Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Corporate tax risk: a literature review and future research directions

- Author & abstract

- 50 References

- 2 Citations

- Most related

- Related works & more

Corrections

(Universitas Gadjah Mada Universitas Indonesia)

(Universitas Gadjah Mada)

Suggested Citation

Download full text from publisher, references listed on ideas.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

Corporate tax risk: a literature review and future research directions

- Department of Fiscal Administration

Research output : Contribution to journal › Article › peer-review

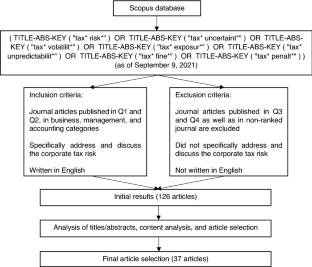

Our study aims to analyze the current state of, and avenues for, future studies into the tax risk literature. The construct of the corporate tax risk (tax uncertainty) has increasingly begun to attract significant interest from both academics and practitioners. Most previous studies discussing corporate tax behavior have also focused on tax planning, tax avoidance, and tax evasion. Studies investigating the tax risk are still very limited and it is an underexplored subject. Examining the tax risk is crucial because it relates to the tax outcomes arising from a firm’s taxation activities. Furthermore, analyzing the tax risk simultaneously with other tax behavior constructs may provide a deeper understanding. Despite the importance of the tax risk construct, there is no published literature review regarding the tax risk. Using a systematic review process, this study selected 37 articles published in 21 highly reputable journals listed in the Scopus database. The findings of this study are provided in two sections: (1) A discussion of the current studies of tax risk, including the theories, methods, and measurements of tax risk, its determinants and consequences; and (2) Recommendations for future research agendas. From the review, we find that tax risk research still tends to be limited and understudied; many relevant research gaps can be identified. Finally, we suggest several research directions into 12 themes: corporate governance, executive personal characteristics, executive compensation plans, ownership structure, firm-level characteristics, the external market, institutional factor, accounting and auditing, operating environment, regulators and regulation, reputational costs, and others.

- Corporate tax risk

- Literature review

- Tax uncertainty

- Tax volatility

Access to Document

- 10.1007/s11301-021-00251-8

Other files and links

- Link to publication in Scopus

Fingerprint

- Tax Risk Keyphrases 100%

- Corporate Tax Keyphrases 100%

- Taxation Economics, Econometrics and Finance 100%

- Corporate Taxation Economics, Econometrics and Finance 100%

- Tax Behavior Keyphrases 18%

- Tax Avoidance Economics, Econometrics and Finance 16%

- Ownership Structure Keyphrases 9%

- Scopus Database Keyphrases 9%

T1 - Corporate tax risk

T2 - a literature review and future research directions

AU - Saragih, Arfah Habib

AU - Ali, Syaiful

N1 - Publisher Copyright: © 2021, The Author(s), under exclusive licence to Springer Nature Switzerland AG.

PY - 2023/6

Y1 - 2023/6

N2 - Our study aims to analyze the current state of, and avenues for, future studies into the tax risk literature. The construct of the corporate tax risk (tax uncertainty) has increasingly begun to attract significant interest from both academics and practitioners. Most previous studies discussing corporate tax behavior have also focused on tax planning, tax avoidance, and tax evasion. Studies investigating the tax risk are still very limited and it is an underexplored subject. Examining the tax risk is crucial because it relates to the tax outcomes arising from a firm’s taxation activities. Furthermore, analyzing the tax risk simultaneously with other tax behavior constructs may provide a deeper understanding. Despite the importance of the tax risk construct, there is no published literature review regarding the tax risk. Using a systematic review process, this study selected 37 articles published in 21 highly reputable journals listed in the Scopus database. The findings of this study are provided in two sections: (1) A discussion of the current studies of tax risk, including the theories, methods, and measurements of tax risk, its determinants and consequences; and (2) Recommendations for future research agendas. From the review, we find that tax risk research still tends to be limited and understudied; many relevant research gaps can be identified. Finally, we suggest several research directions into 12 themes: corporate governance, executive personal characteristics, executive compensation plans, ownership structure, firm-level characteristics, the external market, institutional factor, accounting and auditing, operating environment, regulators and regulation, reputational costs, and others.

AB - Our study aims to analyze the current state of, and avenues for, future studies into the tax risk literature. The construct of the corporate tax risk (tax uncertainty) has increasingly begun to attract significant interest from both academics and practitioners. Most previous studies discussing corporate tax behavior have also focused on tax planning, tax avoidance, and tax evasion. Studies investigating the tax risk are still very limited and it is an underexplored subject. Examining the tax risk is crucial because it relates to the tax outcomes arising from a firm’s taxation activities. Furthermore, analyzing the tax risk simultaneously with other tax behavior constructs may provide a deeper understanding. Despite the importance of the tax risk construct, there is no published literature review regarding the tax risk. Using a systematic review process, this study selected 37 articles published in 21 highly reputable journals listed in the Scopus database. The findings of this study are provided in two sections: (1) A discussion of the current studies of tax risk, including the theories, methods, and measurements of tax risk, its determinants and consequences; and (2) Recommendations for future research agendas. From the review, we find that tax risk research still tends to be limited and understudied; many relevant research gaps can be identified. Finally, we suggest several research directions into 12 themes: corporate governance, executive personal characteristics, executive compensation plans, ownership structure, firm-level characteristics, the external market, institutional factor, accounting and auditing, operating environment, regulators and regulation, reputational costs, and others.

KW - Corporate tax risk

KW - Literature review

KW - Tax risk

KW - Tax uncertainty

KW - Tax volatility

UR - http://www.scopus.com/inward/record.url?scp=85120477102&partnerID=8YFLogxK

U2 - 10.1007/s11301-021-00251-8

DO - 10.1007/s11301-021-00251-8

M3 - Article

AN - SCOPUS:85120477102

SN - 2198-1620

JO - Management Review Quarterly

JF - Management Review Quarterly

Corporate tax risk: a literature review and future research directions

- Related Documents

Developing Management from Islamic Perspectives (MIP) as a Formal Academic Discipline

Management from Islamic Perspectives (MIP) is an emerging field that has begun to attract scholarly attention. However, the research undertaken so far has been rather fragmented and lack a clear agenda. This paper presents a literature review of the field and the areas of current focus. Although the field has a huge growth potential, I argue that it faces several challenges and problems as it develops further. I outline these potential pitfalls, suggest how to develop MIP as a formal discipline, and explain how to integrate it within real-life business practices. The article closes with a call for research to be conducted in a more organized fashion through an international consortium of researchers as well as recommendations for future research directions.

The strategic use of artificial intelligence in the digital era: Systematic literature review and future research directions

Computer vision-based interior construction progress monitoring: a literature review and future research directions, process improvement project failure: a systematic literature review and future research agenda.

Purpose Although scholars have considered the success factors of process improvement (PI) projects, limited research has considered the factors that influence failure. The purpose of this paper is to extend the understanding of PI project failure by systematically reviewing the research on generic project failure, and developing research propositions and future research directions specifically for PI projects. Design/methodology/approach A systematic literature review protocol resulted in a total of 97 research papers that are reviewed for contributions on project failure. Findings An inductive category formation process resulted in three categories of findings. The first category are the causes for project failure, the second category is about relatedness between failure factors and the third category is on failure mitigation strategies. For each category, propositions for future research on PI projects specifically are developed. Additional future research directions proposed lay in better understanding PI project failure as it unfolds (i.e. process studies vs cross-sectional), understanding PI project failure from a theoretical perspective and better understanding of PI project failure antecedents. Originality/value This paper takes a multi-disciplinary and project type approach, synthesizes the existing knowledge and reflects upon the developments in the field of research. Propositions and a framework for future research on PI project failure are presented.

Social media and innovation: A systematic literature review and future research directions

Research in urban logistics: a systematic literature review.

Purpose The last decades have witnessed an increased interest in urban logistics originating from both the research and the practitioners’ communities. Sustainable freight transports today are on the political, social and technological agenda of many actors operating in urban contexts. Due to the extent of the covered areas and the continuous progress in many fields, the resulting body of research on urban logistics appears quite fragmented. From an engineering management perspective, the purpose of this paper is to present a systematic literature review (SLR) that aims to consolidate the knowledge on urban logistics, analyse the development of the discipline, and provide future research directions. Design/methodology/approach The paper discusses the main evidence emerging from a SLR on urban logistics. The corpus resulting from the SLR has been used to perform a citation network analysis and a main path analysis that together underpin the identification of the most investigated topics and methodologies in the field. Findings Through the analysis of a corpus of 104 articles, the most important research contributions on urban logistics that represent the structural backbone in the development of the research over time in the field are detected. Based on these findings, this work identifies and discusses three areas of potential interest for future research. Originality/value This paper presents an SLR related to a research area in which the literature is extremely fragmented. The results provide insights about the research path, current trends and future research directions in the field of urban logistics.

Internet addiction: A structured literature review and future research directions

The use of owner resources in small and family owned businesses: literature review and future research directions, design thinking for social innovation: a systematic literature review & future research directions, export citation format, share document.

One platform for all researcher needs

AI-powered academic writing assistant

R Discovery

Your #1 AI companion for literature search

Mind the Graph

AI tool for graphics, illustrations, and artwork

Unlock unlimited use of all AI tools with the Editage Plus membership.

Content Type

R discovery prime.

Audio Papers, Translation, Collaboration, Auto-sync, Multi-feed,

Audio Papers, Translation, Collaboration, Auto-sync, Multi-feed

Audio Papers

Translation

Collaboration

Corporate tax risk: a literature review and future research directions

https://doi.org/10.1007/s11301-021-00251-8

- Full-Text PDF

Similar Papers

Join us for a 30 min session where you can share your feedback and ask us any queries you have

More From: Management Review Quarterly

Disclaimer: All third-party content on this website/platform is and will remain the property of their respective owners and is provided on "as is" basis without any warranties, express or implied. Use of third-party content does not indicate any affiliation, sponsorship with or endorsement by them. Any references to third-party content is to identify the corresponding services and shall be considered fair use under The CopyrightLaw.

Copyright 2024 Cactus Communications. All rights reserved.

Corporate tax risk: a literature review and future research directions

- Published: 02 December 2021

- Volume 73 , pages 527–577, ( 2023 )

Cite this article

- Arfah Habib Saragih ORCID: orcid.org/0000-0003-4190-3196 1 , 2 &

- Syaiful Ali ORCID: orcid.org/0000-0002-0563-4980 1

3176 Accesses

12 Citations

1 Altmetric

Explore all metrics

Our study aims to analyze the current state of, and avenues for, future studies into the tax risk literature. The construct of the corporate tax risk (tax uncertainty) has increasingly begun to attract significant interest from both academics and practitioners. Most previous studies discussing corporate tax behavior have also focused on tax planning, tax avoidance, and tax evasion. Studies investigating the tax risk are still very limited and it is an underexplored subject. Examining the tax risk is crucial because it relates to the tax outcomes arising from a firm’s taxation activities. Furthermore, analyzing the tax risk simultaneously with other tax behavior constructs may provide a deeper understanding. Despite the importance of the tax risk construct, there is no published literature review regarding the tax risk. Using a systematic review process, this study selected 37 articles published in 21 highly reputable journals listed in the Scopus database. The findings of this study are provided in two sections: (1) A discussion of the current studies of tax risk, including the theories, methods, and measurements of tax risk, its determinants and consequences; and (2) Recommendations for future research agendas. From the review, we find that tax risk research still tends to be limited and understudied; many relevant research gaps can be identified. Finally, we suggest several research directions into 12 themes: corporate governance, executive personal characteristics, executive compensation plans, ownership structure, firm-level characteristics, the external market, institutional factor, accounting and auditing, operating environment, regulators and regulation, reputational costs, and others.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

The evolution of tax strategies in multinational companies: a historical perspective

Perceived tax audit aggressiveness, tax control frameworks and tax planning: an empirical analysis

Ethics of Corporate Taxation: A Systematic Literature Review

Data availability.

All articles included in this review are accessible through the Scopus database.

Abernathy JL, Finley AR, Rapley ET, Stekelberg J (2021) External auditor responses to tax risk. J Accounting, Audit Financ 36:489–516. https://doi.org/10.1177/0148558X19867821

Article Google Scholar

Alsadoun N, Naiker V, Navissi F, Sharma DS (2018) Auditor-provided tax nonaudit services and the implied cost of equity capital. Audit A J Pract Theory 37:1–24. https://doi.org/10.2308/ajpt-51866

Arlinghaus BP (1998) Goal setting and performance measures. Tax Exec 50:434–441

Google Scholar

Armstrong CS, Blouin JL, Jagolinzer AD, Larcker DF (2015) Corporate governance, incentives, and tax avoidance. J Account Econ 60:1–17. https://doi.org/10.1016/j.jacceco.2015.02.003

Atwood TJ, Lewellen C (2019) The Complementarity between tax avoidance and manager diversion: evidence from tax haven firms. Contemp Account Res 36:259–294. https://doi.org/10.1111/1911-3846.12421

Atwood TJ, Drake MS, Myers JN, Myers LA (2012) Home country tax system characteristics and corporate tax avoidance: International evidence. Account Rev 87:1831–1860. https://doi.org/10.2308/accr-50222

Austin CR, Wilson RJ (2017) An examination of reputational costs and tax avoidance: evidence from firms with valuable consumer brands. J Am Tax Assoc 39:67–93. https://doi.org/10.2308/atax-51634

Beasley MS, Goldman NC, Lewellen CM, McAllister M (2021) Board risk oversight and corporate tax-planning practices. J Manag Account Res 33:7–32. https://doi.org/10.2308/JMAR-19-056

Beck PJ, Lisowsky P (2014) Tax uncertainty and voluntary real-time tax audits. Account Rev 89:867–901. https://doi.org/10.2308/accr-50677

Beer S, de Mooij RA, Liu Li (2019) International corporate tax avoidance: a review of the channels, magnitudes, and blind spots. J Econ Surv. https://doi.org/10.1111/joes.12305

Blouin J (2014) Defining and measuring tax planning aggressiveness. Natl Tax J 67:875–899. https://doi.org/10.17310/ntj.2014.4.06

Borthick AF, Smeal LN (2020) Data analytics in tax research: analyzing worker agreements and compensation data to distinguish between independent contractors and employees using irs factors. Issues Account Educ 35:1–23. https://doi.org/10.2308/issues-18-061

Brown JL, Drake KD, Martin MA (2016) Compensation in the post-FIN 48 period: the case of contracting on tax performance and uncertainty. Contemp Account Res 33:121–151. https://doi.org/10.1111/1911-3846.12152

Campbell JL, Cecchini M, Cianci AM (2019) Tax-related mandatory risk factor disclosures, future profitability, and stock returns. Rev Account Stud 24:264–308. https://doi.org/10.1007/s11142-018-9474-y

Campbell JL, Goldman NC, Li B (2021) Do financing constraints lead to incremental tax planning? evidence from the pension protection act of 2006. Contemp Account Res 38:1961–1999. https://doi.org/10.1111/1911-3846.12679

Casino F, Dasaklis TK, Patsakis C (2019) A systematic literature review of blockchain-based applications: current status, classification and open issues. Telemat Informatics 36:55–81. https://doi.org/10.1016/j.tele.2018.11.006

Chang H, Dai X, He Y, Wang M (2020) How internal control protects shareholders’ welfare: evidence from tax avoidance in China. J Int Account Res 19:19–39. https://doi.org/10.2308/jiar-19-046

Chen W (2020) Tax risks control and sustainable development: evidence from China. Meditari Account Res. https://doi.org/10.1108/MEDAR-05-2020-0884

Chen W (2021) Too far east is west: tax risk, tax reform and investment timing. Int J Manag Financ 17:303–326. https://doi.org/10.1108/IJMF-03-2020-0132

Chen S, Chen X, Cheng Q, Shevlin T (2010) Are family firms more tax aggressive than non-family firms? J Financ Econ 95:41–61. https://doi.org/10.1016/j.jfineco.2009.02.003

Chen H, Yang D, Zhang X, Zhou N (2020) The moderating role of internal control in tax avoidance: evidence from a COSO-Based internal control index in China. J Am Tax Assoc 42:23–55. https://doi.org/10.2308/atax-52408

Chen JZ, Hong HA, Kim J-B, Ryou JW (2021a) Information processing costs and corporate tax avoidance: evidence from the SEC’s XBRL mandate. J Account Public Policy 40:49. https://doi.org/10.1016/j.jaccpubpol.2021.106822

Chen TY, Chen Z, Li Y (2021b) Restrictions on managerial outside job opportunities and corporate tax policy: evidence from a natural experiment. J Account Public Policy. https://doi.org/10.1016/j.jaccpubpol.2021.106879

Chen X, Cheng Q, Chow T, Liu Y (2021c) Corporate in-house tax departments. Contemp Account Res 38:443–482. https://doi.org/10.1111/1911-3846.12637

Chyz JA, Gaertner FB (2018) Can paying “too much” or “too little” tax contribute to forced CEO turnover? Account Rev 93:103–130. https://doi.org/10.2308/accr-51767

Clark WR, Clark LA, Raffo DM, Williams RI (2021) Extending Fisch and Block’s (2018) tips for a systematic review in management and business literature. Manag Rev Q 71:215–231. https://doi.org/10.1007/s11301-020-00184-8

Cooper M, Nguyen QTK (2020) Multinational enterprises and corporate tax planning: a review of literature and suggestions for a future research agenda. Int Bus Rev 29:101692. https://doi.org/10.1016/j.ibusrev.2020.101692

De Simone L, Nickerson J, Seidman J, Stomberg B (2020) How reliably do empirical tests identify tax avoidance? Contemp Account Res 37:1536–1561. https://doi.org/10.1111/1911-3846.12573

Demeré P, Donohoe MP, Lisowsky P (2020) The economic effects of special purpose entities on corporate tax avoidance. Contemp Account Res 37:1562–1597. https://doi.org/10.1111/1911-3846.12580

Dhawan A, Ma L, Kim MH (2020) Effect of corporate tax avoidance activities on firm bankruptcy risk. J Contemp Account Econ 16:100187. https://doi.org/10.1016/j.jcae.2020.100187

Donelson DC, Glenn JL, Yust CG (2021) Is tax aggressiveness associated with tax litigation risk? evidence from D&O insurance. Rev Account Stud. https://doi.org/10.1007/s11142-021-09612-w

Downes JF, Kang T, Kim S, Lee C (2019) Does the mandatory adoption of IFRS improve the association between accruals and cash flows? Evidence from accounting estimates. Account Horizons 33:39–59. https://doi.org/10.2308/acch-52262

Drake KD, Lusch SJ, Stekelberg J (2017) Does tax risk affect investor valuation of tax avoidance? J Accounting, Audit Financ 34:151–176. https://doi.org/10.1177/0148558X17692674

Dwivedi A, Dwivedi P, Bobek S, Sternad Zabukovšek S (2019) Factors affecting students’ engagement with online content in blended learning. Kybernetes 48:1500–1515. https://doi.org/10.1108/K-10-2018-0559

Dyreng SD, Hanlon M, Maydew EL (2010) The effects of executives on corporate tax avoidance. Account Rev 85:1163–1189. https://doi.org/10.2308/accr.2010.85.4.1163

Dyreng SD, Hanlon M, Maydew EL (2019) When does tax avoidance result in tax uncertainty? Account Rev 94:179–203. https://doi.org/10.2308/accr-52198

Faúndez-Ugalde A, Mellado-Silva R, Aldunate-Lizana E (2020) Use of artificial intelligence by tax administrations: an analysis regarding taxpayers’ rights in Latin American countries. Comput Law Secur Rev 38:105441. https://doi.org/10.1016/j.clsr.2020.105441

Federico C, Thompson T (2019) Do IRS computers dream about tax cheats? artificial intelligence and big data in tax enforcement and compliance. J Tax Pract Proced 21:35–39

Fisch C, Block J (2018) Six tips for your (systematic) literature review in business and management research. Manag Rev Q 68:103–106. https://doi.org/10.1007/s11301-018-0142-x

Frank MM, Lynch LJ, Rego SO (2009) Tax reporting aggressiveness and its relation to aggressive financial reporting. Account Rev 84:467–496. https://doi.org/10.2308/accr.2009.84.2.467

Ftouhi K, Ghardallou W (2020) International tax planning techniques: a review of the literature. J Appl Account Res 21:329–343. https://doi.org/10.1108/JAAR-05-2019-0080

Gallemore J, Labro E (2015) The importance of the internal information environment for tax avoidance. J Account Econ 60:149–167. https://doi.org/10.1016/j.jacceco.2014.09.005

Gallemore J, Maydew EL, Thornock JR (2014) The reputational costs of tax avoidance. Contemp Account Res 31:1103–1133. https://doi.org/10.1111/1911-3846.12055

Görlitz A, Dobler M (2021) Financial accounting for deferred taxes: a systematic review of empirical evidence. Manag Rev Q. https://doi.org/10.1007/s11301-021-00233-w

Guenther DA, Matsunaga SR, Williams BM (2017) Is tax avoidance related to firm risk? Account Rev 92:115–136. https://doi.org/10.2308/accr-51408

Guenther DA, Wilson RJ, Wu K (2019) Tax uncertainty and incremental tax avoidance. Account Rev 94:229–247. https://doi.org/10.2308/accr-52194

Guggenmos RD, Van der Stede WA (2020) The effects of creative culture on real earnings management. Contemp Account Res 37:2319–2356. https://doi.org/10.1111/1911-3846.12586

Hamann PM (2017) Towards a contingency theory of corporate planning: a systematic literature review. Manag Rev Q 67:227–289. https://doi.org/10.1007/s11301-017-0132-4

Hamilton R, Stekelberg J (2017) The effect of high-quality information technology on corporate tax avoidance and tax risk. J Inf Syst 31:83–106. https://doi.org/10.2308/isys-51482

Hanlon M, Heitzman S (2010) A review of tax research. J Account Econ 50:127–178. https://doi.org/10.1016/j.jacceco.2010.09.002

Hanlon M, Maydew EL, Saavedra D (2017) The taxman cometh: does tax uncertainty affect corporate cash holdings? Rev Account Stud 22:1198–1228. https://doi.org/10.1007/s11142-017-9398-y

Hardeck I, Harden JW, Upton DR (2019) Consumer reactions to tax avoidance: evidence from the United States and Germany. J Bus Ethics 170:75–96. https://doi.org/10.1007/s10551-019-04292-8

He G, Ren HM, Taffler R (2019) The impact of corporate tax avoidance on analyst coverage and forecasts. Rev Quant Financ Account 54:447–477. https://doi.org/10.1007/s11156-019-00795-7

Herron R, Nahata R (2020) Corporate tax avoidance and firm value discount. Q J Financ. https://doi.org/10.1142/S2010139220500081

Higgins D, Omer TC, Phillips JD (2015) The influence of a firm’s business strategy on its tax aggressiveness. Contemp Account Res 32:674–702. https://doi.org/10.1111/1911-3846.12087

Hoopes JL, Mescall D, Pittman JA (2012) Do IRS audits deter corporate tax avoidance? Account Rev 87:1603–1639. https://doi.org/10.2308/accr-50187

Inger KK, Vansant B (2019) Market valuation consequences of avoiding taxes while also being socially responsible. J Manag Account Res 31:75–94. https://doi.org/10.2308/jmar-52169

Jackson M (2015) Book-tax differences and future earnings changes. J Am Tax Assoc 37:49–73. https://doi.org/10.2308/atax-51164

Jacob M, Schütt HH (2020) Firm valuation and the uncertainty of future tax avoidance. Eur Account Rev 29:409–435. https://doi.org/10.1080/09638180.2019.1642775

Joshi P, Outslay E, Persson A et al (2020) Does public country-by-country reporting deter tax avoidance and income shifting? evidence from the European banking industry. Contemp Account Res 37:2357–2397. https://doi.org/10.1111/1911-3846.12601

Kanagaretnam K, Lee J, Lim CY, Lobo GJ (2016) Relation between auditor quality and tax aggressiveness: implications of cross-country institutional differences. Audit A J Pract Theory 35:105–135. https://doi.org/10.2308/ajpt-51417

Karjalainen J, Kasanen E, Kinnunen J, Niskanen J (2020) Dividends and tax avoidance as drivers of earnings management: evidence from dividend-paying private SMEs in Finland. J Small Bus Manag. https://doi.org/10.1080/00472778.2020.1824526

Keding C (2021) Understanding the interplay of artificial intelligence and strategic management: four decades of research in review. Manag Rev Q 71:91–134. https://doi.org/10.1007/s11301-020-00181-x

Khan M, Srinivasan S, Tan L (2017) Institutional ownership and corporate tax avoidance: new evidence. Account Rev 92:101–122. https://doi.org/10.2308/accr-51529

Khurana IK, Moser WJ (2013) Institutional shareholders’ investment horizons and tax avoidance. J Am Tax Assoc 35:111–134. https://doi.org/10.2308/atax-50315

Kim J, McGuire ST, Savoy S et al (2019) How quickly do firms adjust to optimal levels of tax avoidance? Contemp Account Res 36:1824–1860. https://doi.org/10.1111/1911-3846.12481

Koester A, Shevlin T, Wangerin D (2016) The role of managerial ability in corporate tax avoidance. Manage Sci 63:3285–3310. https://doi.org/10.1287/mnsc.2016.2510

Kovermann JH (2018) Tax avoidance, tax risk and the cost of debt in a bank-dominated economy. Manag Audit J 33:683–699. https://doi.org/10.1108/MAJ-12-2017-1734

Kovermann J, Velte P (2019) The impact of corporate governance on corporate tax avoidance—A literature review. J Int Accounting, Audit Tax 36:100270. https://doi.org/10.1016/j.intaccaudtax.2019.100270

Kubick TR, Lockhart GB (2016) Do external labor market incentives motivate CEOs to adopt more aggressive corporate tax reporting preferences? J Corp Financ 36:255–277. https://doi.org/10.1016/j.jcorpfin.2015.12.003

Kubick TR, Masli ANS (2016) Firm-level tournament incentives and corporate tax aggressiveness. J Account Public Policy 35:66–83. https://doi.org/10.1016/j.jaccpubpol.2015.08.002

Law KKF, Mills LF (2017) Military experience and corporate tax avoidance. Rev Account Stud 22:141–184. https://doi.org/10.1007/s11142-016-9373-z

Lennox C, Lisowsky P, Pittman J (2013) Tax aggressiveness and accounting fraud. J Account Res 51:739–778. https://doi.org/10.1111/joar.12002

Lin X, Liu M, So S, Yuen D (2019) Corporate social responsibility, firm performance and tax risk. Manag Audit J 34:1101–1130. https://doi.org/10.1108/MAJ-04-2018-1868

Moore RD (2021) The concave association between tax reserves and equity value. J Am Tax Assoc 43:107–124. https://doi.org/10.2308/JATA-17-109

Neubig T, Sangha B (2004) Tax risk and strong corporate governance. Tax Exec 56:114–119

Neuman SS, Omer TC, Schmidt AP (2020) Assessing tax risk: practitioner perspectives. Contemp Account Res 37:1788–1827. https://doi.org/10.1111/1911-3846.12556

Nguyen JH (2020) Tax avoidance and financial statement readability. Eur Account Rev 30:1043–1066. https://doi.org/10.1080/09638180.2020.1811745

Nobes C (2020) On theoretical engorgement and the myth of fair value accounting in China. Accounting, Audit Account J 33:59–76. https://doi.org/10.1108/AAAJ-11-2018-3743

Olsen KJ, Stekelberg J (2016) CEO narcissism and corporate tax sheltering. J Am Tax Assoc 38:1–22. https://doi.org/10.2308/atax-51251

Overesch M, Wolff H (2021) Financial transparency to the rescue: effects of public country-by-country reporting in the European Union banking sector on tax avoidance. Contemp Account Res 38:1616–1642. https://doi.org/10.1111/1911-3846.12669

Plečnik JM, Wang S (2021) Top management team intrapersonal functional diversity and tax avoidance. J Manag Account Res 33:103–128. https://doi.org/10.2308/jmar-19-058

Powers K, Robinson JR, Stomberg B (2016) How do CEO incentives affect corporate tax planning and financial reporting of income taxes? Rev Account Stud 21:672–710. https://doi.org/10.1007/s11142-016-9350-6

Rasel MA, Win S (2020) Microfinance governance: a systematic review and future research directions. J Econ Stud 47:1811–1847. https://doi.org/10.1108/JES-03-2019-0109

Rego SO, Wilson R (2012) Equity risk incentives and corporate tax aggressiveness. J Account Res 50:775–810. https://doi.org/10.1111/j.1475-679X.2012.00438.x

Saavedra D (2019) Is tax volatility priced by lenders in the syndicated loan market? Eur Account Rev 28:767–789. https://doi.org/10.1080/09638180.2018.1520641

Schweikl S, Obermaier R (2020) Lessons from three decades of IT productivity research: towards a better understanding of IT-induced productivity effects. Manag Rev Q 70:461–507. https://doi.org/10.1007/s11301-019-00173-6

Taylor G, Richardson G (2013) The determinants of thinly capitalized tax avoidance structures: evidence from Australian firms. J Int Accounting, Audit Tax 22:12–25. https://doi.org/10.1016/j.intaccaudtax.2013.02.005

Taylor G, Richardson G (2014) Incentives for corporate tax planning and reporting: empirical evidence from Australia. J Contemp Account Econ 10:1–15. https://doi.org/10.1016/j.jcae.2013.11.003

Taylor G, Richardson G, Al-Hadi A (2018) Income-shifting arrangements, audit specialization and uncertain tax benefits, international tax risk, and audit specialization: evidence from US multinational firms. Int J Audit 22:1–19. https://doi.org/10.1111/ijau.12117

Towery EM (2017) Unintended consequences of linking tax return disclosures to financial reporting for income taxes: Evidence from schedule UTP. Account Rev 92:201–226. https://doi.org/10.2308/accr-51660

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222. https://doi.org/10.1111/1467-8551.00375

Wang F, Xu S, Sun J, Cullinan CP (2020) Corporate tax avoidance: a literature review and research agenda. J Econ Surv 34:793–811. https://doi.org/10.1111/joes.12347

Watrin C, Burggraef S, Weiss F (2019) Auditor-provided tax services and accounting for tax uncertainty. Int J Account. https://doi.org/10.1142/S1094406019500112

Wilde JH, Wilson RJ (2018) Perspectives on corporate tax planning: observations from the past decade. J Am Tax Assoc 40:63–81. https://doi.org/10.2308/ATAX-51993

Wunder HF (2009) Tax risk management and the multinational enterprise. J Int Accounting, Audit Tax 18:14–28. https://doi.org/10.1016/j.intaccaudtax.2008.12.003

Ying T, Wright B, Huang W (2017) Ownership structure and tax aggressiveness of Chinese listed companies. Int J Account Inf Manag 25:313–332. https://doi.org/10.1108/IJAIM-07-2016-0070

Download references

Acknowledgments

We would like to thank the editor and the anonymous reviewer for their helpful and valuable comments and recommendations. The authors would like to thank the Department of Accounting Faculty of Economics and Business Universitas Gadjah Mada and the Department of Fiscal Administration Faculty of Administrative Sciences Universitas Indonesia for supporting this study.

There is no funding for the research project.

Author information

Authors and affiliations.

Department of Accounting, Faculty of Economics and Business, Universitas Gadjah Mada, Jl. Sosio Humaniora 1, Yogyakarta, Indonesia

Arfah Habib Saragih & Syaiful Ali

Department of Fiscal Administration, Faculty of Administrative Sciences, Universitas Indonesia, Jl. Prof. Dr. Selo Soemardjan, Pondok Cina, Kecamatan Beji, Kota Depok, 16424, Jawa Barat, Indonesia

Arfah Habib Saragih

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Arfah Habib Saragih .

Ethics declarations

Conflict of interest.

We reported no potential conflict of interest.

Ethics Approval

We declared that the principles of ethical and professional conduct have been followed.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Saragih, A.H., Ali, S. Corporate tax risk: a literature review and future research directions. Manag Rev Q 73 , 527–577 (2023). https://doi.org/10.1007/s11301-021-00251-8

Download citation

Received : 15 September 2021

Accepted : 19 November 2021

Published : 02 December 2021

Issue Date : June 2023

DOI : https://doi.org/10.1007/s11301-021-00251-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Corporate tax risk

- Tax uncertainty

- Tax volatility

- Literature review

JEL Classification

- Find a journal

- Publish with us

- Track your research

Corporate tax avoidance: a systematic literature review and future research directions

LBS Journal of Management & Research

ISSN : 0972-8031

Article publication date: 28 June 2023

Issue publication date: 3 November 2023

The increased interest among academicians to explore more about tax management behavior is evident in the literature on corporate tax avoidance. This paper aims to illustrate the multiple aspects that influence the tax avoidance behavior of corporations and its impacts through the systematic review method.

Design/methodology/approach

This study used “Tax Avoidance” OR “Tax Aggressiveness” OR “Tax Planning” as search strings to extract the relevant literature from the Scopus database. This study is a comprehensive analysis of existing literature on corporate tax avoidance behavior. Further, the keyword network analysis has been used to find out the most explored and dry research areas related to corporate tax avoidance behavior using VOSviewer software.

The study finds that taxation decision is an important managerial decision. Managers adopt tax avoidance tactics to boost postax profits to meet the shareholders’ expectations, particularly of risk-averse shareholders, and sometimes for their benefit also. With this, this study also finds that firms’ characteristics, political connections and corporate social responsibility activities also impact taxation decisions. In addition, the study identifies that tax-avoiding behavior has a contradictory impact on firm value, market growth and corporate transparency disclosure decisions.

Research limitations/implications

The study assists the researchers by providing a brief overview of tax avoidance behavior, for corporates in understanding the implications of tax avoidance, and for policymakers to fix the taxation loopholes and bring necessary tax reforms.

Originality/value

This study adds to the existing literature by providing a thorough overview of theories, determinants and outcomes of corporate tax avoidance behavior.

- Tax avoidance

- Tax management

- Tax planning

Duhoon, A. and Singh, M. (2023), "Corporate tax avoidance: a systematic literature review and future research directions", LBS Journal of Management & Research , Vol. 21 No. 2, pp. 197-217. https://doi.org/10.1108/LBSJMR-12-2022-0082

Emerald Publishing Limited

Copyright © 2023, Anshu Duhoon and Mohinder Singh

Published in LBS Journal of Management & Research . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

Tax is the largest source of income for the government, and a major portion of it comes from direct taxes ( Gober & Burns, 1997 ). Corporate tax is a type of direct tax and it is the responsibility of the companies to make the payment of their fair share of tax to the government ( Rao & Chakraborty, 2010 ). The taxes are the fixed charge against the company’s profit and reduce the available distributed profit to the shareholders ( Putra, dwi, & Sriwedari, 2018 ).

Companies adopt acceptable (tax management) and non-acceptable (tax evasion) methods to reduce their tax liability ( Aliani, 2013 ). Tax avoidance is legal and is done by taking advantage of tax loopholes, in contrast, tax evasion violates taxation rules and is punishable and unacceptable ( Fisher, 2014 ).

Corporate tax avoidance is arising as a matter of public concern and getting researchers’ attention continuously ( Desai & Dharmapala, 2006 ; Hanlon & Heitzman, 2010 ; Huang, Ying, & Shen, 2018 ; Putra et al. , 2018 ). Tax avoidance activities are the result of privileges and reliefs provided by the government to the companies. Companies are adopting different techniques such as more investment in fixed assets, profit shifting to tax haven countries, base erosion, thin capitalization, IP structuring, etc., for reducing their tax liability ( Ey, 2014 ). Around $650bn in revenue has been lost by governments across the world due to the shifting of nearly 40% of total profits by multinational companies to tax haven countries.

There is not any universal definition of tax avoidance. The concept of tax avoidance has been defined by different authors in their own words, such as Hanlon and Heitzman (2010, p. 137) describe tax avoidance as “a continuum of tax planning strategies where perfectly legal activities are at one end, and more aggressive activities would be closer to the other end”, and Dyreng, Hanlon, and Maydew (2010) state that all financial transactions that lead to a reduction in tax liability reflect the tax avoidance behavior of the firm.

Tax avoidance is a legal way of reducing the tax burden ( Slemrod, 2004 ; Slemrod & Gillitzer, 2014 ). While tax evasion refers to the destruction of original documents, the production of fake financial statements, the alteration of original entries and any other activity that accounts for tax sheltering ( Gottschalk, 2010 ; Malkawi & Haloush, 2008 ). The available literature ( Foster Back, 2013 ; Lenz, 2020 ) states tax avoidance, tax management and tax planning are all simultaneous terms while tax evasion is an unlawful act of tax reduction. The firms having the following features are considered “low-tax” firms ( Figure 1 ).

The paper has been categorized into the following sections. The second section briefly explains the theories of corporate tax avoidance behavior and theoretical background of the study, the third section is related to research methodology, the fourth section is related to results, the fifth section is about keywords networking analysis and the last section reports the conclusion, implications and unexplored areas for further research.

2. Theories of corporate tax avoidance

Tax avoidance decisions are considered as the shifting of funds from the government to the businesses by legal means ( Khuong et al. , 2020 ). However, the adoption of tax avoidance behavior in an organization is influenced by (a) agency issues arising from the separation of management and shareholders, (b) social needs and (c) the legitimacy of tax avoidance decisions.

1. Traditional concept and agency theory

Traditional theory suggests that tax avoidance activities reduce tax liability and increase the shareholders’ value ( Boussaidi & Hamed-Sidhom, 2020 ; Nugroho & Agustia, 2017 ). While on the other hand, tax planning is considered the managers’ follow-up action, making tax reductions by not violating the taxation provisions ( Putra et al. , 2018 ). To avoid detection from taxation authorities, managers create sophisticated transactions for tax avoidance purposes. Managers use these transactions to hide their tax avoidance practices from the taxation authorities, but sometimes also for hiding from investors.

2. Social obligation approach

Tax avoidance behavior is considered a sign of irresponsible behavior toward society ( Hoi, Wu, & Zhang, 2013 ; Chircop, Fabrizi, Ipino, & Parbonetti, 2018 ). Slemrod (2004) explained that the firms with high corporate social responsibility (CSR) scores are more cautious about tax avoidance practices. These firms avoid tax-aggressive decisions because the detection of such behavior offsets the positive effects of CSR practices ( Lanis & Richardson, 2015 ) and also causes reputational damages to the firms ( Ortas & Gallego-Álvarez, 2020 ). In contrast, Landry, Deslandes, and Fortin (2013) and Mahon (2002) stated that corporate tax avoidance behavior leads to more tax administration penalties and reputational costs to the firm. CSR disclosure is considered a risk management function by the firms and is preferred to strengthen investors’ beliefs and community concern toward the firm performance ( Hanlon & Slemrod, 2009 ). More tax-avoiding firms disclose high CSR practices to hide such practices ( Abdelfattah & Aboud, 2020 ; Gras-Gil, Palacios Manzano, & Hernández Fernández, 2016 ).

3. Legitimacy approach

Like other taxpayers, it is also the right of the company to minimize its tax obligations but within the boundaries of the law ( Hasseldine & Morris, 2013 ; Whait, Christ, Ortas, & Burritt, 2018 ). Managers do not consider tax avoidance as unacceptable and enormous activity. Instead, it is a choice-based decision adopted for higher profits, status and high remuneration expectations ( Sikka, 2010 ). Tax avoidance decisions, on the other hand, have been subjected to a slew of criticisms. Transfer pricing schemes have been used by some big firms, like Apple, Starbucks and Google, to evade taxes ( Barford & Holt, 2013 ). Tax avoidance activities are considered inconsistent with societal expectations and create legitimacy risks for organizations ( Christensen & Murphy, 2004 ).

2.1 Theoretical framework

A review-based study is considered the relevant form of research because it addresses all research evidence related to a particular research area ( Baumeister & Leary, 1997 ; Murata, Wakabayashi, & Watanabe, 2014 ). The publications in the finance and accounting sectors have been selected for review purposes. Accounting scholars have a comparative advantage in reading and assessing income and expenditure measures from financial statements while financial literature deals with agency issues in the organization. Both of these theories are related to tax avoidance issues and are considered appropriate for review. By considering the significance of the review-based study, different authors have carried out the review-based study on tax avoidance behavior from different perspectives such as tax planning behavior of multinational enterprises ( Cooper & Nguyen, 2020 ; Wang, Xu, Sun, & Cullinan, 2020 ), family firms ( Khelil & Khlif, 2022 ), determinants ( Sritharan, Salawati, Sharon, & Syubaili, 2022 ), proxies ( Lee et al. , 2015 ), institutional ownership ( Putra et al. , 2019 ), CSR disclosure ( Jiang, Zhang, & Si, 2022 ) and corporate governance ( Kovermann & Velte, 2019 ). Still, there is a lack of work that gives a thorough overview of the factors that contribute to tax avoidance decisions in corporations. This study is the first thorough, in-depth systematic study to provide insight into the theories, causes and effects of corporate tax avoidance behavior.

3. Research methodology

To select the relevant literature, a comprehensive search was conducted in the Scopus database, the most extensive database consisting of peer-reviewed journals ( Cooper & Nguyen, 2020 ). “Tax Avoidance” OR “Tax Aggressiveness” OR “Tax Planning” were the three search keywords used to extract the relevant studies from the database and a total of 1345 records were identified in this stage. Then the authors applied the PRISMA approach for the selection of relevant papers ( Figure 2 ). PRISMA guidelines ensure the quality of selected papers and also address the misinterpretation issues in the reviewed articles ( Moher, Liberati, Tetzlaff, & Altman, 2009 ; Mengist, Soromessa, & Legese, 2020 ). Then, the research articles published in the English language in the Economics, Econometrics and Finance, and Business Management and Accounting domains were retained. This criterion limited the number of articles to 720. Case studies and conceptual papers were also excluded and finally 102 articles were considered for the systematic review.

A systematic review is a form of review analysis that is conducted to identify the research evidence to answer research questions and also to suggest the scope for policy framework and future research work ( Aromataris & Pearson, 2014 ; Darzi, Islam, Khursheed, & Bhat, 2023 ). For creating the keyword networking diagram, VOSviewer software has been used. VOSviewer software tool was created by Eck and Waltman in 2010 and is used for creating and exploring bibliometric maps ( Arruda, Silva, Lessa, Proença, & Bartholo, 2022 ).

4. Results of systematic analysis

This part is divided into two subsections, the first one explains the factors that contribute to tax avoidance and the second part describes the effects of such behavior ( Figure 3 ).

4.1 Factors affecting the corporate tax avoidance decisions

Factors that contribute to corporate tax avoidance have been grouped into seven categories, with each category having many subcategories. Table 1 displays the impact of corporate governance mechanisms on corporate tax avoidance practices and the impact of other identified factors in Table 2 .

1. Ownership pattern

The ownership structure is considered a significant predator of the tax avoidance behavior of the firm ( Hanlon & Heitzman, 2010 ). The impact of ownership structure on tax avoidance does not show consistency in the result. In concentrated ownership, majority shareholders exploit the tax-saving benefits at the expense of minority shareholders ( Ying, Wright, & Huang, 2017 ). Family-based firms are more engaged in tax avoidance than non-family-based firms because of higher ownership and more opportunities to seek high profit as they are the founding members ( Gaaya et al., 2017 ; Kovermann & Wendt, 2019 ; Supantri & Rahmiati, 2020 ; Ying et al. , 2017 ). In contrast to the above findings, Alkurdi and Mardini (2020 ), Bauweraerts, Vandernoot, and Buchet (2020 ), Landry et al. (2013 ), Moore, Suh, and Werner (2017 ), and Sánchez-Marín, Portillo-Navarro, and Clavel (2016 ) suggested that family firms are more concerned about their reputation and prefer to avoid tax aggressive decisions. Alkurdi and Mardini (2020 ), Khurana and Moser (2013 ), Resti Yulistia, Minovia, and Anison (2020 ), Wahab et al. (2017 ), and Ying et al. (2017 ) concluded that as the percentage of institutional ownership increases, the tax avoidance level starts to decline because of the better monitoring of managers’ performance. But Bird and Karolyi (2017) and Khan et al. (2017) suggest that an increment in institutional ownership results in more tax avoidance due to their concern about high market value. Insiders have voting rights in dual-class ownership, which implies less pressure from outsiders to use tax avoidance strategies ( McGuire, Wang, & Wilson, 2014 ). Bradshaw, Liao, and Ma (2019 ), Chan et al. (2013 ), Liu and Lee (2019 ), and Mafrolla (2019 ) stated that tax avoidance decisions generate short-term benefits for the company. But state-owned firms are more concerned with long-term goals than with profit maximization, indicating a negative attitude toward tax avoidance decisions.

2. Board components

The board’s efficiency varies depending on its independence, size, ethnicity, gender diversity, professional knowledge, etc. The presence of more independent directors reduces the likelihood of the adoption of tax avoidance behavior because of effective monitoring of boards’ tax minimization behavior ( Alkurdi & Mardini, 2020 ; Zaqeeba & Iskandar, 2020 ). Cho and Yoon (2020) suggested that religious diversity onboard has a significant impact on tax planning decisions. In comparison to concentrated board religion, boards with varied religions show a higher rate of tax avoidance. Gender diversity on board leads to less tax avoidance because feminine characteristics are associated with less risk-taking and more moral choices ( Francis, Hasan, Wu, & Yan, 2014 ; Richardson, Wang, & Zhang, 2016 ; Lanis, Richardson, & Taylor, 2017 ; Hoseini, Safari Gerayli, & Valiyan, 2019 ; Jarboui, Kachouri Ben Saad, & Riguen, 2020 ). Hoseini et al. (2019) claimed that large boards are less effective than small boards due to many perspectives in taking any decision. But chances of accounting fraud increase with the increment in board members ( Zemzem & Ftouhi, 2013 ) which lead to more tax avoidance.

3. Audit quality

Audit quality is an important element of corporate governance that reduces the conflicts between management and shareholders and prevents managers to indulge in fraudulent and accounting-manipulating activities ( Abdel-Wanis, 2021 ). Gaaya et al. (2017) claimed that the companies audited by the Big Four are less likely to participate in tax avoidance because of the risk of reputational cost and litigation cost, and adopt fair tax auditing practices. Similarly, the presence of more independent directors in the audit committee and audit tenure negatively impacts tax avoidance decisions. The presence of more independent auditors in the audit committee results in effective monitoring and less tax avoidance ( Deslandes, Fortin, & Landry, 2020 ). This study also stated that auditors with large tenure favor less tax-aggressive strategies due to having more in-depth knowledge of the company’s operations and more effectiveness in detecting tax-evading practices.

4. Compensation

Managerial ability is characterized as the better assessment of risk and return related to investment decisions ( Gober & Burns, 1997 ). The attitude of key personnel toward tax avoidance decisions could be affected by remuneration incentives ( Walsh & Ryan, 1997 ). Equity-based incentives align the interest of owners and agents and encourage management to undertake risky decisions such as tax avoidance to increase posttax income ( Taylor & Richardson, 2014 ). But, tax avoidance decisions with short-term benefits might have a long-term reputational damaging effect on the firm and such activities may bring additional costs to the firm such as penalties, auditing firms’ intervention, reputational damage, etc. ( Huang et al. , 2018 ; Sudirjo, 2020 ). In contrast to this, Phillips, Pincus, and Rego (2003) found the insignificant effect of CEO after-tax compensation on such decisions due to their unwillingness to take on additional compensation risk.

5. Corporate social responsibility (CSR) disclosure

Corporate actions have a substantial impact on local communities and civil society organizations ( Dyreng et al. , 2010 ). CSR practices are defined as all actions taken by companies to have a positive impact on the environment and society. Firms consider tax avoidance practices as socially irresponsible decisions and avoid such practices ( Gulzar et al. , 2018 ; Lanis & Richardson, 2015 ; López-González, Martínez-Ferrero, & García-Meca, 2019 ; Mao & Wu, 2019 ; Mao, 2019 ; Park, 2017 ). In contrast to these findings, Alsaadi (2020) and Arifin and Rahmiati (2020) found that firms also use the benefits of tax savings to fulfill their responsibility toward society and publicly display good CSR scores, safeguarding themselves from unfavorable consequences of such action in the event of detection ( Jiang, Zheng, & Wang, 2021 ; Zeng, 2019 ).

6. Firm characteristics

Firm characteristics have a significant impact on tax avoidance practices. The impact of tax-avoiding behavior on firm size has been explained through political cost and political power theory. Political power theory states that large-sized firms are more engaged in tax avoidance activities due to high economic and political power ( Sucahyo, Damayanti, Prabowo, & Supramono, 2020 ). While political cost theory ( Salman, 2018 ) states that large firms are under more pressure to disclose performance transparency to regulatory bodies compared to small-sized firms, which shows a negative attitude toward tax avoidance decisions. Contradictory to political power and political cost theory, Kismanah et al . (2018) concluded the insignificant relationship between tax avoidance and firm value. The firms use debt (leverage) in their capital structure as a tax shield because interest payable on debt is deductible expense before calculating tax liability ( Loney, 2015 ). The study ( Firmansyah & Bayuaji, 2019 ; Salman, 2018 ) found a positive relationship between tax avoidance and profitability. Firms with more fixed assets have a low effective tax rate (ETR) because depreciation on the fixed assets is allowable as a deductible expense from profit ( Salman, 2018 ). Large inventories enhance a company’s overall financial burden due to higher transportation, warehouse, maintenance and storage expenses and such decisions do not affect the companies’ tax burden ( Urrahmah & Mukti, 2021 ).

7. Political connections

Politically connected firms face the burden of disclosure transparency and official intervention and thus engage in more tax avoidance practices. These political connections provide special rights to the firms and firms adopt more tax-aggressive practices due to less audit risk ( Kim & Kim, 2016 ; Wahab et al. , 2017 ). Same in this regard, the study ( Resti Yulistia et al. , 2020 ) claimed that these political ties can assist businesses in easy access to government contracts but do not have any impact on tax avoidance decisions.

4.2 Consequences of tax avoidance decisions

The adoption of tax avoidance tactics may have many economic ramifications for businesses. The detection of illegal tax avoidance behavior results in lawsuits, penalties and a loss of reputation for the companies. Table 3 shows the probable outcomes of tax avoidance activity as extracted from the literature:

1. Stock market reaction

The stock market is significantly affected by the disclosure of tax management strategies. The market value of the company declines in case of the detection of any illegal tax managing practices ( Hanlon & Slemrod, 2009 ). The stock market reaction also depends on the news related to the legitimacy of tax minimization strategies. The stock market behaves negatively in case of tax evasion (illegal) news but there is no adverse reaction when the company is engaging in tax avoidance (legal) practices ( Blaufus et al., 2019 ).

2. Firm value

Two distinct viewpoints have been proposed based on existing literature to explain the influence of tax avoidance on corporate value. The tax-saving concept shows that tax avoidance decisions minimize the tax liability of the firm. As a result, the profit goes up, which positively impacts the firm value ( Lim, 2011 ; Abdul Wahab & Holland, 2012 ; Chyz, 2013 ; Guenther, Matsunaga, & Williams, 2017 ; Bimo, Prasetyo, & Susilandari, 2019 ; Li, Lu, & Li, 2019 ). While Park et al. (2016 ) stated that if there are not any incentive alignment contracts between managers and firms, then because of the rent extraction behavior of managers, tax avoidance decisions deteriorate the firm value.

3. Earning management

Frank, Lynch, and Rego (2009) and Kubick and Lockhart (2016) suggested that the increasing gap between taxable and book income could be the outcome of earning management decisions rather than tax-saving decisions. Earning management is the manipulation of financial statements to falsely report the high profits of the company for misleading investors and other related parties ( Madan & Bhasin, 2016 ). Putri, Rohman, and Chariri (2016) , Balakrishnan, Blouin, and Guay (2019) and Susanto et al. (2019) stated that the adoption of tax avoidance practices is mainly oriented toward earning management behavior.

4. Corporate transparency

Tax-avoiding activities increase the information complexities in organizations due to the adoption of tax-saving methods ( Drucker, 2023 ). Information asymmetry in financial disclosure increases when firms are engaged in tax-avoiding behavior ( Balakrishnan et al. , 2019 ). Companies resist disclosing more about their taxation strategies to avoid penalties in case of detection of any illegal practice by auditing firms.

5. Keyword network analysis

The term “keyword networking diagram” has been considered one of the important tools to find the most researched areas and also emphasizes the presence of patterns and trends in a particular field ( Goyal & Kumar, 2021 ). The enormous bubbles in Figure 4 represent the areas that have been thoroughly researched, while the small bubbles indicate the subjects that require further investigation. Thicker lines mean more frequent co-occurrences. The smaller the distance between the nodes, the stronger the relationship they have. Table 4 represents the number of research occurrences based on the keyword co-occurrence network, which identified 266 keywords in 102 research articles. Tax avoidance is the most frequently used keyword with 82 occurrences, tax aggressiveness with 34 occurrences, tax planning with 6 occurrences and tax management with 3 occurrences. This demonstrates that authors have considered the terms “Tax Avoidance”, “Tax Aggressiveness”, “Tax Management” and “Tax Planning” interchangeably.

6. Conclusion

Tax avoidance is defined as the legal “transfer of revenue” from the government to corporations. This saved income could be utilized by firms for productive purposes and could be exploited by managers for personal gain at the expense of investors. It has been observed that agency theory significantly affects managers’ tax planning decisions. Managers feel pressured because of the high expectations of owners, especially from riskless shareholders and adopt tax avoidance strategies to improve posttax income to fulfill the owners’ expectations, and sometimes for their benefit.

The reviewed literature shows that the effect of various ownership structure forms on tax-avoiding behavior has unpredictable outcomes. The study finds that institutional investors put some of their money into other businesses in the hopes of earning dividends and profits, which shows a positive attitude toward tax management decisions. The literature reveals family firms are more concerned about their reputation in society, which affects their tax-avoiding behavior. The attitude of state-owned firms was found to be negative toward tax-avoiding decisions, because of their concern toward securing the government revenue. The study also reveals that firms are more likely to employ tax avoidance tactics when equity incentives are offered to executives.

The effect of corporate governance on firms’ tax-sheltering practices is also explored in this study. The percentage of independent directors, gender diversity, board size and audit quality parameters have been used for evaluating the impact of corporate governance frameworks on tax avoidance behavior. The presence of more independent directors on the board is linked to effective monitoring and better control, which can limit tax-sheltering decisions. Gender diversity on boards shows a negative attitude toward managing the tax aggressively due to the risk-averse behavior of the women. Smaller boards are considered more effective than larger boards due to fewer communication and coordination problems, however, the influence of board size on tax sheltering behavior is not always consistent. This study also suggests that auditing by Big Four auditing firms reduces the possibility of a firm’s engagement in earnings manipulation. Other than corporate governance mechanisms, tax avoidance decisions are also affected by various firm characteristics such as the use of leverage capital, the use of capital-intensive products, and firm size as explained in the existing literature. Companies usually benefit from the advantage of using debt to finance operations which is in the form of a debt tax shield. A company’s investment in fixed assets is referred to as capital intensity and charged depreciation on these assets is a deductible expense which further reduces the tax liability of the firm.

Tax avoidance behavior is considered a sign of irresponsible behavior toward society, the literature states that firms with high CSR scores are more cautious about tax avoidance practices. These firms avoid tax-aggressive decisions because the detection of such behavior offsets the positive effects of CSR practices and also causes reputational damages to the firm. On the other hand, some studies claim that firm with more tax avoidance practices discloses high CSR score to show a positive attitude toward their social responsibilities, which means that there is no stable relationship between firm tax avoidance practices and CSR score.

The associated costs and advantages of such decisions affect shareholder perceptions of the tax avoidance strategies of the firms. If any firm is found to be engaged in illegal tax avoidance by auditing firms, it will have to pay a penalty as imposed by taxation authorities. When such behavior is discovered, the firms’ reputations are also harmed, which causes share values to drop. Also, tax-aggressive firms have a less transparent information environment and do not disclose all information related to their tax management strategies.

Keyword network shows that the three terms, “Tax Planning”, “Tax Avoidance” and “Tax Aggressiveness”, have been used in the same context in the existing literature. This networking map also suggests that board gender diversity, board size, market reaction, disclosure transparency, capital market pressure, social capital and executive compensation have not been explored in-depth and can be regarded as emerging avenues for future research.

7. Practical and theoretical implications

This study provides an overview of the factors that contribute to tax-avoiding practices. This study is helpful to corporates to understand the effect of tax-saving decisions on their performance. This study is useful to the policymakers to understand the different practices adopted by the firms for reducing their taxation and liabilities and also to formulate policies for fixing these gaps. This systematic study can add greater clarity to other review analyses such as the bibliometric review method and meta-analyses, as well as to empirical studies.

8. Scope for future research

This study provides a thorough coverage of existing literature on corporate tax avoidance and is helpful for new researchers who want to understand this concept and also for those who are looking to explore new directions in the same field. One of the major issues that academicians confront when conducting a study on corporate tax avoidance is related to its measurement. The actual picture of overall tax avoidance by various firms can be obtained either from taxation authority or by the tax returns filed by the company, which in both cases is difficult to obtain. Salihu, Obid, and Annuar (2013 ), in their study on corporate tax avoidance measures, conclude that the availability of data and predetermined objectives of the study influence the choice of tax avoidance measures. This study is focused on identifying causes and outcomes of corporate tax avoidance behavior, with no discussion on tax avoidance assessment methodologies. To gain a better knowledge of firms’ tax avoidance behavior, measurement techniques for tax avoidance practices could be investigated further. The articles published only in the Scopus database were used for review purpose, which limits the generalization of the findings. So, future consideration of other databases such as “EBESCO”, “Web of Science”, “Google Scholar” or “Dimensions” can be significant to explore new directions related to corporate tax avoidance behavior.

Identified predictors

PRISMA framework

Determinants and consequences of corporate tax avoidance behavior

Keywords co-occurrence network

Effects of corporate governance components on corporate tax avoidance

Source(s): Authors’ own compilation

Abdel-Wanis , E. ( 2021 ). The impact of audit quality on the relationship between ownership structure and stock price crash risk in Egypt . Academy of Accounting and Financial Studies Journal , 25 ( 6 ), 1 – 15 .

Abdelfattah , T. , & Aboud , A. ( 2020 ). Tax avoidance, corporate governance, and corporate social responsibility: The case of the Egyptian capital market . Journal of International Accounting, Auditing and Taxation , 38 , 100304 . doi: 10.1016/j.intaccaudtax.2020.100304 .

Abdul Wahab , N. S. , & Holland , K. ( 2012 ). ‘Tax planning, corporate governance and equity value . British Accounting Review , 44 ( 2 ), 111 – 124 . doi: 10.1016/j.bar.2012.03.005 .

Aliani , K. ( 2013 ). Does corporate governance affect tax planning? Evidence from American companies . International Journal of Advanced Research , 1 ( 10 ), 864 – 873 .

Alkurdi , A. , & Mardini , G. H. ( 2020 ). The impact of ownership structure and the board of directors’ composition on tax avoidance strategies: Empirical evidence from Jordan . Journal of Financial Reporting and Accounting , 18 ( 4 ), 795 – 812 . doi: 10.1108/JFRA-01-2020-0001 .

Alsaadi , A. ( 2020 ). Financial-tax reporting conformity, tax avoidance and corporate social responsibility . Journal of Financial Reporting and Accounting , 18 ( 3 ), 639 – 659 . doi: 10.1108/JFRA-10-2019-0133 .

Arifin , I. S. , & Rahmiati , A. ( 2020 ). The relationship between corporate social responsibility and tax aggressiveness: An Indonesian study . International Journal of Innovation, Creativity and Change , 13 ( 4 ), 645 – 663 . Available from: https://www.scopus.com/inward/record.uri?eid=2-s2.085087047041&partnerID=40&md5=cff8f99011aba56842c3f7f0c1d8b0f0

Aromataris , E. , & Pearson , A. ( 2014 ). The systematic review: An overview . American Journal of Nursing , 114 ( 3 ), 53 – 58 . doi: 10.1097/01.NAJ.0000444496.24228.2c .

Arruda , H. , Silva , E. R. , Lessa , M. , Proença , D. Jr. , & Bartholo , R. ( 2022 ). VOSviewer and bibliometrix . Journal of the Medical Library Association , 110 ( 3 ), 392 – 395 .

Balakrishnan , K. , Blouin , J. L. , & Guay , W. R. ( 2019 ). Tax aggressiveness and corporate transparency . Accounting Review , 94 ( 1 ), 45 – 69 . doi: 10.2308/accr-52130 .

Barford , V. , & Holt , G. ( 2013 ). Google, amazon, Starbucks: The rise of ‘tax shaming . BBC News Magazine , 21 .

Baumeister , R. F. , & Leary , M. R. ( 1997 ). Writing narrative literature reviews . Review of General Psychology , 1 ( 3 ), 311 – 320 . doi: 10.1037/1089-2680.1.3.311 .

Bauweraerts , J. , Vandernoot , J. , & Buchet , A. ( 2020 ). Family firm heterogeneity and tax aggressiveness: A mixed gamble approach . Canadian Journal of Administrative Sciences , 37 ( 2 ), 149 – 163 . doi: 10.1002/cjas.1528 .

Bimo , I. D. , Prasetyo , C. Y. , & Susilandari , C. A. ( 2019 ). The effect of internal control on tax avoidance: The case of Indonesia . Journal of Economics and Development , 21 ( 2 ), 131 – 143 . doi: 10.1108/jed-10-2019-0042 .

Bird , A. , & Karolyi , S. A. ( 2017 ). Governance and taxes: Evidence from regression discontinuity . Accounting Review , 92 ( 1 ), 29 – 50 . doi: 10.2308/accr-51520 .

Blaufus , K. , Möhlmann , A. , & Schwäbe , A. N. ( 2019 ). Stock price reactions to news about corporate tax avoidance and evasion . Journal of Economic Psychology , 72 , 278 – 292 . doi: 10.1016/j.joep.2019.04.007 .

Boussaidi , A. , & Hamed-Sidhom , M. ( 2020 ). Board’s characteristics, ownership’s nature and corporate tax aggressiveness: New evidence from the Tunisian context . EuroMed Journal of Business , 16 ( 4 ), 487 – 511 . doi: 10.1108/EMJB-04-2020-0030 .

Bradshaw , M. , Liao , G. , & Ma , M. S. ( 2019 ). Agency costs and tax planning when the government is a major Shareholder . Journal of Accounting and Economics , 67 ( 2-3 ), 255 – 277 . doi: 10.1016/j.jacceco.2018.10.002 .

Chan , K. H. , Mo , P. L. L. , & Zhou , A. Y. ( 2013 ). Government ownership, corporate governance and tax aggressiveness: Evidence from China . Accounting and Finance , 53 ( 4 ), 1029 – 1051 . doi: 10.1111/acfi.12043 .

Chee , S. , Choi , W. , & Shin , J. E. ( 2017 ). The non-linear relationship between CEO compensation incentives and corporate tax avoidance . Journal of Applied Business Research , 33 ( 3 ), 439 – 450 . doi: 10.19030/jabr.v33i3.9935 .

Chen , S. , Chen , X. , Cheng , Q. , & Shevlin , T. ( 2010 ). Are family firms more tax aggressive than non-family firms? . Journal of Financial Economics , 95 ( 1 ), 41 – 61 . doi: 10.1016/j.jfineco.2009.02.003 .

Chircop , J. , Fabrizi , M. , Ipino , E. , & Parbonetti , A. ( 2018 ). Does social capital constrain firms’ tax avoidance? . Social Responsibility Journal , 14 ( 3 ), 542 – 565 . doi: 10.1108/SRJ-08-2017-0157 .

Cho , H. T. , & Yoon , S. M. ( 2020 ). Is the board of directors’ religion related to tax avoidance? Empirical evidence in South Korea . Religions , 11 ( 10 ), 1 – 12 . doi: 10.3390/rel11100526 .

Christensen , J. , & Murphy , R. ( 2004 ). The social irresponsibility of corporate tax avoidance: Taking CSR to the bottom line . Development , 47 ( 3 ), 37 – 44 . doi: 10.1057/palgrave.development.1100066 .

Chyz , J. A. ( 2013 ). Personally tax aggressive executives and corporate tax sheltering . Journal of Accounting and Economics , 56 ( 2-3 ), 311 – 328 . doi: 10.1016/j.jacceco.2013.09.003 .

Cooper , M. , & Nguyen , Q. T. K. ( 2020 ). Multinational enterprises and corporate tax planning: A review of literature and suggestions for a future research agenda . International Business Review , 29 ( 3 ). doi: 10.1016/j.ibusrev.2020.101692 .

Darzi , M. A. , Islam , S. B. , Khursheed , S. O. , & Bhat , S. A. ( 2023 ). Service quality in the healthcare sector: A systematic review and meta-analysis . LBS Journal of Management & Research , (ahead-of-print) .

Desai , M. A. , & Dharmapala , D. ( 2006 ). Corporate tax avoidance and high-powered incentives . Journal of Financial Economics , 79 ( 1 ), 145 – 179 . doi: 10.1016/j.jfineco.2005.02.002 .

Deslandes , M. , Fortin , A. , & Landry , S. ( 2020 ). Audit committee characteristics and tax aggressiveness . Managerial Auditing Journal , 35 ( 2 ), 272 – 293 . doi: 10.1108/MAJ-12-2018-2109 .

Drucker , J. ( 2023 ). Companies dodge $60 billion in taxes even tea party condemns . Bloomberg , 2023 .

Dyreng , S. D. , Hanlon , M. , & Maydew , E. L. ( 2010 ). The effects of executives on corporate tax avoidance . Accounting Review , 85 ( 4 ), 1163 – 1189 . doi: 10.2308/accr.2010.85.4.1163 .

Ey ( 2014 ). Worldwide corporate tax guide - Qatar . Available from: http://www.ey.com/GL/en/Services/Tax/Worldwide-Corporate-Tax-Guide_XMLQS?preview&XmlUrl=/ec1mages/taxguides/WCTG-2013-2/WCTG-QA.xml

Fernández-Rodríguez , E. , García-Fernández , R. , & Martínez-Arias , A. ( 2019 ). Influence of ownership structure on the determinants of effective tax rates of Spanish Companies . Sustainability (Switzerland) , 11 ( 5 ). doi: 10.3390/su11051441 .

Firmansyah , A. , & Bayuaji , R. ( 2019 ). Financial constraints, investment opportunity set, financial reporting aggressiveness, tax aggressiveness: Evidence from Indonesia manufacturing companies . Academy of Accounting and Financial Studies Journal , 23 ( 5 ), 1 – 18 .

Fisher , J. M. ( 2014 ). Fairer shores: Tax havens, tax avoidance, and corporate social responsibility . Boston University Law Review , 94 ( 1 ), 337 – 365 . Available from: https://www.scopus.com/inward/record.uri?eid=2-s2.0-84896953995&partnerID=40&md5=1df175eeceda5da1d32bcb4846ff6286

Foster Back , P. ( 2013 ). Avoiding tax may be legal, but can it ever be ethical? . Available from: http://www.theguardian.com/sustainable-business/avoiding-tax-legal-but-ever-ethical

Francis , B. B. , Hasan , I. , Wu , Q. , & Yan , M. ( 2014 ). Are female CFOS less tax aggressive? Evidence from tax aggressiveness . Journal of the American Taxation Association , 36 ( 2 ), 171 – 202 . doi: 10.2308/atax-50819 .

Frank , M. M. , Lynch , L. J. , & Rego , S. O. ( 2009 ). Tax reporting aggressiveness and its relation to aggressive financial reporting . Accounting Review , 84 ( 2 ), 467 – 496 . doi: 10.2308/accr.2009.84.2.467 .

Gaaya , S. , Lakhal , N. , & Lakhal , F. ( 2017 ). Does family ownership reduce corporate tax avoidance? The moderating effect of audit quality . Managerial Auditing Journal , 32 ( 7 ), 731 – 744 . doi: 10.1108/MAJ-02-2017-1530 .

Gober , J. R. , & Burns , J. O. ( 1997 ). The relationship between tax structures and economic indicators . Journal of International Accounting, Auditing and Taxation , 6 ( 1 ), 1 – 24 . doi: 10.1016/S1061-9518(97)90010-0 .

Gottschalk , P. ( 2010 ). Categories of financial crime . Journal of Financial Crime , 17 ( 4 ), 441 – 458 . doi: 10.1108/13590791011082797 .

Goyal , K. , & Kumar , S. ( 2021 ). Financial literacy: A systematic review and bibliometric analysis . International Journal of Consumer Studies , 45 ( 1 ), 80 – 105 . doi: 10.1111/ijcs.12605 .

Gras-Gil , E. , Palacios Manzano , M. , & Hernández Fernández , J. ( 2016 ). Investigating the relationship between corporate social responsibility and earnings management: Evidence from Spain . BRQ Business Research Quarterly , 19 ( 4 ), 289 – 299 . doi: 10.1016/j.brq.2016.02.002 .

Guenther , D. A. , Matsunaga , S. R. , & Williams , B. M. ( 2017 ). Is tax avoidance related to firm risk? . Accounting Review , 92 ( 1 ), 115 – 136 . doi: 10.2308/accr-51408 .

Gulzar , M. A. , Cherian , J. , Sial , M.S. , Badulescu , A. , Thu , P.A. , Badulescu , D. , & Khuong , N.V. ( 2018 ). Does corporate social responsibility influence corporate tax avoidance of Chinese listed companies? Sustainability (Switzerland) , 10 ( 12 ). doi: 10.3390/su10124549 .