5 Professional Actuary Cover Letter Examples for 2024

Your actuary cover letter must immediately highlight your proficiency in statistical analysis and risk assessment. Demonstrate your expertise with real-world examples of how you've successfully managed complex calculations and data interpretation. In this letter, it's crucial to also convey your understanding of the business and its actuarial needs. Show them that you're not just a numbers person, but someone who applies mathematical skills to drive informed business decisions.

All cover letter examples in this guide

Entry Level Actuary

Actuary Internship

Experienced Actuary

Pension Actuary

Cover letter guide.

Actuary Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Actuary Cover Letter

Key Takeaways

By Experience

Embarking on your actuarial career, you've likely hit the common snag of crafting the perfect cover letter. While your resume showcases your credentials, your cover letter should be a narrative of your proudest professional achievement, not a repeat of your resume. It's about striking a balance between formal tone and originality, steering clear of tired clichés. Remember, brevity is key—your compelling story must captivate in just one page. Let's dive into how you can make that happen.

- Making excellent use of job-winning real-life professional cover letters;

- Writing the first paragraphs of your actuary cover letter to get attention and connect with the recruiters - immediately;

- Single out your most noteworthy achievement (even if it's outside your career);

- Get a better understanding of what you must include in your actuary cover letter to land the job.

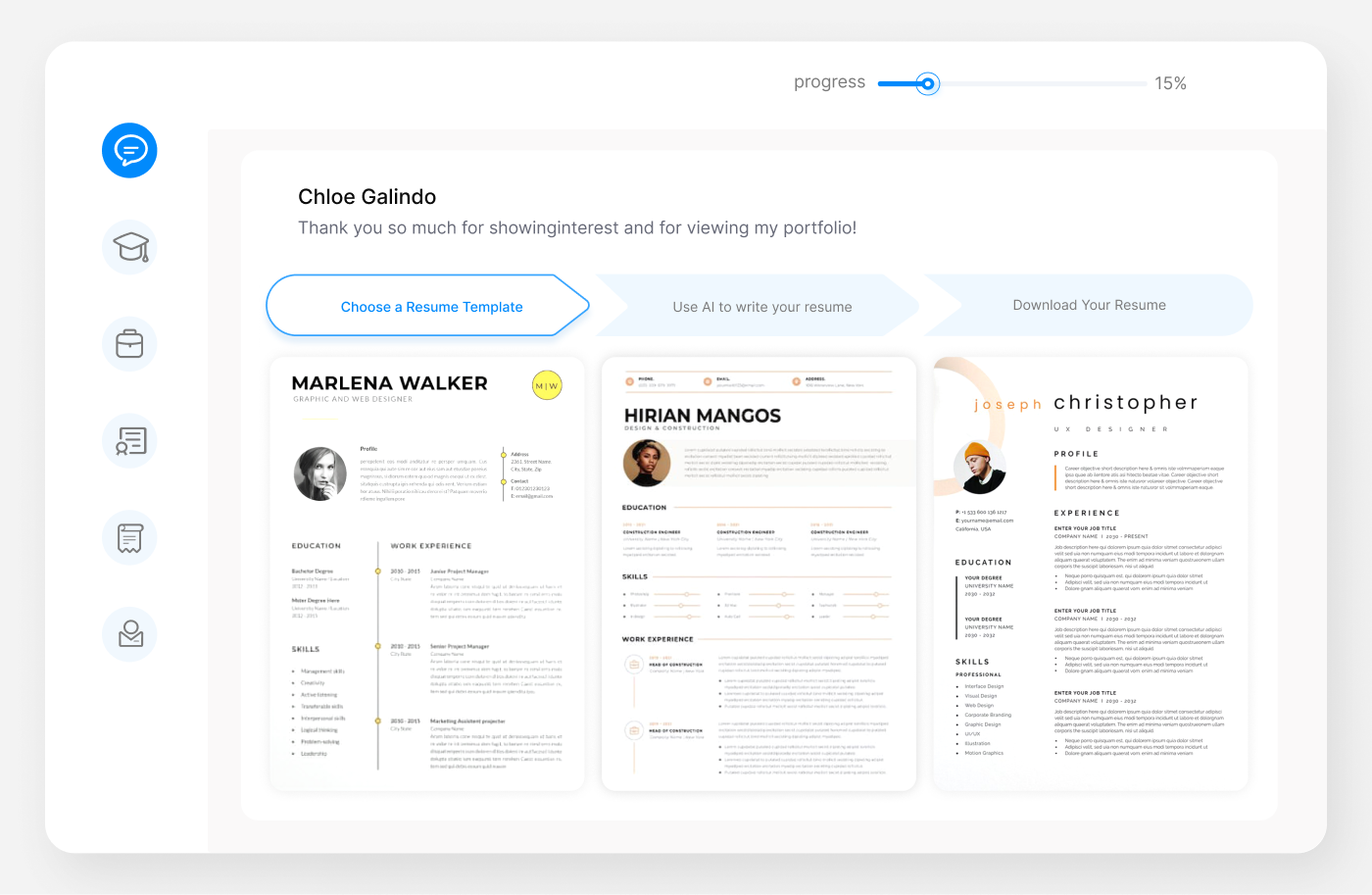

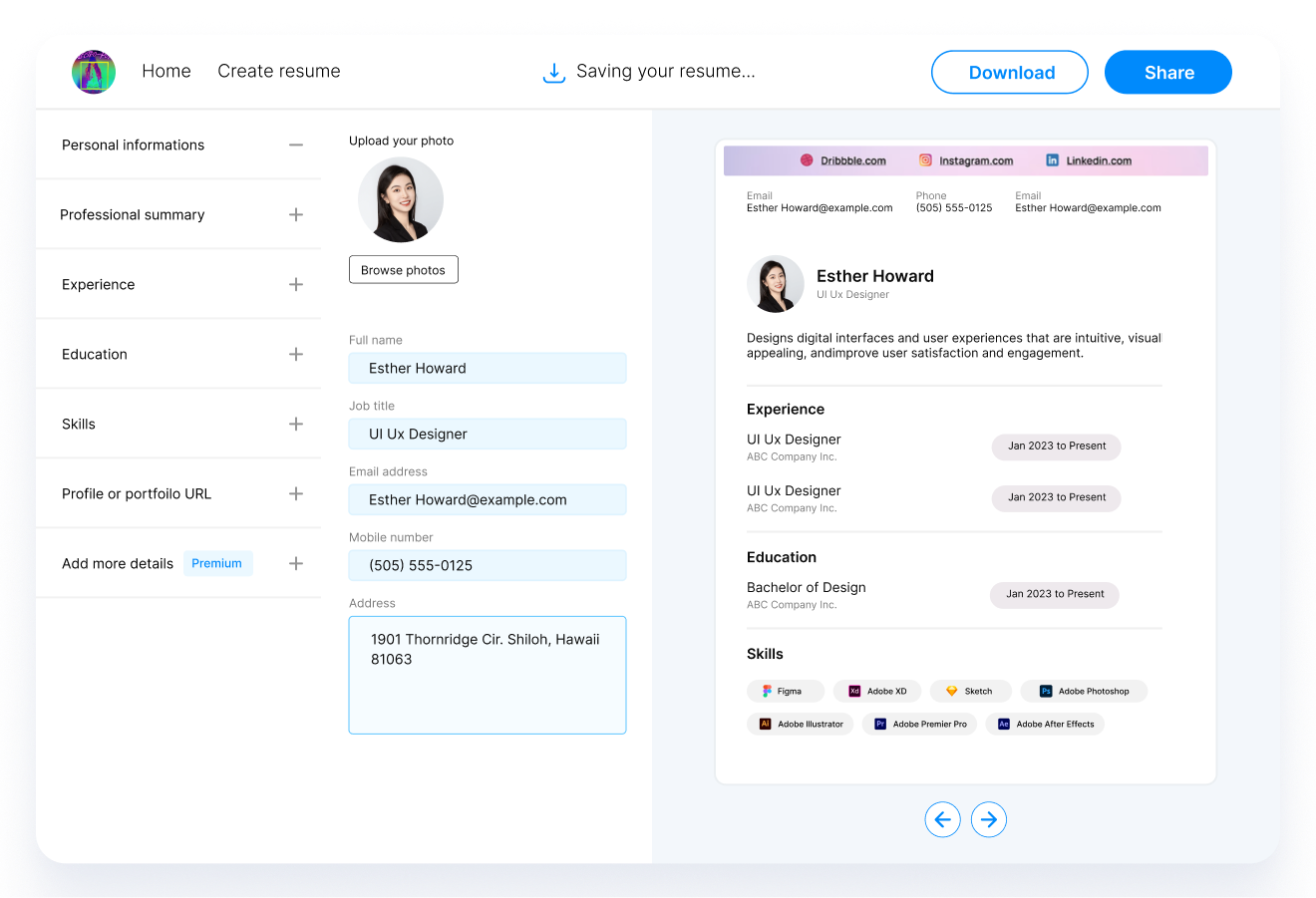

Let the power of Enhancv's AI work for you: create your actuary cover letter by uploading your resume.

If the actuary isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Actuary resume guide and example

- Banking cover letter example

- Financial Planning Analyst cover letter example

- Financial Operations Manager cover letter example

- Purchasing Director cover letter example

- Phone Banking cover letter example

- Hotel Accounting cover letter example

- Public Accounting cover letter example

- Entry Level Actuary cover letter example

- Accountant cover letter example

- Project Accounting cover letter example

Actuary cover letter example

Alexander Taylor

New York City, New York

+1-(234)-555-1234

- Relevant Experience: The letter mentions the candidate's tenure at MetLife and a specific project that showcases experience directly relevant to the role, emphasizing their capacity to revamp risk evaluation models.

- Quantifiable Achievements: It highlights a significant accomplishment (20% reduction in forecast errors), which demonstrates the candidate's ability to deliver measurable results, a key aspect in actuarial and risk assessment positions.

- Technical Skillset: The cover letter references expertise in predictive analytics and advanced statistical techniques, showing the candidate's technical competency, which is essential for an actuarial role that depends heavily on data analysis.

- Leadership and Teamwork: It showcases the candidate's leadership experience by mentioning the successful management of a team and the collaborative nature of their work, essential skills for a senior position where leadership is expected.

Five tips on formatting your actuary cover letter

Do you want to make a good impression on recruiters and, at the same time, follow the best industry advice on writing your actuary cover letter?

Make sure to include the following:

- Header and Salutation;

- Introductory paragraph;

- Body paragraph;

- Closing paragraph;

- Signature (this one is up to you).

Remember to use the same modern, simple font for your actuary cover letter as you did for your resume (e.g. Lato, Rubik, etc.)

Ensure your actuary cover letter is single-spaced and is wrapped around a one-inch margin, like in our cover letter templates .

Once completed, use our cover letter builder to export your actuary cover letter in the best format to keep your information intact - PDF.

At the end of the day, your actuary cover letter won't be assessed by the Applicant Tracker System (ATS) software, but by the recruiters. Your information should thus be legible, organized, and follow a structured logic.

The top sections on a actuary cover letter

Header: This includes your contact information, the date, and the recipient's details, and it ensures your cover letter looks professional and is directed to the correct person or department.

Opening Greeting: A personalized salutation addresses the hiring manager by name and demonstrates your attention to detail and interest in establishing a personal connection.

Introduction: Introduce yourself by mentioning your actuarial qualifications and express your enthusiasm for the position, as it sets the tone and engages the reader from the start.

Professional Experience and Skills: Highlight specific instances of your analytical skills, risk assessment experience, and any relevant actuarial exams passed, as these are key competencies that recruiters look for in candidates for actuary roles.

Closing Section: Reiterate your interest in the role, summarize why you are a great fit, thank the recruiter for their time, and include a call to action such as looking forward to discussing your qualifications in further detail, which shows proactiveness and eagerness.

Key qualities recruiters search for in a candidate’s cover letter

Strong mathematical and statistical analysis skills: Actuaries use these skills to assess risk and the financial implications of uncertainty and to make predictions about future events.

Proficiency in actuarial software: Recruiters look for candidates familiar with relevant tools like Prophet, MoSes, or similar actuarial software to model and evaluate financial risks efficiently.

Knowledge of insurance and finance principles: A solid understanding of the insurance industry, finance, and economics allows actuaries to design, test, and manage insurance policies and pension plans.

Detail-oriented mindset: Attention to detail ensures accurate calculations, which is crucial in an actuary's role since small errors can lead to significant financial consequences.

Strong communication skills: Actuaries must clearly explain complex mathematical concepts to non-experts, including clients, managers, and other stakeholders.

Professional certification progress: Recruiters often look for candidates who have started or completed actuarial exams and are on the path to becoming an Associate or Fellow of recognized actuarial societies (e.g., Society of Actuaries or Casualty Actuarial Society).

Personalizing your actuary cover letter salutation

Always aim to address the recruiter from the get-go of your actuary cover letter.

- the friendly tone (e.g. "Dear Paul" or "Dear Caroline") - if you've previously chatted up with them on social media and are on a first-name basis;

- the formal tone (e.g. "Dear Ms. Gibbs" or "Dear Ms. Swift") - if you haven't had any previous conversation with them and have discovered the name of the recruiter on LinkedIn or the company website;

- the polite tone (e.g. "Dear Hiring Manager" or "Dear HR Team") - at all costs aim to avoid the "To whom it may concern" or "Dear Sir/Madam", as both greetings are very old-school and vague.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Recruiter,

- Dear Mr./Ms. [Last Name],

- Dear Members of the [Team Name] Team,

- Dear Recruitment Committee,

Your actuary cover letter intro: showing your interest in the role

On to the actual content of your actuary cover letter and the introductory paragraph .

The intro should be no more than two sentences long and presents you in the best light possible.

Use your actuary cover letter introduction to prove exactly what interests you in the role or organization. Is it the:

- Company culture;

- Growth opportunities;

- Projects and awards the team worked on/won in the past year;

- Specific technologies the department uses.

When writing your actuary cover letter intro, be precise and sound enthusiastic about the role.

Your introduction should hint to recruiters that you're excited about the opportunity and that you possess an array of soft skills, e.g. motivation, determination, work ethic, etc.

That one achievement in your actuary cover letter body

The lengthiest part of your actuary cover letter is the body.

Within the next three to six middle paragraphs, present yourself as the best candidate for the role .

How can you do that without retelling your whole professional resume?

Select one key achievement that covers job-crucial skills and technologies (and is memorable).

Within the body of your actuary cover letter, aim to tell the story of how you achieved your success. Also, write about how this would help out your potential team.

Thinking about the closing paragraph of your actuary cover letter

Before your signature, you have extra space to close off your actuary cover letter .

Use it to either make a promise or look to the future.

Remind recruiters how invaluable of a candidate you are by showing what you plan to achieve in the role.

Also, note your availability for a potential next meeting (in person or over the telephone).

By showing recruiters that you're thinking about the future, you'd come off as both interested in the opportunity and responsible.

Is it beneficial to mention that you have no experience in your actuary cover letter?

Lacking professional experience isn't the end of the world for your actuary cover letter .

Just be honest that you may not have had roles in the industry, but bring about so much more.

Like, your transferable skills, attained thanks to your whole work and life experience (e.g. the skills your summer spent working abroad taught you).

Or, focus on what makes you, you, and that one past success that can help you stand out and impress recruiters (think of awards you've attained and how they've helped you become a better professional).

Alternatively, write about your passion and drive to land the job and the unique skill set you would bring to enhance the workplace culture.

Key takeaways

Winning at your job application game starts with a clear and concise actuary cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the actuary resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.

Actuary cover letter examples

Explore additional actuary cover letter samples and guides and see what works for your level of experience or role.

Cover letter examples by industry

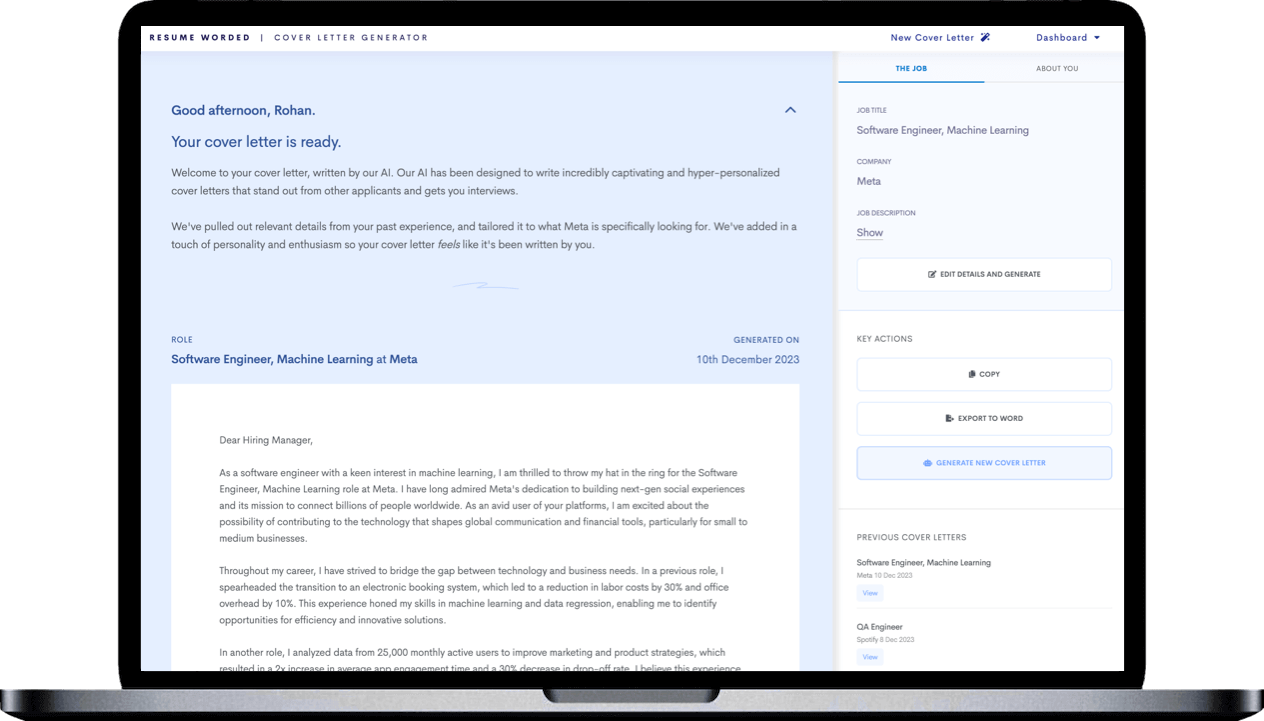

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

How To Write a Resume for France – Applying for a Job in France? Here's the Right Resume Format and Rules To Follow!

+20 useful chatgpt prompts to optimize your linkedin profile for the dream job, expert advice: how to handle layoffs and downsizing on your resume, 40+ resume tips and advice for 2024, what is a resume builder, how to write an effective personal resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- AI Resume Review

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- [email protected]

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

Made with love by people who care.

© 2024 . All rights reserved.

Crafting Your Actuary Cover Letter: A Quick Guide with Examples and Tips

In the realm of accounting and finance, the role of an actuary stands out as both challenging and rewarding. Actuaries are the backbone of financial security, using mathematics, statistics, and financial theory to study uncertain future events, especially those of concern to insurance and pension programs. However, landing a job as an actuary requires not just exceptional analytical skills but also the ability to communicate your capabilities effectively, starting with your cover letter. In this article, we're going to guide you through perfecting the cover letter for your next job application as an actuary. We'll delve into what makes a cover letter stand out, share a sample that you can draw inspiration from, and provide you with step-by-step advice tailored specifically to actuarial positions. Whether you're a seasoned professional or new to the field, our tips and examples will help you craft a cover letter that showcases your skills and passion for the role.

Crafting an Actuary Cover Letter: Your Blueprint for Success

Alex Mercer 123 Finance Avenue Math City, Quantland 45678 (123) 456-7890 [email protected] LinkedIn: linkedin.com/in/alexmerceractuary

October 15, 2024

Hiring Manager Global Insurance Group 123 Risk Road Insurance City, Stateland 12345

Dear Hiring Manager,

I am writing to express my keen interest in the Actuary position listed on your website. With a Master’s degree in Actuarial Science and over five years of experience at HighTower Insurance, I have honed my skills in statistical analysis, risk assessment, and financial modeling, making significant contributions to our risk management strategies.

In my current role, I spearheaded the development of a predictive model that identified potential high-risk policyholders, reducing unexpected payouts by 20% in the first year of implementation. My adeptness at using statistical software and programming languages such as R and Python has allowed me to improve our data analysis processes, leading to more accurate risk assessments and pricing strategies.

I am particularly attracted to Global Insurance Group because of your innovative approach to insurance solutions and your commitment to leveraging technology to predict and mitigate risks. I am excited about the opportunity to bring my expertise in analytics and my passion for problem-solving to your team, contributing to your mission of providing secure and innovative insurance products.

Thank you for considering my application. I am looking forward to the possibility of discussing my application in further detail and how I can contribute to the continued success and growth of Global Insurance Group.

Warm regards,

Alex Mercer

Crafting the Perfect Actuary Cover Letter: An Introduction

In the actuarial field, where precision and detail are paramount, your cover letter is your first opportunity to demonstrate these qualities to potential employers. A well-crafted cover letter not only introduces you and your qualifications but also reflects your analytical skills and your ability to communicate complex information in an accessible way. It's your chance to make a compelling case for why you're the ideal candidate for the position, highlighting your unique skills and experiences that align with the job requirements. To assist you in this endeavor, we've outlined the key components of an effective actuary cover letter, complete with examples and tips tailored to the actuarial profession. From the initial greeting to the final sign-off, we'll provide you with all the tools you need to create a cover letter that stands out and showcases your expertise in risk management, statistical analysis, and financial planning.

How to Format Your Actuary Cover Letter: A Guide to Getting Noticed

Your actuary cover letter is more than just a formality; it's a crucial part of your job application that can distinguish you from other candidates. To ensure it catches the hiring manager's attention for all the right reasons, here's how to format it properly:

Heading and Salutation: Setting the Stage for Success

Start with your contact information at the top, including your name, address, phone number, email, and any relevant professional profiles, such as LinkedIn. This should be followed by the date and the employer's contact details. When addressing the hiring manager, personalization is key. A generic "To Whom It May Concern" can feel impersonal and detached. Instead, do some research to find the name of the hiring manager or the head of the department you're applying to. If you can't find a specific name, "Dear Hiring Manager" is a respectful and professional alternative.

Correct Example:

Alex Mercer - Actuary 123-456-7890 [email protected]

Incorrect Example:

Alex - Numbers Guru 123-456-7890 [email protected]

The Opening: Grab Their Attention

The opening of your cover letter should immediately engage the reader. Start with a strong statement about why you're excited about the opportunity and how your background makes you a perfect fit for the role. Mention any connections you have to the company or how your values align with theirs. This shows that you're not just looking for any job, but you're interested in this specific position at their company.

The Body: Showcase Your Expertise

In the body of your cover letter, dive deeper into your qualifications and experiences. Highlight specific achievements and how they've prepared you for the challenges of the actuary role. Use concrete examples and quantify your successes whenever possible. This could include projects you've worked on, challenges you've overcome, or any recognition you've received. Focus on how your work has positively impacted your current or previous employers, demonstrating your potential value to the company you're applying to.

The Closing: A Strong Finish

End your cover letter on a confident and positive note. Reiterate your enthusiasm for the role and the company, and express your desire for a personal interview to discuss how you can contribute to their team. Thank them for considering your application, and sign off professionally.

Addressing Your Actuary Cover Letter: A Personal Touch Makes the Difference

The way you address your actuary cover letter can significantly influence its first impression. A personalized greeting shows you've taken the time to research the company and highlights your attention to detail—qualities highly valued in the actuarial profession.

Finding the Right Contact

Before settling for a generic greeting, invest some time in finding out the name of the hiring manager or the head of the actuarial department. LinkedIn, the company's website, or even a direct call to the company's reception can yield this information. Addressing the letter directly to the decision-maker establishes a personal connection from the outset.

Example Addressing Hiring Manager:

- Dear Mr. Johnson

- Dear Emily Johnson

Example Addressing Company:

- Dear Actuarial Department

- Dear Hiring Team at Global Insurance Group

When Specific Names Are Unavailable

Despite your best efforts, there might be times when you cannot find a specific person to address. In such cases, "Dear Hiring Manager" or "Dear [Company Name] Actuarial Team" are suitable alternatives. These options are still more targeted than "To Whom It May Concern," reflecting an effort to address the letter appropriately.

Avoid Overly Generic Salutations:

"To Whom It May Concern" or "Dear Sir/Madam" can make your application seem impersonal and detached.

The Impact of Personalization

A personalized greeting not only shows that you've done your homework but also demonstrates your genuine interest in the position. It sets a professional and respectful tone for your application, indicating that you value personalization and attention to detail—key traits for a successful actuary.

By starting your cover letter with the right touch of personalization, you increase the likelihood that it will be received positively, making a memorable first impression on your potential employer.

Crafting an Opening That Captivates: Your Actuary Cover Letter

The opening of your actuary cover letter is your first opportunity to grab the hiring manager's attention. A compelling introduction sets the tone for the rest of your letter and can make the difference between your application being noticed or overlooked. Here’s how to create an opening statement that captivates:

Highlight Your Enthusiasm and Fit

Begin by expressing your genuine enthusiasm for the position and the company. Mention how your professional interests and goals align with the company's mission or recent achievements. This not only shows you've done your research but also that you're a candidate who is truly interested in what the company stands for.

Share a Noteworthy Achievement

Early in your opening, highlight a specific achievement or experience that is directly relevant to the actuary role you’re applying for. This could be a successful project you led, a complex problem you solved, or a recognition you received. Quantify your success with numbers whenever possible, as this adds credibility and gives the hiring manager a clear picture of your capabilities.

Effective Opening Statement:

I am thrilled to apply for the Actuary position at Global Insurance Group, inspired by your innovative use of data analytics to improve customer service. At HighTower Insurance, I led a team that developed a new predictive model for assessing policyholder risk, reducing claim payouts by 20% within the first year. My passion for data-driven decision-making and my track record of delivering results align perfectly with the values and goals of your team.

Make It Personal and Professional

Your opening should not only showcase your qualifications but also reflect your personality. The actuary field values precision and analytical skills, but showing your human side can make your application memorable. Briefly mention why you chose this career path or how you believe you can contribute to the company's success in a unique way.

Why This Matters

A strong opening can significantly increase your chances of making it to the next stage of the hiring process. It demonstrates your ability to communicate effectively, an essential skill for actuaries who must often explain complex information in an accessible way. Moreover, it shows that you’re not just applying to any job—you have a specific interest in this role at this company.

Detailing Your Expertise in the Actuary Cover Letter Body

The main body of your actuary cover letter is where you can expand on your qualifications, experiences, and the unique skills you bring to the table. This section is your opportunity to demonstrate how your background makes you the ideal candidate for the position. Here’s how to articulate your expertise effectively:

Tailor Your Experiences to the Job Description

Review the job posting carefully and align your experiences with the requirements listed by the employer. For example, if the position emphasizes risk management, statistical analysis, and software proficiency, highlight your experiences and achievements in these areas.

For instance,

"At HighTower Insurance, I implemented a comprehensive risk assessment model using Python, which resulted in a 15% reduction in unforeseen liabilities within the first year of application."

Use Quantifiable Achievements

Whenever possible, quantify your successes with specific figures to provide concrete evidence of your impact. This could include percentages, dollar amounts, or other measurable outcomes. Quantifiable achievements stand out to hiring managers because they offer tangible evidence of your capabilities.

Quantifiable Example:

"My work on optimizing pension fund portfolios at FinTrust Capital resulted in a 25% improvement in long-term sustainability projections, directly contributing to the fund's financial health."

Demonstrate Your Soft Skills

While technical skills are crucial for an actuary, don't overlook the importance of soft skills such as problem-solving, communication, and teamwork. Illustrate how these skills have played a role in your achievements and how they will benefit the potential employer.

Soft Skills Example:

"Collaborating closely with the underwriting and product development teams, I utilized my analytical skills and clear communication to facilitate the launch of three new insurance products that catered to previously unaddressed market segments."

Show Your Knowledge of the Company and Industry

Expressing knowledge about the company’s challenges, culture, or objectives can significantly bolster your cover letter. Relate your experiences and skills to how you can solve specific problems or contribute to projects at the company.

Company Knowledge Example:

"I have followed Global Insurance Group's innovations in integrating AI into risk assessment with great interest. My experience in developing predictive models aligns with your company’s forward-thinking approach to leveraging technology for enhanced decision-making."

Crafting the body of your cover letter with these strategies not only showcases your technical expertise and soft skills but also demonstrates your enthusiasm and how you can contribute to the company’s success. By providing specific examples and quantifiable achievements, you make a compelling case for why you are the best candidate for the job.

Concluding Your Actuary Cover Letter with Impact

The closing of your actuary cover letter is your final opportunity to make a memorable impression and express your enthusiasm for the role. It's crucial to end on a strong, positive note that encourages the hiring manager to take the next step. Here’s how to craft a conclusion that resonates:

Reiterate Your Interest and Fit for the Role

Briefly summarize why you are enthusiastic about the opportunity and why you believe you are the right fit for the position. This reiteration reinforces your interest and reminds the hiring manager of your qualifications.

For example,

"I am highly enthusiastic about the opportunity to contribute to Global Insurance Group’s innovative risk management strategies with my expertise in statistical analysis and predictive modeling."

Include a Call to Action

Politely prompt the hiring manager to take action, such as inviting you for an interview. This demonstrates your eagerness to move forward in the selection process and engage with them further.

Call to Action Example:

"I look forward to the possibility of discussing how my skills and experiences align with Global Insurance Group’s goals in more detail. I am available at your convenience for an interview."

Professional Sign-off

End your cover letter with a professional closing, followed by your name. Options like "Sincerely," "Best regards," or "Warm regards" are appropriate and convey a sense of professionalism and respect.

Professional Closing:

Thank you for considering my application. I am excited about the opportunity to contribute to your team and make a positive impact.

Why This Approach Works

A well-crafted closing section leaves the hiring manager with a strong, positive impression of you as a candidate. It reinforces your qualifications, expresses your enthusiasm for the role, and invites further communication, setting the stage for the next steps in the hiring process.

Essential Tips for Crafting a Standout Actuary Cover Letter

When competing for a coveted actuary position in the accounting & finance sector, your cover letter is a prime opportunity to differentiate yourself. Here are essential tips to ensure your application grabs attention and showcases your qualifications effectively:

1. Customize Your Cover Letter for Each Application

Generic cover letters are easy to spot and often end up overlooked. Tailor each cover letter to the specific job and company by mentioning why you're interested in the role and how your skills align with the company’s objectives. This personal touch demonstrates your genuine interest and effort.

2. Highlight Actuarial Skills and Accomplishments

Focus on the skills and experiences that are most relevant to the actuarial profession, such as your proficiency with data analysis tools, your experience in risk assessment, and any specific achievements that have contributed to your current or previous employers' success.

Skills Highlight:

"My role in developing an advanced risk prediction tool for FinTrust Capital involved complex data analysis and model testing, leading to a 30% decrease in unanticipated risk exposures."

3. Address Any Gaps or Career Changes Thoughtfully

If your career path includes gaps or transitions, briefly explain these in a positive light. Focus on what you learned during these times or how your diverse experiences contribute to a unique perspective you bring to the actuary role.

4. Proofread for Perfection

Errors in your cover letter can detract from your professionalism and attention to detail—critical attributes for an actuary. Proofread your letter several times, and consider having someone else review it to catch any mistakes you may have missed.

Implementing these tips in your actuary cover letter will not only demonstrate your qualifications and readiness for the role but also show your dedication and professionalism. A well-crafted cover letter can set you apart from other candidates and bring you one step closer to securing the actuarial position you desire.

Key Takeaways for Crafting Your Actuary Cover Letter

Writing a compelling cover letter for an actuary position is a critical step in your job application process. It's your opportunity to personalize your application, showcase your unique skills and experiences, and demonstrate your enthusiasm for the role and the company. Here are the key takeaways to remember as you craft your cover letter:

Personalize Your Application: Tailor your cover letter for each job you apply for. Highlight how your skills and experiences align with the specific role and the company's needs. This shows you've done your research and are genuinely interested in the position.

Showcase Your Analytical Skills: Actuaries are valued for their ability to analyze data and make informed decisions. Provide concrete examples of how you've used your analytical skills in professional settings to solve problems or improve processes.

Demonstrate Continuous Learning: The actuarial field is constantly evolving. Show that you're committed to keeping up with the latest trends and technologies by mentioning any relevant courses, seminars, or certifications you've completed.

Detail Your Professional Experiences: Use the body of your cover letter to delve into your professional background. Focus on experiences that are most relevant to the job you're applying for, and quantify your achievements whenever possible.

Conclude with a Strong Closing: End your cover letter on a positive note. Reiterate your interest in the role and the company, and include a call to action, such as expressing your desire for an interview.

Proofread and Edit: Ensure your cover letter is free from typos and grammatical errors. A well-written, error-free cover letter presents you as a professional and detail-oriented candidate.

Remember, your cover letter is an opportunity to sell yourself as the ideal candidate for the actuary position. By following these guidelines and putting in the effort to create a personalized, well-crafted letter, you can stand out in the competitive job market and move one step closer to securing your desired role.

Other Related Cover Letter Examples from Accounting & Finance Sector

Payroll specialist cover letter, accountant cover letter, collector cover letter, accounts payable/receivable cover letter, billing specialist cover letter, auditor cover letter.

Recommended Reading

Your Next Opportunity Awaits!

Don't let your dream job slip away. Create a standout resume in minutes with Bolt Resume and take the first step towards a brighter future.

Ready to impress your future employer with the AI Resume Builder?

5+ Actuary Cover Letter Examples and Templates

Home » Cover Letter Examples » 5+ Actuary Cover Letter Examples and Templates

Create the simple Actuary cover letter with our top examples and expert guidance. Use our sample customizable templates to craft a cover letter that’ll impress recruiters and get you that interview today. Start now and make your dream job come true!

Are you looking to kickstart your career as an Actuary? A well-crafted cover letter is an essential tool to showcase your skills, passion, and suitability for the role. By effectively highlighting your qualifications, achievements, and enthusiasm, you can grab the attention of potential employers and increase your chances of landing an interview.

In this comprehensive guide, we will provide you with examples and templates for writing a captivating cover letter specifically tailored for an Actuary position. Whether you are an experienced professional or a recent graduate, our tips and techniques will help you create a persuasive cover letter that stands out.

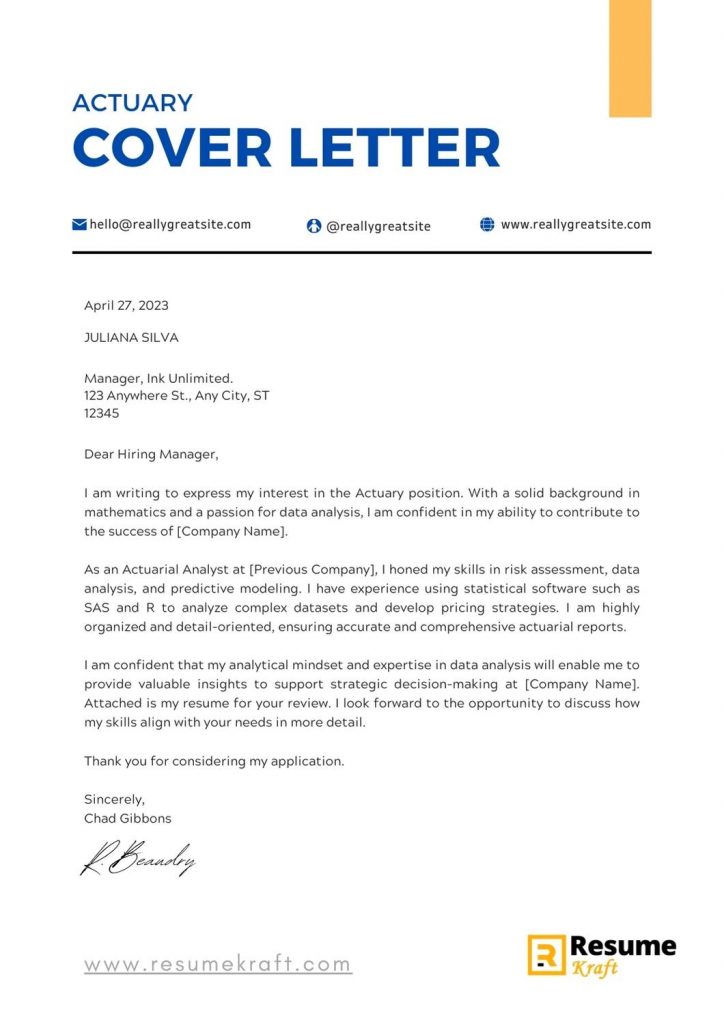

Actuary Cover Letter Examples and Templates

1. Actuary Cover Letter Example

Dear Hiring Manager,

I am writing to apply for the Actuary position at [Company Name]. With a strong background in mathematics and a passion for data analysis, I believe I am a perfect fit for this role.

During my previous role as an Actuarial Analyst at [Previous Company], I was responsible for conducting risk assessments, analyzing data to determine insurance premiums, and developing pricing models. I also have experience in using statistical software such as SAS and R to analyze large datasets and develop predictive models.

I am highly skilled in problem-solving and critical thinking, which are essential skills for actuaries. Additionally, my strong communication skills allow me to effectively present complex actuarial concepts in a clear and concise manner.

I am confident that my analytical skills, attention to detail, and ability to interpret complex data will greatly contribute to the success of [Company Name]. I am eager to leverage my expertise to assess risks accurately, develop pricing strategies, and support strategic decision-making.

Thank you for considering my application. I am eager to discuss how my qualifications align with your needs further. Please find attached my resume for your review. I look forward to the opportunity to interview with you and further demonstrate my suitability for the Actuary role.

Sincerely, [Your Name]

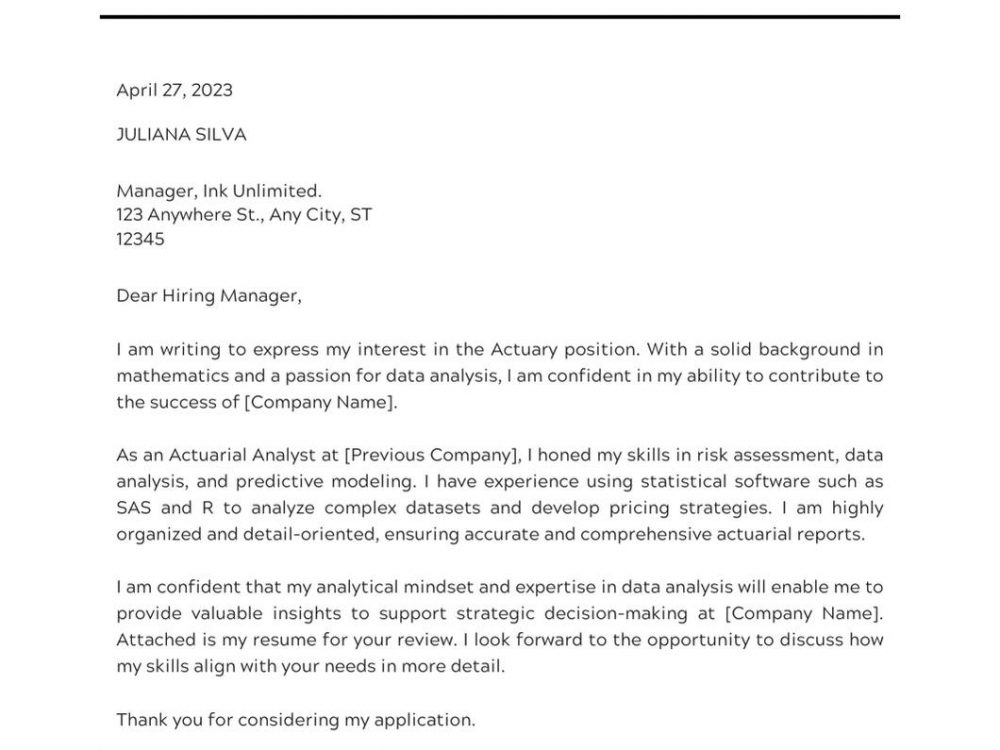

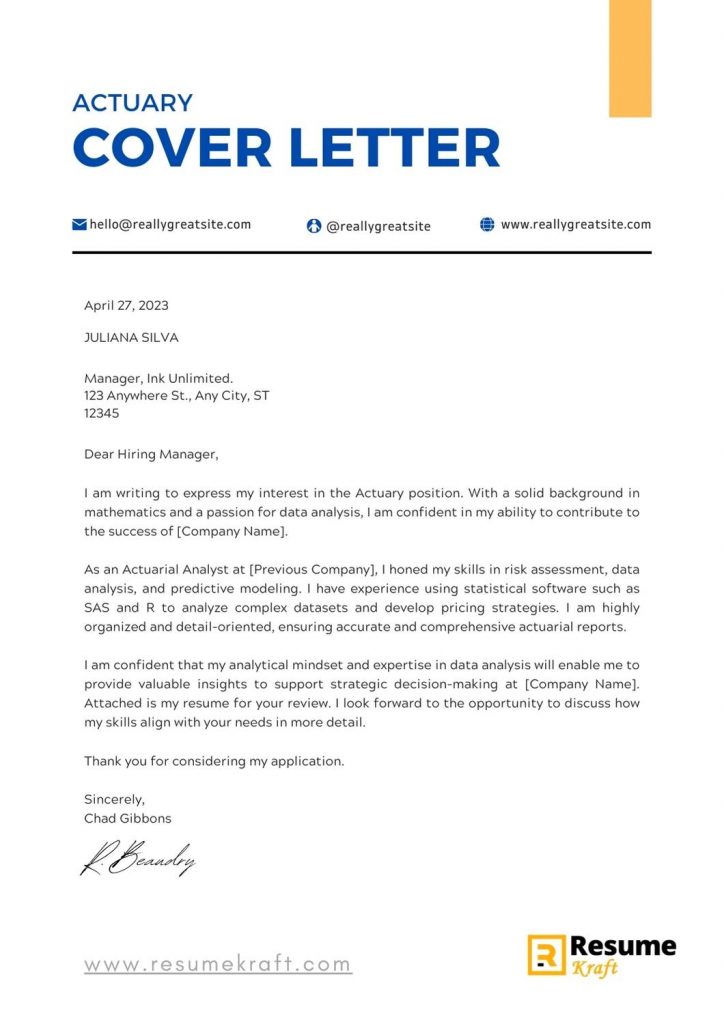

2. Short Actuary Cover Letter Sample

I am writing to express my interest in the Actuary position. With a solid background in mathematics and a passion for data analysis, I am confident in my ability to contribute to the success of [Company Name].

As an Actuarial Analyst at [Previous Company], I honed my skills in risk assessment, data analysis, and predictive modeling. I have experience using statistical software such as SAS and R to analyze complex datasets and develop pricing strategies. I am highly organized and detail-oriented, ensuring accurate and comprehensive actuarial reports.

I am confident that my analytical mindset and expertise in data analysis will enable me to provide valuable insights to support strategic decision-making at [Company Name]. Attached is my resume for your review. I look forward to the opportunity to discuss how my skills align with your needs in more detail.

Thank you for considering my application.

3. Actuary Cover Letter for Job Application

Dear [Recipient’s Name],

I am writing to apply for the Actuary position at [Company Name] as advertised on [Job Board/Company Website]. With a strong background in mathematics and a passion for data analysis, I am confident in my ability to contribute to [Company Name]’s success.

In my previous role as an Actuarial Analyst at [Previous Company], I successfully conducted risk assessments, developed pricing models, and analyzed complex data sets to support strategic decision-making. I have experience in using statistical software such as SAS and R to analyze large datasets and develop predictive models.

I am confident in my ability to analyze complex data, identify trends, and provide actionable recommendations. Furthermore, my strong communication and presentation skills enable me to effectively communicate actuarial findings to stakeholders.

I am excited about the opportunity to contribute to [Company Name]’s growth and success as an Actuary. Attached is my resume for your consideration. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

Thank you for considering my application. I look forward to the opportunity to interview with you.

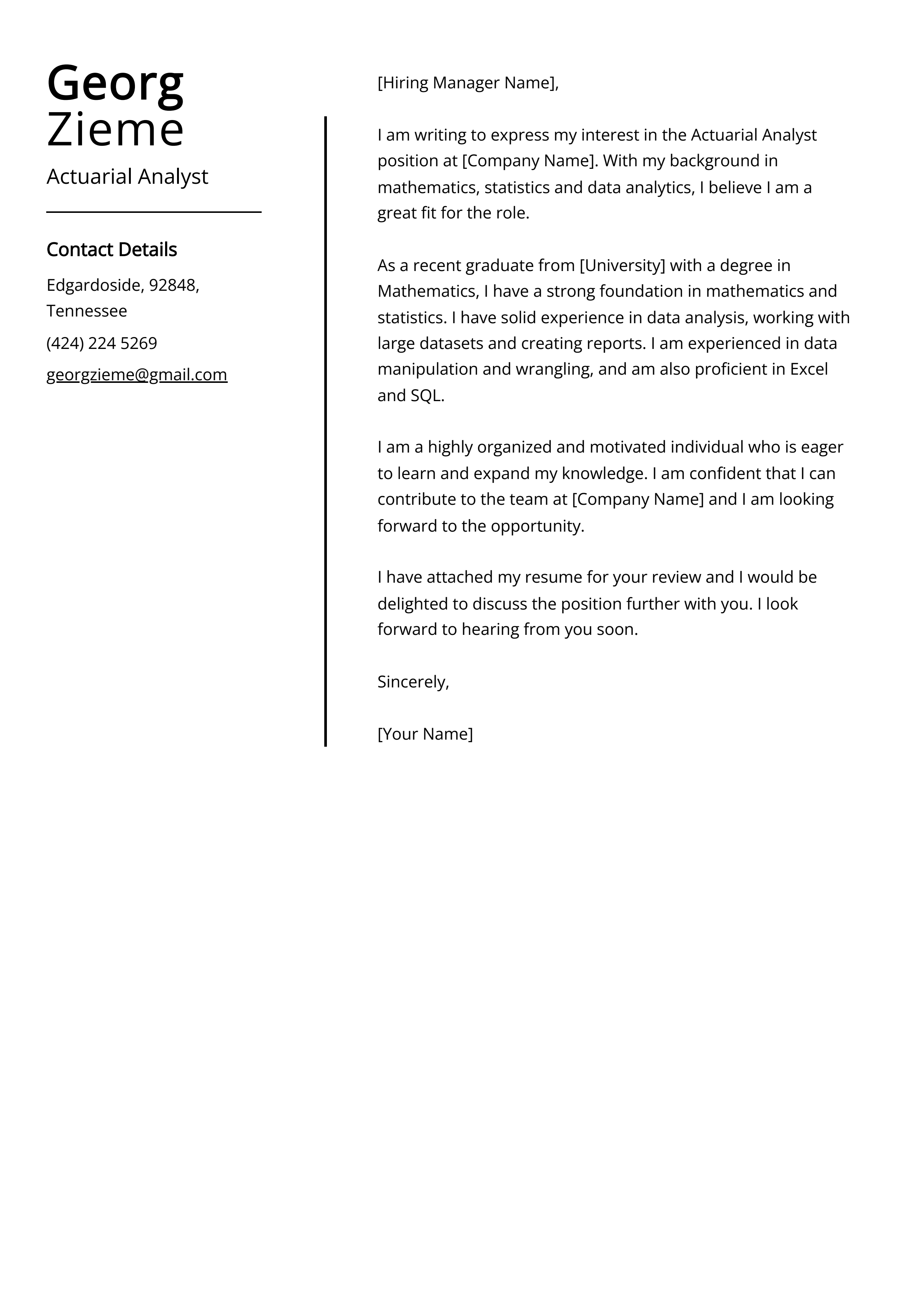

4. Actuary Cover Letter for a Candidate with no Experience

I am writing to express my interest in the Actuary position at [Company Name]. Although I have recently graduated with a degree in Mathematics, I am eager to apply my knowledge and skills to contribute to [Company Name]’s success.

During my academic studies, I developed a strong foundation in mathematics, statistics, and data analysis. My coursework and projects provided me with hands-on experience in using statistical software such as SAS and R to analyze complex datasets. I am a quick learner with a strong analytical mindset and attention to detail.

I am confident that my ability to analyze data, along with my excellent problem-solving skills, make me a strong candidate for the Actuary role. Additionally, my internship experience in a different field has equipped me with valuable transferable skills such as teamwork, time management, and effective communication.

I am eager to contribute to [Company Name]’s success as an Actuary. Attached is my resume for your consideration. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

5. Sample Application Letter for Actuary with Experience

I am excited to apply for the Actuary position at [Company Name]. With over [Number of Years] years of experience in risk assessment, data analysis, and predictive modeling, I bring a wealth of knowledge and expertise to support [Company Name]’s growth.

In my current role as an Actuarial Analyst at [Current Company], I have successfully provided strategic insights and supported decision-making through data analysis. I am well-versed in using statistical software such as SAS and R to analyze complex datasets and develop pricing models. Moreover, I have a proven track record of developing comprehensive actuarial reports to drive business performance and optimize risk management.

I am highly skilled in analyzing data, conducting risk assessments, and developing pricing strategies. My strong communication and presentation skills have enabled me to effectively communicate complex actuarial information to stakeholders at various levels.

I am confident that my extensive experience, analytical mindset, and attention to detail make me an ideal candidate for the Actuary role. Attached is my resume for your review. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

How to Write an Actuary Cover Letter

Writing an effective Actuary cover letter involves following a clear structure and including relevant information that showcases your qualifications and demonstrates your commitment to the field. Let’s explore the step-by-step guide to help you craft a compelling cover letter that captures the attention of potential employers.

Objective of an Actuary Cover letter:

- Introduce yourself and express your interest in the position.

- Highlight your relevant skills, experiences, and achievements.

- Demonstrate your knowledge of actuarial concepts and methodologies.

- Show your passion for analyzing data, assessing risks, and making informed decisions.

- Thank the employer for considering your application.

Key Components For Actuary Cover Letters:

- Contact Information: Include your name, address, phone number, and email address at the top of the cover letter.

- Salutation: Begin the cover letter with a professional greeting, such as “Dear Hiring Manager” or “Dear [Company Name] Recruiting Team.”

- Introduction Paragraph: In a concise and engaging manner, introduce yourself, mention the position you are applying for, and briefly indicate your motivation for applying.

- Body Paragraphs:

- Skills and Qualifications: Highlight your relevant technical skills, such as proficiency in statistical analysis, data modeling, programming languages, and actuarial software.

- Experience and Achievements: Discuss your experience in the field of actuarial science, including internships, projects, or any relevant work experience. Highlight any achievements or recognition you have received.

- Knowledge of Actuarial Concepts: Demonstrate your understanding of actuarial concepts, methodologies, and regulations. Discuss your ability to apply these concepts to real-world scenarios.

- Passion for the Field: Express your enthusiasm for working as an Actuary and your dedication to continuous learning and professional development.

- Closing Paragraph: Conclude your cover letter by restating your interest in the position and expressing your availability for an interview or further discussion. Mention any further enclosed documents, like your resume or references.

- Formal Closing: End the letter with a professional closing, such as “Sincerely” or “Best Regards,” followed by your full name.

- Signature: Sign your name between the closing and your printed name. If the cover letter will be sent electronically, you can type your name instead.

Formatting Tips for an Actuary Cover Letter:

- Keep the cover letter length to one page.

- Use a professional and well-structured format, using bullets or paragraphs to highlight key information.

- Use consistent font sizing and alignment throughout the letter.

- Proofread your letter carefully for spelling, grammar, and formatting errors.

Tips for Writing Your Actuary Cover Letter:

- Customize the cover letter to the specific job requirements and company information.

- Highlight your technical skills and expertise in statistical analysis, data modeling, and actuarial software.

- Emphasize your ability to work with complex data sets and analyze risks accurately.

- Showcase your experience in applying actuarial concepts and methodologies to solve real-world problems.

- Mention any certifications or professional memberships you hold, such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Provide evidence of your success in previous actuarial roles, such as cost savings, improved risk management, or accurate forecasting.

- Use industry-related keywords throughout the cover letter to demonstrate your familiarity with key concepts.

- Maintain a professional tone and language throughout the letter, while injecting your personality and enthusiasm.

- End the cover letter on a positive and hopeful note, expressing gratitude for the opportunity to apply.

How long should a cover letter be for an Actuary?

Ideally, an Actuary cover letter should be concise but impactful, usually not exceeding one page. Aim for 3-4 paragraphs that cover your key qualifications and leave the hiring manager eager to learn more about you. Remember to be specific, concise, and emphasize your most relevant experiences and accomplishments.

How do I write a cover letter for an Actuary with no experience?

If you are a recent graduate or have limited experience in the field of actuarial science, focus on transferable skills and demonstrate your passion for the industry. Here are a few tips to help you compose a cover letter without direct actuarial experience:

- Highlight transferable skills, such as strong analytical abilities, mathematical aptitude, attention to detail, and problem-solving skills.

- Emphasize your coursework or projects related to actuarial science, statistics, mathematics, or finance.

- Discuss any internships or part-time positions where you gained exposure to data analysis, risk assessment, or financial modeling.

- Showcase your ability to learn quickly and adapt to new concepts and methodologies.

- If possible, provide examples of personal qualities that make you well-suited for an actuarial role, such as being detail-oriented, meticulous, or a strong team player.

Remember, while experience is valuable, highlighting your skills, passion, and willingness to learn can be equally valuable when applying for an entry-level Actuary position.

Key Takeaways

A well-written and tailored cover letter is your opportunity to make a strong impression as an Actuary candidate. Remember the following:

- Customize the cover letter for each job application.

- Showcase your technical skills and expertise in actuarial science.

- Provide specific examples of accomplishments and experiences.

- Express your industry knowledge and passion.

In Conclusion

Writing an attention-grabbing and well-crafted cover letter as an Actuary can significantly increase your chances of securing an interview. Tailor your letter to portray your suitability for the role, highlight your skills and achievements, and demonstrate your passion for the field. By following the guidelines provided in this article, you’ll be equipped to create a standout cover letter that puts you a step ahead of the competition.

Now, put your skills into action and start crafting your tailor-made Actuary cover letter, tailored to the job and company you are applying to. Good luck!

Career Expert Tips:

- If you're stepping into the professional world, understanding the basics is crucial. Learn What is a cover letter and its role in the job application process.

- How to start a cover letter can be a challenging task. Get a comprehensive guide on how to kickstart your cover letter and make a strong first impression.

- Looking for inspiration to draft your own cover letter? Browse through these Cover letter examples to find a style that fits your profession.

- Why start from scratch? Use these Cover Letter Templates tailored for various professions to simplify your job application process.

- How long should a cover letter be : The length of a cover letter is vital in conveying your message concisely. Discover the optimal length to make sure your cover letter is not too short nor too long.

- Ensure that you know how to write a resume in a way that highlights your competencies.

- Check the expert curated popular good CV and resume examples

Privacy Overview

Resume Worded | Career Strategy

14 actuarial analyst cover letters.

Approved by real hiring managers, these Actuarial Analyst cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Actuarial Analyst

- Senior Actuarial Analyst

- Entry-Level Actuarial Analyst

- Alternative introductions for your cover letter

- Actuarial Analyst resume examples

Actuarial Analyst Cover Letter Example

Why this cover letter works in 2024, analyzing data sets.

In this cover letter, the applicant showcases their ability to interpret complex data sets and identify patterns. This is a crucial skill for an Actuarial Analyst, and mentioning it early on helps set the tone for the rest of the letter.

Effective Communication

Highlighting the importance of effective communication when presenting findings to a diverse team is a great way to show that the applicant is not only skilled in data analysis but also understands the need to communicate results in a clear and concise manner.

Implementing New Systems

By mentioning a specific accomplishment - implementing a risk modeling system that increased revenue - the applicant demonstrates their ability to make a significant impact in their previous role. This is a strong selling point for any job seeker.

Showcase of Achievements

What strikes me about this is your self-assuredness in highlighting your accomplishments. You've nicely quantified your success, stating that your risk models led to a 15% increase in policyholder profitability. Employers love to see results, and you've delivered them with tangible numbers.

Highlighting Strengths in Key Skills

You've done well in pointing out your strong mathematical skills and ability to identify trends and patterns. This gives me a sense of your strengths and how they've played a part in your achievements. It sends a clear message that these are your key skills, and they've contributed to your success.

Expressing Genuine Interest

Employers want to feel that you want the job, not just any job. You've made it clear why you're interested in this role specifically - wanting to work on a larger scale and have a more significant impact. It really shows you've thought about why this role could be a good fit for you.

Show genuine interest in the company

This cover letter immediately stands out because it shows a deep connection and interest in the company. When you specifically mention why you're attracted to the company, it tells me that you're not just applying for any job, you're applying for this job at this company. It demonstrates that you know what we're about and that you're passionate about the same things.

Highlight your quantifiable achievements

Showing me your quantifiable achievements, just like you did here, is a really effective way of demonstrating your skills and potential. It tells me exactly what you've accomplished and it makes me think about what you could potentially do for us. Plus, it shows me that you're about action and results, not just talk.

Express your excitement for specific opportunities

When you mention specific projects or opportunities at our company that excite you, it shows me that you've done your homework. It tells me that you're informed about what we do and that you're genuinely interested in contributing to our efforts. It also shows that you're not just looking for any job, but the right job where you can make an impact.

Emphasize your alignment with company's values

Showing me that you identify with our company's values and mission, like you did in this cover letter, is a real plus. It tells me that you're not just about the paycheck, but about making a meaningful contribution to our team. And that's the type of person we want to hire.

End on a strong, positive note

Ending your cover letter by thanking me for considering your application and expressing your eagerness to contribute to our team's success leaves a lasting positive impression. It shows me that you're keen, motivated, and genuinely interested in the job. Always leave them wanting more.

Show your early passion for actuarial tasks

Telling a story about your early interest in math and prediction makes your application memorable and shows your genuine passion for the actuarial field.

Quantify your internship achievements

Detailing specific results you achieved during your internship, like a 15% reduction in losses, demonstrates your ability to impact real-world business outcomes.

Highlight your skills in data analysis

Discussing your role in creating reports for senior management showcases your analytical skills and your ability to contribute to important business decisions.

Emphasize your communication abilities

Stating your skill in explaining complex concepts in simple terms highlights an essential skill for actuarial analysts, who must often present their findings to non-technical stakeholders.

Express eagerness to learn and contribute

Your closing statement should reinforce your interest in the role and your readiness to bring your skills to the team, inviting a discussion on how you can align with their needs.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Start with a personal connection

Talking about how a personal experience led you to this career path makes your cover letter memorable and personal. It helps us understand your motivation.

Quantify your achievements

Using percentages to show how your work led to significant improvements gives us concrete evidence of your skills. It's exactly the kind of result-driven mindset we value.

Highlight your relevant experiences

Mentioning specific skills you've developed through your experiences, like statistical analysis and problem-solving, directly ties your background to what we're looking for in a candidate.

Show enthusiasm for the team’s mission

When you express excitement about working with our team and contributing to our mission, it shows us that you're not just looking for a job, but a place where you can belong and grow.

End with a forward-looking statement

A closing that anticipates future discussions about how you can contribute to our success leaves a positive, proactive impression. It's a good note to end on.

Talking about your admiration for the company's work helps me see that you've done your homework and really care about joining us. This makes your application feel more personal and thoughtful.

Highlight actuarial project experience

Describing a specific project where you used your actuarial skills shows me exactly what you're capable of. It's good to see real-world applications of your knowledge.

Point out key actuarial skills

Mentioning your analytical skills and the ability to explain complex ideas in simple terms is crucial for an actuarial role. It tells me you're not just smart, but you can also help others understand the data.

Emphasize ongoing learning

Knowing that you're keeping up with the latest in actuarial science through conferences and exams tells me you're committed to your professional growth. This is a great trait in a potential hire.

Express eagerness to contribute

Ending your letter by inviting further discussion shows me you're genuinely interested in the role and ready to talk about how you can help the company. It sets the stage for the next step in the hiring process.

Senior Actuarial Analyst Cover Letter Example

Display of leadership and skill development.

Leadership is a sought-after trait, particularly for senior roles. You've wonderfully highlighted your experience leading a team of junior analysts, demonstrating not just your technical skills but also your leadership capabilities. Additionally, stating how you've honed your skills in predictive modeling and risk assessment gives a positive impression of your commitment to continuous learning.

Emphasizing Impact of Your Actions

I love that you've connected your actions to tangible outcomes - reduction in financial risks and an increase in policy sales. This helps me understand the kind of impact you can make. Remember, employers are always looking for problem solvers who can deliver results and your cover letter shows that you're one of them.

Alignment with Company's Mission

Your eagerness to contribute to MetLife's mission is palpable in your letter. Expressing your interest in the company's focus and how your skills align with it, helps paint a picture of how you can fit within the organization and contribute to its objectives. This is a very effective way of showing your enthusiasm for the role.

Connect your interests to the company

When you connect your personal interests to our company's work, like you did here, it tells me that you're not just looking for a job, but a mission that aligns with your passions. This shows me that you're likely to be more engaged and productive, and that's the kind of candidate we're looking for.

Prove your impact with concrete outcomes

When you talk about your achievements, try to include the concrete outcomes that resulted from your actions. Not only does it make your achievement more tangible, but it also gives me a glimpse of what you could potentially do for our company. This kind of detail can really make a difference.

Show enthusiasm for the role

Showing me your enthusiasm for the role, like you did here, really grabs my attention. It tells me that you're genuinely excited about the opportunity and that you're likely to bring that energy to your work. This is always a good sign.

Express alignment with company's mission

When you express your alignment with our mission and goals, it reassures me that we're on the same page. It tells me that you're not just looking for any job, but specifically this job, at this company. That's the kind of commitment we value.

Offer to discuss your skills further

Offering to discuss your skills and how they can benefit our company, like you did here, shows me that you're confident in your abilities and eager to make a difference. It also leaves a window open for further conversation, which is always a good move.

Connect your passion with the job

When you talk about how a field excites you, you show me you're not just looking for any job. You want this one. That's important to us.

Show your actuarial analyst impact

Telling us about a time you improved profitability and reduced risk by a specific percentage makes your achievement real and measurable. We look for impact like that.

Demonstrate your foundational skills

By discussing your core skills and how they were useful in past roles, you help us understand your professional foundation. We need people who have a strong base to build upon.

Highlight your leadership and innovation

Leadership and the ability to innovate are key. If you can show us how you've led teams to create new solutions, you're showing us exactly what we're looking for.

A closing statement that looks forward to discussing how you fit into our team adds a personal touch and shows you're genuinely interested in the role.

Highlight your successful actuarial experience

Starting with your achievements sets a strong precedent. It grabs attention and immediately showcases your value.

Demonstrate impact with numbers

Quantifying your achievements makes your experience tangible and relatable. It helps hiring managers understand the scale of your contributions.

Emphasize leadership and innovation

Leadership skills are key for a senior role. Highlighting your ability to lead and innovate shows you're ready for more responsibility.

Show excitement for the company's future

Demonstrating knowledge of and enthusiasm for the company's direction can align your goals with theirs, making you a more attractive candidate.

Request a conversation

Asking to discuss your potential contributions further shows initiative and a genuine interest in adding value to the team.

Show your enthusiasm for the senior actuarial analyst role

When you express excitement about the role and admiration for the company, it shows that you have a true interest in joining their team and understand their values. This can make your application memorable.

Talking about specific results, like saving a client $10M, demonstrates the tangible impact of your work. It gives a clear picture of what you can bring to the table. This is especially important in a data-driven field like actuarial analysis.

Highlight alignment with company values

Mentioning your alignment with the company’s global reach and innovation focus shows that you’ve done your homework. It suggests that you’re not just looking for any job, but a place where you can truly fit in and contribute.

Emphasize your leadership and communication skills

Pointing out your ability to manage teams and communicate complex ideas effectively signals that you’re ready for a senior role. It’s crucial in a senior actuarial analyst position, where collaboration and clarity are key.

Express your interest in further discussion

Closing by inviting further discussion shows openness and eagerness to engage with the hiring team. It’s a polite and proactive way to finish your cover letter, indicating your enthusiasm for the opportunity.

Entry-Level Actuarial Analyst Cover Letter Example

Connect your degree to your career choice.

Explaining how your academic background fuelled your interest in becoming an actuarial analyst provides a solid foundation for your application, demonstrating a clear path to your career choice.

Showcase academic projects with real impact

Detailing a project that improved prediction accuracy by 20% not only highlights your academic achievements but also your potential to contribute valuable insights in a professional setting.

State your motivation for joining the company

Expressing excitement about contributing to the company's mission adds a personal touch to your application, showing that you have done your research and are genuinely interested in the role.

Summarize your key strengths

In your conclusion, reiterating your analytical skills, creativity, and ability to work well in teams succinctly wraps up why you are a good fit for the actuarial analyst position.

End with a call to action

Inviting a discussion about how you can contribute to the team’s success leaves the door open for further communication, signaling your eagerness to move forward in the application process.

Show your enthusiasm for the actuarial analyst role

Explain your strong interest in the field and the company. This shows you have done your research and are not just applying randomly.

Detail your project experience

Talk about specific projects that highlight your skills. This gives a clear example of your ability to apply theory to real life, which is crucial for an actuarial role.

Express eagerness to learn from experienced actuaries

Showing that you value learning and growth opportunities demonstrates your commitment to your professional development.

Thank the hiring manager

Always end with a thank you. It shows good manners and respect for the person reading your application.

Invite further discussion

Encouraging a conversation about how you can contribute adds a proactive touch to your application, making you seem more engaged and interested.

Link degree to job relevance

Making a clear connection between your degree in actuarial science and the job shows me you have the educational background needed. It's a good start to showing you're a fit for the role.

Detail collaborative project experience

Sharing your experience working in a team on an actuarial project gives me a peek into how you tackle problems and work with others. Teamwork is key in our work environment.

Express attraction to company values

Your reason for being drawn to the company gives me insight into what you value professionally. It helps me understand why you think you'd be a good match for us.

Emphasize soft skills and creativity

Highlighting your communication, teamwork, and positive approach tells me you're not just about numbers. These soft skills are just as important as your technical abilities in our collaborative work environment.

Show readiness to contribute

Asking to discuss your qualifications further shows you're proactive and eager. This tells me you're not just looking for any job, but are interested in making a meaningful contribution to our team.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Actuarial Analyst Roles

- Actuarial Analyst Cover Letter Guide

- Actuarial Manager Cover Letter Guide

- Chief Actuarial/Risk Officer Cover Letter Guide

- Senior Actuarial Analyst Cover Letter Guide

Other Data & Analytics Cover Letters

- Business Analyst Cover Letter Guide

- Data Engineer Cover Letter Guide

- Data Scientist Cover Letter Guide

- Data Specialist Cover Letter Guide

- Director of Analytics Cover Letter Guide

- Intelligence Analyst Cover Letter Guide

- Program Analyst Cover Letter Guide

- Reporting Analyst Cover Letter Guide

- SQL Developer Cover Letter Guide

- Supply Chain Planner Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Actuary Cover Letter Examples

A great actuary cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following actuary cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Nirali Jaqua

(409) 908-2636

Dear Rea Garsee,

I am writing to express my interest in the Actuary position at Milliman, as advertised on your company website. With a solid foundation of five years of actuarial experience at Willis Towers Watson, I am eager to bring my expertise in risk assessment and financial modeling to your esteemed firm.

During my tenure at Willis Towers Watson, I honed my analytical skills, working on a diverse range of projects that allowed me to develop a deep understanding of actuarial sciences and its application in real-world scenarios. My role involved performing complex data analysis, developing actuarial models, and providing strategic insights that helped our clients navigate through various financial risks. My commitment to excellence and attention to detail have been the cornerstone of my approach to every task I undertake.

What excites me about the opportunity at Milliman is the company's reputation for innovation and its client-focused approach. I am particularly drawn to the prospect of working in an environment that not only values analytical rigor but also encourages creative solutions to the complex challenges facing your clients. I am confident that my proactive attitude and ability to adapt to the rapidly changing landscape of actuarial science would make a significant contribution to your team.

I also bring a strong background in regulatory compliance and a proven track record of developing strategies that align with both client objectives and industry standards. My experience has equipped me with the knowledge to effectively communicate technical concepts to non-actuarial stakeholders, ensuring that our collaborative efforts lead to successful outcomes.

I am keen to further discuss how my background, skills, and enthusiasms align with the goals of Milliman. I am looking forward to the opportunity to contribute to your team and to help drive the continued success of your company. Thank you for considering my application. I hope to discuss my candidacy with you in more detail.

Warm regards,

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Actuary Cover Letter Template

Get more job offers and pick up more ideas for your cover letter with our free, expertly drafted Actuary cover letter template. Copy and paste this cover letter sample free of charge or revise it in our powerful cover letter builder.

Related resume guides and samples

How to craft an appealing administration resume?

How to create a professional facilities manager resume

How to write an effective front desk receptionist resume?

How to build an effective office staff resume

How to build an effective personal assistant resume?

Actuary Cover Letter Template (Full Text Version)

Velimir ramiae.

Dear Hiring Manager,

I am writing to express my interest in the Actuary position at APP Group, Inc. After reviewing the job listing on your company's careers website, I am confident that my skills and qualifications align perfectly with the requirements of the role.

I am a Certified Actuarial Analyst with a degree in Economics & Finance from ESSEC Business School, and I have over two years of experience working as an Actuary at Phoenix Group, Inc. During my time there, I successfully managed a team, conducted financial analysis, and contributed to recruitment and training efforts. I was recognized as Employee of the Month for my dedication and exceptional work.

I am a detail-oriented professional with strong analytical skills and the ability to thrive in high-pressure situations. I am excited about the opportunity to bring my expertise to your team at APP Group, Inc.

Thank you for considering my application. I look forward to the possibility of discussing my qualifications further.

Sincerely, Velimir Ramiae

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Flight Attendant Librarian Personal Trainer Facilities Manager Office Staff Front Desk Receptionist Administration Personal Assistant

Related others resume samples

Related administration cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Career Advice Home | Actuarial Career and Employment Advice | Writing Cover Letters

Writing Cover Letters

Every week, the Actuary.com Employment Blog brings you the top career articles with the best advice. This week, we’re looking at resources to help you write a cover letter!

- 3 Cover Letter Tips for People Who Haven’t Written One in Forever If it’s been awhile since you’ve written a cover letter, this one is for you!

- I’ve Read Over 300+ Cover Letters and This Is How I Decide if It’s Good or Bad Within 3 Minutes Get advice from the pros! Learn how to stand out from a crowd of qualified talent, from a seasoned hiring manager.

- The Difference Between a Cover Letter and the Email You Send With Your Application Learn what you should write in an email application so that you’re not copy-pasting your cover letter.

Sign up for a free job seeker account at Actuary.com for access to the newest and freshest opportunities available!

By Actuary.com

Actuary.com is the leader in helping job seekers find actuarial jobs at leading companies, consulting firms and recruiting firms. Sign up for a free job seeker account to access the newest and freshest actuarial job postings available to professionals seeking employment.

Social Media

Most popular.

Announcement from ASNY Career Day for 2024

Weekly Actuary Career Advice: 36

Weekly Actuarial Career Advice: 35

Weekly Actuarial Career Advice: 34

Get job alerts, add your resume, employers, find the right candidates.

Post your insurance job today to reach top talent in the insurance industry.

Actuarial Analyst Cover Letter Example for 2024

Create a standout actuarial analyst cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

If you're looking to pursue a career as an actuarial analyst, a well-crafted cover letter can help you stand out to potential employers. In this guide, we'll provide you with a step-by-step approach to creating an effective cover letter for the actuarial analyst position. From highlighting your skills and experience to showcasing your passion for the field, we'll help you craft a compelling cover letter that will impress hiring managers.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- Why you should use a cover letter template

Related Cover Letter Examples

- Trading Analyst Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Loan Consultant Cover Letter Sample

- Full Charge Bookkeeper Cover Letter Sample

- Junior Business Analyst Cover Letter Sample

- Credit Manager Cover Letter Sample

- Treasury Analyst Cover Letter Sample

- Senior Analyst Cover Letter Sample

- Accountant Cover Letter Sample

- Mortgage Broker Cover Letter Sample

- Financial Consultant Cover Letter Sample

- Director Of Accounting Cover Letter Sample

- Accounts Receivable Analyst Cover Letter Sample