How to Write a Marketing Research Objective

We all know the old adage: is marketing is an art or a science?

At Seer, we think it’s both. But not necessarily both at the same time. We believe the better question is: which comes first in marketing, art or science?

And if you ask us that question, we’d tell you it’s a science first.

"The science of marketing is all about using data and insights to drive your strategy. The art of marketing is how you express that strategy."

Now that we know we are starting with science, what does that mean exactly?

Well, remember when you were in school and you had to come up with your own science research experiment? Remember what came first? The objective. Why? Because without an objective, you don’t have a testable proposition. And without a testable proposition, you don’t have direction. And we all know that when research doesn’t have a direction, it typically doesn’t garner any groundbreaking takeaways.

So, what does your high school science experiment have to do with marketing research?

Similar to the traditional objective, a great marketing research plan starts with a strong objective. One that is focused, measurable, and effective. Without a clear objective, your marketing research will not be as successful.

What is a Marketing Research Objective?

[TIP] By definition, a "Research Objective" is a statement of purpose that outlines a specific result to achieve within a dedicated time frame and available resources.

Applying this logic to marketing, a marketing research objective is a statement that outlines what you want to know about your customer. Clearly defining your objective at the beginning stages will help you avoid conflicting expectations or wasted collecting irrelevant data.

How Do You Create a Marketing Research Objective?

Start at the end. I know it sounds counterintuitive, but if you start with the desired outcome, you will be able to create a more focused objective. What’s the one thing you want to be able to take away from this research? What do you plan to do with the information? What does success look like? Use this objective as your compass while you navigate your research and analysis.

Typically, it’s easiest to do this in the form of a question. Here are a few examples.

- Example 1: Which features in Product X are most important to our Enterprise customers?

This question will give you a list of features, in order of importance, for your Enterprise customer.

- Example 2: What are the different search triggers amongst our four customer segments?

This question will result in a list of common factors that result in users searching for Service Y.

When you start seeing all the data points, behaviors, and survey responses - curiosity can set in.

An abundance of data can pull you in multiple directions because each finding is interesting in its own right. That’s when your objective comes in. Know the end result you are working toward and stay on that path.

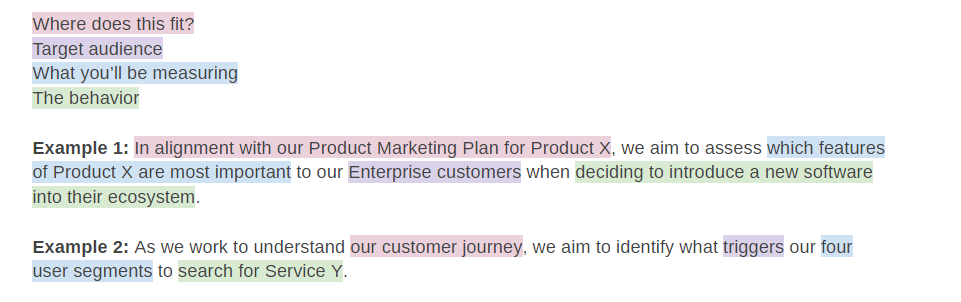

Creating a Research Objective

Once you’ve got your desired outcome, you’ll want to create your objective. A few things to consider as you create your statement:

- Where does this fit into your marketing strategy? Where does this objective fit into your larger marketing strategy? Not only is this helpful when dispersing information internally or getting buy-in, it keeps the research team focused on the higher business objectives attached to this research. Is this part of your company’s focus on brand awareness? A new product launch? An analysis of competitors? These are all very different things.

- Include your target audience. Typically, it’s difficult to understand everything with every user segment so pick which segment you plan to analyze. Is it your Enterprise customers? Customers living in a specific region? A certain demographic segment? Including this in your objective will be a helpful gut check when choosing participants.

- What will you measure? You don’t need to list out all of the data points you plan to measure, but there should be some measurable element in your objective. Is it sentiment? Are you looking for frequencies? What about behavioral trends? Including this in your objective will ensure you pick the most appropriate research methodology to acquire that measurable element.

- A behavior. What is the behavior or action that we are going to be researching? Is navigating your website? Is it purchasing a product? Is it clicking on an ad?

Let’s look at some examples:

Common Marketing Research Objective Pitfalls

While creating an objective may seem relatively straightforward, it can be easy to get wrong. Let’s go over some of the common pitfalls.

Objective is Too Broad

Now, if you follow the outline above, this shouldn’t be an issue because it forces you to get granular with your objective.

- Specific: As part of our rebranding, we are conducting a sentiment analysis with our recurring customers

- Broad: As part of our rebranding, we will ask customers how they feel about it

We want to avoid broad objectives because they can allow curiosity to get the best of us and a once seemingly clear research project can get muddied.

More Than One Objective

Every research project should have one objective and one objective only. Again, while this may seem easy enough to manage, you’d be surprised just how easy it is to sneak those secondary and tertiary objectives into your statement.

- One objective: We aim to understand what questions our customers have when considering purchasing a car

- Two objectives: We aim to understand what questions our customers have when searching for and considering a car

You see, the questions customers may have when searching for a car could be completely different than the questions they have when considering purchasing a car.

Making Assumptions

Avoid making your objective into a hypothesis with absolute statements and assumptions. Your objective should be more of a question than a prediction. That comes later.

- Objective: Uncover the purchase journey of our target demographic

- Assumption: Uncover what part search plays in the purchase journey of our target demographic

This looks unsuspecting, but in reality, we're already assuming that search plays a role in our audience's journey. That could sway the focus of the research.

Once you’ve created your objective, let it (and only it) drive the beginning stages of your marketing research.

Write it on a post-it and stick it on your desk, write it on the whiteboard at every meeting you have, keep it top of mind as you continue your research. It will serve as a compass and help you avoid being led astray by interesting data, curious colleagues, and conflicting agendas.

More Tips for Understanding Your Audience

Check back on the Seer blog for the next installment from our Audience team. Sign up for our newsletter to read the latest blogs on audience, SEO, PPC, and more.

We love helping marketers like you.

Sign up for our newsletter to receive updates and more:

Related Posts

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

6.3: Steps in a Successful Marketing Research Plan

- Last updated

- Save as PDF

- Page ID 99245

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Learning Objectives

By the end of this section, you will be able to:

- Identify and describe the steps in a marketing research plan.

- Discuss the different types of data research.

- Explain how data is analyzed.

- Discuss the importance of effective research reports.

Define the Problem

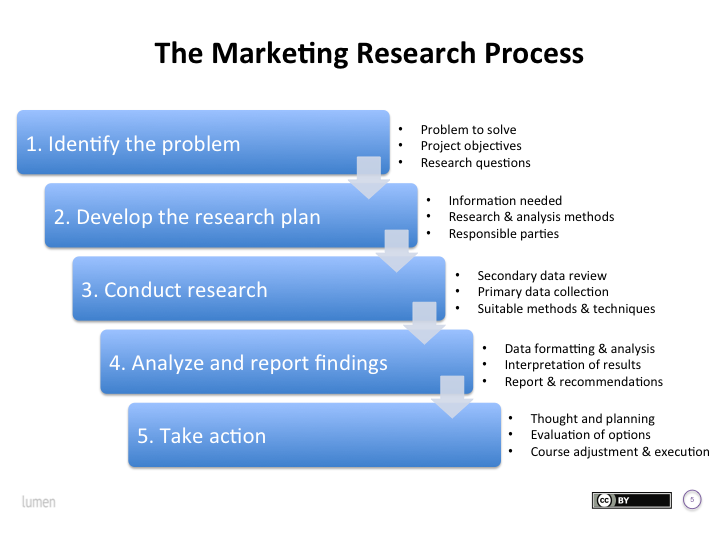

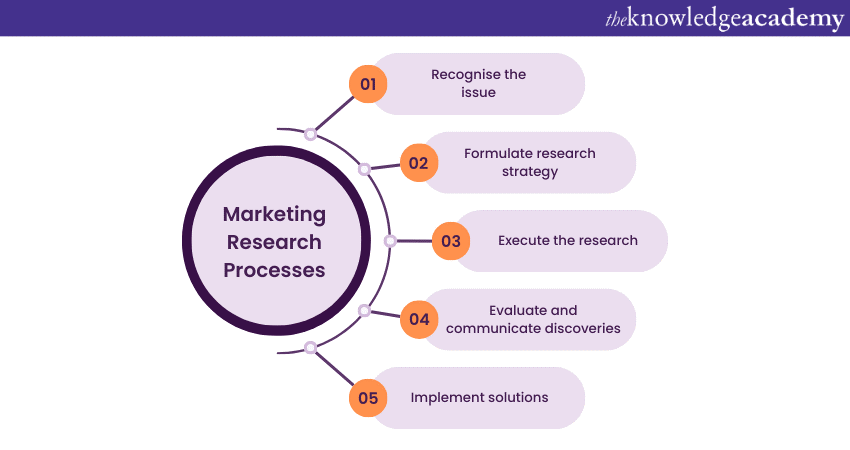

There are seven steps to a successful marketing research project (see Figure 6.3). Each step will be explained as we investigate how a marketing research project is conducted.

The first step, defining the problem, is often a realization that more information is needed in order to make a data-driven decision. Problem definition is the realization that there is an issue that needs to be addressed. An entrepreneur may be interested in opening a small business but must first define the problem that is to be investigated. A marketing research problem in this example is to discover the needs of the community and also to identify a potentially successful business venture.

Many times, researchers define a research question or objectives in this first step. Objectives of this research study could include: identify a new business that would be successful in the community in question, determine the size and composition of a target market for the business venture, and collect any relevant primary and secondary data that would support such a venture. At this point, the definition of the problem may be “Why are cat owners not buying our new cat toy subscription service?”

Additionally, during this first step we would want to investigate our target population for research. This is similar to a target market, as it is the group that comprises the population of interest for the study. In order to have a successful research outcome, the researcher should start with an understanding of the problem in the current situational environment.

Develop the Research Plan

Step two is to develop the research plan. What type of research is necessary to meet the established objectives of the first step? How will this data be collected? Additionally, what is the time frame of the research and budget to consider? If you must have information in the next week, a different plan would be implemented than in a situation where several months were allowed. These are issues that a researcher should address in order to meet the needs identified.

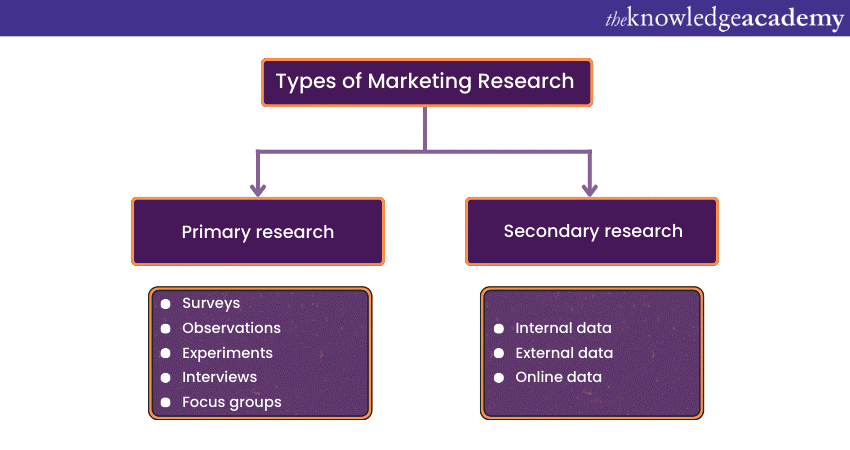

Research is often classified as coming from one of two types of data: primary and secondary. Primary data is unique information that is collected by the specific researcher with the current project in mind. This type of research doesn’t currently exist until it is pulled together for the project. Examples of primary data collection include survey, observation, experiment, or focus group data that is gathered for the current project.

Secondary data is any research that was completed for another purpose but can be used to help inform the research process. Secondary data comes in many forms and includes census data, journal articles, previously collected survey or focus group data of related topics, and compiled company data. Secondary data may be internal, such as the company’s sales records for a previous quarter, or external, such as an industry report of all related product sales. Syndicated data , a type of external secondary data, is available through subscription services and is utilized by many marketers. As you can see in Table 6.1, primary and secondary data features are often opposite—the positive aspects of primary data are the negative side of secondary data.

There are four research types that can be used: exploratory, descriptive, experimental, and ethnographic research designs (see Figure 6.4). Each type has specific formats of data that can be collected. Qualitative research can be shared through words, descriptions, and open-ended comments. Qualitative data gives context but cannot be reduced to a statistic. Qualitative data examples are categorical and include case studies, diary accounts, interviews, focus groups, and open-ended surveys. By comparison, quantitative data is data that can be reduced to number of responses. The number of responses to each answer on a multiple-choice question is quantitative data. Quantitative data is numerical and includes things like age, income, group size, and height.

Exploratory research is usually used when additional general information in desired about a topic. When in the initial steps of a new project, understanding the landscape is essential, so exploratory research helps the researcher to learn more about the general nature of the industry. Exploratory research can be collected through focus groups, interviews, and review of secondary data. When examining an exploratory research design, the best use is when your company hopes to collect data that is generally qualitative in nature. 7

For instance, if a company is considering a new service for registered users but is not quite sure how well the new service will be received or wants to gain clarity of exactly how customers may use a future service, the company can host a focus group. Focus groups and interviews will be examined later in the chapter. The insights collected during the focus group can assist the company when designing the service, help to inform promotional campaign options, and verify that the service is going to be a viable option for the company.

Descriptive research design takes a bigger step into collection of data through primary research complemented by secondary data. Descriptive research helps explain the market situation and define an “opinion, attitude, or behavior” of a group of consumers, employees, or other interested groups. 8 The most common method of deploying a descriptive research design is through the use of a survey. Several types of surveys will be defined later in this chapter. Descriptive data is quantitative in nature, meaning the data can be distilled into a statistic, such as in a table or chart.

Again, descriptive data is helpful in explaining the current situation. In the opening example of LEGO , the company wanted to describe the situation regarding children’s use of its product. In order to gather a large group of opinions, a survey was created. The data that was collected through this survey allowed the company to measure the existing perceptions of parents so that alterations could be made to future plans for the company.

Experimental research , also known as causal research , helps to define a cause-and-effect relationship between two or more factors. This type of research goes beyond a correlation to determine which feature caused the reaction. Researchers generally use some type of experimental design to determine a causal relationship. An example is A/B testing, a situation where one group of research participants, group A, is exposed to one treatment and then compared to the group B participants, who experience a different situation. An example might be showing two different television commercials to a panel of consumers and then measuring the difference in perception of the product. Another example would be to have two separate packaging options available in different markets. This research would answer the question “Does one design sell better than the other?” Comparing that to the sales in each market would be part of a causal research study. 9

The final method of collecting data is through an ethnographic design. Ethnographic research is conducted in the field by watching people interact in their natural environment. For marketing research, ethnographic designs help to identify how a product is used, what actions are included in a selection, or how the consumer interacts with the product. 10

Examples of ethnographic research would be to observe how a consumer uses a particular product, such as baking soda. Although many people buy baking soda, its uses are vast. So are they using it as a refrigerator deodorizer, a toothpaste, to polish a belt buckle, or to use in baking a cake?

Select the Data Collection Method

Data collection is the systematic gathering of information that addresses the identified problem. What is the best method to do that? Picking the right method of collecting data requires that the researcher understand the target population and the design picked in the previous step. There is no perfect method; each method has both advantages and disadvantages, so it’s essential that the researcher understand the target population of the research and the research objectives in order to pick the best option.

Sometimes the data desired is best collected by watching the actions of consumers. For instance, how many cars pass a specific billboard in a day? What website led a potential customer to the company’s website? When are consumers most likely to use the snack vending machines at work? What time of day has the highest traffic on a social media post? What is the most streamed television program this week? Observational research is the collecting of data based on actions taken by those observed. Many data observations do not require the researched individuals to participate in the data collection effort to be highly valuable. Some observation requires an individual to watch and record the activities of the target population through personal observations .

Unobtrusive observation happens when those being observed aren’t aware that they are being watched. An example of an unobtrusive observation would be to watch how shoppers interact with a new stuffed animal display by using a one-way mirror. Marketers can identify which products were handled more often while also determining which were ignored.

Other methods can use technology to collect the data instead. Instances of mechanical observation include the use of vehicle recorders, which count the number of vehicles that pass a specific location. Computers can also assess the number of shoppers who enter a store, the most popular entry point for train station commuters, or the peak time for cars to park in a parking garage.

When you want to get a more in-depth response from research participants, one method is to complete a one-on-one interview . One-on-one interviews allow the researcher to ask specific questions that match the respondent’s unique perspective as well as follow-up questions that piggyback on responses already completed. An interview allows the researcher to have a deeper understanding of the needs of the respondent, which is another strength of this type of data collection. The downside of personal interviews it that a discussion can be very time-consuming and results in only one respondent’s answers. Therefore, in order to get a large sample of respondents, the interview method may not be the most efficient method.

Taking the benefits of an interview and applying them to a small group of people is the design of a focus group . A focus group is a small number of people, usually 8 to 12, who meet the sample requirements. These individuals together are asked a series of questions where they are encouraged to build upon each other’s responses, either by agreeing or disagreeing with the other group members. Focus groups are similar to interviews in that they allow the researcher, through a moderator, to get more detailed information from a small group of potential customers (see Figure 6.5).

Link to Learning: Focus Groups

Focus groups are a common method for gathering insights into consumer thinking and habits. Companies will use this information to develop or shift their initiatives. The best way to understand a focus group is to watch a few examples or explanations. TED-Ed has this video that explains how focus groups work.

You might be asking when it is best to use a focus group or a survey. Learn the differences, the pros and cons of each, and the specific types of questions you ask in both situations in this article .

Preparing for a focus group is critical to success. It requires knowing the material and questions while also managing the group of people. Watch this video to learn more about how to prepare for a focus group and the types of things to be aware of.

One of the benefits of a focus group over individual interviews is that synergy can be generated when a participant builds on another’s ideas. Additionally, for the same amount of time, a researcher can hear from multiple respondents instead of just one. 11 Of course, as with every method of data collection, there are downsides to a focus group as well. Focus groups have the potential to be overwhelmed by one or two aggressive personalities, and the format can discourage more reserved individuals from speaking up. Finally, like interviews, the responses in a focus group are qualitative in nature and are difficult to distill into an easy statistic or two.

Combining a variety of questions on one instrument is called a survey or questionnaire . Collecting primary data is commonly done through surveys due to their versatility. A survey allows the researcher to ask the same set of questions of a large group of respondents. Response rates of surveys are calculated by dividing the number of surveys completed by the total number attempted. Surveys are flexible and can collect a variety of quantitative and qualitative data. Questions can include simplified yes or no questions, select all that apply, questions that are on a scale, or a variety of open-ended types of questions. There are four types of surveys (see Table 6.2) we will cover, each with strengths and weaknesses defined.

Let’s start off with mailed surveys —surveys that are sent to potential respondents through a mail service. Mailed surveys used to be more commonly used due to the ability to reach every household. In some instances, a mailed survey is still the best way to collect data. For example, every 10 years the United States conducts a census of its population (see Figure 6.6). The first step in that data collection is to send every household a survey through the US Postal Service (USPS). The benefit is that respondents can complete and return the survey at their convenience. The downside of mailed surveys are expense and timeliness of responses. A mailed survey requires postage, both when it is sent to the recipient and when it is returned. That, along with the cost of printing, paper, and both sending and return envelopes, adds up quickly. Additionally, physically mailing surveys takes time. One method of reducing cost is to send with bulk-rate postage, but that slows down the delivery of the survey. Also, because of the convenience to the respondent, completed surveys may be returned several weeks after being sent. Finally, some mailed survey data must be manually entered into the analysis software, which can cause delays or issues due to entry errors.

Phone surveys are completed during a phone conversation with the respondent. Although the traditional phone survey requires a data collector to talk with the participant, current technology allows for computer-assisted voice surveys or surveys to be completed by asking the respondent to push a specific button for each potential answer. Phone surveys are time intensive but allow the respondent to ask questions and the surveyor to request additional information or clarification on a question if warranted. Phone surveys require the respondent to complete the survey simultaneously with the collector, which is a limitation as there are restrictions for when phone calls are allowed. According to Telephone Consumer Protection Act , approved by Congress in 1991, no calls can be made prior to 8:00 a.m. or after 9:00 p.m. in the recipient’s time zone. 12 Many restrictions are outlined in this original legislation and have been added to since due to ever-changing technology.

In-person surveys are when the respondent and data collector are physically in the same location. In-person surveys allow the respondent to share specific information, ask questions of the surveyor, and follow up on previous answers. Surveys collected through this method can take place in a variety of ways: through door-to-door collection, in a public location, or at a person’s workplace. Although in-person surveys are time intensive and require more labor to collect data than some other methods, in some cases it’s the best way to collect the required data. In-person surveys conducted through a door-to-door method is the follow-up used for the census if respondents do not complete the mailed survey. One of the downsides of in-person surveys is the reluctance of potential respondents to stop their current activity and answer questions. Furthermore, people may not feel comfortable sharing private or personal information during a face-to-face conversation.

Electronic surveys are sent or collected through digital means and is an opportunity that can be added to any of the above methods as well as some new delivery options. Surveys can be sent through email, and respondents can either reply to the email or open a hyperlink to an online survey (see Figure 6.7). Additionally, a letter can be mailed that asks members of the survey sample to log in to a website rather than to return a mailed response. Many marketers now use links, QR codes, or electronic devices to easily connect to a survey. Digitally collected data has the benefit of being less time intensive and is often a more economical way to gather and input responses than more manual methods. A survey that could take months to collect through the mail can be completed within a week through digital means.

Design the Sample

Although you might want to include every possible person who matches your target market in your research, it’s often not a feasible option, nor is it of value. If you did decide to include everyone, you would be completing a census of the population. Getting everyone to participate would be time-consuming and highly expensive, so instead marketers use a sample , whereby a portion of the whole is included in the research. It’s similar to the samples you might receive at the grocery store or ice cream shop; it isn’t a full serving, but it does give you a good taste of what the whole would be like.

So how do you know who should be included in the sample? Researchers identify parameters for their studies, called sample frames . A sample frame for one study may be college students who live on campus; for another study, it may be retired people in Dallas, Texas, or small-business owners who have fewer than 10 employees. The individual entities within the sampling frame would be considered a sampling unit . A sampling unit is each individual respondent that would be considered as matching the sample frame established by the research. If a researcher wants businesses to participate in a study, then businesses would be the sampling unit in that case.

The number of sampling units included in the research is the sample size . Many calculations can be conducted to indicate what the correct size of the sample should be. Issues to consider are the size of the population, the confidence level that the data represents the entire population, the ease of accessing the units in the frame, and the budget allocated for the research.

There are two main categories of samples: probability and nonprobability (see Figure 6.8). Probability samples are those in which every member of the sample has an identified likelihood of being selected. Several probability sample methods can be utilized. One probability sampling technique is called a simple random sample , where not only does every person have an identified likelihood of being selected to be in the sample, but every person also has an equal chance of exclusion. An example of a simple random sample would be to put the names of all members of a group into a hat and simply draw out a specific number to be included. You could say a raffle would be a good example of a simple random sample.

Another probability sample type is a stratified random sample , where the population is divided into groups by category and then a random sample of each category is selected to participate. For instance, if you were conducting a study of college students from your school and wanted to make sure you had all grade levels included, you might take the names of all students and split them into different groups by grade level—freshman, sophomore, junior, and senior. Then, from those categories, you would draw names out of each of the pools, or strata.

A nonprobability sample is a situation in which each potential member of the sample has an unknown likelihood of being selected in the sample. Research findings that are from a nonprobability sample cannot be applied beyond the sample. Several examples of nonprobability sampling are available to researchers and include two that we will look at more closely: convenience sampling and judgment sampling.

The first nonprobability sampling technique is a convenience sample . Just like it sounds, a convenience sample is when the researcher finds a group through a nonscientific method by picking potential research participants in a convenient manner. An example might be to ask other students in a class you are taking to complete a survey that you are doing for a class assignment or passing out surveys at a basketball game or theater performance.

A judgment sample is a type of nonprobability sample that allows the researcher to determine if they believe the individual meets the criteria set for the sample frame to complete the research. For instance, you may be interested in researching mothers, so you sit outside a toy store and ask an individual who is carrying a baby to participate.

Collect the Data

Now that all the plans have been established, the instrument has been created, and the group of participants has been identified, it is time to start collecting data. As explained earlier in this chapter, data collection is the process of gathering information from a variety of sources that will satisfy the research objectives defined in step one. Data collection can be as simple as sending out an email with a survey link enclosed or as complex as an experiment with hundreds of consumers. The method of collection directly influences the length of this process. Conducting personal interviews or completing an experiment, as previously mentioned, can add weeks or months to the research process, whereas sending out an electronic survey may allow a researcher to collect the necessary data in a few days. 13

Analyze and Interpret the Data

Once the data has been collected, the process of analyzing it may begin. Data analysis is the distillation of the information into a more understandable and actionable format. The analysis itself can take many forms, from the use of basic statistics to a more comprehensive data visualization process. First, let’s discuss some basic statistics that can be used to represent data.

The first is the mean of quantitative data. A mean is often defined as the arithmetic average of values. The formula is:

A common use of the mean calculation is with exam scores. Say, for example, you have earned the following scores on your marketing exams: 72, 85, 68, and 77. To find the mean, you would add up the four scores for a total of 302. Then, in order to generate a mean, that number needs to be divided by the number of exam scores included, which is 4. The mean would be 302 divided by 4, for a mean test score of 75.5. Understanding the mean can help to determine, with one number, the weight of a particular value.

Another commonly used statistic is median. The median is often referred to as the middle number. To generate a median, all the numeric answers are placed in order, and the middle number is the median. Median is a common statistic when identifying the income level of a specific geographic region. 14 For instance, the median household income for Albuquerque, New Mexico, between 2015 and 2019 was $52,911. 15 In this case, there are just as many people with an income above the amount as there are below.

Mode is another statistic that is used to represent data of all types, as it can be used with quantitative or qualitative data and represents the most frequent answer. Eye color, hair color, and vehicle color can all be presented with a mode statistic. Additionally, some researchers expand on the concept of mode and present the frequency of all responses, not just identifying the most common response. Data such as this can easily be presented in a frequency graph, 16 such as the one in Figure 6.9.

Additionally, researchers use other analyses to represent the data rather than to present the entirety of each response. For example, maybe the relationship between two values is important to understand. In this case, the researcher may share the data as a cross tabulation (see Figure 6.10). Below is the same data as above regarding social media use cross tabulated with gender—as you can see, the data is more descriptive when you can distinguish between the gender identifiers and how much time is spent per day on social media.

Not all data can be presented in a graphical format due to the nature of the information. Sometimes with qualitative methods of data collection, the responses cannot be distilled into a simple statistic or graph. In that case, the use of quotations, otherwise known as verbatims , can be used. These are direct statements presented by the respondents. Often you will see a verbatim statement when reading a movie or book review. The critic’s statements are used in part or in whole to represent their feelings about the newly released item.

Link to Learning: Infographics

As they say, a picture is worth a thousand words. For this reason, research results are often shown in a graphical format in which data can be taken in quickly, called an infographic .

Check out this infographic on what components make for a good infographic. As you can see, a good infographic needs four components: data, design, a story, and the ability to share it with others. Without all four pieces, it is not as valuable a resource as it could be. The ultimate infographic is represented as the intersection of all four.

Infographics are particularly advantageous online. Refer to this infographic on why they are beneficial to use online .

Prepare the Research Report

The marketing research process concludes by sharing the generated data and makes recommendations for future actions. What starts as simple data must be interpreted into an analysis. All information gathered should be conveyed in order to make decisions for future marketing actions. One item that is often part of the final step is to discuss areas that may have been missed with the current project or any area of further study identified while completing it. Without the final step of the marketing research project, the first six steps are without value. It is only after the information is shared, through a formal presentation or report, that those recommendations can be implemented and improvements made. The first six steps are used to generate information, while the last is to initiate action. During this last step is also when an evaluation of the process is conducted. If this research were to be completed again, how would we do it differently? Did the right questions get answered with the survey questions posed to the respondents? Follow-up on some of these key questions can lead to additional research, a different study, or further analysis of data collected.

Methods of Quantifying Marketing Research

One of the ways of sharing information gained through marketing research is to quantify the research . Quantifying the research means to take a variety of data and compile into a quantity that is more easily understood. This is a simple process if you want to know how many people attended a basketball game, but if you want to quantify the number of students who made a positive comment on a questionnaire, it can be a little more complicated. Researchers have a variety of methods to collect and then share these different scores. Below are some of the most common types used in business.

Is a customer aware of a product, brand, or company? What is meant by awareness? Awareness in the context of marketing research is when a consumer is familiar with the product, brand, or company. It does not assume that the consumer has tried the product or has purchased it. Consumers are just aware. That is a measure that many businesses find valuable. There are several ways to measure awareness. For instance, the first type of awareness is unaided awareness . This type of awareness is when no prompts for a product, brand, or company are given. If you were collecting information on fast-food restaurants, you might ask a respondent to list all the fast-food restaurants that serve a chicken sandwich. Aided awareness would be providing a list of products, brands, or companies and the respondent selects from the list. For instance, if you give a respondent a list of fast-food restaurants and ask them to mark all the locations with a chicken sandwich, you are collecting data through an aided method. Collecting these answers helps a company determine how the business location compares to those of its competitors. 17

Customer Satisfaction (CSAT)

Have you ever been asked to complete a survey at the end of a purchase? Many businesses complete research on buying, returning, or other customer service processes. A customer satisfaction score , also known as CSAT, is a measure of how satisfied customers are with the product, brand, or service. A CSAT score is usually on a scale of 0 to 100 percent. 18 But what constitutes a “good” CSAT score? Although what is identified as good can vary by industry, normally anything in the range from 75 to 85 would be considered good. Of course, a number higher than 85 would be considered exceptional. 19

Customer Acquisition Cost (CAC) and Customer Effort Score (CES)

Other metrics often used are a customer acquisition cost (CAC) and customer effort score (CES). How much does it cost a company to gain customers? That’s the purpose of calculating the customer acquisition cost. To calculate the customer acquisition cost , a company would need to total all expenses that were accrued to gain new customers. This would include any advertising, public relations, social media postings, etc. When a total cost is determined, it is divided by the number of new customers gained through this campaign.

The final score to discuss is the customer effort score , also known as a CES. The CES is a “survey used to measure the ease of service experience with an organization.” 20 Companies that are easy to work with have a better CES than a company that is notorious for being difficult. An example would be to ask a consumer about the ease of making a purchase online by incorporating a one-question survey after a purchase is confirmed. If a number of responses come back negative or slightly negative, the company will realize that it needs to investigate and develop a more user-friendly process.

Knowledge Check

It’s time to check your knowledge on the concepts presented in this section. Refer to the Answer Key at the end of the book for feedback.

Sagar is completing a marketing research project and is at the stage where he must decide who will be sent the survey. What stage of the marketing research plan is Sagar currently on?

- Defining the problem

- Developing the research plan

- Selecting a data collection method

- Designing the sample

A strength of mailing a survey is that ________.

- you are able to send it to all households in an area

- it is inexpensive

- responses are automatically loaded into the software

- the data comes in quickly

Bartlett is considering the different types of data that can be pulled together for a research project. Currently they have collected journal articles, survey data, and syndicated data and completed a focus group. What type(s) of data have they collected?

- Primary data

- Secondary data

- Secondary and primary data

- Professional data

Which statistic can be used to show how many people responded to a survey question with “strongly agree”?

Why would a researcher want to use a cross tabulation?

- It shows how respondents answered two variables in relation to each other and can help determine patterns by different groups of respondents.

- By presenting the data in the form of a picture, the information is easier for the reader to understand.

- It is an easy way to see how often one answer is selected by the respondents.

- This analysis can used to present interview or focus group data.

- Skip to primary navigation

- Skip to main content

Better Knowledge. Your Insight Is Sharper

Marketing Research: Objectives, Types, Steps, Methods

Updated: August 18, 2024 · Reviewed by: Ahmad Nasrudin

This post may contain affiliate links, meaning we may earn a small commission if you purchase through our links. This helps support our work.

What’s it: Marketing research is the efforts of systematically collecting and analyzing markets to support more effective marketing decision making. The stages usually include setting objectives, designing research and methods, collecting data, analyzing data, and reporting research results.

Why marketing research is important

Companies need accurate and current information about the marketing environment’s conditions to develop an effective marketing strategy. Demand and competition in the market continue to change from time to time, including about:

- Trending tastes and needs of consumers – for example, people are getting online and leaving conventional media such as print newspapers.

- Changes in the macro-environment , be it political, economic, social, technological, environmental, or regulatory. For example, technology enables companies to explore more data about consumers. Or, COVID-19 can make the economy crash and reduce outdoor activities.

- Competitive dynamics – for example, globalization brings more fierce competition because companies are not only competing with local companies but also globally.

Such changes present both threats and opportunities. Competitive advantage can turn into a disadvantage because companies do not adapt to such changes. They need different strategies and tactics to support a sustainable competitive advantage.

Marketing research objectives

Marketing research aims to identify challenges and opportunities to achieve marketing goals. Companies process data, analyze data, and interpret relevant facts to provide valuable information about it.

Research results also help companies plan, evaluate, and develop marketing strategies and tactics. Management uses it in decision making related to exploiting opportunities, minimizing threats, designing alternative actions, and solving marketing problems.

Meanwhile, the specific objectives of marketing research are:

- Understand what consumers need today – as consumer tastes and preferences change, companies may need different marketing strategies.

- Identifying market gaps – the company may find opportunities to develop new products, which are not being served by products currently on the market.

- Reducing product failure – marketing research information is useful for developing the right marketing mix, so it is profitable and better than competitors.

- Minimizing business risk – companies use research results to anticipate and develop appropriate responses to address threats in their business environment.

- Forecasting future trends – the company anticipates future consumer needs, so it is one step ahead of competitors exploiting market opportunities.

Types of marketing research

Marketing research covers three research areas:

- Market research : about the market, such as market size, profitability level, growth prospects, and competition intensity.

- Product research : about the characteristics and attributes of the right product to satisfy customers

- Consumer research : about consumer needs, tastes, preferences, attitudes, and behavior.

Marketing research can be causal, exploratory, or descriptive.

Causality research is when companies are trying to understand the cause-and-effect relationship of a phenomenon. For example, how much does a company’s advertising affect customer perception?

Descriptive research seeks to understand more about the nature or characteristics of the phenomenon itself. For example, companies try to understand the shopping habits of consumers when they go to the mall.

Exploratory research seeks to understand phenomena more profoundly and is usually useful for developing new products. For example, a company explores the shopping experience to gain insight into what first-time consumers see when shopping, whether price, packaging, store atmosphere, or brand.

Marketing research steps

The marketing stages usually include:

First , determine the problem or research objective. Marketing research covers various aspects of the market, such as product, sales, promotion, distribution, buyer behavior, pricing, and packaging. You cannot investigate them all at once. Therefore, you must be selective and determine what problems you want to answer through research.

Second , determine the research design, whether you want to do exploratory, descriptive, or causality studies.

Third , determine the data collection method. In this section, you have to decide whether to use secondary data or primary data. If it is primary data, will you use surveys, observations, experiments, or consumer panels? Another task is to design data collection forms, questionnaires, and sampling.

Fourth , collect data. Data can be either qualitative or quantitative.

Data collection depends on the research method you use, whether it is primary or secondary research. For example, suppose you decide to use secondary data. In that case, you may have to collect some statistics or reports from government agencies, international agencies, research firms, competitors, or trade associations.

Fifth , analyze and interpret data. Your first task is usually to integrate data into a database. Also, you may need to clean it up, so it’s ready for analysis.

You can use several descriptive or inferential statistical methods to describe the data, depending on your needs. The statistical techniques commonly used for social research are regression analysis, t-test, cluster analysis, factor analysis, cross-tabulation, and conjoint analysis.

Sixth , preparing a research report. You draw conclusions from the results of the analysis and, perhaps, make recommendations. You may need to make a full report or just present your findings in a PowerPoint.

Tables and charts are two tools for summarizing data so that it is easy to read. Both help you explain your findings and support the arguments for your recommendations.

Free Up Your Learning Journey

Note: While those offer many free courses, some might require payment for certificates or additional materials. Please check individual course details.

Marketing research methods

Marketing research methods fall into two categories based on its data sources:

- Primary research – you are the first to collect data. This is also known as field research.

- Secondary research – you are second hand collecting data. Also known as desk research because you are collecting data from external sources.

Primary research

You are taking data from original sources, such as consumers. You can use various methods, such as surveys, observations, and focus groups, to collect data.

In a survey, you create a questionnaire containing several questions. You may do it yourself or hire a few people to help you. You then meet with respondents and ask questions in the questionnaire.

Questions may be closed questions for which you have provided alternative answers. Or, it is an open-ended question where you let the respondent answer according to their knowledge.

You can also do interviews without a questionnaire. You have some open-ended questions for you to ask respondents. Then, you record each answer. You can do this face-to-face, over the phone, or via online channels.

Then, you can also interview focus groups. In this case, you gather a few people, say, six to ten people. You then ask for their opinion on a particular topic. You listen to their views or record them.

Under observation, you observe people’s reactions, often without having to get into the conversation directly. If you’re researching shoppers, you’ll probably notice the first shelf they go to, the items they cart, and the items they end up buying at the checkout.

Secondary research

In this method, you rely on data from secondary sources. These sources can come from:

- Publications from government institutions such as central statistical agencies.

- Publications from international institutions such as the world bank and world trade center.

- Publications from research companies like Nielsen.

- Company or other stakeholder reports such as financial reports, annual reports, public presentations and press releases.

- General media such as newspapers and magazines, both print and online.

- Publications from business associations or trade journals.

Secondary research offers the convenience of collecting data, as well as being cheap. You can do it on the table without having to go out on the pitch.

However, unlike primary research, the accuracy of the data is a significant problem for secondary research. You depend on external parties for data quality. It can produce biased information and errors in making conclusions and decisions.

No related posts.

About Ahmad Nasrudin

I am an introspective writer with a strong passion for storytelling and a keen analytical mind. Drawing on my experience in equity research and credit risk, I bring a unique perspective to my writing. I aim to provide you with the information you need to start a business or make informed investment decisions. Learn more about me

- Multidivisional Structure: Importance, How it Works, Pros, Cons

- Business Size: How Business Scale Shapes Success (Importances, Measurement, Classification)

- Values, Attitudes and Lifestyles (VALS): Categories and Why They Matter

- Roles of Business: Satisfying Needs and Wants and Creating Value, Jobs, Income

- Span of Control: Importance, Types, Advantages, Disadvantages

Module 6: Marketing Information and Research

The marketing research process, learning objectives.

- Identify the steps of conducting a marketing research project

A Standard Approach to Research Inquiries

Marketing research is a useful and necessary tool for helping marketers and an organization’s executive leadership make wise decisions. Carrying out marketing research can involve highly specialized skills that go deeper than the information outlined in this module. However, it is important for any marketer to be familiar with the basic procedures and techniques of marketing research.

It is very likely that at some point a marketing professional will need to supervise an internal marketing research activity or to work with an outside marketing research firm to conduct a research project. Managers who understand the research function can do a better job of framing the problem and critically appraising the proposals made by research specialists. They are also in a better position to evaluate their findings and recommendations.

Periodically marketers themselves need to find solutions to marketing problems without the assistance of marketing research specialists inside or outside the company. If you are familiar with the basic procedures of marketing research, you can supervise and even conduct a reasonably satisfactory search for the information needed.

Step 1: Identify the Problem

The first step for any marketing research activity is to clearly identify and define the problem you are trying to solve. You start by stating the marketing or business problem you need to address and for which you need additional information to figure out a solution. Next, articulate the objectives for the research: What do you want to understand by the time the research project is completed? What specific information, guidance, or recommendations need to come out of the research in order to make it a worthwhile investment of the organization’s time and money?

It’s important to share the problem definition and research objectives with other team members to get their input and further refine your understanding of the problem and what is needed to solve it. At times, the problem you really need to solve is not the same problem that appears on the surface. Collaborating with other stakeholders helps refine your understanding of the problem, focus your thinking, and prioritize what you hope to learn from the research. Prioritizing your objectives is particularly helpful if you don’t have the time or resources to investigate everything you want.

To flesh out your understanding of the problem, it’s useful to begin brainstorming actual research questions you want to explore. What are the questions you need to answer in order to get to the research outcomes? What is the missing information that marketing research will help you find? The goal at this stage is to generate a set of preliminary, big-picture questions that will frame your research inquiry. You will revisit these research questions later in the process, but when you’re getting started, this exercise helps clarify the scope of the project, whom you need to talk to, what information may already be available, and where to look for the information you don’t yet have.

Applied Example: Marketing Research for Bookends

To illustrate the marketing research process, let’s return to Uncle Dan and his ailing bookstore, Bookends. You need a lot of information if you’re going to help Dan turn things around, so marketing research is a good idea. You begin by identifying the problem and then work to set down your research objectives and initial research questions:

Step 2: Develop a Research Plan

Once you have a problem definition, research objectives, and a preliminary set of research questions, the next step is to develop a research plan. Essential to this plan is identifying precisely what information you need to answer your questions and achieve your objectives. Do you need to understand customer opinions about something? Are you looking for a clearer picture of customer needs and related behaviors? Do you need sales, spending, or revenue data? Do you need information about competitors’ products, or insight about what will make prospective customers notice you? When do need the information, and what’s the time frame for getting it? What budget and resources are available?

Once you have clarified what kind of information you need and the timing and budget for your project, you can develop the research design. This details how you plan to collect and analyze the information you’re after. Some types of information are readily available through secondary research and secondary data sources. Secondary research analyzes information that has already been collected for another purpose by a third party, such as a government agency, an industry association, or another company. Other types of information need to from talking directly to customers about your research questions. This is known as primary research , which collects primary data captured expressly for your research inquiry. Marketing research projects may include secondary research, primary research, or both.

Depending on your objectives and budget, sometimes a small-scale project will be enough to get the insight and direction you need. At other times, in order to reach the level of certainty or detail required, you may need larger-scale research involving participation from hundreds or even thousands of individual consumers. The research plan lays out the information your project will capture—both primary and secondary data—and describes what you will do with it to get the answers you need. (Note: You’ll learn more about data collection methods and when to use them later in this module.)

Your data collection plan goes hand in hand with your analysis plan. Different types of analysis yield different types of results. The analysis plan should match the type of data you are collecting, as well as the outcomes your project is seeking and the resources at your disposal. Simpler research designs tend to require simpler analysis techniques. More complex research designs can yield powerful results, such as understanding causality and trade-offs in customer perceptions. However, these more sophisticated designs can require more time and money to execute effectively, both in terms of data collection and analytical expertise.

The research plan also specifies who will conduct the research activities, including data collection, analysis, interpretation, and reporting on results. At times a singlehanded marketing manager or research specialist runs the entire research project. At other times, a company may contract with a marketing research analyst or consulting firm to conduct the research. In this situation, the marketing manager provides supervisory oversight to ensure the research delivers on expectations.

Finally, the research plan indicates who will interpret the research findings and how the findings will be reported. This part of the research plan should consider the internal audience(s) for the research and what reporting format will be most helpful. Often, senior executives are primary stakeholders, and they’re anxious for marketing research to inform and validate their choices. When this is the case, getting their buy-in on the research plan is recommended to make sure that they are comfortable with the approach and receptive to the potential findings.

Applied Example: A Bookends Research Plan

You talk over the results of your problem identification work with Dan. He thinks you’re on the right track and wants to know what’s next. You explain that the next step is to put together a detailed plan for getting answers to the research questions.

Dan is enthusiastic, but he’s also short on money. You realize that such a financial constraint will limit what’s possible, but with Dan’s help you can do something worthwhile. Below is the research plan you sketch out:

Step 3: Conduct the Research

Conducting research can be a fun and exciting part of the marketing research process. After struggling with the gaps in your knowledge of market dynamics—which led you to embark on a marketing research project in the first place—now things are about to change. Conducting research begins to generate information that helps answer your urgent marketing questions.

Typically data collection begins by reviewing any existing research and data that provide some information or insight about the problem. As a rule, this is secondary research. Prior research projects, internal data analyses, industry reports, customer-satisfaction survey results, and other information sources may be worthwhile to review. Even though these resources may not answer your research questions fully, they may further illuminate the problem you are trying to solve. Secondary research and data sources are nearly always cheaper than capturing new information on your own. Your marketing research project should benefit from prior work wherever possible.

After getting everything you can from secondary research, it’s time to shift attention to primary research, if this is part of your research plan. Primary research involves asking questions and then listening to and/or observing the behavior of the target audience you are studying. In order to generate reliable, accurate results, it is important to use proper scientific methods for primary research data collection and analysis. This includes identifying the right individuals and number of people to talk to, using carefully worded surveys or interview scripts, and capturing data accurately.

Without proper techniques, you may inadvertently get bad data or discover bias in the responses that distorts the results and points you in the wrong direction. The module on Marketing Research Techniques discusses these issues in further detail, since the procedures for getting reliable data vary by research method.

Applied Example: Getting the Data on Bookends

Dan is on board with the research plan, and he’s excited to dig into the project. You start with secondary data, getting a dump of Dan’s sales data from the past two years, along with related information: customer name, zip code, frequency of purchase, gender, date of purchase, and discounts/promotions (if any).

You visit the U.S. Census Bureau Web site to download demographic data about your metro area. The data show all zip codes in the area, along with population size, gender breakdown, age ranges, income, and education levels.

The next part of the project is customer-survey data. You work with Dan to put together a short survey about customer attitudes toward Bookends, how often and why they come, where else they spend money on books and entertainment, and why they go other places besides Bookends. Dan comes up with the great idea of offering a 5 percent discount coupon to anyone who completes the survey. Although it eats into his profits, this scheme gets more people to complete the survey and buy books, so it’s worth it.

For a couple of days, you and Dan take turns doing “man on the street” interviews (you interview the guy in the red hat, for instance). You find people who say they’ve never been to Bookends and ask them a few questions about why they haven’t visited the store, where else they buy books and other entertainment, and what might get them interested in visiting Bookends sometime. This is all a lot of work, but for a zero-budget project, it’s coming together pretty well.

Step 4: Analyze and Report Findings

Analyzing the data obtained in a market survey involves transforming the primary and/or secondary data into useful information and insights that answer the research questions. This information is condensed into a format to be used by managers—usually a presentation or detailed report.

Analysis starts with formatting, cleaning, and editing the data to make sure that it’s suitable for whatever analytical techniques are being used. Next, data are tabulated to show what’s happening: What do customers actually think? What’s happening with purchasing or other behaviors? How do revenue figures actually add up? Whatever the research questions, the analysis takes source data and applies analytical techniques to provide a clearer picture of what’s going on. This process may involve simple or sophisticated techniques, depending on the research outcomes required. Common analytical techniques include regression analysis to determine correlations between factors; conjoint analysis to determine trade-offs and priorities; predictive modeling to anticipate patterns and causality; and analysis of unstructured data such as Internet search terms or social media posts to provide context and meaning around what people say and do.

Good analysis is important because the interpretation of research data—the “so what?” factor—depends on it. The analysis combs through data to paint a picture of what’s going on. The interpretation goes further to explain what the research data mean and make recommendations about what managers need to know and do based on the research results. For example, what is the short list of key findings and takeaways that managers should remember from the research? What are the market segments you’ve identified, and which ones should you target? What are the primary reasons your customers choose your competitor’s product over yours, and what does this mean for future improvements to your product?

Individuals with a good working knowledge of the business should be involved in interpreting the data because they are in the best position to identify significant insights and make recommendations from the research findings. Marketing research reports incorporate both analysis and interpretation of data to address the project objectives.

The final report for a marketing research project may be in written form or slide-presentation format, depending on organizational culture and management preferences. Often a slide presentation is the preferred format for initially sharing research results with internal stakeholders. Particularly for large, complex projects, a written report may be a better format for discussing detailed findings and nuances in the data, which managers can study and reference in the future.

Applied Example: Analysis and Insights for Bookends

Getting the data was a bit of a hassle, but now you’ve got it, and you’re excited to see what it reveals. Your statistician cousin, Marina, turns out to be a whiz with both the sales data and the census data. She identified several demographic profiles in the metro area that looked a lot like lifestyle segments. Then she mapped Bookends’ sales data into those segments to show who is and isn’t visiting Bookends. After matching customer-survey data to the sales data, she broke down the segments further based on their spending levels and reasons they visit Bookends.

Gradually a clearer picture of Bookends’ customers is beginning to emerge: who they are, why they come, why they don’t come, and what role Bookends plays in their lives. Right away, a couple of higher-priority segments—based on their spending levels, proximity, and loyalty to Bookends—stand out. You and your uncle are definitely seeing some possibilities for making the bookstore a more prominent part of their lives. You capture these insights as “recommendations to be considered” while you evaluate the right marketing mix for each of the new segments you’d like to focus on.

Step 5: Take Action

Once the report is complete, the presentation is delivered, and the recommendations are made, the marketing research project is over, right? Wrong.

What comes next is arguably the most important step of all: taking action based on your research results.

If your project has done a good job interpreting the findings and translating them into recommendations for the marketing team and other areas of the business, this step may seem relatively straightforward. When the research results validate a path the organization is already on, the “take action” step can galvanize the team to move further and faster in that same direction.

Things are not so simple when the research results indicate a new direction or a significant shift is advisable. In these cases, it’s worthwhile to spend time helping managers understand the research, explain why it is wise to shift course, and explain how the business will benefit from the new path. As with any important business decision, managers must think deeply about the new approach and carefully map strategies, tactics, and available resources to plan effectively. By making the results available and accessible to managers and their execution teams, the marketing research project can serve as an ongoing guide and touchstone to help the organization plan, execute, and adjust course as it works toward desired goals and outcomes.

It is worth mentioning that many marketing research projects are never translated into management action. Sometimes this is because the report is too technical and difficult to understand. In other cases, the research conclusions fail to provide useful insights or solutions to the problem, or the report writer fails to offer specific suggestions for translating the research findings into management strategy. These pitfalls can be avoided by paying due attention to the research objectives throughout the project and allocating sufficient time and resources to do a good job interpreting research results for those who will need to act on them.

Applied Example: Bookends’ New Customer Campaign

Your research findings and recommendations identified three segments for Bookends to focus on. Based on the demographics, lifestyle, and spending patterns found during your marketing research, you’re able to name them: 1) Bored Empty-Nesters, 2) Busy Families, and 3) Hipster Wannabes. Dan has a decent-sized clientele across all three groups, and they are pretty good spenders when they come in. But until now he hasn’t done much to purposely attract any of them.

With newly identified segments in focus, you and Dan begin brainstorming about a marketing mix to target each group. What types of books and other products would appeal to each one? What activities or events would bring them into the store? Are there promotions or particular messages that would induce them to buy at Bookends instead of Amazon or another bookseller? How will Dan reach and communicate with each group? And what can you do to bring more new customers into the store within these target groups?

Even though Bookends is a real-life project with serious consequences for your uncle Dan, it’s also a fun laboratory where you can test out some of the principles you’re learning in your marketing class. You’re figuring out quickly what it’s like to be a marketer.

Well done, rookie!

Check Your Understanding

Answer the question(s) below to see how well you understand the topics covered in this outcome. This short quiz does not count toward your grade in the class, and you can retake it an unlimited number of times.

Use this quiz to check your understanding and decide whether to (1) study the previous section further or (2) move on to the next section.

- Revision and Adaptation. Authored by : Lumen Learning. License : CC BY: Attribution

- Chapter 3: Marketing Research: An Aid to Decision Making, from Introducing Marketing. Authored by : John Burnett. Provided by : Global Text. Located at : http://solr.bccampus.ca:8001/bcc/file/ddbe3343-9796-4801-a0cb-7af7b02e3191/1/Core%20Concepts%20of%20Marketing.pdf . License : CC BY: Attribution

- Urban life (Version 2.0). Authored by : Ian D. Keating. Located at : https://www.flickr.com/photos/ian-arlett/19313315520/ . License : CC BY: Attribution

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home QuestionPro Marketing

How to Set Marketing Research Goals and Objectives

Marketing research goals.

Begin with the END

Instead of setting your goals and objectives from where you are NOW, imagine yourself ALREADY having achieved your goal – then work backwards and document HOW YOU GOT THERE.

The reason for this is very simple. If you set your goal based on where you are now – there is a good chance that you will get caught up in fixing a problem that is actually irrelevant in getting your business to where you want it to be.

Set your goals and objectives based on your vision for where you want your company to BE and not where it is NOW.

An Example:

If the vision and mission of your business is to help your customers be successful in their business — then imagine your customers being successful and then imagine in what ways you are helping them do that. This may include things you are currently doing — or NOT. And this is the key to creating marketing research goals and objectives that will help you measure the potential market opportunity, the target audience for your products and how they buy.

(I know that this sounds a little way out. But if you’re wondering how some of the successful businesses you see out there got that way — this is IT)

Take Clate Mask and Scott Martineau from InfusionSoft as an example. InfusionSoft is an email marketing intelligence software that automates your sales and marketing process. It’s a high-end software and it isn’t cheap. Clate and Scott found out that their customers really didn’t know how to put marketing messages together — and hence, the software didn’t appear to be “working.”

They quickly realized that if their customers knew what to put INTO the software – the customers would make more than enough money to pay the fee for the software and also refer the software to their friends and colleagues. As a result, they set a goal to have their entire client base double their sales within a 12 month period.

Having set this goal and objective — they were not only fired up and inspired about what was possible for their business. But their customers bought into the very same goal. Suddenly finding out what their customers needed or wanted that would help them grow and prosper was easy.

And what do you think happened to their response rates? Of course, every time they asked their customers what they wanted — these customers were eager to tell them.

So How is this Relevant to YOU?

If you’ve not been successful collecting feedback from your community or if the research you’ve done hasn’t delivered on results — you might want to look at the goals and objectives that you’ve set.

Are these goals and objectives more focused on solving a problem you have today? If so, that problem might be relevant to YOU but not your customer.

Use Social Media Chatter to Help You Find a Meaningful Goal

Enough of the heady stuff. Let’s get to the meat of how you can set these kinds of goals and objectives.

If you don’t already, set up several social media communication channels that include the following:

- Facebook Fan Page

- LinkedIn Company Profile

- LinkedIn Industry Group

- Twitter Account

The next thing you want to do is start posting articles on your blog that focus on your vision and how you are helping you customers be successful. Get active on industry community sites and spaces, ask questions, answer questions and participate. Then, TELL your customers, suppliers, industry experts to participate as well.

If you keep participating and reminding your audience to visit these sites – you will see conversations, get data and start forming relevant, success based goals and objectives.

Trying this backwards strategy of setting goals and objectives might identify new and exciting opportunities for your business.

Reader Interactions

[…] QuestionPro Blog Insights and sneak peeks into QuestionPro.com Skip to content HomeFree Online TrainingFree Webinar Schedule ← How to Set Marketing Research Goals and Objectives […]

[…] How to Set Marketing Research Goals and Objectives (questionpro.com) […]

MORE LIKE THIS

You Can’t Please Everyone — Tuesday CX Thoughts

Oct 22, 2024

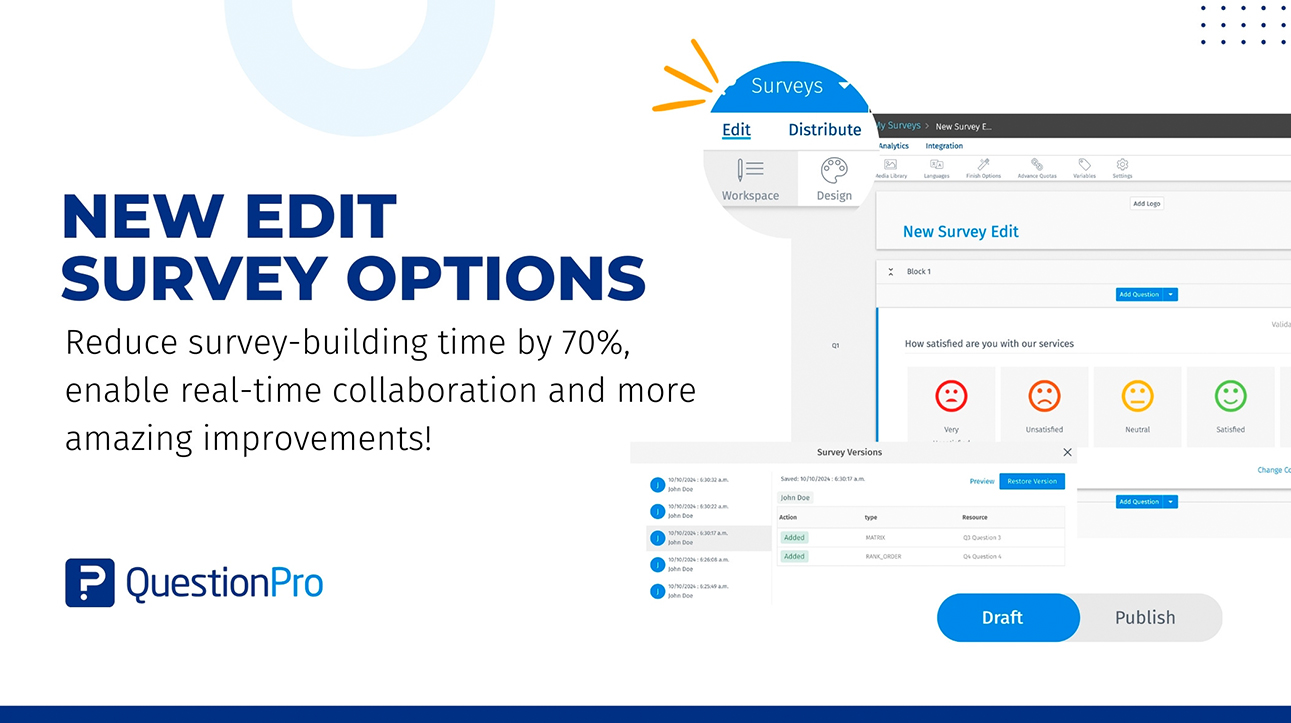

Edit survey: A new way of survey building and collaboration

Oct 10, 2024

Pulse Surveys vs Annual Employee Surveys: Which to Use

Oct 4, 2024

Employee Perception Role in Organizational Change

Oct 3, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

- Onsite training

3,000,000+ delegates

15,000+ clients

1,000+ locations

- KnowledgePass

- Log a ticket

01344203999 Available 24/7

Marketing Research Process: A Step-by-Step Guide

Explore the dynamic realm of business strategy with our comprehensive blog on the Marketing Research Process. Uncover the intricacies of this crucial methodology through our step-by-step guide, gaining insights into market trends, consumer behaviour, and strategic decision-making. Elevate your Marketing game with a deep dive into the Marketing Research Process.

Exclusive 40% OFF

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Share this Resource

- BCS Foundation Certificate in IS Project Management

- BCS Foundation Certificate in Business Analysis

- Introduction to Marketing Training

- Marketing Budget Course

- BCS International Diploma in Business Analysis

Table of Contents

1) The Process of Marketing Research

a) Recognise the Issue