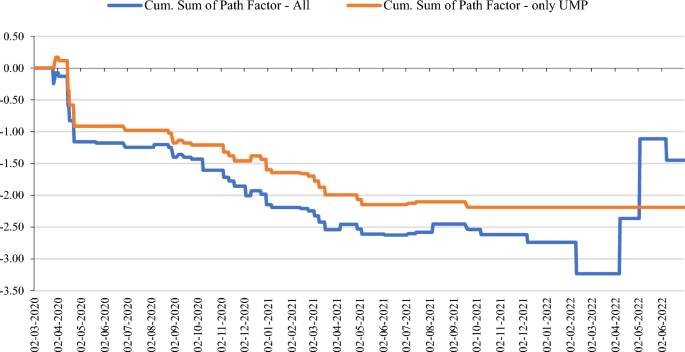

Figure 4 shows the cumulated surprises of the path factor for the full pandemic sample. The blue line shows the cumulative changes on all announcement days while the orange line depicts only unconventional announcement days. There are a few interesting things to point out from this graph. First, we showed in Fig. 2 above that expansionary surprise changes to the short-rate were clustered in the beginning of the pandemic and that by mid-2021 the cumulated 1-month OIS rate had bottomed out, staying there until the hiking cycle in 2022. For the path factor, the story is quite different. While path factor surprises do trend downward in the first few months of the pandemic, they continue to fall over the entirety of the pandemic. This suggests that forward guidance shocks continued to have an expansionary effect on market interest rates in the latter part of 2021 and early 2022. Second, when comparing the blue and the yellow line, we notice that they are surprisingly close to each other. The orange line only considers the unconventional monetary policy announcements. The fact that the orange line is so close to the blue line suggests that most of the effect of forward guidance happened on days with unconventional monetary policy announcements. This is further evidence that the signaling channel of monetary policy is at play. Since unconventional monetary policy actions ceased in September 2021, we see that the contractionary forward guidance shocks in mid-2022 were all on RBI announcements about conventional actions.

Cumulative Effect of Policy Announcements on the Path Factor Surprises during the Pandemic. The above plot shows the cumulative sum of the path factor during the pandemic sample on all announcement days and only UMP announcement days, in solid blue and solid orange line, respectively. Our sample period is from March 2020 to June 2022.

Since forward guidance appears to be an important component of the RBI toolkit in the pandemic, next we formally evaluate the direct effect of forward guidance shocks on the bond market. We conduct this analysis using an event-study framework of regressing changes in government bond yields on the target and path factors calculated from OIS rate changes on RBI announcement days. Details on data and sources have been provided in the Appendix. Summary statistics for the target and path factors for the pandemic sample together with a pre-pandemic sample that runs from January 2016 to February 2020 are shown in Appendix Table 9 . The table shows that the properties of the target and path factor in the pandemic sample are qualitatively similar to the pre-pandemic sample.

In Tables 4 and 5 , we present the results of regressing GSec yields (3-month, 1-year and 10-year) on the target and path factors. Table 4 shows the results for a pre-pandemic sample from January 2016 to February 2022. Focusing on the response of the 10-year GSec yields, we notice that only the target factor is statistically significant. Moreover, the size of the target factor coefficient and the associated R 2 are much bigger relative to the path factor. This suggests that bond markets were responding mainly to surprise changes in the RBI’s short-term interest rate changes rather than any forward guidance. In the pandemic sample, the story is quite different. Now only the path factor is significant, and it explains substantially more of the variation in the 10-year GSec yields.

We conduct several robustness checks. First, for the pandemic sample, we include a daily measure of global risk aversion and uncertainty proposed by Bekaert et al. ( 2022 ) to control for global factors that maybe influencing domestic bond yields during the pandemic period. We report the results in Appendix Table 11 . The path factor continues to be statistically significant implying our main result is robust to this specification. We also estimate the model using US VIX index as a proxy for uncertainty/risk aversion and our results hold. We do not report the results here for brevity. Next, we drop all such observations where announcements by the RBI were immediately preceded by policy announcements from the Federal Open Market Committee (FOMC) of the US Fed and/or the European Central Bank (ECB). Footnote 20 In such cases, announcements by the FOMC or the ECB could drive the changes in domestic bond yields. Shown in Appendix Table 12 , we find that our results are also robust to dropping such observations. Thus, we conclude that the RBI’s forward guidance has been effective in driving long-term interest rates in the pandemic sample.

5 Conclusion

In recent years, unconventional monetary policies have been used regularly by central banks in advanced countries. However, some of the pandemic era monetary policies implemented by the RBI were new and untested in the Indian context. In this paper, we investigated the bond market response to these policies. Combining a narrative analysis with an event-study framework, we find that the RBI’s actions were responsible in keeping long-term interest rates low, especially at the beginning of the pandemic. We find that some of the unconventional monetary policy actions had a substantial signaling channel component where the market perceived the announcement of an unconventional monetary policy action as representing a lower future path for the short-term policy rate. We also find that the RBI’s forward guidance was more effective in the pandemic than it had been in the couple of years preceding the pandemic.

In addition to documenting the effects of these policies, our results have implications for the design of future monetary policy. One important finding is that unconventional measures implemented at the beginning of the pandemic were more effective than those that happened a year into the pandemic. Moreover, the initial announcements of the unconventional actions were more effective than subsequent expansions of the programs. Thus, a potential policy implication for the RBI is to strike quickly in response to the next crisis but also to wind down quickly.

Data availability

The financial market data, such as government bond yields and overnight indexed swaps (OIS), used in this study were sourced from Bloomberg and Thomson Reuters. Restrictions apply to the availability of this data which were used under license and so are not publicly available. Dataset on monetary policy announcements made by the Reserve Bank of India (RBI) was constructed using publicly available information on RBI's official website (www.rbi.org.in). The dataset constructed for the purpose of this study, including information on monetary policy announcements and target/path factors, are publicly available on the authors' website.

During the pandemic, the growth rate of non-food bank credit fell dramatically (to six decades low of around 5–6 percent) owing to heightened risk aversion in the banking sector, and hence transmission through this channel was seriously impaired.

Only exception being the usage of Operation Twist since December 2019 and the announcement of Long-term repo operations in February 2020.

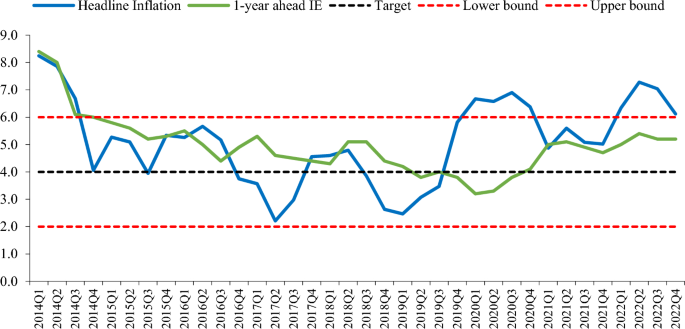

The official inflation target in India has been fixed at 4% headline CPI inflation with a ± 2% band on either side. As Appendix Figure 5 shows, barring a brief spell in 2021, headline inflation has been consistently above the 6% upper threshold of the inflation targeting band in recent years. Even in 2021, inflation remained closer to the upper threshold rather than the target level of 4%. One-year ahead inflation expectations were also above the target level during our sample period.

See for example the RBI Governor’s statement of October 9, 2020: “ As the monetary policy authority with the responsibilities for development and regulation of financial markets and the management of public debt, the RBI has prioritised the orderly functioning of markets and financial institutions, easing of financing conditions and the provision of adequate system-level as well as targeted liquidity. This is important from the point of view of smooth and seamless transmission of monetary policy impulses as well as the completion of market borrowing programmes of the centre and states in a non-disruptive manner with a normal evolution of the yield curve. Since February 2020, the RBI has taken a series of measures in this direction. ”

We restrict our analysis to government bonds in this study. Ideally, we would have liked to analyse the response of the corporate bond yields as well, but in India, the secondary market for corporate bonds is highly illiquid with the average daily trading volume less than 1 percent of the total outstanding bonds.

With the shift in focus of the RBI to inflation stabilization in the later part of the pandemic, it is natural to wonder if this changed the monetary transmission mechanism. However, due to a short sample, we do not test if the monetary transmission of target and path factors to bond yields changed but it is an interesting question left for future research.

See for example Agarwal ( 2007 ), Sasidharan ( 2009 ), Prabu et al. ( 2016 ), Khuntia and Hiremath ( 2019 ), Das et al., ( 2020b ), Lakdawala and Sengupta ( 2021 ) and Ahmed et al. ( 2022 )

https://economictimes.indiatimes.com/markets/stocks/news/rbi-brings-out-heavy-artillery-to-fight-corona-crisis-heres-what-experts-say/articleshow/74841412.cms .

https://economictimes.indiatimes.com/markets/stocks/news/rbi-to-step-up-liquidity-measures/articleshow/75150864.cms .

https://economictimes.indiatimes.com/markets/stocks/news/economists-hail-rbi-steps-say-tltro-2-0-a-much-needed-move/articleshow/75197723.cms .

https://economictimes.indiatimes.com/markets/stocks/news/rbi-signals-rate-cuts-as-it-boosts-liquidity/articleshow/75206649.cms .

https://economictimes.indiatimes.com/markets/bonds/rbi-special-operation-leaves-traders-wary-but-bonds-rally/articleshow/75327136.cms .

https://economictimes.indiatimes.com/opinion/et-view/et-view-welcome-steps-by-rbi-it-can-surely-do-more/articleshow/75895544.cms .

https://economictimes.indiatimes.com/news/economy/policy/rbis-monetary-policy-committee-begins-deliberations-to-announce-policy-review-on-friday/articleshow/78532290.cms .

https://economictimes.indiatimes.com/news/economy/policy/reserve-bank-expected-to-hold-rates-this-week/articleshow/81904477.cms .

During the pandemic, monetary policy communication by the MPC were accompanied with the announcement of policy measures related to other functions of the RBI, such as regulation, supervision, payments systems etc., by the RBI Governor. These announcements were made under a separate “Statement on Developmental and Regulatory Policies”. To that extent, several unconventional monetary policy measures were also announced under such statements and press releases issued by the RBI. We take this into account by separate classification of announcement days as described in the paper. Lastly, since the additional policy measures announced as a part of the separate statement focus on other areas of central banking functions, such as payments systems, banking regulation and supervision, it is assumed not to have any significant impact on bond markets.

This archived document can be accessed at https://web.archive.org/web/20181029064140/https://rbi.org.in/Scripts/CommunicationPolicy.aspx .

This new policy can be found at https://bit.ly/2V6sCIm .

https://economictimes.indiatimes.com/markets/stocks/news/key-takeaways-from-surprise-rbi-rate-hike-what-investors-should-look-for/articleshow/91319104.cms .

We find that there were three days when RBI announcements were preceded by FOMC/ECB announcements—(a) RBI’s December 11, 2020 announcement was preceded by ECB announcement of December 10, 2020; (b) Policy announcement by RBI on March 18, 2021 and April 29, 2021 were preceded by announcement of FOMC’s decision on March 17, 2021 and April 28, 2021. We also find two overlapping policy days between RBI and FOMC, namely November 05, 2020 and May 04, 2022. However, these dates should not matter for Indian bond market given the time zone difference.

Agarwal, Gaurav (2007) “Monetary policy announcements and stock price behavior: empirical evidence from CNX Nifty.,” Decision (0304–0941), 34 (2).

Ahmed, F., Binici, M., & Turunen, J. (2022). Monetary policy communication and financial markets in India. IMF Working Papers , 2022 (209), International Monetary Fund, Washington, USA.

Bauer, M., & Rudebusch, G. D. (2014). The signaling channel for Federal Reserve bond purchases. International Journal of Central Banking .

Bekaert, G., Engstrom, E. C., & Xu, N. R. (2022). The time variation in risk appetite and uncertainty. Management Science, 68 (6), 3975–4004.

Article Google Scholar

BIS (2019), Unconventional monetary policy tools: a cross country analysis, bank for international settlements, CGFS papers No 63, October

Das, S., Ghosh, S., & Kamate, V. (2020a). Monetary policy and financial markets: twist and tango. RBI Bulletin, August 2020a, Reserve Bank of India, Mumbai, India.

Das, S., Surti, J., & Tomar, S. (2020b). Does inflation targeting help information transmission? Available at SSRN: https://ssrn.com/abstract=3701541 .

Dua, P. (2020). Monetary policy framework in India. Indian Economic Review, 55 (1), 117–154.

Garga, V., Lakdawala, A., & Sengupta, R. (2022). Assessing central bank commitment to inflation targeting: evidence from financial market expectations in India. IGIDR working papers WP-2022–017, Indira Gandhi Institute of Development Research (IGIDR), Mumbai, India. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4245158 .

Gürkaynak, R. S., Sack, B., & Swanson, E. (2005). The sensitivity of long-term interest rates to economic news: evidence and implications for macroeconomic models. American Economic Review, 95 (1), 425–436.

Khuntia, S., & Hiremath, G. S. (2019). Monetary policy announcements and stock returns: some further evidence from India. Journal of Quantitative Economics, 17 (4), 801–827.

Krishnamurthy, A., & Vissing-Jorgensen, A. (2012). The aggregate demand for treasury debt. Journal of Political Economy, 120 (2), 233–267.

Lakdawala, A., & Sengupta, R. (2021). Measuring monetary policy shocks in India. IGIDR Working papers WP-2021–021, Indira Gandhi Institute of Development Research (IGIDR), Mumbai, India. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3905642 .

Lloyd, S. P. (2018). Overnight index swap market-based measures of monetary policy expectations. Staff working paper No. 709, Bank of England, London, UK.

Mathur, A., & Sengupta, R. (2019). Analysing monetary policy statements of the Reserve Bank of India. IGIDR working papers WP-2019–012, Indira Gandhi Institute of Development Research (IGIDR), Mumbai, India. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3383869 .

Patra, M. D., & Bhattacharya, I. (2022). Priming monetary policy for the pandemic. Economic and political weekly, 57 (20).

Prabu A, E., Bhattacharyya, I., & Ray, P. (2016). Is the stock market impervious to monetary policy announcements: Evidence from emerging India. International Review of Economics & Finance, 46 (C), 166–179.

Rebucci, A., Hartley, J. S., & Jiménez, D. (2022). An event study of COVID-19 central bank quantitative easing in advanced and emerging economies. In Essays in honor of M. Hashem Pesaran: prediction and macro modeling . Emerald Publishing Limited.

Rituraj, & Kumar, A. V. (2021). Assessing the markets’ expectations of monetary policy in india from overnight indexed swap rates. RBI Bulletin , February 2021, Reserve Bank of India, Mumbai, India.

Sasidharan, Anand (2009) “Stock market’s reaction to monetary policy announcements in India,” MPRA paper 24190, University Library of Munich, Germany.

Talwar, A. B., Kushwaha, K. M., & Bhattacharya, I. (2021). Unconventional monetary policy in times of COVID-19. RBI Bulletin, March 2021, Reserve Bank of India, Mumbai, India.

Download references

Acknowledgements

We would like to thank the guest editor Kundan Kishor and two anonymous reviewers for their helpful comments and suggestions. The views expressed in this paper are those of the authors and do not necessarily represent the views of the organizations that they represent

No funding was received to assist with the preparation of this manuscript.

Author information

Authors and affiliations.

Wake Forest University, Winston-Salem, NC, USA

Aeimit Lakdawala

Reserve Bank of India, Mumbai, India

Bhanu Pratap

Indira Gandhi Institute of Development Research, Mumbai, India

Rajeswari Sengupta

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Bhanu Pratap .

Ethics declarations

Conflict of interest.

The corresponding author states that there is no conflict of interest. The authors have no competing interest to declare that are relevant to the content of this article.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Figs. 5 , 6 , 7 and 8 , Tables 6 , 7 , 8 , 9 , 10 , 11 and 12 .

Source: Reserve Bank of India

Actual and Expected Inflation in India. The above chart shows the quarterly headline inflation and one year ahead expected inflation rate for India for Q1:2014 to Q4:2022. Headline inflation, shown by solid blue line, is measured in terms of year-on-year percentage change in consumer price index (CPI-combined). Inflation expectations, shown by solid green line, were taken from the Survey of Professional Forecasters (SPF) conducted by the RBI. The official target rate of inflation at 4 per cent, along with the ± 2 per cent band, is shown using dotted black and red lines, respectively.

Source: Bloomberg

Long-term Interest Rates (10-Year Benchmark Government Bond Yield) in India. The above figure shows the daily yield on 10-year Government Securities (GSec) for the period beginning March 2020 and ending in August 2022.

Source: Authors’ calculations; Bloomberg

Impact of unconventional monetary policy announcements on OIS rates: the signaling channel of monetary policy. The above figure shows the OIS yield curve one day prior ( t – 1), same day ( t ) and one day after ( t + 1) the announcement of ( a) Operation Twist (OT) or simultaneous sale-purchase operations; ( b) Targeted Long-term Repo Operations (TLTROs); ( c) G-Sec Acquisition Programme 1.0; and ( d) G-Sec Acquisition Programme 2.0. Our sample period is from March 2020 to June 2022.

Impact of unconventional monetary policy announcements on sovereign bond yield curve. The above figure shows the government securities yield curve one-day prior ( t – 1), same day ( t ) and one day after ( t + 1) the announcement of ( a) Operation Twist (OT) or simultaneous sale-purchase operations; ( b) Targeted Long-term Repo Operations (TLTROs); ( c) G-Sec Acquisition Programme 1.0; and ( d) G-Sec Acquisition Programme 2.0. In case of multiple announcements, rates have been averaged across all announcements. Our sample period is from March 2020 to June 2022. Source: Authors’ calculations; Bloomberg

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Lakdawala, A., Pratap, B. & Sengupta, R. Impact of RBI’s monetary policy announcements on government bond yields: evidence from the pandemic. Ind. Econ. Rev. 58 (Suppl 2), 261–291 (2023). https://doi.org/10.1007/s41775-023-00171-2

Download citation

Accepted : 04 April 2023

Published : 20 May 2023

Issue Date : September 2023

DOI : https://doi.org/10.1007/s41775-023-00171-2

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Monetary Policy, Reserve Bank of India

- Unconventional Monetary Policy

- Bond Yields

- Forward Guidance

JEL Classification

- Find a journal

- Publish with us

- Track your research

There have been recent incidents of individuals and groups falsely claiming to be associated with AQR on social media platforms. These imposters have engaged in a variety of unauthorized conduct, including soliciting customers to carry out trading activities with them, impersonating AQR using the genuine names of AQR senior executives or employees to offer investment opportunities, claiming to offer investment training courses that are supposedly provided by AQR or claiming that AQR is backing certain initial coin offerings or is otherwise engaged in crypto related trading activity. There have also been fake websites and mobile applications that claim to be AQR (or associated with AQR) when in fact they are not. These are scams and not authorized by AQR in any way.

Please be aware that AQR does not engage in any investment activities, provide training or financial services, or conduct other regulated activities through social media platforms or messaging apps. Similarly, AQR, its executives and employees do not contact prospects, clients or members of the public via social media platforms or messaging apps such as WhatsApp, Discord and Telegram to offer investment opportunities. AQR does not offer direct investments in cryptocurrencies or other digital assets, it does not provide a trading platform to members of the public, it does not have a mobile app, and it does not offer investment training courses to the public.

AQR and its partners, employees, directors, officers, advisors, successors, and agents are not responsible for any conduct by unauthorized parties and channels, nor are they responsible for the services or information provided by such unauthorized parties and channels. If you have any questions or wish to ascertain whether you are communicating with an authorized representative of AQR, please contact us at https://www.aqr.com/Contact-Us . If you believe that you or someone you know has been a victim of fraud, please report the matter to your local law enforcement or other relevant authorities. For India residents, you may lodge a report at the national cybercrime reporting portal ( https://cybercrime.gov.in ).

- Featured Thinking

- Cliff's Perspectives

- Alternative Thinking

- Learning Center

- Quick Takes

- Alternatives

- Investment Vehicles

- Academic Engagement

- Log In Register

An August of Discontent

September 5, 2024 - Jordan Brooks Jonathan Fader

We cover why investors should not shrug off the August market reversal as a blip. In an environment of continued macroeconomic uncertainty, episodes of volatility will likely persist. We discuss the importance of building a well-diversified portfolio that is resilient to a wide range of future economic scenarios.

Portable Alpha: Still A Great Solution For Improving Return Outcomes

July 30, 2024 - Portfolio Solutions Group

In the face of lower-than-average expected returns for equities, some investors may be considering adding active management to their equity allocations. However, the evidence supporting active long-only equities has long been underwhelming. We review an alternative approach – portable alpha.

Levering Up to Do Good

July 9, 2024

Long/short tax aware strategies can be a win-win for the charitably inclined: larger donations for the charity and larger tax benefits for the donor.

Machine Learning

Can Machines Time Markets? The Virtue of Complexity in Return Prediction

May 6, 2024 - Portfolio Solutions Group

Common wisdom has suggested that small, simple models are best suited for market timing applications, given finance’s “small data” constraint and naturally low predictability. However, we show that complex models better identify true nonlinear relationships and therefore produce better market timing strategy performance. We validate this "virtue of complexity" result in three practical market timing applications.

Levering Up to Do Good: Direct Long-Short Investing and Charitable Giving

April 23, 2024 - Stanley Krasner Joseph Liberman Nathan Sosner Sydney Filler

We use historical strategy simulations to evaluate the advantages of donating appreciated stock in the context of tax-aware long-short factor strategies. We find long-short strategies exhibit several advantages over long-only investments.

A 3-for-1 Solution for Concentrated Stock

April 9, 2024

Long/short tax-aware factor strategies may provide the means to offset gains resulting from a transition from a concentrated stock to a diversified portfolio.

Annual ESG Report 2023

March 25, 2024

AQR Factor Research Papers Win Prestigious Academic Awards

March 12, 2024

Factor investing (combined with tax-aware implementation) can offer investors substantial rewards in the form of both pre-tax returns and tax benefits. Two papers by our colleagues recently won highly prestigious awards from top academic and practitioner journals for their research on factor investing, demonstrating our commitment to top-notch factor research.

Combining VPFs and Tax-Aware Strategies to Diversify Low-Basis Stock

March 7, 2024 - Joseph Liberman Nathan Sosner

We illustrate how combining VPFs (variable prepaid forwards) with tax-aware strategies can help diversify low-basis stock and thereby improve after-tax wealth accumulation. Long-run after-tax wealth outcomes are significantly better when a VPF is combined with tax-aware long-short factor strategies rather than with other alternatives, such as a direct-indexing strategy or a market index fund.

ESG Investing

In Search of the True Greenium

March 1, 2024 - Marc Eskildsen Markus Ibert Theis Ingerslev Jensen Lasse H. Pedersen

The greenium (the expected return of green securities relative to brown) is a central impact measure for ESG investors. We propose a robust green score combined with forward-looking expected returns, yielding a more precisely estimated annual equity greenium.

You are now leaving AQR.com

AQR Capital Management, LLC, (“AQR”) provides links to third-party websites only as a convenience, and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. If you choose to visit the linked sites, you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies, over which AQR.com has no control. In no event will AQR be responsible for any information or content within the linked sites or your use of the linked sites.

You are about to leave AQR.com and are being re-directed to the {siteName}. Please note that {siteName} site may be subject to rules and regulations that may differ significantly from those to which the AQR website is subject and may not be appropriate for use by residents in all jurisdictions. Your access to and use of the {siteName} site will be subject to the applicable Terms of Use posted on the site.

Understanding Bond Paper: Origins, Features, Uses and Buying Guide

Ever found yourself standing in an office supply store, staring at the reams of paper with a puzzled look? You’re not alone. The world of paper types can be confusing, especially when terms like ‘bond paper’ are thrown around. But don’t worry, you’re about to unravel this mystery.

Bond paper, despite its rather fancy name, is a staple in most offices and homes. But what exactly is it, and why is it so widely used? If you’ve ever wondered about this, you’re in the right place. This article will shed light on the ins and outs of bond paper, its unique characteristics, and its various uses. So buckle up and get ready for a deep dive into the world of bond paper.

Key Takeaways

- Bond paper is a high-quality, durable paper type originally used for printing bond or debt certificates. It is heavier, stronger, and more resilient than regular paper, making it ideal for professional documents such as business letterheads, reports, and resumes.

- A key characteristic of bond paper is its basis weight. This refers to the weight of 500 sheets (a ream) of 17×22-inch paper, measured in pounds (lbs). The weight of bond paper typically ranges from 20 to 32 lbs, with a higher weight signifying increased thickness and sturdiness.

- The versatility of bond paper is evident in its wide range of uses, from student notebooks and large scale banners, to important business documents. It’s particularly favored for inkjet and laser printers due to its smooth surface, which allows for clear text and detailed images.

- Bond paper is used heavily across academic, commercial, and home applications. In academic settings, it’s preferred for student notebooks, assignments, and so on. Commercially, it’s used for meeting notes, reports, presentations, etc. At home, it’s often used for printing needs like invitations or homemade business cards.

- Unique features of bond paper include high tensile strength, superior printing quality, versatility, good ink absorption and drying properties, and availability in different weights and sizes. This selection of features gives better results across various printing applications.

- Choosing the right bond paper involves considering the paper size, weight, finish, printer compatibility, and product quality. Generally, lighter bond paper is used for general office work, while heavier bond paper is better suited for formal documents and presentations.

- Recyclability and sustainable sourcing are significant environmental advantages of using bond paper. A high percentage of post-consumer waste is used in its production, and it helps reduce greenhouse gas emissions.

- The pros and cons of using bond paper revolve around its superior printability, enhanced durability, wide usability, cost considerations, printer compatibility issues, lack of waterproofing, and limited options for creative prints.

What is Bond Paper: A Brief Overview

In the realm of paper, bond paper holds a significant position. Originally, it found its use in printing bond or debt certificates, hence the moniker. Created with durability in mind, bond paper exhibits higher-end characteristics that set it apart from regular paper. It’s heavier, stronger, and more resilient, making it ideal for documents that require a professional touch – think business letterheads, resumes or official reports.