, , , , , , .

, , .

- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

The Ultimate Guide to Writing a Nonprofit Business Plan

A business plan can be an invaluable tool for your nonprofit. Even a short business plan pushes you to do research, crystalize your purpose, and polish your messaging. This blog shares what it is and why you need it, ten steps to help you write one, and the dos and don’ts of creating a nonprofit business plan.

Nonprofit business plans are dead — or are they?

For many nonprofit organizations, business plans represent outdated and cumbersome documents that get created “just for the sake of it” or because donors demand it.

But these plans are vital to organizing your nonprofit and making your dreams a reality! Furthermore, without a nonprofit business plan, you’ll have a harder time obtaining loans and grants , attracting corporate donors, meeting qualified board members, and keeping your nonprofit on track.

Even excellent ideas can be totally useless if you cannot formulate, execute, and implement a strategic plan to make your idea work. In this article, we share exactly what your plan needs and provide a nonprofit business plan template to help you create one of your own.

What is a Nonprofit Business Plan?

A nonprofit business plan describes your nonprofit as it currently is and sets up a roadmap for the next three to five years. It also lays out your goals and plans for meeting your goals. Your nonprofit business plan is a living document that should be updated frequently to reflect your evolving goals and circumstances.

A business plan is the foundation of your organization — the who, what, when, where, and how you’re going to make a positive impact.

The best nonprofit business plans aren’t unnecessarily long. They include only as much information as necessary. They may be as short as seven pages long, one for each of the essential sections you will read about below and see in our template, or up to 30 pages long if your organization grows.

Why do we need a Nonprofit Business Plan?

Regardless of whether your nonprofit is small and barely making it or if your nonprofit has been successfully running for years, you need a nonprofit business plan. Why?

When you create a nonprofit business plan, you are effectively creating a blueprint for how your nonprofit will be run, who will be responsible for what, and how you plan to achieve your goals.

Your nonprofit organization also needs a business plan if you plan to secure support of any kind, be it monetary, in-kind , or even just support from volunteers. You need a business plan to convey your nonprofit’s purpose and goals.

It sometimes also happens that the board, or the administration under which a nonprofit operates, requires a nonprofit business plan.

To sum it all up, write a nonprofit business plan to:

- Layout your goals and establish milestones.

- Better understand your beneficiaries, partners, and other stakeholders.

- Assess the feasibility of your nonprofit and document your fundraising/financing model.

- Attract investment and prove that you’re serious about your nonprofit.

- Attract a board and volunteers.

- Position your nonprofit and get clear about your message.

- Force you to research and uncover new opportunities.

- Iron out all the kinks in your plan and hold yourself accountable.

Before starting your nonprofit business plan, it is important to consider the following:

- Who is your audience? E.g. If you are interested in fundraising, donors will be your audience. If you are interested in partnerships, potential partners will be your audience.

- What do you want their response to be? Depending on your target audience, you should focus on the key message you want them to receive to get the response that you want.

10-Step Guide on Writing a Business Plan for Nonprofits

Note: Steps 1, 2, and 3 are in preparation for writing your nonprofit business plan.

Step 1: Data Collection

Before even getting started with the writing, collect financial, operating, and other relevant data. If your nonprofit is already in operation, this should at the very least include financial statements detailing operating expense reports and a spreadsheet that indicates funding sources.

If your nonprofit is new, compile materials related to any secured funding sources and operational funding projections, including anticipated costs.

Step 2: Heart of the Matter

You are a nonprofit after all! Your nonprofit business plan should start with an articulation of the core values and your mission statement . Outline your vision, your guiding philosophy, and any other principles that provide the purpose behind the work. This will help you to refine and communicate your nonprofit message clearly.

Your nonprofit mission statement can also help establish your milestones, the problems your organization seeks to solve, who your organization serves, and its future goals.

Check out these great mission statement examples for some inspiration. For help writing your statement, download our free Mission & Vision Statements Worksheet .

Step 3: Outline

Create an outline of your nonprofit business plan. Write out everything you want your plan to include (e.g. sections such as marketing, fundraising, human resources, and budgets).

An outline helps you focus your attention. It gives you a roadmap from the start, through the middle, and to the end. Outlining actually helps us write more quickly and more effectively.

An outline will help you understand what you need to tell your audience, whether it’s in the right order, and whether the right amount of emphasis is placed on each topic.

Pro tip: Use our Nonprofit Business Plan Outline to help with this step! More on that later.

Step 4: Products, Programs, and Services

In this section, provide more information on exactly what your nonprofit organization does.

- What products, programs, or services do you provide?

- How does your nonprofit benefit the community?

- What need does your nonprofit meet and what are your plans for meeting that need?

E.g. The American Red Cross carries out its mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.

Don’t skimp out on program details, including the functions and beneficiaries. This is generally what most readers will care most about.

However, don’t overload the reader with technical jargon. Try to present some clear examples. Include photographs, brochures, and other promotional materials.

Step 5: Marketing Plan

A marketing plan is essential for a nonprofit to reach its goals. If your nonprofit is already in operation, describe in detail all current marketing activities: any outreach activities, campaigns, and other initiatives. Be specific about outcomes, activities, and costs.

If your nonprofit is new, outline projections based on specific data you gathered about your market.

This will frequently be your most detailed section because it spells out precisely how you intend to carry out your business plan.

- Describe your market. This includes your target audience, competitors, beneficiaries, donors, and potential partners.

- Include any market analyses and tests you’ve done.

- Outline your plan for reaching your beneficiaries.

- Outline your marketing activities, highlighting specific outcomes.

Step 6: Operational Plan

An operational plan describes how your nonprofit plans to deliver activities. In the operational plan, it is important to explain how you plan to maintain your operations and how you will evaluate the impact of your programs.

The operational plan should give an overview of the day-to-day operations of your organization such as the people and organizations you work with (e.g. partners and suppliers), any legal requirements that your organization needs to meet (e.g. if you distribute food, you’ll need appropriate licenses and certifications), any insurance you have or will need, etc.

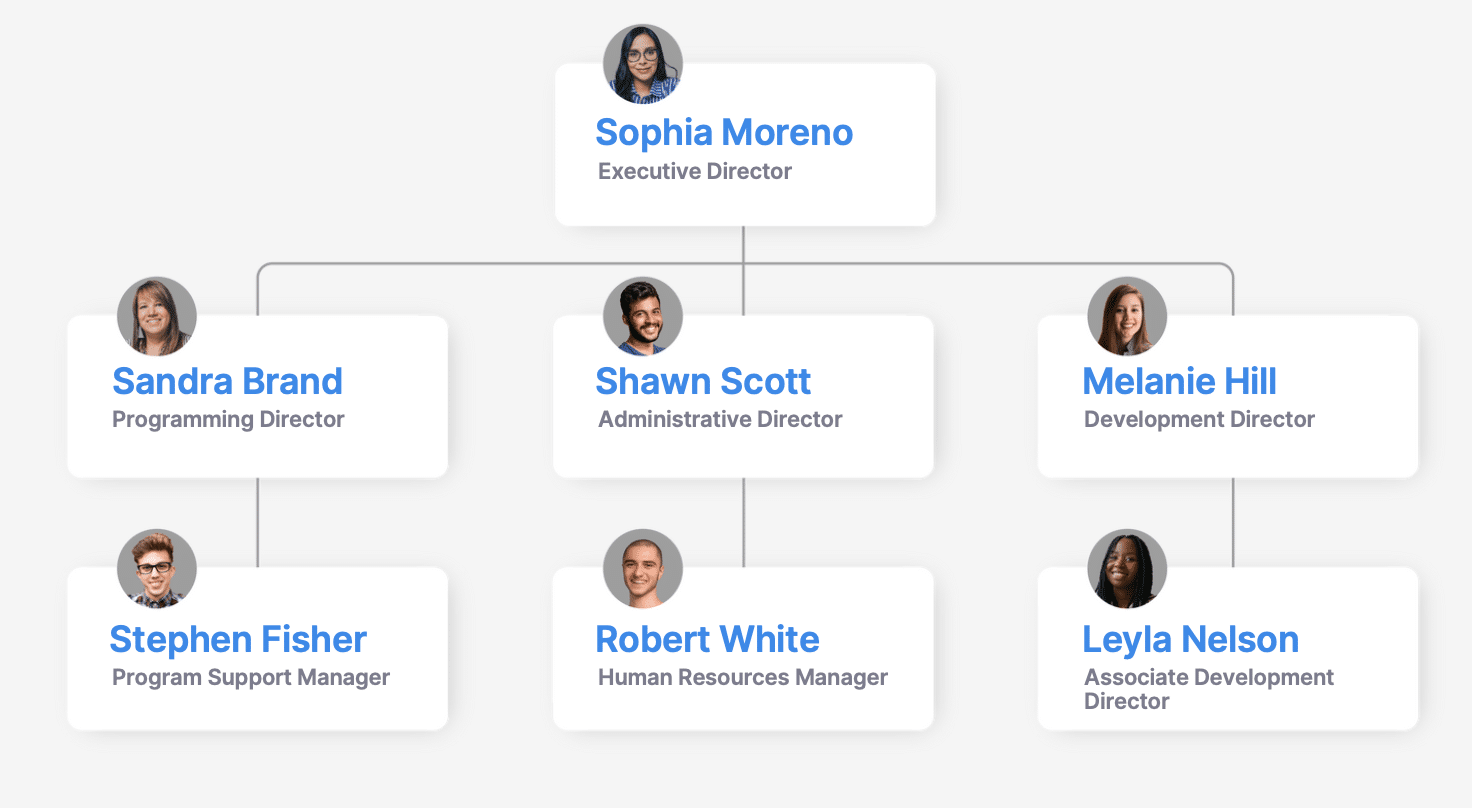

In the operational plan, also include a section on the people or your team. Describe the people who are crucial to your organization and any staff changes you plan as part of your business plan.

Pro tip: If you have an organizational chart, you can include it in the appendix to help illustrate how your organization operates. Learn more about the six types of nonprofit organizational charts and see them in action in this free e-book .

Step 7: Impact Plan

For a nonprofit, an impact plan is as important as a financial plan. A nonprofit seeks to create social change and a social return on investment, not just a financial return on investment.

Your impact plan should be precise about how your nonprofit will achieve this step. It should include details on what change you’re seeking to make, how you’re going to make it, and how you’re going to measure it.

This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives.

These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.

Answer these in the impact plan section of your business plan:

- What goals are most meaningful to the people you serve or the cause you’re fighting for?

- How can you best achieve those goals through a series of specific objectives?

E.g. “Finding jobs for an additional 200 unemployed people in the coming year.”

Step 8: Financial Plan

This is one of the most important parts of your nonprofit business plan. Creating a financial plan will allow you to make sure that your nonprofit has its basic financial needs covered.

Every nonprofit needs a certain level of funding to stay operational, so it’s essential to make sure your organization will meet at least that threshold.

To craft your financial plan:

- Outline your nonprofit’s current and projected financial status.

- Include an income statement, balance sheet , cash flow statement, and financial projections.

- List any grants you’ve received, significant contributions, and in-kind support.

- Include your fundraising plan .

- Identify gaps in your funding, and how you will manage them.

- Plan for what will be done with a potential surplus.

- Include startup costs, if necessary.

If your nonprofit is already operational, use established accounting records to complete this section of the business plan.

Knowing the financial details of your organization is incredibly important in a world where the public demands transparency about where their donations are going.

Pro tip : Leverage startup accelerators dedicated to nonprofits that can help you with funding, sponsorship, networking, and much more.

Step 9: Executive Summary

Normally written last but placed first in your business plan, your nonprofit executive summary provides an introduction to your entire business plan. The first page should describe your non-profit’s mission and purpose, summarize your market analysis that proves an identifiable need, and explain how your non-profit will meet that need.

The Executive Summary is where you sell your nonprofit and its ideas. Here you need to describe your organization clearly and concisely.

Make sure to customize your executive summary depending on your audience (i.e. your executive summary page will look different if your main goal is to win a grant or hire a board member).

Step 10: Appendix

Include extra documents in the section that are pertinent to your nonprofit: organizational chart , current fiscal year budget, a list of the board of directors, your IRS status letter, balance sheets, and so forth.

The appendix contains helpful additional information that might not be suitable for the format of your business plan (i.e. it might unnecessarily make it less readable or more lengthy).

Do’s and Dont’s of Nonprofit Business Plans – Tips

- Write clearly, using simple and easy-to-understand language.

- Get to the point, support it with facts, and then move on.

- Include relevant graphs and program descriptions.

- Include an executive summary.

- Provide sufficient financial information.

- Customize your business plan to different audiences.

- Stay authentic and show enthusiasm.

- Make the business plan too long.

- Use too much technical jargon.

- Overload the plan with text.

- Rush the process of writing, but don’t drag it either.

- Gush about the cause without providing a clear understanding of how you will help the cause through your activities.

- Keep your formatting consistent.

- Use standard 1-inch margins.

- Use a reasonable font size for the body.

- For print, use a serif font like Times New Roman or Courier. For digital, use sans serifs like Verdana or Arial.

- Start a new page before each section.

- Don’t allow your plan to print and leave a single line on an otherwise blank page.

- Have several people read over the plan before it is printed to make sure it’s free of errors.

Nonprofit Business Plan Template

To help you get started we’ve created a nonprofit business plan outline. This business plan outline will work as a framework regardless of your nonprofit’s area of focus. With it, you’ll have a better idea of how to lay out your nonprofit business plan and what to include. We have also provided several questions and examples to help you create a detailed nonprofit business plan.

Download Your Free Outline

At Donorbox, we strive to make your nonprofit experience as productive as possible, whether through our donation software or through our advice and guides on the Nonprofit Blog . Find more free, downloadable resources in our Library .

Many nonprofits start with passion and enthusiasm but without a proper business plan. It’s a common misconception that just because an organization is labeled a “nonprofit,” it does not need to operate in any way like a business.

However, a nonprofit is a type of business, and many of the same rules that apply to a for-profit company also apply to a nonprofit organization.

As outlined above, your nonprofit business plan is a combination of your marketing plan , strategic plan, operational plan, impact plan, and financial plan. Remember, you don’t have to work from scratch. Be sure to use the nonprofit business plan outline we’ve provided to help create one of your own.

It’s important to note that your nonprofit should not be set in stone—it can and should change and evolve. It’s a living organism. While your vision, values, and mission will likely remain the same, your nonprofit business plan may need to be revised from time to time. Keep your audience in mind and adjust your plan as needed.

Finally, don’t let your plan gather dust on a shelf! Print it out, put up posters on your office walls, and read from it during your team meetings. Use all the research, data, and ideas you’ve gathered and put them into action!

If you want more help with nonprofit management tips and fundraising resources, visit our Nonprofit Blog . We also have dedicated articles for starting a nonprofit in different states in the U.S., including Texas , Minnesota , Oregon , Arizona , Illinois , and more.

Learn about our all-in-one online fundraising tool, Donorbox, and its simple-to-use features on the website here .

Raviraj heads the sales and marketing team at Donorbox. His growth-hacking abilities have helped Donorbox boost fundraising efforts for thousands of nonprofit organizations.

Join the fundraising movement!

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

13 min. read

Updated May 10, 2024

Believe it or not, creating a business plan for a nonprofit organization is not that different from planning for a traditional business.

Nonprofits sometimes shy away from using the words “business planning,” preferring to use terms like “strategic plan” or “operating plan.” But, the fact is that preparing a plan for a for-profit business and a nonprofit organization are actually pretty similar processes. Both types of organizations need to create forecasts for revenue and plan how they’re going to spend the money they bring in. They also need to manage their cash and ensure that they can stay solvent to accomplish their goals.

In this guide, I’ll explain how to create a plan for your organization that will impress your board of directors, facilitate fundraising, and ensures that you deliver on your mission.

- Why does a nonprofit need a business plan?

Good business planning is about setting goals, getting everyone on the same page, tracking performance metrics, and improving over time. Even when your goal isn’t to increase profits, you still need to be able to run a fiscally healthy organization.

Business planning creates an opportunity to examine the heart of your mission , the financing you’ll need to bring that mission to fruition, and your plan to sustain your operations into the future.

Nonprofits are also responsible for meeting regularly with a board of directors and reporting on your organization’s finances is a critical part of that meeting. As part of your regular financial review with the board, you can compare your actual results to your financial forecast in your business plan. Are you meeting fundraising goals and keeping spending on track? Is the financial position of the organization where you wanted it to be?

In addition to internal use, a solid business plan can help you court major donors who will be interested in having a deeper understanding of how your organization works and your fiscal health and accountability. And you’ll definitely need a formal business plan if you intend to seek outside funding for capital expenses—it’s required by lenders.

Creating a business plan for your organization is a great way to get your management team or board to connect over your vision, goals, and trajectory. Even just going through the planning process with your colleagues will help you take a step back and get some high-level perspective .

- A nonprofit business plan outline

Keep in mind that developing a business plan is an ongoing process. It isn’t about just writing a physical document that is static, but a continually evolving strategy and action plan as your organization progresses over time. It’s essential that you run regular plan review meetings to track your progress against your plan. For most nonprofits, this will coincide with regular reports and meetings with the board of directors.

A nonprofit business plan will include many of the same sections of a standard business plan outline . If you’d like to start simple, you can download our free business plan template as a Word document, and adjust it according to the nonprofit plan outline below.

Executive summary

The executive summary of a nonprofit business plan is typically the first section of the plan to be read, but the last to be written. That’s because this section is a general overview of everything else in the business plan – the overall snapshot of what your vision is for the organization.

Write it as though you might share with a prospective donor, or someone unfamiliar with your organization: avoid internal jargon or acronyms, and write it so that someone who has never heard of you would understand what you’re doing.

Your executive summary should provide a very brief overview of your organization’s mission. It should describe who you serve, how you provide the services that you offer, and how you fundraise.

If you are putting together a plan to share with potential donors, you should include an overview of what you are asking for and how you intend to use the funds raised.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Opportunity

Start this section of your nonprofit plan by describing the problem that you are solving for your clients or your community at large. Then say how your organization solves the problem.

A great way to present your opportunity is with a positioning statement . Here’s a formula you can use to define your positioning:

For [target market description] who [target market need], [this product] [how it meets the need]. Unlike [key competition], it [most important distinguishing feature].

And here’s an example of a positioning statement using the formula:

For children, ages five to 12 (target market) who are struggling with reading (their need), Tutors Changing Lives (your organization or program name) helps them get up to grade-level reading through a once a week class (your solution).

Unlike the school district’s general after-school homework lab (your state-funded competition), our program specifically helps children learn to read within six months (how you’re different).

Your organization is special or you wouldn’t spend so much time devoted to it. Layout some of the nuts and bolts about what makes it great in this opening section of your business plan. Your nonprofit probably changes lives, changes your community, or maybe even changes the world. Explain how it does this.

This is where you really go into detail about the programs you’re offering. You’ll want to describe how many people you serve and how you serve them.

Target audience

In a for-profit business plan, this section would be used to define your target market . For nonprofit organizations, it’s basically the same thing but framed as who you’re serving with your organization. Who benefits from your services?

Not all organizations have clients that they serve directly, so you might exclude this section if that’s the case. For example, an environmental preservation organization might have a goal of acquiring land to preserve natural habitats. The organization isn’t directly serving individual groups of people and is instead trying to benefit the environment as a whole.

Similar organizations

Everyone has competition —nonprofits, too. You’re competing with other nonprofits for donor attention and support, and you’re competing with other organizations serving your target population. Even if your program is the only one in your area providing a specific service, you still have competition.

Think about what your prospective clients were doing about their problem (the one your organization is solving) before you came on this scene. If you’re running an after-school tutoring organization, you might be competing with after school sports programs for clients. Even though your organizations have fundamentally different missions.

For many nonprofit organizations, competing for funding is an important issue. You’ll want to use this section of your plan to explain who donors would choose your organization instead of similar organizations for their donations.

Future services and programs

If you’re running a regional nonprofit, do you want to be national in five years? If you’re currently serving children ages two to four, do you want to expand to ages five to 12? Use this section to talk about your long-term goals.

Just like a traditional business, you’ll benefit by laying out a long-term plan. Not only does it help guide your nonprofit, but it also provides a roadmap for the board as well as potential investors.

Promotion and outreach strategies

In a for-profit business plan, this section would be about marketing and sales strategies. For nonprofits, you’re going to talk about how you’re going to reach your target client population.

You’ll probably do some combination of:

- Advertising: print and direct mail, television, radio, and so on.

- Public relations: press releases, activities to promote brand awareness, and so on.

- Digital marketing: website, email, blog, social media, and so on.

Similar to the “target audience” section above, you may remove this section if you don’t promote your organization to clients and others who use your services.

Costs and fees

Instead of including a pricing section, a nonprofit business plan should include a costs or fees section.

Talk about how your program is funded, and whether the costs your clients pay are the same for everyone, or based on income level, or something else. If your clients pay less for your service than it costs to run the program, how will you make up the difference?

If you don’t charge for your services and programs, you can state that here or remove this section.

Fundraising sources

Fundraising is critical for most nonprofit organizations. This portion of your business plan will detail who your key fundraising sources are.

Similar to understanding who your target audience for your services is, you’ll also want to know who your target market is for fundraising. Who are your supporters? What kind of person donates to your organization? Creating a “donor persona” could be a useful exercise to help you reflect on this subject and streamline your fundraising approach.

You’ll also want to define different tiers of prospective donors and how you plan on connecting with them. You’re probably going to include information about your annual giving program (usually lower-tier donors) and your major gifts program (folks who give larger amounts).

If you’re a private school, for example, you might think of your main target market as alumni who graduated during a certain year, at a certain income level. If you’re building a bequest program to build your endowment, your target market might be a specific population with interest in your cause who is at retirement age.

Do some research. The key here is not to report your target donors as everyone in a 3,000-mile radius with a wallet. The more specific you can be about your prospective donors —their demographics, income level, and interests, the more targeted (and less costly) your outreach can be.

Fundraising activities

How will you reach your donors with your message? Use this section of your business plan to explain how you will market your organization to potential donors and generate revenue.

You might use a combination of direct mail, advertising, and fundraising events. Detail the key activities and programs that you’ll use to reach your donors and raise money.

Strategic alliances and partnerships

Use this section to talk about how you’ll work with other organizations. Maybe you need to use a room in the local public library to run your program for the first year. Maybe your organization provides mental health counselors in local schools, so you partner with your school district.

In some instances, you might also be relying on public health programs like Medicaid to fund your program costs. Mention all those strategic partnerships here, especially if your program would have trouble existing without the partnership.

Milestones and metrics

Without milestones and metrics for your nonprofit, it will be more difficult to execute on your mission. Milestones and metrics are guideposts along the way that are indicators that your program is working and that your organization is healthy.

They might include elements of your fundraising goals—like monthly or quarterly donation goals, or it might be more about your participation metrics. Since most nonprofits working with foundations for grants do complex reporting on some of these, don’t feel like you have to re-write every single goal and metric for your organization here. Think about your bigger goals, and if you need to, include more information in your business plan’s appendix.

If you’re revisiting your plan on a monthly basis, and we recommend that you do, the items here might speak directly to the questions you know your board will ask in your monthly trustee meeting. The point is to avoid surprises by having eyes on your organization’s performance. Having these goals, and being able to change course if you’re not meeting them, will help your organization avoid falling into a budget deficit.

Key assumptions and risks

Your nonprofit exists to serve a particular population or cause. Before you designed your key programs or services, you probably did some research to validate that there’s a need for what you’re offering.

But you probably are also taking some calculated risks. In this section, talk about the unknowns for your organization. If you name them, you can address them.

For example, if you think there’s a need for a children’s literacy program, maybe you surveyed teachers or parents in your area to verify the need. But because you haven’t launched the program yet, one of your unknowns might be whether the kids will actually show up.

Management team and company

Who is going to be involved and what are their duties? What do these individuals bring to the table?

Include both the management team of the day-to-day aspects of your nonprofit as well as board members and mention those who may overlap between the two roles. Highlight their qualifications: titles, degrees, relevant past accomplishments, and designated responsibilities should be included in this section. It adds a personal touch to mention team members who are especially qualified because they’re close to the cause or have special first-hand experience with or knowledge of the population you’re serving.

There are probably some amazing, dedicated people with stellar qualifications on your team—this is the place to feature them (and don’t forget to include yourself!).

Financial plan

The financial plan is essential to any organization that’s seeking funding, but also incredibly useful internally to keep track of what you’ve done so far financially and where you’d like to see the organization go in the future.

The financial section of your business plan should include a long-term budget and cash flow statement with a three to five-year forecast. This will allow you to see that the organization has its basic financial needs covered. Any nonprofit has its standard level of funding required to stay operational, so it’s essential to make sure your organization will consistently maintain at least that much in the coffers.

From that point, it’s all about future planning: If you exceed your fundraising goals, what will be done with the surplus? What will you do if you don’t meet your fundraising goals? Are you accounting for appropriate amounts going to payroll and administrative costs over time? Thinking through a forecast of your financial plan over the next several years will help ensure that your organization is sustainable.

Money management skills are just as important in a nonprofit as they are in a for-profit business. Knowing the financial details of your organization is incredibly important in a world where the public is ranking the credibility of charities based on what percentage of donations makes it to the programs and services. As a nonprofit, people are interested in the details of how money is being dispersed within organizations, with this information often being posted online on sites like Charity Navigator, so the public can make informed decisions about donating.

Potential contributors will do their research—so make sure you do too. No matter who your donors are, they will want to know they can trust your organization with their money. A robust financial plan is a solid foundation for reference that your nonprofit is on the right track.

- Business planning is ongoing

It’s important to remember that a business plan doesn’t have to be set in stone. It acts as a roadmap, something that you can come back to as a guide, then revise and edit to suit your purpose at a given time.

I recommend that you review your financial plan once a month to see if your organization is on track, and then revise your plan as necessary .

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

Related Articles

8 Min. Read

What Type of Business Plan Do You Need?

7 Min. Read

8 Steps to Write a Useful Internal Business Plan

6 Min. Read

Differences Between Single-Use and Standing Plans Explained

14 Min. Read

How to Write a Five-Year Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Raise More & Grow Your Nonprofit.

The complete guide to writing a nonprofit business plan.

August 14, 2019

Leadership & Management

July 7, 2022

TABLE OF CONTENTS

Statistics from the National Center for Charitable Statistics (NCCS) show that there are over 1.5 million nonprofit organizations currently operating in the U.S. alone. Many of these organizations are hard at work helping people in need and addressing the great issues of our time. However, doing good work doesn’t necessarily translate into long-term success and financial stability. Other information has shown that around 12% of non-profits don’t make it past the 5-year mark, and this number expands to 17% at the 10-year mark.

12% of non-profits don’t make it past the 5-year mark and 17% at the 10-year mark

There are a variety of challenges behind these sobering statistics. In many cases, a nonprofit can be sunk before it starts due to a lack of a strong nonprofit business plan. Below is a complete guide to understanding why a nonprofit needs a business plan in place, and how to construct one, piece by piece.

The purpose of a nonprofit business plan

A business plan for a nonprofit is similar to that of a for-profit business plan, in that you want it to serve as a clear, complete roadmap for your organization. When your plan is complete, questions such as "what goals are we trying to accomplish?" or "what is the true purpose of our organization?" should be clear and simple to answer.

Your nonprofit business plan should provide answers to the following questions:

1. What activities do you plan to pursue in order to meet the organization’s high level goals?

2. What's your plan on getting revenue to fund these activities?

3. What are your operating costs and specifically how do these break down?

Note that there’s a difference between a business plan and a strategic plan, though there may be some overlap. A strategic plan is more conceptual, with different ideas you have in place to try and meet the organization’s greater vision (such as fighting homelessness or raising climate change awareness). A business plan serves as an action plan because it provides, in as much detail as possible, the specifics on how you’re going to execute your strategy.

More Reading

- What is the Difference Between a Business Plan and a Strategic Plan?

- Business Planning for Nonprofits

Creating a nonprofit business plan

With this in mind, it’s important to discuss the individual sections of a nonprofit business plan. Having a proper plan in a recognizable format is essential for a variety of reasons. On your business’s end, it makes sure that as many issues or questions you may encounter are addressed up front. For outside entities, such as potential volunteers or donors, it shows that their time and energy will be managed well and put to good use. So, how do you go from conceptual to concrete?

Step 1: Write a mission statement

Having a mission statement is essential for any company, but even more so for nonprofits. Your markers of success are not just how the organization performs financially, but the impact it makes for your cause.

One of the easiest ways to do this is by creating a mission statement. A strong mission statement clarifies why your organization exists and determines the direction of activities.

At the head of their ethics page , NPR has a mission statement that clearly and concisely explains why they exist. From this you learn:

- The key point of their mission: creating a more informed public that understands new ideas and cultures

- Their mechanism of executing that vision: providing and reporting news/info that meets top journalistic standards

- Other essential details: their partnership with their membership statement

You should aim for the same level of clarity and brevity in your own mission statement.

The goal of a mission statement isn’t just about being able to showcase things externally, but also giving your internal team something to realign them if they get off track.

For example, if you're considering a new program or services, you can always check the idea against the mission statement. Does it align with your higher level goal and what your organization is ultimately trying to achieve? A mission statement is a compass to guide your team and keep the organization aligned and focused.

Step 2: Collect the data

You can’t prepare for the future without some data from the past and present. This can range from financial data if you’re already in operation to secured funding if you’re getting ready to start.

Data related to operations and finances (such as revenue, expenses, taxes, etc.) is crucial for budgeting and organizational decisions.

You'll also want to collect data about your target donor. Who are they in terms of their income, demographics, location, etc. and what is the best way to reach them? Every business needs to market, and answering these demographic questions are crucial to targeting the right audience in a marketing campaign. You'll also need data about marketing costs collected from your fundraising, marketing, and CRM software and tools. This data can be extremely important for demonstrating the effectiveness of a given fundraising campaign or the organization as a whole.

Then there is data that nonprofits collect from third-party sources as to how to effectively address their cause, such as shared data from other nonprofits and data from governments.

By properly collecting and interpreting the above data, you can build your nonprofit to not only make an impact, but also ensure the organization is financially sustainable.

Step 3: Create an outline

Before you begin writing your plan, it’s important to have an outline of the sections of your plan. Just like an academic essay, it’s easier to make sure all the points are addressed by taking inventory of high level topics first. If you create an outline and find you don’t have all the materials you need to fill it, you may need to go back to the data collection stage.

Writing an outline gives you something simple to read that can easily be circulated to your team for input. Maybe some of your partners will want to emphasize an area that you missed or an area that needs more substance.

Having an outline makes it easier for you to create an organized, well-flowing piece. Each section needs to be clear on its own, but you also don’t want to be overly repetitive.

As a side-note, one area where a lot of business novices stall in terms of getting their plans off the ground is not knowing what format to choose or start with. The good news is there are a lot of resources available online for you to draw templates for from your plan, or just inspire one of your own.

Using a business plan template

You may want to use a template as a starting point for your business plan. The major benefit here is that a lot of the outlining work that we mentioned is already done for you. However, you may not want to follow the template word for word. A nonprofit business plan may require additional sections or parts that aren’t included in a conventional business plan template.

The best way to go about this is to try and focus less on copying the template, and more about copying the spirit of the template. For example, if you see a template that you like, you can keep the outline, but you may want to change the color scheme and font to better reflect your brand. And of course, all your text should be unique.

When it comes to adding a new section to a business plan template, for the most part, you can use your judgment. We will get into specific sections in a bit, but generally, you just want to pair your new section with the existing section that makes the most sense. For example, if your non-profit has retail sales as a part of a financial plan, you can include that along with the products, services and programs section.

- Free Nonprofit Sample Business Plans - Bplans

- Non-Profit Business Plan Template - Growthink

- Sample Nonprofit Business Plans - Bridgespan

- Nonprofit Business Plan Template - Slidebean

- 23+ Non Profit Business Plan Templates - Template.net

Nonprofit business plan sections

The exact content is going to vary based on the size, purpose, and nature of your nonprofit. However, there are certain sections that every business plan will need to have for investors, donors, and lenders to take you seriously. Generally, your outline will be built around the following main sections:

1. Executive summary

Many people write this last, even though it comes first in a business plan. This is because the executive summary is designed to be a general summary of the business plan as a whole. Naturally, it may be easier to write this after the rest of the business plan has been completed.

After reading your executive summary a person should ideally have a general idea of what the entire plan covers. Sometimes, a person may be interested in learning about your non-profit, but doesn’t have time to read a 20+ page document. In this case, the executive summary could be the difference between whether or not you land a major donor.

As a start, you want to cover the basic need your nonprofit services, why that need exists, and the way you plan to address that need. The goal here is to tell the story as clearly and and concisely as possible. If the person is sold and wants more details, they can read through the rest of your business plan.

2. Products/Services/Programs

This is the space where you can clarify exactly what your non-profit does. Think of it as explaining the way your nonprofit addresses that base need you laid out earlier. This can vary a lot based on what type of non-profit you’re running.

This page gives us some insight into the mechanisms Bucks County Historical Society uses to further their mission, which is “to educate and engage its many audiences in appreciating the past and to help people find stories and meanings relevant to their lives—both today and in the future.”

They accomplish this goal through putting together both permanent exhibits as well as regular events at their primary museum. However, in a non-profit business plan, you need to go further.

It’s important here not only to clearly explain who benefits from your services, but also the specific details how those services are provided. For example, saying you “help inner-city school children” isn’t specific enough. Are you providing education or material support? Your non-profit business plan readers need as much detail as possible using simple and clear language.

3. Marketing

For a non-profit to succeed, it needs to have a steady stream of both donors and volunteers. Marketing plays a key role here as it does in a conventional business. This section should outline who your target audience is, and what you’ve already done/plan on doing to reach this audience. How you explain this is going to vary based on what stage your non-profit is in. We’ll split this section to make it more clear.

Nonprofits not in operation

Obviously, it’s difficult to market an idea effectively if you’re not in operation, but you still need to have a marketing plan in place. People who want to support your non-profit need to understand your marketing plan to attract donors. You need to profile all the data you have about your target market and outline how you plan to reach this audience.

Nonprofits already in operation

Marketing plans differ greatly for nonprofits already in operation. If your nonprofit is off the ground, you want to include data about your target market as well, along with other key details. Describe all your current marketing efforts, from events to general outreach, to conventional types of marketing like advertisements and email plans. Specific details are important. By the end of this, the reader should know:

- What type of marketing methods your organization prefers

- Why you’ve chosen these methods

- The track record of success using these methods

- What the costs and ROI of a marketing campaign

4. Operations

This is designed to serve as the “how” of your Products/Services/Programs section.

For example, if your goal is to provide school supplies for inner-city schoolchildren, you’ll need to explain how you will procure the supplies and distribute them to kids in need. Again, detail is essential. A reader should be able to understand not only how your non-profit operates on a daily basis, but also how it executes any task in the rest of the plan.

If your marketing plan says that you hold community events monthly to drum up interest. Who is in charge of the event? How are they run? How much do they cost? What personnel or volunteers are needed for each event? Where are the venues?

This is also a good place to cover additional certifications or insurance that your non-profit needs in order to execute these operations, and your current progress towards obtaining them.

Your operations section should also have a space dedicated to your team. The reason for this is, just like any other business plan, is that the strength of an organization lies in the people running it.

For example, let’s look at this profile from The Nature Conservancy . The main points of the biography are to showcase Chief Development Officer Jim Asp’s work history as it is relevant to his job. You’ll want to do something similar in your business plan’s team section.

Equally important is making sure that you cover any staff changes that you plan to implement in the near future in your business plan. The reason for this is that investors/partners may not want to sign on assuming that one leadership team is in place, only for it to change when the business reaches a certain stage.

The sections we’ve been talking about would also be in a traditional for profit business plan. We start to deviate a bit at this point. The impact section is designed to outline the social change you plan to make with your organization, and how your choices factor into those goals.

Remember the thoughts that go into that mission statement we mentioned before? This is your chance to show how you plan to address that mission with your actions, and how you plan to track your progress.

Let’s revisit the idea of helping inner-city school children by providing school supplies. What exactly is the metric you’re going to use to determine your success? For-profit businesses can have their finances as their primary KPI, but it’s not that easy for non-profits. Let’s say that your mission is to provide 1,000 schoolchildren in an underserved school district supplies for their classes. Your impact plan could cover two metrics:

- How many supplies are distributed

- Secondary impact (improved grades, classwork completed, etc).

The primary goal of this section is to transform that vision into concrete, measurable goals and objectives. A great acronym to help you create these are S.M.A.R.T. goals which stands for: specific, measurable, attainable, relevant, and timely.

Vitamin Angels does a good job of showing how their action supports the mission. Their goal of providing vitamins to mothers and children in developing countries has a concrete impact when we look at the numbers of how many children they service as well as how many countries they deliver to. As a non-profit business plan, it’s a good idea to include statistics like these to show exactly how close you are to your planned goals.

6. Finances

Every non-profit needs funding to operate, and this all-important section details exactly how you plan to cover these financial needs. Your business plan can be strong in every other section, but if your financial planning is flimsy, it’s going to prove difficult to gather believers to your cause.

It's important to paint a complete, positive picture of your fundraising plans and ambitions. Generally, this entails the following parts:

- Current financial status, such as current assets, cash on hand, liabilities

- Projections based off of your existing financial data and forms

- Key financial documents, such as a balance sheet, income statements, and cash flow sheet

- Any grants or major contributions received

- Your plan for fundraising (this may overlap with your marketing section which is okay)

- Potential issues and hurdles to your funding plan

- Your plans to address those issues

- How you'll utilize surplus donations

- Startup costs (if your non-profit is not established yet)

In general, if you see something else that isn’t accounted for here, it’s better to be safe than sorry, and put the relevant information in. It’s better to have too much information than too little when it comes to finances, especially since there is usually a clear preference for transparent business culture.

- How to Make a Five-Year Budget Plan for a Nonprofit

- Financial Transparency - National Council of Nonprofits

7. Appendix

Generally, this serves as a space to attach additional documents and elements that you may find useful for your business plan. This can include things like supplementary charts or a list of your board of directors.

This is also a good place to put text or technical information that you think may be relevant to your business plan, but might be long-winded or difficult to read. A lot of the flow and structure concerns you have for a plan don’t really apply with an appendix.

In summary, while a non-profit may have very different goals than your average business, the ways that they reach those goals do have a lot of similarities with for-profit businesses. The best way to ensure your success is to have a clear, concrete vision and path to different milestones along the way. A solid, in-depth business plan also gives you something to refer back to when you are struggling and not sure where to turn.

Alongside your business plan, you also want to use tools and resources that promote efficiency at all levels. For example, every non-profit needs a consistent stream of donations to survive, so consider using a program like GiveForms that creates simple, accessible forms for your donors to easily make donations. Accounting and budgeting for these in your plans can pay dividends later on.

Share this Article

Related articles, start fundraising today.

Free Nonprofit Business Plan Templates

By Joe Weller | September 18, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up the most useful list of nonprofit business plan templates, all free to download in Word, PDF, and Excel formats.

Included on this page, you’ll find a one-page nonprofit business plan template , a fill-in-the-blank nonprofit business plan template , a startup nonprofit business planning timeline template , and more. Plus, we provide helpful tips for creating your nonprofit business plan .

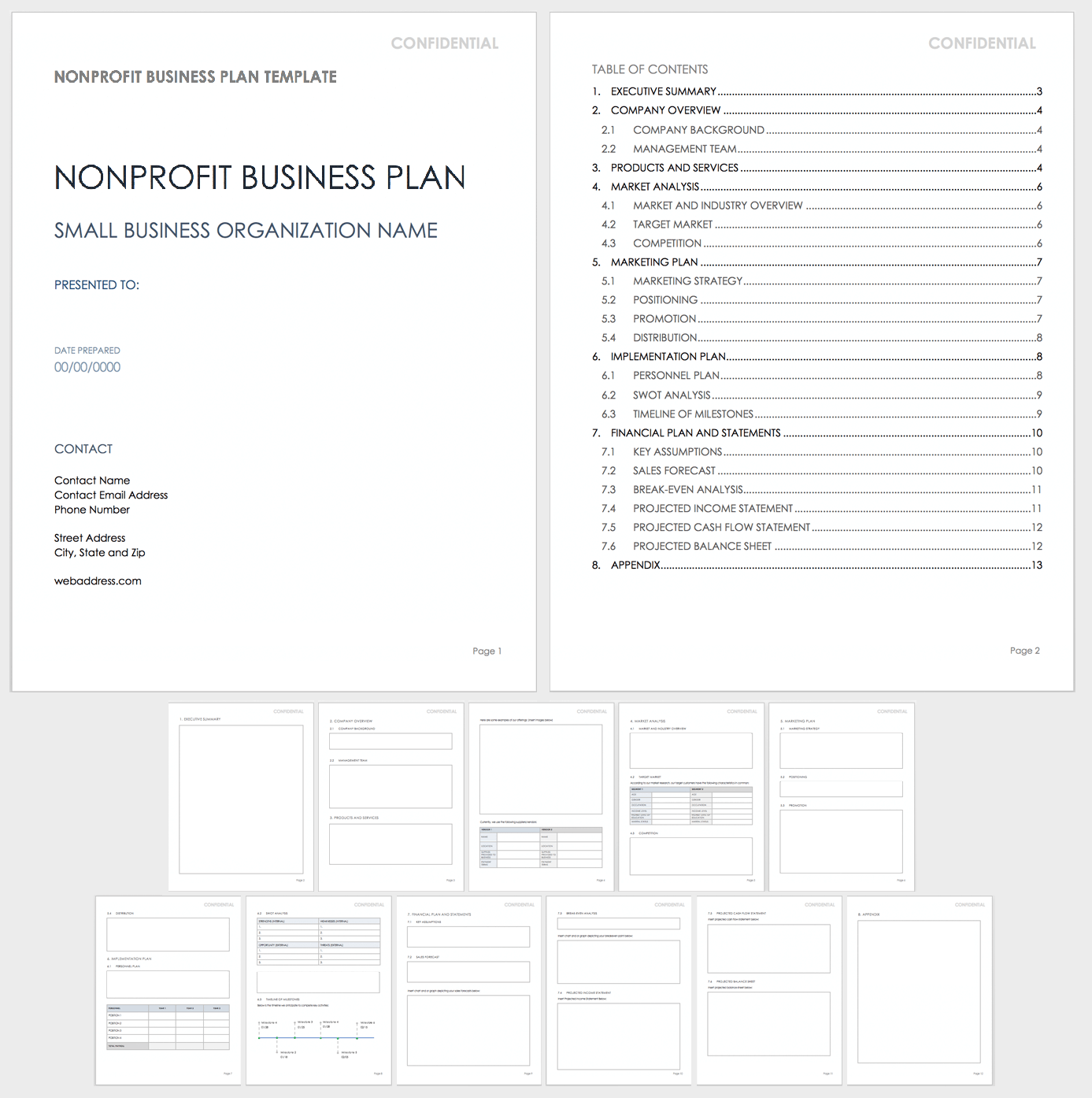

Nonprofit Business Plan Template

Use this customizable nonprofit business plan template to organize your nonprofit organization’s mission and goals and convey them to stakeholders. This template includes space for information about your nonprofit’s background, objectives, management team, program offerings, market analysis, promotional activities, funding sources, fundraising methods, and much more.

Download Nonprofit Business Plan Template

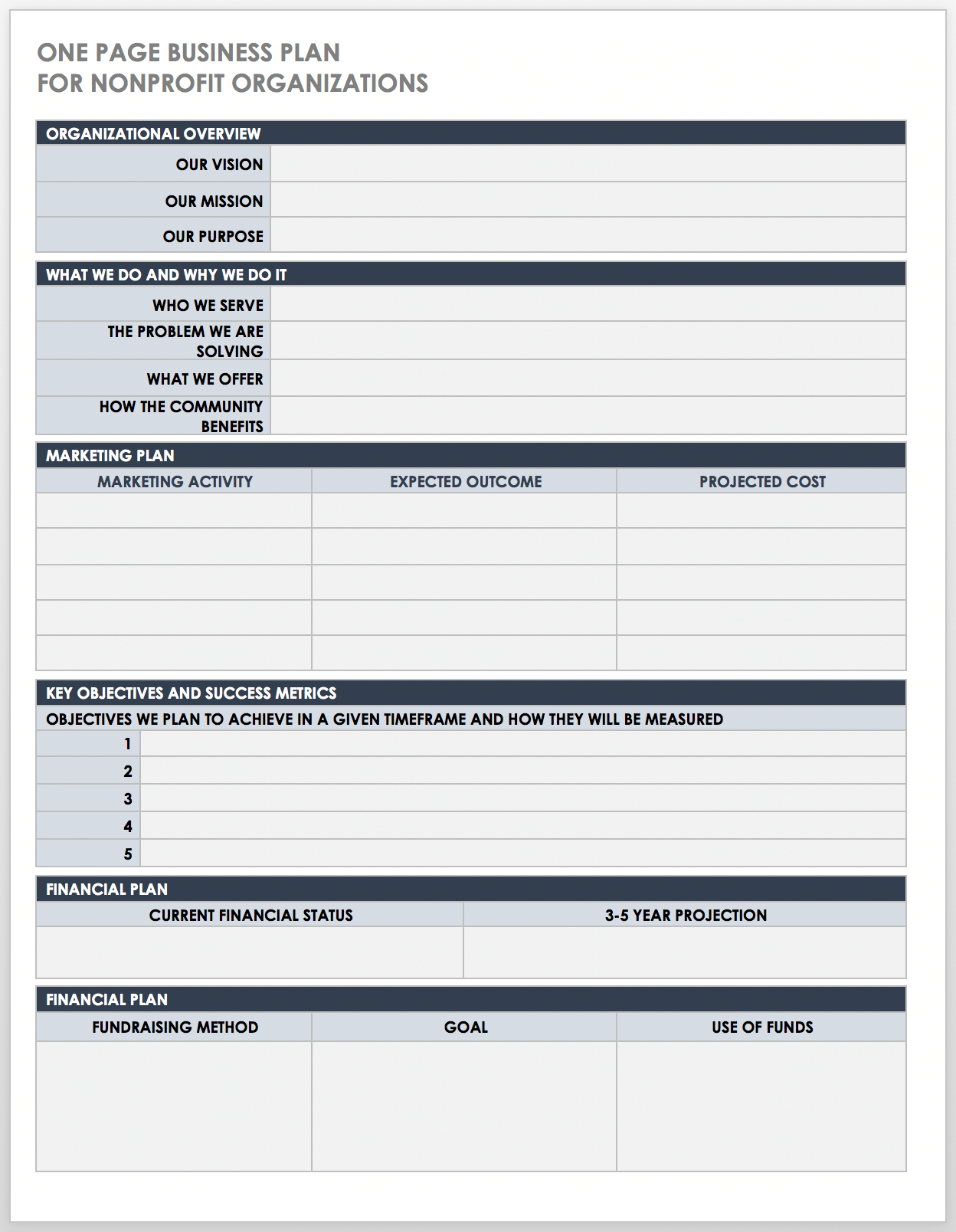

One-Page Business Plan for Nonprofit Template

This one-page nonprofit business plan template has a simple and scannable design to outline the key details of your organization’s strategy. This template includes space to detail your mission, vision, and purpose statements, as well as the problems you aim to solve in your community, the people who benefit from your program offerings, your key marketing activities, your financial goals, and more.

Download One-Page Business Plan for Nonprofit Template

Excel | Word | PDF

For additional resources, including an example of a one-page business plan , visit “ One-Page Business Plan Templates with a Quick How-To Guide .”

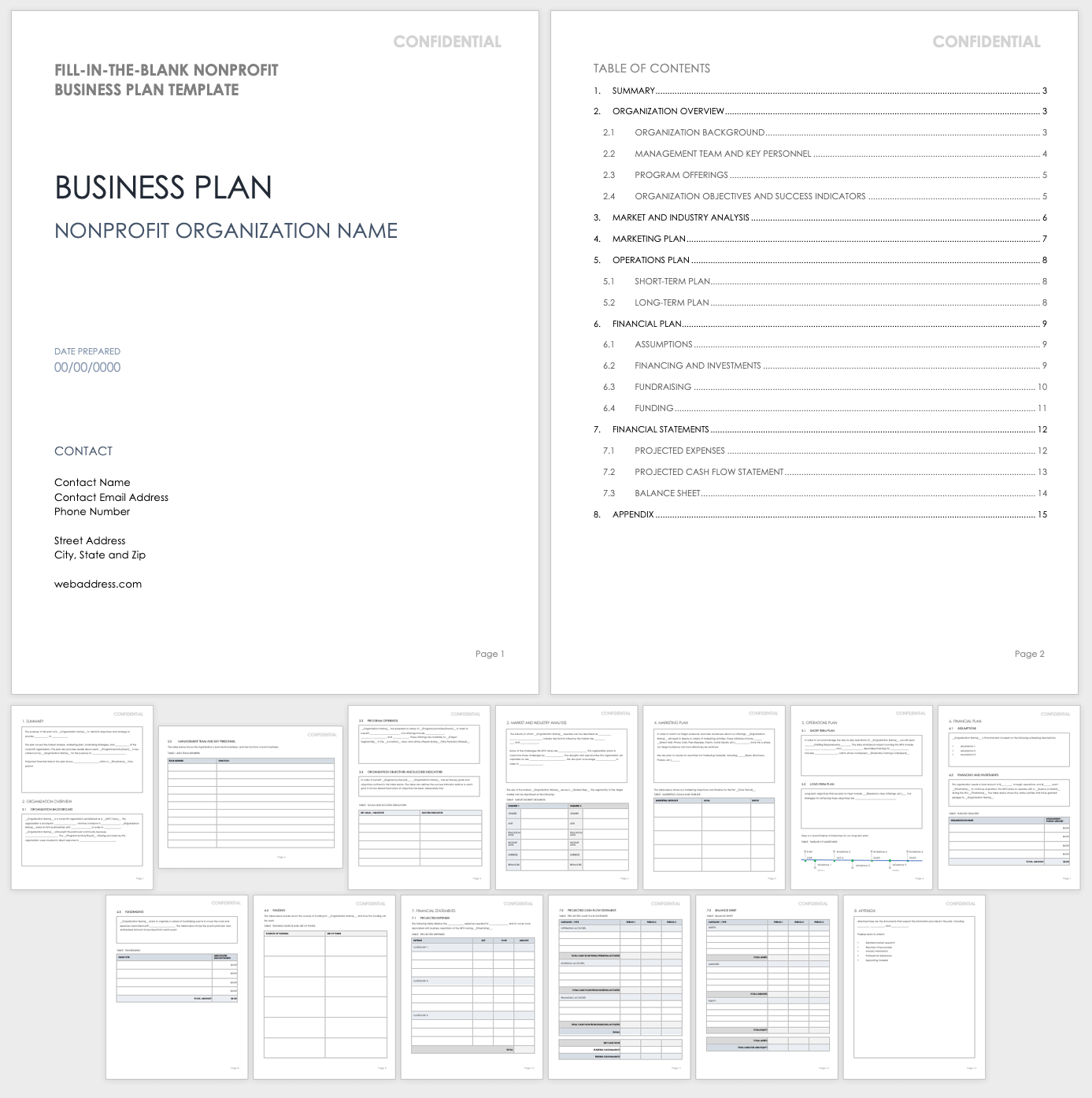

Fill-In-the-Blank Nonprofit Business Plan Template

Use this fill-in-the-blank template as the basis for building a thorough business plan for a nonprofit organization. This template includes space to describe your organization’s background, purpose, and main objectives, as well as key personnel, program and service offerings, market analysis, promotional activities, fundraising methods, and more.

Download Fill-In-the-Blank Nonprofit Business Plan Template

For additional resources that cater to a wide variety of organizations, visit “ Free Fill-In-the-Blank Business Plan Templates .”

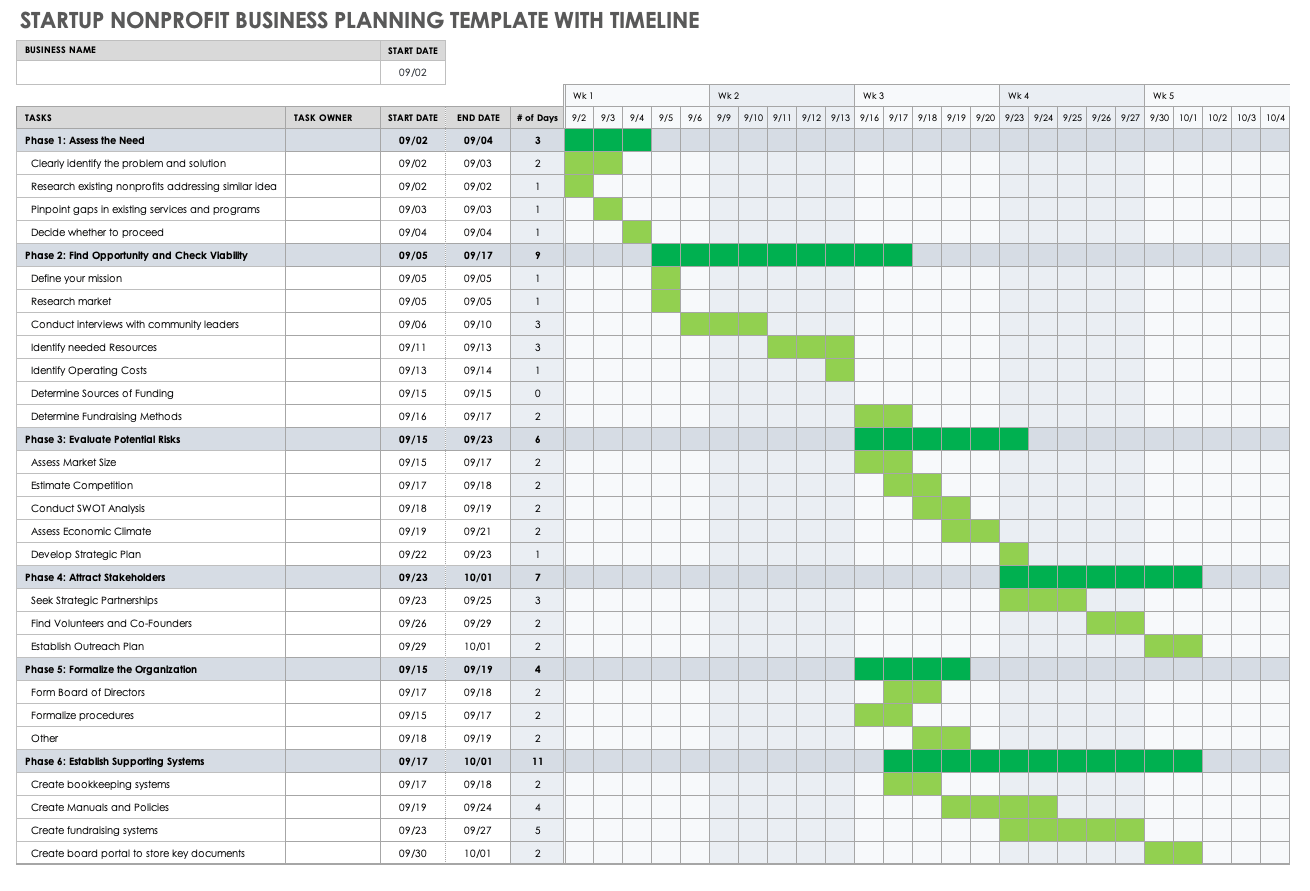

Startup Nonprofit Business Planning Template with Timeline

Use this business planning template to organize and schedule key activities for your business. Fill in the cells according to the due dates, and color-code the cells by phase, owner, or category to provide a visual timeline of progress.

Download Startup Nonprofit Business Planning Template with Timeline

Excel | Smartsheet

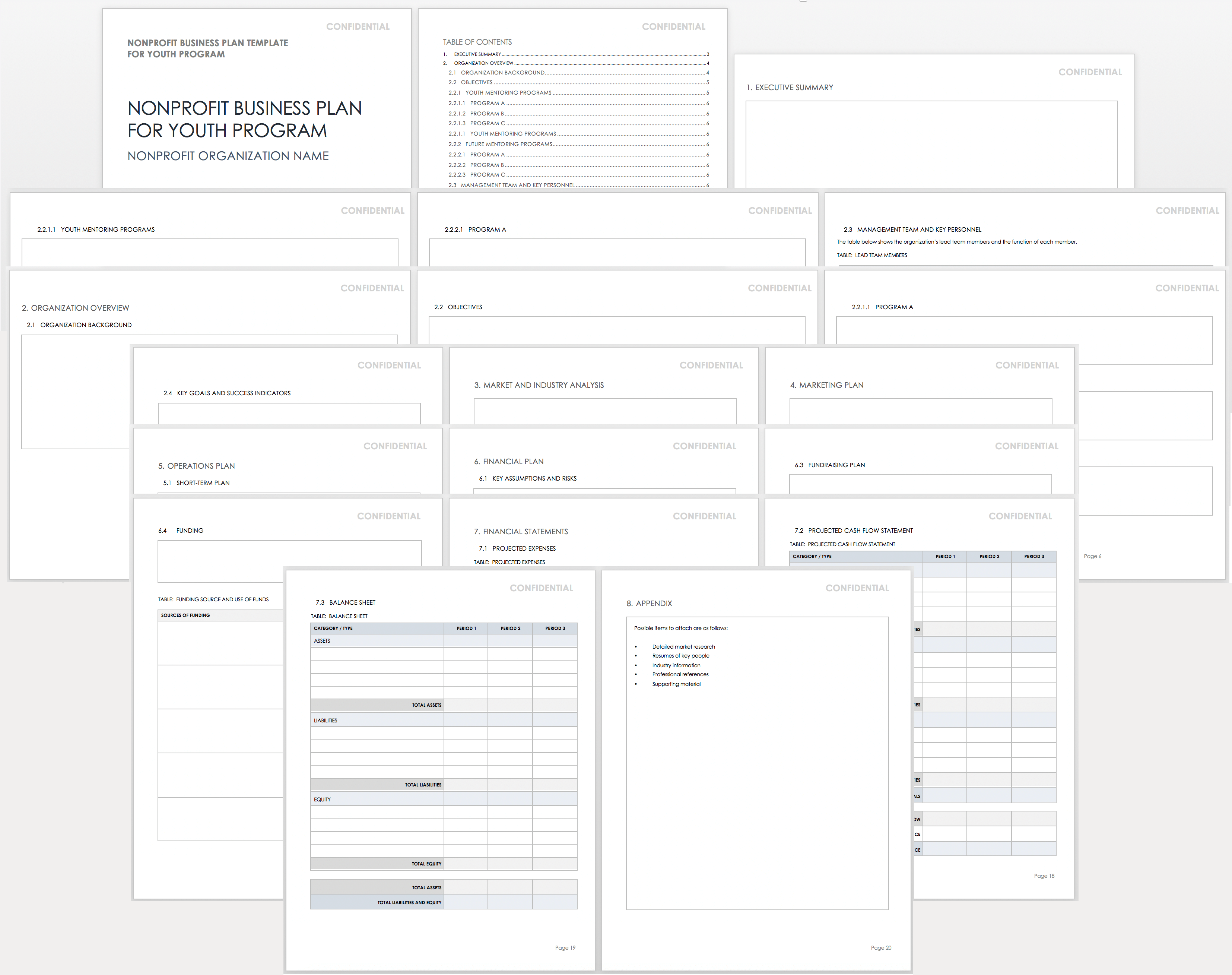

Nonprofit Business Plan Template for Youth Program

Use this template as a foundation for building a powerful and attractive nonprofit business plan for youth programs and services. This template has all the core components of a nonprofit business plan. It includes room to detail the organization’s background, management team key personnel, current and future youth program offerings, promotional activities, operations plan, financial statements, and much more.

Download Nonprofit Business Plan Template for Youth Program

Word | PDF | Google Doc

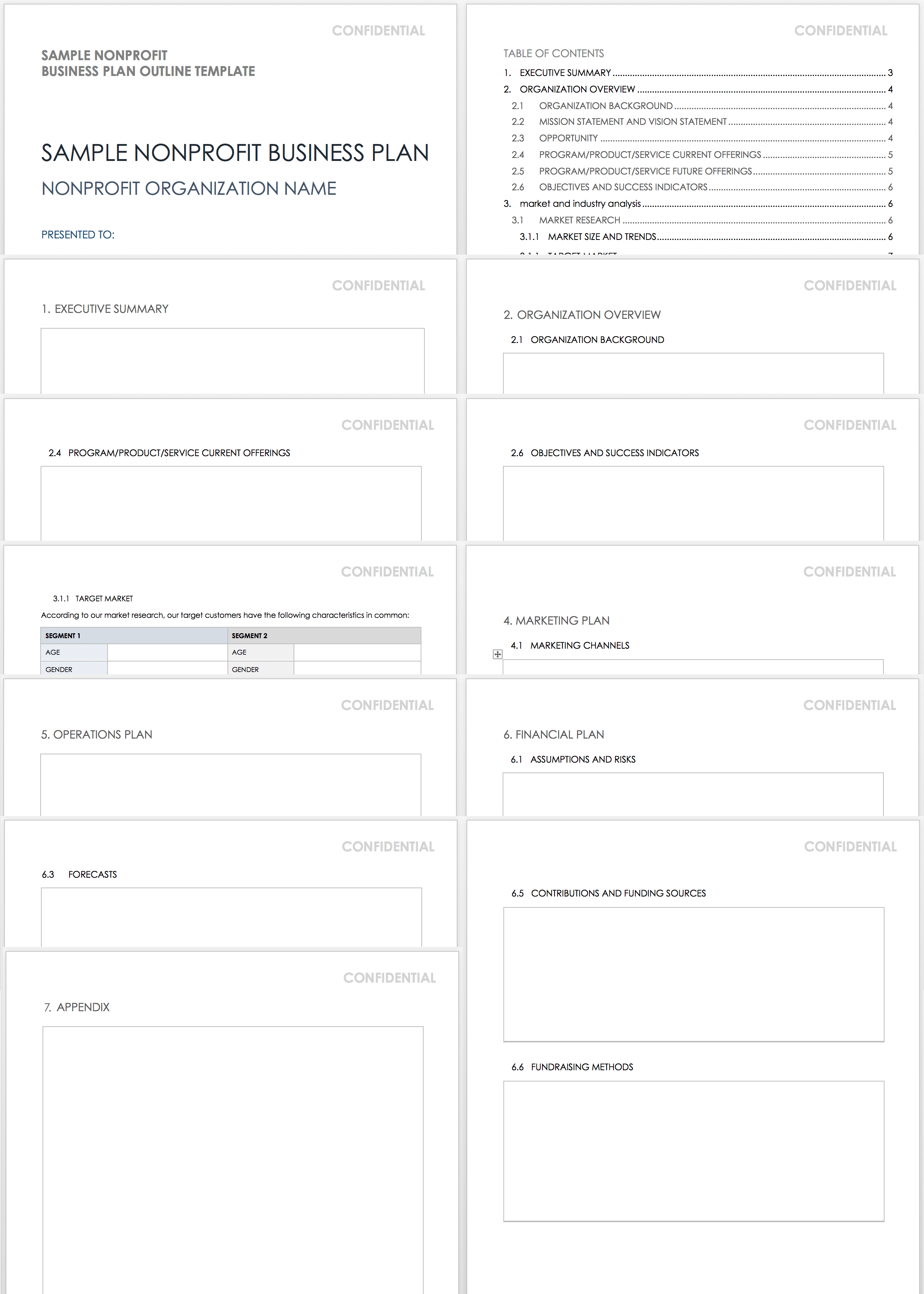

Sample Nonprofit Business Plan Outline Template

You can customize this sample nonprofit business plan outline to fit the specific needs of your organization. To ensure that you don’t miss any essential details, use this outline to help you prepare and organize the elements of your plan before filling in each section.

Download Sample Nonprofit Business Plan Outline Template

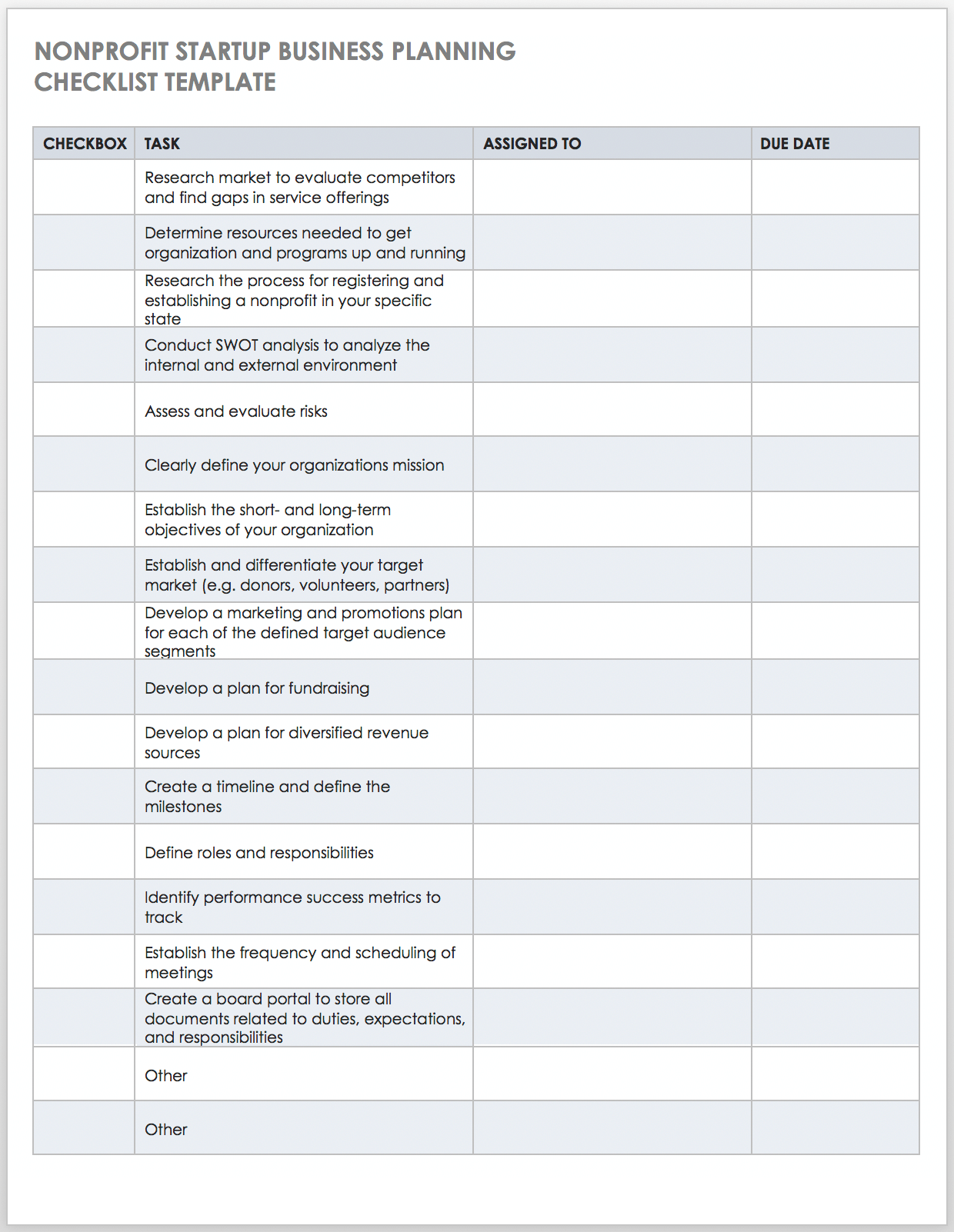

Nonprofit Startup Business Planning Checklist Template

Use this customizable business planning checklist as the basis for outlining the necessary steps to get your nonprofit organization up and running. You can customize this checklist to fit your individual needs. It includes essential steps, such as conducting a SWOT analysis , fulfilling the research requirements specific to your state, conducting a risk assessment , defining roles and responsibilities, creating a portal for board members, and other tasks to keep your plan on track.

Download Nonprofit Startup Business Planning Checklist Template

Tips to Create Your Nonprofit Business Plan

Your nonprofit business plan should provide your donors, volunteers, and other key stakeholders with a clear picture of your overarching mission and objectives. Below, we share our top tips for ensuring that your plan is attractive and thorough.

- Develop a Strategy First: You must aim before you fire if you want to be effective. In other words, develop a strategic plan for your nonprofit in order to provide your team with direction and a roadmap before you build your business plan.

- Save Time with a Template: No need to start from scratch when you can use a customizable nonprofit business plan template to get started. (Download one of the options above.)

- Start with What You Have: With the exception of completing the executive summary, which you must do last, you aren’t obligated to fill in each section of the plan in order. Use the information you have on hand to begin filling in the various parts of your business plan, then conduct additional research to fill in the gaps.

- Ensure Your Information Is Credible: Back up all the details in your plan with reputable sources that stakeholders can easily reference.

- Be Realistic: Use realistic assumptions and numbers in your financial statements and forecasts. Avoid the use of overly lofty or low-lying projections, so stakeholders feel more confident about your plan.

- Strive for Scannability: Keep each section clear and concise. Use bullet points where appropriate, and avoid large walls of text.

- Use Visuals: Add tables, charts, and other graphics to draw the eye and support key points in the plan.

- Be Consistent: Keep the voice and formatting (e.g., font style and size) consistent throughout the plan to maintain a sense of continuity.

- Stay True to Your Brand: Make sure that the tone, colors, and overall style of the business plan are a true reflection of your organization’s brand.

- Proofread Before Distribution: Prior to distributing the plan to stakeholders, have a colleague proofread the rough version to check for errors and ensure that the plan is polished.

- Don’t Set It and Forget It: You should treat your nonprofit business plan as a living document that you need to review and update on a regular basis — as objectives change and your organization grows.

- Use an Effective Collaboration Tool: Use an online tool to accomplish the following: collaborate with key personnel on all components of the business plan; enable version control for all documents; and keep resources in one accessible place.

Improve Your Nonprofit Business Planning Efforts with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

91k Grant Applications Reveals Success Rates 🏆 Which grants are easiest to win? Access report .

How to Write The Best Nonprofit Business Plan: Ultimate Step By Step Guide in 2024

Reviewed by:

January 11, 2024

Table of Contents

Many assume that running a nonprofit is very different from running a company. And in some ways, they are right—from their philanthropic mission to the legalities of a tax-exempt status, those dedicating their time to operating a successful nonprofit organization deal with many worries that would not cross the mind of the average CEO.

But that is not to say that there aren’t any similarities between the two. One example is the necessity of a good business plan.

If you’ve never created one before, below you will find the ultimate step-by-step guide to how to write a nonprofit business plan.

.png)

Why Do You Need a Nonprofit Business Plan?

As their name implies, nonprofits are organizations that operate not for the purpose of profits, but rather in search of furthering philanthropic causes that help the world.

So why does a nonprofit need a business plan?

The truth is that a business plan does a lot more than strategizing for future profits. When done well, a business plan helps not only lay out an organization’s current standing, but it also demonstrates what it hopes to accomplish in the next three to five years, and how it will do so.

By seeing plans laid out in such a manner, one can more easily see both new possibilities and potential pitfalls. Business plans also help manage expectations so that one knows what is feasible, what is a stretch but still possible, and what is out of reach.

More than that, in the case of nonprofits, a nonprofit business plan is crucial when trying to secure support from others. Be it in the recruitment of new volunteers , in trying to sign corporate partnerships , or in applying for certain grants , when a nonprofit business plan is clear and comprehensive, it adds credibility to your organization which in turn can help you secure new sources of funding and support.

Insights Straight To Your Inbox

What makes a good nonprofit business plan.

Understanding why you need a nonprofit business plan is very different from understanding what distinguishes a good one from those that are only serviceable.

If you’re familiar with regular business plans, then the good news is that there are not that many differences between that and a nonprofit business plan. There will be some changes of phrases and certain sections will be adapted to reflect the charitable nature of the organization, but at the core of its structure, the two can operate in very similar manners.

A good nonprofit business plan should be:

- Easy to understand not only to those who are familiar with the organization, but also to those who are getting to know it through it.

- Easy to read, with not a lot of technical terms.

- Visually engaging.

- Include as much information as possible while not being overly long.

Whoever reads your nonprofit business plan should, by the end of it, have a solid understanding of your goals, the structure of your organization, your vision for the future, and how you plan to accomplish these different things.

More than that, a good nonprofit business plan should provide you with a comprehensive roadmap for the next three to five years.

As is the case with any road trip, it is natural to sometimes go at a slower pace than expected or to deviate from the planned route due to unforeseeable circumstances; but by having planned the most efficient way to achieve your goals, you can use your roadmap to get back on track and adapt to the changes and challenges that come your way.

Find Your Next Grant

17K Live Grants on Instrumentl

150+ Grants Added Weekly

10 Things to Include in a Nonprofit Business Plan

Now that you understand why you need a nonprofit business plan and what qualities are featured in a good one, it is time to explore some of the elements that go into crafting a successful nonprofit business plan.

1. Executive Summary

When building a good nonprofit business plan, the executive summary is the last thing you write, but the first thing—and sometimes the only thing—that anyone will read. As the name it implies, it is a summary of the entire document.

Typically, your executive summary should:

- Be no longer than two pages.

- Explain your nonprofit’s reason for existing.

- Discuss the issues you are trying to solve.

- Detail your approach to solving these issues.

- Go over your fundraising strategies.

- Give an overview of the general structure of your nonprofit.

In a strong nonprofit business plan, this part of the document should give people a good idea of what your organization does by providing a summary of all the information that will be included in the business plan.

Potential donors and investors presented with your nonprofit business plan might not have the time to read the entire document. For this reason, consider also making the executive summary a soft sell as to why they should support your cause.

Don’t solicit donations, but instead make your writing persuasive enough so that while talking about your organization, your operations, and your plans for the future, you can also secure their support.

One common mistake to make with this section is including tons of acronyms and technical terms that would be unfamiliar to those not working closely with your cause.

Remember that the executive summary is meant to be read quickly so it can efficiently familiarize outsiders who may never have heard of your nonprofit, the problem you are trying to solve, or the innovative solutions you’re employing. There will be space to include and explain those technical terms later on, but the executive summary is not the place to do this.

2. Mission Statement

If you’ve worked on a website, worked on incorporating your nonprofit, or applied to possible funding opportunities, then you have probably written some version of a mission statement.

Your nonprofit’s mission statement should be written with simple words and be easy to understand. It should be concise while also being specific. When written well, the mission statement should include the main ideas behind your nonprofit and how you plan on executing this vision.

While you should be able to summarize this with one or two sentences, this section of your nonprofit business plan will also give you the opportunity to go into details of how your organization will make a difference in the world.

Take this What We Do page for the British nonprofit Arts Derbyshire as an example.

This mission statement is only three sentences long, but with it, it gives you enough information to understand what the nonprofit’s goal is and how it seeks to achieve this mission.

The first two top lines explain what the aim of the organization is and why they believe this is important. Notice how the highlights draw attention not only to the nonprofit’s name (“Arts Derbyshire”), but also its nature (“strategic arts charity”) and its mission (“enrich people’s lives through art”).

The third line details how Arts Derbyshire fulfills the goal mentioned above by working together with artists and art groups and communities by providing them with strategic direction. They do not need to go into more detail than this—an overview that is concise but specific is all you need for a successful mission statement.

For more examples and tips to help you craft your own effective mission statement, check out this post on our blog.

3. Information on Your Team

Those who read your business plan will be interested in knowing who works in your nonprofit and what function they serve . As such, it is important to lay out the structure of your organization by describing the important positions and their responsibilities.

When discussing your team, consider answering these questions:

- Who are your board members?

- Who is on your management team?

- What are their qualifications?

- Do they have past experience working with nonprofits?

- Do they have a personal reason to be invested in this cause?

- What does their daily schedule look like?

- What are some responsibilities they have outside their usual day-to-day tasks?

- How do they help with fundraising efforts?

- How do they help with recruitment strategies?

Not only will answering these questions help outsiders learn what distinguishes your team from other similar nonprofits by highlighting what each individual brings to the table, it also gives you a better overview of how your nonprofit currently operates and the different ways you might be able to expand in the near future.

4. Target Audience

In most regular business plans, companies will often talk about their target audience and why they believe their product is a good fit for this demographic.

While nonprofits may not usually think of their interactions with others in such terms, the truth is that you still have an equivalent of a target audience. This would be your benefactors and your supporters.

When writing your nonprofit business plan, explain how your nonprofit will benefit communities and why you believe certain individuals are more likely to support your nonprofit.

Remember that this section is not exclusive to organizations focused on human beings or human communities and activities. Be it if your nonprofit fights for animal rights or if it seeks to preserve the natural environment, you should still go into details as to how you are benefiting these causes and who your supporters are.

5. Marketing Plan and Branding

We tend to think of marketing and branding as sales techniques. And while that is not entirely inaccurate, to limit yourself to this definition is to possibly ignore the role they play in the success of your nonprofit.

For a nonprofit, a marketing plan is not a plan on how to sell your product or service, but rather a plan on how to reach your supporters so that they will donate to your cause. For this reason, a good nonprofit business plan will include your different outreach strategies.

Advertisements, press releases, your website, and social media platforms are ways you can reach and engage with your audience. Not only should you understand how to best promote your nonprofit through each of these channels, but you should also craft a strategy based on the strengths and weaknesses of each format. This understanding and strategies should, in turn, be discussed in detail in your nonprofit business plan.

Remember to be specific. It could be beneficial to include projections on how you believe you will grow based on your marketing plan . If you’ve done any focus groups or market tests, or if there are any potential partners you would like to work with, you can also include them in this section. If appropriate, you can also touch upon the costs of your plan.

When it comes to branding, think about the following:

- Your colors

- Your slogan

All of these will be key in your communication efforts with your supporters and potential partners. You must pick something that not only fits your cause, but that will effectively motivate others to donate to your nonprofit.

6. Financial Plan

Nonprofits, just like any organizations operating in our modern world, need money in order to stay afloat.

However, in the case of a nonprofit, the organization needs money not only to pay for its operational expenses, but also in order to contribute to its cause.

Your financial plan will cover all of this and more. In it, you should include details of:

- Your current financial standing

- All your costs and expenses

- A detailed budget that takes into consideration both short-term expenses and long-term expectations

- Your possible fundraising strategies

- A plan for how to most effectively use any potential surplus

Your financial plan should show how you are covering all of your financial needs while also giving you a long-term budget that helps you create projections as to how your nonprofit will grow in the near future.

Some other things you should consider including in your financial plan include:

- List of Assets

- List of Liabilities

- List of Revenue Streams

- List of Grants Received

- Cash Flow Statements

The financial plan section of your nonprofit business plan would also be a good spot to discuss potential corporate partnerships, and how you would plan to integrate said initiatives into your overall strategy.

When taken as a whole, your financial plan should help you see gaps in your strategy and give you an idea on how to address these issues. It should also prove to potential supporters and investors that your nonprofit knows how to responsibly manage any potential donations or grants that it might receive now or in the future.

7. Impact Plan

Most business plans include a section reserved exclusively to discussing profits. Naturally, when it comes to building a nonprofit business plan, this section is tweaked to reflect the not-for-profit nature of your organization.