- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Lecture 1 Introduction to Banking Systems.

Published by Kristóf Gulyás Modified over 5 years ago

Similar presentations

Presentation on theme: "Lecture 1 Introduction to Banking Systems."— Presentation transcript:

Banks and their products VOŠ – 3. ročník – 2. semestr.

WHY STUDY FINANCIAL MARKETS AND INSTITUTIONS?

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Chapter 13 Money and Financial Markets.

Chapter One.

Copyright © 2004 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill /Irwin Chapter One Introduction.

Stephen G. CECCHETTI Kermit L. SCHOENHOLTZ An Introduction to Money and the Financial System Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights.

Lecture # 2 Financial Institutions

Finance THE BANKING SYSTEM. Finance Lecture outline The types and functions of banking Central banking Commercial and investment.

Money and Banking Lecture 02.

An Introduction to Money and the Financial System

©2007, The McGraw-Hill Companies, All Rights Reserved Chapter One Introduction.

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill /Irwin Chapter One Introduction.

University of Palestine International Business And Finance Management Accounting For Financial Firms Part (3) Ibrahim Sammour.

Financial Markets and Institutions. Financial Markets Financial markets provide for financial intermediation-- financial savings (Surplus Units) to investment.

Chapter One Introduction.

Today’s Objectives Hand back and Review Tests Test Corrections in Groups (Assigned already) Begin Notes on Chapter 8 – Banking You will… – Understand your.

Basic Terminologies of Financial Institutions By: Sajad Ahmad.

Financial Institutions Accounting Dr. Salah Hammad Chapter 1 An Overview of the Changing Financial-Services Sector 2.

Ch. 01: Money and Banking. Money Money, also referred to as the money supply, is defined as anything that is generally accepted in payment for goods or.

Chapter 10SectionMain Menu Money What is money? What are the three uses of money? What are the six characteristics of money? What are the sources of money’s.

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

- Customer Favorites

Bank Management System

Design Services

Business PPTs

Business Plan

Introduction PPT

Self Introduction

Startup Business Plan

Cyber Security

Digital Marketing

Project Management

Product Management

Artificial Intelligence

Target Market

Communication

Supply Chain

Google Slides

Research Services

All Categories

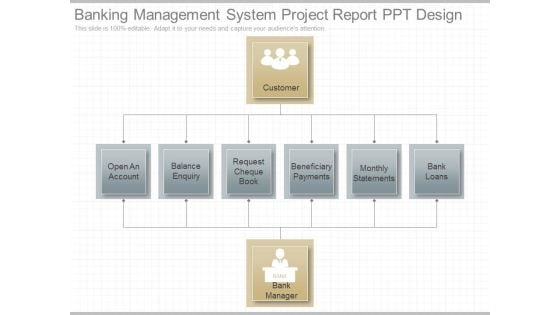

Banking Management System Project Report Ppt Design

This is a banking management system project report ppt design. This is a eight stage process. The stages in this process are customer, open an account, balance enquiry, request cheque book, beneficiary payments, monthly statements, bank loans, bank manager.

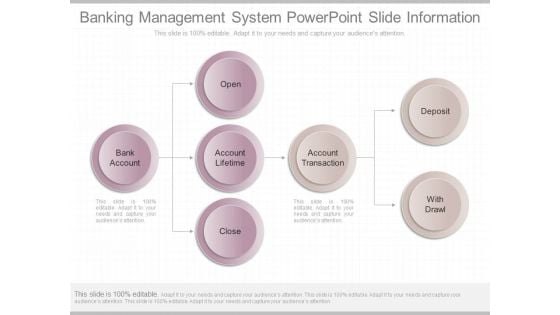

Banking Management System Powerpoint Slide Information

This is a banking management system powerpoint slide information. This is a seven stage process. The stages in this process are bank account, open, account lifetime, close, account transaction, deposit, with drawl.

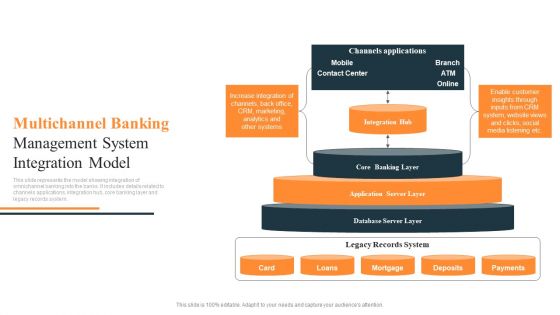

Multichannel Banking Management System Integration Model Ppt Slides Show PDF

This slide represents the model showing integration of omnichannel banking into the banks. It includes details related to channels applications, integration hub, core banking layer and legacy records system. Presenting Multichannel Banking Management System Integration Model Ppt Slides Show PDF to dispense important information. This template comprises one stages. It also presents valuable insights into the topics including Channels Applications, Database Server Layer, Application Server Layer, Core Banking Layer. This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

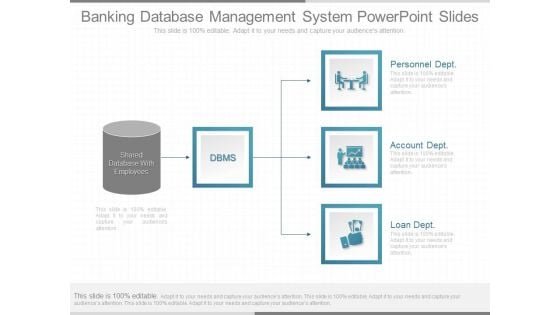

Banking Database Management System Powerpoint Slides

This is a banking database management system powerpoint slides. This is a three stage process. The stages in this process are shared database with employees, dbms, personnel dept, account dept, loan dept.

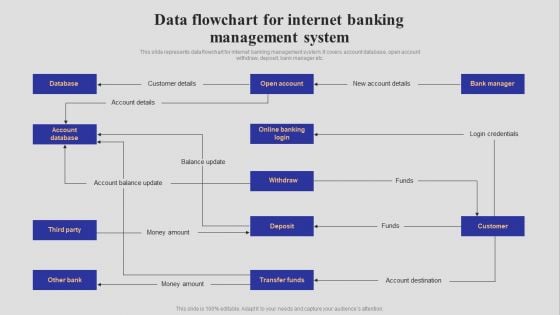

Introduction To Digital Banking Services Data Flowchart For Internet Banking Management System Guidelines PDF

This slide represents data flowchart for internet banking management system. It covers account database, open account withdraw, deposit, bank manager etc. Boost your pitch with our creative Introduction To Digital Banking Services Data Flowchart For Internet Banking Management System Guidelines PDF. Deliver an awe-inspiring pitch that will mesmerize everyone. Using these presentation templates you will surely catch everyones attention. You can browse the ppts collection on our website. We have researchers who are experts at creating the right content for the templates. So you do not have to invest time in any additional work. Just grab the template now and use them.

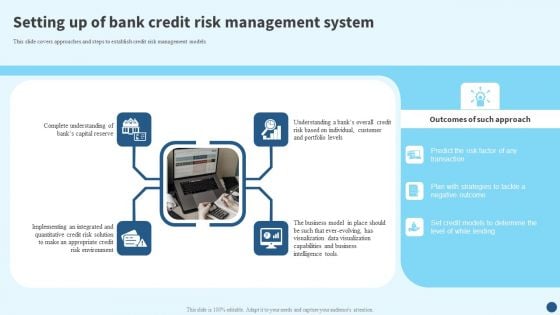

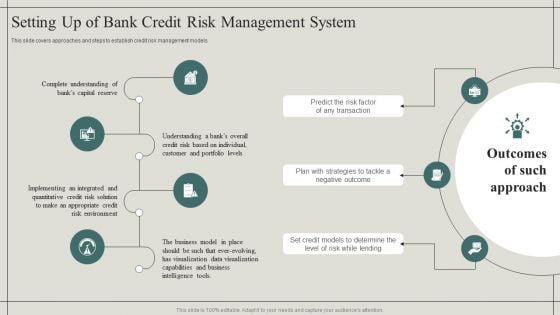

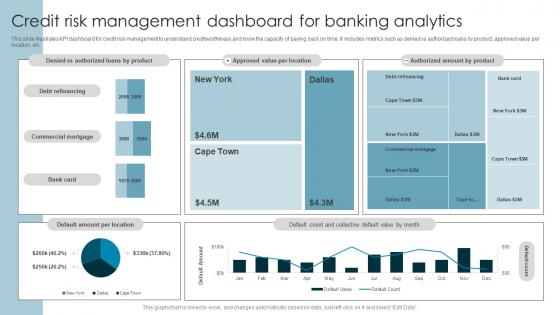

Credit Risk Management Setting Up Of Bank Credit Risk Management System Themes PDF

This slide covers approaches and steps to establish credit risk management models. From laying roadmaps to briefing everything in detail, our templates are perfect for you. You can set the stage with your presentation slides. All you have to do is download these easy-to-edit and customizable templates. Credit Risk Management Setting Up Of Bank Credit Risk Management System Themes PDF will help you deliver an outstanding performance that everyone would remember and praise you for. Do download this presentation today.

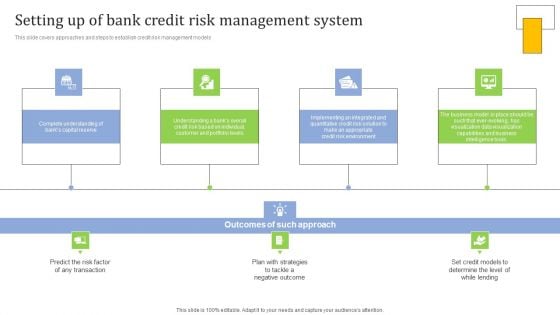

Strategies For Credit Risk Management Setting Up Of Bank Credit Risk Management System Background PDF

This slide covers approaches and steps to establish credit risk management models. This modern and well-arranged Strategies For Credit Risk Management Setting Up Of Bank Credit Risk Management System Background PDF provides lots of creative possibilities. It is very simple to customize and edit with the Powerpoint Software. Just drag and drop your pictures into the shapes. All facets of this template can be edited with Powerpoint, no extra software is necessary. Add your own material, put your images in the places assigned for them, adjust the colors, and then you can show your slides to the world, with an animated slide included.

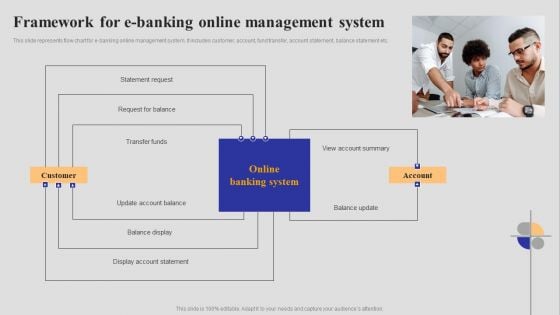

Introduction To Digital Banking Services Framework For E Banking Online Management System Guidelines PDF

This slide represents flow chart for e-banking online management system. It includes customer, account, fund transfer, account statement, balance statement etc. Slidegeeks is one of the best resources for PowerPoint templates. You can download easily and regulate Introduction To Digital Banking Services Framework For E Banking Online Management System Guidelines PDF for your personal presentations from our wonderful collection. A few clicks is all it takes to discover and get the most relevant and appropriate templates. Use our Templates to add a unique zing and appeal to your presentation and meetings. All the slides are easy to edit and you can use them even for advertisement purposes.

Effective Financial Risk Management Strategies Setting Up Of Bank Credit Risk Management System Structure PDF

This slide covers approaches and steps to establish credit risk management models. This is a Effective Financial Risk Management Strategies Setting Up Of Bank Credit Risk Management System Structure PDF template with various stages. Focus and dispense information on three stages using this creative set, that comes with editable features. It contains large content boxes to add your information on topics like Strategies, Determine, Risk. You can also showcase facts, figures, and other relevant content using this PPT layout. Grab it now.

Bank Borrowing System Management System Icon Ppt Icon Designs Download PDF

Persuade your audience using this Bank Borrowing System Management System Icon Ppt Icon Designs Download PDF. This PPT design covers three stages, thus making it a great tool to use. It also caters to a variety of topics including Bank Borrowing System, Management System, Icon. Download this PPT design now to present a convincing pitch that not only emphasizes the topic but also showcases your presentation skills.

Setting Up Of Bank Credit Risk Management System Credit Risk Analysis Model For Banking Institutions Icons PDF

This slide covers approaches and steps to establish credit risk management models. If you are looking for a format to display your unique thoughts, then the professionally designed Setting Up Of Bank Credit Risk Management System Credit Risk Analysis Model For Banking Institutions Icons PDF is the one for you. You can use it as a Google Slides template or a PowerPoint template. Incorporate impressive visuals, symbols, images, and other charts. Modify or reorganize the text boxes as you desire. Experiment with shade schemes and font pairings. Alter, share or cooperate with other people on your work. Download Setting Up Of Bank Credit Risk Management System Credit Risk Analysis Model For Banking Institutions Icons PDF and find out how to give a successful presentation. Present a perfect display to your team and make your presentation unforgettable.

Queue Management System Bank Ppt PowerPoint Presentation Professional Background Cpb Pdf

Presenting this set of slides with name queue management system bank ppt powerpoint presentation professional background cpb pdf. This is an editable Powerpoint five stages graphic that deals with topics like queue management system bank to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

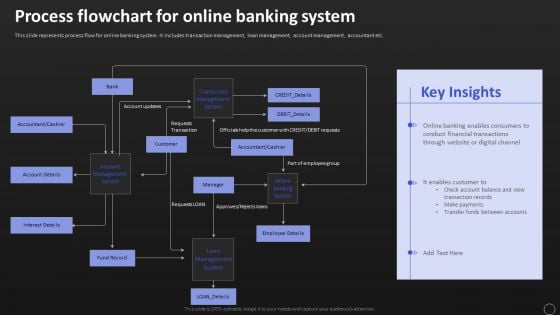

Net Banking Channel And Service Management Process Flowchart For Online Banking System Inspiration PDF

This slide represents process flow for online banking system. It includes transaction management, loan management, account management, accountant etc. Do you have to make sure that everyone on your team knows about any specific topic. I yes, then you should give Net Banking Channel And Service Management Process Flowchart For Online Banking System Inspiration PDF a try. Our experts have put a lot of knowledge and effort into creating this impeccable Net Banking Channel And Service Management Process Flowchart For Online Banking System Inspiration PDF. You can use this template for your upcoming presentations, as the slides are perfect to represent even the tiniest detail. You can download these templates from the Slidegeeks website and these are easy to edit. So grab these today.

Icon For Customer Personal Relationship Management In Banking System Elements PDF

Showcasing this set of slides titled Icon For Customer Personal Relationship Management In Banking System Elements PDF. The topics addressed in these templates are Icon Fcustomer, Personal Relationship, Management Banking System. All the content presented in this PPT design is completely editable. Download it and make adjustments in color, background, font etc. as per your unique business setting.

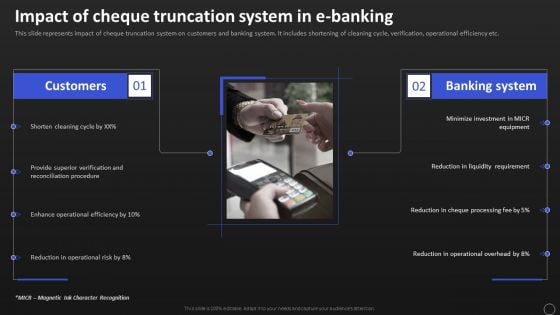

Net Banking Channel And Service Management Impact Of Cheque Truncation System In E Banking Download PDF

This slide represents impact of cheque truncation system on customers and banking system. It includes shortening of cleaning cycle, verification, operational efficiency etc. Want to ace your presentation in front of a live audience Our Net Banking Channel And Service Management Impact Of Cheque Truncation System In E Banking Download PDF can help you do that by engaging all the users towards you. Slidegeeks experts have put their efforts and expertise into creating these impeccable powerpoint presentations so that you can communicate your ideas clearly. Moreover, all the templates are customizable, and easy to edit and downloadable. Use these for both personal and commercial use.

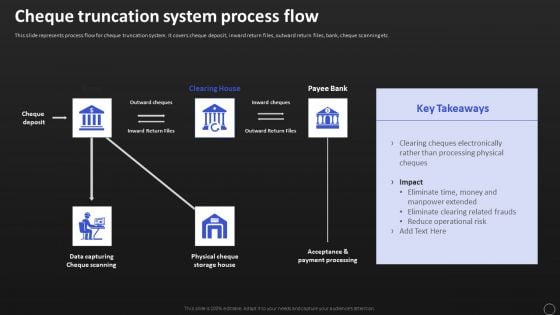

Net Banking Channel And Service Management Cheque Truncation System Process Flow Template PDF

This slide represents process flow for cheque truncation system. It covers cheque deposit, inward return files, outward return files, bank, cheque scanning etc. This Net Banking Channel And Service Management Cheque Truncation System Process Flow Template PDF from Slidegeeks makes it easy to present information on your topic with precision. It provides customization options, so you can make changes to the colors, design, graphics, or any other component to create a unique layout. It is also available for immediate download, so you can begin using it right away. Slidegeeks has done good research to ensure that you have everything you need to make your presentation stand out. Make a name out there for a brilliant performance.

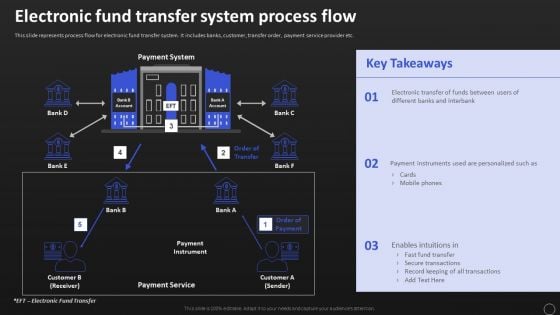

Net Banking Channel And Service Management Electronic Fund Transfer System Process Flow Structure PDF

This slide represents process flow for electronic fund transfer system. It includes banks, customer, transfer order, payment service provider etc. Do you know about Slidesgeeks Net Banking Channel And Service Management Electronic Fund Transfer System Process Flow Structure PDF These are perfect for delivering any kind od presentation. Using it, create PowerPoint presentations that communicate your ideas and engage audiences. Save time and effort by using our pre designed presentation templates that are perfect for a wide range of topic. Our vast selection of designs covers a range of styles, from creative to business, and are all highly customizable and easy to edit. Download as a PowerPoint template or use them as Google Slides themes.

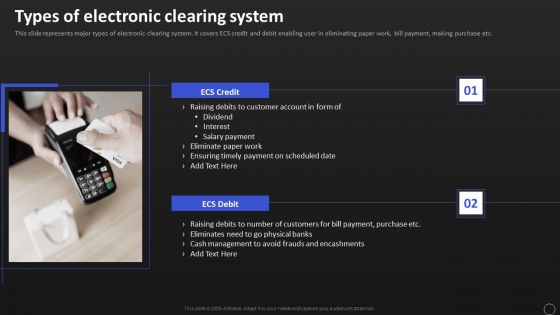

Net Banking Channel And Service Management Types Of Electronic Clearing System Template PDF

This slide represents major types of electronic clearing system. It covers ECS credit and debit enabling user in eliminating paper work, bill payment, making purchase etc. Present like a pro with Net Banking Channel And Service Management Types Of Electronic Clearing System Template PDF. Create beautiful presentations together with your team, using our easy to use presentation slides. Share your ideas in real time and make changes on the fly by downloading our templates. So whether youre in the office, on the go, or in a remote location, you can stay in sync with your team and present your ideas with confidence. With Slidegeeks presentation got a whole lot easier. Grab these presentations today.

Bank Account Administration System Features Summary PDF

The following slide highlights multiple features of bank account management system such as online registration for new users, user account activation and approval by admin, transferring money to local customer account number etc. Presenting Bank Account Administration System Features Summary PDF to dispense important information. This template comprises nine stages. It also presents valuable insights into the topics including Online Registrations, Transferring Money, Transaction History, Account Statement . This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

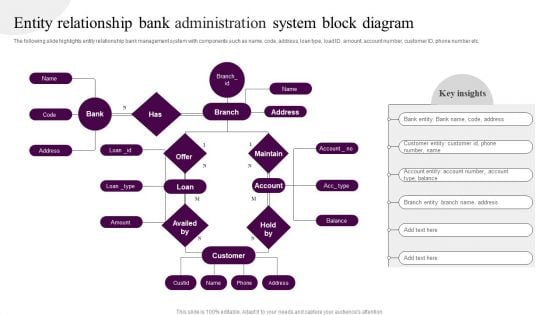

Entity Relationship Bank Administration System Block Diagram Sample PDF

The following slide highlights entity relationship bank management system with components such as name, code, address, loan type, load ID, amount, account number, customer ID, phone number etc. Showcasing this set of slides titled Entity Relationship Bank Administration System Block Diagram Sample PDF. The topics addressed in these templates are Branch, Account, Offer, Loan. All the content presented in this PPT design is completely editable. Download it and make adjustments in color, background, font etc. as per your unique business setting.

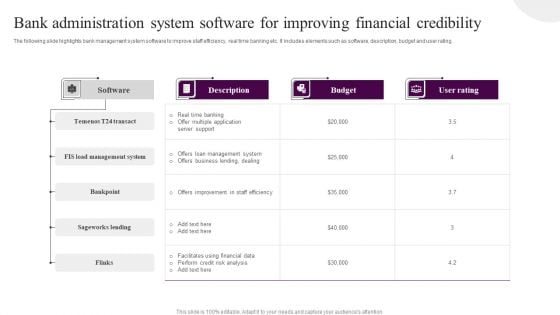

Bank Administration System Software For Improving Financial Credibility Designs PDF

The following slide highlights bank management system software to improve staff efficiency, real time banking etc. It includes elements such as software, description, budget and user rating. Showcasing this set of slides titled Bank Administration System Software For Improving Financial Credibility Designs PDF. The topics addressed in these templates are FIS Load Management System, Bankpoint, Sageworks Lending . All the content presented in this PPT design is completely editable. Download it and make adjustments in color, background, font etc. as per your unique business setting.

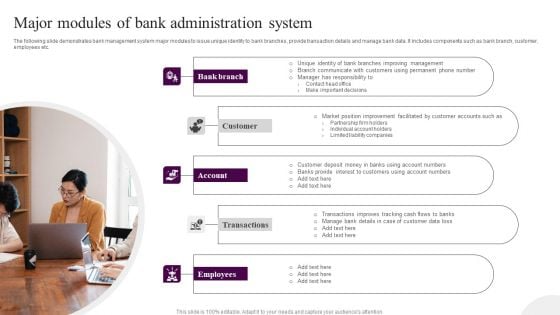

Major Modules Of Bank Administration System Professional PDF

The following slide demonstrates bank management system major modules to issue unique identity to bank branches, provide transaction details and manage bank data. It includes components such as bank branch, customer, employees etc. Presenting Major Modules Of Bank Administration System Professional PDF to dispense important information. This template comprises five stages. It also presents valuable insights into the topics including Bank Branch, Customer, Account . This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

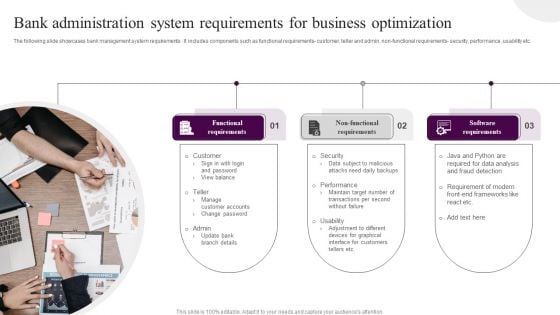

Bank Administration System Requirements For Business Optimization Rules PDF

The following slide showcases bank management system requirements . It includes components such as functional requirements- customer, teller and admin, non-functional requirements- security, performance, usability etc. Presenting Bank Administration System Requirements For Business Optimization Rules PDF to dispense important information. This template comprises three stages. It also presents valuable insights into the topics including Functional Requirements, Non Functional Requirements, Software Requirements . This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

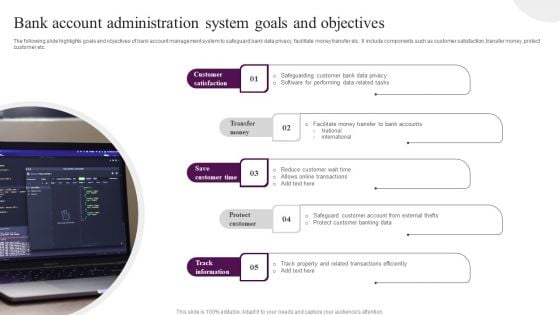

Bank Account Administration System Goals And Objectives Brochure PDF

The following slide highlights goals and objectives of bank account management system to safeguard bank data privacy, facilitate money transfer etc. It include components such as customer satisfaction, transfer money, protect customer etc. Presenting Bank Account Administration System Goals And Objectives Brochure PDF to dispense important information. This template comprises five stages. It also presents valuable insights into the topics including Customer Satisfaction, Transfer Money, Save Customer Time . This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

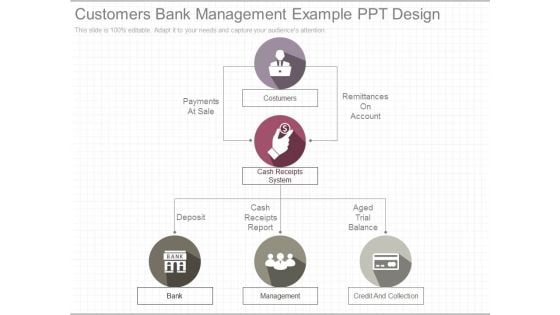

Customers Bank Management Example Ppt Design

This is a customers bank management example ppt design. This is a five stage process. The stages in this process are payments at sale, customers, remittances on account, cash receipts system, deposit, cash receipts report, aged trial balance, bank, management, credit and collection.

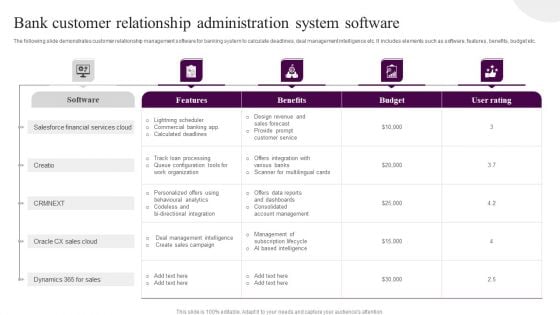

Bank Customer Relationship Administration System Software Infographics PDF

The following slide demonstrates customer relationship management software for banking system to calculate deadlines, deal management intelligence etc. It includes elements such as software, features, benefits, budget etc. Showcasing this set of slides titled Bank Customer Relationship Administration System Software Infographics PDF. The topics addressed in these templates are Salesforce Financial Services Cloud, Oracle CX Sales Cloud, Dynamics Sales. All the content presented in this PPT design is completely editable. Download it and make adjustments in color, background, font etc. as per your unique business setting.

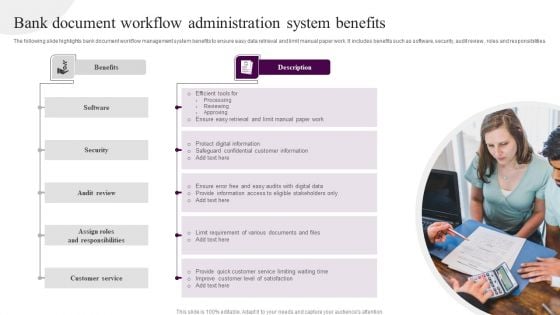

Bank Document Workflow Administration System Benefits Slides PDF

The following slide highlights bank document workflow management system benefits to ensure easy data retrieval and limit manual paper work. It includes benefits such as software, security, audit review, roles and responsibilities. Presenting Bank Document Workflow Administration System Benefits Slides PDF to dispense important information. This template comprises one stages. It also presents valuable insights into the topics including Software, Security, Audit Review . This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

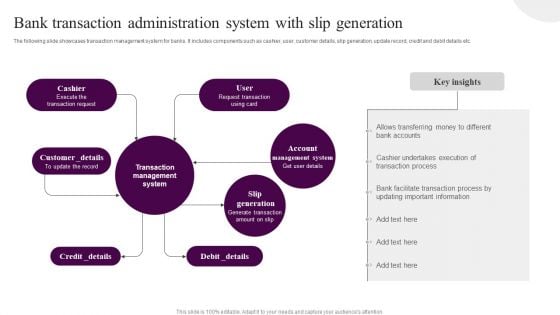

Bank Transaction Administration System With Slip Generation Background PDF

The following slide showcases transaction management system for banks. It includes components such as cashier, user, customer details, slip generation, update record, credit and debit details etc. Presenting Bank Transaction Administration System With Slip Generation Background PDF to dispense important information. This template comprises one stages. It also presents valuable insights into the topics including Cashier Account, Management System, Slip Generation. This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

Cryptocurrency Ledger Blockchain Technology Vs Bank System Rules PDF

This slide represents the comparison between blockchain technology and the bank system. It shows how blockchain technology is available for users 24 into 7 throughout the year. This is a Cryptocurrency Ledger Blockchain Technology Vs Bank System Rules PDF template with various stages. Focus and dispense information on two stages using this creative set, that comes with editable features. It contains large content boxes to add your information on topics like Blockchain, Bank System. You can also showcase facts, figures, and other relevant content using this PPT layout. Grab it now.

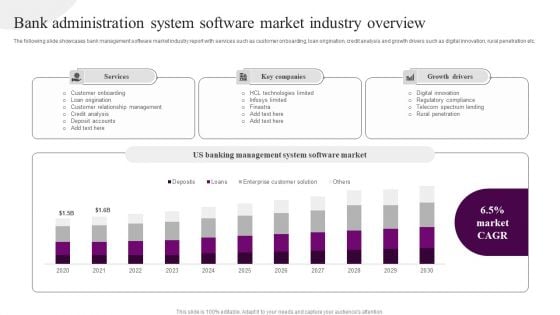

Bank Administration System Software Market Industry Overview Background PDF

The following slide showcases bank management software market industry report with services such as customer onboarding, loan origination, credit analysis and growth drivers such as digital innovation, rural penetration etc. Showcasing this set of slides titled Bank Administration System Software Market Industry Overview Background PDF. The topics addressed in these templates are Customer Onboarding, Loan Origination, Customer Relationship Management, Credit Analysis. All the content presented in this PPT design is completely editable. Download it and make adjustments in color, background, font etc. as per your unique business setting.

Money Transfer Using Bank Administration System Icon Portrait PDF

Presenting Money Transfer Using Bank Administration System Icon Portrait PDF to dispense important information. This template comprises four stages. It also presents valuable insights into the topics including Money Transfer Using, Bank Administration System Icon. This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

Integrated Bank Administration System Icon With Gear Download PDF

Presenting Integrated Bank Administration System Icon With Gear Download PDF to dispense important information. This template comprises four stages. It also presents valuable insights into the topics including Integrated Bank Administration, System Icon With Gear. This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

Icon For Cashless Payment Using Bank Administration System Pictures PDF

Presenting Icon For Cashless Payment Using Bank Administration System Pictures PDF to dispense important information. This template comprises four stages. It also presents valuable insights into the topics including Icon Cashless Payment, Using Bank, Administration System. This is a completely customizable PowerPoint theme that can be put to use immediately. So, download it and address the topic impactfully.

Bank Administration System Ppt PowerPoint Presentation Complete Deck

Improve your presentation delivery using this Bank Administration System Ppt PowerPoint Presentation Complete Deck. Support your business vision and objectives using this well-structured PPT deck. This template offers a great starting point for delivering beautifully designed presentations on the topic of your choice. Comprising fifteen this professionally designed template is all you need to host discussion and meetings with collaborators. Each slide is self-explanatory and equipped with high-quality graphics that can be adjusted to your needs. Therefore, you will face no difficulty in portraying your desired content using this PPT slideshow. This PowerPoint slideshow contains every important element that you need for a great pitch. It is not only editable but also available for immediate download and utilization. The color, font size, background, shapes everything can be modified to create your unique presentation layout. Therefore, download it now.

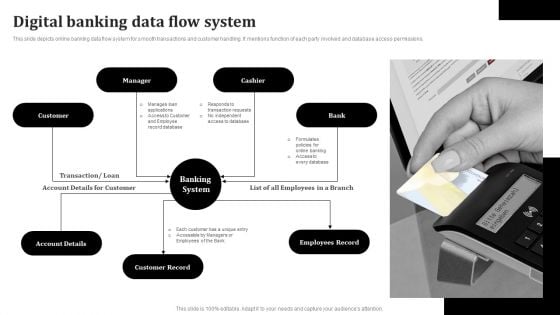

Digital Banking Data Flow System Template PDF

This slide depicts online banking data flow system for smooth transactions and customer handling. It mentions function of each party involved and database access permissions. Persuade your audience using this Digital Banking For Financial Management Icon Information PDF. This PPT design covers Seven stages, thus making it a great tool to use. It also caters to a variety of topics including Manager, Cashier, Banking System, Employees Record. Download this PPT design now to present a convincing pitch that not only emphasizes the topic but also showcases your presentation skills.

Banking Operations Management Multinational Bank Profile With Key Services Designs PDF

This slide highlights the multinational bank profile which includes founded year, headquarter, area served, no of employees it also showcases the key services which includes credit cards, consumer and corporate banking and investment banking etc. This is a Banking Operations Management Multinational Bank Profile With Key Services Designs PDF template with various stages. Focus and dispense information on seven stages using this creative set, that comes with editable features. It contains large content boxes to add your information on topics like Investment Banking, Corporate Banking, Consumer Banking. You can also showcase facts, figures, and other relevant content using this PPT layout. Grab it now.

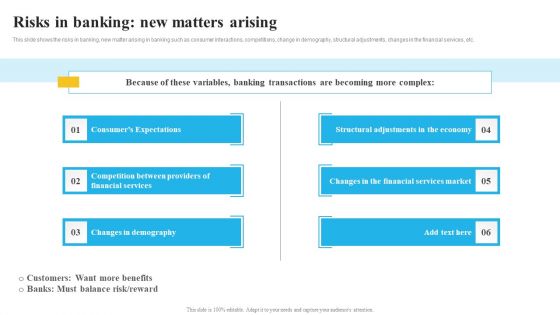

Bank And Finance Risk Management Tools And Methodologies Risks In Banking New Microsoft PDF

This slide shows the risks in banking, new matter arising in banking such as consumer interactions, competitions, change in demography, structural adjustments, changes in the financial services, etc. From laying roadmaps to briefing everything in detail, our templates are perfect for you. You can set the stage with your presentation slides. All you have to do is download these easy-to-edit and customizable templates. Bank And Finance Risk Management Tools And Methodologies Risks In Banking New Microsoft PDF will help you deliver an outstanding performance that everyone would remember and praise you for. Do download this presentation today.

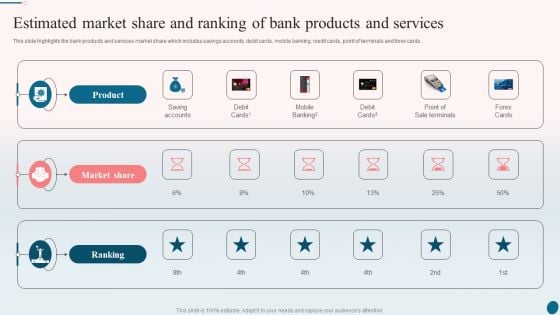

Banking Operations Management Estimated Market Share And Ranking Of Bank Products And Services Sample PDF

This slide highlights the bank products and services market share which includes savings accounts, debit cards, mobile banking, credit cards, point of terminals and forex cards. This is a Banking Operations Management Estimated Market Share And Ranking Of Bank Products And Services Sample PDF template with various stages. Focus and dispense information on three stages using this creative set, that comes with editable features. It contains large content boxes to add your information on topics like Market Share, Product, Ranking. You can also showcase facts, figures, and other relevant content using this PPT layout. Grab it now.

Bank Customer Management Ppt PowerPoint Presentation File Ideas Cpb

This is a bank customer management ppt powerpoint presentation file ideas cpb. This is a six stage process. The stages in this process are bank customer management.

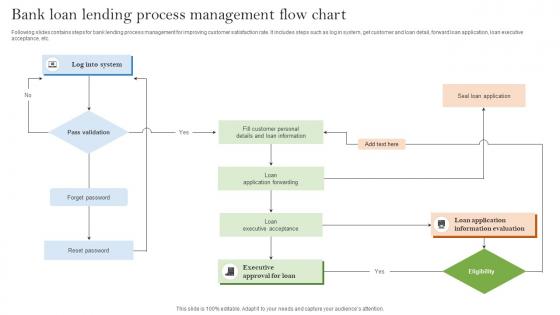

Bank Loan Lending Process Management Flow Chart Formats Pdf

Following slides contains steps for bank lending process management for improving customer satisfaction rate. It includes steps such as log in system, get customer and loan detail, forward loan application, loan executive acceptance, etc. Showcasing this set of slides titled Bank Loan Lending Process Management Flow Chart Formats Pdf. The topics addressed in these templates are Loan Application, Information Evaluation, Eligibility. All the content presented in this PPT design is completely editable. Download it and make adjustments in color, background, font etc. as per your unique business setting. Following slides contains steps for bank lending process management for improving customer satisfaction rate. It includes steps such as log in system, get customer and loan detail, forward loan application, loan executive acceptance, etc.

Management Commercial Bank Ppt PowerPoint Presentation Summary Slideshow Cpb

Presenting this set of slides with name management commercial bank ppt powerpoint presentation summary slideshow cpb. This is an editable Powerpoint four stages graphic that deals with topics like management commercial bank to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Bank Customer Relationship Management Ppt PowerPoint Presentation Layouts Template Cpb

Presenting this set of slides with name bank customer relationship management ppt powerpoint presentation layouts template cpb. This is an editable Powerpoint five stages graphic that deals with topics like bank customer relationship management to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Bank Relationship Management Ppt PowerPoint Presentation Show Backgrounds Cpb Pdf

Presenting this set of slides with name bank relationship management ppt powerpoint presentation show backgrounds cpb pdf. This is an editable Powerpoint four stages graphic that deals with topics like bank relationship management to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

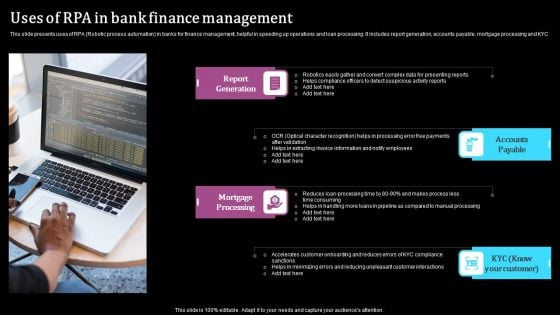

Uses Of RPA In Bank Finance Management Download PDF

This slide presents uses of RPA Robotic process automation in banks for finance management, helpful in speeding up operations and loan processing. It includes report generation, accounts payable, mortgage processing and KYC. Persuade your audience using this Uses Of RPA In Bank Finance Management Download PDF. This PPT design covers four stages, thus making it a great tool to use. It also caters to a variety of topics including Report Generation, Accounts Payable, Mortgage Processing. Download this PPT design now to present a convincing pitch that not only emphasizes the topic but also showcases your presentation skills.

Bank RPA Management Plan With Icons Ppt Styles Deck PDF

Presenting bank rpa management plan with icons ppt styles deck pdf to provide visual cues and insights. Share and navigate important information on four stages that need your due attention. This template can be used to pitch topics like streamline account creation, detect financial crime, revenue loss and improve dispute resolution. In addition, this PPT design contains high-resolution images, graphics, etc, that are easily editable and available for immediate download.

Hospital Management System Healthcare Finance Summary PDF

Deliver an awe inspiring pitch with this creative hospital management system healthcare finance summary pdf bundle. Topics like finance performance key trends, healthcare expenditure comparison, healthcare financing models can be discussed with this completely editable template. It is available for immediate download depending on the needs and requirements of the user.

Hospital Management System Content Summary PDF

Deliver an awe inspiring pitch with this creative hospital management system content summary pdf bundle. Topics like strategic planning marketing, financial management, cost accounting, kpi metrics and dashboard can be discussed with this completely editable template. It is available for immediate download depending on the needs and requirements of the user.

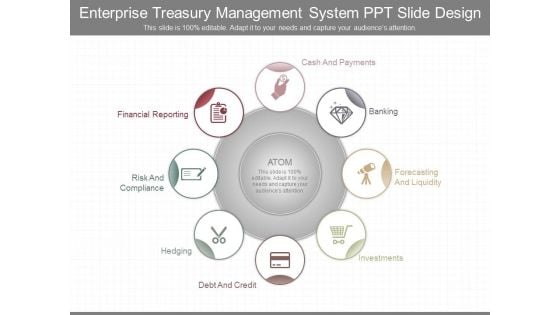

Enterprise Treasury Management System Ppt Slide Design

This is a enterprise treasury management system ppt slide design. This is a eight stage process. The stages in this process are cash and payments, banking, forecasting and liquidity, investments, hedging, risk and compliance, financial reporting, atom.

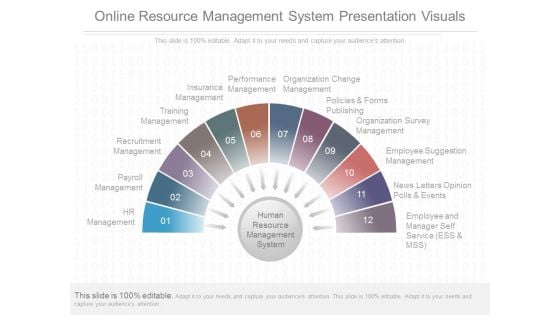

Online Resource Management System Presentation Visuals

This is a online resource management system presentation visuals. This is a twelve stage process. The stages in this process are hr management, payroll management, recruitment management, training management, insurance management, performance management, organization change management, policies and forms publishing, organization survey management, employee suggestion management, news letters opinion polls and events, employee and manager self service ess and mss, human resource management system.

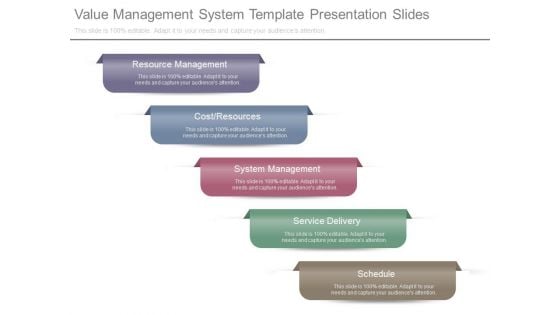

Value Management System Template Presentation Slides

This is a value management system template presentation slides. This is a five stage process. The stages in this process are resource management, cost resources, system management, service delivery, schedule.

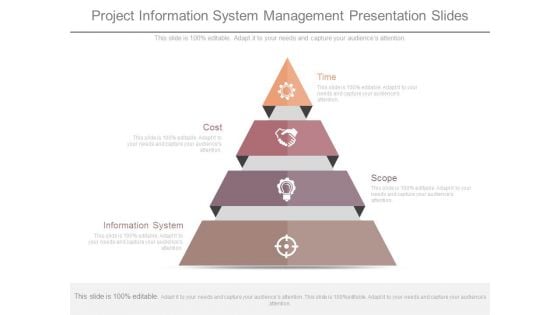

Project Information System Management Presentation Slides

This is a project information system management presentation slides. This is a four stage process. The stages in this process are cost, time, information system, scope.

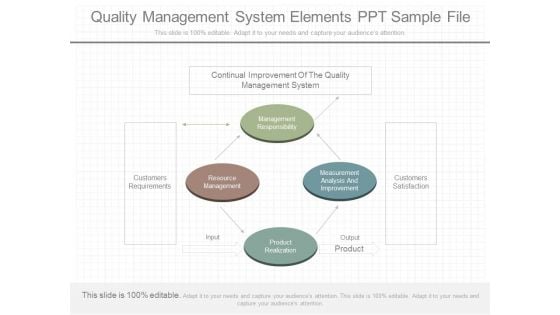

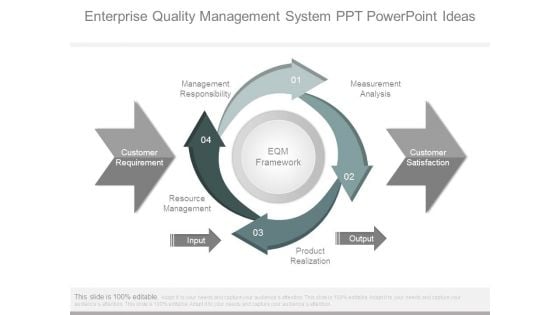

Quality Management System Elements Ppt Sample File

This is a quality management system elements ppt sample file. This is a four stage process. The stages in this process are continual improvement of the quality management system, customers requirements, management responsibility, resource management, product realization, measurement analysis and improvement, input, output, product, customers satisfaction.

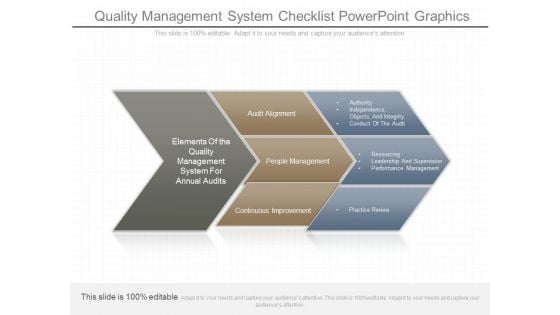

Quality Management System Checklist Powerpoint Graphics

This is a quality management system checklist powerpoint graphics. This is a three stage process. The stages in this process are process are elements of the quality management system for annual audits, audit alignment, people management, continuous improvement, authority independence, objects, and integrity conduct of the audit, resourcing leadership and supervision, performance management, practice review.

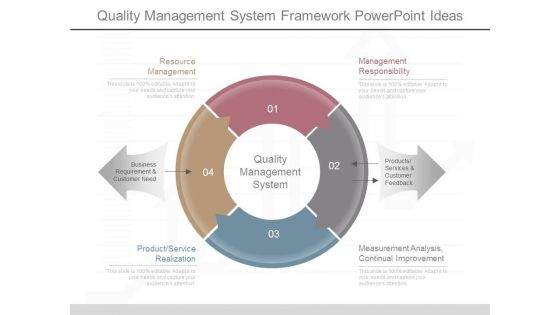

Quality Management System Framework Powerpoint Ideas

This is a quality management system framework powerpoint ideas. This is a four stage process. The stages in this process are resource management, product service realization, measurement analysis continual improvement, management responsibility, quality management system, business requirement and customer need, products services and customer, feedback.

Enterprise Quality Management System Example Of Ppt

This is a enterprise quality management system example of ppt. This is a four stage process. The stages in this process are product realization, continual improvement, measurement analysis and improvement, customer satisfaction, management responsibility, resource management, customer requirement.

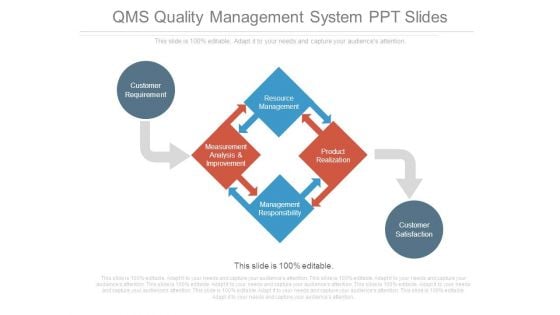

Qms Quality Management System Ppt Slides

This is a qms quality management system ppt slides. This is a three stage process. The stages in this process are customer requirement, measurement analysis and improvement, resource management, product realization, management responsibility, customer satisfaction.

Enterprise Quality Management System Ppt Powerpoint Ideas

This is a enterprise quality management system ppt powerpoint ideas. This is a four stage process. The stages in this process are eqm framework, management responsibility, customer requirement, resource management, input, product realization, output, customer satisfaction, measurement analysis.

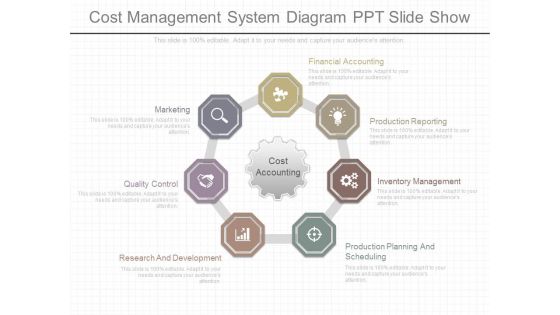

Cost Management System Diagram Ppt Slide Show

This is a cost management system diagram ppt slide show. This is a seven stage process. The stages in this process are research and development, quality control, marketing, financial accounting, production reporting, inventory management, production planning and scheduling, cost accounting.

Implementing Marketing Resource Management System Pictures PDF

This slide covers marketing resource management system for its optimum utilization. It involves key benefits of integrating system such as enhanced efficiency, reduced costs and enhanced collaboration. Crafting an eye-catching presentation has never been more straightforward. Let your presentation shine with this tasteful yet straightforward Implementing Marketing Resource Management System Pictures PDF template. It offers a minimalistic and classy look that is great for making a statement. The colors have been employed intelligently to add a bit of playfulness while still remaining professional. Construct the ideal Implementing Marketing Resource Management System Pictures PDF that effortlessly grabs the attention of your audience Begin now and be certain to wow your customers

Quality Management System In Construction Powerpoint Templates

This is a quality management system in construction powerpoint templates. This is a three stage process. The stages in this process are quality, cost, scope, schedule.

- Preferences

United States Banking System - PowerPoint PPT Presentation

Something went wrong! Please try again and reload the page.

United States Banking System

United states banking system an fldc presentation what is a banking system a network of commercial, savings, and specialized banks that provide financial services ... – powerpoint ppt presentation.

- An FLDC Presentation

- A network of commercial, savings, and specialized banks that provide financial services, including accepting deposits and providing loans and credit, money transmission, and investment facilities.

- The United States Banking System is also known as the Federal Reserve System.

- Before 1863, banks issued notes that functioned like our present day currency, except they were the duty of individual banks.

- The money that was in circulation fluctuated with the business cycle, possibly exaggerating them.

- Banks were subject to liquidity problems and the economy suffered several crashes which led to the crash of 1907.

- It was then that the Federal Reserve Act was created in 1913.

- Serve as a leader of last resort

- Provide an elastic currency (money supply control).

- Provide for a sounder banking system

- Improving how transactions were processed (check clearing and promoting payments system technology).

- Conducting the Nations monetary policy by influencing monetary and conditions in the economy, in pursuit of employment, stable prices, and moderate long-term interest rates.

- Supervising and regulating banking institutions to ensure the safety of the banking system and to protect credit rights of consumers.

- Providing financial services to depository institutions, the U.S government and other foreign institutions.

- They also make loans to commercial banks, and are authorized to issue Federal Reserve Notes.

- Regulation Q They establish the maximum rate that depository institutions could pay on deposit accounts.

- Securities Credit Regulation Establishes borrowing limit for buyers on securities margins.

- Supervision Examination of State Member Banks by Feds.

- Regulation of Bank and Financial holding companies.

- Regulation of payment system.

- Control of International Banking actions.

- Consumer Credit Regulation

- Being a Fiscal Agent for the U.S Treasury

- Seven Members make up the Board of Governors.

- 12 Regional Federal Reserve Banks.

- Thousands of Member Commercial Banks

- Federal Open Market Committee( FOTC)

- The FOTC consists of the Board of Governors and the 5 Presidents from the district banks.

- The Assets of the Federal Reserve System include

- U.S Government and Agency Securities (Primary).

- Net loan of reserves of extended.

- Treasury coin.

- Loans to member banks.

- Gold Certificates and SDRs.

- Bank deposits (reserves) in the Fed are needed to clear checks and to satisfy reserve requirements.

- Actual reserves (AR) are balances needed to meet check clearing and legal reserve requirements including

- -vault cash.

- -noninterest bearing bank deposits in Federal Reserve banks.

- Excess Reserves equals actual minus the required reserves.

- Excess Reserves may loaned to customers or sold to other banks (federal funds market) by an individual bank.

- If the level of the banking system's Federal Reserve borrowed reserves (BR) (Fed loan credited to reserve accounts) exceeds the level of excess reserves in a period, the banking system is in a net borrowed reserve position, is less likely to promote lending activities, and interest rates are most likely to be increasing.

- If the level of level of excess reserves exceeds Fed borrowing, the banking system is in a net-free reserve position, credit is easier and interest rates are generally lower.

- Many analysts prefer to examine banks net-free reserves (Excess Reserves - Borrowed Reserves).

- 2. Open market operations affect the level of member bank reserves and the monetary base.

- Buying government securities from the private sector, the Fed eventually credits member bank deposits, thus increasing the level of bank reserves and the banks' ability to make loans and expand the money supply.

- Selling securities (could be any asset) to private security dealers or banks, the Fed is paid with a bank check which reduces the level of member bank actual reserves.

- The Federal Reserve usually expands or contracts its liabilities by engaging in Open Market Operations.

- When they buy securities, they write a check on themselves.

- The Federal Reserve increases the monetary base via the banks reserve accounts whenever it acquires more assets

- Discount Rate Policy -- The rate of interest depository institutions pay for borrowing from the Fed.

- Raising the discount rate increases the cost of borrowing for needed reserve balances.

- Lowering the discount rate lowers the cost of bank liquidity and encourages lending and money supply expansion

- Rarely used as a tool of monetary policy now.

- Changes in the assets and liabilities of the Federal Reserve System largely determine the nations Monetary Base

- The Monetary Base equals currency in circulation plus financial institution deposits at the Federal Reserve.

- The Federal Reserve increases the monetary base via the banks reserve account whenever it acquires more assets. It decreases the monetary base when it sells assets.

- Expansionary monetary policy

- Open market operations -- purchase securities -- increase bank excess reserves and the monetary base.

- Reserve requirements -- reduce reserve requirements -- increase excess reserves and increase the deposit expansion multiplier.

- Discount rate -- reduce the rate -- reduce the cost of borrowing reserves.

- Expands the money supply reduces interest rates.

- Restrictive monetary policy

- Open market operations -- sell securities, reduce bank reserves and the monetary base.

- Reserve requirements -- increase reserve requirements, reduces excess reserves and the deposit expansion multiplier.

- Discount rate -- increase the discount rate and the cost of borrowing reserve deficiencies.

- Reduce the money supply or its growth rate increase interest rates.

- Moral Suasion - Chairman of the Federal Reserve System makes a speech or testifies before Congress

- Regulation of Banks

- International Activities arising from acting as the Agent of the United States Government in International Finance

- The Federal Reserve has ultimate power in influencing interest rates.

- During a period of time when interest rates are low, capital is easy to acquire and this spurs development because the more cash a consumer has, the more items they buy.

- In contrast, if interest rates are too high, the result can be a recession and in extreme cases even deflation.

- There are two ways that the Federal Reserve can influence the interest rates.

- 1- The Federal Reserve can either increase or decrease the discount rate.

- 2- By indirectly influencing direction of the Federal Funds Rate.

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

62 templates

pink flowers

255 templates

15 templates

23 templates

22 templates

100 templates

Banking Infographics

It seems that you like this template, free google slides theme, powerpoint template, and canva presentation template.

Do you know everything about banks? After using these infographics you sure do! Indeed, this is a set of infographics related to a wide variety of banking concepts. Mortgages, credits, loans, debts, online banking... download these infographics now to find out what else we have included! They are very complete!

Features of these infographics

- 100% editable and easy to modify

- 31 different infographics to boost your presentations

- Include icons and Flaticon’s extension for further customization

- Designed to be used in Google Slides, Canva, and Microsoft PowerPoint and Keynote

- 16:9 widescreen format suitable for all types of screens

- Include information about how to edit and customize your infographics

How can I use the infographics?

Am I free to use the templates?

How to attribute the infographics?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Register for free and start downloading now

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

- Collections

- Online Banking System PPT

Online Banking System PPT Template and Google Slides

Four Noded Online Banking Service Presentation Slide

Features of this template:.

- Online Banking System

- Online Banking

- Internet Banking

- E Banking System

- 4 Step Online Banking

- Google Slides

705+ Templates

24+ Templates

158+ Templates

195+ Templates

Credit Card

21+ Templates

26+ Templates

32+ Templates

54+ Templates

43+ Templates

You May Also Like These PowerPoint Templates

Core systems strategy for banks

Serves financial institutions, helping them get their legacy technologies ready for the digital age

Specializes in getting legacy systems “digital ready”

May 4, 2020 Core transaction processing engines for banks—or “core banking systems”—have been making news in the world of banking technology of late. Some of the major global banks have announced partnerships with new cloud-based core banking systems providers. There have been a few instances in the US of these partnerships as well. Many small and midcap banks in the US and Latin America are known to be shopping around for new cores. This topic seems to have suddenly gained visibility in the US and the rest of the world

In this article we look at the forces that are raising the core banking profile, and at the alternatives available to banking leaders as they consider their technology roadmap.

Banks all over the world spend millions of dollars each on maintaining their core banking systems, which usually interface with tens or hundreds of systems. Core banking systems handle a high volume of transactions and are expected to function without interruption—prolonged outages can invite regulatory scrutiny, customer opprobrium, and significant loss of revenue.

Legacy core banking systems have traditionally succeeded in terms of reliability. Failures are rare, with some banks going without an outage for months, if not years. However, with the advent of digital banking, cloud, and APIs, banks have seen a significant shift in the way banking products and partnerships are constructed. Banks are now expected to process transactions in real time, be able to stitch together partnerships with fintech companies in a matter of weeks, release new features frequently, be able to scale (up and down) their infrastructure needs at will, and even execute on M&A quickly. Older core banking systems— usually designed for reliability rather than open architecture—may need to respond to this new requirement, which, to their credit, many are doing with alacrity.

In addition to the existential issues listed above, banks endure some tactical day-to-day pain points with legacy core banking systems. These problems vary from bank to bank, but include a dwindling engineering talent pool, excessive undocumented customization leading to a complex code base that can be difficult and risky to change, and various vendor-support issues.

In response to these issues, a new breed of core banking systems has emerged in the last few years. They are, or will be, cloud-ready and open-banking compliant, and, in some cases, have very advanced architectures that make frequent feature releases easier. Some of these systems are also pushing the envelope in customer experience and offering innovative and reasonable pricing schemes for core banking replacements. More importantly, they claim not to compromise on the core tenet of faultless transaction processing.

Most banking leaders are aware of the significance of their core banking system, but many do not have explicit strategies tied to the core. And as banking continues to be disrupted, the traditional core architecture may not be able to deliver for incumbent banks; and given the long lead times required for transitioning to a new core, they need to set their strategies in motion now.

The best place to begin this effort is by answering five questions:

Does our legacy core banking system require intervention?

What interventions are possible to stave off a full transformation, if a core banking replacement is needed, what are the options.

- What are the core elements of a good business case for such a transformation ?

What does a bank do next?

Another set of simple questions can give decision-makers a sense of the urgency of their core system problem (Exhibit 1). Affirmative answers to more than two of the questions indicate a potential problem and merit further intervention.

It is important to carry out this exercise dispassionately and in a business-risk focused manner. This does not mean taking a myopic view of the problem. If a bank believes that there are no problems now, but there could be in the future, then preparing for an intervention now may make sense. It is common for core banking projects to take two to three years to complete, so the assessment should be made considering a medium-term horizon.

Contrary to popular opinion, a “rip-and-replace” is not the only possible intervention—and often it is often actually not the right choice. Depending on the urgency, several responses are possible, ranging from small tactical changes to large-scale re-architecture. Measures like this can extend the life of a core banking system by as long as five to ten years, which is especially valuable for banks that lack the capital to install a new core banking system, have other near-term priorities, or want to wait until more advanced offerings come to market.

Many banks have used these measures (popularly known as “hollowing out”) to extend the service life of their core banking system by many years, with a lot of success, and more importantly without slowing down their “digital” journeys.

Exhibit 2 shows a (non-exhaustive) range of options available for extending the effective life of a core banking system. It is important to remember that these are at best medium-term measures.

There are two main options (with a few variations) for banks that conclude that they need to replace their core banking system: a traditional enterprise core banking system (self-hosted or as a utility) and a next-generation cloud-based core banking system .

Most current implementations are still of the traditional variety. But we are seeing an increase in banks of all sizes putting off traditional core implementations with the aim of experimenting with next-gen systems.

There is some evidence to suggest that banks will try and shift en masse to a cloud-based microservice architecture in the next few years. The core method of communication between machines will be APIs. Armed with a micro-service based architecture, the new core banking applications will become core enablers of the shift to this architecture. Traditional core banking providers have become aware of the need and potential inherent in a cloud-based microservice architecture; banking leaders should keep a close watch on developments here. We also expect to see some M&A activity between traditional and next-gen core banking system providers.

For now, there are four primary issues that prevent banks from replacing their core applications with next-generation core banking applications.

- The “at-scale” problem: Banks are very risk averse when it comes to core replacement, and rightfully so. Given how embedded these core applications are, banks tend to prefer a tried and tested system to replace them. It is likely that once the first bank successfully implements a large, “at-scale” next-gen core system, the floodgates of demand will open. We increasingly see banks willing to experiment with these players and put their own engineering resources to work to accelerate this trend.

- The “functionality” problem: Traditional core banking systems come with a range of product and process functionality and are made for heavy customization to meet the individual needs of the bank. Next-generation core banking systems are designed to support a slightly more limited set of products and processes, but with a versatile toolkit (a software development kit, or a repository of APIs), and fulfill additional needs using an ecosystem of fintech or traditional partners. This is the right architectural answer, as it ensures loose coupling and fewer customization problems down the line, but will take some getting used to for traditional banks. We see this as an opportunity for banks to start building their ecosystem muscle

- The “integration” problem: This problem is proving to be a little more intractable. Banks expect new core banking systems to integrate with their existing stack of channels, customer-relationship-management systems, data architecture, risk systems, and middleware—all of which are very difficult to replace and represent hundreds of millions of dollars of investment over the years, meaning they cannot be written off without causing significant disruption and losses. The problem is that this integration entails high risk and high cost. The incumbent core banking system has usually undergone significant customization and development, reflecting changes in business logic over decades. Untangling the integration from the old system and re-integrating the new core banking system is an extremely difficult exercise—the banking equivalent of a high-risk brain surgery. For a medium-size bank, the cost of this integration could exceed $50 million depending upon its complexity; for larger banks, $300 million to $400 million is not unheard of (based on estimates for traditional implementations). Most banks understandably have very little appetite for this sort of expense. Banks expect to avoid this problem by installing next-generation core banking systems separate from the current stack, migrating customers gradually into the new stack over time and executing a “reverse-takeover” of the old stack. We believe there is a significant opportunity for banks to use this as a forcing mechanism to decommission their redundant systems, simplify their product set, and improve their technology skills, specifically in the areas of cloud, API based ecosystems, and automation in general.

- The public cloud problem: There are a few other issues related to core banking systems on the public cloud. Most banks are just finding their feet in this arena and starting to come to grips with the security implications of the cloud. It will take some time for banks to start storing public data on the cloud without any fear. We see a lot of positive momentum in this area, with “neo banks” leading the way. We also see very sophisticated; and constructive engagement by regulators as far as cloud hosting is concerned. We anticipate that as banks start honing their cloud operating models, this will soon become a non-issue.

What are the elements of a good core banking business case?

Whatever option is chosen, an initiative like core banking transformation requires a solid business case. This is not a trivial exercise: a core banking transformation is akin to replacing the foundation of a building, and is therefore not always amenable to a straightforward revenue-based business case. Traditional core banking replacements have tried to make their case by adding in cost-saving elements through process automation and clean-ups, but it has proven very difficult to pay for a core banking transformation purely through efficiencies.

Next-generation core banking systems may present some additional advantages in making a business case because of their architecture and business model. Some examples:

- Faster time to market for new products if they are truly API driven

- Faster set up of ecosystems

- Reduced cost of change if testing is truly automated and if core banking vendors follow a “train the trainer” model and not a “consulting plus model”

- Reduced upfront costs if the core banking vendor charges fees based on revenue-like events such as customer uptake or profits

The next steps for any bank depend, naturally, upon the context. For some banks, the core system is an urgent priority; for others less so. Some banks have an appetite for experimentation, while others prefer to be followers and wait for other incumbents to pioneer a new core banking system. In general, we expect that core banking implementations will become cheaper and their architecture will become more and more open. Irrespective of appetite for change, there are several no-regret moves banks can make now:

- Make a list of tactical modernization needs for the current core banking system, but invest only if there is a burning need. Minimize any strategic non-reusable investment on the current core banking system, unless it is expected to be the bank’s core system for the next decade.

- Maintain general preparedness for a migration. This includes maintaining a clean Chart of Accounts and a clean set of customer accounts. Ensure that duplicate, unpopular, or redundant products are minimized, and dormant accounts or inactive accounts are reduced where regulation allows it.

- If you can experiment with a new application, do so. If an affordable opportunity arises to set up a new stack using a next-gen core banking system, a bank should grab the chance to get learn about managing a core system in the cloud.

- Build up core talent. Start building up a core team made up of cloud specialists, data engineers, and core banking subject matter experts in product, finance, and operations. This core team does not need to be more than six to seven people.

Even if the core banking system is not an immediate issue for a bank, it is very likely to reach the C-suite agenda at some point. Next-gen cloud-based core banking systems are gaining more and more traction, and they will rapidly try to become natural alternatives to traditional core banking systems. Banks should start laying the no-regret groundwork and do all they can now to prepare for a migration to a newer system in the medium-term without neglecting tactical modernization of the existing core.

Banking System in India

Oct 11, 2014

3.3k likes | 9.79k Views

Banking System in India. Indigenous bankers. Individual bankers like Shroffs, Seths, Sahukars, Mahajans, etc. combine trading and other business with money lending. Vary in size from petty lenders to substantial shroffs

Share Presentation

- sector banks

- branch expansion

- narasimham committee

- 3 years npa

- nationalised banks 1969 1980

Presentation Transcript

Banking Systemin India

Indigenous bankers • Individual bankers like Shroffs, Seths, Sahukars, Mahajans, etc. combine trading and other business with money lending. • Vary in size from petty lenders to substantial shroffs • Act as money changers and finance internal trade through hundis (internal bills of exchange) • Indigenous banking is usually family owned business employing own working capital • At one point it was estimated that IBs met about 90% of the financial requirements of rural India

RBI and indigenous bankers • IB should have their accounts audited by certified chartered accountants • Submit their accounts to RBI periodically • As against these obligations the RBI promised to provide them with privileges offered to commercial banks including • Being entitled to borrow from and rediscount bills with RBI • The IBs declined to accept the restrictions as well as compensation from the RBI • Therefore, the IBs remain out of RBI’s purview

BANKING SYSTEM IN INDIA

SCHEDULED BANK: • which is registered in Second Schedule of the RBI • Must be carrying on a business of banking in India • Must have paid-up capital and reserve of an aggregate value of not less than Rs.5 lakh(100cr.-for New) • It must satisfy RBI- not in a manner detrimental to the interest of depositor • NON SCHEDULED BANK: • Which is not included in Second Schedule of RBI • Not entitled to facility of borrowing & rediscounting

Co-operative Banks

SCHEDULED COMMERCIAL BANKS • PUBLIC SECTOR BANKS • SBI & Associates (SBI Act, 1955) • Nationalised Banks (1969-1980) • PRIVATE SECTOR BANKS: • Post Reform Period 24 banks in pvt. Sector Banks • Initial minimum paid up capital from Rs.100 to Rs.200 crore.

REGIONAL RURAL BANKS • Bank with local knowledge and familiarity • Organisation ability to mobilize deposits, access to money market and modernized outlook • ORGANISATION- Separate body corporate with perpetual succession and common seal- may establish its branches • CAPITAL- Authorised-1 cr.- paid up-50laks- -50% subscribed by Central Govt.-15%State Govt. – 35% by Sponsor Bank

FOREIGN BANKS: Registered outside India- to operate in India the minimum capital requirement of US $25 million, spread over 3 branches, that is, US$ 10million for the 1st and 2nd bank respectively and US$5million for the 3rd branch • The no. of licences fixed is 12 per year both for new and expansion by existing banks

Development Oriented Banking • Historically, close association between banks and some traditional industries- cotton textiles in the west, jute textiles in the east • Banking has not been mere acceptance of deposits and lending money; included development banking • Lead Bank Scheme- opening bank offices in all important localities • Providing credit for development of the district • Mobilising savings in the district. ‘Service area approach’

Progress of banking in India (1) • Nationalisation of banks in 1969: 14 banks were nationalised • Branch expansion: Increased from 8260 in 1969 to 71177 in 2006 • Population served per branch has come down from 64000 to 16000 • A rural branch office serves 15 to 25 villages within a radius of 16 kms • However, at present only 32,180 villages out of 5 lakh have been covered

Progress of banking in India (2) • Deposit mobilisation: • 1951-1971 (20 years)- 700% or 7 times • 1971-1991 (20 years)- 3260% or 32.6 times • 1991- 2006 (11 years)- 1100% or 11 times • Expansion of bank credit: Growing at 20-30% p.a. thanks to rapid growth in industrial and agricultural output • Development oriented banking: priority sector lending

Progress of banking in India (3) • Diversification in banking: Banking has moved from deposit and lending to • Merchant banking and underwriting • Mutual funds • Retail banking • ATMs • Internet banking • Venture capital funds • Factoring

Profitability of Banks(1) • Reforms have shifted the focus of banks from being development oriented to being commercially viable • Prior to reforms banks were not profitable and in fact made losses for the following reasons: • Declining interest income • Increasing cost of operations

Profitability of banks (2) • Declining interest income was for the following reasons: • High proportion of deposits impounded for CRR and SLR, earning relatively low interest rates • System of directed lending • Political interference- leading to huge NPAs • Rising costs of operations for banks was because of several reasons: economic and political

Profitability of Banks (3) • As per the Narasimham Committee (1991) the reasons for rising costs of banks were: • Uneconomic branch expansion • Heavy recruitment of employees • Growing indiscipline and inefficiency of staff due to trade union activities • Low productivity • Declining interest income and rising cost of operations of banks led to low profitability in the 90s

Bank profitability: Suggestions • Some suggestions made by Narasimham Committee are: • Set up an Asset Reconstruction Fund to take over doubtful debts • SLR to be reduced to 25% of total deposits • CRR to be reduced to 3 to 5% of total deposits • Banks to get more freedom to set minimum lending rates • Share of priority sector credit be reduced to 10% from 40%

Suggestions (cont’d) • All concessional rates of interest should be removed • Branch expansion should be carried out strictly on commercial principles • Diversification of banking activities • Almost all suggestions of the Narasimham Committee have been accepted and implemented in a phased manner since the onset of Reforms

Income Recognition • Incomes from NPAs not recognised on accruals basis but on receipt basis • If interest debited not recovered within 180 days(2 quarters) then the same shall not be recognised as income

Non Performing Asset(NPA)For Cash Credit & OD • Where the outstanding balance remains continuously in excess of the sanctioned limit/Drawing power OR • Where the outstanding balance is less than the sanctioned limit/Drawing power, but there is no credits continuously for 6 months OR • Where the credits are not enough to cover the interest debited during the 6 months as on the date of the Balance Sheet

Non Performing Asset(NPA)(For Loans & Advances) • Standard Assets: are those which are not NPA as they are regular and performing and there are no adverse features • Sub-Standard Assets: are those which are NPAs for a period Not exceeding Two Years • Doubtful Assets: are those non-performing assets which remain as such for a period, Exceeding 2 years • Loss Assets: are those NPAs where 100% loss has been identified but not yet written off in the books of accounts

Name of Asset Standard Asset Substandard Asset Doubtful Assets Doubtful upto 1 year (NPA more than 2 years but upto 3years) Doubtful for more than 1 year but upto 3 years (NPA more than 3yrs but upto 5 years) Doubtful for more than 3 years(NPA for more than 5 yrs) Loss Assets Provisioning Requirement No provision is required General prov.10% of outstanding 100% to the extent of deficit (deficit=advance –security) Plus 20% of Tangible Security 30% of Tangible Security 50% of Tangible Security 100% of the outstanding Provisioning for Loans & Advances

Capital Adequacy Norms (9%) • Tier I Capital: • Paidup Capital • Statutary and other disclosed free reserves including share premium • General Reserve less • Investment in subsidiaries • Intangible assets • Brought forward and current losses

Capital Adequacy Norms Tier II capital consists: • Undisclosed reserves & cumulative perpetual preference shares • Revaluation Reserves at a discount of 25% • Surplus provisions/loss reserves subject to a maximum of 1.25% weighted Risk Assets • Hybrid Debt Capital instrument • Subordinated Debt

Capital Adequacy Formula Capital Adequacy=Capital Funds * 100 Weighted Risk Assets

Other Important Terms • On Balance Sheet Items: Those Items which appear on the Balance Sheet of a Bank & for which RBI has given percentage weights to various types of assets • Off Balance Sheet Items: Those items which do not appear on the face of the Balance Sheet like Guarantees, Letter of Credit etc. • Dividend Payout Ratio: Banks should have a Capital Adequacy Ratio of atleast 9 for the a/c yr. for which it proposes to declare dividend subject to a ceiling on DP ratio 40%

NPA Management • The Narasimham Committee recommendations were made, among other things, to reduce the Non-Performing Assets (NPAs) of banks • To tackle this the government enacted the Securitization and Reconstruction of Financial Assets and Enforcement of Security Act (SARFAESI) Act, 2002 • Enabled banks to realise their dues without intervention of courts

SARFAESI Act • Enables setting up of Asset Management Companies to acquire NPAs of any bank or FI (SASF, ARCIL are examples) • NPAs are acquired by issuing debentures, bonds or any other security • As a second creditor can serve notice to the defaulting borrower to discharge his/her liabilities in 60 days • Failing which the company can take possession of assets, takeover the management of assets and appoint any person to manage the secured assets • Borrowers have the right to appeal to the Debts Tribunal after depositing 75% of the amount claimed by the second creditor

- More by User

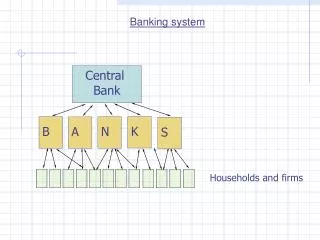

Banking system

Banking system. Central Bank. K. B. N. A. S. Households and firms. The role of commercial banks is to Serve as a financial intermediary between savings and investments; Assist the process of money circulation, connect lenders to borrowers, in other words, “create money”.

687 views • 44 slides

The Banking System

The Banking System. What is a Bank?. What is a Bank?. A FINANCIAL INTERMEDIARY —connects money from savers to people who need to borrow it. Financial intermediaries include many types of institutions—some are banks, some are not

495 views • 18 slides

CO-OPERATIVE BANKING IN INDIA

CO-OPERATIVE BANKING IN INDIA. Introduction of co-operative banks Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

1.73k views • 7 slides

Indian Banking System

Status of integration with global Banking system. Indian Banking System. A few India Banks have presence overseas Stringent RBI restriction on opening office overseas Indian Banks overseas mainly provide trade finance with host country

645 views • 12 slides

CONSUMER BANKING SYSTEM

CONSUMER BANKING SYSTEM. PURPOSE STATEMENT . The purpose of our project is to provide fast and safe analysis of sales data of banks by the state bank and also to create a platform where the state bank can communicate and monitor the commercial banks. PROBLEM DESCRIPTION.

386 views • 24 slides

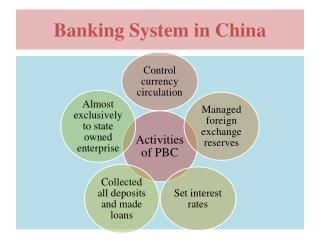

Banking System in China

Banking System in China. Three specialized Banks -. Chinese Bank reforms : 1979-92. Two stages of reform have been undertaken , from 1979 to 1992 and 1993 to present . Stage one began with the creation of a ‘two-tier’ banking system.

501 views • 8 slides

Banking system in turkey

Banking system in turkey. PROF. Yaprak Gülcan. Main Objective of the Central Bank of The Republic of turkey (CBRT). Price Stability Article 4- (As amended by Law No. 4651 of April 25, 2001) "The primary objective of the Bank shall be to achieve and maintain price stability.

301 views • 11 slides

Banking System in India. BANKING SYSTEM IN INDIA. Commercial Banks by Ownership. BANKS BY INCLUSION IN SECOND SCHEDULE OF RBI ACT, 1934 AS ON MARCH 31, 2003. Classification Continued. Public Sector Banks Nationalized Banks (19) State Bank of India and its assosciates Private Sector Banks

1.2k views • 9 slides

RURAL BANKING IN INDIA

RURAL BANKING IN INDIA. Presented by :. What’s Making NEWS ???. Rural banking & microfinance need to be addressed for sustainable growth : RBI Deputy Governor.

2.09k views • 36 slides

JAK BANKING SYSTEM

JAK BANKING SYSTEM. THE PURPOSES OF JAK:. TO SUPPORT THE MEMBERS WITH A BANKING SYSTEM AT COST PRICE. ... AND TO SPREAD INFORMATION ON INTEREST-FREE ECONOMY. Deposits and Loans (1991 -2009). Deposits Loans. FAIR!. SAVER. BORROWER. UNFAIR!. BORROWERS. SAVER.

404 views • 25 slides

Rethinking Branchless Banking in India

Rethinking Branchless Banking in India. Doug Johnson Centre for Microfinance. Introduction to Branchless Banking. branchless banking: outsourcing the processing of transactions by banks to third party agents. Branchless Banking’s Risks:

416 views • 13 slides

Banking System, Canadian Banking, Canadian Banking, Mortgage System, Mortgage Loans, Banking Mortgages, Banking System

Websoftex Software Solutions Private Limited-a Bangalore based Company-an authorized Software service provider engaged in Microfinance-Banking-Co-Operative-NBFC-Pigmy-Mortgage-RD FD Software-Loan-Accounting-Custom-Cooperative Agent-Mortgage-Accounting-E Commerce-Billing Software-Core Banking-Micro Finance-CRM-Loan Software-Development in Bangalore-with maximum level protection. We take pride in rendering good and protective services to small- medium Microfinance Institutions and other sector for more than 5 years. http://microfinanceSoftware.net

290 views • 3 slides

stem cell banking in india

With over 50 centers, Cordlife India is one of the largest umbilical cord stem cell banking companies. Discover more about cord blood banking now!

56 views • 2 slides

Investment Banking in India

www.righthorizons.com/our-services/investment-banking-services - Investment Banking in India. Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting.

215 views • 7 slides

Social Banking in India

Banks provide financial aid to economically weaker sections of the society so as to enable them to participate and benefit from the developmental initiatives of the government. This process is called Social Banking.

356 views • 8 slides

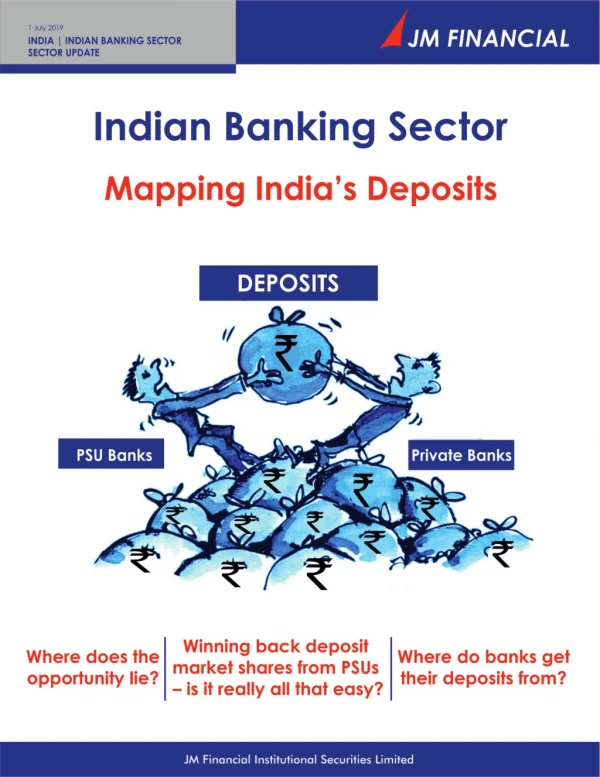

Investment Banking In India

We are delighted to inform you that we are extremely happy with your services. Your deep understanding of the Real Estate Industry is highly appreciated. It has been quiet sometime that we have been dealing with you and your work culture and professional ethics represent some of the best business in the industry. We value your sincerity, honesty and promptness in problem solving solutions. We definitely wish to continue this association in the long run. https://jmfl.com/

229 views • 20 slides

U.S. Banking System

MTRA 16 th Annual Conference November 14, 2006 The Banking Environment for Money Services Businesses Lisa Arquette FDIC Associate Director Anti-Money Laundering & Financial Crimes Section. U.S. Banking System. US Banking System is Large, Diverse, and Complex

213 views • 17 slides

BANKING SYSTEM

BANKING SYSTEM. Software Requirements Document. CEN5011 - Advanced Software Engineering Fall Term - 2004. TEAM MEMBERS. Jing Zhang Wei Peng Erliang Zeng Ramakrishna Varadarajan Xiaosi Zhou Fernando Farf á n. Bank with services in South Florida. +200K Clients Next 5 years:

838 views • 28 slides

Kiosk Banking india

oxigen is huge opportunities to work in kiosk sector as a CSP, online money transfer, bank kiosk, bill payments. Get CSP Customer Service Point Registration with us Online at oxigen.org.in. Visit here: https://oxigen.org.in/

156 views • 5 slides

Press Release

Amd to significantly expand data center ai systems capabilities with acquisition of hyperscale solutions provider zt systems.

— Strategic acquisition to provide AMD with industry-leading systems expertise to accelerate deployment of optimized rack-scale solutions addressing $400 billion data center AI accelerator opportunity in 2027 —