Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

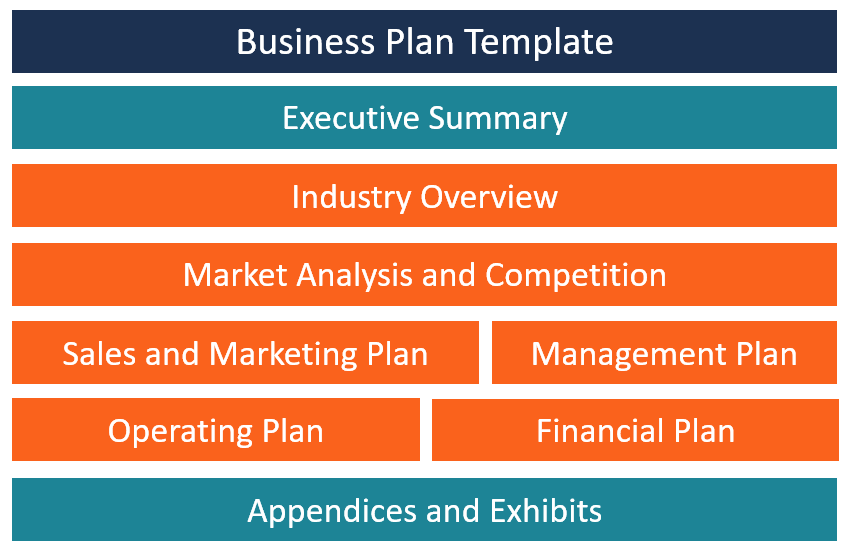

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Inc. Best in Business Early-Rate Deadline Friday, August 16! Apply Today!

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.

- Breakeven analysis. The breakeven point, Pinson says, is when your business's expenses match your sales or service volume. The three-year income projection will enable you to undertake this analysis. "If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest." This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit strategy.

Dig Deeper: How to Price Business Services

How to Write the Financial Section of a Business Plan: How to Use the Financial Section One of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. "I like to quote former President Dwight D. Eisenhower," says Berry. "'The plan is useless, but planning is essential.' What people do wrong is focus on the plan, and once the plan is done, it's forgotten. It's really a shame, because they could have used it as a tool for managing the company." In fact, Berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the future. Pinson also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. Part of this is a ratio analysis. She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. "This is all for your benefit," she says. "That's what financial statements are for. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours." If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. This is a summary of your business from its start to the present. Sometimes a bank might have a section like this on a loan application. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities. All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. "It's a pretty well-known fact that if you are going to seek equity investment from venture capitalists or angel investors," Pinson says, "they do like visuals."

Dig Deeper: How to Protect Your Margins in a Downturn

Related Links: Making It All Add Up: The Financial Section of a Business Plan One of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely. Persuasive Projections You can avoid some of the most common mistakes by following this list of dos and don'ts. Making Your Financials Add Up No business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible. How many years should my financial projections cover for a new business? Some guidelines on what to include. Recommended Resources: Bplans.com More than 100 free sample business plans, plus articles, tips, and tools for developing your plan. Planning, Startups, Stories: Basic Business Numbers An online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers. Out of Your Mind and Into the Marketplace Linda Pinson's business selling books and software for business planning. Palo Alto Software Business-planning tools and information from the maker of the Business Plan Pro software. U.S. Small Business Administration Government-sponsored website aiding small and midsize businesses. Financial Statement Section of a Business Plan for Start-Ups A guide to writing the financial section of a business plan developed by SCORE of northeastern Massachusetts.

Editorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means editors and reporters research and write on these products free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site.

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regards to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Finish Your Business Plan Today!

How to write a business plan for an accounting firm.

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, or the amount of revenue earned.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the accounting industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the accounting industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your accounting business plan:

- How big is the accounting industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your accounting business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your accounting business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, organizations, government entities, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of accounting business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r accounting firms.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes CPAs, other accounting service providers, or bookkeeping firms. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of accounting business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for multiple customer segments?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a accounting business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f accounting company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide auditing services, tax accounting, bookkeeping, or risk accounting services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your accounting company. Document where your company is situated and mention how the site will impact your success. For example, is your accounting business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your accounting marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your accounting business, including answering calls, scheduling meetings with clients, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your accounting business to a new city.

Management Team

To demonstrate your accounting business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing accounting businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an accounting business or bookkeeping firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer discounts for referrals ? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your accounting business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a accounting business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of your most prominent clients. Summary Writing a business plan for your accounting business is a worthwhile endeavor. If you follow the accounting business plan example above, by the time you are done, you will truly be an expert. You will understand the accounting industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful accounting business.

Don’t you wish there was a faster, easier way to finish your Accounting business plan?

OR, Let Us Develop Your Plan For You Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan writer can create your business plan for you. Other Helpful Business Plan Articles & Templates

You are using an outdated browser. Please upgrade your browser to improve your experience.

The Basic Legal Aspects of an Effective Business Plan

As we enter the final month of the year and excitement grows for the holiday season many people may not realize December also holds a special designation for business owners and aspiring entrepreneurs. It is National Write a Business Plan Month . And while the holidays often serve as a time for reflection on the year that was, developing a business plan forces business owners to look forward and put constructive thought into the years ahead.

No matter what stage a business is at, it is always beneficial to develop and strengthen a strategic plan. A well-drafted business plan serves as a strong foundation for a successful business. The plan acts as a road map directing what the business will do, how it will grow, the markets its will serve, the manner in which it will operate, the struggles it may encounter and the goals it hopes to achieve. Similar to a road map, your business may encounter roadblocks and detours requiring you to rethink the plan’s path, but ultimately an effective business plan will force the owner to think critically and objectively about the future of the business and should continuously serve as a compass for the company going forward.

Along with addressing overarching business matters, the development of the business plan presents a great opportunity to address certain legal matters that may seem minor today but can prevent major stress down the road.

One of the biggest decisions a business faces at the outset is determining how it will be structured. The chosen structure will have lasting implications related to business operations, liability protections, and tax strategies. The most common business structures are limited liability companies, corporations, and partnerships. The entity you chose will likely require state filing and may necessitate obtaining a tax identification number from the IRS and State Department of Revenue.

In addition to determining business entity type, an effective business plan must consider all applicable federal, state and local laws that may be applicable to its operations for each location it intends to conduct business. These considerations keep the business ahead of the curve when it comes to obtaining necessary licenses or permits to operate. The business must also consider local zoning ordinances for each physical location from which it will operate in order to ensure the location is suitable for the operation. Effective planning in these areas helps avoid future hurdles that could delay expansion into a new market and hinder growth.

Finally, the business should consider contracts and legal agreements that may be necessary in its operations. While many of these documents will develop over time and need not be specifically addressed in the business plan, they should be given some forethought as the business considers its operations. Specific contracts that may require particular attention in the business plan are Confidentiality and Non-Disclosure Agreements. These documents are not absolutely necessary in every business venture, but in the right circumstances they can be crucial to the development or growth of the business. By entering into Confidentiality and Non-Disclosure Agreements the business owner will be able to talk freely about the innovative ideas and creative potential of the business without concern that the information will be stolen or publicly disclosed. The more sensitive the information the higher the likelihood the business will require strong Confidentiality and Non-Disclosure agreements.

Ultimately, these are just a few of the issues a business owner must address and there are many other matters that should be taken into consideration when developing a strategic plan. A business owner need not develop the plan alone. They may consult with experts in tax, law, and business as well as trusted individuals invested emotionally or financially in their success. While the business plan will not address every detail that may impact the company, it should plot the road the business will follow. Establishing an effective plan for the business will pave a way that leads to success down the road.

- Business (7)

- Estate Planning (19)

- Franchise & Distribution Law (5)

- General (3)

- Labor & Employment (12)

- Municipal Government (2)

- Personal Injury (1)

- Real Estate (1)

Recent Posts

Office of cannabis management issues a guide for local governments on adult-use cannabis, incorporating your pet into your estate planning: it’s not as unusual as you may think…, non-competes no more: the 120 days begins to toll may 7, we value your privacy, privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

The Role of Accounting in Business and Why It’s Important

- February 19, 2019

The term accounting is very common, especially during tax season.

But before we dive into the importance of accounting in business, let’s cover the basics – what is accounting?

Accounting refers to the systematic and detailed recording of financial transactions of a business. There are many types, from accounting for small businesses, government, forensic, and management accounting, to accounting for corporations.

Why Is Accounting Important?

Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions.

There are three key financial statements generated by your records.

- The income statement provides you with information about the profit and loss

- The balance sheet gives you a clear picture on the financial position of your business on a particular date.

- The cash flow statement is a bridge between the income statement and balance sheet and reports the cash generated and spent during a specific period of time.

It is critical you keep your financial records clean and up to date if you want to keep your business afloat. Here are just a few of the reasons why it is important for your business, big or small!

It Helps in Evaluating the Performance of Business

Your financial records reflect the results of operations as well as the financial position of your small business or corporation. In other words, they help you understand what’s going on with your business financially. Not only will clean and up to date records help you keep track of expenses, gross margin, and possible debt, but it will help you compare your current data with the previous accounting records and allocate your budget appropriately.

It Ensures Statutory Compliance

Laws and regulations vary from state to state, but proper accounting systems and processes will help you ensure statutory compliance when it comes to your business.

The accounting function will ensure that liabilities such as sales tax, VAT, income tax, and pension funds, to name a few, are appropriately addressed.

It Helps to Create Budget and Future Projections

Budgeting and future projections can make or break a business, and your financial records will play a crucial role when it comes to it.

Business trends and projections are based on historical financial data to keep your operations profitable. This financial data is most appropriate when provided by well-structured accounting processes.

It Helps in Filing Financial Statements

Businesses are required to file their financial statements with the Registrar of Companies. Listed entities are required to file them with stock exchanges, as well as for direct and indirect tax filing purposes. Needless to say, accounting plays a critical role in all these scenarios.

Work with PDR CPAs

If you are interested in a prosperous future from a personal and/or business standpoint, reach out to our team of dedicated specialists. When considering accounting, audits, tax or business consulting, one call can make all the difference. Click here to get started – we look forward to working with you!

- Topics: accounting , business planning

Schedule a Consultation

Newsletter sign-up.

Sign up for industry accounting and tax tips below

Interested in our services?

At PDR CPAs, we leverage our 50 years of industry expertise to help you keep your finances strong and your business moving forward.

Financial Education

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

Accounting for a Small Business: What You Need to Know

You also might be interested in....

Sign up for emails

Get the latest financial tips and advice by signing up to receive our emails.

Connect with us:

- Personal 508.732.7072

- | Business 508.732.7078

Popular Request

- Reorder Checks Here

- Branches with Sunday Hours

- Branches with Coin Counters

Explore Rockland

- About Rockland Trust

- Branch Services

- Community Support Programs

Customer Information Center Hours

- M-F 7:00 a.m. to 8:00 p.m.

- Sat 8:00 a.m. to 5:00 p.m.

- Sun 10:00 a.m. to 3:00 p.m.

How Can We Help

- Branch & ATM Locations

- Security Center

- Contact Us Online

- Reporting Fraud

- Personal Banking

- Investment Accounts

- Business Banking

- × Close modal

Log in to your Personal Accounts

Rockland Trust Online Banking gives you a variety of services that help you use and manage your accounts, whenever and wherever you want. * indicates a required field.

- Personal Credit Card Log In

Log in to your Investment Accounts

Rockland Trust makes it easy to manage all of your accounts with our simple online portals.

- Investment Management – IMG Wealth Log In

- LPL Account View Log In

Log in to your Business Accounts

Rockland Trust gives you a variety of services that help you use and manage your accounts, whenever and wherever you want. * indicates a required field.

- Remote Deposit Plus Log In

- Business Credit Card Log In

- Tax Payments Log In

- Foreign Exchange Online Log In

- Dealer Access System Log In

Business development

- Billing management software

- Court management software

- Legal calendaring solutions

Practice management & growth

- Project & knowledge management

- Workflow automation software

Corporate & business organization

- Business practice & procedure

Legal forms

- Legal form-building software

Legal data & document management

- Data management

- Data-driven insights

- Document management

- Document storage & retrieval

Drafting software, service & guidance

- Contract services

- Drafting software

- Electronic evidence

Financial management

- Outside counsel spend

Law firm marketing

- Attracting & retaining clients

- Custom legal marketing services

Legal research & guidance

- Anywhere access to reference books

- Due diligence

- Legal research technology

Trial readiness, process & case guidance

- Case management software

- Matter management

Recommended Products

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

Accelerate how you find answers with powerful generative AI capabilities and the expertise of 650+ attorney editors. With Practical Law, access thousands of expertly maintained how-to guides, templates, checklists, and more across all major practice areas.

A business management tool for legal professionals that automates workflow. Simplify project management, increase profits, and improve client satisfaction.

- All products

Tax & Accounting

Audit & accounting.

- Accounting & financial management

- Audit workflow

- Engagement compilation & review

- Guidance & standards

- Internal audit & controls

- Quality control

Data & document management

- Certificate management

- Data management & mining

- Document storage & organization

Estate planning

- Estate planning & taxation

- Wealth management

Financial planning & analysis

- Financial reporting

Payroll, compensation, pension & benefits

- Payroll & workforce management services

- Healthcare plans

- Billing management

- Client management

- Cost management

- Practice management

- Workflow management

Professional development & education

- Product training & education

- Professional development

Tax planning & preparation

- Financial close

- Income tax compliance

- Tax automation

- Tax compliance

- Tax planning

- Tax preparation

- Sales & use tax

- Transfer pricing

- Fixed asset depreciation

Tax research & guidance

- Federal tax

- State & local tax

- International tax

- Tax laws & regulations

- Partnership taxation

- Research powered by AI

- Specialized industry taxation

- Credits & incentives

- Uncertain tax positions

Unleash the power of generative AI through an accounting and tax research tool. Find answers faster with dialogue-based research and quick, on-point search results.

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

Automate work paper preparation and eliminate data entry

Trade & Supply

Customs & duties management.

- Customs law compliance & administration

Global trade compliance & management

- Global export compliance & management

- Global trade analysis

- Denied party screening

Product & service classification

- Harmonized Tariff System classification

Supply chain & procurement technology

- Foreign-trade zone (FTZ) management

- Supply chain compliance

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Risk & compliance management.

- Regulatory compliance management

Fraud prevention, detection & investigations

- Fraud prevention technology

Risk management & investigations

- Investigation technology

- Document retrieval & due diligence services

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Who we serve.

- Broadcasters

- Governments

- Marketers & Advertisers

- Professionals

- Sports Media

- Corporate Communications

- Health & Pharma

- Machine Learning & AI

Content Types

- All Content Types

- Human Interest

- Business & Finance

- Entertainment & Lifestyle

- Reuters Community

- Reuters Plus - Content Studio

- Advertising Solutions

- Sponsorship

- Verification Services

- Action Images

- Reuters Connect

- World News Express

- Reuters Pictures Platform

- API & Feeds

- Reuters.com Platform

Media Solutions

- User Generated Content

- Reuters Ready

- Ready-to-Publish

- Case studies

- Reuters Partners

- Standards & values

- Leadership team

- Reuters Best

- Webinars & online events

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

- Reuters Media Center

- Jurisdiction

- Practice area

- View all legal

- Organization

- View all tax

Featured Products

- Blacks Law Dictionary

- Thomson Reuters ProView

- Recently updated products

- New products

Shop our latest titles

ProView Quickfinder favorite libraries

- Visit legal store

- Visit tax store

APIs by industry

- Risk & Fraud APIs

- Tax & Accounting APIs

- Trade & Supply APIs

Use case library

- Legal API use cases

- Risk & Fraud API use cases

- Tax & Accounting API use cases

- Trade & Supply API use cases

Related sites

United states support.

- Account help & support

- Communities

- Product help & support

- Product training

International support

- Legal UK, Ireland & Europe support

New releases

- Westlaw Precision

- 1040 Quickfinder Handbook

Join a TR community

- ONESOURCE community login

- Checkpoint community login

- CS community login

- TR Community

Free trials & demos

- Westlaw Edge

- Practical Law

- Checkpoint Edge

- Onvio Firm Management

- Proview eReader

How to start an accounting firm: Your checklist for successfully starting a firm

So, you're thinking of starting an accounting firm.

That's great. No doubt you have plenty of questions about how to set up a new firm and get off to a great start.

Thomson Reuters spoke with some of our industry experts to get answers to the big questions you may have.

Here's what they told us.

Useful links

- Tax preparation software

- Accounting software

- Tax and accounting research

- Practice management software

- See all solutions

Starting your own accounting business sounds like a lot of work. Why would I want to start an accounting firm?

Starting an accounting firm is like starting any small business – it requires a lot of work. However, industry and consulting firms list accounting firms as one of the single most profitable small businesses a person can start right now.

Here are a few questions to consider when starting a firm:

- Do you want to be a cog in the machine or own a firm? Frankly, there isn’t a wrong answer to this question, but rather a preference. However, going out on your own comes with one significant benefit: you’re getting the profit from the firm, not just your wages. You go from employee to owner.

- What’s my business purpose? While perhaps a bit esoteric, defining your business’s purpose is crucial. Why am I doing this? What’s my goal behind this? It’s not just a philosophical exercise. Knowing why you’re starting a firm can help you define your target market, whether it’s helping small businesses, real estate, or another service area.

- Do you want to be nimble and cutting edge? Small firms tend to be much more agile and have a greater ability to do new things. From adopting new technology to discovering and implementing new software or other efficiency creating tools, running your own firm lets you make the decisions about what makes your business unique—and profitable.

- Should you start a legal entity? For some, a sole proprietorship won’t require incorporation – especially if the work is centered around less complex tasks such as basic tax preparation. However, there are certain liability protections by becoming an LLC, including limiting risk for your business. Assets become owned by your business and are distinguished from personal assets. When a business is not incorporated, it becomes harder to draw that line and the entire enterprise becomes at risk.

What are the requirements to open an accounting firm? What do I need?

Starting an accounting firm is no different from starting any other small business. And while there are accounting-specific requirements, it’s important to remember that you’re starting a business first.

Start by figuring out your purpose, goal, and market. This will influence many other decisions, including the function of the services you provide, whether you want a physical or virtual location, your target demographic, and the location of your business.

Once you’ve selected a location and determined your goals, it’s time to consider the nuts and bolts of owning a business.

You’ll need to:

- Obtain Employer Identification Number (EIN) and Tax ID number

- Investigate employment laws

- Determine startup costs

- Develop a pricing structure for services

- Decide on the legal structure of your business (S-Corp, L-Corp, LLC, Partnership, LLP )

- Look at business insurance

- Create a business bank account

- Develop internal policies and rules

- Hire employees

Additionally, you’ll have to think about the day-to-day needs of running a business, including managing risk, basic administrative tasks, and general questions of how and where you will meet clients.

Will I need to get a new EIN from the federal government ?

In most cases, owning and running an accounting firm necessitates an Employer Identification Number (EIN). However, the IRS website provides an in-depth explanation of who is required to have an EIN and when. A good rule of thumb is: if you plan on hiring employees – or plan to in the future – you’ll probably need an EIN.

That said, even if you don’t think you need one – or the website says it isn’t a requirement– most businesses are probably better off acquiring an EIN.

Luckily, the online process is fast, easy, and free.

If I’m not a Certified Public Accountant, do I need a CPA to open an accounting firm ?

It depends.

While all CPAs are accountants, not all accountants are CPAs. There are differences between the two, including education, experience, and certain opportunities. However, the answer goes back to the question, “What services do you want to offer?”

An accounting firm can do almost everything a CPA firm can do with one exception – audits and assurance services. So, if that is a part of your goals or your target market, then it’s probably wise to think about the steps needed to become a CPA.

However, if you are looking to focus on the multitude of other services accounting firms provide, it’s likely not a necessary credential to start. And while there are certain state-by-state exceptions about what can and cannot be undertaken by a CPA, they are not a requirement for starting an accounting firm.

However, if you want to call yourself a “CPA firm” – you will need a CPA.

Can accountants work from home ?

One of the benefits of starting an accounting firm is flexibility. So, the simple answer to the question is, yes—many accountants can and do work from a home office.

All the regulations that apply to a physical location also apply to virtual or home offices. So not having a physical office does not put an accounting firm at a disadvantage.

In fact, working from home is even easier with modern technology and software solutions that help bring vital aspects of your daily workflow into one dedicated (and usually online) space. For instance, Thomson Reuters makes its CS Professional Suite of tax and accounting software available as hosted online solutions and designed its Onvio products to run entirely in the cloud.

It’s important to note: an accounting firm must have a dedicated EFIN (Electronic Filing Identification Number) for every separate location where they perform work. So, if you have a physical location and do work in a home office, you’ll need to investigate whether you’ll need a separate EFIN for home office.

The answer largely depends on how much – and the extent of the work – you do from home. Check with the IRS for further guidance.

If I’d prefer a home-based accounting business, what should I know about starting an accounting firm from home ?

Luckily, accounting firms don’t need a physical space to operate successfully. And like the traditional brick and mortar approach, having a home-based or virtual business brings both opportunities and challenges that are unique to that approach. When considering a home-based business, it’s important to think about the unique challenges and opportunities involved.

These include:

- Shared work locations. There are many co-working locations across the country, many of which include both space for professionals to perform their tasks, as well as providing a professional, on-demand space to meet with clients. While there is usually a monthly fee to use these spaces, the benefits they provide are often worth the cost (and are significantly cheaper than leasing or purchasing office space).

- Low costs. New businesses often struggle with overhead. As you build your client list, keeping costs low is a priority. Not only does it allow you to see a profit early, but it also allows you to adjust your service menu to attract clients with lower-than-normal prices.

- Liability issues. If you choose to meet clients in your home, liability and zoning can be an issue. If a client gets hurt inside your home office, or falls outside of it, it’s important to know the laws surrounding liability.

- Zoning laws. Most cities and counties have zoning regulations. Make sure you investigate and comply with any laws to ensure your home-based business isn’t operating illegally.

- Turn limitations into unique opportunities. While not having a physical space can be challenging at times, it can also be an advantage. Consider visiting clients onsite. Not only does it solve space concerns, it communicates a message to the client—you offer a higher level of service.

What are the key services offered by accounting firm s?

In many ways, this question can be answered by once again looking at your goals and target market. What are the key services needed by that population? How can you serve them better? Still, while many services will be dictated by the specifics of your clients and their business, there are a few standards most accounting firms offer, including:

- Assurance services

- Bookkeeping

While these are typically the core offerings – and the ones that will provide consistent business in most accounting firms – it’s also important to investigate emerging and buzz-worthy services that are attracting bigger and more progressive accounting businesses.

From consulting and advising to outsourced CFO services (serving as the embedded strategic financial decision-maker for a client), taking a cue from the bigger firms – and anticipating what trends might trickle down to smaller and independent businesses – can increase the clients you serve and put you steps ahead of your competition.

What should I know about running an accounting firm ?

Starting a business is filled with new and challenging decisions. However, once the business is up and running, it’s common to be unprepared for typical day-to-day operations. Anticipating (and planning for) these concerns helps make sure you’re working as efficiently as possible.

Common questions and concerns include:

- Talent acquisition and development. Frankly, finding and keeping staff is a significant challenge, which is why hiring always leads industry surveys about common needs and concerns. Even if you aren’t ready to hire a team, it’s wise to start developing a strategy early.

- Going beyond the seasonal business . Every year it gets harder and harder to operate a seasonal accounting business, especially if you’re looking to offer a variety of services. Unless you’re doing just cookie-cutter tax prep – and you avoid complex returns – you won’t be able to operate on a seasonal basis. That said, prioritizing the season and maximizing your efficiency (and your profits) during the heavy times is critical to finding success.

- Keep on top of regulatory changes. Keeping up with major regulatory changes can be a challenge – especially if you add staff. Finding a solution that helps minimize the burden and risk that otherwise exists will help stave off the constant onslaught of new information.

- Rethink the traditional role of the accounting firm. Traditional accounting firms used to meet with clients just once a year to do their tax return. More progressive firms are moving to a year-round schedule, which not only allows them to expand services for current and future clients but implies a partnership relationship that goes beyond the “one touchpoint” per year model.

How much should an accountant charge per hour? Or should accountants charge a fixed fee ?

This, in many ways, is an unanswerable question because the only reliable advice that can be given is, “It depends.” Every context is different and is swayed by factors such as competition, location, service offerings, and level of expertise.

However, even though there isn’t a standard fee, most accounting firms are moving away from an hourly fee structure and choosing to institute to a fixed fee model that allows for better value for clients, a more manageable business plan, and eventually an increase in earnings.

Again, every context is unique, and there are certain situations when an hourly fee structure is best. These include:

- When you’re gathering information to develop a fee structure

- Gauging profitability in a newer firm and trying to determine the hours you need to work and remain profitable

- Early in your career when you need more time to complete basic tasks

Outside of those circumstances, a fixed fee is recommended and preferred. As your skill and expertise grow, so will your abilities to complete tasks quickly. With an hourly fee, this means having to take on more clients to maintain (and hopefully increase) your profits.

A fixed fee structure is about value. The expertise and skill you bring to service are of more importance than just an hour of work for clients. Pricing your abilities based on knowledge is not only good for your business but is ultimately valuable for your clients as well.

How should I price accounting and bookkeeping services ?

While there is still a debate surrounding hourly versus fixed fees in some aspects of the business, accounting and bookkeeping is not one of them.

Accounting and bookkeeping services (as well as other service lines, such as simple tax preparations) are almost universally charged as a fixed fee, and there is a market expectation for that pricing structure.

When determining a fee structure, many accountants call other firms and ask for quotes. They use the average of those quotes to determine a fair and competitive price for their services.

Another resource is local and national affiliations and associations. Many of the larger ones (such as the National Association of Tax Preparers) will distribute recommended price structures and other useful information.

How much should a CPA charge for taxes?

While you do not have to be a CPA to prepare or file taxes, the training and expertise it requires to gain that credential matters. Simply put, you’re a CPA, and you deserve a premium for your services.

When trying to structure fees, it’s important to set a minimum job value. By setting a minimum job value at, say, $500, you won’t get mired in lower-level work that you likely don’t want to take on. Plus, that work can take up time and pull you away from more valuable work that you’d rather be doing.

Knowing what you want to charge and identifying the value you bring to your clients is critical. You are providing a service to your clients, but you’re also giving them a value based on your credentials and experience. So, it’s up to you to set the standards and have them choose between lower costs (them doing it their self) versus the value of having a CPA prepare your taxes.

That said, there’s a balance.

Many CPAs make a practice of “writing down” certain services because they know their hourly rate for larger projects can quickly become untenable for a client. Not only is this seen as a discount by the client, but it also allows you to create a fixed-fee structure for your services and show the clients the savings and value they receive.

If they need more staff, what do accounting firms look for when hiring?

When hiring, accounting firms are like many businesses and are looking for a combination of credentials, experience, and the ability to perform the necessary tasks. However, in an increasingly competitive hiring market, many firms are beginning to look at soft skills as valuable for new hires.

For decades, accounting firms have focused primarily on credentials. However, more and more, it’s less and less about certification and more about aptitude. For the most part, it’s easier to train accounting knowledge than it is to build customer service skills. When hiring, it’s important to look at the qualities a candidate can bring into a firm – not necessarily just credentials.

Of course, experience and credentials do matter. Especially when the experience sets for an accountant is specific and narrow. What types of tax returns have you prepared? What specializations do you carry? And credentials such as CPA, EA, attorneys, and state certifications (when required) are all still attractive to firms looking to hire.

How much does it cost to start an accounting firm?

Start-up costs can range from $2,500 to $25,000. Your location and your goals will determine cost in several ways, including whether you want to start a traditional brick and mortar firm or are looking to create a virtual office environment.

It’s important to remember that, besides physical (or virtual) space, accounting firms need to find and install the necessary equipment and technology to help their practice run more efficiently. That, in many ways, is the first step for a new entrepreneur. Once they’ve found a tax solution that can help them achieve their goals, they’ll be able to begin tackling the other day-to-day tasks and questions of running a business.

What’s the best business structure for accounting firms?

Finding the best business structure for your accounting firm is a critical part of not only ensuring success but helping to minimize both your tax burden and your risk.

While the circumstances of what your incorporation looks like will depend on your approach, it is considered a best practice to become incorporated right off the bat due to the legal protections it provides.

Popular options include:

- Partnership

If you’re running a solo firm, you’re likely going to be looking at an S-Corp, which allows you to pay yourself as an employee. However, if you are working with other partners, a partnership might be more preferential, as it provides a little more flexibility with payment. You are permitted to take draws or distributions, and it doesn’t necessarily require a payroll department because it’s not considered “wages” per se.

Whichever structure you choose at the beginning, know that it will likely evolve throughout the maturity of your firm. For instance, a firm might accept the risk and start as unincorporated to avoid the incorporation fees. Then they might transition to S-Corp. Over time, as additional owners move into the entity structure, the firm can add additional shareholders or can reorganize as a partnership.