Assignment Of Loan: Definition & Sample

Jump to section, what is an assignment of loan.

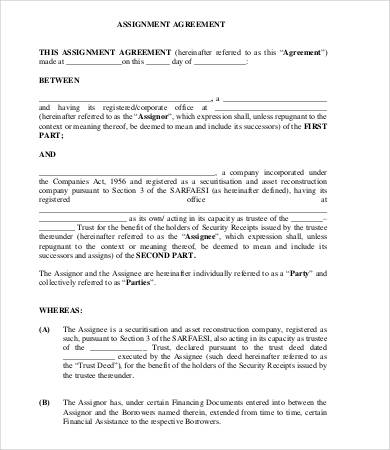

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

The debtor, the recipient of the loan, must be notified when a debt is assigned. When there is an assignment of a loan, a Notice of Assignment (NOA) is sent out to the debtor informing them that a new party is now responsible for collecting any outstanding amount.

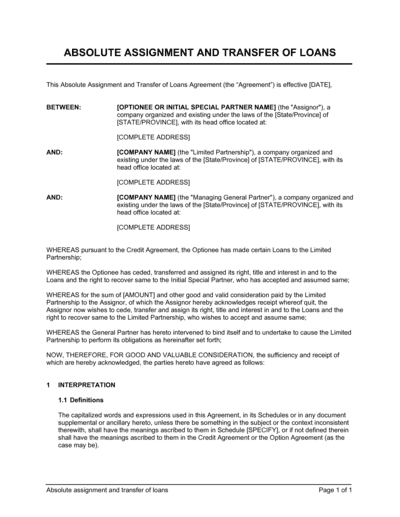

Assignment Of Loan Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.14 5 dex1014.htm ASSIGNMENT OF LOAN DOCUMENTS , Viewed October 21, 2021, View Source on SEC .

Who Helps With Assignment Of Loans?

Lawyers with backgrounds working on assignment of loans work with clients to help. Do you need help with an assignment of loan?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of loans. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Loan Lawyers

I am a lawyer with over 10 years of experience drafting and negotiating complex capital agreements, service agreements, SaaS agreements, waivers and warranties.

John Arthur-Mensah is a highly skilled attorney with extensive expertise in drafting contracts, information law, international law, insurance defense, and complex civil litigation. Throughout his career, he has demonstrated a keen eye for detail and a strong ability to craft well-structured, comprehensive legal agreements. John's track record includes successfully managing the entire contract drafting process, from initial negotiation to final execution. His proficiency in legal research and documentation enables him to ensure that contracts comply with applicable laws and regulations. With a strategic approach and persuasive communication skills, John excels in negotiating contract terms and providing valuable counsel on contractual matters. Admitted to the Maryland Bar and the United States District Court in Maryland, he is well-equipped to handle a diverse range of legal challenges, making him a valuable asset in contract drafting and beyond.

Construction lawyer practicing in Southern California since 1988. Have extensive experience in construction contracts and forms drafting, negotiating. I also serve as counsel for large material suppliers and have extensive experience in commercial transactions, drafting and negotiation of commercial documents including dealerships, NDAs, etc.

Business attorney with over 15 years of experience serving companies big and small with contracting including business, real estate and employment.

At Whalen Legal Group, PC, we strive to ensure that our clients are provided with the highest quality legal representation. Our team is committed to providing you with personalized and effective legal advice. We specialize in Business Law, Estate Planning and Trust, and Real Estate Law and have years of experience in these fields.Our goal is to provide our clients with the best possible service and to ensure that their legal matters are handled with compassion, integrity, and transparency. We understand that every situation is different and we take the time to listen and understand each and every one of our clients’ needs.

I represent business owners throughout California with their business, IP and employment law matters.

I attended the University of Illinois- College of Law on a full merit scholarship. While in law school, I was a 711 Attorney at the Lake County State's Attorney's Office, specializing in traffic and misdemeanor cases. After graduation, I served as in-house counsel for one of the largest insurance companies in the world, managing thousands of cases from initial intake to trial. Upon leaving this position, I accepted a role as Legal Counsel to the Illinois Senate Minority Leader. There, I advised Senators on legislative matters, labor and employment law, and complex constitutional questions. After leaving public service, I accepted a role at a mid-size Chicago-based law firm, where I practice insurance defense and litigation. In addition to this, I also serve as outside general counsel to a food brokerage business, where I handle all of their labor and employment matters.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Loan lawyers by city

- Austin Assignment Of Loan Lawyers

- Boston Assignment Of Loan Lawyers

- Chicago Assignment Of Loan Lawyers

- Dallas Assignment Of Loan Lawyers

- Denver Assignment Of Loan Lawyers

- Houston Assignment Of Loan Lawyers

- Los Angeles Assignment Of Loan Lawyers

- New York Assignment Of Loan Lawyers

- Phoenix Assignment Of Loan Lawyers

- San Diego Assignment Of Loan Lawyers

- Tampa Assignment Of Loan Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

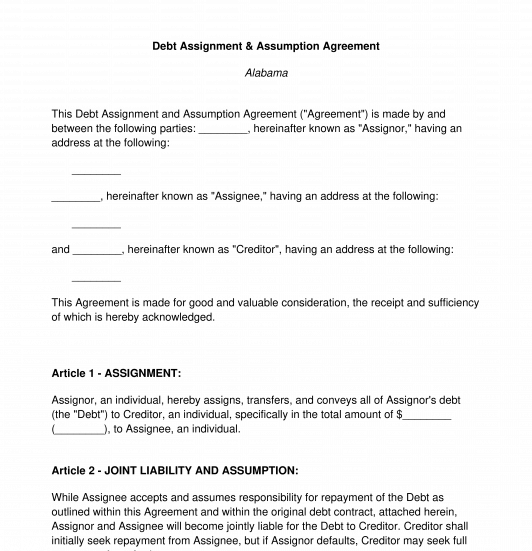

Debt Assignment and Assumption Agreement

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Debt Assignment and Assumption Agreement - FREE

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

Quick Links

Legal documents.

- All Templates

- Authorizations

- Bill of Sale

- Disclaimers

- Privacy Policy

© 2023 EasyLegalDocs.com. All rights reserved.

Make your free

Loan Agreement

Worldwide Compatabilty - USA, Canada, UK & Australia etc. Read our disclaimer. " class="info-cursor border-0 bg-transparent ms-1 p-0" data-bs-original-title="assignment of loan agreement template" title="assignment of loan agreement template">

Download for Word (.doc) or Adobe (.pdf).

Found this useful? Share it!

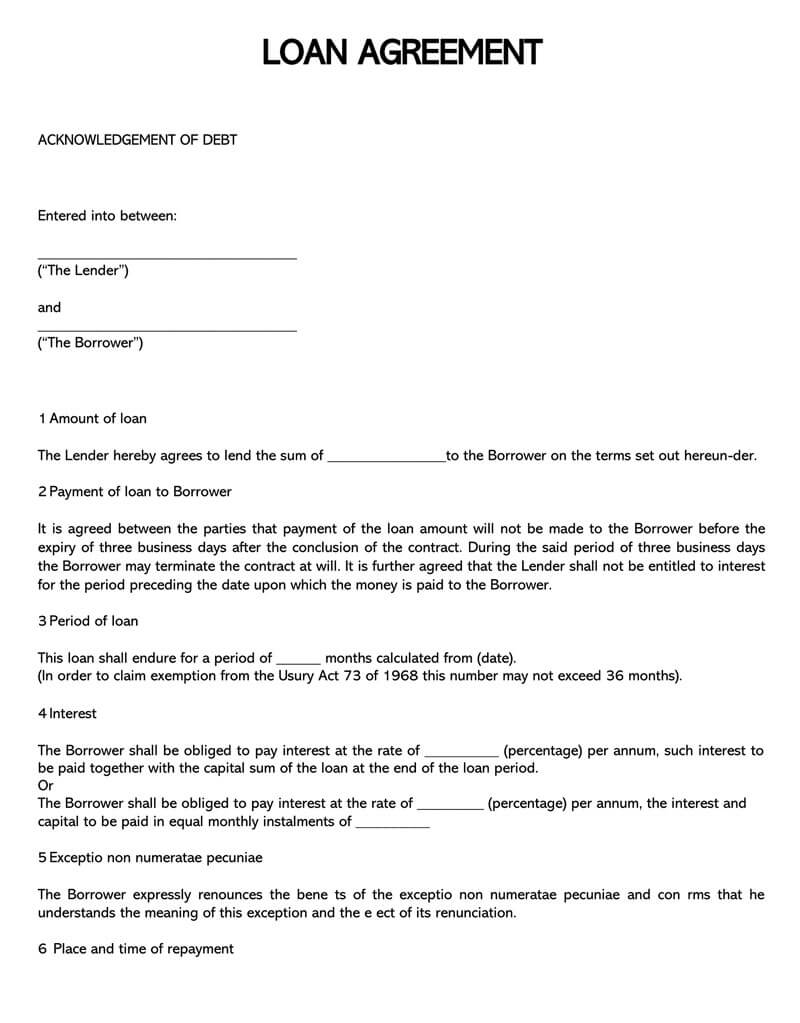

Free Loan Agreement Template

A loan agreement serves as a legally binding contract between two entities: the lender and the borrower. These entities can be individuals, businesses, or a mix of the two. The agreement outlines the terms and conditions under which money is lent.

If you’re using our free loan agreement template, it’s important to continue reading to understand each component of the document and how it functions.

The Importance of a Loan Agreement

A loan agreement might seem like a mere formality, especially if it’s between friends or acquaintances.

Nonetheless, its importance should not be underestimated. Here’s why securing a loan with a formal agreement is crucial:

- Clarity and Transparency: Every term and condition is explicitly outlined, eliminating ambiguities and ensuring both parties know their responsibilities.

- Legal Safeguard: In case of disputes, the loan agreement serves as a reference point and offers legal protection to both parties.

- Building Trust: An agreement on paper reinforces commitment, fostering trust between the lender and borrower.

- Structured Repayment: Clear repayment terms are set, ensuring both parties are aligned on expectations.

In essence, while it may seem tedious, a loan agreement is the backbone of any lending process. It brings clarity, legal protection, and establishes trust — invaluable aspects of any financial transaction.

Who Should Use a Loan Agreement?

A loan agreement is not just limited to formal financial institutions but extends its importance across various scenarios:

- Individuals Personal loans between friends or family members can benefit from such agreements. While it might seem overly formal among close acquaintances, having clear terms can prevent potential disputes or misunderstandings down the line.

- Business Entities Businesses, whether lending or borrowing, should use loan agreements to ensure that both parties understand their obligations. This is especially important when substantial amounts are involved, or the loan’s terms are complex.

In essence, loan agreements act as safeguards in financial interactions, ensuring both transparency and commitment, regardless of the context or parties involved.

How to Fill Out and Use the Loan Agreement Template

Step 1: date of execution.

Begin by entering the date when the agreement is being signed in the [DATE OF EXECUTION] field. This will mark the official commencement of the terms outlined in the agreement.

Step 2: Names of the Parties Involved

In the fields labeled [NAME OF LENDER] and [NAME OF BORROWER] , enter the full names of the lender and the borrower, respectively. Ensure accuracy to prevent any disputes regarding the parties involved.

Step 3: Principal Loan Amount

Input the amount being loaned in the [LOAN AMOUNT] section. This sum represents the initial amount before the addition of any interest.

Step 4: Payment Details

Replace [DUE DATE] with the exact date by which the borrower is expected to repay the loan in full, including any interest.

Step 5: Interest Rate Specification

Replace [INTEREST RATE] with the agreed-upon interest rate. Ensure that this rate is compliant with any local or national regulations to prevent legal complications.

Step 6: Signatures and Addresses

Both the lender and the borrower must sign their names where indicated. Below their signatures, each party should provide their current address to ensure proper channels of communication.

Ideally, this agreement should be witnessed to add an extra layer of legitimacy. A third-party witness should sign and provide their address in the designated areas.

Step 7: Retain Copies for Safekeeping

Once filled out and signed, both the lender and the borrower should retain copies of the agreement. Store the agreement in a safe and accessible location. It’s also advisable to have digital copies for easy retrieval.

By following this step-by-step guide, you can ensure that the Loan Agreement serves its purpose effectively, offering protection and clarity to all parties involved.

Did you find this helpful?

Share Your Feedback

How can we improve your experience? Please share your feedback with us.

Loan Agreement Template

Below you can see a sample of the Loan Agreement template:

Loan Agreement FAQs

What is a loan agreement.

A loan agreement is a contract between a borrower and a lender that spells out the terms of the payment of a loan and the rights and obligations of the lender and the borrower. Loans can be secured or unsecured; that is, it may or may not attract collateral. And there can also be fixed-rate or variable-rate loans. Loans can also vary based on their interest rates and repayment schedules.

What should a loan agreement include?

In addition to the rights and obligations of the lender and the borrower, a loan agreement should include the principle loan amount, payment terms, interest rate, due date as well as the legal obligations of both parties (lender and borrower).

Why is a loan agreement important?

A loan agreement helps protect the lender or borrower in the event of a breach or default. A signed loan agreement is valid proof of the agreement between both parties to be bound by its terms. And it protects the interest of both parties. In the event of a legal dispute then a loan agreement can be the vital evidence you’ll need to make your case. A loan agreement is also evidence that the money involved was a loan and not a gift. And you can legally enforce the obligations of the other party in the event of breach or default.

When should I use a loan agreement?

You should always use a loan agreement when lending or borrowing money, even if you lending to friends or family. You want to be sure that you’ll be paid back on or before the agreed date. So you should use a loan agreement anytime you want to lend or borrow money. It’s extra security!

How to write a loan agreement?

Writing a loan agreement from scratch is not an easy task and often requires legal expertise. But you can make things easier and start with a template that outlines the essential components of a loan agreement. You can download our free template in Microsoft Word (.doc), Adobe (.pdf), and copy to your Google Docs account or print a copy online from your browser. All you have to do is answer just a few simple questions, and we will generate your loan agreement in a few minutes.

Create Your Free Loan Agreement Online

Or choose a file format:

Looking for Something Else?

There are plenty of templates to choose from, and we're adding more each week!

Lease Assignment Agreement

A Lease Assignment Agreement or Assignment of Lease is a legally binding contract...

Arbitration Agreement

An arbitration agreement is a legal contract between two parties that agree to re...

Sale of Goods Agreement

This article explores Sale of Goods Agreements, essential contracts in business t...

Land Lease Agreement

A Land Lease Agreement, often simply referred to as a lease agreement, is a bindi...

Profit Sharing Agreement

In the landscape of business partnerships, a clearly outlined agreement is vital ...

Business Partnership Agreement

Entering into a business partnership is a major decision that can shape the traje...

Create your free Loan Agreement today using our online editor. Print or download your document in minutes!

License Summary

Our free-for-all license means that all our legal templates and documents are 100% free to use.

- Free access to all templates and documents, for both commercial and non-commercial use.

- Keep, edit, re-brand, and modify the legal documents without any restrictions.

- No need for attribution — though it's appreciated to help our community grow!

Restrictions apply:

- Reselling or redistributing our templates or documents as your own is not allowed.

- Our documents should not replace professional legal advice.

Like what you see? Share this with your friends!

Or copy link

WTO / Legal / Loan Agreement / 38 Free Loan Agreement Templates & Forms (Word | PDF)

38 Free Loan Agreement Templates & Forms (Word | PDF)

Obtaining a loan can be a significant financial decision that requires careful consideration and understanding of the loan agreement. Loan agreements are legally binding contracts that outline the terms and conditions of a loan, including repayment terms, interest rates, and other crucial details. For borrowers, it’s crucial to fully comprehend the complexities of loan agreements to make informed decisions and ensure successful borrowing.

In this article, we will provide a comprehensive guide to explain loan agreements, covering key elements such as loan terms, interest rates, collateral, repayment schedules, and more. Whether you are a first-time borrower or seeking to refine your understanding of loan agreements, this article aims to provide valuable insights and practical tips to navigate the loan agreement process with confidence and clarity.

What is Loan Agreement?

A loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan.

It serves as a written agreement that establishes the rights and responsibilities of both parties in relation to the loan transaction.

The agreement typically includes the following key elements:

- Loan Amount: It specifies the amount of money that is being borrowed by the borrower from the lender.

- Interest Rate: It outlines the interest rate that will be charged on the loan, which is the cost of borrowing the money.

- Repayment Terms: It includes the repayment terms, such as the installment amounts, due dates, and duration of the loan, which specify how and when the borrower is required to repay the loan.

- Security or collateral: If the loan is secured, the agreement will specify the collateral or security that the borrower is providing to the lender to secure the loan. This can be a property, a vehicle, or any other valuable asset that the lender can seize in the event of default.

- Default and Remedies: It may include provisions related to events of default, such as failure to repay the loan or breach of other terms, and the remedies available to the lender in case of default, such as late fees, penalties, or the right to accelerate the loan and demand immediate repayment.

- Governing Law and Jurisdiction: It may specify the governing law and jurisdiction that will govern the interpretation and enforcement of the agreement, which can be important in the event of disputes between the parties.

- Representations and Warranties: It may include representations and warranties made by the borrower to the lender, such as statements about the borrower’s financial condition, creditworthiness, and the purpose of the loan.

- Covenants: It may include covenants or promises made by the borrower to the lender, such as maintaining certain financial ratios, providing financial statements, or obtaining the lender’s consent for certain actions during the term of the loan.

- Other Terms: Depending on the nature of the loan, the agreement may include other terms and conditions, such as prepayment penalties, loan fees, dispute resolution mechanisms, and other provisions that are negotiated and agreed upon by the parties.

Loan Agreement Templates

Types of Loan Agreements

There are several different types of loan agreements, each with its own unique features and purposes.

Some common types of these agreements include:

Personal loan agreement

A personal loan agreement is a contract between an individual borrower and a lender for a loan used for personal purposes, such as funding education, home improvements, or other personal expenses.

Business loan agreement

It is a contract between a business borrower and a lender for a loan used for business purposes, such as financing working capital, purchasing equipment, or expanding operations.

Mortgage loan agreement

It is a contract between a borrower and a lender for a loan used to finance the purchase of a property, with the property itself serving as collateral for the loan.

Auto loan agreement

It is a contract between a borrower and a lender for a loan used to finance the purchase of a vehicle, with the vehicle serving as collateral for the loan.

Student loan agreement

It is a contract between a borrower and a lender for a loan used to finance education expenses, such as tuition, books, and living expenses, and is typically offered by financial institutions or government entities.

Payday loan agreement

It is a short-term loan agreement typically used for small amounts of money with high interest rates and fees and intended to be repaid by the borrower’s next paycheck.

Revolving credit agreement

A revolving credit agreement is a type of loan agreement that provides the borrower with a pre-approved credit limit that can be used repeatedly, with the borrower repaying and borrowing against the credit line as needed, similar to a credit card.

Bridge loan agreement

It is a short-term loan agreement that provides temporary financing to bridge the gap between two transactions, such as the purchase of a new property before the sale of an existing property.

Construction loan agreement

It is a type of the agreement used to finance the construction or renovation of a property, with the loan typically dispersed in stages, or “draws,” as the construction progresses.

These are just a few examples of the various types of loan agreements that exist. Each type of the agreement may have its own unique terms, conditions, and requirements, and it is important to carefully review and understand the specific terms and conditions of any contract before entering into it and to seek legal or financial advice if needed.

When is a Loan Agreement Necessary?

The agreements are signed for the purposes of clarifying the terms and conditions of the loan.

Here are some of the reasons why they are written:

Legal protection

An agreement serves as a legally binding contract that outlines the terms and conditions of the loan, including repayment terms, interest rate (if applicable), security or collateral (if any), late payment or default provisions, and other important provisions. Having a written contract helps protect the rights and interests of both the borrower and the lender and provides a legal framework for resolving any disputes that may arise during the loan term.

Clarity and understanding

An agreement helps ensure that both the borrower and the lender have a clear understanding of the terms and conditions of the loan. It outlines the loan amount, repayment schedule, interest rate (if applicable), and other relevant terms, which helps prevent misunderstandings or miscommunications between the parties. This can help foster a healthy borrower-lender relationship based on transparency and trust.

Compliance with applicable laws

The agreements are subject to various laws and regulations, depending on the jurisdiction and type. Writing an agreement helps ensure that the transaction complies with applicable laws, such as usury laws, consumer protection laws, and other relevant regulations.

Customization and flexibility

The agreement can be customized to suit the specific needs and requirements of the parties involved. This allows for flexibility in negotiating and documenting the terms of the loan, including repayment terms, interest rate, security or collateral, and other provisions. A written agreement provides a clear record of the agreed-upon terms, which helps avoid confusion or disagreements in the future.

Record keeping and documentation

A written agreement serves as an important piece of documentation that can be used for record keeping and evidence purposes. It provides a written record of the loan transaction, including the terms and conditions agreed upon, which can be referred to in case of any disputes or legal proceedings.

Lender’s requirements

In some cases, a lender may require a written agreement as a condition for providing a loan. Lenders may have their own internal policies or requirements for documenting loan transactions, and a written agreement may be necessary to comply with these requirements.

Components of Standard Loan Agreement

The elements of a loan agreement are as follows:

- Detailed contact information: The details of the borrower, the lender, the guarantors, if any, and referees and witnesses are required. The information is given on their official names, nationalities, physical postal addresses, gender, ages, and dependents.

- Maturity date: The maturity date in the agreement refers to the date on which the loan is due and payable in full. It is the date by which the borrower is obligated to repay the loan amount, including any accrued interest, fees, and other applicable charges, to the lender according to the terms and conditions of the agreement.

- Acceleration: These are details that give the lender protection from defaulting. Here the details of the payment mode, the interest, and the principal amounts are indicated.

- The principal amount: This is the money that the borrower receives. It does not include the interest or any other charges that the loans might attract.

- The interest: Lenders make their profits through interest. This is the amount added to the principal amount as payback for the loan given. Interest is always a percentage of the given amount spread across the paying period.

- Collateral: Loan security is important. Collateral is usually an asset that the borrower commits to using to recover the loan should they fail to repay it.

- Amendments: Amendments occur when, in the future, there are changes in the form of payment. Sometimes the lending institution might change localities or management, and the new information must be updated in the agreement to ensure the accuracy of the details.

- Default: Information on what constitutes defaulting, as well as associated fines, is provided here. These details are important, especially when legal action is needed later.

- The repayment schedule: If there is a possibility to pay back in installments, a repayment schedule is also indicated. The information about what happens in case of default is also mentioned. There are two types of schedules: even total and even principal payments. The lender chooses the schedule.

- Late repayment: In cases of prepayment or late payments, the agreement outlines exactly what is expected by both parties. There might be charges in some cases.

- The applicable laws: Every country has its own laws on lending money. Companies and firms also have their own that are tailored to meet legal requirements. These details are also included in some agreements as legal references.

- Loan transfer: Loan transfer, also known as loan assignment or loan assumption, refers to the transfer of an existing loan from one party (the original borrower) to another party (the new borrower). In other words, it involves changing the borrower on an existing loan without changing the terms and conditions of the loan itself.

- Joint Liability: In cases of joint and several liability, every involved party is given the details of their roles and the terms and conditions of participating.

- Security Details: The details about any collateral must be mentioned. Both parties should approve the security specifics.

- Dates and signatures: Accurate dates are given, and spaces for signatures and names are provided.

Frequently Asked Questions

In some cases, a loan agreement may contain provisions for early termination, such as prepayment options or acceleration clauses. However, such provisions, if any, should be clearly stated in the agreement. It typically requires mutual agreement and compliance with the terms and conditions of the contract.

Interest rates for loans are determined based on various factors, including the lender’s assessment of the borrower’s creditworthiness, prevailing market rates, and the type of loan being offered.

Defaulting on a loan agreement typically triggers consequences outlined in the agreement, such as late fees, penalties, acceleration of repayment, or other remedies available to the lender. Understanding the default provisions in the agreement and being aware of the potential consequences of default are important.

Loaning money to someone with bad credit is a risk that one should really think through before going ahead with it. If someone has a bad credit rating, they are likely to default on the loan if it is granted. However, there are people who have been badly rated for genuine reasons. Before lending, it is good to do background research on why the person was poorly rated. Here, an informed decision can be made.

It may be possible to obtain a loan even with a bad credit rating, but it can be more challenging. Lenders typically consider credit ratings as an indicator of a borrower’s creditworthiness, and a low credit score can affect the terms and conditions of a loan. Borrowers with a bad credit rating may face higher interest rates, stricter loan terms, or may need to provide additional collateral or guarantors to secure a loan. However, some lenders specialize in offering loans to borrowers with poor credit ratings, often referred to as “bad credit loans” or “subprime loans.” These loans may have higher interest rates or fees, but they can provide an option for borrowers who have difficulty obtaining loans from traditional lenders due to their credit histories.

A subsidized loan is a type of federal student loan available to undergraduate students with financial need. It is offered by the U.S. Department of Education and is designed to help students cover the cost of their education. Unlike unsubsidized loans, which accrue interest while the borrower is in school, a subsidized loan does not accrue interest during certain periods, making it a more cost-effective borrowing option for eligible students.

Sharking occurs when money is given to individuals or companies to manage a business or work on income and profit-generating ideas. The sharks give money and expect returns after investments. The sharks additionally hold full or partial ownership of the company until the amount agreed on is fully paid, along with the estimated profits.

When one consolidates a loan, all of their outstanding debts are combined and paid off together under new loan terms and conditions. Loan consolidations are considered for their low interest rates and the ability to focus on one loan rather than many. Larger loans are used to pay small ones in this case.

A Parent PLUS loan is a type of federal student loan available to parents of dependent undergraduate students who are enrolled in eligible colleges or universities. It is designed to help parents cover the cost of their child’s education. The Parent PLUS loan is offered by the U.S. Department of Education and requires a separate application process from other federal student loans.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Agreements , Legal , Loan Agreement

Free family loan agreement templates (word | pdf).

Applications , Forms

40 free credit application forms and samples.

Legal , Release

Free release of liability forms (hold harmless) | pdf – word.

Legal , Loan Agreement

Free personal guarantee forms for loan (word | pdf).

Release of Personal Guarantee: Request Letters & Forms

35+ IOU Forms and Acknowledgment of Debt Forms

Free Personal Loan Agreement Templates (Word | PDF)

Agreements , Debt

22 free (i owe you) iou templates and forms | word, pdf.

40 Free Payment Agreement Templates (Samples) – Word | PDF

Thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

This assignment and assumption of agreement is between , an individual a(n) (the " Assignor ") and , an individual a(n) (the " Assignee ").

The Assignor and , an individual a(n) (the " Other Party "), entered an agreement dated (the " Agreement "), a copy of which is attached as Exhibit A .

Under section of the Agreement relating to assignments, the Assignor may assign the Agreement to the Assignee and the Other Party wants to permit this assignment.

The parties therefore agree as follows:

1. ASSIGNMENT.

The Assignor assigns to the Assignee of all its rights in, and delegates to the Assignee all of its obligations under, the Agreement. This transfer will become effective on (the " Effective Date "), and will continue until the current term of the Agreement ends.

2. ASSUMPTION OF RIGHTS AND DUTIES.

After the Effective Date, the Assignee shall assume all rights and duties under the Agreement. The Assignor will have no further obligations under the Agreement The Assignor will remain bound to the Other Party under the Agreement for the following purposes: . However, the Assignor remains responsible for obligations accruing before the Effective Date.

3. INCONSISTENCY.

If there is a conflict between this assignment and the Agreement, the terms of this assignment will govern.

4. AGREEMENT CONTINUANCE.

Except as expressly modified and supplemented by this assignment, all other terms in the Agreement remain in full effect and continue to bind the parties, including the prohibition against further assignments without the Other Party's express written consent.

5. ASSIGNOR'S REPRESENTATIONS .

The Assignor represents that:

- (a) it is the lawful and sole owner of the interests assigned under this assignment;

- (b) it has not previously assigned its rights under the Agreement;

- (c) the interests assigned under this assignment are free from all encumbrances; and

- (d) it has performed all obligations under the Agreement.

6. INDEMNIFICATION.

- (a) Of Other Party by Assignee. The Assignee shall indemnify the Other Party against all claims, actions, judgments, liabilities, proceedings, and costs, including reasonable attorney's fees and other costs of defense, resulting from the Assignee's performance under the Agreement after the Effective Date.

- (b) Of Other Party by Assignor. The Assignor shall indemnify the Other Party against all claims, actions, judgments, liabilities, proceedings, and costs, including reasonable attorneys' fees and other costs of defense, resulting from the Assignor's performance under the Agreement before the Effective Date. With respect to claims, actions, judgments, liabilities, proceedings, and costs resulting from the Assignee's performance under the Agreement after the Effective Date, the Other Party shall look first to the Assignee to satisfy those claims, actions, judgments, liabilities, proceedings and costs, including reasonable attorneys' fees and other costs of defense.

- (c) Of Assignee by Assignor. The Assignor shall indemnify the Assignee against all claims, actions, judgments, liabilities, proceedings, and costs, including reasonable attorneys' fees and other costs of defense, that may after the Effective Date be suffered by or asserted against the Assignee because of the Assignor's failure to have performed, before the Effective Date, all of the Assignor's obligations under the Agreement or because of any other claims accruing before the Effective Date that may be asserted with respect to the Agreement.

- (d) Of Assignor by Assignee. The Assignee shall indemnify the Assignor against all claims, actions, judgments, liabilities, proceedings, and costs, including reasonable attorneys' fees and other costs of defense, that may after the Effective Date be suffered by or asserted against the Assignor because of the Assignee's failure to have performed, after the Effective Date, all of the Assignor's obligations under the Agreement or because of any other claims accruing after the Effective Date that may be asserted with respect to the Agreement.

7. COUNTERPARTS; ELECTRONIC SIGNATURES.

- (a) Counterparts. The parties may execute this assignment in any number of counterparts, each of which is an original but all of which constitute one and the same instrument.

- (b) Electronic Signatures. This assignment, agreements ancillary to this assignment, and related documents entered into in connection with this assignment are signed when a party's signature is delivered by facsimile, email, or other electronic medium. These signatures must be treated in all respects as having the same force and effect as original signatures.

8. SEVERABILITY.

If any provision contained in this assignment is, for any reason, held to be invalid, illegal, or unenforceable in any respect, that invalidity, illegality, or unenforceability will not affect any other provisions of this assignment, but this assignment will be construed as if the invalid, illegal, or unenforceable provisions had never been contained in it, unless the deletion of those provisions would result in such a material change so as to cause completion of the transactions contemplated by this assignment to be unreasonable.

No waiver of a breach, failure of any condition, or any right or remedy contained in or granted by the provisions of this assignment will be effective unless it is in writing and signed by the party waiving the breach, failure, right, or remedy. No waiver of any breach, failure, right, or remedy will be deemed a waiver of any other breach, failure, right, or remedy, whether or not similar, and no waiver will constitute a continuing waiver, unless the writing so specifies.

10. ENTIRE AGREEMENT.

This assignment, together with the Agreement, constitutes the final agreement of the parties. It is the complete and exclusive expression of the parties' agreement with respect to its subject matter. All prior and contemporaneous communications, negotiations, and agreements between the parties relating to the subject matter of this assignment are expressly merged into and superseded by this assignment. The provisions of this assignment may not be explained, supplemented, or qualified by evidence of trade usage or a prior course of dealings. No party was induced to enter this assignment by, and no party is relying on, any statement, representation, warranty, or agreement of any other party except those set forth expressly in this assignment. Except as set forth expressly in this assignment, there are no conditions precedent to this assignment's effectiveness.

11. HEADINGS.

The descriptive headings of the sections and subsections of this assignment are for convenience only, and do not affect this assignment's construction or interpretation.

12. EFFECTIVENESS.

This assignment will become effective when all parties have signed it. The date this assignment is signed by the last party to sign it (as indicated by the date associated with that party's signature) will be deemed the date of this assignment.

13. NECESSARY ACTS; FURTHER ASSURANCES.

Each party shall use all reasonable efforts to take, or cause to be taken, all actions necessary or desirable to consummate and make effective the transactions this assignment contemplates or to evidence or carry out the intent and purposes of this assignment.

[SIGNATURE PAGE FOLLOWS]

Each party is signing this assignment on the date stated opposite that party's signature.

| Date: _____________________________ | By: _________________________________________________________ |

| Name: |

The Other Party hereby acknowledges and consents to the above assignment and assumption, and as of its effective date, releases the Assignor from all future obligation and liability under the Agreement. In executing its consent to this assignment, the Other Party does not release the Assignor from any claims or remedies it may have against the Assignor under the Agreement.

In executing its consent to this assignment, the Other Party does not release the Assignor from any claims or remedies it may have against the Assignor under the Agreement.

[PAGE BREAK HERE]

EXHIBIT A Attach copy of original agreement

Free Assignment of Agreement Template

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Assignment of agreement: How-to guide

Assignment agreements are foundational documents in legal transactions that enable the transfer of contractual rights and responsibilities from one party to another. Understanding the complexities of assignment agreements is critical for individuals and corporations alike. In this detailed article, we will look at the specifics of assignment agreements, from their concept to practical uses.

What is an assignment of agreement?

An assignment agreement is a legal procedure that transfers contractual rights and duties from the original party (the assignor) to a third party (the assignee). This transfer includes substituting one party for another, with the assignee taking over the rights and contractual obligations indicated in the original contract. Assignment agreements are critical in many legal transactions, facilitating the smooth transfer of interests while maintaining the integrity of contractual relationships.

When do you need an assignment agreement?

You may need an assignment agreement in various scenarios where the transfer of contractual rights and obligations is required. Some common situations include:

- Business acquisitions : When acquiring a business, you may need to assign existing contracts to ensure the smooth transition of rights and responsibilities to the new owner.

- Real estate transactions : Assignment agreements are often used in real estate deals to transfer leases, mortgages, or other property interests from one party to another.

- Intellectual property transfers : Assignments play a crucial role in transferring intellectual property rights, such as patents ( patent assignment ), trademarks ( trademark assignment ), and copyrights ( copyright assignment ), from one entity to another.

- Employment arrangements : Assignment agreements may be necessary to transfer employment contracts from one employer to another in mergers, acquisitions, or corporate restructuring.

- Contractual agreements : Any situation where one party wishes to delegate its rights or obligations under a contract to another party may necessitate an assignment agreement.

By utilizing assignment agreements in these scenarios, parties can ensure the seamless transfer of rights and obligations, protect their interests, and mitigate potential disputes.

What are the elements of an assignment agreement?

The primary element in an assignment agreement is the transfer of rights and contractual obligations from the assignor to the assignee. This transfer ensures that the assignee assumes the same rights and obligations originally outlined in the contract.

Assumption of rights and duties

Upon accepting the assignment, the assignee takes over all the rights and duties specified in the original contract. This includes responsibilities, privileges, and obligations previously held by the assignor.

Inconsistencies

To address any discrepancies between the terms of the assignment and the existing contract, it's essential to include provisions outlining how to resolve such differences or disputes. Clarity in addressing inconsistencies helps ensure the enforceability of the agreement.

Agreement continuance

Despite changes in the parties involved, the terms and conditions of the existing contract typically continue to govern the relationship between the parties. This continuity ensures that the contractual obligations remain in effect following the assignment.

Assignor's representations

The assignor asserts the legality of the assignment and the rights being transferred. These representations assure the assignee of the transaction's legitimacy and legality.

Indemnification

Indemnity provisions must be added to protect the assignee from any liabilities that result from the assignment. These provisions safeguard the assignee from losses, damages, or obligations arising from the assignor's actions or omissions.

Proper execution of the assignment agreement requires the signatures of all parties concerned. Obtaining signatures assures formal recognition and approval of the conditions of the agreement.

Including clear and detailed headings in the assignment agreement will help organize the document and guide the parties through its content. These titles improve reading and understanding, decreasing uncertainty and ambiguity while interpreting the agreement.

Effectiveness

Add the clauses addressing the effectiveness of the assignment agreement. Establish the date or conditions under which the assignment takes effect, providing clarity and certainty to the parties concerned.

Necessary acts

To enable a smooth and efficient transfer of interests, include provisions requiring the parties to perform specified activities or meet specific responsibilities to complete the assignment, such as obtaining third-party approval or signing supplementary agreements.

Severability

Severability clauses are added to guarantee that the assignment agreement remains enforceable even if a court declares specific terms or sections unlawful or unenforceable. By incorporating severability clauses, parties ensure the agreement's overall enforceability, as the other sections will stay in effect.

Waiver provisions allow any party to voluntarily surrender rights or duties in an assignment agreement. These provisions allow parties to waive particular rights or responsibilities mentioned in the agreement, allowing flexibility and mutual consent to change certain aspects as needed.

Entire agreement

This phrase indicates that the assignment agreement is the complete understanding of the parties concerned. By incorporating an entire agreement language, the parties certify that the terms and conditions of the assignment agreement override any earlier agreements, conversations, or understandings, whether oral or written. This provision helps avoid conflicts arising from misunderstandings or competing provisions outside of the written agreement.

Together, these components create the structure of an assignment agreement, assuring clarity, enforceability, and legal compliance.

What are the governing laws guiding assignment agreements?

In the United States, the assignment of agreements is controlled by both federal government and state legislation, as well as common law principles. Federal laws, such as the Uniform Commercial Code (UCC), may apply to some components of assignment agreements, particularly those involving the transfer of goods and commercial transactions.

Contract law legislation and regulations differ by state, and each state may have its procedures for enforcing and interpreting assignment agreements. In addition, courts may use common law concepts and precedents established via case law to address problems involving assignment agreements.

Ensure that the assignment complies with the terms of the original contract, get any necessary consents from relevant parties, and adhere to any statutory or contractual limits on assignment. A violation of public policy or legislative prohibitions could make an assignment unlawful or unenforceable.

What are the best practices for drafting assignment agreements?

Assignment agreements must be drafted with great attention to detail and by best practices to guarantee clarity, enforceability, and protection of the parties' interests. Here are some significant points to keep in mind.

Writing simple and comprehensible language

Avoid using vague or ambiguous language that could lead to misunderstandings or disputes. Instead, use clear and precise language to outline the rights, duties, and obligations of each party. Define terms explicitly to avoid interpretation issues.

Including “consideration”

Include consideration, such as monetary compensation or services rendered, to validate the agreement. Failing to do so can invalidate the agreement, so ensure that valuable consideration is exchanged between the parties.

Obtaining consent

Before assigning rights, obtain written consent from all relevant parties involved. Assigning rights without necessary consent may render the assignment unenforceable, so verify consent requirements and obtain written consent to ensure validity and enforceability.

Including indemnification clause

Include indemnification clauses to protect parties from liabilities arising from the assignment. Specify the scope and limitations of indemnification to avoid disputes and safeguard against losses, damages, or liabilities resulting from actions or omissions.

Identifying applicable laws and regulations

Conduct thorough research to identify federal, state, and local laws governing assignment agreements. Compliance with applicable laws and regulations is essential to avoid non-compliance and legal challenges.

Adding severability clause

Include severability clauses to guarantee that the entire agreement is enforceable. If any term is invalid, severability clauses require that the remaining sections stay in effect, ensuring the agreement's overall enforceability.

Specifying the governing law

Designate the governing law of the assignment agreement to avoid uncertainty in case of disputes. Specify the jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

Seeking legal counsel

Engage qualified legal counsel experienced in contract law to assist in drafting, reviewing, and negotiating assignment agreements. Legal professionals can provide invaluable expertise and ensure compliance with legal requirements.

For individuals and businesses seeking a convenient and reliable resource to draft assignment agreements, LegalZoom offers a free assignment agreement template. This template provides a structured framework for creating comprehensive assignment agreements, incorporating key provisions to protect the interests of all parties involved.

In conclusion, assignment agreements are critical tools in legal transactions because they allow for the clear and precise transfer of contractual rights and duties. Understanding the aspects of assignment agreements, recognizing their practical uses, and adhering to legal concerns allows parties to confidently traverse complicated contractual relationships and preserve the integrity of their transactions.

Frequently asked questions

What does an assignment of agreement mean.

An assignment agreement allows a party to transfer their contract's obligations and rights to another party, provided it's permitted under the original agreement. This can be beneficial for various reasons, such as changes in business circumstances, local laws, or market conditions. Here's what you'll need to complete your assignment agreement:

- Assignor information : Gather the name and contact details of the party transferring their rights and duties

- Assignee information : Obtain the information of the party who will assume the responsibilities under the agreement

- Other party information : Know the details of the other party involved in the original agreement

What is the purpose of the assignment agreement?

The purpose of the assignment contract is to allow a party to transfer their contractual rights and obligations to another party, with consent, under the terms of the original agreement.

How do you assign an agreement?

To assign an agreement, you typically need to obtain consent from all relevant parties involved in the original contract and then draft an assignment agreement outlining the transfer of rights and obligations to the new party.

Related categories

Related templates.

Assignment of Residential Lease

Simplify lease transfers with an assignment of residential lease agreement. With the landlord's approval, smoothly transfer your lease responsibilities to a new tenant while documenting the arrangement comprehensively.

Consulting Services Agreement

Establish clear terms of service for successful engagements with consultants. Define the working relationship, including scope of work, compensation, and duration.

General Agreement

Establish all the required terms and conditions of business relationships with the other party. Define crucial details, including the scope of work, expected outcomes, and governing laws.

Management Services Agreement

Protect your business and outline the responsibilities when working with an outside management firm. A management services agreement helps define work terms, responsibilities, payment, and reporting expectations.

Trademark Assignment

Simplify the buying and selling of trademarks with a trademark assignment agreement. Transfer intellectual property rights and ensure a fair and smooth transaction.

Trademark License Agreement

Ensure fair use of intellectual property with a trademark license agreement. Outline the terms of usage and compensation.

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

Absolute Assignment and Transfer of Loans Template

Document description.

This absolute assignment and transfer of loans template has 6 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our absolute assignment and transfer of loans template:

ABSOLUTE ASSIGNMENT AND TRANSFER OF LOANS This Absolute Assignment and Transfer of Loans Agreement (the �Agreement�) is effective [DATE], BETWEEN: [OPTIONEE OR INITIAL SPECIAL PARTNER NAME] (the "Assignor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Limited Partnership"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Managing Genera

Related documents

3,000+ templates & tools to help you start, run & grow your business, all the templates you need to plan, start, organize, manage, finance & grow your business, in one place., templates and tools to manage every aspect of your business., 8 business management modules, in 1 place., document types included.

All Formats

15+ Assignment Agreement Templates – Word, PDF, Pages

Have you ever wondered if it was possible for someone to take over a contractual agreement samples for you? Perhaps a successor or protege is to step into your shoes, or you are entering into a business partnership where you feel the rights and obligations would be better handled by the other party. Perhaps you just want to get out of a loan you have no way of paying, and someone offers to take on the burden for you. Instead of voiding your contract (which might be a legal breach and cause trouble) and having the person or entity sign a new contract, you can use an assignment agreement contract.

- 330+ Agreement Templates in Word

- Agreement Templates in Apple Pages

Agreement Template Bundle

- Google Docs

Assignment Agreement Template

Industrial Design Assignment Agreement Template

Technology Assignment Agreement Template

Simple Agreement to Assign Template

Domain Name Assignment Agreement Template

Agreement of Absolute Transfer and Assignment of Accounts Receivable Template

Lease Assignment Agreement Template

Tenant Assignment Agreement Template

Free Assignment Agreement Template

Patent Assignment Agreement Sample

Software Assignment Agreement Sample

What Can You Assign?

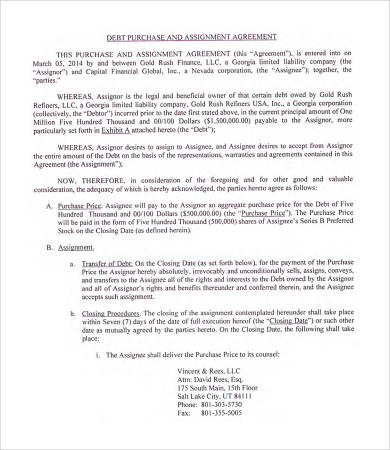

- You can shift all obligations of a debt you owe over to someone you trust, who is more capable to pay it off. This is done using some form of the Debt Assignment Agreement Template.

- Similar to the debt assignment is the Assumption Assignment Agreement, which is another way to get out of your mortgage by having a third party assume the obligation of loan repayment.

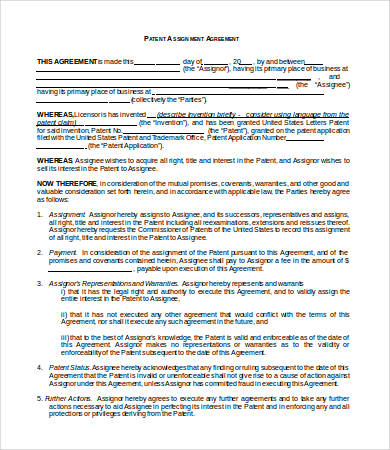

- Patent Assignment Agreement Sample allows the inventor to hand over the intellectual property rights of the invention to another individual or entity.

- This is similar to the Copyright Assignment Agreement Sample.

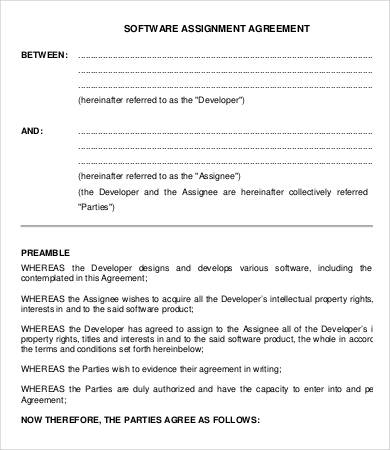

- Software Assignment Agreement Sample is another example where developers of proprietary software can then transfer all intellectual property rights.

- See Tenant Assignment Agreement Template and Lease Assignment Agreement Template for straightforward examples.

- See Equipment Assignment Agreement Template to temporarily assign the responsibilities of equipment to a subordinate, for example.

Related Agreements

Copyright assignment agreement sample.

Debt Assignment Agreement Template

Assumption Assignment Agreement Template

Contract Assignment Agreement

Equipment Assignment Agreement Template

What to Do with These Templates

More in agreements.

Transport and Logistics Intellectual Property Assignment Agreement Template

Nonprofit organization copyright assignment agreement template, lease agreement template, linking agreement template, assignment of mortgage template, assignment of real estate contract and sale agreement template, deed of reassignment and retransfer template, exclusivity, confidentiality and assignment of work product template, notice of assignment template.

- 44+ Simple Rental Agreement Templates – PDF, Word

- 33+ Purchase and Sale Agreement Templates in MS Word | PDF | Apple Pages | Google Docs

- 41+ Best Tenancy Agreement Templates

- 21+ Payment Agreement Templates in Google Docs | Pages | MS Word | PDF

- 11+ Recruitment Agency Service Level Agreement Templates in PDF | MS Word

- 5+ Retained Search Agreement Templates in PDF

- 15+ Recruitment Agreement Templates in PDF | MS Word | Google Docs | Apple Pages |

- 11+ Logistics Service Agreement Templates in PDF | MS Word

- 10+ Recruitment Services Agreement Template in PDF | MS Word

- 11+ Logistics Agreement Templates in Google Docs | MS Word | Pages | PDF

- 28+ Simple Tenancy Agreement Templates – PDF

- 9+ Retirement Agreement Templates in Google Docs | Word | Pages | PDF

- 12+ Divorce Agreement Templates

- 27+ Simple Rental Agreement Templates – Free Sample, Example Format Download

- 16+ Memorandum of Agreement Templates – PDF, DOC

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

- Practical Law

Assignment of loan

Practical law uk standard document 9-500-4767 (approx. 31 pages), get full access to this document with a free trial.

Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

About Practical Law

This document is from Thomson Reuters Practical Law, the legal know-how that goes beyond primary law and traditional legal research to give lawyers a better starting point. We provide standard documents, checklists, legal updates, how-to guides, and more.

650+ full-time experienced lawyer editors globally create and maintain timely, reliable and accurate resources across all major practice areas.

83% of customers are highly satisfied with Practical Law and would recommend to a colleague.

81% of customers agree that Practical Law saves them time.

- Lending - General

- Corporate lending

COMMENTS

Virginia. Create Document. Updated October 04, 2021. A loan assignment agreement is when another entity agrees to take over the debt of someone else. This is when the debtor has changed for any type of event such as when a business or real estate is purchased. The new owner will agree to assume the debts of the past debtholder and release them ...

Assignment Agreement Template. Use our assignment agreement to transfer contractual obligations. An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the "assignor") to another (the "assignee"). You can use it to reassign debt, real estate, intellectual property, leases ...

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement. The debtor, the recipient of the loan, must be ...

II. ASSIGNMENT OF DEBT. It is known that the Debtor is indebted to the Cre ditor, under a separate agreement, for the current principal sum of $_____, plus any interest ("Debt"). Under this Agreement, the Assuming Party agrees to assume: (choose one) ☐- All. of the Debt. ☐- Portion. of the Debt.

Loan Assignment Agreement sample contracts and agreements. THIS LOAN ASSIGNMENT AGREEMENT (this "Agreement") is made and entered into as of this 26th day of March 2014 (the "Effective Date") by and among HELPFUL CAPITAL GROUP LLC, a Florida corporation having its address at 3732 SW 30 Avenue, Suite 204, Fort Lauderdale, FL 33312 ("Assignor") and HELPFUL ALLIANCE COMPANY a Florida ...

Size 3 to 4 pages. Download a basic template (FREE) Create a customized document. A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

A loan agreement is a contract between a borrower and a lender that spells out the terms of the payment of a loan and the rights and obligations of the lender and the borrower. Loans can be secured or unsecured; that is, it may or may not attract collateral. And there can also be fixed-rate or variable-rate loans.

A loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan. ... Loan Agreement Templates. Loan Agreement Template 01. Loan Agreement Template 02. ... Loan transfer, also known as loan assignment or loan assumption, refers to the transfer of an existing loan from one party (the ...

The parties therefore agree as follows: 1. ASSIGNMENT. The Assignor assigns to the Assignee of all its rights in, and delegates to the Assignee all of its obligations under, the Agreement. This transfer will become effective on (the " Effective Date "), and will continue until the current term of the Agreement ends. 2.

Download. Business in a Box templates are used by over 250,000 companies in United States, Canada, United Kingdom, Australia, South Africa and 190 countries worldwide. Download your Absolute Assignment and Transfer of Loans Template in MS Word (.docx). Everything you need to plan, manage, finance, and grow your business.

This Agreement contains the entire agreement between the Parties hereto with respect to the subject matter hereof, and supersedes all prior negotiations, understandings and agreements. XII. MODIFICATION AND WAIVER. This Agreement may be amended or modified only by a written agreement signed by both of the Parties.

LOAN AGREEMENT PARTIES - This Loan Agreement (hereinafter referred to as the "Agreement") is entered into on _____ (the "Effective Date"), by and between _____, with an address of _____ (hereinafter referred to as the "Borrower"), and ... - As such, any amendments made by the Parties will be applied to this Agreement. ASSIGNMENT

ASSIGNMENT OF DEBT. It is known that the Debtor is indebted to the Creditor, under a separate agreement, for the current principal sum of $[CURRENT DEBT AMOUNT], plus any interest ("Debt"). Under this Agreement, the Assuming Party agrees to assume: (choose one) ☐ - All. of the Debt. ☐ - Portion. of the Debt.

This agreement must clearly establish the calendar date when the assignment of the debt to the Assuming Party becomes active. (2) Debtor Name And Mailing Address. The current Holder of the debt should be identified as the Debtor in this agreement. To this end, record the Debtor's name and address. (3) Assuming Party.

A simple loan agreement is a contract between two parties — the borrower and lender — that details and formalizes the terms of a loan. While a loan agreement is often characterized as a one-way agreement setting out terms of repayment, such contracts are actually two-way, detailing obligations on the part of both the lender and the borrower.

THIS COLLATERAL ASSIGNMENT OF MORTGAGES, LOAN DOCUMENTS AND SECURITY AGREEMENTS (this "Assignment") is made and entered into as of the [DATE] day of [MONTH], [YEAR], by [ELIGIBLE CDFI], a nonprofit corporation duly organized and existing under the laws of the State of [STATE] (the "Assignor"), as Borrower, to and for the benefit of ...

Have You Written an Assignment Agreement Before? Template.net Is Here to Help You Out. Create the Agreement Using Our Free Sample Templates, Whether It's for Lease, Real Estate, Claim, Debt, Loan, Wholesale, or Employee Confidentiality Purposes, We Have the Perfect Template for You. So What's Keeping You? Grab One Today!

Instead of voiding your contract (which might be a legal breach and cause trouble) and having the person or entity sign a new contract, you can use an assignment agreement contract. Assignment agreements will shift all your rights and obligations to the third party, your saving grace. These Agreement Templates will show you how and when this ...

This is a form of assignment agreement (which is typically attached as an exhibit to a credit agreement) which can then be used to transfer a loan from assignor to assignee. Included in Model Credit Agreement Provisions. Downloads. File. Form-of-Assignment-Agreement-May-4-2022.docx.

Virginia. Create Document. Updated July 20, 2024. A mortgage assignment agreement is between a holder of debt (assignor) and a party that assumes the debt (assignee). Under most mortgages, the borrower has no rights to object. Since a mortgage is centered upon a specific borrower's credit profile, it is difficult to replace with a new borrower.

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee). Only the assignor's rights under the facility agreement (such as to receive repayment of the loan and to receive interest) are assigned. The assignor will still have to perform any obligations it may have ...

Loan Assignment Agreement Template (Debtor Change) - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. This document is a loan assignment agreement between Lionhold Limited (Assignor) and Lis Trading Group Ltd (Assignee). The key points are: 1. Lionhold owes $2,000,000 to Jenerous Estates Limited under a prior agreement.

A loan assignment agreement template is a pre-made document that outlines the terms and conditions of transferring the rights, benefits, and obligations of a loan from one party to another. This agreement is used when the original borrower (assignor) wants to transfer the loan to a new borrower (assignee).