The Great Depression

"Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again." —Ben Bernanke, November 8, 2002, in a speech given at "A Conference to Honor Milton Friedman … On the Occasion of His 90th Birthday."

In 2002, Ben Bernanke , then a member of the Federal Reserve Board of Governors, acknowledged publicly what economists have long believed. The Federal Reserve’s mistakes contributed to the "worst economic disaster in American history" (Bernanke 2002).

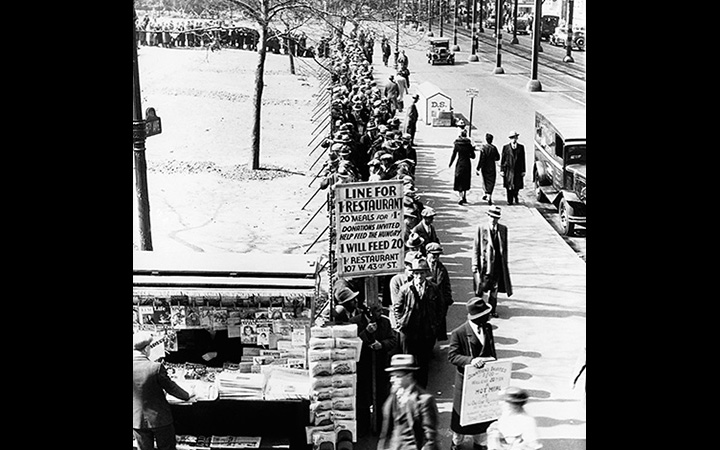

Bernanke, like other economic historians, characterized the Great Depression as a disaster because of its length, depth, and consequences. The Depression lasted a decade, beginning in 1929 and ending during World War II. Industrial production plummeted. Unemployment soared. Families suffered. Marriage rates fell. The contraction began in the United States and spread around the globe. The Depression was the longest and deepest downturn in the history of the United States and the modern industrial economy.

The Great Depression began in August 1929, when the economic expansion of the Roaring Twenties came to an end. A series of financial crises punctuated the contraction. These crises included a stock market crash in 1929 , a series of regional banking panics in 1930 and 1931 , and a series of national and international financial crises from 1931 through 1933 . The downturn hit bottom in March 1933, when the commercial banking system collapsed and President Roosevelt declared a national banking holiday . 1 Sweeping reforms of the financial system accompanied the economic recovery, which was interrupted by a double-dip recession in 1937 . Return to full output and employment occurred during the Second World War.

To understand Bernanke’s statement, one needs to know what he meant by "we," "did it," and "won’t do it again."

By “we,” Bernanke meant the leaders of the Federal Reserve System. At the start of the Depression, the Federal Reserve’s decision-making structure was decentralized and often ineffective. Each district had a governor who set policies for his district, although some decisions required approval of the Federal Reserve Board in Washington, DC. The Board lacked the authority and tools to act on its own and struggled to coordinate policies across districts. The governors and the Board understood the need for coordination; frequently corresponded concerning important issues; and established procedures and programs, such as the Open Market Investment Committee, to institutionalize cooperation. When these efforts yielded consensus, monetary policy could be swift and effective. But when the governors disagreed, districts could and sometimes did pursue independent and occasionally contradictory courses of action.

The governors disagreed on many issues, because at the time and for decades thereafter, experts disagreed about the best course of action and even about the correct conceptual framework for determining optimal policy. Information about the economy became available with long and variable lags. Experts within the Federal Reserve, in the business community, and among policymakers in Washington, DC, had different perceptions of events and advocated different solutions to problems. Researchers debated these issues for decades. Consensus emerged gradually. The views in this essay reflect conclusions expressed in the writings of three recent chairmen, Paul Volcke r, Alan Greenspan , and Ben Bernanke .

By "did it," Bernanke meant that the leaders of the Federal Reserve implemented policies that they thought were in the public interest. Unintentionally, some of their decisions hurt the economy. Other policies that would have helped were not adopted.

An example of the former is the Fed’s decision to raise interest rates in 1928 and 1929. The Fed did this in an attempt to limit speculation in securities markets. This action slowed economic activity in the United States. Because the international gold standard linked interest rates and monetary policies among participating nations, the Fed’s actions triggered recessions in nations around the globe. The Fed repeated this mistake when responding to the international financial crisis in the fall of 1931. This website explores these issues in greater depth in our entries on the stock market crash of 1929 and the financial crises of 1931 through 1933 .

An example of the latter is the Fed’s failure to act as a lender of last resort during the banking panics that began in the fall of 1930 and ended with the banking holiday in the winter of 1933. This website explores this issue in essays on the banking panics of 1930 to 1931 , the banking acts of 1932 , and the banking holiday of 1933 .

One reason that Congress created the Federal Reserve, of course, was to act as a lender of last resort. Why did the Federal Reserve fail in this fundamental task? The Federal Reserve’s leaders disagreed about the best response to banking crises. Some governors subscribed to a doctrine similar to Bagehot’s dictum, which says that during financial panics, central banks should loan funds to solvent financial institutions beset by runs. Other governors subscribed to a doctrine known as real bills. This doctrine indicated that central banks should supply more funds to commercial banks during economic expansions, when individuals and firms demanded additional credit to finance production and commerce, and less during economic contractions, when demand for credit contracted. The real bills doctrine did not definitively describe what to do during banking panics, but many of its adherents considered panics to be symptoms of contractions, when central bank lending should contract. A few governors subscribed to an extreme version of the real bills doctrine labeled “liquidationist.” This doctrine indicated that during financial panics, central banks should stand aside so that troubled financial institutions would fail. This pruning of weak institutions would accelerate the evolution of a healthier economic system. Herbert Hoover’s secretary of treasury, Andrew Mellon, who served on the Federal Reserve Board, advocated this approach. These intellectual tensions and the Federal Reserve’s ineffective decision-making structure made it difficult, and at times impossible, for the Fed’s leaders to take effective action.

Among leaders of the Federal Reserve, differences of opinion also existed about whether to help and how much assistance to extend to financial institutions that did not belong to the Federal Reserve. Some leaders thought aid should only be extended to commercial banks that were members of the Federal Reserve System. Others thought member banks should receive assistance substantial enough to enable them to help their customers, including financial institutions that did not belong to the Federal Reserve, but the advisability and legality of this pass-through assistance was the subject of debate. Only a handful of leaders thought the Federal Reserve (or federal government) should directly aid commercial banks (or other financial institutions) that did not belong to the Federal Reserve. One advocate of widespread direct assistance was Eugene Meyer , governor of the Federal Reserve Board, who was instrumental in the creation of the Reconstruction Finance Corporation .

These differences of opinion contributed to the Federal Reserve’s most serious sin of omission: failure to stem the decline in the supply of money. From the fall of 1930 through the winter of 1933, the money supply fell by nearly 30 percent. The declining supply of funds reduced average prices by an equivalent amount. This deflation increased debt burdens; distorted economic decision-making; reduced consumption; increased unemployment; and forced banks, firms, and individuals into bankruptcy. The deflation stemmed from the collapse of the banking system, as explained in the essay on the banking panics of 1930 and 1931 .

The Federal Reserve could have prevented deflation by preventing the collapse of the banking system or by counteracting the collapse with an expansion of the monetary base, but it failed to do so for several reasons. The economic collapse was unforeseen and unprecedented. Decision makers lacked effective mechanisms for determining what went wrong and lacked the authority to take actions sufficient to cure the economy. Some decision makers misinterpreted signals about the state of the economy, such as the nominal interest rate, because of their adherence to the real bills philosophy. Others deemed defending the gold standard by raising interests and reducing the supply of money and credit to be better for the economy than aiding ailing banks with the opposite actions.

On several occasions, the Federal Reserve did implement policies that modern monetary scholars believe could have stemmed the contraction. In the spring of 1931, the Federal Reserve began to expand the monetary base, but the expansion was insufficient to offset the deflationary effects of the banking crises. In the spring of 1932, after Congress provided the Federal Reserve with the necessary authority, the Federal Reserve expanded the monetary base aggressively. The policy appeared effective initially, but after a few months the Federal Reserve changed course. A series of political and international shocks hit the economy, and the contraction resumed. Overall, the Fed’s efforts to end the deflation and resuscitate the financial system, while well intentioned and based on the best available information, appear to have been too little and too late.

The flaws in the Federal Reserve’s structure became apparent during the initial years of the Great Depression. Congress responded by reforming the Federal Reserve and the entire financial system. Under the Hoover administration, congressional reforms culminated in the Reconstruction Finance Corporation Act and the Banking Act of 1932 . Under the Roosevelt administration, reforms culminated in the Emergency Banking Act of 1933 , the Banking Act of 1933 (commonly called Glass-Steagall) , the Gold Reserve Act of 1934 , and the Banking Act of 1935 . This legislation shifted some of the Federal Reserve’s responsibilities to the Treasury Department and to new federal agencies such as the Reconstruction Finance Corporation and Federal Deposit Insurance Corporation. These agencies dominated monetary and banking policy until the 1950s.

The reforms of the 1930s, ’40s, and ’50s turned the Federal Reserve into a modern central bank. The creation of the modern intellectual framework underlying economic policy took longer and continues today. The Fed’s combination of a well-designed central bank and an effective conceptual framework enabled Bernanke to state confidently that "we won’t do it again."

- 1 These business cycle dates come from the National Bureau of Economic Research . Additional materials on the Federal Reserve can be found at the website of the Federal Reserve Bank of St. Louis.

Bibliography

Bernanke, Ben. Essays on the Great Depression . Princeton: Princeton University Press, 2000.

Bernanke, Ben, " On Milton Friedman's Ninetieth Birthday ," Remarks by Governor Ben S. Bernanke at the Conference to Honor Milton Friedman, University of Chicago, Chicago, IL, November 8, 2002.

Chandler, Lester V. American Monetary Policy, 1928 to 1941 . New York: Harper and Row, 1971.

Chandler, Lester V. American’s Greatest Depression, 1929-1941 . New York: Harper Collins, 1970.

Eichengreen, Barry. " The Origins and Nature of the Great Slump Revisited ." Economic History Review 45, no. 2 (May 1992): 213–239.

Friedman, Milton and Anna Schwartz. A Monetary History of the United States: 1867-1960 . Princeton: Princeton University Press, 1963.

Kindleberger, Charles P. The World in Depression, 1929-1939 : Revised and Enlarged Edition. Berkeley: University of California Press, 1986.

Meltzer, Allan. A History of the Federal Reserve: Volume 1, 1913 to 1951 . Chicago: University of Chicago Press, 2003.

Romer, Christina D. " The Nation in Depression ." Journal of Economic Perspectives 7, no. 2 (1993): 19-39.

Temin, Peter. Lessons from the Great Depression (Lionel Robbins Lectures) . Cambridge: MIT Press, 1989.

Written as of November 22, 2013. See disclaimer and update policy .

Essays in this Time Period

- Bank Holiday of 1933

- Banking Act of 1933 (Glass-Steagall)

- Banking Act of 1935

- Banking Acts of 1932

- Banking Panics of 1930-31

- Banking Panics of 1931-33

- Stock Market Crash of 1929

- Emergency Banking Act of 1933

- Gold Reserve Act of 1934

- Recession of 1937–38

- Roosevelt's Gold Program

Federal Reserve History

Home — Essay Samples — History — Great Depression — The Great Depression in the USA

The Great Depression in The USA

- Categories: Great Depression

About this sample

Words: 1221 |

Published: Feb 12, 2019

Words: 1221 | Pages: 3 | 7 min read

Table of contents

Introducition, impact of the great depression.

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: History

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

2 pages / 1046 words

3 pages / 1283 words

11 pages / 4845 words

7 pages / 3196 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Great Depression

The Great Depression of the 1930s remains one of the most catastrophic economic downturns in the history of the United States. This essay delves into the multifaceted factors that contributed to the Great Depression, its [...]

Cinderella Man, directed by Ron Howard and released in 2005, is a film that portrays the struggle of an individual during the Great Depression. The movie provides a glimpse into the social issues and challenges faced by the [...]

During the late 1920s and early 1930s, the world witnessed one of the most devastating economic crises in modern history – the Great Depression. The depression lasted for over a decade and heavily impacted countries across the [...]

In John Steinbeck’s novel Of Mice and Men, the character of Curley’s wife stands out as a lonely and isolated figure. Despite being married to the ranch owner’s son, she is constantly seeking attention and companionship from [...]

Famed American novelist F. Scott Fitzgerald could not have anticipated what was on the horizon when he penned The Great Gatsby in 1925. Fitzgerald was no prophet, but he seemed to have an innate sensibility that allowed him to [...]

The Great Depression had a massive impact on everyone throughout the United States, and any number of programs to try and improve the well-being of the American people and the economy were put into place under Franklin D. [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

The History of Great Depression Research Paper

Introduction, works cited.

The Great Depression was one of the most meaningful and devastating events of the 20th century. It affected every person in the United States and other countries, no matter their status, money, or job.

The collapse happening was influenced by the consequences of World War I and other factors that combined at that time. The Great Depression was a highly significant and destructive event caused by multiple factors, ending in a shift in the whole world and every structure and changing Americans’ attitude toward the government. The Great Depression was the most severe recession of the past centuries. It affected the whole world and lasted for approximately 12 years.

Field claims that gross domestic production (GDP) fell by 30%, almost half of the banks in the United States collapsed, and about 25% of the population became jobless during the Great Depression (para 1). Unemployment insurance did not exist at that time, and no one was prepared for these events, and it became a disaster for millions of people. Kiger states that the Great Depression affected everyone, from investors who became bankrupt overnight to clerks and factory workers who became unemployed (para 1).

The event influenced every person despite their status or profession.

Thus, the Great Depression was a devastating event that affected everyone.

It is believed that the reason for the recession was the market collapse in 1929; however, it is not. There was no one exact reason for the collapse happening.

Field claims that the genuine reason for the event was a combination of different factors, such as ill-timed tariffs and misguided moves (para 2).

Thus, the Great Depression had predispositions and was provoked by many factors.

Moreover, Segal, Cheng. et al. affirm that “inactivity followed by overaction by the Fed also contributed to the Great Depression” (para 6).

After the eight-year inactivity, Fed, the central US banking system, drastically increased the money supply, which influenced the economy and became a predisposition for the collapse. Thus, there were several factors that contributed to the Great Depression happening. Furthermore, it is believed that the consequences of World War I also caused the Great Depression. The world experienced a crisis and tried to stabilize the economy.

Kiger states that after the war, the level of consumption increased, which brought wealth to many businesses (para 9). However, this also made them vulnerable to any changes in consumers’ preferences.

Kiger adds that the economy throughout the world was unstable and many connections were broken, and cooperation between many countries stopped (para 9). This led to exaggerating the problem with the economy and made all the businesses unstable and at constant risk of bankruptcy. Thus, World War I impacted the collapse severely and destroyed the ability of cooperation among many countries.

The consequences of the Great Depression were deplorable and, meanwhile, significant: it affected people’s lives and their attitudes toward the government. It is hard to determine the exact number of human casualties during that time.

However, Amadeo, Kelly et al. state that the rate of committing suicide increased by 22.8% at that time (para 25). His means that the recession severely affected people’s mental health. Amadeo, Kelly. et al. affirm that in the 1930s, the level of trust in the government reached its peak and was never higher (para 26). Americans believed in the New Deal that was formed after the Great Depression and its decisions. Thus, the collapse changed the population on different levels and shaped its relations with the government.

In conclusion, the Great Depression was a meaningful and devastating event of the 20th century that led to a significant shift in the world and changed the attitude of the US people toward their government. It was caused by a combination of varied factors, such as the consequences of World War I, the Fed overaction, lack of cooperation of many countries, and others. The event made many humans suffer; however, it led to stabilizing the economy and evoked trust and cooperation between the residents and the government.

Amadeo, Kimberly. Kelly, Robert. Jonson, Arron. “ Great Depression: What Happened, Causes, How it Ended. ” 2022.

Field, Anne. “ The Main Causes of the Great Depression, and how the Road to Recovery Transformed the US Economy. ” Insider. 2020

Kiger, Patrick. “ 5 Causes of the Great Depression. ” History. 2022

Segal, Troy. Cheng, Marguerita. Kvilhaug, Suzanne. “ What Was the Great Depression? ” Investopedia. 2022

- Aspects of Industrialization in Newark

- The History of Progressive Era in the US

- Evidence of Climate Change

- How the Federal Reserve Controls Inflation

- Macroeconomic Variables Overview

- The Death of the U.S.S. Maine

- Change in the 1920s in the United States

- The USA: From Reconstruction to Civil Rights, 1877 - 1981

- “Were Heckscher and Ohlin Right?” by O’Rourke

- American Colonization Society

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2022, August 16). The History of Great Depression. https://ivypanda.com/essays/the-history-of-great-depression/

"The History of Great Depression." IvyPanda , 16 Aug. 2022, ivypanda.com/essays/the-history-of-great-depression/.

IvyPanda . (2022) 'The History of Great Depression'. 16 August.

IvyPanda . 2022. "The History of Great Depression." August 16, 2022. https://ivypanda.com/essays/the-history-of-great-depression/.

1. IvyPanda . "The History of Great Depression." August 16, 2022. https://ivypanda.com/essays/the-history-of-great-depression/.

Bibliography

IvyPanda . "The History of Great Depression." August 16, 2022. https://ivypanda.com/essays/the-history-of-great-depression/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

IMAGES

VIDEO

COMMENTS

Example Introduction Paragraph for a Descriptive Great Depression Essay: The Great Depression left an indelible mark on the lives of ordinary Americans, shaping their daily experiences and aspirations.

This essay delves into the multifaceted factors that contributed to the Great Depression, its far-reaching economic and social consequences, and the comprehensive government response that aimed to rescue the nation from the depths of despair.

Great Depression, worldwide economic downturn that began in 1929 and lasted until about 1939. It was the longest and most severe depression ever experienced by the industrialized Western world, sparking fundamental changes in economic institutions, macroeconomic policy, and economic theory.

The Great Depression was a severe worldwide economic depression that took place during the 1930s, profoundly affecting many countries. Essays on the Great Depression could explore its causes, such as the stock market crash of 1929, its impact on people’s lives, and the political and social repercussions.

Bernanke, like other economic historians, characterized the Great Depression as a disaster because of its length, depth, and consequences. The Depression lasted a decade, beginning in 1929 and ending during World War II.

The Great Depression: Causes, Impact, and Government Response Essay. The Great Depression of the 1930s remains one of the most catastrophic economic downturns in the history of the United States. This essay delves into the multifaceted factors that contributed to the Great Depression, its [...]

Looking for Great Depression topics 🗽 for your argumentative essay, research, or debate? ️ Find them here! Check out our Great Depression essay questions & other ideas.

Why should students learn about the Great Depression? Our grandparents and great-grandparents lived through these tough times, but you may think that you should focus on more recent episodes in Ameri-can life. In this essay, I hope to convince you that the Great Depression is worthy of your interest and

The Great Depression was a highly significant and destructive event caused by multiple factors, ending in a shift in the whole world and every structure and changing Americans’ attitude toward the government.

The Great Depression, starting in 1929 on Black Tuesday, was the crash of the United States economy. During that time, 25% of Americans were unemployed, and millions lost their savings due to bank failure, leaving them poor and frustrated with the government.